As filed electronically with the Securities and Exchange Commission on or about May 8, 2019

Registration No. 333-______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_________________________________________

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

[ ] Pre-Effective Amendment No. ___ [ ] Post-Effective Amendment No. ___

| | FIRST TRUST EXCHANGE-TRADED FUND II | |

(Exact Name of Registrant as Specified in Charter)

| 120 East Liberty Drive

Suite 400

Wheaton, Illinois 60187 | |

(Address of Principal Executive Offices) (Zip Code)

(Registrant’s Area Code and Telephone Number)

| | W. Scott Jardine

First Trust Advisors L.P.

Suite 400

120 East Liberty Drive

Wheaton, Illinois 60187 | |

(Name and Address of Agent for Service)

With copies to:

Eric F. Fess

Chapman and Cutler LLP

111 West Monroe Street

Chicago, Illinois 60603

TITLE OF SECURITIES BEING REGISTERED:

Shares of beneficial interest ($0.01 par value per share) of

First Trust FTSE EPRA/NAREIT Developed Markets Real Estate Index Fund, a Series of the Registrant.

Approximate date of proposed public offering: As soon as practicable after the effective date of this Registration Statement.

No filing fee is required because of reliance on Section 24(f) and an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

First Trust Heitman Global Prime Real Estate ETF

A Message from the Chairman of the Board of Trustees

[ ], 2019

Dear Shareholder:

I am writing to you to ask for your vote on a very important matter that will significantly affect your investment in First Trust Heitman Global Prime Real Estate ETF (“PRME”). Enclosed is a proxy statement and prospectus (“Proxy Statement/Prospectus”) seeking your approval of a proposal at a special meeting of shareholders of PRME (the “Meeting”).

At the Meeting, which will be held at the offices of First Trust Advisors L.P., 120 East Liberty Drive, Suite 400, Wheaton, Illinois 60187, on [__], 2019, at [___] p.m., shareholders will be asked to consider and vote upon a proposed transaction involving a reorganization transaction (the “Reorganization”) whereby PRME will be combined with First Trust FTSE EPRA/NAREIT Developed Markets Real Estate Index Fund (“FFR”), an exchange-traded fund (“ETF”) organized as a separate series of First Trust Exchange-Traded Fund II, an open-end management investment company, pursuant to which shareholders of PRME would become shareholders of FFR.

Through the Reorganization, shares of PRME would be exchanged, on a tax-free basis for federal income tax purposes as further described herein, for shares of FFR with an equal aggregate net asset value, and PRME shareholders will become shareholders of FFR.

In determining to recommend approval of the proposal, the Board of Trustees of PRME considered the following factors, among others:

| · | PRME and FFR have similar investment strategies; |

| · | the Reorganization is expected to allow shareholders of PRME to hold shares of a fund with significantly greater net assets; and |

| · | the Reorganization is expected to qualify as a tax-free reorganization for federal income tax purposes. |

The Board of Trustees of PRME has unanimously approved the Agreement and Plan of Reorganization (the “Plan”) and the transactions it contemplates and recommends that PRME shareholders vote “FOR” approval of the Plan and the Reorganization it contemplates. A copy of the form of the Plan is attached as Exhibit A to the enclosed Proxy Statement/Prospectus.

Also included in this booklet are the following materials concerning the upcoming Meeting:

| · | a Notice of Special Meeting of Shareholders, which summarizes the proposal for which you are being asked to provide voting instructions; and |

| · | a Proxy Statement/Prospectus, which provides detailed information on FFR, the specific proposal being considered at the Meeting and why the proposal is being made, including the differences between shares of PRME and the shares of FFR that PRME shareholders will receive as a result of the Reorganization. |

While you are, of course, welcome to join us at the Meeting, most shareholders cast their vote by filling out and signing the enclosed proxy card or by voting by touch-tone telephone or via the Internet. We urge you to review the enclosed materials thoroughly. Once you’ve determined how you would like your interests to be represented, please promptly complete, sign, date and return the enclosed proxy card or vote by touch-tone telephone or via the Internet. A postage-paid envelope is enclosed for mailing, and touch-tone telephone and Internet voting instructions are listed at the top of your proxy card.

Your vote is very important. As a shareholder, you are entitled to cast one vote for each share of PRME that you own. Please take a few moments to read the enclosed materials and then cast your vote.

Our proxy solicitor, AST Fund Solutions LLC, may contact you to encourage you to exercise your right to vote.

We appreciate your participation in this important Meeting. Thank you.

Sincerely yours,

James A. Bowen

Chairman of the Board of Trustees,

First Trust Heitman Global Prime Real Estate ETF

If You Need Any Assistance, Or Have Any Questions Regarding The Proposed Reorganization Or How To Vote Your Shares, Call AST Fund Solutions LLC at [( ) - ] Weekdays From 9:00 a.m. To 10:00 p.m. Eastern Time.

Important Notice to Shareholders of

First Trust Heitman Global Prime Real Estate ETF

Questions & Answers

[ ], 2019

Although we recommend that you read the entire Proxy Statement/Prospectus, for your convenience, we have provided a brief overview of the issues to be voted on.

| A. | You are being asked to vote on the following proposal to be considered at a special meeting of shareholders (the “Meeting”) of First Trust Heitman Global Prime Real Estate ETF (“PRME”): |

| • | The approval of an Agreement and Plan of Reorganization (the “Plan”) between First Trust Exchange-Traded Fund IV (“First Trust ETF IV”), of which PRME is a series, and First Trust Exchange-Traded Fund II (“First Trust ETF II”), of which First Trust FTSE EPRA/NAREIT Developed Markets Real Estate Index Fund is a series (“FFR,” and PRME and FFR are each a “Fund” and, together, the “Funds”), and the reorganization contemplated thereby pursuant to which FFR will acquire the assets and assume the liabilities of PRME, and shareholders of PRME will become shareholders of FFR (collectively, the “Reorganization”). |

The Board of Trustees of PRME has determined that the proposal is in the best interests of the Fund. The Board of Trustees unanimously recommends that you vote FOR the proposal.

| Q. | How will the Reorganization be effected? |

| A. | Assuming PRME shareholders approve the Reorganization, PRME will be reorganized into FFR. Immediately following the reorganization, PRME will terminate its registration under the Investment Company Act of 1940, as amended (the “1940 Act”). |

Upon the closing of the reorganization of PRME into FFR, PRME shareholders will receive newly issued shares of FFR. Shareholders of PRME will receive a number of FFR shares equal in value to the value of the PRME shares held by such shareholders, each computed as of the close of regular trading on the NYSE Arca (the “NYSE Arca”) on the business day immediately prior to the date of the closing of the Reorganization (the “Valuation Time”).

| Q. | Why is the Reorganization being recommended? |

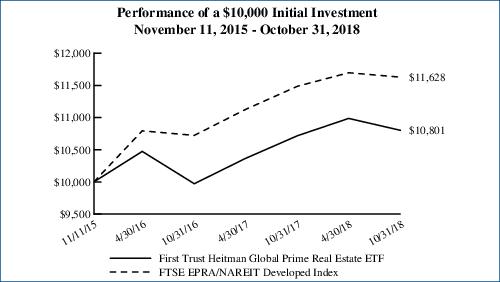

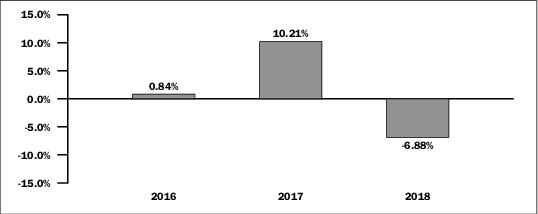

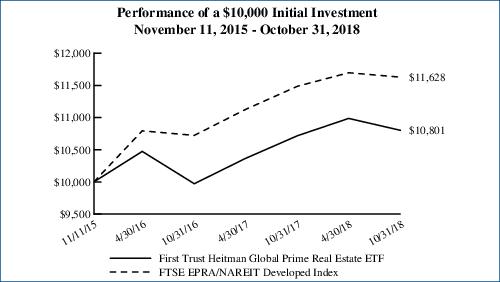

| A. | Since its inception, PRME has failed to gather assets and reach scale. This may be partially due to the fact that, since inception, PRME has underperformed its benchmark. PRME’s Board of Trustees and management have regularly monitored the size and performance of PRME and considered a variety of alternatives to increase its assets and have sought to develop a viable approach to address PRME’s lack of scale. FFR has significantly greater assets than PRME and has outperformed PRME since PRME’s inception on November 11, 2015 through the end of 2018. The Board of Trustees and management of PRME believe the Reorganization may allow PRME shareholders who become shareholders of FFR to experience the benefits associated with holding shares in a fund with significantly greater assets than PRME while allowing PRME’s shareholders the opportunity to continue their investment in a similar global real estate strategy. If the Reorganization is consummated, PRME’s shareholders will receive FFR shares equal in value to the value of their PRME shares as of the Valuation Time. Immediately after the Reorganization, FFR will have a greater asset base than PRME prior to the Reorganization. In addition, FFR has and is expected to maintain a lower total operating expense ratio than PRME following the Reorganization and FFR has historically made higher distributions than PRME. No assurances can be given that FFR’s total operating expense ratio and distributions will remain at their current rate. |

