UNITED STATESSECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: December 31, 2009

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to _______________

Commission file number: 333-138465

La Cortez Energy, Inc.

(Exact name of registrant as specified in its charter)

| Nevada | | 20-5157768 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

Calle 67 #7-35, Oficina 409 Bogotá, Colombia | | None |

| (Address of principal executive offices) | | (Postal Code) |

Registrant’s telephone number, including area code: (941) 870-5433

Securities registered under Section 12(b) of the Act: None

Securities registered under Section 12(g) of the Act: Common Stock, $0.001 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a smaller reporting company. See the definitions of the “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer ¨ | Accelerated Filer ¨ |

Non-Accelerated Filer ¨ | Smaller reporting company x |

| (Do not check if a smaller reporting company) | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

On June 30, 2009, the last business day of the registrant’s most recently completed second fiscal quarter, 16,995,224 shares of its Common Stock, $0.001 par value per share (its only class of voting or non-voting common equity) were held by non-affiliates of the registrant. The market value of those shares was $33,990,448, based on the last sale price of $2.00 per share of the Common Stock on that date. For this purpose, shares of Common Stock beneficially owned by each executive officer and director of the registrant, and each person known to the registrant to be the beneficial owner of 10% or more of the Common Stock then outstanding, have been excluded because such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of April 12, 2010, there were 40,000,349 shares of the registrant’s Common Stock, par value $0.001 per share, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

TABLE OF CONTENTS

| Item Number and Caption | | Page |

| | | | |

| Forward-Looking Statements | | 3 |

| | | | |

| PART I | | | 4 |

| | | | |

| 1. | Business | | 4 |

| 1A. | Risk Factors | | 19 |

| 1B. | Unresolved Staff Comments | | 36 |

| 2. | Properties | | 36 |

| 3. | Legal Proceedings | | 42 |

| | | |

| PART II | | 43 |

| | | | |

| 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | 43 |

| 6. | Selected Financial Data | | 46 |

| 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | | 46 |

| 8. | Financial Statements and Supplemental Data | | 60 |

| 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | 60 |

| 9A.[T] | Controls and Procedures | | 60 |

| 9B. | Other Information | | |

| | | |

| PART III | | 63 |

| | | | |

| 10. | Directors, Executive Officers, and Corporate Governance | | 63 |

| 11. | Executive Compensation | | 69 |

| 12. | Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters | | 75 |

| 13. | Certain Relationships and Related Transactions and Director Independence | | 78 |

| 14. | Principal Accountant Fees and Services | | 78 |

| | | |

| PART IV | | 79 |

| | | | |

| 15. | Exhibits and Financial Statement Schedules | | 79 |

| | | | |

| Financial Statements | | F-1 |

| | | |

| Glossary of Oil and Gas Terms | | G-1 |

FORWARD-LOOKING STATEMENTS

Some of the statements contained in this Annual Report on Form 10-K that are not historical facts are “forward-looking statements” which can be identified by the use of terminology such as “estimates,” “projects,” “plans,” “believes,” “expects,” “anticipates,” “intends,” or the negative or other variations, or by discussions of strategy that involve risks and uncertainties. We urge you to be cautious of the forward-looking statements, that such statements, which are contained in this Annual Report, reflect our current beliefs with respect to future events and involve known and unknown risks, uncertainties and other factors affecting operations, market growth, services, products and licenses. No assurances can be given regarding the achievement of future results, and although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, actual results may differ materially as a result of the risks we face, and actual events may differ from the assumptions underlying the statements that have been made regarding anticipated events. Factors that may cause actual results, performance or achievements, or industry results, to differ materially from those contemplated by such forward-looking statements include without limitation those discussed in the sections of this Annual Report titled “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and those set forth below:

| | ● | Changes in the political and regulatory environment and in business and fiscal conditions in South America, and in Colombia and Peru in particular; |

| | ● | Our ability to attract and retain management and field personnel with experience in oil and gas exploration and production; |

| | ● | Our ability to identify corporate acquisition, farm-in and/or joint venture opportunities in the energy sector in Colombia and Peru; |

| | ● | Our ability to successfully operate, or influence the operator of, exploration and production blocks where we have participation interests, in a cost effective and efficient way; |

| | ● | Our ability to raise capital when needed and on acceptable terms and conditions; |

| | ● | The intensity of competition; |

| | ● | Changes and volatility in oil and gas pricing; and |

| | ● | General economic conditions. |

You should carefully review the risks described in this Annual Report and in other documents we file from time to time with the Securities and Exchange Commission (the “SEC”). You are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this Annual Report.

All written and oral forward-looking statements made in connection with this Annual Report that are attributable to us or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. Given the uncertainties that surround such statements, you are cautioned not to place undue reliance on such forward-looking statements.

All references in this Form 10-K to “La Cortez Energy,” the “Company,” “we,” “us” or “our” or similar terms are to La Cortez Energy, Inc., and its wholly owned subsidiaries.

PART I

For definitions of certain oil and gas industry terms used in this annual report on Form 10-K, please see the Glossary appearing on page G-1.

Overview of Our Business

We are an international, early-stage oil and gas exploration and production company focusing our business in South America. We have established an operating branch in Colombia, and we have entered into two initial working interest agreements, with Petroleos del Norte S.A. (“Petronorte”), a subsidiary of Petrolatina Plc. (AIM: PELE), and with Emerald Energy Plc Sucursal Colombia (“Emerald”), a branch of Emerald Energy Plc. (discussed below). In addition, in March 2010, we acquired all of the outstanding capital stock of Avante Colombia S.à r.l. (“Avante Colombia”) from Avante Petroleum S.A. (“Avante”); Avante Colombia currently has a 50% participation interest in, and is the operator of, the Rio de Oro and Puerto Barco production contracts with Ecopetrol S.A. in the Catatumbo region of northeastern Colombia, under an operating joint venture with Vetra Exploración y Producción S.A. (“Vetra”). We are currently evaluating additional investment prospects, companies and existing exploration and production opportunities in Colombia, while keeping alert for opportunities in other South American countries.

We expect to explore investment opportunities in oil and gas exploration and development as well as in associated infrastructure (e.g., storage tanks, processing facilities and/or pipelines). The scope of our activities in this regard may include, but not be limited to, the acquisition of or assignment of rights to develop exploratory acreage under concessions with government authorities and other private or public exploration and production (“E&P”) companies, the purchase of oil and gas producing properties, farm-in and farm-out opportunities (i.e., the assumption of or assignment of obligations to fund the cost of drilling and development), and/or the purchase of debt or equity in, and/or assets of, existing oil and gas exploration and development companies currently conducting activities in Colombia.

We are currently evaluating ways to optimize our business structure in each jurisdiction where we conduct and where we intend to develop our business, in order to comply with local regulations while optimizing our tax, legal and operational flexibility. To this end, we have established an operating branch in Bogotá, Colombia where we will engage in our initial business ventures.

Industry Introduction

The oil and gas industry is a complex, multi-discipline sector that varies greatly across geographies. As a heavily regulated industry, operating conditions are subject to political regimes and changing legislation. Governments can either induce or deter investment in exploration and production, depending on legal requirements, fiscal and royalty structures, and regulation. Beyond the political considerations, exploration and production for hydrocarbons is an extremely risky business with countless perils, both endogenous and exogenous to the core business. Exploration and production wells require substantial amounts of investment and are long-term projects, sometimes exceeding twenty to thirty years. Regardless of the efforts spent on an exploration or production prospect, success is difficult to attain. Even though modern equipment including seismic and advanced software has helped geologists find producing sands and map reservoirs, they do not guarantee any particular outcome. Early oil & gas explorers relied on surface indicators to find reservoirs. Drilling is the only method to determine whether a prospect will be productive, and even then many complications can arise during drilling (e.g., those relating to drilling depths, pressure, porosity, weather conditions, permeability of the formation and rock hardness). Typically, there is a significant probability that a particular prospect will turn-up a dry-well, leaving investors with the cost of seismic and a dry well which during current times can total in the millions of dollars. Even if oil is produced from a particular well, there is always the possibility that treatment, at additional cost, may be required to make production commercially viable. Furthermore, most production profiles decline over time, which hinders any cost-benefit analysis. In sum, oil and gas is an industry with high risks and high entry barriers but significant potential for success.

