UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 1-33100

Owens Corning

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 43-2109021 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

One Owens Corning Parkway, Toledo, OH | | 43659 |

| (Address of principal executive offices) | | (Zip Code) |

(419) 248-8000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule12b-2 of the Exchange Act. (Check one):

Large accelerated filer þ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

On June 28, 2013, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of $0.01 par value common stock (the voting stock of the registrant) held by non-affiliates (assuming for purposes of this computation only that the registrant had no affiliates) was approximately $4,654,656,423.

As of January 31, 2014, 117,835,363 shares of the registrant’s common stock, par value $0.01 per share, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of Owens Corning’s proxy statement to be delivered to stockholders in connection with the Annual Meeting of Stockholders to be held on April 17, 2014 (the “2014 Proxy Statement”) are incorporated by reference into Part III hereof.

-1-

PART I

OVERVIEW

Owens Corning was founded in 1938. Since then the Company has continued to grow as a market-leading innovator of glass fiber technology. Owens Corning is a world leader in composite and building materials systems, delivering a broad range of high-quality products and services. Our products range from glass fiber used to reinforce composite materials for transportation, electronics, marine, infrastructure, wind-energy and other high-performance markets to insulation and roofing for residential, commercial and industrial applications.

Unless the context indicates otherwise, the terms “Owens Corning,” “Company,” “we” and “our” in this report refer to Owens Corning and its subsidiaries. References to a particular year mean the Company’s year commencing on January 1 and ending on December 31 of that year.

SEGMENT OVERVIEW

We operate within two segments: Composites, which includes our Reinforcements and Downstream businesses; and Building Materials, which includes our Insulation and Roofing businesses. Our Composites and Building Materials reportable segments accounted for approximately 34 percent and 66 percent of our total reportable segment net sales, respectively, in 2013.

Note 2 to the Consolidated Financial Statements contains information regarding net sales to external customers and total assets attributable to each of Owens Corning’s reportable segments and geographic regions, earnings before interest and taxes for each of Owens Corning’s reportable segments, and information concerning the dependence of our reportable segments on foreign operations, for each of the years 2013, 2012 and 2011.

Composites

Owens Corning glass fiber materials can be found in over 40,000 end-use applications within seven primary markets: power and energy, housing, water distribution, industrial, transportation, consumer and aerospace/military. Such end-use applications include pipe, roofing shingles, sporting goods, computers, telecommunications cables, boats, aircraft, defense, automotive, industrial containers and wind-energy. Our products are manufactured and sold worldwide. We primarily sell our products directly to parts molders and fabricators. Within the building and construction market, our Composites segment sells glass fiber and/or glass mat directly to a small number of major shingle manufacturers, including our own Roofing business.

Our Composites segment is comprised of our Reinforcements and Downstream businesses. Within the Reinforcements business, the Company manufactures, fabricates and sells glass reinforcements in the form of fiber. Within the Downstream business, the Company manufactures and sells glass fiber products in the form of fabrics, mat, veil and other specialized products.

Demand for composites is driven by general global economic activity and, more specifically, by the increasing replacement of traditional materials such as aluminum, wood and steel with composites that offer lighter weight, improved strength, lack of conductivity and corrosion resistance. We estimate that over the last 15 years, on average, annual global demand for composite materials grew at about 1.5 times global GDP.

We compete with composite manufacturers worldwide. According to various industry reports and Company estimates, our Composites segment is a world leader in the production of glass fiber reinforcement materials. Primary methods of competition include innovation, quality, customer service and global geographic reach. For

-2-

| ITEM 1. | BUSINESS (continued) |

our commodity products, price is also a method of competition. Significant competitors to the Composites segment include China Fiberglass Co., Ltd., Chongqing Polycom International Corporation Ltd (CPIC), PPG Industries, Taishan Glass Fiber Co., Ltd, and Johns Manville.

Our manufacturing operations in this segment are generally continuous in nature, and we warehouse much of our production prior to sale since we operate primarily with short delivery cycles.

Building Materials

Our Building Materials reportable segment is comprised of the following businesses:

Insulation

Our insulating products help customers conserve energy, provide improved acoustical performance and offer convenience of installation and use, making them a preferred insulating product for new home construction and remodeling. These products include thermal and acoustical batts, loose fill insulation, foam sheathing and accessories, and are sold under well-recognized brand names and trademarks such as Owens Corning PINK® FIBERGLAS™ Insulation. Our Insulation business also manufactures and sells glass fiber pipe insulation, energy efficient flexible duct media, bonded and granulated mineral wool insulation and foam insulation used in above- and below-grade construction applications. We sell our insulation products primarily to insulation installers, home centers, lumberyards, retailers and distributors in the United States and Canada.

Demand for Owens Corning’s insulating products is driven by new residential construction, remodeling and repair activity, commercial and industrial construction activity, increasingly stringent building codes and the growing need for energy efficiency. Sales in this business typically follow seasonal home improvement, remodeling and renovation and new construction industry patterns. Demand for new residential construction typically follows on a three-month lagged basis. The peak season for home construction and remodeling in our geographic markets generally corresponds with the second and third calendar quarters, and therefore, our sales levels are typically higher during the second half of the year.

Our Insulation business competes primarily with manufacturers in the United States. According to various industry reports and Company estimates, Owens Corning is North America’s largest producer of residential, commercial and industrial insulation, and the second-largest producer of extruded polystyrene foam insulation. Principal methods of competition include innovation and product design, service, location, quality, price and compatibility of systems solutions. Significant competitors in this business include CertainTeed Corporation, Johns Manville, Dow Chemical and Knauf Insulation.

Our Insulation business includes a diverse portfolio with a geographic mix of United States, Canada, Asia-Pacific, and Latin America, a market mix of residential, commercial, industrial and other markets, and a channel mix of retail, contractor and distribution.

Working capital practices for this business historically have followed a seasonal cycle. Typically, our insulation plants run continuously throughout the year. This production plan, along with the seasonal nature of the business, generally results in higher finished goods inventory balances in the first half of the year. Since sales increase during the second half of the year, our accounts receivable balances are typically higher during this period.

Roofing

Our primary products in the Roofing business are laminate and strip asphalt roofing shingles. Other products include oxidized asphalt and roofing accessories. We have been able to meet the growing demand for longer lasting, aesthetically attractive laminate products with modest capital investment.

-3-

| ITEM 1. | BUSINESS (continued) |

We sell shingles and roofing accessories primarily through home centers, lumberyards, retailers, distributors and contractors in the United States and sell other asphalt products internally to manufacture residential roofing products and externally to other roofing manufacturers. We also sell asphalt to roofing contractors and distributors for built-up roofing asphalt systems and to manufacturers in a variety of other industries, including automotive, chemical, rubber and construction.

Demand for products in our Roofing business is generally driven by both residential repair and remodeling activity and by new residential construction. Roofing damage from major storms can significantly increase demand in this business. As a result, sales in this segment do not always follow seasonal home improvement, remodeling and new construction industry patterns as closely as our Insulation business.

Our Roofing business competes primarily with manufacturers in the United States. According to various industry reports and Company estimates, Owens Corning’s Roofing business is the second largest producer of asphalt roofing shingles in the United States. Principal methods of competition include innovation and product design, proximity to customers and quality. Significant competitors in the Roofing business include GAF, CertainTeed Corporation and TAMKO.