| Q. | Will shareholders of the Funds have to pay any fees or expenses in connection with the Reorganization? |

| A. | Yes. The direct costs associated with the proposed Reorganization, including the costs associated with the Meeting, will be borne by First Trust Advisors, L.P., the investment adviser of the Funds (“First Trust” or the “Adviser”). However, the indirect expenses of the Reorganization, primarily relating to the repositioning of the assets of PRME, will be borne by PRME and will impact the net asset value of PRME prior to the Reorganization. |

| Q. | How will the Reorganization affect distribution rates? |

| A. | Historically, FFR has had a higher distribution rate than PRME. As a result, PRME shareholders who continue as FFR shareholders following the Reorganization are expected to receive distributions at a higher rate. No assurances can be given that FFR distributions will remain at their current rate. |

| Q. | Will the shares held by PRME shareholders continue to be listed on the NYSE Arca following the Reorganization? |

| A. | Yes. PRME shares and FFR shares are both currently listed and trade on the NYSE Arca and FFR shares will continue to be listed and trade on the NYSE Arca following the Reorganization. |

| Q. | Do the Funds have similar investment strategies and risks? |

| A. | Yes. The investment strategies of PRME and FFR are similar in certain respects, but have some important differences. As a result of such similarities, the Funds are subject to many of the same investment risks. |

PRME is an actively managed exchange-traded fund (“ETF”) whose investment objective is to provide long-term total return. In contrast, FFR is an index-based ETF whose investment objective is to seek investment results that correspond generally to the price and yield (before the Fund’s fees and expenses) of the FTSE EPRA/ NAREIT Developed Index (the “Index”).

PRME seeks to achieve its investment objective by investing at least 80% of its net assets (including investment borrowings) in U.S. and non-U.S. exchange-traded real estate securities, which includes real estate investment trusts (“REITs”), real estate operating companies (“REOCs”) and common stocks or depositary receipts of companies primarily engaged in the real estate industry (collectively, “Real Estate Securities”). Accordingly, PRME is concentrated in REITs and/or real estate management and development companies (including REOCs), sub-industries of the real estate industry group. Real estate management and development companies generally derive at least 50% of their revenue from, or have at least 50% of their assets invested in, real estate, including the ownership, construction, management, or sale of real estate. PRME does not invest directly in real estate.

FFR pursues its investment objective by investing at least 90% of its net assets (including investment borrowings) in the common stocks and depositary receipts that comprise the Index. The Index is composed of publicly traded REITs and real estate holding and development companies. FFR, using an indexing investment approach, attempts to replicate, before fees and expenses, the performance of the Index. The Fund’s investment advisor seeks a correlation of 0.95 or better (before fees and expenses) between the Fund’s performance and the performance of the Index; a figure of 1.00 would represent perfect correlation. The Index is compiled and maintained by FTSE International Limited (“FTSE” or the “Index Provider”).

The principal differences between the investment strategies of PRME and FFR are as follows: (i) PRME is an actively managed ETF while FFR is an index-based ETF; and (ii) in addition to investing in REITs, PRME has or may have a significant holding in REOCs. As a result of such differences, PRME and FFR are subject to different risks associated with such different investments and strategies.

| Q. | Are the Funds managed by the same portfolio management team? |

| A. | No. Although First Trust Advisors L.P. serves as the investment adviser to both PRME and FFR, PRME is sub-advised by Heitman Real Estate Securities LLC, which provides the day-to-day management of PRME’s securities and investment strategy and sub-sub-advised by Heitman International Real Estate Securities HK Limited and Heitman International Real Estate Securities GmbH. First Trust manages the strategy of FFR. |

| Q. | Will the Reorganization constitute a taxable event for PRME shareholders? |

| A. | No. The Reorganization is expected to qualify as a tax-free reorganization for federal income tax purposes and will not occur unless PRME’s counsel provides a tax opinion to that effect. If a shareholder chooses to sell PRME shares prior to the Reorganization, the sale will generate taxable gain or loss; therefore, such shareholder may wish to consult a tax advisor before doing so. Of course, the shareholder also may be subject to periodic capital gains as a result of the normal operations of PRME whether or not the proposed Reorganization occurs. |

PRME, if requested by FFR, will attempt to dispose of assets that do not conform to FFR’s investment objective, policies and restrictions in advance of the Reorganization. PRME intends to pay a dividend of any realized undistributed net investment income and capital gains, which may be substantial, immediately prior to the closing of the Reorganization of PRME into FFR. The amount of dividends actually paid, if any, will depend on a number of factors, such as changes in the value of PRME’s holdings and the extent of the liquidation of securities between the date of the Meeting and the closing of such Reorganization.

| Q. | Will the value of my investment change as a result of the approval of the proposed Reorganization? |

| A. | Shareholders of PRME will receive a number of FFR shares equal in value to the value of the PRME shares held as of the Valuation Time. It is estimated that portfolio repositioning will result in transaction costs payable by PRME in advance of the Reorganization of approximately $1,700, or 0.08% of its net assets, based on average costs normally incurred in such transactions. It is likely that the number of shares a PRME shareholder owns will change as a result of the Reorganization because shares of PRME will be exchanged for shares of FFR at an exchange ratio based on the Funds' relative net asset values, which will likely differ from one another at the Valuation Time. |

| Q. | What vote is required to approve the proposed Reorganization? |

| A. | The approval of the proposed Reorganization requires the affirmative vote of (i) 67% or more of the PRME shares present at the Meeting, if the holders of more than 50% of the outstanding shares of PRME are present or represented by proxy, or (ii) more than 50% of the outstanding shares of PRME, whichever is less. |

| Q. | How does the Board of Trustees recommend that shareholders vote on the proposal? |

| A. | After careful consideration, the Board of Trustees has determined that the Reorganization is in the best interests of PRME and that, the interests of PRME’s existing shareholders will not be diluted as a result of the Reorganization and recommends that shareholders vote FOR the proposal. |

| Q. | What will happen if the required shareholder approval is not obtained? |

| A. | In the event that shareholders of PRME do not approve the Reorganization, each Fund will continue to exist and operate on a stand alone basis. |

| Q. | When would the proposed Reorganization be effective? |

| A. | If approved, the Reorganization is expected to occur as soon as reasonably practicable after shareholder approval is obtained. Shortly after completion of the Reorganization, shareholders of PRME will receive notice indicating that the Reorganization was completed. |

A. You can vote in any one of four ways:

| • | by mail, by sending the enclosed proxy card, signed and dated; |

| • | by phone, by calling one of the toll-free numbers listed on your proxy card for an automated touchtone voting line or to speak with a live operator; |

| • | via the Internet by following the instructions set forth on your proxy card; or |

| • | in person, by attending the Meeting. |

Whichever method you choose, please take the time to read the full text of the enclosed Proxy Statement/Prospectus before you vote.

| Q. | Whom should I call for additional information about the Proxy Statement/Prospectus? |

A. Please call AST Fund Solutions LLC, the Funds’ proxy solicitor, at [( ) - ].

First Trust Heitman Global Prime Real Estate ETF

120 East Liberty Drive, Suite 400

Wheaton, Illinois 60187

Notice of Special Meeting of Shareholders

To be held on [ ], 2019

[ ], 2019

To the Shareholders of First Trust Heitman Global Prime Real Estate ETF:

Notice is hereby given that a Special Meeting of Shareholders (the “Meeting”) of First Trust Heitman Global Prime Real Estate ETF (“PRME”), a series of First Trust Exchange-Traded Fund IV, a Massachusetts business trust, will be held at the offices of First Trust Advisors L.P., 120 East Liberty Drive, Suite 400, Wheaton, Illinois 60187, on [ ], 2019, at [ ] p.m. Central time, to consider the following (the “Proposal”):

To approve an Agreement and Plan of Reorganization by and between First Trust Exchange-Traded Fund IV, on behalf of PRME, and First Trust Exchange-Traded Fund II, on behalf of First Trust FTSE EPRA/NAREIT Developed Markets Real Estate Index Fund (“FFR”) pursuant to which PRME would (i) transfer all of its assets to FFR in exchange solely for newly issued shares of FFR and FFR’s assumption of all of the liabilities of PRME and (ii) immediately distribute such newly issued shares of FFR to PRME shareholders (collectively, the “Reorganization”).

The persons named as proxies will vote in their discretion on any other business that may properly come before the Meeting and any adjournments or postponements thereof.

