UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

Amendment No. 2

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2008

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission file number: 01-31937

YANGLIN SOYBEAN, INC.

(Exact name of registrant as specified in its charter)

| Nevada | | 20-4136884 |

| (State or other jurisdiction | | (I.R.S. Employer |

| of incorporation or organization) | | Identification No.) |

NO. 99 FANRONG STREET, JIXIAN COUNTY

SHUANG YA SHAN CITY

HEILONGJIANG PROVINCE

CHINA, 155900

(Address of Principal Executive Offices)

86-469-469300

(Registrant’s Telephone Number, Including Area Code)

VICTORY DIVIDE MINING COMPANY

(Former Name, Former Address And Former Fiscal Year, If Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

| Title of Each Class: | | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.001 | | None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes ¨ No þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ | Accelerated filer o |

Non-accelerated filer ¨ | Smaller Reporting Company þ |

(Do not check if a Smaller Reporting Company) | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act):

Yes ¨ No þ

The aggregate market value of the 1,700,003 shares of voting and non-voting common equity stock held by non-affiliates of the registrant was $9,350,016.5 as of June 30, 2008, the last business day of the registrant’s most recently completed second fiscal quarter, based on the last sale price of the registrant’s common stock on such date of $5.50 per share, as reported by The Over-The-Counter Bulletin Board.

As of April 10, 2009, there are 20,000,003 shares of common stock outstanding.

EXPLANATORY NOTE

This amendment no. 2 to our annual report on Form 10-K initially filed with the Securities and Exchange Commission (“Commission”) on April 13, 2009 is being filed in response to Commission’s comment letter dated May 21, 2009. Together with amendment no. 1 to our annual report on Form 10-K filed with the Commission on May 8, 2009, we (i) added two more risk factors on page 26 regarding Mr. Liu Shulin, our chief executive officer’s conflict of interest and the uncertainties with our contractual control over domestic Yanglin Soybean Group Co. because of the new Merger & Acquisition Rules issued by the Chinese government; (ii) added summary of terms for the RMB 190 million credit line on page 48; (iii) revised note 1 to our financial statements to indicate that on April 3, 2009. we amended the Exclusive Purchase Option Agreement and the Consigned Management Agreement between us and domestic Yanglin Soybean Group Co.; and (iv) also revised note 20 to our financial statements regarding parent-only balance sheets.

YANGLIN SOYBEAN, INC.

(A Nevada Corporation)

TABLE OF CONTENTS

| | | | Page | |

| | PART I | | | |

| Item 1 | Business | | | 3 | |

| Item 1A | Risk Factors | | | 18 | |

| Item 1B | Unresolved Staff Comments | | | | |

| Item 2 | Properties | | | 31 | |

| Item 3 | Legal Proceedings | | | 34 | |

| Item 4 | Submission of Matters to a Vote of Security Holders | | | 34 | |

| | | | | | |

| | PART II | | | | |

| Item 5 | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | | 34 | |

| Item 6 | Selected Financial Data | | | 35 | |

| Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operation | | | 36 | |

| Item 7A | Quantitative and Qualitative Disclosures About Market Risk | | | 54 | |

| Item 8 | Financial Statements and Supplementary Data | | | 55 | |

| Item 9 | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | | | 56 | |

| Item 9A | Controls and Procedures | | | 56 | |

| Item 9B | Other Information | | | 58 | |

| | | | | | |

| | PART III | | | | |

| Item 10 | Directors, Executive Officers and Corporate Governance | | | 58 | |

| Item 11 | Executive Compensation | | | 61 | |

| Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | | 63 | |

| Item 13 | Certain Relationships and Related Transactions, and Director Independence | | | 66 | |

| Item 14 | Principal Accounting Fees and Services | | | 66 | |

| | | | | | |

| | PART IV | | | | |

| Item 15 | Exhibits and Financial Statement Schedules | | | 67 | |

PART I

Item 1. Business

Organizational History

Yanglin Soybean, Inc. (formerly known as Victory Divide Mining Company, the “Company”) was incorporated in the state of Nevada on May 26, 1921. Our original Articles of Incorporation were oriented toward mining operations. Our Common Stock traded on the San Francisco Mining Exchange and on the OTCBB. We operated a number of mining properties and in 1980, we became inactive and trading in our Common Stock ceased. We have had no operations, assets or liabilities since 1980 and accordingly, were deemed to be a "blank check" or shell company, that is, a development stage company that has no specific business plan or purpose or has indicated that its business plan is to engage in a merger or other acquisition with an unidentified company or companies, or other entity or person. Our Articles of Incorporation were restated and amended on June 29, 2006 to reflect our objective of finding a merger partner.

On October 3, 2007, the Company executed a reverse-merger with Faith Winner Investments Limited (“Faith Winner (BVI)”) by an exchange of shares whereby the Company issued 18,500,000 common shares at $0.001 par value in exchange for all Faith Winner (BVI) shares.

Faith Winner (BVI) formed Faith Winner (Jixian) Agriculture Development Company (“Faith Winner (Jixian)” or “WFOE”), which entered into a series of agreements with Heilongjiang Yanglin Soybean Group Co., Ltd. (“Yanglin”). As a result of entering the agreements, WFOE gained control of all of Yanglin’s assets, management and business as if Yanglin were a wholly-owned subsidiary of WFOE. However, the shareholders of Yanglin, Mr. Shulin Liu with his wife, Mrs. Huanqin Ding, also have effective control over Faith Winner (BVI) and WFOE as our subsidiaries, because they beneficially own approximately 91% of our common stock through their 100% holding in Winner State (BVI) and thus have a controlling interest in us. These contractual arrangements included a loan agreement, a consigned management agreement, two consignment agreements of equity interests, an exclusive purchase option agreement, a registered trademark transfer contract and a trademark licensing agreement. The Consignment Agreement was entered into on September 1, 2007, and the other agreements were all signed on September 24, 2007. The exclusive purchase option agreement and the consigned management agreement were amended as of April 3, 2009.

Pursuant to those agreements, Faith Winner made a loan of $17 million and intended to satisfy Yanglin’s working capital needs in the future (the “Loan”). In return, the Company obtained the management control of Yanglin and an exclusive right to acquire all of the equity of Yanglin. The rights of existing shareholders of Yanglin are assigned by the consignment of equity interests to Faith Winner (BVI). The exclusive purchase agreement and the loan agreement restrict both Yanglin and its shareholders from significant decisions including but not limited to any amendments of articles of assocaiton or rules of the Company, any change in registered capital, any transfer, mortgage or disposal of Yanglin’s assets or income in a way that would affect WFOE’s security interest, entering any material contract (exceeding RMB5 million in value) and distributing any dividends to the shareholders. Pursuant to the consigned management agreement between WFOE and Yanglin, Yanglin agreed to entrust the business operations of Yanglin and its management to WFOE until WFOE formally acquires all equity or substantially all the assets of Yanglin. Under the consigned management agreement as amended on April 3, 2009, WFOE will provide financial, technical and human resources management services to Yanglin which will enable WFOE to control Yanglin's operations, assets and cash flows. In turn, it will be entitled to 5% of Yanglin’s revenue on a yearly basis.

Under the Registered Trademark Transfer Agreement, Yanglin agreed to transfer to WFOE all of its rights in connection with the two trademarks, including without limitation the title of the trademarks and right to license ( the “Transferred Trademark”) for a purchase price of $1,000,000, which is subject to a purchase price adjustment based on the minimum appraised value on intellectual property (“IP”) rights allowed under PRC laws and regulations for such transfer. Under the Trademark Licensing Agreement, WFOE agreed to grant an exclusive license to Yanglin, for a term of 10 years, to use the Transferred Trademark for an annual licensing fee equal to 1% of Yanglin’s revenue of that year. The license fee and the management fee aforesaid – total of 6% of the revenue of Yanglin- entitled to WFOE are designed to approximate Yanglin’s annual net profit before tax. Any excess profit in Yanglin will not be distributed as dividend according to the contractual arrangements until WFOE exercises the Exclusive Purchase Option Agreement to acquire all shareholders’ equity interest of Yanglin. If the 6% of licence and management fees exceed the net profit before tax of Yanglin, the amount the WFOE is entitled to receive is limited to the actual annual net profit before tax of Yanglin under the contracts.