Our manufacturing operations are generally continuous in nature, and we warehouse much of our production prior to sale since we operate with relatively short delivery cycles. One of the raw materials important to this business is sourced from a sole supplier. We have a long-term supply contract for this material, and have no reason to believe that any availability issues will exist. If this supply was to become unavailable, our production could be interrupted until such time as the supplies again became available or the Company reformulated its products. Additionally, the supply of asphalt, another significant raw material in this segment, has been constricted at times. Although this has not caused an interruption of our production in the past, prolonged asphalt shortages would restrict our ability to produce products in this business.

GENERAL

Major Customers

No one customer accounted for more than 10 percent of our consolidated net sales for 2013. A significant portion of the net sales in our Building Materials segment is generated from large United States home improvement retailers.

Intellectual Property

We rely on a combination of intellectual property laws, as well as confidentiality procedures and contractual provisions, to protect our proprietary technology and our brands. Through continuous and extensive use of the color PINK since 1956, Owens Corning became the first owner of a single color trademark registration. In addition to our Owens Corning and PINK brands, we have registered, and applied for the registration of, U.S. and international trademarks, service marks, and domain names. Additionally, we have filed U.S. and international patent applications, including numerous issued patents, covering certain of our proprietary technology resulting from research and development efforts. Over time, we have assembled a portfolio of intellectual property rights including patents, trademarks, service marks, copyrights, domain names, know-how and trade secrets covering our products and services. Our proprietary technology is not dependent on any single or group of intellectual property rights and we do not expect the expiration of existing intellectual property to have a material adverse affect on the business as a whole. We believe the duration of our patents is adequate relative to the expected lives of our products. Although we protect our proprietary technology, any significant impairment of, or third-party claim against, our intellectual property rights could harm our business or our ability to compete.

-4-

| ITEM 1. | BUSINESS (continued) |

Backlog

Our customer volume commitments are generally short term, and we do not have a significant backlog of orders.

Research and Development

The Company’s research and development expense during each of the last three years is presented in the table below (in millions):

| | | | |

Period | | Research and

Development Expense | |

Twelve Months Ended December 31, 2013 | | $ | 77 | |

Twelve Months Ended December 31, 2012 | | $ | 79 | |

Twelve Months Ended December 31, 2011 | | $ | 77 | |

Environmental Control

Owens Corning is committed to complying with all environmental laws and regulations that are applicable to our operations. We are dedicated to continuous improvement in our environmental, health and safety performance.

We have not experienced a material adverse effect upon our capital expenditures or competitive position as a result of environmental control legislation and regulations. Operating costs associated with environmental compliance were approximately $34 million in 2013. We continue to invest in equipment and process modifications to remain in compliance with applicable environmental laws and regulations worldwide.

Our manufacturing facilities are subject to numerous national, state and local environmental protection laws and regulations. Regulatory activities of particular importance to our operations include those addressing air pollution, water pollution, waste disposal and chemical control. The most significant current regulatory activity is the United States Environmental Protection Agency’s ongoing evaluation of the past air emission and air permitting activities of the glass industry, including fiberglass insulation. We expect passage and implementation of new laws and regulations specifically addressing climate change, toxic air emissions, ozone forming emissions and fine particulate during the next two to five years. However, based on information known to the Company, including the nature of our manufacturing operations and associated air emissions, at this time we do not expect any of these new laws, regulations or activities to have a material adverse effect on our results of operations, financial condition or long-term liquidity.

We have been deemed by the United States Environmental Protection Agency to be a Potentially Responsible Party (“PRP”) with respect to certain sites under the Comprehensive Environmental Response Compensation and Liability Act. We have also been deemed a PRP under similar state or local laws and in other instances other PRPs have brought suits against us as a PRP for contribution under such federal, state, or local laws. At December 31, 2013, we had environmental remediation liabilities as a PRP at 20 sites where we have a continuing legal obligation to either complete remedial actions or contribute to the completion of remedial actions as part of a group of PRPs. For these sites we estimate a reserve to reflect environmental liabilities that have been asserted or are probable of assertion, in which liabilities are probable and reasonably estimable. At December 31, 2013, our reserve for such liabilities was $5 million.

Number of Employees

As of December 31, 2013 Owens Corning had approximately 15,000 employees. Approximately 7,000 of such employees are subject to collective bargaining agreements. We believe that our relations with employees are good.

-5-

| ITEM 1. | BUSINESS (continued) |

AVAILABILITY OF INFORMATION

Owens Corning makes available, free of charge, through its website the Company’s Annual Report onForm 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission. These documents are available through the Investor Relations page of the Company’s website at www.owenscorning.com.

-6-

RISKS RELATED TO OUR BUSINESS AND OUR INDUSTRY

Low levels of residential or commercial construction activity can have a material adverse impact on our business and results of operations.

A large portion of our products are used in the markets for residential and commercial construction, repair and improvement, and demand for certain of our products is affected in part by the level of new residential construction in the United States, although typically not until a number of months after the change in the level of construction. Historically, construction activity has been cyclical and is influenced by prevailing economic conditions, including the level of interest rates and availability of financing and other factors outside our control.

We face significant competition in the markets we serve and we may not be able to compete successfully.

All of the markets we serve are highly competitive. We compete with manufacturers and distributors, both within and outside the United States, in the sale of building products and composite products. Some of our competitors may have superior financial, technical, marketing and other resources than we do. In some cases, we face competition from manufacturers in countries able to produce similar products at lower costs. We also face competition from the introduction by competitors of new products or technologies that may address our customers’ needs in a better manner, whether based on considerations of pricing, usability, effectiveness, sustainability or other features or benefits. If we are not able to successfully commercialize our innovation efforts, we may lose market share. Price competition or overcapacity may limit our ability to raise prices for our products when necessary, may force us to reduce prices and may also result in reduced levels of demand for our products and cause us to lose market share. In addition, in order to effectively compete, we must continue to develop new products that meet changing consumer preferences and successfully develop, manufacture and market these new products. Our inability to effectively compete could result in the loss of customers and reduce the sales of our products, which could have a material adverse impact on our business, financial condition and results of operations.

Our sales may fall rapidly in response to declines in demand because we do not operate under long-term volume agreements to supply our customers and because of customer concentration in certain segments.

Many of our customer volume commitments are short-term; therefore, we do not have a significant manufacturing backlog. As a result, we do not benefit from the hedge provided by long-term volume contracts against downturns in customer demand and sales. Further, we are not able to immediately adjust our costs in response to declines in sales. In addition, although no single customer represents more than 10 percent of our annual sales, our ability to sell some of the products in our building materials product category is dependent on a limited number of customers, who account for a significant portion of such sales. The loss of key customers for these products, or a significant reduction in sales to those customers, could significantly reduce our revenues from these products. In addition, if key customers experience financial pressure, they could attempt to demand more favorable contractual terms, which would place additional pressure on our margins and cash flows. Lower demand for our products, loss of key customers and material changes to contractual terms could materially and adversely impact our business, financial condition and results of operations.

Worldwide economic conditions and credit tightening could have a material adverse impact on the Company.

