AMENDED AND RESTATED OPERATING AGREEMENT

OF

TEKOIL AND GAS GULF COAST, LLC

formerly known as MASTERS ACQUISITION CO., LLC

May 11, 2007

THE MEMBERSHIP INTERESTS CREATED BY THIS OPERATING AGREEMENT ARE NOT INTENDED TO CONSTITUTE SECURITIES. TO THE EXTENT THESE MEMBERSHIP INTERESTS ARE CONSTRUED TO BE SECURITIES, THEN SUCH SECURITIES REPRESENTED BY THIS OPERATING AGREEMENT HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, NOR REGISTERED NOR QUALIFIED UNDER ANY STATE SECURITIES LAWS. SUCH SECURITIES MAY NOT BE OFFERED FOR SALE, SOLD, DELIVERED AFTER SALE, TRANSFERRED, PLEDGED, OR HYPOTHECATED UNLESS QUALIFIED AND REGISTERED UNDER APPLICABLE STATE AND FEDERAL SECURITIES LAWS OR UNLESS, IN THE OPINION OF COUNSEL SATISFACTORY TO THE COMPANY, SUCH QUALIFICATION AND REGISTRATION IS NOT REQUIRED. ANY TRANSFER OF ANY SECURITIES REPRESENTED BY THIS OPERATING AGREEMENT IS FURTHER SUBJECT TO OTHER RESTRICTIONS, TERMS AND CONDITIONS.

AMENDED AND RESTATED OPERATING AGREEMENT

OF

TEKOIL AND GAS GULF COAST, LLC

formerly known as MASTERS ACQUISITION CO., LLC

In accordance with the Delaware Limited Liability Company Act and subject to the Certificate of Formation, which was filed on January 17, 2007 with the Delaware Secretary of State, the members listed on Exhibit A, and such other persons or entities who from time to time are signatories hereto (the "Members"), adopt the following Amended and Restated Operating Agreement (this "Agreement") regarding the conduct of the business and affairs of Tekoil and Gas Gulf Coast, LLC, a Delaware limited liability company formerly known as Masters Acquisition Co., LLC (the "Company").

WITNESSETH:

WHEREAS, Tekoil & Gas Corporation, a Delaware corporation ("Tekoil"), as the sole member of the Company, formed the Company as a limited liability company named "Masters Acquisition Co., LLC" under the Delaware Limited Liability Company Act;

WHEREAS, Tekoil, as the sole member of the Company, adopted an Operating Agreement on January 17, 2007 (the "Original Agreement"), in order to set forth the regulations, terms and conditions under which the Company would be operated;

WHEREAS, on January 26, 2007, the Company effected a name change, changing the name of the Company to "Tekoil and Gas Gulf Coast, LLC";

WHEREAS, effective as of the date hereof, in connection with that certain Credit Facility (as defined below), the Company is issuing to Goldman, Sachs & Co. ("Goldman") a Membership Interest (as defined below) having the Membership Percentage (as defined below) set forth next to Goldman's name on Exhibit A hereto and is admitting Goldman as a member of the Company; and

WHEREAS, the Members now desire to amend and restate the Original Agreement in its entirety and set forth herein the regulations, terms, and conditions under which the Company will be operated by adopting this Agreement.

NOW, THEREFORE, set forth below are the regulations, terms and conditions of the operation of the Company.

ARTICLE I - DEFINED TERMS; EXHIBITS, ETC.

1.1 Definitions. As used in this Agreement, the following terms shall have the respective meanings indicated below:

"Act" means the Delaware Limited Liability Company Act, as the same may be amended from time to time.

"Adjusted Capital Account Deficit" means, with respect to any Member, the deficit balance, if any, in such Member's Capital Account as of the end of the relevant Fiscal Year, after giving effect to the following adjustments:

(a) Decrease such deficit by any amounts which such Member is obligated or deemed obligated to restore pursuant to this Agreement or the penultimate sentence of each of Regulation Sections 1.704-2(g)(1) and 1.704-2(i)(5). For these purposes, a Member is obligated to restore an amount to the Company to the extent (i) the Member is unconditionally obligated to restore part or all of its negative Capital Account balance in the manner described in Regulation Section 1.704-1(b)(2)(ii)(b)(3), or (ii) the Member is unconditionally obligated to contribute capital to the Company; and

(b) Increase such deficit by the items described in Regulation Section 1.704-1(b)(2)(ii)(d)(4), (5) and (6).

The foregoing definition of Adjusted Capital Account Deficit is intended to comply with the provisions of Regulation Section 1.704-1(b)(2)(ii)(d) and shall be interpreted consistently therewith.

"Affiliate" means any Person who or which, directly or indirectly, through one or more intermediaries, controls or is controlled by, or is under common control with an entity (the term "control" for purposes of this definition meaning the ability, whether by ownership of shares or other equity interests, by contract or otherwise, to elect a majority of the directors of a corporation, to select the managing or general partner of a partnership, or otherwise to select, or have the power to remove and then select, a majority of those Persons exercising governing authority over an entity).

"Agreement" means this Amended and Restated Operating Agreement, as originally executed and as amended, modified, supplemented or restated from time to time, as the context requires.

"Bankrupt Member" means any Member (a) that (i) makes a general assignment for the benefit of creditors; (ii) files a voluntary bankruptcy petition; (iii) becomes the subject of an order for relief or is declared insolvent in any federal or state bankruptcy or insolvency proceedings; (iv) files a petition or answer seeking for the Member a reorganization, arrangement, composition, readjustment, liquidation, dissolution, or similar relief under any law; (v) files an answer or other pleading admitting or failing to contest the material allegations of a petition filed against the Member in a proceeding of the type described in subclauses (i) through (iv) of this clause (a); or (vi) seeks, consents to, or acquiesces in the appointment of a trustee, receiver, or liquidator of the Member's or of all or any substantial part of the Member's properties; or (b) against which, a proceeding seeking reorganization, arrangement, composition, readjustment, liquidation, dissolution, or similar relief under any law has been commenced and sixty (60) days have expired without dismissal thereof or with respect to which, without the Member's consent or acquiescence, a trustee, receiver, or liquidator of the Member or of all or any substantial part of the Member's properties has been appointed and sixty (60) days have expired without the appointments having been vacated or stayed, or sixty (60) days have expired after the date of expiration of a stay, if the appointment has not previously been vacated.

"Business Day" means any day on which banks are open for business in New York, New York.

"Capital Account" means, with respect to any Member, the separate "book" account which the Company shall establish and maintain for each Member in accordance with Section 704(b) of the Code and Regulation Section 1.704-1(b)(2)(iv) and such other provisions of Regulation Section 1.704-1(b) that must be complied with in order for the Capital Accounts to be determined in accordance with the provisions of the Regulations. In furtherance of the foregoing, the Capital Accounts shall be maintained in compliance with Regulation Section 1.704-1(b)(2)(iv), and the provisions hereof shall be interpreted and applied in a manner consistent therewith. For purposes of computing the Members' Capital Accounts, Simulated Depletion Deductions, Simulated Gains and Simulated Losses shall be allocated among the Members in the same proportions as they (or their predecessors in interest) were allocated the basis of Company oil and gas properties pursuant to Code Section 613A(c)(7)(D), the Regulations thereunder and Regulations Section 1.704-1(b)(4)(v). In accordance with Code Section 613A(c)(7)(D), the Regulations thereunder and Regulations Section 1.704-1(b)(4)(v), the adjusted basis of all oil and gas properties shall be allocated among the Members in accordance with their respective Membership Percentages.

"Capital Contribution" means, with respect to each Member, the amount of money and the initial Gross Asset Value of any property (other than money) contributed to the Company by such Member from time to time.

"Certificate" means the Certificate of Formation of the Company filed with the Secretary of State of the State of Delaware, as amended from time to time.

"Code" means the Internal Revenue Code of 1986, as amended, or any replacement or successor law thereto.

"Company Minimum Gain" has the meaning ascribed to partnership minimum gain in Regulation Sections 1.704-2(b)(2) and 1.704-2(d), and any Member's share of Company Minimum Gain shall be determined in accordance with Regulations Section 1.704-2(g)(1).

"Credit Agreement" means that certain Credit Agreement dated as of May 11, 2007 among the Company, Tekoil, the other Guarantors (as defined in the Credit Agreement), the Lenders (as defined in the Credit Agreement), J. Aron & Company as Lead Arranger and Syndication Agent, and J. Aron & Company as Administrative Agent, pursuant to which Lenders have agreed to extend the Credit Facility to the Company.

"Credit Facility" means a senior secured credit facility, governed by the Credit Agreement consisting of a fifty million dollar ($50,000,000.00) term loan.

"Depreciation" means, for each Fiscal Year or other period, an amount equal to the depreciation, amortization or other cost recovery deduction allowable for federal income tax purposes with respect to an asset for such year or other period in accordance with the depreciation method elected by the Company with respect to such asset, except that if the Gross Asset Value of an asset differs from its adjusted basis for federal income tax purposes at the beginning of such year or other period, Depreciation shall be an amount which bears the same ratio to such beginning Gross Asset Value as the federal income tax depreciation, amortization or other cost recovery deduction allowable for such year or other period bears to such beginning adjusted tax basis or as otherwise required under Section 1.704-1(b)(2)(iv)(g)(3) of the Regulations, or, in the reasonable discretion of the Managing Member, as otherwise permitted thereunder.

"Distributable Cash" means, with respect to any Fiscal Year or other applicable period, the excess, if any, as determined by the Managing Member, of (a) all cash of the Company from all sources for such period, including, without limitation, receipts from operations, contributions of capital by the Members, proceeds of borrowing or from the issuance of securities by the Company, deposits and all other Company cash sources and all Company cash reserves on hand at the beginning of such period over (b) all cash expenses and capital expenditures of the Company for such period, all payments of principal and interest on account of Company indebtedness (including any loans by any Member) and such cash reserves as the Managing Member determines in its discretion (or those mandated by law, contract or the Company's debt instruments).

"Entity" means any corporation, partnership (general, limited or other), limited liability company, company, trust, business trust, cooperative or association.

"Event of Bankruptcy" means any event that causes a Member to be deemed a Bankrupt Member.

"Fiscal Year" means the twelve-month period ending on December 31 of each year.

"Gross Asset Value" means, with respect to any asset of the Company, the adjusted basis of such asset for federal income tax purposes, except as follows:

(a) The Gross Asset Value of any asset contributed by a Member to the Company shall, as of the date of such contribution and subject to further adjustment as herein provided, be the gross fair market value of such asset, as agreed upon by the contributing Member and all other Members.

(b) The Gross Asset Values of all Company assets (including assets contributed to the Company) shall be adjusted to equal their respective gross fair market values, as reasonably determined by the Managing Member, as of each of the following times: (i) the acquisition of an additional Membership Interest by any new or existing Member in exchange for more than a de minimis Capital Contribution; (ii) the distribution by the Company to a Member of more than a de minimis amount of Company property or cash in consideration of the redemption, or partial redemption, of the Membership Interest of the Member or Members to whom such distribution shall be made if, in connection therewith, the Managing Member reasonably determines that such adjustment is necessary or appropriate to reflect the relative economic interests of the Members in the Company; and (iii) the liquidation of the Company within the meaning of Regulation Section 1.704-1(b)(2)(ii)(g).

(c) The Gross Asset Value of any Company asset distributed to any Member shall be the gross fair market value of such asset on the date of distribution as determined by all Members.

(d) The Gross Asset Value of any Company assets shall be increased (or decreased) to reflect any adjustments to the adjusted basis of such assets pursuant to Code Section 734(b) or Code Section 743(b), but only to the extent that such adjustments are taken into account in determining Capital Accounts pursuant to Regulation Section 1.704-1(b)(2)(iv)(m); provided, however, that Gross Asset Values shall not be adjusted to the extent the Managing Member determines that an adjustment pursuant to subparagraph (b) above is necessary or appropriate in connection with a transaction that would otherwise result in an adjustment pursuant to this subparagraph (d).

If the Gross Asset Value of an asset has been determined or adjusted pursuant to any of the foregoing, such Gross Asset Value shall thereafter be adjusted by the Depreciation or Simulated Depletion Deductions taken into account with respect to such asset for purposes of computing Net Income and Net Losses.

"Incapacitated" shall mean the inability, by reason of a reasonably verifiable physical or mental disability, of a person to perform such person's assigned duties to the Company, on a full-time basis, for a continuous period of 120 days or for an aggregate of 180 days in any 365 day period.

"Investment" shall mean (i) with respect to Tekoil, the sum of (A) $27,182,542 plus (B) the aggregate amount of all Excess Capital Contributions made by Tekoil pursuant to Section 3.3(c) and (ii) with respect to Goldman, the sum of (C) $9,060,847 plus (D) the aggregate amount of all Excess Capital Contributions made by Goldman pursuant to Section 3.3(c).

"Liquidating Trustee" means such Person as is selected at the time of dissolution by the Managing Member, which Person may include an Affiliate of the Managing Member or any Member. The Liquidating Trustee shall be empowered to give and receive notices, reports and payments in connection with the dissolution, liquidation and/or winding-up of the Company and shall hold and exercise such other rights and powers as are necessary or required to permit all parties to deal with the Liquidating Trustee in connection with the dissolution, liquidation, and/or winding-up of the Company.

"Managing Member" means the managing member of the Company as appointed in Section 7.1 of this Agreement.

"Member Nonrecourse Debt" has the meaning ascribed to partner nonrecourse debt in Regulation Section 1.704-2(b)(4).

"Member Nonrecourse Debt Minimum Gain" means an amount, with respect to each Member Nonrecourse Debt, equal to the Company Minimum Gain that would result if such Member Nonrecourse Debt was treated as a Nonrecourse Liability, determined in accordance with Regulation Sections 1.704-2(i)(2) and (3).

"Member Nonrecourse Deductions" has the meaning ascribed to partner nonrecourse deductions in Regulation Sections 1.704-2(i)(1) and 1.704-2(i)(2).

"Members" means the Persons listed on Exhibit A attached hereto and incorporated herein by reference, as the same shall be amended from time to time, who have been admitted to the Company in accordance with this Agreement and other Persons who become signatories hereto from time to time.

"Membership Interest" means a Member's entire interest in the Company, which shall entitle the Member to (a) an interest in the Net Income, Net Loss, Distributable Cash, and net proceeds of liquidation of the Company, as set forth herein, (b) any right to vote as set forth herein or as required under the Act, and (c) any right to participate in the management of the Company as set forth herein or as required under the Act. A Membership Interest is personal property and a Member shall have no interest in the specific assets or property of the Company.

"Membership Percentage" means, with respect to each Member, such Member's percentage ownership interest in the Company set forth on Exhibit A attached hereto, as may be amended or adjusted from time to time in accordance with Section 3.3(c).

"Net Income" or "Net Loss" shall mean the income or loss for federal income tax purposes determined as of the close of the Company's Fiscal Year or as of such other time as may be required by this Agreement or the Code, as well as, where the context requires, related federal tax items such as tax preferences and credits, appropriately adjusted with respect to final determination of any of the foregoing for federal income tax purposes, and also adjusted as follows:

(a) Any income that is exempt from federal income tax and not otherwise taken into account in computing Net Income or Net Loss shall be added to such taxable income or loss.

(b) Any expenditures described in Section 705(a)(2)(B) of the Code, or treated as Section 705(a)(2)(B) expenditures pursuant to Regulation Section 1.704-1(b)(2)(iv)(i), and not otherwise taken into account in computing Net Income or Net Loss shall be subtracted from such taxable income or loss.

(c) In lieu of depreciation, amortization or other cost recovery deductions taken into account in computing such taxable income or loss, there shall be taken into account Depreciation for such Fiscal Year or other period.

(d) Gain or loss during any Fiscal Year on account of the sale, exchange, condemnation or other disposition of any assets, as determined in accordance with Section 1001 of the Code (or, where applicable, Section 453 of the Code), appropriately adjusted, however, with respect to final determination of the foregoing for federal income tax purposes, and also adjusted as follows:

(i) In the event the Gross Asset Value of any asset is adjusted pursuant to subparagraphs (b) or (c) of the definition of Gross Asset Value, the amount of such adjustment shall be taken into account as though the same constituted gain or loss from the disposition of such asset for purposes of computing Net Income or Net Loss under the provisions of this Agreement.

(ii) Gain or loss, if any, resulting from any disposition of Company assets with respect to which gain or loss is recognized for federal income tax purposes shall be computed by reference to the Gross Asset Value of the property disposed of, notwithstanding that the adjusted tax basis of such property differs from its Gross Asset Value.

(e) Notwithstanding any other provision of this definition, any items that are specially allocated pursuant to Section 4.3 hereof shall not be taken into account in computing Net Income or Net Loss.

"Nonrecourse Deductions" has the meaning set forth in Regulation Section 1.704-2(b)(1).

"Nonrecourse Liability" has the meaning set forth in Regulation Section 1.704-2(b)(3).

"Person" means any natural person or Entity.

"Prime Rate" shall mean the fluctuating rate as reported in the Wall Street Journal or, in the event publication of the Wall Street Journal is terminated, in such successor national financial publication as determined by the Managing Member.