Holders of record of shares of PRME at the close of business on [ ], 2019 are entitled to notice of and to vote at the Meeting and at any adjournments or postponements thereof.

By order of the Board of Trustees of PRME,

W. Scott Jardine

Secretary

Shareholders Who Do Not Expect To Attend The Meeting Are Requested To Promptly Complete, Sign, Date And Return The Proxy Card In The Enclosed Envelope Which Does Not Require Postage If Mailed In The Continental United States. Instructions For The Proper Execution Of Proxies Are Set Forth On The Next Page. If You Need Any Assistance, Or Have Any Questions Regarding Your Fund’s Proposal Or How To Vote Your Shares, Call AST Fund Solutions LLC at [( ) - ] Weekdays From 9:00 a.m. To 10:00 p.m. Eastern Time.

INSTRUCTIONS FOR SIGNING PROXY CARDS

The following general rules for signing proxy cards may be of assistance to you and help you to avoid the time and expense involved in validating your vote if you fail to sign your proxy card properly.

1. Individual Accounts: Sign your name exactly as it appears in the registration on the proxy card.

2. Joint Accounts: Either party may sign, but the name of the party signing should conform exactly to the name shown in the registration on the proxy card.

3. All Other Accounts: The capacity of the individual signing the proxy card should be indicated unless it is reflected in the form of registration. For example:

| Registration | Valid Signature |

| Corporate Accounts | |

| (1) ABC Corp. | ABC Corp. |

| (2) ABC Corp. | John Doe, Treasurer |

| (3) ABC Corp. c/o John Doe, Treasurer | John Doe |

| (4) ABC Corp. Profit Sharing Plan | John Doe, Director |

| | |

| Partnership Accounts | |

| (1) The XYZ Partnership | Jane B. Smith, Partner |

| (2) Smith and Jones, Limited Partnership | Jane B. Smith, General Partner |

| | |

| Trust Accounts | |

| (1) ABC Trust Account | Jane B. Doe, Director |

| (2) Jane B. Doe, Trustee u/t/d 12/28/78 | Jane B. Doe |

| | |

| Custodial or Estate Accounts | |

(1) John B. Smith, Cust. f/b/o John B. Smith Jr.

UGMA/ UTMA |

John B. Smith |

| (2) Estate of John B. Smith | John B. Smith, Jr., Executor |

IMPORTANT INFORMATION FOR SHAREHOLDERS OF

First Trust Heitman Global Prime Real Estate ETF

This document contains a Proxy Statement/Prospectus and is accompanied by a proxy card. A proxy card is, in essence, a ballot. When you vote your proxy, it tells us how to vote on your behalf on an important issue relating to your fund. If you complete and sign the proxy card and return it to us in a timely manner (or tell us how you want to vote by phone or via the Internet), we’ll vote exactly as you tell us. If you simply sign and return the proxy card without indicating how you wish to vote, we’ll vote it in accordance with the recommendation of the Board of Trustees as indicated on the cover of the Proxy Statement/Prospectus.

We urge you to review the Proxy Statement/Prospectus carefully and either fill out your proxy card and return it to us by mail, vote by phone or vote via the Internet. Your prompt return of the enclosed proxy card (or vote by phone or via the Internet) may save the necessity and expense of further solicitations.

If you have any questions, please call AST Fund Solutions LLC, the proxy solicitor, at the special toll-free number we have set up for you: [( ) - ].

The information contained in this Proxy Statement/Prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This Proxy Statement/Prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities, in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 8, 2019

First Trust Heitman Global Prime Real Estate ETF

120 East Liberty Drive, Suite 400

Wheaton, Illinois 60187

(630) 765-8000

PROXY STATEMENT/PROSPECTUS

[ ], 2019

This Proxy Statement/Prospectus is being furnished to shareholders of First Trust Heitman Global Prime Real Estate ETF (“PRME”), an exchange-traded fund organized as a separate series of First Trust Exchange-Traded Fund IV, an open-end management investment company (“First Trust ETF IV”), in connection with a Special Meeting of Shareholders (the “Meeting”) called by the Board of Trustees of PRME (the “Board of Trustees”) to be held at the offices of PRME, 120 E. Liberty Drive, Suite 400, Wheaton, Illinois 60187, on [ ], 2019, at [ ] p.m. Central time, as may be adjourned or postponed, to consider the proposal listed below, and discussed in greater detail elsewhere in this Proxy Statement/Prospectus. PRME and First Trust FTSE EPRA/NAREIT Developed Markets Real Estate Index Fund (“FFR”), an exchange-traded fund organized as a separate series of First Trust Exchange-Traded Fund II, an open-end management investment company (“First Trust ETF II”), are referred to herein collectively as the “Funds” and each is referred to herein individually as a “Fund.”

This Proxy Statement/Prospectus explains concisely what you should know before voting on the proposal described in this Proxy Statement/Prospectus or investing in FFR. Please read it carefully and keep it for future reference.

At the Meeting, the shareholders of PRME will be asked to approve the proposal, as described below (the “Proposal”):

To approve an Agreement and Plan of Reorganization by and between First Trust ETF IV, on behalf of PRME, and First Trust ETF II, on behalf of FFR, the form of which is attached to this Proxy Statement/Prospectus as Exhibit A (the “Plan”), pursuant to which PRME would (i) transfer all of its assets to FFR in exchange solely for newly issued shares of FFR and FFR’s assumption of all of the liabilities of PRME and (ii) immediately distribute such newly issued shares of FFR to PRME shareholders (collectively, the “Reorganization”).

The Board of Trustees has unanimously approved the Proposal as being in the best interests of PRME, and unanimously recommends that you vote FOR the Proposal. The Board of Trustees believes the Reorganization will allow PRME shareholders to hold shares in a fund with significantly greater assets while allowing PRME’s shareholders the opportunity to continue their investment in a global real estate strategy. In addition, FFR has historically paid a higher distribution than PRME. FFR is expected to maintain a higher distribution rate than PRME following the Reorganization. No assurances can be given that FFR distributions will remain at their current rate.

The proposed Reorganization seeks to combine the Funds, which have similar investment strategies and risks, but also have important distinctions. The Plan provides for the reorganization of PRME into FFR, pursuant to which PRME would (i) transfer all of its assets to FFR in exchange solely for newly issued shares of FFR and FFR’s assumption of all of the liabilities of PRME and (ii) immediately distribute such newly issued shares of FFR to PRME shareholders. Shareholders of PRME will receive a number of FFR shares equal in value to the value of the PRME shares held as of the close of regular trading on the NYSE Arca (the “NYSE Arca”) on the business day immediately prior to the closing of the reorganization of PRME into FFR (the “Valuation Time”). Through the Reorganization, shares of PRME would be exchanged on a tax-free basis for federal income tax purposes for shares of FFR. In the event that shareholders of PRME do not approve the Reorganization, each Fund will continue to exist and operate on a stand alone basis.

The securities offered by this Proxy Statement/Prospectus have not been approved or disapproved by the Securities and Exchange Commission (the “SEC”), nor has the SEC passed upon the accuracy or adequacy of this Proxy Statement/Prospectus. Any representation to the contrary is a criminal offense.

FFR lists and trades its shares on the NYSE Arca. Shares of FFR are not redeemable individually and therefore liquidity for individual shareholders of FFR will be realized only through a sale on the NYSE Arca at market prices that may differ to some degree from the net asset value of the FFR shares. Reports, proxy materials and other information concerning FFR can be inspected at the offices of the NYSE Arca.

The following documents contain additional information about PRME and FFR, have been filed with the SEC and are incorporated by reference into this Proxy Statement/Prospectus:

(i) the prospectus and Statement of Additional Information of FFR, dated February 1, 2019, relating to shares of FFR;

(ii) the prospectus and Statement of Additional Information of PRME, dated March 1, 2019, relating to shares of PRME;

(iii) the audited financial statements and related independent registered public accounting firm’s report for FFR and the financial highlights for FFR contained in FFR’s Annual Report to Shareholders for the fiscal year ended September 30, 2018 (SEC File No. 811-21944); and

(iv) the audited financial statements and related independent registered public accounting firm’s report for PRME and the financial highlights for PRME contained in PRME’s Annual Report to Shareholders for the fiscal year ended October 31, 2018 (SEC File No. 811-22559)

A copy of the FFR prospectus accompanies this Proxy Statement/Prospectus. The Statement of Additional Information to this Proxy Statement/Prospectus is also incorporated by reference and legally deemed to be part of this document, and is available upon oral or written request at no charge by calling First Trust Advisors L.P. (“First Trust”) at (800) 621-1675 or by writing to First Trust at 120 E. Liberty Drive, Suite 400, Wheaton, Illinois 60187. In addition, FFR will furnish, without charge, a copy of its prospectus, most recent Annual Report or Semi-Annual Report to a shareholder upon request. PRME’s prospectus dated March 1, 2019, and Annual Report to Shareholders for the fiscal year ended October 31, 2018, containing audited financial statements, have been previously made available or mailed to shareholders. Copies of these documents are available upon request and without charge by writing to First Trust at the address listed above or by calling (800) 621-1675.