According to the exclusive purchase option agreement, the WFOE has the exclusive purchase option to purchase all or part of Yanglin’s shareholders’ equity interest in Yanglin when and as permitted under PRC laws and regulations and any other party has no right to purchase any equity from the shareholders of Yanglin. The agreement provides that, unless otherwise required under PRC laws and regulations, the consideration for the equity transfer or the asset transfer under the agreement will be $17 million or such greater amount as required by the then applicable Chinese law and regulations (the “Option Price”). Under the loan agreement and the exclusive purchase option agreement, the money received as the Option Price by the shareholders of Yanglin upon execution of the option shall be contributed to Yanglin and used to satisfy the repayment of the Loan, that is, any amount of money received by Yanglin’s shareholders shall be paid back to WFOE as the repayment of Loan on behalf of Yanglin. Therefore, the actual consideration of acquisition of the direct investment in Yanglin is exactly the amount of the Loan. Under such contractual arrangements, all of assets and equity including any residual profits of Yanglin are totally controlled by WFOE and will be formally captured upon exercise of the exclusive purchase option.

The loan of $17 million to Yanglin is considered as an investment in Yanglin by the Company through a series of contractual arrangements by way of the Loan. As a result of entering into the abovementioned agreements, WFOE is deemed to control Yanglin as a Variable Interest Entity as required by FASB Interpretation No. 46 (revised December 2003) Consolidation of Variable Interest Entities, and Interpretation of ARB No. 51. The reverse-merger also included an equity financing of $21,500,000 by the issuance of 10,000,000 Series A Convertible Preferred Stock at $2.15 per share to 10 accredited investors.

The Company, through its subsidiaries and Yanglin, (hereinafter, collectively referred to as “the Group”), is now in the business of manufacturing, distribution, and selling of non-genetically modified soybean products, including soybean oil, soybean salad oil, and soybean meal, throughout the Province of Heilongjiang and other parts of China.

The contractual agreements were utilized instead of a direct acquisition of Yanglin’s assets because current PRC law which took effect on September 8, 2006 does not specifically establish the approval procedures and detailed implementation regulations for a non-PRC entity’s equity to be used as consideration to acquire a PRC entity's equity or assets. This makes it highly uncertain, if not impossible, for a non-PRC entity to use its equity to acquire a PRC entity. If acquisition of a PRC entity using foreign equity were possible, we could have acquired 100% of the stock of Yanglin by paying the price of $17 million with any excess treated as interests pursuant to amendment to exclusive purchase option agreement dated April 3, 2009. While PRC law does allow for the purchase of equity interests in (or assets of) a PRC entity by a non-PRC entity for cash, the purchase price must be based on the appraised value of such equity (or assets). Because we presently do not have sufficient cash to pay the estimated full value of all of the assets of Yanglin, we, through WFOE, purchased the maximum amount of assets possible with the net proceeds of the private placement on October 7, 2007, and leased from Yanglin the remainder of the assets used in Yanglin’s business.

On January 18, 2008, the Company changed its name from “Victory Divide Mining Company” to Yanglin Soybean, Inc.”

Our Industry

We are a leading non-genetically modified (non-GM) soybean processor in the PRC. We currently manufacture soybean oil in bulk and soybean meal, which are sold throughout China to our customers directly or through distributors. Most of our customer (approximately 80%) are located in Northern China.

Our manufacturing process includes sifting, crushing, heating and pressing soybeans, extracting and separating oil from crushed soybeans, and cleansing, hydrating and packaging oil as well as drying and packaging soybean meal. Currently, our main products include soybean oil, salad oil and soybean meal. We plan to broaden our product line to include high end products such as squeezed oil, powdered oil, protein concentrates, textured protein, and defatted soybean powder, while greatly enlarging the production capacity of salad oil. We have installed the equipment for manufacturing squeezed oil and expanded the production line for salad oil and have started production of these products at the end of 2007. The production facilities for powdered soy oil have been built and are now in trial production and the “debugging” phase. The pilot production of protein concentrates began in late 2008, with small quantities of commercial grade product provided to customers. Defatted soy powder will be launched in 2009, and the production line of textured protein will also be put into operation in 2009.

The Soybean Processing Industry

Soybean processing is a traditional industry. Typically, soybeans are ground and refined into soybean oil and protein meal, which in turn are processed into refined oils, animal feed, proteins and more value-added products such as foods, pharmaceuticals and cosmetics.

(i) Soybean Oil and Soybean Salad Oil

Soybean oil is obtained by the extraction of oil from soybean seeds. Soybean oil contains various vitamins, minerals and unsaturated fatty acids which are essential to the well-being of the human body. It is an important ingredient in products such as salad dressings, margarine, paint and medicines. The price, adaptability and performance of soybean oil make it appropriate for a broad range of food, chemical and medical manufacturing applications. Soybean oil refers to Grade IV oil, as compared to the more refined salad oil. Both oils are for human consumption.

(ii) Soybean Meal

Soybean meal is manufactured by grinding soybean flakes which remain after removal of most of the oil from soybeans by a solvent or mechanical extraction process. Soybean meal is an important raw material used in the animal feed and farming industry due to its high protein content, low fat composition and edible characteristics. Given the PRC’s closer proximity to customers in the Asia, there is a growing demand for PRC produced soybean meal from countries such as Korea and Japan. This in turn has led to an increase in demand for our soybean meal products.

Growth in the Soybean Industry

Apart from being a food commodity, soybean oil is also used in the cosmetics, pharmaceutical and medical industries. As soybean oil consumption in the PRC has been rapidly increasing, the PRC has imported soybean oil from other countries, such as Argentina, Brazil and the USA.

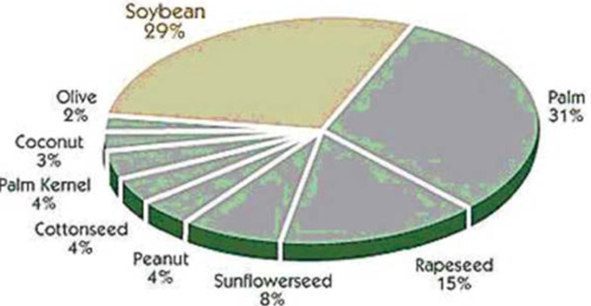

World Vegetable Oil Consumption 2006

| | | Million Short Tons | | | Million Metric Tons | |

| Palm | | | 42.0 | | | | 38.1 | |

| Soybeans | | | 39.3 | | | | 35.7 | |

| Rapeseed | | | 19.7 | | | | 17.8 | |

| Sunflower seed | | | 11.3 | | | | 10.2 | |

| Peanut | | | 5.4 | | | | 4.9 | |

| Cottonseed | | | 5.2 | | | | 4.8 | |

| Palm Kernel | | | 4.8 | | | | 4.3 | |

| Coconut | | | 3.6 | | | | 3.3 | |

| Olive | | | 3.2 | | | | 2.9 | |

| Total | | | 134.5 | | | | 122.0 | |

Source: USDA

World Protein Meal Consumption 2006

| | | Million Short Tons | | | Million Metric Tons | |

| Soybeans | | | 166.7 | | | | 151.3 | |

| Rapeseed | | | 30.2 | | | | 27.4 | |

| Cottonseed | | | 16.4 | | | | 14.9 | |

| Sunflower seed | | | 12.7 | | | | 11.5 | |

| Peanut | | | 6.3 | | | | 5.7 | |

| Fish | | | 6.0 | | | | 5.5 | |

| Palm Kernel | | | 6.1 | | | | 5.5 | |

| Copra | | | 1.9 | | | | 1.7 | |

| Total | | | 246.3 | | | | 223.4 | |

Source: USDA

In the past few years, the soybean industry has seen a period of sustained growth. We believe that the soybean industry in the PRC has significant potential for further growth and we, through Yanglin, are well positioned to take advantage of such growth. Soybeans are grown for their oil and protein and are used to manufacture various products including soybean oil and soybean meal. According to the Food and Agriculture Organization of the United Nations, during the year of 2005/06, global consumption of oils and fats has been steadily increasing, rising at an average rate of approximately 3-4%.