Oil and gas prices determine the commercial feasibility of a project. Certain projects may become feasible with higher prices or, conversely, may falter with lower prices. Volatility in the pricing of oil, gas, and other commodities has increased during the last few years, and particularly in the last year, complicating the practicability of a proper assessment of revenue projections. Most governments have enforced strict regulations to uphold the highest standards of environmental awareness, thus, holding companies to the highest degree of responsibility and sensibility vis à vis protecting the environment. Aside from such environmental factors, oil and gas drilling is often conducted in populated areas. For a company to be successful in its drilling endeavors, working relationships with local communities are crucial, to promote its business strategies and to avoid any repercussions of disputes that might arise over local business operations.

Global Recession, Volatility and Crude Oil Prices

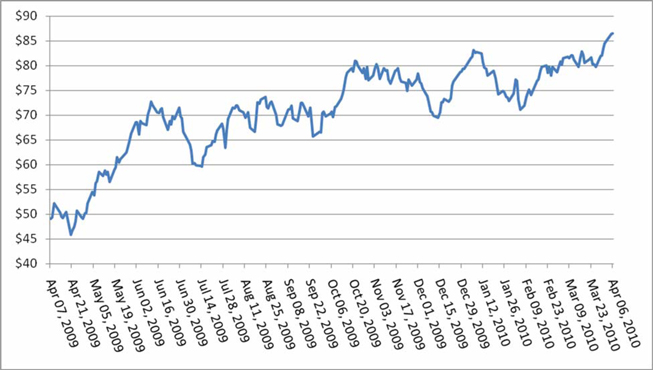

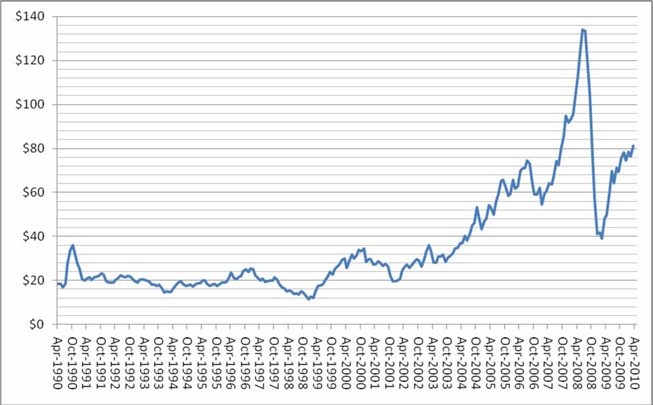

Aside from operational and regulatory issues that affect E&P companies, every major market has been affected by the global recession during the past year. The energy sector is no exception. West Texas Intermediate (“WTI”) crude prices, the standard oil benchmark for the western hemisphere, tumbled from over $140 per barrel in mid 2008 to less than $40 per barrel in early 2009, before rebounding somewhat to approximately $85 now. The new price threshold makes many previously economically viable opportunities less feasible. We are currently re-evaluating opportunities to reflect this new market environment. Furthermore, the volatility in crude oil prices increases the risks involved. We cannot be sure that the projections we use in evaluating investment opportunities will be valid and in effect as conditions in the oil markets rapidly change. We compensate for this uncertainty by increasing the range of values for our assumptions and by working with numerous sensitivities that might be in line with the situation in the marketplace.

One-Year Daily Spot Price of WTI FOB Cushing, OK (U.S. Dollars per Barrel)*

Twenty-Year Monthly Spot Price of WTI FOB Cushing, OK (U.S. Dollars per Barrel)*

* Source: U.S. Energy information Administration

Financing activity in both the equity and debt capital markets, the most common financing vehicles for E&P companies like ours, has increased from 2008 and 2009, when it had virtually disappeared. Financing is now more accessible to companies that have demonstrated sound managerial and technical capacity. Companies that are able to secure financing from existing and financially sound investor bases are in a position to take advantage of current business opportunities.

New Opportunities for Smaller Companies

In today’s energy market, there are significant opportunities for smaller companies. The greatest opportunity exists in countries where small scale resource opportunities have been overlooked or have been considered immaterial or uneconomic by medium to larger companies, and/or where local governments are promoting the development of small reservoirs to increase production to satisfy internal demand as well as export needs. To accomplish this governmental purpose, certain of the regional governing bodies have modified their oil and gas E&P contracting terms and conditions making them more attractive for the oil industry in general, and in some cases, for smaller companies as well.

Business Plan and Strategic Outlook

We plan to build a successful oil and gas exploration and production company focused in select countries in South America. We will concentrate our efforts initially in Colombia, where, we believe, good E&P opportunities exist with straight forward oil and gas contracting terms and conditions. At a later stage, we will turn to opportunities in other regional countries if we deem the relevant considerations (see list of factors below) to merit our investment. Within the spectrum of the oil and gas business, we plan to focus on a blend between exploration and production of hydrocarbons through a variety of transactions. Our initial plan is to acquire oil and gas production and to start to build a reserves base.

An integral part of our strategy is our focus on continuing to build a competent and professional management and operations team to enable us to successfully carry out our business plan. We have hired experienced personnel including technical specialists (e.g., geologists, geophysicists and petroleum and facilities engineers, as required by the scope of our operations), administrators, financial experts and functional specialists in fields such as environment and community relations, to encompass the different areas that are critical to our business. Because the focus of our business is in South America, the majority of our staff will be hired locally and will live in the region. This will provide us with a significant base of relevant oil and gas business experience in the region.

We are motivating our employees through a positive, team oriented work environment and an incentive stock ownership plan. We believe that employee ownership, which is encouraged through our Amended and Restated 2008 Equity Incentive Plan, is essential for attracting, retaining and motivating qualified personnel.

We have established a time-line for our expansion into new geographies to avoid overextending our reach and to focus on immediate prospects. We have initially concentrated our efforts in Colombia and are looking at Peru as a potential next target. Both countries have similar E&P contract terms and conditions as well as business opportunities that are appropriate for a small, early stage company such as La Cortez Energy. Our second and subsequent development phases will focus on exploration and production opportunities in other South American countries as we explore investment opportunities in these locales. We plan to adhere to this time-line but reserve the option of being flexible if the right investment presents itself.

Acquisition Strategy

We intend to acquire producing oil and gas properties (and/or fields) where we believe significant value exists or where additional value can be created. Our senior management is primarily interested in developmental properties where some combination of the following factors exists:

| | (1) | Opportunities for medium to long term production life with clear understandings of production mechanisms and output levels; |

| | (2) | Geological formations with multiple producing horizons; |

| | (3) | Substantial upside potential; and |

| | (4) | Relatively low capital investment and production costs. |

We will continue to pursue joint ventures or farm-ins in exploration ventures with limited risk, in areas where nearby oil discoveries have been found.