The Funds are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended (the “1940 Act”), and in accordance therewith are required to file reports and other information with the SEC. These reports, proxy statement/prospectus materials and other information can be inspected and copied, after paying a duplicating fee, by electronic request at publicinfo@sec.gov. In addition, copies of these documents may be viewed online or downloaded without charge from the SEC’s website at www.sec.gov. Reports, proxy materials and other information concerning PRME and FFR may be inspected at the offices of the NYSE Arca.

This Proxy Statement/Prospectus serves as a prospectus of FFR in connection with the issuance of the FFR common shares in the Reorganization. In this connection, no person has been authorized to give any information or make any representation not contained in this Proxy Statement/Prospectus and, if so given or made, such information or representation must not be relied upon as having been authorized. This Proxy Statement/Prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction in which, or to any person to whom, it is unlawful to make such offer or solicitation.

TABLE OF CONTENTS

| INTRODUCTION | 1 |

| A. Synopsis | 4 |

| B. Risk Factors | 14 |

| C. Information About the Reorganization | 21 |

| D. Additional Information About the Investment Policies | 27 |

| Proposal — Reorganization of PRME Into FFR | 32 |

| ADDITIONAL INFORMATION ABOUT PRME AND FFR | 33 |

| GENERAL INFORMATION | 40 |

| OTHER MATTERS TO COME BEFORE THE MEETING | 45 |

| EXHIBIT A FORM OF AGREEMENT AND PLAN OF REORGANIZATION | A-1 |

INTRODUCTION

This Proxy Statement/Prospectus, along with the Notice of Special Meeting of Shareholders and the proxy card, is being mailed to shareholders of PRME on or about [ ], 2019. Much of the information is required to be disclosed under rules of the SEC. If there is anything you don’t understand, please contact AST Fund Solutions LLC, proxy solicitor for the Funds, at [( ) - ].

Shareholders of record of PRME as of the close of business on [ ], 2019 (the “Record Date”) are entitled to notice of and to vote at the Meeting and any and all adjournments or postponements thereof. If you are unable to attend the Meeting or any adjournment or postponement thereof, the Board of Trustees requests that you vote your shares by completing and returning the enclosed proxy card or by recording your voting instructions by telephone or via the Internet. On the matters coming before the Meeting as to which a choice has been specified by shareholders on the accompanying proxy card, the shares will be voted accordingly where such proxy card is properly executed and not properly revoked. If a proxy is returned and no choice is specified, the shares will be voted FOR the Proposal. Shareholders who execute proxies or provide voting instructions by telephone or by Internet may revoke them at any time before a vote is taken on the Proposal by filing with PRME a written notice of revocation, by delivering a duly executed proxy bearing a later date, or by attending the Meeting and voting in person. A prior proxy can also be revoked prior to its exercise by voting again through the toll-free number or the Internet address listed in the proxy card. Merely attending the Meeting, however, will not revoke any previously submitted proxy. Shareholders who intend to attend the Meeting will need to show valid identification and proof of share ownership to be admitted to the Meeting.

AST Fund Solutions LLC has been engaged to assist in the solicitation of proxies for PRME. As the date of the Meeting approaches, certain shareholders of PRME may receive a telephone call from a representative of AST Fund Solutions LLC if their votes have not yet been received. Authorization to permit AST Fund Solutions LLC to execute proxies may be obtained by telephonic instructions from shareholders of PRME. Proxies that are obtained telephonically will be recorded in accordance with the procedures described below. The Board of Trustees believes that these procedures are reasonably designed to ensure that both the identity of the shareholder casting the vote and the voting instructions of the shareholder are accurately determined.

In all cases where a telephonic proxy is solicited, the representative of AST Fund Solutions LLC is required to ask for each shareholder’s full name and address, or zip code, or both, and to confirm that the shareholder has received the proxy materials in the mail. If the shareholder is a corporation or other entity, the representative is required to ask for the person’s title and confirmation that the person is authorized to direct the voting of the shares. If the information solicited agrees with the information provided to AST Fund Solutions LLC, then the representative has the responsibility to explain the process, read the Proposal on the proxy card, and ask for the shareholder’s instructions on the Proposal. Although the representative is permitted to answer questions about the process, he or she is not permitted to recommend to the shareholder how to vote, other than to read any recommendation set forth in this Proxy Statement/Prospectus. AST Fund Solutions LLC will record the shareholder’s instructions on the proxy card. Within 72 hours, the shareholder will be sent a letter or mailgram to confirm his or her vote and asking the shareholder to call AST Fund Solutions LLC immediately if the shareholder’s instructions are not correctly reflected in the confirmation.

Please see the instructions on your proxy card for voting by phone or via the Internet. Shareholders will have an opportunity to review their voting instructions and make any necessary changes before submitting their voting instructions by phone or via the Internet.

Under the By-Laws of PRME, a quorum for the transaction of business is constituted by the presence in person or by proxy of the holders of at least thirty-three and one-third percent (33-1/3%) of the voting power of the outstanding shares of the respective Fund entitled to vote at the Meeting. For purposes of establishing whether a quorum is present, all shares present and entitled to vote, including abstentions and broker non-votes (i.e., shares held by brokers or nominees as to which (i) instructions have not been received from the beneficial owners or the persons entitled to vote and (ii) the broker or nominee does not have discretionary voting power on a particular matter), are counted.

If a quorum is not present, the chair of the Meeting or person presiding thereat, as applicable, may adjourn the Meeting from time to time until a quorum is present. In the event that a quorum is present but sufficient votes in favor of the Proposal have not been received, the Meeting may, by motion of the person presiding thereat, be adjourned when such adjournment is approved by the vote of holders of shares of PRME representing a majority of the voting power of the shares of PRME present and entitled to vote with respect to the matter to be adjourned, and voting on the adjournment. Unless a proxy is otherwise limited in this regard, any shares of PRME present and entitled to vote at the Meeting that are represented by broker non-votes may, at the discretion of the proxies named therein, be voted in favor of adjournment.

Broker-dealer firms holding shares of PRME in “street name” for the benefit of their customers and clients will request the instructions of such customers and clients on how to vote their shares on the Proposal. Pursuant to NYSE Rule 452, broker-dealers that are members of the NYSE Arca and that have not received instructions from a customer prior to the date specified in the broker-dealer’s request for voting instructions may not vote such customer’s shares on the Proposal being considered at the Meeting. Broker-dealers who are not members of the NYSE Arca may be subject to other rules, which may or may not permit them to vote customer shares without instruction.

The affirmative vote of a majority of the outstanding voting securities of PRME is required to approve the Proposal relating to the Plan as set forth on the cover of this Proxy Statement/Prospectus. The “vote of a majority of the outstanding voting securities” is defined in the 1940 Act as the vote of the lesser of (i) 67% or more of the shares of PRME present at the Meeting, if the holders of more than 50% of such outstanding shares are present in person or represented by proxy; or (ii) more than 50% of such outstanding shares of PRME. For purposes of determining the approval of the Plan and the Reorganization it contemplates by PRME shareholders, abstentions and broker non-votes will have the effect of a vote against such Proposal.

Proxy solicitations will be made, beginning on or about [ ], 2019, primarily by mail, but such solicitations may also be made by telephone or personal interviews conducted by (i) officers of PRME, as applicable; (ii) AST Fund Solutions LLC, PRME’ proxy solicitor that will provide proxy solicitation services in connection with the Proposal set forth herein; (iii) First Trust Advisors L.P. (“First Trust” or, the “Advisor”), the investment adviser of the Funds; (iv) Brown Brothers Harriman & Co., the administrator, accounting agent, custodian and transfer agent of PRME ; or (v) any affiliates of those entities.

The direct expenses associated with the preparation of the Proposal and of the proxy solicitation activities with respect thereto, including the costs incurred in connection with the preparation of this Proxy Statement/Prospectus and its enclosures, will be paid by First Trust.

The indirect expenses of the Reorganization, primarily relating to the repositioning of the assets of PRME, will be borne by PRME and are estimated to be approximately $1,700, or 0.08% of its net assets, based on average costs normally incurred in such transactions.

As of the Record Date, [ ] shares of PRME were outstanding. Shareholders of record on the Record Date are entitled to one vote for each share of PRME the shareholder owns.

A. Synopsis

The following is a summary of certain information contained elsewhere in this Proxy Statement/Prospectus with respect to the proposed Reorganization and is qualified in its entirety by reference to the more complete information contained in this Proxy Statement/Prospectus and in the Reorganization SAI and the appendices thereto. Shareholders should read the entire Proxy Statement/Prospectus carefully. Certain capitalized terms used but not defined in this summary are defined elsewhere in this Proxy Statement/Prospectus.

