Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to Section 240.14a-12. | |||

Athersys, Inc. | ||||

| (Name of Registrant as Specified in its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| ||||

| (5) | Total fee paid: | |||

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| ||||

| (3) | Filing Party:

| |||

| ||||

| (4) | Date Filed:

| |||

| ||||

Table of Contents

| Page | ||||

| 2 | ||||

| 5 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| COMPENSATION COMMITTEE REPORT | 20 | |||

| 21 | ||||

SUBMISSION OF STOCKHOLDERS’ PROPOSALS AND ADDITIONAL INFORMATION | 24 | |||

| 24 | ||||

| 25 | ||||

-i-

Table of Contents

Athersys, Inc.

3201 Carnegie Avenue

Cleveland, Ohio 44115-2634

To Our Stockholders:

You are invited to attend the 2012 Annual Meeting of Stockholders, or Annual Meeting, of Athersys, Inc. to be held at the Marriott Hotel at Key Center, 127 Public Square, Cleveland, Ohio 44114 on Wednesday, June 20, 2012 at 8:00 a.m. Eastern Standard Time. We are pleased to enclose the notice of our Annual Meeting, together with a proxy statement, a proxy and an envelope for returning the proxy.

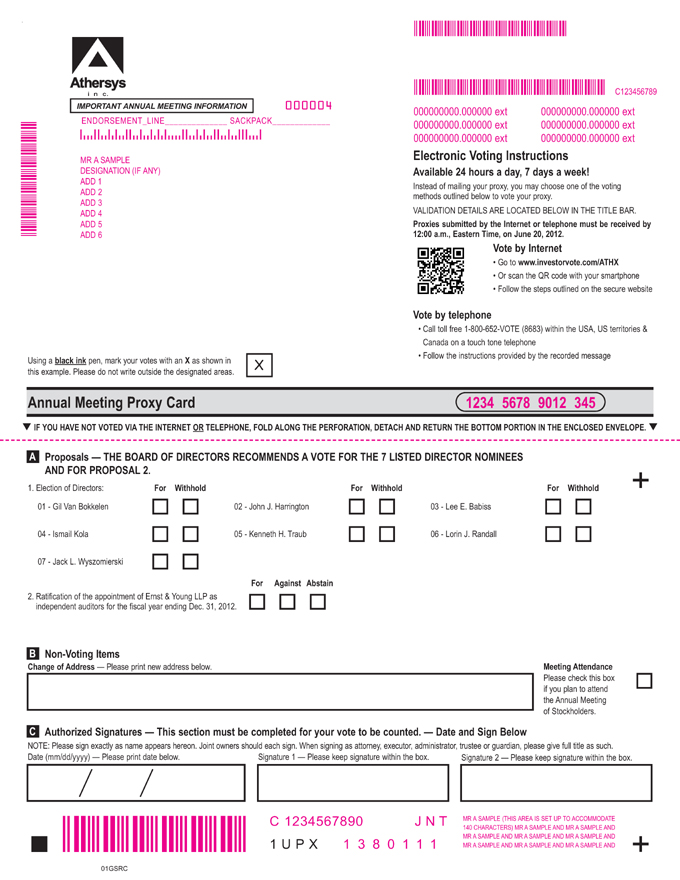

You are asked to: (1) elect the seven Directors nominated by the Board of Directors; and (2) ratify the appointment of Ernst & Young LLP as Athersys, Inc.’s independent auditors for the fiscal year ending December 31, 2012. Your Board of Directors unanimously recommends that you vote “FOR” the election of each of the seven Director nominees named in the proxy statement and “FOR” the ratification of the appointment of Ernst & Young LLP as independent auditors for the fiscal year ending December 31, 2012.

Please carefully review the proxy statement and then complete and sign your proxy and return it promptly. If you attend the Annual Meeting and decide to vote in person, you may withdraw your proxy at the meeting. You may also vote electronically atwww.investorvote.com/ATHX or telephonically at 1-800-652-VOTE (8683) within the Unites States and Canada.

Your time and attention to this letter and the accompanying proxy statement and proxy are appreciated.

Sincerely,

/s/ Gil Van Bokkelen

Gil Van Bokkelen

Chairman and Chief Executive Officer

April 27, 2012

Table of Contents

Athersys, Inc.

3201 Carnegie Avenue

Cleveland, Ohio 44115-2634

NOTICE OF ANNUAL MEETING OF

STOCKHOLDERS

June 20, 2012

The 2012 Annual Meeting of Stockholders, or Annual Meeting, of Athersys, Inc., a Delaware corporation, will be held on Wednesday, June 20, 2012, at 8:00 a.m. Eastern Standard Time, at the Marriott Hotel at Key Center, 127 Public Square, Cleveland, Ohio 44114 for the following purposes:

| (1) | To elect the seven Directors nominated by the Board of Directors; |

| (2) | To ratify the appointment of Ernst & Young LLP as Athersys, Inc.’s independent auditors for the fiscal year ending December 31, 2012; and |

| (3) | To consider any other matters that may properly come before the Annual Meeting or any adjournment thereof. |

Stockholders of record at the close of business on Monday, April 23, 2012 are entitled to vote at the Annual Meeting.

By Order of the Board of Directors

/s/ William Lehmann, Jr.

William Lehmann, Jr.

Secretary

April 27, 2012

Even if you expect to attend the Annual Meeting, please promptly complete, sign, date and mail the enclosed proxy card. A self-addressed envelope is enclosed for your convenience. No postage is required if mailed in the United States. Stockholders who attend the Annual Meeting may revoke their proxies and vote in person if they so desire. You may also vote electronically atwww.investorvote.com/ATHX or telephonically at 1-800-652-VOTE (8683) within the Unites States and Canada.

Table of Contents

Athersys, Inc.

3201 Carnegie Avenue

Cleveland, Ohio 44115-2634

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 20, 2012

The 2012 Annual Meeting of Stockholders, or Annual Meeting, of Athersys, Inc., a Delaware corporation, which we refer to as Athersys or the Company, will be held on Wednesday, June 20, 2012, at 8:00 a.m. Eastern Standard Time, at the Marriott Hotel at Key Center, 127 Public Square, Cleveland, Ohio 44114.

This proxy statement is furnished in connection with the solicitation by the Board of Directors (the “Board”) of the Company, of proxies to be used at the Annual Meeting. This proxy statement and the related proxy card are being mailed to stockholders commencing on or about May 2, 2012.

Stockholders of record of the Company at the close of business on Monday, April 23, 2012, will be entitled to vote at the Annual Meeting. On that date, 29,398,024 shares of common stock, par value $0.001 per share, of the Company, which we refer to as Common Stock, were outstanding and entitled to vote. Each share of Common Stock is entitled to one vote. At the Annual Meeting, inspectors of election shall determine the presence of a quorum and shall tabulate the results of the vote of the stockholders. The holders of a majority of the total number of outstanding shares of Common Stock entitled to vote must be present in person or by proxy to constitute the necessary quorum for any business to be transacted at the Annual Meeting. Properly executed proxies marked “abstain,” as well as “broker non-votes,” as described below, will be considered “present” for purposes of determining whether a quorum has been achieved at the Annual Meeting.

Brokers or other nominees who hold shares of Common Stock in “street name” for a beneficial owner of those shares typically have the authority to vote in their discretion on “routine” proposals when they have not received instructions from beneficial owners. However, brokers are not allowed to exercise their voting discretion with respect to the election of directors or for the approval of other matters which are “non-routine,” without specific instructions from the beneficial owner. Proposal One — Election of Directors is considered a non-routine matter, and without your instruction, your broker cannot vote your shares with respect to this proposal. Proposal Two — Ratification of the Appointment of Ernst & Young LLP as Independent Auditors for The Fiscal Year Ending December 31, 2012, is considered to be a “routine” matter. Accordingly, we do not expect “broker non-votes” on this proposal. The nominees for Director receiving the greatest number of votes cast at the Annual Meeting in person or by proxy shall be elected. Consequently, withhold votes and broker non-votes will have no impact in the election of Directors, except to the extent that the failure to vote for an individual may result in another individual receiving a larger number of votes. Stockholders have no right to cumulative voting as to any matter, including the election of Directors.

