UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to 240.14a-12. | |||

| Athersys, Inc. | ||||

| (Name of Registrant as Specified in its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| ||||

| (5) | Total fee paid: | |||

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| ||||

| (3) | Filing Party:

| |||

| ||||

| (4) | Date Filed:

| |||

| ||||

Athersys, Inc.

3201 Carnegie Avenue

Cleveland, Ohio 44115-2634

To Our Stockholders:

You are invited to attend a Special Meeting of Stockholders, or Special Meeting, of Athersys, Inc. to be held at the offices of our corporate counsel, Jones Day, 901 Lakeside Avenue, Cleveland, Ohio 44114, City View Room, on February 21, 2013 at 9:00 a.m. Eastern Standard Time. We are pleased to enclose the notice of our Special Meeting, together with a proxy statement, a proxy and an envelope for returning the proxy.

You are asked to approve an adjustment of the exercise price of Athersys, Inc.’s March 2012 Warrants from $2.07 per share to $1.01 per share. Your Board of Directors recommends that you vote “FOR” the warrant exercise price adjustment.

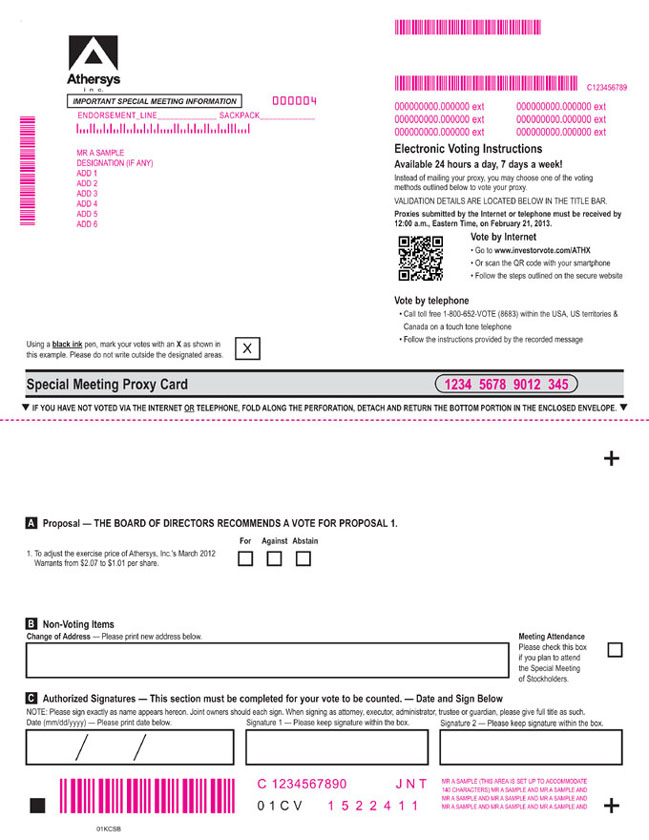

Please carefully review the proxy statement and then complete and sign your proxy and return it promptly. If you attend the Special Meeting and decide to vote in person, you may withdraw your proxy at the meeting. You may also vote electronically atwww.investorvote.com/ATHX or telephonically at 1-800-652-VOTE (8683) within the Unites States and Canada.

Your time and attention to this letter and the accompanying proxy statement and proxy are appreciated.

| Sincerely, |

| /s/ Gil Van Bokkelen |

| Gil Van Bokkelen |

| Chairman and Chief Executive Officer |

January 24, 2013

Athersys, Inc.

3201 Carnegie Avenue

Cleveland, Ohio 44115-2634

NOTICE OF SPECIAL MEETING OF

STOCKHOLDERS

January 24, 2013

A Special Meeting of Stockholders, or Special Meeting, of Athersys, Inc., a Delaware corporation, will be held on February 21, 2013, at 9:00 a.m. Eastern Standard Time, at the offices of our corporate counsel, Jones Day, 901 Lakeside Avenue, Cleveland, Ohio 44114, City View Room, for the purpose of approving an adjustment of the exercise price of Athersys, Inc.’s March 2012 Warrants from $2.07 per share to $1.01 per share. The March 2012 Warrants were issued on March 14, 2012 in a private placement.

Stockholders of record at the close of business on January 23, 2013 are entitled to vote at the Special Meeting; provided, however, that pursuant to the rules and regulations of the NASDAQ Capital Market, the shares of common stock issued in the March 14, 2012 private placement may not be voted, either in person or by proxy, on the proposal to adjust the exercise price of the March 2012 Warrants.

| By Order of the Board of Directors |

| /s/ William Lehmann, Jr. |

William Lehmann, Jr. Secretary |

January 24, 2013

Even if you expect to attend the Special Meeting, please promptly complete, sign, date and mail the enclosed proxy card. A self-addressed envelope is enclosed for your convenience. No postage is required if mailed in the United States. Stockholders who attend the Special Meeting may revoke their proxies and vote in person if they so desire. You may also vote electronically atwww.investorvote.com/ATHX or telephonically at 1-800-652-VOTE (8683) within the Unites States and Canada.

Athersys, Inc.

3201 Carnegie Avenue

Cleveland, Ohio 44115-2634

PROXY STATEMENT

SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON FEBRUARY 21, 2013

A Special Meeting of Stockholders, or Special Meeting, of Athersys, Inc., a Delaware corporation, which we refer to as Athersys, the Company or we, will be held on February 21, 2013, at 9:00 a.m. Eastern Standard Time, at the offices of our corporate counsel, Jones Day, 901 Lakeside Avenue, Cleveland, Ohio 44114, City View Room. This proxy statement is furnished in connection with the solicitation by the Board of Directors, or the Board, of the Company, of proxies to be used at the Special Meeting. This proxy statement and the related proxy card are being mailed to stockholders commencing on or about January 30, 2013.

On March 14, 2012, we closed a private placement in which we issued 4,347,827 shares of our common stock, par value $0.001 per share, which we refer to as Common Stock, and warrants to purchase up to 4,347,827 shares of Common Stock at an exercise price of $2.07 per share, which we refer to as the March 2012 Warrants or simply the warrants. The warrants contain full-ratchet anti-dilution provisions that require a reduction in the exercise price upon an issuance by us of shares of Common Stock or securities convertible into or exchangeable for shares of Common Stock at a price per share below the then-current exercise price of the warrants, subject to certain exceptions. The anti-dilution provisions also provide that if an exercise price adjustment would require us to obtain stockholder approval of the private placement pursuant to Nasdaq Marketplace Rule 5635(d), we must call a special meeting of stockholders to vote on the exercise price adjustment. During the fourth quarter of 2012, we completed a public offering of an aggregate of 22,772,300 shares of Common Stock at a price to the public of $1.01 per share. As a result, we are seeking stockholder approval in accordance with the terms of the warrants and Nasdaq Marketplace Rule 5635(d)(2) to reduce the exercise price of the warrants to $1.01 per share, which we refer to as the Proposal. For additional information on the private placement, the terms of the warrants and the Proposal, see “Proposal One – Warrant Exercise Price Adjustment” elsewhere in this proxy statement.

Stockholders of record of the Company at the close of business on January 23, 2013, or the Record Date, will be entitled to vote at the Special Meeting; provided, however, that pursuant to the rules and regulations of the NASDAQ Capital Market, the 4,347,827 shares of Common Stock issued in the March 14, 2012 private placement may not be voted, either in person or by proxy, on the Proposal. On January 23, 2012, 53,058,632 shares of Common Stock were outstanding, and excluding the 4,347,827 shares issued in the private placement, 48,710,805 shares were entitled to vote. At the Special Meeting, inspectors of election shall determine the presence of a quorum and shall tabulate the results of the vote of the stockholders. The holders of a majority of the total number of outstanding shares of Common Stock entitled to vote must be present in person or by proxy to constitute the necessary quorum for any business to be transacted at the Special Meeting. Properly executed proxies marked “abstain,” as well as “broker non-votes,” as described below, will be considered “present” for purposes of determining whether a quorum has been achieved at the Special Meeting. Other than as described above, each share of Common Stock is entitled to one vote.