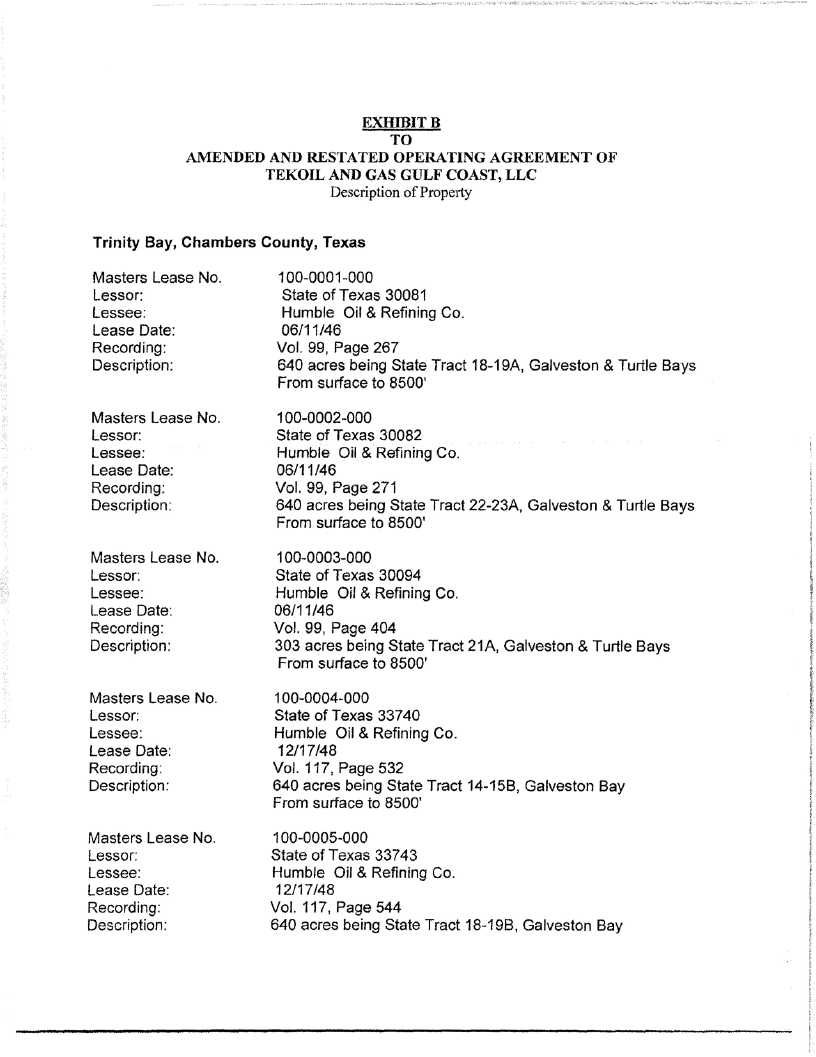

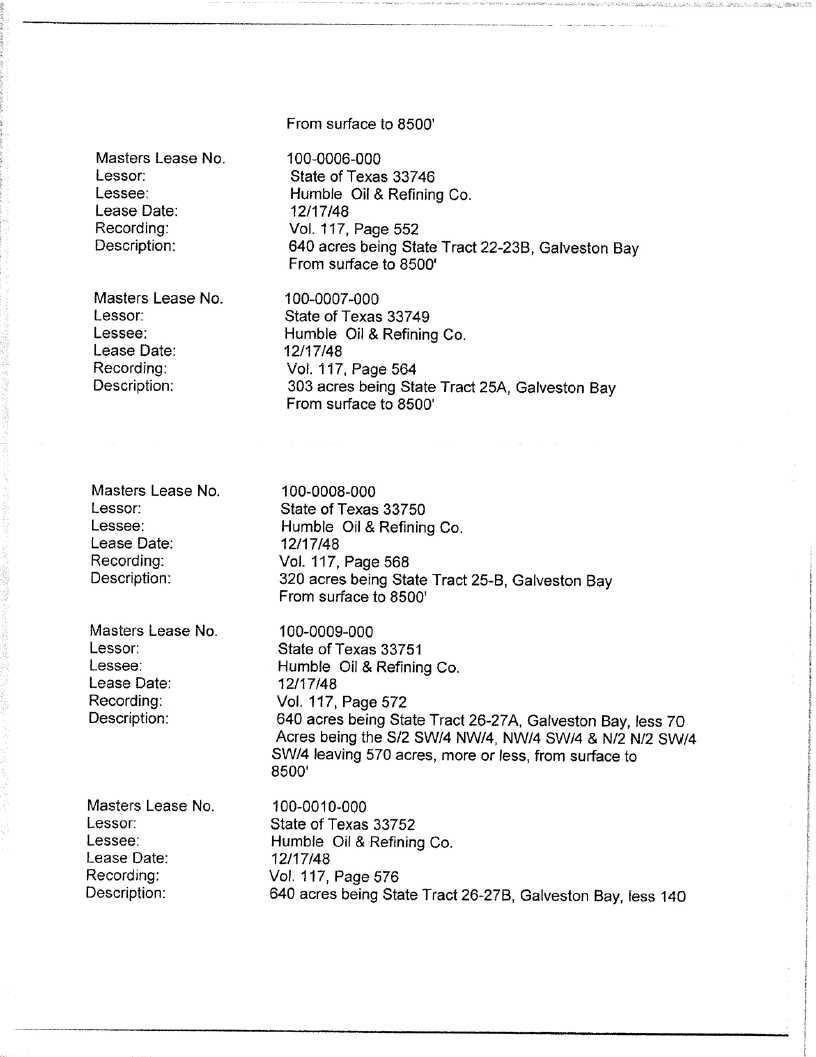

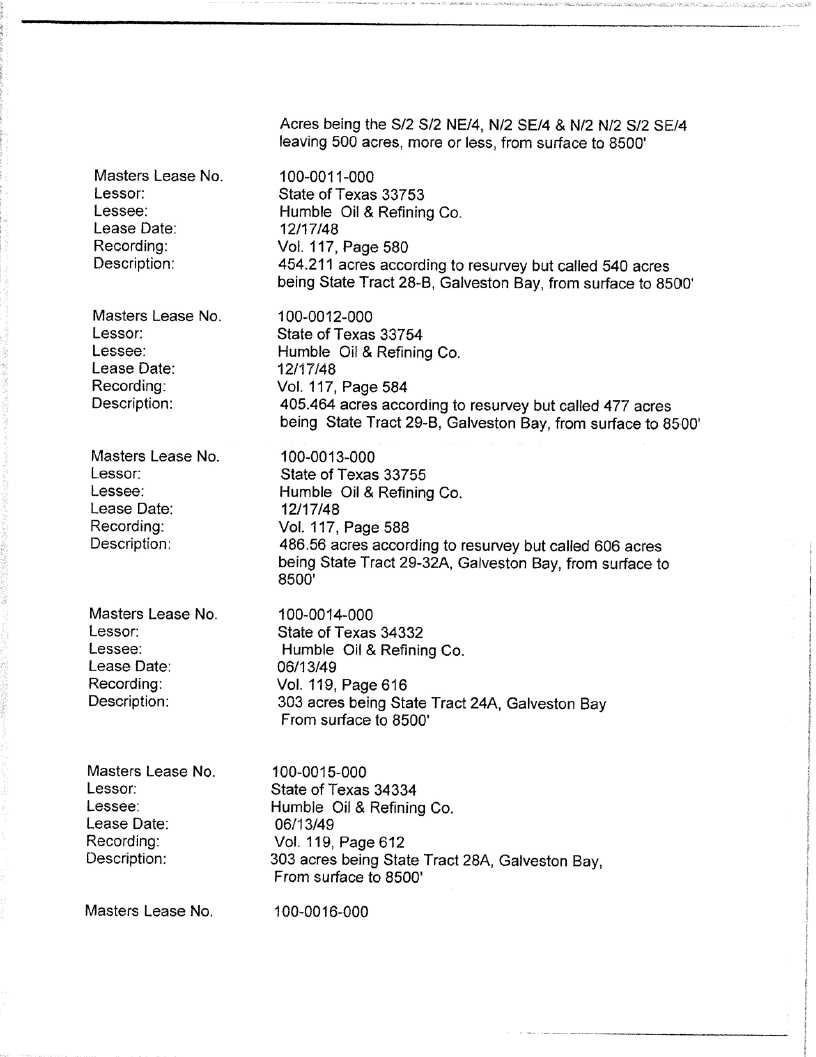

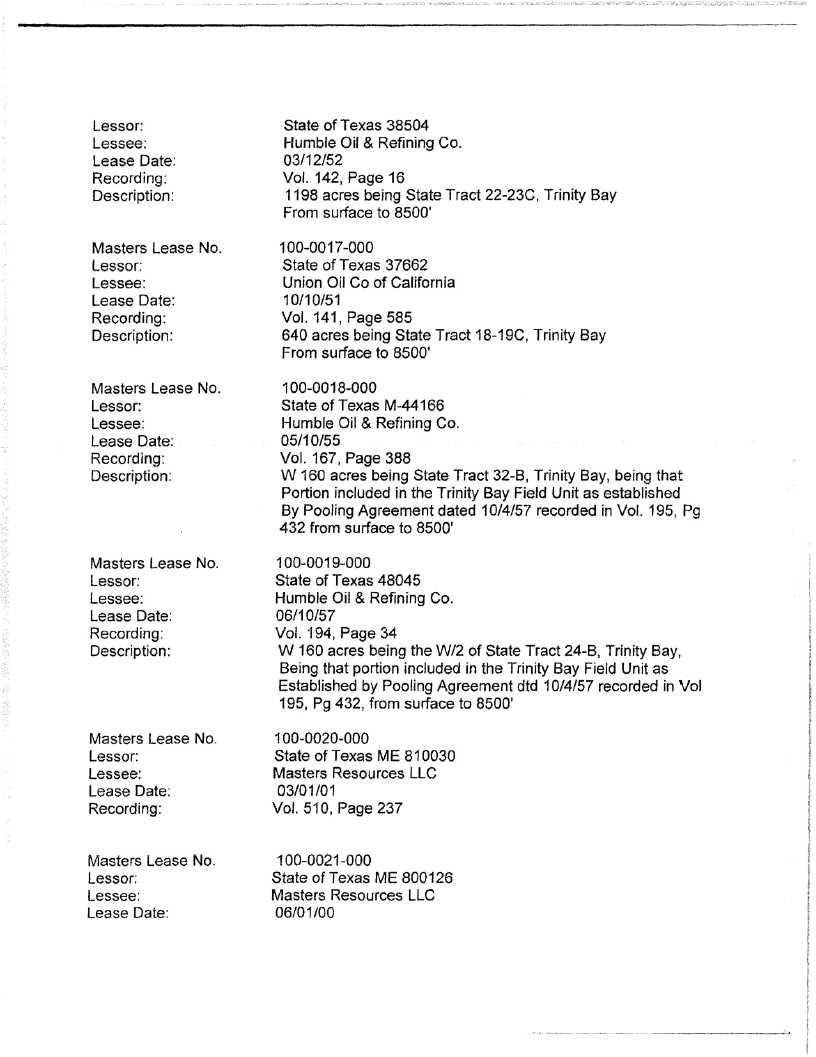

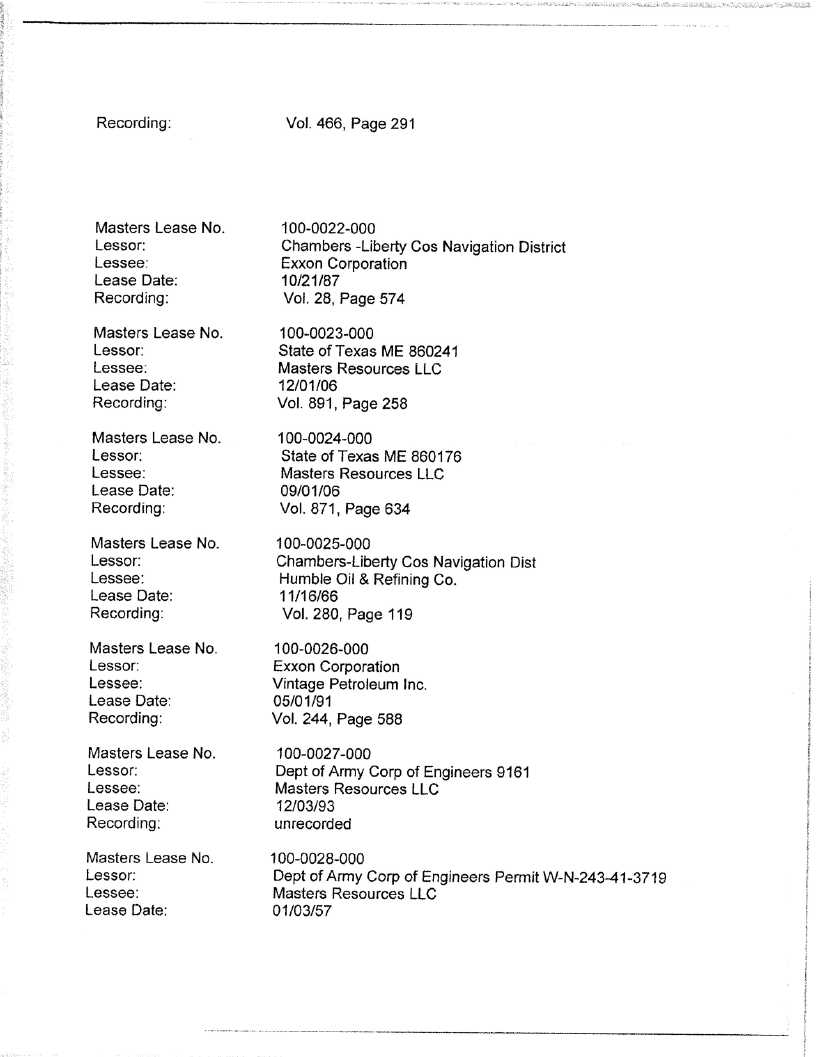

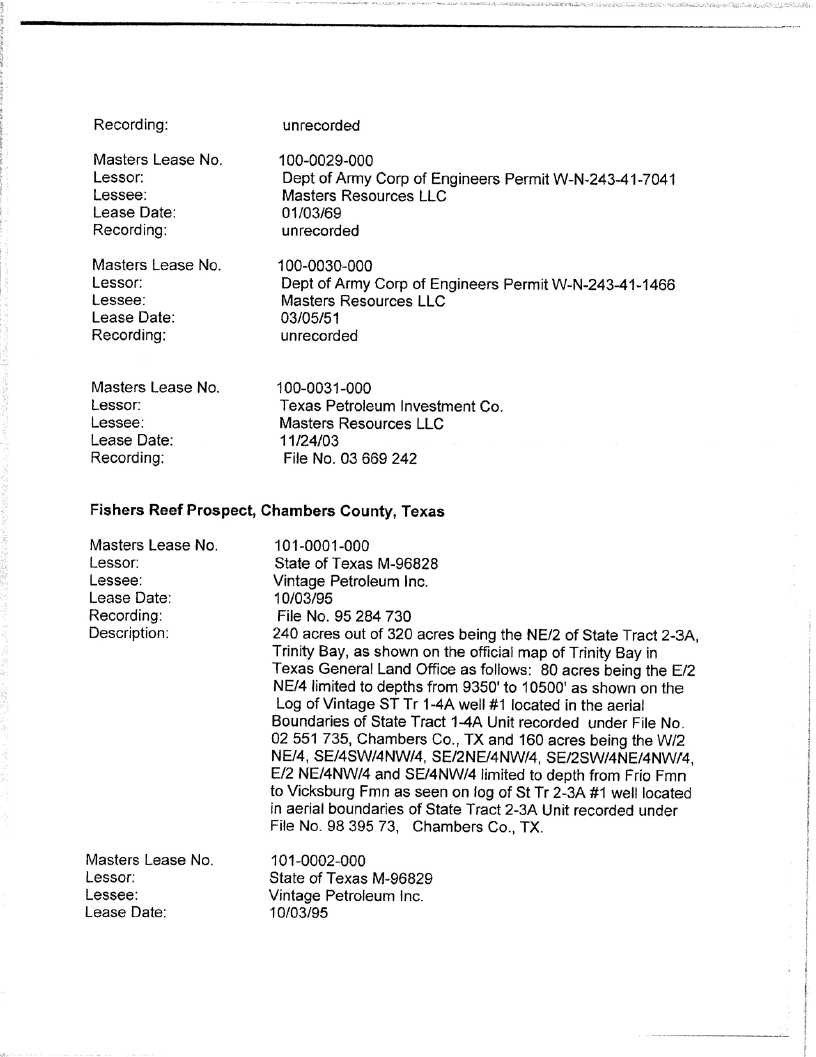

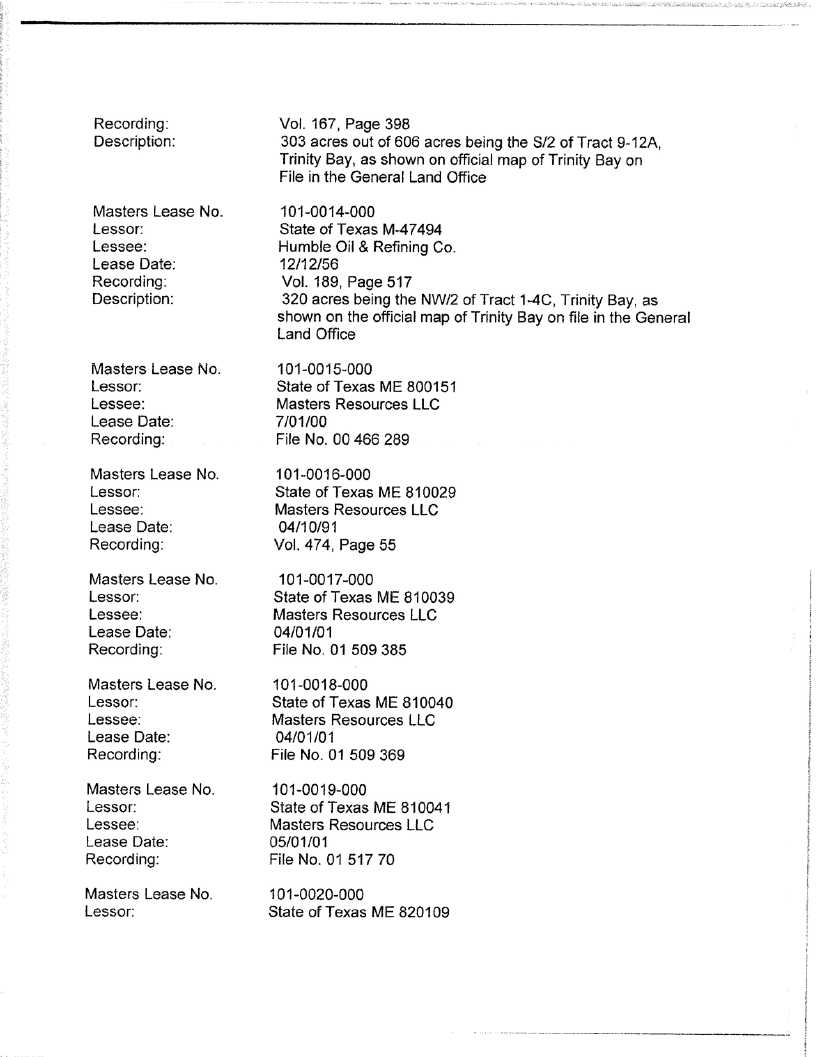

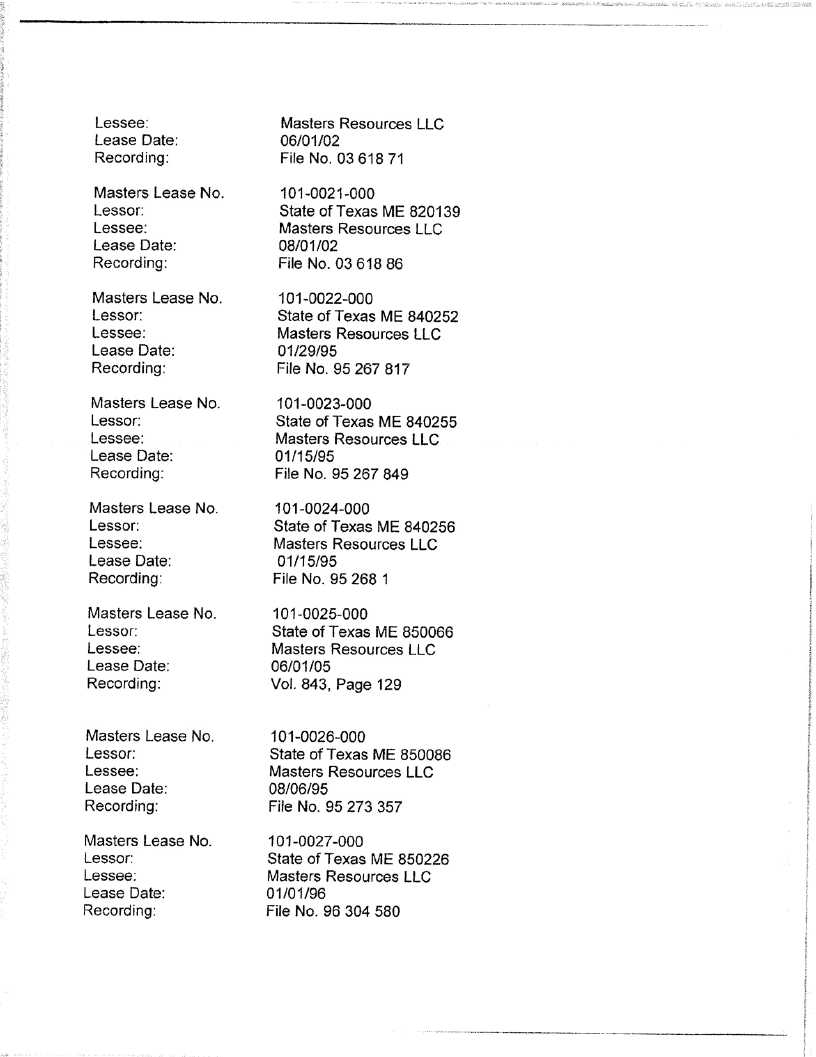

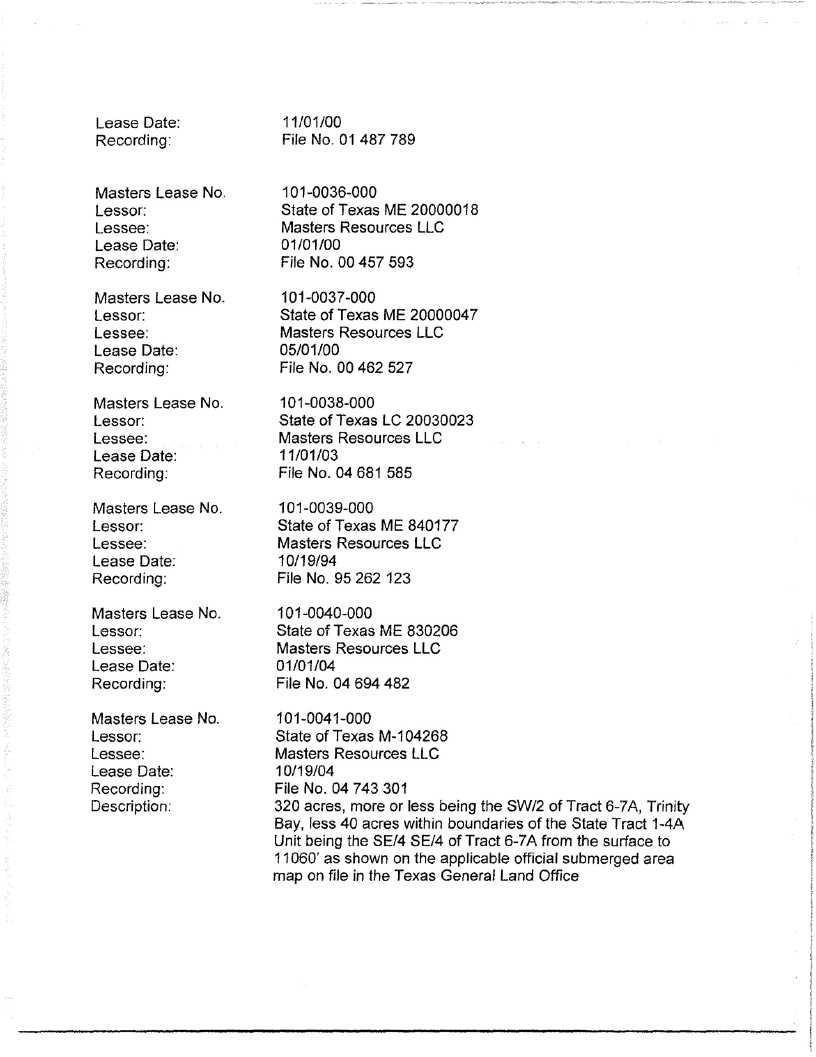

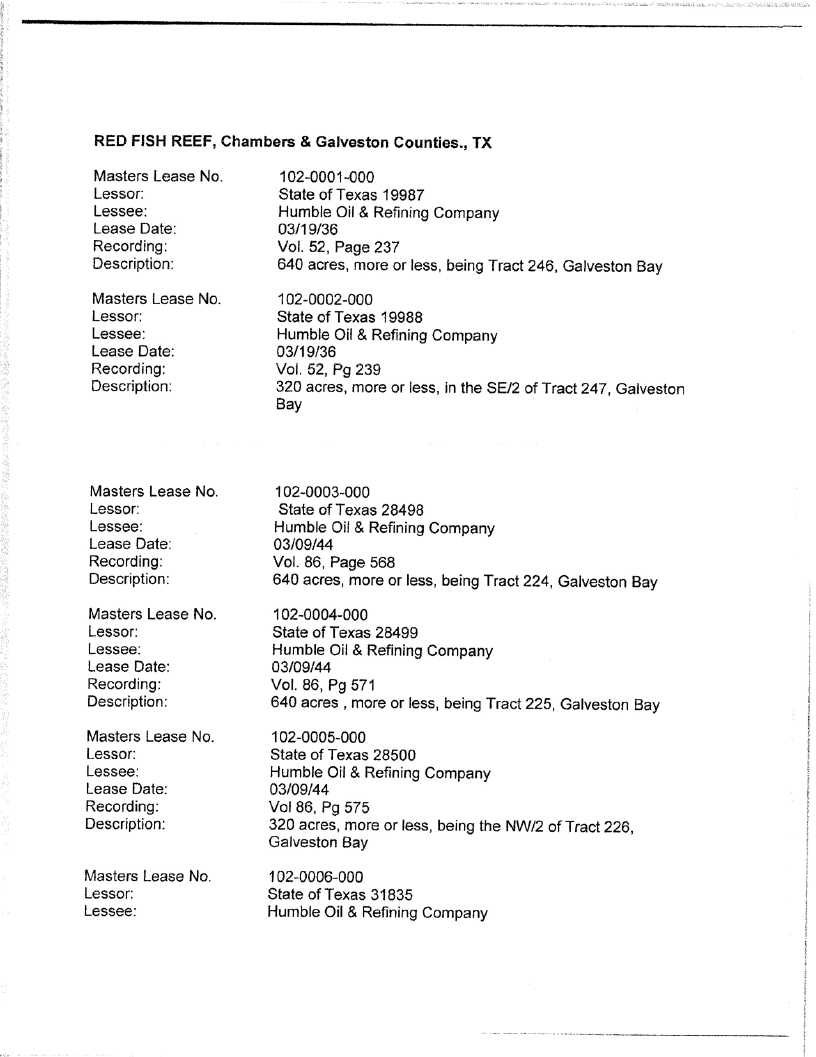

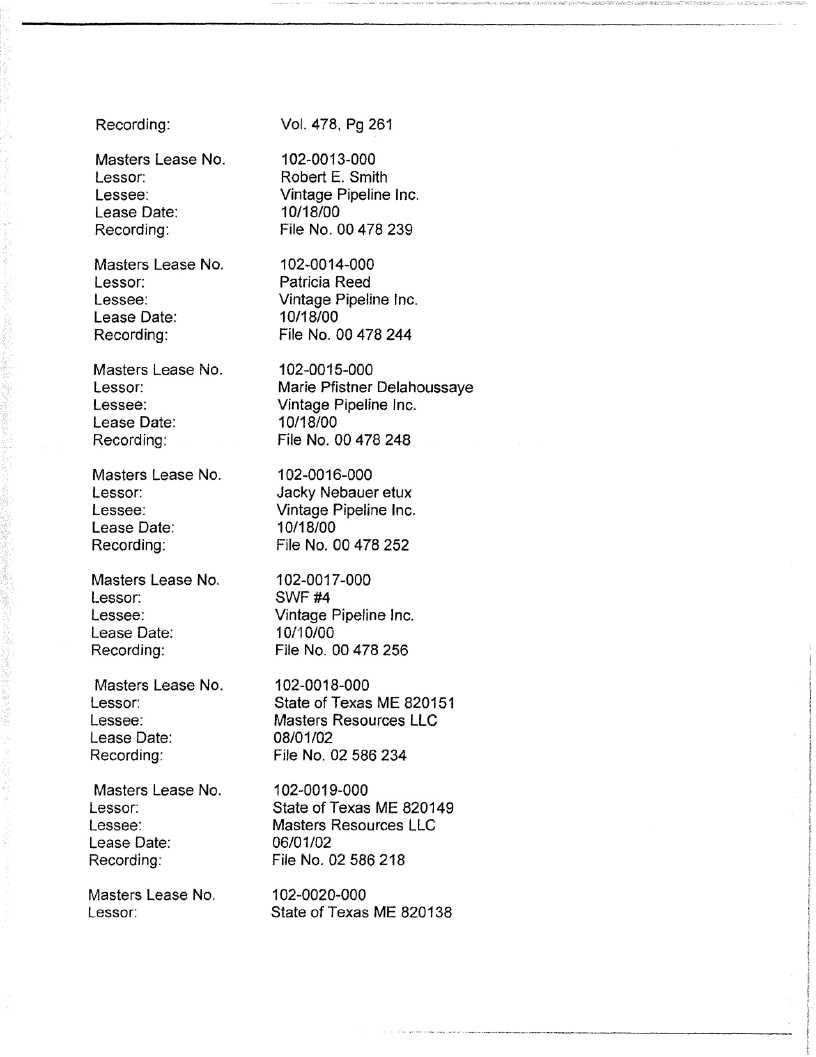

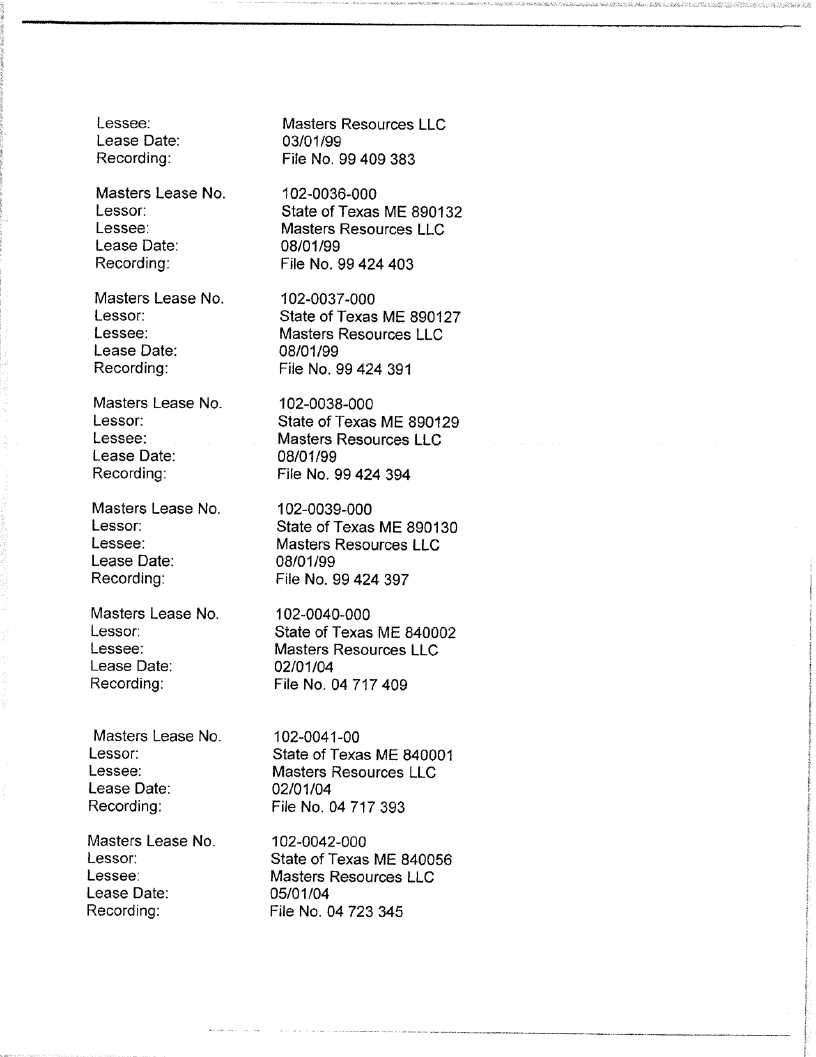

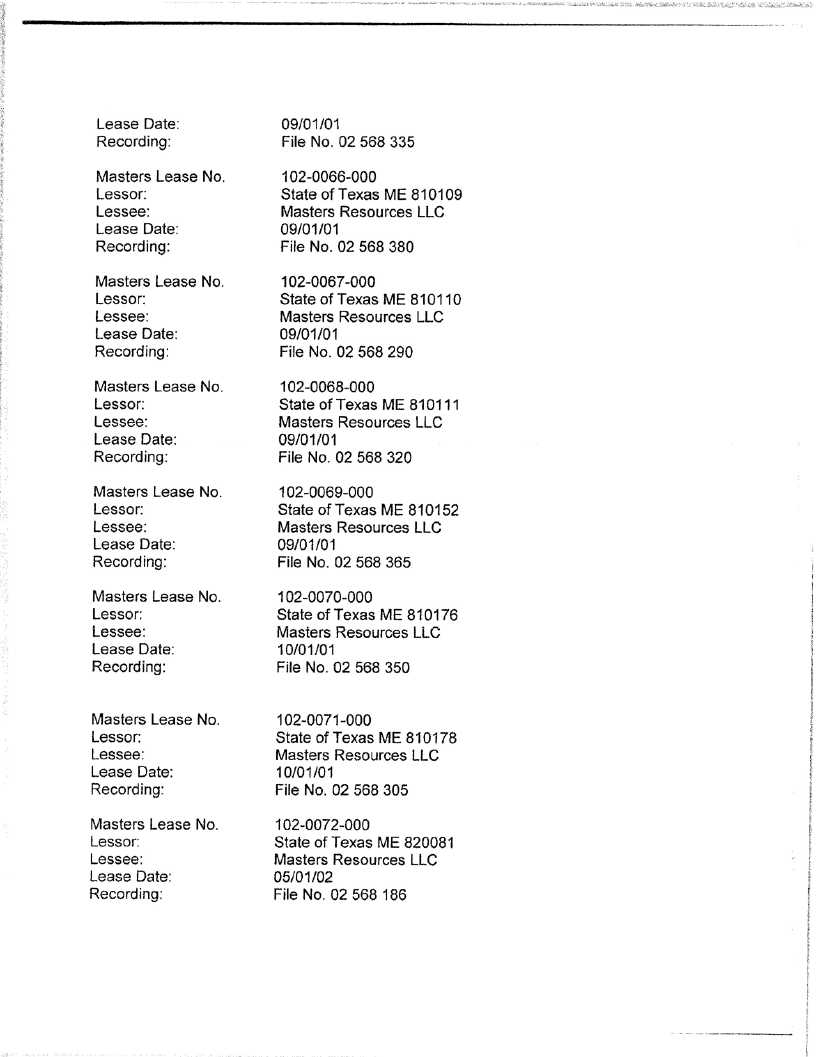

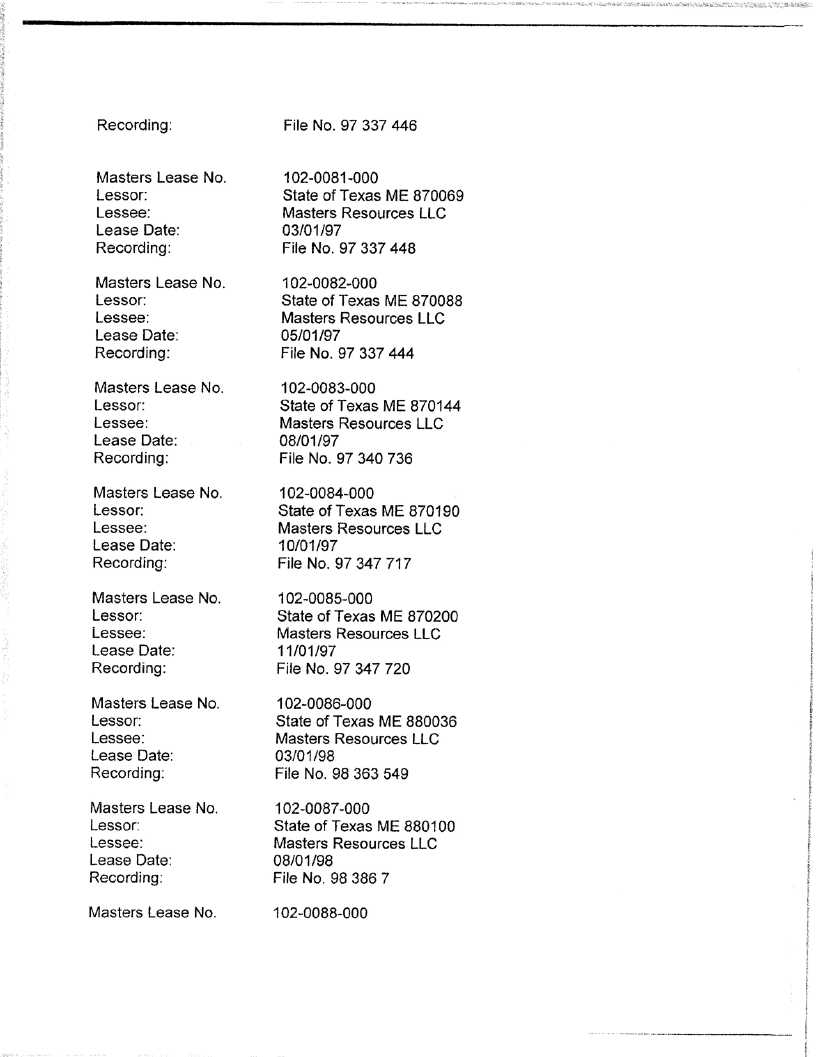

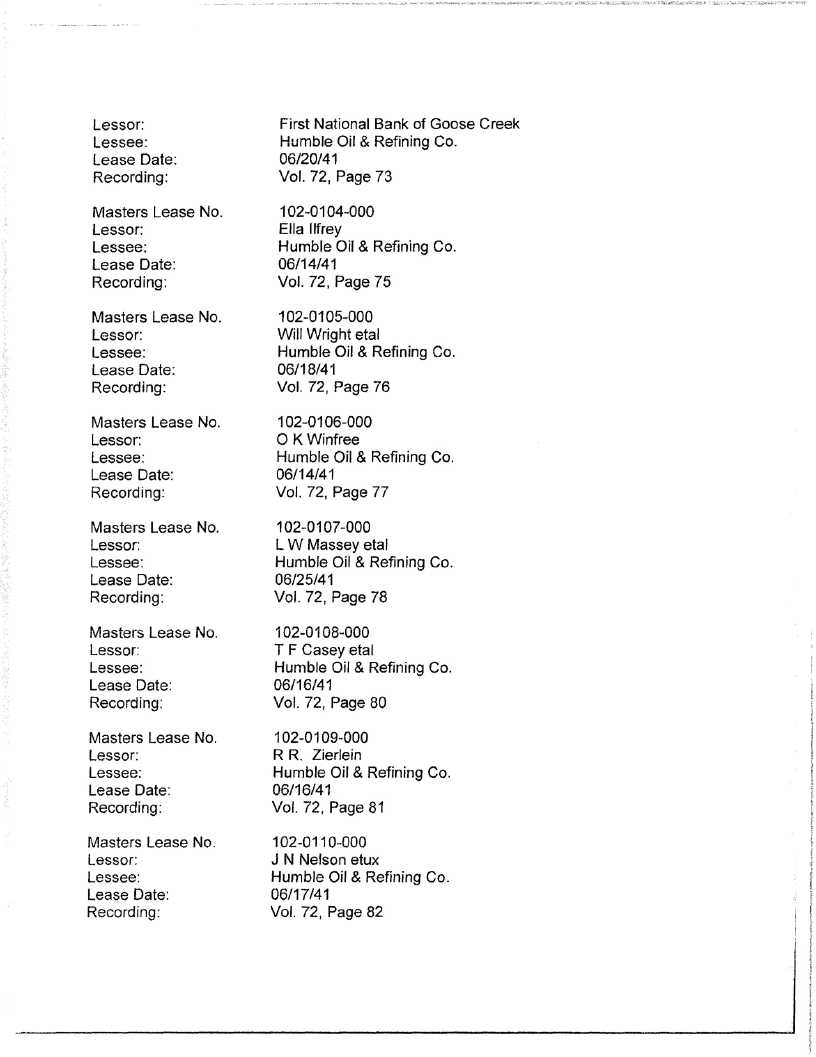

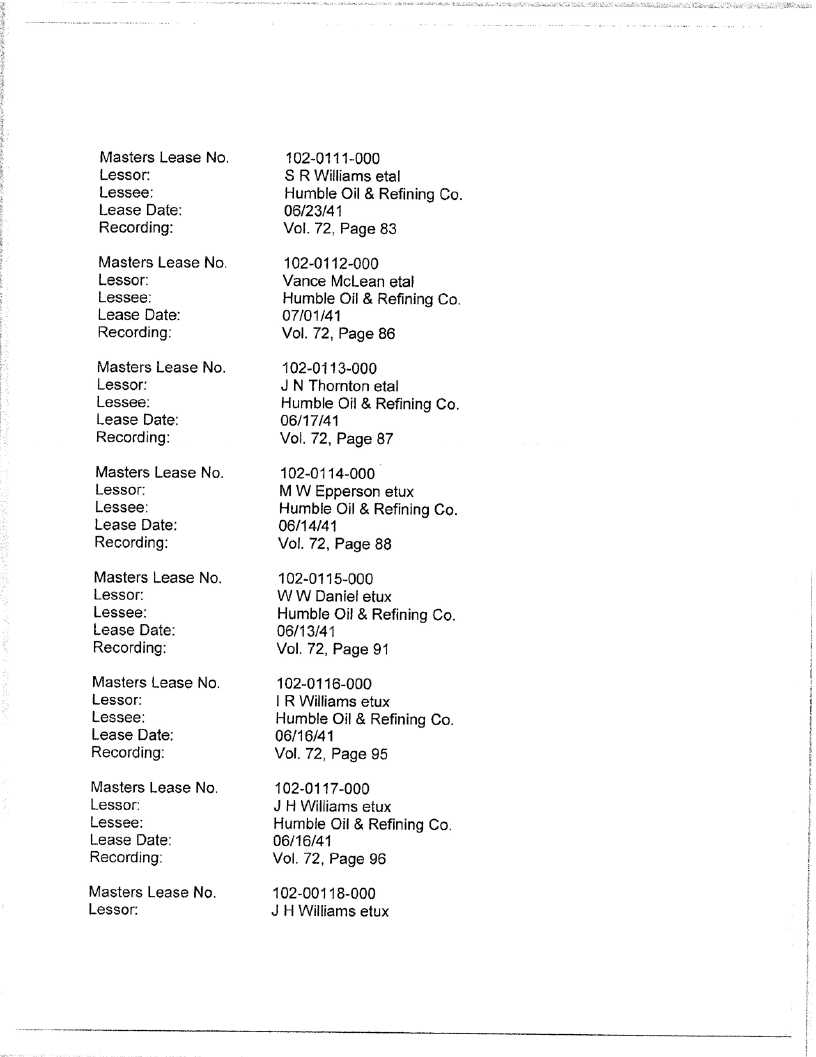

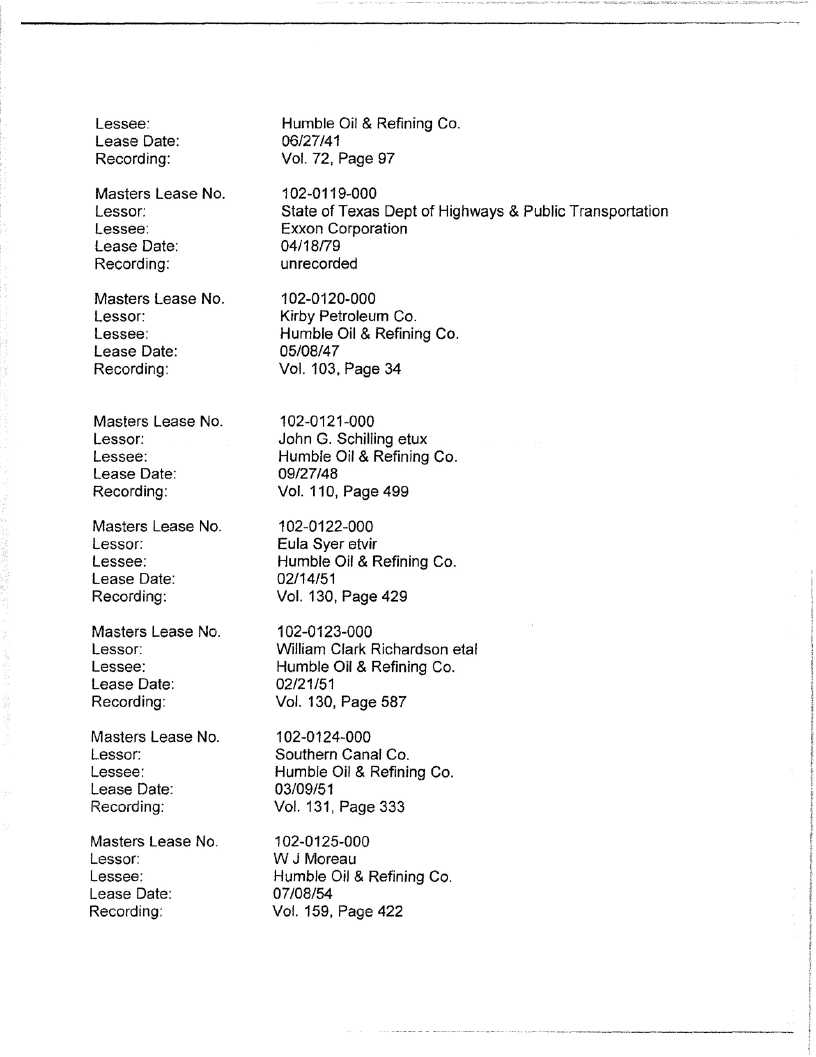

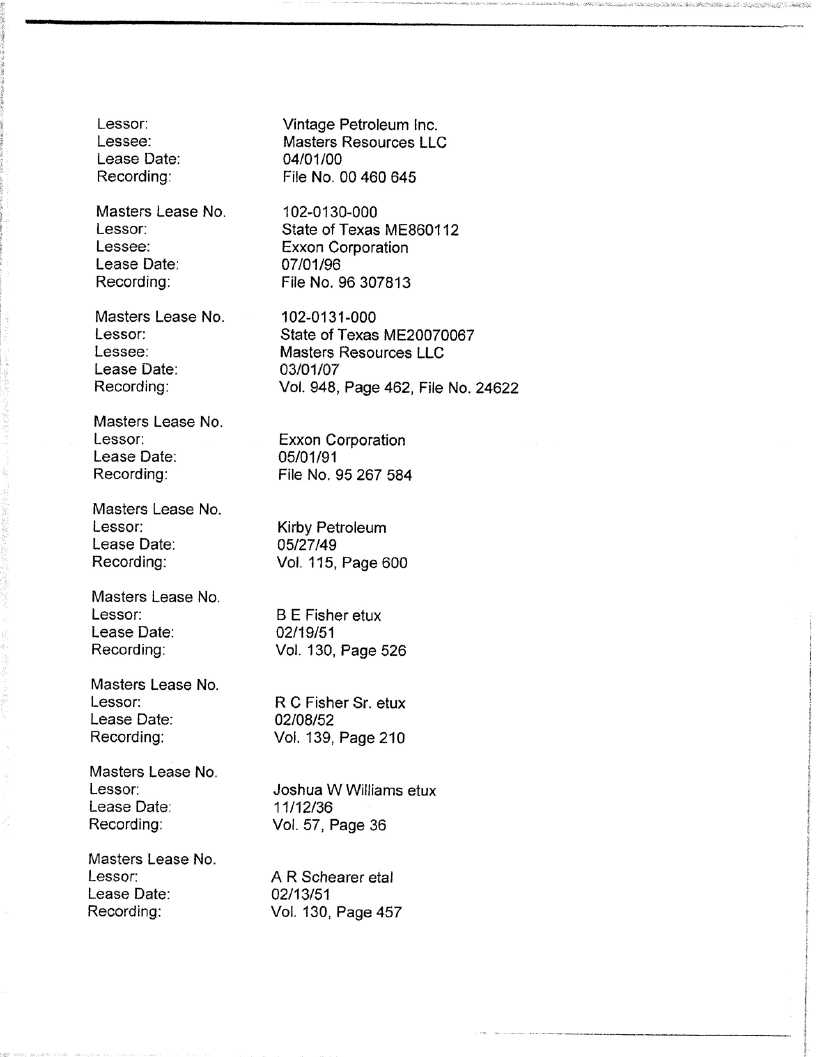

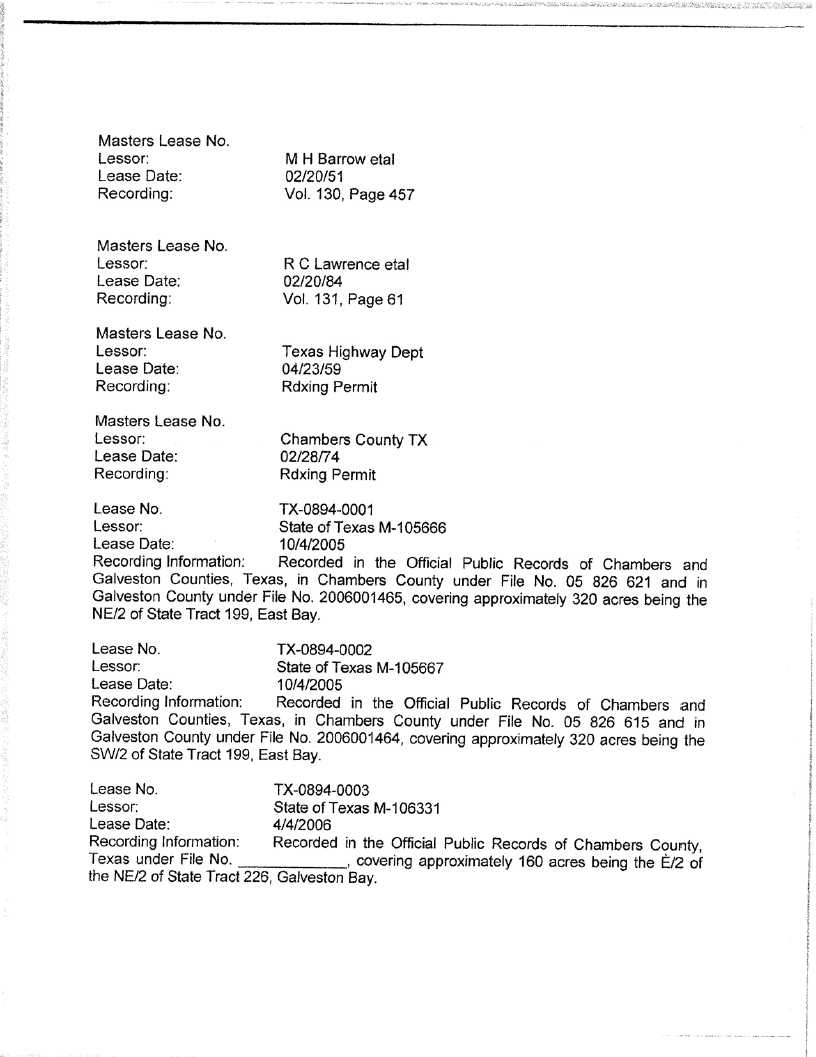

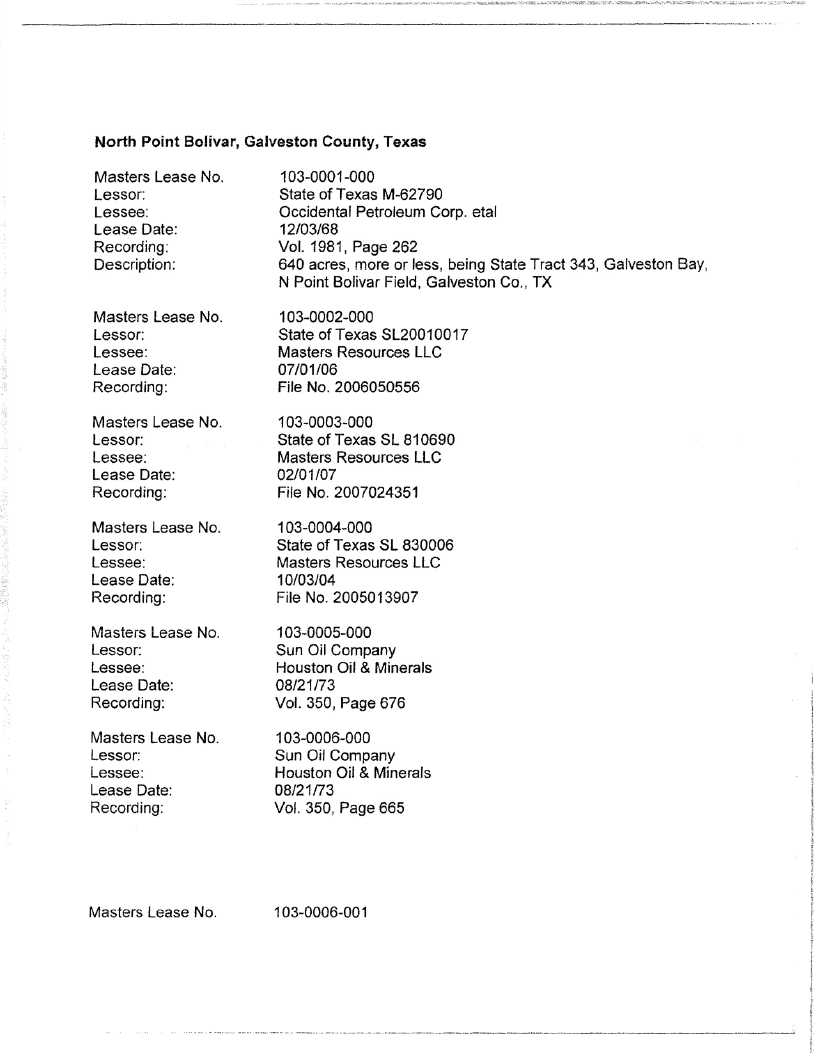

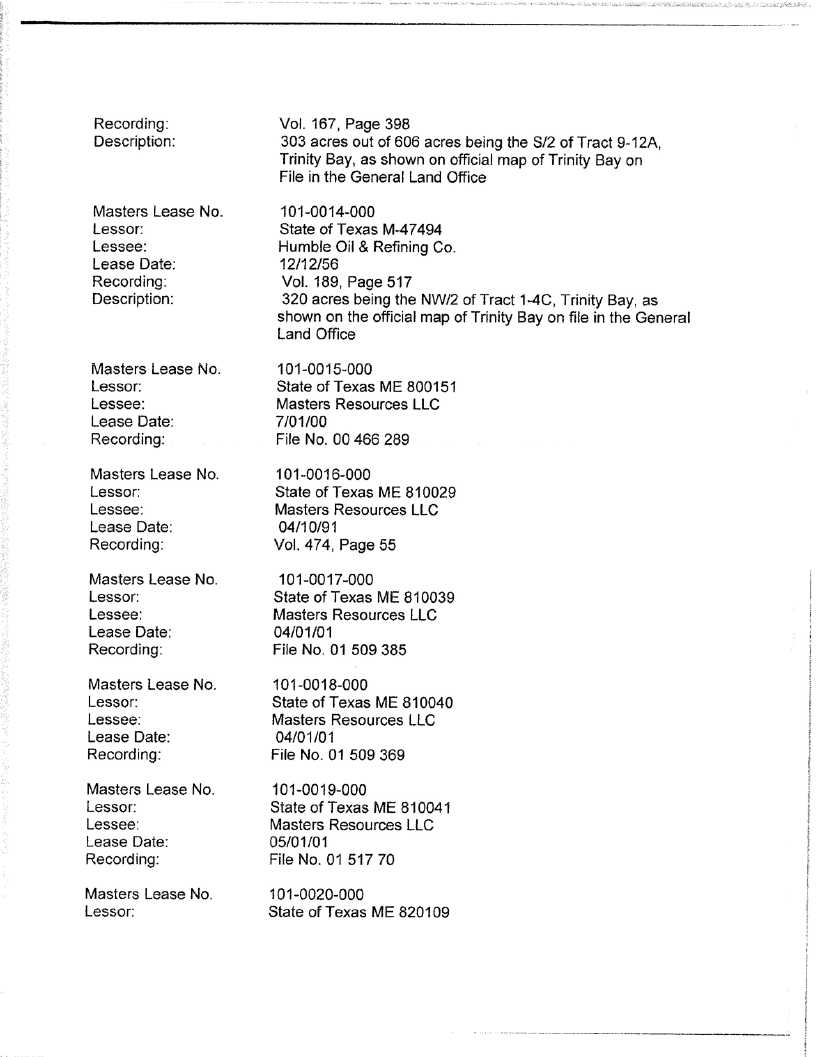

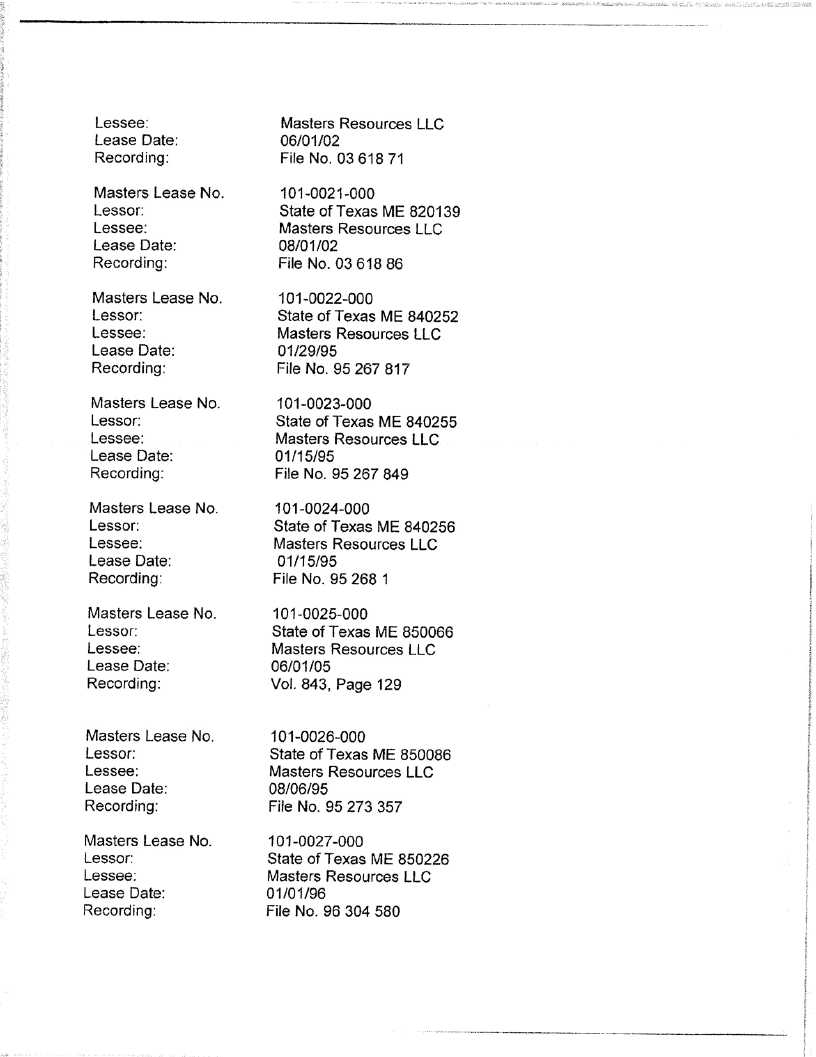

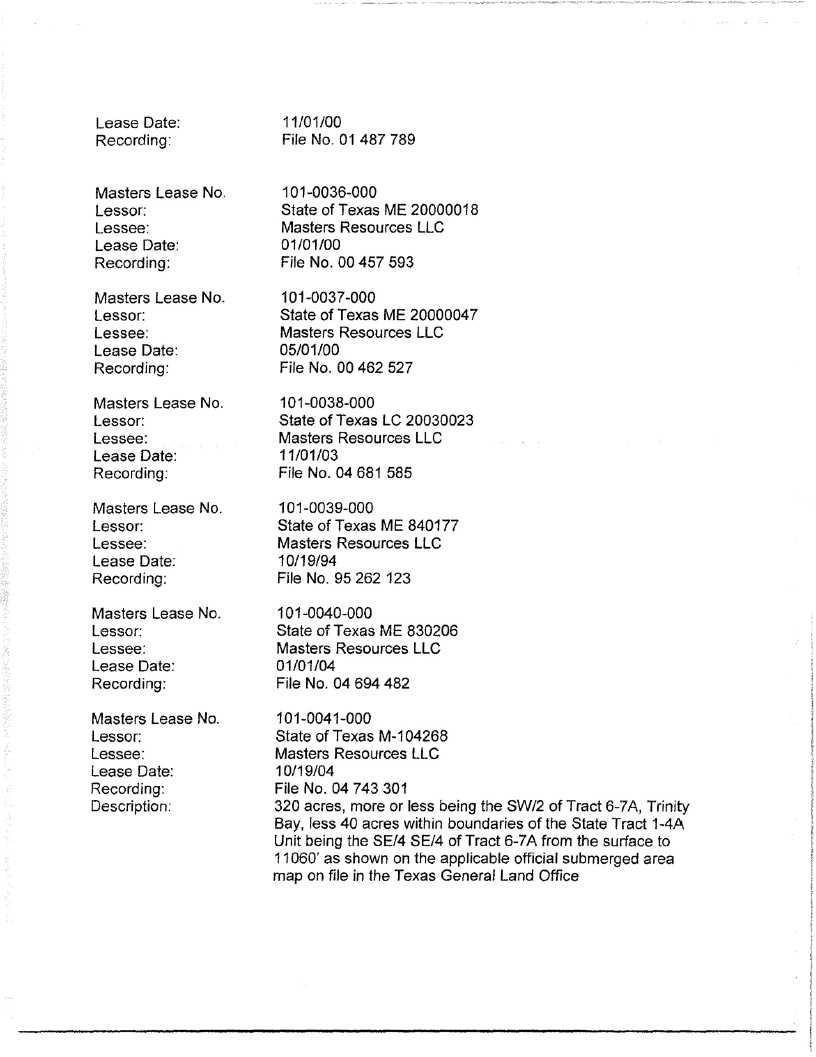

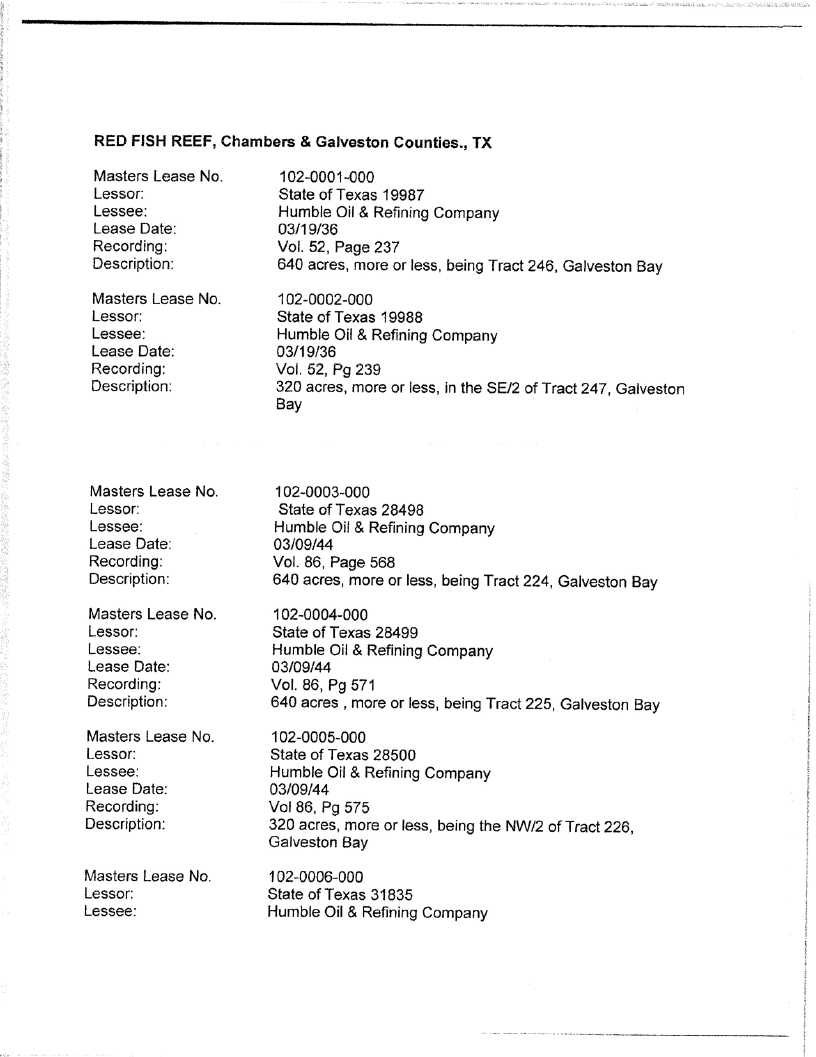

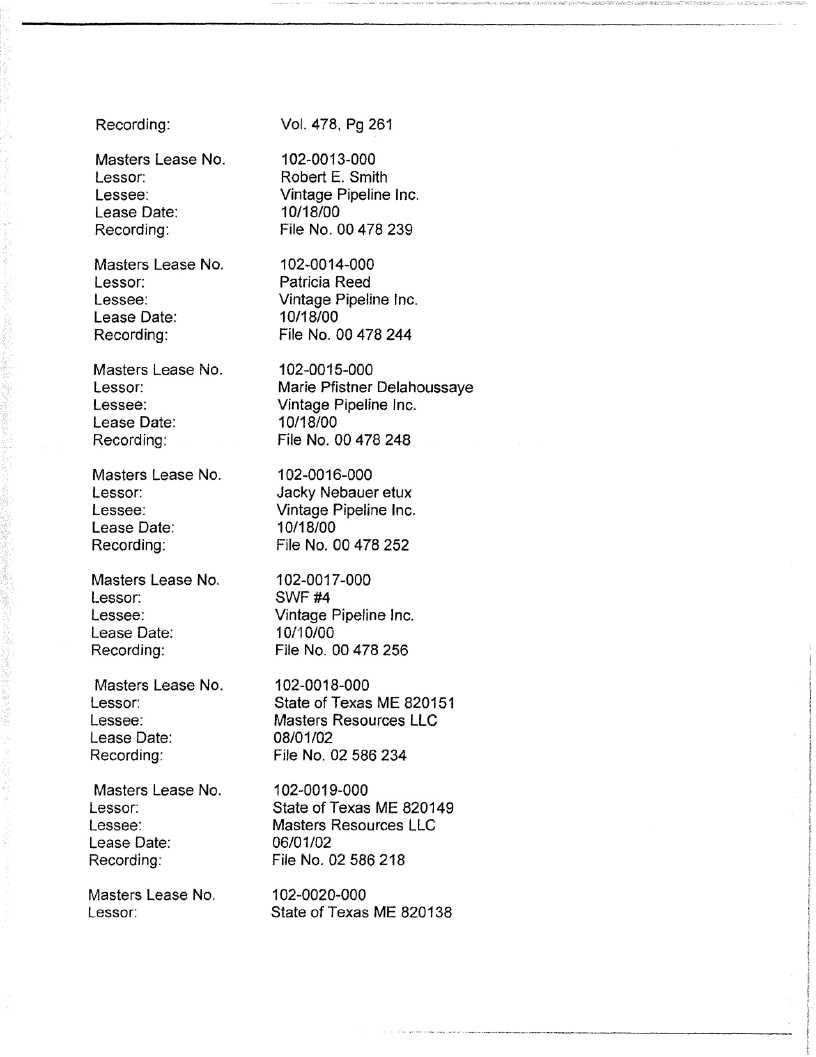

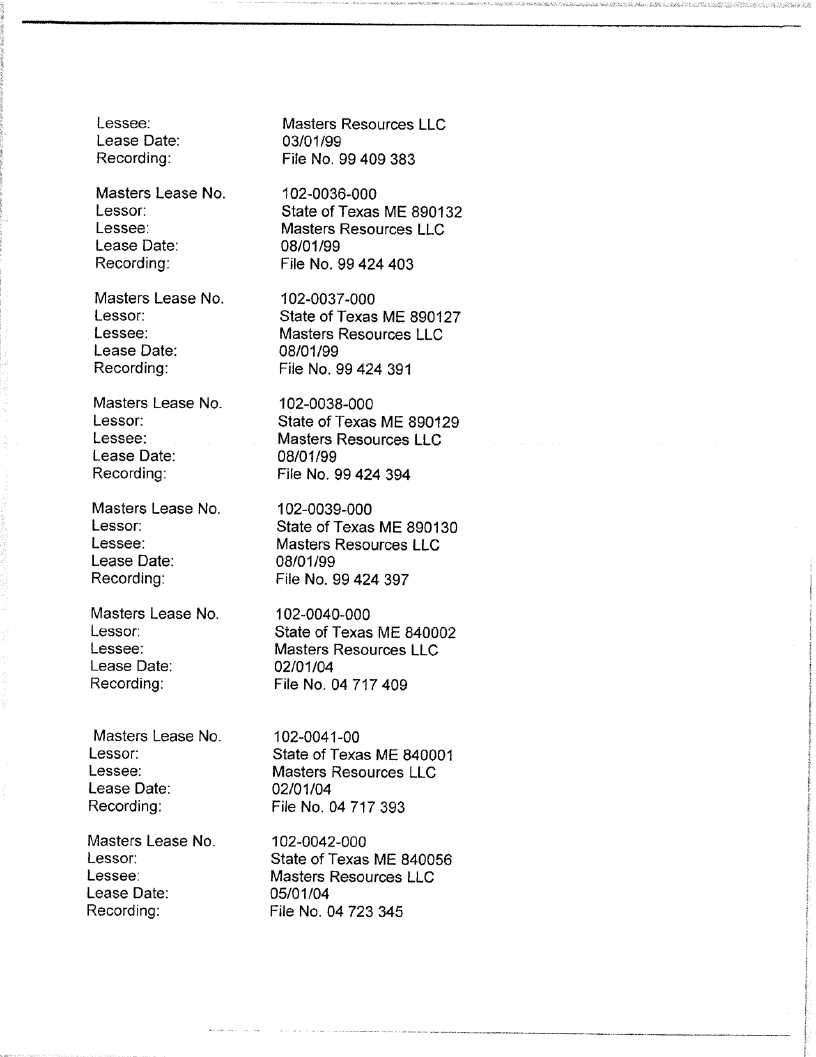

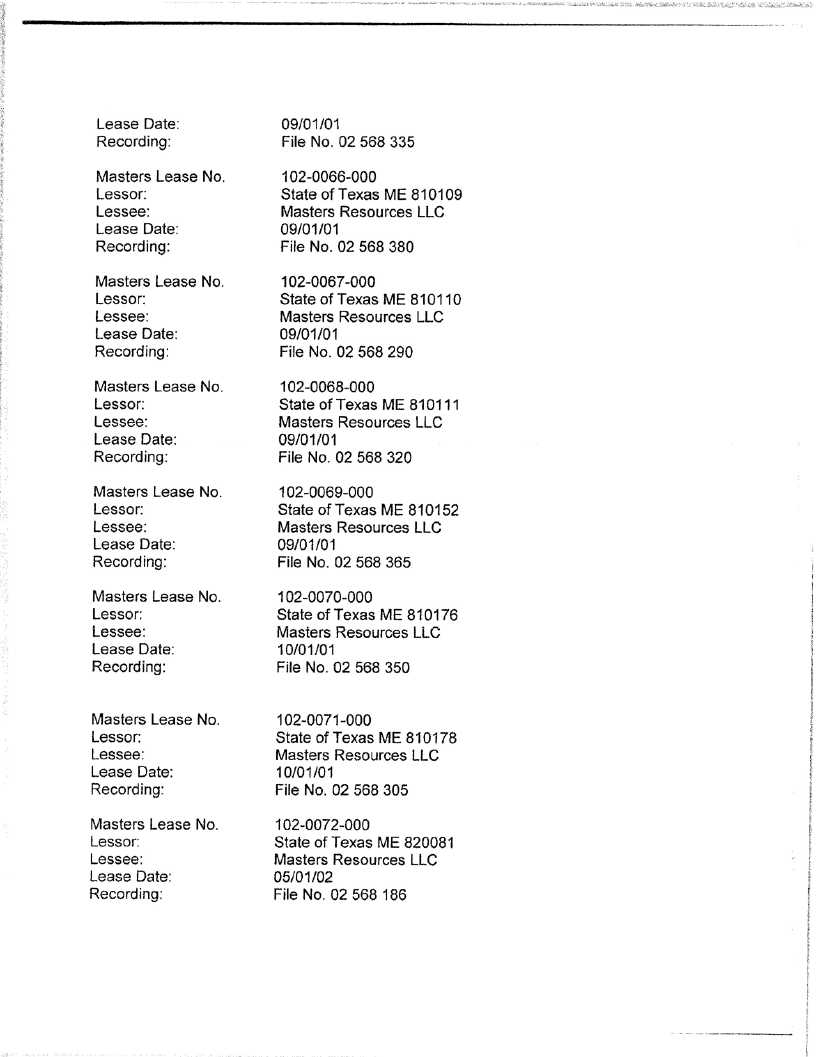

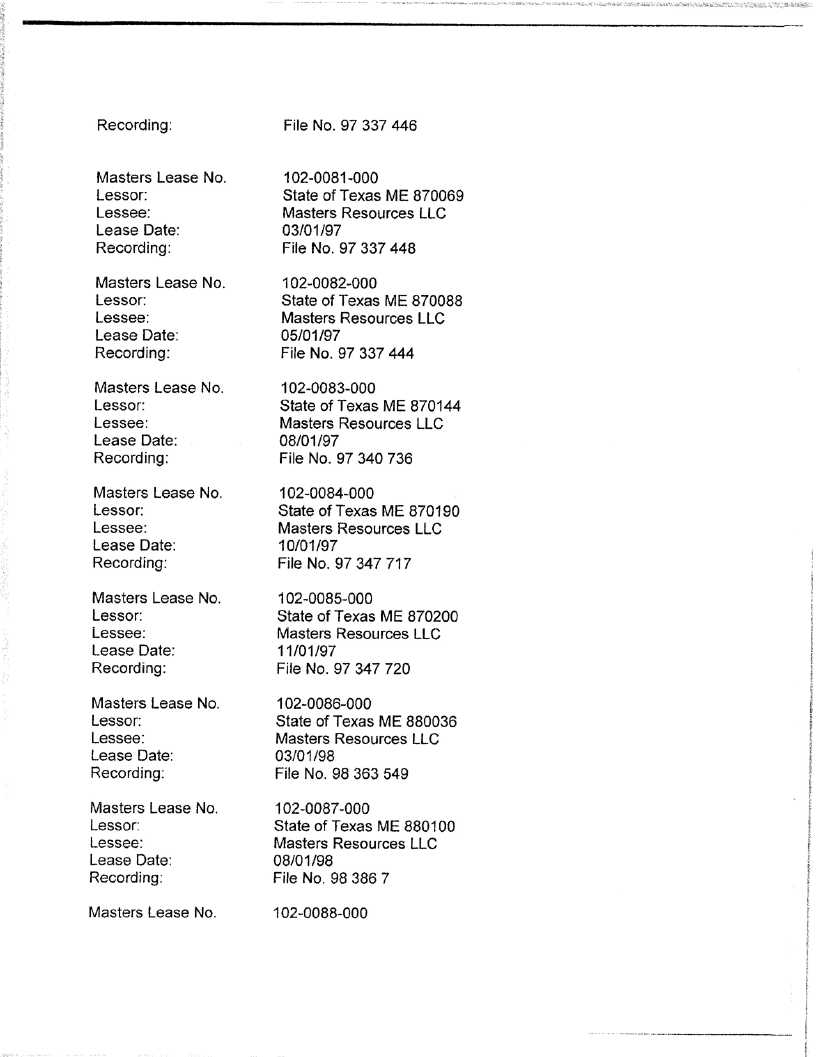

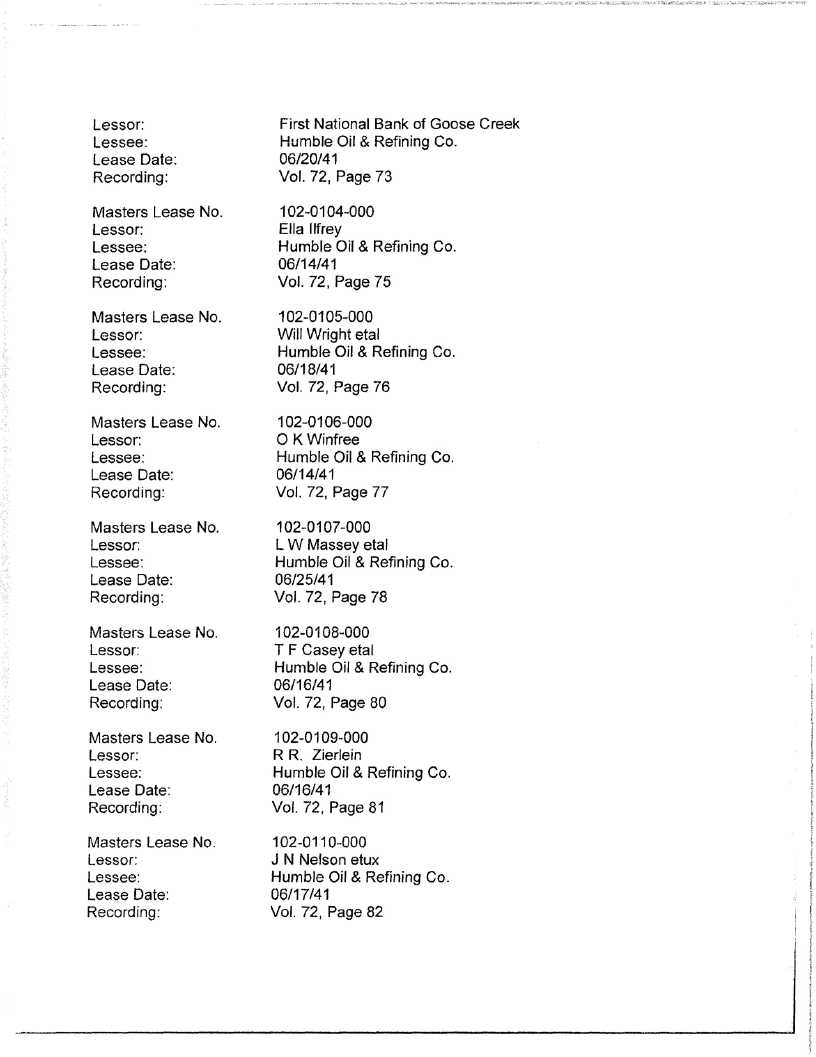

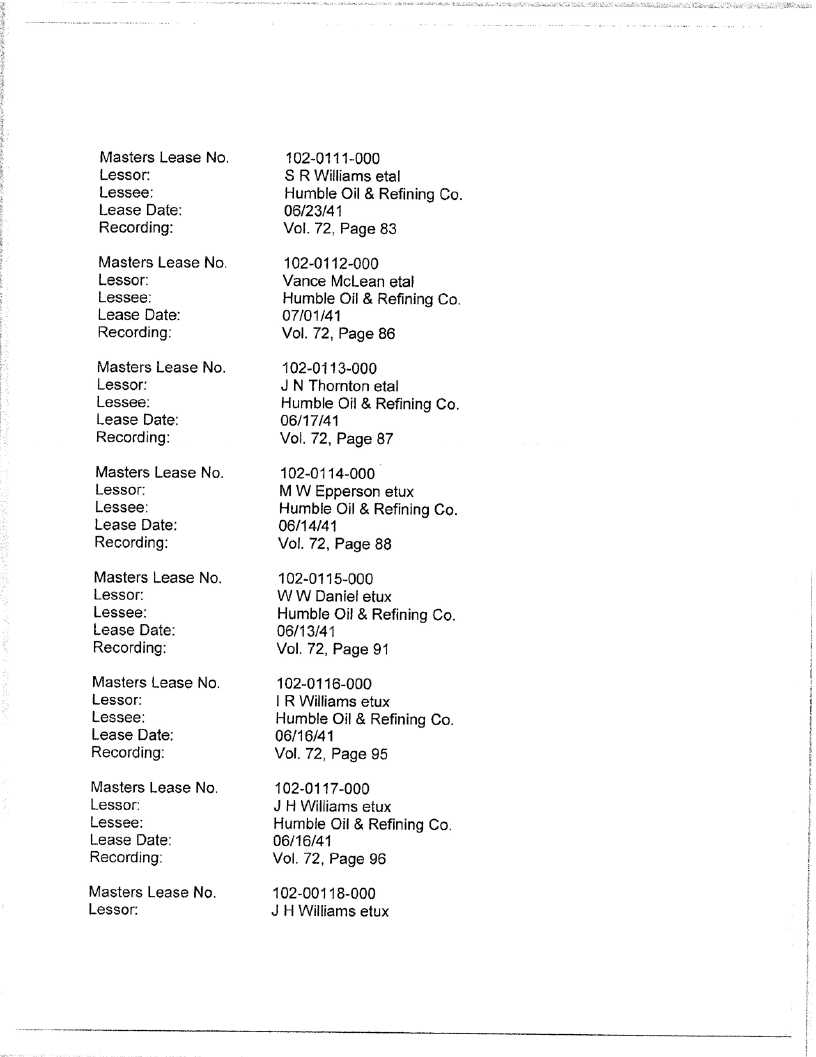

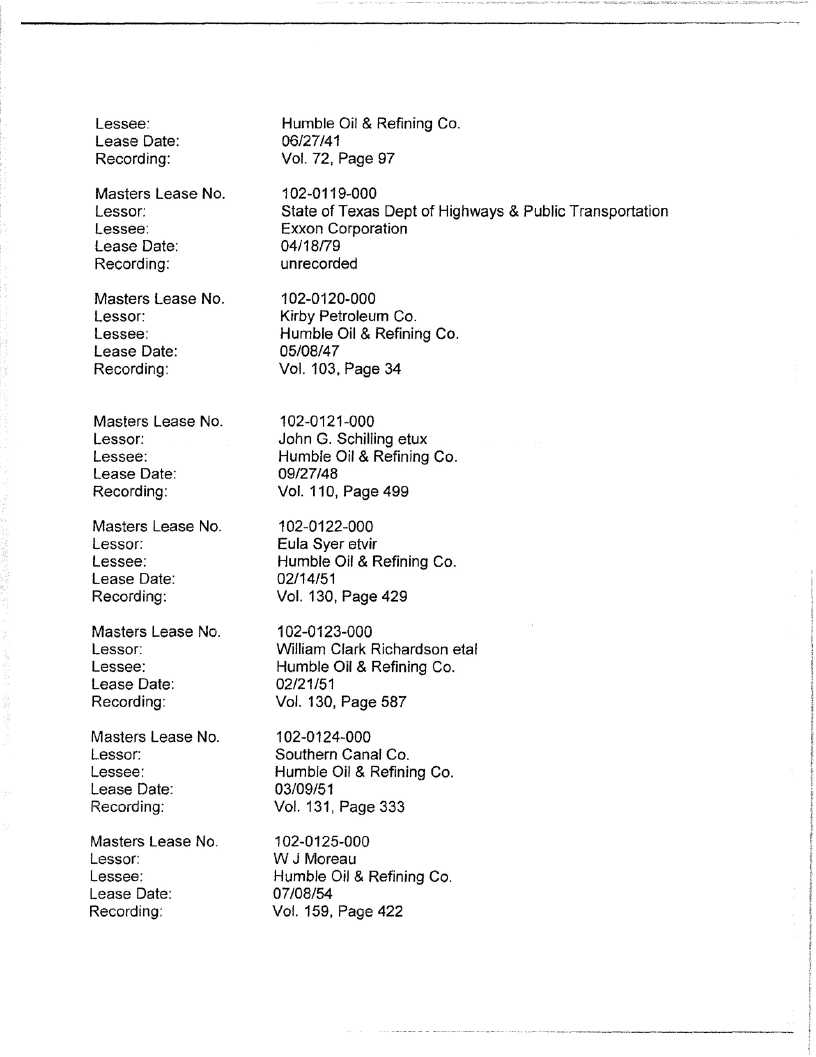

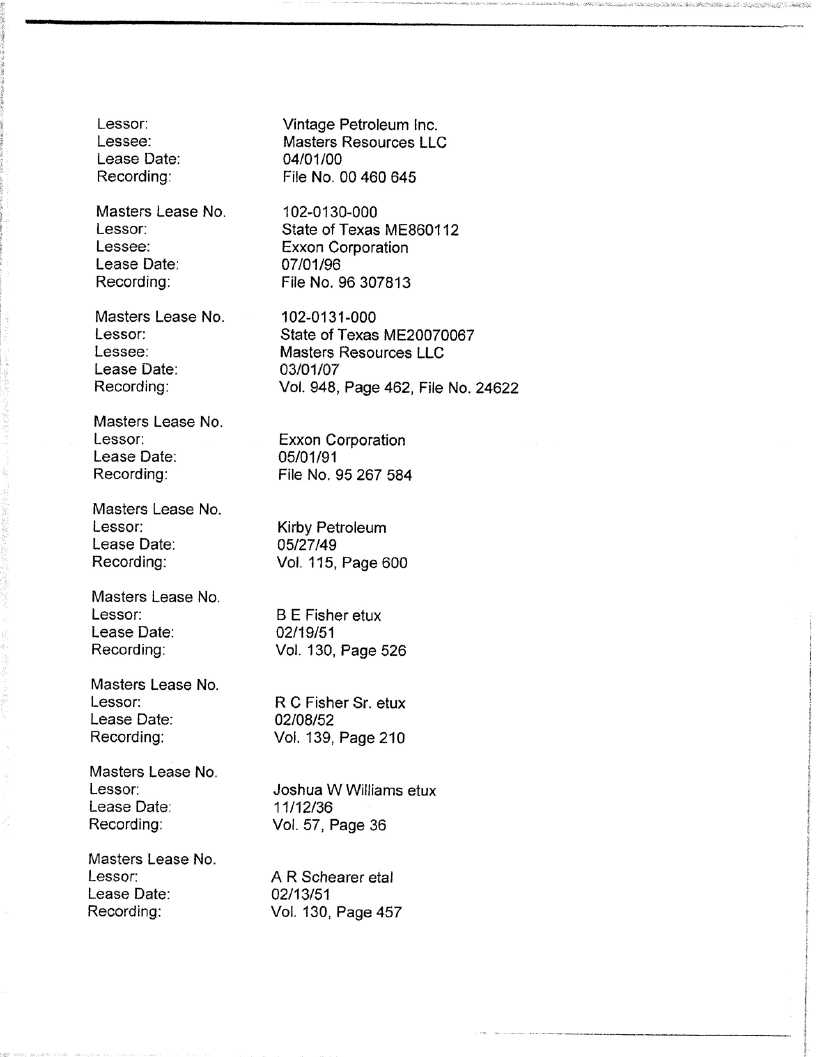

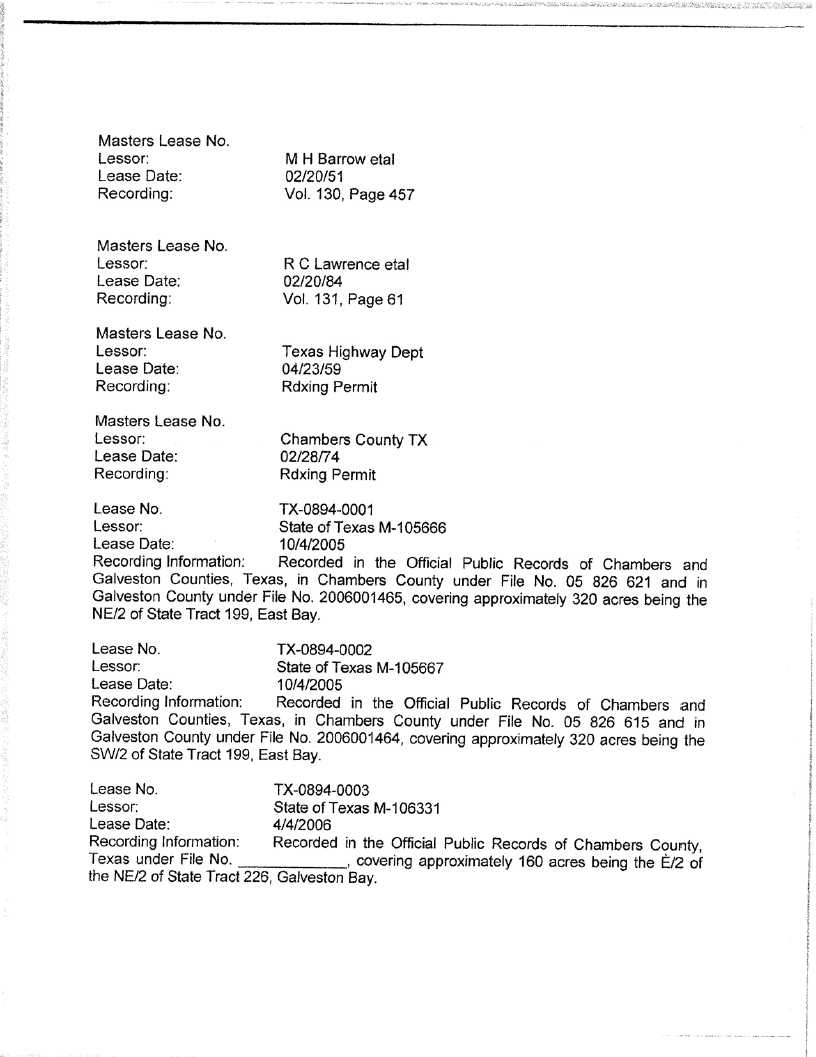

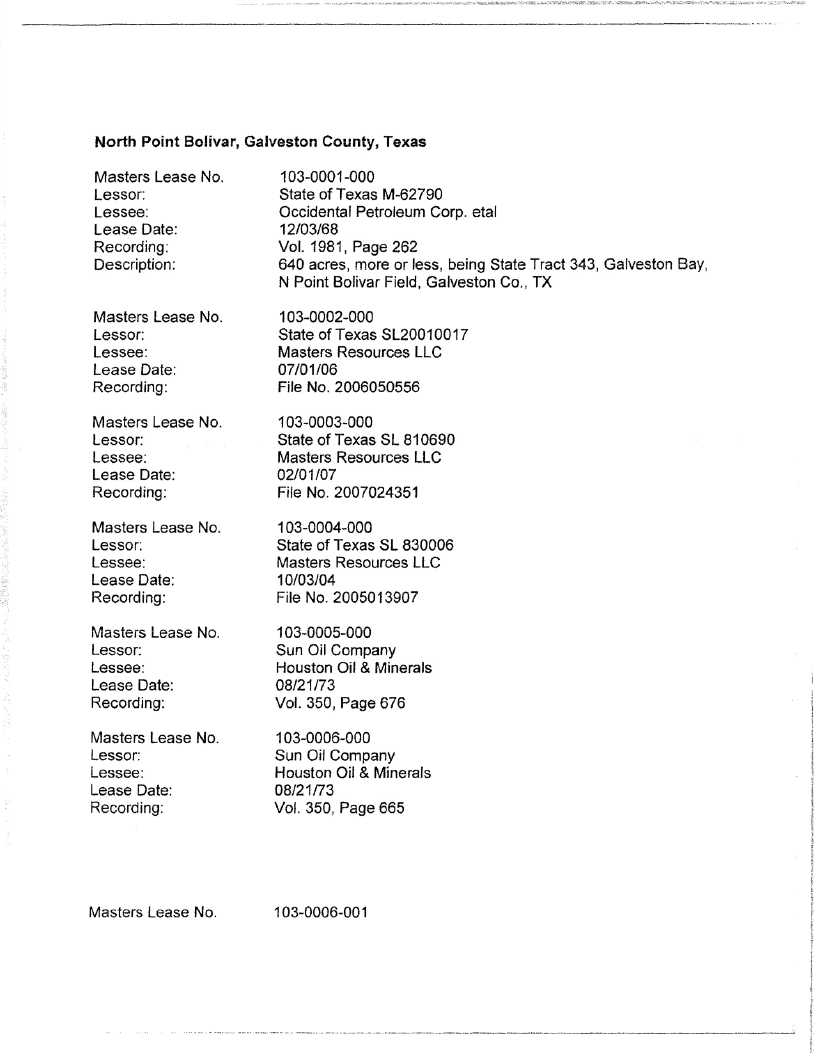

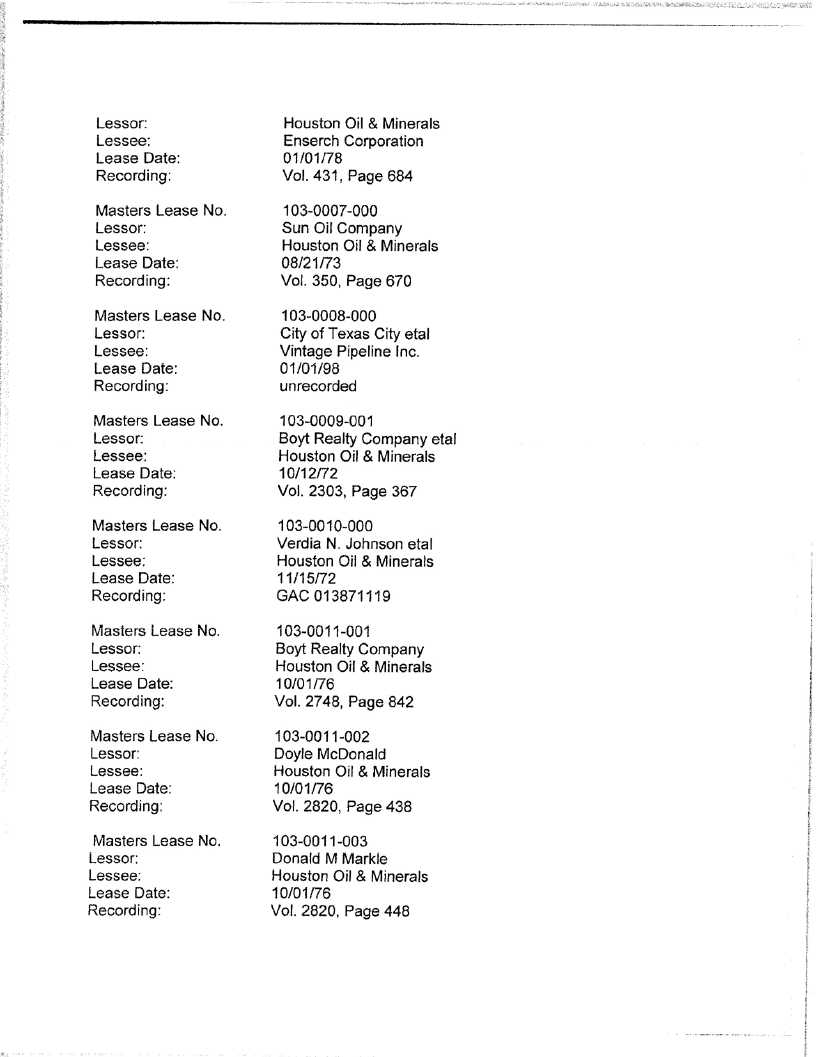

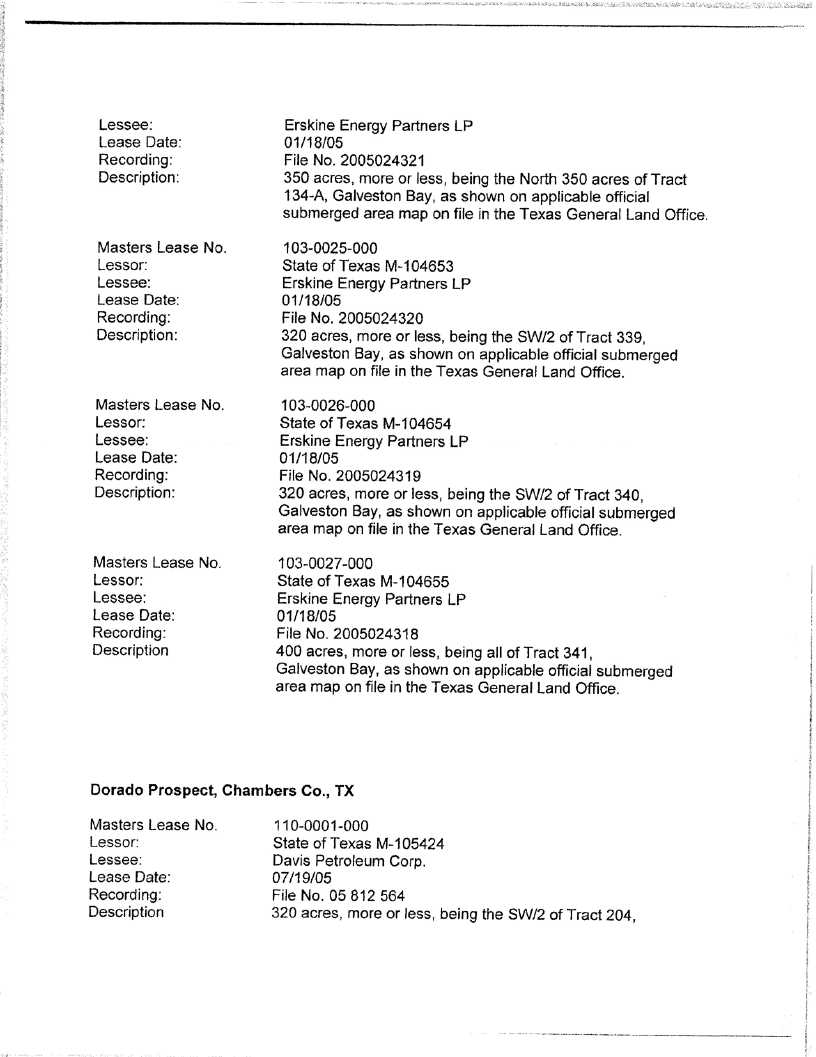

"Properties" means the oil and gas properties described on Exhibit B attached hereto and incorporated herein by reference.