The affirmative vote of the holders of a majority of the shares cast, in person or by proxy, is necessary for the ratification of the appointment of Ernst & Young LLP as independent auditors for the fiscal year ending December 31, 2012. Abstentions will have no effect on this proposal as abstentions will not be counted in determining the number of votes cast. As an advisory vote, the ratification of the appointment of Ernst & Young LLP as independent auditors for the fiscal year ending December 31, 2012 is not binding on the Company.

The shares of Common Stock represented by all valid proxies received will be voted in the manner specified on the proxies. Where specific choices are not indicated on a valid proxy, the shares of Common Stock represented by such proxies received will be voted: (i) for the election of each of the seven Director nominees named in this proxy statement; (ii) for the ratification of the appointment of Ernst & Young LLP as independent auditors for the fiscal year ending December 31, 2012; and (iii) in accordance with the best judgment of the persons named in the enclosed proxy, or their substitutes, for any other matters that properly come before the Annual Meeting.

Returning your completed proxy will not prevent you from voting in person at the Annual Meeting should you be present and desire to do so. In addition, you may revoke the proxy at any time prior to its exercise either by giving written notice to the Company or by submission of a later-dated proxy.

1

Table of Contents

PROPOSAL ONE

The Board currently consists of the following seven Directors, Gil Van Bokkelen, Lee E. Babiss, John J. Harrington, Ismail Kola, George M. Milne, Jr., Lorin J. Randall and Jack L. Wyszomierski, and their current term of office will expire at the Annual Meeting. One of our Directors, George M. Milne, Jr., is not standing for re-election, and a new Director, Kenneth H. Traub has been recommended for election as the designee of Radius Venture Partners, or Radius. Radius has the right to nominate one individual as a Director pursuant to the terms of a securities purchase agreement so long as Radius meets certain ownership requirements. At each annual stockholders’ meeting, Directors are elected for a one-year term and hold office until their successors are elected and qualified or until their earlier removal or resignation. Newly created directorships resulting from an increase in the authorized number of Directors or any vacancies on the Board resulting from death, resignation, disqualification, removal or other cause may be filled by a majority vote of the remaining Directors then in office.

At the Annual Meeting, seven Directors are to be elected to hold office for a term of one year and until their successors are elected and qualified. The Board recommends that its nominees for Director be elected at the Annual Meeting. The nominees are Gil Van Bokkelen, Lee E. Babiss, John J. Harrington, Ismail Kola, Lorin J. Randall, Kenneth H. Traub and Jack L. Wyszomierski.

If any nominee becomes unavailable for any reason or should a vacancy occur before the election, which events are not anticipated, the proxies will be voted for the election of such other person as a Director as the Board may recommend. Information regarding the nominees for Director is set forth below.

Gil Van Bokkelen, 51. Dr. Van Bokkelen has served as our Chief Executive Officer and Chairman since August 2000. Dr. Van Bokkelen co-founded Athersys, Inc. in 1995 and served as Chief Executive Officer and Director since the Company’s founding. Prior to May 2006, he also served as the Company’s President. Dr. Van Bokkelen is the current Chairman of the Alliance for Regenerative Medicine, a Washington D.C. based consortium of companies, patient advocacy groups, disease foundations, and clinical and research institutions that are committed to the advancement of the field of regenerative medicine. He is also the Chairman of the Board of Governors for the National Center for Regenerative Medicine, and has served on a number of other boards, including the Biotechnology Industry Organization’s ECS board of directors (from 2001 to 2004, and from 2008 to present). He received his Ph.D. in Genetics from Stanford University, his B.A. in Economics from the University of California at Berkeley, and his B.A. in Molecular Biology from the University of California at Berkeley. Dr. Van Bokkelen brings to the Board leadership, extensive business, operating, financial and scientific experience, and tremendous knowledge of our Company and the biopharmaceutical industry. Dr. Van Bokkelen also brings his broad strategic vision for our Company to the Board of Directors and his service as the Chairman and CEO of Athersys creates a critical link between management and the Board, enabling the Board to perform its oversight function with the benefit of management’s perspectives on the business. In addition, having the CEO, and Dr. Van Bokkelen, in particular, on our Board of Directors provides our Company with ethical, decisive and effective leadership.

Lee E. Babiss, 56. Dr. Babiss has served as a Director since August 2010. Dr. Babiss is currently Chief Scientific Officer and Executive Vice President of Global Laboratory Services of PPD, Inc., a contract research organization, where he has served since February 2010, providing strategic direction and scientific leadership. Dr. Babiss was formerly President and Director of Global Pharmaceutical Research at Roche in Switzerland, a pharmaceutical company, from 1998 until his appointment at PPD, Inc. Prior to Roche, Dr. Babiss spent seven years with Glaxo, Inc., now GlaxoSmithKline, a pharmaceutical company, where he held senior positions, including Vice President of Biological Sciences and Genetics. Dr. Babiss received his doctorate in Microbiology from Columbia University and completed his postdoctoral fellowship at the Rockefeller University, where he served as an assistant and associate professor. Dr. Babiss has received numerous fellowship awards and grants and serves on several scientific advisory committees. Dr. Babiss has authored over 60 technical publications in scientific and medical journals. Dr. Babiss’ brings over 20 years of experience developing and leading research and development programs. His strategic leadership and product development knowledge provide a valuable perspective to the Board.

John J. Harrington, 44. Dr. Harrington has served as our Chief Scientific Officer, Executive Vice President and Director since our founding. Dr. Harrington co-founded Athersys, Inc. in 1995. Dr. Harrington led the development of the RAGE® technology as well as its application for gene discovery, drug discovery and commercial protein production applications. He is a listed inventor on over 20 issued or pending United States patents, has authored numerous scientific publications, and has received numerous awards for his work, including being named one of the top international young scientists by MIT Technology Review in 2002. Dr. Harrington has overseen the therapeutic product development programs at Athersys since their inception, and is also focused on the clinical development and manufacturing of MultiStem®. During his career, he has also held positions at Amgen and Scripps Clinic. He received his B.A. in Biochemistry and Cell Biology from the University of California at San Diego and his Ph.D. in Cancer Biology from Stanford University. Dr. Harrington’s scientific experience and deep understanding of our Company, combined with his drive for innovation and excellence, position him well to serve on the Board of Directors.

2

Table of Contents

Ismail Kola, 55. Dr. Kola has served as a Director since October 2010. Dr. Kola has served as Executive Vice President of UCB S.A. in Belgium, a biopharmaceutical company dedicated to the development of innovative medicines focused on the fields of central nervous system and immunology disorders, and President of UCB New Medicines, UCB’s discovery research through proof-of-concept organization, since November 2009. Dr. Kola was formerly Senior Vice President, Discovery Research and Early Clinical Research & Experimental Medicine at Schering-Plough Research Institute, the pharmaceutical research arm of Schering-Plough Corporation, and Chief Scientific Officer at Schering-Plough Corporation, a pharmaceutical company, from March 2007 until his appointment at UCB. Prior to Schering-Plough, Dr. Kola held senior positions from January 2003 to March 2007 at Merck, a pharmaceutical company, where he was Senior Vice President and Site Head, Basic Research. From 2000 to 2003, Dr. Kola was Vice President, Research, and Global Head, Genomics Science and Biotechnology, at Pharmacia Corporation. Prior to his position with Pharmacia, Dr. Kola spent 15 years as Professor of Human Molecular Genetics and was Director of the Centre for Functional Genomics and Human Disease at Monash Medical School in Australia. Dr. Kola received his Ph.D. in Medicine from the University of Cape Town, South Africa, his B.Sc. from the University of South Africa, and his B.Pharm. from Rhodes University, South Africa. Dr. Kola currently serves on the boards of directors of Astex Therapeutics (NASDAQ: ASTX) since May 2010, Biotie Therapies (and previously Synosia who merged with Biotie) since February 2011, and previously served on the board of directors of Ondek Pty Ltd from 2009 to 2011 and Promega Corporation from 2003 to 2007. Dr. Kola has authored 160 technical publications in scientific and medical journals and is the named inventor on at least a dozen patents. Dr. Kola holds Adjunct Professorships of Medicine at Washington University in St. Louis, Missouri, and Monash University Medical School; a Foreign Adjunct Professorship at the Karolinska Institute in Stockholm, Sweden; and was elected William Pitt Fellow at Pembroke College, Cambridge University, United Kingdom in 2008. For more than 20 years, Dr. Kola has created a bridge between the scientific and academic worlds though various projects funded by renowned institutes, and Dr. Kola’s experience and leadership in taking numerous drugs from the research stage to market or late stage development brings a unique and valuable perspective to our Board.

