UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F/A

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: 31 December 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transition period from to

Commission file number 000-53684

CSR plc

(Exact name of Registrant as specified in its charter)

ENGLAND

(Jurisdiction of incorporation or organization)

Churchill House, Cambridge Business Park, Cowley Road, Cambridge, CB4 0WZ, England, Tel: +44 (0) 1223 692 000

(Address of principal executive offices)

Adam R. Dolinko, General Counsel – Tel: +44 (0) 1223 692 000, Fax: +44 (0) 1223 692 001 Churchill House, Cambridge Business Park, Cowley Road, Cambridge CB4 0WZ, England

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act: None

Securities registered or to be registered pursuant to Section 12(g) of the Act: Ordinary Shares, par value £0.001

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

| | |

| Ordinary Shares, par value £0.001 | | 177,808,312 |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes¨ Nox

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | |

Large accelerated filer x | | Accelerated filer ¨ | | Non-accelerated filer ¨ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | |

U.S. GAAP ¨ | | International Financial Reporting Standards as issued by the International Accounting Standards Board x | | Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS.)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ¨ No ¨

Preliminary Note

Preliminary Note

Events occurring subsequent to the approval of the Company’s 2010 Annual Report to its shareholders by its Board of Directors on 8 February 2011

In response to comments from the Staff of the SEC, we have amended our Form 20-F, as reflected in this Form 20-F/A, to include in the body of this Form 20-F/A the reports previously filed as Exhibits 16, 17 and 18, to remove certain parent company financial information that is not required by Form 20-F and to update certain disclosures for developments occurring after March 16, 2011, the date of the original filing of our Form 20-F.

Amended and Restated Agreement and Plan of Merger

On 21 February 2011, CSR announced its entry into an Agreement and Plan of Merger with Zoran Corporation (“Zoran”). Subsequently, on 17 June 2011, CSR announced that it and Zoran had entered into an Amended and Restated Agreement and Plan of Merger (the “Amended Acquisition Agreement”) that provides for revised terms for the acquisition (the “Acquisition”). Under the revised terms, it is proposed that Zoran shareholders will receive US$6.26 in cash and 0.589 ordinary shares of CSR in the form of American Depositary Shares (each American Depositary Share representing four ordinary shares) for each share of Zoran common stock held.

Completion of the Acquisition is expected in the third quarter of 2011 and is subject to the approval of CSR and Zoran shareholders and other customary closing conditions.

For a more detailed description of the Acquisition, please see CSR’s current report on Form 6-K furnished to the US Securities and Exchange Commission on 17 June 2011. This Form 6-K is not incorporated by reference in this Annual Report. The Amended Acquisition Agreement is filed as Exhibit 4.7 to this Annual Report on Form 20-F/A.

Share Buy-back

On 21 February 2011, CSR announced that it intended to return up to US$240 million over the next twelve months to shareholders via an on-market share buy-back programme (the “Share Buy-back Programme”). The Share Buy-back Programme replaced the US$50 million programme announced on 13 September 2010, under which approximately US$37.5 million had been spent on the buy-back of CSR shares on the London Stock Exchange prior to entering our close period on 1 January 2011. As described above, on 17 June 2011, CSR announced that it and Zoran had entered into the Amended Acquisition Agreement pursuant to which approximately $313 million of the acquisition consideration will be paid in cash. As a result of this use of cash, CSR no longer intends to proceed with the Share Buy-back Programme.

Settlement with Wi-Lan

On 17 February 2011, CSR and Wi-Lan reached a comprehensive settlement that ended the litigation referred to in note 31 of CSR’s consolidated financial statements. The financial impact of the settlement is considered immaterial.

CSR plc Annual Report and Financial Statements 2010

Our mission

At CSR our mission is to make our customers successful by providing innovative technologies that enrich consumer experience in a location-aware, wire-free connected world.

This is the Annual Report on Form 20-F/A of CSR plc for the 52 week period ended 31 December 2010 in accordance with the requirements of the US Securities and Exchange Commission, referred to herein as the “Annual Report”. Cross references to the itemized headings of the Form 20-F are included on page 146.

In this Annual Report, references to “CSR”, “the Group”, “the Company”, “we”, and “our” are to CSR plc and its subsidiaries (including SiRF Technology Holdings, Inc., which became a subsidiary of CSR in June 2009) and lines of business, or any of them as the context may require.

References to the years 2010, 2009 and 2008 are to the financial periods ended 31 December 2010, (for 2010), 1 January 2010 (for 2009) and 2 January 2009 (for 2008). Unless otherwise stated, all non-financial statistics are at 31 December 2010.

This Annual Report contains forward looking statements with respect to the Group’s financial condition, operating results and business strategy, plans and objectives. Please see the section entitled “Cautionary Note Regarding Forward Looking Statements” and the discussion of our principal risks and uncertainties in the section entitled “Risk Factors”.

This Annual Report includes measures which are not defined by generally accepted accounting principles, or GAAP, such as International Financial Reporting Standards, or IFRS. These non-GAAP measures are included in this Annual Report because the directors believe they are useful to investors. Our management uses these non-GAAP measures, along with the most directly comparable GAAP financial measures, in evaluating our operating performance and value creation. These non-GAAP measures include “underlying research and development expenses”, “underlying sales, marketing and administration expenses”, “underlying gross profit”, “underlying operating profit”, “underlying net profit”, “underlying diluted earnings per share” , “underlying tax”, “underlying cost of sales”, and “free cash flow”. For a detailed discussion of the reasons behind this presentation and full reconciliations of each measure to the most directly comparable IFRS measure, refer to the discussion on pages 10 and 30 to 34.

Statutory income statement information is given on page 70 of the financial statements. This Annual Report contains references to CSR’s website. These references are for convenience only – we are not incorporating by reference any information posted on www.csr.com.

Directors’ report

Chairman’s statement

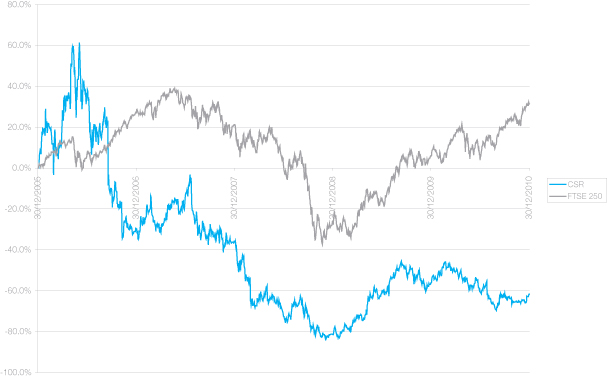

CSR made good progress in 2010 further strengthening our product portfolio, building on our leading technologies and enhancing our own processes, at the same time as the global economy began to emerge from the worst of the downturn. We continue to look forward with confidence and the introduction during 2011 of a dividend policy is a clear expression of the Board’s confidence in your Company’s strategy, its product portfolio and its future financial performance.

Following a significant uplift in revenue during the first six months of the year, against 2009 we saw a slight downturn in the second half as the global economy slowed to a more sustainable level. Although our performance was positive in the circumstances, it was impacted by falling sales at one of our major customers and exacerbated by a rapid shift in consumer demand from feature phones, where we have proven strengths, towards smartphones, where we are not presently so well-positioned. We are addressing this issue and believe that our product portfolio will win additional smartphone business as we introduce our 40nm multi radio combo chip technology.

As the Business and Financial Review will cover in more detail, the year was characterised by a marked increase in revenue in the non-phone market segments, with both the Automotive & PND and Audio & Consumer businesses performing well.

Total revenue for the year was $800.6 million, up by 33% on 2009 and an increase of 17% when compared to a 2009 revenue comparative which includes SiRF’s first half revenue pre-acquisition of $82.5 million (as derived from SiRF’s accounting records) as well as CSR’s IFRS revenue of $601.4 million. The operating loss for the year was $6.3 million, against a loss of $15.9 million in the previous year. This year’s loss reflects an exceptional charge of $59.8 million arising in the fourth quarter from the litigation settlement with Broadcom Corporation which we announced on 11 January 2011. Underlying operating profit rose from $26.9 million in 2009 to $79.0 million in 2010.

Maiden dividend and share buy-back

Joep van Beurden and much of his senior team are well established, and the benefits of their continued focus on the Connectivity Centre are feeding through to results, as anticipated. We are continuing to expand the customer segments we address and CSR technology is being adopted by many different consumer electronics segments in increasing volumes, from cameras and TVs to automotive, which includes systems for two-wheeled vehicles as well as for cars.

Reflecting our confidence in the growth prospects and the strong underlying cash generation of the Company, your Board announced its intention to propose a maiden full year dividend in respect of the 2010 financial year. The Board is proposing the Company’s first dividend of $0.065 (£0.04) per share in respect of the 2010 financial year, representing 2/3 of a notional $0.098 (£0.06) per share full year dividend that would have been paid if the Company had commenced payment of dividends sooner. It is the Board’s intention to follow a progressive dividend policy that reflects the underlying growth prospects of the Company as well as the long term outlook for growth in earnings per share and group cash flow. The Board intends to pay dividends on a semi-annual basis.