Phased Approach

| | ● | Phase 1 – We are concentrating our initial efforts in Colombia where opportunities as well as operating terms and conditions are perceived in the industry to be appropriate for small, early stage oil and gas E&P companies. In these markets are pursuing: |

| | – | Acquisitions of established oil and gas exploration and production fields and/or companies, which will enable us to establish base production with upside potential; |

| | – | Joint ventures and farm-ins on exploration projects with up to a 20% to 50% maximum participation interest; and |

| | – | Participation in bidding processes for property operator opportunities, in conjunction with established E&P companies or independently, if allowed under local regulations. |

| | ● | Phase 2 – Once we have established our business in Colombia, we will turn our attention to new opportunities in other South American countries. We intend to take advantage of promising opportunities in these additional markets while we consolidate our E&P activities in our Phase 1 countries. In these markets, we intend to search for the following market environments and types of projects: |

| | – | Frontier exploration areas (joint ventures with up to a 25% ownership participation) where limited competition exists; |

| | – | Acquisitions with significant upside potential; |

| | – | Political stability; and |

| | – | Supportive local oil and gas industry regulatory environments. |

The following is a list of some of the factors we take into account when considering potential investments in any country:

| | · | Stable political regimes: |

| | o | Countries that exhibit a desire to uphold stability and progress in their legislation, striving towards open markets and a global approach to best business practices. |

| | · | Clear fiscal/taxation/royalty terms. |

| | · | Manageable security in and around production and exploration areas and facilities. |

| | · | Openness to foreign direct investment. |

| | · | Good oil and gas E&P prospects: |

| | o | Where despite the presence of large multi-national integrated oil companies, there are open acreage opportunities as well as farm-in, joint venture, and direct block negotiation opportunities, as well producing fields and/or company acquisition possibilities, with some access to local capital. |

| | · | Potential for underexploited hydrocarbon formations with promising upside potential: |

| | o | We are searching for investment opportunities in countries where there are regions with limited seismic coverage within hydrocarbon prospective areas. |

La Cortez Energy can engage in any of the following types of transactions to achieve our strategic goals:

| | · | Exploration and Production: |

| | o | Direct government concessions in blocks with specific exploration and development plans. |

| | · | Technical Evaluation Agreements. |

| | o | The assumption of or assignment of obligations to fund the cost of exploration and/or drilling and/or development for a participating interest in a particular block. |

| o | Acquisitions of producing fields; |

| o | Acquisitions of exploration acreage; |

| o | Corporate acquisitions; and |

| o | Asset based acquisitions (e.g., blocks and concession rights). |

| | o | Partnering with other established oil and gas companies will allow us to access certain government concession rounds, benefit from technical and market expertise from our potential partners and provide liquidity to our partners. |

Role of Our Board of Directors

Our Board of Directors is an essential component of our successful operation and growth, serving in various support capacities. Because our Board of Directors is comprised of senior industry executives and experienced capital market professionals, we believe that our directors have the experience and skills necessary to effectively assist our management in the execution of our strategy. We expect that our Board of Directors will be able to provide an informed view as to the commercial, technical and financial viability of our business prospects.

Through the establishment of relevant committees (Audit and Evaluation and Reserves, to date), the Board of Directors will provide an independent view into all of our operations, providing feedback and guidance on the quality of the projects we may invest in. Additionally, our Board of Directors regularly confers with senior management to help us ensure that all relevant and required controls are in place and operating appropriately. Our Board of Directors serves as a means of confirming the integrity of senior management’s estimates with respect to valuations, reserve estimates and other crucial components of our business.

Aside from the functions enumerated above, we believe that our Board of Directors will serve as an integral element of our business development efforts. We expect that our Board of Directors will provide both invaluable insight and access to their business relationships in the region, as well as augment the technical, financial, accounting and other expertise of our management team.

Execution of our Strategy and Recent Developments

In February 2008, Nadine C. Smith became the Chairman of our Board of Directors (sometimes referred to hereinafter as the “Board”). Ms. Smith also became our Interim Chief Financial Officer and Vice President at that time. Ms. Smith most recently served as a director of another publicly traded oil and gas exploration and production company, Gran Tierra Energy, Inc. (“Gran Tierra”), which also operates in South America.

On March 14, 2008, we closed a private placement of our Common Stock at a price of $1.00 per share pursuant to which we raised $2,400,000, or $2,314,895 net of offering expenses.

On September 10, 2008, we closed a private placement of 4,784,800 units at a price of $1.25 per unit, for an aggregate offering price of $5,981,000, or $5,762,126 after offering expenses. Each of these units consisted of (i) one share of our common stock and (ii) a common stock purchase warrant to purchase one-half share of our common stock, exercisable for a period of five years at an exercise price of $2.25 per share.

On June 1, 2008, Andrés Gutierrez Rivera became our President and Chief Executive Officer and a member of our Board of Directors. Mr. Gutierrez recently served as the senior executive officer of Lewis Energy Colombia Inc. and a vice president of Hocol, S.A. Both of these companies operate in the oil and gas sector in South America.

On June 19, 2009, we conducted an initial closing of a private placement of units. Each unit consisted of (i) one share of our common stock and (ii) a common stock purchase warrant to purchase one share of our common stock, exercisable for a period of five years at an exercise price of $2.00 per share. We offered these units at a price of $1.25 per unit and we derived total proceeds at the initial closing of $6,074,914 ($5,244,279 net after expenses) from the sale of 4,860,000 units. On July 31, 2009, we completed the final closing of this unit offering. At the final closing, we received gross proceeds of $256,250 from the sale of 205,000 units. In the aggregate, we received gross proceeds of $6,331,164 in this unit offering on the sale of a total of 5,065,000 units. This unit offering terminated on July 31, 2009.

On December 29, 2009, we consummated the initial closing of a second 2009 private placement of units of our securities, selling 1,428,571 units at a price of $1.75 per unit, for aggregate gross proceeds of $2.5 million. We consummated a second closing of this offering on January 29, 2010, in which we sold 571,428 units for an aggregate of $1 million, and a third closing on March 2, 2010, in which we sold 857,143 units for an aggregate of $1.5 million.

In connection with the acquisition of Avante Colombia, on March 2, 2010, Avante purchased (in addition to the shares of common stock issued to Avante in consideration for the acquisition) 2,857,143 shares of our common stock and three-year warrants to purchase 2,857,143 shares of our common stock at an exercise price of $3.00 per share (the “Avante Warrants”), for an aggregate purchase price of $5,000,000, or $1.75 per unit.

We have been using the funds raised in the private unit offerings (net of offering expenses) to continue building of our administrative and operations infrastructure and to invest in our initial oil and gas development projects in South America and have taken the following steps in our ramping-up process:

| | ● | Added the following independent directors to our Board of Directors: Jaime Ruiz Llano, a former Colombian senator and a member of the Board of Directors of the World Bank; Jaime Navas Gaona, an experienced oil industry executive; Richard G. Stevens, an “audit committee financial expert”; and José Fernando Montoya Carrillo, a 27-year veteran of the oil industry in South America and former President of Hocol, S.A.; |

| | ● | Established a wholly owned subsidiary in the Cayman Islands, La Cortez Energy Colombia, Inc., to own our operating branch in Colombia; |

| | ● | Established and organized a branch office in Colombia to conduct local operations and, to this end, opened and began staffing our headquarter offices in Bogotá, Colombia; |

| | ● | Hired an Exploration Manager, Carlos Lombo, and a Production and Operations Manager, William Giron, as well as business development and administrative personnel; |

| | ● | Signed a memorandum of understanding and joint operating agreement with one oil and gas exploration and production company in Colombia and a farm-in agreement with another, as further discussed below; |

| | Acquired a privately-held company that is the operator of, and owner of a 50% participation interest in, two production contracts with Ecopetrol S.A. in Colombia, as further discussed below; and |

| | ● | Have begun identifying, investigating, evaluating and finalizing our participation in oil and gas investment opportunities in Colombia. |

Additionally, in the coming months, we expect to:

| ● | Hire a Chief Financial Officer, additional geologists and a petroleum engineer, to form a strong technical team, as well as additional finance and administrative personnel; and |

| ● | Enter into one or more additional agreements to acquire oil and gas exploration and/or production rights in Colombia. (Although we have not yet finalized decisions to pursue any such particular opportunities, we have begun to identify and evaluate potential prospects.) |

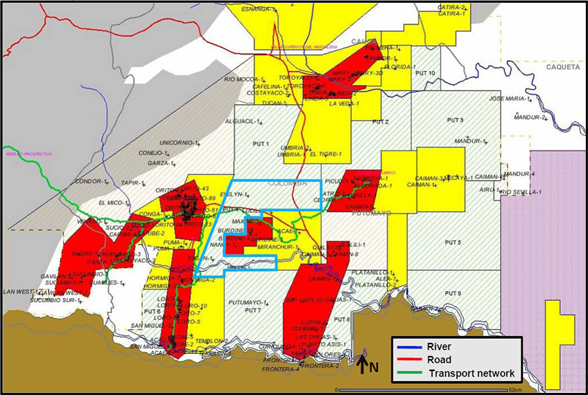

Putumayo 4 Block

On December 22, 2008, we entered into a memorandum of understanding with Petronorte that entitles us to a 50% net working interest in the Putumayo 4 Block located in the south of Colombia. We executed a related joint operating agreement with Petronorte on October 14, 2009, effective as of February 23, 2009.

