UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22435

Kayne Anderson Energy Development Company

(Exact name of registrant as specified in charter)

| | |

| 717 Texas Avenue, Suite 3100, Houston, Texas | | 77002 |

| (Address of principal executive offices) | | (Zip code) |

David Shladovsky, Esq.

KA Fund Advisors, LLC, 717 Texas Avenue, Suite 3100, Houston, Texas 77002

(Name and address of agent for service)

Registrant’s telephone number, including area code: (713) 493-2020

Date of fiscal year end: November 30, 2013

Date of reporting period: May 31, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The report of Kayne Anderson Energy Development Company (the “Registrant”) to stockholders for the semi-annual period ended May 31, 2013 is attached below.

Energy Development Company

KED Semi-Annual Report

May 31, 2013

CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS: This report of Kayne Anderson Energy Development Company (the “Company”) contains “forward-looking statements” as defined under the U.S. federal securities laws. Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “will” and similar expressions identify forward-looking statements, which generally are not historical in nature. Forward-looking statements are subject to certain risks and uncertainties that could cause actual results to materially differ from the Company’s historical experience and its present expectations or projections indicated in any forward-looking statements. These risks include, but are not limited to, changes in economic and political conditions; regulatory and legal changes; master limited partnership (“MLP”) industry risk; leverage risk; valuation risk; interest rate risk; tax risk; and other risks discussed in the Company’s filings with the Securities and Exchange Commission (“SEC”). You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. The Company undertakes no obligation to update or revise any forward-looking statements made herein. There is no assurance that the Company’s investment objectives will be attained.

KAYNE ANDERSON ENERGY DEVELOPMENT COMPANY

MANAGEMENT DISCUSSION

(UNAUDITED)

Company Overview

Kayne Anderson Energy Development Company is a non-diversified, closed-end management investment company organized under the laws of the State of Maryland. We are a taxable corporation, paying federal and applicable state taxes on our taxable income. Our operations are externally managed and advised by our investment adviser, KA Fund Advisors, LLC (“KAFA” or the “Adviser”), pursuant to an investment management agreement. Our investment objective is to generate both current income and capital appreciation primarily through equity and debt investments. We seek to achieve this objective by investing at least 80% of our total assets in securities of Energy Companies. A key focus area for our investments is equity and debt investments in private and public entities structured as limited partnerships (“MLPs”). We also own equity and debt investments in Upstream, Midstream and Other Energy Companies (as such terms are defined in Note 1 — Organization).

As of May 31, 2013, we had total assets of $391 million, net assets of $276 million (net asset value of $26.44 per share), and 10.4 million shares of common stock outstanding. As of May 31, 2013, we held $351 million in equity investments and $31 million in debt investments.

Recent Events

On May 14, 2013, Emerge Energy Services LP (“Emerge”) completed its initial public offering (“IPO”) and trades on the New York Stock Exchange (“NYSE”) under the ticker “EMES.” Emerge is a variable-pay MLP involved in fuel wholesaling, transmix processing and frac sand production. Emerge was formed when the Company’s prior investment, Direct Fuels Partners, L.P. (“Direct Fuels”), combined with two other private companies. As a result of the IPO, we received $23.1 million in cash and 1.7 million Emerge common units.

Results of Operations — For the Three Months Ended May 31, 2013

Investment Income. Investment income totaled $1.6 million for the quarter and consisted primarily of net dividends and distributions and interest income on our debt investments. We received $5.6 million of dividends and distributions during the quarter, of which $4.7 million was treated as a return of capital. Interest income was $0.7 million. We received $0.2 million of paid-in-kind dividends during the quarter, which are not included in investment income but are reflected as an unrealized gain, and $0.6 million of non-cash distributions from VantaCore Partners LP (“VantaCore”) that is included in investment income.

Operating Expenses. Operating expenses totaled $2.6 million, including $1.6 million of investment management fees, $0.6 million of interest expense and $0.4 million of other operating expenses. Interest expense included $0.1 million of amortization of debt issuance costs.

Net Investment Loss. Our net investment loss totaled $0.6 million and included a current income tax benefit of $0.02 million and a deferred income tax benefit of $0.4 million.

Net Realized Losses. We had net realized losses from investments of $4.5 million, after taking into account a deferred income tax benefit of $1.6 million and a current income tax benefit of $1.0 million.

Net Change in Unrealized Gains. We had a net change in unrealized gains of $26.0 million. The net change consisted of $41.1 million of unrealized gains from investments and a deferred income tax expense of $15.1 million.

Net Increase in Net Assets Resulting from Operations. We had an increase in net assets resulting from operations of $20.8 million. This increase was comprised of net investment loss of $0.6 million, net realized losses of $4.5 million and net unrealized gains of $26.0 million, as noted above.

1

KAYNE ANDERSON ENERGY DEVELOPMENT COMPANY

MANAGEMENT DISCUSSION

(UNAUDITED)

Distributions to Common Stockholders

We pay quarterly distributions to our common stockholders, funded generally by net distributable income (“NDI”) generated from our portfolio investments. NDI is the amount of income received by us from our portfolio investments less operating expenses, subject to certain adjustments as described below. NDI is not a financial measure under the accounting principles generally accepted in the United States of America (“GAAP”). Refer to the “Reconciliation of NDI to GAAP” section below for a reconciliation of this measure to our results reported under GAAP.

Income from portfolio investments includes (a) cash dividends and distributions, (b) paid-in-kind dividends or non-cash distributions received, and (c) interest income from debt securities and commitment fees from private investments in public equity (“PIPE investments”).

Operating expenses include (a) investment management fees paid to KAFA, (b) other expenses (mostly comprised of fees paid to other service providers) and (c) interest expense.

Net Distributable Income (NDI)

(amounts in millions, except for per share amounts)

| | | | |

| | | Three Months

Ended

May 31,

2013 | |

Distributions and Other Income from Investments | | | | |

Dividends and Distributions | | $ | 5.1 | |

Paid-In-Kind Dividends and Non-Cash Distributions(1) | | | 0.8 | |

Cash Interest and Other Income | | | 0.7 | |

| | | | |

Total Distributions and Other Income from Investments | | | 6.6 | |

Expenses | | | | |

Investment Management Fee | | | (1.6 | ) |

Other Expenses | | | (0.4 | ) |

Interest Expense | | | (0.5 | ) |

| | | | |

Net Distributable Income (NDI) | | $ | 4.1 | |

| | | | |

Weighted Average Shares Outstanding | | | 10.4 | |

NDI per Weighted Average Share Outstanding | | $ | 0.39 | |

| | | | |

Adjusted NDI per Weighted Average Share Outstanding(2)(3) | | $ | 0.45 | |

| | | | |

Distributions paid per Common Share(4) | | $ | 0.44 | |

| (1) | Includes $0.2 million of paid-in-kind dividends from Buckeye Partners, L.P. (Class B Units) and Kinder Morgan Management, LLC and $0.6 million of non-cash distributions from VantaCore common and Preferred A units. |

| (2) | As a result of the IPO of Emerge on May 14, 2013, we did not receive a distribution from Direct Fuels with respect to the first calendar quarter, which normally would have been paid in mid-May. Instead, we received cash proceeds from the IPO, a portion of which is attributable to the distribution which would have been paid in mid-May. As a result, Adjusted NDI includes $1.1 million of cash proceeds from the IPO, which represents the minimum quarterly distribution multiplied by the Direct Fuels common units owned by us during the first quarter. |

| (3) | Adjusted to exclude $0.6 million of non-cash distributions from VantaCore common and Preferred A units. |

| (4) | The distribution of $0.44 per share for the second quarter of fiscal 2013 was paid on July 19, 2013 to common stockholders of record on July 12, 2013. |

2

KAYNE ANDERSON ENERGY DEVELOPMENT COMPANY

MANAGEMENT DISCUSSION

(UNAUDITED)

