Exhibit 10.40

EXECUTION COPY

| STATE OF TEXAS | § |

| | § |

| COUNTIES OF CHAMBERS | § |

| AND GALVESTON | § |

ASSIGNMENT AND BILL OF SALE

IN CONSIDERATION OF Ten Dollars ($10.00) and other good and valuable consideration, all cash, the receipt and sufficiency of which are acknowledged, and subject to the other provisions in this Assignment and Bill of Sale (the “Assignment”), to the extent of each of their respective interests, each of MASTERS RESOURCES, L.L.C. and MASTERS OIL & GAS, L.L.C., (collectively, “Assignor”) each a Texas limited liability company having its principal place of business at 9801 Westheimer, Suite 1070, Houston, Texas 77042, hereby grants, bargains, sells, transfers, conveys and assigns to TEKOIL AND GAS GULF COAST, LLC, a Delaware limited liability company, having its principal place of business at 25050 I-45 North, Suite 528, The Woodlands, Texas 77380, all of the interest of Assignor in and to the following (collectively, the “Assets”):

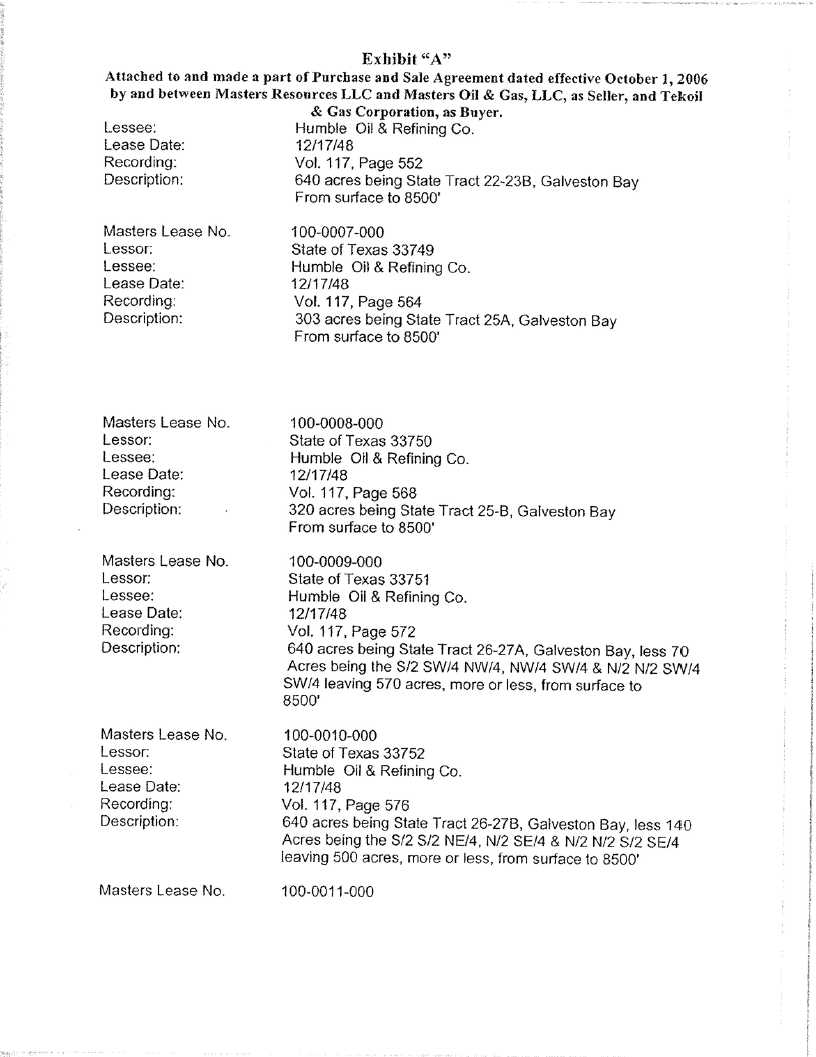

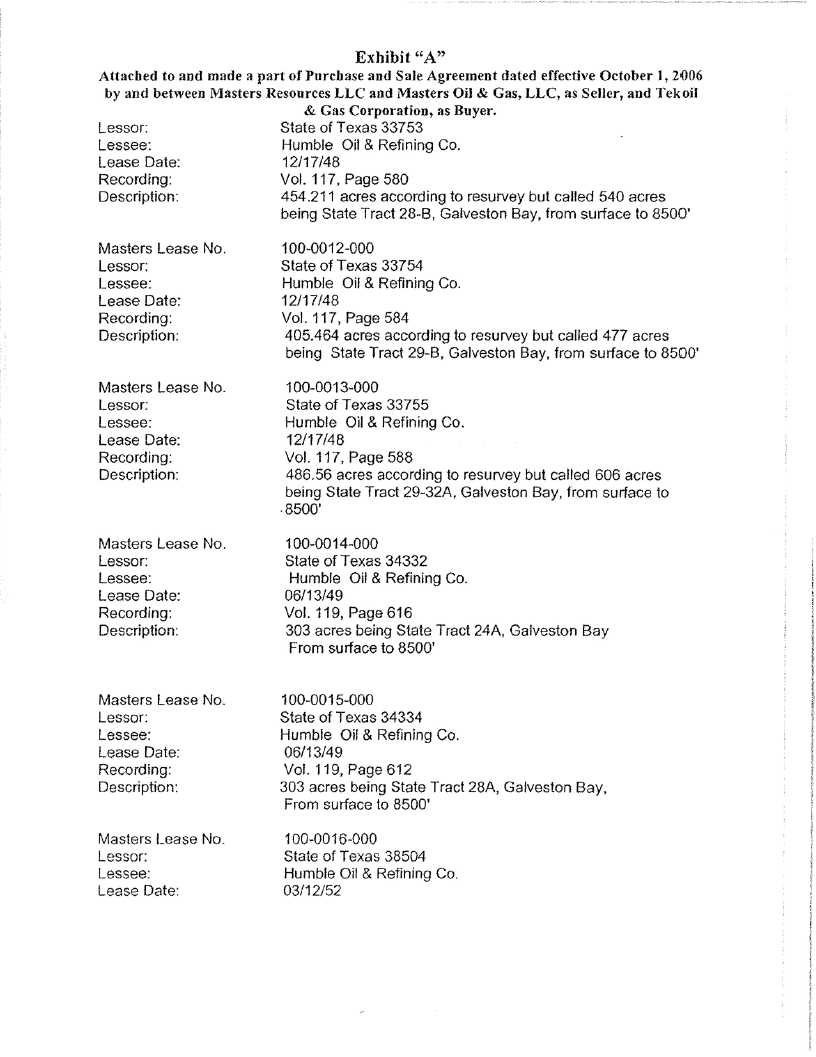

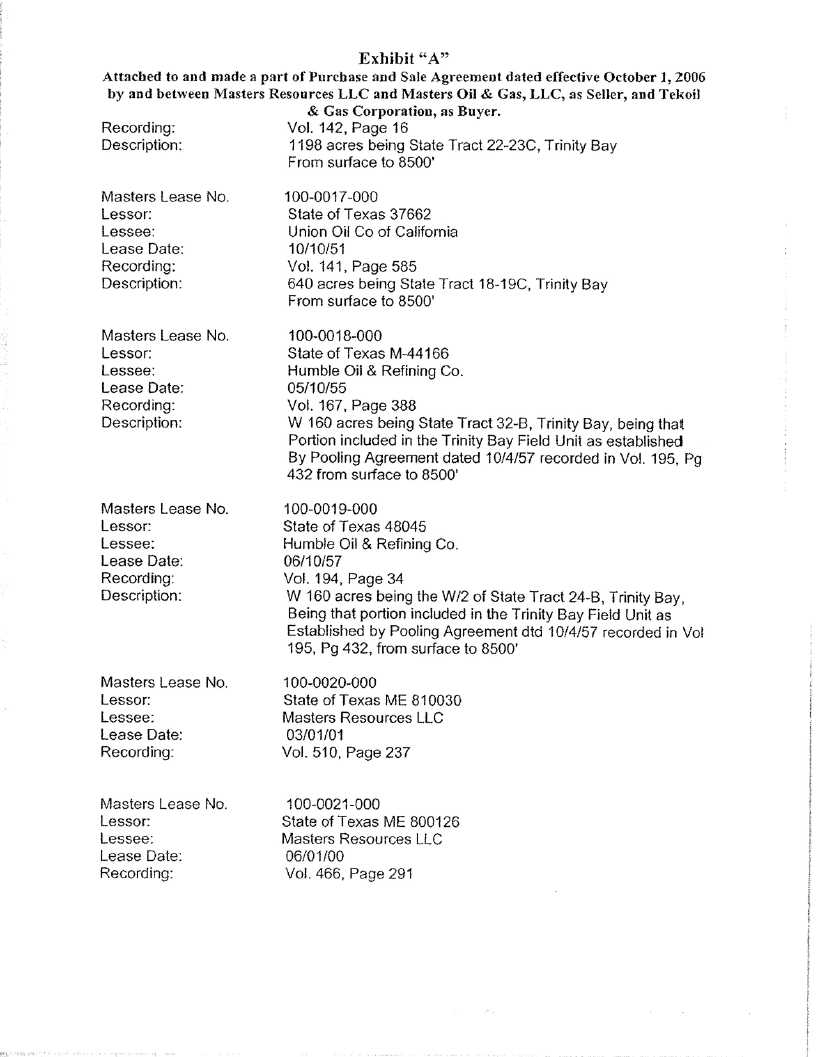

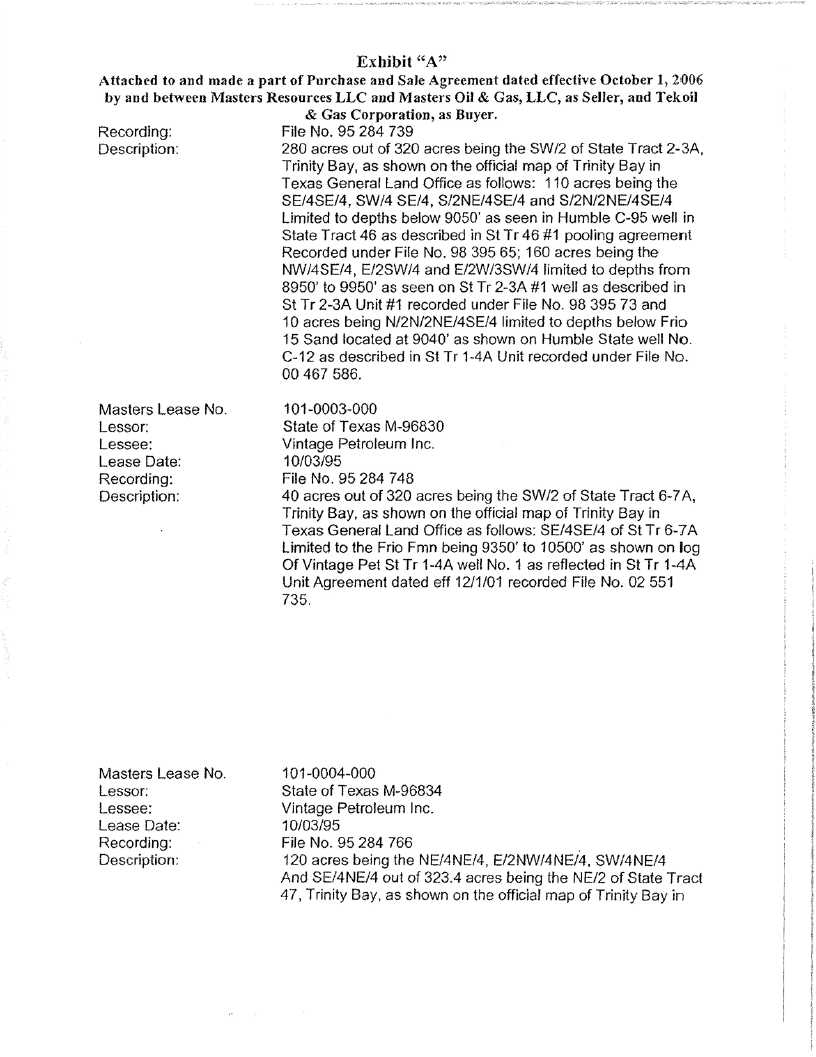

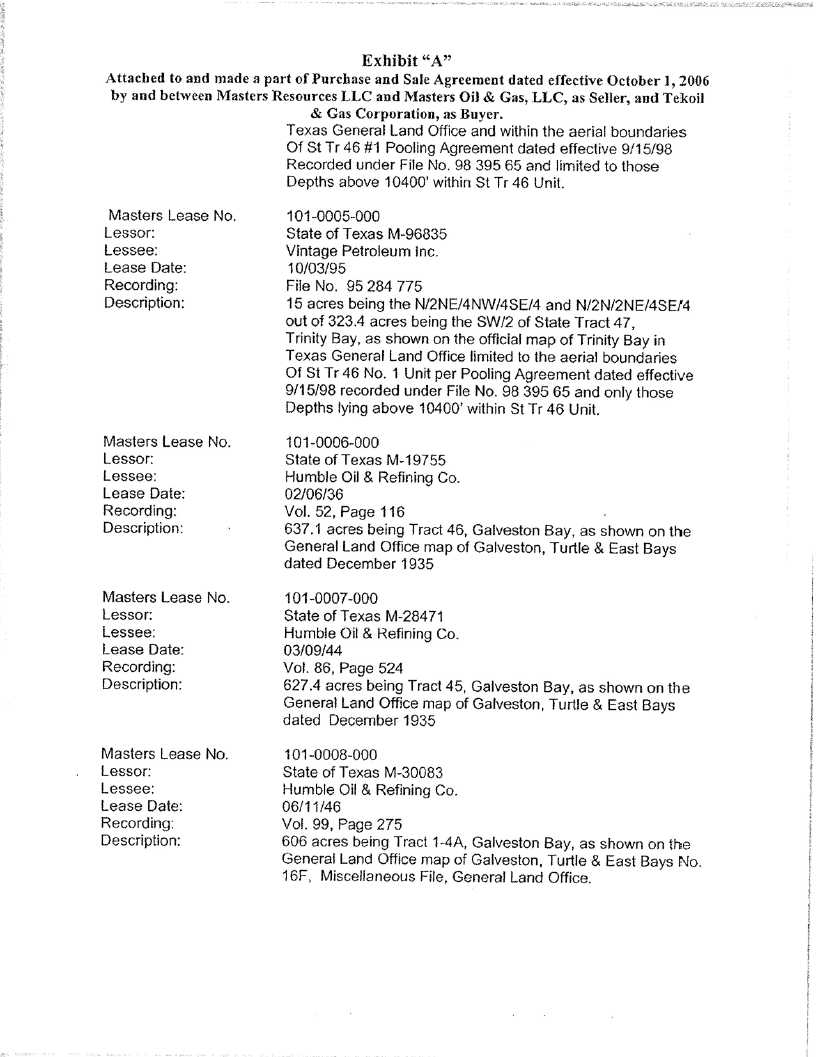

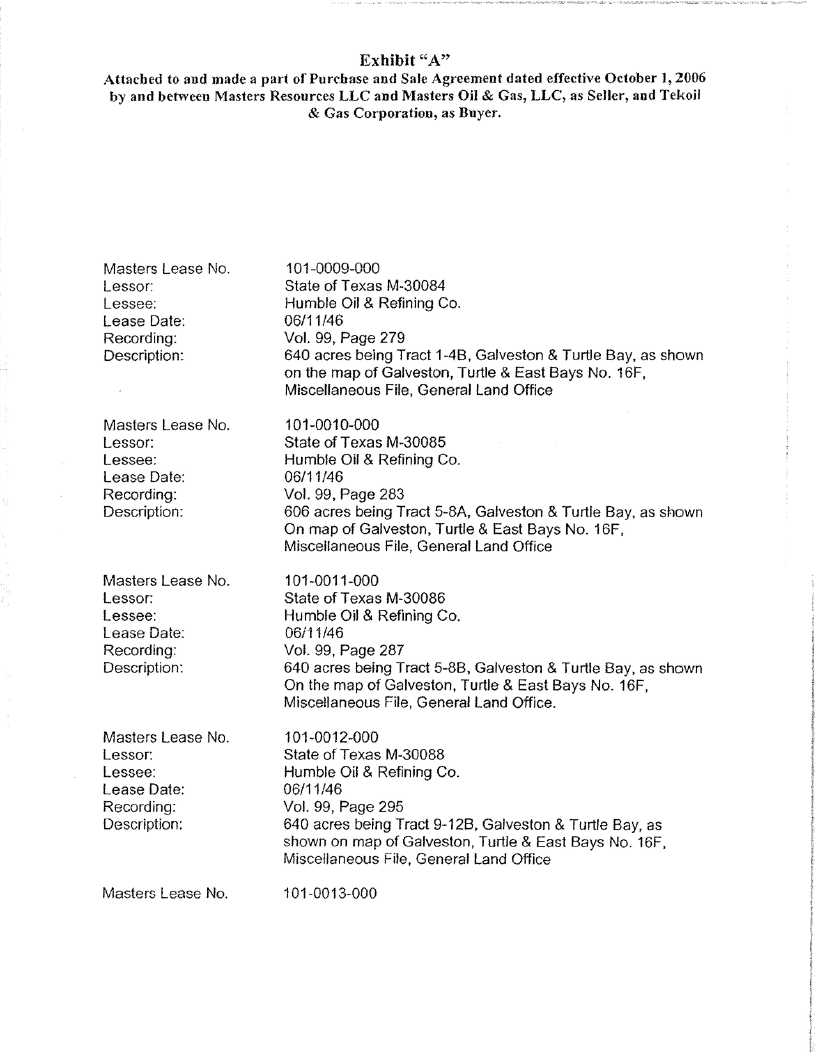

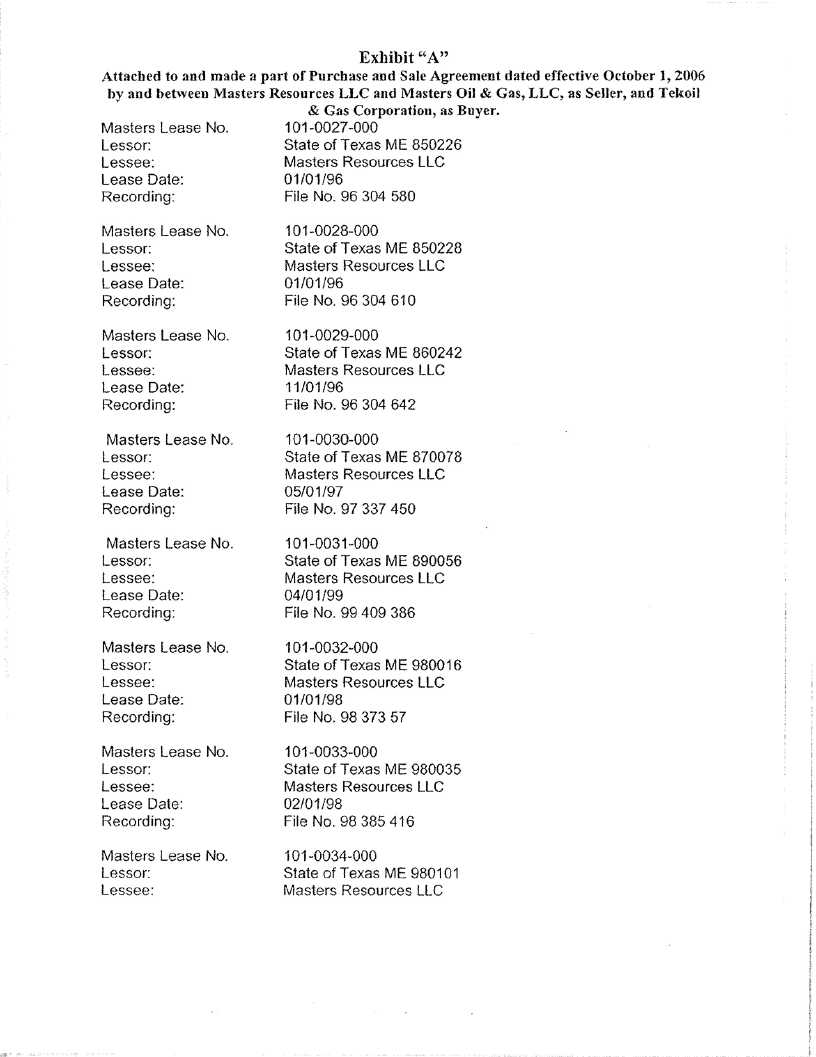

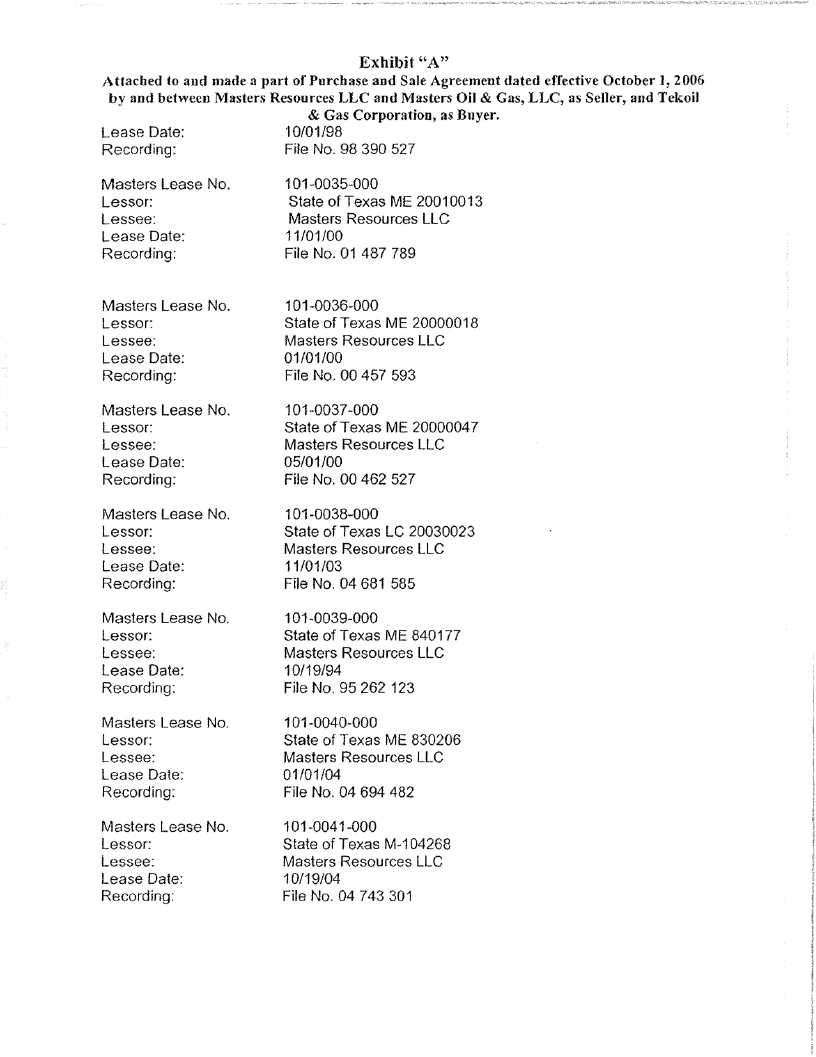

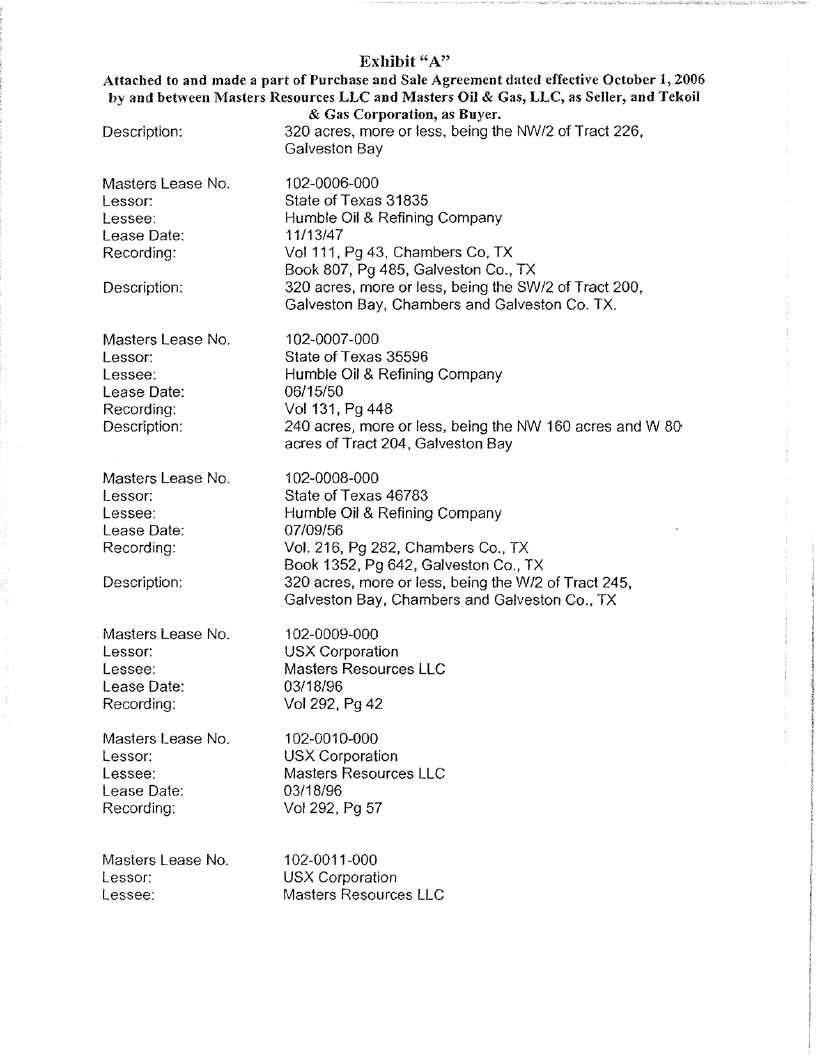

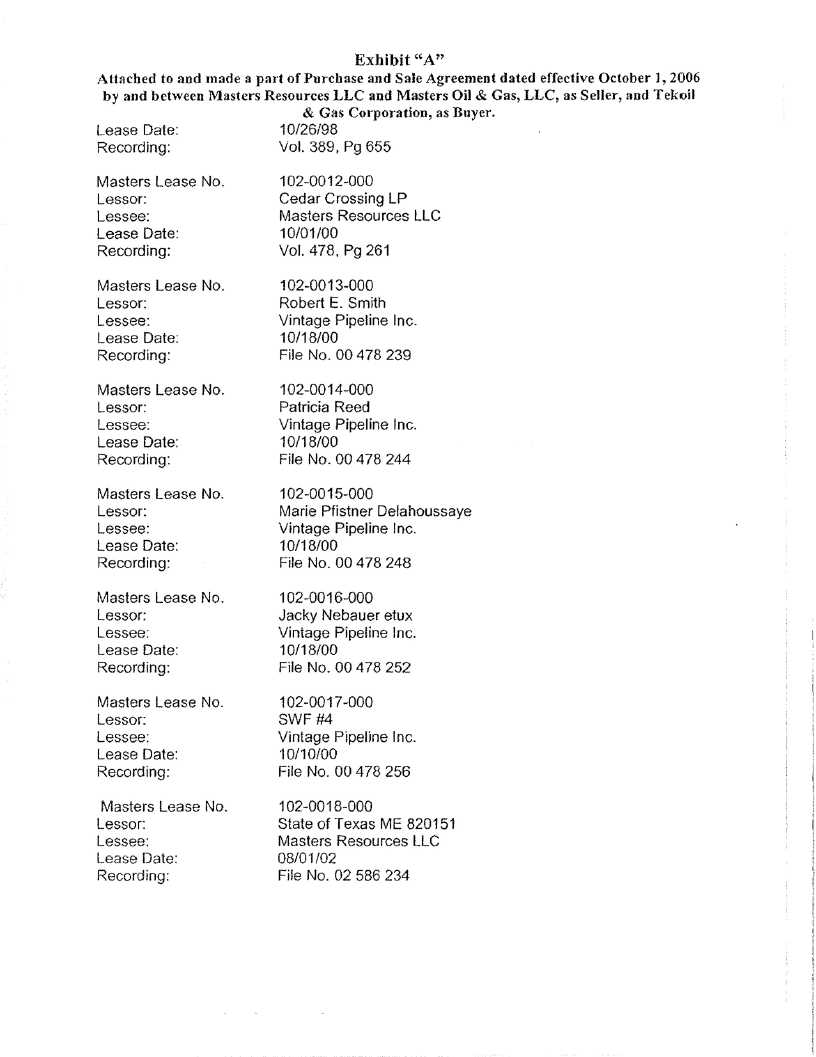

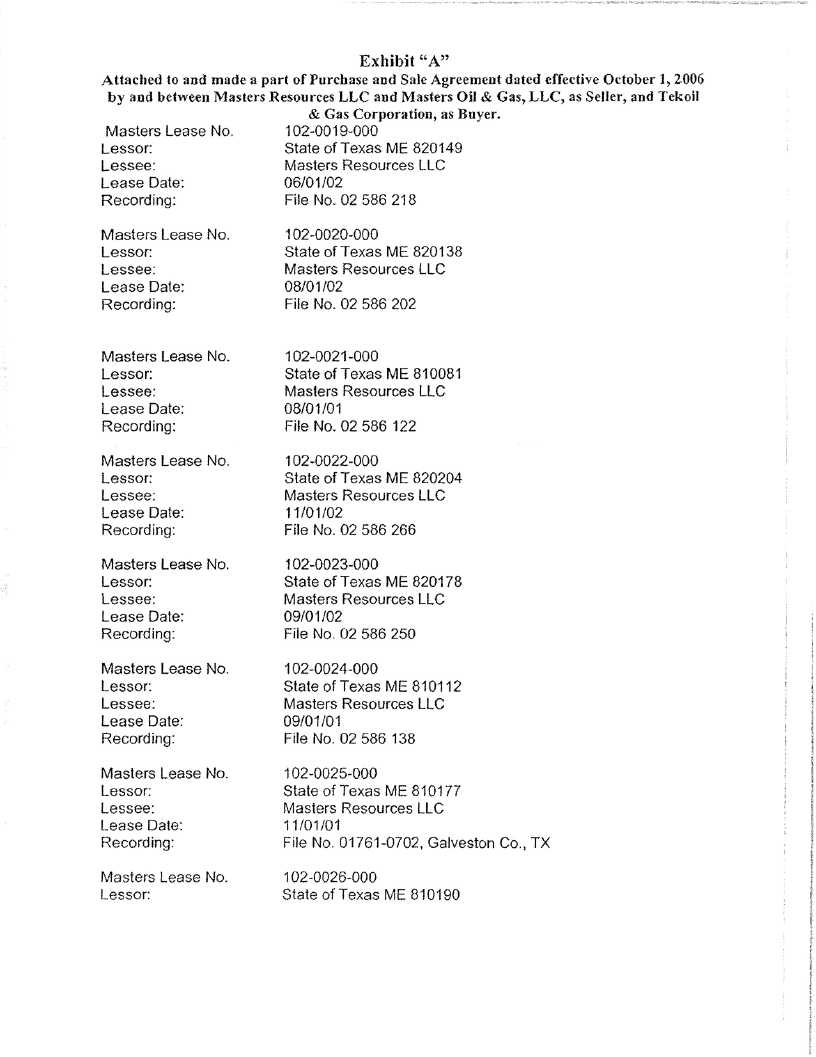

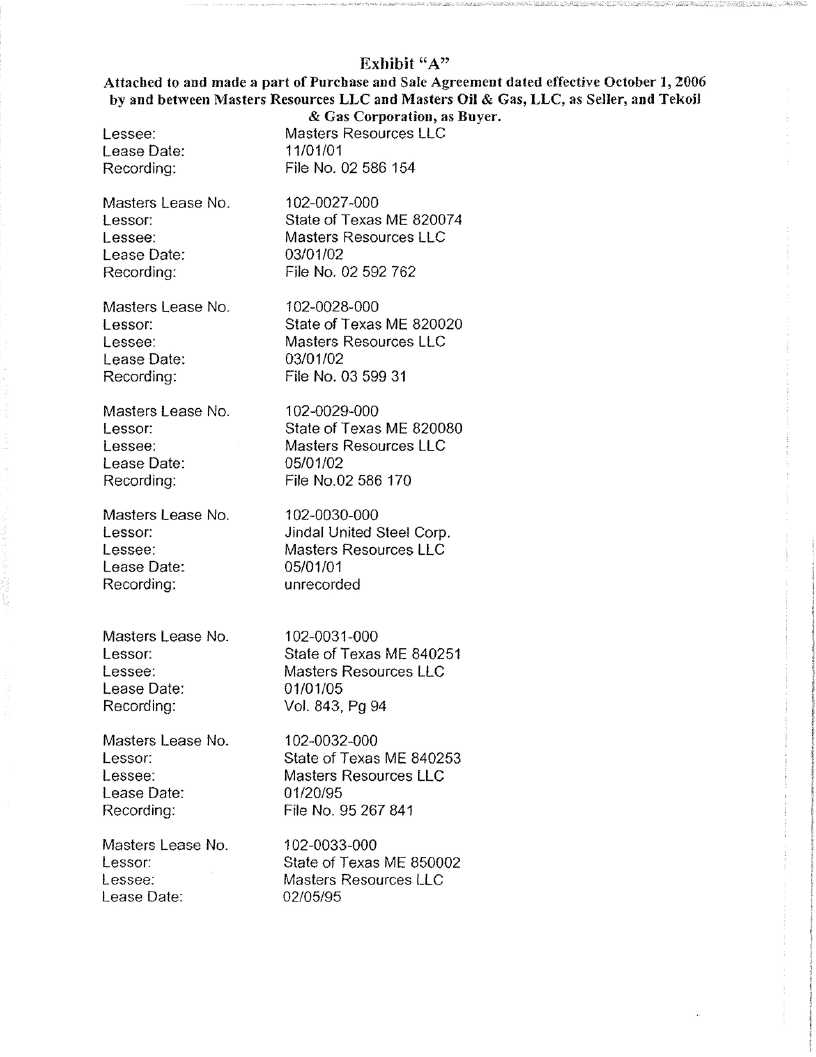

