As filed electronically with the Securities and Exchange Commission on or about June 21, 2019

Registration No. 333-231299

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_________________________________________

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

[X] Pre-Effective Amendment No. 1 [ ] Post-Effective Amendment No. ___

| | FIRST TRUST EXCHANGE-TRADED FUND II | |

(Exact Name of Registrant as Specified in Charter)

| 120 East Liberty Drive

Suite 400

Wheaton, Illinois 60187 | |

(Address of Principal Executive Offices) (Zip Code)

(Registrant’s Area Code and Telephone Number)

| | W. Scott Jardine

First Trust Advisors L.P.

Suite 400

120 East Liberty Drive

Wheaton, Illinois 60187 | |

(Name and Address of Agent for Service)

With copies to:

Eric F. Fess

Chapman and Cutler LLP

111 West Monroe Street

Chicago, Illinois 60603

_________________________________________

TITLE OF SECURITIES BEING REGISTERED:

Shares of beneficial interest ($0.01 par value per share) of

First Trust FTSE EPRA/NAREIT Developed Markets Real Estate Index Fund, a Series of the Registrant.

Approximate date of proposed public offering: As soon as practicable after the effective date of this Registration Statement.

No filing fee is required because of reliance on Section 24(f) and an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

First Trust Heitman Global Prime Real Estate ETF

A Message from the Chairman of the Board of Trustees

[ ], 2019

Dear Shareholder:

I am writing to you to ask for your vote on a very important matter that will significantly affect your investment in First Trust Heitman Global Prime Real Estate ETF (“PRME”). Enclosed is a proxy statement and prospectus (“Proxy Statement/Prospectus”) seeking your approval of a proposal at a special meeting of shareholders of PRME (the “Meeting”).

At the Meeting, which will be held at the offices of First Trust Advisors L.P., 120 East Liberty Drive, Suite 400, Wheaton, Illinois 60187, on [__], 2019, at [___] p.m., shareholders will be asked to consider and vote upon a proposed transaction involving a reorganization transaction (the “Reorganization”) whereby PRME will be combined with First Trust FTSE EPRA/NAREIT Developed Markets Real Estate Index Fund (“FFR”), an exchange-traded fund (“ETF”) organized as a separate series of First Trust Exchange-Traded Fund II, an open-end management investment company, pursuant to which shareholders of PRME would become shareholders of FFR.

Through the Reorganization, shares of PRME would be exchanged, on a tax-free basis for federal income tax purposes as further described herein, for shares of FFR with an equal aggregate net asset value, and PRME shareholders will become shareholders of FFR.

In determining to recommend approval of the proposal, the Board of Trustees of PRME considered the following factors, among others:

| · | PRME and FFR have similar investment strategies; |

| · | the Reorganization is expected to allow shareholders of PRME to hold shares of a fund with significantly greater net assets; and |

| · | the Reorganization is expected to qualify as a tax-free reorganization for federal income tax purposes. |

The Board of Trustees of PRME has unanimously approved the Agreement and Plan of Reorganization (the “Plan”) and the transactions it contemplates and recommends that PRME shareholders vote “FOR” approval of the Plan and the Reorganization it contemplates. A copy of the form of the Plan is attached as Exhibit A to the enclosed Proxy Statement/Prospectus.

Also included in this booklet are the following materials concerning the upcoming Meeting:

| · | a Notice of Special Meeting of Shareholders, which summarizes the proposal for which you are being asked to provide voting instructions; and |

| · | a Proxy Statement/Prospectus, which provides detailed information on FFR, the specific proposal being considered at the Meeting and why the proposal is being made, including the differences between shares of PRME and the shares of FFR that PRME shareholders will receive as a result of the Reorganization. |

While you are, of course, welcome to join us at the Meeting, most shareholders cast their vote by filling out and signing the enclosed proxy card or by voting by touch-tone telephone or via the Internet. We urge you to review the enclosed materials thoroughly. Once you’ve determined how you would like your interests to be represented, please promptly complete, sign, date and return the enclosed proxy card or vote by touch-tone telephone or via the Internet. A postage-paid envelope is enclosed for mailing, and touch-tone telephone and Internet voting instructions are listed at the top of your proxy card.

Your vote is very important. As a shareholder, you are entitled to cast one vote for each share of PRME that you own. Please take a few moments to read the enclosed materials and then cast your vote.

Our proxy solicitor, AST Fund Solutions LLC, may contact you to encourage you to exercise your right to vote.

We appreciate your participation in this important Meeting. Thank you.

Sincerely yours,

James A. Bowen

Chairman of the Board of Trustees,

First Trust Heitman Global Prime Real Estate ETF

If You Need Any Assistance, Or Have Any Questions Regarding The Proposed Reorganization Or How To Vote Your Shares, Call AST Fund Solutions LLC at (800) 284-1755 Weekdays From 9:00 a.m. To 10:00 p.m. Eastern Time.

Important Notice to Shareholders of

First Trust Heitman Global Prime Real Estate ETF

Questions & Answers

[ ], 2019

Although we recommend that you read the entire Proxy Statement/Prospectus, for your convenience, we have provided a brief overview of the issues to be voted on.

| A. | You are being asked to vote to approve, at a special meeting of shareholders (the “Meeting”), the reorganization of First Trust Heitman Global Prime Real Estate ETF (“PRME”) into First Trust FTSE EPRA/NAREIT Developed Markets Real Estate Index Fund (“FFR,” and PRME and FFR are each a “Fund” and, together, the “Funds”). Specifically, you are being asked to consider and approve an Agreement and Plan of Reorganization (the “Plan”) between First Trust Exchange-Traded Fund IV (“First Trust ETF IV”), of which PRME is a series, and First Trust Exchange-Traded Fund II (“First Trust ETF II”), of which FFR is a series, pursuant to which the assets and liabilities of PRME will be transferred to FFR, and shareholders of PRME will become shareholders of FFR (collectively, the “Reorganization”). |

The Board of Trustees of PRME has determined that the proposal is in the best interests of the Fund. The Board of Trustees unanimously recommends that you vote FOR the proposal.

| Q. | How will the Reorganization be effected? |

| A. | Assuming PRME shareholders approve the Reorganization, PRME will be reorganized into FFR. Immediately following the reorganization, PRME will terminate its registration under the Investment Company Act of 1940, as amended (the “1940 Act”). |

Upon the closing of the reorganization of PRME into FFR, PRME shareholders will receive newly issued shares of FFR. Shareholders of PRME will receive a number of FFR shares equal in aggregate net asset value to the aggregate net asset value of the PRME shares held by such shareholders, each computed as of the close of regular trading on the NYSE Arca (the “NYSE Arca”) on the business day immediately prior to the date of the closing of the Reorganization (the “Valuation Time”).

| Q. | Why is the Reorganization being recommended? |

| A. | Since its inception, PRME has failed to gather assets and reach scale. This may be partially due to the fact that, since inception, PRME has underperformed its benchmark. PRME’s Board of Trustees and management have regularly monitored the size and performance of PRME and considered a variety of alternatives to increase its assets andhave sought to develop a viable approach to address PRME’s lack of scale. FFR has significantly greater assets than PRME and has outperformed PRME since PRME’s inception on November 11, 2015 through the end of 2018. The Board of Trustees and management of PRME believe the Reorganization may allow PRME shareholders who become shareholders of FFR to experience the benefits associated with holding shares in a fund with significantly greater assets than PRME while allowing PRME’s shareholders the opportunity to continue their investment in a similar global real estate strategy. If the Reorganization is consummated, PRME’s shareholders will receive FFR shares equal in aggregate net asset value to the aggregate net asset value of their PRME shares as of the Valuation Time. Immediately after the Reorganization, FFR will have a greater asset base than PRME prior to the Reorganization. In addition, FFR has and is expected to maintain a lower total operating expense ratio than PRME following the Reorganization and FFR has historically made higher distributions than PRME. No assurances can be given that FFR’s total operating expense ratio and distributions will remain at their current rate. |

| Q. | Will shareholders of the Funds have to pay any fees or expenses in connection with the Reorganization? |

| A. | Yes. The direct costs associated with the proposed Reorganization, including the costs associated with the Meeting, will be borne by First Trust Advisors, L.P., the investment adviser of the Funds (“First Trust” or the “Adviser”). However, the indirect expenses of the Reorganization, primarily relating to the repositioning of the assets of PRME, will be borne by PRME and will impact the net asset value of PRME prior to the Reorganization. |

| Q. | Will the shares held by PRME shareholders continue to be listed on the NYSE Arca following the Reorganization? |

| A. | Yes. PRME shares and FFR shares are both currently listed and trade on the NYSE Arca and FFR shares will continue to be listed and trade on the NYSE Arca following the Reorganization. |

| Q. | Do the Funds have similar investment strategies and risks? |

| A. | Yes. The investment strategies of PRME and FFR are similar in certain respects, but have some important differences. As a result of such similarities, the Funds are subject to many of the same investment risks. |

PRME is an actively managed exchange-traded fund (“ETF”) whose investment objective is to provide long-term total return. In contrast, FFR is an index-based ETF whose investment objective is to seek investment results that correspond generally to the price and yield (before the Fund’s fees and expenses) of the FTSE EPRA/ NAREIT Developed Index (the “Index”).

