AmTrust Financial

Exhibit 99.1

Who We Are

Multinational specialty property and casualty insurance company

Founded in 1998

Founders: Michael and George Karfunkel, Barry Zyskind

Inside ownership 57%

NASDAQ ticker symbol “AFSI”

“A-” rating from A.M. Best

We focus on underserved, niche markets:

Small business workers’ compensation (42.1% of GPW 6 months ended

June 30, 2007)

Specialty risk and extended warranty (29.3% of GPW 6 months ended

June 30, 2007)

Specialty middle-market property and casualty (28.6% of GPW 6 months

ended June 30, 2007)

We have grown our business organically and through opportunistic renewal

rights transactions

High teens ROE business model

2

Company Overview

US only (31 states and DC)

$205 MM GPW in 2005

$258.9 MM GPW in 2006

$168.1 MM through 6/30/07

Insured Profile

Average premium < $5,000

Europe, US

$81 MM GPW in 2005

$132.8 MM GPW in 2006

$117.3 MM through 6/30/07

Warranty coverage for selected

consumer and commercial goods

50.6% of GPW through 6/30/07

was written outside US

US only (nationwide)

Entered through renewal rights

transaction from Alea

$446 MM GPW (2004) and over

$250 MM (9/30/05) for Alea

$134.3 MM in 2006

$114.3 MM through 6/30/07

Specialty Middle-Market P&C

Insurance

Specialty Risk and Extended

Warranty

Small Business Workers’

Compensation

Mix of Business

25.3%

28.5%

49.2%

71.5%

2006

2005

25.5%

0%

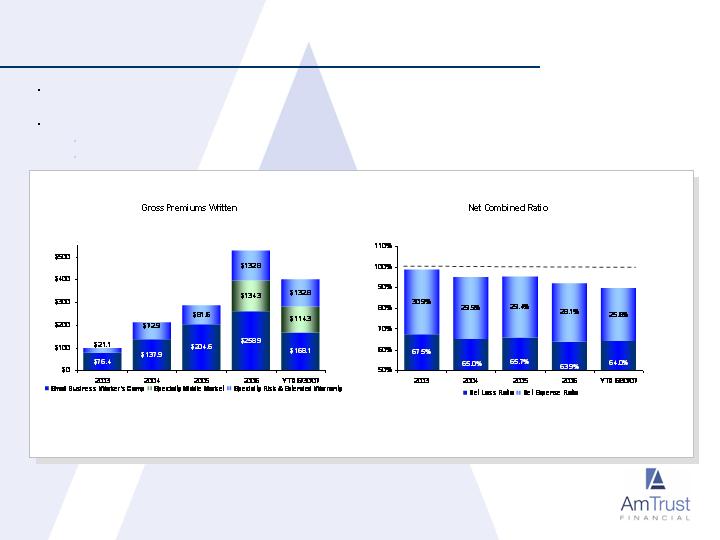

Gross Premiums Written

$526 MM

$286 MM

2006

2005

29.3%

42.1%

6/30/07

28.6%

$400 MM

YTD 6/30/07

3

Small Business Workers’ Compensation

Target Customers

Average annual premium

less than $5,000

Small employers –

typically underserved by

larger carriers

Average 6 employees

Low to mid hazard

profile

Underserved segment,

competitors include

state funds and

regional carriers

AmTrust Approach

Expense control

Paperless proprietary

underwriting system

Risks individually

underwritten

Prompt response to

agents and insureds

8,000 active agents

Result

Cost efficient strategy

Historically high retention

and renewal rates (over

80%)

