Use these links to rapidly review the document

TABLE OF CONTENTS

Index to Financial Statements of Ellora Energy Inc

As filed with the Securities and Exchange Commission on August 13, 2007

Registration No. 333-138583

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3 to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Ellora Energy Inc.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of

incorporation or organization) | | 1311

(Primary Standard Industrial

Classification Code Number) | | 01-0717160

(I.R.S. Employer

Identification Number) |

5665 Flatiron Parkway

Boulder, CO 80301

(303) 444-8881

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices) |

T. Scott Martin

Chairman, President and Chief Executive Officer

5665 Flatiron Parkway

Boulder, CO 80301

(303) 444-8881

(Name, address, including zip code, and telephone number, including area code, of agent for service) |

Copies to: |

Dallas Parker

Kirk Tucker

Thompson & Knight LLP

333 Clay Street, Suite 3300

Houston, TX 77002

(713) 654-8111 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement is declared effective.

If any securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the "Securities Act"), check the following box. ý

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in the prospectus is not complete and may be changed. The securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED AUGUST 13, 2007

PRELIMINARY PROSPECTUS

11,623,261 Shares

Common Stock

This prospectus relates to up to 11,623,261 shares of the common stock of Ellora Energy Inc., which may be offered and sold, from time to time, by the selling stockholders named in this prospectus. The selling stockholders acquired the shares of common stock offered by this prospectus in a private equity placement. We are registering the offer and sale of the shares of common stock to satisfy registration rights we have granted to the selling stockholders. We are not selling any shares of common stock under this prospectus and will not receive any proceeds from the sale of common stock by the selling stockholders.

The shares of common stock to which this prospectus relates may be offered and sold from time to time directly by the selling stockholders or alternatively through underwriters or broker-dealers or agents. The shares of common stock may be sold in one or more transactions, at fixed prices, at prevailing market prices at the time of sale, or at negotiated prices. Prior to this offering, there has been no public market for the common stock. We estimate that the selling stockholders initially will sell their shares at prices between $ per share and $ per share, if any shares are sold. Future prices will likely vary from this range and initial sales may not be indicative of prices at which our common stock will trade in the future. Please read "Plan of Distribution."

We have applied to list our common stock on the Nasdaq Global Market under the symbol "LORA."

Investing in our common stock involves a high degree of risk. You should read the section entitled "Risk Factors" beginning on page 11 for a discussion of certain risks that you should consider before buying shares of our common stock.

You should rely only on the information contained in this prospectus or any prospectus supplement or amendment. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2007.