Non-Genetically Modified Soybean Products

Genetically modified soybean plants are widespread in the world’s leading soybean producing countries (such as Brazil, Argentina and the United States) and genetically modified soybeans comprise a very large proportion of the world’s soybean production. Conversely, most of the soybean food products exported from the PRC is primarily made from non-genetically modified soybeans that are cultivated and grown in the PRC.

We believe that a growing number of consumers prefer their food products to be made from non-genetically modified raw materials, including soybean based products. Such non-genetically modified soybean products are perceived to be “green” and hence more desirable to certain classes of consumers than genetically modified soybean products, especially with respect to soy protein and other value-added soybean products. Furthermore, we believe that as a result of the increasing affluence and sophistication of the consumers in the PRC, European Union, Korea and Japan, they have also become more aware of potential health issues arising from the consumption of genetically modified soybean products and are willing to pay a premium for non-genetically modified soybean products.

As a producer of non-genetically modified soybean products, we believe we are well positioned to take advantage of such growth.

Government Support for the Soybean Industry

In addition, there has been strong government support for the development of our industry. In recent years, the PRC government has sought to differentiate soybean exports from the PRC from those from other international exporters of soybeans such as the United States and Argentina. Specifically, the PRC government has take measures to promote industries and enterprises, such as our business operations, that produce non-genetically modified soybean food products. In 2003, the PRC Ministry of Agriculture announced a plan to develop the PRC’s northeastern region (including the Heilongjiang province where we are located) into the world’s largest non-genetically modified soybean production centre for export within five years.

In addition, the Heilongjiang provincial government has introduced a number of measures to develop its organic farming industry such as improving its local agriculture infrastructure and promoting the development of large industrial groups that produce green and organic food products. Over the past five years, Heilongjiang's green food industry has grown significantly and has become an important growth sector in Heilongjiang’s burgeoning economy. Further, we believe that the proportion of “deep-processed” soybean food products produced by the PRC will increase and is expected to grow significantly, particularly with the completion of the PRC’s largest non-genetically modified soybean deep-processing base in by 2010.

We believe that these various government initiatives at the national and local levels will have a positive impact on the further development of our business operations.

Our Competitive Advantages

We believe that we have several competitive advantages:

| · | Our products have favorable brand-name recognition due to their superior quality and our proven track record in the industry; |

| · | We are strategically located to access cheaper and more stable soybean supplies. Jixian County, where the company is headquartered, is in heart of the Three Rivers Plains, a major soybean production area, and Yanglin has established long-term relationships with the local farmers and suppliers; |

| · | We have an extensive sales network covering most areas of China and have negotiated better arrangements with distributors to save costs and to promote higher efficiency; |

| · | Our business is better managed and our operations are more efficient compared to many larger state-owned soybean processors. Our costs are lower, margins are higher and we are in better financial conditions; |

| · | We believe that we do not face direct competition from international conglomerates such as Archer Daniels Midlands and Cargill as they produce predominantly genetically modified soybean products whereas Yanglin produce non-genetically modified soybean products which appeal to more health-conscious customers; |

| · | Both our management and workers are skilled and experienced in the soybean industry. Many of them have worked in the industry for more than 20 years. |

Our Strategy

Increase Our Sources of Supply

Due to the increasing market demand, we expect our business to grow significantly in the next few years. We believe that our need for soybean supply will only increase. In order to increase our raw material supplies, we intend to expand the soybean cultivation area supplying us through the development of further supply arrangements with other private and state-owned farms within the Heilongjiang province. Currently, we have access to soybeans produced in approximately 164,745 acres of farmland and we plan to increase our access in the next few years in other locations by signing up more soybean farmers and through other arrangements.

Expand Capacity by Building New Plants or through Acquisitions

To meet the demand for soybean products, we plan to increase our capacity. We intend to expand our production facilities by acquiring some additional factories. We expect that these acquisitions will allow us to increase our current annual soybean processing capacity to over 1 million tons of soybeans or even higher over the next few years.

Expansion of our Sales Network

We currently sell more volume of products in northern China than any other parts of China and currently do not have many sales offices in the South. We plan to expand our sales and marketing network by establishing more sales offices within the PRC. In addition, we are negotiating with potential agents in Southeast Asia and Russia. Our plan is to expand internationally into countries such as Singapore, Malaysia, Canada and the United States. We intend to use Chinese export agents to manage currency risks.

Expansion of our Product Line

We believe that value added soybean products will yield higher profit margins for our operations. We intend to expand our product lines to include the following high-end soybean products:

(i) Powdered Soybean Oil

Powdered soybean oil is manufactured by processing soybean oil and soybean salad oil together with corn syrup and other raw materials. Powdered soybean oil not only retains the nutritional value of liquid soybean oil, but also has a long shelf life and can be easily packaged and transported. In addition, powdered soybean oil can be used as a cheap substitute for milk or powdered milk because it can be easily dissolved or mixed with other ingredients in water to produce a mixture that has a strong fragrance similar to that of milk, as well as containing beneficial proteins and minerals.

(ii) Textured Protein

Textured protein products are manufactured from soy protein. Textured protein products are hydrated in the production process and accordingly have a symmetrical, consistent and smooth texture and specific structure. Textured protein can be added to food products to impart a taste that is similar to that of meat. Therefore, textured protein can be used as a food substitute for beef and pork. In addition, textured protein contains anti-oxygenation ingredients that could prolong the shelf-life of certain food products.

(iii) Defatted Soybean Powder

Defatted soybean powder is manufactured from specially-extracted soy meal and has a high protein content (higher than 50 percent). Defatted soybean powder can be added to fish, noodles, meat, dairy products and candy to improve the quality and taste of food. Further, defatted soybean powder can prolong shelf life and reduce cost.

(iv) Squeezed Oil

Squeezed oil is made by extracting crude soybean oil from selected soybeans through traditional methods of refining and hydration in order to remove the acids in the oil. Squeezed oil is readily absorbed by the human body and contains no cholesterol. It possesses vitamins such as A, D, and E, as well as other nutrients which have been shown to help growth, improve immunity and prevent hypertension and arteriosclerosis.

(v) Concentrated Soy Protein

Concentrated soy protein has a high protein content of up to 98% and contains no cholesterol. Concentrated soy protein can be used as an ingredient in food products to improve their texture and nutritional value. Concentrated soy protein is used as an ingredient in a wide range of food products, including nutritional supplements, seafood, processed meats, frozen food, nutritional beverages, cream soups, sauces and snacks.

Our Current Products

Our current products include the following:

| Product | | Use | | Major Customers | | 2008 Volume (tons) | |

| Soybean Oil | | Cooking | | Hou Xinglin, Yingkou Bohai Oil Industries Co. Ltd. | | | 52,842 | |

| Salad Oil | | Cooking | | Yingkou Bohai Oil Industries Co. Ltd., Gu Changchun | | | 17,708 | |

| Soybean Meal | | Animal Feed | | Jilin Zhuoyue Animal Feed Factory | | | 337,660 | |

We sell our products under the “Yanglin” brand name to various geographic regions of the PRC through our various distribution channels (see “Sales and Marketing” below) and directly to our customers primarily within the PRC market. In the fiscal year ending 2008, we processed approximately 420,000 tons of soybeans and generated total revenues amounting to approximately $250.7 million with net income amounting to $14.4 million. Within the 2008 production volume of our main products, namely soybean meal, soybean oil and salad oil, soybean meal occupied a major share of about 83%, while soybean oil and salad oil combined made up of approximately 17% of our production volume.