Petronorte was the successful bidder on the Putumayo 4 Block in the Colombia Mini Round 2008 conducted by the Agencia Nacional de Hidrocarburos (the “ANH”), Colombia’s hydrocarbon regulatory agency, and signed an E&P contract with the ANH on February 23, 2009. According to our memorandum of understanding and the joint operating agreement with Petronorte, we are entitled to the exclusive right to a fifty percent (50%) net participation interest in the Putumayo 4 Block and in the E&P contract (subject to approval by the ANH), after ANH royalties and an ANH one percent (1%) production participation. Petronorte will be the “operator” of the E&P contract.

The Putumayo 4 Block covers an area of 126,845 acres (51,333 hectares) located in the Putumayo Basin in southern Colombia and has over 1,000 km of pre-existing 2D seismic through which we and Petronorte have identified promising leads. We and Petronorte have reprocessed relevant seismic information that confirmed our initial evaluation of seven potential leads. During this initial stage, we and Petronorte are conducting activities related to identification of the number of indigenous people and communities in the area.

We and Petronorte plan to acquire about 103 km of 2D seismic during the course of this year, as well as to drill an exploration well in early 2011.

Under the terms of the E&P contract, Petronorte is required to shoot 103 km of 2D seismic and to drill an exploratory well and to carry our certain additional work in the first three years of our work program in the Block (which ends in September 2012) at an estimated cost of $1.6 million.

The E&P contract will consist of two three-year exploration phases and a twenty-four year production phase.

As criteria for awarding blocks in the 2008 Mini Round, the ANH considered proposed additional work commitments, comprised of capital expenditures and an additional production revenue payment after royalties, called the “X Factor.” We and Petronorte offered to invest $1.6 million in additional seismic work in the Putumayo 4 Block and to pay ANH a 1% of net production revenues X Factor.

Under the memorandum of understanding and the joint operating agreement, we will be responsible for fifty percent (50%) of the costs incurred under the E&P contract, entitling us to fifty percent (50%) of the revenues originated from the Putumayo 4 Block, net of royalty and production participation interest payments to the ANH, except that we will be responsible for paying two-thirds (2/3) of the costs originated from the first 103 kilometers of 2D seismic to be performed in the Putumayo 4 Block, in accordance with the expected Phase 1 minimum exploration program under the E&P contract. If a prospective Phase 1 well in a prospect in the Putumayo 4 Block proves productive, Petronorte will reimburse us for its share of these seismic costs paid by us (one-sixth (1/6)) with their revenues from production from the Putumayo 4 Block. We expect that our capital commitments to Petronorte will be approximately $2.8 million in 2010 for Phase 1 seismic reprocessing, seismic acquisition and permitting activities.

Provided that we have satisfactorily complied with all ANH legal, financial and technical requirements for being a partner in an E&P contract (which we expect to be the case shortly) and we have made the required payment relating to our share of all costs incurred to the date of our request, Petronorte will submit a request to the ANH to have our 50% interest in the E&P contract officially assigned to us and will assist us in obtaining such assignment through reasonable means.

.

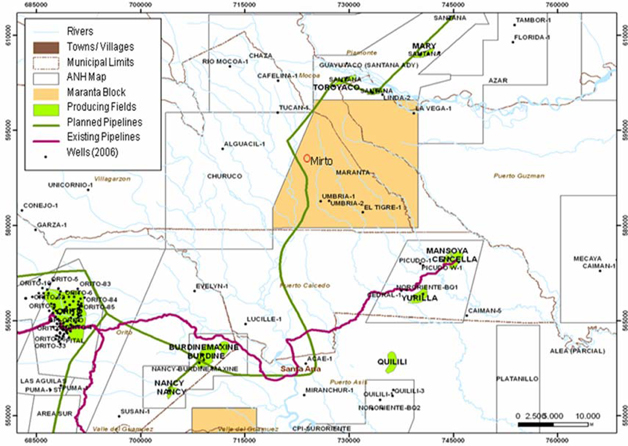

Maranta Block

On February 6, 2009, La Cortez Energy Colombia, Inc., our wholly owned Cayman Islands operating subsidiary (“La Cortez Colombia”), entered into a farm-in agreement with Emerald for a 20% participating interest in the Maranta E&P block in the Putumayo Basin in Southwest Colombia.

Emerald signed an E&P contract for the Maranta Block with the ANH on September 12, 2006. La Cortez Colombia executed a joint operating agreement with Emerald with respect to the Maranta Block on February 4, 2010, having met its Phase 1 and Phase 2 (drilling and completion of the Mirto-1 exploratory well) payment obligations described below. We have asked Emerald to submit a request to the ANH to approve Emerald’s assignment of the 20% participating interest to us. Under the farm-in agreement and the joint operating agreement, Emerald will remain the operator for the block. If the ANH does not approve the assignment of this participating interest to us, Emerald and we have agreed to use our best endeavors to seek in good faith a legal way to enter into an agreement with terms equivalent to the farm-in agreement and the joint operating agreement, that shall privately govern the relations between the parties with respect to the Maranta Block and which will not require ANH approval.

The Maranta Block covers an area of 90,459 acres (36,608 hectares) in the foreland of the Putumayo Basin in southwest Colombia. Emerald completed the first phase exploratory program for the Maranta Block by acquiring 71 square kilometers of new 2D seismic and reprocessing 40 square kilometers of existing 2D seismic, identifying several promising prospects and leads. Emerald has identified the Mirto prospect, namely the Mirto-1 well, as the first exploratory well in the Maranta Block. The Maranta Block is adjacent to Gran Tierra’s Chaza block and close to both the Orito and Santana crude oil receiving stations, allowing transportation by truck directly to either station (depending on going rates and capacity), and consequently tying into the pipeline to Colombia’s Pacific Ocean port at Tumaco.

As consideration for its 20% participating interest, we reimbursed Emerald $0.948 million of its Phase 1 sunk costs. This amount was paid to Emerald in February 2009. Additionally, we have borne 65% of the Maranta Block Phase 2 costs, of which the “dry hole” costs1 were $4.875 million, $2.433 million of which we paid to Emerald in February 2009. We made additional Phase 2 payments to Emerald in the amount of $2.433 million and $1.2285 million in May 2009 and July 2009, respectively. We also paid Emerald a cash call of $0.2433 million in August 2009 for overhead costs. On January 7, 2010, we paid an additional $1.41 million to Emerald, to cover exploration costs associated with the Mirto-1 well, as well as certain 3d seismic and facilities costs. On February 5, 2010, we paid an additional $234,553 to Emerald for our share of the final exploration costs of the Mirto-1 well.

Emerald reached the intended total depth of 11,578 feet on the Mirto-1 exploration well in July 2009, with oil and gas recorded across the four target reservoirs. On July 23, 2009, based on the preliminary results of the drilling of the Mirto-1 well, we decided to participate with Emerald in the completion and evaluation of Mirto-1. In accordance with the terms of the farm-in agreement, we have borne 65% ($1.2285 million) of the currently estimated $1.8 million Mirto-1 completion costs. We made this $1.2285 million payment to Emerald on July 27, 2009. 65% of any additional Phase 2 costs will be paid by us as needed, following cash calls by Emerald.