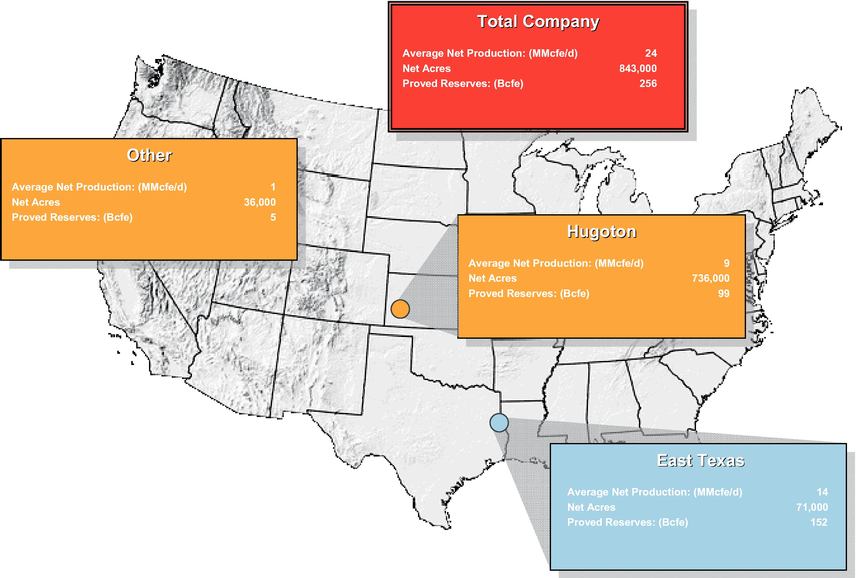

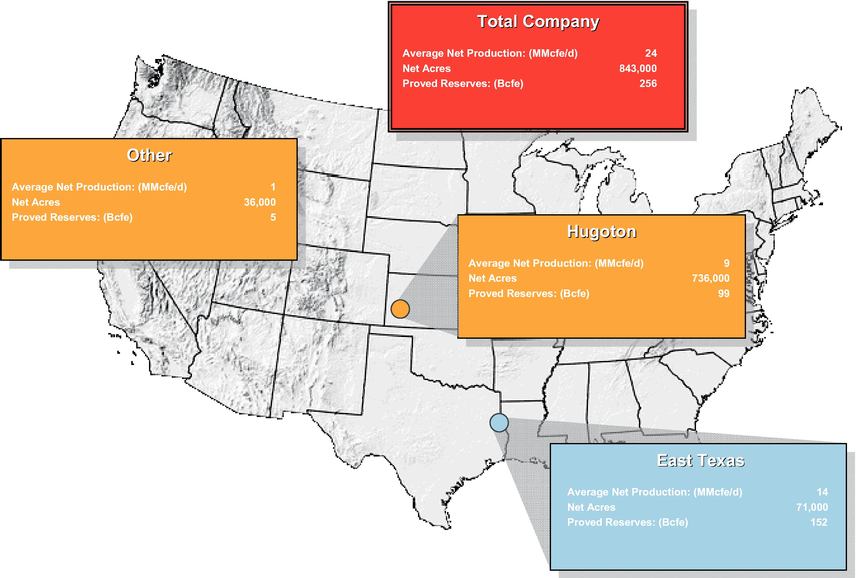

Ellora Energy Inc. Areas of Operation

As of and for the six months ended June 30, 2007

TABLE OF CONTENTS

PROSPECTUS SUMMARY

This summary highlights selected information from this prospectus but does not contain all information that you should consider before investing in our common stock. You should read this entire prospectus carefully, including "Risk Factors" beginning on page 12, and the financial statements included elsewhere in this prospectus. In this prospectus, we refer to Ellora Energy Inc., its subsidiaries and predecessors as "Ellora Energy," "we," "us," "our," or "our company." References to the number of shares of our common stock outstanding have been revised to reflect a 8.09216-for-1 stock split effected in July 2006. We engage MHA Petroleum Consultants, Inc., independent petroleum engineers ("MHA"), to evaluate our properties annually. The estimates of our proved reserves included in this prospectus as of June 30, 2007 are based on a reserve report prepared by MHA. A summary of MHA's report with respect to these estimated proved reserves as of June 30, 2007 is attached to this prospectus as Appendix A. We discuss sales volumes, per Mcf revenue, per Mcf cost and other data in this prospectus net of any royalty owner's interest. We have provided definitions for some of the industry terms used in this prospectus in the "Glossary of Selected Oil and Gas Terms."

Ellora Energy Inc.

Overview

We are an independent oil and gas company engaged in the acquisition, exploration, development and production of onshore domestic U.S. oil and gas properties and have been operating since our inception in June 2002. We primarily operate in two areas: east Texas and adjacent lands in western Louisiana, which we collectively refer to as East Texas, and the Hugoton field in southwest Kansas. We have assembled combined acreage of approximately 913,000 gross (843,000 net) acres providing us with 754 identified drilling locations. At June 30, 2007 we owned interests in 293 gross (161 net) producing wells, and for the three months ended June 30, 2007, our average net production was approximately 28.0 MMcfe/d. At June 30, 2007, our estimated total proved oil and gas reserves were approximately 256 Bcfe. Our proved reserves are approximately 73% gas and 36% proved developed. Our total proved reserves have a reserve life index of approximately 29 years and our proved producing reserves have a reserve life index of 10 years. Using prices as of June 30, 2007, our proved reserves had an estimated pre-tax net present value, discounted at 10%, or PV-10, of approximately $576 million, of which 40% was proved developed. See "Selected Combined Historical Financial Data—Reconciliation of Non-GAAP Financial Measures" for additional information regarding PV-10. As operator of over 90% of our proved reserves, we have a high degree of control over our capital expenditure budget and other operating matters.

The following table sets forth by operating area a summary of our estimated net proved reserves and estimated average daily net production information as of and for the six months ended June 30, 2007.

| | Estimated Proved Reserves at June 30, 2007

| |

| | Production for the Six Months Ended

June 30, 2007

| |

|---|

| | Developed (Bcfe)

| | Undeveloped (Bcfe)

| | Total (Bcfe)

| | Percent of Total Reserves

| | PV-10(1)

($Millions)

| | Identified

Drilling

Locations(2)

| | Net

Average MMcfe/d

| | Percent of Total

| |

|---|

| East Texas | | 60 | | 92 | | 152 | | 59 | % | $ | 268 | | 270 | | 14 | | 58 | % |

| Hugoton (Kansas) | | 28 | | 71 | | 99 | | 39 | | | 295 | | 469 | | 9 | | 38 | |

| Other | | 3 | | 2 | | 5 | | 2 | | | 13 | | 15 | | 1 | | 4 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| | Total | | 91 | | 165 | | 256 | | 100 | % | $ | 576 | | 754 | | 24 | | 100 | % |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

- (1)

- Based on June 30, 2007 posted field prices of $6.795 per MMBtu of gas and $67.25 per Bbl of oil, respectively, adjusted for basis and held flat for the life of the reserves and adjusted for quality differentials.

- (2)

- Represents total gross drilling locations identified by management as of June 30, 2007, of which 197 locations are classified as proved. Based on fluctuations in commodity prices, the number of drilling locations will change.

