Prospectus Supplement No. 2 to

Prospectus dated September 20, 2006

Registration No. 333-135376

Filed pursuant to Rule 424(b)(3)

PIEDMONT MINING COMPANY

Supplement No. 2

To

Prospectus Dated September 20, 2006

This Prospectus Supplement supplements our Prospectus dated September 20, 2006, and our Prospectus Supplement No. 1 dated November 16, 2006 and filed with the Securities and Exchange Commission on November 17, 2006, (collectively, the “Prospectus”) relating to the sale of up to 8,137,560 shares of our common stock, no par value, (“Common Stock”) by the Selling Stockholders listed under “Selling Stockholders” on page 14 of the Prospectus. This Prospectus also covers the sale of 4,693,667 shares of our Common Stock by the Selling Stockholders upon the exercise of outstanding warrants. This Prospectus Supplement No. 2 includes: (i) the attached Current Report on Form 8-K for October 31, 2006, as filed with the Securities and Exchange Commission on November 3, 2006; (ii) the attached Current Report on Form 8-K for March 19, 2007, as filed with the Securities and Exchange Commission on March 23, 2007; (iii) the attached Current Report on Form 8-K for April 17, 2007, as filed with the Securities and Exchange Commission on April 23, 2007; (iv) the attached Annual Report on Form 10-KSB as filed with the Securities and Exchange Commission on April 5, 2007; and (v) the attached Quarterly Report on Form 10-QSB as filed with the Securities and Exchange Commission on May 17, 2007. We encourage you to read this Supplement carefully with the Prospectus.

Our Common Stock is not traded on any national securities exchange or on a NASDAQ Stock Market. Our Common Stock trades on the Pink Sheets’ Electronic Quotation System, under the symbol “PIED” or “PIED.PK.” On May 24, 2007, the last reported sale price for our Common Stock was $0.11. There is no public market for the warrants.

Investing in our common stock involves certain risks and uncertainties. See “Risk Factors” beginning on page 5 of the Prospectus and the risk factors included in our Annual Report on Form 10-KSB for the year ended December 31, 2006.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus Supplement is May 25, 2007.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 31, 2006

PIEDMONT MINING COMPANY, INC.

(Exact name of registrant as specified in its charter)

North Carolina (State or other jurisdiction of incorporation) | 333-135376 (Commission File No.) | 56-1378516 (IRS Employer Identification No.) |

18124 Wedge Parkway, Suite 214

Reno, NV 89511

(Address and telephone number of principal executive offices) (Zip Code)

(212) 734-9848

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 4a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Section 4 - Matters Related to Accountants and Financial Statements

| Item 4.01. | Changes in Registrant’s Certifying Accountant |

| | (a) | Previous Independent Accountants |

On October 31, 2006, Piedmont Mining Company, Inc. (the “Company”) received written notice of Pratt-Thomas & Gumb, CPAs (“Pratt-Thomas”) that it would be resigning as the Company's independent accountant following Pratt-Thomas’ review for the quarter ended September 30, 2006.

Pratt-Thomas’ report on the Company's consolidated financial statements for the fiscal year ended December 31, 2004 and December 31, 2005, and further through the subsequent interim periods ended March 31, 2006, June 30, 2006 and September 30, 2006 did not contain an adverse opinion or disclaimer of opinion, or was modified as to uncertainty, audit scope or accounting principles, however, they were modified to include an explanatory paragraph wherein they expressed substantial doubt about the Registrant's ability to continue as a going concern.

During the period from May 2005 through fiscal year ended December 31, 2005, and further through the subsequent interim periods ended March 31, 2006, June 30, 2006 and September 30, 2006, there have been no disagreements with Pratt-Thomas on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreement if not resolved to the satisfaction of Pratt-Thomas, would have caused them to make reference to the subject matter of the disagreement(s) in connection with their report.

During the period May 2005 through fiscal year ended December 31, 2005, and further through the subsequent interim periods ended March 31, 2006, June 30, 2006 and September 30, 2006, Pratt-Thomas did not advise the Company on any matter set forth in Item 304(a)(1)(iv)(B) of Regulation S-B.

The Company requested that Pratt-Thomas furnish it with a letter addressed to the SEC stating whether or not it agrees with the above statements. A copy of such letter is filed as Exhibit 16.1 to this Form 8-K.

| | (b) | New Independent Accountants |

On November 1, 2006, the Company engaged Dale Matheson Carr-Hilton Labonte, Chartered Accountants to audit its financial statements for the year ended December 31, 2006. During the two most recent fiscal years end December 31, 2004 and December 31, 2005, and through November 1, 2006, the Company did not consult with Dale Matheson Carr-Hilton Labonte, Chartered Accountants regarding (i) the application of accounting principles to a specific transaction, either completed or contemplated transaction, or the type of audit opinion that might be rendered on the Company’s financial statements, and no written report or oral advice was provided to the Company by concluding there was an important factor to be considered by the Company in reaching a decision as to an accounting, auditing or financial reporting issue; or (ii) any matter that was either the subject of a disagreement, as that term is defined in Item 304 (a)(1)(iv)(A) of Regulation S-B or an event, as that term is defined in Item 304 (a)(1)(iv)(B) of Regulation S-B.

Section 9 - Financial Statements and Exhibits

| Item 9.01. | Financial Statements and Exhibits |

| 16.1 | Letter from Pratt-Thomas & Gumb, CPAs |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | PIEDMONT MINING COMPANY, INC., |

| | a North Carolina corporation |

| | |

| | |

| Date: November 2, 2006 | /s/ Robert M. Shields, Jr. |

| | Robert M. Shields, Jr., |

| | Chief Executive Officer, Chief Financial Officer, |

| | President, Director, Chairman of the Board of Directors |

EXHIBIT INDEX

Exhibit No. | Exhibit Description |

| 16.1 | Letter from Pratt-Thomas & Gumb, CPAs |

Exhibit 16.1

October 31, 2006

Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

| Re: | Form 8-K dated October 31, 2006 |

Filed by Piedmont Mining Company, Inc.

Ladies and Gentlemen:

We have read the disclosure entitled “Changes in Registrant’s Certifying Accountants” included Piedmont Mining Company, Inc.’s Form 8-K dated October 31, 2006, and we agree with the statements made in the that disclosure.

Very truly yours,

/s/ Pratt-Thomas & Gumb, CPAs

Pratt-Thomas & Gumb, CPAs

Charleston, South Carolina

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 19, 2007

PIEDMONT MINING COMPANY, INC.

(Exact name of registrant as specified in its charter)

North Carolina (State or other jurisdiction of incorporation) | 333-135376 (Commission File No.) | 56-1378516 (IRS Employer Identification No.) |

18124 Wedge Parkway, Suite 214

Reno, NV 89511

(Address and telephone number of principal executive offices) (Zip Code)

(212)734-9848

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 4a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

SECTION 1 - BUSINESS AND OPERATIONS

Item 1.01 | Entry into a Material Definitive Agreement |

On March 19, 2007 Piedmont Mining Company, Inc. (the “Company”) and Golden Odyssey Exploration Inc., Bravo Alaska, Inc. and Rio Fortuna Exploration (US) Inc. (collectively the “Contracting Parties”) entered into a Drilling Agreement (“Agreement”) with Drift Exploration Drilling, Inc. (“DED”). The Agreement is effective for one year from January 1, 2007 to December 31, 2007 whereby the Contracting Parties engaged DED to perform certain drilling services on specified properties controlled by the Contracting Parties as set forth in the Agreement.

The terms include twelve (12) months of drilling services from one track mounted drill rig and compensation to DED primarily based upon footage drilled and days worked, as more fully described in the Agreement. The Contracting Parties agreed: (1) to guarantee DED twelve (12) months of drilling work starting January 1, 2007 and ending December 31, 2007, as more fully described in the Agreement, and (2) to pay DED as full compensation for services contemplated by the Agreement the amounts as set forth in the Agreement.

In addition, the Agreement contemplates the following terms: (1) any damage to the DED’s equipment used during the term of the Agreement will be borne by DED, (2) a termination clause available upon notice, (3) DED will be deemed to be an independent contractor for purposes of the Agreement, (4) DED may not assign the Agreement without express consent by the Contracting Parties , and (5) the Agreement may be amended to provide for DED to perform work for other companies as designated by the Contracting Parties and under the same terms of the Agreement.

The foregoing description is qualified in its entirety by reference to the Agreement which is filed as Exhibit 10.1 hereto and incorporated herein by reference.