Now that the Phase 2 work is completed, we will pay 20% of all subsequent costs related to the Maranta Block.

Evaluation of the Mirto-1 exploratory well across all of the target reservoirs has been completed2. Following the completion of operations in the Mirto-1 well, the drilling rig was released from the location. After an unsuccessful workover attempting to isolate the water production, the Mirto-1 well is producing at an average rate of 145 bopd with a water cut close to 80%.

Emerald and La Cortez continue to believe that despite the mechanical problems encountered in the Mirto-1 well, there is sufficient accumulation of hydrocarbons in the area to merit the drilling of at least two additional wells. Emerald, as operator of the Maranta Block, has determined to enter the exploration commitment in the Maranta Block, which will entail the drilling of an additional exploratory/appraisal well. We have acquired about 25 km2 of 3D seismic, and we are in the process of mobilizing the rig to start drilling the new appraisal well in early May 2010. It is planned that after the Mirto-2 appraisal well has been drilled and completed, a new intervention in Mirto-1 well will be executed to increase perforation density of the producing "U" sand to increase total production capacity of the well. Now that the Company has the final Mirto-1 evaluation results, La Cortez Colombia has asked Emerald to file a request with the ANH to have the participating interest in the Maranta Block officially assigned from Emerald to La Cortez Colombia.

Effective October 12, 2009, Emerald’s parent, Emerald Energy Plc, was acquired by Sinochem Resources UK Limited, a United Kingdom subsidiary of Sinochem Group, a Chinese state-owned energy and chemicals conglomerate.

1. Costs of getting to the abandon or complete decision point. 2 . For a discussion of the Mirto-1 evaluation results, see “Description of Properties – Maranta Block” below.

Rio de Oro and Puerto Barco Fields

On March 2, 2010, we acquired all of the outstanding capital stock of Avante Colombia, which became our wholly owned subsidiary. As consideration for the acquisition, we issued an aggregate of 10,285,819 shares of our common stock to Avante.

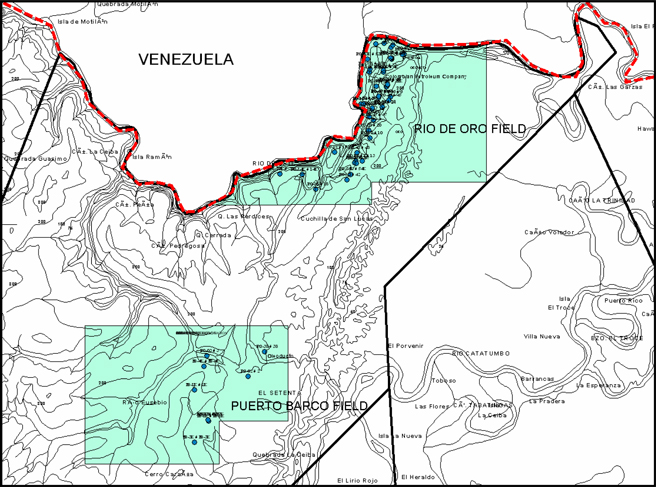

Avante Colombia currently has a 50% participation interest (acquired in late 2005) in, and is the operator of, the Rio de Oro and Puerto Barco production contracts with Ecopetrol S.A. in the Department of North Santander in the Catatumbo region of northeastern Colombia, under an operating joint venture with Vetra. The Rio de Oro field covers 5,590 acres (2,262 hectares), and the Puerto Barco field covers 5,945 acres (2,406 hectares). Both production contracts are for a ten-year term expiring at the end of 2013.

The Catatumbo basin is the southern-most extension of the Maracaibo basin of Venezuela, the second most petroliferous basin in the world according to the US Department of Energy and Petroleos de Venezuela. This sub-basin has produced over 800 million barrels of oil to-date from numerous fields.

Under the Puerto Barco production contract, Ecopetrol has a 6% participation on production, Vetra a 47% participation on production and a 50% working interest and Avante Colombia a 47% participation on production and a 50% working interest, in each case after royalties. Royalties payable are 20% of audited production. The operator is Avante Colombia. Production on the field began in 1958 and was stopped in July 2008, as a result of insurgent activity. Total historical production was 811,000 barrels of oil.

Under the Rio de Oro production contract, Ecopetrol has a 12% production participation, Vetra a 44% production participation and a 50% working interest and Avante Colombia a 44% production participation and a 50% working interest, in each case after royalties. Royalties payable are 20% of audited production. The operator is Avante Colombia. Production on the field began in 1950 and was stopped in June 1999, as a result of insurgent activity. Total historical production was 11.3 million barrels of oil and 27,041 million cubic feet of gas.

In the Rio de Oro field, the remediation of certain historical environmental conditions generated prior to the Acquisition will be the responsibility of previous operators. In addition to the contractual responsibility of previous operators for these liabilities, Avante has agreed in the SPA to indemnify us for 50% of any environmental losses we incur, up to a maximum of $2.5 million.

Under the terms of the stock purchase agreement, we and Avante have also agreed to pursue certain opportunities in the Catatumbo area on a joint venture basis. If we enter into such a joint venture with Avante, then we would own 70% of the joint venture and commit to pay 70% of the geological and geophysical costs, and Avante would own 30% of the joint venture and commit to pay 30% of the geological and geophysical costs, up to a maximum commitment by Avante of $1,500,000. If the total costs of the venture exceed $5,000,000, then Avante may elect either (a) not to pay any additional costs of the venture and incur dilution of its ownership percent from future payments by us, (b) to continue to pay additional costs of the venture at 30% or (c) to pay a larger proportion of the costs of the venture, in which case Avante’s ownership percent would be increased in proportion to the percentage of total venture costs paid by each party, up to a maximum ownership interest for Avante of 50%.

Plan of Operation

We plan to use our currently available cash for work programs in our Maranta Block, Putumayo 4 Block and our Rio de Oro / Puerto Barco Fields, and for corporate transactions and/or acquisitions, as well as for general working capital purposes. The current work program for our Putumayo 4 Block is comprised of the acquisition of an additional 103 kilometers of new 2D seismic in 2010 and, subsequently, the drilling of an exploratory well in the first quarter of 2011. We have evaluated the reprocessed seismic information, which validated the existence of the seven initial leads we have identified to date, and will redirect our new seismic campaign of 103 km of 2D or equivalent 3D seismic in a more efficient manner. Under Petronorte’s contractual obligations with the ANH, we have until August 23, 2012, to complete Phase 1 commitments comprised of seismic acquisition and the drilling of an exploratory well. A complete evaluation of the project’s impact on the indigenous peoples in the area of the Putumayo 4 Block is also being conducted at this time.

In our Maranta Block, we have completed funding our share of the costs of the Mirto-1 exploratory well. We have acquired 25 km of 3D seismic over the field to better determine the extent of the reservoir and to determine the position of the two or three appraisal wells that we plan to drill in 2010.

In Catatumbo, we plan to reinitiate production in Puerto Barco during this year and have presented a work program to Ecopetrol. Our plans with respect to Avante Colombia’s business depend, among other things, on obtaining an extension of the term of existing contracts between Avante Colombia and Ecopetrol, which expire in December 2013. We believe that, in order to negotiate a term extension, we will have to commit to additional investment in the area, such as additional seismic acquisition as well the drilling of exploration wells.