Payment of future distributions is subject to Board of Directors approval, as well as meeting the covenants of our credit facility. In determining our quarterly distribution to common stockholders, our Board of Directors considers a number of factors which include, but are not limited to:

| | • | | NDI and Adjusted NDI generated in the current quarter; |

| | • | | Expected NDI and Adjusted NDI over the next twelve months; |

| | • | | The extent to which NDI and Adjusted NDI is comprised of paid-in-kind dividends or non-cash interest and distributions; |

| | • | | The impact of potential liquidity events at our portfolio companies; and |

| | • | | Realized and unrealized gains generated by the portfolio. |

Reconciliation of NDI to GAAP

The difference between distributions and other income from investments in the NDI calculation and total investment income as reported in our Statement of Operations is reconciled as follows:

| | • | | GAAP recognizes that a significant portion of the cash distributions received from MLPs is characterized as a return of capital and therefore excluded from investment income, whereas the NDI calculation includes the return of capital portion of such distributions. |

| | • | | NDI includes the value of paid-in-kind dividends, whereas such amounts are not included as investment income for GAAP purposes during the period received, but rather are recorded as unrealized gains upon receipt. |

| | • | | NDI includes commitment fees from PIPE investments, whereas such amounts are generally not included in investment income for GAAP purposes, but rather are recorded as a reduction to the cost of the investment. |

| | • | | Certain of our investments in debt securities were purchased at a discount or premium to the par value of such security. When making such investments, we consider the security’s yield to maturity, which factors in the impact of such discount (or premium). Interest income reported under GAAP includes the non-cash accretion of the discount (or amortization of the premium) based on the effective interest method. When we calculate interest income for purposes of determining NDI, in order to better reflect the yield to maturity, the accretion of the discount (or amortization of the premium) is calculated on a straight-line basis to the earlier of the expected call date or the maturity date of the debt security. |

The treatment of expenses included in NDI also differs from what is reported in the Statement of Operations as follows:

| | • | | The non-cash amortization or write-offs of capitalized debt issuance costs related to our debt financings is included in interest expense for GAAP purposes, but is excluded from our calculation of NDI. |

Liquidity and Capital Resources

As of May 31, 2013, our amended and restated senior secured revolving credit facility (the “Credit Facility”) had a total commitment amount of $95.0 million. On March 11, 2013, we amended our Credit Facility to add a new lender to the syndicate and to increase the total commitment amount by $10.0 million to $95.0 million. All other terms of the Credit Facility, including its maturity date of March 30, 2014, remained the same. Outstanding loan balances under the Credit Facility accrue interest at an annual rate equal to LIBOR plus 2.00% based on the current borrowings and the current borrowing base. If borrowings exceed the borrowing base attributable to “quoted” securities (generally defined as equity investments in public MLPs and midstream companies and investments in bank debt and high yield bonds that are traded), the interest rate will increase to LIBOR plus 3.00%. We pay a commitment fee of 0.50% per annum on any unused amounts of the Credit Facility. A full copy of our Credit Facility is available on our website, www.kaynefunds.com.

3

KAYNE ANDERSON ENERGY DEVELOPMENT COMPANY

MANAGEMENT DISCUSSION

(UNAUDITED)

The maximum amount that we can borrow under our Credit Facility is limited to the lesser of our commitment amount of $95.0 million and our borrowing base. Our borrowing base, subject to certain limitations, is generally calculated by multiplying the fair value of each of our investments by an advance rate. The total contribution to our borrowing base from private MLPs is limited to no more than 25% of the total borrowing base, and there is a $9.5 million limit on the borrowing base contribution from any single issuer.

As of May 31, 2013, we had $60.0 million of borrowings under our Credit Facility (at an interest rate of 2.20%), which represented 33.8% of our borrowing base of $177.4 million (35.0% of our borrowing base of $171.6 million attributable to quoted securities). At May 31, 2013, our asset coverage ratio under the Investment Company Act of 1940, as amended (the “1940 Act”), was 560%.

As of July 25, 2013, we had $82.0 million borrowed under our Credit Facility (at an interest rate of 2.20%), and we had $1.1 million of cash. Our borrowings represented 43.9% of our borrowing base of $186.7 million (45.4% of our borrowing base of $180.5 million attributable to quoted securities).

4

KAYNE ANDERSON ENERGY DEVELOPMENT COMPANY

PORTFOLIO SUMMARY

(UNAUDITED)

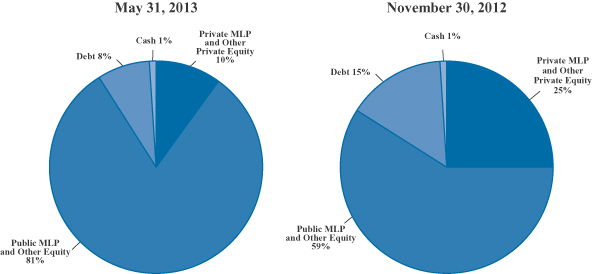

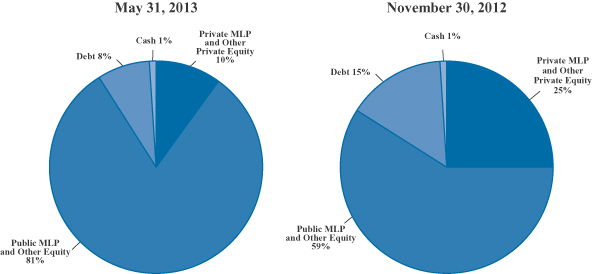

Portfolio Investments by Category

Top 10 Holdings by Issuer

| | | | | | | | | | | | | | | | | | | | | | |

| | | Public/ Private | | Equity/ Debt | | | | Percent of Total

Investments* as of

|

| Holding | | | | Sector | | May 31,

2013 | | November 30,

2012 |

1. Emerge Energy Services LP(1) | | Public | | Equity | | Other | | | | 7.5 | % | | | | 13.3 | % |

2. VantaCore Partners LP | | Private | | Equity | | Aggregates | | | | 7.1 | | | | | 7.5 | |

3. Enterprise Products Partners L.P. | | Public | | Equity | | Midstream | | | | 5.2 | | | | | 5.2 | |

4. Crestwood Holdings Partners, LLC | | Private | | Debt | | Midstream | | | | 4.6 | | | | | 4.3 | |

5. DCP Midstream Partners, LP | | Public | | Equity | | Midstream | | | | 4.4 | | | | | 3.0 | |

6. MarkWest Energy Partners, L.P. | | Public | | Equity | | Midstream | | | | 4.3 | | | | | 2.0 | |

7. Regency Energy Partners LP | | Public | | Equity | | Midstream | | | | 3.9 | | | | | 3.9 | |

8. Energy Transfer Partners, L.P. | | Public | | Equity | | Midstream | | | | 3.6 | | | | | 1.3 | |

9. Buckeye Partners, L.P. | | Public | | Equity | | Midstream | | | | 3.4 | | | | | 3.0 | |

10. ONEOK Partners, L.P. | | Public | | Equity | | Midstream | | | | 3.3 | | | | | 3.2 | |

| * | Includes cash and repurchase agreement (if any). |

| (1) | As of November 30, 2012, our private investment in Direct Fuels represented 13.3% of total investments. Direct Fuels combined with two other private companies to form Emerge on May 14, 2013. |

5

KAYNE ANDERSON ENERGY DEVELOPMENT COMPANY

SCHEDULE OF INVESTMENTS

MAY 31, 2013

(amounts in 000’s) (UNAUDITED)