SECTION 5 - CORPORATE GOVERNANCE AND MANAGEMENT

Item 5.02. | Departure of Directors, Principal Officers; Election of Directors; Appointment of Principal Officers |

(d) Appointment of Directors

On March 22, 2007, the Company’s Board of Directors appointed Ian C. MacDonald to serve as director.

There are no arrangements or understandings between Mr. MacDonald and any other persons, naming such persons, pursuant to which Mr. MacDonald was selected as a director. In addition, Mr. MacDonald is expected to serve on the Company’s Audit and Compensation Committees.

Mr. MacDonald has over thirty (30) years of experience in precious metals trading and investment banking. Since 2004 he has operated his own precious metals advisory service, Ian C. MacDonald, LLC. From 1999 to 2004 he was Vice President and Manager of the Global Precious Metals department of Commerzbank AG in New York, where he managed their precious metals operations and dealings with central banks, mines, funds and industrial users of precious metals. He was then Executive Vice President of MKS Finance (USA) Inc., a Geneva based corporation providing advice to the precious metals clients. From 1988 to 2003 he was a director of The Gold Institute in Washington, DC. From 1982 to 1998 Mr. MacDonald was the Manager of Credit Suisse’s Precious Metals Divisions. From 1969 to 1979 he was a director of Billiton (UK) Ltd. Mr. MacDonald was a director of the COMEX Divisions of the New York Mercantile Exchange for twenty (20) years where he served on the advisory committee.

Mr. MacDonald holds a BA degree in Business (Marketing) from Highbury College in England. He is also a graduate of the Royal Marines Officer Training School in England and served more than three (3) years in the Royal Marine Commandos.

SECTION 9 - FINANCIAL STATEMENTS AND EXHIBITS.

Item 9.01 Financial Statements and Exhibits

| | Exhibit No. | Exhibit Description |

| | 10.1 | Drilling Agreement dated January 1, 2007. |

| | 99.1 | Press Release dated March 19, 2007 entitled “Piedmont Mining Company Announces New Director.” |

| | 99.2 | Press Release dated March 22, 2007 entitled “Piedmont Mining Company Signs Drilling Agreement.” |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | PIEDMONT MINING COMPANY, INC., |

| | a North Carolina corporation |

| | |

| | |

| Date: March 23, 2007 | /s/ Robert M. Shields, Jr. |

| | Robert M. Shields, Jr., |

| | Chief Executive Officer, Chief Financial Officer, President, Director, Chairman of the Board of Directors |

EXHIBIT INDEX

Exhibit No. | Exhibit Description |

| 10.1 | Drilling Agreement dated January 1, 2007. |

| 99.1 | Press Release dated March 19, 2007 entitled “Piedmont Mining Company Announces New Director.” |

| 99.2 | Press Release re Drilling Agreement dated March 22, 2007 entitled “Piedmont Mining Company Signs Drilling Agreement.” |

Exhibit 10.1

DRILLING AGREEMENT

THIS DRILLING AGREEMENT, made and entered into this 1st day of January 2007 by and between Golden Odyssey Exploration Inc., Piedmont Mining Company, Inc., Bravo Alaska, Inc., and Rio Fortuna Exploration (US) Inc. (hereinafter designated "COMPANY"), and Drift Exploration Drilling, Inc. (hereinafter designated "CONTRACTOR"):

WITNESSETH:

WHEREAS, COMPANY desires to have certain drilling services performed with relation to the properties described in EXHIBIT "A", attached hereto and by this reference made a part hereof (hereinafter designated the "PROPERTIES"); and

WHEREAS, CONTRACTOR represents that it has the necessary equipment, personnel and experience to perform such drilling services and is willing to perform such services on the terms and conditions hereinafter set forth.

NOW THEREFORE, in consideration of the mutual promises, covenants and conditions herein contained, and other good and valuable consideration, it is understood and agreed by and between the parties hereto as follows:

I.

CONTRACTOR hereby covenants and agrees:

A. To conduct such drilling as shall be designated by the authorized representatives of COMPANY upon the PROPERTIES. Such drilling shall meet the specifications set forth in EXHIBIT "B", attached hereto and by this reference made a part hereof, and consist of one or more holes which shall be drilled to the depth or depths which are designated by the authorized representatives of the COMPANY. The services to be performed by CONTRACTOR and the items to be furnished by CONTRACTOR pursuant hereto are hereinafter collectively designated as the "WORK".

B. To supply supervision and crews possessing the experience and expertise necessary to complete the WORK, together with facilities for transporting said personnel to and from the site of the WORK.

C. To furnish at the drilling site, at CONTRACTOR's sole expense, for use in WORK hereunder, drill(s) of suitable size and capacity, together will all necessary equipment and supplies and all other accessory and auxiliary equipment, material and supplies necessary to accomplish the WORK as described in EXHIBIT "B"

D. To haul water needed for drilling to the drill site.

E. To furnish daily drill reports to the authorized representatives of the COMPANY with regard to hours spent in drilling and other activities, the upper and lower footage of each run, amounts and type of drilling fluid, additives and grouts consumed, and other details of the WORK.

F. To preserve, identify and deliver to the authorized representatives of the COMPANY such cuttings from rotary drill holes as may be requested by COMPANY.

G. To provide trash disposal and maintain clean drill sites, and upon completion of WORK hereunder, to plug and abandon each drill hole as requested by COMPANY and in accordance with applicable law or regulation, and to remove its equipment and restore each drill site as nearly as possible to its condition before it was occupied by CONTRACTOR's drill rig.

H. To perform all WORK herein provided in a good and workmanlike manner meeting standards acceptable to COMPANY.

I. To indemnify and save harmless COMPANY, its officers, agents and employees, against any and all liability, loss or damage of every kind and nature, including attorney's fees, arising from any act by, omission of, or negligence of CONTRACTOR or its subcontractors, or the officers, agents or employees of either, while engaged in the performance of this Drilling Agreement or while on or about the PROPERTIES, or arising from any debt, expense or claim incurred by the CONTRACTOR or its subcontractors or the officers, agents or employees of either.

J. To secure and maintain at all times during which CONTRACTOR is performing WORK hereunder, commercial general liability insurance, with policy limits for Bodily Injury and Property Damage not less than $1,000,000.00 per occurrence, covering the performance of WORK hereunder and all operations conducted by or on behalf of CONTRACTOR. Such policy shall be issued by a company or companies acceptable to COMPANY.

Prior to commencement of the WORK hereunder, CONTRACTOR shall furnish to COMPANY certificates of the issuing insurance company or companies, evidencing that the above-referenced commercial general liability insurance is in force and effect, naming Company as an additional insured, and agreeing that said insurance will not be cancelled or modified without having given at least thirty (30) days advance written notice to COMPANY. All of the CONTRACTOR's policies hereunder shall be endorsed to provide a waiver of subrogation on behalf of COMPANY.

K. To secure and maintain, at all times during the course of WORK, workmen's compensation and occupational disease and disability insurance, sufficient to comply with the requirements of the state in which the PROPERTIES are situated, covering all employees of CONTRACTOR and any subcontractor engaged in WORK, and to furnish COMPANY with written evidence that said insurance is in force prior to commencement of WORK.

L. To pay any and all taxes and make any deductions required by the Federal Insurance Contributions Act, the Federal Unemployment Tax Act, and any other laws relating to employment security for which CONTRACTOR or any subcontractor may become obligated.

M. Not to show, sell, or otherwise reveal any information or data assembled or obtained from, or results of, the WORK to any party other than COMPANY and to exercise the utmost diligence in preventing any party other than COMPANY from gaining access to any such data, information or results. The provisions of this Section I.M. shall be deemed a continuing obligation and shall survive the completion of WORK and termination of this Drilling Agreement.

N. To hold harmless and fully indemnify COMPANY from and against any and all claims, demands, or causes of action for damages or otherwise, whether actual or alleged, based upon alleged infringement or use of any patent or invention as a consequence of conducting any aspect of the WORK.

O. To permit COMPANY to have its representative or representatives present on location during the performance of WORK, to permit such representative or representatives to inspect the WORK, and to keep COMPANY advised and fully informed at all times as to the progress of WORK, and the results currently obtained during the course of said WORK.