1

Areas of Operation

East Texas

We acquired our initial position in East Texas in June 2002, and as of June 30, 2007, we held 74,000 gross acres (71,000 net acres) in East Texas, primarily in the James Lime play. From June 2002 until June 30, 2007, we have invested $95 million to drill and complete 29 of 30 James Lime wells, a 97% completion rate, and during the first six months of 2007, we produced an average of 14 MMcfe/d from this region. The wells drilled to date have all been completed naturally with open-hole horizontal well bores. We have recently applied a frac stimulation technology to certain wells previously drilled in the area. We are continuing to drill, complete and produce wells utilizing conventional drilling and production techniques, but once a significant reduction in the production level of a well occurs, we will assess the suitability for utilizing stimulation frac technology to increase the production of a well. An average well costs approximately $2.1 million to drill and complete for unstimulated wells and $3.6 million for stimulated wells. We may also drill multilateral wells in the future at an expected cost of $2.6 million to $3.6 million per well subject to the number of laterals drilled. As of June 30, 2007, our producing wells in the James Lime had produced an average of 0.9 gross Bcfe per well and had estimated proved reserves remaining of 1.5 gross Bcfe for a total of 2.4 gross Bcfe per well. At June 30, 2007, we had 74 productive wells in East Texas, of which 66 are in the James Lime play and total proved reserves of approximately 152 Bcfe in East Texas. In the James Lime we have identified 144 future drilling locations and drilled 5 wells during the six months ended June 30, 2007.

In addition to the James Lime play we have started developing the lower Cretaceous Fredericksburg (or Edwards) formation using horizontal drilling. We believe there are additional productive formations under our properties in East Texas.

We plan to drill or stimulate an additional 11 to 13 wells in the James Lime play during the remainder of 2007, depending on our drilling success. All of our drilling in East Texas will be developmental drilling. See "Summary of Capital Expenditures" for our estimated capital expenditures in East Texas.

In East Texas, we own and operate approximately 100 miles of four-to-eight-inch gas gathering lines and gas pipelines and operate nine compressor stations with 10,395 total compression horsepower, which gather, process and transport our gas and third party gas in our East Texas operations area, which we refer to as English Bay Pipeline. Our ownership of this pipeline system provides us with the benefit of controlling compression location and timing of connection to newly completed wells. Our system interconnects to the Texas Eastern, Centerpoint and Gulf South pipelines. In February 2007, we acquired a 100% interest in the Shelby Pipeline in Shelby County, Texas for $6.5 million. The Shelby Pipeline transports gas from the southern portion of the Huxley Field for us and other independent producers. The addition of this approximate 20-mile pipeline increased the English Bay Pipeline to approximately 100 miles. During the six months ended June 30, 2007 we transported an average of approximately 29 MMcf/d of gas. Our pipeline activities from transporting third-party production provided us with revenues of approximately $4.5 million for the full year 2006 and $4.5 million for the six months ended June 30, 2007.

Hugoton Field (Kansas)

We initially acquired our acreage position in the Hugoton field through our 2005 acquisition of Presco Western LLC, which is a party to a farmout agreement that covers approximately 651,000 gross (631,000 net) acres in the Hugoton field. The farmout grants us mineral rights in reservoirs below the Heebner Shale (located at a depth of approximately 4,000 feet), which we refer to as the Hugoton Deep. We acquired, in a series of transactions that were completed by July 2007, the mineral rights to that farmout acreage and acquired additional acreage and producing wells in the Hugoton Deep for $27.5 million. As a result of this acquisition and additional leasing activities, we increased our acreage

2

in the Hugoton Deep from an approximate 651,000 acres (631,000 net) to 793,000 acres (736,000 net) and increased the net revenue interest in virtually all of the Hugoton Deep acreage from 80% to 87.5%.

Since our entry to the Hugoton Deep, we have invested $42.4 million to complete 54 of 63 wells, an 86% completion rate. At June 30, 2007 we had 180 productive wells and total proved reserves of approximately 98 Bcfe, of which 28 Bcfe were proved developed producing and approximately 64% oil. During the first six months of 2007, we produced an average of 8.5 MMcfe/d, up from the 2.0 MMcfe/d at the time of acquisition. For the six months ended June 30, 2007, we completed 17 of 19 wells drilled. We have identified three waterfloods, 469 drilling locations and anticipate drilling 37 wells during the remainder of 2007, including 20 injection and production wells in the Southwest Lemon Victory waterflood project, a secondary recovery project in the field. We expect water injection to commence in August 2007.

Summary of Capital Expenditures

The following table summarizes information regarding our historical 2006 and our estimated 2007 and 2008 capital expenditures. The estimated 2007 and 2008 capital expenditures shown are preliminary full year estimates, including approximately $34.0 million spent from January 1, 2007 through June 30, 2007. The estimated capital expenditures are subject to change depending upon a number of factors, including availability of capital, drilling results, oil and gas prices, costs of drilling and completion and availability of drilling rigs, equipment and labor.

| |

| | Estimated

|

|---|

| | Historical

| | Year Ending December 31,

|

|---|

| | Year Ended December 31,

2006

|

|---|

| | 2007

| | 2008

|

|---|

| | (In thousands)

|

|---|

| Capital expenditures: | | | | | | | | | |

| | East Texas | | $ | 22,400 | | $ | 45,000 | | $ | 48,000 |

| | Hugoton | | | 31,200 | | | 46,000 | | | 48,000 |

| Other | | | 1,400 | | | 5,000 | | | 9,000 |

| Geological and geophysical | | | 2,400 | | | 4,000 | | | 4,000 |

| Growth capital expenditures(1) | | | — | | | — | | | 30,000 |

| | |

| |

| |

|

| | Total capital expenditures | | $ | 57,400 | | $ | 100,000 | | $ | 139,000 |

| | |

| |

| |

|

- (1)

- Growth capital expenditures are for the acceleration of drilling and secondary recovery in addition to capital expenditures contemplated in the reserve report. We do not budget for possible acquisitions.