The Proposed Reorganization

The Board of Trustees of PRME, including the trustees who are not “interested persons” of the Fund (as defined in the 1940 Act), has unanimously approved the proposed Reorganization, including the Plan. If the shareholders of PRME approve the Proposal, PRME will reorganize into FFR, pursuant to which PRME would (i) transfer all of its assets to FFR in exchange solely for newly issued shares of FFR and FFR’s assumption of all of the liabilities of PRME and (ii) immediately distribute such newly issued shares of FFR to PRME shareholders. In connection with the Reorganization, FFR will issue to PRME shareholders book entry interests for the shares of FFR registered in a “street name” brokerage account held for the benefit of such shareholders. Shareholders of PRME will receive a number of FFR shares equal in value to the value of the PRME shares held as of the Valuation Time. Through the Reorganization, shares of PRME would be exchanged on a tax-free basis for federal income tax purposes for shares of FFR. Like shares of PRME, shares of FFR are not deposits or obligations of, or guaranteed or endorsed by, any financial institution, are not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other agency, and involve risk, including the possible loss of the principal amount invested.

Background and Reasons for the Proposed Reorganization

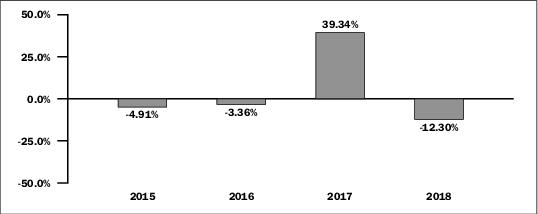

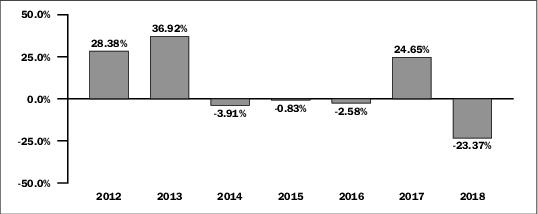

Since its inception, PRME has failed to gather assets and reach scale. This may be partially due to the fact that, since inception, PRME has underperformed its benchmark. PRME’s Board of Trustees and management have regularly monitored the size and performance of PRME and considered a variety of alternatives to increase its assets and have sought to develop a viable approach to address PRME’s lack of scale. FFR has significantly greater assets than PRME and has outperformed PRME since PRME’s inception on November 11, 2015 through the end of 2018. The Board of Trustees and management of PRME believe the Reorganization may allow PRME shareholders who become shareholders of FFR to experience the benefits associated with holding shares in a fund with significantly greater assets than PRME while allowing PRME’s shareholders the opportunity to continue their investment in a similar global real estate strategy. Immediately after the Reorganization, FFR will have a greater asset base than PRME prior to the Reorganization. In addition, FFR has and is expected to maintain a lower total operating expense ratio than PRME following the Reorganization and FFR has historically made higher distributions than PRME. No assurances can be given that FFR’s total operating expense ratio and distributions will remain at their current rate.

Board Considerations Relating to the Proposed Reorganization

Based on information provided by First Trust, the Board of Trustees considered the following factors, among others, in determining to recommend that shareholders of PRME approve the Plan and the Reorganization it contemplates:

| · | Compatibility of Investment Objectives and Policies. The Board noted that, although PRME is an actively managed exchange-traded fund (“ETF”) that seeks to provide long-term total return while FFR is an index-based ETF that seeks to track an index, both Funds primarily invest in real estate securities traded on U.S. and non-U.S. exchanges, including real estate investment trusts (“REITs”). The Board considered the significant overlap of the Funds’ then-current portfolio holdings and the Funds’ similar country exposures. The Board also considered that the index that FFR seeks to track serves as the benchmark for PRME. |

| · | Comparison of Fees and Expense Ratios; Expense Savings. The Board considered comparative expense information for PRME and FFR, including comparisons between the current advisory fee rates and expense ratios for PRME and FFR and the estimated pro forma advisory fee rate and expense ratio of the combined fund. The Board noted that FFR’s advisory fee rate would not change as a result of the Reorganization. The Board considered that FFR’s total expenses are capped 35 basis points lower than PRME’s unitary management fee through January 31, 2020, which will result in immediate expense savings for PRME shareholders following the Reorganization. The Board noted the Advisor’s statement that it plans to propose the extension of the current expense cap until January 31, 2021 in connection with the renewal of FFR’s advisory agreement in June 2019. The Board considered that any expense savings for FFR after the Reorganization would initially benefit the Advisor by reducing the amount of the fees to be waived or expenses to be reimbursed by the Advisor for FFR. |

| · | Expenses of the Reorganization. The Board noted that the Advisor proposed to bear the direct costs of the Reorganization, including costs associated with proxy solicitation. The Board also noted the indirect costs to be borne by PRME as a result of portfolio repositioning prior to the Reorganization. The Board considered the Advisor’s estimate that, based on estimated annual expense savings as a result of the Reorganization, shareholders of PRME were expected to recoup the indirect Reorganization costs within three months of the completion of the Reorganization. |

| · | Potential Improved Trading and Liquidity. The Board considered the larger asset size and trading volume of FFR as compared to PRME and that PRME shareholders may benefit from becoming shareholders of a larger fund with higher trading volume, potentially resulting in improved liquidity and narrower bid-ask spreads. |

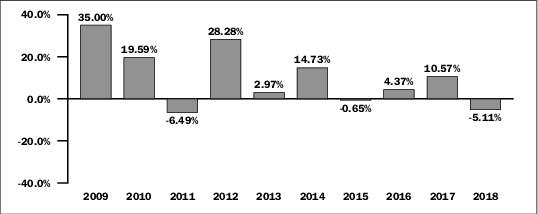

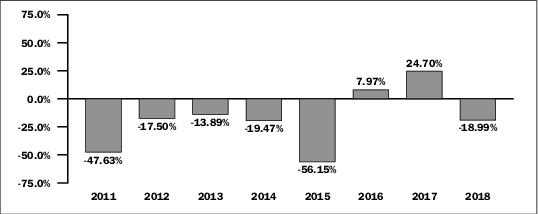

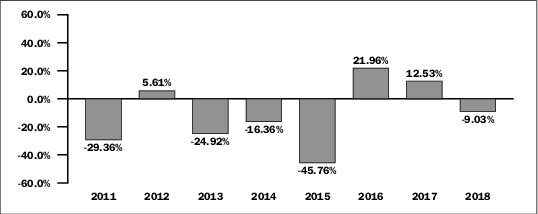

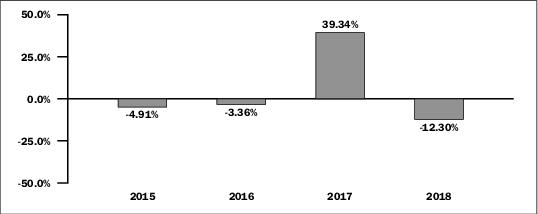

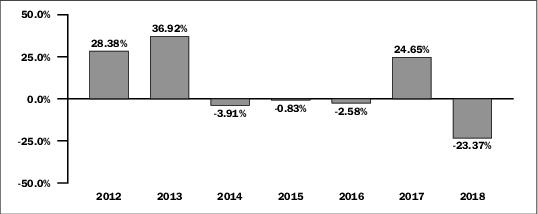

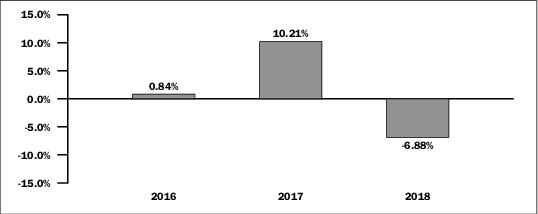

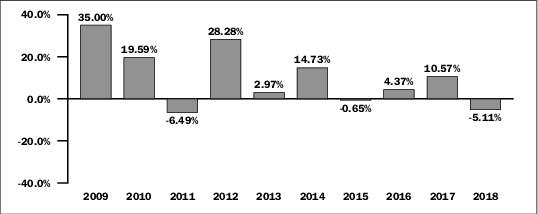

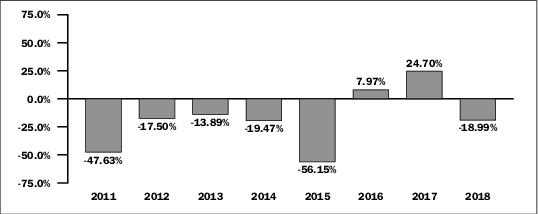

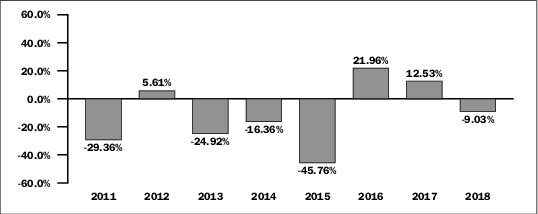

| · | Fund Performance and Distribution Rates. The Board reviewed the historical performance of PRME and FFR, noting that FFR has outperformed PRME over the one- and three-year periods ended December 31, 2018 and has outperformed PRME since PRME’s inception through December 31, 2018. The Board also received information comparing the Funds’ distribution rates and noted that FFR’s current distribution rate is higher than PRME’s current distribution rate. |