| | | | | | | | | | | | |

Description | | | | | | No. of

Shares/Units | | | Value | |

Long-Term Investments — 138.3% | | | | | | | | | | | | |

Equity Investments(1) — 127.1% | | | | | | | | | | | | |

Public MLP and Other Equity — 113.0% | | | | | | | | | | | | |

Access Midstream Partners, L.P. | | | 188 | | | $ | 8,090 | |

Alliance Holdings GP, L.P. | | | 66 | | | | 4,232 | |

Atlas Pipeline Partners, L.P. | | | 91 | | | | 3,397 | |

Buckeye Partners, L.P. | | | 93 | | | | 6,181 | |

Buckeye Partners, L.P. — Class B Units(2)(3) | | | 107 | | | | 6,912 | |

Capital Product Partners L.P. | | | 352 | | | | 3,232 | |

Capital Product Partners L.P. — Class B Units(3)(4) | | | 606 | | | | 5,949 | |

Crestwood Midstream Partners LP | | | 320 | | | | 7,908 | |

Crosstex Energy, L.P. | | | 300 | | | | 5,780 | |

DCP Midstream Partners, LP | | | 355 | | | | 16,958 | |

El Paso Pipeline Partners, L.P. | | | 199 | | | | 8,196 | |

Emerge Energy Services LP(3)(5)(6) | | | 1,684 | | | | 28,964 | |

Enbridge Energy Partners, L.P. | | | 220 | | | | 6,494 | |

Energy Transfer Equity, L.P. | | | 103 | | | | 5,861 | |

Energy Transfer Partners, L.P. | | | 286 | | | | 13,916 | |

Enterprise Products Partners L.P. | | | 341 | | | | 20,232 | |

Exterran Partners, L.P. | | | 249 | | | | 6,911 | |

Global Partners LP | | | 205 | | | | 6,736 | |

Inergy, L.P. | | | 200 | | | | 4,669 | |

Inergy Midstream, L.P. | | | 262 | | | | 5,894 | |

Kinder Morgan, Inc. | | | 38 | | | | 1,443 | |

Kinder Morgan Energy Partners, L.P | | | 6 | | | | 495 | |

Kinder Morgan Management, LLC(2) | | | 96 | | | | 7,814 | |

KNOT Offshore Partners LP(7) | | | 6 | | | | 128 | |

Legacy Reserves LP | | | 14 | | | | 363 | |

MarkWest Energy Partners, L.P.(6) | | | 256 | | | | 16,855 | |

Mid-Con Energy Partners, LP | | | 55 | | | | 1,273 | |

NuStar Energy L.P. | | | 18 | | | | 829 | |

ONEOK, Inc. | | | 28 | | | | 1,255 | |

ONEOK Partners, L.P. | | | 246 | | | | 12,719 | |

PetroLogistics LP | | | 65 | | | | 879 | |

Plains All American Pipeline, L.P.(6) | | | 206 | | | | 11,547 | |

PVR Partners, L.P.(6) | | | 366 | | | | 9,438 | |

Regency Energy Partners LP | | | 581 | | | | 14,905 | |

SandRidge Mississippian Trust II | | | 119 | | | | 1,499 | |

SandRidge Permian Trust | | | 115 | | | | 1,627 | |

Summit Midstream Partners, LP | | | 223 | | | | 6,963 | |

SunCoke Energy Partners, L.P. | | | 100 | | | | 2,126 | |

Targa Resources Partners LP | | | 116 | | | | 5,416 | |

Teekay LNG Partners L.P. | | | 27 | | | | 1,175 | |

Teekay Offshore Partners L.P. | | | 129 | | | | 4,171 | |

Tesoro Logistics LP | | | 68 | | | | 4,244 | |

USA Compression Partners, LP | | | 126 | | | | 2,785 | |

The Williams Companies, Inc. | | | 95 | | | | 3,353 | |

VOC Energy Trust | | | 68 | | | | 891 | |

See accompanying notes to financial statements.

6

KAYNE ANDERSON ENERGY DEVELOPMENT COMPANY

SCHEDULE OF INVESTMENTS

MAY 31, 2013

(amounts in 000’s) (UNAUDITED)

| | | | | | | | | | | | | | | | |

Description | | | | | | | | No. of

Shares/Units | | | Value | |

Public MLP and Other Equity — (continued) | | | | | | | | | | | | | | | | |

| | |

Western Gas Equity Partners, LP | | | | 19 | | | $ | 707 | |

Western Gas Partners, LP | | | | 159 | | | | 9,348 | |

Williams Partners L.P. | | | | 221 | | | | 11,016 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 311,776 | |

| | | | | | | | | | | | | | | | |

Private MLP and Other Private Equity(3)(6) — 14.1% | | | | | | | | | | | | | |

Plains All American GP LLC | | | | 3 | | | | 11,361 | |

VantaCore Partners LP — Common Units(2) | | | | 2,187 | | | | 19,681 | |

VantaCore Partners LP — Class A Preferred Units(2)(8) | | | | 334 | | | | 5,588 | |

VantaCore Partners LP — Class B Preferred Units(9) | | | | 133 | | | | 2,235 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 38,865 | |

| | | | | | | | | | | | | | | | |

Total Equity Investments (Cost $258,164) | | | | | | | | 350,641 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount | | | | |

Debt Investments — 11.2% | | | | | | | | | | | | | | | | |

Midstream — 6.5% | | | | | | | | | | | | | | | | |

Crestwood Holdings Partners, LLC | | | (10 | ) | | | 3/26/18 | | | $ | 13,782 | | | | 14,126 | |

Crestwood Holdings Partners, LLC | | | (11 | ) | | | 6/18/18 | | | | 3,750 | | | | 3,816 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 17,942 | |

| | | | | | | | | | | | | | | | |

Upstream — 1.2% | | | | | | | | | | | | | | | | |

Rex Energy Corporation | | | 8.875 | % | | | 12/1/20 | | | | 2,946 | | | | 3,160 | |

| | | | | | | | | | | | | | | | |

Other Energy — 3.5% | | | | | | | | | | | | | | | | |

ProPetro Services, Inc.(3)(12) | | | 10.000 | | | | 6/30/15 | | | | 9,754 | | | | 9,754 | |

| | | | | | | | | | | | | | | | |

Total Debt Investments (Cost $30,045) | | | | 30,856 | |

| | | | | | | | | | | | | | | | |

Total Long-Term Investments — 138.3% (Cost $288,209) | | | | 381,497 | |

| | | | | | | | | | | | | | | | |

Credit Facility | | | | (60,000 | ) |

Other Liabilities in Excess of Other Assets | | | | (45,668 | ) |

| | | | | | | | | | | | | | | | |

Net Assets | | | | | | | | | | | | | | $ | 275,829 | |

| | | | | | | | | | | | | | | | |

| (1) | Unless otherwise noted, equity investments are common units/common shares. |

| (2) | All or a portion of distributions are paid-in-kind. |

| (3) | Fair valued and restricted security. See Notes 2, 3 and 9 in Notes to Financial Statements. |

| (4) | Security is convertible on a one-for-one basis into common units of Capital Product Partners L.P. (“CPLP”) and is senior to the common units in terms of liquidation preference and priority of distributions. The Class B units pay quarterly cash distributions of $0.21375 per unit and are convertible at any time at the option of the holder. If CPLP increases the quarterly cash distribution per common unit, the distribution per Class B unit will increase by an equal amount. If CPLP does not redeem the Class B units by May 2022, then the distribution increases by 25% per quarter to a maximum of $0.33345 per unit. CPLP may require that the Class B units convert into common units after May 2015 if the common unit price exceeds $11.70 per unit, and the Class B units are callable after May 2017 at a price of $9.27 per unit and after May 2019 at $9.00 per unit. |

See accompanying notes to financial statements.

7

KAYNE ANDERSON ENERGY DEVELOPMENT COMPANY

SCHEDULE OF INVESTMENTS

MAY 31, 2013

(amounts in 000’s) (UNAUDITED)

| (5) | On May 14, 2013, Emerge Energy Services LP (“Emerge”) completed its initial public offering (“IPO”) and trades on the New York Stock Exchange (“NYSE”) under the ticker “EMES.” Emerge is a variable-pay MLP involved in fuel wholesaling, transmix processing and frac sand production. Emerge was formed when the Company’s prior investment, Direct Fuels Partners, L.P. (“Direct Fuels”), combined with two other private companies. As a result of the IPO, the Company received $23,110 in cash and 1,684 Emerge common units, which are subject to a six-month lockup. |

| (6) | The Company believes that it is an affiliate of Emerge, MarkWest Energy Partners, L.P., Plains All American GP LLC, Plains All American Pipeline, L.P., PVR Partners, L.P. and VantaCore Partners LP (“VantaCore”). See Note 6 — Agreements and Affiliations. |

| (7) | Security is not currently paying cash distributions, but is expected to pay cash distributions within the next 12 months. |

| (8) | The Class A Preferred Units have a liquidation preference of $17.50 per unit and were issued by VantaCore to holders of the Common and Class A Preferred Units to the extent that such units did not receive full cash distributions. The Class A Preferred Units have a minimum quarterly distribution of $0.475 per unit and are senior to VantaCore’s Common Units in liquidation preference. See Note 9 — Restricted Securities. |

| (9) | The Class B Preferred Units have a liquidation preference of $17.50 per unit and a minimum quarterly distribution of $0.3825 per unit and are senior to all other equity classes of VantaCore in distributions and liquidation preference. See Note 9 — Restricted Securities. |

| (10) | Floating rate first lien senior secured term loan. Security pays interest at a rate of LIBOR + 825 basis points with a 1.5% LIBOR floor (9.75% as of May 31, 2013). |

| (11) | Floating rate first lien secured term loan. Security pays interest at a rate of LIBOR + 600 basis points with a 1.0% LIBOR floor (7.00% as of May 31, 2013). |

| (12) | The First Lien Term B Loan matures on June 30, 2015 and pays interest in cash at a rate of 10.00% per annum. |

See accompanying notes to financial statements.