Strategy

Our strategy is to increase stockholder value by profitably increasing our reserves, production, cash flow and earnings using a balanced program of (1) developing existing properties, (2) exploiting and exploring undeveloped properties, (3) completing strategic acquisitions and (4) maintaining financial flexibility. The following are key elements of our strategy:

- •

- Maintain Technological Expertise. We intend to utilize and expand the technological expertise that has enabled us to achieve a drilling completion rate of 90% since our inception and helped us improve and maximize field recoveries.

- •

- Accelerate the Development of our Existing Properties. We intend to further develop the significant remaining upside potential of our properties.

3

- •

- As discussed, we will sometimes use multi-stage frac technology or multilateral drilling to enhance production from the James Lime wells in East Texas.

- •

- In the Hugoton field we are completing studies of two secondary recovery projects that will use traditional waterflood techniques. The Southwest Lemon Victory waterflood project has shown increased production in response to waterflood projects operated by others on contiguous properties. We expect to commence initial operations on the Southwest Lemon Victory waterflood project during the third quarter of 2007.

- •

- In the Hugoton field, we drill to the lowest known hydrocarbon producing formation in our area, then attempt completion in zones that have shown the presence of hydrocarbons during drilling. Geological evaluation through traditional logging methods and this pragmatic test has led to regular finding hydrocarbons. We have found at least two economic production zones in each completed well using this method.

- •

- Acquisition Growth. We continually review opportunities to acquire producing properties, undeveloped acreage and drilling prospects, particularly on opportunities where we believe our reservoir management and operational expertise will enhance the value and performance of acquired properties. Initial acquisition targets are expected to be in and around our major producing and activity areas.

- •

- Endeavor to be a Low Cost Producer. We will strive to minimize our operating costs by concentrating our assets within geographic areas where we can consolidate operating control and capture operating efficiencies.

- •

- Maintain Financial Flexibility. Upon the completion of our initial public offering, we expect to have approximately $39 million in cash, no bank debt and at least $110 million available for borrowings under our revolving line of credit, providing us with significant financial flexibility to pursue our business strategy.

Competitive Strengths

We believe our historical success is, and future performance will be, directly related to the following combination of strengths which enable us to implement our strategy:

- •

- Experienced Management Team. The members of our executive management team have an average of over 23 years of experience in the oil and gas industry and significant experience in managing public and private oil and gas companies.

- •

- High Quality, Operated Asset Base. We own a high quality asset base comprised of long-lived reserves along with shorter-lived, higher return reserves. We operate over 90% of our estimated proved reserves.

- •

- Large Acreage Positions. We are a significant acreage holder in each of our two primary operating areas. In East Texas we control over 74,000 gross (71,000 net) acres and in the Hugoton field our BP Amoco farmout covers 793,000 gross (736,000 net) acres.

- •

- Significant Hugoton Reserve Potential. We believe the deeper zones of the Hugoton field have not been fully explored or developed. Accordingly, we believe that significant amounts of gas and oil remain to be recovered in the current higher price environment using modern exploration and production technologies.

- •

- Drilling Inventory. We have identified 754 drillable, low to moderate risk locations providing us with multiple years of drilling inventory. Of these locations, 197 are classified as proved undeveloped.

4

- •

- Proven Technical Team. Our technical staff includes 16 geologists, geophysicists, reservoir engineers and technicians with an average of over 16 years of relevant technical experience. Our staff has a proven record of analyzing complex structural and stratigraphic plays using 3-D seismic, geological and geophysical expertise, producing and optimizing oil and gas reservoirs, and drilling, completing and fracing tight gas reservoirs.

- •

- Developmental Drilling Success. The competencies of our proven technical team focused in our large and productive acreage holdings have helped us to achieve a developmental drilling success rate of 90% since our inception in 2002. Our technical expertise has also allowed us to improve the production rates and ultimate hydrocarbon recoveries on our wells as compared to those wells drilled by others in similar reservoirs in our primary operating areas. We do not expect to drill any exploratory wells during the next 18 months.

- •

- Low Finding and Development Costs. Since our inception, we have invested approximately $149.3 million to drill and complete 90 wells in our East Texas and Hugoton operating areas. Our average acquisition, finding and development costs from inception to June 30, 2007 was $1.58 per Mcfe. For a discussion of how we calculate our finding and development costs, see "Business—Historical Finding and Development Costs."

- •

- Control of Low-Pressure Gas Gathering Infrastructure. We own and operate approximately 100 miles of gas gathering lines and gas pipelines that collect and transport our production and third-party production in our East Texas operations area. We intend to

acquire or construct additional gas gathering assets as necessary to fully develop our East Texas opportunities.

- •

- Gas Marketing Flexibility. Production from both East Texas and the Hugoton field has access to multiple delivery points to several regional and interstate pipelines that provide more than sufficient take away capacity to sell our production.