Brokers or other nominees who hold shares of Common Stock in “street name” for a beneficial owner of those shares typically have the authority to vote in their discretion on “routine” proposals when they have not received instructions from beneficial owners. However, brokers are not allowed to exercise their voting discretion with respect to the approval of other matters which are “non-routine,” without specific instructions from the beneficial owner. The Proposal is considered a non-routine matter. Accordingly, without your instruction, your broker cannot vote your shares with respect to the Proposal and your shares would be considered “broker non-votes.”

Under Nasdaq Marketplace Rule 5635(e), the affirmative vote of a majority of the votes cast on the Proposal is required for approval of the Proposal. Abstentions and broker non-votes will have no effect on the Proposal as abstentions and broker non-votes will not be counted in determining the number of votes cast.

The shares of Common Stock represented by all valid proxies received will be voted in the manner specified on the proxies. Where specific choices are not indicated on a valid proxy, the shares of Common Stock represented by such proxies received will be voted: (i) for the adjustment of the exercise price of the warrants from $2.07 per share to $1.01 per share; and (ii) in accordance with the best judgment of the persons named in the enclosed proxy, or their substitutes, for any other matters that properly come before the Special Meeting.

1

Returning your completed proxy will not prevent you from voting in person at the Special Meeting should you be present and desire to do so. In addition, you may revoke the proxy at any time prior to its exercise either by giving written notice to the Company or by submission of a later-dated proxy.

2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This proxy statement contains forward-looking statements that involve risks and uncertainties. These forward-looking statements relate to, among other things, the expected timetable for development of our product candidates, our growth strategy, and our future financial performance, including our operations, economic performance, financial condition, prospects, and other future events. We have attempted to identify forward-looking statements by using such words as “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “should,” “will,” or other similar expressions. These forward-looking statements are only predictions and are largely based on our current expectations. These forward-looking statements may appear in a number of places in this proxy statement.

In addition, a number of known and unknown risks, uncertainties, and other factors could affect the accuracy of these statements. Some of the more significant known risks that we face are the risks and uncertainties inherent in the process of discovering, developing, and commercializing products that are safe and effective for use as human therapeutics, including the uncertainty regarding market acceptance of our product candidates and our ability to generate revenues. These risks may cause our actual results, levels of activity, performance, or achievements to differ materially from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements.

Other important factors to consider in evaluating our forward-looking statements include:

| • | uncertainty regarding market acceptance of our product candidates and our ability to generate revenues, including MultiStem® for the treatment of inflammatory bowel disease, acute myocardial infarction, stroke and other disease indications, and the prevention of graft-versus-host disease; |

| • | our ability to raise capital to fund our operations; |

| • | final results from our MultiStem clinical trials; |

| • | the possibility of delays in, adverse results of, and excessive costs of the development process; |

| • | our ability to successfully initiate and complete clinical trials and obtain all necessary regulatory approvals to commercialize our product candidates; |

| • | changes in external market factors; |

| • | changes in our industry’s overall performance; |

| • | changes in our business strategy; |

| • | our ability to protect our intellectual property portfolio; |

| • | our possible inability to realize commercially valuable discoveries in our collaborations with pharmaceutical and other biotechnology companies; |

| • | our ability to meet milestones under our collaboration agreements; |

| • | our collaborators’ ability to continue to fulfill their obligations under the terms of our collaboration agreement; |

| • | our possible inability to execute our strategy due to changes in our industry or the economy generally; |

| • | changes in productivity and reliability of suppliers; and |

| • | the success of our competitors and the emergence of new competitors. |

Although we currently believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee our future results, levels of activity or performance. We undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. You are advised, however, to consult any further disclosures we make on related subjects in our reports on Forms 10-Q, 8-K and 10-K furnished to the SEC. You should understand that it is not possible to predict or identify all risk factors. Consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties.

3

PROPOSAL ONE

WARRANT EXERCISE PRICE ADJUSTMENT

The March 2012 Private Placement

On March 9, 2012, we entered into a Securities Purchase Agreement with certain investors pursuant to which we completed a private placement of 4,347,827 shares of our Common Stock. Investors in the private placement also received five-year warrants to purchase an aggregate of 4,347,827 shares of our Common Stock with an exercise price of $2.07 per share. The shares and the warrants were sold in multiples of a fixed combination of one share of Common Stock and a warrant to purchase one share of Common Stock at an offering price of $2.07 per fixed combination. The private placement closed on March 14, 2012 and generated net proceeds of approximately $8.1 million.

Nasdaq Marketplace Rule 5635(d)(2)

Our Common Stock is currently listed on The NASDAQ Capital Market, or Nasdaq. Nasdaq rules governing issuers with shares listed on Nasdaq require stockholder approval prior to certain issuances of securities. Nasdaq’s Marketplace Rule 5635(d)(2), or Rule 5635(d)(2), requires stockholder approval prior to the issuance of Common Stock equal to 20% or more of the Common Stock (or 20% or more of the voting power) outstanding before the issuance for less than the greater of book or market value of the issuer’s Common Stock. Additionally, Nasdaq attributes a value of $0.125 per share to securities convertible into shares of Common Stock for purposes of the market value restriction of Rule 5635(d). Therefore, when securities are sold in fixed combinations of one share of Common Stock together with a security convertible into one share of Common Stock, the purchase price per fixed combination must exceed the market value of one share of the issuer’s Common Stock by at least $0.125.

Prior to closing the private placement, we had 24,702,260 shares of Common Stock outstanding. Therefore, the issuance of 4,347,827 shares of Common Stock and potential issuance of an additional 4,347,827 shares of Common Stock upon exercise of the warrants would have constituted approximately 35% of the shares of Common Stock outstanding prior to giving effect to the private placement. The market value of our Common Stock at closing was $1.94 per share, which exceeded its book value. Accordingly, in order to close the private placement without being required to obtain stockholder approval pursuant to Rule 5635(d)(2), the offering price per fixed combination of one share of Common Stock and a warrant to purchase one share of Common Stock was set at $2.07. The exercise price of the warrants was also set at $2.07 per share.

The Anti-Dilution Provisions of the Warrants

In addition to customary anti-dilution provisions relating to stock splits and similar events, the warrants contain full-ratchet anti-dilution provisions that require a reduction in the exercise price upon an issuance by us of shares of Common Stock or securities convertible into or exchangeable for shares of Common Stock at a price per share below the then-current exercise price of the warrants, subject to certain exceptions. Because a reduction in the exercise price could trigger the market value restriction of Rule 5635(d)(2), the warrants also provide that if a reduction in the exercise price would require us to obtain stockholder approval of the private placement pursuant to Rule 5635(d)(2) and such stockholder approval has not been obtained, we shall use commercially reasonable efforts to obtain such stockholder approval as soon as reasonably practicable, including by calling a special meeting of stockholders to vote on the exercise price adjustment.

For additional information on the terms of the warrants, see “Description of Securities—Warrants” below and the Form of Warrant attached hereto asAnnex A.

Why We Are Seeking Stockholder Approval

During the fourth quarter of 2012, we completed a public offering of 19,802,000 shares of Common Stock and issued another 2,970,300 shares pursuant to an over-allotment option granted to the underwriters. The shares were offered at a price to the public of $1.01 per share, which is below the initial and current exercise price of the warrants of $2.07 per share. If the $2.07 per share exercise price were adjusted to $1.01 per share pursuant to the full-ratchet anti-dilution provisions of the warrants, the private placement would be deemed to violate Rule 5635(d)(2) because $1.01 per share is less than the per share market value of our Common Stock as of the closing date of the private placement. Accordingly, we are seeking stockholder approval under Rule 5635(d)(2) and in accordance with the terms of the warrants to adjust the $2.07 per share exercise price of the warrants to $1.01 per share.

4

Reasons for the Private Placement and the Terms of the Warrants

As disclosed in our Form 10-K for the year ended December 31, 2011, we had available cash and cash equivalents of approximately $8.8 million, available-for-sale securities of approximately $4.0 million and working capital of approximately $7.0 million at December 31, 2011. We required substantial additional funding in order to continue our research and product development programs, including preclinical evaluation and clinical trials of our product candidates such as MultiStem.