After obtaining shareholder approval at the Annual General Meeting held on 18 May 2011, the dividend was paid on 3 June 2011 to shareholders of record on 13 May 2011. The dividend was paid in sterling and holders of ordinary shares received £0.04 per ordinary share.

In September, we announced the introduction of a share buy-back programme of up to $50 million. By the end of the year, we had used approximately $37.5 million in acquiring approximately 7 million ordinary shares. The decision to initiate a buy back reflected the fact that the Company is significantly cash generative and has the financial flexibility to consider potential acquisitions that meet its strict investment criteria, to drive its organic development and to return capital to our shareholders.

Changes to the Board

In October, we welcomed Teresa Vega to the Board as a Non-Executive Director. Teresa has over 30 years experience gained working in the technology and telecommunications industries for leading global companies, including Motorola Inc where she was Senior Vice President and led their CDMA handset business. She also served as the Chief Operating Officer of the wireless infrastructure unit at Lucent Technologies Inc. In each of these organisations, Teresa led and built multi-billion dollar divisions and spearheaded major product launches, and her experience will bring invaluable expertise to CSR.

Also in October, Dado Banatao stood down from his position as a Non-Executive Director. A former Executive Chairman and Interim CEO at SiRF, Dado joined our Board at the time of the merger with SiRF and played an important role in the integration of the two businesses. We thank him for his contribution and strategic insight, and wish him well.

James Collier, one of our founders, decided to focus on a new entrepreneurial venture and therefore resigned from his executive role during the year. However, I am pleased to say that James remains on our board as a Non-Executive Director, where his vast experience and unique perspective on our industry will continue to be valued.

An outstanding team, playing its part to the full

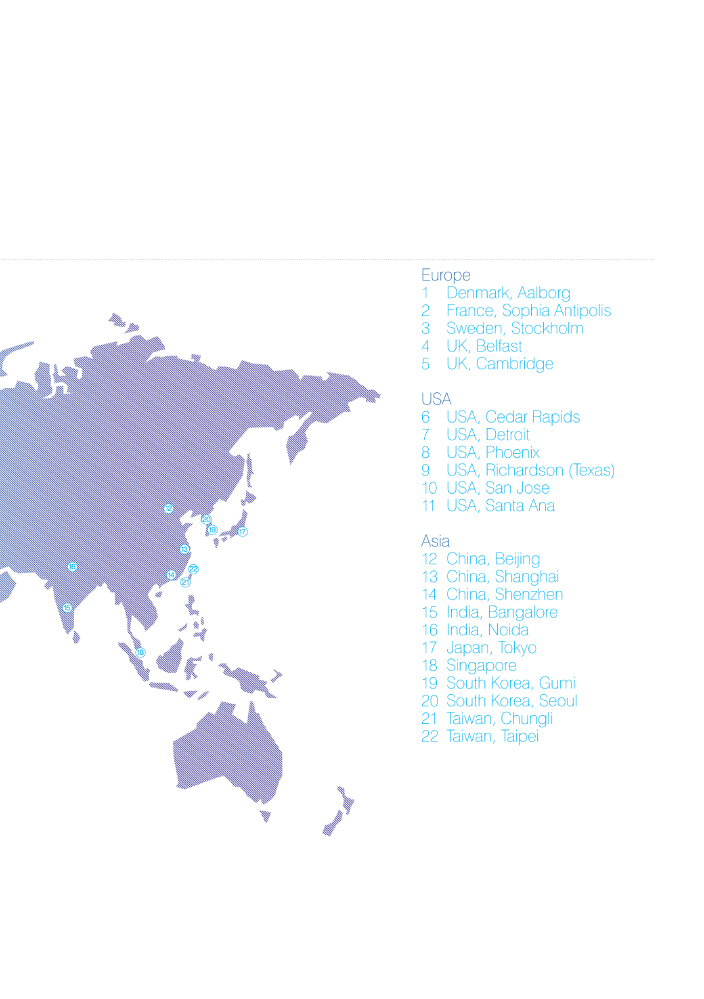

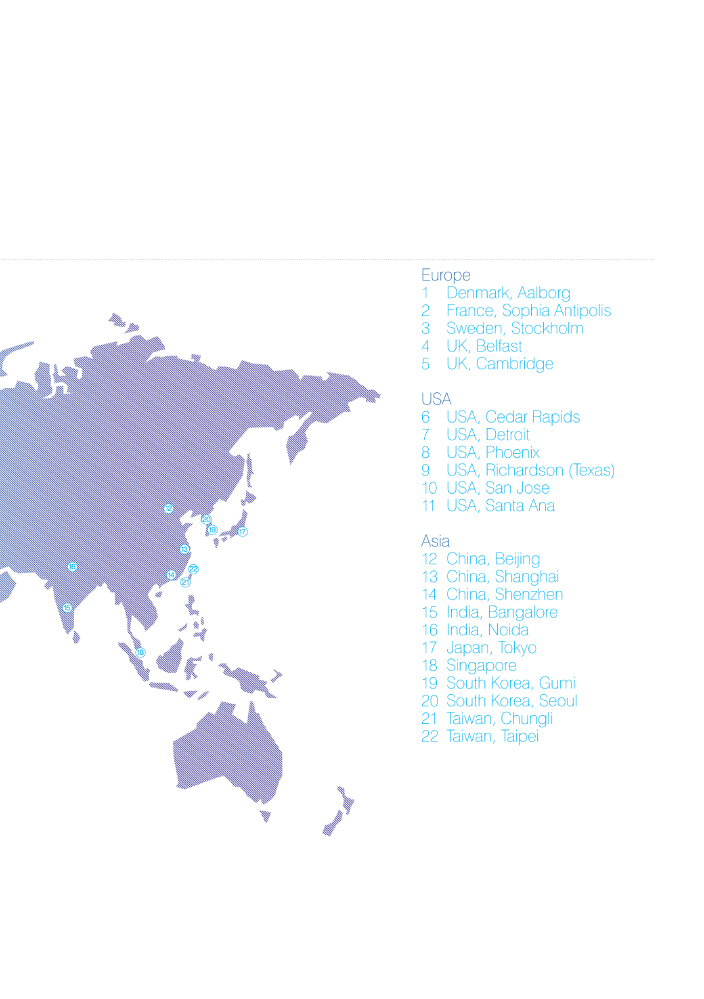

Our success would not be possible without the support of our fifteen hundred strong team, which is based at 22 locations worldwide. Their impressive technical ability is a given, but I would also like to pay tribute to their customer focus and enthusiasm. Meeting customer needs is a core capability at CSR, and our people work tirelessly alongside customers to ensure that the products we develop are tailored to their specific requirements, whether they are for handsets or cameras, automotive infotainment systems, audio headsets, games or other applications.

CSR plc Annual Report and Financial Statements 2010

Chairman’s statement continued

CSR is an integral part of the communities where we operate. From Shanghai to Cambridge, the South of France to the West Coast of the USA, I am proud of the way in which our people give freely of their time and skills in order to help those communities thrive. During the year we introduced a formal Social Responsibility policy for the first time, built on the four pillars of Community, Workplace, Marketplace and Environment. The policy will help us to meet customer and shareholder expectations by providing a clear process by which we can demonstrate that we are “doing the right thing”, an assurance that is as important to the Board as it is to our people.

Looking Ahead

CSR has a strong track record of delivering innovative solutions that provide our customers with high quality differentiated products. Our objective remains to grow our business through our existing markets while developing new technologies in adjacent areas which we believe complement our focus on connectivity and location and provide opportunities for growth. As part of that commitment we intend during 2011 to further increase our investment in R&D to enhance our product portfolio in areas such as Bluetooth low energy and deep indoors location where we believe we can offer compelling solutions to end consumers. We believe this will help support the extension of our customer base as well as extend our reach into growing markets such as India and China.

The combination of our talented people, our investment in them, our technologies and the successful execution on our strategy gives us considerable confidence for the future.

Ron Mackintosh,

Chairman

2/3

Directors’ report

Chief Executive’s review

Following the decisive actions we took during the downturn, we made good progress in 2010. We have emerged from the recession as a stronger business, and the first full year since the SiRF integration has delivered a broad-based and diversified company that is well-positioned to exploit extensive growth opportunities in multiple technologies.

The first six months were buoyant as the industry rebounded from a difficult 2009, and we benefited from significant restocking by our customers. Not surprisingly, the second half was more restrained as the industry returned to more normal levels of underlying growth.

Total revenue for the year rose by 33% to $800.6 million from $601.4 million in 2009. SiRF contributed some $270 million to that figure, confirming our belief that the integration would form the basis for immediate financial benefits as well as a competitive long-term product pipeline. The maiden dividend announced in October 2010 and our share buy-back programme are further expressions of confidence, underlining our ability to generate earnings growth into the future.

Market overview

Our products enhance the end-user experience across many different devices, from handsets and audio headsets to gaming, cameras and car information and communication systems. The phone you carry, the music you listen to, the games you play, the way you navigate from place to place… all these experiences and many more are enriched and enhanced by CSR products. We are a leading player in one of the fastest-growing segments of the semiconductor industry for connectivity and location.