PRME seeks to achieve its investment objective by investing at least 80% of its net assets (including investment borrowings) in U.S. and non-U.S. exchange-traded real estate securities, which includes real estate investment trusts (“REITs”), real estate operating companies (“REOCs”) and common stocks or depositary receipts of companies primarily engaged in the real estate industry (collectively, “Real Estate Securities”). Accordingly, PRME is concentrated in REITs and/or real estate management and development companies (including REOCs), sub-industries of the real estate industry group. Real estate management and development companies generally derive at least 50% of their revenue from, or have at least 50% of their assets invested in, real estate, including the ownership, construction, management, or sale of real estate. PRME does not invest directly in real estate.

FFR pursues its investment objective by investing at least 90% of its net assets (including investment borrowings) in the common stocks and depositary receipts that comprise the Index. The Index is composed of publicly traded REITs and real estate holding and development companies. FFR, using an indexing investment approach, attempts to replicate, before fees and expenses, the performance of the Index. The Fund’s investment advisor seeks a correlation of 0.95 or better (before fees and expenses) between the Fund’s performance and the performance of the Index; a figure of 1.00 would represent perfect correlation. The Index is compiled and maintained by FTSE International Limited (“FTSE” or the “Index Provider”).

The principal differences between the investment strategies of PRME and FFR are as follows: (i) PRME is an actively managed ETF while FFR is an index-based ETF; and (ii) in addition to investing in REITs, PRME has significant holdings in REOCs. As a result of such differences, PRME and FFR are subject to different risks associated with such different investments and strategies.

| Q. | Are the Funds managed by the same portfolio management team? |

| A. | No. Although First Trust Advisors L.P. serves as the investment adviser to both PRME and FFR, PRME is sub-advised by Heitman Real Estate Securities LLC, which provides the day-to-day management of PRME’s securities and investment strategy and sub-sub-advised by Heitman International Real Estate Securities HK Limited and Heitman International Real Estate Securities GmbH. First Trust manages the strategy of FFR. |

| Q. | Will the Reorganization constitute a taxable event for PRME shareholders? |

| A. | No. The Reorganization is expected to qualify as a tax-free reorganization for federal income tax purposes and will not occur unless PRME’s counsel provides a tax opinion to that effect. If a shareholder chooses to sell PRME shares prior to the Reorganization, the sale will generate taxable gain or loss; therefore, such shareholder may wish to consult a tax advisor before doing so. Of course, the shareholder also may be subject to periodic capital gains as a result of the normal operations of PRME whether or not the proposed Reorganization occurs. |

PRME, if requested by FFR, will attempt to dispose of assets that do not conform to FFR’s investment objective, policies and restrictions in advance of the Reorganization. PRME intends to pay a dividend of any undistributed realized net investment income, if any, immediately prior to the closing of the Reorganization of PRME into FFR. The amount of dividends actually paid, if any, will depend on a number of factors, such as changes in the value of PRME’s holdings and the extent of the liquidation of securities between the date of the Meeting and the closing of such Reorganization. Any net investment income realized prior to the Reorganization will be distributed to PRME’s shareholders as ordinary dividends (to the extent of net realized short-term capital gains distributed) during or with respect to the year of sale, and such distributions will be taxable to PRME’s shareholders. As of the date hereof, no long-term capital gains dividends are expected prior to the Reorganization.

| Q. | Will the value of my investment change as a result of the approval of the proposed Reorganization? |

| A. | Shareholders of PRME will receive a number of FFR shares equal in aggregate net asset value to the aggregate net asset value of the PRME shares held as of the Valuation Time. It is estimated that portfolio repositioning will result in transaction costs payable by PRME in advance of the Reorganization of approximately $1,700, or 0.08% of its net assets, based on average costs normally incurred in such transactions. It is likely that the number of shares a PRME shareholder owns will change as a result of the Reorganization because shares of PRME will be exchanged for shares of FFR at an exchange ratio based on the Funds’ relative net asset values, which will likely differ from one another at the Valuation Time. |

| Q. | What vote is required to approve the proposed Reorganization? |

| A. | The approval of the proposed Reorganization requires the affirmative vote of (i) 67% or more of the PRME shares present at the Meeting, if the holders of more than 50% of the outstanding shares of PRME are present or represented by proxy, or (ii) more than 50% of the outstanding shares of PRME, whichever is less. |

| Q. | How does the Board of Trustees recommend that shareholders vote on the proposal? |

| A. | After careful consideration, the Board of Trustees has determined that the Reorganization is in the best interests of PRME and that the interests of PRME’s existing shareholders will not be diluted as a result of the Reorganization, and recommends that shareholders vote FOR the proposal. |

| Q. | What will happen if the required shareholder approval is not obtained? |

| A. | In the event that shareholders of PRME do not approve the Reorganization, each Fund will continue to exist and operate on a stand alone basis. |

| Q. | When would the proposed Reorganization be effective? |

| A. | If approved, the Reorganization is expected to occur as soon as reasonably practicable after shareholder approval is obtained. Shortly after completion of the Reorganization, shareholders of PRME will receive notice indicating that the Reorganization was completed. |

A. You can vote in any one of four ways:

| • | by mail, by sending the enclosed proxy card, signed and dated; |

| • | by phone, by calling one of the toll-free numbers listed on your proxy card for an automated touchtone voting line or to speak with a live operator; |

| • | via the Internet by following the instructions set forth on your proxy card; or |

| • | in person, by attending the Meeting. |

Whichever method you choose, please take the time to read the full text of the enclosed Proxy Statement/Prospectus before you vote.

| Q. | Whom should I call for additional information about the Proxy Statement/Prospectus? |

A. Please call AST Fund Solutions LLC, the Funds’ proxy solicitor, at (800) 284-1755.

First Trust Heitman Global Prime Real Estate ETF

120 East Liberty Drive, Suite 400

Wheaton, Illinois 60187

Notice of Special Meeting of Shareholders

To be held on [ ], 2019

[ ], 2019

To the Shareholders of First Trust Heitman Global Prime Real Estate ETF:

Notice is hereby given that a Special Meeting of Shareholders (the “Meeting”) of First Trust Heitman Global Prime Real Estate ETF (“PRME”), a series of First Trust Exchange-Traded Fund IV, a Massachusetts business trust, will be held at the offices of First Trust Advisors L.P., 120 East Liberty Drive, Suite 400, Wheaton, Illinois 60187, on [ ], 2019, at [ ] p.m. Central time, to consider the following (the “Proposal”):

To approve an Agreement and Plan of Reorganization by and between First Trust Exchange-Traded Fund IV, on behalf of PRME, and First Trust Exchange-Traded Fund II, on behalf of First Trust FTSE EPRA/NAREIT Developed Markets Real Estate Index Fund (“FFR”) pursuant to which PRME would (i) transfer all of its assets to FFR in exchange solely for newly issued shares of FFR and FFR’s assumption of all of the liabilities of PRME and (ii) immediately distribute such newly issued shares of FFR to PRME shareholders (collectively, the “Reorganization”).