Management sought, reviewed and evaluated several financing options prior to the private placement. Among other factors, they considered the benefits of additional liquidity, the certainty of obtaining this liquidity in the context of the instability and uncertainty of the financing markets and the importance of additional capital and liquidity for the Company’s operations. As part of this evaluation process, management held discussions with financial advisors and various investors, as well as internal discussions.

The Board and management determined that an offering of shares of Common Stock, together with warrant coverage, was in the best interests of the Company and its stockholders. However, the Board and management believed that an extended period of time required to obtain stockholder approval of any financing activities could have been detrimental to the Company’s liquidity and financial position, could serve as a distraction to employees and management and ultimately could hinder ongoing research and product development programs. Accordingly, the Board and management determined that it would be more beneficial to structure the transaction so that closing would precede any necessary stockholder approvals. Therefore, the private placement was structured so that the Company could issue a combination of Common Stock and warrants without stockholder approval and seek such approval if and when it became necessary under Rule 5635(d)(2).

We believe that the private placement, which yielded net proceeds of approximately $8.1 million, provided needed capital to support our continuing operations, including the continued research and development of MultiStem. We also believe that the anti-dilution protections afforded the warrants were reasonable in light of market conditions and the size and type of the offering, and that we would not have been able to close the private placement unless such anti-dilution protections were offered. We are using, and currently intend to continue to use, the net proceeds from the private placement and the proceeds from the exercise of warrants (if any) for working capital and general corporate purposes.

Potential Effects of Approval or Non-Approval of this Proposal

Although the Board has approved the adjustment of the exercise price of the warrants in accordance with the March 2012 Private Placement, the terms and completion of which were determined by the Board to be in the best interest of our stockholders, our stockholders should consider the information contained in this proxy statement in evaluating the Proposal.

Potential Dilution and Market Consequences of Approval

If the Proposal is approved, the exercise price of the warrants will immediately be reduced on a full-ratchet basis as a result of the public offering from $2.07 per share to $1.01 per share, which would increase the likelihood that the warrants will be exercised and dilute the interests of our other stockholders. If all of the warrants were exercised in full, the number of shares outstanding as a result of the private placement, as of the date of the private placement, would have been 33,397,914, an increase of approximately 15%. Similarly, the issuance of shares underlying the warrants would increase the number of shares outstanding as of the record date to 57,406,459, an increase of approximately 8%. Further, shares of Common Stock issued in the private placement and issuable upon exercise of the warrants were registered with the SEC for resale by the private placement investors, and, therefore, are freely tradeable. (For additional information on the registration of the shares, see “Description of Securities—Registration Rights Agreement” below.) To the extent the warrants are exercised and the shares received upon exercise are sold, our stock price could decrease due to the additional number of shares available in the market, and subsequent sales of those shares could encourage short sales by our stockholders and others, which could place further downward pressure on our stock price.

Potential Effects of Non-Approval

The private placement closed on March 14, 2012 and will not be affected if stockholders do not approve the Proposal. However, in compliance with Rule 5635(d)(2) and the terms of the warrants, the exercise price of the warrants may not be reduced to $1.01 per share without stockholder approval. If our stockholders do not approve the Proposal, we will not reduce the exercise price of the warrants to $1.01 per share, which would delay and could inhibit the holders of the warrants from exercising them, and in turn, delay or prevent us from receiving the additional proceeds from the exercise of the warrants.

5

Quorum and Voting Requirements

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of our Common Stock entitled to vote at the Special Meeting is necessary to constitute a quorum for the transaction of business at the Special Meeting. On the Record Date, we had 53,058,632 shares of Common Stock issued and outstanding, and, excluding the 4,347,827 shares issued in the private placement, 48,710,805 shares were entitled to vote. Accordingly, a total of at least 24,355,403 shares of our Common Stock must be present at the Special Meeting in person or by proxy to constitute a quorum.

Under Nasdaq Marketplace Rule 5635(e), at the Special Meeting, the affirmative vote of a majority of the votes cast on the Proposal is required for approval of the Proposal. Pursuant to the rules and regulations of the NASDAQ Capital Market, the holders of the 4,347,827 shares of Common Stock issued in the private placement are not entitled to vote those shares, either in person or by proxy, on the Proposal.

If you are the beneficial owner of your shares of Common Stock, your broker, bank or nominee is prohibited to vote your shares of Common Stock without instructions from you on matters that are considered significant. The Proposal is considered significant. Therefore, if you do not vote by proxy, your broker, bank or other nominee cannot vote your shares of Common Stock on the Proposal and your shares will be considered broker “non-votes.” Abstentions and broker “non-votes” will be counted for purposes of calculating whether a quorum is present at the Special Meeting, but will have no effect on the Proposal as abstentions and broker non-votes will not be counted in determining the number of votes cast.

Recommendation of the Board of Directors

The Board unanimously recommends that stockholders vote FOR the adjustment of the exercise price of the warrants from $2.07 per share to $1.01 per share.

6

DESCRIPTION OF SECURITIES

The Company is authorized to issue 100,000,000 shares of Common Stock and 10,000,000 shares of preferred stock, par value $0.001 per share.

Common Stock

This section describes the general terms and provisions of our Common Stock. For more detailed information, you should refer to our Certificate of Incorporation and Bylaws, copies of which have been filed with the SEC.

Holders of shares of Common Stock will be entitled to receive dividends if and when declared by the Board from funds legally available therefor, and, upon liquidation, dissolution or winding-up of our company, will be entitled to share ratably in all assets remaining after payment of liabilities. The holders of shares of Common Stock will not have any preemptive rights, but will be entitled to one vote for each share of Common Stock held of record. Stockholders will not have the right to cumulate their votes for the election of directors.

The 8,695,654 shares of Common Stock issued in the private placement and issuable upon exercise of the March 2012 Warrants were registered with the SEC for resale under the Securities Act of 1933, or the Securities Act, by the investors in the private placement. For additional information, see “—Registration Rights Agreement” below.

Preferred Stock

This section describes the general terms and provisions of our preferred stock. For more detailed information, you should refer to our Certificate of Incorporation and Bylaws, copies of which have been filed with the SEC.

The Board is authorized, without action by our stockholders, to designate and issue up to 10,000,000 shares of preferred stock, par value $0.001 per share, in one or more series. The Board can fix the rights, preferences and privileges of the shares of each series and any of its qualifications, limitations or restrictions. The Board may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the holders of Common Stock. The issuance of preferred stock, while providing flexibility in connection with possible future financings, acquisitions and other corporate purposes could, under certain circumstances, have the effect of delaying, deferring or preventing a change in control of us and could adversely affect the market price of our Common Stock. We do not have any shares of preferred stock outstanding, and we have no current plans to issue any preferred stock.

Warrants

In the private placement, we issued warrants to investors to 4,347,827 shares of our Common Stock, which we refer to as the March 2012 Warrants or simply the warrants. The warrants have a cash or cashless exercise price of $2.07 per share and a term of five years from the closing date of the private placement. The exercise price and the number of shares issuable upon exercise of the warrants are subject to adjustment for stock splits, stock dividends, recapitalization or otherwise of the Common Stock.

The warrants also contain full-ratchet anti-dilution provisions that require a reduction in the exercise price upon an issuance by us of shares of Common Stock or securities convertible into or exchangeable for shares of Common Stock at a price per share below the then-current exercise price of the warrants, subject to certain exceptions. Because a reduction in the exercise price could trigger the market value restriction of Rule 5635(d)(2), the warrants also provide that if a reduction in the exercise price would require us to obtain stockholder approval of the private placement pursuant to Rule 5635(d)(2) and such stockholder approval has not been obtained, we shall use commercially reasonable efforts to obtain such stockholder approval as soon as reasonably practicable, including by calling a special meeting of stockholders to vote on the exercise price adjustment.