The Company’s business may be materially and adversely impacted by changes in United States or global economic conditions, including global industrial production rates, inflation, deflation, interest rates, availability of capital, consumer spending rates, energy availability and costs, and the effects of governmental initiatives to

-7-

| ITEM 1A. | RISK FACTORS (continued) |

manage economic conditions. Volatility in financial markets and the deterioration of national and global economic conditions could materially adversely impact the Company’s operations, financial results and/or liquidity including as follows:

| | • | | the financial stability of our customers or suppliers may be compromised, which could result in reduced demand for our products, additional bad debts for the Company or non-performance by suppliers; |

| | • | | one or more of the financial institutions syndicated under the Credit Agreement applicable to our committed senior revolving credit facility may cease to be able to fulfill their funding obligations, which could materially adversely impact our liquidity; |

| | • | | it may become more costly or difficult to obtain financing or refinance the Company’s debt in the future; |

| | • | | the value of the Company’s assets held in pension plans may decline; and/or |

| | • | | the Company’s assets may be impaired or subject to write down or write off. |

Uncertainty about global economic conditions may cause consumers of our products to postpone spending in response to tighter credit, negative financial news and/or declines in income or asset values. This could have a material adverse impact on the demand for our products and on our financial condition and operating results. A deterioration of economic conditions would likely exacerbate these adverse effects and could result in a wide-ranging and prolonged impact on general business conditions, thereby negatively impacting our operations, financial results and/or liquidity.

Our level of indebtedness could adversely impact our business, financial condition or results of operations.

Our debt level and degree of leverage could have important consequences, including the following:

| | • | | they may limit our ability to obtain additional debt or equity financing for working capital, capital expenditures, debt service requirements, acquisitions and general corporate or other purposes; |

| | • | | a substantial portion of our cash flows from operations could be required for the payment of principal and interest on our indebtedness and may not be available for other business purposes; |

| | • | | certain of our borrowings are at variable rates of interest exposing us to the risk of increased interest rates; |

| | • | | if due to liquidity needs we must replace any indebtedness upon maturity, we would be exposed to the risk that we may not be able to refinance such indebtedness; |

| | • | | they may limit our ability to adjust to changing market conditions and place us at a competitive disadvantage compared to our competitors that have less debt; and |

| | • | | we may be vulnerable in a downturn in general economic conditions or in our business, or we may be unable to carry out important capital spending. |

In addition, the credit agreement governing our senior credit facility, the indentures governing our senior notes and the Receivables Purchase Agreement governing our receivables securitization facility contain various covenants that impose operating and financial restrictions on us and/or our subsidiaries.

-8-

| ITEM 1A. | RISK FACTORS (continued) |

Adverse weather conditions and the level of severe storms could have a material adverse impact on our results of operations.

Weather conditions and the level of severe storms can have a significant impact on the markets for residential and commercial construction, repair and improvement, which can in turn impact our business as follows:

| | • | | Generally, any weather conditions that slow or limit residential or commercial construction activity can adversely impact demand for our products. |

| | • | | A portion of our annual product demand is attributable to the repair of damage caused by severe storms. In periods with below average levels of severe storms, demand for such products could be reduced. |

Lower demand for our products as a result of either of these scenarios could adversely impact our business, financial condition and results of operations.

Our operations require substantial capital, leading to high levels of fixed costs that will be incurred regardless of our level of business activity.

Our businesses are capital intensive, and regularly require capital expenditures to expand operations, maintain equipment, increase operating efficiency and comply with applicable laws and regulations, leading to high fixed costs, including depreciation expense. Also, increased regulatory focus could lead to additional or higher costs in the future. We are limited in our ability to reduce fixed costs quickly in response to reduced demand for our products and these fixed costs may not be fully absorbed, resulting in higher average unit costs and lower gross margins if we are not able to offset this higher unit cost with price increases. Alternatively, we may be limited in our ability to quickly respond to unanticipated increased demand for our products, which could result in an inability to satisfy demand for our products and loss of market share.

We may be exposed to increases in costs of energy, materials and transportation or reductions in availability of materials and transportation, which could reduce our margins and have a material adverse impact on our business, financial condition and results of operations.

Our business relies heavily on certain commodities and raw materials used in our manufacturing processes. Additionally, we spend a significant amount on natural gas inputs and services that are influenced by energy prices, such as asphalt, a large number of chemicals and resins and transportation costs. Price increases for these inputs could raise costs and reduce our margins if we are not able to offset them by increasing the prices of our products, improving productivity or hedging where appropriate. Availability of certain of the raw materials we use has, from time to time, been limited, and our sourcing of some of these raw materials from a limited number of suppliers, and in some cases a sole supplier, increases the risk of unavailability. Despite our contractual supply agreements with many of our suppliers, it is possible that we could experience a lack of certain raw materials which could limit our ability to produce our products, thereby materially and adversely impact our business, financial condition and results of operations.

We are subject to risks relating to our information technology systems, and any failure to adequately protect our critical information technology systems could materially affect our operations.

We rely on information technology systems across our operations, including for management, supply chain and financial information and various other processes and transactions. Our ability to effectively manage our business depends on the security, reliability and capacity of these systems. Information technology system failures, network disruptions or breaches of security could disrupt our operations, causing delays or cancellation of customer orders or impeding the manufacture or shipment of products, processing of transactions or reporting of

-9-

| ITEM 1A. | RISK FACTORS (continued) |

financial results. An attack or other problem with our systems could also result in the disclosure of proprietary information about our business or confidential information concerning our customers or employees, which could result in significant damage to our business and our reputation.

We have put in place security measures designed to protect against the misappropriation or corruption of our systems, intentional or unintentional disclosure of confidential information, or disruption of our operations. However, advanced cyber-security threats, such as computer viruses, attempts to access information, and other security breaches, are persistent and continue to evolve making them increasingly difficult to identify and prevent. Protecting against these threats may require significant resources, and we may not be able to implement measures that will protect against all of the significant risks to our information technology systems. In addition, we rely on a number of third party service providers to execute certain business processes and maintain certain IT systems and infrastructure, any breach of security on their part could impair our ability to affectively operate. Moreover, our operations in certain geographic locations, may be particularly vulnerable to security attacks or other problems. Any breach of our security measures could result in unauthorized access to and misappropriation of our information, corruption of data or disruption of operations or transactions, any of which could have a material adverse effect on our business.

We are subject to risks associated with our international operations.

We sell products and operate plants throughout the world. Our international sales and operations are subject to risks and uncertainties, including:

| | • | | difficulties and costs associated with complying with a wide variety of complex and changing laws, treaties and regulations; |

| | • | | limitations on our ability to enforce legal rights and remedies; |

| | • | | adverse economic and political conditions, business interruption, war and civil disturbance; |

| | • | | tax inefficiencies and currency exchange controls that may adversely impact our ability to repatriate cash from non-United States subsidiaries; |

| | • | | the imposition of tariffs or other import or export restrictions; |

| | • | | costs and availability of shipping and transportation; |

| | • | | nationalization of properties by foreign governments; and |

| | • | | currency exchange rate fluctuations between the United States dollar and foreign currencies. |

As we continue to expand our business globally, we may have difficulty anticipating and effectively managing these and other risks that our international operations may face, which may adversely impact our business outside the United States and our business, financial condition and results of operations.

In addition, we operate in many parts of the world that have experienced governmental corruption and we could be adversely affected by violations of the Foreign Corrupt Practices Act (“FCPA”) and similar worldwide anti-corruption laws. The FCPA and similar anti-corruption laws in other jurisdictions generally prohibit companies and their intermediaries from making improper payments to non-U.S. officials for the purpose of obtaining or retaining business. Although we mandate compliance with these anti-corruption laws and maintain an anti-corruption compliance program, we cannot assure you that these measures will necessarily prevent violations of

-10-

| ITEM 1A. | RISK FACTORS (continued) |

these laws by our employees or agents. If we were found to be liable for violations of anti-corruption, we could be liable for criminal or civil penalties or other sanctions, which could have a material adverse impact on our business, financial condition and results of operations.