The persons named as proxies will vote in their discretion on any other business that may properly come before the Meeting and any adjournments or postponements thereof.

Holders of record of shares of PRME at the close of business on May 31, 2019 are entitled to notice of and to vote at the Meeting and at any adjournments or postponements thereof.

By order of the Board of Trustees of PRME,

W. Scott Jardine

Shareholders Who Do Not Expect To Attend The Meeting Are Requested To Promptly Complete, Sign, Date And Return The Proxy Card In The Enclosed Envelope Which Does Not Require Postage If Mailed In The Continental United States. Instructions For The Proper Execution Of Proxies Are Set Forth On The Next Page. If You Need Any Assistance, Or Have Any Questions Regarding Your Fund’s Proposal Or How To Vote Your Shares, Call AST Fund Solutions LLC at (800) 284-1755 Weekdays From 9:00 a.m. To 10:00 p.m. Eastern Time.

INSTRUCTIONS FOR SIGNING PROXY CARDS

The following general rules for signing proxy cards may be of assistance to you and will avoid the time and expense to the Fund involved in validating your vote if you fail to sign your proxy card properly.

1. Individual Accounts: Sign your name exactly as it appears in the registration on the proxy card.

2. Joint Accounts: Either party may sign, but the name of the party signing should conform exactly to the name shown in the registration.

3. All Other Accounts: The capacity of the individual signing the proxy should be indicated unless it is reflected in the form of registration. For example:

| Registration | Valid Signature |

| |

| Corporate Accounts |

| (1) | ABC Corp. | ABC Corp. |

| (2) | ABC Corp. | John Doe, Treasurer |

| (3) | ABC Corp.

c/o John Doe, Treasurer |

John Doe |

| (4) | ABC Corp. Profit Sharing Plan | John Doe, Trustee |

| |

| Trust Accounts |

| (1) | ABC Trust | Jane B. Doe, Trustee |

| (2) | Jane B. Doe, Trustee

u/t/d 12/28/78 |

Jane B. Doe |

| | |

| Custodial or Estate Accounts |

| (1) | John B. Smith, Cust.

f/b/o John B. Smith, Jr., UGMA |

John B. Smith |

| (2) | John B. Smith | John B. Smith, Jr., Executor |

| | | | | |

IMPORTANT INFORMATION FOR SHAREHOLDERS OF

First Trust Heitman Global Prime Real Estate ETF

This document contains a Proxy Statement/Prospectus and is accompanied by a proxy card. A proxy card is, in essence, a ballot. When you vote your proxy, it tells us how to vote on your behalf on an important issue relating to your fund. If you complete and sign the proxy card and return it to us in a timely manner (or tell us how you want to vote by phone or via the Internet), we’ll vote exactly as you tell us. If you simply sign and return the proxy card without indicating how you wish to vote, we’ll vote it in accordance with the recommendation of the Board of Trustees as indicated on the cover of the Proxy Statement/Prospectus.

We urge you to review the Proxy Statement/Prospectus carefully and either fill out your proxy card and return it to us by mail, vote by phone or vote via the Internet. Your prompt return of the enclosed proxy card (or vote by phone or via the Internet) may save the necessity and expense of further solicitations.

If you have any questions, please call AST Fund Solutions LLC, the proxy solicitor, at the special toll-free number we have set up for you: (800) 284-1755.

This page is intentionally left blank.

The information contained in this Proxy Statement/Prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective.

SUBJECT TO COMPLETION, DATED JUNE 21, 2019

First Trust Heitman Global Prime Real Estate ETF

120 East Liberty Drive, Suite 400

Wheaton, Illinois 60187

(630) 765-8000

PROXY STATEMENT/PROSPECTUS

[ ], 2019

This Proxy Statement/Prospectus is being furnished to shareholders of First Trust Heitman Global Prime Real Estate ETF (“PRME”), an exchange-traded fund organized as a separate series of First Trust Exchange-Traded Fund IV, an open-end management investment company (“First Trust ETF IV”), in connection with a Special Meeting of Shareholders (the “Meeting”) called by the Board of Trustees of PRME (the “Board of Trustees”) to be held at the offices of PRME, 120 E. Liberty Drive, Suite 400, Wheaton, Illinois 60187, on [ ], 2019, at [ ] p.m. Central time, as may be adjourned or postponed, to consider the proposal listed below, and discussed in greater detail elsewhere in this Proxy Statement/Prospectus. PRME and First Trust FTSE EPRA/NAREIT Developed Markets Real Estate Index Fund (“FFR”), an exchange-traded fund organized as a separate series of First Trust Exchange-Traded Fund II, an open-end management investment company (“First Trust ETF II”), are referred to herein collectively as the “Funds” and each is referred to herein individually as a “Fund.”

This Proxy Statement/Prospectus explains concisely what you should know before voting on the proposal described in this Proxy Statement/Prospectus or investing in FFR. Please read it carefully and keep it for future reference.

At the Meeting, the shareholders of PRME will be asked to approve the proposal, as described below (the “Proposal”):

To approve an Agreement and Plan of Reorganization by and between First Trust ETF IV, on behalf of PRME, and First Trust ETF II, on behalf of FFR, the form of which is attached to this Proxy Statement/Prospectus as Exhibit A (the “Plan”), pursuant to which PRME would (i) transfer all of its assets to FFR in exchange solely for newly issued shares of FFR and FFR’s assumption of all of the liabilities of PRME and (ii) immediately distribute such newly issued shares of FFR to PRME shareholders (collectively, the “Reorganization”).

The Board of Trustees has unanimously approved the Proposal as being in the best interests of PRME, and unanimously recommends that you vote FOR the Proposal. The Board of Trustees believes the Reorganization will allow PRME shareholders to hold shares in a fund with significantly greater assets while allowing PRME’s shareholders the opportunity to continue their investment in a global real estate strategy. In addition, FFR has historically paid a higher distribution than PRME. No assurances can be given that FFR distributions will remain at their current rate.

The proposed Reorganization seeks to combine the Funds, which have similar investment strategies and risks, but also have important distinctions. The Plan provides for the reorganization of PRME into FFR, pursuant to which PRME would (i) transfer all of its assets to FFR in exchange solely for newly issued shares of FFR and FFR’s assumption of all of the liabilities of PRME and (ii) immediately distribute such newly issued shares of FFR to PRME shareholders. Shareholders of PRME will receive a number of FFR shares equal in aggregate net asset value to the aggregate net asset value of the PRME shares held as of the close of regular trading on the NYSE Arca (the “NYSE Arca”) on the business day immediately prior to the closing of the reorganization of PRME into FFR (the “Valuation Time”). Through the Reorganization, shares of PRME would be exchanged on a tax-free basis for federal income tax purposes for shares of FFR. In the event that shareholders of PRME do not approve the Reorganization, each Fund will continue to exist and operate on a stand alone basis.

The securities offered by this Proxy Statement/Prospectus have not been approved or disapproved by the Securities and Exchange Commission (the “SEC”), nor has the SEC passed upon the accuracy or adequacy of this Proxy Statement/Prospectus. Any representation to the contrary is a criminal offense.

FFR lists and trades its shares on the NYSE Arca. Shares of FFR are not redeemable individually and therefore liquidity for individual shareholders of FFR will be realized only through a sale on any national securities exchange on which the shares are traded at market prices that may differ to some degree from the net asset value of the FFR shares. Reports, proxy materials and other information concerning FFR can be inspected at the offices of the NYSE Arca.