Historical organic premium

growth of over 15%

annually

Target combined ratio

of 95% or better

4

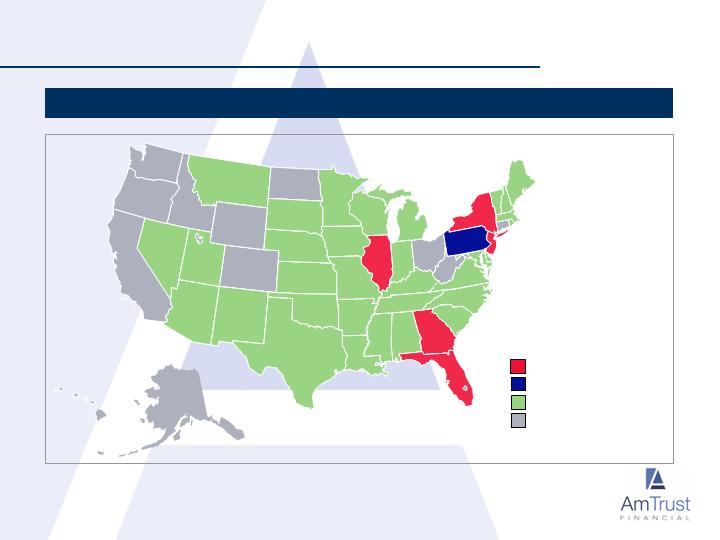

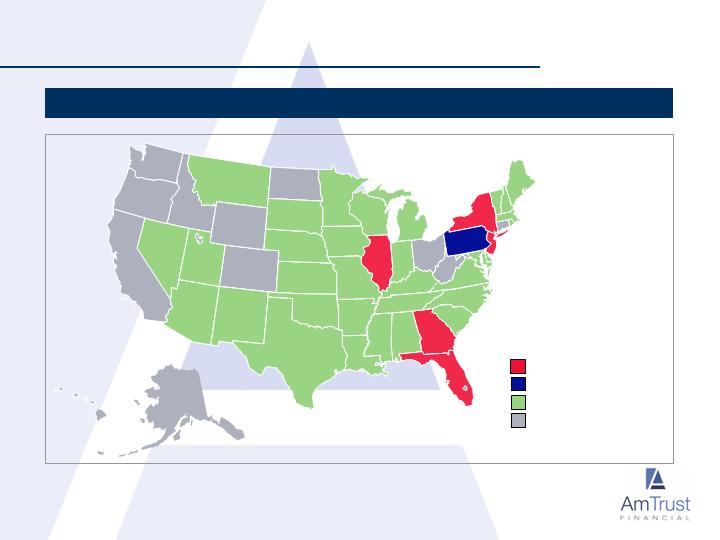

Small Business Workers’ Compensation (cont’d)

Premium Distribution by State

(6 months ended June 30, 2007 )

11%

11.8%

5.8%

1.5%

2.7%

10.5%

10.2%

3.3%

1.4%

4.1%

25%

Greater than 5% Less than 10%

Less than 5%

No Operations

Greater than 10%

1.3%

1.7%

5

Specialty Risk and Extended Warranty

We provide extended warranties for a wide range of

consumer and commercial goods

Target Customers

Manufacturers and retailers of

consumer and commercial

goods

Geography

Europe (50.6% of GPW for

6 months ended 6/30/07)

US (49.4% of GPW for

6 months ended 6/30/07)

AmTrust Approach

Extensive front-end

diligence and actuarial

review for each new

product and client

Develop customized and

strictly defined policy

forms that fit the needs

of the client

Proactively managing

claims and adjusting

premiums if needed

Result

Profit center or cost

reduction for client

Cost effective for

warranty buyer

Profitable for AmTrust

6

Specialty Middle Market P&C (Alea)

Target Customers

Retail, wholesale, service

operations covered

through 25 wholesale

agents

Lines of business:

Workers’ compensation

(37%), general liability

(22%), commercial auto

liability (28%), other (13%)