"Regulation" or "Regulations" means the proposed, temporary and final regulations promulgated by the Treasury Department pursuant to the Code, as amended from time to time.

"Simulated Depletion Deductions" means the simulated depletion allowance computed by the Company with respect to its oil and gas properties pursuant to Regulations Section 1.704-1(b)(2)(iv)(k)(2).

"Simulated Gains" or "Simulated Losses" means, respectively, the simulated gains or simulated losses computed by the Company with respect to its oil and gas properties pursuant to Regulations Section 1.704-1(b)(2)(iv)(k)(2).

"Total Investments" shall mean the sum of Tekoil's Investment and Goldman's Investment.

1.2 Other Defined Terms. Capitalized terms not defined in Section 1.1 shall have the meanings set forth in the other sections of this Agreement.

1.3 References. References to an "Exhibit" are, unless otherwise specified, to one of the exhibits attached to this Agreement, and references to an "Article" or a "Section" are, unless otherwise specified, to one of the articles or sections of this Agreement. Each Exhibit attached hereto and referred to herein is hereby incorporated herein by such reference.

ARTICLE II - ORGANIZATION

2.1 Organization of Company. Effective as of January 17, 2007, the date of the filing of the Certificate with the Secretary of State of the State of Delaware, the initial Member of the Company formed the Company as a limited liability company governed by the terms hereof. Except as provided herein or in the Certificate, the rights and obligations of the Members are as provided under the Act.