The following documents contain additional information about PRME and FFR, have been filed with the SEC and are incorporated by reference into this Proxy Statement/Prospectus:

(i) the prospectus and Statement of Additional Information of FFR, dated February 1, 2019, relating to shares of FFR (SEC File No. 333-143964);

(ii) the prospectus and Statement of Additional Information of PRME, dated March 1, 2019, relating to shares of PRME (SEC File No. 333-174332);

(iii) the audited financial statements and related independent registered public accounting firm’s report for FFR and the financial highlights for FFR contained in FFR’s Annual Report to Shareholders for the fiscal year ended September 30, 2018 (SEC File No. 811-21944);

(iv) the unaudited financial statements for FFR contained in FFR’s Semi-Annual Report to Shareholders for the six months ended March 31, 2019 (SEC File No. 811-21944).and

(v) the audited financial statements and related independent registered public accounting firm’s report for PRME and the financial highlights for PRME contained in PRME’s Annual Report to Shareholders for the fiscal year ended October 31, 2018 (SEC File No. 811-22559)

A copy of the FFR prospectus accompanies this Proxy Statement/Prospectus. The Statement of Additional Information to this Proxy Statement/Prospectus is also incorporated by reference and legally deemed to be part of this document, and is available upon oral or written request at no charge by calling First Trust Advisors L.P. (“First Trust”) at (800) 621-1675 or by writing to First Trust at 120 E. Liberty Drive, Suite 400, Wheaton, Illinois 60187. In addition, FFR will furnish, without charge, a copy of its prospectus, most recent Annual Report or Semi-Annual Report to a shareholder upon request. PRME’s prospectus dated March 1, 2019, and Annual Report to Shareholders for the fiscal year ended October 31, 2018, containing audited financial statements, have been previously made available or mailed to shareholders. Copies of these documents are available upon request and without charge by writing to First Trust at the address listed above or by calling (800) 621-1675.

The Funds are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended (the “1940 Act”), and in accordance therewith are required to file reports and other information with the SEC. These reports, proxy statement/prospectus materials and other information can be inspected and copied, after paying a duplicating fee, by electronic request at publicinfo@sec.gov. In addition, copies of these documents may be viewed online or downloaded without charge from the SEC’s website at www.sec.gov. Reports, proxy materials and other information concerning PRME and FFR may be inspected at the offices of the NYSE Arca.

This Proxy Statement/Prospectus serves as a prospectus of FFR in connection with the issuance of the FFR common shares in the Reorganization. In this connection, no person has been authorized to give any information or make any representation not contained in this Proxy Statement/Prospectus and, if so given or made, such information or representation must not be relied upon as having been authorized. This Proxy Statement/Prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction in which, or to any person to whom, it is unlawful to make such offer or solicitation.

TABLE OF CONTENTS

| INTRODUCTION | 1 |

| A. Synopsis | 1 |

| B. Risk Factors | 7 |

| C. Information About the Reorganization | 14 |

| D. Additional Information About the Investment Policies | 23 |

| Proposal — Reorganization of PRME Into FFR | 31 |

| ADDITIONAL INFORMATION ABOUT PRME AND FFR | 32 |

| GENERAL INFORMATION | 36 |

| OTHER MATTERS TO COME BEFORE THE MEETING | 42 |

| EXHIBIT A FORM OF AGREEMENT AND PLAN OF REORGANIZATION | A-1 |

| EXHIBIT B FORM OF PROXY CARD FOR FIRST TRUST HEITMAN GLOBAL PRIME REAL ESTATE ETF | B-1 |

INTRODUCTION

You are being asked to vote at the Meeting to approve the reorganization of PRME into FFR. Specifically, you are being asked to consider and approve the Plan, pursuant to which the assets and liabilities of PRME will be transferred to FFR, and shareholders of PRME will become shareholders of FFR.

A. Synopsis

The following is a summary of certain information contained elsewhere in this Proxy Statement/Prospectus with respect to the proposed Reorganization and shareholders should reference the more complete information contained in this Proxy Statement/Prospectus and in the Reorganization SAI and the appendices thereto. Shareholders should read the entire Proxy Statement/Prospectus carefully. Certain capitalized terms used but not defined in this summary are defined elsewhere in this Proxy Statement/Prospectus.

The Proposed Reorganization

The Board of Trustees of PRME, including the trustees who are not “interested persons” of the Fund (as defined in the 1940 Act), has unanimously approved the proposed Reorganization, including the Plan. If the shareholders of PRME approve the Proposal, PRME will reorganize into FFR, pursuant to which PRME would (i) transfer all of its assets to FFR in exchange solely for newly issued shares of FFR and FFR’s assumption of all of the liabilities of PRME and (ii) immediately distribute such newly issued shares of FFR to PRME shareholders. In connection with the Reorganization, FFR will issue to PRME shareholders book entry interests for the shares of FFR registered in a “street name” brokerage account held for the benefit of such shareholders. Shareholders of PRME will receive a number of FFR shares equal in aggregate net asset value to the aggregate net asset value of the PRME shares held as of the Valuation Time. Through the Reorganization, shares of PRME would be exchanged on a tax-free basis for federal income tax purposes for shares of FFR. Like shares of PRME, shares of FFR are not deposits or obligations of, or guaranteed or endorsed by, any financial institution, are not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other agency, and involve risk, including the possible loss of the principal amount invested.

Background and Reasons for the Proposed Reorganization

Since its inception, PRME has failed to gather assets and reach scale. This may be partially due to the fact that, since inception, PRME has underperformed its benchmark. PRME’s Board of Trustees and management have regularly monitored the size and performance of PRME and considered a variety of alternatives to increase its assets and have sought to develop a viable approach to address PRME’s lack of scale. FFR has significantly greater assets than PRME and has outperformed PRME since PRME’s inception on November 11, 2015 through the end of 2018. The Board of Trustees and management of PRME believe the Reorganization may allow PRME shareholders who become shareholders of FFR to experience the benefits associated with holding shares in a fund with significantly greater assets than PRME while allowing PRME’s shareholders the opportunity to continue their investment in a similar global real estate strategy. Immediately after the Reorganization, FFR will have a greater asset base than PRME prior to the Reorganization. In addition, FFR has and is expected to maintain a lower total operating expense ratio on a net basis, after fee waivers and expense reimbursements, than PRME, although FFR’s total operating expenses could increase after the current fee waivers and expense reimbursements terminate. FFR has historically made higher distributions than PRME. No assurances can be given that FFR’s total operating expense ratio and distributions will remain at their current rate.

Board Considerations Relating to the Proposed Reorganization

Based on information provided by First Trust, the Board of Trustees considered the following factors, among others, in determining to recommend that shareholders of PRME approve the Plan and the Reorganization it contemplates:

| · | Compatibility of Investment Objectives and Policies. The Board noted that, although PRME is an actively managed exchange-traded fund (“ETF”) that seeks to provide long-term total return while FFR is an index-based ETF that seeks to track an index, both Funds primarily invest in real estate securities traded on U.S. and non-U.S. exchanges, including real estate investment trusts (“REITs”). The Board considered the significant overlap of the Funds’ then-current portfolio holdings and the Funds’ similar country exposures. The Board also considered that the index that FFR seeks to track serves as the benchmark for PRME. |

| · | Comparison of Fees and Expense Ratios; Expense Savings. The Board considered comparative expense information for PRME and FFR, including comparisons between the current advisory fee rates and expense ratios for PRME and FFR and the estimated pro forma advisory fee rate and expense ratio of the combined fund. The Board noted that FFR’s advisory fee rate would not change as a result of the Reorganization. The Board considered that FFR’s total expenses are capped 35 basis points lower than PRME’s unitary management fee through January 31, 2020, which will result in immediate expense savings for PRME shareholders following the Reorganization. The Board noted the Advisor’s statement that it plans to propose the extension of the current expense cap until January 31, 2021 in connection with the renewal of FFR’s advisory agreement in June 2019. The Board considered that any expense savings for FFR after the Reorganization would initially benefit the Advisor by reducing the amount of the fees to be waived or expenses to be reimbursed by the Advisor for FFR. |

| · | Expenses of the Reorganization. The Board noted that the Advisor proposed to bear the direct costs of the Reorganization, including costs associated with proxy solicitation. The Board also noted the indirect costs to be borne by PRME as a result of portfolio repositioning prior to the Reorganization. The Board considered the Advisor’s estimate that, based on estimated annual expense savings as a result of the Reorganization, shareholders of PRME were expected to recoup the indirect Reorganization costs within three months of the completion of the Reorganization. |