P. That COMPANY may, by notifying the CONTRACTOR in writing, refuse any person (including, but not limited to, any employee of CONTRACTOR or of any subcontractor) admission to the drill site and to the property of COMPANY upon which the drill site is situated. If COMPANY so notifies CONTRACTOR, CONTRACTOR will not permit the persons named in the notice on the drill site or on the drill rigs of CONTRACTOR while on the property of COMPANY. In addition, CONTRACTOR will use CONTRACTOR's best efforts to exclude persons named in the notice from the property of COMPANY on which the drill site and/or the drilling rig is situated.

Q. To commence WORK hereunder on the date specified in EXHIBIT “B” and diligently pursue such WORK to completion, according to the schedule set forth in EXHIBIT "B" hereto.

R. To comply with all federal, state and local laws, rules and regulations applicable to the WORK, including but not limited to, laws, rules and regulations of the Mine Safety and Health Administration and Occupational Safety and Health Administration, those laws relating to equal employment opportunity, affirmative action programs and employment discrimination and those applicable to drill-hole plugging and abandonment.

S. CONTRACTOR shall, before commencement of WORK hereunder, obtain and furnish to COMPANY a Mine Safety and Health Administration identification number.

T. To follow good environmental practices in connection with performance of the WORK, and to contain and prevent from escaping any waste oil, drill mud, cuttings, and other residue from WORK performed hereunder, and upon completion of the WORK, to dispose of the same in accordance with applicable environmental requirements.

U. To comply with all obligations contained in leases, permits, agreements, or other documents relating to the PROPERTIES.

V. To supply all safety equipment needed to safely operate and protect employees of CONTRACTOR and of any subcontractor, including but not limited to, first-aid equipment, fire equipment and similar items.

W. Not to permit livestock or wildlife in the area of the PROPERTIES to be exposed to grease or other harmful materials utilized in or resulting from performance of the WORK.

X. To advise COMPANY promptly of any personnel changes or changes in the work schedule.

Y. CONTRACTOR shall promptly advise the authorized representatives of COMPANY, by the fastest available means (which ordinarily will be by telephone), of the following:

| | (i) | Unusual drilling problems; and/or |

Z. Not to put oil or toxic substances in drill mud without prior permission of COMPANY, and to remove any such oil or toxic substances put in drill mud by CONTRACTOR without permission of COMPANY.

AA. To inspect each drill site, which shall be staked by COMPANY, and advise COMPANY prior to commencement of drilling as to whether the site is acceptable to CONTRACTOR from the standpoint of safety and access.

AB. If artesian water is encountered in the course of drilling, to notify COMPANY immediately and to divert or control the flow of the water to minimize damages therefrom.

AC. To accept as full compensation for services rendered hereunder, and all personnel, equipment and materials supplied hereunder, the amounts provided in Section II.A. and to comply with the billing procedure and requirements specified in Section II.A.

AD. To, at all times, maintain the PROPERTIES free and clear of any and all liens, claims or encumbrances of any description whatsoever, or any possibility thereof, arising out of material or labor furnished by or to CONTRACTOR or any subcontractor in connection with the WORK or in any way arising by reason of acts, omissions or negligence of the CONTRACTOR or any subcontractor, and CONTRACTOR agrees that no such claim or lien shall be filed against the PROPERTIES or the COMPANY. CONTRACTOR specifically waives any right CONTRACTOR may have under the lien laws of the state in which the PROPERTIES are situated, on behalf of CONTRACTOR or any subcontractors, or other persons whatsoever, as a result of labor or materials furnished in connection with the WORK. CONTRACTOR will, if requested by COMPANY, and prior to payment of any amounts due CONTRACTOR hereunder, deliver to COMPANY full and complete lien waivers from all persons who have, to the date of payment, furnished any labor, material or supplies in connection with the WORK. Such lien waivers shall be in a form acceptable to COMPANY and shall waive any rights the party executing the same has or might have to claim or maintain a lien or liens upon the PROPERTIES or make any claim against COMPANY. Delivery of such lien waivers shall be a condition precedent to such payment being made. CONTRACTOR will, if requested, furnish additional evidence satisfactory to COMPANY, that all payrolls, material bills and other indebtedness connected with the WORK have been paid. If after COMPANY has made payment of all amounts due CONTRACTOR hereunder, any lien or claim is made against the PROPERTIES or COMPANY, which lien or claim arises out of activities of CONTRACTOR hereunder, or any subcontractor or person employed by CONTRACTOR, CONTRACTOR will reimburse COMPANY for all amounts that COMPANY may be required to pay in discharge of such lien or claims.

AE. CONTRACTOR agrees to preserve all records, books, maps, plans, drawings, receipts, vouchers, and other documents relating to performance of WORK hereunder for a period of two (2) years following termination of WORK hereunder and CONTRACTOR agrees that the authorized representatives of COMPANY shall have the right, at reasonable times and places during said two-year period, to examine, copy and audit said records. All of the above provided by COMPANY shall be considered property of COMPANY and shall be returned to COMPANY upon its request.

AF. To provide at the site where any of the WORK is being performed and use the same as circumstances require, adequate equipment in good operating condition to prevent the starting and spreading of any fire from the performance of the WORK which would pose a hazard to persons, property or the environment. Such equipment shall include, but not be limited to, the following:

Fire extinguishers

Shovels

Axes

Bucket

II.

COMPANY hereby covenants and agrees:

A. To guarantee the CONTRACTOR 12 months (one year) of WORK, as described in Exhibit “B” commencing January 1, 2007 and ending December 31, 2007, for one MPD 1000 track mounted drill rig or equivalent, and this guarantee will be based on 10 day shifts of 10 hours of drilling per day, followed by 4 days off. Any increase in shifts or number of drill rigs must be agreed to among the parties and will not affect the one year term of the guaranteed WORK.

B. To pay CONTRACTOR, as full compensation for services rendered hereunder, and all personnel, equipment and materials supplied hereunder, amounts determined in accordance with EXHIBIT "C" attached hereto and by this reference made a part hereof. Amounts due to CONTRACTOR hereunder shall be calculated separately with relation to billing periods, which billing periods shall be the periods which end on the last day of each month. Within five (5) days following the end of the billing period, CONTRACTOR shall prepare and submit to COMPANY a statement setting forth all amounts due to CONTRACTOR with relation to the previous billing period. Such statements shall be in sufficient detail to enable COMPANY to determine the propriety of the charges set forth therein and shall be accompanied by vouchers, paid receipts, or other evidence of amounts paid to third parties for which CONTRACTOR is claiming reimbursement hereunder. COMPANY shall, within thirty (30) days following receipt of each such statement, make payment of amounts due to CONTRACTOR pursuant to said statement.

III.

The parties mutually agree:

A. The full responsibility for any damage to or destruction of equipment or materials owned or used by CONTRACTOR and any subcontractor during the time the same is being used in performance of WORK shall be borne by CONTRACTOR, and COMPANY shall not be liable to CONTRACTOR or to any other person for any damage to or loss or destruction of said equipment or materials, whether or not said damage, loss or destruction is a result of negligence of COMPANY, its agents or employees.

B. COMPANY shall have the right, at any time, to terminate performance of further WORK on any specific drill job, upon twenty-four (24) hour written notice to CONTRACTOR, advising that conditions on a specific hole or holes preclude the continuation of WORK on that particular drill job.

C. COMPANY shall have the right to terminate Drilling Agreement upon providing ten (10) days written notice to CONTRACTOR of a material breach of Drilling Agreement by the CONTRACTOR. Such termination will be per the provisions of Section III.D. CONTRACTOR shall have the right to terminate Drilling Agreement upon providing ten (10) days written notice to COMPANY of a material breach of Drilling Agreement by the COMPANY. Such termination will be per the provisions of Section III.D.

D. In the event of termination of WORK hereunder pursuant to Section III.B or Section III.C, this Drilling Agreement shall remain in force and effect until the parties have complied with all obligations hereunder, including the obligation to make payment for WORK performed, to and including the date of termination of the WORK, and for any demobilization provided for hereby, whereupon all provisions of this Drilling Agreement, except those intended by their terms to survive termination of the Drilling Agreement, shall cease and terminate.

E. For purposes hereof, the authorized representatives of COMPANY shall be deemed to be Lee Lizotte, David Shaddrick, Joseph Kizis, Lewis Gustafson, or such other person or persons as shall be designated by COMPANY to CONTRACTOR in writing.

F. Any notice or delivery of information herein contemplated to be given to CONTRACTOR shall be sufficient if given in writing by certified or registered mail, or if delivered personally, and any payment herein provided to be paid to CONTRACTOR shall be deemed made when mailed to CONTRACTOR, and in either case, addressed to:

Drift Exploration Drilling, Inc.