2.2 Name. The name of the Company is "TEKOIL AND GAS GULF COAST, LLC". Subject to all applicable laws, the business of the Company shall be conducted in the name of the Company unless, under the law of some jurisdiction in which the Company does business, such business must be conducted under another name or unless the Managing Member determines that it is advisable to conduct Company business under another name. The Managing Member shall cause to be filed on behalf of the Company such limited liability company or assumed or fictitious name certificate or certificates or similar instruments as may from time to time be required by law.

2.3 Purpose and Powers. The purpose and business of the Company is to acquire, explore, and develop the Properties, and to engage in any and all activities or businesses related or incidental thereto as permitted by the Act. The Company shall not engage in any other activity not incidental to the foregoing.

2.4 Principal Office. The location of the Company's principal office 25050 I-45 North, Suite 528, The Woodlands, Texas 77380, or such other place as from time to time may be selected by the Managing Member. The Managing Member shall promptly notify each of the other Members of any change of the Company's principal office.

2.5 Registered Agent and Registered Office. The statutory agent for service of process and the registered office of the Company in the State of Delaware shall be Corporation Service Company at 2711 Centerville Road, Suite 400, Wilmington, Delaware 19808, or such other statutory agent and registered office as the Managing Member may determine from time to time.

2.6 Registered Members. The Company shall be entitled to recognize the exclusive right of a person registered on its books as the owner of Membership Interests to receive distributions, and to vote or take other action as such owner, and to hold liable for calls and assessments (to the extent permitted hereby) a person registered on its books as the owner of Membership Interests, and shall not be bound to recognize any equitable or other claim to or interest in such Membership Interests on the part of any other Person.

2.7 Members. The Members listed on Exhibit A, as the same may be amended from time to time in accordance herewith, have been admitted to the Company as Members. The names and mailing addresses of the Members are set forth in Exhibit A attached hereto and incorporated herein by reference.

2.8 No State Law Partnership; Liability to Third Parties. The Members intend that the Company not be a partnership (including, without limitation, a limited partnership) or joint venture under any state law, and that no Member or Managing Member be a partner or joint venturer of any other Member, for any purposes other than federal and state tax purposes (for which the Members do intend to be taxed as a "partnership"), and that this Agreement not be construed to suggest otherwise. Except as otherwise specifically provided in the Act, no Member shall be liable for the debts, obligations or liabilities of the Company, including under a judgment decree or order of a court and shall not be obligated to make any contributions to the Company to restore any negative balances in any Capital Accounts.

2.9 Scope of Members' Authority. Unless otherwise expressly provided in this Agreement, no Member shall have any authority to act for, or assume any obligations or responsibility on behalf of the Company or any other Member. Nothing contained herein shall constitute the Members as partners with one another in any matter (other than for federal income tax purposes) or render any of them liable for the debts or obligations of any other Member.