AmTrust Approach

Extensive front-end

diligence and actuarial

review for each new

product and client

Develop customized and

strictly defined policy

forms that fit the needs

of the client

Leverage proprietary

technology systems

to process business

efficiently

Result

Business integration

on-going

Most of Alea’s former

senior management,

underwriting and support

team have joined AmTrust

Generated $114.3 MM

of gross premiums written

for the 6 months ended

6/30/07

Expansion of workers’ comp, general liability & commercial auto

and property coverage

7

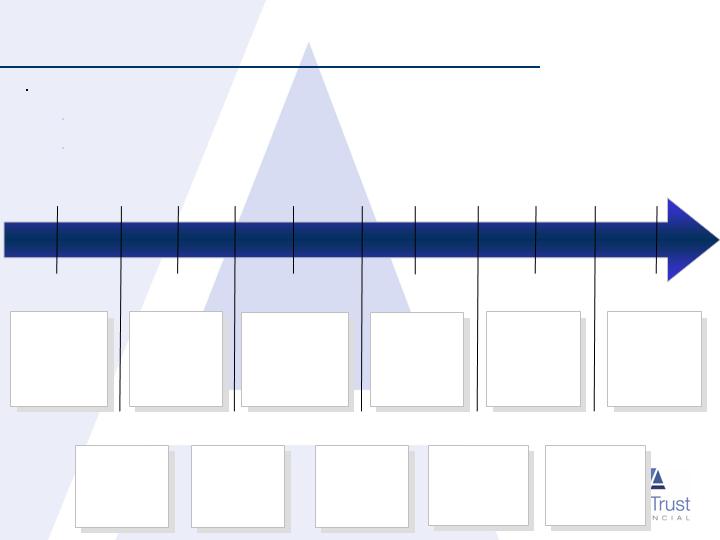

We have grown our business organically and through:

Key hires of underwriting teams in the US and Europe

Opportunistic renewal rights transactions

History of Disciplined Growth

Princeton Insurance

Company

Total book of business:

Approximately $111 MM

Dec.

2002

Renewal

Rights

Early

2003

Hired European

specialty risk and

extended warranty

insurance team hired in

London

Key Hires

Dec.

2003

The Covenant Group

Total book of business:

Approximately $62 MM

Renewal

Rights

Aug.

2004

Associated Industries

Insurance Company

Total book of business:

Approximately $100 MM

Renewal

Rights

Alea US

Small-, Middle-market

P&C book

Total book of business:

Approximately $450 MM

for 2004

Dec.

2005

Renewal

Rights

May

2006

Renewal

Rights

Muirfield Underwriters

Total book of business:

Approximately $60 MM

June

2006

Shell

Acquisition

Acquisition of Wesco

Insurance Co. (WIC), from

HSBC Insurance Co., an

affiliate of HIG

Feb.

2006

Raised ~$166 MM to

finance acquisition of

renewal rights of Alea

and fund growth in

existing businesses

144A Offering

April

2007

Acquisition of IGI

Group, Ltd.

Acquisition

June

2007

Acquisition

Announce plans

to acquire

Associated Industries

Insurance Services, Inc.

Expected to close in 3 rd

quarter 2007

July

2007

40% quota-share

reinsurance

agreement with

Maiden Insurance Co.

Reinsurance

Agreement

8

Renewal Rights Transaction Overview

Typically occur when an insurance company needs to raise cash quickly or exit line

Opportunity to re-underwrite and cherry pick the book of business

Access to historical loss data

Seasoned book of business

Hire key employees

Policy renewals at sole discretion of AmTrust

Continuing payments to selling carrier only if policies renewed by AmTrust

Continue relationships with agents

Right to renew another carrier’s insurance policies without assuming historical liabilities

These have been highly profitable, low risk transactions for AmTrust

9

Business Model

Deliver high teens ROE through:

Focus on earning underwriting profit

Target at or below 95% combined ratio

Proprietary technology platform designed to process small policies

Effective tax rate of less than 30%

10

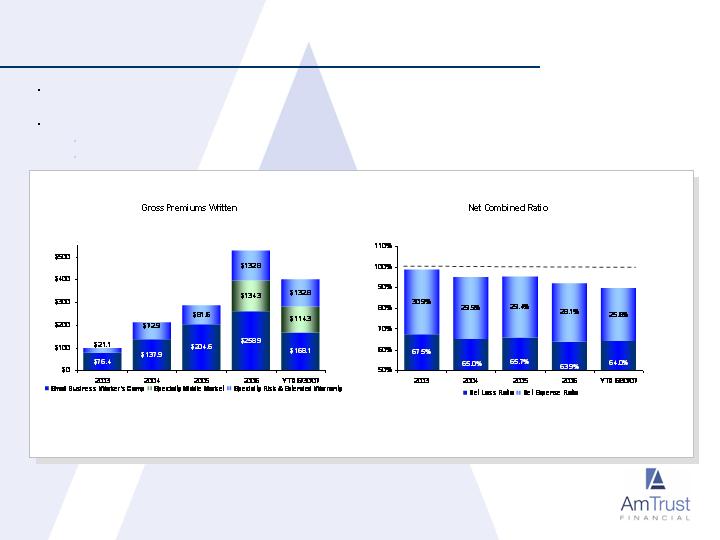

Financial Performance

$97.5

$210.9

$526.0

91.9%

95.1%

94.8%

98.4%

We produce an underwriting profit by having consistent loss ratios and focusing on expenses

As our premium has grown, we have:

Increased our operating leverage

Decreased our expense ratio

$286.1

$399.7

89.6%

11

Recent Financial Results

Summary Income Statement

($ in millions)

Gross Premiums Written

Net Premiums Written

Net Premiums Earned

Fee Income

Net Investment Income and Realized Gains

Loss and LAE Expense

Acquisition Expense

Salaries and G&A Expense

Pretax Income from Continuing Operations

Income Tax Expense

Net Income from Continuing Operations

Annualized ROE from Net Income from Continuing Operations

Net Loss Ratio

Net Expense Ratio

Net Combined Ratio

2005

$286.1

259.2

216.0

8.2

16.4

142.0

30.1

33.4

29.6

6.7

$20.1

17.3%

65.7%

29.4%

95.1%

2006

$526.1

436.3

329.0

12.4

42.4

210.1

43.3

49.0

70.7

17.8

$48.4

21.1%

63.9%

28.1%

91.9%

6/30/2007

$399.7

324.1

249.1

8.8

35.7

159.6

32.0

31.5

59.5

16.6

$42.9

23.8%

64.0%

25.6%

89.6%

12

Recent Financial Position

Balance Sheet

($ in millions)

Cash and Investments

Reinsurance Recoverable

Premiums Receivable, Net

Goodwill & Intangible Assets

Other

Loss and LAE Reserve

Unearned Premium Reserve

(1)

Junior Subordinate Debentures

Other

Common Equity & APIC

Shareholders' Equity

Total Liabilities and Shareholders' Equity

1.

Trust Preferred Securities.

2.

Includes assets managed on behalf of others.

Preferred Stock

Book Value Per Share

12/31/05

$415.8

17.7

81.1

20.8

77.5

612.9

168.0

156.8

51.6

118.1

494.5

58.4

118.4

$612.9

60.0

12/31/06

$785.9

44.1

147.8

29.4

178.2

1,185.4

295.8

323.2

82.5

143.4

844.9

340.5

340.5

$1,185.4

-

$5.68

(2)

(2)

6/30/07

$1,052.2

52.3

239.3

40.4

269.8

1,654.0

386.0

452.0

123.7

287.6

1,249.3

379.2

379.2

$1,654.0

-

$6.32

(2)

(2)

13

Financial Objectives for Remainder

of 2007 and 2008

At least 20% Organic Growth in Premiums

Combined Ratio of 95% or better

Investment Yield of at least 6.0%

Effective Tax Rate less than 30%

ROE of 15% or higher

14

AmTrust Financial