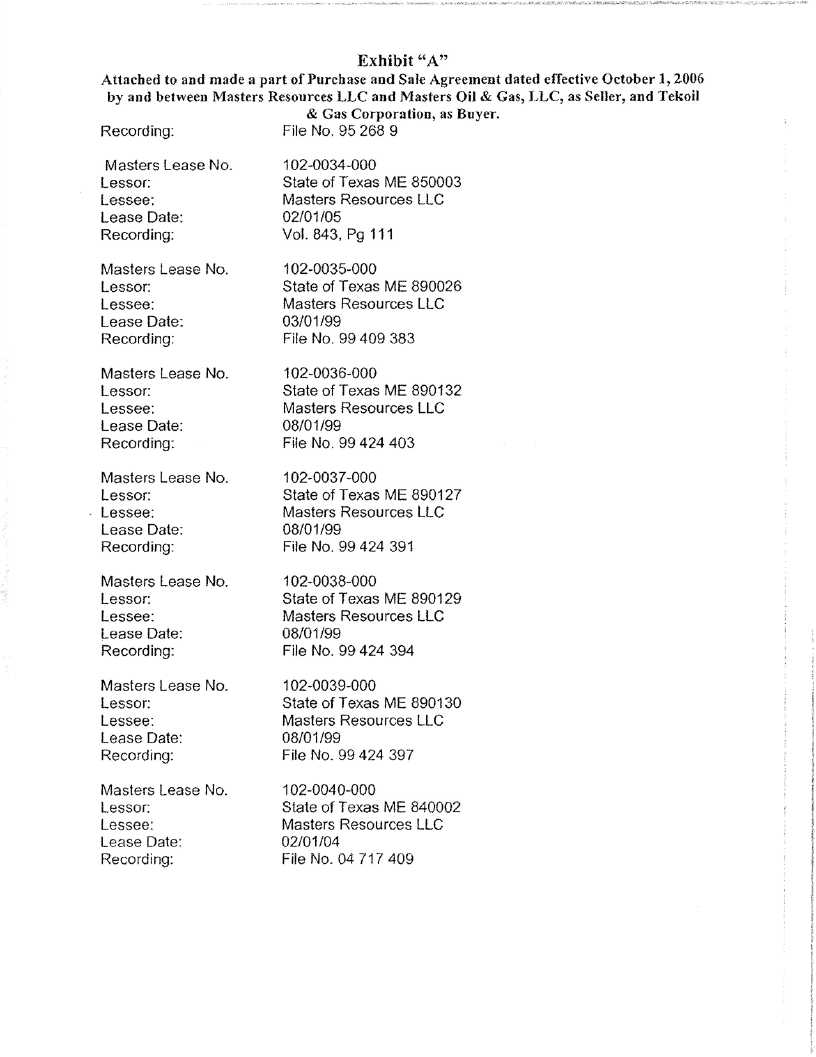

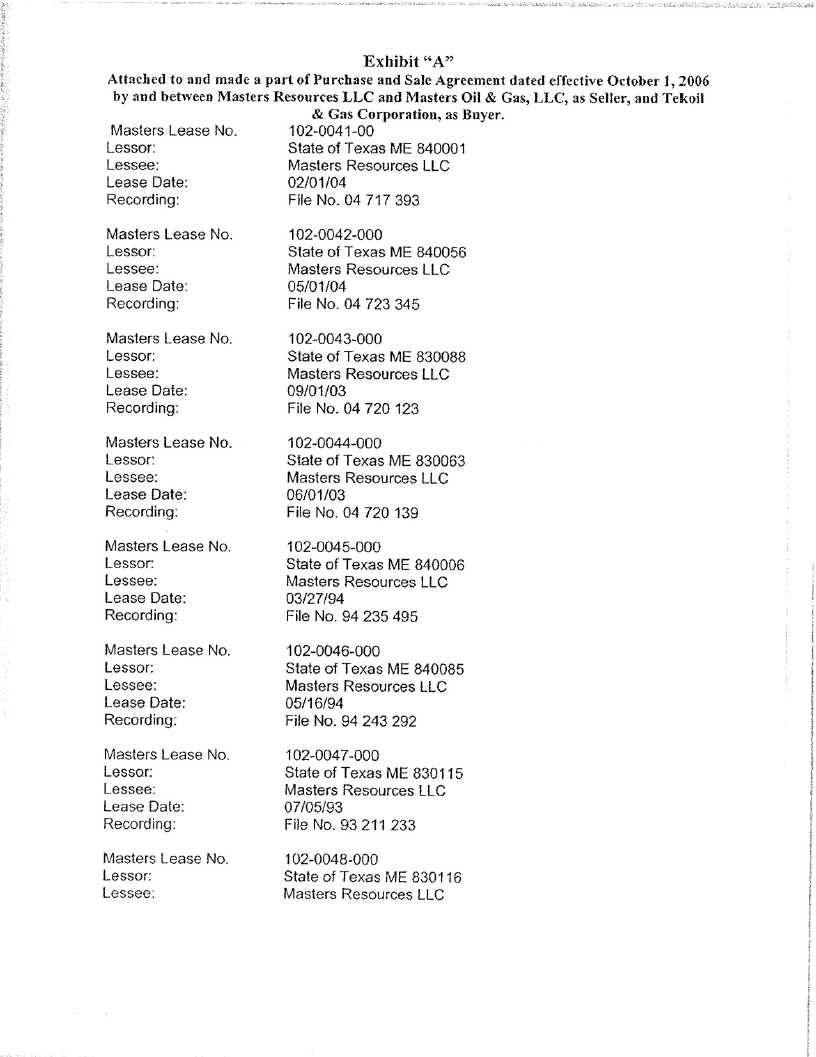

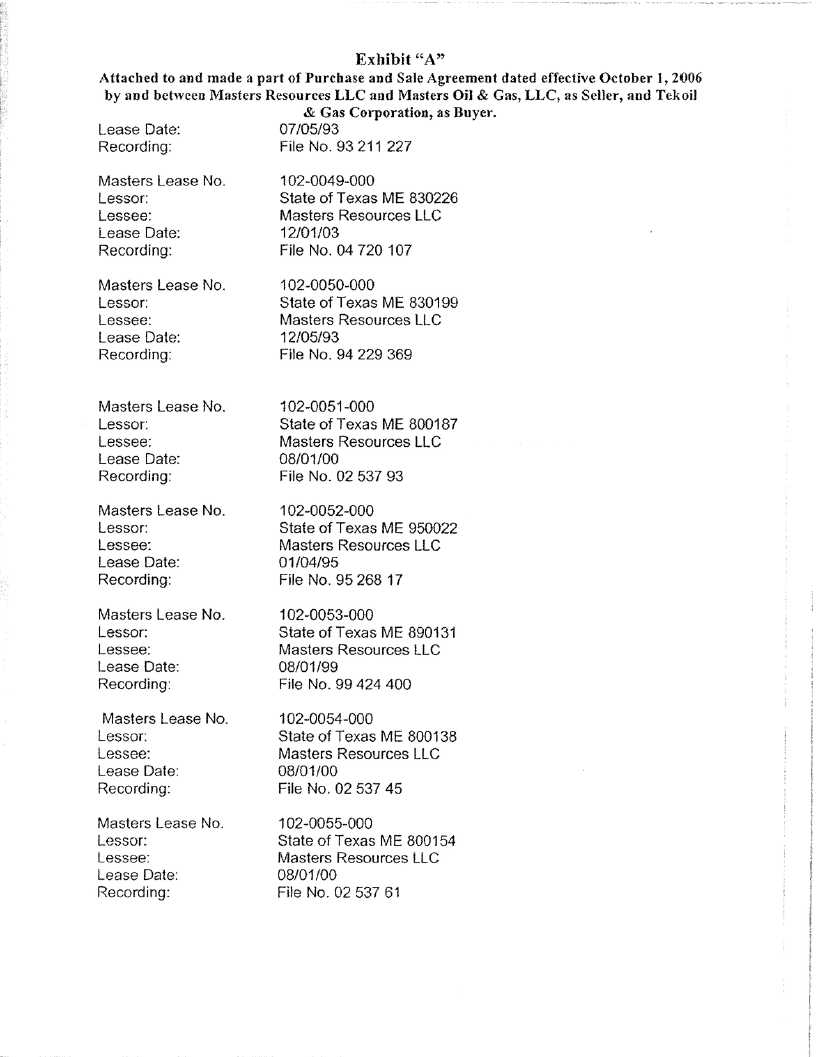

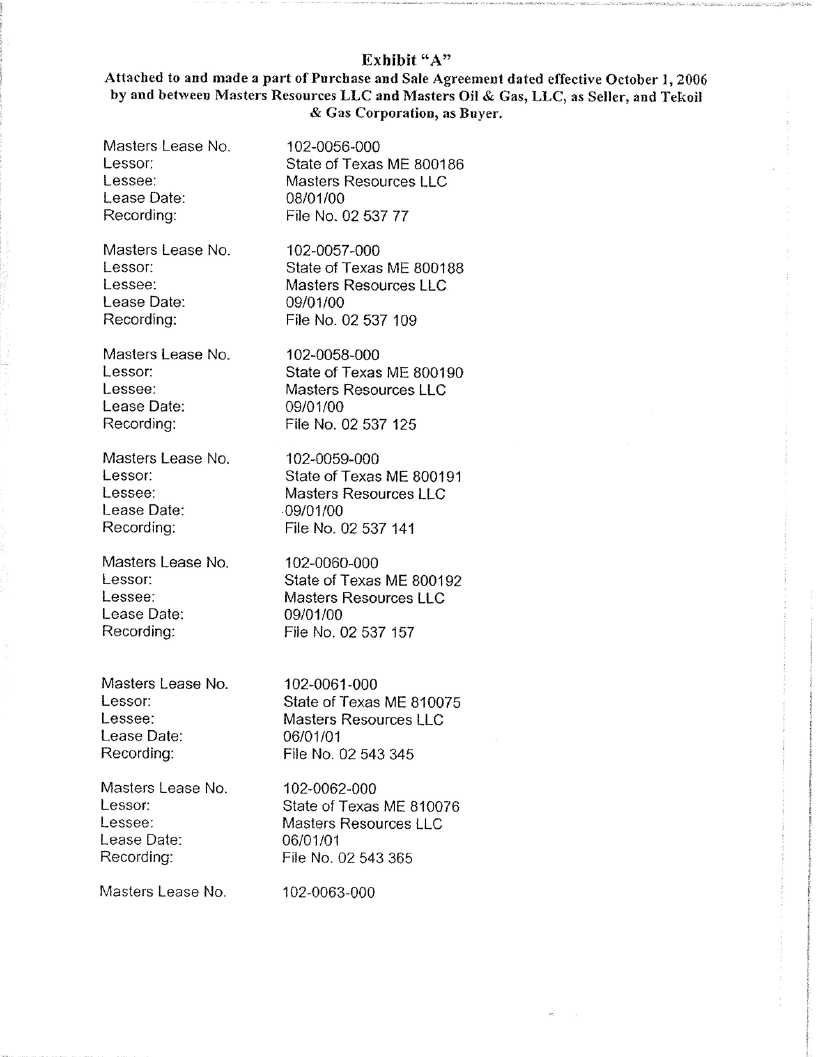

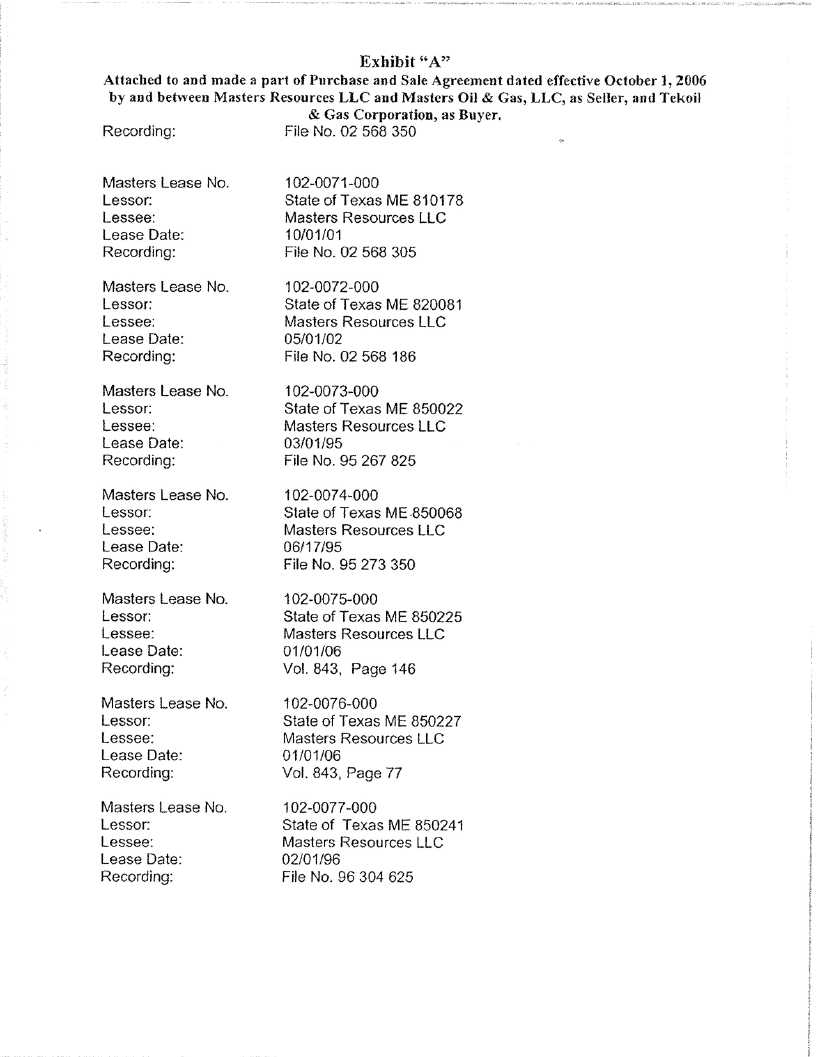

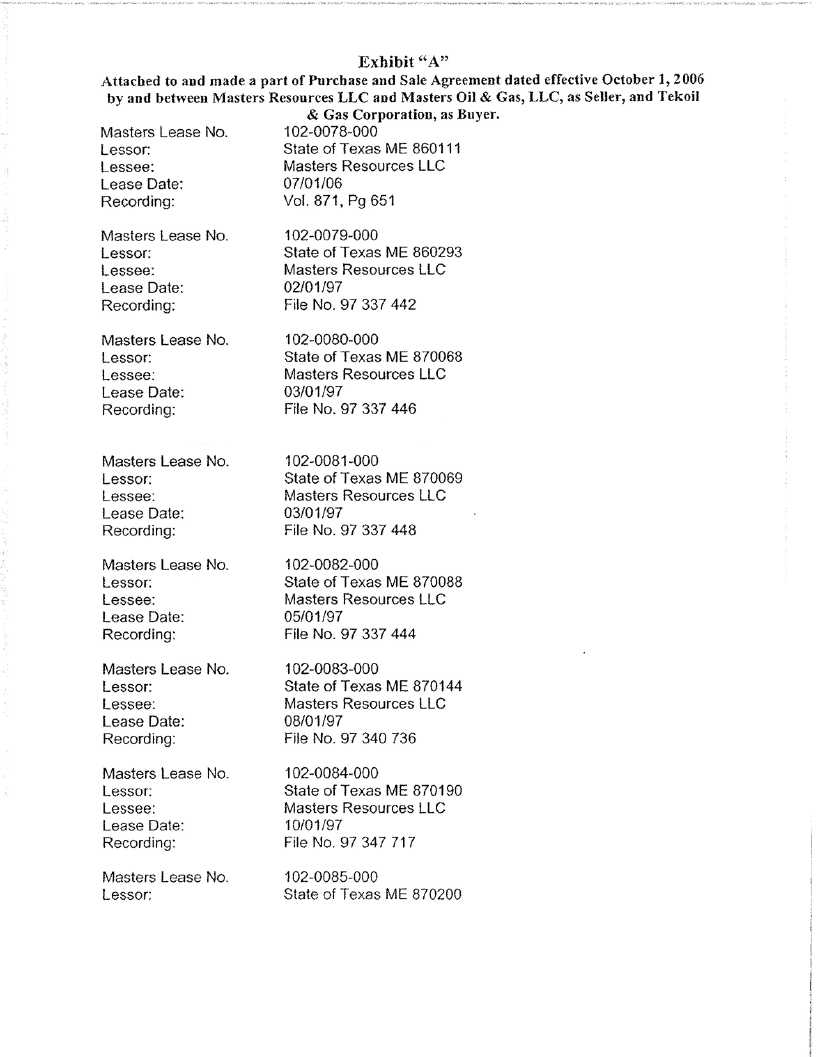

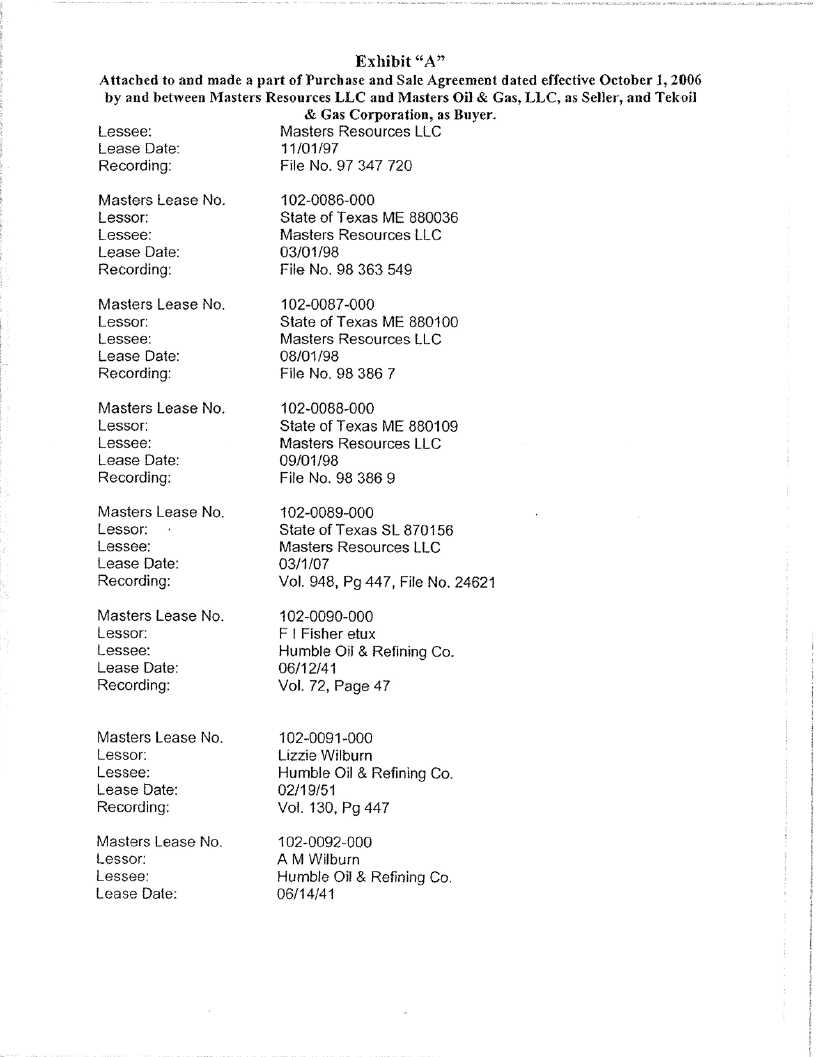

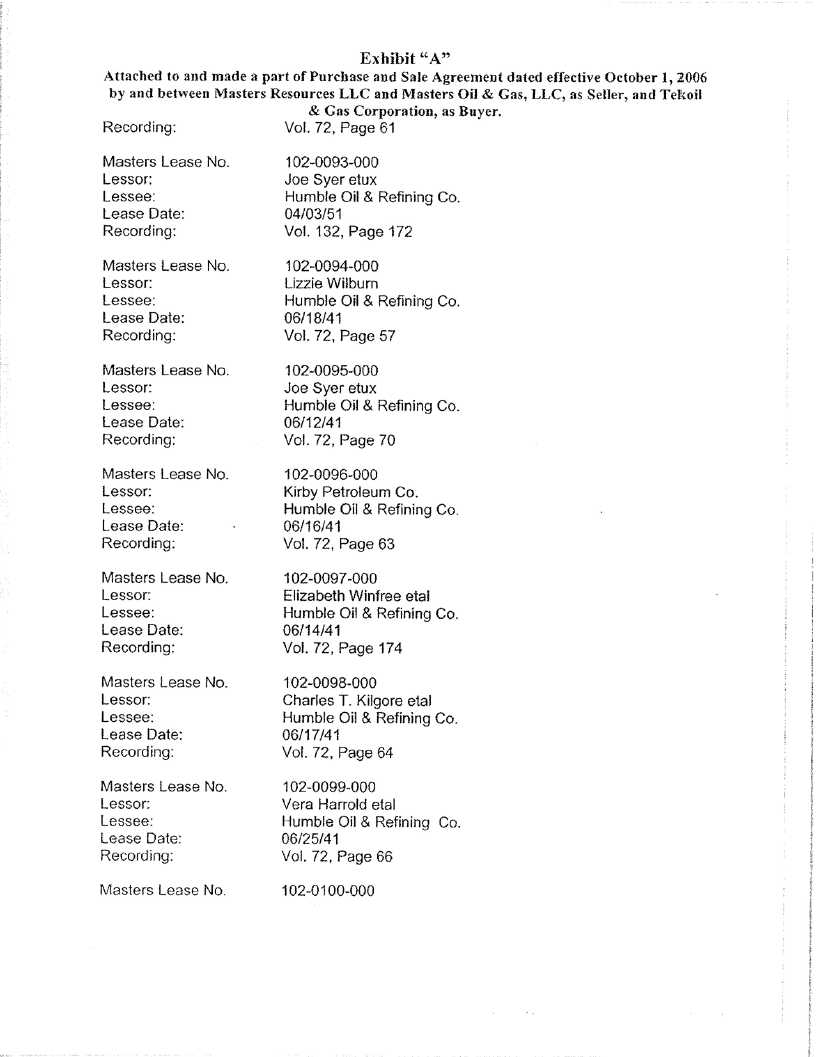

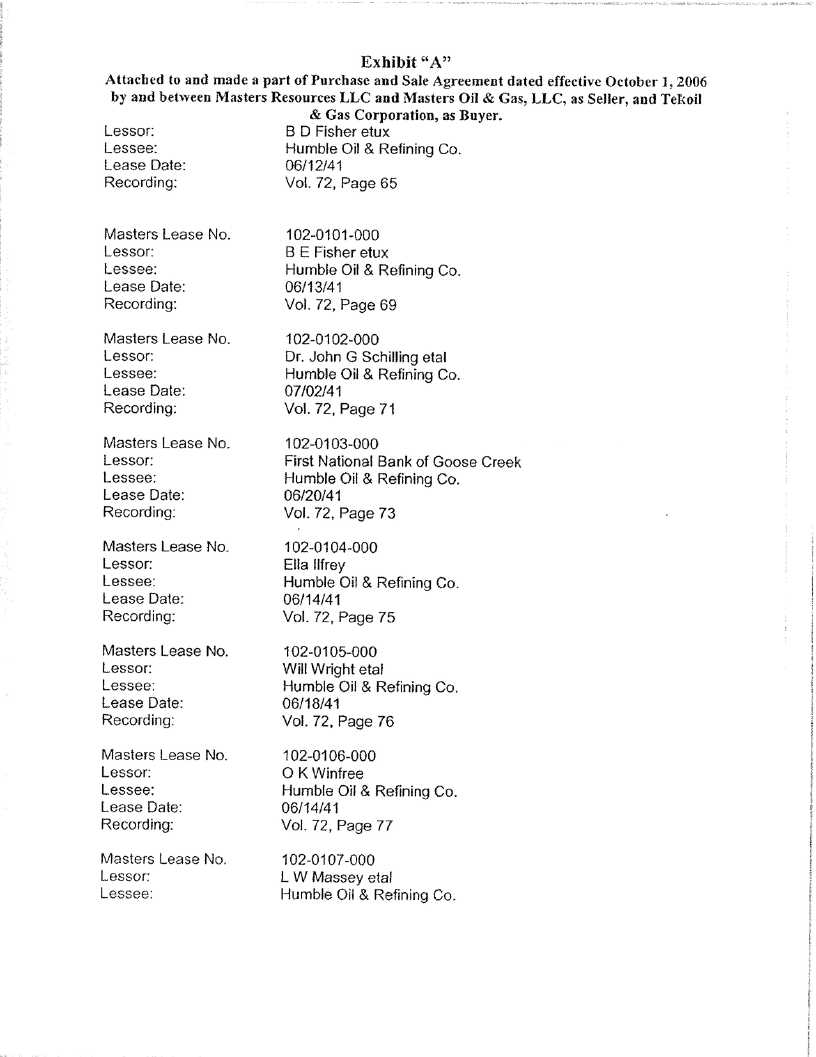

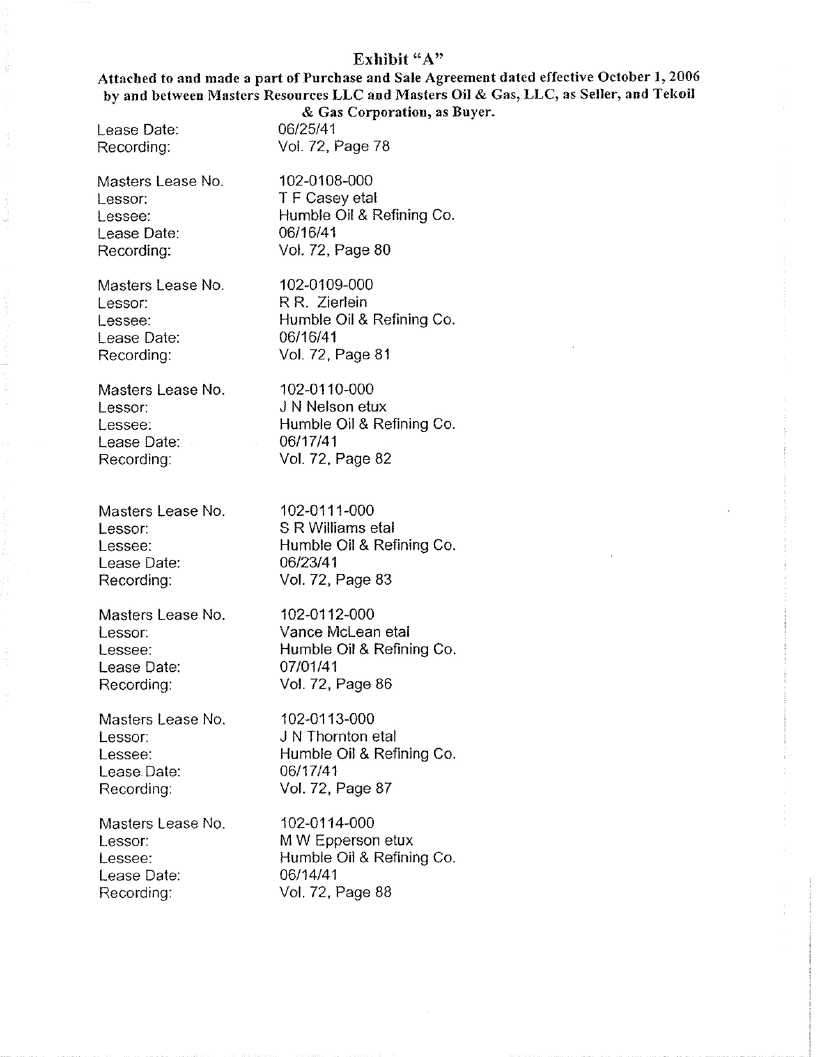

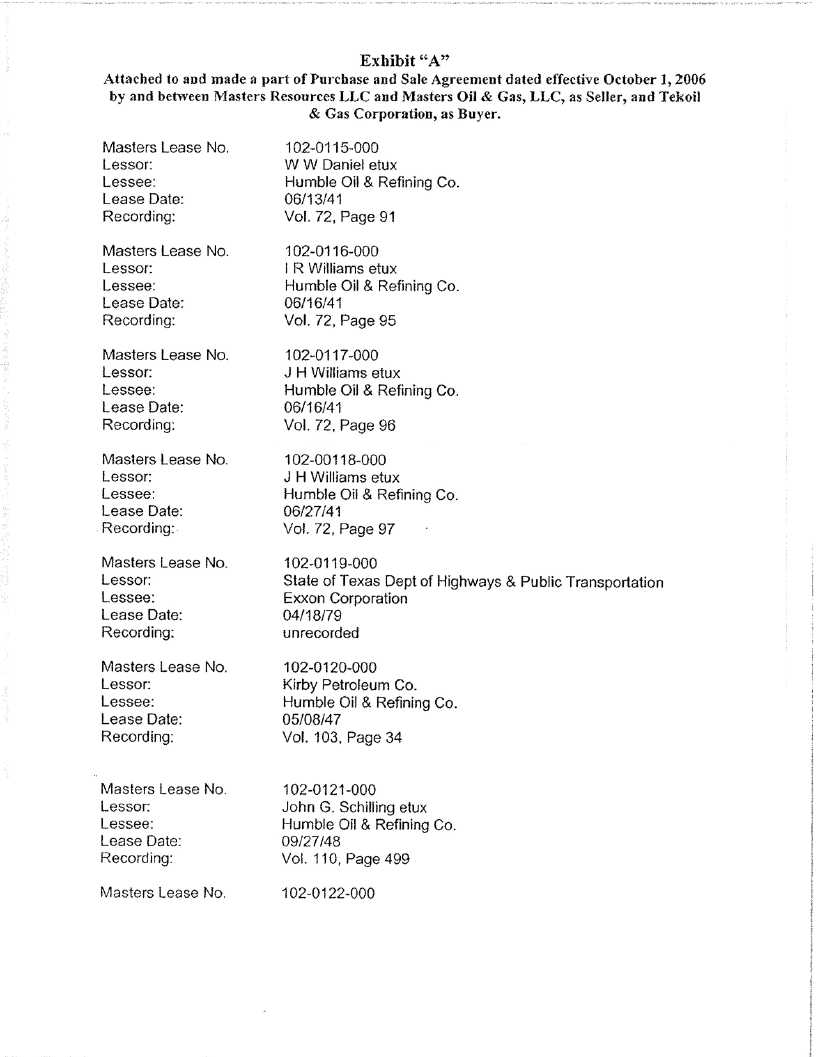

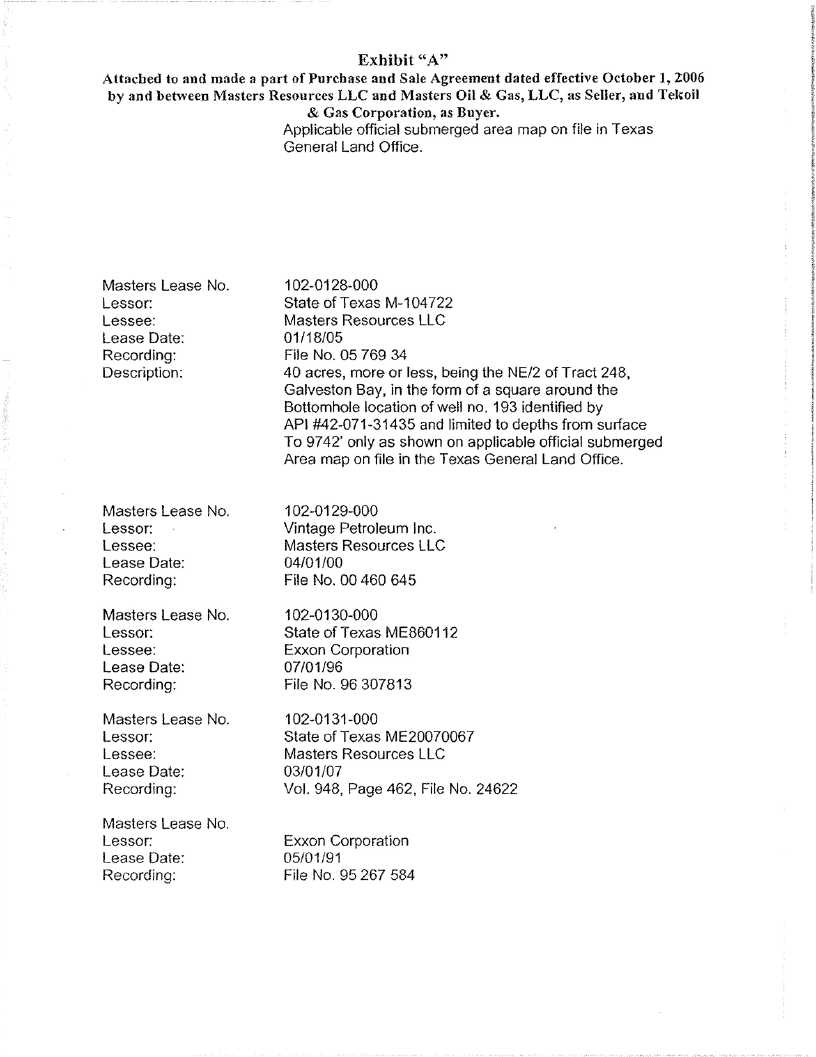