P.O. Box 5515

High River, Alberta T1V 1M4

403-652-5530

or to such other address as CONTRACTOR may from time to time designate to COMPANY in writing.

Any notice or delivery of information herein contemplated to be given to COMPANY shall be sufficient if given in writing by certified or registered mail, or if delivered personally, and any invoices herein provided to be delivered to COMPANY, shall be deemed delivered when mailed to COMPANY, and in either case, addressed to:

| | Golden Odyssey Exploration Inc. | Bravo Alaska, Inc. |

| | 121 Woodland Ave., Suite 130 | 4790 Caughlin Pkwy., #207 |

| | Reno, NV 89523 | Reno, NV 89509-0907 |

| | Attn: Lee N. Lizotte | Attn: Joseph A. Kizis, Jr. |

| | Rio Fortuna Exploration (US) Inc. | Piedmont Mining Company, Inc. |

| | 4790 Caughlin Pkwy., #207 | 5320 Cross Creek Lane |

| | Reno, NV 89509 | Reno, NV 89511 |

| | Attn: Joseph A. Kizis, Jr. | Lewis B. Gustafson |

or such other address(es) as COMPANY may from time to time designate to CONTRACTOR in writing.

Service of notice by mail shall be deemed effective and complete at the time of posting and mailing thereof, with postage prepaid, and addressed as aforesaid. Personal service of notice shall be deemed effective and complete at the time of delivery thereof to the address indicated.

G. CONTRACTOR shall, for all purposes of this Drilling Agreement, be deemed to be an independent contractor and nothing in this Drilling Agreement shall be deemed to constitute CONTRACTOR an agent, employee, or legal representative of COMPANY for any purpose whatsoever.

H. CONTRACTOR shall not have the right to assign the Drilling Agreement or sublet or subcontract any portion of the WORK to be performed by CONTRACTOR hereunder, without the express written consent of COMPANY.

I. This Drilling Agreement is and shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns.

J. This Drilling Agreement may be amended in order to provide for the CONTRACTOR to perform work for other companies as may be designated by COMPANY and said companies shall be bound by the terms of this Drilling Agreement.

K. This Drilling Agreement contains the entire agreement by and between COMPANY and CONTRACTOR and no oral agreement, promise, statement or representation not contained herein shall be binding on COMPANY or CONTRACTOR. No amendment or modification of this Drilling Agreement shall become effective unless and until reduced to writing and duly signed and executed by CONTRACTOR and the president of COMPANY or a person designated by him in writing. Authorized representatives of COMPANY have authority only as specifically provided herein.

DATED this day and year first above written.

Golden Odyssey Exploration Inc. | Drift Exploration Drilling, Inc. |

| | |

| By:_______________________ | By:_____________________ |

| David R. Shaddrick, President | Donald T. Patterson, President |

| | |

Bravo Alaska, Inc. | Rio Fortuna Exploration (US) Inc. |

| | |

| By:________________________ | By:______________________ |

| Joseph A. Kizis, Jr., President | Joseph A. Kizis, Jr., President |

Piedmont Mining Company, Inc.

By:________________________

Lewis B. Gustafson, Vice President

EXHIBIT "A"

DESCRIPTION OF PROPERTY TO BE DRILLED

Various Project Locations In Nevada

EXHIBIT "B"

PROJECT SPECIFICATIONS

| I. | LOCATION RESPONSIBILITY |

Preparation of access roads and drill sites by Company

Maintenance of access roads and drill sites by Company

| II. | REVERSE CIRCULATION DRILLING |

One or more vertical or angle holes of varying depths, not to exceed 1200 feet maximum, commencing no later than January 3, 2007 .

Diameter of holes, cores and casing through objective interval:

| Depth | Hole Size Casing Size |

Depths are an estimate. Hole size, core size and casing size must be adhered to unless authorized by COMPANY.

| | Hole angle or straight hole requirements: | Vertical and angle |

Work Schedule:

| | (b) | Work days per week 10 days on/4 days off |

| (c) | Hours per shift 12 with a minimum (3) man crew per shift, per drill. |

Materials, equipment and services to be provided by CONTRACTOR:

All labor, equipment, tools, material, supplies and services necessary and proper to the drilling and other contract services specified, with the following being particularly itemized:

A. Cyclone sample splitter with ability to substantially remove excess water from samples without significant loss of suspended fines

B. Contractor will plug all holes to surface with bentonite and cement plug prior to abandonment as per Nevada State Regulations.

| | C. | Contractor will split, bag and mark samples of approximately 5 pounds at 5 foot intervals and provide on-site geologist with washed, approximately 50 gram split as directed by an authorized company representative, or as instructed by the Company’s field representative. |

| CONTRACTOR’S MSHA identification number: | ______ |

EXHIBIT "C"

SCHEDULE OF RATES

See attached “Drilling Proposal”

DRILLING PROPOSAL

| BETWEEN: | DRIFT EXPLORATION DRILLING, INC. herein called the Contractor | |

- and -

Golden Odyssey Exploration Inc., Bravo Alaska, Inc., Rio Fortuna Exploration (US) Inc., and Piedmont Mining Company, Inc.

herein called the Operator

| 1. | COMPENSATION TO BE PAID CONTRACTOR: |

For work performed on a footage drilling basis.

Such linear measure shall be determined by steel line measurement and measurement shall be from the top rotary drive bushing to total depth drilled, less footage drilling while work is performed on a daywork basis. IF PENETRATION RATE FALLS BELOW 20 FEET PER. HOUR DUE TO GROUND CONDITIONS OR EXCESSIVE WATER THEN HOURLY RATE WILL APPLY.

IF THE PRICE PER GALLON OF FUEL EXCEEDS $2.25 A 5% FUEL SURCHARGE WILL BE APPLIED TO ALL FOOTAGE AND HOURLY ACTIVITIES INCLUDING LOCATION MOVES AND WATER HAULS. THE 5% FUEL SURCHARGE WILL NOT BE APPLIED TO MOBILIZATION, DEMOBILIZATION, DAILY CREW SUBSISTENCE OR STANDBY TIME.

(1) For all work performed with a full crew on a daywork basis, Contractor shall be paid a rate for each hour as follows:

Rate will be applied for following operations:

Drilling, Reaming, Testing, Cementing and Hole plugging or any other Drilling Operation at Operators request.

(2) For Standby Time while waiting on orders of materials, logging, services or other items to be furnished by Operator at a Standby Rate of $200.00 per hour will apply.

(3) For standby time as a result of shutdown for force majeure a Standby Rate of $ N/A per hour will apply plus actual cost of labour plus 20% wage burden.

A full crew shall consist of 1 crew of 3 men per tour, each working 12 hours.

If it becomes necessary to shut down Contractor's Rig for repairs of equipment for which Contractor is responsible hereunder while Contractor is performing work on a daywork basis excluding routine Rig Servicing, Contractor shall be allowed compensation during such repairs at applicable daywork rate commensurate with the stage of operation then in effect. The number of hours for which Contractor is to be compensated shall be limited as follows:

| | Total hours accumulated per month | 0 |

Thereafter Contractor will not be compensated

| | (e) | REPLACEMENT OF EQUIPMENT |

The Contractor will immediately notify the Operator of any drilling conditions which might cause the loss of in-hole equipment, including, but not limited to, drill pipe, drill collars, drill bits, down-hole hammers and casing. If the Contractor fails to notify the Operator of any unusual or dangerous drilling conditions, then the Contractor will assume all costs for any lost in-hole equipment. The basis of payment to Contractor for equipment lost or damaged in the hole or for equipment lost or damaged in any other circumstance where Operator is liable or responsible for Contractor's equipment under or by reason of any provision of the Contract shall be 90 % of new replacement cost at the time of delivery, F.O.B. job site. Replacement costs for lost equipment will not be subject to 15% handling charge.

Should Contractor purchase for Operator at Operator's request any materials, supplies, services or equipment including tubular goods, which Operator is obligated to furnish under the terms of this Agreement, Operator agrees to pay Contractor within 30 days of receipt of Contractor's invoice the actual cost of such materials, supplies or equipment plus 15 % handling charge.