8

KAYNE ANDERSON ENERGY DEVELOPMENT COMPANY

STATEMENT OF ASSETS AND LIABILITIES

MAY 31, 2013

(amounts in 000’s, except share and per share amounts)

(UNAUDITED)

| | | | |

ASSETS | | | | |

Investments, at fair value: | | | | |

Non-affiliated (Cost — $210,276) | | $ | 275,829 | |

Affiliated (Cost — $77,933) | | | 105,668 | |

| | | | |

Total investments (Cost — $288,209) | | | 381,497 | |

Cash | | | 5,576 | |

Income tax receivable | | | 96 | |

Receivable for securities sold | | | 2,399 | |

Interest, dividends and distributions receivable | | | 413 | |

Debt issuance costs, prepaid expenses and other assets | | | 617 | |

| | | | |

Total Assets | | | 390,598 | |

| | | | |

| |

LIABILITIES | | | | |

Payable for securities purchased | | | 6,065 | |

Investment management fee payable | | | 1,656 | |

Accrued directors’ fees and expenses | | | 75 | |

Accrued expenses and other liabilities | | | 507 | |

Deferred income tax liability | | | 46,466 | |

Credit facility | | | 60,000 | |

| | | | |

Total Liabilities | | | 114,769 | |

| | | | |

NET ASSETS | | $ | 275,829 | |

| | | | |

NET ASSETS CONSIST OF | | | | |

Common stock, $0.001 par value (200,000,000 shares authorized; 10,430,545 shares issued and outstanding) | | $ | 10 | |

Paid-in capital | | | 201,546 | |

Accumulated net investment loss, net of income taxes, less dividends | | | (45,611 | ) |

Accumulated net realized gains on investments, net of income taxes | | | 61,204 | |

Net unrealized gains on investments, net of income taxes | | | 58,680 | |

| | | | |

NET ASSETS | | $ | 275,829 | |

| | | | |

NET ASSET VALUE PER SHARE | | $ | 26.44 | |

| | | | |

See accompanying notes to financial statements.

9

KAYNE ANDERSON ENERGY DEVELOPMENT COMPANY

STATEMENT OF OPERATIONS

(amounts in 000’s)

(UNAUDITED)

| | | | | | | | |

| | | For the Three

Months Ended

May 31, 2013 | | | For the Six

Months Ended

May 31, 2013 | |

INVESTMENT INCOME | | | | | | | | |

Income | | | | | | | | |

Dividends and distributions: | | | | | | | | |

Non-affiliated investments | | $ | 3,684 | | | $ | 6,684 | |

Affiliated investments | | | 1,949 | | | | 5,002 | |

| | | | | | | | |

Total dividends and distributions | | | 5,633 | | | | 11,686 | |

Return of capital | | | (4,731 | ) | | | (9,405 | ) |

| | | | | | | | |

Net dividends and distributions | | | 902 | | | | 2,281 | |

Interest and other income — non-affiliated investments | | | 698 | | | | 1,376 | |

Interest — affiliated investments | | | — | | | | 448 | |

| | | | | | | | |

Total Investment Income | | | 1,600 | | | | 4,105 | |

| | | | | | | | |

Expenses | | | | | | | | |

Investment management fees | | | 1,656 | | | | 3,194 | |

Professional fees | | | 152 | | | | 266 | |

Directors’ fees and expenses | | | 76 | | | | 151 | |

Insurance | | | 17 | | | | 34 | |

Administration fees | | | 21 | | | | 42 | |

Other expenses | | | 102 | | | | 205 | |

| | | | | | | | |

Total Expenses — Before Interest Expense | | | 2,024 | | | | 3,892 | |

Interest expense | | | 600 | | | | 1,142 | |

| | | | | | | | |

Total Expenses | | | 2,624 | | | | 5,034 | |

| | | | | | | | |

Net Investment Loss — Before Income Taxes | | | (1,024 | ) | | | (929 | ) |

Current income tax benefit | | | 20 | | | | — | |

Deferred income tax benefit | | | 370 | | | | 366 | |

| | | | | | | | |

Net Investment Loss | | | (634 | ) | | | (563 | ) |

| | | | | | | | |

REALIZED AND UNREALIZED GAINS (LOSSES) | | | | | | | | |

Net Realized Gains (Losses) | | | | | | | | |

Investments — non-affiliated | | | 5,283 | | | | 8,698 | |

Investments — affiliated | | | (12,443 | ) | | | (12,443 | ) |

Current income tax benefit | | | 1,033 | | | | — | |

Deferred income tax benefit | | | 1,602 | | | | 1,378 | |

| | | | | | | | |

Net Realized Losses | | | (4,525 | ) | | | (2,367 | ) |

| | | | | | | | |

Net Change in Unrealized Gains | | | | | | | | |

Investments — non-affiliated | | | 16,041 | | | | 32,084 | |

Investments — affiliated | | | 25,083 | | | | 31,373 | |

Deferred income tax expense | | | (15,133 | ) | | | (23,352 | ) |

| | | | | | | | |

Net Change in Unrealized Gains | | | 25,991 | | | | 40,105 | |

| | | | | | | | |

Net Realized and Unrealized Gains | | | 21,466 | | | | 37,738 | |

| | | | | | | | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 20,832 | | | $ | 37,175 | |

| | | | | | | | |

See accompanying notes to financial statements.

10

KAYNE ANDERSON ENERGY DEVELOPMENT COMPANY

STATEMENT OF CHANGES IN NET ASSETS

(amounts in 000’s, except share amounts)

| | | | | | | | |

| | | For the Six

Months Ended

May 31,

2013

(Unaudited) | | | For the Fiscal

Year Ended

November 30,

2012 | |

OPERATIONS | | | | | | | | |

Net investment income (loss) | | $ | (563 | ) | | $ | 808 | |

Net realized gains (losses) | | | (2,367 | ) | | | 9,885 | |

Net change in unrealized gains | | | 40,105 | | | | 13,630 | |

| | | | | | | | |

Net Increase in Net Assets Resulting from Operations | | | 37,175 | | | | 24,323 | |

| | | | | | | | |

DIVIDENDS AND DISTRIBUTIONS | | | | | | | | |

Dividends | | | — | (1) | | | (16,794 | )(2) |

Distributions — return of capital | | | (9,006 | )(1) | | | — | (2) |

| | | | | | | | |

Dividends and Distributions | | | (9,006 | ) | | | (16,794 | ) |

| | | | | | | | |

CAPITAL STOCK TRANSACTIONS | | | | | | | | |

Issuance of 25,415 and 62,400 shares of common stock from reinvestment of dividends and distributions | | | 643 | | | | 1,458 | |

| | | | | | | | |

Total Increase in Net Assets | | | 28,812 | | | | 8,987 | |

| | | | | | | | |

NET ASSETS | | | | | | | | |

Beginning of period | | | 247,017 | | | | 238,030 | |

| | | | | | | | |

End of period | | $ | 275,829 | | | $ | 247,017 | |

| | | | | | | | |

| (1) | This is an estimate of the characterization of the distributions paid to common stockholders for the six months ended May 31, 2013 as either a dividend (eligible to be treated as qualified dividend income) or distribution (return of capital). This estimate is based solely on the Company’s operating results during the period and does not reflect the expected results during the fiscal year. The actual characterization of the common stock distributions made during the current year will not be determinable until after the end of the fiscal year when the Company can determine earnings and profits. Therefore, the characterization may differ from the preliminary estimates. |

| (2) | Distributions paid to common stockholders for the fiscal year ended November 30, 2012 are characterized as either a dividend (eligible to be treated as qualified dividend income) or distribution (return of capital). This characterization is based on the Company’s earnings and profits. |

See accompanying notes to financial statements.

11

KAYNE ANDERSON ENERGY DEVELOPMENT COMPANY

STATEMENT OF CASH FLOWS

FOR THE SIX MONTHS ENDED MAY 31, 2013

(amounts in 000’s) (UNAUDITED)

| | | | |

CASH FLOWS FROM OPERATING ACTIVITIES | | | | |

Net increase in net assets resulting from operations | | $ | 37,175 | |

Adjustments to reconcile net increase in net assets resulting from operations to net cash provided by operating activities: | | | | |

Return of capital distributions | | | 9,405 | |

Net realized losses on investments | | | 3,745 | |

Net unrealized gains on investments | | | (63,457 | ) |

Amortization of bond premium, net | | | 18 | |

Purchase of long-term investments | | | (78,985 | ) |

Proceeds from sale of long-term investments | | | 83,366 | |

Increase in income tax receivable | | | (96 | ) |

Decrease in receivable for securities sold | | | 3,050 | |

Decrease in interest, dividends and distributions receivable | | | 219 | |

Decrease in other receivable | | | 2,900 | |

Amortization of deferred debt issuance costs | | | 219 | |

Decrease in prepaid expenses and other assets | | | 2 | |

Increase in payable for securities purchased | | | 5,506 | |

Increase in investment management fee payable | | | 146 | |

Decrease in accrued directors’ fees and expenses | | | (3 | ) |

Decrease in accrued expenses and other liabilities | | | (66 | ) |

Decrease in current income tax liability | | | (460 | ) |

Increase in deferred income tax liability | | | 21,607 | |

| | | | |

Net Cash Provided by Operating Activities | | | 24,291 | |

| | | | |

CASH FLOWS FROM FINANCING ACTIVITIES | | | | |

Repayment of credit facility | | | (12,000 | ) |

Cash distributions paid to stockholders | | | (8,363 | ) |

| | | | |

Net Cash Used in Financing Activities | | | (20,363 | ) |

| | | | |

NET INCREASE IN CASH | | | 3,928 | |

CASH — BEGINNING OF PERIOD | | | 1,648 | |

| | | | |

CASH — END OF PERIOD | | $ | 5,576 | |

| | | | |

Supplemental disclosure of cash flow information:

Non-cash financing activities not included herein consisted of reinvestment of distributions pursuant to the Company’s dividend reinvestment plan of $643 for the six months ended May 31, 2013.