ARTICLE III - CAPITAL CONTRIBUTIONS

3.1 Initial Capital Contributions. The initial Capital Contributions of the Members named in the preamble to this Agreement have been or shall be made on the date of this Agreement in the form and amount as set forth on Exhibit A attached hereto. As of the date of this Agreement, the initial Capital Account balance of Tekoil shall be equal to $15,932,542. Tekoil's initial Capital Account balance shall be increased by $7,500,000 upon Tekoil's additional Capital Contribution of $7,500,000 as required by the Credit Agreement. As of the date of this Agreement, the initial Capital Account balance of Goldman shall be equal to $7,810,847. If the Company is liquidated pursuant to Article X prior to the date of Tekoil's additional Capital Contribution of $7,500,000 as required by the Credit Agreement, the initial Capital Account balance of Goldman shall be equal to $5,310,847.

3.2 Withdrawal; Return of Capital; Interest. Except as specifically provided herein, no Member shall be entitled to any distributions from the Company or to withdraw any part of such Member's Capital Contribution prior to the Company's dissolution and liquidation, or when such withdrawal of capital is permitted, to demand distribution of property other than money. No Member shall be entitled to interest on its Capital Contribution. No Member shall be obligated to restore any deficit balance in its Capital Account or bring its Capital Account into any particular relationship with the Capital Account of any other Member.