And it is those technologies – connectivity and location, which are two of the drivers propelling and proliferating the digital, wirefree and connected world. Whether in the home, the office, the car or enjoying leisure time, people demand greater and improved connectivity, and we expect this trend to continue for the foreseeable future. Since May 2008, we have focused on the Connectivity Centre, which brings together many aspects of wireless connectivity – such as Bluetooth, FM radio, Wi-Fi, high quality audio and Near Field Communications – a strategy that is delivering real rewards.

Location has become an increasingly important aspect of the internet experience and the integration with SiRF has given us a clear market-leading position. No longer simply providing guidance from A to B via satellite navigation, location technology is the basis for many services that will soon become part of day-to-day life. It will help people find the shops they are looking for, even deep inside shopping centres, meet up with friends and discover the names of the historic monument they have just photographed, among many other examples.

In both the connectivity and location spaces, the year saw key innovations that are driving CSR forward. For example, Bluetooth low energy provides high performance but at such low levels of power consumption that a single battery could last for the entire lifetime of a device such as a TV remote control or a computer mouse. “Deep Indoors” location technology draws on different techniques to establish location, even inside large buildings or shopping centres. This is a key technology for applications such as proximity marketing, geotagging, asset tracking and secure shopping.

Catalysts for near-term growth

Focusing on 2011, there are exciting opportunities right across our business.

For theHandset Business Unit, we are working hard to take advantage of the rapidly-growing smartphone segment. Today we recognise that we have had relatively limited exposure to smartphones, particularly with regard to Bluetooth / Wi-Fi combination chips. This will be addressed during the summer of 2011 when we expect to start sampling our 40nm combination chip product. In feature phones, we continue to play to our strengths and have recently launched CSR8000, our eighth-generation family of Bluetooth chips. Our partnership with Infineon, which was announced last October, will allow phone manufacturers to quickly and easily integrate Wi-Fi and Bluetooth connectivity with shorter development time and lower associated costs.

We expect theAudio and Consumer Business Unit to enjoy significant growth in the near-term. Partnerships with Intel, Ralink and Realtek are helping us gain market share in the PC segment, while we will continue to have a strong position in digital still cameras through our location capability. Gaming remains an area of key competitive advantage and we anticipate increasing our market share during 2011. Our already strong position in high-end audio has been strengthened further by the acquisition of aptX, which was completed in July. Based in Belfast, aptX has an industry-wide reputation for audio compression technology. Through a collaboration which started in 2007, we already had been able to offer this technology to our customers, We believe that the acquisition enables us to enhance our high quality offering in a broad range of audio markets as evidenced by the adoption by Samsung Mobile of our aptX technology.

TheAutomotive and PND Business Unit represents our fastest-growing segment. We are already shipping to sixteen of the world’s car manufacturers, and our pipeline indicates sustained growth as more customers create automotive infotainment systems that rely on seamless connectivity between devices such as tablets and netbooks, as well as phones and GPS. The penetration of all connectivity technologies and GPS is expected to continue to drive strong growth. And our design win pipeline bodes well for us: we are for instance designing in our WiFi automotive platforms with four different OEM’s. In PNDs, we are very strong in China which remains a fast growing region for these products.

CSR plc Annual Report and Financial Statements 2010

Chief Executive’s review continued

Strategic priorities

Going forward we have the following strategic priorities:

1. Focused product differentiation

We are investing significantly in R&D to differentiate our products. Specifically, we are developing technology that will directly impact the end-user experience when using our products. For instance, consumers, listening to a CSR powered Bluetooth stereo headset notice not just a robust Bluetooth link but also excellent audio quality, low power consumption and state of the art echo and noise cancellation. This helps us to protect market share and improve gross margins.

Key differentiators including connectivity, location and audio quality are already enhancing the end-user experience and therefore encouraging our customers to design their products around CSR technology. We will continue to focus on differentiated products with unique, high value features, complementing our in-house skills with partnerships, mergers and acquisitions as appropriate.

2. Disciplined development execution

With the development cycle for a new product sometimes lasting longer than the life of the product itself, timely delivery of products is critical. At CSR, we have 700 engineers based at 10 design centres around the world, working under the guidance of our new SVP Development, Klaus Buehring who joined us during 2010. A key part of Klaus’ work is enhancing the existing processes we have for bringing our technologies through the key development phases to sampling with our customers that in turn creates design win opportunities. Drawing on his 25 years experience, which includes the turnaround of Freescale’s billion dollar radio products division, Klaus is introducing new ways of working, which have and will continue to improve the predictability and product development cycle time of our organisation.

3. Strong operational efficiency

For many years, CSR has been a world leader in developing the process which enables us to package our chips at the wafer-level. This approach brings benefits to better manufacturing processes, which are also cost effective – an important differentiator in our industry. The focus in recent times has been to identify and understand the key issues we face as we move to 40nm technology. We have developed a robust process design kit, electronic design automation and computer automated design tools enabling faster development and reduced time to market. We are now working closely with our supply chain partners ASE and TSMC – each of whom are world leaders in their field – to explore new three-dimensional packaging techniques.

4. Developing our Platform capabilities

Central to our strategy is developing more complete platforms for our customers. A platform is a product that contains much of the critical semiconductor functionality in a product. For example, our headset products include not only bluetooth technology, but also audio and power management. Another example is the SiRFprima platform, which includes most of a PND’s semiconductor technology on one chip. Platforms offer our customers a simpler route to designing and manufacturing their products and offer us the opportunities to differentiate. Going forward it is our intention to grow further in this area. SiRFprimaII and CSR8670 are examples of this strategy.

5. Adding adjacent technologies

As we have grown, we have added expertise in areas adjacent to Bluetooth, such as GPS, through the acquisition of SIRF, WiFi which we have developed internally, and audio, developed both internally and through acquisitions such as CVC and aptX. As opportunities for growth present themselves in adjacent areas, we expect to continue to develop adjacent technologies.

Looking ahead

The last twelve months have seen a return to growth, building on the improvement we saw towards the latter part of 2009.

Our continued focus on the Connectivity Centre supported by market-leading strengths in location technology have energised our business and yielded a roadmap rich in potential. We anticipate that the market will continue to grow at around 15% year-on-year for the next five years. We believe that we are well positioned to exploit this growth.

The opportunities for sustained growth are diverse, exciting and extensive. I am confident that we have the strategy, the commitment and the resources to exploit them to the full in the coming years.

Joep van Beurden,

Chief Executive Officer

4/5

Directors’ report

Business and financial review

Introduction

CSR is a leading provider of multifunction connectivity, audio and location platforms. CSR’s technology portfolio includes:

| · | | Global Positioning System (GPS) and Global Navigation Satellite Systems (GNSS) |

| · | | Frequency Modulated (FM) Radio |

| · | | Wi-Fi or Wireless Fidelity (typically associated with wireless communication standard IEEE802.11) |

| · | | Near-Field Communication (NFC), a short range wireless frequency which enables the transfer of data, including larger files and secure transaction, between devices. |

Together, these technologies enable us to deliver platforms that integrate silicon, software and our proprietary algorithms to significantly enhance consumer experience in a broad range of devices and applications. Some of our platforms incorporate fully integrated radios, along with baseband, digital signal processor (DSP) and microcontroller elements while others are complete multifunction system-on-chip (SOC) platforms that integrate multimedia, 3D visualization and powerful application processors along with location capabilities for auto navigation and infotainment systems.

CSR’s technologies have been adopted by market leaders into a wide range of mobile consumer devices such as mobile phones, automobile navigation and telematics systems, personal navigation devices (PNDs), wireless headsets, wireless audio systems, personal computers (PCs), tablets, GPS recreational devices, tracking & logistics management systems, digital cameras and gaming devices.