During 2010, we expect to require the following amounts of capital in order to bear our share of expenses with respect to the Putumayo 4 Block, the Maranta Block and Avante Colombia’s projects:

| | ● | Approximately $2.8 million in the Putumayo 4 Block, related to Phase 1 seismic acquisition and permitting activities; |

| | ● | Approximately $5.4 million in the Maranta Block, related to Phase 3 processing of the recently acquired 25 km of 3D seismic, conducting a workover on the Mirto-1 well, the drilling of two or three appraisal wells and the construction of the production facilities at the field; and |

| | ● | Up to $3.4 million on Rio de Oro and Puerto Barco, related to additional seismic in the area and either deepening an existing well or drilling an additional well. |

Additionally, we are actively pursuing strategic and acquisition opportunities with the goal of adding production and proven reserves to our current project portfolio. While we have no definitive agreements or binding letters of intent in place with respect to any acquisition or strategic transactions, we may enter into one or more definitive agreement by the end of 2010. We believe that current market conditions, (e.g., current WTI crude prices) are optimal for entering into corporate transactions and/or acquisitions and we plan to aggressively execute this strategy during 2010, provided that our assessment of market conditions remains favorable.

Governmental Regulation

The oil and gas industry in Colombia is broadly regulated. Rights and obligations with regard to exploration, development and production activities are explicit for each project; economics are governed by a royalty/tax regime. Various government approvals are required for acquisitions and transfers of exploration and exploitation rights, including, meeting financial, operational, legal and technical qualification criteria. Oil and gas concessions are typically granted for fixed terms with opportunity for extension.

Colombia

In Colombia, state owned Ecopetrol was formerly responsible for all activities related to the exploration, production, refining, transportation and marketing of oil for export. Historically, all oil and gas exploration and production was governed by agreements granted to local and foreign operators, under Association or Shared Risk Contracts with companies and joint ventures which generally provided Ecopetrol with back-in rights that allowed for Ecopetrol to acquire a working interest share in any commercial discovery by paying its share of the costs for that discovery. Alternatively, exploration and production of certain areas and of those areas relinquished by operators, were operated directly by Ecopetrol.

Effective January 1, 2004, the regulatory regime in Colombia underwent a significant change with the formation of the Agencia Nacional de Hidrocarburos - ANH. The ANH is now exclusively responsible for regulating the Colombian oil industry, including managing all exploration areas not subject to a previously existing Association contract and collecting royalty payments on behalf of the Colombian government. The former state oil company, Ecopetrol, maintains title to agreements executed before January 1, 2004 and its own operated exploration, production, refining and transportation activities across the country. It also continues to internationally market its oil related products and has become a direct competitor of private operators in E&P projects.

Ecopetrol is a Mixed Economy Company (private and public equity), established as a stock corporation, with a commercial orientation.

In conjunction with this change, the ANH developed a new exploration risk contract that took effect during the first quarter of 2005. This exploration and production contract has significantly changed the way the industry views Colombia. In place of the earlier Association contracts in which Ecopetrol had a direct co-management of the contract together with the associate and an immediate back-in to production, the new ANH agreement provides full risk/reward benefits for the contractor. Under the terms of the contract, the E&P operator retains the rights to all reserves, production and income from any new exploration block, subject to an existing royalty (variable royalty from 8% to 25% depending upon daily production rates) and an additional royalty for the ANH, payable beginning when total production reaches 5 MBBLS.

E&P companies have to comply with certain minimum requirements (legal, operational, financial, and technical) to become eligible to be granted an ANH Exploration and Production contract. Companies can also apply for Technical Evaluation Agreements (TEA). Domiciled and non domiciled oil companies may participate in the various bidding rounds for E&P contracts on and offshore in Colombia. In a bidding round, the companies that offer greater investment programs in the initial exploration phase (Phase 1) and, in some cases, that provide ANH with a higher participation in production will be the ones to be awarded E&P contracts.

Colombia, in the last few years has become very attractive to foreign oil, gas and mining investors as a result of political and regulation stability, perceived good contract terms and conditions and improved security. It is, therefore, a competitive environment for us, with good business opportunities available.

See “Risk Factors” for information regarding the regulatory risks that we face.

Environmental Regulation – Community Relations

Our activities will be subject to existing laws and regulations governing environmental quality and pollution control in the foreign countries where we expect to maintain operations. Our activities with respect to exploration, drilling and production from wells, facilities, including the operation and construction of pipelines, plants and other facilities for transporting, processing, treating or storing crude oil and other products, will be subject to stringent environmental regulation by regional, provincial and federal authorities in Colombia. Such regulations relate to, for example, environmental impact studies, permissible levels of air and water emissions, control of hazardous wastes, construction of facilities, recycling requirements and reclamation standards. Risks are inherent in oil and gas exploration, development and production operations, and we can give no assurance that significant costs and liabilities will not be incurred in connection with environmental compliance issues. There can be no assurance that all licenses and permits which may be required to carry out exploration and production activities will be obtainable on reasonable terms or on a timely basis, or that such laws and regulations would not have an adverse effect on any project that we may wish to undertake.

In some countries in South America, it is usually required for oil and gas E&P companies to present their operational plans to local communities or indigenous populations living in the area of a proposed project before project activities can be initiated. Usually, E&P companies try to benefit the community in which they are operating by hiring local, unskilled labor or contracting locally for services such as workers’ transportation. For La Cortez Energy, working with local communities will be an essential part of our work program for the development of any of our E&P projects in the region.

Competition

The oil and gas industry is highly competitive. We face competition from both local and international companies in matters such as acquiring properties, contracting for drilling equipment and securing trained personnel. Many of these competitors have financial and technical resources that exceed ours, and we believe that these companies have a competitive advantage in these areas. Others are smaller, and we believe our technical and managerial capabilities give us a competitive advantage over these companies.

Research and Development

We have not spent any amounts on research and development activities during either of the last two fiscal years.

Employees

We currently have 12 full time employees, all of whom, including our Chief Executive Officer, Andrés Gutierrez, our Exploration Manager, Mr. Carlos Lombo, and our Production and Operations Manager, William Giron, are based in our executive offices in Bogotá, Colombia.

We intend to continue to build an experienced leadership team of energy industry veterans with direct exploration and production experience in the region combined with an efficient managerial and administrative staff, to enable us to achieve our strategic and operational goals.

Additionally, we expect to maintain a highly competitive assembly of experienced and technically proficient employees, motivating them through a positive, team oriented work environment and our incentive stock ownership plan. We believe that employee ownership, which is encouraged through our 2008 Equity Incentive Plan, is essential for attracting, retaining and motivating qualified personnel.

Legacy Business Formation and Split-Off

The Company was incorporated in the State of Nevada on June 9, 2006, under the name La Cortez Enterprises, Inc. to pursue certain business opportunities in Mexico. La Cortez Enterprises, Inc. was originally formed to create, market and sell gourmet chocolates wholesale and retail throughout Mexico, as more fully described in our registration statement on Form SB-2 as filed with the Securities and Exchange Commission (the “SEC”) on November 7, 2006 (the “Legacy Business”). In early 2008 after the Legacy Business terminated, our new Board of Directors decided to redirect the Company’s efforts towards identifying and pursuing business in the oil and gas sector in South America. As a reflection of this change in our strategic direction, we changed our name to La Cortez Energy, Inc.

In connection with the discontinuation of our Legacy Business, we decided to sell all of the assets and liabilities of the Legacy Business (the “Split-Off”) to Maria de la Luz, our founding stockholder.

As of August 15, 2008, we assigned all of our assets and property and all of our liabilities relating to the Legacy Business, accrued, contingent or otherwise to our newly organized, wholly owned subsidiary, de la Luz Gourmet Chocolates, Inc., a Nevada corporation (“Split-Off Sub”). Additionally, we sold all the outstanding capital stock of Split-Off Sub to Ms. de la Luz in exchange for 9,000,000 shares of our common stock previously surrendered by Ms. de la Luz and all of our common stock that Ms. de la Luz then owned, an additional 2,250,000 shares.

Pursuant to the terms of the Split-Off, Ms. de la Luz agreed to indemnify us and our officers and directors against any third party claims relating to the Legacy Business.