In addition, upon the occurrence of certain “fundamental transactions,” such as a merger or consolidation of the Company into another entity or a sale of all or substantially all of the Company’s assets in a single transaction or a series of transactions, the holders of the warrants, at their option, will be entitled to receive in cash an amount equal to the “Black Scholes value” of the warrants as of the date of such “fundamental transaction” as determined in accordance with the terms of the warrants. Furthermore, the warrants contain a blocker provision that prevents a holder from exercising the warrants to the extent that such exercise would result in the holder beneficially owning greater than 4.999% of the Company’s outstanding Common Stock immediately after giving effect to the exercise. The 4.999% blocker provision may be waived by a holder by providing the Company with 61 days’ prior notice of its election, in which case the blocker provision will increase to a percentage not in excess of 9.999% and will be applicable to that holder only.

7

The 4,347,827 shares of Common Stock issuable upon exercise of the warrants were afforded the same registration rights as the 4,347,827 shares of Common Stock issued in the private placement and are therefore included in the registration statement on Form S-3 that was filed with the SEC pursuant to the Registration Rights Agreement described below.

The foregoing description of the warrants is qualified in its entirety by reference to the Form of Warrant attached hereto asAnnex A.

Registration Rights Agreement

In connection with the private placement, we entered into a Registration Rights Agreement dated March 9, 2012 pursuant to which we agreed to register both the shares issued in the private placement and the shares issuable upon exercise of the warrants for resale under the Securities Act by the investors. Pursuant to the Registration Rights Agreement, we also agreed to use commercially reasonable efforts to keep the registration statement continuously effective under the Securities Act until the earlier of (1) the date on which all of the shares issued in the private placement and upon exercise of the warrants have been publicly sold by the investors in the private placement and (2) March 14, 2013. We also agreed to other customary obligations regarding registration, including matters relating to indemnification and payment of expenses. On March 28, 2012, we filed a registration statement on Form S-3 to fulfill our obligations under the Registration Rights Agreement, and the registration statement was declared effective by the SEC on April 9, 2012. Subject to certain exceptions, the Registration Rights Agreement requires that we pay customary liquidated damages if we fail to maintain the effectiveness of the registration statement until March 14, 2013 or until all securities registered thereunder are sold by the investors, whichever is earlier.

The foregoing description of the Registration Rights Agreement is qualified in its entirety by the terms of the Registration Rights Agreement, a copy of which has been filed with the SEC.

Transfer Agent and Registrar

We have appointed Computershare Investor Services as the transfer agent and registrar for our Common Stock.

Listing

Our Common Stock is listed on the NASDAQ Capital Market under the symbol “ATHX.”

8

BENEFICIAL OWNERSHIP OF COMMON STOCK

The following table sets forth certain information known to us regarding the beneficial ownership of our Common Stock as of December 31, 2012 by:

| • | each person known by us to beneficially own more than 5% of our Common Stock; |

| • | each of our directors; |

| • | each of the executive officers named in the Summary Compensation Table in our proxy statement for our 2012 annual meeting of stockholders; and |

| • | all of our directors and executive officers as a group. |

We have determined beneficial ownership in accordance with the rules of the SEC. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of Common Stock that could be issued upon the exercise of outstanding options and warrants held by that person that are exercisable within 60 days of December 31, 2012 are considered outstanding. These shares, however, are not considered outstanding when computing the percentage ownership of each other person.

Percentage ownership calculations for beneficial ownership for each person or entity are based on 53,058,632 shares of Common Stock outstanding as of December 31, 2012.

Except as indicated in the footnotes to this table and pursuant to state community property laws, each stockholder named in the table has sole voting and investment power for the shares shown as beneficially owned by them.

Name of Beneficial Owner | Number of Shares | Percent of Class | ||||||

Greater Than 5% Stockholders | ||||||||

Aspire Capital Fund, LLC(1) | 2,811,200 | 5.3 | % | |||||

AMP&A Management III, LLC and affiliates(2) | 2,767,900 | 5.2 | % | |||||

Directors, Director Nominees and Executive Officers | ||||||||

Gil Van Bokkelen(3) | 976,986 | 1.8 | % | |||||

Lee Babiss(4) | 88,125 | * | ||||||

John Harrington(5) | 819,144 | 1.5 | % | |||||

Ismail Kola(6) | 83,438 | * | ||||||

Lorin Randall(7) | 65,625 | * | ||||||

Kenneth Traub(8) | 7,500 | * | ||||||

Jack Wyszomierski(9) | 88,125 | * | ||||||

Laura Campbell(10) | 250,563 | * | ||||||

Robert Deans(11) | 267,500 | * | ||||||

William (BJ) Lehmann, Jr.(12) | 429,400 | * | ||||||

All directors and executive officers as a group (10 persons) | 3,076,406 | 3.3 | % | |||||

| * | Less than 1%. |

| (1) | A Schedule 13G filed with the SEC on January 23, 2013 reported that Aspire Capital Fund, LLC, an Illinois limited liability company, or Aspire Capital, has direct beneficial ownership of 2,811,200 shares of common stock. Aspire Capital also holds warrants to purchase 1,066,084 shares of common stock; however, these warrants are exercisable only if the holder beneficially owns less than 4.99% of the outstanding shares of common stock and, therefore, the shares underlying these warrants are not beneficially owned by Aspire Capital as of the date hereof. Aspire Capital Partners, LLC, or Aspire Partners, as the managing member of Aspire Capital, SGM Holdings Corp., or SGM, as the managing member of Aspire Partners, Steven G. Martin, the president and sole shareholder of SGM and a principal of Aspire Partners, Erik J. Brown, the president and sole shareholder of Red Cedar Capital Corporation, or Red Cedar, and a principal of Aspire Partners, and Christos Komissopoulos, the president and sole shareholder of Chrisko Investors, Inc., or Chrisko, and a principal of Aspire Partners, may be deemed to have shared voting and investment power over shares of common stock owned by Aspire Capital. Each of Aspire Partners, SGM, Red Cedar, Chrisko, Mr. Martin, Mr. Brown and Mr. Komissopoulos disclaims beneficial ownership of the shares of common stock held by Aspire Capital. The address for Aspire Capital and its affiliates is 155 North Wacker Drive, Suite 1600, Chicago, Illinois 60606. |

| (2) | A Schedule 13G filed with the SEC on November 5, 2012 reported that AMP&A Management III, LLC, a Delaware limited liability company, or AMP&A Management, and A.M. Pappas & Associates, LLC, a North Carolina limited liability company, or Pappas, have shared voting and dispositive power over 2,767,900 shares of Common Stock. AMP&A Management is the general partner of each of two funds: A.M. Pappas Life Science Ventures III, LP, a Delaware limited partnership that directly owns 2,605,889 shares, and PV III CEO Fund, LP, a Delaware limited partnership that directly owns 162,011 shares. AMP&A Management has a management agreement with Pappas whereby Pappas provides management services for the funds. Due to its arrangements with the funds, Pappas’s investment committee has sole power to vote or to direct the vote of, and sole power to dispose or to direct the disposition of, all shares owned by the funds. By virtue of these relationships, each of AMP&A Management and Pappas may be deemed to beneficially own the 2,767,900 shares owned by the funds. |

| (3) | Includes vested options for 737,500 shares of Common Stock at a weighted average exercise price of $5.01 per share. |

9

| (4) | Includes vested options for 88,125 shares of Common Stock at a weighted average exercise price of $2.96 per share. |

| (5) | Includes vested options for 722,500 shares of Common Stock at a weighted average exercise price of $5.01 per share. |

| (6) | Includes vested options for 83,438 shares of Common Stock at a weighted average exercise price of $2.67 per share. |

| (7) | Includes vested options for 65,625 shares of Common Stock at a weighted average exercise price of $2.16 per share. |

| (8) | Includes vested options for 7,500 shares of Common Stock at a weighted average exercise price of $1.43 per share. |

| (9) | Includes vested options for 88,125 shares of Common Stock at a weighted average exercise price of $2.89 per share. |

| (10) | Includes vested options for 217,500 shares of Common Stock at a weighted average exercise price of $5.02 per share. |

| (11) | Includes vested options for 260,000 shares of Common Stock at a weighted average exercise price of $5.02 per share. |

| (12) | Includes vested options for 422,500 shares of Common Stock at a weighted average exercise price of $5.01 per share. |