Lorin J. Randall, 68. Mr. Randall has served as a Director since September 2007. Mr. Randall is an independent financial consultant and previously was Senior Vice President and Chief Financial Officer of Eximias Pharmaceutical Corporation, a development-stage drug development company, from 2004 to 2006. From 2002 to 2004, Mr. Randall served as Senior Vice President and Chief Financial Officer of i-STAT Corporation, a publicly-traded manufacturer of medical diagnostic devices that was acquired by Abbott Laboratories in 2004. From 1995 to 2001, Mr. Randall was Vice President and Chief Financial Officer of CFM Technologies, Inc., a publicly-traded manufacturer of semiconductor manufacturing equipment. Mr. Randall currently serves on the boards of directors of Acorda Therapeutics, Inc. (NASDAQ: ACOR) since 2006, where he serves as chairman of the compensation committee and is a member of the audit and nominations and governance committees, Nanosphere, Inc. (NASDAQ: NSPH) since 2008, where he serves as chairman of the audit committee, and Tengion, Inc. (NASDAQ: TNGN) since 2008, where he serves as chairman of the audit committee and a member of the compensation committee. He previously served on the board of directors of Opexa Therapeutics, Inc. (NASDAQ: OPXA) from 2007 to 2009, where he served as chair of the audit committee. Mr. Randall received a B.S. in accounting from The Pennsylvania State University and an M.B.A. from Northeastern University. Mr. Randall’s strong financial and human resources background and his service on the audit and compensation committees of other companies provides expertise to the Board, including an understanding of financial statements, compensation policies and practices, corporate finance, developing and maintaining effective internal controls, accounting, employee benefits, investments and capital markets. These qualities also formed the basis for the Board’s decision to appoint Mr. Randall as chairman of the Audit Committee and the Compensation Committee.

Kenneth H. Traub,50. Mr. Traub has been the President and Chief Executive Officer of Ethos Management LLC, a private consulting and investment firm since 2009. Mr. Traub served as President, Chief Executive Officer and a director of American Bank Note Holographics, Inc., or ABNH, a global leader in product and document security, from 1999 until its sale in 2008 to JDS Uniphase Corporation, or JDSU, a provider of optical products and measurement solutions for the communications industry. Mr. Traub managed the rebuilding, growth and sale of ABNH. Following the sale of ABNH, Mr. Traub served as vice president of JDSU in 2008. In 1994, Mr. Traub co-founded Voxware, Inc., a pioneer in ‘Voice over IP’, and acted as its Executive Vice President, Chief Financial Officer and director until January 1998. Prior to Voxware, he was Vice President of Finance of Trans-Resources, Inc. Mr. Traub currently serves on the boards of the following publicly traded companies: MRV Communications, Inc. (OTC: MRVC) since November 2011 and as Chairman since January 2012 where he is a member of the Audit Committee, Compensation Committee and Nominating and Governance Committee; iPass Inc. (NASDAQ: IPAS) since June 2009, where he is a member of the Compensation Committee and Corporate Governance and Nominating Committee; and MIPS Technologies, Inc. (NASDAQ: MIPS) since December 2011 where he is a member of the Audit Committee. Mr. Traub also served on the board of Phoenix Technologies Ltd. (NASDAQ: PTEC) from November 2009 through its sale in December 2010, where he was a member of the Audit Committee and Compensation Committee. Mr. Traub received a Master’s in Business Administration from Harvard Business School in 1988 and a Bachelor of Arts degree from Emory University in 1983. As a director for Athersys, Mr. Traub contributes his extensive experience and expertise in managing and growing companies to maximize shareholder value.

3

Table of Contents

Jack L. Wyszomierski, 56. Mr. Wyszomierski has served as a Director since June 2010 and is currently retired. From 2004 until his retirement in June 2009, Mr. Wyszomierski served as the Executive Vice President and Chief Financial Officer of VWR International, LLC, a supplier and distributor of laboratory supplies, equipment and supply chain solutions to the global research laboratory industry. From 1982 to 2004, Mr. Wyszomierski held positions of increasing responsibility within the finance group at Schering-Plough Corporation, a pharmaceutical company, culminating with his appointment as Executive Vice President and Chief Financial Officer in 1996. Prior to joining Schering-Plough, he was responsible for capitalization planning at Joy Manufacturing Company, a producer of mining equipment, and was a management consultant at Data Resources, Inc., a distributor of economic data. Mr. Wyszomierski currently serves on the board of directors of Xoma Corporation (NASDAQ: XOMA) since 2010, where he serves as chairman of the audit committee and as a member of the compensation committee, Unigene Laboratories, Inc. (OTC:UGNE) since 2012, where he serves as chairman of the audit committee, and Exelixis, Inc. (NASDAQ: EXEL) since 2004, where he serves as chairman of the audit committee. Mr. Wyszomierski holds a M.S. in Industrial Administration and a B.S. in Administration, Management Science and Economics from Carnegie Mellon University. Mr. Wyszomierski’s extensive financial reporting, accounting and finance experience and his service on the audit committees of other public companies, as well as his experience in the healthcare and life sciences industries, provides financial expertise to the Board, including an understanding of financial statements, corporate finance, developing and maintaining effective internal controls, accounting, investments and capital markets.

The Board unanimously recommends that stockholders vote FOR the election of each of the seven Director nominees named in this proxy statement.

4

Table of Contents

THE BOARD OF DIRECTORS AND ITS COMMITTEES

Director Independence

The Board reviews the independence of each Director at least annually. During these reviews, the Board will consider transactions and relationships between each Director (and his or her immediate family and affiliates) and the Company and our management to determine whether any such transactions or relationships are inconsistent with a determination that the Director was independent. The Board conducted its annual review of Director independence to determine if any transactions or relationships exist that would disqualify any of the individuals who serve as a Director under the rules of the NASDAQ Capital Market or require disclosure under Securities and Exchange Commission, or SEC, rules. Based upon the foregoing review, the Board determined the following individuals are independent under the rules of the NASDAQ Capital Market: Lee E. Babiss, Ismail Kola, George M. Milne, Jr., Lorin J. Randall, Kenneth H. Traub and Jack L. Wyszomierski. In making this determination with respect to Dr. Babiss, the Board determined that the provision of certain contract research services to the Company by PPD, Inc., of which Dr. Babiss serves as an executive officer, did not create a material relationship or impair the independence of Dr. Babiss because Dr. Babiss receives no material direct or indirect benefit from such transactions, which were undertaken in the ordinary course of business. Currently, we have two members of management who also serve on the Board: Dr. Van Bokkelen, who is also our Chairman and Chief Executive Officer, and Dr. Harrington, who is our Executive Vice President and Chief Scientific Officer. Neither Dr. Van Bokkelen nor Dr. Harrington is considered independent under the independence rules of the NASDAQ Capital Market.

Board Meetings

The Board held 14 meetings during fiscal year 2011. All of the Directors attended at least 75% of the total meetings held by the Board of Directors and by all committees on which he served during fiscal year 2011, other than Dr. Babiss, who attended 64% of the total meetings held by the Board of Directors.

Attendance at Annual Meeting

Although the Company does not have a policy with respect to attendance by the Directors at the Annual Meeting, Directors are encouraged to attend. The Company held an annual meeting of stockholders last year, which was attended by six of the seven Directors.