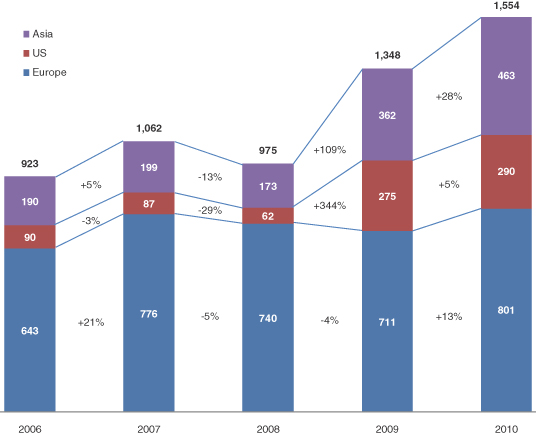

Overview

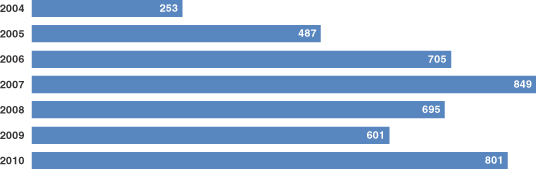

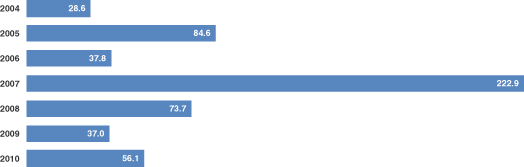

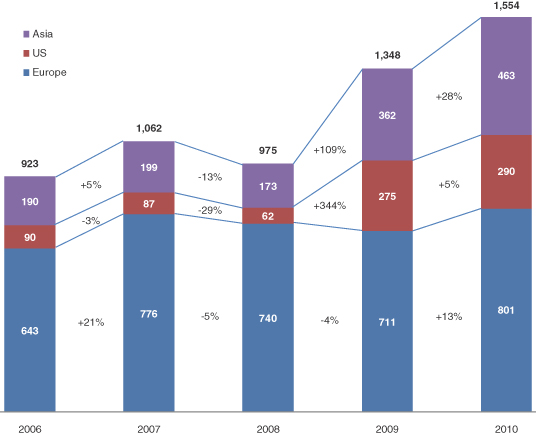

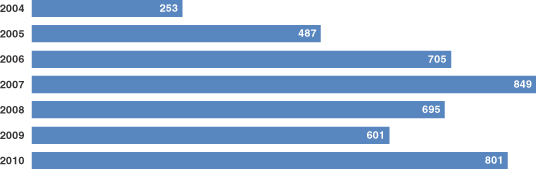

Our revenue is generated principally from the sale of our products to original equipment manufacturers (OEMs) and original design manufacturers (ODMs) serving the retail consumer market. Our revenue in 2010 was $800.6 million, an increase of 33.1% compared to 2009 revenue of $601.4 million (2008: $694.9 million). About half of this increase was attributable to the inclusion of revenues from product lines acquired through our acquisition of SiRF Technology Holdings, Inc. (‘SiRF’) on 26 June 2009 for all of 2010 but in 2009 only for the portion of the year following the completion of the acquisition. The balance of the increase was attributable to the strong sales performance across our product lines described in more detail below.

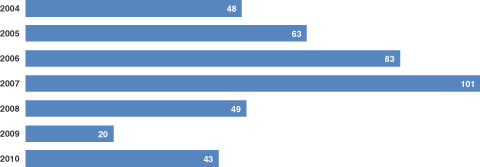

Our operating loss for 2010 was $6.3 million, compared to a loss of $15.9 million in 2009 (2008: loss of $8.5 million).

Our operating loss in 2010 was significantly affected by our comprehensive settlement with Broadcom Corporation. In December 2010 mediation commenced between CSR and Broadcom with the intention to settle all outstanding litigation regarding alleged intellectual property infringment, including the litigation against SiRF that was pending at the time of its acquisition. Settlement was signed on 10 January 2011. Under the terms of this settlement, we made an initial payment to Broadcom of $5 million and will make further payments of $12.5 million per year for five years. Under the settlement, all outstanding litigation has been dismissed, all pending litigation has been terminated and the parties have entered into a mutual covenant not to sue that expires in January 2016. Although these payments will be made over a five-year period, because they relate to alleged past infringement by SiRF and the related discharge of pending claims and termination of litigation, we recorded $59.8 million, the estimated net present value of these payments, as a charge to 2010 earnings, resulting in the full-year operating loss. Prior to commencement of mediation, the amount of any liability was not readily estimable and no cash outflow was considered probable.

Cash, cash equivalents and treasury deposits increased to $440.1 million at 31 December 2010 from $412.4 million at 1 January 2010, which was an increase of $27.7 million. This increase reflected our strong net cash from operating activities in 2010 of $77.9 million (2009: $50.2 million).

On 13 September 2010, the Board announced a share buy-back programme of up to $50 million. The Company is significantly cash generative and has the financial flexibility both to consider potential acquisitions that meet its strict investment criteria and to drive its organic development. In light of this, the Board initiated the share buy-back programme. Prior to entering our close period on 1 January 2011, we had purchased 7,145,000 of our ordinary shares for an aggregate of $37.5 million.

As previously announced, the Board of CSR is proposing the Company’s first dividend of $0.065 (£0.04) per share in respect of the 2010 financial year, representing 2/3 of a notional $0.098 (£0.06) per share full year dividend that would have been paid if the Company had commenced payment of dividends sooner. It is the Board’s intention to follow a progressive dividend policy that reflects the underlying growth prospects of the Company as well as the long term outlook for growth in earnings per share and group cash flow. The Board intends to pay dividends on a semi-annual basis.

As noted above, our financial results for the comparative financial year to 1 January 2010 include the results of SiRF from the date of acquisition, but SiRF’s financial performance is not reflected in our financial results for the first six month period of 2009 prior to the acquisition or for any of the financial years prior to 2009.

CSR plc Annual Report and Financial Statements 2010

Business and financial review continued

Over the past year, we have further strengthened our position in all of our key product categories: Bluetooth, Wi-Fi and GPS. The proliferation of connectivity and location beyond the handset into home, office and in-vehicle is continuing rapidly, changing end customers’ experience and expectations – in fact, changing the way we all work, live and play.

This is changing the profile of our business and expanding our opportunities. In all our market segments, we have strong positions and we are leveraging these positions to open new markets with focused and differentiated product and software development, establishing feature-rich platforms, disciplined development execution and strong operational efficiency.

In handsets, our growth was flat, reflecting lower growth in the market for feature phones, the production delays at one of our lead customers for our CSR8000 and the sharp market swing to smartphones. We have acknowledged our relative weakness in smartphones and we are making good progress on our product route map to reposition our portfolio and address this.

We are seeing rapidly growing attach rates for connectivity and location in the automotive and PC/tablet sectors, rapidly growing attach rates for location in the camera sector, and rapidly growing attach rates for connectivity in the gaming sector.

Last year, we launched next-generation products that are now gaining traction and are expected to drive growth in 2011. Our CSR8000 latest generation Bluetooth product, which includes our proprietary Classic Bluetooth, Bluetooth High Speed and Bluetooth low energy technologies, is shipping with two Tier One handset manufacturers, and sales are increasing as expected. SiRFstarIV, our latest generation GPS product, has been designed in with a second Tier One customer. Our SiRFprimaII and SiRFatlasV platforms are having good success in winning designs for feature-rich location platforms with in-dash automotive and PND customers. In 2010, WI-Fi was a small, but strategically important part of our business. Many of the leading companies in the handset and automotive markets are using our Wi-Fi products, and we continue to build momentum, winning a number of additional design wins.

We also introduced CSR µEnergy™, which enables Bluetooth ultra low power connectivity and basic data transfer in a variety of applications previously hindered by power consumption requirements, size constraints and complexity of prevailing wireless technologies. We believe CSR µEnergy™, unique to CSR, has wide potential, including high-volume products such as remote controls, keyboards and mice and a variety of health and well-being products.

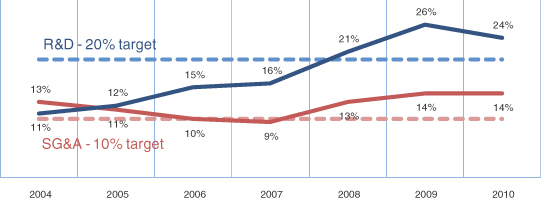

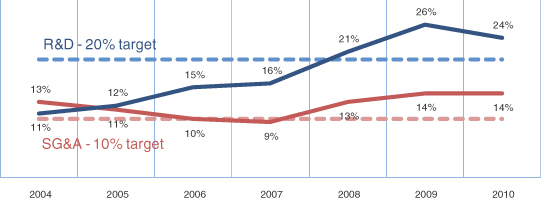

CSR invested $199.9 million in R&D in 2010 compared with $169.7 million in 2009 and $158.1 million in 2008. The increase was due to the inclusion of a full year of SiRF R&D expenditure as well as new investment in R&D in 2010, offset by some R&D expense synergies realised following the SiRF acquisition. We believe that this level of investment is important to ensure that we are able to continue to compete effectively in a rapidly evolving market which requires the advancement of existing technologies and the development of innovative solutions in order to sell our products to customers, and we expect to continue increasing our investment in R&D during 2011.

CSR’s commitment to new technology continues to demonstrate the strength of working relationships with key supply chain partners. As examples, 2010 brought firstly the completion of 40nm RF CMOS IP development enabling the parallel roll out of multiple product development programmes using proven advanced RF IP on 40nm. In addition to 40nm IP delivery, CSR executed a programme that resulted in the conversion of high volume wire bond packages using gold wire. Conversion from gold to copper wire mitigated the risk of economic / trade conditions driving gold pricing and increased package costs.

A discussion of the changes in financial performance of the Business Segments starts on page 11. We made good progress in 2010 to extend our product portfolio by expanding our Wi-Fi, location and audio businesses. We maintained a strong position in many of the markets we target, such as Bluetooth headsets, PNDs, automotive and gaming. While we lost some share of the Smartphone market, as discussed below, we also gained market share in markets such as PCs and feature phones.