The Company’s income tax net operating loss carryforwards may be limited and our results of operations may be adversely impacted.

The Company has substantial deferred tax assets related to net operating losses (NOLs) for United States federal and state income tax purposes, which are available to offset future taxable income. However, the Company’s ability to utilize or realize the current carrying value of the NOLs may be impacted as a result of certain events, such as changes in tax legislation or insufficient future taxable income prior to expiration of the NOLs or annual limits imposed under Section 382 of the Internal Revenue Code, or by state law, as a result of a change in control. A change in control is generally defined as a cumulative change of 50 percent or more in the ownership positions of certain stockholders during a rolling three year period. Changes in the ownership positions of certain stockholders could occur as the result of stock transactions by such stockholders and/or by the issuance of stock by the Company. Such limitations may cause the Company to pay income taxes earlier and in greater amounts than would be the case if the NOLs were not subject to such limitations.

Should the Company determine that it is likely that its recorded NOL benefits are not realizable, the Company would be required to reduce the NOL tax benefit reflected on its financial statements to the net realizable amount either by a direct adjustment to the NOL tax benefit or by establishing a valuation reserve and recording a corresponding charge to current earnings. The corresponding charge to current earnings would have an adverse effect on the Company’s financial condition and results of operations in the period in which it is recorded. Conversely, if the Company is required to increase its NOL tax benefit either by a direct adjustment or reversing any portion of the accounting valuation against its deferred tax assets related to its NOLs, such credit to current earnings could have a positive effect on the Company’s business, financial condition and results of operations in the period in which it is recorded.

Our intellectual property rights may not provide meaningful commercial protection for our products or brands, which could adversely impact our business, financial condition and results of operations.

Owens Corning relies on its proprietary intellectual property, including numerous registered trademarks, as well as its licensed intellectual property. We monitor and protect against activities that might infringe, dilute, or otherwise harm our patents, trademarks and other intellectual property and rely on the patent, trademark and other laws of the United States and other countries. However, we may be unable to prevent third parties from using our intellectual property without our authorization. To the extent we cannot protect our intellectual property, unauthorized use and misuse of our intellectual property could harm our competitive position and have a material adverse impact on our business, financial condition and results of operations. In addition, the laws of some non-United States jurisdictions provide less protection for our proprietary rights than the laws of the United States and we therefore may not be able to effectively enforce our intellectual property in these jurisdictions. If we are unable to maintain certain exclusive licenses, our brand recognition and sales could be adversely impacted. Current employees, contractors and suppliers have, and former employees, contractors and suppliers may have, access to information regarding our operations which could be disclosed improperly and in breach of contract to our competitors or otherwise used to harm us.

Our hedging activities to address energy price fluctuations may not be successful in offsetting increases in those costs or may reduce or eliminate the benefits of any decreases in those costs.

In order to mitigate short-term variation in our operating results due to commodity price fluctuations, we hedge a portion of our near-term exposure to the cost of energy, primarily natural gas. The results of our hedging practices could be positive, neutral or negative in any period depending on price changes of the hedged exposures.

-11-

| ITEM 1A. | RISK FACTORS (continued) |

Our hedging activities are not designed to mitigate long-term commodity price fluctuations and, therefore, will not protect us from long-term commodity price increases. In addition, in the future, our hedging positions may not correlate to our actual energy costs, which would cause acceleration in the recognition of unrealized gains and losses on our hedging positions in our operating results.

We could face potential product liability and warranty claims, we may not accurately estimate costs related to such claims, and we may not have sufficient insurance coverage available to cover such claims.

Our products are used and have been used in a wide variety of residential and commercial applications. We face an inherent business risk of exposure to product liability or other claims in the event our products are alleged to be defective or that the use of our products is alleged to have resulted in harm to others or to property. We may in the future incur liability if product liability lawsuits against us are successful. Moreover, any such lawsuits, whether or not successful, could result in adverse publicity to us, which could cause our sales to decline.

In addition, consistent with industry practice, we provide warranties on many of our products and we may experience costs of warranty or breach of contract claims if our products have defects in manufacture or design or they do not meet contractual specifications. We estimate our future warranty costs based on historical trends and product sales, but we may fail to accurately estimate those costs and thereby fail to establish adequate warranty reserves for them. We maintain insurance coverage to protect us against product liability, warranty and breach of contract claims, but that coverage may not be adequate to cover all claims that may arise or we may not be able to maintain adequate insurance coverage in the future at an acceptable cost. Any liability not covered by insurance or that exceeds our established reserves could materially and adversely impact our business, financial condition and results of operations.

We may be subject to liability under and may make substantial future expenditures to comply with environmental laws and regulations.

Our manufacturing facilities are subject to numerous foreign, federal, state and local laws and regulations relating to the presence of hazardous materials, pollution and the protection of the environment, including those governing emissions to air, discharges to water, use, storage and transport of hazardous materials, storage, treatment and disposal of waste, remediation of contaminated sites and protection of worker health and safety.

Liability under these laws involves inherent uncertainties. Violations of environmental, health and safety laws are subject to civil, and, in some cases, criminal sanctions. As a result of these uncertainties, we may incur unexpected interruptions to operations, fines, penalties or other reductions in income which could adversely impact our business, financial condition and results of operations. Continued and increased government and public emphasis on environmental issues is expected to result in increased future investments for environmental controls at ongoing operations, which will be charged against income from future operations. Present and future environmental laws and regulations applicable to our operations, and changes in their interpretation, may require substantial capital expenditures or may require or cause us to modify or curtail our operations, which may have a material adverse impact on our business, financial condition and results of operations.

We will not be insured against all potential losses and could be seriously harmed by natural disasters, catastrophes or sabotage.

Many of our business activities involve substantial investments in manufacturing facilities and many products are produced at a limited number of locations. These facilities could be materially damaged by natural disasters such as floods, tornados, hurricanes and earthquakes or by sabotage. We could incur uninsured losses and liabilities arising from such events, including damage to our reputation, and/or suffer material losses in operational capacity, which could have a material adverse impact on our business, financial condition and results of operations.

-12-

| ITEM 1A. | RISK FACTORS (continued) |

We depend on our senior management team and other skilled and experienced personnel to operate our business effectively, and the loss of any of these individuals or the failure to attract additional personnel could adversely impact our financial condition and results of operations.

We are highly dependent on the skills and experience of our senior management team and other skilled and experienced personnel. These individuals possess sales, marketing, manufacturing, logistical, financial, business strategy and administrative skills that are important to the operation of our business. We cannot assure that we will be able to retain all of our existing senior management personnel. The loss of any of these individuals or an inability to attract additional personnel could prevent us from implementing our business strategy and could adversely impact our business and our future financial condition or results of operations.

Downgrades of our credit ratings could adversely impact us.

Our credit ratings are important to our cost of capital. The major debt rating agencies routinely evaluate our debt based on a number of factors, which include financial strength and business risk as well as transparency with rating agencies and timeliness of financial reporting. A downgrade in our debt rating could result in increased interest and other expenses on our existing variable interest rate debt, and could result in increased interest and other financing expenses on future borrowings. Downgrades in our debt rating could also restrict our access to capital markets and affect the value and marketability of our outstanding notes.

Increases in the cost of labor, union organizing activity, labor disputes and work stoppages at our facilities could delay or impede our production, reduce sales of our products and increase our costs.