Committees

The Board has three standing committees: the Audit Committee; the Compensation Committee; and the Nominations and Corporate Governance Committee. The Board has adopted a written charter for each of the committees of the Board of Directors. These charters, as well as our Code of Business Conduct and Ethics, are posted and available under the Investor page on our website at www.athersys.com. Stockholders may request copies of these corporate governance documents, free of charge, by writing to Athersys, Inc., 3201 Carnegie Avenue, Cleveland, Ohio 44115, Attention: Corporate Secretary.

Audit Committee

The Audit Committee is responsible for overseeing the accounting and financial reporting processes of the Company and the audits of the financial statements of the Company. The Audit Committee is also directly responsible for the appointment, compensation, retention and oversight of the work of the Company’s independent auditors, including the resolution of disagreements between management and the auditors regarding financial reporting. Additionally, the Audit Committee approves all related-party transactions that are required to be disclosed pursuant to Item 404 of Regulation S-K. The current members of the Audit Committee are Lorin J. Randall, Jack L. Wyszomierski, George M. Milne, Jr. and Ismail Kola. The Board has determined that each of Mr. Randall and Mr. Wyszomierski is an “audit committee financial expert,” as defined in Item 407(d)(5)(ii) of Regulation S-K, and an “independent director,” as defined in the NASDAQ listing standards. The Audit Committee held five meetings during fiscal year 2011.

Compensation Committee

The Compensation Committee is responsible for, among other things, annually reviewing and recommending to the Board the salaries and other compensation, including stock incentives, of our executive officers, including our Chief Executive Officer, reviewing and recommending to the Board the compensation of our non-employee Directors, engaging and determining the fees of compensation consultants, if any, and overseeing regulatory compliance with respect to compensation matters. In 2011, the Compensation Committee engaged an independent compensation consultant, Arnosti Consulting, Inc., to review the Company’s comparable peer group, and review and make recommendations regarding the (i) general compensation structure, (ii) Company-wide equity incentives, taking into consideration existing agreements with the named executive officers, (iii) cash bonus program, and (iv) Director cash and equity compensation. The Compensation Committee reviews and recommends corporate goals and objectives relevant to the compensation of the executive officers and evaluates the performance of the executive officers in light of those corporate goals and objectives. The Compensation Committee also considers the duties and responsibilities of the executive officers and recommends to the Board the compensation levels for those executive officers based on those evaluations and any other factors as it deems appropriate. In recommending incentive compensation, the Compensation Committee also considers the Company’s performance and relative stockholder return, the value of similar awards to executive officers of comparable companies, and the awards given to the Company’s executive officers in past years. The current members of the Compensation Committee are Lorin J. Randall, Jack L. Wyszomierski, George M. Milne, Jr. and Lee E. Babiss. The Compensation Committee held five meetings during fiscal year 2011.

5

Table of Contents

Nominations and Corporate Governance Committee

The Nominations and Corporate Governance Committee is responsible for, among other things, evaluating and recommending to the Board qualified nominees for election as Directors and qualified Directors for committee membership, as well as developing and recommending to the Board corporate governance principles applicable to the Company. The current members of the Nominations and Corporate Governance Committee are Lee E. Babiss, Lorin J. Randall, George M. Milne, Jr. and Jack L. Wyszomierski. The Nominations and Corporate Governance Committee held one meeting during fiscal year 2011.

The Nominations and Corporate Governance Committee shall identify individuals qualified to become members of the Board and recommend candidates to the Board to fill new or vacant positions. Except as may be required by rules promulgated by NASDAQ or the SEC, there are currently no specific, minimum qualifications that must be met by each candidate for the Board, nor are there specific qualities or skills that are necessary for one or more of the members of the Board of Directors to possess. In recommending candidates, the Nominations and Corporate Governance Committee considers such factors as it deems appropriate, consistent with criteria approved by the Board of Directors. These factors may include judgment, skill, diversity, integrity, experience with businesses and other organizations of comparable size, experience in corporate governance, experience in business and human resource management, the interplay of the candidate’s experience with the experience of other members of the Board of Directors, and the extent to which the candidate would be a desirable addition to the Board of Directors and any committees of the Board. When considering diversity, the Nominations and Corporate Governance Committee considers the breadth and diversity of experience brought by the various nominees for Director in functional areas including pharmaceutical, capital markets, biotechnology, clinical and financial. The Nominations and Corporate Governance Committee recommends candidates to the Board based on these factors and also considers possible conflicts of interest when making its recommendations to the Board.

The Nominations and Corporate Governance Committee also has used an independent search firm in identifying candidates, as needed and routinely identifies potential Director candidates for us. Radius recommended Mr. Traub as a potential nominee for Director, as Radius’ contractual designee. Thereafter, the Nominations Committee evaluated Mr. Traub’s qualifications and initiated a process that resulted in his nomination as a Director.

The Nominations and Corporate Governance Committee will give appropriate consideration to qualified persons recommended by stockholders for nomination as our Directors, provided that the stockholder delivers written notice to the Secretary of the Company, which contains the following information:

| • | the name and address of the stockholder and each Director nominee; |

| • | a representation that the stockholder is entitled to vote and intends to appear in person or by proxy at the meeting; |

| • | a description of any and all arrangements or understandings between the stockholder and each nominee; |

| • | such other information regarding the nominee that would have been required to be included by the SEC in a proxy statement had the nominee been named in a proxy statement; |

| • | a brief description of the nominee’s qualifications to be a Director; and |

| • | the written consent of the nominee to serve as a Director if so elected. |

The Nominations and Corporate Governance Committee evaluates candidates proposed by stockholders, if any, using the same criteria as for other candidates not nominated by stockholders.

6

Table of Contents

Board Leadership Structure

We operate in a complex, dynamic industry. Therefore, the Board of Directors believes that our Chief Executive Officer is the most appropriate person to serve as our Chairman because he possesses in-depth knowledge of the issues, opportunities and challenges facing our business. Because of this knowledge and insight, he is in the best position to effectively identify strategic opportunities and priorities and to lead the discussion for the execution of the Company’s strategies and achievement of its objectives. As Chairman, our Chief Executive Officer is able to:

| • | focus the Board on the most significant strategic goals and risks of our businesses; |

| • | utilize the individual qualifications, skills and experience of the other members of the Board in order to maximize their contributions to the Board; |

| • | ensure that each other member of the Board has sufficient knowledge and understanding of our businesses to enable him to make informed judgments; and |

| • | facilitate the flow of information between the Board and management of the Company. |

The Board of Directors believes that the combined role of Chairman and Chief Executive Officer promotes strategic development and execution of our business strategies, which is essential to effective governance. The Board of Directors has chosen not to appoint a “lead director,” but instead uses executive sessions of the independent Directors, as necessary. In addition, the committees of the Board are comprised solely of independent Directors. We believe that shared leadership responsibility among the independent Directors, as opposed to a single lead director, results in increased engagement of the Board as a whole, and that having a strong, independent group of Directors fully engaged is important for good governance.

The Board’s Role in Risk Oversight

The Board oversees the risk management of the Company. The full Board of Directors, as supplemented by the appropriate board committee in the case of risks that are overseen by a particular committee, reviews information provided by management in order for the Board to oversee its risk identification, risk management and risk mitigation strategies. The Board committees assist the full Board’s oversight of our material risks by focusing on risks related to the particular area of concentration of the relevant committee. For example, our Compensation Committee oversees risks related to our executive compensation plans and arrangements, our Audit Committee oversees the financial reporting and control risks, and our Nominations and Corporate Governance Committee oversees risks associated with the independence of the Board and potential conflicts of interest. Each committee reports on these discussions of the applicable relevant risks to the full Board during the committee reports portion of each Board meeting, as appropriate. The full Board incorporates the insight provided by these reports into its overall risk management analysis. We believe that the Board leadership structure complements our risk management structure because it allows our independent directors, through independent committees, to exercise effective oversight of the actions of management in identifying risks and implementing effective risk management policies and controls.