10

SUBMISSION OF STOCKHOLDERS’ PROPOSALS FOR 2013 ANNUAL MEETING

AND ADDITIONAL INFORMATION

The deadline for submission of any proposal of a stockholder intended to be presented at the 2013 annual meeting of stockholders of the Company, or the 2013 Annual Meeting, and to be included in the Company’s proxy, notice of meeting and proxy statement related to the 2013 Annual Meeting pursuant to Rule 14a-8 under the Exchange Act was January 2, 2013 and has passed. Proposals of stockholders submitted outside the processes of Rule 14a-8 under the Exchange Act in connection with the 2013 Annual Meeting, or Non-Rule 14a-8 proposals, must be received by the Company no later than March 18, 2013 or such proposals will be considered untimely under Rule 14a-4(c) of the Exchange Act. Such proposals must be addressed to Athersys, Inc., 3201 Carnegie Avenue, Cleveland, Ohio 44115 and should be submitted to the attention of the Secretary by certified mail, return receipt requested. The Company’s proxy related to the 2013 Annual Meeting may give discretionary authority to the proxy holders to vote with respect to all Non-Rule 14a-8 proposals received by us.

We will furnish without charge to each person from whom a proxy is being solicited, upon written request of any such person, a copy of the Annual Report on Form 10-K of the Company for the fiscal year ended December 31, 2011, as filed with the SEC, including the financial statements and schedules thereto. Requests for copies of such Annual Report on Form 10-K should be directed to: Athersys, Inc., 3201 Carnegie Avenue, Cleveland, Ohio 44115-2634, Attention: Corporate Secretary.

SOLICITATION OF PROXIES

The Company will bear the costs of soliciting proxies from its stockholders. In addition to the use of the mails, proxies may be solicited by the Directors, officers and employees of the Company by personal interview or telephone. Such Directors, officers and employees will not be additionally compensated for such solicitation but may be reimbursed for out-of-pocket expenses incurred in connection with such solicitation. Arrangements will also be made with brokerage houses and other custodians, nominees and fiduciaries for the forwarding of solicitation materials to the beneficial owners of Common Stock held of record by such persons, and we will reimburse such brokerage houses, custodians, nominees and fiduciaries for reasonable out-of-pocket expenses incurred in connection with such solicitation.

OTHER MATTERS TO COME BEFORE SPECIAL MEETING

Pursuant to our Bylaws, business transacted at the Special Meeting will be confined to the purposes stated in the notice that accompanies this proxy statement, unless all stockholders entitled to vote are present at the Special Meeting and consent.

| By Order of the Board of Directors |

| /s/ William Lehmann, Jr. |

| William Lehmann, Jr. |

| Secretary |

January 24, 2013

IT IS IMPORTANT THAT THE PROXIES BE RETURNED PROMPTLY. EVEN IF YOU

EXPECT TO ATTEND THE SPECIAL MEETING, PLEASE PROMPTLY COMPLETE, SIGN,

DATE AND MAIL THE ENCLOSED PROXY CARD IN THE ENCLOSED ENVELOPE, WHICH

REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE STOCKHOLDER MEETING TO BE HELD ON FEBRUARY 21, 2013

This proxy statement and our Annual Report for the fiscal year ended December 31, 2011 are available free of charge athttp://ir.athersys.com/annuals.cfm. We will furnish without charge to each person from whom a proxy is being solicited, upon written request of any such person, a copy of the Annual Report on Form 10-K of the Company for the fiscal year ended December 31, 2011, as filed with the SEC. Requests for such copies should be directed to: Athersys, Inc., 3201 Carnegie Avenue, Cleveland, Ohio 44115-2634, Attention: Corporate Secretary.

11

For information on how to obtain directions to be able to attend the Special Meeting and vote in person, please contact the Company’s Vice President of Finance atlcampbell@athersys.com. You may also vote electronically atwww.investorvote.com/ATHXor telephonically at 1-800-652-VOTE (8683) within the Unites States and Canada.

12

ANNEX A

FORM OF WARRANT

NEITHER THESE SECURITIES NOR THE SECURITIES ISSUABLE UPON EXERCISE OF THESE SECURITIES HAVE BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR APPLICABLE STATE SECURITIES LAWS. THE SECURITIES MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED OR ASSIGNED (I) IN THE ABSENCE OF (A) AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE SECURITIES ACT OR (B) AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS OR BLUE SKY LAWS AS EVIDENCED BY A LEGAL OPINION OF COUNSEL REASONABLY SATISFACTORY TO THE COMPANY AND ITS TRANSFER AGENT.

ATHERSYS, INC.

FORM OF WARRANT TO PURCHASE COMMON STOCK

Warrant No.:

Number of Shares of Common Stock:

Date of Issuance: March 14, 2012 (“Issuance Date”)

Athersys, Inc., a Delaware corporation (the “Company”), hereby certifies that, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, [INVESTOR NAME], the registered holder hereof or its permitted assigns (the “Holder”), is entitled, subject to the terms set forth below, to purchase from the Company, at the Exercise Price (as defined below) then in effect, upon surrender of this Warrant to Purchase Common Stock (including any Warrants to Purchase Common Stock issued in exchange, transfer or replacement hereof, the “Warrant”), at any time or times on or after the Issuance Date, but not after 5:30 p.m., New York time, on the Expiration Date (as defined below), March 14, 2017 (subject to adjustment as provided herein) fully paid nonassessable shares of Common Stock (the “Warrant Shares”). Except as otherwise defined herein, capitalized terms in this Warrant shall have the meanings set forth inSection 16. This Warrant is the Warrant issued pursuant to that certain Securities Purchase Agreement dated as of March 9, 2012 (the “Purchase Date”), by and between the Company and the Holder (the “Purchase Agreement” and together with the other Purchase Agreements entered into by the Company on the Purchase Date, the “Purchase Agreements”).

1. EXERCISE OF WARRANT.

(a)Mechanics of Exercise. Subject to the terms and conditions hereof, this Warrant may be exercised by the Holder on any day on or after the Issuance Date, in whole or in part, by delivery of a written notice (via overnight courier, facsimile or e-mail), in the form attached hereto asExhibit A (the “Exercise Notice”), of the Holder’s election to exercise this Warrant. Within two (2) days following the Exercise Notice, the Holder shall make payment to the Company of an amount equal to the applicable Exercise Price multiplied by the number of Warrant Shares as to which this Warrant is being exercised (the “Aggregate Exercise Price”) in cash or by wire transfer of immediately available funds, or provided the conditions for cashless exercise set forth in Section 1(e) are satisfied, by notifying the Company that this Warrant is being exercised pursuant to a Cashless Exercise (as defined in Section 1(e)). Execution and delivery of the Exercise Notice with respect to less than all of the Warrant Shares shall have the same effect as cancellation of the original Warrant and issuance of a new Warrant evidencing the right to purchase the remaining number of Warrant Shares. On or before the first (1st) Business Day following the date on which the Company has received the Exercise Notice, the Company shall transmit by facsimile an acknowledgment of confirmation of receipt of the Exercise Notice to the Holder and the Company’s transfer agent (the “Transfer Agent”). On or before the third (3rd) Business Day following the date on which the Company has received the Exercise Notice (the “Share Delivery Date”), the Company shall, (X) upon the request of the Holder, credit such aggregate number of shares of Common Stock to which the Holder is entitled pursuant to such exercise to the Holder’s or its designee’s balance