The costs of labor are generally increasing, including the costs of employee benefit plans. We are subject to the risk that strikes or other types of conflicts with personnel may arise or that we may become the subject of union organizing activity at additional facilities. In particular, renewal of collective bargaining agreements typically involves negotiation, with the potential for work stoppages or increased costs at affected facilities.

We are subject to litigation in the ordinary course of business and uninsured judgments or a rise in insurance premiums may adversely impact our business, financial condition and results of operations.

In the ordinary course of business, we are subject to various claims and litigation. Any such claims, whether with or without merit, could be time consuming and expensive to defend and could divert management’s attention and resources. In accordance with customary practice, we maintain insurance against some, but not all, of these potential claims. In the future, we may not be able to maintain insurance at commercially acceptable premium levels at all. In addition, the levels of insurance we maintain may not be adequate to fully cover any and all losses or liabilities. If any significant judgment or claim is not fully insured or indemnified against, it could have a material adverse impact on our business, financial condition and results of operations.

If our efforts in acquiring and integrating other businesses, establishing joint ventures or expanding our production capacity are not successful, our business may not grow.

We have historically grown our business through acquisitions, joint ventures and the expansion of our production capacity. Our ability to grow our business through these investments depends upon our ability to identify, negotiate and finance suitable arrangements. If we cannot successfully execute on our investments on a timely basis, we may be unable to generate sufficient revenue to offset acquisition, integration or expansion costs, we may incur costs in excess of what we anticipate, and our expectations of future results of operations, including cost savings and synergies, may not be achieved. Acquisitions, joint ventures and production capacity expansions involve substantial risks, including:

| | • | | unforeseen difficulties in operations, technologies, products, services, accounting and personnel; |

| | • | | diversion of financial and management resources from existing operations; |

-13-

| ITEM 1A. | RISK FACTORS (continued) |

| | • | | unforeseen difficulties related to entering geographic regions or markets where we do not have prior experience; |

| | • | | risks relating to obtaining sufficient equity or debt financing; |

| | • | | difficulty in integrating the acquired business’ standards, processes, procedures and controls with our existing operations; |

| | • | | potential loss of key employees; and |

| | • | | potential loss of customers. |

Our failure to address these risks or other problems encountered in connection with our past or future acquisitions and investments could cause us to fail to realize the anticipated benefits of such acquisitions or investments, incur unanticipated liabilities, and harm our business generally. Future acquisitions and investments could also result in dilutive issuances of our equity securities, the incurrence of debt, contingent liabilities, or amortization expenses, or write-offs of goodwill, any of which could have a material adverse impact on our business, financial condition and results of operations. Also, the anticipated benefits of our investments may not materialize.

Our ongoing efforts to increase productivity and reduce costs may not result in anticipated savings in operating costs.

Our cost reduction and productivity efforts, including those related to our existing operations, production capacity expansions and new manufacturing platforms, may not produce anticipated results. Our ability to achieve cost savings and other benefits within expected time frames is subject to many estimates and assumptions. These estimates and assumptions are subject to significant economic, competitive and other uncertainties, some of which are beyond our control. If these estimates and assumptions are incorrect, if we experience delays, or if other unforeseen events occur, our business, financial condition and results of operations could be adversely impacted.

Significant changes in the factors and assumptions used to measure our defined benefit plan obligations, actual investment returns on pension assets and other factors could have a negative impact on our financial condition or liquidity.

We have certain defined benefit pension plans and other postretirement benefit (“OPEB”) plans. Our future funding requirements for defined benefit pension and OPEB plans depend upon a number of factors and assumptions, including our actual experience against assumptions with regard to interest rates used to determine funding levels; return on plan assets; benefit levels; participant experience (e.g., mortality and retirement rates); health care cost trends; and applicable regulatory changes. To the extent actual results are less favorable than our assumptions, there could be a material adverse impact on our financial condition and results of operations.

Additional risks exist due to the nature and magnitude of our investments, including the implementation of or changes to the investment policy, insufficient market capacity to absorb a particular investment strategy or high volume transactions, and the inability to quickly rebalance illiquid and long-term investments.

As of December 31, 2013 and 2012, our U.S. and worldwide defined benefit pension plans were underfunded by a total of $336 million and $481 million and OPEB obligations were underfunded by $244 million and $273 million. If our cash flows and capital resources are insufficient to fund our pension or OPEB obligations, we could be forced to reduce or delay investments and capital expenditures, seek additional capital, or restructure or refinance our indebtedness.

-14-

| ITEM 1A. | RISK FACTORS (continued) |

RISKS RELATED TO OWNERSHIP OF OUR COMMON STOCK

The market price of our common stock is subject to volatility.

The market price of our common stock could be subject to wide fluctuations in response to numerous factors, many of which are beyond our control. These factors include actual or anticipated variations in our operational results and cash flow, our earnings relative to our competition, changes in financial estimates by securities analysts, trading volume, sales by holders of large amounts of our common stock, short selling, market conditions within the industries in which we operate, seasonality of our business operations, the general state of the securities markets and the market for stocks of companies in our industry, governmental legislation or regulation and currency and exchange rate fluctuations, as well as general economic and market conditions, such as recessions.

We are a holding company with no operations of our own and depend on our subsidiaries for cash.

As a holding company, most of our assets are held by our direct and indirect subsidiaries and we will primarily rely on dividends and other payments or distributions from our subsidiaries to meet our debt service and other obligations and to enable us to pay dividends. The ability of our subsidiaries to pay dividends or make other payments or distributions to us will depend on their respective operating results and may be restricted by, among other things, the laws of their jurisdiction of organization (which may limit the amount of funds available for the payment of dividends or other payments), agreements of those subsidiaries, agreements with any co-investors in non-wholly-owned subsidiaries, the terms of our credit facility and senior notes and the covenants of any future outstanding indebtedness we or our subsidiaries may incur.

Provisions in our amended and restated certificate of incorporation and bylaws or Delaware law might discourage, delay or prevent a change in control of our company or changes in our management and therefore depress the trading price of our common stock.

Our amended and restated certificate of incorporation and bylaws contain provisions that could depress the trading price of our common stock through provisions that may discourage, delay or prevent a change in control of our company or changes in our management that our stockholders may deem advantageous.

Additionally, we are subject to Section 203 of the Delaware General Corporation Law, which generally prohibits a Delaware corporation from engaging in any of a broad range of business combinations with any “interested” stockholder for a period of three years following the date on which the stockholder became an “interested” stockholder and which may discourage, delay or prevent a change in control of our company.

Dividends on our common stock are declared at the discretion of our Board of Directors.

On February 12, 2014, the Company announced the initiation of a quarterly common stock dividend for holders of record as of March 14, 2014. The payment of any future cash dividends to our stockholders will depend on decisions that will be made by our Board of Directors and will depend on then existing conditions, including our operating results, financial conditions, contractual restrictions, corporate law restrictions, capital agreements, applicable laws of the State of Delaware and business prospects.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

-15-

Composites

Our Composites segment operates out of 29 manufacturing facilities. Principal manufacturing facilities for our Composites segment, all of which are owned by us except the Ibaraki, Japan facility, which is leased, include the following:

| | |

Amarillo, Texas | | Kimchon, Korea |

Anderson, South Carolina | | L’Ardoise, France |

Chambery, France | | Rio Claro, Brazil |

Guelph, Ontario, Canada | | Taloja, India |

Gous, Russia | | Tlaxcala, Mexico |

Jackson, Tennessee | | Yuhang, China |

Building Materials

Our Building Materials segment operates out of 61 manufacturing facilities, primarily in North America. These facilities are summarized below by each of the businesses within our Building Materials segment.