| · | Potential Improved Trading and Liquidity. The Board considered the larger asset size and trading volume of FFR as compared to PRME and that PRME shareholders may benefit from becoming shareholders of a larger fund with higher trading volume, potentially resulting in improved liquidity and narrower bid-ask spreads. |

| · | Fund Performance and Distribution Rates. The Board reviewed the historical performance of PRME and FFR, noting that FFR has outperformed PRME over the one- and three-year periods ended December 31, 2018 and has outperformed PRME since PRME’s inception through December 31, 2018. The Board also received information comparing the Funds’ distribution rates and noted that FFR’s current distribution rate is higher than PRME’s current distribution rate. |

| · | Portfolio Management. The Board noted that Heitman Real Estate Securities LLC (“Heitman”) serves as investment sub-adviser to PRME and two Heitman affiliates serve as investment sub-sub-advisers to PRME, and that FFR is managed by the Advisor’s Investment Committee. The Board noted that the Advisor’s Investment Committee would continue to manage FFR following the closing of the Reorganization. |

| · | Anticipated Tax-Free Reorganization; Capital Loss Carryforwards. The Board noted the Advisor’s statement that the Reorganization will be structured with the intention that it qualify as a tax-free reorganization for federal income tax purposes and that PRME and FFR will obtain an opinion of counsel substantially to this effect (based on certain factual representations and certain customary assumptions). In addition, the Board noted the Advisor’s statement that PRME’s capital loss carryforwards could be transferred in the Reorganization, which, subject to certain limitations, could then be used by FFR. |

| · | Terms and Conditions of the Reorganization. The Board considered the terms and conditions of the Reorganization and whether the Reorganization would result in the dilution of the interests of existing shareholders of PRME and FFR in light of the basis on which shares of FFR would be issued to shareholders of PRME. |

Please see “Information About the Reorganization—Background and Trustees’ Considerations Relating to the Proposed Reorganization” below for a further discussion of the deliberations and considerations undertaken by the Board of Trustees in connection with the proposed Reorganization.

The Board of Trustees of each Fund has concluded that the Reorganization is in the best interests of its respective Fund and the interests of the existing shareholders of each Fund will not be diluted as a result of the Reorganization. In the event that shareholders of PRME do not approve the Reorganization, each Fund will continue to exist and operate on a stand-alone basis.

Material Federal Income Tax Consequences of the Reorganization

For federal income tax purposes, no gain or loss is expected to be recognized by PRME or its shareholders as a direct result of the Reorganization. Any undistributed net investment income realized prior to the Reorganization will be distributed to PRME’s shareholders as ordinary dividends (to the extent of net realized short-term capital gains distributed) during or with respect to the year of sale, and such distributions will be taxable to PRME’s shareholders. As of the date hereof, no long-term capital gains dividends are expected prior to the Reorganization. Through the Reorganization, PRME shares will be exchanged, on a tax-free basis for federal income tax purposes, for shares of FFR with an equal aggregate net asset value, and PRME shareholders will become shareholders of FFR.

Comparison of the Funds

General. PRME is a non-diversified, actively managed ETF that was created as a series of First Trust ETF IV, an open-end management investment company organized as a Massachusetts business trust, on November 11, 2015. FFR is a diversified, index-based ETF that was created as a series of First Trust ETF II, an open-end management investment company organized as a Massachusetts business trust, on August 27, 2007.

Investment Objectives, Policies and Strategies. The investment strategies of PRME and FFR are similar, but have some important distinctions, each as discussed and summarized below. The primary differences between the investment strategies of PRME and FFR are as follows: (i) PRME is an actively managed ETF while FFR is an index-based ETF; and (ii) in addition to investing in REITs, which are one of the primary investment classes held by FFR, PRME has a significant holding in real estate operating companies (“REOCs”). As a result of such differences, PRME and FFR are subject to the different risks associated with such different investments and strategies. PRME is sub-advised by Heitman, which provides the day-to-day management of PRME and two Heitman affiliates serve as investment sub-sub-advisers to PRME. The similarities and differences between the Funds’ investment objectives, principal strategies and policies and non-principal and other investment strategies and policies are highlighted below.

Each Fund’s investment objectives are a fundamental policy of the Fund and may not be changed without the approval of a “majority of the outstanding voting securities” of the respective Fund. A “majority of the outstanding voting securities” means the lesser of (i) 67% or more of the shares represented at a meeting at which more than 50% of the outstanding shares are represented, or (ii) more than 50% of the outstanding shares.

Purchase, Redemption and Distribution. PRME and FFR issue and redeem shares on a continuous basis, at net asset value, only in large specified blocks of shares (each a “Creation Unit”). PRME and FFR shares are not individually redeemable securities of PRME and FFR, respectively, except when aggregated as Creation Units. Shares of PRME and FFR are listed and traded on NYSE Arca under the ticker symbol “PRME” and “FFR,” respectively, to provide liquidity for individual shareholders of PRME and FFR shares in amounts less than the size of a Creation Unit. Shareholders of PRME and FFR are entitled to dividends as declared by their respective Trustees. Each of PRME and FFR distribute their net investment income monthly and their net realized capital gains at least annually, if any.

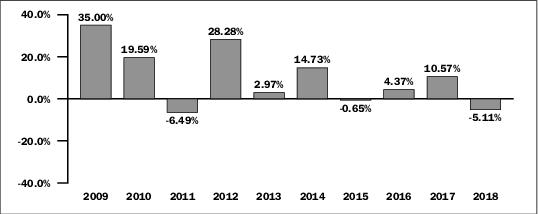

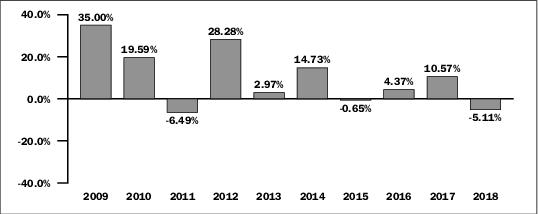

Past Performance. The bar charts and tables below provide some indication of the risks of investing in the Funds by showing you how the performance of each Fund has varied from year to year, and how the average total returns of the Funds for different periods compare. A Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Performance information for FFR is provided below.

First Trust FTSE EPRA/NAREIT Developed Markets Real Estate Index Fund

Calendar Year Total Returns as of 12/31 (1)

(1) The Fund’s calendar year-to-date total return based on net asset value for the

period 12/31/18 to 03/31/19 was 14.45%.

FFR’s past performance (before and after taxes) is not necessarily an indication of how FFR will perform in the future.

Returns before taxes do not reflect the effects of any income or capital gains taxes. All after-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of any state or local tax. Returns after taxes on distributions reflect the taxed return on the payment of dividends and capital gains. Returns after taxes on distributions and sale of shares assume a shareholder sold their shares at period end, and, therefore, are also adjusted for any capital gains or losses incurred. Returns for the market indices do not include expenses, which are deducted from FFR returns, or taxes.

A shareholders own actual after-tax returns will depend on their specific tax situation and may differ from what is shown here. After-tax returns are not relevant to investors who hold FFR shares in tax-deferred accounts such as individual retirement accounts (“IRAs”) or employee-sponsored retirement plans.

| AVERAGE ANNUAL TOTAL RETURNS FOR THE PERIODS ENDED MARCH 31, 2019 |

| FFR | 1 Year | 3 Year | 5 Year | 10 Year |

| Return Before Taxes | 13.48% | 5.94% | 6.59% | 13.99% |

| Return After Taxes on Distributions | 11.87% | 4.40% | 5.19% | 12.42% |

| Return After Taxes on Distributions and Sale of Fund Shares | 7.90% | 3.83% | 4.45% | 10.90% |

| FTSE EPRA/NAREIT Developed Index (reflects no deduction for fees, expenses or taxes) | 14.42% | 6.67% | 7.37% | 14.90% |

| S&P Global REIT Index (reflects no deduction for fees, expenses or taxes) | 13.93% | 4.47% | 6.63% | 14.84% |

| MSCI World REIT Index (reflects no deduction for fees, expenses or taxes) | 16.61% | 5.88% | 8.08% | 15.04% |

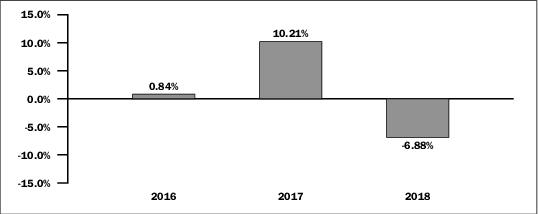

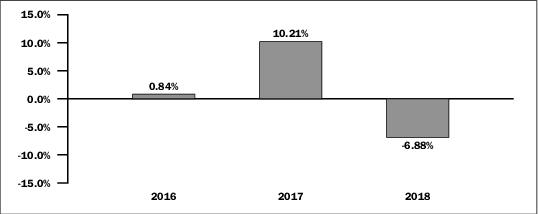

Performance information for PRME is provided below.