As of August 15, 2008, Ms. de la Luz is no longer a stockholder in the Company.

In conjunction with the Split-Off Agreement and effective as of August 15, 2008, we entered into a General Release Agreement with Split-Off Sub and Ms. de la Luz, whereby Split-Off Sub and Ms. de la Luz pledged not to sue us from any and all claims, actions, obligations, liabilities and the like, incurred by Split-Off Sub or Ms. de la Luz arising from any fact, event, transaction, action or omission that occurred or failed to occur on or prior to August 15, 2008 and related to the Legacy Business.

THIS ANNUAL REPORT ON FORM 10-K CONTAINS CERTAIN STATEMENTS RELATING TO FUTURE EVENTS OR THE FUTURE FINANCIAL PERFORMANCE OF OUR COMPANY. YOU ARE CAUTIONED THAT SUCH STATEMENTS ARE ONLY PREDICTIONS AND INVOLVE RISKS AND UNCERTAINTIES, AND THAT ACTUAL EVENTS OR RESULTS MAY DIFFER MATERIALLY. IN EVALUATING SUCH STATEMENTS, YOU SHOULD SPECIFICALLY CONSIDER THE VARIOUS FACTORS IDENTIFIED IN THIS ANNUAL REPORT ON FORM 10-K, INCLUDING THE MATTERS SET FORTH BELOW, WHICH COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE INDICATED BY SUCH FORWARD-LOOKING STATEMENTS.

RISKS RELATED TO OUR BUSINESS AND FINANCIAL CONDITION

We are an early stage oil and gas exploration and production company with very limited operating history for you to evaluate our business. We may never attain profitability.

We are an early stage oil and gas exploration and production company and very limited oil and no natural gas operations. We do not have a full management team in place. As an early stage oil and gas exploration and development company with very limited operating history, it is difficult for potential investors to evaluate our business. Our proposed operations are therefore subject to all of the risks inherent in light of the expenses, difficulties, complications and delays frequently encountered in connection with the formation of any new business, as well as those risks that are specific to the oil and gas industry and to that industry in South America, in particular. Investors should evaluate us in light of the delays, expenses, problems and uncertainties frequently encountered by companies developing markets for new products, services and technologies. We may never overcome these obstacles.

Our senior management team is relatively new to our company and may not be able to develop and execute a successful business strategy.

Although our Chief Executive Officer is experienced in the oil and gas industry in South America, he is relatively new to our Company which itself is new to this business. Our Chief Executive Officer is in the process of developing and executing a business strategy for the Company including, for example, the possible acquisition of oil and gas resources or the participation in joint exploration and production ventures. If our Chief Executive Officer is not able to develop a business strategy that is appropriate for our Company and which we can execute in a successful manner, our business could fail and we could lose all of our money.

We may be unable to obtain development rights that we need to build our business, and our financial condition and results of operations may deteriorate.

Our business plan focuses on international exploration and production opportunities in South America, initially in Colombia. Thus far, we have signed two participation interest agreements with partners in Colombia, only one of which (Maranta) is operational, and have acquired one non-producing company (Avante Colombia). In the event that these two initial projects do not proceed successfully or we do not succeed in negotiating any other property acquisitions, our future prospects will likely be substantially limited, and our financial condition and results of operations may deteriorate.

Our business is speculative and dependent upon the implementation of our business plan and our ability to enter into agreements with third parties for the rights to exploit potential oil and gas reserves on terms that will be commercially viable for us.

We may not be able to renegotiate Avante Colombia’s agreements with Ecopetrol in a manner that would permit us to successfully execute our plans with respect to the affected projects.

Our plans with respect to Avante Colombia’s business depend, among other things, on obtaining an extension of the term of existing contracts between Avante Colombia and Ecopetrol, which expire in December 2013. We believe that, in order to negotiate a term extension, we will have to commit to additional investment in the area. There can be no assurance that we will be able to negotiate a term extension with Ecopetrol or to do so on favorable terms. If we fail to obtain a sufficient extension, or to do so on sufficiently favorable terms, it would have a material adverse effect on our planned operations for Avante Colombia.

Our lack of diversification will increase the risk of an investment in our common stock.

Our business will focus on the oil and gas industry in a limited number of properties, initially in Colombia, with the intention of expanding elsewhere in South America. Larger companies have the ability to manage their risk by diversification. However, we will lack diversification, in terms of both the nature and geographic scope of our business. As a result, factors affecting our industry or the regions in which we operate will likely impact us more acutely than if our business were more diversified.

Strategic relationships upon which we may rely are subject to change, which may diminish our ability to conduct our operations.

Our ability to successfully bid on and acquire properties, to discover reserves, to participate in drilling opportunities and to identify and enter into commercial arrangements with customers will depend on developing and maintaining close working relationships with industry participants and on our ability to select and evaluate suitable properties and to consummate transactions in a highly competitive environment. These realities are subject to change and may impair La Cortez Energy’s ability to grow.

To develop our business, we will endeavor to use the business relationships of our management and our Board of Directors to enter into strategic relationships, which may take the form of joint ventures with other private parties or with local government bodies, or contractual arrangements with other oil and gas companies, including those that supply equipment and other resources that we will use in our business. We may not be able to establish these strategic relationships, or if established, we may not be able to maintain them. In addition, the dynamics of our relationships with strategic partners may require us to incur expenses or undertake activities we would not otherwise be inclined to in order to fulfill our obligations to these partners or maintain our relationships. If our strategic relationships are not established or maintained, our business prospects may be limited, which could diminish our ability to conduct our operations.

Our strategic partners may change ownership or senior management, and this may negatively affect our business relationships with these partners and our results of operations.

Our strategic partners may change ownership or senior management, and this may negatively affect our business relationships with these partners and our results of operations. It is possible that the change of ownership of any of our current or future strategic partners could have a negative impact on our relationship with them and we could lose our investment and suffer considerable losses if any of them should choose to discontinue our relationship or their involvement in a particular project or their operations in Colombia.

Competition in obtaining rights to explore and develop oil and gas reserves and to market our production may impair our business.

The oil and gas industry is extremely competitive. Present levels of competition for oil and gas resources in South America, and particularly in Colombia, are high. Significant amounts of capital are being raised world-wide and directed towards the South American markets and more and more companies are pursuing the same opportunities. Other oil and gas companies with greater resources than ours will compete with us by bidding for exploration and production licenses and other properties and services we will need to operate our business in the countries in which we expect to operate. Additionally, other companies engaged in our line of business may compete with us from time to time in obtaining capital from investors. Competitors include larger, foreign owned companies, which, in particular, may have access to greater financial resources than us, may be more successful in the recruitment and retention of qualified employees and may conduct their own refining and petroleum marketing operations, which may give them a competitive advantage. In addition, actual or potential competitors may be strengthened through the acquisition of additional assets and interests. Because of some or all of these factors, we may not be able to compete.

We may be unable to obtain additional capital that we will require to implement our business plan, which could restrict our ability to grow.

Our current capital and our other existing financial resources may not be sufficient to enable us to execute our business plan. We may not have funds sufficient for any initial investments we might want to undertake. Currently, we are generating only limited revenues. We will require additional capital to continue to operate our business beyond the initial phase, and we may need additional capital to develop and expand our exploration and development programs. We may be unable to obtain the additional capital required. Furthermore, inability to obtain capital may damage our reputation and credibility with industry participants in the event we cannot close previously announced transactions.

We expect to require approximately $2.8 million for our share of costs related to Phase 1 seismic acquisition and permitting activities in the Putumayo 4 Block during 2010. We expect to require an additional approximately $5.4 million for our share of Phase 3 costs with respect to the Maranta Block in 2010, related to processing of the recently acquired 25 km of 3d seismic, conducting a workover on the Mirto-1 well, the drilling of two appraisal wells and the construction of the production facilities at the field. If our negotiations with Ecopetrol regarding extending the contract terms for Rio de Oro and Puerto Barco are successful, then we expect to require up to $15 million of additional funds to pay for our share of costs with respect to additional seismic in the area and, depending upon seismic results, drilling an additional well during the next two years.