Our Insulation business operates out of 32 manufacturing facilities. Principal manufacturing facilities for our Insulation business, all of which are owned, include the following:

| | |

Delmar, New York | | Newark, Ohio |

Edmonton, Alberta, Canada | | Rockford, Illinois |

Fairburn, Georgia | | Santa Clara, California |

Guangzhou, Guandong, China | | Tallmadge, Ohio |

Kansas City, Kansas | | Toronto, Ontario, Canada |

Mexico City, Mexico | | Wabash, Indiana |

Mt. Vernon, Ohio | | Waxahachie, Texas |

Our Roofing business operates out of 29 manufacturing facilities. Principal manufacturing facilities for our Roofing business, all of which are owned by us, include the following:

| | |

Atlanta, Georgia | | Kearny, New Jersey |

Compton, California | | Medina, Ohio |

Denver, Colorado | | Portland, Oregon |

Irving, Texas | | Savannah, Georgia |

Jacksonville, Florida | | Summit, Illinois |

We believe that these properties are in good condition and well maintained, and are suitable and adequate to carry on our business. The capacity of each plant varies depending upon product mix.

Our principal executive offices are located in the Owens Corning World Headquarters, Toledo, Ohio, a leased facility of approximately 400,000 square feet.

Our research and development activities are primarily conducted at our Science and Technology Center, located on approximately 500 acres of land owned by us outside of Granville, Ohio. It consists of approximately 20 structures totaling more than 650,000 square feet. In addition, we have application development and other product and market focused research and development centers in various locations.

-16-

None.

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable

-17-

EXECUTIVE OFFICERS OF OWENS CORNING

The name, age and business experience during the past five years of Owens Corning’s executive officers as of January 1, 2014 are set forth below. Each executive officer holds office until his or her successor is elected and qualified or until his or her earlier resignation, retirement or removal. All those listed have been employees of Owens Corning during the past five years except as indicated.

| | |

Name and Age | | Position* |

John W. Christy (55) | | Senior Vice President, General Counsel and Secretary since December 2011; formerly Vice President, Interim General Counsel and Secretary (2011), Vice President, Deputy General Counsel (2010) and Vice President and Assistant General Counsel, Transactions and Business. |

| |

Charles E. Dana (58) | | Group President, Building Materials since December 2010; formerly Group President, Composite Solutions (2008) and Vice President and President, Composite Solutions Business. |

| |

Arnaud Genis (49) | | Group President, Composite Solutions since December 2010; formerly Vice President and Managing Director, European Composite Solutions Business (2007), President of Saint-Gobain Reinforcement and Composites Business and Textile Solutions Business, Paris. |

| |

Michael C. McMurray (48) | | Senior Vice President and Chief Financial Officer since August 2012; formerly Vice President Finance, Building Materials Group (2011), Vice President Investor Relations and Treasurer (2010), Vice President Finance and Treasurer (2008) and Finance Manager Royal Dutch Shell. |

| |

Kelly J. Schmidt (48) | | Vice President, Controller since April 2011; formerly Vice President, Internal Audit (2010), Assistant Controller, Shared Business Services United Technologies Corporation (“UTC”) (2009). |

| |

Daniel T. Smith (48) | | Senior Vice President, Information Technology and Human Resources since September 2009; formerly Executive Vice President/Chief Administrative Officer, Borders Group, Inc. (2009), Executive Vice President, Human Resources, Borders Group, Inc. |

| |

Michael H. Thaman (49) | | President and Chief Executive Officer since December 2007 and Chairman of the Board since April 2002; Director since January 2002. |

| * | Information in parentheses indicates year during the past five years in which service in position began. The last item listed for each individual represents the position held by such individual at the beginning of the five year period. |

-18-

Part II

| ITEM 5. | MARKET FOR OWENS CORNING’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information

Owens Corning’s common stock trades on the New York Stock Exchange under the symbol “OC.” The following table sets forth the high and low sales prices per share of Owens Corning common stock for each quarter from January 1, 2012 through December 31, 2013:

| | | | | | | | |

Period | | High | | | Low | |

First Quarter 2012 | | $ | 38.00 | | | $ | 29.32 | |

Second Quarter 2012 | | $ | 35.85 | | | $ | 26.36 | |

Third Quarter 2012 | | $ | 35.98 | | | $ | 25.70 | |

Fourth Quarter 2012 | | $ | 37.42 | | | $ | 29.48 | |

First Quarter 2013 | | $ | 43.88 | | | $ | 37.71 | |

Second Quarter 2013 | | $ | 45.55 | | | $ | 36.88 | |

Third Quarter 2013 | | $ | 41.33 | | | $ | 36.68 | |

Fourth Quarter 2013 | | $ | 41.08 | | | $ | 35.23 | |

Holders of Common Stock

The number of stockholders of record of Owens Corning’s common stock on January 31, 2014 was 481.

Cash Dividends

Owens Corning did not pay cash dividends on its common stock during the two most recent years. On February 12, 2014, the Company announced the declaration of a common stock dividend for holders of record as of March 14, 2014. The payment of any future cash dividends to our stockholders will depend on decisions that will be made by our Board of Directors and will depend on then existing conditions, including our operating results, financial conditions, contractual restrictions, corporate law restrictions, capital agreements, and applicable laws of the State of Delaware and business prospects.

Under the credit agreement applicable to our senior revolving credit facility, the Company may not declare a cash dividend if a default or event of default exists or would come to exist at the time of declaration or if a dividend declaration violates the provisions of our formation documents or other material agreements.

The Company’s subsidiaries are subject to certain restrictions on their ability to pay dividends under the agreements governing our senior revolving credit facility and our receivables securitization facility.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

None.

-19-

| ITEM 5. | MARKET FOR OWENS CORNING’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES (continued) |

Issuer Purchases of Equity Securities

The following table provides information about Owens Corning’s purchases of its common stock during the three months ended December 31, 2013:

| | | | | | | | | | | | | | | | |

Period | | Total Number of

Shares (or Units)

Purchased | | | Average Price

Paid per Share

(or Unit) | | | Total Number of

Shares (or Units)

Purchased as Part of

Publicly Announced

Plans or Programs** | | | Maximum Number of

Shares (or Units) that

May Yet Be

Purchased Under the

Plans or Programs** | |

October 1-31, 2013 | | | 2,510 | | | $ | 37.52 | | | | — | | | | 8,600,000 | |

November 1-30, 2013 | | | 102 | | | | 35.88 | | | | — | | | | 8,600,000 | |

December 1-31, 2013 | | | 728 | | | | 38.90 | | | | — | | | | 8,600,000 | |

| | | | | | | | | | | | | | | | |

Total | | | 3,340 | * | | $ | 37.77 | | | | — | | | | 8,600,000 | |

| | | | | | | | | | | | | | | | |

| * | The Company retained 3,340 shares surrendered to satisfy tax withholding obligations in connection with the vesting of restricted shares granted to our employees. |

| ** | On April 25, 2012, the Company announced a share buy-back program under which the Company is authorized to repurchase up to 10 million shares of Owens Corning’s outstanding common stock. Under the buy-back program, shares may be repurchased through open market, privately negotiated, or other transactions. The timing and actual number of shares repurchased will depend on market conditions and other factors and will be at the Company’s discretion. |