First Trust Heitman Global Prime Real Estate ETF

Calendar Year Total Returns as of 12/31 (1)

(1) The Fund’s calendar year-to-date total return based on net asset value for the

period 12/31/18 to 03/31/19 was 15.55%.

PRME’s past performance (before and after taxes) is not necessarily an indication of how PRME will perform in the future.

Returns before taxes do not reflect the effects of any income or capital gains taxes. All after-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of any state or local tax. Returns after taxes on distributions reflect the taxed return on the payment of dividends and capital gains. Returns after taxes on distributions and sale of shares assume a shareholder sold their shares at period end, and, therefore, are also adjusted for any capital gains or losses incurred. Returns for the market indices do not include expenses, which are deducted from PRME returns, or taxes.

A shareholders own actual after-tax returns will depend on their specific tax situation and may differ from what is shown here. After-tax returns are not relevant to investors who hold FFR shares in tax-deferred accounts such as IRAs or employee-sponsored retirement plans.

| AVERAGE ANNUAL TOTAL RETURNS FOR THE PERIODS ENDED MARCH 31, 2019 |

| PRME | 1 Year | 3 Year | Since Inception (11/11/2015) |

| Return Before Taxes | 11.28% | 5.05% | 5.48% |

| Return After Taxes on Distributions | 9.90% | 3.04% | 3.62% |

| Return After Taxes on Distributions and Sale of Fund Shares | 6.60% | 2.91% | 3.32% |

| FTSE EPRA/NAREIT Developed Index (reflects no deduction for fees, expenses or taxes) | 14.42% | 6.67% | 8.33% |

B. Risk Factors

The investment strategies of PRME and FFR are similar, but have some important distinctions, as discussed in this Proxy Statement/Prospectus. The principal differences between the investment strategies of PRME and FFR are as follows: (i) PRME is an actively managed ETF while FFR is an index-based ETF; and (ii) in addition to investing in REITs, PRME has a significant holding in REOCs. As a result of such differences, PRME and FFR are subject to different risks associated with such different investments and strategies. Additionally, as PRME is classified as a “non-diversified” fund under the 1940 Act and FFR is classified as a “diversified” fund under the 1940 Act, PRME is subject to non-diversification risk, as described below.

Aside from these differences, as investment companies following similar strategies, many of the principal risks applicable to an investment in PRME are also applicable to an investment in FFR. Shares of each Fund may change in value, and an investor could lose money by investing in either Fund. The Funds may not achieve their investment objectives. An investment in a Fund is not a deposit with a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. An investment in a Fund involves risks similar to those of investing in equity securities of any fund traded on an exchange. Risk is inherent in all investing.

As noted above, although many of the principal risks applicable to an investment in PRME are also applicable to an investment in FFR, there are some differences in the risks applicable to each Fund. PRME is an actively managed ETF while FFR is an index-based ETF and as such PRME has risks associated with being actively managed which are described in more detail below. PRME is a non-diversified fund while FFR is a diversified fund and PRME has additional risks associated with being non-diversified which are described below. Additionally, PRME has significant holdings in REOCs making it more susceptible to risks associated with holding REOCs than funds without such significant holdings such as FFR. PRME is also a smaller fund than FFR and therefore is susceptible to the risks associated with smaller funds which are described below.

The following specific factors have been identified as the principal risks of investing in FFR. These risks should be considered by shareholders of PRME in their evaluation of the Reorganization. An investment in FFR may not be appropriate for all investors. FFR is not intended to be a complete investment program. Investors should consider their long-term investment goals and financial needs when making an investment decision with respect to FFR. Shares of FFR at any point in time may be worth less than an investor’s original investment. As indicated, PRME may also be subject to certain of these risks.

Principal Risks of FFR

Asia Risk

FFR is subject to certain risks specifically associated with investments in the securities of Asian issuers. Many Asian economies have experienced rapid growth and industrialization, and there is no assurance that this growth rate will be maintained. Some Asian economies are highly dependent on trade, and economic conditions in other countries within and outside Asia can impact these economies. Certain of these economies may be adversely affected by trade or policy disputes with its major trade partners. There is also a high concentration of market capitalization and trading volume in a small number of issuers representing a limited number of industries, as well as a high concentration of investors and financial intermediaries. Certain Asian countries have experienced and may in the future experience expropriation and nationalization of assets, confiscatory taxation, currency manipulation, political instability, armed conflict and social instability as a result of religious, ethnic, socio-economic and/or political unrest. In particular, escalated tensions involving North Korea and any outbreak of hostilities involving North Korea could have a severe adverse effect on Asian economies. Governments of certain Asian countries have exercised, and continue to exercise, substantial influence over many aspects of the private sector. In certain cases, the government owns or controls many companies, including the largest in the country. Accordingly, government actions could have a significant effect on the issuers of the Fund’s securities or on economic conditions generally.

Authorized Participant Concentration Risk (also applicable to PRME)

Only an authorized participant may engage in creation or redemption transactions directly with FFR. A limited number of institutions act as authorized participants for FFR. To the extent that these institutions exit the business or are unable to proceed with creation and/or redemption orders and no other authorized participant steps forward to create or redeem, FFR’s shares may trade at a premium or discount to FFR’s net asset value and possibly face delisting.

Concentration Risk (also applicable to PRME)

To the extent that FFR invests a large percentage of its assets in a single asset class or the securities of issuers within the same country, state, region, industry or sector, an adverse economic, business or political development may affect the value of FFR’s investments more than if FFR were more broadly diversified. A concentration makes FFR more susceptible to any single occurrence and may subject FFR to greater market risk than a fund that is not so concentrated.

Currency Risk (also applicable to PRME)

Changes in currency exchange rates affect the value of investments denominated in a foreign currency, and therefore the value of such investments in FFR’s portfolio. FFR’s net asset value could decline if a currency to which FFR has exposure depreciates against the U.S. dollar or if there are delays or limits on repatriation of such currency. Currency exchange rates can be very volatile and can change quickly and unpredictably. As a result, the value of an investment in FFR may change quickly and without warning.

Cyber Security Risk (also applicable to PRME)

FFR is susceptible to operational risks through breaches in cyber security. A breach in cyber security refers to both intentional and unintentional events that may cause FFR to lose proprietary information, suffer data corruption or lose operational capacity. Such events could cause FFR to incur regulatory penalties, reputational damage, additional compliance costs associated with corrective measures and/or financial loss. Cyber security breaches may involve unauthorized access to FFR’s digital information systems through “hacking” or malicious software coding but may also result from outside attacks such as denial-of-service attacks through efforts to make network services unavailable to intended users. In addition, cyber security breaches of the securities issuers or FFR’s third-party service providers, such as its administrator, transfer agent, custodian, or sub-advisor, as applicable, or issuers in which FFR invests, can also subject FFR to many of the same risks associated with direct cyber security breaches. Although FFR has established risk management systems designed to reduce the risks associated with cyber security, there is no guarantee that such efforts will succeed, especially because FFR does not directly control the cyber security systems of issuers or third-party service providers.