account withThe Depository Trust Company (“DTC”) through its Deposit Withdrawal Agent Commission system (“DWAC”), or (Y) if the Transfer Agent does not have the ability to settle via DWAC, issue and dispatch by overnight courier to the address as specified in the Exercise Notice, a certificate, registered in the Company’s share register in the name of the Holder or its designee, for the number of shares of Common Stock to which the Holder is entitled pursuant to such exercise. The issuance of the Warrant Shares so purchased is not required to be registered under the Securities Act. The Warrant Shares so purchased shall be deemed to be issued to the Holder or the Holder’s designee, as the record owner of such Warrant Shares, as of the close of business on the date of delivery of the Exercise Notice. If this Warrant is submitted in connection with any exercise pursuant to thisSection 1(a) and the number of Warrant Shares represented by this Warrant submitted for exercise is greater than the number of Warrant Shares being acquired upon an exercise, then the Company shall as soon as practicable and in no event later than three (3) Business Days after any exercise and at its own expense, issue a new Warrant (in accordance withSection 7(d)) representing the right to purchase the number of Warrant Shares purchasable immediately prior to such exercise under this Warrant, less the number of Warrant Shares with respect to which this Warrant is exercised. No fractional Common Stock are to be issued upon the exercise of this Warrant, but rather the number of shares of Common Stock to be issued shall be rounded up to the nearest whole number. Except as otherwise provided in Section 4(b), in no event shall this warrant be settled for cash. The Company shall pay any and all transfer taxes and transfer agent fees which may be payable with respect to the issuance and delivery of Warrant Shares to the Holder upon exercise of this Warrant. For purposes of clarification, unless required pursuant to its industry standard stock transfer procedures, the Transfer Agent shall not require the Holder to obtain a medallion guaranty, notary attestation or any similar deliverable in order to effectuate an exercise of all or a portion of this Warrant.

(b)Exercise Price. For purposes of this Warrant, “Exercise Price” means $2.07, subject to adjustment as provided herein.

(c)Disputes. In the case of a dispute as to the determination of the Exercise Price or the arithmetic calculation of the Warrant Shares, the Company shall promptly issue to the Holder the number of Warrant Shares that are not disputed.

(d)Limitations On Exercise. The Company shall not effect the exercise of this Warrant, and the Holder shall not have the right to exercise this Warrant, to the extent that after giving effect to such exercise, such Person (together with such Person’s affiliates) would beneficially own in excess of 4.99% (the “Maximum Percentage”) of the Common Stock outstanding immediately after giving effect to such exercise. For purposes of the foregoing sentence, the aggregate number of shares of Common Stock beneficially owned by such Person and its affiliates shall include the number of shares of Common Stock issuable upon exercise of this Warrant with respect to which the determination of such sentence is being made, but shall exclude shares of Common Stock which would be issuable upon (i) exercise of the remaining, unexercised portion of this Warrant beneficially owned by such Person and its affiliates and (ii) exercise or conversion of the unexercised or unconverted portion of any other securities of the Company beneficially owned by such Person and its affiliates (including, without limitation, any convertible notes or convertible shares or warrants) subject to a limitation on conversion or exercise analogous to the limitation contained herein. Except as set forth in the preceding sentence, for purposes of this paragraph, beneficial ownership shall be calculated in accordance withSection 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). For purposes of this Warrant, in determining the number of outstanding shares of Common Stock, the Holder may rely on the number of outstanding shares of Common Stock as reflected in the most recent of (1) the Company’s most recent Form 10-K, Form 10-Q or other public filing with the Securities and Exchange Commission, as the case may be, (2) a more recent public announcement by the Company or (3) any other notice by the Company or the Transfer Agent setting forth the number of shares of Common Stock outstanding. For any reason at any time, upon the written or oral request of the Holder, the Company shall within two (2) Business Days confirm to the Holder the number of shares of Common Stock then outstanding. In any case, the number of outstanding shares of Common Stock shall be determined after giving effect to the conversion or exercise of securities of the Company, including this Warrant, by the Holder and its affiliates since the date as of which such number of outstanding Common Stock was reported. By written notice to the Company, the Holder may from time to time increase or decrease the Maximum Percentage to any other percentage not less than 4.99% and not in excess of 9.99% specified in such notice; provided that (i) any such increase will not be effective until the sixty-first (61st) day after such notice is delivered to the Company and (ii) any such increase or decrease will apply only to the Holder. The provisions of this paragraph shall be construed, corrected and implemented in a manner so as to effectuate the intended beneficial ownership limitation herein contained. The limitations contained in this paragraph shall apply to any successor Holder of this Warrant.

A-2

(e)Limited Cashless Exercise. Notwithstanding anything contained herein to the contrary, if a registration statement covering the Warrant Shares that are the subject of the Exercise Notice (the “Unavailable Warrant Shares”) is not effective or an exemption from registration is not available for the resale of such Unavailable Warrant Shares, the Holder may, in its sole discretion, exercise this Warrant in whole or in part and, in lieu of making the cash payment otherwise contemplated to be made to the Company upon such exercise in payment of the Aggregate Exercise Price, elect instead to receive upon such exercise the “Net Number” of shares of Common Stock determined according to the following formula (a “Cashless Exercise”):

Net Number = Y [(A-B)/A]

where:

Y = the number of Warrant Shares with respect to which this Warrant is being exercised.

A = the VWAP for the five (5) Trading Days immediately prior to (but not including) the date of delivery of the Exercise Notice.

B = the Exercise Price.

Upon receipt of an Exercise Notice to which thisSection 1(e) is applicable, the Company shall notify the Holder within one (1) Trading Day of such applicability and the calculation of the Net Number of shares of Common Stock issuable upon the noticed exercise of the Warrant utilizing Cashless Exercise, and confirm the Holder’s desire to complete the exercise of the Warrant pursuant to thisSection 1(e).

For purposes of Rule 144 promulgated under the Securities Act of 1933, as amended, it is intended, understood and acknowledged that the Warrant Shares issued in a cashless exercise transaction shall be deemed to have been acquired by the Holder, and the holding period for the Warrant Shares shall be deemed to have commenced, on the date this Warrant was originally issued.

(f)Company’s Failure to Timely Deliver Securities. If the Company shall fail for any reason or for no reason to issue to the Holder within the later of (i) three (3) Trading Days after receipt of the applicable Exercise Notice and (ii) two (2) Trading Days after the Company’s receipt of the Aggregate Exercise Price (or valid notice of a Cashless Exercise)(such later date, the “Share Delivery Deadline”), a certificate for the number of Warrant Shares to which the Holder is entitled and register such shares of Common Stock on the Company’s share register or to credit the Holder’s balance account with DTC for such number of shares of Common Stock to which the Holder is entitled upon the Holder’s exercise of this Warrant, and if on or after such Share Delivery Deadline the Holder, or any third party on behalf of the Holder or for the Holder’s account, purchases (in an open market transaction or otherwise) shares of Common Stock

A-3

to deliver in satisfaction of a sale by the Holder of shares of Common Stock issuable upon such exercise that the Holder anticipated receiving from the Company, then, so long as the Holder has paid the Aggregate Exercise Price, the Company shall, within three (3) Business Days after the Holder’s request and in the Holder’s discretion, either (i) pay cash to the Holder in an amount equal to the Holder’s total purchase price (including brokerage commissions, if any) for the shares of Common Stock so purchased (the “Buy-In Price”), at which point the Company’s obligation to deliver such certificate or credit the Holder’s balance account with DTC for the number of shares of Common Stock to which the Holder is entitled upon the Holder’s exercise hereunder, as the case may be (and to issue such shares of Common Stock), shall terminate, or (ii) promptly honor its obligation to deliver to the Holder a certificate or certificates representing such shares of Common Stock or credit the Holder’s balance account with DTC for the number of shares of Common Stock to which the Holder is entitled upon the Holder’s exercise hereunder, as the case may be, and pay cash to the Holder in an amount equal to the excess (if any) of the Buy-In Price over the product of (A) such number of shares of Common Stock, times (B) the Closing Sale Price on the Share Delivery Deadline.

2.ADJUSTMENT OF EXERCISE PRICE AND NUMBER OF WARRANT SHARES.