-20-

| ITEM 5. | MARKET FOR OWENS CORNING’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES (continued) |

Performance Graph

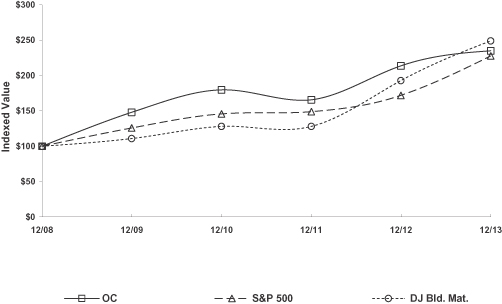

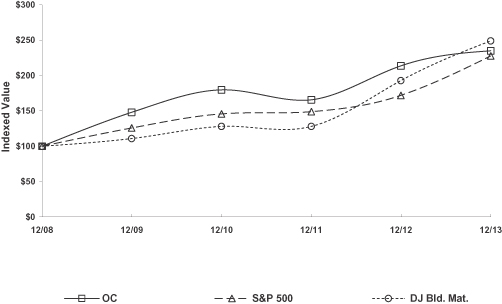

The annual changes for the five-year period shown in the graph on this page are based on the assumption that $100 had been invested in Owens Corning stock and the Standard & Poor’s 500 Stock Index (S&P 500) on December 31, 2008, and that all quarterly dividends were reinvested. The total cumulative dollar returns shown on the graph represent the value that such investments would have had on December 31, 2013.

Performance Graph

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | 2012 | | | 2013 | |

OC | | $ | 100 | | | $ | 148 | | | $ | 180 | | | $ | 166 | | | $ | 214 | | | $ | 235 | |

S&P 500 | | | 100 | | | | 126 | | | | 146 | | | | 149 | | | | 172 | | | | 228 | |

DJ Bld. Mat. | | | 100 | | | | 111 | | | | 128 | | | | 128 | | | | 193 | | | | 249 | |

-21-

| ITEM 6. | SELECTED FINANCIAL DATA |

| | | | | | | | | | | | | | | | | | | | |

| | | Twelve Months Ended | |

| | | Dec. 31,

2013 (a) | | | Dec. 31,

2012 (b) | | | Dec. 31,

2011 | | | Dec. 31,

2010 (c) | | | Dec. 31,

2009 (d) | |

| | | (in millions, except per share amounts) | |

Statement of Earnings (Loss) Data | | | | | | | | | | | | | | | | | | | | |

Net sales | | $ | 5,295 | | | $ | 5,172 | | | $ | 5,335 | | | $ | 4,997 | | | $ | 4,803 | |

Gross margin | | $ | 966 | | | $ | 797 | | | $ | 1,028 | | | $ | 956 | | | $ | 849 | |

Marketing and administrative expenses | | $ | 530 | | | $ | 509 | | | $ | 525 | | | $ | 516 | | | $ | 522 | |

Earnings from continuing operations before interest and taxes | | $ | 385 | | | $ | 148 | | | $ | 461 | | | $ | 206 | | | $ | 192 | |

Interest expense, net | | $ | 112 | | | $ | 114 | | | $ | 108 | | | $ | 110 | | | $ | 111 | |

Loss on extinguishment of debt | | $ | — | | | $ | 74 | | | $ | — | | | $ | — | | | $ | — | |

Income tax expense (benefit) | | $ | 68 | | | $ | (28 | ) | | $ | 74 | | | $ | (840 | ) | | $ | 14 | |

Net earnings (loss) | | $ | 205 | | | $ | (16 | ) | | $ | 281 | | | $ | 940 | | | $ | 67 | |

Net earnings (loss) attributable to Owens Corning | | $ | 204 | | | $ | (19 | ) | | $ | 276 | | | $ | 933 | | | $ | 64 | |

| | | | | | | | | | | | | | | | | | | | |

Amounts attributable to Owens Corning common stockholders: | | | | | | | | | | | | | | | | | | | | |

Earnings (loss) from operations, net of tax | | $ | 204 | | | $ | (19 | ) | | $ | 276 | | | $ | 933 | | | $ | 64 | |

| | | | | | | | | | | | | | | | | | | | |

Net earnings (loss) attributable to Owens Corning | | $ | 204 | | | $ | (19 | ) | | $ | 276 | | | $ | 933 | | | $ | 64 | |

| | | | | | | | | | | | | | | | | | | | |

Basic earnings (loss) per common share attributable to Owens Corning common stockholders | | | | | | | | | | | | | | | | | | | | |

Earnings (loss) from operations | | $ | 1.73 | | | $ | (0.16 | ) | | $ | 2.25 | | | $ | 7.43 | | | $ | 0.51 | |

| | | | | | | | | | | | | | | | | | | | |

Basic earnings (loss) per common share | | $ | 1.73 | | | $ | (0.16 | ) | | $ | 2.25 | | | $ | 7.43 | | | $ | 0.51 | |

| | | | | | | | | | | | | | | | | | | | |

Diluted earnings (loss) per common share attributable to Owens Corning common stockholders | | | | | | | | | | | | | | | | | | | | |

Earnings (loss) from operations | | $ | 1.71 | | | $ | (0.16 | ) | | $ | 2.23 | | | $ | 7.37 | | | $ | 0.50 | |

| | | | | | | | | | | | | | | | | | | | |

Diluted earnings (loss) per common share | | $ | 1.71 | | | $ | (0.16 | ) | | $ | 2.23 | | | $ | 7.37 | | | $ | 0.50 | |

| | | | | | | | | | | | | | | | | | | | |

Weighted-average common shares | | | | | | | | | | | | | | | | | | | | |

Basic | | | 118.2 | | | | 119.4 | | | | 122.5 | | | | 125.6 | | | | 124.8 | |

Diluted | | | 119.1 | | | | 119.4 | | | | 123.5 | | | | 126.6 | | | | 127.1 | |

| | | | | | | | | | | | | | | | | | | | |

Balance Sheet Data | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 7,647 | | | $ | 7,568 | | | $ | 7,527 | | | $ | 7,158 | | | $ | 7,167 | |

Long-term debt, net of current portion | | $ | 2,024 | | | $ | 2,076 | | | $ | 1,930 | | | $ | 1,629 | | | $ | 2,177 | |

Total equity | | $ | 3,830 | | | $ | 3,575 | | | $ | 3,741 | | | $ | 3,686 | | | $ | 2,853 | |

| | | | | | | | | | | | | | | | | | | | |

No dividends were declared or paid for any of the periods presented above.