The first six months of 2010 delivered a significant increase in revenues ($393.8 million compared with revenues of $193.5 million for the same period in 2009) as a result of customers increasing orders and restocking inventory channels in response to a consumer-led increase in demand and the inclusion of SiRF GPS revenues, which we estimate impacted the first six months of 2010 by $128 million. In addition, we experienced strong demand for many of our products, particularly from customers in the automotive sector and emerging markets in PNDs as well as for our PC and consumer products. In each of these markets, we were able to achieve increases in our market share. The second half of 2010 experienced a slight reduction in revenue: $406.9 million compared with $407.9 million for the same period in 2009. This reflected the wider impact of a slower growth in the global economy generally. In addition, during the second half, revenues were affected by the delayed introduction of our products at a major customer, the effect of capacity constraints for the manufacture of products supplied to some of our automotive customers, in addition to a dramatic shift in consumer demand from feature phones (where we are strong) to smartphones (where we are less well positioned).

In July 2010, we acquired APT Licensing Ltd (‘aptX’) after a successful three-year collaboration under the eXtension Partner Programme. In the months since the acquisition, we have secured a number of design wins using our audio compression aptX technology. For example, in January 2011, Samsung announced that it would incorporate aptX in a broad range of its mobile devices and accessories. We believe the aptX technologies will provide further opportunities in other markets, including in automotive and headsets where aptX technologies are market leaders.

Outlook

Looking ahead, we plan to continue to drive revenue growth across all our businesses by creating and introducing differentiated products with unique, high value features in connectivity, location and audio platforms augmented by our recognised capabilities in implementation and support. We are increasing our investment in product innovation to support the more than 30 new products on our roadmap in the coming years. In 2011, we expect to launch our CSR9800 Bluetooth, Wi-Fi and Bluetooth low energy combination chip, as well as SiRFstarV with “Deep Indoors” location technology, among other product launches.

We have a clear plan to reposition our handset business for growth, with new products launched recently and others launching late in 2011.

We intend to build on our strong position to support further growth in our Audio & Consumer Business Unit during 2011. Our focus is to continue to innovate and differentiate our world-class products to improve customer usability and enable new functionality for many of

6/7

Business and financial review continued

the emerging consumer electronics markets. With a market share of more than 50% in automotive and a strong position in PNDs in the higher growth emerging markets, our Automotive & PND business unit is well positioned to benefit from strong growth in its markets.

As a consequence of the market opportunities in connectivity, audio and location-based services, competition has intensified as existing and new entrants seek to establish and grow market share. This trend of increasing competition is expected to continue. As the number of companies supplying wireless technology solutions increases, our customers have access to a greater variety of alternative solutions with differing features to those offered by CSR. They are also able to seek better prices in return for awarding contracts and, similarly, competitors are often prepared to offer lower prices in order to secure new business.

Business Units

Our business is organised into three business units which represent our reportable segments:Handsets (HBU),Audio & Consumer (ACBU) which includes headsets, PCs and consumer products andAutomotive & Personal Navigation Devices (APBU). As stated above segment information for the period prior to the acquisition of SiRF does not include SiRF’s financial results.

In 2010, approximately 42% of revenue was generated by the HBU segment, approximately 30% was generated by the ACBU segment and approximately 28% was derived from the APBU segment. This compared to 52%, 27% and 21% respectively in 2009. Revenues from products historically made by SiRF are primarily in the APBU and HBU segments, although a small portion are in the ACBU segment; the acquisition of SiRF thus has had the biggest impacts on the results of operations in the HBU and APBU segments.

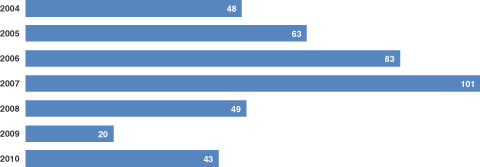

HBU segment During 2010, overall revenue in our Handset Business Unit increased by 9% to $339.1 million, compared with $310.8 million in 2009. A further discussion of HBU revenue is given in the Financial Performance section below.

Our handset performance was constrained by our low share of the Smartphone market and production delays at one of our lead customers for our CSR8000 product. Our continued strong sales in the feature phone market partially offset this weakness.

The feature phone market remains substantial, with expected shipments of more than 700 million units per year, and we have been gaining share within this market for all our technologies. We expect to continue to perform well in feature phones in 2011. We have a clear strategy to improve our position in Smartphones as discussed on page 3 and we are committed to strengthening our position in this market segment.

Our latest Bluetooth and GPS products – the CSR8810 and SiRFstarIV devices – are currently being shipped in increasing volumes with Tier One OEMs. In GPS, we have secured an important additional Tier One design win, and we see opportunity for more design wins in 2011. The CSR9800, our 40nm Bluetooth + Wi-Fi + CSR µEnergy combination chip, is on track to sample with customers this summer, when we also plan to launch SiRFstarV, a highly differentiated GPS device that incorporates “Deep Indoors” location technology. Both devices are receiving positive feedback and we believe they provide the opportunity for us to secure design wins in the Smartphone market in late 2011 that would increase our penetration of the Smartphone market in 2012.

Technologies such as Bluetooth low energy and Wi-Fi Direct are providing new opportunities for discrete solutions in Smartphones and in feature phones. Our platform partnership with Infineon Technologies is progressing well and has resulted in increased interest in our Bluetooth and Wi-Fi technologies for adoption into feature phones in 2011 and beyond. In addition to the Tier One customer currently commencing production with our CSR8810 on the Infineon platform, this partnership is generating interest in emerging economies such as China. The wireless solutions business of Infineon has recently been acquired by Intel, another company with which we have historically had a strong working relationship, and we look forward to continuing these initiatives with Intel.

HBU underlying operating loss was $25.2 million compared to an underlying operating profit of $4.6 million in 2009 (2008: underlying operating loss of $8.5 million). The HBU underlying operating loss in 2010 was as a result of increased investment in HBU product developments compared to investment in 2009. The 2009 HBU underlying operating profit represented an increase in earnings for this segment of $13.1 million, this was as a result of lower HBU product development costs in 2009 when compared to 2008.

ACBU segment Revenue in our Audio & Consumer Business Unit increased by 46% in 2010 to $238.4 million, compared with $163.3 million in 2009. A further discussion of ACBU revenue is given in the Financial Performance section below. This strong growth is a result of maintaining our leadership position in headsets and market share gains in the gaming and PC markets, as well as the incremental growth of new markets such as digital still cameras, athletic watches and wireless speakers. While Bluetooth remains our primary technology in this market, GPS penetration continues to increase as devices such as digital still cameras and athletic watches implement location-based functionality to enhance the user experience.

In the audio space, we remain the market leader, with more than 70% of the overall headset market, and more than 90% of the emerging stereo headset market. In the fourth quarter, CSR won 75% of all new headset designs, about 25% of which were for stereo headset devices. New designs launched recently included headsets from Bose, Creative and Motorola, as well as wireless speakers from Aliph for the JAMBOX and Creative for the ZiiSound. The aptX acquisition we made last year has further enhanced our offering in this market. For example, last month at the Consumer Electronics Show (CES) in Las Vegas, Samsung announced that it would incorporate our aptX hi-fi quality Bluetooth stereo technology into a broad range of its mobile devices and accessories. ID8 also chose this technology for its ultra-slim designer Bluetooth headset, the MoGo Talk HD1. We believe that further deployment of aptX into the handset market will drive additional demand for the technology in the automotive and headset market segments, as well as in other mobile devices.

We continue to gain market share within the PC market with our PC Wi-Fi provider partners and within the tablet market for our Bluetooth and GPS technologies. Recently Intel Corporation, one of our PC partners, introduced two new Wi-Fi + Bluetooth chips as part of the Intel Centrino Wireless product line. These are the first of the Intel branded products to be launched using our Bluetooth IP, which Intel is licensing from CSR. In the fourth quarter, we also won an additional PC design with a Tier One PC manufacture and won a number of tablet designs in Asia. We recently announced our latest PC Bluetooth® Module, BlueSlim2, which is a qualified Bluetooth module reference design for notebooks, netbooks and tablets, providing a fast, simple and cost-effective route for original equipment manufacturers (“OEMs”) to integrate the latest Bluetooth functionality into PC module designs. In the gaming market, our lead customer is expected to maintain its strong position.

CSR plc Annual Report and Financial Statements 2010

Business and financial review continued

In other consumer devices, our GPS solutions are picking up momentum in markets where geo-tagging and location-aware applications gained popularity last year. In the fourth quarter, we won a number of new design wins for digital still cameras and athletic watches.

As we look to 2011 and beyond, demand for the products we offer in the audio and consumer markets continues to grow. We intend to build on our strong position in many of the markets to support further growth in our Audio & Consumer Business during 2011.

ACBU underlying operating profit was $59.4 million compared to an underlying operating profit of $6.2 million in 2009 (2008: underlying operating profit of $63.4 million). The increased underlying operating profit in 2010 compared to 2009, was as a result of segment revenue increasing more than segment costs. The decrease in segment underlying operating profit between 2008 and 2009 was due to the significant reduction in revenue, as the costs attributed to this segment did not decrease to the same extent.