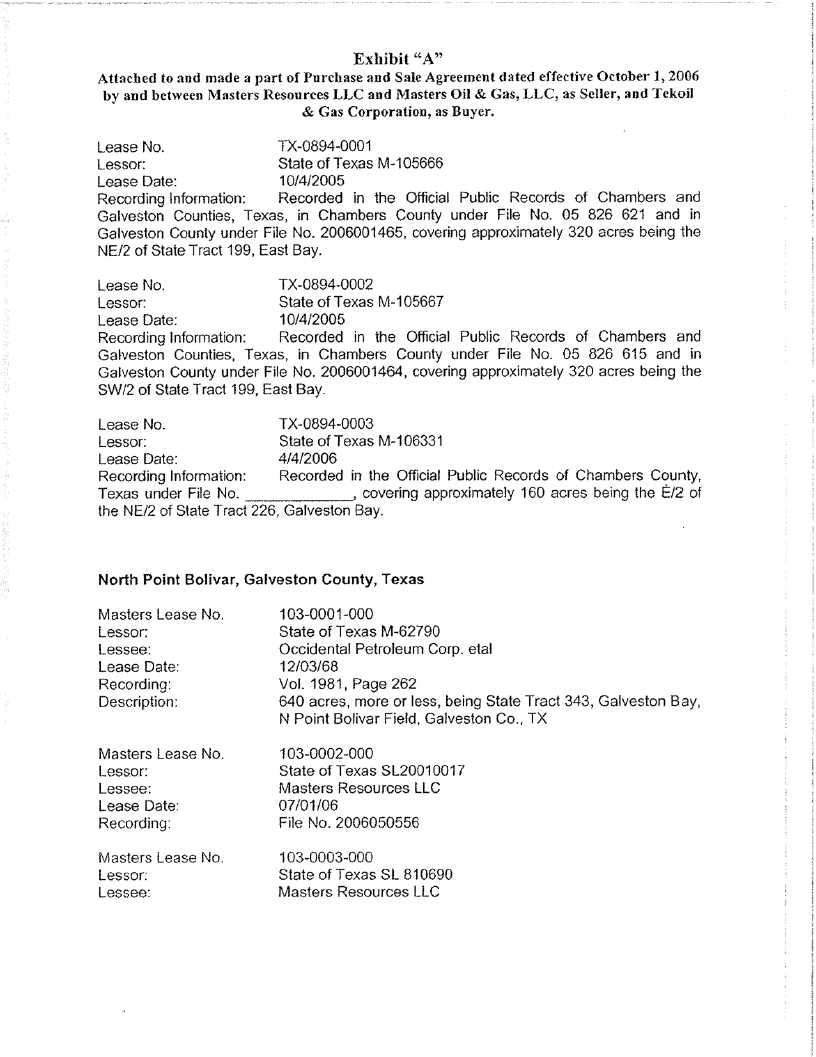

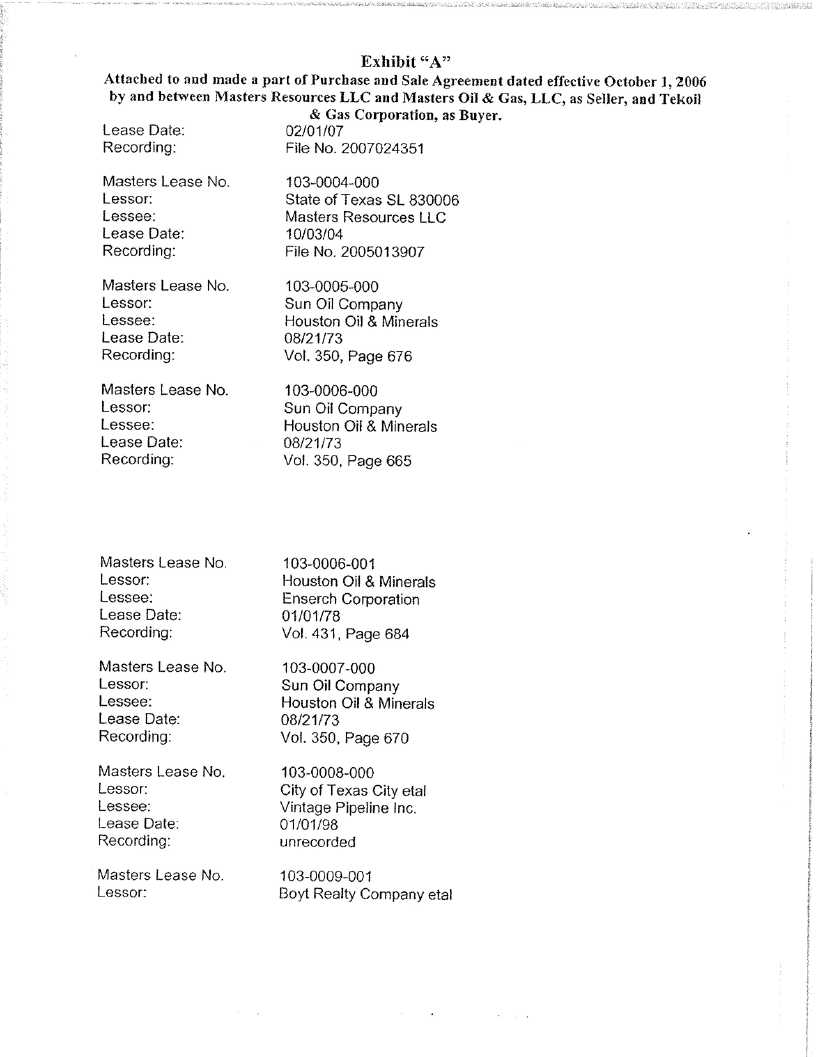

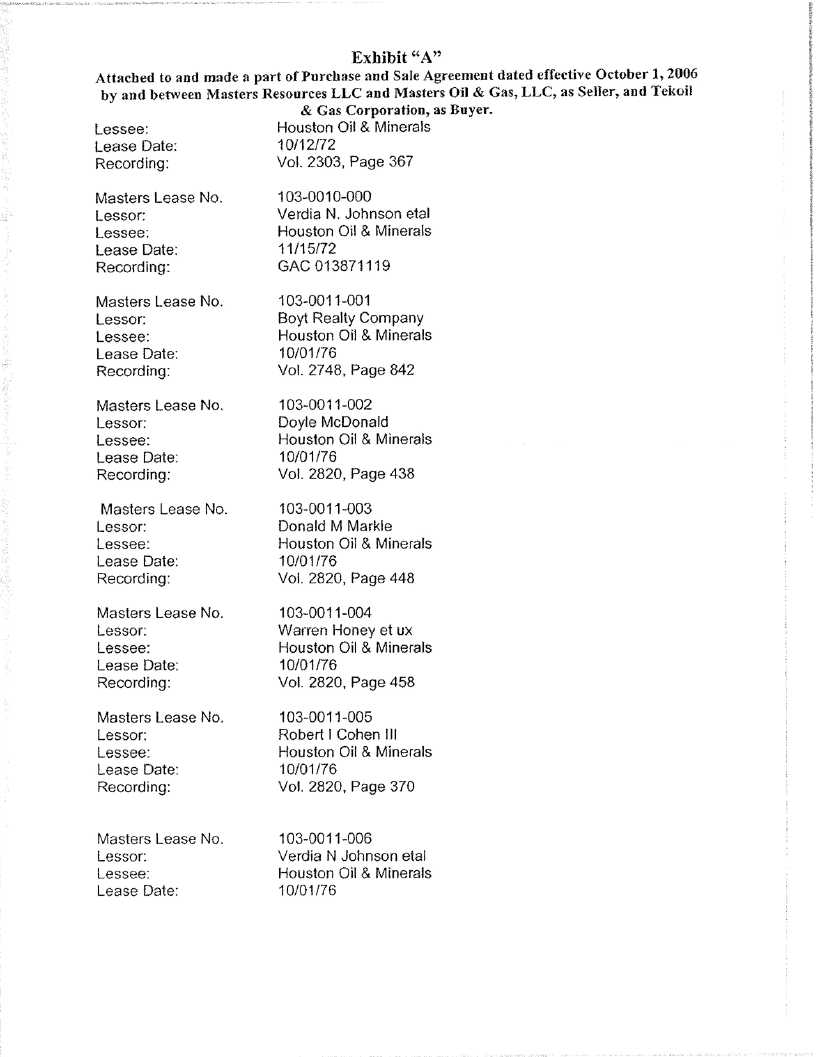

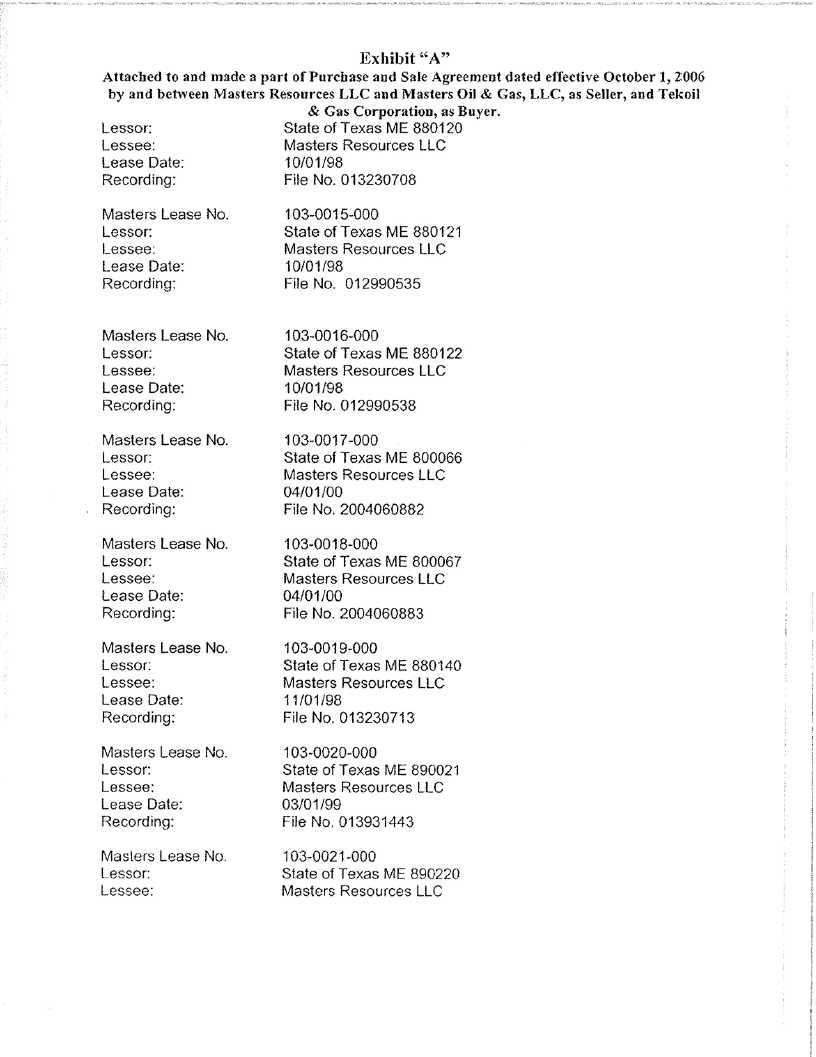

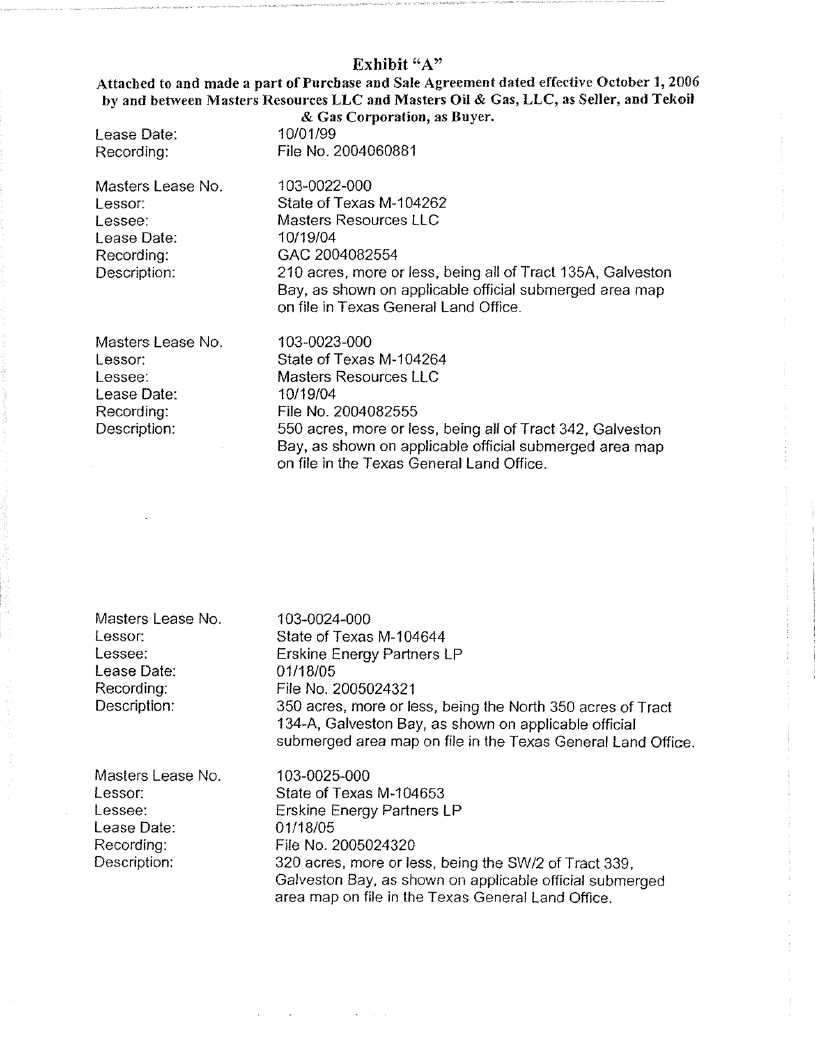

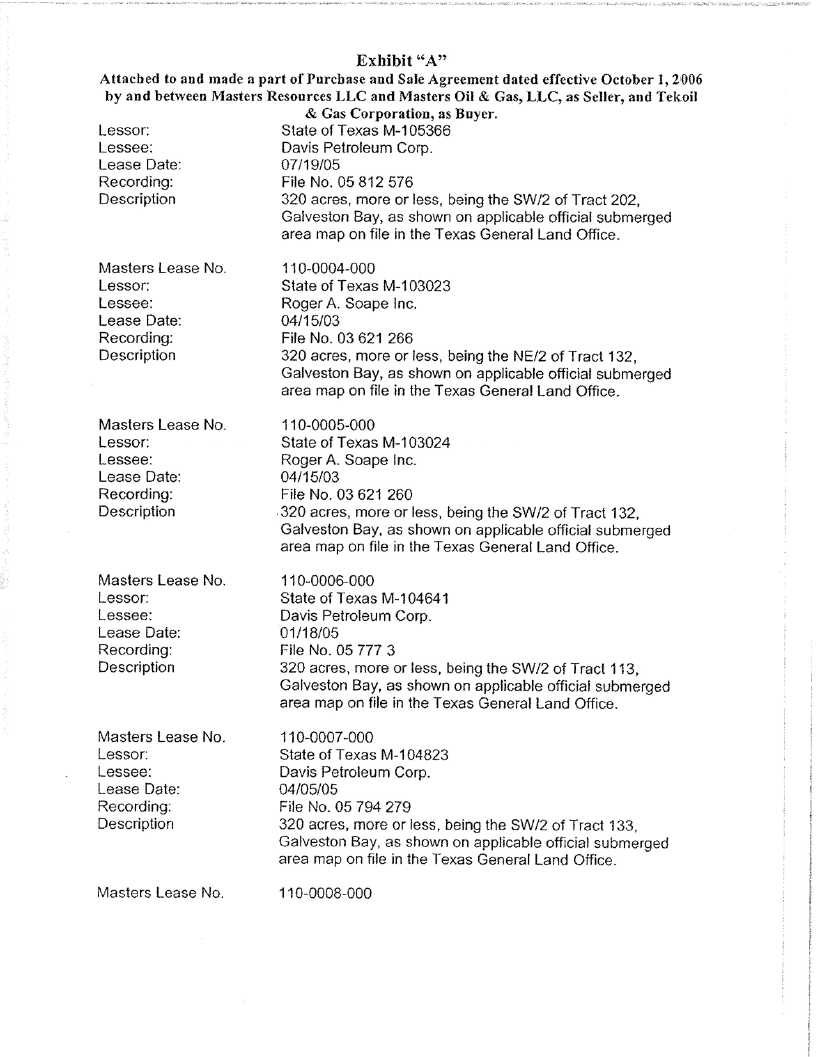

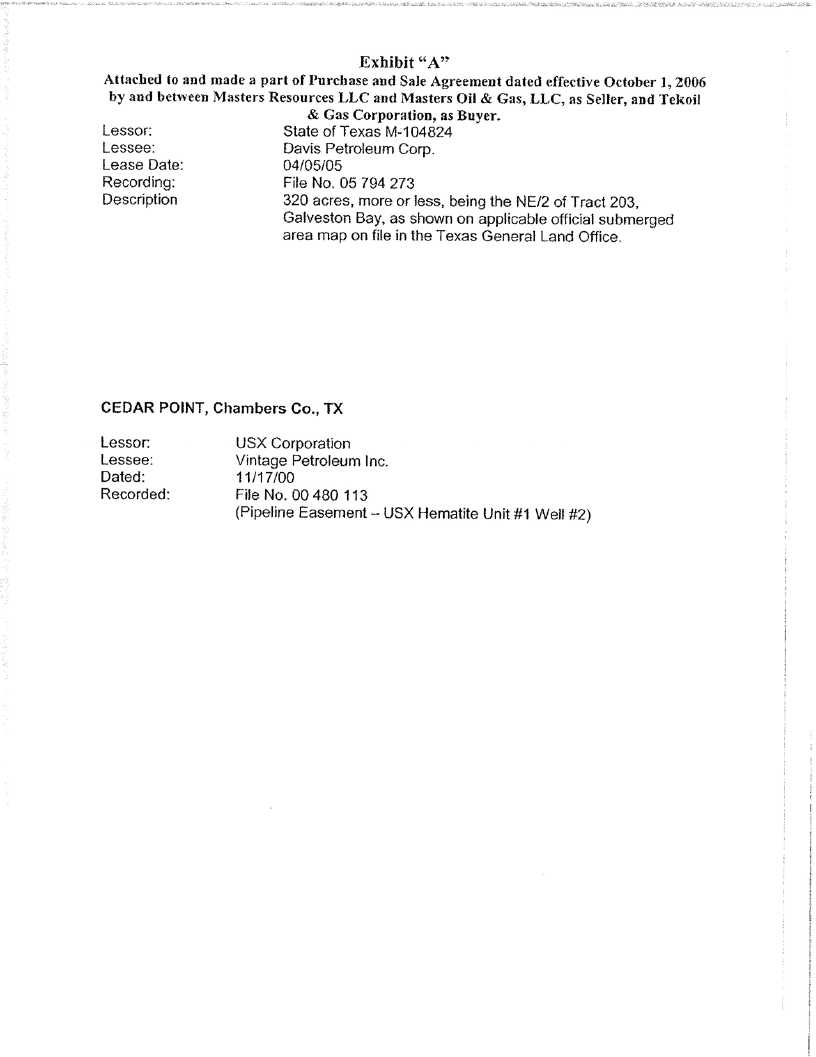

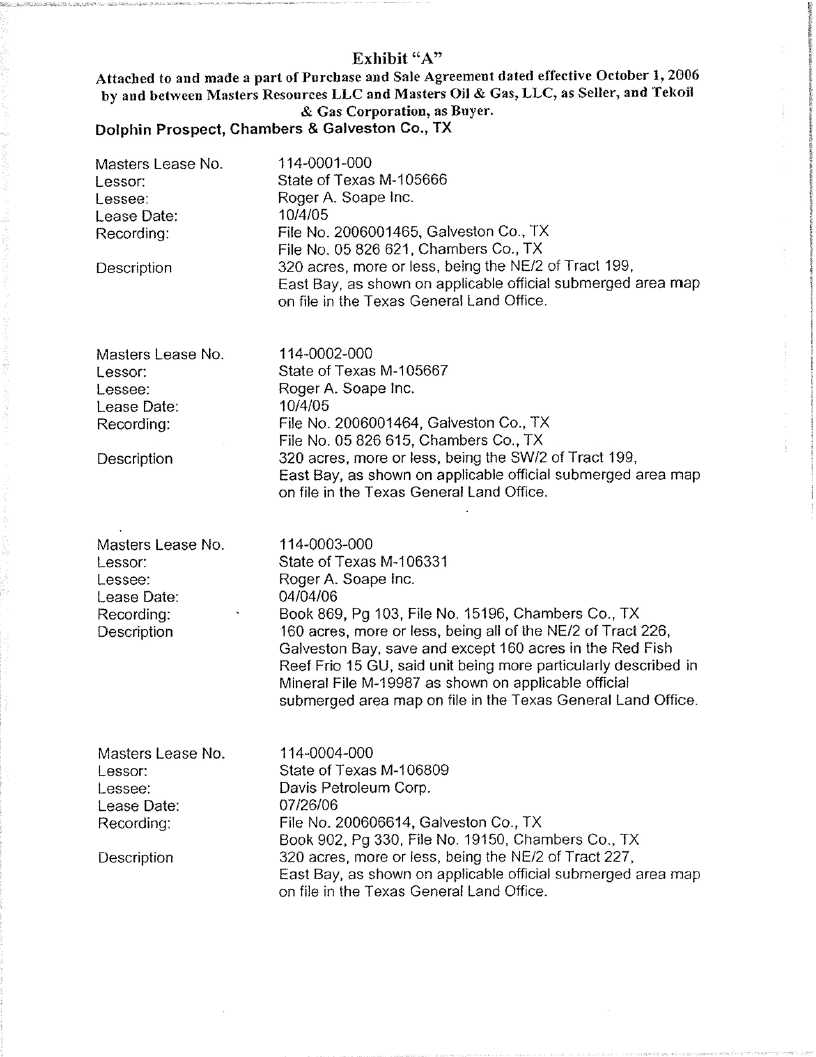

| | 1.1. | The oil, gas and mineral leases and other real property described on Exhibit A attached to and made a part of this Assignment (the “Property”); |

