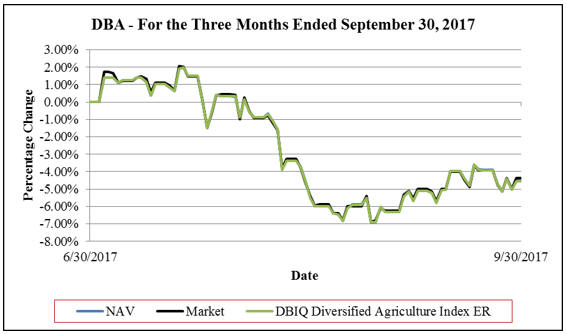

For the three months ended September 30, 2017, the NYSE Arca market value of each Share decreased 4.38% from $19.85 per Share to $18.98 per Share. The Share price low and high for the three months ended September 30, 2017 and related change from the Share price on June 30, 2017 was as follows: Shares traded at a low of $18.48 per Share(-6.90%) on August 29, 2017, and a high of $20.26 per Share (+2.07%) on July 19, 2017.

Fund Share Net Asset Performance

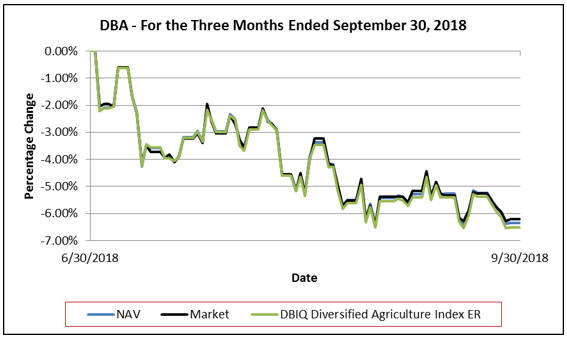

For the three months ended September 30, 2018, the NAV of each Share decreased 6.32% from $18.03 per Share to $16.89 per Share. Falling commodity futures contract prices for Corn, Soybeans, Wheat, Sugar, Cocoa, Coffee, Cotton and Lean Hogs were offset by rising commodity futures contract prices of Kansas City Wheat, Live Cattle and Feeder Cattle during the three months ended September 30, 2018, contributing to an overall 6.52% decrease in the level of the Index and to a 6.04% decrease in the level of the DBIQ Diversified Agriculture Index TR™.

Net income (loss) for the three months ended September 30, 2018 was $(42.1) million, primarily resulting from $3.6 million of income, net realized gain (loss) of $(55.8) million, net change in unrealized gain (loss) of $11.6 million and operating expenses of $1.5 million.

For the three months ended September 30, 2017, the NAV of each Share decreased 4.54% from $19.84 per Share to $18.94 per Share. Falling commodity futures contract prices for Corn, Wheat, Kansas City Wheat, Sugar, Coffee, Live Cattle and Lean Hogs were partially offset by rising commodity futures contract prices of Soybeans, Cocoa, Cotton and Feeder Cattle during the three months ended September 30, 2017, contributing to an overall 4.54% decrease in the level of the Index and to a 4.29% decrease in the level of the DBIQ Diversified Agriculture Index TR™.

Net income (loss) for the three months ended September 30, 2017 was $(33.5) million, primarily resulting from $1.6 million of income, net realized gain (loss) of $(38.4) million, net change in unrealized gain (loss) of $5.0 million and operating expenses of $1.7 million.

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2018 COMPARED TO THE NINE MONTHS ENDED SEPTEMBER 30, 2017

Fund Share Price Performance

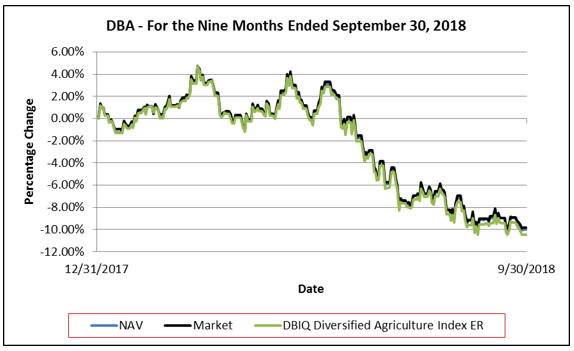

For the nine months ended September 30, 2018, the NYSE Arca market value of each Share decreased 9.81% from $18.75 per Share to $16.91 per Share. The Share price low and high for the nine months ended September 30, 2018 and related change from the Share price on December 31, 2017 was as follows: Shares traded at a low of $16.87 per Share(-10.03%) on August 30, 2018, and a high of $19.63 per Share (+4.69%) on March 5, 2018.

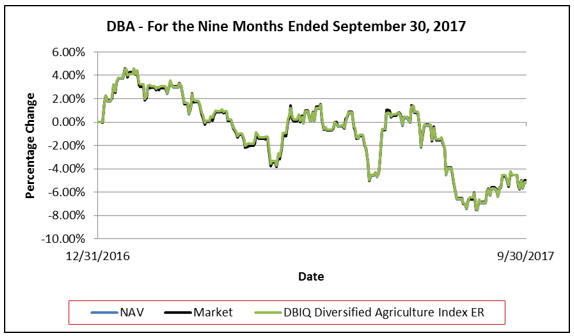

For the nine months ended September 30, 2017, the NYSE Arca market value of each Share decreased 5.01% from $19.98 per Share to $18.98 per Share. The Share price low and high for the nine months ended September 30, 2017 and related change from the Share price on December 31, 2016 was as follows: Shares traded at a low of $18.48 per Share(-7.51%) on August 29, 2017, and a high of $20.90 per Share (+4.61%) on January 17, 2017.

Fund Share Net Asset Performance

For the nine months ended September 30, 2018, the NAV of each Share decreased 9.97% from $18.76 per Share to $16.89 per Share. Falling commodity futures contract prices for Corn, Soybeans, Sugar, Coffee, Cotton, Live Cattle and Lean Hogs were offset by rising commodity futures contract prices of Wheat, Kansas City Wheat, Cocoa, and Feeder Cattle during the nine months ended September 30, 2018, contributing to an overall 10.46% decrease in the level of the Index and to a 9.23% decrease in the level of the DBIQ Diversified Agriculture Index TR™.

Net income (loss) for the nine months ended September 30, 2018 was $(72.7) million, primarily resulting from $8.5 million of income, net realized gain (loss) of $(76.4) million, net change in unrealized gain (loss) of $(0.1) million and operating expenses of $4.7 million.

For the nine months ended September 30, 2017, the NAV of each Share decreased 5.21% from $19.98 per Share to $18.94 per Share. Falling commodity futures contract prices for Corn, Soybeans, Wheat, Kansas City Wheat, Sugar, Cocoa, Coffee, Cotton and Lean Hogs were offset by rising commodity futures contract prices of Live Cattle and Feeder Cattle during the nine months ended September 30, 2017, contributing to an overall 5.13% decrease in the level of the Index and to a 4.52% decrease in the level of the DBIQ Diversified Agriculture Index TR™.

Net income (loss) for the nine months ended September 30, 2017 was $(41.0) million, primarily resulting from $3.7 million of income, net realized gain (loss) of $(49.5) million, net change in unrealized gain (loss) of $9.9 million and operating expenses of $5.1 million.

28