Certain Relationships and Related Person Transactions

We give careful attention to related person transactions because they may present the potential for conflicts of interest. We refer to “related person transactions” as those transactions, arrangements, or relationships in which:

| • | we were, are or are to be a participant; |

| • | the amount involved exceeds $120,000; and |

| • | any of our Directors, Director nominees, executive officers or greater-than five percent stockholders (or any of their immediate family members) had or will have a direct or indirect material interest. |

To identify related person transactions in advance, we rely on information supplied by our executive officers, Directors and certain significant stockholders. We maintain a comprehensive written policy for the review, approval or ratification of related person transactions, and our Audit Committee reviews all related person transactions identified by us. The Audit Committee approves or ratifies only those related person transactions that are determined by it to be, under all of the circumstances, in the best interest of the Company and its stockholders. No related person transactions occurred in fiscal 2011 that required a review by the Audit Committee.

7

Table of Contents

In November 2011, we entered into a purchase agreement with Aspire Capital Fund, LLC, or Aspire Capital, which provides that Aspire Capital is committed to purchase up to an aggregate of $20.0 million of shares of our Common Stock over a two-year term, subject to our election to sell any such shares and the terms and conditions set forth, therein. As part of the purchase agreement, Aspire Capital made an initial investment of $1.0 million in us through the purchase of 666,667 shares of our Common Stock at $1.50 per share and received 266,667 additional shares as compensation for its commitment. As a result of this transaction, combined with shares of our Common Stock that Aspire Capital held prior to the November 2011 transaction, Aspire Capital became one of our larger stockholders, owning more than 5% of our shares of our Common Stock outstanding upon completion of the transaction.

In 2012, we sold an additional 200,000 shares to Aspire Capital pursuant to the purchase agreement at an average price of $1.85 per share. Also, in our March 2012 private placement, Aspire Capital purchased an additional 966,184 shares of Common Stock and five-year warrants to purchase 966,184 shares of Common Stock with an exercise price of $2.07 per share. The securities were sold in multiples of a fixed combination of one share of Common Stock and a warrant to purchase one share of Common Stock at an offering price of $2.07 per fixed combination, for a total purchase price to Aspire Capital of approximately $2.0 million.

Communications with Directors

Information regarding how our stockholders and other interested parties may communicate with the Board of Directors as a group, with the non-management Directors as a group, or with any individual Director is included on the Investors page under “Corporate Governance” — “Contact the Board” on our website at www.athersys.com.

Compensation Committee Interlocks and Insider Participation

In 2011, none of our executive officers or Directors was a member of the Board of any other company where the relationship would be construed to constitute a committee interlock within the meaning of the rules of the SEC.

8

Table of Contents

PROPOSAL TWO

RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS INDEPENDENT AUDITORS FOR THE FISCAL YEAR ENDING DECEMBER 31, 2012

The Audit Committee of the Board has appointed Ernst & Young LLP as the independent auditors of the Company to examine the financial statements of the Company and its subsidiaries for the fiscal year ending December 31, 2012. During fiscal year 2011, Ernst & Young LLP examined the financial statements of the Company and its subsidiaries, including those set forth in our Annual Report on Form 10-K for the fiscal year ended December 31, 2011.

Although stockholder approval of this appointment is not required by law or binding on the Audit Committee, the Board believes that stockholders should be given the opportunity to express their views. If the stockholders do not ratify the appointment of Ernst & Young LLP as the Company’s independent auditors, the Audit Committee will consider this vote in determining whether or not to continue the engagement of Ernst & Young LLP.

It is expected that representatives of Ernst & Young LLP will attend the Annual Meeting, with the opportunity to make a statement if they so desire, and will be available to answer appropriate questions.

The Board unanimously recommends that stockholders vote FOR the ratification of the appointment of Ernst & Young LLP as independent auditors for the fiscal year ending December 31, 2012.

Principal Accountant Fees and Services

Audit Fees. Fees paid to Ernst & Young LLP for the audit of the annual consolidated financial statements included in the Company’s Annual Reports on Form 10-K, for the reviews of the consolidated financial statements included in the Company’s Forms 10-Q, and for services related to registration statements were $540,039 for the fiscal year ended December 31, 2011 and $322,090 for the fiscal year ended December 31, 2010. The increase related primarily to services for registration statements filed in 2011.

Audit-Related Fees. Fees paid to Ernst & Young LLP for audit-related services were $3,100 for 2011, and there were no fees paid to Ernst & Young LLP for audit-related services in 2010.

Tax Fees. Fees paid to Ernst & Young LLP associated with tax compliance and tax consultation were $25,000 and $48,000 for the fiscal years ended December 31, 2011 and 2010, respectively.

All Other Fees. There were no other fees paid to Ernst & Young LLP in 2011 or 2010.

Audit Committee Pre-Approval Policies and Procedures

The Audit Committee has adopted a formal policy on auditor independence requiring the pre-approval by the Audit Committee of all professional services rendered by the Company’s independent auditor prior to the commencement of the specified services.

For the fiscal year ended December 31, 2011, 100% of the services described above were pre-approved by the Audit Committee in accordance with the Company’s formal policy on auditor independence.

9

Table of Contents

The Audit Committee of the Board is composed of at least three Directors who are independent and operates under a written Audit Committee charter adopted and approved by the Board. The Audit Committee annually selects the Company’s independent auditors. The written charter of the Audit Committee is posted and available under the Investor page on our website at www.athersys.com.

Management is responsible for the Company’s internal controls and financial reporting process. Ernst & Young LLP, the Company’s independent auditor, is responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with generally accepted auditing standards and to issue a report thereon. The Audit Committee’s responsibility is to provide oversight to these processes.

In fulfilling its oversight responsibility, the Audit Committee relies on the accuracy of financial and other information, opinions, reports, and statements provided to the Audit Committee. Accordingly, the Audit Committee’s oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Nor does the Audit Committee’s oversight assure that the audit of the Company’s financial statements has been carried out in accordance with generally accepted auditing standards or the audited financial statements are presented in accordance with generally accepted accounting principles.

The Audit Committee has reviewed and discussed with the Company’s management and Ernst & Young LLP the audited financial statements of the Company for the year ended December 31, 2011. The Audit Committee has also discussed with Ernst & Young LLP the matters required to be discussed by the statement on Auditing Standards No. 61, as amended (AICPA,Professional Standards, Vol. 1 AU Section 380), as adopted by the Public Company Oversight Board in Rule 3200T.

The Audit Committee has also received and reviewed the written disclosures and the letter from Ernst & Young LLP required by applicable requirements of the Public Company Accounting Oversight Board regarding Ernst & Young LLP’s communications with the Audit Committee concerning independence, and has discussed with Ernst & Young LLP such independent auditors’ independence. The Audit Committee has also considered whether Ernst & Young LLP’s provision of services to the Company beyond those rendered in connection with their audit and review of the Company’s financial statements is compatible with maintaining their independence.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2011 for filing with the SEC.

Audit Committee

Board of Directors

Lorin J. Randall

Jack L. Wyszomierski

George M. Milne, Jr.

Ismail Kola

10

Table of Contents

Compensation Discussion and Analysis

Executive Summary

This section discusses the principles underlying our executive compensation policies and decisions and the most important factors relevant to an analysis of these policies and decisions. It provides qualitative information regarding the manner and context in which compensation is awarded to and earned by our named executive officers, which include Dr. Gil Van Bokkelen, our Chief Executive Officer, Ms. Laura Campbell, our Vice President of Finance, Mr. William (B.J.) Lehmann, Jr., our President and Chief Operating Officer, Dr. John Harrington, our Executive Vice President and Chief Scientific Officer, and Dr. Robert Deans, our Executive Vice President of Regenerative Medicine, and places in perspective the data presented in the compensation tables and narratives that follow.