Depositary Receipts Risk (also applicable to PRME)

Depositary receipts may be less liquid than the underlying shares in their primary trading market. Any distributions paid to the holders of depositary receipts are usually subject to a fee charged by the depositary. Holders of depositary receipts may have limited voting rights, and investment restrictions in certain countries may adversely impact the value of depositary receipts because such restrictions may limit the ability to convert the equity shares into depositary receipts and vice versa. Such restrictions may cause the equity shares of the underlying issuer to trade at a discount or premium to the market price of the depositary receipts.

Equity Securities Risk (also applicable to PRME)

The value of FFR’s shares will fluctuate with changes in the value of the equity securities in which it invests. Equity securities prices fluctuate for several reasons, including changes in investors’ perceptions of the financial condition of an issuer or the general condition of the relevant equity market, such as market volatility, or when political or economic events affecting an issuer occur. Common stock prices may be particularly sensitive to rising interest rates, as the cost of capital rises and borrowing costs increase. Equity securities may decline significantly in price over short or extended periods of time, and such declines may occur in the equity market as a whole, or they may occur in only a particular country, company, industry or sector of the market.

Europe Risk (also applicable to PRME)

FFR is subject to certain risks specifically associated with investments in the securities of European issuers. Political or economic disruptions in European countries, even in countries in which FFR is not invested, may adversely affect security values and thus FFR’s holdings. A significant number of countries in Europe are member states in the European Union (the “EU”), and the member states no longer control their own monetary policies by directing independent interest rates for their currencies. In these member states, the authority to direct monetary policies, including money supply and official interest rates for the Euro, is exercised by the European Central Bank. The United Kingdom’s referendum on June 23, 2016 to leave the EU (known as “Brexit”) sparked depreciation in the value of the British pound, short-term declines in the stock markets and heightened risk of continued economic volatility worldwide. Although the long-term effects of Brexit are difficult to gauge and cannot be fully known, they could have wide ranging implications for the United Kingdom’s economy, including: possible inflation or recession, continued depreciation of the pound, or disruption to Britain’s trading arrangements with the rest of Europe. The United Kingdom is one of the EU’s largest economies. Its departure may negatively impact the EU and Europe as a whole by causing volatility within the EU, triggering prolonged economic downturns in certain European countries or sparking additional member states to contemplate departing the EU (thereby perpetuating political instability in the region).

Index Constituent Risk

FFR may be a constituent of one or more indices. As a result, FFR may be included in one or more index-tracking exchange-traded funds or mutual funds. Being a component security of such a vehicle could greatly affect the trading activity involving FFR’s shares, the size of FFR and the market volatility of FFR. Inclusion in an index could increase demand for FFR and removal from an index could result in outsized selling activity in a relatively short period of time. As a result, FFR’s net asset value could be negatively impacted and FFR’s market price may be below FFR’s net asset value during certain periods. In addition, index rebalances may potentially result in increased trading activity in FFR’s shares.

Index Provider Risk

There is no assurance that the Index Provider will compile the Index accurately, or that the Index will be determined, maintained, constructed, reconstituted, rebalanced, composed, calculated or disseminated accurately. To correct any such error, the Index Provider may carry out an unscheduled rebalance or other modification of the Index constituents or weightings, which may increase FFR’s costs. The Index Provider does not provide any representation or warranty in relation to the quality, accuracy or completeness of data in the Index, and it does not guarantee that the Index will be calculated in accordance with its stated methodology. Losses or costs associated with any Index Provider errors generally will be borne by FFR and its shareholders.

Inflation Risk (also applicable to PRME)

Inflation risk is the risk that the value of assets or income from investments will be less in the future as inflation decreases the value of money. As inflation increases, the present value of FFR’s assets and distributions may decline.

Market Maker Risk (also applicable to PRME)

FFR faces numerous market trading risks, including the potential lack of an active market for FFR shares due to a limited number of market markers. Decisions by market makers or authorized participants to reduce their role or step away from these activities in times of market stress could inhibit the effectiveness of the arbitrage process in maintaining the relationship between the underlying values of FFR’s portfolio securities and FFR’s market price. FFR may rely on a small number of third-party market makers to provide a market for the purchase and sale of shares. Any trading halt or other problem relating to the trading activity of these market makers could result in a dramatic change in the spread between FFR’s net asset value and the price at which FFR’s shares are trading on the Exchange, which could result in a decrease in value of FFR’s shares. This reduced effectiveness could result in FFR shares trading at a discount to net asset value and also in greater than normal intraday bid-ask spreads for FFR shares.

Market Risk (also applicable to PRME)

Market risk is the risk that a particular security, or shares of FFR in general, may fall in value. Securities are subject to market fluctuations caused by such factors as economic, political, regulatory or market developments, changes in interest rates and perceived trends in securities prices. Shares of FFR could decline in value or underperform other investments.

Non-Correlation Risk

FFR’s return may not match the return of the Index for a number of reasons. FFR incurs operating expenses not applicable to the Index, and may incur costs in buying and selling securities, especially when rebalancing FFR’s portfolio holdings to reflect changes in the composition of the Index. In addition, FFR’s portfolio holdings may not exactly replicate the securities included in the Index or the ratios between the securities included in the Index.

Non-U.S. Securities Risk (also applicable to PRME)

Non-U.S. securities are subject to higher volatility than securities of domestic issuers due to possible adverse political, social or economic developments, restrictions on foreign investment or exchange of securities, lack of liquidity, currency exchange rates, excessive taxation, government seizure of assets, different legal or accounting standards, and less government supervision and regulation of securities exchanges in foreign countries.

Passive Investment Risk

FFR is not actively managed. FFR invests in securities included in or representative of the Index regardless of investment merit. FFR generally will not attempt to take defensive positions in declining markets. In the event that the Index is no longer calculated, the Index license is terminated or the identity or character of the Index is materially changed, FFR will seek to engage a replacement index.

Portfolio Turnover Risk

High portfolio turnover may result in FFR paying higher levels of transaction costs and may generate greater tax liabilities for shareholders. Portfolio turnover risk may cause FFR’s performance to be less than expected.

Premium/Discount Risk (also applicable to PRME)

The market price of FFR’s shares will generally fluctuate in accordance with changes in FFR’s net asset value as well as the relative supply of and demand for shares on the NYSE Arca. FFR’s investment advisor cannot predict whether shares will trade below, at or above their net asset value because the shares trade on the NYSE Arca at market prices and not at net asset value. Price differences may be due, in large part, to the fact that supply and demand forces at work in the secondary trading market for shares will be closely related, but not identical, to the same forces influencing the prices of the holdings of FFR trading individually or in the aggregate at any point in time. However, given that shares can only be issued and redeemed in Creation Units, and only to and from broker-dealers and large institutional investors that have entered into participation agreements (unlike shares of closed-end funds, which frequently trade at appreciable discounts from, and sometimes at premiums to, their net asset value), FFR’s investment advisor believes that large discounts or premiums to the net asset value of shares should not be sustained.

Real Estate Companies Risk (also applicable to PRME)

Real estate companies include REITs and other companies involved in the operation and development of commercial, residential and industrial real estate. An investment in a real estate company may be subject to risks similar to those associated with direct ownership of real estate, including the possibility of declines in the value of real estate, losses from casualty or condemnation, and changes in local and general economic conditions, supply and demand, interest rates, environmental liability, zoning laws, regulatory limitations on rents, property taxes, and operating expenses. Some real estate companies have limited diversification because they invest in a limited number of properties, a narrow geographic area, or a single type of property. The price of a real estate company’s securities may also drop because of dividend reductions, lowered credit ratings, poor management, or other factors that affect companies in general.

REIT Risk (also applicable to PRME)

REITs typically own and operate income-producing real estate, such as residential or commercial buildings, or real-estate related assets, including mortgages. As a result, investments in REITs are subject to the risks associated with investing in real estate, which may include, but are not limited to: fluctuations in the value of underlying properties; defaults by borrowers or tenants; market saturation; changes in general and local operating expenses; and other economic, political or regulatory occurrences affecting companies in the real estate sector. REITs are also subject to the risk that the real estate market may experience an economic downturn generally, which may have a material effect on the real estate in which the REITs invest and their underlying portfolio securities. REITs may have also a relatively small market capitalization which may result in their shares experiencing less market liquidity and greater price volatility than larger companies. Increases in interest rates typically lower the present value of a REIT's future earnings stream, and may make financing property purchases and improvements more costly. Because the market price of REIT stocks may change based upon investors' collective perceptions of future earnings, the value of FFR will generally decline when investors anticipate or experience rising interest rates.