All invoices shall be paid within 15 days of the invoice date. Any sum or sums not paid within 30 days after the invoice date shall bear interest at the rate of 2.5% per month from that date until paid.

| 2. | EQUIPMENT, MATERIALS AND SERVICES TO BE PAID BY DESIGNATED PARTY |

The machinery, equipment, tools, materials, supplies, instruments, servicing and labour as following numbered items include any transportation required for such items otherwise specified and shall be provided at the location and at the expense of the party hereto as designated.

| | CONTRACTOR - C | OPERATOR - O |

| | 1. | Provision for and maintenance of adequate |

roadway to location, rights of way including, road

| | tolls, highway crossings, cattle guards and gates | O |

| | 2. | Clearing and grading of drill sites adequate for |

| | track mounted equipment. | O |

| | 4. | (a) Transportation of rig and associated equipment. |

l. Mobilization:

| | Trucking Co. Invoice plus 20% | O |

2. Demobilization:

| | Trucking Co. Invoice plus 20% | O |

3. Location Moves

(b) Transportation of Personnel:

| | 1. Daily travel time to drill site: $85per day | O |

| | 4. | Towing services to include truck charges for rig |

| | 5. | Special moving equipment for rig supplies or |

personnel if road becomes impassible by normal

| | transportation means of vehicles. | O |

| | 6. Pits and disposal of drilling fluids. | O |

| | 8. Lubricants: Equipment | C |

| | 10. | Water Storage at Location & Hauling $ 150.00 . |

| | 12. Core Barrel, Handling Tools and Accessories | N/A |

| | 13. | Casing and Casing Shoes |

| | 14. Casing Tools (as per program) | C |

| | 15. Cement and hole plug | O |

| | 16. | Electrical logging and other wire line formation |

| | 17. Inspection Services for Drill String | C |

| | 18. | Special strings of Drill Pipe, Drill Collars and |

| | 19. Crew Subsistence expense $65.00 per man per day. | O |

| | 20. | Portable Heater and Winterization: |

Chargeable at $_______ per day.

| | 21. | Mud conditioners/additives and chemicals used |

| | 22. | Third party expenses provided by Contractor's at |

| | | Operator's request will be invoiced at cost plus 15% |

| | 23. Pen Drilling Recorder | N/A |

| | 24. | Fishing Tools and Services |

| | 25. Normal storage for mud and chemicals | C |

| | 26. Welding Services - Casing Shoe | C |

27. Additional equipment and services:

-----------------------------------------------------------------

-----------------------------------------------------------------

-----------------------------------------------------------------

-----------------------------------------------------------------

Note: All Attached figures are in U.S. Dollars

| OPERATOR(S): | CONTRACTOR: |

| | |

| GOLDEN ODYSSEY EXPLORATION INC. | DRIFT EXPLORATION DRILLING INC |

| 121 Woodland Avenue, Suite 130 | PMB 39, 1346 IDAHO STREET |

| RENO NV 89523 | ELKO, NEVADA 89801 |

| | |

| RIO FORTUNA EXPLORATION (US) INC. | |

| 4790 Caughlin Pkwy., #207 | |

| Reno, NV 89509 | |

BRAVO ALASKA, INC

4790 Caughlin Pkwy., #207

Reno, NV 89509

PIEDMONT MINING COMPANY, INC.

5320 Cross Creek Lane

Reno, NV 89511

Signature of Designated Representatives:

Golden Odyssey Exploration Inc. | Drift Exploration Drilling |

| | |

| ________________________ | ________________________ |

| David R. Shaddrick, President | Donald T. Patterson, President |

Bravo Alaska, Inc.

________________________

Joseph A. Kizis, Jr., President

Rio Fortuna Exploration (US) Inc.

________________________

Joseph A. Kizis, Jr., President

Piedmont Mining Company, Inc.

________________________

Lewis B. Gustafson, Vice President

Exhibit 99.1

PIEDMONT MINING COMPANY ANNOUNCES NEW DIRECTOR

Reno, NV - March 19, 2007 - Piedmont Mining Company, Inc. (OTC BB: PIED) today announced that Ian C. MacDonald will be joining Piedmont’s Board of Directors. Mr. MacDonald has had more than 30 years of experience in precious metals trading and investment banking. His areas of expertise include mine financing, hedging, derivatives, hedge fund operations, foreign exchange, commercial banking and central bank operations.

Prior to establishing his own precious metals advisory service, Mr. MacDonald was Vice President and Manager of the Global Precious Metals department of Commerzbank AG in New York, where he managed their precious metals operations and dealings with central banks, mines, funds and industrial users of precious metals. He established the precious metals department for Commerzbank AG in New York in 1999.

From 1982 to 1998, Mr. MacDonald served with Credit Suisse where he was the Manager of their Precious Metals Division and established the precious metals operations for their New York branch in 1982. He was then Executive Vice President of MKS Finance (USA) Inc., a Geneva based corporation providing advice to precious metals clients. He was a Director of Billiton (UK) Ltd. for 10 years and a Director of The Gold Institute in Washington, DC for 15 years. He was also a Member of the COMEX Division of the New York Mercantile Exchange for 20 years, where he served on their Metals Advisory Committee.

Mr. MacDonald has spoken at many industry conferences. He has made numerous appearances on CNBC, CNN and Public Television and has been quoted in Reuters, Investors Daily, the Wall Street Journal and other business publications. He holds a BA degree in Business (Marketing) from Highbury College in England. He is also a graduate of the Royal Marine Officer Training School in England and served for more than 3 years in the Royal Marine Commandos.

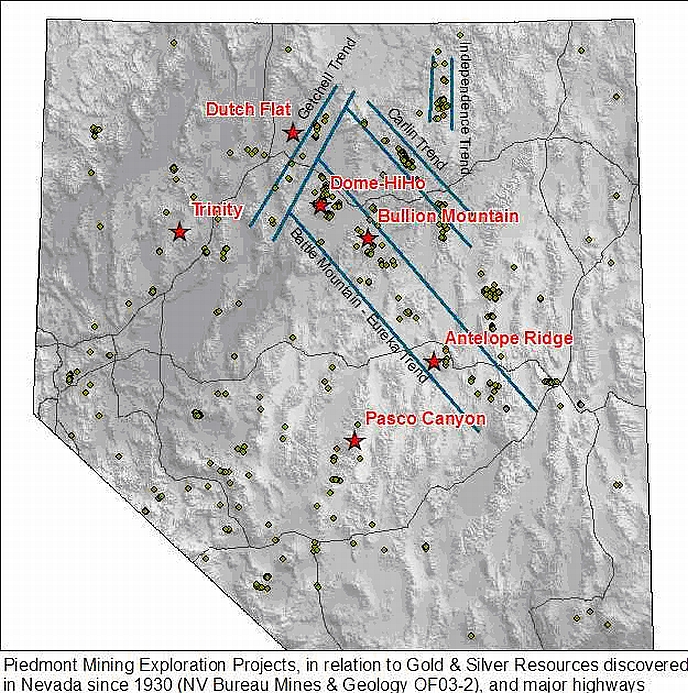

About Piedmont:

Piedmont is an exploration stage company, exploring for gold and silver exclusively in the state of Nevada. It has entered into earn-in agreements with experienced exploration groups on 6 gold and/or silver properties in Nevada. Its Common Stock is traded on the OTC Bulletin Board under the symbol: PIED.

The Company is including the following cautionary statement in this news release to make applicable and take advantage of the safe harbor provisions of the Private Securities Litigation reform Act of 1995 for any forward-looking statements made by, or on behalf of, the Company. Certain forward-looking statements herein involve risks and uncertainties that could cause actual results or outcomes to differ materially from those expressed in the forward-looking statements. These include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions that are other than statements of historical facts. These forward-looking statements are based on various assumptions, many of which are based upon further assumptions. The Company’s expectations, beliefs and projections are expressed in good faith and are believed to have a reasonable basis, but there can be no assurance that management’s expectations, beliefs or projections will be achieved or accomplished.

Piedmont Mining Company, Inc. Reno, Nevada

www.piedmontmining.com

Contact: | Investor Relations: |

Robert Shields: 212-734-9848 | Susan Hahn & Associates: 212-986-6286 |

Exhibit 99.2

Thursday, March 22, 2007

Piedmont Mining Company Signs Drilling Agreement

Reno, NV - March 22, 2007 - Piedmont Mining Company, Inc. (OTC BB: PIED) today announced that it has signed a Drilling Agreement with Drift Exploration Drilling, Inc. and three other junior exploration companies. This Agreement, effective as of January 1, 2007, commits the use of one track-mounted reverse circulation drill rig with an experienced operator amongst these 4 exploration companies for the full year of 2007. This Agreement will ensure that Piedmont will have access to at least one drill rig to drill two or three of its properties in Nevada during 2007.