3.3 No Obligation to Make Additional Capital Contributions; Treatment of Additional Capital Contributions by Tekoil.

(a) Subject to Section 7.3 and except as provided in the Credit Agreement, no Member shall be required to make any additional Capital Contributions.

(b) In the event that Tekoil or any of its Affiliates makes additional Capital Contributions to the Company (other than the $7,500,000 additional Capital Contribution by Tekoil referenced in Section 3.1), twenty five percent (25%) of any such additional Capital Contributions made by Tekoil or any of its Affiliates, up to an aggregate of $5,000,000 of additional Capital Contributions made by Tekoil or any of its Affiliates, shall be reallocated from the Capital Account of Tekoil to the Capital Account of Goldman as of the date such additional Capital Contributions are made.

(c) In the event that Tekoil proposes to make additional Capital Contributions to the Company after the date hereof in excess of $12,500,000 (such amount being the aggregate of the $7,500,000 additional Capital Contribution by Tekoil referenced in Section 3.1 and the $5,000,000 of additional of Capital Contributions of Tekoil referenced in paragraph (b) above) (any such additional Capital Contribution being referred to as an "Excess Capital Contribution"), Goldman shall have the right, in its sole discretion, to make its proportionate share of any such Excess Capital Contribution based on its Membership Percentage in effect immediately prior to such Excess Capital Contribution. In the event that Goldman elects not to make its proportionate share of such Excess Capital Contribution, then upon the making of such Excess Capital Contribution by Tekoil, the Membership Percentages of Tekoil and Goldman shall be adjusted such that (i) Tekoil's Membership Percentage shall be an amount, expressed as a percentage, equal to (A) Tekoil's Investment divided by (B) Total Investments and (ii) Goldman's Membership Percentage shall be an amount, expressed as a percentage, equal to (C) Goldman's Investment divided by (D) Total Investments.

ARTICLE IV - ALLOCATION OF NET INCOME AND NET LOSS; ETC.

4.1 Net Income and Net Loss. After giving effect to the special allocations set forth in Section 4.3, Net Income and Net Loss for any Fiscal Year or other applicable period shall be allocated among the Members in accordance with and in proportion to the Members' respective Membership Percentages.

4.2 Limitations on Net Loss Allocation. Notwithstanding Section 4.1, Net Losses allocated to a Member pursuant to Section 4.1 shall not exceed the maximum amount of Net Losses that can be allocated without causing a Member to have an Adjusted Capital Account Deficit at the end of any Fiscal Year. If any Member would have an Adjusted Capital Account Deficit as a consequence of an allocation of Net Losses pursuant to Section 4.1, the amount of Net Losses that would be allocated to such Member but for the application of this Section 4.2 shall be allocated to the other Members to the extent that such allocations would not cause such other Members to have an Adjusted Capital Account Deficit and allocated among such other Members in proportion to their positive adjusted Capital Account balances. If none of the Members can be allocated Net Losses without such allocation causing such Members to have an Adjusted Capital Account Deficit, such Net Losses shall be allocated as if this Section 4.2 were not in effect. Any allocation of items of income, gain, loss, deduction or credit pursuant to this Section 4.2 shall be taken into account in making subsequent allocations pursuant to Section 4.1, and prior to any allocation of items in Section 4.1 so that the net amount of any items allocated to each Member pursuant to Section 4.1 and this Section 4.2 shall, to the maximum extent practicable, be equal to the net amount that would have been allocated to each Member pursuant to the provisions of Section 4.1 if such allocations under this Section 4.2 had not occurred.

4.3 Special Allocations.

(a) Company Minimum Gain Chargeback. Notwithstanding any other provision of this Article IV, if there is a net decrease in Company Minimum Gain during any Fiscal Year or other period for which allocations are made, prior to any other allocation under this Agreement, each Member will be specially allocated items of income and gain relating to that period (and, if necessary, subsequent periods) in proportion to, and to the extent of, an amount equal to such Member's share of the net decrease in Company Minimum Gain during such year as determined in accordance with Regulation Section 1.704-2(g)(2). The items to be allocated will be determined in accordance with Regulation Section 1.704-2(f).

(b) Member Nonrecourse Debt Minimum Gain Chargeback. Notwithstanding any other provision of this Article IV, if there is a net decrease in Member Nonrecourse Debt Minimum Gain attributable to a Member Nonrecourse Debt, each Member who has a share of the Member Nonrecourse Debt Minimum Gain attributable to such Member Nonrecourse Debt, determined in accordance with Regulation Section 1.704-2(i)(5), shall be specially allocated items of income and gain for such Fiscal Year (and, if necessary, subsequent Fiscal Years) in an amount equal to such Member's share of the net decrease in Member Nonrecourse Debt Minimum Gain attributable to such Member Nonrecourse Debt, determined in accordance with Regulation Section 1.704-2(i)(4).

(c) Qualified Income Offset. A Member who unexpectedly receives any adjustment, allocation or distribution described in Regulation Sections 1.704-1(b)(2)(ii)(d)(4), (5) or (6) will be specially allocated items of income and gain in an amount and manner sufficient to eliminate, to the extent required by the Regulations, the Adjusted Capital Account Deficit of the Member as quickly as possible.

(d) Gross Income Allocations. Each Member who has an Adjusted Capital Account Deficit at the end of any Fiscal Year will be specially allocated, as quickly as possible, items of gross income and gain in the amount of such deficit.

(e) Nonrecourse Deductions. Nonrecourse Deductions for any Fiscal Year or other period for which allocations are made will be allocated to the Members among the Members in proportion to their respective Membership Percentages.

(f) Member Nonrecourse Deductions. Notwithstanding anything to the contrary in this Agreement, any Member Nonrecourse Deductions for any Fiscal Year or other period for which allocations are made will be allocated to the Member who bears the economic risk of loss with respect to the Member Nonrecourse Debt to which the Member Nonrecourse Deductions are attributable in accordance with Regulation Section 1.704-2(i).

(g) Code Section 754 Adjustments. To the extent an adjustment to the adjusted tax basis of any Company asset under Code Sections 734(b) or 743(b) is required to be taken into account in determining Capital Accounts under Regulation Section 1.704-1(b)(2)(iv)(m), the amount of the adjustment to the Capital Accounts will be treated as an item of gain (if the adjustment increases the basis of the asset) or loss (if the adjustment decreases the basis), and the gain or loss will be specially allocated to the Members in a manner consistent with the manner in which their Capital Accounts are required to be adjusted under Regulation Section 1.704-1(b)(2)(iv)(m).

(h) Curative Allocations. The allocations set forth in Sections 4.3(a), 4.3(b), 4.3(c), 4.3(d), 4.3(e), 4.3(f), 4.3(g) and 4.2 (the "Regulatory Allocations") are intended to comply with certain requirements of the Regulations. It is the intent of the Members that, to the extent possible, all Regulatory Allocations shall be offset either with other Regulatory Allocations or with special allocations of other items of Company income, gain, loss or deduction pursuant to this Section 4.3(h). Therefore, notwithstanding any other provision of this Article IV (other than the Regulatory Allocations), the Managing Member shall make such offsetting special allocations of Company income, gain, loss or deduction in whatever manner it determines reasonably appropriate so that, after such offsetting allocations are made, each Member's Capital Account balance is, to the extent possible, equal to the Capital Account balance such Member would have had if the Regulatory Allocations were not part of this Agreement and all Company items were allocated pursuant to Section 4.1.

4.4 Tax Allocations. Except as otherwise provided in this Section 4.4, each item of income, gain, loss and deduction of the Company for federal income tax purposes shall be allocated among the Members in the same manner as such items are allocated for book purposes under this Article IV. In accordance with Code Section 704(c) and the Regulations thereunder, income, gain, loss, and deduction with respect to any property contributed to the capital of the Company shall, solely for tax purposes, be allocated among the Members so as to take account of any variation between the adjusted basis of such property to the Company for federal income tax purposes and its initial Gross Asset Value in accordance with the one of the methods under Regulation Section 1.704-3 as determined by the Members. Any recapture of depreciation pursuant to Sections 1245 or 1250 of the Code shall be allocated to the Members which realized the benefit of the deductions attributable to such recapture.

4.5 Effect on Allocations of New Members or Assignees. In the event that new Members are admitted to the Company or persons become assignees on other than the first day of any Fiscal Year, Net Income and Net Loss for such Fiscal Year shall be allocated among the Members and assignees in accordance with Code Section 706, using any convention permitted by law and selected by the Members.

ARTICLE V - DISTRIBUTIONS

5.1 Distributions. Except as otherwise provided in Article X, Distributable Cash, if any, shall be distributed only in the following order of priority:

(a) Tax Distributions. Except as and to the extent prohibited by applicable law or by the Credit Agreement or other contractual restriction binding upon the Company, within sixty (60) days after the close of each Fiscal Year, the Managing Member shall cause the Company to distribute cash to the Members, such that each Member has received cumulative cash distributions from the Company (taking into account all current and prior distributions pursuant to Sections 5.1(a) and 5.1(b)) equal to such Member's share of the cumulative Net Income (net of prior allocations of Net Losses) allocated to such Member pursuant to Section 4.1 (through the end of the prior Fiscal Year) multiplied by forty percent (40%). Any distributions received by a Member pursuant to this Section 5.1(a) shall be taken into account for purposes of determining subsequent distributions pursuant to Section 5.1(b) such that each Member shall have received an amount of distributions pursuant to this Agreement equal to that which such Member would have received since the date of this Agreement assuming distributions had been made solely pursuant to Section 5.1(b).

(b) Remaining Distributable Cash. After the Managing Member shall have made the distributions set forth in Section 5.1(a), the Managing Member shall, at such times and from time to time as the Managing Member determines and except as and to the extent prohibited by applicable law or by the Credit Agreement or other contractual restriction binding upon the Company, distribute any remaining Distributable Cash to the Members in accordance with their respective Membership Percentages.

5.2 Withholding. Any amount that the Company is required to withhold and deposit with any governmental authority with respect to any federal, state, local or foreign tax liability of a Member, including any withholding pursuant to Sections 1441, 1442, 1445 or 1446 or any other applicable sections of the Code, shall be treated as an amount distributed to such Member and shall reduce, dollar for dollar, any distribution that would otherwise be made to such Member pursuant to this Agreement for that or any subsequent period. To the extent any amount so withheld exceeds the cash otherwise distributable to such Member, such expense shall be deemed a loan to the Member bearing interest at the Prime Rate, payable out of any future distributions, and if not earlier repaid upon termination of the Company or the sale or other disposition of any of such Member's Membership Interest.

ARTICLE VI - ACCOUNTING AND ADMINISTRATIVE MATTERS

6.1 Books and Records. The Company will maintain true, complete and correct books of account of the Company, in accordance with such methodology, consistently applied, as determined by the Managing Member. The books of account shall contain particulars of all monies, goods, assets (including, but not limited to, real, personal, and intangible) or effects belonging to or owing to or by the Company, or paid, received, sold or purchased in the course of the Company's business, and all of such other transactions, matters and things relating to the business of the Company as are usually entered in books of accounts kept by persons engaged in a business of a like kind and character. In addition, the Company shall keep all records required to be kept pursuant to the Act. A Member shall, upon prior written notice and during normal business hours, have access to the information described in Section 18-305 of the Act, for the purpose of inspecting or, at the expense of such Member, copying the same. Any Member reviewing the books and records of the Company pursuant to the preceding sentence shall do so in a manner which does not unduly interfere with the conduct of the business of the Company.

6.2 Reports. The Company will furnish the following statements and reports to each of the Members at the Company's expense:

(a) Within ninety (90) days after the close of each Fiscal Year, a Schedule K-1 or such other form as shall be necessary to advise all Members relative to their investment in the Company for federal, state, local, provincial, territorial and foreign income tax reporting purposes, prepared by an independent certified public accounting firm appointed by the Company and approved by Goldman (such approval not to be unreasonably withheld). Such Schedule K-1 or other form shall be furnished to each Person who was a Member during such Fiscal Year.

(b) As soon as available, and in any event within ninety (90) days after the end of each Fiscal Year (commencing with the fiscal year ending December 31, 2007), complete consolidated financial statements of the company together with all notes thereto, prepared in reasonable detail in accordance with generally accepted accounting principles, together with an unqualified opinion, based on an audit using generally accepted auditing standards, by independent certified public accountants selected by the Company and acceptable to Goldman, stating that such consolidated financial statements have been so prepared. These financial statements shall contain a consolidated balance sheet as of the end of such Fiscal Year and consolidated statements of earnings, of cash flows, and of changes in owners' equity for such Fiscal Year, each setting forth in comparative form the corresponding figures for the preceding Fiscal Year.

(c) As soon as available, and in any event within thirty (30) days after the end of each fiscal quarter of the Company, the Company's consolidated balance sheet as of the end of such fiscal quarter and consolidated statements of earnings and cash flows for the period from the beginning of the then current Fiscal Year to the end of such fiscal quarter, all in reasonable detail and prepared in accordance with generally accepted accounting principles, subject to changes resulting from normal year-end adjustments.

(d) Promptly upon their becoming available, copies of all financial statements, reports, notices and proxy statements sent by Tekoil to its stockholders and all registration statements, periodic reports and other statements and schedules filed by Tekoil with any securities exchange, the Securities and Exchange Commission or any similar governmental authority.

(e) If, as a result of any change in accounting principles and policies from those used in the preparation of the Company's audited consolidated financial statements as of the immediately preceding fiscal year, the consolidated financial statements of the Company and its subsidiaries delivered pursuant to Section 6.2(b) or 6.2(c) will differ in any material respect from the consolidated financial statements that would have been delivered pursuant to such subsections had no such change in accounting principles and policies been made, then, together with the first delivery of such financial statements after such change, one or more statements of reconciliation for such changes in form and substance satisfactory to Goldman.

(f) By March 1 and September 1 of each year, beginning September 1, 2007, an Engineering Report (as defined in the Credit Agreement) prepared as of the preceding January 1 or July 1, respectively, concerning the Properties. Each Engineering Report prepared as of any January 1 must be prepared or audited by the Independent Engineer (as defined in the Credit Agreement or another independent petroleum engineer selected by the Company and approved by Goldman in its sole discretion); each Engineering Report prepared as of any July 1 may, at the Company's option, be prepared by the Company's in-house engineering staff or prepared or audited by the Independent Engineer. In addition, Goldman may (at its expense) request additional Engineering Reports from time to time prepared by the Independent Engineer.

(g) Within thirty (30) days after the end of each calendar month, a report in detail acceptable to Goldman with respect to the Properties during such month:

(i) describing by well and field the net quantities of oil, gas, natural gas liquids, and water produced (and the quantities of water injected) during such month;

(ii) describing by well and field the quantities of oil, gas and natural gas liquids sold during such month out of production from the Properties and calculating the average sales prices of such oil, natural gas, and natural gas liquids;

(iii) specifying any leasehold operating expenses, overhead charges, gathering costs, transportation costs, and other costs with respect to the Properties of the kind chargeable as direct charges or overhead under an Onshore COPAS Accounting Procedure for Joint Operations (1984 form published by the Council of Petroleum Accountants Societies);

(iv) setting forth the amount of Direct Taxes (as defined in the Credti Agreement) on the Properties during such month and the amount of royalties paid with respect to the Properties during such month;

(v) describing all activities carried out during such month in furtherance of the Company's development plan, all other capital expenditures during such month, and all projections of capital expenditures projected to be made on any of the Properties; and

(vi) describing all workover work and drilling during such month including the cost and status of each well drilled or worked over during such month, test reports for each well tested during such month, reports on prices and volumes received for such month, reports for each well completed during such month, and accompanying authorizations for expenditures.

(h) As soon as available, and in any event within thirty (30) days after the end of each fiscal quarter of the Company, a report describing aggregate volume of production and sales attributable to production during such fiscal quarter from the Properties and describing the related severance taxes, leasehold operating expenses and capital costs attributable thereto and incurred during such fiscal quarter.

(i) As soon as practicable and in any event by the last day of each fiscal year, a report in form and substance satisfactory to Goldman outlining all material insurance coverage maintained as of the date of such report by the Company and its subsidiaries and all material insurance coverage planned to be maintained by the Company and its subsidiaries in the immediately succeeding Fiscal Year.

(j) Promptly, and in any event within ten (10) Business Days (i) after any Material Contract (as defined in the Credit Agreement) of the Company or any of its subsidiaries is terminated or amended in a manner that is materially adverse to the Company or such subsidiary, as the case may be, or (ii) any new Material Contract is entered into, a written statement describing such event, with copies of such material amendments or new contracts, delivered to Goldman (to the extent such delivery is permitted by the terms of any such Material Contract, provided, no such prohibition on delivery shall be effective if it were bargained for by the Company or its applicable subsidiary with the intent of avoiding compliance with this Section (j)), and an explanation of any actions being taken with respect thereto.

6.3 Tax Matters Partner. The Managing Member shall be the "Tax Matters Partner," as such term is defined in Section 6231(a)(7) of the Code. The Tax Matters Partner shall take such action as may be reasonably necessary to cause each other Member to become a notice partner within the meaning of Code Section 6231(a)(8). The Tax Matters Partner shall inform each other Member of all significant matters that may come to its attention in its capacity as Tax Matters Partner by giving notice thereof on or before the fifth day after becoming aware thereof and, within that time, shall forward to each other Member copies of all significant written communications it may receive in that capacity. The Tax Matters Partner shall not enter into any extension of the period of limitations for making assessments on behalf of the Members without first obtaining the consent of all Members. The Tax Matters Partner shall not bind any Member to a settlement agreement without obtaining the consent of such Member. Any Member that enters into a settlement agreement with respect to any Company item (within the meaning of Code Section 6231(a)(3)) shall notify the other Members of such settlement agreement and its terms within 30 days from the date of the settlement.

6.4 Tax Elections. The Managing Member shall make the following elections on the appropriate tax returns of the Company:

(a) To adopt the calendar year as the Company's tax year;

(b) To adopt the accrual method of accounting;

(c) Upon request of any Member, an election under Code Section 754;

(d) To deduct expenses incurred in organizing the Company ratably over a sixty month period as provided in Code Section 709;

(e) To expense intangible drilling and development costs; and

(f) Any other election that the Managing Member deems appropriate and in the best interests of the Members after obtaining approval of the Members.

Neither the Company nor any Member may make an election for the Company to be excluded from the application of the provisions of subchapter K of Chapter 1 of subtitle A of the Code or any similar provision of applicable law.

ARTICLE VII - MANAGEMENT OF COMPANY AND VOTING BY MEMBERS

7.1 The Managing Member

(a) Managing Member. Except as specifically provided in this Agreement, the management and control of the Company shall be vested exclusively in Tekoil, as the Managing Member. The Managing Member shall be responsible for the establishment of operating procedures respecting the business affairs of the Company and overseeing or delegating the day-to-day operation of the Company's business. Except as specifically provided in this Agreement, the Managing Member shall have the power and authority to take any actions not prohibited under the Act or which are otherwise conferred or permitted by law, which the Managing Member determines, in its reasonable discretion, are necessary, proper, advisable or convenient to the discharge of its duties under this Agreement or applicable law to conduct the business and affairs of the Company, including, but not limited to, any decision to sell, mortgage, lease or otherwise transfer any assets of the Company, which shall be binding on the Company without the necessity of any further action. Except as specifically provided in this Agreement, the Managing Member shall have the right, power and authority to perform any and all other acts or activities customary or incident to the management of the Company's business on behalf of the Company.

(b) Delegation of Powers. The Managing Member may delegate its powers, but not its responsibilities, to any Member or to any other Person.

7.2 Resignation/Removal of Managing Member. The Managing Member may resign at any time by giving written notice to the Members (the "Resignation Notice"). The resignation of the Managing Member shall take effect thirty (30) days after the Resignation Notice is given or at such earlier time as accepted by the Members; and, unless otherwise specified therein, the acceptance of such resignation shall not be necessary to make it effective. The Managing Member may be removed, with or without cause, upon the affirmative vote of all of the Members. If no one is serving as Managing Member for any reason, then a new Managing Member shall be elected by the affirmative vote of all of the Members. The resignation of the Managing Member shall not affect the Managing Member's rights as a Member, if any, and shall not constitute the Managing Member's withdrawal as a Member.