APBU segment In 2010, our Automotive & PND business unit grew year on year by 75% to $223.1 million, compared with $127.3 million in 2009. A further discussion of APBU revenue is given in the Financial Performance section below. This strong growth was in spite of the capacity constraints we experienced in the second half of the year and is a result of higher attach rates for our technologies in the automotive market where we hold the leading position, and PND growth in emerging markets.

Looking forward, we expect strong growth as overall demand for connectivity and location solutions in the car strengthens, and vehicles become a major connectivity centre for infotainment and telematics applications. Our emerging market customers continue to see significant growth opportunities where penetration rates are still relatively low and where we have a strong market position.

Evidence of the strong growth of the Connectivity Centre in the automotive market was apparent at the Consumer Electronics Show (CES) in Las Vegas where several new automotive products that use CSR’s technologies were introduced. General Motors announced an after-market version of their OnStar communications system that utilises CSR’s Bluetooth and GPS technology. Hyundai launched at CES its BlueLink® Telematics platform, which incorporates more than 30 innovative connectivity functions and core safety services, including maintenance alerts, remote door lock/unlock capabilities, remote start, and “geofence" text-message alert for parents of young drivers, and stolen vehicle slowdown and recovery features. BlueLink® incorporates CSR’s Bluetooth technologies. We have also been leveraging our strong market position in Bluetooth to captialise on growing demand for CSR’s automotive grade Wi-Fi solution. In recent trade shows, Tier One suppliers have given early demonstrations of technologies using CSR Wi-Fi solutions within the automotive sector.

Several CSR Bluetooth and GPS automotive design wins began production in the fourth quarter, including those for Audi, Ford and Toyota. In addition, our SiRFprimaII platform for the automotive market, which is in advanced stages of development, is generating strong customer interest. We now have four lead customers across three different APAC (Asia Pacific) regions for this multifunction location platform. This is a direct result of our efforts to move our system-on-chip platforms into high-end PNDs and in-dash automobiles, where we enjoy higher gross margins for our automotive-grade quality and complete platform solution.

Looking ahead, growth trends for connectivity technologies in the Automotive & PND markets are expected to be strong, driven by increased attach rates as well as emerging applications. With a leading market share in automotive and a strong position in PNDs in the higher growth emerging markets, CSR is well positioned to benefit from these growth trends. We also expect to see incremental growth in the second half of the year, once we have resolved our previously announced capacity constraint issues for this market. In addition, as our best-in-class audio technology, aptX, gains broad adoption in handsets and portable consumer devices, we believe there is an opportunity to expand that technology to the car as well.

APBU underlying operating profit was $44.8 million compared to an underlying operating profit of $16.0 million in 2009 (2008: underlying operating profit of $18.0 million). The increased underlying operating profit in 2010 compared to 2009 was as a result of segment revenue increasing more than segment costs. The small decrease in segment underlying operating profit between 2008 and 2009 was due to an increase in development costs for GPS automotive products following the acquisition of SiRF, which more than offset the increase in revenue, as the costs incurred for Bluetooth developments were small.

Market Overview

Our results of operations during 2008-2010 were materially affected by the following trends, several of which are likely to continue and which we expect are likely to affect performance in 2011. These include:

| · | | change in the size of the market for short-range wireless voice and data communications and location, and location-based services; |

| · | | general economic conditions which affect the level of demand from retail consumers for the connectivity, location and audio products which use our technology; |

| · | | the impact of intense competition from third parties, including in respect of product features, pricing strategies and release of new products; |

| · | | the recognised trend in the semiconductor industry for declining average selling prices; |

| · | | the tendency for demand for consumer products to be affected by seasonality; |

| · | | cyclical trends in the semi-conductor industry generally; |

| · | | the growth in revolutionary new products such as smartphones and tablet PCs; |

| · | | restructuring in the semiconductor industry arising from the economic downturn which can affect the availability of sufficient capacity to meet our demands for integrated circuits; and |

| · | | fluctuations in currency exchange rates which can affect CSR’s costs in light of the global nature of its business. |

8/9

Business and financial review continued

Our current product portfolio has target markets including connectivity technologies such as Bluetooth and Wi-Fi; location technologies such as GPS and audio technologies including FM and codecs, all focused on handsets, consumer, audio, automotive and PND applications. We believe that these markets increased by around 15% in value terms in 2010. A large part of the growth was in the Wi-Fi and smartphone markets, where we have yet to establish a strong presence; however, we did increase our revenues by around 17% in 2010 compared to a 2009 revenue comparative which includes SiRF’s first half revenue pre-acquisition of $82.5 million which has been derived from SiRF’s accounting records, as well as CSR’s IFRS revenue of $601.4 million. This principally reflects growth in the higher ASP (average selling price) markets of our audio and consumer and automotive and PND businesses.

Handsets In handsets, the total market showed some growth compared to 2009, following the small decline in 2009; we estimate that the smartphone sector grew by over 50% with much lower growth in feature phones and a decline in the ultra low cost sector. The momentum behind smartphones has continued, with Apple, Nokia, RIM and other established brands concentrating on this sector. Attach rates continued to grow for Bluetooth, Wi-Fi and GPS in phones of all kinds. The growth in smartphones is driving the adoption of combo chips.

Audio and Consumer As we look to 2011 and beyond, demand for the connectivity, location and audio technologies we offer in the audio and consumer markets is expected by industry analysts to grow at an annual compound growth rate of more than 15%.

Automotive and PND Industry analysts forecast that growth trends for connectivity technologies in the Automotive and PND markets are expected to be strong at a more than 25% compound annual growth rate. The growth is expected to be fueled by increased attach rates as well as emerging applications.

Much of the technology which we develop and supply to our customers is installed into devices which are sold into consumer markets. Demand for consumer products and therefore for our own products is subject to seasonal variation. This in turn affects our results which typically are stronger in the second and third quarters of a financial year as our customers increase orders in anticipation of demand for their own products.

Revenue derived from the supply of integrated circuits featuring our Bluetooth technologies remained the most significant part of our revenue in 2010.

We rely on our suppliers to provide the volumes of integrated circuits sufficient to meet the demands for our products from our customers. The economic downturn through 2009 resulted in measures being taken by a number of foundries that manufacture, assemble and test integrated circuits to restructure their businesses, resulting in a contraction of overall capacity for the supply of integrated circuits.

Product Life Cycle

During 2010, BC6 ROM, our Bluetooth device aimed at the mobile phone segment was again our largest revenue generating product, with the SiRFstarIII GPS chip being the next most significant. BC4 ROM, our largest shipping product in 2006, 2007 and 2008 started to reach the end of its useful life. In 2011, we expect BC6 ROM to continue as the largest shipping device, whilst SiRFstarIII is still expected to make a very material contribution. New products such as SiRFstarIV, SiRFatlasV and CSR8000 are all expected to contribute significantly to 2011 revenue.

Looking further into the future, we expect SiRFprimaII, SiRFstarV and CSR9800 our combination Bluetooth, Wi-Fi and Bluetooth low-energy device to make a meaningful contribution to revenue from 2012 onwards.

Financial Performance

The following table summarises our income statement:

| | | | | | |

| | | 2010

$ million | | 2009

$ million | | 2008

$ million |

| Revenue | | 800.6 | | 601.4 | | 694.9 |

| Other cost of sales | | (418.4) | | (333.1) | | (385.1) |

| Amortisation of acquired intangible assets | | (5.7) | | – | | – |

| Gross profit | | 376.5 | | 268.3 | | 309.8 |

| Other research and development expenses | | 189.2 | | 155.5 | | 147.9 |

| Share-based payment charges | | 5.7 | | 6.8 | | 4.8 |

| Amortisation of acquired intangible assets | | 5.0 | | 7.4 | | 5.4 |

| Total Research and development expenses | | 199.9 | | 169.7 | | 158.1 |

| Other sales, general and administrative expenses | | 114.1 | | 85.9 | | 89.1 |

| Asset impairment | | – | | – | | 52.9 |

| Amortisation of acquired intangible assets | | 3.5 | | 2.0 | | – |

| Share-based payment charges | | 4.0 | | 3.8 | | 2.8 |

| Integration and restructuring expenses | | 1.1 | | 12.2 | | 14.4 |

| Litigation settlement | | 59.8 | | – | | – |

| Deferred tax adjustment to goodwill | | – | | – | | 1.0 |

| Acquisition-related fees | | 0.4 | | 10.6 | | – |

| Total Sales, general and administrative expenses | | 182.9 | | 114.5 | | 160.2 |

| Operating loss | | (6.3) | | (15.9) | | (8.5) |

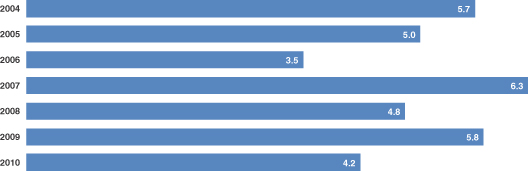

| Investment revenue | | 0.8 | | 1.9 | | 6.1 |

| Finance costs and other gains and losses | | (0.3) | | (0.2) | | (4.1) |

| Loss before tax | | (5.7) | | (14.2) | | (6.5) |

| Tax | | 22.3 | | 2.9 | | (0.5) |

| Profit (loss) for the period | | 16.6 | | (11.3) | | (6.9) |

CSR plc Annual Report and Financial Statements 2010

Business and financial review continued

Non-GAAP measures

Some discussions and analyses in this Annual Report include measures which are not defined by generally accepted accounting principles (GAAP) such as IFRS. We believe this information, along with comparable IFRS measures, is useful to investors. Our management uses these financial measures, along with the most directly comparable IFRS financial measures, in evaluating our operating performance and value creation. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in compliance with IFRS. Non-GAAP financial measures as reported by us may not be comparable with similarly titled amounts reported by other companies.