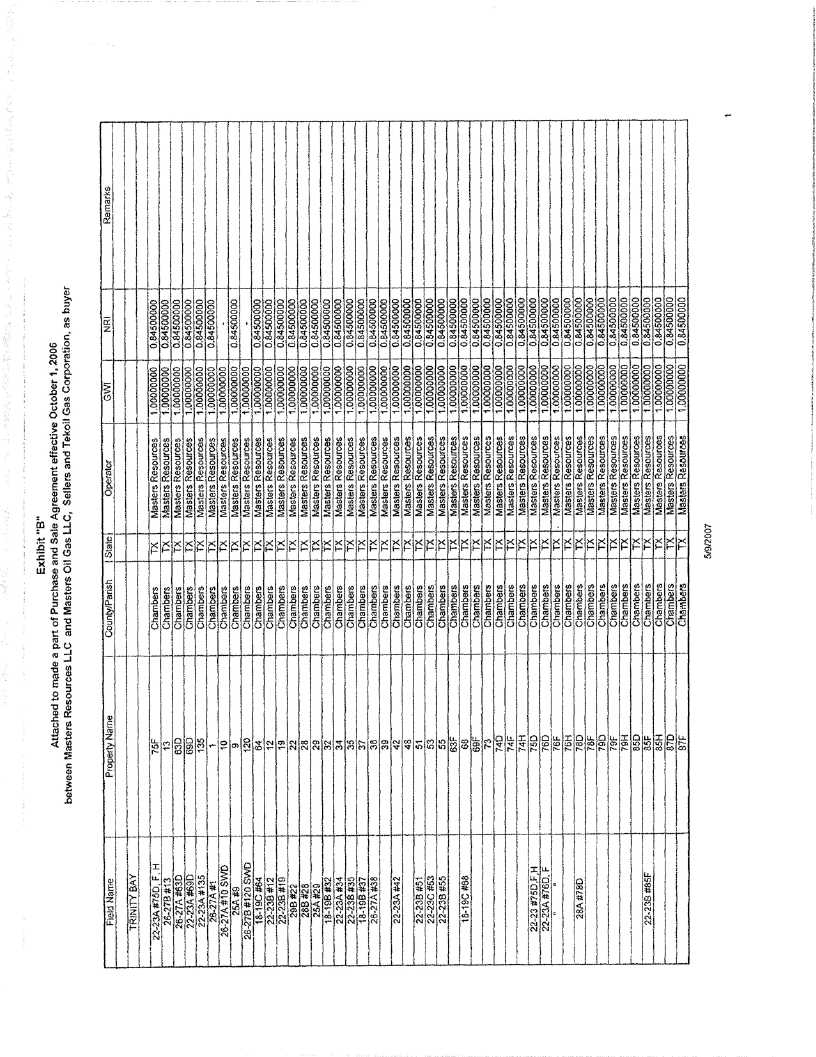

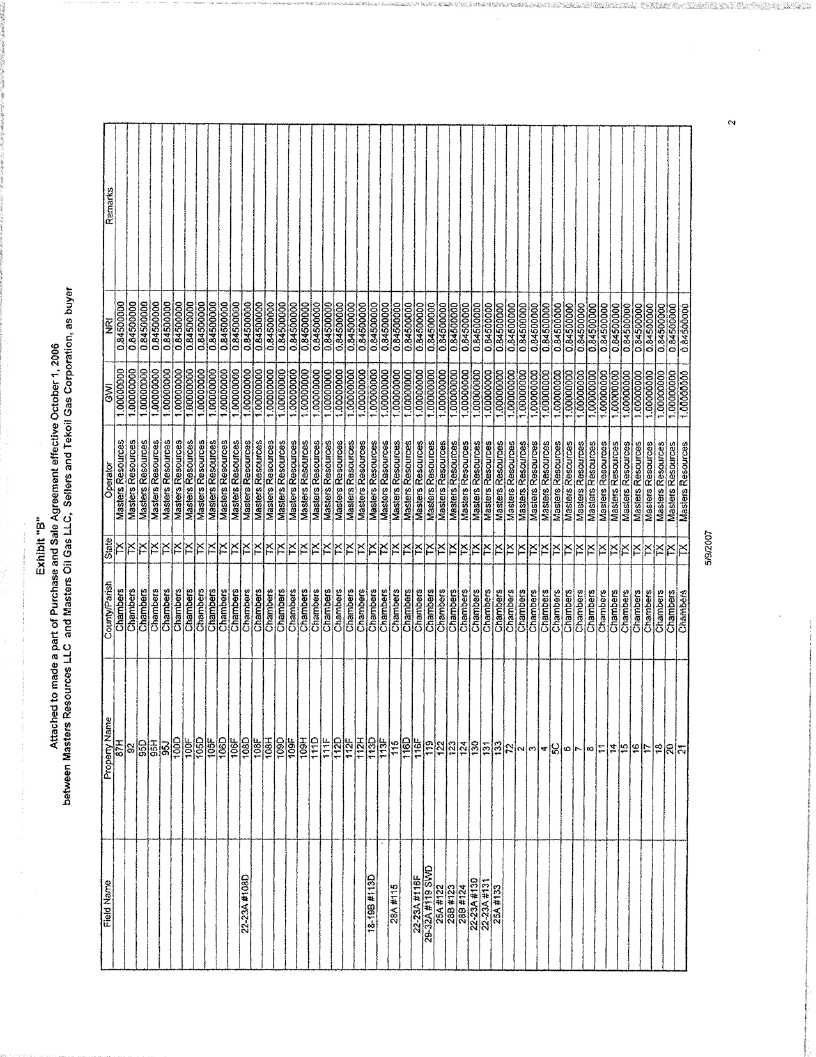

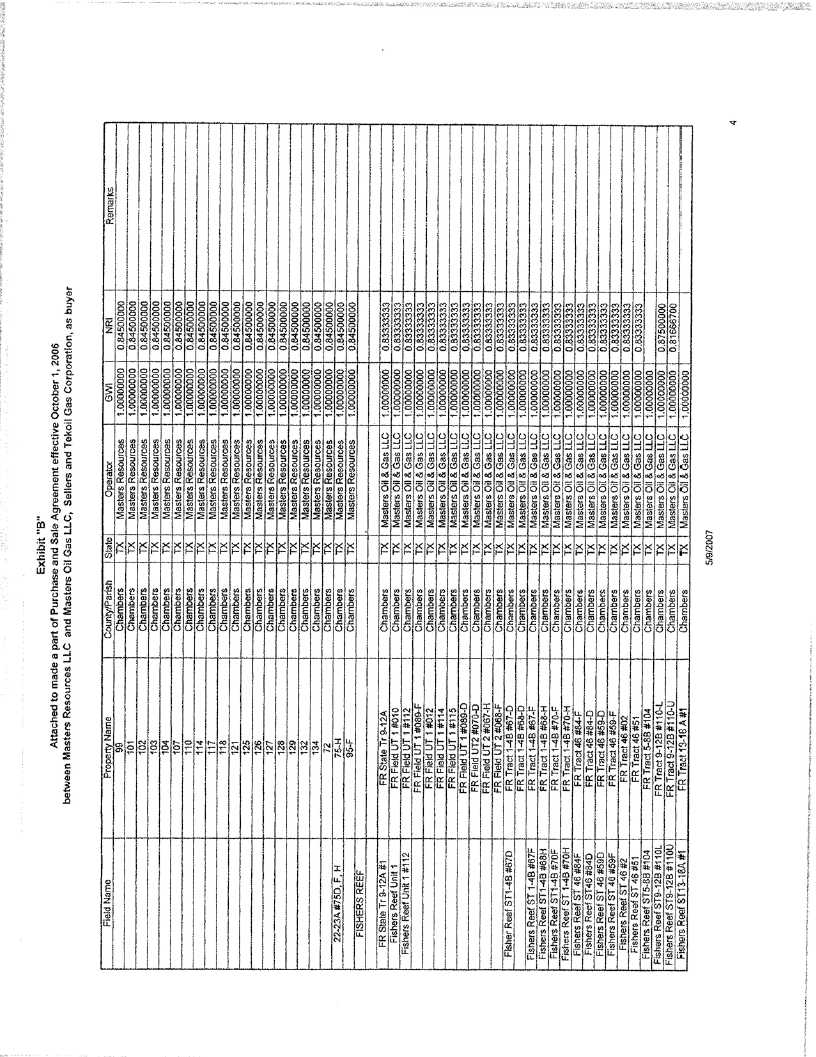

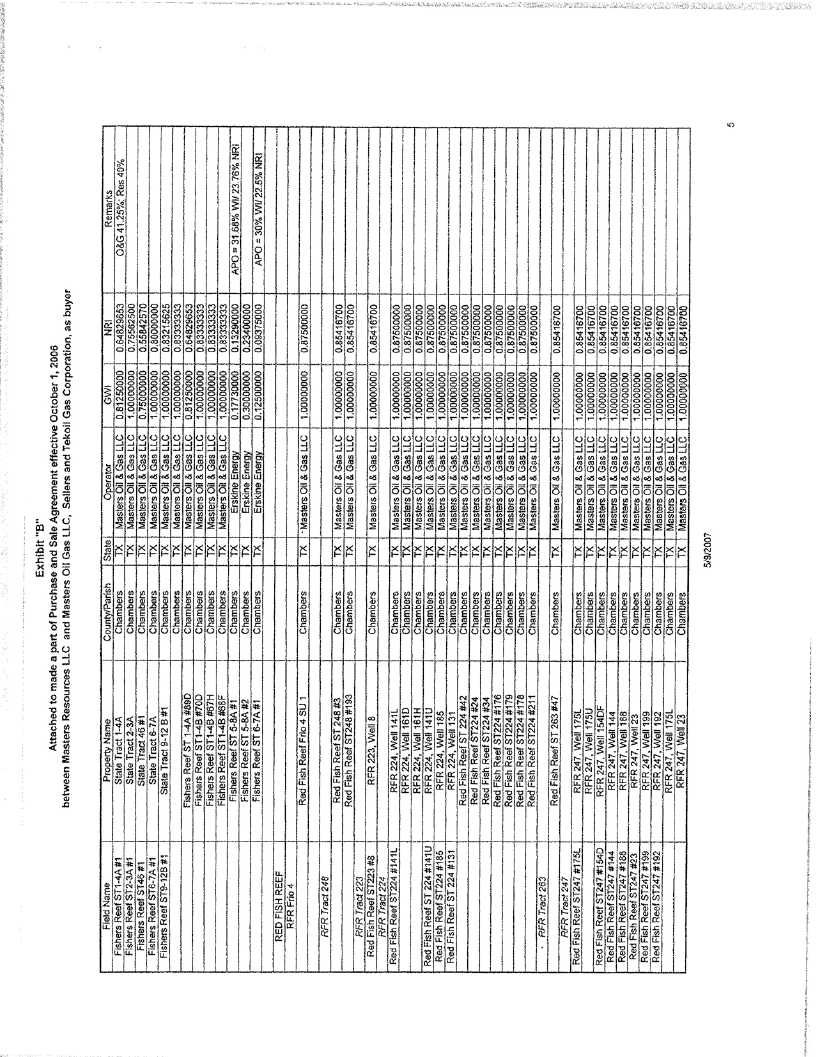

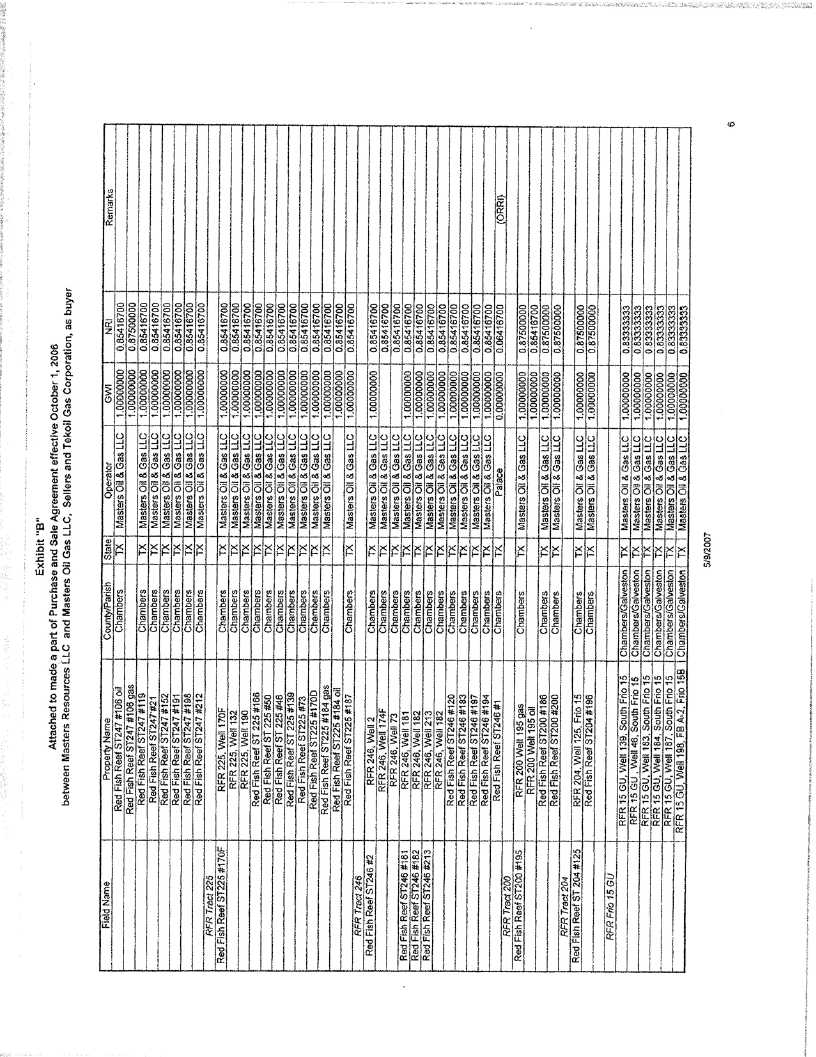

| | 1.2. | All oil and gas wells, salt water disposal wells, injection wells and other wells and pits located on or attributable to the Property (collectively the “Wells”), including, without limitation, the Wells described on Exhibit B attached to and made a part of this Assignment; |

| | 1.3. | All equipment, including without limitation the workover rig, vehicles, crew boats, work barges and vessels listed on Exhibit C attached to and made a part of this Assignment, and all machinery, flowlines, roads, gathering lines, pipelines, pole lines, appurtenances, materials, fixtures, improvements and other personal property located on, used in the operation of or relating to the production, treatment, sale or disposal of hydrocarbons, water or associated substances produced from or attributable to the Property (collectively the “Personal Property”); |

| | 1.4. | All hydrocarbons, including natural gas, casing head gas, drip gasoline, natural gasoline, natural gas liquids, condensate products and crude oil, whether gaseous or liquid, produced from or attributable to the Property or Wells on or after the Effective Time, as defined below (collectively the “Hydrocarbons”); |

| | 1.5. | To the extent transferable at no cost or expense to Assignor, copies (or originals if Assignor does not wish to retain the originals of such records) of all of Assignor’s geological, geophysical or seismic prospect maps, electric logs, survey maps, geological profiles, geophysical data (including, without limitation, field tapes and all processed versions, synthetics, and all other forms of expression of geophysical data), and geological and geophysical interpretative data, to the extent that the foregoing relate to the Property, or any portion thereof; |

| | 1.6. | All contracts, instruments and orders relating to the Property, Wells, Personal Property and Hydrocarbons (collectively the “Contracts”), including without limitation the Contracts described on Exhibit D attached to and made a part of this Assignment; and |

| | 1.7. | All files, records, information and materials relating to the Property, Wells, Personal Property, Hydrocarbons and Contracts owned by or in the possession of Assignor which Assignor is not prohibited from transferring to Assignee by law or existing contractual relationship (collectively the “Records”). |

Any provision to the contrary contained in this Assignment notwithstanding, Assignor excepts and reserves and there shall be excluded from this Assignment the following (collectively, the “Excluded Assets”):

| | 2.1. | The oil and gas properties more particularly described on the attached Exhibit E which is attached to and made a part of this Assignment; |

| | 2.2. | All of Assignor’s reserve estimates, economic analyses, pricing forecasts, legal opinions (other than those related to title to any of the Properties) and other analyses relating to the Assets and all information relating to the Assets which Assignor considers confidential or protected by attorney-client privilege; |

| | 2.3. | All rights and claims relating to the Assets, other than rights or claims in connection with gas imbalances, arising, occurring or existing in favor of Assignor prior to the Effective Time, including all contract rights, claims, penalties, receivables, revenues, recoupment rights, recovery rights, accounting adjustments, mispayments, erroneous payments, property damage claims, insurance claims, indemnity claims, bond claims and condemnation claims; |

| | 2.4. | All corporate, financial and tax records of Assignor; provided, however, that upon request, Assignee will be entitled to receive copies of all financial and tax records which directly relate to the Assets and which are necessary for Assignee’s ownership, administration or operation of the Assets; |

| | 2.5. | All claims of Assignor for refund of or loss carry forwards with respect to production, windfall profit, severance, ad valorem, income, franchise and all other taxes attributable to the Assets for all periods prior to the Effective Time; |

| | 2.6. | All amounts due or payable to Assignor as adjustments or refunds under any contract affecting the Assets for all periods prior to the Effective Time; |

| | 2.7. | All amounts due or payable to Assignor as adjustments to insurance premiums related to the Assets for all periods prior to the Effective Time; |

| | 2.8. | All monies, proceeds, accruals, benefits, receipts, credits, income, revenues, security or deposits attributable to the Assets prior to the Effective Time; |

| | 2.9. | All of Assignor’s patents, trade secrets, copyrights, names, marks and logos; |

| | 2.10. | All computers, hardware, software and software licenses; |

| | 2.11. | All licensed raw or processed geophysical data and all interpretations of that data which Assignor is prohibited from transferring to Assignee by law or existing contractual relationship; |

| | 2.12. | The overriding royalties conveyed by Assignor to Masters Pipeline, L.L.C., by Assignment of Overriding Royalty Interests of even date herewith recorded or to be recorded in Chambers and Galveston Counties, Texas, and all overriding royalties held by individuals associated with Assignor as of the Effective Time; and |

| | 2.13. | All personal property owned by Masters Offshore, L.L.C., and its surface facilities located in the vicinity of the Assets as depicted on the attached Exhibit F which is attached to and made a part of this Assignment. |

This Assignment from Assignor to Assignee is delivered by Assignor and accepted by Assignee subject to the following (“Existing Burdens”):

| | 3.1. | Lessor’s royalties, non-participating royalties, overriding royalties, division orders and sales contracts containing customary terms and provisions covering oil, gas or other associated liquefied or gaseous hydrocarbons, reversionary interests and similar burdens; |