7.3 Actions Requiring Member Approval. Notwithstanding anything in this Agreement to the contrary, no action shall be taken, sum expended, decision made or obligation incurred with respect to a matter within the scope of any of the major decisions enumerated below (the "Major Decisions"), unless such a Major Decision has been approved by unanimous consent of the Members of the Company. The Major Decisions are:

(a) Amending, modifying, waiving or repealing any provisions of this Agreement or the Certificate, except as otherwise contemplated in this Agreement;

(b) Engaging, directly or indirectly through subsidiaries, in any business or activity other than as specified in Section 2.3;

(c) Requiring additional Capital Contributions of the Members, except as expressly provided in the Credit Agreement with respect to Tekoil (provided that this clause (c) shall not be interpreted to prohibit additional Capital Contributions by Tekoil and Goldman in accordance with Sections 3.3(b) and 3.3(c));

(d) Reorganizing the Company or causing the Company to merge or consolidate with or into another Entity or acquiring, directly or indirectly through subsidiaries, another Entity or all or substantially all the assets of another Entity, or selling all or substantially all of the assets of the Company or its subsidiaries;

(e) Selling, transferring, leasing, disposing of or abandoning any of the properties and assets of the Company or its subsidiaries (exclusive of properties, materials, supplies, equipment or other items of personal property disposed of in the ordinary course of business, which do not have a value of more than $2,000,000 individually or in the aggregate and are not otherwise material to the business of the Company) or farmout any assets or properties which are material to the business of the Company and its subsidiaries;

(f) Compromising or settling any lawsuit, administrative matter or other dispute where the amount the Company or any of its subsidiaries may recover or might be obligated to pay, as applicable, is in excess of $2,000,000 or to repairing or replacing property or assets damaged or destroyed as a result of an accident or other occurrence when the Company's or its subsidiaries' share of the costs of repair or replacement (either individually or in the aggregate) is in excess of $2,000,000;

(g) Causing the Company or any of its subsidiaries to enter into any material contract or agreement, which for the purpose of this Agreement shall mean any contract, agreement, or series of contracts or agreements that would obligate the Company or any of its subsidiaries to expend (or transfer assets with a value of) $2,000,000 or more, or which cannot be terminated by the Company or its subsidiaries without penalty upon notice of 60 days or less;

(h) Admitting a Person as a Member of the Company, except as a substituted Member in accordance with Section 9.1 hereof;

(i) Dissolving or liquidating the Company or commencing a voluntary bankruptcy by the Company, or consenting to the appointment of a receiver, liquidator, assignee, custodian, or trustee for the purposes of winding up the affairs of the Company;

(j) Engaging, directly or indirectly through subsidiaries, in any transaction or arrangement with any Member or any Affiliate of any Member except as expressly contemplated hereby or by the Credit Agreement;

(k) Directly or indirectly through subsidiaries, borrowing money, incurring any indebtedness or assuming or guaranteeing any indebtedness of any other Person, other than normal trade accounts payable and lease obligations in the normal course of business, or granting consensual liens on the Properties; provided, however, that the Managing Member is hereby authorized to secure financing for the Company pursuant to the terms of the Credit Agreement and other indebtedness expressly permitted in the Credit Agreement and any other documents related to the Credit Facility, and to grant a mortgage, lien or liens on the Company's property to secure the Credit Facility; and

(l) Materially modifying, changing or amending any agreement or arrangement which is the subject of the matters referred to in this Section 7.3.

7.4 Member Meetings. An annual meeting of the Members shall be held, with notice, in April of each year or with notice on such other date selected by the Managing Member, for the purposes of discussing any business that may come before the annual meeting. The Managing Member may call special meetings of the Members for any reason the Managing Member may deem necessary. Member meetings shall be chaired by the Managing Member.

7.5 Quorum and Voting. Members owning all of the Membership Percentages of the Company shall constitute a quorum if present in person or by proxy. Except as provided elsewhere in this Agreement (including in Section 7.3), for any act for which the vote of the membership is taken, the vote of Members holding at least fifty percent (51%) of the Membership Percentages shall be the act of the Company. For actions on which the Members will vote, no action may be taken at a meeting of the Members unless a quorum is present.

7.6 Proxies. At any meeting of the Members, a Member may vote by proxy executed in writing by the Member or by his, her or its duly authorized attorney in fact. Such proxy shall be filed with the Company before or at the time of the meeting. Unless otherwise provided therein, a proxy shall not be valid more than three (3) years after the date of its execution, unless the proxy provides for a longer period.

7.7 Waiver of Notice. Whenever written notice is required to be given to the Member, a written waiver thereof signed by the Member entitled to such notice (whether, in the case of notice of a meeting, the written waiver thereof is signed before or after the meeting) shall be in all respects tantamount to notice. Attendance of a Member at a meeting of the Member shall constitute a waiver of notice of such meeting, except where a Member attends a meeting for the express purpose of objection to the transaction of any business on the grounds that the meeting is not lawfully called or convened.

7.8 Telephonic Meetings. Any meetings of the Members may be held, or any Member may participate in any meeting of the Members, by use of a conference telephone or similar communications equipment by means of which all persons participating in the meeting can hear each other and communicate with each other.

7.9 Compensation; Reimbursement of Expenses. Except as determined by the Managing Member, neither the Managing Member nor any Member shall receive compensation for their services to the Company in such capacity. The Company shall reimburse the Managing Member for all reasonable costs and expenses incurred by it in or related to the performance of its duties to the Company.

7.10 No Authority of Individual Member. Except as set forth in this Article VII, or otherwise in this Agreement, no Member, acting individually, nor any of their respective Affiliates, has the power or authority to bind the Company, or any other Member or to authorize any action to be taken by the Company, or to act as agent for the Company or any other Member, unless that power or authority has been specifically delegated or authorized by action of the Members.

7.11 Presumption of Assent. A Member who is present at a meeting of the Members shall be conclusively presumed to have assented to any action taken unless his, her or its dissent shall be expressed at such meeting and entered in the minutes of the meeting.

7.12 Decision of Members by Written Consent. Any action to be made by the Members may be taken without a meeting if a consent in writing, setting forth the action so taken, is signed by the Members owning the Membership Percentages otherwise required for taking such action.

7.13 Related Party Transactions. Subject to Section 7.3, the Members acknowledge that the Company may engage in transactions with Members or their Affiliates. With respect to contracts which the Company enters into with an Affiliate of a Member, in the event the non-affiliated Member reasonably determines that the Affiliate has defaulted under the terms of the contract at issue, such non-affiliated Member shall have the right, on behalf of the Company, to declare a default under such contract and to pursue any and all remedies which the Company may have at law or in equity, including all remedies available under the contract, without the consent or approval of the other Member. The acts of the non-affiliated Member with respect to any of the foregoing shall be deemed to be the acts of the Company.

ARTICLE VIII - LIMITATION ON LIABILITY AND INDEMNIFICATION

8.1 Exculpation of Liability. No Managing Member or Member (each, an "Exculpated Party"), shall be liable, in damages or otherwise, to the Company or to any of the Members for any act or omission by any such Exculpated Party pursuant to the authority granted by this Agreement, unless such act or omission results from fraud, gross negligence, or willful misconduct. The Company may indemnify, defend and hold harmless each Exculpated Party from and against any and all claims or liabilities of any nature whatsoever, including reasonable attorneys' fees, arising out of or in connection with any action taken or omitted by an Exculpated Party pursuant to the authority granted by this Agreement or otherwise, except where attributable to the fraud, gross negligence, or willful misconduct of such Exculpated Party. Each Exculpated Party shall be entitled to rely on the advice of counsel, public accountants or other independent experts experienced in the manner at issue, and any act or omission of such Exculpated Party pursuant to such advice shall in no event subject such Exculpated Party to liability to the Company or any Member.

8.2 Liability of Exculpated Parties and Members.

(a) In carrying out their respective powers and duties hereunder, each Exculpated Party (as defined in Section 8.1 above) shall exercise its best efforts and shall not be liable to the Company or to any Member for any actions taken or omitted to be taken in good faith and reasonably believed to be in the best interest of the Company or for errors of judgment made in good faith.

(b) In no event shall a Member who ceases to be a Member be liable for or on account of obligations or liabilities of the Company incurred subsequent to its ceasing to be a Member.

8.3 Indemnification of Managing Member. In any pending or completed action, suit, or proceeding to which the Managing Member or any Member is or was a party by reason of the fact that such Managing Member or Member is or was the Managing Member or Member, the Company shall hold harmless and indemnify such Managing Member or Member from and against any and all losses, harm, liabilities, damages, costs, and expenses (including, but not limited to, attorneys' fees, judgments, and amounts paid in settlement) incurred by such Managing Member or Member in connection with such action, suit, or proceeding if such Managing Member or Member determined in good faith, that the course of conduct which caused the loss or liability was in the best interests of the Company, and provided that such Managing Member's or Member's conduct does not constitute gross negligence, willful misconduct, or breach of fiduciary duty to the Company or the Members.

8.4 Advancement of Legal Costs and Expenses. The Company shall advance Company funds to the Managing Member or Member for legal expenses and other costs incurred as a result of any legal action if the following conditions are satisfied: (a) the legal action relates to acts or omissions with respect to the performance of duties or services on behalf of the Company; (b) the legal action is initiated by a third party who is not a Member, or the legal action is initiated by a Member and a court of competent jurisdiction specifically approves such advancement; and (c) the Managing Member or Member undertakes to repay the advanced funds, together with interest at the Prime Rate plus one percent (1%), to the Company in cases in which the Members determine that the Managing Member or Member should not be indemnified under this Article VIII.

8.5 Provisions Not Exclusive. The exculpation of liability and indemnification provided by this Article VIII shall not be deemed exclusive of any other limitation on liability or rights to which those seeking indemnification may be entitled under any statute, agreement, vote of Members or otherwise.

8.6 Insurance. The Company may purchase insurance to insure against the liabilities contemplated by this Article VIII.

8.7 Reliance by Managing Member. In discharging its duties, the Managing Member, when acting in good faith, may rely upon information, opinions, reports, or statements, including financial statements and other financial data, in each case presented or prepared by (a) one or more officers of the Company whom the Managing Member reasonably believes to be reliable and competent in the matters presented, (b) counsel, public accountants, or other persons as to matters that the Managing Member believes to be within that person's professional or expert competence, or (c) a committee of Members upon which the Managing Member does not serve, duly designated according to law, as to matters within its designated authority, if the Managing Member reasonably believes that the committee is competent.

ARTICLE IX - RESTRICTION ON TRANSFERS; RIGHT OF FIRST REFUSAL

9.1 Transfer of Membership Interests.

(a) Except as otherwise set forth in this Article IX, Tekoil may not assign, sell, transfer, pledge or encumber ("Transfer") its Membership Interest or any portion thereof except (i) with the written approval of all of the other Members or (ii) in a bona fide sale of its entire Membership Interest to a Person or Persons who are not Affiliates of Tekoil and that complies with Section 9.2. Except as otherwise set forth in this IX, the Membership Interest of each Member other than Tekoil shall be freely Transferable without the approval of any Member.

(b) Unless an assignee becomes a substituted Member in accordance with the provisions set forth below, such assignee shall not be entitled to any of the rights granted to a Member hereunder, other than the right to receive allocations of income, gain, loss, deduction, credit and similar items and distributions to which the assignor would otherwise be entitled, to the extent such items are assigned.

(c) An assignee of the Membership Interest of a Member, or any portion thereof, shall become a substituted Member entitled to all of the rights of a Member with respect to such Membership Interest if, and only if, (i) the assignor gives the assignee such right, (ii) in the case of a Transfer by Tekoil, such Transfer is made in accordance with the first sentence of Section 9.1(a), and (iii) the assignee executes and delivers such instruments, in form and substance satisfactory to the Managing Member, as the Managing Member may deem necessary or desirable in its sole and absolute discretion to effect such substitution and to confirm the agreement of the assignee to be bound by all of the terms and provisions of this Agreement. Upon the satisfaction of such requirements, such assignee shall be concurrently (or as of such later date as shall be provided for in any applicable written instruments furnished to the Managing Member) admitted as a substituted Member of the Company.

(d) The Company shall be entitled to treat the record owner of any Membership Interest as the absolute owner thereof in all respects and shall incur no liability for distributions of cash or other property made to such owner until such time as a written assignment of such interest that complies with the terms of this Agreement has been received by the Managing Member.

(e) In the event that any Member other than Tekoil desires to Transfer all or any part of its Membership Interest, other than in a Transfer pursuant to Section 9.2, such Member shall provide written notice to Tekoil that it intends to Transfer such Membership Interest. Until the expiration of 30 days after the giving of such notice, such transferring Member shall not Transfer its Membership Interest to any Person other than Tekoil and shall not solicit offers from or engage in negotiations with any Person other than Tekoil with respect to the Transfer of its Membership Interest. Tekoil shall have the right during such 30-day period to make a written proposal to the transferring Member with respect to the purchase by Tekoil of the Membership Interest to be Transferred. If Tekoil makes any such proposal, the transferring Member shall notify Tekoil in writing whether it accepts or declines such proposal, which the transferring Member may do in its sole discretion. If the transferring Member accepts such proposal, then Tekoil and the transferring Member shall cooperate in good faith to complete the purchase of the Membership Interest by Tekoil as soon as practicable and in any event within 30 days after the acceptance of such proposal by the transferring Member. If the transferring Member declines such proposal or if it accepts the proposal and such purchase is not completed within 30 days after such acceptance notwithstanding the good faith cooperation of the transferring Member, then the transferring Member shall have 90 days from the date it declines such offer or the date on which such 30-day period expires, as applicable, to complete the Transfer of its Membership Interest to any Person, subject to the other provisions of this Section 9.1. In the event the transferring Member has not completed the Transfer within such 90-day period, any proposed Transfer of such Member's Membership Interest shall again be subject to this paragraph (e).

(f) No Transfer of any Membership Interest shall be made if counsel for the Company shall be of the opinion that (i) such Transfer would be in violation of any federal, state or foreign law, or would cause the original issuance of the Membership Interests by the Company to be in violation of such laws or (ii) such Transfer would result in the Company being treated as a corporation for tax purposes.

(g) Any assignment, sale, exchange or other transfer in contravention of any of the provisions of this Section 9.1 shall be void and of no force or effect, and shall not bind or be recognized by the Company.

9.2 Tag-Along Right.

(a) In the event that Tekoil proposes to sell all of its Membership Interest (such proposed transfer, a "Tag-Along Sale"), (i) Tekoil shall provide each other Member notice of the terms and conditions of such proposed sale (the "Tag-Along Notice") and offer each other Member the opportunity to participate in such sale in accordance with this Section 9.2 and (ii) each other Member may elect, at its option, to participate in the proposed sale in accordance with this Section 9.2 (each such electing Member, a "Tagging Member").

(b) The Tag-Along Notice shall identify the consideration for which the transfer is proposed to be made, and all other material terms and conditions of the Tag-Along Sale, including the form of the proposed agreement, if any.

(c) From the date of its receipt of the Tag-Along Notice, each Tagging Member shall have the right (a "Tag-Along Right"), exercisable by notice (the "Tag-Along Response Notice") given to Tekoil within ten Business Days after its receipt of the Tag-Along Notice (the "Tag-Along Notice Period"), to request that Tekoil include in the proposed transfer the Membership Interest held by such Tagging Member.

(d) Each Tag-Along Response Notice shall include wire transfer instructions for payment of the purchase price for the Membership Interest to be sold in such Tag-Along Sale. Each Tagging Member that exercises its Tag-Along Rights hereunder shall deliver to Tekoil, with its Tag-Along Response Notice, a limited power-of-attorney authorizing Tekoil to transfer its Membership Interests on the terms set forth in the Tag-Along Notice and all other documents required to be executed in connection with such Tag-Along Sale. Delivery of the Tag-Along Response Notice with such limited power-of-attorney shall constitute an irrevocable acceptance of the terms of the Tag-Along Sale by such Tagging Member.

(e) If, at the end of a 90-day period after delivery of the Tag-Along Response Notice (which 90-day period shall be extended if any of the transactions contemplated by the Tag-Along Sale are subject to regulatory approval until the expiration of five Business Days after all such approvals have been received, but in no event later than 120 days following receipt by Tekoil of the Tag-Along Response Notice), Tekoil has not completed the transfer of its Membership Interest on substantially the same terms and conditions set forth in the Tag-Along Notice, Tekoil shall (i) return to each Tagging Member the limited power-of-attorney (and all copies thereof) that such Tagging Member executed and any other documents in the possession of Tekoil executed by the Tagging Members in connection with the proposed Tag-Along Sale, and (ii) not conduct any transfer of its Membership Interest without again complying with this Section 9.2.

(f) Concurrently with the consummation of the Tag-Along Sale, Tekoil shall (i) notify the Tagging Members thereof, (ii) remit to the Tagging Members the total consideration for the Membership Interests of the Tagging Members transferred pursuant thereto, and (iii) promptly after the consummation of the Tag-Along Sale, furnish such other evidence of the completion and the date of completion of such transfer and the terms thereof as may be reasonably requested by the Tagging Members.

(g) If at the termination of the Tag-Along Notice Period any other Member shall not have elected to participate in the Tag-Along Sale, such Member shall be deemed to have waived its rights under this Section 9.2 with respect to the transfer of its Membership Interest pursuant to such Tag-Along Sale.

(h) Notwithstanding anything contained in this Section 9.2, there shall be no liability on the part of Tekoil to the Tagging Members if the transfer of the Membership Interests pursuant to this Section 9.2 is not consummated for whatever reason. Whether to effect a transfer of Membership Interests by Tekoil is in the sole and absolute discretion of Tekoil.

(i) Notwithstanding anything contained in this Section 9.2, the rights and obligations of the other Members to participate in a Tag-Along Sale are subject to the following conditions:

(i) subject to the allocation provisions set forth in Section 10.4, upon the consummation of such Tag-Along Sale, all of the Members participating therein will receive the same form of consideration and shall be subject to all of the same other terms and conditions of such sale (and no such terms and conditions shall be less favorable to the Tagging Members than to Tekoil) in a manner proportionate to their relative Membership Interests being sold; and

(ii) no Member participating therein shall be obligated to pay any expenses incurred in connection with any unconsummated Tag-Along Sale, and each such Member shall be obligated to pay only its pro rata share (based on the relative Membership Percentage transferred) of expenses incurred in connection with a consummated Tag-Along Sale to the extent such expenses are incurred for the benefit of all such Members and are not otherwise paid by the Company or another person.

9.3 Death, Incapacity, Bankruptcy or Insolvency of a Member; Purchase Option.

(a) If a Member dies or becomes Incapacitated, or becomes a Bankrupt Member, the remaining Member or Members (the "Remaining Members") shall forthwith become vested with the exclusive right and option, to be exercised in writing to such Bankrupt, deceased or Incapacitated Member, for a period of ninety (90) days after the Remaining Members have received (i) written notice from the Bankrupt Member of the occurrence of any Event of Bankruptcy (which notice shall be delivered within three (3) Business Days after such occurrence), or (ii) notice of the death or incapacity of a Member, to elect to purchase the Membership Interest of the Bankrupt, deceased or Incapacitated Member at a purchase price determined in accordance with subsection (c) of this Section 9.3. In the event that more than one Remaining Member desires to exercise the option to purchase the Membership Interest of the Bankrupt, deceased or Incapacitated Member, such option shall be exercised by all such Remaining Members in proportion to their relative Membership Percentages.

(b) A Bankrupt, deceased or Incapacitated Member (or its legal representative) whose entire Membership Interest is to be purchased and succeeded to by the Remaining Members pursuant to this Section 9.3 shall, within ten (10) days after receipt of notice from the Remaining Members of their intent to purchase the entire Membership Interest of the Bankrupt, deceased or Incapacitated Member, execute and deliver such deeds, bills of sale and other instruments as shall reasonably be requested by such Remaining Members to effect the conveyance and transfer of the entire right, title and interest of such Bankrupt, deceased or Incapacitated Member in the Company, and shall, to the extent requested by the Remaining Members, cooperate to effect a smooth and efficient continuation of the Company affairs. If the Bankrupt Member (or its legal representative) or the legal representative of the deceased or Incapacitated Member disputes the right of the Remaining Members to purchase and succeed to the Bankrupt, deceased or Incapacitated Member's entire Membership Interest in the Company, such Bankrupt Member (and its legal representative) or the legal representative of the deceased or Incapacitated Member, as the case may be, shall nevertheless execute instruments and cooperate with the Remaining Members pursuant to the immediately preceding sentence, without, however, being deemed to have waived his, her or its rights to damages if the Remaining Members shall have purchased and succeeded to the Membership Interest of the Bankrupt, deceased or Incapacitated Member under this Section 9.3 without having the right to do so.