The Exercise Price and the number of Warrant Shares shall be adjusted from time to time as follows:

(a)Adjustment upon Subdivision or Combination of Common Stock. If the Company at any time on or after the Purchase Date subdivides (by any stock split, stock dividend, recapitalization or otherwise) one or more classes of its outstanding Common Stock into a greater number of shares, the Exercise Price in effect immediately prior to such subdivision will be proportionately reduced and the number of Warrant Shares will be proportionately increased. If the Company at any time on or after the Purchase Date combines (by any reverse stock split, recapitalization or otherwise) one or more classes of its outstanding Common Stock into a smaller number of shares, the Exercise Price in effect immediately prior to such combination will be proportionately increased and the number of Warrant Shares will be proportionately decreased. Any adjustment under thisSection 2(a) shall become effective at the close of business on the date the subdivision or combination becomes effective.

(b)Subsequent Equity Sales.

(i) Except as provided in paragraph (b)(iii) of thisSection 2, if and whenever the Company shall issue or sell, or is, in accordance with any of paragraphs (b)(ii)(l) through (b)(ii)(7) of thisSection 2, deemed to have issued or sold, any shares of Common Stock for a consideration per share less than the Exercise Price in effect immediately prior to the time of such issue or sale, then and in each such case (a “Trigger Issuance”) the then-existing Exercise Price shall be reduced as of the close of business on the effective date of the Trigger Issuance, to equal such lower price but the number of Warrant Shares which the Holder may acquire under this Warrant will not be affected thereby;provided, however, that in no event shall the Exercise Price after giving effect to such Trigger Issuance be greater than the Exercise Price immediately prior to such Trigger Issuance.

For purposes of this paragraph (b), “Additional Shares of Common Stock” shall mean all shares of Common Stock issued by the Company or deemed to be issued pursuant to this paragraph (b), other than Excluded Issuances (as defined in paragraph (b)(iii) of thisSection 2).

(ii) For purposes of this paragraph (b), the following paragraphs (b)(ii)(l) to (b)(ii)(7) shall also be applicable:

A-4

(1)Issuance of Rights or Options. In case at any time the Company shall in any manner grant (directly and not by assumption in a merger or otherwise) any warrants or other rights to subscribe for or to purchase, or any options for the purchase of, Common Stock or any stock or security convertible into or exchangeable for Common Stock (such warrants, rights or options being called “Options” and such convertible or exchangeable stock or securities being called “Convertible Securities”), other than Excluded Issuances, whether or not such Options or the right to convert or exchange any such Convertible Securities are immediately exercisable, and the price per share for which Common Stock is issuable upon the exercise of such Options or upon the conversion or exchange of such Convertible Securities (determined by dividing (i) the sum (which sum shall constitute the applicable consideration) of (x) the total amount, if any, received or receivable by the Company as consideration for the granting of such Options, plus (y) the aggregate amount of additional consideration payable to the Company upon the exercise of all such Options, plus (z), in the case of such Options that relate to Convertible Securities, the aggregate amount of additional consideration, if any, payable upon the issue or sale of such Convertible Securities and upon the conversion or exchange thereof, by (ii) the total maximum number of shares of Common Stock issuable upon the exercise of such Options or upon the conversion or exchange of all such Convertible Securities issuable upon the exercise of such Options) shall be less than the Exercise Price in effect immediately prior to the time of the granting of such Options, then the total number of shares of Common Stock issuable upon the exercise of such Options or upon conversion or exchange of the total amount of such Convertible Securities issuable upon the exercise of such Options shall be deemed to have been issued for such price per share as of the date of granting of such Options or the issuance of such Convertible Securities and thereafter shall be deemed to be outstanding for purposes of adjusting the Exercise Price. Except as otherwise provided in paragraph (b)(ii)(3), no adjustment of the Exercise Price shall be made upon the actual issue of such Common Stock or of such Convertible Securities upon exercise of such Options or upon the actual issue of such Common Stock upon conversion or exchange of such Convertible Securities.

(2)Issuance of Convertible Securities. In case the Company shall in any manner issue (directly and not by assumption in a merger or otherwise) or sell any Convertible Securities, other than Excluded Issuances, whether or not the rights to exchange or convert any such Convertible Securities are immediately exercisable, and the price per share for which Common Stock is issuable upon such conversion or exchange (determined by dividing (i) the sum (which sum shall constitute the applicable consideration) of (x) the total amount received or receivable by the Company as consideration for the issue or sale of such Convertible Securities, plus (y) the aggregate amount of additional consideration, if any, payable to the Company upon the conversion or exchange thereof, by (ii) the total number of shares of Common Stock issuable upon the conversion or exchange of all such Convertible Securities) shall be less than the Exercise Price in effect immediately prior to the time of such issue or sale, then the total maximum number of shares of Common Stock issuable upon conversion or exchange of all such Convertible Securities shall be deemed to have been issued for such price per share as of the date of the issue or sale of such Convertible Securities and thereafter shall be deemed to be outstanding for purposes of adjusting the Exercise Price, provided that (a) except as otherwise provided in paragraph (b)(ii)(3), no adjustment of the Exercise Price shall be made upon the actual issuance of such Common Stock upon conversion or exchange of such Convertible Securities and (b) no further adjustment of the Exercise Price shall be made by reason of the issue or sale of Convertible Securities upon exercise of any Options to purchase any such Convertible Securities for which adjustments of the Exercise Price have been made pursuant to the other provisions of paragraph (b).

(3)Change in Option Price or Conversion Rate. Upon the happening of any of the following events, namely, if the purchase price provided for in any Option referred to in paragraph (b)(ii)(l) of thisSection 2, the additional consideration, if any, payable upon the conversion or exchange of any Convertible Securities referred to in paragraphs (b)(ii)(l) or (b)(ii)(2), or the rate at which Convertible Securities referred to in paragraphs (b)(ii)(l) or (b)(ii)(2) are convertible into or exchangeable for Common Stock shall change at any time (including, but not limited to, changes under or by reason of provisions designed to protect against dilution), but excluding any adjustments for any stock split, stock dividend, recapitalization or otherwise), the Exercise Price in effect at the time of such event shall forthwith be readjusted to the Exercise Price that would have been in effect at such time had such Options or Convertible Securities still outstanding provided for such changed purchase price, additional consideration or conversion rate, as the case may be, at the time initially granted, issued or sold.

A-5

(4)Stock Dividends. Subject to the provisions of this paragraph (b), in case the Company shall declare a dividend or make any other distribution upon any stock of the Company (other than the Common Stock) payable in Common Stock, Options or Convertible Securities, then any Common Stock, Options or Convertible Securities, as the case may be, issuable in payment of such dividend or distribution shall be deemed to have been issued or sold without consideration.

(5)Consideration for Stock. In case any shares of Common Stock, Options or Convertible Securities shall be issued or sold for cash, the consideration received therefor shall be deemed to be the gross amount received by the Company therefor. In case any shares of Common Stock, Options or Convertible Securities shall be issued or sold for a consideration other than cash, the amount of the consideration other than cash received by the Company shall be deemed to be the fair value of such consideration as determined in good faith by the Board of Directors of the Company. In case any Options shall be issued in connection with the issue and sale of other securities of the Company, together comprising one integral transaction in which no specific consideration is allocated to such Options by the parties thereto, such Options shall be deemed to have been issued for such consideration as determined in good faith by the Board of Directors of the Company. If Common Stock, Options or Convertible Securities shall be issued or sold by the Company and, in connection therewith, other Options or Convertible Securities (the “Additional Rights”) are issued, then the consideration received or deemed to be received by the Company shall be reduced by the fair market value of the Additional Rights (as determined using the Black Scholes Option Pricing Model or another method mutually agreed to by the Company and the Holder). The Board of Directors of the Company shall respond promptly, in writing, to an inquiry by the Holder as to the fair market value of the Additional Rights. In the event that the Board of Directors of the Company and the Holder are unable to agree upon the fair market value of the Additional Rights, the Company and the Holder shall jointly select an appraiser who is experienced in such matters. The decision of such appraiser shall be final and conclusive, and the cost of such appraiser shall be borne evenly by the Company and the Holder.

(6)Record Date. In case the Company shall take a record of the holders of its Common Stock for the purpose of entitling them (i) to receive a dividend or other distribution payable in Common Stock, Options or Convertible Securities or (ii) to subscribe for or purchase Common Stock, Options or Convertible Securities, then such record date shall be deemed to be the date of the issue or sale of the shares of Common Stock deemed to have been issued or sold upon the declaration of such dividend or the making of such other distribution or the date of the granting of such right of subscription or purchase, as the case may be.