During the six months ended May 31, 2013, there were $643 of federal income taxes paid and $87 of state income tax refunds, net of payments. Interest paid was $927.

During the six months ended May 31, 2013, the Company received $461 of paid-in-kind dividends, $1,247 of non-cash distributions and $448 of paid-in-kind interest. See Note 2 — Investment Income.

See accompanying notes to financial statements.

12

KAYNE ANDERSON ENERGY DEVELOPMENT COMPANY

FINANCIAL HIGHLIGHTS

(amounts in 000’s, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the

Six Months

Ended

May 31,

2013

(Unaudited) | | | For the Fiscal Year Ended

November 30, | | | For the

Period

September 21,

2006

through

November 30,

2006 | |

| | | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | | |

Per Share of Common Stock(1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 23.74 | | | $ | 23.01 | | | $ | 20.56 | | | $ | 16.58 | | | $ | 16.10 | | | $ | 23.95 | | | $ | 24.03 | | | $ | 23.32 | |

Net investment income (loss) | | | (0.05 | ) | | | 0.08 | | | | 0.25 | | | | (0.18 | ) | | | 0.10 | | | | 0.09 | | | | 0.08 | | | | (0.07 | ) |

Net realized and unrealized gain (loss) on investments | | | 3.62 | | | | 2.27 | | | | 3.60 | | | | 5.39 | | | | 1.68 | | | | (5.89 | ) | | | 1.18 | | | | 0.78 | |

Net change in unrealized losses — conversion to taxable corporation | | | — | | | | — | | | | — | | | | — | | | | — | | | | (0.38 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total income (loss) from investment operations | | | 3.57 | | | | 2.35 | | | | 3.85 | | | | 5.21 | | | | 1.78 | | | | (6.18 | ) | | | 1.26 | | | | 0.71 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends(2) | | | — | | | | (1.62 | ) | | | (1.37 | ) | | | (0.51 | ) | | | — | | | | — | | | | (0.95 | ) | | | — | |

Distributions from net realized long-term capital gains(2)(3) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (0.15 | ) | | | — | |

Distributions — return of capital(2) | | | (0.87 | ) | | | — | | | | — | | | | (0.69 | ) | | | (1.30 | ) | | | (1.67 | ) | | | (0.24 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total dividends and distributions | | | (0.87 | ) | | | (1.62 | ) | | | (1.37 | ) | | | (1.20 | ) | | | (1.30 | ) | | | (1.67 | ) | | | (1.34 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Effect of shares issued in reinvestment of distributions | | | — | | | | — | | | | (0.03 | ) | | | (0.03 | ) | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 26.44 | | | $ | 23.74 | | | $ | 23.01 | | | $ | 20.56 | | | $ | 16.58 | | | $ | 16.10 | | | $ | 23.95 | | | $ | 24.03 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Market value per share, end of period | | $ | 25.51 | | | $ | 26.01 | | | $ | 20.21 | | | $ | 18.21 | | | $ | 13.53 | | | $ | 9.63 | | | $ | 23.14 | | | $ | 22.32 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total investment return based on market value(4) | | | 1.5 | %(5) | | | 37.8 | % | | | 19.3 | % | | | 45.8 | % | | | 56.0 | % | | | (54.8 | )% | | | 9.3 | % | | | (10.7 | )%(5) |

See accompanying notes to financial statements.

13

KAYNE ANDERSON ENERGY DEVELOPMENT COMPANY

FINANCIAL HIGHLIGHTS

(amounts in 000’s, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the

Six Months

Ended

May 31,

2013

(Unaudited) | | | For the Fiscal Year Ended

November 30, | | | For the

Period

September 21,

2006

through

November 30,

2006 | |

| | | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | | |

Supplemental Data and Ratios(6) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period | | $ | 275,829 | | | $ | 247,017 | | | $ | 238,030 | | | $ | 211,041 | | | $ | 168,539 | | | $ | 162,687 | | | $ | 240,758 | | | $ | 240,349 | |

Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Management fees | | | 2.4 | % | | | 2.4 | % | | | 2.4 | % | | | 2.1 | % | | | 2.0 | % | | | 0.4 | % | | | 3.1 | % | | | 2.4 | % |

Other expenses | | | 0.5 | | | | 0.6 | | | | 0.7 | | | | 1.0 | | | | 1.3 | | | | 1.1 | | | | 0.9 | | | | 1.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Subtotal | | | 2.9 | | | | 3.0 | | | | 3.1 | | | | 3.1 | | | | 3.3 | | | | 1.5 | | | | 4.0 | | | | 3.7 | |

Interest expense | | | 0.9 | | | | 0.9 | | | | 0.8 | | | | 0.9 | | | | 0.8 | | | | 2.0 | | | | 1.0 | | | | — | |

Management fee waivers | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (0.4 | ) | | | (0.5 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses (excluding tax expense) | | | 3.8 | | | | 3.9 | | | | 3.9 | | | | 4.0 | | | | 4.1 | | | | 3.5 | | | | 4.6 | | | | 3.2 | |

Tax expense | | | 16.2 | | | | 5.6 | | | | 10.0 | | | | 16.3 | | | | 6.9 | | | | — | (7) | | | 0.8 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total expenses(8) | | | 20.0 | % | | | 9.5 | % | | | 13.9 | % | | | 20.3 | % | | | 11.0 | % | | | 3.5 | % | | | 5.4 | % | | | 3.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Ratio of net investment income (loss) to average net assets | | | (0.4 | )% | | | 0.3 | % | | | 1.1 | % | | | (1.0 | )% | | | 0.7 | % | | | 0.4 | % | | | 0.3 | % | | | (0.3 | )% |

Net increase (decrease) in net assets resulting from operations to average net assets | | | 13.9 | %(5) | | | 9.9 | % | | | 17.1 | % | | | 28.3 | % | | | 11.3 | % | | | (29.5 | )% | | | 5.1 | % | | | 3.0 | %(5) |

Portfolio turnover rate | | | 21.8 | %(5) | | | 34.6 | % | | | 68.1 | % | | | 33.4 | % | | | 20.9 | % | | | 27.0 | % | | | 28.8 | % | | | 5.6 | %(5) |

Average net assets | | $ | 267,627 | | | $ | 246,183 | | | $ | 231,455 | | | $ | 188,307 | | | $ | 160,847 | | | $ | 211,531 | | | $ | 246,468 | | | $ | 234,537 | |

Average shares of common stock outstanding | | | 10,416,348 | | | | 10,372,215 | | | | 10,301,878 | | | | 10,212,289 | | | | 10,116,071 | | | | 10,073,398 | | | | 10,014,496 | | | | 10,000,060 | |

Average amount of borrowings outstanding under the credit facility | | $ | 76,385 | | | $ | 78,180 | | | $ | 62,559 | | | $ | 54,956 | | | $ | 53,422 | | | $ | 75,563 | | | $ | 32,584 | | | | — | |

Asset coverage of total debt(9) | | | 559.7 | % | | | 443.1 | % | | | 409.1 | % | | | 470.2 | % | | | n/a | | | | n/a | | | | n/a | | | | n/a | |

Average amount of borrowings outstanding per share of common stock during the period | | $ | 7.33 | | | $ | 7.54 | | | $ | 6.07 | | | $ | 5.38 | | | $ | 5.28 | | | $ | 7.50 | | | $ | 3.25 | | | | — | |

See accompanying notes to financial statements.