In the following sections and elsewhere in this Annual Report we discuss the following non-GAAP measures:

| · | | “Underlying research and development expenses” which is equivalent to the heading “Other research and development expenses” in the table above; |

| · | | “Underlying sales, general and administration expenses” which is equivalent to the heading “Other sales, general and administration expenses” in the table above; |

| · | | “Underlying gross profit” which represents “Revenue” less “Cost of sales” in the table above, and excludes “Amortisation of acquired intangible assets” recorded before “Gross Profit” in the table above; |

| · | | “Underlying cost of sales” which represents “Cost of sales” less “Amortisation of acquired intangible assets”; |

| · | | “Underlying operating profit” which represents “Underlying gross profit” after deduction of “underlying research and development” and “underlying sales, general and administrative expenses”; |

| · | | “Underlying net profit” which represents “underlying operating profit”, plus investment income, less finance costs and tax, excluding the tax effects of the adjustments made to underlying operating profit and the recognition of deferred tax assets for acquired tax losses; |

| · | | “Underlying tax” which represents “Tax” excluding the tax effects of the adjustments made to underlying operating profit and the recognition of deferred tax assets for acquired tax losses; |

| · | | “Underlying diluted earnings per share” which represents underlying net profit divided by the weighted average number of diluted shares; and |

| · | | “Free cash flow” which represents cash generated by operations, less amounts spent on tangible and intangible fixed assets. |

For a detailed discussion of the reasons behind this presentation and full reconciliations of each measure to the most directly comparable IFRS measure, refer to pages 30 to 33.

The following table presents revenue, cost of sales, underlying cost of sales, gross profit, underlying gross profit, total research and development expenses, underlying research and development expenses, total sales, general and administrative expenses, underlying sales, general and administrative expenses, operating (loss) profit and underlying operating profit, all in absolute terms and as a percentage of revenue, for 2010 and 2009:

| | | | | | | | | | | | |

| | | 2010 | | 2009 | | Increase/

(decrease)

$ million | | %

change |

| | Amount

$ million | | % of

Revenue | | Amount

$ million | | % of

Revenue | | |

| Revenue | | 800.6 | | 100 | | 601.4 | | 100 | | 199.2 | | 33.1 |

| Cost of sales | | 424.0 | | 53.0 | | 333.1 | | 55.4 | | 90.9 | | 27.3 |

| Underlying cost of sales | | 418.4 | | 52.3 | | 333.1 | | 55.4 | | 85.3 | | 25.6 |

| Gross profit | | 376.6 | | 47.0 | | 268.3 | | 44.6 | | 108.3 | | 40.4 |

| Underlying gross profit | | 382.2 | | 47.7 | | 268.3 | | 44.6 | | 113.9 | | 42.5 |

| Research and development expenses | | 199.9 | | 25.0 | | 169.7 | | 28.2 | | 30.2 | | 17.8 |

| Underlying Research and development expenses | | 189.2 | | 23.6 | | 155.5 | | 25.9 | | 33.7 | | 21.7 |

| Sales, general and administrative expenses | | 182.9 | | 22.8 | | 114.5 | | 19.0 | | 68.4 | | 59.7 |

| Underlying sales, general and administrative expenses | | 114.1 | | 14.3 | | 85.9 | | 14.3 | | 28.2 | | 32.8 |

| Operating loss | | (6.3) | | (0.8) | | (15.9) | | (2.6) | | 9.6 | | (60.4) |

| Underlying operating profit | | 79.0 | | 9.9 | | 26.9 | | 4.5 | | 52.1 | | 193.7 |

10/11

Business and financial review continued

The following table presents revenue, cost of sales, gross profit, total research and development expenses, underlying research and development expenses, total sales, general and administrative expenses, underlying sales, general and administrative expenses, operating loss and underlying operating profit, all in absolute terms and as a percentage of revenue, for 2009 and 2008 (underlying cost of sales and underlying gross profit are not shown as they are the same as cost of sales and gross profit respectively):

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2009 | | | 2008 | | | Increase/

(decrease)

$ million | | | %

change | |

| | Amount

$ million | | | % of

Revenue | | | Amount

$ million | | | % of

Revenue | | | |

Revenue | | | 601.4 | | | | 100 | | | | 694.9 | | | | 100 | | | | (93.5 | ) | | | (13.5 | ) |

Cost of sales | | | 333.1 | | | | 55.4 | | | | 385.1 | | | | 55.4 | | | | (52.0 | ) | | | (13.5 | ) |

Gross profit | | | 268.3 | | | | 44.6 | | | | 309.8 | | | | 44.6 | | | | (41.5 | ) | | | (13.4 | ) |

Research and development expenses | | | 169.7 | | | | 28.2 | | | | 158.1 | | | | 22.8 | | | | 11.6 | | | | 7.3 | |

Underlying Research and development expenses | | | 155.5 | | | | 25.9 | | | | 147.9 | | | | 21.3 | | | | 7.6 | | | | 5.1 | |

Sales, general and administrative expenses | | | 114.5 | | | | 19.0 | | | | 160.2 | | | | 23.1 | | | | (45.7 | ) | | | (28.5 | ) |

Underlying sales, general and administrative expenses | | | 85.9 | | | | 14.3 | | | | 89.1 | | | | 12.8 | | | | (3.2 | ) | | | (3.6 | ) |

Operating loss | | | (15.9 | ) | | | (2.6 | ) | | | (8.5 | ) | | | (1.2 | ) | | | (7.4 | ) | | | (87.1 | ) |

Underlying operating profit | | | 26.9 | | | | 4.5 | | | | 72.8 | | | | 10.5 | | | | (45.9 | ) | | | (63.0 | ) |

Revenue Our revenue in 2010 increased to $800.6 million representing a 33% increase on 2009 revenue ($601.4 million). During 2009, we acquired SiRF which, had it been acquired on the first day of 2009, would have contributed a total of $212.5 million of GPS revenue in the year. In 2010, we recorded a full year of GPS revenues totalling $273.9 million. The remaining growth was driven by our legacy Bluetooth business.

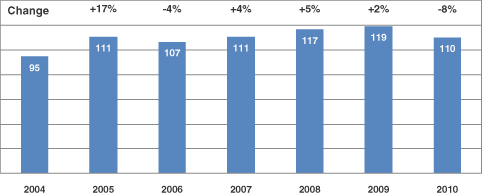

The increase in revenue was achieved despite the volume-weighted average selling price across all products declining by 1% from 2009 to 2010. Volume weighted average selling prices declined for both Bluetooth and GPS products, however, these declines were substantially offset by the higher proportion of revenues from GPS products which have a higher average selling price (although they are subject to the trend for decline described above).

We saw particularly strong growth in our automotive and PND and audio and consumer businesses, which are described further below. This positive impact was offset to an extent by weakness in our handset business, where our lack of penetration in smartphones and the related trend favouring combination devices have meant that the handset business was able to achieve only modest growth.

Our revenue in 2009 fell to $601.4 million, representing a 13% decrease on 2008 revenue ($694.9 million). Excluding SiRF GPS revenue, our revenue declined by $223.5 million, or 32%, in 2009. We believe that over the same period, the Bluetooth market increased by around 10% in terms of total units sold, although our units sold fell by 16%. SiRF’s contribution to revenue since its acquisition on 26 June 2009 reduced the revenue decline by approximately $130.0 million.

There were two primary reasons for our declining sales volumes from 2008 to 2009. The first was the loss of market share in handsets, due to the loss of a Bluetooth+FM programme with our BC5 FM chip at one of our largest customers. The second was the overall decline in the headset market, which we believe fell by around 50% in revenue terms, with our business impacted to a similar extent.

There was a further revenue impact due to the volume-weighted average selling price declining by around 8% year on year. Average selling price for the legacy CSR Bluetooth business declined by around 20% but this was partially offset by the higher average selling price for SiRF products.

In the second half of 2009, as expected, we commenced volume shipments of our BC7000 devices to several major customers of the handset business unit, which had a positive impact on revenue and there was further growth in revenue from this product in 2010.

The proportion of revenue derived from our top ten customers has fallen to 50% from 54% in 2009 (2008: 67%). The SiRF acquisition in 2009 has brought increased diversity to our customer base and has significantly reduced our dependency on several key customers. Our largest customer represented 14% of revenue in 2010 compared to 11% in 2009 and 19% in 2008.