-22-

| ITEM 6. | SELECTED FINANCIAL DATA (continued) |

| (a) | During 2013, the Company recorded $26 million of charges related to cost reduction actions and related items (comprised of $8 million of severance costs and $18 million of other costs, inclusive of $9 million of accelerated depreciation and $9 million in other related charges). There was also $20 million in accelerated depreciation related to a change in the useful life of assets and a $15 million net gain related to Hurricane Sandy insurance activity. |

| (b) | During 2012, the Company recorded $136 million of charges related to cost reduction actions and related items (comprised of $51 million of severance costs and $85 million of other costs, inclusive of $55 million of accelerated depreciation and $30 million in other related charges). There was also $9 million in losses related to Hurricane Sandy insurance activity. |

| (c) | During 2010, the Company recorded impairment charges of $117 million, $40 million of charges related to cost reduction actions and related items (comprised of $29 million of severance costs and $11 million of other costs), and charges of $13 million of integration costs related to the acquisition of Saint-Gobain’s reinforcement and composite fabrics business in 2007 (“2007 Acquisition”). |

| (d) | During 2009, the Company recorded $53 million of charges related to cost reduction actions and related items (comprised of $34 million of severance costs, and $19 million of other costs, inclusive of $13 million of accelerated depreciation), charges of $33 million of integration costs related to the 2007 Acquisition, and $29 million for charges related to our employee emergence equity program. |

-23-

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

This Management’s Discussion and Analysis (“MD&A”) is intended to help investors understand Owens Corning, our operations and our present business environment. MD&A is provided as a supplement to, and should be read in conjunction with, our Consolidated Financial Statements and the accompanying Notes thereto contained in this report. Unless the context requires otherwise, the terms “Owens Corning,” “Company,” “we” and “our” in this report refer to Owens Corning and its subsidiaries.

GENERAL

Owens Corning is a leading global producer of glass fiber reinforcements and other materials for composites and of residential and commercial building materials. The Company’s business operations fall within two reportable segments, Composites and Building Materials. Composites includes our Reinforcements and Downstream businesses. Building Materials includes our Insulation and Roofing businesses. Through these lines of business, we manufacture and sell products worldwide. We maintain leading market positions in many of our major product categories.

EXECUTIVE OVERVIEW

We reported $385 million in earnings before interest and taxes (“EBIT”) in 2013 compared to $148 million in 2012. We generated $416 million in adjusted earnings before interest and taxes (“Adjusted EBIT”, see definition below) in 2013. EBIT in our Building Materials segment increased by $133 million and EBIT in our Composites segment increased by $7 million compared to 2012.

In 2013, we have adjusted $31 million of net charges out of reported EBIT to arrive at adjusted EBIT. Restructuring actions initiated in 2012 and 2013 represented $26 million of the net charges, with the majority due to the repositioning of our European assets in our Composites business (see further discussion of these actions in Note 15 of the Consolidated Financial Statements). An additional charge of $20 million of accelerated depreciation was recorded as a result of our assessment of the future utility of an incomplete Insulation facility located in Cordele, Georgia. These charges were partially offset by a net gain of $15 million related to the final insurance settlement for flood damage sustained by our Kearny, New Jersey roofing manufacturing facility as a result of Hurricane Sandy in October 2012 (see further discussion in Note 19 of the Consolidated Financial Statements). The Kearny facility returned to full operating capacity in the third quarter of 2013. See below for further information regarding adjusted EBIT, including the reconciliation to net earnings attributable to Owens Corning.

In our Composites segment, EBIT in 2013 was $98 million compared to $91 million in 2012 driven primarily by higher capacity utilization and sales volumes being partially offset by inflation and unfavorable mix.

In our Building Materials segment, EBIT in 2013 was $426 million compared to $293 million in 2012. In our Roofing business, EBIT increased $55 million on higher selling prices and lower manufacturing costs. This increase was partially offset by weaker volumes. Our Insulation business reported EBIT of $40 million in 2013, an increase of $78 million compared to the prior year on higher selling prices and sales volumes.

We maintain a strong balance sheet with ample liquidity. We have access to an $800 million senior revolving credit facility with a November 2018 maturity date and a $250 million receivables securitization facility with a July 2016 maturity date. We have no significant debt maturities before 2016.

In 2013, we generated $418 million in cash flow from operating activities compared to $330 million over the same period of 2012. This improvement was primarily from improved earnings, partially offset by increased investment in working capital.

-24-

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (continued) |

We repurchased 1.4 million shares of the Company’s common stock for $54 million in 2013 under a previously announced repurchase program. As of December 31, 2013, 8.6 million shares remain available for repurchase under the authorized program. In addition, in February 2014, our Board of Directors authorized a quarterly cash dividend of $0.16 per share to be paid on April 3, 2014 to stockholders of record as of the close of business on March 14, 2014.

RESULTS OF OPERATIONS

Consolidated Results (in millions)

| | | | | | | | | | | | |

| | | Twelve Months Ended

Dec. 31, | |

| | | 2013 | | | 2012 | | | 2011 | |

Net sales | | $ | 5,295 | | | $ | 5,172 | | | $ | 5,335 | |

Gross margin | | $ | 966 | | | $ | 797 | | | $ | 1,028 | |

% of net sales | | | 18 | % | | | 15 | % | | | 19 | % |

Charges related to cost reduction actions | | $ | 8 | | | $ | 51 | | | $ | — | |

Earnings before interest and taxes | | $ | 385 | | | $ | 148 | | | $ | 461 | |

Interest expense, net | | $ | 112 | | | $ | 114 | | | $ | 108 | |

Loss on extinguishment of debt | | $ | — | | | $ | 74 | | | $ | — | |

Income tax expense (benefit) | | $ | 68 | | | $ | (28 | ) | | $ | 74 | |

Net earnings (loss) attributable to Owens Corning | | $ | 204 | | | $ | (19 | ) | | $ | 276 | |

| | | | | | | | | | | | |

The Consolidated Results discussion below provides a summary of our results and the trends affecting our business, and should be read in conjunction with the more detailed Segment Results discussion that follows.

NET SALES

2013 Compared to 2012: Net sales increased by $123 million in 2013 as compared to 2012 primarily due to higher selling prices across our Building Materials businesses and increased sales volumes in our Insulation business which were partially offset by lower sales volumes in our Roofing business.

2012 Compared to 2011: Net sales decreased by $163 million in 2012 as compared to 2011 driven by lower sales volumes in our Roofing business, which were partially offset by higher sales volumes in our Insulation business, and the unfavorable impact of translating sales denominated in foreign currencies into United States dollars in our Composites segment.

GROSS MARGIN

2013 Compared to 2012: Gross margin in 2013 increased 3 percentage points as compared to 2012 primarily due to higher contribution margins in our Building Materials Segment. Gross margin also included $18 million of charges in 2013 resulting from our 2012 restructuring actions as compared to $85 million in 2012. Partially offsetting the improvement in gross margin was $27 million of losses related to Hurricane Sandy, a $21 million increase from the impact in 2012.

2012 Compared to 2011: Gross margin in 2012 included $85 million in charges resulting from our European restructuring actions, which are reflected in cost of sales. The primary contributor to the remaining change in gross margin as a percentage of net sales was a decrease in gross margin in our Composites segment. Gross margin as a percentage of net sales decreased in our Roofing business; however this was partially offset by an increase in our Insulation business.

-25-

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (continued) |

CHARGES RELATED TO COST REDUCTION ACTIONS

During 2013, we entered into an agreement to sell our Composites glass reinforcements facility in Hangzhou, China to the Hangzhou Municipal Land Reservation Center and the Development and Construction Management Office of Taoyuan New Zone of Gongshu District in Hangzhou. This sale is expected to be complete in the first half of 2014. As a result of this action, we recognized $6 million in charges related to severance costs in 2013.

During 2012, we took actions to improve the competitive position of our global Composites manufacturing network through the closure or optimization of certain facilities, with our most significant actions taking place in France, Spain and Italy. These actions were primarily due to market conditions that led to lower capacity requirements within the European region. As a result of these actions, in addition to the charges recorded in cost of sales discussed above, we recognized $2 million and $51 million in charges related to cost reduction actions in 2013 and 2012 respectively. The total charges related to cost reduction actions and related items associated with these actions for 2013 was $20 million as compared to $136 million in 2012.