Our Challenges in Capitalizing on Our Strengths and Implementing Our Strategies

Our ability to successfully leverage our competitive strengths and execute our strategy depends upon many factors and is subject to a variety of risks. For example, our ability to accelerate drilling on our properties and fund the remainder of our 2007 capital budget and, in particular, our estimated growth capital expenditures depend, to a large extent, upon our ability to generate cash flow from operations at or above current levels, maintain borrowing capacity at or near current levels under our revolving credit facility, and the availability of future debt and equity financing at attractive prices. Our ability to fund property acquisitions and compete for and retain the qualified personnel necessary to conduct our business is also dependent upon our financial resources. Changes in oil and gas prices, which may affect both our cash flows and the value of our reserves, our ability to replace production through drilling activities, a material adverse change in our oil and gas reserves due to factors other than oil and gas pricing changes, drilling costs and other factors, may adversely affect our ability to fund our anticipated capital expenditures, pursue property acquisitions, and compete for qualified personnel, among other things. You are urged to the read the section entitled "Risk Factors" for more information regarding these and other risks that may affect our business and our common stock.

Corporate Information

Ellora Energy Inc. was formed in June 2002 and secured an equity investment from Yorktown Energy Partners V, L.P. to fund our first East Texas acquisition that same year.

In July 2006, we completed a private equity offering of 12,400,000 shares of our common stock, consisting of 2,500,000 shares issued by us and 9,900,000 shares sold by certain of our existing stockholders. We received aggregate consideration (before offering expenses of approximately $1,400,000 but after the initial purchaser's discount) of approximately $27.9 million, or $11.16 per

5

share. We did not receive any proceeds from the shares sold by the selling stockholders. However, we did receive approximately $6.4 million from certain of the selling stockholders who are employees of our company for the repayment of loans that were made to them in connection with previous purchases of our common stock. We used the net proceeds from the offering, together with the proceeds from the repayment of the selling stockholders' loans, principally to pay down the entire outstanding balance on our credit facility.

Prior to the private equity offering in July 2006 we operated as two separate entities, Ellora Energy Inc. and Ellora Oil & Gas Inc., with one management team and substantially similar ownership. Ellora Oil and Gas Inc. was formed in April 2005 to acquire Presco Western, LLC and Ellora Energy Inc.'s assets in Colorado and interests in a joint venture with Centurion Exploration Company. These entities were merged prior to the closing of the private equity offering, with Ellora Energy Inc. as the surviving entity. The exchange factor was determined by the management and approved by the Board of Directors of Ellora Oil and Gas Inc. and Ellora Energy Inc. based upon an analysis of management's estimates of the relative equity value of each of Ellora Oil and Gas Inc. and Ellora Energy Inc. These estimates of equity value were based on an analysis of estimated cash flow and net asset value for both Ellora Energy Inc. and Ellora Oil and Gas Inc. relative to comparable public companies' cash flow, net asset valuations and equity valuations. Ellora Oil & Gas Inc. stockholders received 2.49 shares of Ellora Energy Inc. for each share of Ellora Oil & Gas Inc. Following the merger, we effected an 8.09216-to-1 stock split of our common stock.

Presentations in this prospectus that reflect shares, shares outstanding, or weighted average shares of our common stock or options exercisable for shares of our common stock are reflected on a post-merger and post-split basis.

Ellora Energy Inc., a Delaware corporation, was incorporated in June 2002. Our principal executive offices are located at 5665 Flatiron Parkway, Boulder, Colorado 80301. Our telephone number is (303) 444-8881. Our corporate website address iswww.elloraenergy.com. Information on our website or any other website is not incorporated by reference into this prospectus and does not constitute a part of this prospectus.

6

THE OFFERING

| Common stock offered by the selling stockholders | | 11,623,261 shares. |

Common stock to be outstanding after this offering(1) |

|

52,855,999 shares. |

Use of proceeds |

|

We will not receive any proceeds from the sale of the shares of common stock offered in this prospectus. |

Dividend policy |

|

We do not anticipate that we will pay cash dividends in the foreseeable future. Our existing credit facility restricts our ability to pay cash dividends. |

Risk factors |

|

For a discussion of factors you should consider in making an investment, see "Risk Factors." |

Proposed Nasdaq Global Market symbol |

|

"LORA" |

- (1)

- Assumes the issuance of 8,000,000 shares of our common stock in our initial public offering. Excludes options to purchase 2,556,376 shares of our common stock outstanding as of June 30, 2007, of which 2,008,602 were exercisable within 60 days.

7

SUMMARY COMBINED HISTORICAL FINANCIAL DATA

The following table shows the combined historical financial data as of and for each of the three years ended December 31, 2004, 2005 and 2006, and the unaudited combined historical financial data as of and for each of the six-month periods ended June 30, 2006 and 2007 for Ellora Energy Inc. and Ellora Oil & Gas Inc. as if they had been one entity throughout the periods presented. These entities were merged in July 2006. You should read the following summary combined historical financial information together with the combined financial statements and related notes included elsewhere in this prospectus. The historical combined financial data as of December 31, 2005 and 2006 and for the three fiscal years ended December 31, 2004, 2005 and 2006 were derived from the combined audited financial statements included in this prospectus. The data for the six-month periods ended June 30, 2006 and 2007 were derived from the unaudited combined interim financial statements also included in this prospectus. The summary combined historical results are not necessarily indicative of results to be expected in future periods.