About Piedmont:

Piedmont is an exploration stage company, exploring for gold and silver exclusively in the state of Nevada. It has entered into earn-in agreements with experienced exploration groups on 6 gold and/or silver properties in Nevada. Its Common Stock is traded on the OTC Bulletin Board under the symbol: PIED.

The Company is including the following cautionary statement in this news release to make applicable and take advantage of the safe harbor provisions of the Private Securities Litigation reform Act of 1995 for any forward-looking statements made by, or on behalf of, the Company. Certain forward-looking statements herein involve risks and uncertainties that could cause actual results or outcomes to differ materially from those expressed in the forward-looking statements. These include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions that are other than statements of historical facts. These forward-looking statements are based on various assumptions, many of which are based upon further assumptions. The Company’s expectations, beliefs and projections are expressed in good faith and are believed to have a reasonable basis, but there can be no assurance that management’s expectations, beliefs or projections will be achieved or accomplished.

Piedmont Mining Company, Inc. Reno, Nevada

www.piedmontmining.com

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 17 , 2007

PIEDMONT MINING COMPANY, INC.

(Exact name of registrant as specified in its charter)

North Carolina (State or other jurisdiction of incorporation) | 333-135376 (Commission File No.) | 56-1378516 (IRS Employer Identification No.) |

18124 Wedge Parkway, Suite 214

Reno, NV 89511

(Address and telephone number of principal executive offices) (Zip Code)

(212)734-9848

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 4a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

SECTION 1 – BUSINESS AND OPERATIONS

| Item1.01 | Entry into a Material Definitive Agreement |

Effective April 17, 2007 (the “Effective Date”) Piedmont Mining Company, Inc., a North Carolina corporation (the “Company”) and Miranda Gold U.S.A., a Nevada corporation and wholly-owned subsidiary of Miranda Gold Corp., a British Columbia, Canada corporation (“Miranda”) (collectively the “Parties”) entered into an Exploration Agreement with Option to Form a Joint Venture with Piedmont Mining Company Inc. (“Agreement”) whereby the Company may earn a joint venture interest in the group of forty-four (44) unpatented lode mining claims situated in Humboldt County, Nevada (the “PPM Project”).

Under the terms of the agreement, the Company has an exclusive option to earn a fifty-five percent (55%) interest in the Property, as defined in the Agreement, by funding $1,750,000 in exploration activities during five (5) year period. The Company agreed to spend a minimum of $175,000 in work expenditures on the Property within one (1) year of the Effective Date, with the work expenditure to increase in subsequent years. Once the initial earn-in phase of 55% has been reached, the Company and Miranda agreed to enter into a Joint Venture agreement whereby the Company will be the operator and have a participating interest of 55%. The Parties agreed that the Operator shall make cash calls from time to time.

Prior to the commencement of each contract year, the Company agreed to prepare a general plan and budget setting forth the description and amount of the Company’s proposed exploration expenditures for the year. In addition, the Company agreed to maintain the claims in good standing and to pay the federal claim maintenance fees to the Nevada Bureau of Land Management. The Company agreed to indemnify Miranda from any claims, demands, or liabilities arising from acts of gross negligence or willful misconduct on the part of the Company and to carry a policy of public liability insurance in the minimum amounts of $1,000,000 or more for personal injury and $300,000 for property damage. The Company also agreed to keep the property free and clear from any liens and to acquire all necessary federal, state and local permits required for its operations.

In connection with the Agreement, the Parties entered into a Services Agreement on April 17, 2007 (“Services Agreement”) which sets forth the labor, services and materials to be provided in conjunction with the exploration related services for the PPM Gold Project.

The foregoing description is qualified in its entirety by reference to the Agreement and the Services Agreement which is filed as Exhibit 10.1 and Exhibit 10.2 hereto and incorporated herein by reference.

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS.

Item 9.01 Financial Statements and Exhibits

| | Exhibit No. | Exhibit Description |

| | 10.1 | Exploration Agreement with Option to Form a Joint Venture with Piedmont Mining Company Inc. dated April 17, 2007 |

| | 10.2 | Services Agreement dated April 17, 2007 |

| | 99.1 | Press Release dated April 23, 2007 entitled Piedmont Mining Signs Agreement with Miranda on PPM Gold Project, Nevada |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | PIEDMONT MINING COMPANY, INC., |

| | a North Carolina corporation |

| | |

| | |

| Date: April 23, 2007 | /s/ Robert M. Shields, Jr. |

| | Robert M. Shields, Jr., |

| | Chief Executive Officer, Chief Financial Officer, |

| | President, Director, Chairman of the Board of Directors |

EXHIBIT INDEX

Exhibit No. | Exhibit Description |

| 10.1 | Exploration Agreement with Option to Form a Joint Venture with Piedmont Mining Company Inc. dated April 17, 2007 |

| 10.2 | Services Agreement dated April 17, 2007 |

| 99.1 | Press Release dated April 23, 2007 entitled Piedmont Mining Signs Agreement with Miranda on PPM Gold Project, Nevada |

Exhibit 10.1

EXPLORATION AGREEMENT WITH

OPTION TO FORM JOINT VENTURE

(PPM GOLD PROJECT)

THIS EXPLORATION AGREEMENT WITH OPTION TO FORM JOINT VENTURE (PPM GOLD PROJECT) (the “Agreement”) is made effective this 17th day of April, 2007 (the “Effective Date”) by and between MIRANDA U.S.A., INC., a Nevada corporation (“Miranda”); and PIEDMONT MINING COMPANY, INC., a North Carolina corporation (“Piedmont”).

RECITALS

A. Miranda owns and possesses the “PPM” group of forty-four (44) unpatented lode mining claims situated in Humboldt County, Nevada (the “PPM Gold Project”). The claims are more particularly described on Exhibit A attached hereto.

These claims, together with all ores, minerals, surface and mineral rights, and the right to explore for, mine, and remove the same, and all water rights and improvements, easements, licenses, rights-of-way and other interests appurtenant thereto, shall be referred to collectively as the “Property.”

B. Miranda U.S.A., Inc. is a wholly owned subsidiary of Miranda Gold Corp., a British Columbia corporation.

C. Piedmont wishes to acquire an interest in the Property by making a cash payment to Miranda and funding a work program on the Property pursuant to Section 1.1 of this Agreement.

C. Following completion of the work program and satisfaction of the terms and conditions of Section 1.1 of this Agreement, Piedmont and Miranda may form a Joint Venture for further exploration and development of the Property.

THEREFORE, the parties have agreed as follows:

SECTION ONE

Exploration Agreement

1.1 Option to Earn 55% Interest. Miranda hereby grants to Piedmont the exclu-sive option to earn an undivided fifty-five percent (55%) interest in the Property by funding ONE MILLION SEVEN HUNDRED FIFTY THOUSAND DOLLARS ($1,750,000.00) in exploration activities during a five-year period. In order to earn this interest, Piedmont shall make the following payments:

a. Within thirty (30) days of the Effective Date of this Agreement, Piedmont will pay to Miranda the sum of TWENTY-FIVE THOUSAND DOLLARS ($25,000.00). This payment shall not be credited against the work requirement.

b. Piedmont agrees to spend a minimum of ONE HUNDRED SEVENTY-FIVE THOUSAND DOLLARS ($175,000.00) in Exploration Expenditures on the Property within one (1) year following the Effective Date. The term “Exploration Expenditures” shall include monies expended on geological, geophysical, and geochemical surveys on the Property; sampling, trenching, drilling, and assaying; federal claim maintenance fees payable to the Nevada Bureau of Land Management; recording fees payable to Humboldt County in connection with the recording of Affidavits and Notices of Intent to Hold; and related exploration costs (but excluding the value of any cash payments made to Miranda). This is a binding commitment and cannot be cancelled through termination of this Agreement.

c. Thereafter, Piedmont may elect to continue funding of Exploration Expenditures on the Property by completing the following expenditure requirements:

Year of Agreement | Amount of Expenditures |

| 2 | Additional $200,000.00 |

| 3 | Additional $300,000.00 |

| 4 | Additional $425,000.00 |

| 5 | Additional $650,000.00 |

Any excess of expenditures in one year shall be carried forward as a credit against the subsequent years’ expenditures. Any shortfall in expenditures can be made up in the following year with Miranda’s consent. Absent such consent, a shortfall in expenditures shall be paid to Miranda at the end of each contract year, provided the provisions of Section Eight have not been invoked or the Agreement has not been terminated in accordance with Section 4.1 below.

d. At such time as Piedmont has expended ONE MILLION SEVEN HUNDRED FIFTY THOUSAND DOLLARS ($1,750,000.00) in exploration expenditures in accordance with Sections 1.(b) and 1.(c) above, Piedmont will have earned an undivided 55% interest in the Property. The parties shall then proceed to form a Joint Venture in accordance with Section 3 below.

