period. Consequently, the Fund’s aggregate return is expected to outperform the Excess Return Index by the amount of the excess, if any, of the Fund’s Treasury Income, Money Market Income andT-Bill ETF Income over its fees and expenses. As a result of the Fund’s fees and expenses, however, the aggregate return on the Fund is expected to underperform the Total Return Index. If the Fund’s fees and expenses were to exceed the Fund’s Treasury Income, Money Market Income andT-Bill ETF Income, if any, the aggregate return on an investment in the Fund is expected to underperform the Excess Return Index.

FOR THE YEARS ENDED DECEMBER 31, 2018, 2017 AND 2016

Fund Share Price Performance

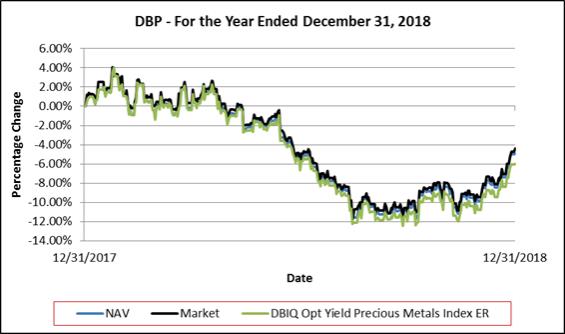

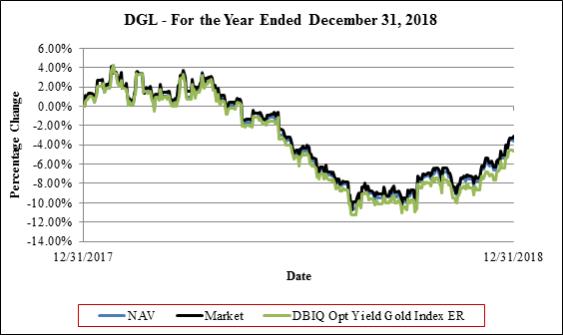

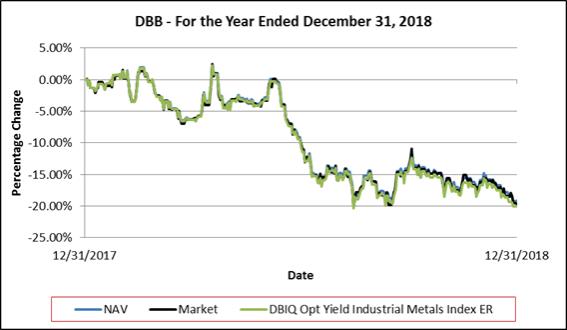

For the year ended December 31, 2018, the NYSE Arca market value of each Share decreased 3.06% from $41.37 per Share to $39.52 per Share. The Share price low and high for the year ended December 31, 2018 and related change from the Share price from December 31, 2017 was as follows: Shares traded at a low of $36.93 per Share(-10.73%) on August 16, 2018, and a high of $43.09 per Share (+4.17%) on January 24, 2018. On December 31, 2018, the Fund paid a distribution of $0.57908 for each General Share and Share to holders of record as of December 26, 2018. Therefore, the total return for the Fund, on a market value basis, was-3.06%.

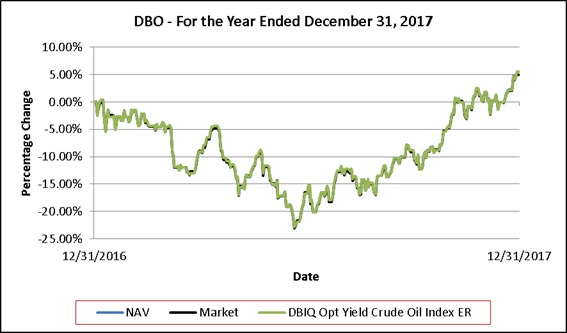

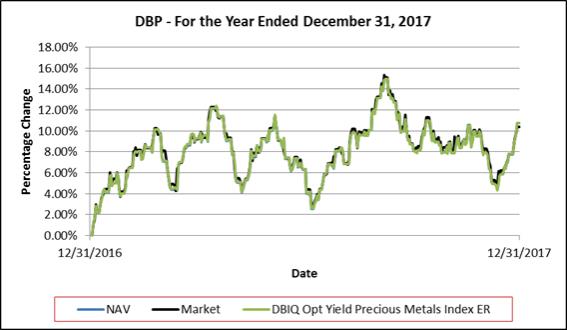

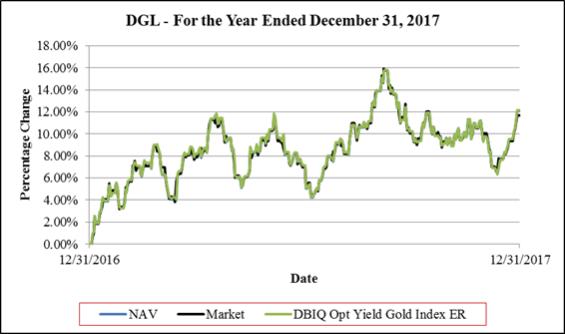

For the year ended December 31, 2017, the NYSE Arca market value of each Share increased 11.78% from $37.05 per Share to $41.37 per Share. The Share price low and high for the year ended December 31, 2017 and related change from the Share price from December 31, 2016 was as follows: Shares traded at a low of $37.29 per Share (+0.66%) on January 3, 2017, and a high of $42.95 per Share (+15.94%) on September 7, 2017. On December 29, 2017, the Fund paid a distribution of $0.04202 for each General Share and Share to holders of record as of December 19, 2017. Therefore, the total return for the Fund, on a market value basis, was +11.78%.