| | Year Ended December 31,

| | Six Months Ended

June 30,

|

|---|

| | 2004

| | 2005

| | 2006

| | 2006

| | 2007

|

|---|

| |

| |

| |

| | (Unaudited)

|

|---|

| | (In thousands, except per share data)

|

|---|

| Operating Results Data | | | | | | | | | | | | | | | |

| Revenue | | | | | | | | | | | | | | | |

| | Oil and gas sales | | $ | 22,780 | | $ | 47,595 | | $ | 52,050 | | $ | 26,824 | | $ | 31,339 |

| | Gas aggregation, pipeline sales and other | | | 1,491 | | | 5,487 | | | 10,638 | | | 4,874 | | | 4,551 |

| | |

| |

| |

| |

| |

|

| | | Total revenue | | | 24,271 | | | 53,082 | | | 62,688 | | | 31,698 | | | 35,890 |

| Costs and expenses | | | | | | | | | | | | | | | |

| | Lease operating expense | | | 4,539 | | | 6,141 | | | 10,091 | | | 5,770 | | | 5,685 |

| | Production taxes | | | 1,291 | | | 1,813 | | | 1,973 | | | 602 | | | 1,148 |

| | Gas aggregation and pipeline cost of sales | | | 1,316 | | | 4,020 | | | 5,247 | | | 2,111 | | | 4,483 |

| | Depreciation, depletion and amortization | | | 3,479 | | | 8,189 | | | 11,770 | | | 4,543 | | | 8,604 |

| | Exploration | | | — | | | 422 | | | 3,441 | | | 284 | | | 2,019 |

| | General and administrative | | | 3,407 | | | 11,766 | | | 11,889 | | | 4,284 | | | 7,349 |

| | Interest | | | 355 | | | 716 | | | 1,642 | | | 1,032 | | | 1,776 |

| | |

| |

| |

| |

| |

|

| | | Total costs and expenses | | | 14,387 | | | 33,067 | | | 46,053 | | | 18,626 | | | 31,064 |

| | |

| |

| |

| |

| |

|

| Income before provision for income taxes | | | 9,884 | | | 20,015 | | | 16,635 | | | 13,072 | | | 4,826 |

| Provision for deferred income taxes | | | 3,850 | | | 9,234 | | | 6,424 | | | 5,241 | | | 1,858 |

| | |

| |

| |

| |

| |

|

| Net income | | $ | 6,034 | | $ | 10,781 | | $ | 10,211 | | $ | 7,831 | | $ | 2,968 |

| | |

| |

| |

| |

| |

|

| Net income per common share: | | | | | | | | | | | | | | | |

| | Basic | | $ | 0.22 | | $ | 0.28 | | $ | 0.23 | | $ | 0.19 | | $ | 0.07 |

| | Diluted | | $ | 0.22 | | $ | 0.27 | | $ | 0.23 | | $ | 0.18 | | $ | 0.06 |

| Weighted average number of shares of common stock – basic | | | 27,541,033 | | | 38,753,063 | | | 43,485,783 | | | 42,310,871 | | | 44,837,712 |

| Weighted average number of shares of common stock – diluted | | | 27,945,641 | | | 40,209,654 | | | 45,339,821 | | | 44,055,137 | | | 46,660,930 |

8

| | As of December 31,

| |

|

|---|

| | As of

June 30,

2007

|

|---|

| | 2004

| | 2005

| | 2006

|

|---|

| |

| |

| |

| | (Unaudited)

|

|---|

| | (In thousands)

|

|---|

| Balance Sheet Data | | | | | | | | | | | | |

| Property and equipment, net, successful efforts method | | $ | 70,811 | | $ | 170,094 | | $ | 216,239 | | $ | 275,536 |

| Total assets | | | 80,206 | | | 192,300 | | | 231,913 | | | 295,098 |

| Long-term debt | | | 10,683 | | | 25,750 | | | 16,000 | | | 71,000 |

| Stockholders' equity | | | 51,757 | | | 131,669 | | | 176,166 | | | 179,662 |

| Working capital (deficiency) | | | (1,581 | ) | | 3,648 | | | (920 | ) | | 1,215 |

|

|

Year Ended December 31,

|

|

Six Months Ended

June 30,

|

|

|---|

| | 2004

| | 2005

| | 2006

| | 2006

| | 2007

| |

|---|

| |

| |

| |

| | (Unaudited)

| |

|---|

| | (In thousands)

| |

|---|

| Other Financial Data | | | | | | | | | | | | | | | | |

| Net cash provided (used) by: | | | | | | | | | | | | | | | | |

| | Operating activities | | $ | 16,313 | | $ | 30,166 | | $ | 29,158 | | $ | 20,238 | | $ | 10,141 | |

| | Investing activities | | | (27,491 | ) | | (106,355 | ) | | (50,209 | ) | | (23,394 | ) | | (63,482 | ) |

| | Financing activities | | | 12,350 | | | 76,602 | | | 22,219 | | | 4,206 | | | 54,619 | |

| EBITDA(1) | | $ | 13,718 | | $ | 33,777 | | $ | 31,427 | | $ | 19,348 | | $ | 15,850 | |

- (1)

- See "Selected Combined Historical Financial Data—Reconciliation of Non-GAAP Financial Measures" for a reconciliation of our net income to EBITDA.