(7)Treasury Shares. The number of shares of Common Stock outstanding at any given time shall not include shares owned or held by or for the account of the Company or any of its wholly-owned subsidiaries, and the disposition of any such shares (other than the cancellation or retirement thereof) shall be considered an issue or sale of Common Stock for the purpose of this paragraph (e).

(iii)Excluded Issuances. Notwithstanding the foregoing, no adjustment will be made under this paragraph (b) in respect of the issuance of: (1) shares of Common Stock (including restricted stock) or options or other equity awards to purchase Common Stock to directors, officers or employees of the Company in their capacity as such pursuant to a duly authorized Company equity incentive plan; (2) shares of Common Stock issued upon the conversion or exercise of Common Stock Equivalents (other than options or other equity awards to purchase Common Stock issued pursuant to an that are covered by clause (1) above) issued prior to the date hereof; (3) shares of Common Stock or Common Stock Equivalents of the Company issued in connection with an acquisition, merger or other business combination; (4) Common Stock or Common Stock Equivalents of the Company issued in connection with a joint venture, collaboration or other strategic or commercial relationship or relationship with a foundation; (5) the Warrant Shares and shares of Common Stock issuable pursuant other warrants issued pursuant to the Purchase Agreement; (6) shares of Common Stock issuable pursuant to an existing stock purchase agreement in effect as of the date hereof; (7) shares of Common Stock that the Company is obligated to or may issue pursuant to its existing agreement with Venture Lending & Leasing IV, Inc. and Costella Kirsch IV, L.P.; and (8) the issuance of securities in a transaction described in paragraph (a) and (b) of thisSection 2 (collectively, “Excluded Issuances”).

A-6

(iv)Nasdaq Limitation. Notwithstanding any other provisions in this Section 2 to the contrary, if a reduction in the Exercise Price pursuant to Section 2(b) would require the Company to obtain stockholder approval of the transactions contemplated by the Purchase Agreement pursuant to Nasdaq Marketplace Rule 5635(d) and such stockholder approval has not been obtained, (i) the Exercise Price shall be reduced to the maximum extent that would not require stockholder approval under such Rule, and (ii) the Company shall use its commercially reasonable efforts to obtain such stockholder approval (including causing the Board of Directors of the Company to recommend to the stockholders that they grant such approval) as soon as reasonably practicable, including by calling a special meeting of stockholders to vote on such Exercise Price adjustment.

(c)Calculations. All calculations made under this Section 2 shall be made by rounding to the nearest cent or the nearest 1/100th of a Common Share, as applicable.

3.RIGHTS UPON DISTRIBUTION OF ASSETS.

(a) If at any time or from time to time the holders of shares of Common Stock of the Company (or any other securities at the time receivable upon the exercise of this Warrant) shall have received or become entitled to receive, without payment therefor:

(i) shares of Common Stock or other securities which are at any time directly or indirectly convertible into or exchangeable for Common Stock, by way of dividend or other distribution (other than an issuance due to a subdivision covered inSection 2(a) above);

(ii) any cash paid or payable, including any declared and paid cash dividends; or

(iii) shares of Common Stock or additional shares or other securities or property (including cash) by way of spinoff, split-up, reclassification, combination of shares or similar corporate rearrangement (other than shares of Common Stock pursuant toSection 2(a) above), then and in each such case, the Holder hereof will, upon the exercise of this Warrant, be entitled to receive, in addition to the number of shares of Common Stock receivable thereupon, and without payment of any additional consideration therefor, the amount of shares of Common Stock and other securities and property (including cash in the cases referred to in clause (iii) above) which such Holder would hold on the date of such exercise had such Holder been the holder of record of such Common Stock as of the date on which holders of Common Stock received or became entitled to receive such shares or other securities and property,provided,however, (x) in the event that the holders of Common Stock have received options, warrants or rights that have expired prior to the date of exercise of this Warrant, the Holder shall not be entitled to receive such options, warrants or rights and (y) in the event of a distribution consisting of cash as referred to in clause (ii) above, the Exercise Price in effect immediately prior to such distribution will be proportionately reduced by the amount of the distribution per Common Share such Holder would have been entitled to receive had such Holder been the holder of record of such Common Stock as of the date on which holders of Common Stock received or became entitled to receive such cash distribution.

(b) Upon the occurrence of each adjustment pursuant to thisSection 3, the Company at its expense will, at the written request of the Holder, promptly compute such adjustment in accordance with the terms of this Warrant and prepare a certificate setting forth such adjustment, including a statement of the adjusted number or type of Warrant Shares or other securities issuable upon exercise of this Warrant (as applicable), describing the transactions giving rise to such adjustments and showing in detail the facts upon which such adjustment is based, including the expiration date of any applicable options, warrants or rights. Upon written request, the Company will promptly deliver a copy of each such certificate to the Holder and to the Transfer Agent. All calculations made under thisSection 3(b) shall be made by rounding to the nearest cent or the nearest 1/100th of any security, as applicable.

A-7

4.FUNDAMENTAL TRANSACTIONS.

(a)Fundamental Transactions. The Company shall not consummate a Fundamental Transaction (other than an Involuntary Change of Control) or permit the consummation of any Involuntary Change of Control unless the Successor Entity (if a Person other than the Company) assumes in writing all of the obligations of the Company under this Warrant in accordance with the provisions of thisSection 4(a), including agreements to deliver to each holder of Warrants in exchange for such Warrants a security of the Successor Entity evidenced by a written instrument substantially similar in form and substance to this Warrant, including, without limitation, an adjusted exercise price equal to the value for the Common Stock reflected by the terms of such Fundamental Transaction, and exercisable for a corresponding number of shares of capital stock equivalent to the Common Stock acquirable and receivable upon exercise of this Warrant (without regard to any limitations on the exercise of this Warrant) prior to such Fundamental Transaction, and reasonably satisfactory to the Required Holders (each such Fundamental Transaction, an “Assumption Fundamental Transaction”). Upon the occurrence of any Assumption Fundamental Transaction, the Successor Entity shall succeed to, and be substituted for (so that from and after the date of such Assumption Fundamental Transaction, the provisions of this Warrant referring to the “Company” shall refer instead to the Successor Entity), and may exercise every right and power of the Company and shall assume all of the obligations of the Company under this Warrant with the same effect as if such Successor Entity (including its Parent Entity) had been named as the Company herein. Notwithstanding the foregoing, the Holder may elect, at its sole option, by delivery of written notice to the Company to waive thisSection 4(a) to permit the Fundamental Transaction without the assumption of this Warrant. In addition to and not in substitution for any other rights hereunder, prior to the consummation of any Fundamental Transaction pursuant to which holders of Common Stock are entitled to receive securities or other assets with respect to or in exchange for Common Stock (a “Corporate Event”), the Company shall (or, with respect to any tender offer Involuntary Change of Control, shall use its reasonable best efforts to) make appropriate provision to insure that the Holder will thereafter have the right to receive upon an exercise of this Warrant at any time after the consummation of the Fundamental Transaction but prior to the Expiration Date, in lieu of the Common Stock (or other securities, cash, assets or other property) purchasable upon the exercise of the Warrant prior to such Fundamental Transaction or the capital stock of the Successor Entity upon an Assumption Fundamental Transaction, such shares, securities, cash, assets or any other property whatsoever (including warrants or other purchase or subscription rights) which the Holder would have been entitled to receive upon the happening of such Fundamental Transaction had the Warrant been exercised immediately prior to such Fundamental Transaction. If holders of Common Stock are given any choice as to the securities, cash or property to be received in a Fundamental Transaction, then the Holder shall be given the same choice as to the consideration it receives upon any exercise of this Warrant following such Fundamental Transaction. The provisions of this Section shall apply similarly and equally to successive Fundamental Transactions and Corporate Events and shall be applied without regard to any limitations on the exercise of this Warrant.