Our Suppliers of Soybeans

Maintaining a stable supply of raw materials (soybeans) is one of the key components for our success. We purchase all of our soybean supplies from various farms in the Heilongjiang province. We have established and maintained good relationships with these farms.

The following is a list of our top ten major suppliers of soybeans for the financial year ended December 31, 2008:

| Supplier | | Amount Purchased (in US$) | | | % of Total Purchases (%) | |

| Cui Binyan | | | 9,054,611 | | | | 4.4 | % |

| Duan Xufeng | | | 8,694,515 | | | | 4.2 | % |

| Tang Lijun | | | 8,398,688 | | | | 4.1 | % |

| Jiang Minghui | | | 8,093,791 | | | | 3.9 | % |

| Wang Li | | | 7,664,558 | | | | 3.7 | % |

| Baoqing North Granary | | | 7,605,785 | | | | 3.7 | % |

| Bian Chaofeng | | | 7,564,136 | | | | 3.7 | % |

| Guo Hongjun | | | 7,286,556 | | | | 3.5 | % |

| Chi Cui’e | | | 7,128,677 | | | | 3.4 | % |

| Lin Baosen | | | 7,122,672 | | | | 3.4 | % |

Note: the amounts are converted from RMB value using the yearly average rate of 2008, 1USD = 6.9623RMB.

Our top ten suppliers together made up an aggregate of 38% of our total supply of soybeans, but our biggest supplier only supplied about 4.4% of our total supply. We believe this diversification of supply is beneficial to us as it increases our bargaining power and prevents us from being over-reliant on any single supplier.

We have implemented unique arrangements with soybean suppliers. Through our affiliate company, Heilongjiang Yanglin Group Seed Co. Ltd., we supply these farmers with “Yanglin” soybean seeds which provide higher oil yield. Pursuant to annual supply contracts, the farmers sell the harvested soybeans back to us. We extend favorable commercial terms to these farmers, such as low price and credit payment terms, for them to purchase “Yanglin” soybean seeds, and offer favorable price, which is higher than average market price, and cash-upon-delivery payment terms to the farmers for our purchases of the harvested soybeans grown from “Yanglin” soybean seeds. These arrangements ensure that we maintain good relations with our suppliers, enjoy a stable supply of soybeans that meet our high quality standards at competitive rates, and allow us to maintain a low rate of expenditure on raw materials.

To further ensure a consistent supply of soybeans and to increase its volume, we intend to enter into similar supply agreements with other soybean farmers in the PRC.

The Supplier of “Yanglin” Soybean Seeds

Heilongjiang Yanglin Group Seed Co, Ltd. is owned and managed by Mr. Shulin Liu, our chief executive officer.

Heilongjiang Yanglin Group Seed Co., Ltd has developed several strains of non-genetically modified soybean seeds (collectively, “Yanglin” seeds”). The Yanglin “East Nong 42” and the “Black Nong 44” boast high protein and fat content. It has also developed the high oil content “Yang 02-01”, “Yang 03-02” and “Yang 03-03” soybean seeds, the high protein content “Yang 03-656” soybean seeds and the high protein and high yielding “Yang 03-149” soybean seeds.

A brief summary of the characteristics of each strain of soybean seed is set forth below:

| Soybean | | Oil Content | | Protein Content | | Status of Development |

| “East Nong 42” | | 19.33% | | 45% - 46.4% | | Completed |

| “Black Nong 44” | | 21.56% -22.61% | | 38.56% -46.69% | | Completed |

| “Yang 02-01” (high oil) | | 22.3%-22.6% | | 37.8%-40.2% | | Received governmental approval |

| “Yang 03-02” (high oil) | | 21.9%-22.7% | | 37.2%-41.5% | | In trial phase |

| ��Yang 03-03” (high protein) | | 21.7%-22.1% | | 38.4%-45.9% | | In trial phase |

| “Yang 03-656” (high protein) | | 19.8%-20.6% | | 39.7%-45.3% | | In trial phase |

| “Yang 03-149” (high protein) | | 20.3%-21.9% | | 41.5%-44.7% | | In trail phase |

Major Customers

Our customers are primarily distributors of soybean oil and soybean meal, with some of them being soybean food processors and animal feed manufacturers. The following is a list of our top ten major customers for fiscal year 2008. All of our major customers are located in the PRC.

| Customers | | Type of Product | | Fiscal 2007 Sales (USD) | | | % of Total Sales (%) | |

| Yingkou Bohai Grease Industrial Co. Ltd. | | Soybean Oil | | | 24,078,664 | | | | 9.6 | % |

| Gu Changchun | | Soybean Meal | | | 8,461,130 | | | | 3.4 | % |

| Hou Xinglin | | Soybean Meal | | | 7,175,525 | | | | 2.9 | % |

| Zhao San | | Soybean Meal | | | 6,914,165 | | | | 2.8 | % |

| Huang Zujian | | Soybean Meal | | | 6,912,752 | | | | 2.8 | % |

| Li Zhengqian | | Soybean Meal | | | 6,697,392 | | | | 2.7 | % |

| Lin Xiwu | | Soybean Meal | | | 6,420,336 | | | | 2.6 | % |

| Wang Chunyu | | Soybean Meal | | | 6,405,120 | | | | 2.6 | % |

| Wang Xihe | | Soybean Meal | | | 5,905,945 | | | | 2.4 | % |

| Jilin Zhuoyue Animal Feed Factory | | Soybean Meal | | | 5,832,863 | | | | 2.3 | % |

Note: the amounts are converted from RMB value using the yearly average rate of 2008, 1USD = 6.9623 RMB

Our sales are widely diversified among our customers. Our largest customer accounts for only 9.6% of our total sales in fiscal 2008 while our top ten customers accounted for about 33.8% of our net sales in fiscal 2008. As such, we are not dependent on any single customer and have accordingly maintained our bargaining position in relation to our customers. Holding such a diversified customer base, we have mitigated the commercial risk and associated impact of the loss of sales from any single customer. As we begin to expand our product offering to include “high end” soybean products, our customer base will accordingly change to include more industrial users and some retail consumers.

Sales of Products by Type and Locations

The following table shows the breakdown of sales volume by customer type for fiscal year 2008.

| | | Salad Oil | | | Soy Oil | | | Soy Meal | |

Type | | Volume (Tonnes) | | | Number of customers | | | % | | | Volume (Tonnes) | | | Number of customers | | | % | | | Volume (Tonnes) | | | Number of customers | | | % | |

| Distributor | | | 17,708 | | | | 64 | | | | 100 | | | | 52,842 | | | | 93 | | | | 100 | | | | 337,660 | | | | 64 | | | | 100 | |

| Food Manufacturer | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Animal Feed Manufacturer | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Others | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total | | | 17,708 | | | | 64 | | | | 100 | | | | 52,842 | | | | 93 | | | | 100 | | | | 337,660 | | | | 64 | | | | 100 | |

All our sales are primarily made to customers within the PRC, although some of our products may be exported by some of the distributors to countries such as Japan, Korea, Russia and India. The geographical distribution of our sales in the PRC for fiscal 2008 is shown below.