| · | Portfolio Management. The Board noted that Heitman Real Estate Securities LLC (“Heitman”) serves as investment sub-adviser to PRME and two Heitman affiliates serve as investment sub-sub-advisers to PRME, and that FFR is managed by the Advisor’s Investment Committee. The Board noted that the Advisor’s Investment Committee would continue to manage FFR following the closing of the Reorganization. |

| · | Anticipated Tax-Free Reorganization; Capital Loss Carryforwards. The Board noted the Advisor’s statement that the Reorganization will be structured with the intention that it qualify as a tax-free reorganization for federal income tax purposes and that PRME and FFR will obtain an opinion of counsel substantially to this effect (based on certain factual representations and certain customary assumptions). In addition, the Board noted the Advisor’s statement that PRME’s capital loss carryforwards could be transferred in the Reorganization, which, subject to certain limitations, could then be used by FFR. |

| · | Terms and Conditions of the Reorganization. The Board considered the terms and conditions of the Reorganization and whether the Reorganization would result in the dilution of the interests of existing shareholders of PRME and FFR in light of the basis on which shares of FFR would be issued to shareholders of PRME. |

Please see “Information About the Reorganization—Background and Trustees’ Considerations Relating to the Proposed Reorganization” below for a further discussion of the deliberations and considerations undertaken by the Board of Trustees in connection with the proposed Reorganization.

The Board of Trustees of each Fund has concluded that the Reorganization is in the best interests of its respective Fund and the interests of the existing shareholders of each Fund will not be diluted as a result of the Reorganization. In the event that shareholders of PRME do not approve the Reorganization, each Fund will continue to exist and operate on a stand-alone basis.

Material Federal Income Tax Consequences of the Reorganization

For federal income tax purposes, no gain or loss is expected to be recognized by PRME or its shareholders as a direct result of the Reorganization. Any capital gains realized prior to the Reorganization will be distributed to PRME’s shareholders as capital gain dividends (to the extent of net realized long-term capital gains distributed) and/or ordinary dividends (to the extent of net realized short-term capital gains distributed) during or with respect to the year of sale, and such distributions will be taxable to PRME’s shareholders. Through the Reorganization, PRME shares will be exchanged, on a tax-free basis for federal income tax purposes, for shares of FFR with an equal aggregate net asset value, and PRME shareholders will become shareholders of FFR.

Comparison of the Funds

General. PRME is a non-diversified, actively managed ETF that was created as a series of First Trust ETF IV, an open-end management investment company organized as a Massachusetts business trust, on November 11, 2015. FFR is a diversified, index-based ETF that was created as a series of First Trust ETF II, an open-end management investment company organized as a Massachusetts business trust, on August 27, 2007.

Investment Objectives Policies and Strategies. The investment strategies of PRME and FFR are similar, but have some important distinctions, each as discussed and summarized below. The primary differences between the investment strategies of PRME and FFR are as follows: (i) PRME is an actively managed ETF while FFR is an index-based ETF; and (ii) in addition to investing in REITs, which are one of the primary investment classes held by FFR, PRME has a significant holding in real estate operating companies (“REOCs”). As a result of such differences, PRME and FFR are subject to the different risks associated with such different investments and strategies. PRME is sub-advised by Heitman, which provides the day-to-day management of PRME and two Heitman affiliates serve as investment sub-sub-advisers to PRME. The similarities and differences between the Funds’ investment objectives, principal strategies and policies and non-principal and other investment strategies and policies are highlighted below.

Each Fund’s investment objectives are a fundamental policy of the Fund and may not be changed without the approval of a “majority of the outstanding voting securities” of the respective Fund. A “majority of the outstanding voting securities” means the lesser of (i) 67% or more of the shares represented at a meeting at which more than 50% of the outstanding shares are represented, or (ii) more than 50% of the outstanding shares.

Each Fund’s complete portfolio holdings as of the end each month are filed on Form N-PORT with the SEC.

Investment Objectives. PRME’s investment objective is to provide long-term total return. FFR seeks investment results that correspond generally to the price and yield (before the Fund’s fees and expenses) of an equity index called the FTSE EPRA/ NAREIT Developed Index (the “Index”).

Principal Investment Strategies and Policies. PRME seeks to achieve its investment objective by investing at least 80% of its net assets (including investment borrowings) in U.S. and non-U.S. exchange-traded real estate securities, which includes REITs, REOCs and common stocks or depositary receipts of companies primarily engaged in the real estate industry (collectively, “Real Estate Securities”). Accordingly, PRME is concentrated in REITs and/or real estate management and development companies (including REOCs), sub-industries of the real estate industry group. Real estate management and development companies generally derive at least 50% of their revenue from, or have at least 50% of their assets invested in, real estate, including the ownership, construction, management, or sale of real estate. PRME does not invest directly in real estate.

PRME’s portfolio managers select Real Estate Securities by implementing an investment process that is outlined below:

As a first screen, all securities in the Global Industry Classification Standard (GICS®) real estate industry are filtered for size and liquidity, based upon free float market capitalization for size and a threshold daily trading volume for liquidity. The purpose of these quantitative screens is to ensure that the investment strategy can be executed in a buy and hold manner without undue stress.

In the second stage, screening is conducted using a combination of qualitative and quantitative tools. From a qualitative perspective, portfolio analysts maintain a close coverage universe and are in regular contact with the management of potential Real Estate Securities issuers, regularly visiting properties and markets to see as many of the properties in person as is reasonably possible. In addition to their own research, the analysts have access to other property experts and sell-side professionals within their organizations who also evaluate their companies. The task of the analysts is to identify those companies that meet the test of two quantitative filters. The issuers in which PRME invests must generally have (1) more than 75% of their gross asset value in prime markets and (2) more than 50% of their assets under management in prime assets.

Executing the quantitative and qualitative screens produces a universe of companies that meet the size, liquidity, and concentration in prime markets and assets tests. From this universe of prime assets and markets, the portfolio managers’ regional teams construct a high conviction portfolio that, in the opinion of the portfolio managers, offers the best expected risk/return profile of the names within the prime universe. Consideration for inclusion in the portfolio includes the issuer’s balance sheet, assessment of management’s acumen and the projected long-term growth profile of the company.

PRME invests in REITs and REOCs, companies that own and often manage income-generating real estate. REITs distribute most of their income to investors and therefore receive special tax considerations and are typically a highly liquid method of investing in real estate. REOCs, on the other hand, reinvest most income into their operations and therefore do not get the same benefits of lower corporate taxation that are a common characteristic of REITs.

PRME typically invests in 25 to 100 Real Estate Securities issued by small, mid and large capitalization companies. PRME invests in securities of issuers domiciled or operating in Asia and Europe, as well as other non-U.S. issuers, including those in emerging market countries. PRME generally invests at least 40% of its net assets in securities of non-U.S. issuers and in issuers domiciled or operating in at least three different countries.

PRME is classified as “non-diversified” under the 1940 Act and as a result may invest a relatively high percentage of its assets in a limited number of issuers. PRME is only limited as to the percentage of its assets which may be invested in the securities of any one issuer by diversification requirements imposed by the Internal Revenue Code of 1986, as amended (the “Code”). As of January 31, 2019, PRME had significant investments in real estate companies.

FFR will normally invest at least 90% of its net assets (including investment borrowings) in the common stocks and depositary receipts that comprise the Index. FFR, using an indexing investment approach, attempts to replicate, before fees and expenses, the performance of the Index. FFR’s investment advisor seeks a correlation of 0.95 or better (before fees and expenses) between FFR’s performance and the performance of the Index; a figure of 1.00 would represent perfect correlation. The Index is compiled and maintained by FTSE International Limited (“FTSE” or the “Index Provider”).

The Index is designed to measure the stock performance of companies engaged in specific real estate activities, including the ownership, trading and development of income-producing real estate, in the North American, European and Asian real estate markets. The Index is modified market cap weighted based on free float market capitalization and includes the securities of real estate companies or REITs that are publicly traded on an official stock exchange located in North America, Europe or Asia and provides an audited annual report in English. The securities must also meet certain size and liquidity tests to be included in the Index.

The Index is rebalanced and reconstituted quarterly and FFR will make corresponding changes to its portfolio shortly after the Index changes are made public. FFR will be concentrated in an industry or a group of industries to the extent that the Index is so concentrated. As of December 31, 2018, FFR had significant investments in real estate companies.