14

KAYNE ANDERSON ENERGY DEVELOPMENT COMPANY

FINANCIAL HIGHLIGHTS

(amounts in 000’s, except share and per share amounts)

| (1) | Based on average shares of common stock outstanding. |

| (2) | The information presented for the six months ended May 31, 2013 is an estimate of the characterization of the distribution paid and is based on the Company’s operating results during the period. The information presented in each of the other periods is a characterization of a portion of the total distributions paid to common stockholders as either dividends (eligible to be treated as qualified dividend income) or distributions (long-term capital gains or return of capital) and is based on the Company’s earnings and profits. |

| (3) | For the fiscal year ended November 30, 2007 and prior periods, the Company was treated as a regulated investment company under the U.S. Internal Revenue Code of 1986, as amended. Since December 1, 2007, the Company has been taxed as a corporation, and, as a result, the categorization of distributions from net realized long-term capital gains is no longer applicable. |

| (4) | Total investment return is calculated assuming a purchase of common stock at the market price on the first day and a sale at the current market price on the last day of the period reported. The calculation also assumes reinvestment of distributions, if any, at actual prices pursuant to the Company’s dividend reinvestment plan. |

| (6) | Unless otherwise noted, ratios are annualized. |

| (7) | For the fiscal year ended November 30, 2008, the Company accrued deferred income tax benefits of $33,264 (15.5% of average net assets) primarily related to unrealized losses on investments. Realization of the deferred tax benefit was dependent on whether there was sufficient taxable income of the appropriate character within the carryforward periods to realize a portion or all of the deferred tax benefit. Because it could not have been predicted whether the Company would incur a benefit in the future, a deferred income tax expense of 0% was assumed. |

| (8) | For the fiscal year ended November 30, 2008, total expenses exclude 0.4% relating to bad debt expense for the ratio of expenses to average net assets. |

| (9) | Calculated pursuant to section 18(a)(1)(A) of the 1940 Act. Represents the value of total assets less all liabilities not represented by senior securities representing indebtedness divided by senior securities representing indebtedness. Under the 1940 Act, the Company may not declare or make any distribution on its common stock nor can it incur additional indebtedness if at the time of such declaration or incurrence its asset coverage with respect to senior securities representing indebtedness would be less than 300%. For purposes of this test, the Credit Facility is considered a senior security representing indebtedness. Prior to July 7, 2010, the Company was a business development company under the 1940 Act and not subject to the requirements of section 18(a)(1)(A) for the asset coverage of total debt disclosure. |

15

See accompanying notes to financial statements.

KAYNE ANDERSON ENERGY DEVELOPMENT COMPANY

NOTES TO FINANCIAL STATEMENTS

(amounts in 000’s, except share and per share amounts)

(UNAUDITED)

Kayne Anderson Energy Development Company (the “Company”) was organized as a Maryland corporation on May 24, 2006. The Company is an externally managed, non-diversified closed-end management investment company. The Company commenced investment operations on September 21, 2006. The Company’s shares of common stock are listed on the New York Stock Exchange (“NYSE”) under the symbol “KED.” Prior to November 30, 2007, the Company was treated as a regulated investment company (“RIC”) under the U.S. Internal Revenue Code of 1986, as amended. Since December 1, 2007, the Company has been taxed as a corporation. See Note 4 — Income Taxes.

The Company’s investment objective is to generate both current income and capital appreciation primarily through equity and debt investments. The Company seeks to achieve this objective by investing at least 80% of its total assets in securities of companies that derive the majority of their revenue from activities in the energy industry (“Energy Companies”), including: (a) Midstream Energy Companies, which are businesses that operate assets used to gather, transport, process, treat, terminal and store natural gas, natural gas liquids, propane, crude oil or refined petroleum products; (b) Upstream Energy Companies, which are businesses engaged in the exploration, extraction and production of natural resources, including natural gas, natural gas liquids and crude oil, from onshore and offshore geological reservoirs; and (c) Other Energy Companies, which are businesses engaged in owning, leasing, managing, producing, processing and selling of coal and coal reserves; the marine transportation of crude oil, refined petroleum products, liquefied natural gas, as well as other energy-related natural resources using tank vessels and bulk carriers; and refining, marketing and distributing refined energy products, such as motor gasoline and propane, to retail customers and industrial end-users. A majority of the Company’s investments are in entities structured as master limited partnerships (“MLPs”), including both publicly-traded MLPs and private MLPs, which are structured much like publicly-traded MLPs.

| 2. | Significant Accounting Policies |

A. Use of Estimates — The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the period. Actual results could differ materially from those estimates.

B. Cash and Cash Equivalents — Cash and cash equivalents include short-term, liquid investments with an original maturity of three months or less and include money market fund accounts.

C. Calculation of Net Asset Value — The Company determines its net asset value no less frequently than as of the last day of each quarter based on the most recent close of regular session trading on the NYSE, and makes its net asset value available for publication quarterly. Net asset value is computed by dividing the value of the Company’s assets (including accrued interest and distributions and current and deferred income tax assets), less all of its liabilities (including accrued expenses, distributions payable, current and deferred accrued income taxes, and any borrowings) by the total number of common shares outstanding.

As of June 30, 2013, the Company began providing adjusted net asset value on a monthly basis for those months that do not constitute the end of a fiscal quarter. The Company’s adjusted net asset value is a non-GAAP measure and is intended to provide investors with a monthly update on the impact of prices changes for the public securities in the Company’s portfolio. Adjusted net asset value is calculated based on the same methodology as net asset value and incorporates updated values for the publicly-traded equity securities (including PIPE investments) and quoted debt investments in the Company’s portfolio, including any related income tax impact. The Company’s adjusted net asset value calculation incorporates the Company’s month end balance sheet (including borrowings on its credit facility and accruals related to operating and administration

16

KAYNE ANDERSON ENERGY DEVELOPMENT COMPANY

NOTES TO FINANCIAL STATEMENTS

(amounts in 000’s, except share and per share amounts)

(UNAUDITED)

expenses), but does not update the value of the non-traded securities in its portfolio (i.e., equity or non-traded debt investments in private companies).

D. Investment Valuation — Readily marketable portfolio securities listed on any exchange other than the NASDAQ Stock Market, Inc. (“NASDAQ”) are valued, except as indicated below, at the last sale price on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean of the most recent bid and ask prices on such day. Securities admitted to trade on the NASDAQ are valued at the NASDAQ official closing price. Portfolio securities traded on more than one securities exchange are valued at the last sale price on the business day as of which such value is being determined at the close of the exchange representing the principal market for such securities.

Equity securities traded in the over-the-counter market, but excluding securities admitted to trading on the NASDAQ, are valued at the closing bid prices. Debt securities that are considered bonds are valued by using the mean of the bid and ask prices provided by an independent pricing service. For debt securities that are considered bank loans, the fair market value is determined by using the mean of the bid and ask prices provided by the agent or syndicate bank or principal market maker. When price quotes are not available, fair market value will be based on prices of comparable securities. In certain cases, the Company may not be able to purchase or sell debt securities at the quoted prices due to the lack of liquidity for these securities.

Exchange-traded options and futures contracts are valued at the last sale price at the close of trading in the market where such contracts are principally traded or, if there was no sale on the applicable exchange on such day, at the mean between the quoted bid and ask price as of the close of trading on such exchange.

The Company holds securities that are privately issued or otherwise restricted as to resale. For these securities, as well as any other portfolio security held by the Company for which reliable market quotations are not readily available, valuations are determined in a manner that most accurately reflects fair value of the security on the valuation date. Unless otherwise determined by the Board of Directors, the following valuation process is used for such securities:

| | • | | Investment Team Valuation. The applicable investments are valued by senior professionals of KA Fund Advisors, LLC (“KAFA” or the “Adviser”) who are responsible for the portfolio investments. |

| | • | | Investment Team Valuation Documentation. Preliminary valuation conclusions will be determined by senior management of KAFA. Such valuations are submitted to the Valuation Committee (a committee of the Company’s Board of Directors) on a quarterly basis. |

| | • | | Valuation Committee. The Valuation Committee meets each quarter to consider valuations presented by KAFA, which were made in accordance with valuation procedures adopted by the Board of Directors in such quarter. The Valuation Committee’s valuation determinations are subject to ratification by the Board of Directors at its next regular meeting. |

| | • | | Valuation Firm. On a quarterly basis, a third-party valuation firm engaged by the Board of Directors reviews the valuation methodologies and calculations employed for these securities. The independent valuation firm provides third-party valuation consulting services to the Board of Directors, which consist of certain limited procedures that the Company identified and requested them to perform. As of May 31, 2013, the independent valuation firm performed limited procedures on investments in six portfolio companies comprising approximately 23.2% of total assets. Upon completion of the limited procedures, the independent valuation firm concluded that the fair value of those investments subjected to the limited procedures appeared reasonable. |

| | • | | Board of Directors Determination. The Board of Directors meets quarterly to consider the valuations provided by KAFA and the Valuation Committee, if applicable, and ratify valuations for the applicable |

17

KAYNE ANDERSON ENERGY DEVELOPMENT COMPANY

NOTES TO FINANCIAL STATEMENTS

(amounts in 000’s, except share and per share amounts)

(UNAUDITED)

| | securities. The Board of Directors considers the report provided by the third-party valuation firm in reviewing and determining in good faith the fair value of the applicable portfolio securities. |

At May 31, 2013, the Company held 32.8% of its net assets applicable to common stockholders (23.2% of total assets) in securities that were fair valued pursuant to the procedures adopted by the Board of Directors. The aggregate fair value of these securities at May 31, 2013 was $90,444. See Note 3 — Fair Value and Note 9 — Restricted Securities.