| | | Sales Revenue (Salad Oil) | | | Sales Revenue (Soybean Oil) | | | Sales Revenue (Soybean Meal) | |

| Province | | Volume (Tonnes) | | | Value (USD) | | | Volume (Tonnes) | | | Value (USD) | | | Volume (Tonnes) | | | Value (USD) | |

| Heilongjiang | | | 6,590 | | | | 9,612,783 | | | | 21,384 | | | | 28,479,808 | | | | 149,200 | | | | 68,285,578 | |

| Jilin | | | 1,589 | | | | 2,317,456 | | | | 6,263 | | | | 8,340,771 | | | | 56,611 | | | | 25,905,799 | |

| Liaoning | | | 5,808 | | | | 8,470,600 | | | | 13,236 | | | | 17,627,088 | | | | 29,570 | | | | 13,531,548 | |

| Inner Mongolia | | | 862 | | | | 1,257,172 | | | | 3,108 | | | | 4,139,090 | | | | 15,278 | | | | 6,991,376 | |

| Shanghai | | | | | | | - | | | | 1,155 | | | | 1,538,175 | | | | 1,631 | | | | 746,363 | |

| Jiangsu | | | 331 | | | | 482,743 | | | | 814 | | | | 1,084,047 | | | | 1,939 | | | | 887,307 | |

| Shanxi | | | 268 | | | | 390,861 | | | | 1,804 | | | | 2,402,483 | | | | 19,798 | | | | 9,059,776 | |

| Henan | | | | | | | - | | | | 303 | | | | 403,521 | | | | 9,719 | | | | 4,447,518 | |

| Sha’anxi | | | | | | | - | | | | 363 | | | | 483,426 | | | | 7,117 | | | | 3,256,815 | |

| Zhejiang | | | 518 | | | | 755,470 | | | | 1,248 | | | | 1,662,028 | | | | 10,445 | | | | 4,779,744 | |

| Guangxi | | | 270 | | | | 393,778 | | | | 1,210 | | | | 1,611,422 | | | | 5,995 | | | | 2,743,376 | |

| Sichuan | | | 466 | | | | 679,631 | | | | 1,029 | | | | 1,370,374 | | | | 16,369 | | | | 7,490,629 | |

| Hebei | | | 1,006 | | | | 1,467,187 | | | | 925 | | | | 1,231,872 | | | | 13,988 | | | | 6,401,058 | |

Note: the amounts are converted from RMB value using the yearly average rate of 2008, 1USD = 6.9623RMB.

Our Competitors

Our competitors are the non-genetically modified soybean processors operating in the PRC. Our main competitor is Heilongjiang 93 Oil and Fat Co., Ltd., an integrated state-owned enterprise which is located in Heilongjiang, Dalian and Tianjin. The rest of our competitors are smaller state-owned enterprises.

| Position | | Company | | Estimated Annual Non- GM Production Capacity (in Tonnes) | | | Estimated Market Share | |

| 1 | | Heilongjiang Jiushan 93 Group (SOE) | | | 600,000 | | | | 6.7 | % |

| 2 | | Yanglin Soybean Group, Ltd | | | 520,000 | | | | 5.0 | % |

| 3 | | Shandong Gaotang Lanshan Group (SOE) | | | 200,000 | | | | 2.2 | % |

| 4 | | Henan Xuchang Vegetable Oil Company (SOE) | | | 100,000 | | | | 1.1 | % |

| 5 | | Qitaihe City Nature Oil Company | | | 100,000 | | | | 1.1 | % |

| 6 | | Shandong Guanxian Vegetable Oil Company | | | 100,000 | | | | 1.1 | % |

| 7 | | Jiamusi Zhenda Company | | | 90,000 | | | | 1.0 | % |

Source: Information from respective companies' websites and Yanglin estimates

Generally, we do not compete with companies that are engaged primarily in the manufacturing of genetically modified soybean products, especially international agriculture conglomerates. Currently, most major producers of genetically modified soybean products are state-owned enterprises and joint ventures of global agriculture companies. Their operations are mostly located in the coastal cities in Southern China, which enables them to conveniently import genetically modified soybean from the U.S., Brazil, Argentina and other countries in bulk volume at acceptable prices. The market for their products is also mainly in the southern parts of China. Meanwhile our supply sources, production facilities and customers are mostly in Northern China, where there is abundant supply of non-genetically modified soybean. There is a geographical division between the market for genetically modified soybean products and that for non-genetically modified soybean products. Thus, we generally do not have direct competition with our genetically modified counterparts.

Sales and Marketing

Apart from our high product quality, our marketing efforts have also contributed to our success in the PRC markets. Presently, our main method of selling our products is direct marketing, supplemented with indirect marketing. Given that we are located in the Heilongjiang province, we are in close proximity to our suppliers and customers and, thus, are able to communicate with them directly (as opposed to going through the Dalian Commodities Exchange).

We have sales offices in more than 5 cities in the PRC with approximately 40 independent distributors spread over approximately 27 provinces. These provinces include locations in the northeastern, northwestern and southern regions of the PRC. Furthermore, we have a dedicated in-house sales team with 10 salespersons. Their duties include monitoring the soybean industry, collecting market and price information, developing and managing distributors, providing recommendations for our marketing and sales strategy and pricing policies, filling sales orders and after-sale services.

The following map illustrates the geographical coverage of our sales and distribution network within the PRC:

In addition to our direct marketing efforts in the PRC, and as part of our international expansion plans, we plan to appoint sales agents in North America, Europe, Russia, Japan, Korea and other countries in southeast Asia in the near future.

Advertising

We advertise our products through various forms of media, including billboards alongside highways. We are now building our own business website at the domain name www.yanglin.com.cn.

In addition, our marketing team develops and maintains a unified and distinctive image throughout all of our corporate publicity materials, including our corporate billboard advertisements, media publicity and corporate branding.

Publicity

We hold an annual conference with distributors and potential customers to promote our products. We regularly attend exhibitions in different regions to market our products.We plan to maintain and strengthen our existing customer relations through symposiums, guided tours of the company and direct correspondences that provide further information of our product offering. We will also strengthen communications with the relevant government departments in order to keep abreast of new policies and guidelines. This will enable us to adapt quickly to any changes, better seize business opportunities and develop new markets.

Delivery of Products

Approximately 70% of our products are transported to our customers by railways, thanks to our easy access to the PRC railroad network (see “Our Competitive Advantages”). The costs of transportation are borne by our customers and are pre-paid in advance ahead of delivery of the products. The remainder of our products is collected from our facilities by our customers.

Pricing and Terms

Prices of our products are determined based on the daily spot market price, which is determined by the average of ex-works prices of local producers and the quotation on commodities exchanges. We distinguish between long-term customers and short-term customers and provide rebate policies accordingly. Our short-term customers (typically customers we have been dealing with for less than a year) are required to pay us the full retail price in cash in advance of delivery of their ordered products. For our long-term customers, we may offer credit terms as well as certain preferential terms to them depending on the size of their orders. Since we are paid with cash in advance most of the time, there are almost no accounts receivables.

The current prices for our products, as of December 31, 2008 are: (excluding VAT)

| Products | | Price (USD/metric ton) | |

| Soybean oil (Grade IV) | | $ | 930 | |

| Salad oil | | $ | 981 | |

| Soybean meal | | $ | 385 | |

Based on 2008 year end exchange rate of 1US$ = 6.8542RMB

For the past three years, the price of soybean meal has been in the range of $232 per metric ton to $600 per metric ton (converted at the above mentioned foreign exchange rate 1US$ = 6.8542RMB; the same rate is used hereinafter). By comparison, the price range of soybean oil has been in the range of $633 per metric ton to $2247 per metric ton, while the price range of salad oil was from $704 per metric ton to $2324 per metric ton. The prices of our products are determined by taking into account the costs of labor as well as the seasonality of demand in the soybean market. Traditionally, the prices of our raw materials are lowest during the soybean harvest period between October and December. Our prices then peak from January to February because of the New Year and Spring Festival.