Trustees and Officers. The Trustees of First Trust ETF II (of which FFR is a series) are the same as those of First Trust ETF IV (of which PRME is a series). The following individuals comprise the Board of Trustees of both First Trust ETF II and First Trust ETF IV: James A. Bowen, Richard E. Erickson, Thomas R. Kadlec, Robert F. Keith and Niel B. Nielson. The Board of Trustees is responsible for the management of the Funds, including supervision of the duties performed by First Trust as an investment adviser to the Funds. In addition, the officers of First Trust ETF II are the same as those of First Trust ETF IV. See “Management of the Funds” in the Reorganization SAI for additional information on the trustees and officers of FFR.

Investment Advisers and Portfolio Managers. First Trust Advisors L.P., 120 East Liberty Drive, Wheaton, Illinois 60187, is the investment adviser to the Funds. In this capacity, First Trust provides certain clerical, bookkeeping and other administrative services to each Fund as well as fund reporting services. In addition to the foregoing, in the case of FFR, First Trust is also responsible for the selection and ongoing monitoring of the portfolio securities. Heitman Real Estate Securities LLC is the sub-adviser of PRME and is responsible for the day-to-day management of the portfolio of the Fund and Heitman International Real Estate Securities HK Limited and Heitman International Real Estate Securities GmbH are sub-sub-advisers to the Fund. Following the Reorganization, First Trust will continue in its capacity as the investment adviser of FFR.

First Trust is a limited partnership with one limited partner, Grace Partners of DuPage L.P., and one general partner, The Charger Corporation. Grace Partners of DuPage L.P. is a limited partnership with one general partner, The Charger Corporation, and a number of limited partners. The Charger Corporation is an Illinois corporation controlled by James A. Bowen, the Chief Executive Officer of First Trust. First Trust discharges is responsibilities subject to the policies of the Board of Trustees of the Funds.

As of March 31, 2019, First Trust served as investment advisor to seven mutual funds, ten exchange-traded funds consisting of 141 series and 15 closed-end funds. It is also the portfolio supervisor of certain unit investment trusts sponsored by First Trust Portfolios L.P., an affiliate of First Trust Advisors, 120 East Liberty Drive, Wheaton, Illinois 60187 (“FTP”). FTP specializes in the underwriting, trading and distribution of unit investment trusts and other securities. As of March 31, 2019, First Trust collectively managed or supervised approximately $127 billion through unit investment trusts, exchange traded funds, closed-end funds, mutual funds and separate managed accounts. First Trust is the supervisor of the First Trust unit investment trusts, while FTP is the sponsor. FTP is also a distributor of mutual fund shares and exchange-traded fund creation units. First Trust and FTP are based in Wheaton, Illinois.

Heitman, located at 191 North Wacker Drive, 25th Floor, Chicago, Illinois 60606, is an investment adviser registered with the SEC. As of March 31, 2019, Heitman has assets under management of approximately $6.02 billion.

The portfolio management team for PRME consists of Mr. Jerry Ehlinger, CFA, Mr. John White, Mr. Jacques Perdrix and Mr. Andreas Welter of Heitman.

Jerry Ehlinger, CFA, is Managing Director of Heitman and the Lead Portfolio Manager in Heitman’s North American Public Real Estate Securities group. He also serves as a Portfolio Manager for the firm’s global real estate securities strategies. Throughout his career, Jerry has held a number of related investment positions in the REIT industry. Before joining Heitman in 2013, Jerry was Lead Portfolio Manager and Head of Real Estate Securities, Americas at DB/RREEF Real Estate. Prior, Jerry served as Senior Vice President and Portfolio Manager of Heitman’s real estate securities group from 2000 to 2004. He began his career at Morgan Stanley in 1996 where he primarily covered the REIT sector both as a sell-side analyst and as a senior research associate at Morgan Stanley Asset Management. Jerry received an MS in Finance, Investment and Banking from the University of Wisconsin-Madison and a BS in Finance from the University of Wisconsin-Whitewater. Among other professional affiliations, Jerry is a member of the National Multi Housing Council, International Council of Shopping Centers, the CFA Institute, the CFA Society of Chicago, and the National Association of Real Estate Investment Trusts.

John White, is Managing Director and the Lead Portfolio Manager in Heitman’s Asia-Pacific Public Real Estate Securities group. He is an equity owner of the firm and a member of Heitman’s Management Committee. He also serves as a Portfolio Manager for the firm's global real estate securities strategies. John has over 20 years of experience in the public and private equity and debt real estate markets across the Asia-Pacific region. Prior to joining Heitman in 2010, John was co-head of real estate securities at Challenger (Heitman’s Asian JV partner for real estate securities) for five years; he was also senior investment manager, real estate securities at HSBC Asset Management from 2001. Before moving to investment management, John worked in investment banking as a senior property analyst at HSBC and as a manager—real estate credit at ANZ Banking Group in Australia and in South-East Asia. He began his career as a real estate valuer at Landauer and Chesterton. John received a BBus in Land Economy from University of Western Sydney-Hawkesbury and a Graduate Diploma in Applied Finance and Investment from the Securities Institute of Australia. He is a member of the Royal Institute of Chartered Surveyors, the Asian Public Real Estate Association, the Australian Property Institute and the Financial Services Institute of Australasia.

Jacques Perdrix is a Senior Vice President in Heitman’s European Public Real Estate Securities group. His role with Heitman focuses on portfolio management, including fundamental company and market analysis. Prior to joining Heitman, Mr. Perdrix was at Griffin Capital Management where he worked as an analyst and assistant portfolio manager on long-only and long/short equity and fixed income funds covering mid/large-caps on a broad range of sectors and geographies. Previously, Mr. Perdrix worked at equity long/short hedge fund Gugner Partners as a senior analyst and back-up trader focusing on European small/mid-caps across all sectors. Mr. Perdrix started his career within Citigroup’s Investment Banking Division, M&A Financial Institutions Group, in both Paris and London. Mr. Perdrix, a French national, received a Specialized Master’s in Corporate Finance from EM Lyon School of Management and a Master of Science in Management from ESC Grenoble School of Management. He is FSA qualified.

Andreas Welter is a Senior Vice President in Heitman’s European Public Real Estate Securities group. His role with Heitman focuses on portfolio construction, fundamental company and market analysis supporting the Portfolio Management team. Prior to joining the firm, Mr. Welter was at Deutsche Bank AG, where he was a senior sell-side equity research analyst for three years. In that time, Mr. Welter covered companies in various industry sectors in Germany (e.g., real estate, financials, construction, logistics). Previously, Mr. Welter worked at the Middle Office & Advisory Desk of B. Metzler seel. Sohn & Co., one of Germany’s largest family-owned investment managers. Mr. Welter earned the title of Bankkaufmann (apprenticeship in banking) from the Chamber of Commerce and Industry Frankfurt and holds a Diploma in International Business Administration (Diplom-Betriebswirt) from one of the top-ranked universities in Europe (Hochschule Darmstadt).

There is no one individual primarily responsible for portfolio management decisions for FFR. Investments are made under the direction of the Investment Committee of First Trust with daily decisions being made jointly by Investment Committee members. The Investment Committee consists of Daniel J. Lindquist, Jon C. Erickson, David G. McGarel, Roger F. Testin, Stan Ueland and Chris A. Peterson.

Mr. Lindquist is Chairman of the Investment Committee and presides over Investment Committee meetings. Mr. Lindquist is responsible for overseeing the implementation of the Fund’s investment strategy. Mr. Lindquist joined First Trust as a Vice President in April 2004 and was a Senior Vice President of First Trust and FTP from September 2005 to July 2012. Mr. Lindquist has been a Managing Director of First Trust and FTP since 2012.

Mr. Erickson has been a Senior Vice President of First Trust and FTP since 2001. As the head of First Trust’s Equity Research Group, Mr. Erickson is responsible for determining the securities to be purchased and sold by funds that do not utilize quantitative investment strategies.

Mr. McGarel is the Chief Investment Officer, Chief Operating Officer and a Managing Director of First Trust and FTP. As First Trust’s Chief Investment Officer, Mr. McGarel consults with the other members of the Investment Committee on market conditions and First Trust’s general investment philosophy. As Chief Operating Officer, Mr. McGarel is responsible for First Trust and FTP operations, including information systems, trust administration and First Trust administration. Mr. McGarel was a Senior Vice President of First Trust and FTP from January 2004 to July 2012.

Mr. Testin has been a Senior Vice President of First Trust and FTP since 2003. Mr. Testin is the head of First Trust’s Portfolio Management Group.

Mr. Ueland joined First Trust as a Vice President in August 2005 and has been a Senior Vice President of First Trust and FTP since September 2012. At First Trust, he plays an important role in executing the investment strategies of each portfolio of exchange-traded funds advised by First Trust.