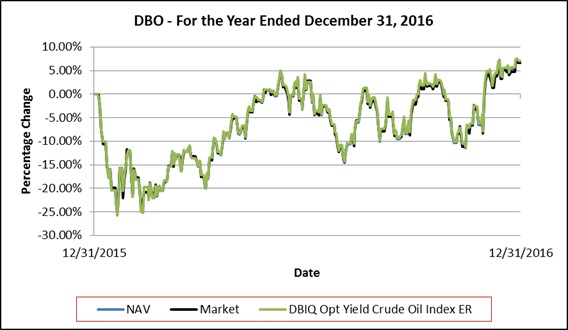

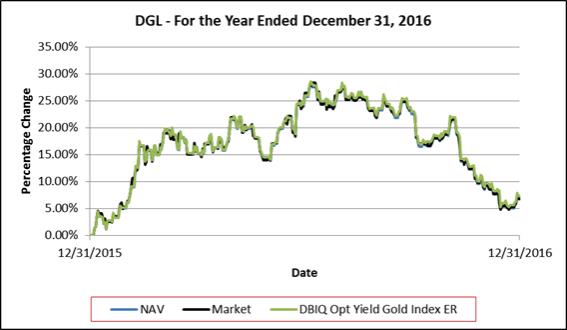

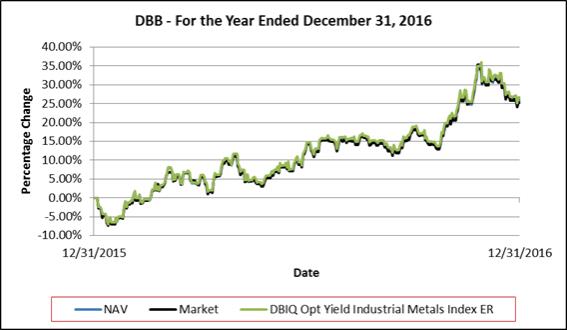

For the year ended December 31, 2016, the NYSE Arca market value of each Share increased 6.86% from $34.67 per Share to $37.05 per Share. The Share price low and high for the year ended December 31, 2016 and related change from the Share price from December 31, 2015 was as follows: Shares traded at a low of $35.15 per Share (+1.38%) on January 4, 2016, and a high of $44.53 per Share (+28.43%) on July 8, 2016. No distributions were paid to Shareholders during the year ended December 31, 2016. Therefore, the total return for the Fund, on a market value basis, was +6.86%.

Fund Share Net Asset Performance

For the year ended December 31, 2018, the NAV of each Share decreased 3.63% from $41.51 per Share to $39.42 per Share. Falling prices in the price of gold futures contracts during the year ended December 31, 2018 contributed to an overall 4.65% decrease in the level of the Index and a 2.76% decrease in the level of theDBIQ-OY Gold TR™. On December 31, 2018, the Fund paid a distribution of $0.57908 for each General Share and Share to holders of record as of December 26, 2018. Therefore, the total return for the Fund on a NAV basis was-3.63%.

Net income (loss) for the year ended December 31, 2018 was $(9.6) million, primarily resulting from $2.6 million of income, net realized gain (loss) of $(7.9) million, net change in unrealized gain (loss) of $(3.2) million and operating expenses of $1.1 million.

For the year ended December 31, 2017, the NAV of each Share increased 12.18% from $37.04 per Share to $41.51 per Share. Rising prices in the price of gold futures contracts during the year ended December 31, 2017 contributed to an overall 12.12% increase in the level of the Index and a 13.17% increase in the level of theDBIQ-OY Gold TR™. On December 29, 2017, the Fund paid a distribution of $0.04202 for each General Share and Share to holders of record as of December 19, 2017. Therefore, the total return for the Fund on a NAV basis was +12.18%.

Net income (loss) for the year ended December 31, 2017 was $13.4 million, primarily resulting from $1.3 million of income, net realized gain (loss) of $(25.0) million, net change in unrealized gain (loss) of $38.3 million and operating expenses of $1.2 million.

For the year ended December 31, 2016, the NAV of each Share increased 6.78% from $34.69 per Share to $37.04 per Share. Rising prices in the price of gold futures contracts during the year ended December 31, 2016 contributed to an overall 7.62% increase in the level of theDBIQ-OY Gold TR™. No distributions were paid to Shareholders during the year ended December 31, 2016. Therefore, the total return for the Fund on a NAV basis was 6.78%.

Net income (loss) for the year ended December 31, 2016 was $0.2 million, primarily resulting from $0.7 million of income, net realized gain (loss) of $28.3 million, net change in unrealized gain (loss) of $(27.1) million and operating expenses of $1.7 million.

Critical Accounting Policies

The Fund’s critical accounting policies are as follows:

Preparation of the financial statements and related disclosures in conformity with U.S. GAAP requires the application of appropriate accounting rules and guidance, as well as the use of estimates, and requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, revenue and expense and related disclosure of contingent assets and liabilities during the reporting period of the financial statements and accompanying notes. The Fund’s application of these policies involves judgments and actual results may differ from the estimates used. There were no significant estimates used in the preparation of these financial statements.

25