E. Repurchase Agreements — From time to time, the Company has agreed to purchase securities from financial institutions subject to the seller’s agreement to repurchase them at an agreed-upon time and price (“repurchase agreements”). The financial institutions with whom the Company enters into repurchase agreements are banks and broker/dealers which KAFA considers creditworthy. The seller under a repurchase agreement is required to maintain the value of the securities as collateral, subject to the agreement, at not less than the repurchase price plus accrued interest. KAFA monitors daily the mark-to-market of the value of the collateral, and, if necessary, requires the seller to maintain additional securities, so that the value of the collateral is not less than the repurchase price. Default by or bankruptcy of the seller would, however, expose the Company to possible loss because of adverse market action or delays in connection with the disposition of the underlying securities. As of May 31, 2013, the Company did not have any repurchase agreements.

F. Security Transactions — Security transactions are accounted for on the date the securities are purchased or sold (trade date). Realized gains and losses are reported on an identified cost basis.

G. Derivative Financial Instruments — The Company may utilize derivative financial instruments in its operations. As of May 31, 2013, the Company did not have any derivative financial instruments.

Interest rate swap contracts. The Company may use hedging techniques such as interest rate swaps to mitigate potential interest rate risk on a portion of the Company’s leverage. Such interest rate swaps would principally be used to protect the Company against higher costs on its leverage resulting from increases in interest rates. The Company does not hedge any interest rate risk associated with portfolio holdings. Interest rate transactions the Company may use for hedging purposes may expose it to certain risks that differ from the risks associated with its portfolio holdings. A decline in interest rates may result in a decline in the value of the swap contracts, which, everything else being held constant, would result in a decline in the net assets of the Company. In addition, if the counterparty to an interest rate swap or cap defaults, the Company would not be able to use the anticipated net receipts under the interest rate swap or cap to offset its cost of financial leverage.

Interest rate swap contracts are recorded at fair value with changes in value during the reporting period, and amounts accrued under the agreements, included as unrealized gains or losses in the Statement of Operations. Monthly cash settlements under the terms of interest rate swap agreements are recorded as realized gains or losses in the Statement of Operations. The Company generally values interest rate swap contracts based on dealer quotations, if available, or by discounting the future cash flows from the stated terms of the interest rate swap agreement by using interest rates currently available in the market.

Option contracts. The Company is exposed to financial market risks including changes in the valuations of its investment portfolio. The Company may purchase or write (sell) call options. A call option on a security is a contract that gives the holder of the option, in return for a premium, the right to buy from the writer of the option the security underlying the option at a specified exercise price at any time during the term of the option.

The Company would realize a gain on a purchased call option if, during the option period, the value of such securities exceeded the sum of the exercise price, the premium paid and transaction costs; otherwise the Company would realize either no gain or a loss on the purchased call option. The Company may also purchase put option contracts. If a purchased put option is exercised, the premium paid increases the cost basis of the securities sold by the Company.

18

KAYNE ANDERSON ENERGY DEVELOPMENT COMPANY

NOTES TO FINANCIAL STATEMENTS

(amounts in 000’s, except share and per share amounts)

(UNAUDITED)

The Company may also write (sell) call options with the purpose of generating income or reducing its ownership of certain securities. If the Company writes a call option on a security, the Company has the obligation upon exercise of the option to deliver the underlying security upon payment of the exercise price. The Company will only write call options on securities that the Company holds in its portfolio (i.e., covered calls).

When the Company writes a call option, an amount equal to the premium received by the Company is recorded as a liability and is subsequently adjusted to the current fair value of the option written. Premiums received from writing options that expire unexercised are treated by the Company on the expiration date as realized gains from investments. If the Company repurchases a written call option prior to its exercise, the difference between the premium received and the amount paid to repurchase the option is treated as a realized gain or loss. If a call option is exercised, the premium is added to the proceeds from the sale of the underlying security in determining whether the Company has realized a gain or loss. The Company, as the writer of an option, bears the market risk of an unfavorable change in the price of the security underlying the written option.

H. Return of Capital Estimates — Dividends and distributions received from the Company’s investments are comprised of income and return of capital. The payments made by MLPs are categorized as “distributions” and payments made by corporations are categorized as “dividends.” At the time such dividends and distributions are received, the Company estimates the amount of such payments that is considered investment income and the amount that is considered a return of capital. The Company estimates that 90% of the distributions received from Public MLPs will be treated as a return of capital. Such estimates for Public or Private MLPs and other investments are based on historical information available from each investment and other industry sources. These estimates may subsequently be revised based on information received from investments after their tax reporting periods are concluded.

The following table sets forth (i) the components of total dividends and distributions from the Company’s private and public investments, (ii) the percentage of return of capital attributable to each category and (iii) the estimated total return of capital portion of the dividends and distributions received from investments and the amounts that are attributable to net realized gains (losses) and net change in unrealized gains (losses). The return of capital portion of the dividends and distributions received is a reduction to investment income, results in an equivalent reduction in the cost basis of the associated investments, and increases net realized gains (losses) and net change in unrealized gains (losses). In accordance with GAAP, the return of capital cost basis reductions are limited to the total amount of the cash distributions received, but for income tax purposes, the cost basis reductions typically exceed cash distributions received due to allocated losses from MLP investments. See Note 4 – Income Taxes.

| | | | | | | | |

| | | For the

Three Months

Ended

May 31,

2013 | | | For the

Six Months

Ended

May 31,

2013 | |

Distributions from private MLPs | | $ | 1,419 | | | $ | 3,959 | |

Distributions from public MLPs and dividends from other public equity investments | | | 4,214 | | | | 7,727 | |

| | | | | | | | |

Total dividends and distributions from investments | | $ | 5,633 | | | $ | 11,686 | |

| | | | | | | | |

Distributions from private MLPs — % return of capital | | | 75 | % | | | 68 | % |

Distributions from public MLPs and dividends

from other public equity investments — % return of capital | | | 87 | % | | | 87 | % |

Total dividends and distributions — % return of capital | | | 84 | % | | | 80 | % |

Return of capital — attributable to net realized gains (losses) | | $ | 2,863 | | | $ | 3,297 | |

Return of capital — attributable to net change in unrealized gains (losses) | | | 1,868 | | | | 6,108 | |

| | | | | | | | |

Total return of capital | | $ | 4,731 | | | $ | 9,405 | |

| | | | | | | | |

19

KAYNE ANDERSON ENERGY DEVELOPMENT COMPANY

NOTES TO FINANCIAL STATEMENTS

(amounts in 000’s, except share and per share amounts)

(UNAUDITED)

I. Investment Income — The Company records dividends and distributions on the ex-dividend date. Interest income is recognized on the accrual basis, including amortization of premiums and accretion of discounts to the extent that such amounts are expected to be collected. When investing in securities with payment in-kind interest, the Company will accrue interest income during the life of the security even though it will not be receiving cash as the interest is accrued. To the extent that interest income to be received is not expected to be realized, a reserve against income is established. During the six months ended May 31, 2013, the Company did not have a reserve against interest income, since all interest income accrued is expected to be received.

Certain of the Company’s debt securities were purchased at a discount or premium to the par value of the security. The non-cash accretion of a discount to par value increases interest income while the non-cash amortization of a premium to par value decreases interest income. The accretion of a discount and amortization of a premium are based on the effective interest method. The amount of these non-cash adjustments can be found in the Company’s Statement of Cash Flows. The non-cash accretion of a discount increases the cost basis of the debt security, which results in an offsetting unrealized loss. The non-cash amortization of a premium decreases the cost basis of the debt security which results in an offsetting unrealized gain. To the extent that par value is not expected to be realized, the Company discontinues accruing the non-cash accretion of the discount to par value of the debt security.