Mr. Peterson is a Senior Vice President and head of First Trust’s strategy research group. He joined First Trust in January of 2000. Mr. Peterson is responsible for developing and implementing quantitative equity investment strategies. Mr. Peterson received his B.S. in Finance from Bradley University in 1997 and his M.B.A. from the University of Chicago Booth School of Business in 2005. He has over 20 years of financial services industry experience and is a recipient of the Chartered Financial Analyst designation.

Pursuant to the Investment Management Agreement between First Trust and First Trust ETF IV, on behalf of PRME, First Trust currently receives an annual unitary management fee equal to 0.95% of PRME’s average daily managed assets. In connection with the unitary management fee First Trust receives from PRME, First Trust is responsible for paying all expenses of PRME excluding fee payments under the Investment Management Agreement, interest, taxes, brokerage commissions and other expenses connected with the execution of portfolio transactions, distribution and service fees payable pursuant to a Rule 12b-1 plan, if any, and extraordinary expenses. Pursuant to the Investment Management Agreement between First Trust and First Trust ETF II, on behalf of FFR, First Trust is paid an annual management fee of 0.40% of FFR’s average daily net assets. Unlike PRME, FFR does not pay a unitary management fee and therefore FFR is responsible for paying all its own expenses of operation. First Trust has agreed to waive fees and/or reimburse FFR for expenses to the extent necessary to prevent FFR’s operating expenses (excluding interest expense, brokerage commissions and other trading expenses, taxes and extraordinary expenses) from exceeding (as a percentage of average daily net assets) 0.60%. First Trust may benefit as a result of the Reorganization as it currently pays Heitman a fee for its services as subadvisor to PRME. As there is no subadvisor for FFR and First Trust does not pay a subadvisory fee or other expenses of FFR, First Trust may receive a greater net management fee in connection with the assets of PRME after the Reorganization.

Capitalization

| Fund | Authorized Shares | Shares Outstanding(1) | Par Value Per Share | Preemptive, Appraisal or Exchange Rights | Rights to Cumulative Voting | Exchange on which the Shares are Listed |

| PRME | Unlimited | 100,002 | $0.01 | None | None | NYSE Arca |

| FFR | Unlimited | 1,050,002 | $0.01 | None | None | NYSE Arca |

| (1) As of April 30, 2019. |

Comparative Fees and Expenses

The following table sets forth the fees and expenses of investing in shares of PRME and FFR and the estimated pro forma fees and expenses of FFR after giving effect to the Reorganization. Actual expenses of the combined Fund may be higher. As shown below, the proposed Reorganization is expected to result in a lower total expense ratio for shareholders of PRME who become shareholders of FFR as a result of the Reorganization. However, there can be no assurance that the Reorganization will result in expense savings.

| PRME | FFR | Pro Forma Combined Fund |

| Shareholder Fees (fees paid directly from your investment) | | | |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | None(1) | None(2) | None(2) |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | | | |

| Management Fees | 0.95%(3) | 0.40%(4) | 0.40%(4) |

| Dividend Reinvestment Plan Fees | None | None | None |

| Distribution and Service (12b-1) Fees | 0.00% | 0.00% | 0.00% |

| Other Expenses | 0.00% | 0.47% | 0.47% |

| Total Annual Fund Operating Expenses | 0.95% | 0.87% | 0.87% |

| Fee Waiver and Expense Reimbursement | 0.00% | 0.27%(5) | 0.27%(5) |

| Net Annual Fund Operating Expenses | 0.95% | 0.60% | 0.60% |

________________ (1) As an ETF, PRME trades on NYSE Arca and does not charge a sales load or a redemption fee on individual Fund shares. When buying or selling Fund shares, investors will incur customary brokerage commissions and charges. Purchasers of Creation Units (as hereinafter defined) of PRME and shareholders redeeming Creation Units of PRME must pay a standard creation or redemption transaction fee of $600, as applicable. (2) As an ETF, FFR trades on NYSE Arca and does not charge a sales load or a redemption fee on individual Fund shares. When buying or selling Fund shares, investors will incur customary brokerage commissions and charges. Purchasers of Creation Units of FFR and shareholders redeeming Creation Units of FFR must pay a standard creation or redemption transaction fee of $4,500, as applicable. (3) The management fee of PRME is based on the Fund’s average daily net assets. (4) The management fee of FFR is based on the Fund’s average daily net assets. (5) First Trust has agreed to waive fees and/or expenses to the extent that the operating expenses of FFR (excluding interest expense, brokerage commissions and other trading expenses, taxes and extraordinary expenses) exceed 0.60% of FFR’s average daily net assets per year (the “Expense Cap”) at least through January 31, 2020. It is anticipated that the current expense cap will be extended until January 31, 2021 in connection with the renewal of FFR’s advisory agreement in June 2019. Expenses reimbursed and fees waived under such agreement are subject to recovery by First Trust for up to three years from the date the fee was waived or expense was incurred, but no reimbursement payment will be made by FFR if it results in FFR exceeding an expense ratio equal to the Expense Cap in place at the time the expenses were reimbursed or fees waived by First Trust. The agreement may be terminated by the First Trust ETF II, on behalf of FFR, at any time and by First Trust only after January 31, 2020 upon 60 days’ written notice. |

Example

The following example is intended to help you compare the costs of investing in the shares of FFR on a pro forma basis following the Reorganization with the costs of investing in PRME and FFR without the Reorganization. An investor would pay the following expenses on a $10,000 investment that is held for the time periods provided in the table, assuming that all dividends and other distributions are reinvested and that operating expenses remain the same. The example also assumes a 5% annual return and that FFR’s investment advisor’s agreement to waive fees and/or pay FFR’s expenses to the extent necessary to prevent the operating expenses of FFR (excluding interest expense, brokerage commissions

and other trading expenses, taxes, and extraordinary expenses) from exceeding 0.60% of average daily net assets per year will be terminated following January 31, 2020. The example should not be considered a representation of future expenses or returns. Actual expenses may be greater or lesser than those shown.

| | 1 Year | 3 Years | 5 Years | 10 Years |

| PRME | $97 | $303 | $525 | $1,166 |

| FFR | $61 | $251 | $456 | $1,048 |

| FFR (pro forma) | $61 | $251 | $456 | $1,048 |

PRME distributes its net investment income monthly and FFR distributes its net investment income quarterly and each fund distributes its net realized capital gains at least annually, if any. Neither PRME nor FFR have established a dividend reinvestment plan, but dividends may be reinvested automatically in additional PRME or FFR shares, respectively, if the broker through whom you hold such shares makes this option available. Such shares will generally be reinvested by the broker based upon the market price of those shares and investors may be subject to brokerage commissions charged by the broker.

Further Information Regarding the Reorganization

Each Fund’s Board of Trustees has determined that the proposed Reorganization is in the best interests of its Fund. Accordingly, the Board of Trustees of PRME recommends that PRME shareholders vote FOR approval of the Plan and the Reorganization it contemplates.

The affirmative vote of a majority of the outstanding voting securities of PRME is required to approve the Plan. The “vote of a majority of the outstanding voting securities” is defined in the 1940 Act as the vote of the lesser of (i) 67% or more of the shares of the Fund present at the Meeting, if the holders of more than 50% of such outstanding shares are present in person or represented by proxy; or (ii) more than 50% of such outstanding shares of the Fund.

If the Reorganization is approved by shareholders of PRME, PRME shareholders will receive confirmation of the approval after the Reorganization is completed, indicating the number of shares of FFR such PRME shareholders are receiving as a result of the Reorganization. Otherwise, PRME shareholders will be notified in the next shareholder report of PRME. If the Reorganization is completed, the number of shares owned by a PRME shareholder will change following the Reorganization, as the shareholder will own shares in a different entity. However, the shareholders of PRME will receive a number of FFR shares equal in value to the value of the PRME shares held as of the Valuation Time.

B. Risk Factors

The investment strategies of PRME and FFR are similar, but have some important distinctions, as discussed in this Proxy Statement/Prospectus. The principal differences between the investment strategies of PRME and FFR are as follows: (i) PRME is an actively managed ETF while FFR is an index-based ETF; and (ii) in addition to investing in REITs, PRME has a significant holding in REOCs. As a result of such differences, PRME and FFR are subject to different risks associated with such different investments and strategies. Additionally, as PRME is classified as a “non-diversified” fund under the 1940 Act and FFR is classified as a “diversified” fund under the 1940 Act, PRME is subject to non-diversification risk, as described below.

Aside from these differences, as investment companies following similar strategies, many of the principal risks applicable to an investment in PRME are also applicable to an investment in FFR. Shares of each Fund may change in value, and an investor could lose money by investing in either Fund. The Funds may not achieve their investment objectives. An investment in a Fund is not a deposit with a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. An investment in a Fund involves risks similar to those of investing in equity securities of any fund traded on an exchange. Risk is inherent in all investing.