| | 3.2. | Preferential rights to purchase with respect to which prior to the date of this Assignment, waivers have been obtained from the appropriate parties or the appropriate time period for asserting those rights have expired without an exercise of those rights; |

| | 3.3. | Third party consents to assignment to the extent only that such consents are customarily obtained after Closing, including rights to consent by, required notices to, filings with or other actions required by governmental entities in connection with this Assignment; |

| | 3.4. | Liens for taxes or assessments not yet due or delinquent, or if delinquent, that are being contested in good faith in the normal course of business and for which an appropriate reserve has been established by Assignor and transferred to Assignee; |

| | 3.5. | Conventional rights of reassignment requiring notice to the holders of those rights; |

| | 3.6. | Easements, road-use agreements, rights-of-way, servitudes, permits, surface leases and other rights with respect to surface operations as long as the rights do not have a Material Adverse Effect on the Assets and do not otherwise impair the ownership, operation, use or value of the Assets on or after the Effective Time; |

| | 3.7. | Zoning, planning and environmental laws and regulations to the extent that they are valid and applicable to the Assets and do not have a Material Adverse Effect on the Assets; |

| | 3.8. | Vendors’, carriers’, warehousemen’s, repairmen’s, mechanics’, workmen’s, materialmen’s, construction and other liens arising by operation of law in the ordinary course of business or incident to the construction or improvement of any property whose underlying obligations are not yet due; |

| | 3.9. | Defects, irregularities and deficiencies in title which in the aggregate do not have a Material Adverse Effect on the Assets and do not otherwise impair the ownership, operation, use or value of the Assets on or after the Effective Time; |

| | 3.10. | Farmouts, areas of mutual interest, participation agreements and other exploration agreements relating to the Assets; |

| | 3.11. | The overriding royalties conveyed by Assignor to Masters Pipeline, L.L.C., by Assignment of Overriding Royalty Interests of even date herewith recorded or to be recorded in Chambers and Galveston Counties, Texas, and all overriding royalties held by individuals associated with Assignor as of the Effective Time. |

TO HAVE AND TO HOLD, all and singular, the Assets unto Assignee and Assignee’s successors in title and assigns forever. Assignor agrees to warrant and forever defend title to the Assets unto Assignee, its successors and assigns, against the claims and demands of all persons claiming, or to claim the same, or any part thereof by, thorugh or under Assignor, but not otherwise. The reference herein to the Existing Burdens is for the purposes of protecting Assignor on Assignor’s warranties, and shall not create, nor constitute a recognition of, any rights in third parties. This Assignment, in respect of the Personal Property, Hydrocarbons, Contracts and Records, is made without further warranty or covenants, express or implied, and, in respect of the Personal Property, the IMPLIED WARRANTY OF MERCHANTABILITY AND THE IMPLIED WARRANTY OF FITNESS FOR A PARTICULAR PURPOSE ARE HEREBY EXPRESSLY NEGATED. This Assignment is made with full substitution and subrogation of Assignee in and to all covenants, indemnities, representations and warranties by others heretofore given or made with respect to the Assets or any part thereof.

The term “oil, gas and mineral lease” as used in this Assignment and in Exhibit A hereto includes in addition to oil, gas and mineral leases, oil and gas leases, oil, gas and sulphur leases, other mineral leases, co-lessor’s agreements, lease ratifications and extensions and subleases of any of the foregoing, as appropriate. The term “Material Adverse Effect” as used in this Assignment means any fact, condition or circumstance having a value of greater than $100,000.

Assignor agrees to execute, to acknowledge and to deliver to Assignee any additional instruments, notices, division orders, transfer orders and other documents and to do any other acts and things which may be necessary to more fully and effectively assign and convey to Assignee and Assignee’s successors in title and assigns the Properties intended to be assigned hereby.

This Assignment is further subject to the following provisions:

| | 4.1. | No Warranties or Representations. Assignor makes no warranty or representation of any kind as to the accuracy or completeness of any data, information or material furnished to Assignee in connection with the Assets, the quality or quantity of Hydrocarbon reserves attributable to the Assets or the ability of the Assets to produce Hydrocarbons. Assignee has inspected the Assets and is satisfied with their physical and environmental condition, both surface and subsurface. Assignee accepts the Assets in an “As Is, Where Is” condition. |

| | 4.2. | Assumption of Duties and Obligations. As of the Effective Time, Assignee will assume all duties and obligations of Assignor with respect to the Assets, including any request or order to plug, re-plug or abandon any Well, remove any Well or appurtenance, or take any clean-up or remediation action with respect to the Assets. |

| | 4.3. | Indemnity. Assignee will indemnify Assignor and hold Assignor harmless for all expenses, settlements, judgments, court costs, interest and attorney’s fees incurred as a result of any litigation or threat of litigation relating to this Assignment, the Assets or any prior or future operations on, of or with respect to the Assets. |

| | 4.4. | Taxes/Fees. Assignee will pay all transactional taxes, including sales, use, lease and ad valorem taxes, and all recording fees due as a result of this Assignment. |

| | 4.5. | Other Agreements. This Assignment is made subject to the Purchase and Sale Agreement, between Assignor and Assignee, dated November 13, 2006. |

| | 4.6. | Effect of Assignment and Bill of Sale. This Assignment shall be binding upon Assignor and Assignee as well as their respective successors and assigns. |

[REMAINDER OF PAGE INTENTIONALLY BLANK. SIGNATURES ARE ON NEXT PAGE.]