Intellectual Property

Yanglin has registered the following trademarks in the PRC, which are currently used for all of our products:

| Trademark | | Country of Registration | | Class | | Registration Number | | Date of Registration | | Validity Period |

| “Yanglin”logo | | PRC | | 29 | | | 1587278 | | June 14, 2001 | | From June 14, 2001 to June 13, 2011 |

| “Yanglin”logo | | PRC | | 31 | | | 1586742 | | June 14, 2001 | | From June 14, 2001 to June 13, 2011 |

Class 29 is for meat, fish, poultry and game; meat extracts, preserved, dried and cooked fruits and vegetables; jellies, jams, fruit sauces; eggs, milk and milk products; edible oils and fats. Class 31 is for agricultural, horticultural and forestry products and grains not included in other classes; live animals, fresh fruits and vegetables; seeds, natural plants and flowers; foodstuffs for animals, malt.

Employees

Currently we have 472 employees, most of whom are involved in production and operations.

The functional breakdown of our full-time employees as at December 31, 2007 and 2008 was:

| | | FY2007 | | | FY2008 | |

| Production and operations | | | 291 | | | | 291 | |

| Sales | | | 10 | | | | 10 | |

| Management | | | 165 | | | | 171 | |

| Total number of employees | | | 466 | | | | 472 | |

Along with staff incentive policies, we provide social security to every employee who signs a long term contract with us, and we have paid all social security fees as required by laws and regulations.

We have a system of periodic performance reviews that are conducted annually.

Insurance

We have the following insurance policies:

| Description of Policy | | Term | | Coverage ($) | | | Premium ($) | | Insured |

| China Pingan Property | | July 9, | | | 4,623,476 | | | | 6,372 | | The assets of Plant 3 |

| Insurance Co. Ltd., | | 2008 to | | | | | | | | | |

| 21900004601010800092 | | July 9, | | | | | | | | | |

| | | 2009 | | | | | | | | | |

| China Pingan Property | | July 9, | | | 350,150 | | | | 2,068 | | The assets of Plant 3 |

| Insurance Co. Ltd., | | 2008 to | | | | | | | | | |

| 21900005801100800002 | | July 9, | | | | | | | | | |

| | | 2009 | | | | | | | | | |

Note: the amounts in the column Coverage are converted from RMB value using the year end rate of 2008, 1USD = 6.8542 RMB, and those in the column Premium are converted from RMB value using the yearly average rate of 2008, 1USD = 6.9623 RMB.

Government Regulations

We are subject to various government regulations, such as Food Sanitation Law, Environment Protection Law and Fire Prevention Law, and to national standards for food issued by the national Food and Drug Administration. We have obtained the Sanitation Admission certificate from the local Sanitation Bureau as well as the industrial production permit, and our facilities are regularly inspected by local authorities.

In addition, we have been issued an ISO 9001-2000 Certificate by the Beijing Zhongjing Kehuan Quality Authorization Co. Ltd and a Certificate of Class A Green Food by the China Center of Development of Green Food.

Environmental Compliance

We are subject to the PRC environmental laws, rules and regulations governing our type of manufacturing facility. We have complied with the prescribed standard of environmental protection as evidenced by a certificate issued by the Jixian Environment Protection Bureau dated February, 2007.

The treatment of our waste water is subject to the PRC Environment Protection Law. Our process of treating waste water meets the strict requirement of this law.

Item 1A. Risk Factors

Cautionary Statement Regarding Future Results, Forward-Looking Information And Certain Important Factors

In this report we make, and from time to time we otherwise make, written and oral statements regarding our business and prospects, such as projections of future performance, statements of management’s plans and objectives, forecasts of market trends, and other matters that are forward-looking statements .. Statements containing the words or phrases “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimates,” “projects,” “believes,” “expects,” “anticipates,” “intends,” “target,” “goal,” “plans,” “objective,” “should” or similar expressions identify forward-looking statements, which may appear in documents, reports, filings with the Securities and Exchange Commission, news releases, written or oral presentations made by officers or other representatives made by us to analysts, stockholders, investors, news organizations and others, and discussions with management and other of our representatives.

Our future results, including results related to forward-looking statements, involve a number of risks and uncertainties. No assurance can be given that the results reflected in any forward-looking statements will be achieved. Any forward-looking statement speaks only as of the date on which such statement is made. Our forward-looking statements are based upon assumptions that are sometimes based upon estimates, data, communications and other information from suppliers, government agencies and other sources that may be subject to revision. There are other factors that could cause our future results to differ materially from historical results or trends, results anticipated or planned by us, or which are reflected from time to time in any forward-looking statement.

We face special risks for doing business in China. We face the risk of changes in the policies of the PRC government, the risk of recent PRC regulations restricting the establishment of offshore companies by PRC residents, the risk of ineffective contractual control of Yanglin, the risk of uncertain legal environment in China, the risk of substantial influence by the PRC government over the manner we conduct our business activities, the risk of inflation in China, the risk of restrictions on currency exchange, the risk of fluctuation of Renminbi exchange rate, the risk of distribution our assets upon liquidation, the risk of being treated as a resident enterprise for PRC tax purposes, the risk of limited business insurance coverage, and the risk of future outbreaks of SARS and Avain Flu in China.

In addition to other matters identified or described by us from time to time in filings with the SEC, there are several important factors that could cause our future results to differ materially from historical results or trends, results anticipated or planned by us, or results that are reflected from time to time in any forward-looking statement. Some of these important factors, but not necessarily all important factors, include the following:

Risks Related To Our Business

Our raw material supply is vulnerable to natural disasters, which could severely disrupt the normal operation of our business and therefore adversely affect our business.

As soybeans are our main raw materials and most of our soybeans are grown in and obtained from farmers in the Heilongjiang province, natural disasters such as drought, earthquakes, floods, and heavy rains in Heilongjiang may lead to a shortage in our supply of soybeans and result in soybean price increases, and consequently adversely affect our operations.

Our efforts to manufacture value added products may not be successful.

In order to grow our business and achieve higher profit margins, we have begun to construct new plants and add new equipment to manufacture value added products such as high-grade oil, protein concentrate, textured protein, powdered oil, etc. If the consumers do not accept our new products, the market for such products has not fully developed, or we do not have experienced sales personnel to market such products, we may not achieve the result as we expect and our business operation and financial conditions may be adversely affected.

Soybean prices fluctuate greatly. This may adversely affect our operations.

As a commodity, soybeans are subject to the price fluctuation of the commodity market in China and indirectly to the international commodity market. For example, the soybean price went up from RMB 2.16 per 500 grams at the beginning of 2008 to RMB2.75 per 500 grams at the beginning of Mar 2008, then to RMB 2.70 per 500 grams in early July and went down to RMB 1.65 per 500 grams at the end of 2008, due to both the shortage in soybean supply caused by a severe drought in 2007 and farmers’ cutting growing areas of soybeans brought by the continuously low price level by the end of 2006. If the soybean price increases significantly, we may have a problem caused by increased demand on working capital to satisfy the raw materials needs of our operations.

Our full capacity may be reached soon. Our growth may be impacted if we could not expand our capacity in the near future.

The designed capacity of our facilities is 520,000 tons per year and the maximum utilization rate for our industry is approximately 90%. We processed 420,000 tons of soybean in 2008 and we expect to process about 450,000 tons in 2009.We will soon need additional capacity to grow our business. If we are not able to build or acquire new facilities in 2009, the growth of our business maybe adversely affected.

We do not have long-term soybean supply contracts, which could have a material adverse effect on us.

Currently, we source about 70%of our raw materials from farmers with whom we have a long term relationship and about 30% from intermediaries who purchase directly from other farmers. However, we do not have long term contracts with the farmers or the intermediaries. All current supply contracts with the soybean farmers are one-year contracts without fixed prices. Therefore, we may not be able to control supply risks. Any significant fluctuation in price of our raw materials could have a material adverse effect on the manufacturing cost of our products.