Segment analysis The following table presents CSR’s segmental revenue for 2010, 2009 and 2008. SiRF revenue is included in this data only for the portion of 2009 following the acquisition on 26 June 2009.

| | | | | | | | | | | | | | | | | | | | |

| | | 2010 $ million | | | 2009 $ million | | | 2010 vs. 2009 % change | | | 2008 $ million | | | 2009 vs. 2008 % change | |

Handsets Business Unit | | | 339.1 | | | | 310.8 | | | | 9.1 | | | | 344.2 | | | | (9.7 | ) |

Audio & Consumer Business Unit | | | 238.4 | | | | 163.3 | | | | 46.0 | | | | 299.6 | | | | (45.5 | ) |

Automotive & PND Business Unit | | | 223.1 | | | | 127.3 | | | | 75.3 | | | | 51.1 | | | | 149.1 | |

Total | | | 800.6 | | | | 601.4 | | | | 33.1 | | | | 694.9 | | | | (13.5 | ) |

Results for each business unit are regularly reviewed in various forums by senior management, including the CEO and CFO to understand how they have impacted the results of the Group and to assist in the allocation of resources.

HBU segment Handset segment revenue, which represented 42% of our total revenue in 2010, increased 9.1% compared to 2009, as 2010 included the impact of a full year of SiRF GPS revenue.

CSR plc Annual Report and Financial Statements 2010

Business and financial review continued

Non-GPS revenues fell due to normal reductions in weighted average selling prices, whilst volume shipments increased. Growth was constrained by our low share of the smartphone market and the delayed production increase at one of our lead customers for our CSR8000 product.

The net decline in the legacy Bluetooth business was more than offset by the increased revenue from GPS shipments which increased as a result of including a full year of the GPS business. Second half GPS revenues in this segment increased by 9% compared to the second half of 2009, although shipment volumes increased by more than this as a major customer switched volume production to a new lower cost device.

Handset segment revenue, which represented around half of our total revenue in 2009 decreased around 10% in 2009 compared to 2008. This was mainly due to the loss of market share arising from a lost Bluetooth+FM programme.

These effects were partially offset by the increased revenue from GPS shipments in the second half of the year, following the acquisition of SiRF. The GPS derived revenue in the HBU segment represented approximately $52 million out of the total GPS revenue of approximately $130 million following the acquisition of SiRF.

ACBU segment Audio & Consumer segment revenue, which represented 30% of our total revenue in 2010, increased 46% compared to 2009, when it represented 27% of total revenue. In 2010, this includes the impact of a full year of SiRF GPS revenue.

ACBU revenues grew in all their markets. The majority of the growth came from the headset market, where shipment volumes increased and revenues increased significantly as the market oversupply problems experienced in the first half of 2009 did not recur. There was also significant strength in the gaming market where revenues grew as a result of the launch of new products and increased market share for our main end customer in this market. GPS revenues in this segment almost doubled as GPS technology was included in more cameras and fitness applications. Bluetooth revenues increased from the PC market as we won a number of new customers.

Audio & Consumer segment revenue decreased 46% in 2009 compared to 2008. Headset revenue was adversely impacted during 2009 by a decline in the total headset market of around 50%, as a result of the headset supply chain being significantly oversupplied during the first half of 2009, due to the build up of inventory during the second half of 2008 and the global economic downturn. These levels of inventory had largely cleared by the start of the second half of the year, with the result that order levels recovered, better reflecting underlying market demand.

APBU segment Automotive & PND segment revenue, which represented 28% of our total revenue in 2010, increased 75% compared to 2009, when it represented 21% of total revenue. 2010 includes the impact of a full year of SiRF GPS revenue.

First half revenues in this segment grew from $14.1 million in the first half of 2009 to $104.5 million in the first half of 2010, mainly as a result of the inclusion of SiRF GPS revenues.

Bluetooth revenues showed strong growth in both PNDs and automotive applications. Second half revenues in this segment increased by around 5% compared to the second half of 2009, although sales were constrained during the second half of 2010 due to the limited manufacturing capacity of one supplier for some devices.

Automotive & PND segment revenue increased 149% in 2009 compared to 2008, when it represented 7% of total revenue. The increase was due to the SiRF GPS revenue after the acquisition, with Bluetooth revenue performing relatively well and remaining flat against 2008 in a challenging market.

Geographical analysis We operate in four principal geographic areas – the UK, the rest of Europe, the Americas (particularly the USA) and Asia. The table below provides, for the periods indicated, our revenue from external customers by geographical location, on the basis of customers’ manufacturing location:

| | | | | | | | | | | | |

| | | 52 weeks

ended

31 December

2010 $ million | | | 52 weeks

ended

1 January

2010 $ million | | | 53 weeks

ended

2 January

2009 $ million | |

UK | | | 6.6 | | | | 0.3 | | | | 1.0 | |

Rest of Europe | | | 110.2 | | | | 69.2 | | | | 62.8 | |

USA (including the Americas) | | | 92.3 | | | | 62.5 | | | | 45.1 | |

Asia | | | 591.5 | | | | 469.4 | | | | 586.0 | |

| | | | 800.6 | | | | 601.4 | | | | 694.9 | |

Major Customers Sales to our largest customer accounted for approximately 14% of revenue (approximately $115.2 million) in 2010, compared with 11% of revenue (approximately $67.8 million) in 2009 and 19% of revenue ($135.0 million) in 2008. In 2010, only our largest customer exceeded 10% of revenue in the period. In 2009, sales to our second largest customer also contributed nearly 11% of revenue or approximately $63.9 million. In 2008, sales to the second largest customer contributed 11% of revenue (approximately $75.6 million). In 2010, revenue from our top five customers represented 42% of total revenue, as compared to 43% in 2009 and 50% in 2008.

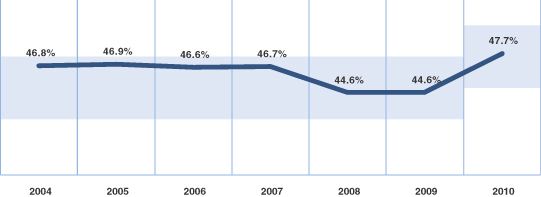

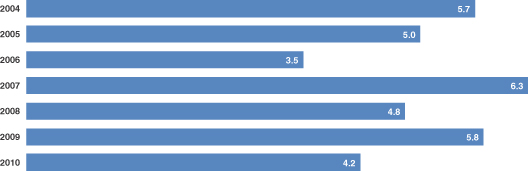

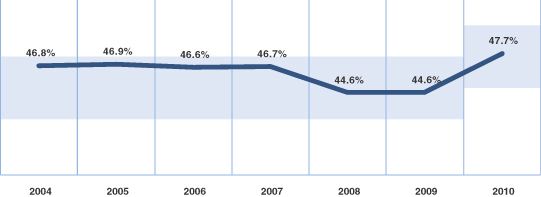

Gross profit Gross profit consists of revenue less cost of sales. In 2010, our gross margin, which is the ratio of gross profit to revenue increased to 47.0% of revenue, from 44.6% in 2009. In absolute terms, gross profit increased from $268.3 million to $376.6 million in 2010, an increase of 40.4%.

12/13

Business and financial review continued

Gross profit is stated after charging $5.6 million of amortisation of intangible assets which were recognised on the acquisition of SiRF in 2009 and related to products in development at that time. During 2010, these products started shipping in volume and the amortisation was therefore charged to cost of sales, whilst in 2009 it was charged to research and development as the products developed from the acquired intangible assets had not yet been launched. Excluding this charge, the underlying gross margin was 47.7%.

The underlying gross margin increased from 44.6% in 2009 to 47.7% in 2010 due to a combination of the fair value adjustment in 2009 which reduced the 2009 gross margin by 1%, the increased proportion of GPS revenues as a result of the inclusion of a full year of GPS revenues, and the mix away from the handset business unit to the other segments which generally have a higher gross margin.

In 2009, our gross margin, the ratio of gross profit to revenue, remained at 44.6% of revenue, the same as in 2008. In absolute terms, gross profit fell to $268.3 million from $309.8 million in 2008, a decrease of 13.4%.

The 2009 gross profit is stated after a $5.8 million charge for fair valued inventory acquired in connection with the acquisition of SiRF; the $5.8 million fair value adjustment had a negative effect of 1% on the gross margin.

The acquisition of SiRF had a significant favourable impact on gross margins and increased the second half gross margin percentage. We estimate that SiRF’s historical gross margins on a comparable basis to CSR were around 47% for 2008 and 54% in 2007, which are above the levels historically achieved by CSR. Our gross margin in the first half of 2009 was 41.2% and this increased to 46.4% in the second half of the year due to a significant improvement in the Bluetooth margins achieved and the acquisition of SiRF as there are generally higher gross margins on GPS products.

Research and development R&D expense consists of total research and development which is further broken down into underlying research and development, share-based payment charges and amortisation of acquired intangible assets. Underlying R&D consists primarily of staff costs, engineering costs and depreciation. The following table sets forth the primary components of R&D expenses during the 2010 and 2009 fiscal years:

| | | | | | | | | | | | | | | | | | | | | | | | |