Signed: May 11, 2007, TO BE EFFECTIVE, HOWEVER, AS OF October 1, 2006, at 12:00 midnight Central Standard Time (the “Effective Time”).

| | | | |

| ASSIGNOR: | ASSIGNEE: |

| | | |

MASTERS RESOURCES, L.L.C. and MASTERS OIL & GAS, L.L.C. | TEKOIL AND GAS GULF COAST, LLC |

| | | |

| |

| By: | Tekoil & Gas Corporation, Its Managing Member |

| | | | |

| By: | /s/ John W. Barton | By: | /s/ Mark Western |

| |

John W. Barton, Managing Member | |

Mark Western, CEO and Chairman of the Board of Directors |

EXHIBITS:

| Exhibit A | Property |

| Exhibit B | Wells |

| Exhibit C | Personal Property |

| Exhibit D | Contracts |

| Exhibit E | Excluded oil and gas properties |

| Exhibit F | Excluded personal property and surface facilities in vicinity of Assets owned by Masters Offshore, L.L.C. |

Signature Page to Assignment and Bill of Sale

| STATE OF TEXAS | § |

| | § |

| COUNTY OF HARRIS | § |

This instrument was acknowledged before me this 11th day of May, 2007, by John W. Barton, Managing Member of each of Masters Resources, L.L.C. and Masters Oil & Gas, L.L.C., each a Texas limited liability company, on behalf of each of said limited liability companies.

| | | |

| RHONDEE M. DAMON | | /s/ Rhondee M. Damon |

Notary Public, State of Texas My Commission Expires April 26, 2009 |

Notary Public in and for the State of Texas |

| STATE OF TEXAS | § |

| | § |

| COUNTY OF HARRIS | § |

This instrument was acknowledged before me this 11th day of May, 2007, by Mark Western, CEO and Chairman of the Board of Directors of Tekoil & Gas Corporation, the Managing Member of Tekoil and & Gas Gulf Coast, LLC, a Delaware limited liability company, on behalf of said limited liability company.

| | | |

| RHONDEE M. DAMON | | /s/ Rhondee M. Damon |

Notary Public, State of Texas My Commission Expires April 26, 2009 |

Notary Public in and for the State of Texas |

Exhibit C

Personal Property

PERSONAL PROPERTY

(OWNED)

Equipment/Vessel | | ID No. | | Location | | Year Built | | Length | | Depth | | Width |

| | | | | | | | | | | | | |

Masters Rig #1 (Slotted Key Way Barge | | No Hull # | | | | 2005 | | 200’ | | 3’ | | 53’ |

| Generator | | Inline 6 Cyl Detroit 200 HP | | | | | | | | | | |

| Generator | | Kubota 2 Cyl 20 HP | | | | | | | | | | |

| Rig | | 12V 71 Detroit 450 HP | | | | | | | | | | |

| Pump | | 8V 71 Detroit 300 HP | | | | | | | | | | |

| Mixing Pump | | Inline 4 Cyl CAT 100 HP | | | | | | | | | | |

| Blending Pump | | Inline 4 CYl Deutz 50 HP | | | | | | | | | | |

| Manitowoc (30 ton) Crane | | Inline 4 Cycl Detroit 150 HP | | | | | | | | | | |

| Miss Tracy | | LAFCO1224 | | Oak Island | | 1974 | | 29’ | | 3” | | 10” |

| Miss Susie | | JBC19893G495 | | | | 1994 | | 18’ | | 1” | | 6” |

| Miss Rhea | | 1138953 | | Oak Island | | 1972 | | 39’ | | 6.5” | | 14” |

| Airboat | | MPH00196B494 | | Oak Island | | 1994 | | 15’ | | 0 | | 8” |

| Kabota Tractor 8200 | | | | Pt. Barrow | | | | | | | | |

| Kabota Tractor B21 | | | | Goat Island | | | | | | | | |

| Welding Machines (2) | | | | Oak Island | | | | | | | | |

| Air Compressors (2) | | | | Oak Island | | | | | | | | |

| 1998 Chevrolet S-10 Pickup Truck | | 1GCCS14XXW8213584 | | Pt. Barrow | | | | | | | | |

| 2006 Ford F150 Pickup Truck | | 1FTPW145X6KB15212 | | Pt. Barrow | | | | | | | | |

| 2006 Ford F350 Pickup Truck | | 1FTWW31P96ED61003 | | Pt. Barrow | | | | | | | | |

Cat 398 - Engine G398 A-51 Compressor Chicago Pneumatiac Size 6FE Frame | | 73B1282P 82210PPNt1000 | | A-Lease | | | | | | | | |

Exhibit C

Personal Property

PERSONAL PROPERTY

(LEASED)

Equipment/Vessel | | Location. | | Lessor/Term | | Year Built | | Length | | Depth | | Width |

| | | | | | | | | | | | | |

| Taylor Forklift | | Oak Island | | Paul’s Rentals (monthly) | | | | | | | | |

| Cat. Forklift | | Oak Island | | Paul’s Rentals (monthly) | | | | | | | | |

| Roanoke Forklift | | Pt. Barrow | | Paul’s Rentals (monthly) | | | | | | | | |

| Carry Deck Crane | | Pt. Barrow | | Paul’s Rentals (Monthly) | | | | | | | | |

| Mahindra Tractor | | Pt. Barrow | | Paul’s Rentals (Monthly) | | | | | | | | |

| Case Tractor | | Pt. Barrow | | Paul’s Rentals (Monthly) | | | | | | | | |

| Masters Meteor (Crew Boat) | | Oak Island | | Marine Transportation (Monthly) | | 2004 | | 27’ | | 48” | | 10” |

| M/V Carp (Crew Boat) | | Oak Island | | Marine Transportation (Monthly) | | 1984 | | 29’ | | 48” | | 10” |

| Audrey (Crew Boat) | | Oak Island | | Marine Transportation (Monthly) | | 1971 | | 28’ | | 2’ | | 10’4” |

| Who Dat | | Oak Island | | Marine Transportation (Monthly) | | 1970 | | 28’ | | 10.8’ | | 3’ |

| Houma II | | Oak Island | | CWR Rental (Monthly) | | 1995 | | 32’ | | 10.3’ | | .5’ |

| Tiger II (Tug Boat) | | Oak Island | | Marine Towing & Salvage (Monthly) | | | | | | | | |

| Barge #1 | | Oak Island | | Marine Towing & Salvage (Monthly) | | | | | | | | |

| American Crane | | Oak Island | | Marine Towing & Salvage (Monthly) | | | | | | | | |

| F-250 (Land Gauger) | | Pt. Barrow | | Enterprise (Monthly) | | | | | | | | |

| Cat 3516 Compressor | | F-Lease | | Universal (Monthly) | | | | | | | | |

| Waukashau 3521 | | C-Lease | | Hanover (Monthly) | | | | | | | | |

| Waukashau 7042 | | Aggie Junction | | JW Operating (Monthly) | | | | | | | | |

| Cat 3516 | | Aggie Junction | | JW Operating (Monthly) | | | | | | | | |

| Waukashau F18 | | Goat Island | | Hanover (Monthly) | | | | | | | | |

| Cat Compressor | | Monroe City | | Delta Compression (Monthly) | | | | | | | | |

| 30’ Gooseneck | | | | Monthly | | | | | | | | |

| 6 HP 33 Gallon Electric Air Compressor | | | | Monthly | | | | | | | | |

| 50 KW Generator Greenpower Canopy | | | | Monthly | | | | | | | | |

| 16’ Trailer | | | | Paul’s Rentals (Monthly) | | | | | | | | |

| 21’ Trailer | | | | Paul’s Rentals (Monthly) | | | | | | | | |

| Bushhog 10’ | | | | Monthly | | | | | | | | |

| Case backhoe-580 SuperL | | | | Paul’s Rentals (Monthly) | | | | | | | | |

| 1979 Galion 15 ton crane | | | | Monthly | | | | | | | | |

| 5000 lb warehouse forklift | | | | Paul’s Rentals (Monthly) | | | | | | | | |

| 3” Pump | | | | Paul’s Rentals (Monthly) | | | | | | | | |

| 2.5 Power Swivel | | | | Monthly | | | | | | | | |

| | | | | | | | | | | | | |

Exhibit D

Contracts

N Point Bolivar | | |

| | | |

| | Exploration Agrmt & JOA dtd 2/1/06 btwn Masters Resources LLC & Erskine Energy LLC |

| | | |

| LC-103-0014 | | Barge Dock & Surface Use Agrmt dtd eff 9/22/06 btwn Masters Resources LLC, St. Mary Land & Expl Co. & Erskine Energy Partners II LP LLC covering barge dock facility at Goat Island, ST 342 (Expires 9/22/2011) |

| | | |

| GC-103-0008 | | Production Handling Agrmt dtd October 11, 2006 btwn St. Mary Land & Expl Co & Masters Resources LLC (ST 342) |

| | | |

Dorado | | |

| | | |

| LC-110-0001 | | E/A & JOA dtd 4/21/05 btwn Davis Petroleum Corp. & Masters Resources LLC covering ST 113/132/133/203 |

| | | |

| LC-110-0004 | | JOA dtd 6/1/06 btwn Davis Petroleum Corp & Masters Resources LLC covering ST 204 Unit |

| | | |

Fishers Reef | | |

| | | |

| LC-101-0016 | | Exploration Agreement & JOA dtd 1/31/05 btwn Masters Resources LLC & Erskine Energy Partners LP & Erskine Energy LLC covering State Tract 2-3A Unit (M-96828 & M-96829) |

| | | |

| LC-101-0023 | | Exploration Agreement dtd 2/23/05 btwn Masters Resources LLC & Erskine Energy Partners, LP & Erskine Energy LLC Covering State Tract 6-7A |

| | | |

| LC-101-0024 | | Exploration Agreement & O/A dtd 2/27/06 btwn Masters Resources LLC & Masters Oil & Gas LLC & Erskine Energy Partners LP, Erskine Energy LLC covering State Tract 5-8A |

| | | Letter Agreement dtd 6/20/05 btwn Masters Resources LLC & Palace Exploration Co. etal |

| | | Letter Agreement dtd 7/11/05 btwn Masters Resources LLC, Erskine Energy Partners etal & Palace Exploration Co. |

| | | |

| GC-101-0003 | | Gas Transportation Contract dated 5/22/06 between Masters Resources LLC and Erskine Energy Partners II LP (ST 5-8A #1, #2, ST 6-7A #1 wells) |

| | | |

| GC-101-0004 | | Crude Oil Gathering Contract dated 5/22/06 between Masters Resources LLC and Erskine Energy Partners II LP |

| | | (ST 5-8A #1, #2, ST 6-7A #1 wells) |

Red Fish Reef | | |

| | | |

| | Term Acreage Agreement dtd 4/19/01 btwn Masters Resources LLC & Alcorn-Texana Resources et. al. |

| | |

Joint Operating Agreement dated May 1, 2006 by and between Davis Petroleum Corp. (‘Operator’) and Masters Resources, LLC, et. al. covering the Dolphin Prospect, being 800 acres in State Tracts 199 and 226 and the associated Area of Mutual Interest.

Subject to one or more Amendments to Lease of varying dates providing for the addition to the lease of rework and/or shut-in gas well clauses.

Subject to Pooling Agreement dated 10/6/98 covering 320 acres of State Tract 2-3A - 3A (State Tract 2-3A Unit #1) recorded under File No. 98 395 730, Chambers Co., TX

Subject to Pooling Agreement dated 9/15/98 covering 320 acres being 110 acres of State Tract 2-3A -3A, 75 acres of State Tract 46 and 135 acres of State Tract 47 (State Tract 46 No. 1) recorded under File No. 00 453 686.

Subject to Pooling Agreement dated 12/11/01 covering 320 acres being 76 acres out of State Tract 1-4A, 152 acres out of State Tract 5-8A, 80 acres out of State Tract 2-3A, 90 acres out of State Tract 2-3A, 40 acres out of State Tract 6-7A (State Tract 1-4A Unit).

Subject to Participation and Farmout Agreement dated 3/6/00 between Vintage Petroleum Inc. and Davis Petroleum Corp.

Subject to JOA dated 6/20/00 between Vintage Petroleum Inc., Palace Exploration Co., Davis Petroleum Corp., Andex Resources LLC covering land within Pooled Unit for State Tract 1-4A No. 1 well (State Tract 1-4A No. 1 well).

Subject to JOA dated 3/6/00 between Vintage Petroleum Inc., Palace Exploration Co., Davis Petroleum Corp., and Andex Resources LLC covering lands within the Pooled Unit for State Tract 46 No. 1 (State Tract 46 No. 1 well).

Subject to JOA dated 9/1/00 between Vintage Petroleum Inc., Davis Petroleum Corp., Andex Resources LLC covering 250 acres within that portion of State Tract 9-12B, limited from the surface of the ground down to the stratigraphic equivalent of the total depth drilled in the Initial Test, except the Unitized formations established by Unit Agreement for the Fishers Reef Field Unit No. 1 but including any wellbore interest earned therein, as more specifically identified and defined in those certain Participation Farmout Agreements, as amended, between Vintage and each of the other parties (State Tract 9-12B #1 well).

Subject to call on oil and gas production in Assignment and Bill of Sale dated 5/1/91 and recorded under File No. 91 146 152 from Exxon Corporation to Vintage Petroleum Inc. whereby Exxon Corporation reserves a preferential right to purchase oil and gas for a term of 21 years from assignment date.

Possibly subject to two final judgments which are as follows: 1) Final Judgment dated 7/24/74 in the case of State of Texas et al, Plaintiff vs. Exxon Corporation, Defendant in the District Court of Travis County, Texas, the 53rd Judicial District, Case No. 207789 and 2) Final Judgment dated 2/23/76 in the case of the State of Texas et al, Plaintiff vs. Exxon Corporation and Sun Oil Company (Delaware), Defendants, in the District Court of Travis County, Texas, 53rd Judicial District, Case No. 238904.

CEDAR POINT/HEMATITE FIELD

Subject to the certain Operating Agreement dated 2/15/99 by and between Vintage Petroleum Inc. and MCNIC O & G Properties, Inc., Carrizo O&G Inc., Century Offshore Management Corp. and Yuma Exploration and Production Company, Inc.

Subject to that certain Participation Agreement by and between Yuma Exploration and Production Company, Inc., Vintage Petroleum Inc., Carrizo Oil & Gas Inc. and MCNIC

Oil & Gas Properties, Inc. dated 4/6/98.

POINT BARROW FACILITY

Subject to Saltwater Disposal Agreement dated 10/01/01 between Vintage Petroleum Inc. and Masters Resources LLC whereby Vintage will accept Masters’ water produced from Masters’ wells located in the Trinity Bay Field, Chambers Co., TX for disposal in its Point Barrow saltwater disposal facility located on the Point Barrow Facility so long as excess capacity in the Facility exists over and above that required by Vintage’s operations. The term of this Agreement has expired, but both parties continue to perform.

Subject to Surface Lease and Easement dated 12/19/02 between Vintage Petroleum Inc., Lessor, and Masters Resources LLC., Lessee wherein Lessor grants to Lessee a non-exclusive easement on and overt the Point Barrow Facility to Lessee for the purpose of operating and maintaining and constructing pipelines, facilities, power line or roads to and from the leased premises. Lessee owns equipment currently located on the leased premises, including 1) TB #1 - 1500 BBL - Bottled Gun Barrel; 2) TB #2 - 500 BBL - Settling Tank; 3)TB #3 - 1000 BBL - Sales Tank; 4) TB Heater; 5) Associated Flow lines.

Subject to all easements, rights of way, surface leases and all similar grants of surface use affecting this land whether recorded or unrecorded in addition to those specifically described in Deed and Bill of Sale dated 5/31/91 between Exxon Corporation, Grantor and Vintage Petroleum Inc., Grantee recorded under File No. 91 146 205, Chambers Co., TX.

Subject to reservation of a 1/16th of 8/8ths Non-participating Royalty Interest in favor of Estelle Ervine and J. E. Bishop, Individually and as Independent Executors of the Estate of J. E. Ervine, and their predecessors in interest.

GAS CONTRACTS

Crude Oil Purchase Contract Nos. 05-10247, 05-10248 and 06-55239 dated 08/08/05, 08/09/05 and 12/29/06 by and between Masters Resources LLC, as Seller, and Pacific Marketing and Transportation LLC, as Buyer and as assigned to Plains Marketing LP due to merger on 11/15/06.

Base Contract for Sale and Purchase of Natural Gas, as amended, dated 02/27/07 by and between Masters Resources, LLC, Seller and Petrocom Ventures Ltd., as Buyer.

Gas Purchase Agreement, as amended, dated 03/01/07 by and between Masters Resources LLC, as Seller, and Kinder Morgan Tejas Pipeline L.P., as Buyer.

Gas Gathering Agreement dated 07/01/98, as amended, between Masters Resources LLC and Gateway Offshore Pipeline Company for Galveston Bay State Tract 343 Lease.

Exhibit E

Excluded Oil & Gas Properties

EXCLUDED ASSETS

Masters Offshore LLC Properties

All of the assets owned by Masters Offshore LLC, including but not limited to, a construction office facility located at Oak Island, Texas, including various tug boats, barges, vessels, construction equipment not expressly conveyed in the Purchase and Sale Agreement.

Louisiana-Mississippi

All acreage and wells owned by Masters Resources LLC and/or Masters Oil & Gas LLC located in Louisiana and Mississippi, including but not limited to the Bayou Sorrell-Green Jacket Prospect in Iberville Parish and the South Lake Charles Prospect in Calcasieu Parish, Louisiana.

Trout Point Prospect-Chambers County, Texas

All acreage and wells in the Trout Point Prospect being approximately 600 acres in the Edward T. Branch Survey, A-40 and 660 acres in Galveston Bay being the N/2 of State Tract 198 all in Chambers County, Texas.

Lions Field Prospect

All acreage and wells located in the Lions Field Prospect being approximately 1590 acres located in the J.M. Mancha Survey in Goliad County, Texas.

Exhibit F

Excluded Personal Property

EXCLUDED ASSETS OWNED BY MASTERS OFFSHORE LLC

Equipment/Vessel | | ID No. | | Location | | Year Built | | Length | | Depth | | Width |

| | | | | | | | | | | | | |

| Miss Georgia | | 1115314 | | | | 1976 | | 32’ | | 6” | | 12” |

| Bad Dog | | | | | | 1952 | | 43’ | | 6.1” | | 12.3” |

| Opportunity (Jackup) | | | | | | 1978 | | 63’ | | 4.8” | | 24.1” |

| Welding Machines (7) | | | | | | | | | | | | |

| Barge #2 | | Marine Towing & Salvage (Monthly) | | Oak Island | | | | | | | | |