We have tried to mitigate the risks by paying attractive premium to those farmers who will purchase “Yanglin” soybean seeds, cultivate and plant them and then sell the soybeans to us in order to guarantee our soybean supplies. However, if our competitors also pay premium or even pay higher premium to attract the suppliers, we may lose our advantage in purchasing price and lose some of the soybean supplies.

The soybean price is largely beyond our control in addition to natural disaster or supply competition.

The soybean price may also be affected by other factors in addition to natural disaster or supply competition, such as global commodity price increase, government control or suppliers’ financial difficulties. We may have limited options in the short-term for alternative supply if our suppliers fail for any reason, including suppliers’ business failure or financial difficulties to continue the supply of raw materials. Moreover, identifying and accessing alternative sources may increase our costs. Although raw materials are generally available and we have not experienced any raw material shortage in the past, we cannot assure that the necessary materials will continue to be available to us at prices currently in effect or acceptable to us.

Some of our land may be reclaimed by the government and this may materially impact our operations.

Most land in China is state-owned and land use rights may be granted, transferred, leased or allocated. Allocated land use rights are generally provided by the government for an indefinite period (usually to state-owned entities) and cannot be pledged, mortgaged, leased, or transferred by the user. As the same time, allocated land can be reclaimed by the government at any time. The lands occupied by Factory No. 1 and No. 2 is allocated land and accordingly subject to the risk of being reclaimed. We are in the process of applying for the land use rights over Factory No. 2 to be changed to transferred. Although the risk being reclaimed is very small because the government is encouraging the growth of our industry and in general the market economy system and will continue to support our business, we cannot guarantee the land will not be reclaimed in the future.

We may lose our advantages if there is emergence of new production technologies for other competitors.

Our business is dependent on our ability to utilize current technologies to produce high quality products with low cost. Currently, we employ advanced technologies now available in our manufacturing process. However, newer and better manufacturing technologies may emerge. If we are unable to adapt the production processes to newer and more efficient manufacturing technologies that may be used by our competitors to manufacture products that are of higher quality or at a lower cost, we may lose market share and our financial performance may be adversely affected because we do not have the financial resources to build new facilities using such new technologies.

Our manufacturing process is highly dangerous, which could cause adverse effects on our operation.

In our manufacturing process, we use highly inflammable and explosive chemical solutions. Therefore, fires and explosions could occur, which could cause delay in our production, damages to our facilities and injuries to our workers.

We receive a significant portion of our revenues from a small number of customers. Our business will be harmed if our main customers reduce their orders from us.

Our customers mainly comprise approximately 40 distributors of soybean oil and other soybean products, as well as soybean food product and animal feed manufacturers. Although our sales are widely diversified among our customers and our largest customer accounts for only 10% of our total sales, our top ten customers accounted for about 34% of our net sales in fiscal 2008. Dependence on a few customers could make it difficult to negotiate attractive prices for our products and could expose us to the risk of substantial losses if a single dominant customer ceases purchasing. If we lose any customers and are unable to replace them with other customers that would purchase a similar amount of our products, our revenues and net income would decline considerably.

Our product delivery is dependent upon the efficiency of the rail system and any disruption in the services or increase in transportation costs will have a material adverse impact on our operations.

Approximately 70% of our products are transported to our customers by rail. We are largely dependent upon the efficiency of China’s rail system and network to deliver our products. Any disruption of their service will largely impact our ability to fulfill our orders on a timely basis and recognize revenue. Also any increase in transportation costs may deter our customers and lead them to source products from other nearby suppliers, thus negatively affecting our sales.

Potential environmental liability could have a material adverse effect on our operations and financial condition.

To the knowledge of management, we have complied with the prescribed standard of environment protection as evidenced by a certificate issued by the government. Although it has not been alleged by government officials that we have violated any current environmental regulations, we cannot assure that the government will not amend the current environmental protection laws and regulations. Our business and operating results may be materially and adversely affected if we were to be held liable for violating existing environmental regulations or if we were to increase expenditures to comply with environmental regulations affecting our operations.

Inadequate funding for our capital expenditure may affect our growth strategy and profitability.

Our continued growth depends upon our ability to raise capital from outside sources. To maintain our profitability, we should increase the efficiency and achieve economies of scale in production of those low-margin products, and at the same time to develop those high-margin profit products. Adequate funding is needed to expand the production scale or develop new products. However, adequate funding is dependent upon a number of factors, including but without limitation the nation’s or the world’s economy, our business condition, the financial environment as well as the relevant legal environment. If we are unable to obtain sufficient financing, our growth and profitability may be adversely limited.

The sales price fluctuation for our products is periodic, which could affect on our financial results.

The prices of our products vary seasonably, among others, by the change of soybean supply and demand. Usually, our prices are lowest during the soybean harvest time between October and December and on the peak from January to February because of the New Year and Spring Festival. However, the price also subject to other conditions. As a result, we believe that period-to-period comparisons of our historical results of businesses are not necessarily meaningful and that you should not rely on them as an indication for future performance. It is also possible that our quarterly results of operations may be below the expectations of public market analysts and investors.

Risks Related To Our Management and Internal Control

We may not be able to achieve and maintain an effective system of internal control over financial reporting, a failure of which may prevent us from accurately reporting our financial results or detecting and preventing fraud.

We are constantly striving to establish and improve our business management and internal control over financial reporting to forecast, budget and allocate our funds. However, as a Chinese company that has recently become a US public company, we face difficulties in hiring and retaining a sufficient number of qualified employees to achieve and maintain an effective system of internal control over financial reporting in a short period of time.

The following is a description of each deficiency with respect to our internal controls over financial reporting identified by our management.

| | The Company does not have an accounting policy manual based on U.S. GAAP and has not formulated formal procedures on the accounting treatment of significant transactions and processes. |

Because of the above-referenced deficiencies and weaknesses in our disclosure controls and procedures and internal control over financial reporting, we may be unable to comply with the Sarbanes-Oxley Act’s internal controls requirements, and therefore may not be able to obtain the independent auditor certifications that the Sarbanes-Oxley Act requires publicly-traded companies to obtain. As a result of any deficiencies and weaknesses, we may experience difficulty in collecting financial data and preparing financial statements, books of account and corporate records, and instituting business practices that meet international standards, failure of which may prevent us from accurately reporting our financial results or detecting and preventing fraud.

We depend on key personnel for our business operations, whose discontinuance could incur our high replacement cost.

Our future success depends substantially on the continued services of our executive officers, especially Mr. Shulin Liu, our chairman and chief executive officer, Mr. Zhongtai Guo, chief operating officer, and Mr. Shaocheng Xu, chief financial officer. If one or more of our key executive officers are unable or unwilling to continue in their present positions, we may not be able to replace them readily, if at all. Therefore, our business may be severely disrupted, and we may incur additional expenses and take additional time to recruit and retain new officers.

We may not be able to effectively protect our proprietary rights, which could harm our business and competitive position.

Our success depends, in part, on our ability to protect our proprietary rights. At present, we have registered the trademarks for “Yanglin” logo in China which are currently used for all our products. We cannot assure you that we will be able to effectively protect our trademarks in the future. Currently, implementation of PRC intellectual property-related laws has historically been lacking, primarily because of ambiguities in the PRC laws and difficulties in enforcement. Accordingly, intellectual property rights and confidentiality protections in the PRC may not be as effective as in the United States or other developed countries. Policing unauthorized use of proprietary technology is difficult and expensive, and we might need to resort to litigation to enforce our rights or defend us, or to determine the enforceability, scope and validity of our proprietary rights or those of others. Such litigation may require significant expenditure of cash and management efforts and could harm our business, financial condition and results of operations. An adverse determination in any such litigation will impair our intellectual property rights and may harm our business, competitive position, business prospects and reputation.