We are an international biotechnology company that is focused in the field of regenerative medicine. We are committed to the discovery and development of best-in-class therapies designed to extend and enhance the quality of human life, and we have established a portfolio of therapeutic product development programs to address significant unmet medical needs in multiple disease areas. As further discussed in this section, our compensation and benefit programs help us attract, retain and motivate individuals who will maximize our business results by working to meet or exceed established company or individual objectives. In addition, we reward our executive officers for meeting certain developmental milestones, such as completing advancements in product candidate development, strategic partnerships or other financial transactions that add to the capital resources of the Company or create value for stockholders.

The following are the highlights of our 2011 compensation and benefit programs:

| • | increased the base salaries of our named executive officers; and |

| • | made awards of cash bonuses to our named executive officers. |

The following discussion and analysis of our compensation and benefit programs for 2011 should be read together with the compensation tables and related disclosures that follow this section. This discussion includes forward-looking statements based on our current plans, considerations, expectations and determinations about our compensation program. Actual compensation decisions that we may make for 2012 and beyond may differ materially from our recent past.

Compensation Objectives and Philosophy

Our compensation programs are designed to:

| • | recruit, retain, and motivate executives and employees that can help us achieve our core business goals; |

| • | provide incentives to promote and reward superior performance throughout the organization; |

| • | facilitate stock ownership and retention by our executives and other employees; and |

| • | promote alignment between executives and other employees and the long-term interests of stockholders. |

The Compensation Committee seeks to achieve these objectives by:

| • | establishing a compensation program that is market competitive and internally fair; |

| • | linking performance with certain elements of compensation through the use of equity grants, cash performance bonuses or other means of compensation, the value of which is substantially tied to the achievement of Company goals; and |

| • | when appropriate, given the nature of our business, rewarding our executive officers for both company and individual achievements with discretionary bonuses. |

11

Table of Contents

Components of Compensation

Our executive compensation program includes the following elements:

| • | base salary; |

| • | cash bonuses; |

| • | long-term equity incentive plan awards; and |

| • | retirement and health insurance benefits. |

Our Compensation Committee has not adopted any formal or informal policies or guidelines for allocating compensation between long-term and currently paid-out compensation, between cash and non-cash compensation or among different forms of non-cash compensation. We consider competitive practices, relative management level and operating responsibilities of each executive officer when determining the compensation elements to reward his or her ability to impact short-term and long-term results.

Role of the Chief Executive Officer

Historically, our Chief Executive Officer has taken the lead in providing our Board of Directors with advice regarding executive compensation. For 2011, the Compensation Committee considered recommendations from our Chief Executive Officer regarding the compensation for and performance of our executive officers in relation to company-specific strategic goals that were established by the Compensation Committee and approved by the Board of Directors related to potential bonus payments and salary adjustments. The Compensation Committee considers the recommendations made by our Chief Executive Officer because of his knowledge of the business and the performance of the other executive officers. The Compensation Committee is not bound by the input it receives from our Chief Executive Officer. Instead, the Compensation Committee exercises independent discretion when making executive compensation decisions. We describe and discuss the particular compensation decisions made by the Compensation Committee regarding the 2011 compensation of our named executive officers below under “Elements of Executive Compensation.”

Elements of Executive Compensation

Base Salary. We pay base salaries to attract executive officers and provide a basic level of financial security. We establish base salaries for our executives based on the scope of their responsibilities, taking into account competitive market compensation paid by other companies for similar positions. Base salaries are generally reviewed annually, with adjustments based on the individual’s responsibilities, performance and experience during the year. This review generally occurs each year following an annual review of individual performance.

In 2011, the Compensation Committee and the Board of Directors approved that each of the named executive officers be entitled to receive a 3.52% increase in such officer’s salary for 2011 as compared to 2010 based primarily on Company performance for the year ending December 31, 2010. Effective April 1, 2011, Dr. Deans’ salary was further increased to a base of $300,000 per annum based on his performance.

In 2011, the Compensation Committee and the Board of Directors approved that the Chief Executive Officer will be entitled to receive a 6.30% increase in salary for 2012 as compared to 2011, an adjustment based primarily on competitive information provided to the Compensation Committee by its independent compensation consultant. Also for 2012, the Compensation Committee and the Board of Directors approved that each of the named executive officers be entitled to receive an increase in such officer’s salary for 2012 as compared to 2011 based primarily on Company performance for the year ended December 31, 2011. The increases are as follows: Mr. Lehmann — 3.5%; Dr. Harrington — 3.0%; Dr. Deans — 2.5% (taking into consideration his salary adjustment in April 2011); and Ms. Campbell — 2.75%.

Cash Bonuses. We utilize annual incentive bonuses to reward officers and other employees for achieving financial and operational goals and for achieving individual annual performance objectives. These objectives vary depending on the individual executive and employee, but relate generally to strategic factors, including establishment and maintenance of key strategic relationships, advancement of our product candidates, identification and advancement of additional programs or product candidates, and to financial factors, including raising capital and improving our results of operations.

In 2005, in connection with a restructuring of the Company’s internal programs, the Board established an incentive program designed to retain and motivate our executives. The program provided for payments to the executives upon the occurrence of certain business transactions and time-limited financing milestones. The program continues to provide the named executive officers financial participation in the event of certain merger or acquisition or asset sale transactions. In the event of a defined transaction, we would be obligated to make a payment to the named executive officers representing five percent of the consideration received from the transaction, and in the event of a stock-based transaction, the executives would receive fifty percent of any payments due to them in stock. There were no payments under this program in 2011.

12

Table of Contents

In addition, given the nature of our business, when appropriate, we reward our executive officers with discretionary bonuses. Discretionary bonuses were paid to our named executive officers in 2012, for the year ended December 31, 2011, as described in the following paragraph.

The Compensation Committee recommended and the Board approved a cash bonus incentive program for the year ended December 31, 2011 for our named executive officers. Under the 2011 incentive program, each participant is eligible to earn a target bonus of a specified percentage of the named executive officer’s salary during the award term, weighted on the achievement of specific corporate goals, with the remainder based on individual/functional performance, as set forth below:

| Weighted on | ||||||||||||

| Target Bonus | Corporate Goals | Functional Performance | ||||||||||

Dr. Van Bokkelen | 40 | % | 100 | % | 0 | % | ||||||

Dr. Harrington | 33 | % | 80 | % | 20 | % | ||||||

Mr. Lehmann | 33 | % | 80 | % | 20 | % | ||||||

Dr. Deans | 30 | % | 60 | % | 40 | % | ||||||

Ms. Campbell | 25 | % | 60 | % | 40 | % | ||||||

The evaluation of goal achievement is at the discretion of the Compensation Committee of the Board of Directors based on input from the Chief Executive Officer (with respect to the named executive officers other than the Chief Executive Officer, whose bonus potential is based 100% on achievement of specified corporate goals). The 2011 corporate goals included progress on MultiStem clinical development, execution against the established budget and operating plan, and achievement of one or more strategic partnerships. However, any bonus ultimately paid under the 2011 incentive program is at the discretion of the Board of Directors based on the recommendation of the Compensation Committee, after good faith consideration of executive officer performance, overall company performance, market conditions and cash availability. There was no formally adopted plan document for the 2011 incentive program, although the Compensation Committee recommended and the Board of Directors approved the specific corporate goals, target bonus levels and weightings between corporate and functional performance. The Compensation Committee and the Board of Directors agreed that each of our named executive officers would be entitled to a bonus under the 2011 incentive program as a result of individual performance and the achievement of operational and strategic objectives in 2011, specifically the achievement of patient enrollment goals for the Company’s clinical trials and other program development goals, resulting in the payment of bonuses based on a percentage of such officers’ 2011 base salaries as follows:

| Bonus | Cash Bonus | |||||||

| Achieved | Paid | |||||||

Dr. Van Bokkelen | 9.9 | % | $ | 40,000 | ||||

Dr. Harrington | 7.8 | % | $ | 27,000 | ||||

Mr. Lehmann | 7.8 | % | $ | 27,000 | ||||

Dr. Deans | 8.1 | % | $ | 24,300 | ||||

Ms. Campbell | 6.8 | % | $ | 15,300 | ||||

For the year ending December 31, 2012, the Compensation Committee recommended and the Board of Directors approved a similar cash bonus incentive plan for our named executive officers. The 2012 plan has no change to the target bonus percentage or the functional performance weightings for our named executive officers. The 2012 corporate goals include advancing and achieving enrollment goals for our clinical programs for MultiStem, executing against the established operating plan and capital acquisition objectives, and advancement of strategic partnership and program activities.