9

SUMMARY OF OIL AND GAS DATA

Operating Data

The following table presents certain information with respect to our historical operating data for the years ended December 31, 2004, 2005 and 2006 and for the six months ended June 30, 2007:

| | Year Ended December 31,

| |

|

|---|

| | Six Months Ended June 30, 2007

|

|---|

| | 2004

| | 2005

| | 2006

|

|---|

| Gross wells | | | | | | | | | | | | |

| | Drilled | | | 14 | | | 23 | | | 39 | | | 24 |

| | Completed | | | 14 | | | 20 | | | 34 | | | 22 |

| Net wells | | | | | | | | | | | | |

| | Drilled | | | 9.7 | | | 21.6 | | | 32.1 | | | 20.2 |

| | Completed | | | 9.7 | | | 18.6 | | | 28.0 | | | 18.4 |

| Net production data | | | | | | | | | | | | |

| | Net volume (MMcfe) | | | 3,849 | | | 6,098 | | | 7,703 | | | 4,372 |

| | Average daily volume (MMcfe/d) | | | 10.5 | | | 16.7 | | | 21.1 | | | 24.1 |

| Average sales price (per Mcfe) | | | | | | | | | | | | |

| | Average sales price (without hedge) | | $ | 5.91 | | $ | 7.81 | | $ | 6.76 | | $ | 7.17 |

| | Average sales price (with hedge) | | | 5.91 | | | 7.79 | | | 7.54 | | | 7.18 |

| Expenses (per Mcfe) | | | | | | | | | | | | |

| | Lease operating | | $ | 1.18 | | $ | 1.01 | | $ | 1.31 | | $ | 1.30 |

| | Production and ad valorem taxes | | | 0.34 | | | 0.30 | | | 0.26 | | | 0.26 |

| | General and administrative | | | 0.89 | | | 1.93 | | | 1.54 | | | 1.67 |

| | Depreciation, depletion and amortization | | | 0.90 | | | 1.34 | | | 1.53 | | | 1.97 |

Estimated Reserve Data

The estimates in the table below of our net proved reserves as of June 30, 2007 are based on a reserve report prepared by MHA.

| | As of June 30, 2007

|

|---|

| Estimated Proved Reserves | | | |

| | Gas (Bcf) | | | 187 |

| | Oil (MMBbls) | | | 11 |

| | |

|

| | | Total proved reserves (Bcfe)(1) | | | 256 |

| | |

|

| | Total proved developed reserves (Bcfe) | | | 91 |

PV-10 value (millions)(2) |

|

|

|

| | Proved developed reserves | | $ | 228 |

| | Proved undeveloped reserves | | | 348 |

| | |

|

| | | Total PV-10 value | | $ | 576 |

| | |

|

- (1)

- Based on a conversion rate of 6 Mcfe of gas per Bbl of oil/condensate.

- (2)

- Based on June 30, 2007 posted field prices of $6.795 per MMBtu of gas and $67.25 per Bbl of oil, each adjusted for basis and held flat for the life of the reserves and adjusted for quality differentials. See "Selected Combined Historical Financial Data—Reconciliation of Non-GAAP Financial Measures" for a reconciliation of PV-10 to the standardized measure of discounted future net cash flows.

10

RISK FACTORS

You should consider carefully each of the risks described below, together with all of the other information contained in this prospectus, before deciding to invest in our common stock.

Risks Related to Our Business

Oil and gas prices are volatile, and a decline in oil and gas prices would adversely affect our financial results and impede our ability to make capital expenditures necessary to grow.

Our revenues, profitability and cash flow depend substantially upon the prices and demand for oil and gas. The markets for these commodities are volatile, and even relatively modest drops in prices can affect significantly our financial results and impede our growth. Prices for oil and gas fluctuate widely in response to relatively minor changes in the supply and demand for oil and gas, market uncertainty and a variety of additional factors beyond our control, such as:

- •

- domestic and foreign supply of oil and gas;

- •

- price and quantity of foreign imports;

- •

- domestic and foreign governmental regulations;

- •

- political conditions in or affecting other oil producing and gas producing countries, including the current conflicts in the Middle East and conditions in South America and Russia;

- •

- weather conditions, including unseasonably warm winter weather;

- •

- technological advances affecting oil and gas consumption;

- •

- overall U.S. and global economic conditions; and

- •

- price and availability of alternative fuels.

Further, oil prices and gas prices do not necessarily fluctuate in direct relationship to each other. Because approximately 73% of our estimated proved reserves as of June 30, 2007 were gas reserves, our financial results are more sensitive to movements in gas prices. In the past, the price of gas has been extremely volatile, and we expect this volatility to continue. For example, during the year ended December 31, 2006, the NYMEX natural gas spot price ranged from a high of $9.90 per MMBtu to a low of $3.66 per MMBtu. The NYMEX natural gas spot price at December 31, 2006 was $5.50 per MMBtu and on June 29, 2007 it was $6.41 per MMBtu. At August 6, 2007, the NYMEX spot gas price was $6.11 per MMBtu. Our revenues for the six months ended June 30, 2007 were $35.9 million. If, on average, gas prices during that period were $1.00 lower than the actual gas prices, our revenues would have been approximately $3.4 million lower than our actual revenues. The results of higher investment in the exploration for and production of gas and other factors may cause the price of gas to drop. Lower oil and gas prices may not only decrease our revenues but also may reduce the amount of oil and gas that we can produce economically. Lower prices may result in our having to make substantial downward adjustments to our estimated proved reserves. If this occurs or if our estimates of development costs increase, production data factors change or our exploration results deteriorate, accounting rules may require us to write down, as a non-cash charge to earnings, the carrying value of our properties for impairments. We are required to perform impairment tests on our assets whenever events or changes in circumstances lead to a reduction of the estimated useful life or estimated future cash flows that would indicate that the carry amount may not be recoverable or whenever management's plans change with respect to those assets. We may incur impairment charges in the future, which could have a material adverse effect on our results of operations in the period taken.