1.2 Funding of Exploration Activities. Prior to the commencement of each contract year, Piedmont shall prepare a general plan and budget (“Plan”) setting forth the description and amount of Piedmont’s proposed exploration expenditures for the year. Miranda shall review and comment upon the Plan within fifteen (15) days of its submission. However, Piedmont, as Manager during the earn-in period, shall have the final say regarding the Plan. Piedmont may add an overhead fee of ten percent (10%) to all expenditures (except the claim maintenance fees described in Section 1.4 below) as a credit toward its work requirement for that year. Piedmont may, in its sole discretion, elect to nominate Miranda as its contractor to plan and implement exploration activities on the Property in accordance with the Services Agreement attached hereto as Exhibit B.

1.3 Claim Maintenance. So long as the Agreement has not been terminated prior to June 1 of each year, Piedmont shall have the obligation to maintain the claims in good standing. Piedmont shall pay the federal claim maintenance fees to the Nevada Bureau of Land Management by August 1 of each year, and Piedmont shall record an Affidavit and Notice of Intent to Hold with the Humboldt County Recorder not later than October 1 of each year. Piedmont shall promptly provide evidence of these filings to Miranda. These payments shall be credited against Piedmont’s work expenditure requirements.

1.4 Area of Interest. The parties hereby establish an Area of Interest extending one (1) mile from the exterior boundaries of the property, which is depicted on the map attached hereto as Exhibit C. Any mineral claims or rights acquired by either Miranda or Piedmont within the Area of Interest shall be subject to the terms of this Agreement.

SECTION TWO

Conduct of Exploration Work

The following provisions shall govern exploration activities on the Property during the term of the Exploration Agreement described in Section 1 above.

2.1 Conduct of Work. Piedmont shall perform its exploration activities on the Property in accordance with good mining practice, shall comply with the applicable laws and regulations relating to the performance of exploration and mining operations on the Property, and shall comply with the applicable worker's compensation laws of the State of Nevada.

2.2 Liability and Insurance. Piedmont shall defend, indemnify, and hold Miranda harmless from any claims, demands, or liabilities arising from acts of gross negligence or willful misconduct on the part of Piedmont. Piedmont shall obtain and carry a policy of public liability insurance in the minimum amounts of $1,000,000.00 or more for personal injury and $300,000.00 for property damage, protecting Piedmont and Miranda against any claims for injury to persons or damage to property resulting from Piedmont’s operations. Piedmont shall provide Miranda with a certificate of insurance evidencing such insurance.

2.3 Liens. Piedmont shall keep the Property free and clear from any and all mechanics’ or laborers’ liens arising from labor performed on or material furnished to the Property at Piedmont’s request. However, a lien on the Property shall not constitute a default if Piedmont, in good faith, disputes the validity of the claim, in which event the existence of the lien shall constitute a default thirty (30) days after the validity of the lien has been adjudicated adversely to Piedmont.

2.4 Acquisition of Permits. Piedmont shall acquire all federal, state, and local permits required for its operations. Piedmont shall be responsible for reclamation of only those areas disturbed by Piedmont’s activities. Piedmont will post any operating and reclamation bonds required by regulatory agencies for work on the Property. The bond will revert to Piedmont upon satisfactory completion of the reclamation program.

2.5 Inspection of Property. Miranda, or Miranda’ authorized agents or representatives, shall be permitted to enter upon the Property at all reasonable times for the purpose of inspection, but shall enter upon the Property at Miranda’ own risk and so as not to hinder unreasonably the operations of Piedmont. Miranda shall indemnify and hold Piedmont harmless from any damage, claim, or demand by reason of injury to Miranda or Miranda’ agents or representatives on the Property or the approaches thereto.

2.6 Inspection of Accounts. Piedmont shall keep accurate books and records of accounts reflecting its exploration activities on the Property, and Miranda shall have the right, either itself or through a qualified accountant of its choice and at its cost, to examine and inspect the books and records of Piedmont pertaining to operations on the Property.

SECTION THREE

Joint Venture

3.1 Formation of Joint Venture. Following Piedmont’s earn-in of a 55% interest, the parties shall proceed to form a Joint Venture in the general format of Form 5A (“Form 5A”) prepared by the Rocky Mountain Mineral Law Foundation. The parties may mutually agree to use Form 5A-LLC in place of Form 5A, and all references in this Agreement to Form 5A shall then refer to Form 5A-LLC.

3.2 Participating Interests. Piedmont shall have a Participating Interest of 55% and Miranda will have a Participating Interest of 45%. The deemed value of Miranda’s Participating Interest shall be ONE MILLION FOUR HUNDRED THIRTY-ONE THOUSAND EIGHT HUNDRED EIGHTEEN DOLLARS ($1,431,818.00).

3.3 Operator. Following formation of the Joint Venture, Piedmont shall be the Operator of the Joint Venture. A Management Committee, consisting of two representa-tives of each party, shall be responsible for approving programs and budgets and for determining the general policies and directions to be adopted by the Operator in the conduct of its operations. The Management Committee shall meet at least once annually and otherwise on ten (10) days’ advance written notice given by either party.

Prior to the commencement of each contract year, the Operator shall propose Programs and Budgets to the Management Committee at least annually for periods determined necessary or appropriate by the Operator. Programs and Budgets for Exploration or mining Operations shall not exceed one (1) year without unanimous approval of the Participants. The Management Committee will vote upon the proposed work plan and budget within thirty (30) days after delivery by the Operator. Each Party shall give notice to the Operator within thirty (30) days after a Program and Budget is approved by the Management Committee whether it will fund its share of expenditures in respect of such Program and Budget. Each Party who elects to fund its share shall be obligated to do so.

If the Operator does not propose a Program and Budget requiring a total annual expenditure of TWO HUNDRED FIFTY THOUSAND DOLLARS ($250,000.00) or more prior to the beginning of an annual budget period, then, within thirty (30) days after the beginning of the annual period, the non-Operator may propose a Program and Budget requiring an annual expenditure of TWO HUNDRED FIFTY THOUSAND DOLLARS ($250,000.00) or more, and the non-Operator shall thereupon become the Operator. The former Operator shall be entitled to meet with the new Operator to discuss the proposed Program and Budget and suggest any changes it feels are appropriate. The new Operator shall immediately thereafter finalize the Program and Budget and deliver it to the former Operator, whereupon it shall be deemed to have been approved by the Management Committee. If the non-Operator does not present such a proposal within thirty (30) days after the beginning of the annual period, then the non-Operator will have waived its right to do so for that annual period.

3.4 Cash Calls and Dilution. Following approval of an annual Program and Budget, the Operator shall make cash calls from time to time for the conduct of operations. A party whose Participating Interest falls below five percent (5%) shall be deemed to have withdrawn from the Joint Venture, and thereafter that party shall be entitled to receive one-and-one-half percent (1.5%) of net smelter returns derived from the Property. The term “net smelter returns” shall mean the gross value of ores or concentrates shipped to a smelter or other processor (as reported on the smelter settlement sheet) less the following expenses actually incurred and borne by the Operator:

a. Sales, use, gross receipts, severance, and other taxes, if any, payable with respect to severance, production, removal, sale or disposition of the minerals from the Property, but excluding any taxes on net income;

b. Charges and costs, if any, for transportation from the mine or mill to places where the minerals are smelted, refined and/or sold; and

c. Charges, costs (including assaying and sampling costs specifically related to smelting and/or refining), and all penalties, if any, for smelting and/or refining.

In the event smelting or refining are carried out in facilities owned or controlled, in whole or in part, by Operator, charges, costs and penalties for such operations shall mean the amount Operator would have incurred if such operations were carried out at facilities not owned or controlled by Operator then offering comparable services for comparable products on prevailing terms.

Payment of production royalties shall be made not later than thirty (30) days after receipt of payment from the smelter. All payments shall be accompanied by a statement explaining the manner in which the payment was calculated.