13

Table of Contents

Long-Term Incentive Program. We believe that we can encourage superior long-term performance by our executive officers and employees through encouraging them to own, and assisting them with the acquisition of, our Common Stock. Our equity compensation plans provide our employees, including named executive officers, with incentives to help align their interests with the interests of our stockholders. We believe that the use of Common Stock and stock-based awards offers the best approach to achieving our objective of fostering a culture of ownership, which we believe will, in turn, motivate our named executive officers to create and enhance stockholder value. We have not adopted stock ownership guidelines, but our equity compensation plans provide a principal method for our executive officers to acquire equity in our Company.

Our equity compensation plans authorize us to grant, among other types of awards, options, restricted stock and restricted stock units to our employees, Directors and consultants. Historically, we elected to use stock options as our primary long-term equity incentive vehicle. To date, we have not granted any restricted stock or restricted stock units under our equity compensation plans to our named executive officers or Directors. However, in 2011, we granted restricted stock units to our other employees. We expect to continue to use equity-based awards as a long-term incentive vehicle because we believe:

| • | equity-based awards align the interests of our executives with those of our stockholders, support a pay-for-performance culture, foster an employee stock ownership culture and focus the management team on increasing value for our stockholders; |

| • | the value of equity-based awards is based on our performance, because all the value received by the recipient of equity-based awards is based on the growth of our stock price; |

| • | equity-based awards help to provide a balance to the overall executive compensation program because, while base salary and our discretionary annual bonus program focus on short-term performance, vesting equity-based awards reward increases in stockholder value over the longer term; and |

| • | the vesting period of equity-based awards encourages executive retention and efforts to preserve stockholder value. |

In the past, in determining the number of equity-based awards to be granted to executives, we took into account the individual’s position, scope of responsibility, ability to affect results and stockholder value, the individual’s historic and recent performance and the value of equity-based awards in relation to other elements of the individual executive’s total compensation. Currently, awards of equity-based awards are granted from time to time under the guidance and approval of the Compensation Committee and the Board of Directors. The Compensation Committee and the Board of Directors periodically review and approve equity-based awards to executive officers based upon a review of competitive compensation data, an assessment of individual performance, a review of each executive’s existing long-term incentives, retention considerations and a subjective determination of the individual’s potential to positively impact future stockholder value. No equity-based awards were conferred to our named executive officers in 2011.

Retirement and Health Insurance Benefits. Consistent with our compensation philosophy, we maintain benefits for our executive officers, including medical, dental, vision, life and disability insurance coverage and the ability to contribute to a 401(k) retirement plan. The executive officers and employees have the ability to participate in these benefits at the same levels. We began making employer contributions to our 401(k) retirement plan in 2011 and contributed approximately $88,000 in 2011. We provide such retirement and health insurance benefits to our employees to retain qualified personnel. In addition, Dr. Van Bokkelen, Dr. Harrington, Mr. Lehmann, Dr. Deans and Ms. Campbell also receive Company-paid life insurance benefits in the amounts of $2 million for Dr. Van Bokkelen, Dr. Harrington and Mr. Lehmann, and $1 million for Dr. Deans and Ms. Campbell. These additional life insurance policies are provided to these officers due to their extensive travel requirements and contributions to the Company. We have no current plans to change the level of these benefits provided to our named executive officers.

Severance Arrangements

See the disclosure under “Potential Payments Upon Termination or Change of Control” for more information about severance arrangements with our named executive officers. We provide such severance arrangements to attract and retain qualified personnel.

14

Table of Contents

Employment Agreements and Arrangements

We believe that entering into employment agreements with each of our named executive officers was necessary for us to attract and retain talented and experienced individuals for our senior level positions. In this way, the employment agreements help us meet the initial objective of our compensation program. Each agreement contains terms and arrangements that we agreed to through arms-length negotiation with our named executive officers. We view these employment agreements as reflecting the minimum level of compensation that our named executive officers require to remain employed with us, and thus the bedrock of our compensation program for our named executive officers. For more details of our employment agreements and arrangements, see the disclosure under “2011 Summary Compensation Table.”

The 2005 incentive program for our named executive officers provides substantial equity participation in the event of the sale of the Company or substantially all of its assets. The Compensation Committee believes that this program coupled with existing, vested stock option holdings provides strong equity incentives to our named executive officers.

General Tax Deductibility of Executive Compensation

We structure our compensation program to comply with Internal Revenue Code Section 162(m). Under Section 162(m) of the Internal Revenue Code, there is a limitation on tax deductions of any publicly-held corporation for individual compensation to certain executives of such corporation exceeding $1.0 million in any taxable year, unless the compensation is performance-based. The Compensation Committee manages our incentive programs to qualify for the performance-based exemption; however, it also reserves the right to provide compensation that does not meet the exemption criteria if, in its sole discretion, it determines that doing so advances our business objectives.

15

Table of Contents

2011 Summary Compensation Table

The following table and narrative set forth certain information with respect to the compensation earned during the fiscal year ended December 31, 2011 by our named executive officers.

Name and Principal Position (a) | Year (b) | Salary ($) (c) | Bonus ($) (d) | Option Awards ($) (1) (f) | All Other Compensation ($) (i) | Total (4) (j) | ||||||||||||||||||

Gil Van Bokkelen, |

| 2011 2010 2009 |

| $ $ $ | 404,500 390,741 383,079 |

| $ $ $ | 40,000 52,750 76,616 |

| $ $ $ | 0 0 98,250 |

| $ $ $ | 12,620 9,620 5,000 |

| $ $ $ | 457,120 453,111 562,945 |

| ||||||

Laura Campbell, |

| 2011 2010 2009 |

| $ $ $ | 225,365 217,699 213,430 |

| $ $ $ | 15,300 29,389 42,686 |

| $ $ $ | 0 0 68,775 |

| $ $ $ | 5,109 2,109 0 |

| $ $ $ | 245,774 249,197 324,891 |

| ||||||

William (BJ) Lehmann, Jr., |

| 2011 2010 2009 |

| $ $ $ | 346,714 334,921 328,354 |

| $ $ $ | 27,000 45,214 65,671 |

| $ $ $ | 0 0 88,425 |

| $ $ $ | 4,673 1,673 1,000 |

| $ $ $ | 378,387 381,808 483,450 |

| ||||||

John Harrington, |

| 2011 2010 2009 |

| $ $ $ | 346,714 334,921 328,354 |

| $ $ $ | 27,000 45,214 65,671 |

| $ $ $ | 0 0 88,425 |

| $ $ $ | 4,355 1,355 1,000 |

| $ $ $ | 378,069 381,490 483,450 |

| ||||||

Robert Deans, |

| 2011 2010 2009 |

| $ $ $ | 292,898 262,355 257,211 |

| $ $ $ | 24,300 35,418 51,442 |

| $ $ $ | 0 0 78,600 |

| $ $ $ | 5,620 5,620 6,000 |

| $ $ $ | 322,818 303,393 393,253 |

| ||||||

| (1) | Amounts in column (f) do not necessarily reflect compensation actually received by our named executive officers. The amounts in column (f) reflect the full grant date fair value of the equity awards made during the fiscal year ended December 31, 2009 in accordance with Accounting Standards Codification 718, or ASC 718. Assumptions used in the calculation of these amounts are included in the notes to the audited consolidated financial statements included in the Company’s Annual Reports on Form 10-K for the fiscal years ended December 31, 2010 and 2011. |

| (2) | Drs. Van Bokkelen and Harrington also served as our Directors for 2011, 2010 and 2009, but did not receive any compensation as our Directors. |

Employment Agreements and Arrangements

Dr. Gil Van Bokkelen. On December 1, 1998, we entered into a one-year employment agreement, effective April 1, 1998, with Dr. Gil Van Bokkelen, to serve initially as President and Chief Executive Officer. The agreement automatically renews for subsequent one-year terms on April 1 of each year unless either party gives notice of termination at least thirty days before the end of any term. Under the terms of the agreement, Dr. Van Bokkelen was entitled to an initial base salary of $150,000, which may be increased at the discretion of the Board of Directors, and an annual discretionary incentive bonus of up to 33% of his base salary. His salary for 2012 is $430,000 and his target annual incentive bonus is 40% of his base salary. Dr. Van Bokkelen also received options to purchase shares of Common Stock upon his employment that were terminated in 2007, and his current stock options are described in the table below. Dr. Van Bokkelen is also entitled to life insurance coverage for the benefit of his family in the amount of at least $1.0 million (which is $2.0 million for 2012) and is provided the use of a company automobile for business use. For more information about severance arrangements under the agreement, see the disclosure under “Potential Payments Upon Termination or Change of Control.” Dr. Van Bokkelen has also entered into a non-competition and confidentiality agreement with us under which, during his employment and for a period of 18 months thereafter, he is restricted from, among other things, competing with us.