Trading Issues Risk (also applicable to PRME)

Although the shares of FFR are listed for trading on the Exchange, there can be no assurance that an active trading market for such shares will develop or be maintained. Trading in shares on the Exchange may be halted due to market conditions or for reasons that, in the view of the Exchange, make trading in shares inadvisable. In addition, trading in shares on the Exchange is subject to trading halts caused by extraordinary market volatility pursuant to the Exchange’s “circuit breaker” rules. Market makers are under no obligation to make a market in FFR’s shares, and authorized participants are not obligated to submit purchase or redemption orders for Creation Units. In the event market makers cease making a market in FFR’s shares or authorized participants stop submitting purchase or redemption orders for Creation Units, Fund shares may trade at a larger premium or discount to their net asset value. There can be no assurance that the requirements of the Exchange necessary to maintain the listing of FFR will continue to be met or will remain unchanged. FFR may have difficulty maintaining its listing on the Exchange in the event FFR’s assets are small or FFR does not have enough shareholders.

Principal Risks Exclusive to PRME

The investment objectives and strategies of PRME and FFR are similar, but they also have some important distinctions, as discussed in this Proxy Statement/Prospectus. As a result of such differences, PRME is subject to the following additional risks associated with such additional investments and strategies that are not associated with FFR:

Emerging Markets Risk

Investments in securities issued by companies operating in emerging market countries involve additional risks relating to political, economic, or regulatory conditions not associated with investments in securities and instruments issued by U.S. companies or by companies operating in other developed market countries. Investments in emerging markets securities are generally considered speculative in nature and are subject to the following heightened risks: smaller market capitalization of securities markets which may suffer periods of relative illiquidity; significant price volatility; restrictions on foreign investment; possible repatriation of investment income and capital; rapid inflation; and currency convertibility issues. Emerging market countries also often have less uniformity in accounting and reporting requirements, unsettled securities laws, unreliable securities valuation and greater risk associated with custody of securities. Furthermore, investors may be required to register the proceeds of sales and future economic or political crises could lead to price controls, forced mergers, expropriation or confiscatory taxation, seizure, nationalization or creation of government monopolies.

Management Risk

PRME is subject to management risk because it is an actively managed portfolio. In managing PRME’s investment portfolio, the portfolio managers will apply investment techniques and risk analyses that may not produce the desired result. There can be no guarantee that PRME will meet its investment objective.

Non-Diversification Risk

PRME is classified as “non-diversified” under the 1940 Act. As a result, PRME is only limited as to the percentage of its assets which may be invested in the securities of any one issuer by the diversification requirements imposed by the Code. PRME may invest a relatively high percentage of its assets in a limited number of issuers. As a result, PRME may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly invested in certain issuers.

Small Fund Risk

PRME currently has fewer assets than larger funds, and like other smaller funds, large inflows and outflows may impact PRME’s market exposure for limited periods of time. This impact may be positive or negative, depending on the direction of market movement during the period affected. If PRME fails to attract a large amount of assets, shareholders of PRME may incur higher expenses as PRME’s fixed costs would be allocated over a smaller number of shareholders.

Smaller Companies Risk

Small and/or mid capitalization companies may be more vulnerable to adverse general market or economic developments, and their securities may be less liquid and may experience greater price volatility than larger, more established companies as a result of several factors, including limited trading volumes, fewer products or financial resources, management inexperience and less publicly available information. Accordingly, such companies are generally subject to greater market risk than larger, more established companies.

Principal Risks Related to the Proposed Reorganization

The following are principal risks related to the proposed Reorganization:

Anticipated Benefits Risk

Although it is anticipated that the Reorganization will lead to certain benefits for PRME and FFR shareholders, we cannot assure you that these benefits, along with any other benefits that are anticipated from the Reorganization, will be realized.

Tax Risk

In addition to the foregoing risks of investing in FFR, tax risk is associated with the proposed Reorganization. PRME’s counsel is giving an opinion that the Reorganization will be a tax-free reorganization for federal income tax purposes. See “Information about the Reorganization – Federal Income Tax Consequences.” However, no ruling is being sought from the Internal Revenue Service (the “IRS”) to determine whether the IRS in fact agrees with the opinion of PRME’s counsel. The opinion of PRME’s counsel’s opinion is not binding upon the IRS, and the IRS could take a position different from that reflected in the opinion. The opinion does not address state or foreign tax consequences of the Reorganization, which could vary from state to state and country to country. The opinion relies upon the current statute and regulations, portions of which have been changed recently and have not yet been subject to full and complete interpretation by the courts. In addition, tax laws and rules may change in the future, and some changes may apply retroactively. The opinion only addresses current law.

The tax opinion also relies on certain representations by the parties to the Reorganization as to current facts and future behavior. If such representations are not in fact correct, the Reorganization could be viewed as a taxable sale of the assets of PRME to FFR resulting in gain recognition to PRME. Under such circumstances, the shareholders of PRME would individually owe taxes on the gain recognized in the Reorganization, and potentially for their proportionate portion of the taxes of PRME. No reserves are being created to fund any such tax liability, and it is not anticipated that any portion of the distribution of shares will be designated as a capital gain distribution.

C. Information About the Reorganization

General

The Board of Trustees of PRME has unanimously approved, and the shareholders of PRME are being asked to approve, the Plan by and between First Trust ETF IV, on behalf of PRME, and First Trust ETF II, on behalf of FFR, and the transactions it contemplates, including the reorganization of PRME into FFR in exchange for shares of FFR, on a tax-free basis for federal income tax purposes as provided for herein. The Board of Trustees believes the Reorganization will allow PRME shareholders to hold shares in a fund with significantly greater assets while allowing PRME’s shareholders the opportunity to continue their investment in a global real estate strategy. In addition, FFR is expected to maintain a lower total operating expense ratio than PRME following the Reorganization through January 31, 2021. FFR’s total operating expense ratio could increase after January 31, 2021. The Board of Trustees of each Fund has determined that the proposed Reorganization is in the best interests of its respective Fund and that the interests of its respective Fund’s existing shareholders will not be diluted as a result of the transactions contemplated by the Reorganization.

The affirmative vote of a majority of the outstanding voting securities of PRME is required to approve the Plan. The “vote of a majority of the outstanding voting securities” is defined in the 1940 Act as the vote of the lesser of (i) 67% or more of the shares of the Fund present at the Meeting, if the holders of more than 50% of such outstanding shares are present in person or represented by proxy; or (ii) more than 50% of such outstanding shares of the Fund. Abstentions and broker non-votes will be treated as present for purposes of determining a quorum at the Meeting. Abstentions and broker non-votes will have the same effect as a vote against the approval of the Plan and the Reorganization it contemplates.

A copy of the Plan is attached hereto as Exhibit A for your reference.

Terms of the Reorganization

Pursuant to, and subject to the conditions contained in, the Plan, the proposed Reorganization seeks to combine the Funds, which have similar investment strategies and risks, but also have important distinctions. The Plan provides for the reorganization of PRME into FFR, pursuant to which PRME would (i) transfer all of its assets to FFR in exchange solely for newly issued shares of FFR and FFR’s assumption of all of the liabilities of PRME and (ii) immediately distribute such newly issued shares of FFR to PRME shareholders. As a result, all of the assets of PRME will be transferred to FFR and FFR will assume all of the liabilities of PRME, including without limitation PRME’s indemnification obligations to its trustees and officers. Shareholders of PRME will receive a number of FFR shares equal in aggregate net asset value to the aggregate net asset value of the PRME shares held as of the Valuation Time. Through the Reorganization, shares of PRME would be exchanged on a tax-free basis for federal income tax purposes for shares of FFR. In the event that shareholders of PRME do not approve the Reorganization, each Fund will continue to exist and operate on a stand alone basis.