SECTION FOUR

Termination and Default

4.1 Termination. Subject to satisfaction of the provisions of Sections 1.(a) and 1.(b) above, Piedmont shall have the right to terminate this Agreement at its sole discretion at any time by giving thirty (30) days’ advance written notice to Miranda. Upon termination, Miranda shall retain all payments previously made as liquidated damages and this Agreement shall cease and terminate. Piedmont will provide Miranda with all factual data, maps, assays, and reports pertaining to the Property. Piedmont will also deliver a Quitclaim Deed to Miranda.

4.2 Default. If Piedmont fails to perform its obligations under this Agreement, and in particular fails to make any payment due to Miranda hereunder, Miranda may declare Piedmont in default by giving Piedmont written notice of default which specifies the obligation(s) which Piedmont has failed to perform. If Piedmont fails to remedy a default in payment within fifteen days (15) of receiving the notice of default, and thirty (30) days for any other default, Miranda may terminate this Agreement and Piedmont shall peaceably surrender possession of the Property to Miranda. Notice of termination shall be in writing and served in accordance with this Agreement.

SECTION FIVE

Notices and Payments

5.1 Notices. All notices to Piedmont or Miranda shall be in writing and shall be hand delivered, sent by courier, or sent by certified or registered mail, return receipt requested, to the addresses below. Notice of any change in address shall be given in the same manner. All notices shall be effective upon receipt.

| TO MIRANDA: | Miranda Gold Corp. |

| | Unit 1, 15782 Marine Drive |

| | White Rock, British Columbia |

| | Canada V4B 1E6 |

| | |

| With a copy to: | Miranda U.S.A., Inc. |

| | 5900 Philoree Lane |

| | Reno, Nevada 89511 |

| | |

| TO PIEDMONT: | Piedmont Mining Company, Inc. |

| | Attn: Robert Shields |

| | P.O. Box 20675 |

| | New York, New York 10021 |

| | |

| With a copy to: | Piedmont Mining Company, Inc. |

| | 18124 Wedge Parkway, Suite 214 |

| | Reno, Nevada 89511 |

5.2 Payments. All payments shall be in U.S. currency payable to Miranda at the Reno address above.

SECTION SIX

Assignment

No party may assign its interest in this Agreement, in whole or in part, without the prior written consent of the other party, which consent shall not be unreasonably withheld.

SECTION SEVEN

Representation of Title

7.1 Warranty. Miranda represents, to the best of its knowledge, that it owns the unpatented mining claims described in Exhibit A and all lode mineral rights within the boundary of these claims, subject to the paramount title of the United States (but excepting those portions that may overlap adjacent fee lands); that the claims are valid under the mining laws of the United States and the State of Nevada; that Miranda has and will continue to have the right to commit the Claims to this Agreement; and that Miranda is not aware of any claim disputes, legal actions, or environmental hazards affecting the Property.

7.2 Encumbrances. To the best of Miranda’s knowledge, the Property is free from any liens, leases, or other encumbrances created by Miranda.

SECTION EIGHT

Force Majeure

8.1 Suspension of Obligations. If Miranda or Piedmont is prevented by Force Majeure from timely performance of any of its obligations hereunder, the failure of performance shall be excused and the period for performance shall be extended for an additional period equal to the duration of Force Majeure. Upon the occurrence and upon the termination of Force Majeure, Miranda or Piedmont shall promptly notify the other party in writing. Miranda or Piedmont shall use reasonable diligence to remedy Force Majeure, but shall not be required to contest the validity of any law or regulation or any action or inaction of civil or military authority.

8.2 Definition of Force Majeure. “Force Majeure” means any cause beyond a party's reasonable control, including law or regulation; action or inaction of civil or military authority; inability to obtain any license, permit, or other authorization that may be required to conduct operations on or in connection with the Property; interference with mining operations by a lessee of oil, gas, or geothermal resources under the Property; unusually severe weather; mining casualty; unavoidable mill shutdown; damage to or destruction of mine plant or facility; fire; explosion; flood; insurrection; riot; labor disputes; inability after diligent effort to obtain workmen, material, or fuel supplies; unavailability of equipment, including drill rigs with qualified drillers; delay in transportation; acts of God; and a shutdown of the U.S. banking system.

SECTION NINE

Miscellaneous Provisions

9.1 Binding Effect. This Agreement shall inure to the benefit of and be binding upon the parties hereto, their respective heirs, executors, administrators, successors, and assigns.

9.2 Applicable Law. The terms and provisions of this Agreement shall be interpreted in accordance with the laws of the State of Nevada.

9.3 Entire Agreement. This Agreement terminates and replaces all prior agreements, either written, oral or implied, between the parties hereto, and constitutes the entire agreement between the parties.

9.4 Recording Memorandum of Agreement. The parties hereto agree to execute a Memorandum of this Agreement (short form) for the purpose of recording same in the records of Humboldt County, Nevada so as to give public notice, pursuant to the laws of the State of Nevada, of the existence of this Agreement.

9.5 Void or Invalid Provisions. If any term, provision, covenant or condition of this Agreement, or any application thereof, should be held by a court of competent jurisdiction to be invalid, void or unenforceable, all provisions, covenants and conditions of this Agreement, and all applications thereof not held invalid, void or unenforceable, shall continue in full force and effect and shall in no way be affected, impaired, or invalidated thereby.

9.6 Time of the Essence. Time is of the essence in the performance of this Agreement and each and every part thereof.

9.7 No Partnership. Nothing in this Agreement shall create a partnership between Miranda and Piedmont.

9.8 Press Releases. Prior to issuing any press release or other disclosure of information regarding the PPM Gold Project, Piedmont or Miranda, as the case may be, shall submit its press release or information disclosure to the other party for review and approval. If no comments or approval have been given by the receiving party within two (2) working days following receipt, the press release or information distribution shall be deemed approved.

IN WITNESS WHEREOF, the parties hereto have executed this Agreement on the day and year first above written.

| | MIRANDA U.S.A., INC., a Nevada corporation |

| | |

| | |

| | By |

| | KENNETH B. CUNNINGHAM, President |

| | |

| | PIEDMONT MINING COMPANY, INC., |

| | a North Carolina corporation |

| | |

| | |

| | By |

| | ROBERT M. SHIELDS, JR., President and CEO |

Exhibit 10.2

Services Agreement

Services Agreement between Miranda Gold U.S.A, a Nevada corporation having its principal place of business at 310 Silver Street, Elko, Nevada 89810 (“Miranda”) or “Contractor”), and Piedmont Mining Company, Inc., a North Carolina corporation whose address is 18124 Wedge Parkway, #214, Reno, Nevada 89511, (“Piedmont”), dated the Effective Date:

Piedmont and Contractor agree:

| | 1. | Work. The term “Work” is defined for the purposes of this Agreement as all labor, services and materials to be provided by Contractor as set forth in the attached fee schedule and Work description, hereinafter referred to as Addendum “A”, which is incorporated into this Agreement by this reference. |

| | 2. | Commencement of Work. Contractor shall begin Work on the Effective Date, or upon such later date as designated in the Addendum “A”, and shall diligently pursue all Work to completion. |

| | 3. | Performance of Work. Contractor shall perform all Work in a workmanlike manner, maintain all work sites and routes of access thereto in a clean, safe orderly condition, and remove all rubbish and foreign material from any site or other location occupied or used by it in its performance of Work. |

| | 4. | Assumption of Risk. Contractor represents that Contractor has examined all work sites, and assumes all risks affecting its performance of Work at such sites as to surface and subsurface site conditions, including difficulties of access. |

| | 5. | Applicable Laws. Contractor represents that Contractor is familiar with all laws, rules and regulations applicable to its performance of Work. |

| | 6. | Equipment and Personnel. Contractor shall at its own expense furnish all equipment, material, supplies and personnel necessary to perform Work, and shall pay any federal, state or local tax assessed or levied on account thereof. Piedmont shall not be responsible for any loss of tools, equipment or personal affects by Contractor or its employees. |

| | 7. | Independent Contractor. Contractor is an independent contractor, responsible for performing Work and obtaining permits and licenses related to Work in full compliance with all applicable laws, rules, regulations, and permit and license conditions. |

| | 8. | Payment to Contractor. Piedmont agrees to pay and reimburse Contractor for its performance of Work as provided by Addendum “A”, upon submission of appropriate invoices and receipts. |

| | 9. | Insurance and Indemnity: |