During the six months ended May 31, 2013, the Company recognized $448 of paid-in-kind interest, which increased the outstanding principal of the Company’s First Lien Term C investment in ProPetro Services, Inc. (“ProPetro”). On March 5, 2013, the Company exchanged all of its equity investment in ProPetro and a portion of its First Lien Term C Loan for a First Lien Term B Loan issued by ProPetro. The First Lien Term B Loan pays interest in cash at a rate of 10.00% per annum and has a maturity date of June 30, 2015 ($9,754 principal amount). The Company’s remaining investment ($9,754) in the First Lien Term C Loan was repaid in cash at par value including accrued interest.

The Company receives paid-in-kind dividends and non-cash distributions in the form of additional units from its investments in Buckeye Partners, L.P. (Class B Units), Kinder Morgan Management, LLC and VantaCore. For paid-in-kind dividends, the additional units are not reflected in investment income during the period received but are recorded as unrealized gains upon receipt. Non-cash distributions are reflected in investment income, and the Company estimates return of capital on these non-cash distributions. During the three and six months ended May 31, 2013, the Company received the following paid-in-kind dividends and non-cash distributions.

| | | | | | | | |

| | | For the

Three Months

Ended

May 31,

2013 | | | For the

Six Months

Ended

May 31,

2013 | |

Paid-in-kind dividends | | | | | | | | |

Buckeye Partners, L.P. (Class B Units) | | $ | 111 | | | $ | 218 | |

Kinder Morgan Management, LLC | | | 123 | | | | 243 | |

| | | | | | | | |

| | $ | 234 | | | $ | 461 | |

| | | | | | | | |

Non-cash distributions | | | | | | | | |

VantaCore Partners LP | | | 544 | | | | 1,247 | |

| | | | | | | | |

Total paid-in-kind dividends and non-cash distributions | | $ | 778 | | | $ | 1,708 | |

| | | | | | | | |

J. Distributions to Stockholders — Distributions to common stockholders are recorded on the ex-dividend date. The estimated characterization of the distributions paid to common stockholders will be either a dividend (ordinary income) or distribution (return of capital). This estimate is based on the Company’s operating results during the period. The actual characterization of the common stock distributions made during the current year

20

KAYNE ANDERSON ENERGY DEVELOPMENT COMPANY

NOTES TO FINANCIAL STATEMENTS

(amounts in 000’s, except share and per share amounts)

(UNAUDITED)

will not be determinable until after the end of the fiscal year when the Company can determine earnings and profits and, therefore, the characterization may differ from the preliminary estimates.

K. Income Taxes — The Company is taxed as a corporation and pays federal and applicable state corporate taxes on its taxable income. The Company invests its assets primarily in MLPs, which generally are treated as partnerships for federal income tax purposes. As a limited partner in the MLPs, the Company includes its allocable share of the MLPs’ taxable income in computing its own taxable income. Current income taxes reflect the amount of income taxes that the Company expects to be payable as of a measurement date applying the provisions of the enacted tax laws. Deferred income taxes reflect (i) taxes on unrealized gains (losses), which are attributable to the temporary difference between fair market value and tax basis, (ii) the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes and (iii) the net tax benefit of accumulated net operating and capital losses. To the extent the Company has a deferred tax asset, consideration is given as to whether or not a valuation allowance is required. The need to establish a valuation allowance for deferred tax assets is assessed periodically by the Company based on the Income Tax Topic of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification that it is more likely than not that some portion or all of the deferred tax asset will not be realized. In the assessment for a valuation allowance, consideration is given to all positive and negative evidence related to the realization of the deferred tax asset. This assessment considers, among other matters, the nature, frequency and severity of current and cumulative losses, forecasts of future profitability (which are highly dependent on future cash distributions from the Company’s MLP holdings), the duration of statutory carryforward periods and the associated risk that operating and capital loss carryforwards may expire unused.

The Company may rely to some extent on information provided by MLPs, which may not necessarily be timely, to estimate taxable income allocable to the MLP units held in the portfolio and to estimate the associated current or deferred tax liability. Such estimates are made in good faith. From time to time, as new information becomes available, the Company modifies its estimates or assumptions regarding the current or deferred tax liability.

The Company’s policy is to classify interest and penalties associated with underpayment of federal and state income taxes, if any, as income tax expense on its Statement of Operations. For the six months ended May 31, 2013, the Company did not have any outstanding interest or penalties associated with the underpayment of any income taxes. Tax years from 2009 to 2012 remain open and subject to examination by tax jurisdictions.

L. Indemnifications — Under the Company’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the Company. In addition, in the normal course of business, the Company enters into contracts that provide general indemnification to other parties. The Company’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Company that have not yet occurred, and may not occur. However, the Company has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

M. Foreign Currency Translations — The books and records of the Company are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars on the following basis: (i) market value of investment securities, assets and liabilities at the rate of exchange as of the valuation date; and (ii) purchases and sales of investment securities, income and expenses at the relevant rates of exchange prevailing on the respective dates of such transactions.

The Company does not isolate that portion of gains and losses on investments in equity and debt securities which is due to changes in the foreign exchange rates from that which is due to changes in market prices of equity and debt securities. Accordingly, realized and unrealized foreign currency gains and losses with respect to such securities are included in the reported net realized and unrealized gains and losses on investment transactions balances.

21

KAYNE ANDERSON ENERGY DEVELOPMENT COMPANY

NOTES TO FINANCIAL STATEMENTS

(amounts in 000’s, except share and per share amounts)

(UNAUDITED)

Net realized foreign exchange gains or losses represent gains and losses from transactions in foreign currencies and foreign currency contracts, foreign exchange gains or losses realized between the trade date and settlement date on security transactions, and the difference between the amounts of interest and dividends recorded on the Company’s books and the U.S. dollar equivalent of such amounts on the payment date.

Net unrealized foreign exchange gains or losses represent the difference between the cost of assets and liabilities (other than investments) recorded on the Company’s books from the value of the assets and liabilities (other than investments) on the valuation date.

The Fair Value Measurement Topic of the FASB Accounting Standards Codification (“ASC 820”) defines fair value as the price at which an orderly transaction to sell an asset or to transfer a liability would take place between market participants under current market conditions at the measurement date. As required by ASC 820, the Company has performed an analysis of all assets and liabilities (other than deferred taxes) measured at fair value to determine the significance and character of all inputs to their fair value determination. Inputs are the assumptions, along with considerations of risk, that a market participant would use to value an asset or a liability. In general, observable inputs are based on market data that is readily available, regularly distributed and verifiable that the Company obtains from independent, third-party sources. Unobservable inputs are developed by the Company based on its own assumptions of how market participants would value an asset or a liability.

In May 2011, the FASB issued Accounting Standards Update (“ASU”) No. 2011-04 “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs” which amends ASC 820. The amended guidance clarifies the wording used to describe many requirements in accounting literature for fair value measurement and disclosure to establish consistency between U.S. GAAP and International Financial Reporting Standards (“IFRSs”). The Company adopted ASU No. 2011-04 in the fiscal second quarter of 2012.

ASU No. 2011-04 requires the inclusion of additional disclosures on assumptions used by the Company to determine fair value. Specifically, for assets measured at fair value using significant unobservable inputs (Level 3), ASU No. 2011-04 requires that the Company (i) describe the valuation process, (ii) disclose quantitative information about unobservable inputs and (iii) provide a qualitative discussion about the sensitivity of the fair value measurement to changes in the unobservable inputs and inter-relationships between the inputs.

The fair value hierarchy prioritizes the inputs to valuation techniques used to measure fair value into the following three broad categories.

| | • | | Level 1 — Valuations based on quoted unadjusted prices for identical instruments in active markets traded on a national exchange to which the Company has access at the date of measurement. |

| | • | | Level 2 — Valuations based on quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets. Level 2 inputs are those in markets for which there are few transactions, the prices are not current, little public information exists or instances where prices vary substantially over time or among brokered market makers. |

| | • | | Level 3 — Model derived valuations in which one or more significant inputs or significant value drivers are unobservable. Unobservable inputs are those inputs that reflect the Company’s own assumptions that market participants would use to price the asset or liability based on the best available information. |

The following table presents the Company’s assets and liabilities measured at fair value on a recurring basis at May 31, 2013, and the Company presents these assets by security type and description on its Schedule of

22

KAYNE ANDERSON ENERGY DEVELOPMENT COMPANY

NOTES TO FINANCIAL STATEMENTS

(amounts in 000’s, except share and per share amounts)

(UNAUDITED)