We may be exposed to intellectual property infringement and other claims by third parties, which, if successful, could cause us to pay significant damage awards and incur other costs.

While we believe that the technology we use is not protected by any patent or intellectual property rights, we face the risk of being the subject of intellectual property infringement claims. The validity and scope of claims relating to the manufacturing of soybean products may involve complex technical, legal and factual questions and analysis and, therefore, may be highly uncertain. The defense and prosecution of intellectual property suits, patent opposition proceedings and related legal and administrative proceedings can be both costly and time consuming and may significantly divert the efforts and resources of our technical and management personnel. An adverse determination in any such litigation or proceedings to which we may become a party could subject us to significant liability, including damage awards to third parties, require us to seek licenses from third parties, to pay ongoing royalties, or to redesign our products or subject us to injunctions preventing the manufacture and sale of our products. Protracted litigation could also result in our customers or potential customers deferring or limiting their purchase or use of our products until resolution of such litigation. Further, we do not have adequate product liability insurance coverage against defective products as our products are manufactured according to fairly basic formulas. Any disputes so far have been resolved through friendly negotiations. There is no guarantee that we will not be involved in any legal proceedings should such negotiations fail one day.

Risks Related to Our Expansion

We give no assurances that any plans for future expansion will be implemented or that they will be successful.

While we have expansion plans, which include manufacturing “deep-processed” and refined soybean products, expanding our production lines and expanding our sales, there is no guarantee that such plans will be implemented or that they will be successful. These plans are subject to, among other things, the feasibility to meet the challenges we face, our ability to arrange for sufficient funding for more manufacturing facilities and the increasing working capital and the ability to hire qualified and capable employees to carry out these expansion plans.

Our personnel may not effectively support our growth and therefore impeding the expansion plan.

We currently have sufficient experienced and skilled employees for our business operations. But if our business and markets grow and develop, it will be necessary for us to expand our operation in an orderly fashion, which will put added pressure on our management and operational infrastructure. We may not have the requisite experience to manage and operate a larger, more modern manufacturing plant and bigger production lines. In addition, we may face challenges in product offerings and in integrating acquired businesses. These events would increase demands on our existing management, workforce and facilities. Failure to satisfy these increased demands could interrupt or adversely affect our operations and cause production backlogs, longer product development time frames and administrative inefficiencies.

We may not able to increase our sources for soybean supply. As a result, we may not support our plan to increase production.

In order to increase our raw material supplies, we intend to expand our soybean supply area through development of additional farmland soybean agreements, which in turn will be accomplished through contract negotiations with private farmers and cooperation with state-owned farms. However, it is difficult to obtain access to farmlands from private farmers or state-owned farms. If we cannot expand the soybean supply area, we may not be able to increase the supplies of the soybean and our plan to increase soybean production.

We may have difficulty to expand our sales network in domestic market or to explore new overseas market.

We intend to intensify our marketing efforts in the PRC by expanding existing sales and marketing network coverage to reach more areas by establishing more sales offices within the PRC and maybe in other countries such as Singapore, Malaysia, Canada and the United States. However, overseas consumers may not accept the value of non-generically modified soybean products and would not like to pay the premium of it. It also may be difficult to expand the sales channels in China’s markets if we are unable to advertise our products through various forms of media. But the advertising in commercial magazines, popular newspapers or over the internet will enhance our sales costs.

Our acquisition plan may not succeed, which will adversely affect our overall expansion plan.

We plan to expand our production facilities through the acquisition of approximately 3 to 4 additional factories, which can increase our current annual soybean production capacity up to about 1.5 million tons of soybeans over the next 3 years. However, it will be difficult for us to negotiate the acquisition with those factories, who may bargain for higher acquiring prices. Additionally, the acquisition will be submitted to the government for approval. That process may increase the risk of the acquisition failure or increase our acquisition cost, which decreases the value of the acquisition. If our acquisition fails, it will block our overall expansion plan.

Risks Related To Our Industry

Disruptions in the capital and credit markets related to the current national and worldwide financial crisis, which may continue indefinitely or intensify, could adversely affect our results of operations, cash flows and financial condition, or those of our customers and suppliers.

The current disruptions in the capital and credit markets may continue indefinitely or intensify, and adversely impact our results of operations, cash flows and financial condition, or those of our customers and suppliers. Disruptions in the capital and credit markets as a result of uncertainty, changing or increased regulation, reduced alternatives or failures of significant financial institutions could adversely affect our access to liquidity needed to conduct or expand our businesses or conduct acquisitions or make other discretionary investments, as well as our ability to effectively hedge our currency or interest rate. Such disruptions may also adversely impact the capital needs of our customers and suppliers, which, in turn, could adversely affect our results of operations, cash flows and financial condition.

China’s commitments to the World Trade Organization may intensify competition.

In connection with its accession to the World Trade Organization, China made many commitments including opening its markets to foreign products, allowing foreign companies to conduct distribution business and reducing customs duties. Foreign manufacturers may begin to manufacture non-genetically modified soybean products and ship their products or establish manufacturing facilities in China. Competition from foreign companies may reduce profit margins and hence our business results would suffer.

If the substitute products for soybean oil increase, we may lose our market share of soybean oil market.

Substitute products for soybean oil, such as vegetable oil of peanut and palm oil could increase the intensity of competition faced by us. With the appearance of substitute products for soybean oil, consumers have more choices. Part of consumers may prefer vegetable oil. As a result, we may lose our market share of soybean oil market.

If we are not be able to maintain competitive in non-genetically modified soybean product business, we may not achieve sufficient product revenues.

At present, we are the largest and most integrated private non-genetically modified soybean producer in China. Our products compete with a multitude of products developed, manufactured and marketed by others and we expect competition from new market entrants in the future. Our current competitors are the other domestic non-genetically modified soybean companies and global manufacturers who may enter the non-genetically modified soybean business. Although currently we view ourselves in a favorable position, we may not remain competitive if existing or future competing products may provide better quality, greater utility, lower cost or other benefits from their intended uses than our products, or may offer comparable performance at lower cost. If our products fail to capture and maintain market share, we may not achieve sufficient product revenues, and our business would suffer.

The inability of the PRC government to keep the PRC a genetically modified-free soybean zone will remove our competitive edge and negatively impact our operations.

We distinguish ourselves from our competitors in that we manufacture and sell non-genetically modified soybean products. Because the PRC is a non-genetically modified soybean growing zone, our competitors are not the large, better capitalized producers of genetically modified soybean products. The PRC has one of the strictest bio-safety regulations in the world, requiring safety certificates and labeling of genetically modified products. However, with so much genetically modified soybeans being imported into the country, there is a question as to whether the PRC is able to keep it a genetically modified-free soybean zone. If the PRC is unsuccessful in keeping the PRC a genetically modified-free soybean zone and our soybeans are tainted through pollination, we will lose our competition edge and this would adversely affect our operations.

Our failure to comply with ongoing governmental regulations could hurt our operations and reduce our market share.

In China, the food industry is undergoing increasing regulations as environmental awareness increases in China. The trend is that the Chinese government toughens its regulations and penalties for violations of environmental regulations. New regulatory actions are constantly changing our industry. Although we believe we have complied with applicable government regulations, there is no assurance that we will be able to do so in the future.

Risks Related To Doing Business In China

We face the risk that changes in the policies of the PRC government could have a significant impact upon the business we may be able to conduct in the PRC and the profitability of such business.

All of our business operations are conducted in China. Accordingly, our business, financial condition, results of operations and prospects are affected significantly by economic, political and legal developments in China. The Chinese economy differs from the economies of most developed countries in many respects, including level of government involvement in economic activities, stage of national development, and control of foreign exchange.