If we are not able to raise the required funds, we will not be able to meet our funding commitments on the Putumayo 4 Block, the Maranta Block and the Rio de Oro and Puerto Barco fields. As a result, we may lose our interests in these projects and all previously invested capital.

Because we are an early stage exploration and development company with limited resources, we may not be able to compete in the capital markets with much larger, established companies that have ready access to large sums of capital.

Future acquisitions and future exploration, development, production and marketing activities, as well as our administrative requirements (such as salaries, insurance expenses and general overhead expenses, as well as legal compliance costs and accounting expenses) will require a substantial amount of additional capital and cash flow.

We will require such additional capital in the near term and we plan to pursue sources of such capital through various financing transactions or arrangements, including joint venturing of projects, debt financing, equity financing or other means. We may not be successful in locating suitable financing transactions in the time period required or at all, and we may not obtain the capital we require by other means. If we do succeed in raising additional capital, the capital received may not be sufficient to fund our operations going forward without obtaining further, additional capital financing. Furthermore, future financings are likely to be dilutive to our stockholders, as we will most likely issue additional shares of our common stock or other equity to investors in future financing transactions. In addition, debt and other mezzanine financing may involve a pledge of assets and may be senior to interests of equity holders.

Our ability to obtain needed financing may be impaired by such factors as conditions in the capital markets (both generally and in the oil and gas industry in particular), our status as a new enterprise without a demonstrated operating history, the location of our prospective oil and natural gas properties in developing countries and prices of oil and natural gas on the commodities markets (which will impact the amount of asset-based financing available to us) and/or the loss of key management. Further, if oil and/or natural gas prices on the commodities markets decrease, then our potential revenues will likely decrease, and such decreased future revenues may increase our requirements for capital. Some of the contractual arrangements governing our operations may require us to maintain minimum capital, and we may lose our contract rights (including exploration, development and production rights) if we do not have the required minimum capital. If the amount of capital we are able to raise from financing activities, together with our revenues from operations, is not sufficient to satisfy our capital needs (even to the extent that we reduce our operations), we may be required to cease our operations.

There is substantial doubt as to the Company’s ability to continue as a going concern.

In the course of its development activities, the Company has sustained losses and expects such losses to continue through at least December 31, 2010. The Company expects to finance its operations primarily through its existing cash and any future financing. However, there exists substantial doubt about the Company’s ability to continue as a going concern for a period longer than the next twelve months, because the Company will be required to obtain additional capital in the future to continue its operations and there is no assurance that it will be able to obtain such capital, through equity or debt financing, or any combination thereof, or on satisfactory terms or at all. Our independent auditors have included an explanatory paragraph in their report on our consolidated financial statements included in this report that raises substantial doubt about our ability to continue as a going concern. Our audited consolidated financial statements have been prepared in accordance with generally accepted accounting principles applicable to a going concern, which implies we will continue to meet our obligations and continue our operations for the next twelve months. Realization values may be substantially different from carrying values as shown, and our consolidated financial statements do not include any adjustments relating to the recoverability or classification of recorded asset amounts or the amount and classification of liabilities that might be necessary as a result of the going concern uncertainty.

We may be unable to meet our capital requirements in the future, causing us to curtail future growth plans or cut back existing operations.

We will need additional capital in the future, which may not be available to us on reasonable terms or at all. The raising of additional capital may dilute our stockholders’ interests. We may need to raise additional funds through public or private debt or equity financings in order to meet various objectives, including but not limited to:

| | · | complying with funding obligations under our existing contractual commitments; |

| | · | pursuing growth opportunities, including more rapid expansion; |

| | · | acquiring complementary businesses; |

| | · | making capital improvements to improve our infrastructure; |

| | · | hiring qualified management and key employees; |

| | · | responding to competitive pressures; |

| | · | complying with licensing, registration and other requirements; and |

| | · | maintaining compliance with applicable laws. |

Any additional capital raised through the sale of equity may dilute stockholders’ ownership percentage in us. This could also result in a decrease in the fair market value of our equity securities because our assets would be owned by a larger pool of outstanding equity. The terms of securities we issue in future capital transactions may be more favorable to our new investors, and may include preferences, superior voting rights, the issuance of warrants or other derivative securities, and issuances of incentive awards under equity employee incentive plans, which may have a further dilutive effect.

Furthermore, any additional financing we may need may not be available on terms favorable to us, or at all. If we are unable to obtain required additional financing, we may be forced to curtail our growth plans or cut back our existing operations.

We may incur substantial costs in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which will adversely impact our financial condition.

We may not be able to effectively manage our growth, which may harm our profitability.

Our strategy envisions building and expanding our business. If we fail to effectively manage our growth, our financial results could be adversely affected. Growth may place a strain on our management systems and resources. We must continue to refine and expand our business development capabilities, our systems and processes and our access to financing sources. As we grow, we must continue to hire, train, supervise and manage new employees. We cannot assure you that we will be able to:

| | · | expand our systems effectively or efficiently or in a timely manner; |

| | · | optimally allocate our human resources; |

| | · | identify and hire qualified employees or retain valued employees; or |

| | · | incorporate effectively the components of any business that we may acquire in our effort to achieve growth. |

If we are unable to manage our growth and our operations, our financial results could be adversely affected by inefficiency, which could diminish our profitability.

Our business may suffer if we do not attract and retain talented personnel.

Our success will depend in large measure on the abilities, expertise, judgment, discretion, integrity and good faith of our management and other personnel in conducting the business of La Cortez Energy. We are in the process of building our management team which currently consists of Andrés Gutierrez, our President and Chief Executive Officer, Nadine C. Smith, our Chairman, Vice President, Interim Chief Financial Officer and Interim Treasurer, Carlos Lombo, our Exploration Manager, and William Giron, our Production and Operations Manager, as well as a controller, an accountant, a geologist, an administrative/HR analyst and an administrative assistant. We need to hire a Chief Financial Officer. The loss of any of these individuals or our inability to hire a qualified Chief Financial Officer or attract suitably qualified staff could materially adversely impact our business. We may also experience difficulties in certain jurisdictions in our efforts to obtain suitably qualified staff and retaining staff who are willing to work in that jurisdiction. We do not currently carry “key man” life insurance on our key employees.

Our success depends on the ability of our management and employees to interpret market and geological data correctly and to interpret and respond to economic market and other conditions in order to locate and adopt appropriate investment opportunities, monitor such investments and ultimately, if required, successfully divest such investments. Further, our key personnel may not continue their association or employment with La Cortez Energy and we may not be able to find replacement personnel with comparable skills. We have sought to and will continue to ensure that management and any key employees are appropriately compensated; however, their services cannot be guaranteed. If we are unable to attract and retain key personnel, our business may be adversely affected.

If we are unable to hire a chief financial officer with public company experience, our ability to adequately manage the company’s finance function may be compromised.

Nadine C. Smith is currently serving as our interim Chief Financial Officer. Although Ms. Smith has experience as a private company chief financial officer and qualifies as an “audit committee financial expert,” she needs to dedicate a considerable portion of her time and energy to her functions as Chairman of our Board of Directors. We intend to hire a new Chief Financial Officer as soon as possible but if we are not able to do so, the Company may not be able to comply with ongoing regulatory internal financial control and reporting requirements. Additionally, without an experienced public company Chief Financial Officer, the Company may not be able to adequately manage its finance function with respect to capital management, cost control and cash flow and as a result, its financial performance may suffer.

Our management team does not have extensive experience in U.S. public company matters, which could impair our ability to comply with U.S. legal and regulatory requirements.