16

Table of Contents

Dr. John J. Harrington. On December 1, 1998, we entered into a one-year employment agreement, effective April 1, 1998, with Dr. John J. Harrington to serve initially as Executive Vice President and Chief Scientific Officer. The agreement automatically renews for subsequent one-year terms on April 1 of each year unless either party gives notice of termination at least thirty days before the end of any term. Under the terms of the agreement, Dr. Harrington was entitled to an initial base salary of $150,000, which may be increased at the discretion of the Board of Directors, and an annual discretionary incentive bonus of up to 33% of his base salary. His salary for 2012 is $357,116 and his target annual incentive bonus is 33% of his base salary. Dr. Harrington also received options to purchase shares of Common Stock upon his employment that were terminated in 2007, and his current stock options are described in the table below. Dr. Harrington is also entitled to life insurance coverage for the benefit of his family in the amount of at least $1.0 million (which is $2.0 million for 2012). For more information about severance arrangements under the agreement, see the disclosure under “Potential Payments Upon Termination or Change of Control.” Dr. Harrington has also entered into a non-competition and confidentiality agreement with us under which, during his employment and for a period of 18 months thereafter, he is restricted from, among other things, competing with us.

Laura K. Campbell. On May 22, 1998, we entered into a two-year employment agreement with Laura K. Campbell to serve initially as Controller. The agreement automatically renews for subsequent one-year terms on May 22 of each year unless either party gives notice of termination at least thirty days before the end of any term. Under the terms of the agreement, Ms. Campbell was entitled to an initial base salary of $70,200, which may be increased at the discretion of the Board of Directors. Her salary for 2012 is $231,562 and her target annual incentive bonus is 25% of her base salary. Ms. Campbell also received options to purchase shares of Common Stock upon her employment that were terminated in 2007, and her current stock options are described in the table below. For more information about severance arrangements under the agreement, see the disclosure under “Potential Payments Upon Termination or Change of Control.”

William (B.J.) Lehmann, Jr. On January 1, 2004, we entered into a four-year employment agreement with Mr. Lehmann to serve initially as Executive Vice President of Corporate Development and Finance. The agreement automatically renews for subsequent one-year terms on January 1 of each year unless either party gives notice of termination at least thirty days before the end of any term. Under the terms of the agreement, Mr. Lehmann was entitled to an initial base salary of $250,000, which may be increased at the discretion of the Board of Directors. His salary for 2012 is $358,849 and his target annual incentive bonus is 33% of his base salary. Mr. Lehmann also received options to purchase shares of Common Stock upon his employment that were terminated in 2007, and his current stock options are described in the table below. For more information about severance arrangements under the agreement, see the disclosure under “Potential Payments Upon Termination or Change of Control.” Mr. Lehmann has also entered into a non-competition and confidentiality agreement with us under which, during his employment and for a period of six months thereafter, he is restricted from, among other things, competing with us.

Dr. Robert Deans. On October 3, 2003, we entered into a four-year employment agreement with Dr. Robert Deans to serve initially as Vice President of Regenerative Medicine. The agreement automatically renews for subsequent one-year terms on October 3 of each year unless either party gives notice of termination at least thirty days before the end of any term. Under the terms of the agreement, Dr. Deans was entitled to an initial base salary of $200,000, which may be increased at the discretion of the Board of Directors, and an annual discretionary incentive bonus of up to 30% of his base salary. His salary for 2012 is $307,500 and his target annual incentive bonus is 30% of his base salary. Dr. Deans also received options to purchase shares of Common Stock upon his employment that were terminated in 2007, and his current stock options are described in the table below. For more information about severance arrangements under the agreement, see the disclosure under “Potential Payments Upon Termination or Change of Control.” Dr. Deans has also entered into a non-competition and confidentiality agreement with us under which, during his employment and for a period of six months thereafter, he is restricted from, among other things, competing with us.

Equity Compensation Plans

In June 2007, we adopted two equity compensation plans, which authorize the Board of Directors, or a committee thereof, to provide equity-based compensation in the form of stock options, restricted stock, restricted stock units and other stock-based awards, which are used to attract and retain qualified employees, Directors and consultants. Equity awards are granted from time to time under the guidance and approval of the Compensation Committee. Total awards under these plans, as amended, are limited to 5,500,000 shares of Common Stock.

401(k) Plan

We have a tax-qualified employee savings and retirement plan, also known as a 401(k) plan that covers all of our employees. Under our 401(k) plan, eligible employees may elect to reduce their current compensation by up to the statutorily prescribed annual limit, which was $16,500 in both 2011 and 2010, and have the amount of the reduction contributed to the 401(k) plan. The trustees of the 401(k) plan, at the direction of each participant, invest the assets of the 401(k) plan in designated investment options. We may make matching or profit-sharing contributions to the 401(k) plan in amounts to be determined by the Board of Directors. We made matching contributions to the 401(k) plan during fiscal 2011 at a maximum rate of fifty cents for every dollar of the first 6% of participant contributions, up to a dollar maximum of $3,000 per participant, which amounted to approximately $88,000 in 2011. We did not make any matching or profit-sharing contributions to the 401(k) plan during fiscal 2010 or 2009. The 401(k) plan is intended to qualify under Section 401 of the Internal Revenue Code, so that contributions to the 401(k) plan and income earned on the 401(k) plan contributions are not taxable until withdrawn, and so that any contributions we make will be deductible when made.

17

Table of Contents

Outstanding Equity Awards at 2011 Fiscal Year-End

The following table sets forth outstanding options held by our named executive officers at December 31, 2011.

| Option Awards | ||||||||||||||||

Name (a) | Number of Securities Underlying Unexercised Options (#) Exercisable (b) | Number of Securities Underlying Unexercised Options (#) Unexercisable (c) | Option Exercise Price ($)(e) | Option Expiration Date (f) | ||||||||||||

Gil Van Bokkelen | 712,500 | 0 | $ | 5.00 | June 8, 2017 | (1) | ||||||||||

| 25,000 | 0 | $ | 5.28 | December 23, 2019 | (2) | |||||||||||

Laura Campbell | 200,000 | 0 | $ | 5.00 | June 8, 2017 | (1) | ||||||||||

| 17,500 | 0 | $ | 5.28 | December 23, 2019 | (2) | |||||||||||

William (BJ) Lehmann | 400,000 | 0 | $ | 5.00 | June 8, 2017 | (1) | ||||||||||

| 22,500 | 0 | $ | 5.28 | December 23, 2019 | (2) | |||||||||||

John Harrington | 700,000 | 0 | $ | 5.00 | June 8, 2017 | (1) | ||||||||||

| 22,500 | 0 | $ | 5.28 | December 23, 2019 | (2) | |||||||||||

Robert Deans | 240,000 | 0 | $ | 5.00 | June 8, 2017 | (1) | ||||||||||

| 20,000 | 0 | $ | 5.28 | December 23, 2019 | (2) | |||||||||||