11

Our future revenues are dependent on the ability to successfully complete drilling activity.

In general, production from oil and gas properties declines as reserves are depleted, with the rate of decline depending on reservoir characteristics. Our total proved reserves will decline as reserves are produced and, therefore, our level of production and cash flows will be affected adversely unless we conduct successful exploration and development activities or acquire properties containing proved reserves. Exploration and development activities involve numerous risks, including the risk that no commercially productive oil or gas reservoirs will be discovered. In addition, the future cost and timing of drilling, completing and producing wells is often uncertain. Furthermore, drilling operations may be curtailed, delayed or canceled as a result of a variety of factors, including:

- •

- lack of acceptable prospective acreage;

- •

- inadequate capital resources;

- •

- unexpected drilling conditions; pressure or irregularities in formations; equipment failures or accidents;

- •

- adverse weather conditions, including hurricanes;

- •

- unavailability or high cost of drilling rigs, equipment or labor;

- •

- reductions in oil and gas prices;

- •

- limitations in the market for oil and gas;

- •

- title problems;

- •

- compliance with governmental regulations; and

- •

- mechanical difficulties.

The use of a frac technology may not be effective in increasing our levels of production or our levels of ultimate recovery.

We are utilizing a frac technology to stimulate the production of our wells and have not achieved additional production over an extensive period of time to determine whether or not the enhanced production achieved by using the frac technology will be sustained or enhance our ultimate recovery of hydrocarbons. In addition, production results will vary from well to well and there is no assurance that we will obtain or maintain increased levels of production that we have experienced to date using this frac technology.

Drilling multilateral wells may not increase levels of production or our levels of ultimate recovery.

We intend to drill multilateral wells in the James Lime formation in Shelby County. We have not previously drilled multilateral wells in this formation. Production results may not be enhanced from using this multilateral technique while costs to drill these wells will increase from single lateral drilling.

The interpretation and analysis of 3-D seismic data does not allow the interpreter to know if hydrocarbons are present or economically producible.

Our decisions to purchase, explore, develop and exploit prospects or properties depend in part on data obtained through geophysical and geological analyses, production data and engineering studies, the results of which are uncertain. Even when used and properly interpreted, 3-D seismic data and visualization techniques only assist geoscientists and geologists in identifying subsurface structures and hydrocarbon indicators. They do not allow the interpreter to know if hydrocarbons are present or producible economically. In addition, the use of 3-D seismic and other advanced technologies require greater predrilling expenditures than traditional drilling strategies.

12

The credit default of one of our customers could have a temporary adverse effect on us.

Our revenues are generated under contracts with a limited number of customers. Results of operations would be adversely affected as a result of non-performance by two of our large customers, which represent 10% or more of our sales, of their contractual obligations. A non-payment default by one of these large customers could have an adverse effect on us, temporarily reducing our cash flow.

Our identified drilling location inventories are scheduled out over several years, making them susceptible to uncertainties that could materially alter the occurrence or timing of their drilling.

Our management team has specifically identified and scheduled drilling locations as an estimation of our future multi-year drilling activities on our acreage. Our drilling locations represent a significant part of our growth strategy. Our ability to drill and develop these locations depends on a number of factors, including the availability of capital, seasonal conditions, regulatory approvals, oil and gas prices, costs and drilling results. Our final determination on whether to drill any of these drilling locations will be dependent upon the factors described elsewhere in this prospectus as well as, to some degree, the results of our drilling activities with respect to our proved drilling locations. Because of these uncertainties, we do not know if the drilling locations we have identified will be drilled within our timeframe or will ever be drilled or if we will be able to produce oil or gas from these or any other potential drilling locations. As such, our actual drilling activities may be materially different from those presently identified, which could adversely affect our business, results of operations or financial condition.

Unless we replace our oil and gas reserves, our reserves and production will decline.

Our future oil and gas production depends on our success in finding or acquiring additional reserves. The decline rate for our proved developed producing wells has averaged over 20% for the first year of production. Our estimated average decline rates for the life of our reserves are 8.5% for our reserves that are proved developed producing and 9.0% for our total proved reserves. If we fail to replace reserves through drilling or acquisitions, our level of production and cash flows will be affected adversely. In general, production from oil and gas properties declines as reserves are depleted, with the rate of decline depending on reservoir characteristics. Our total proved reserves will decline as reserves are produced unless we conduct other successful exploration and development activities or acquire properties containing proved reserves, or both. Our ability to make the necessary capital investment to maintain or expand our asset base of oil and gas reserves would be impaired to the extent cash flow from operations is reduced and external sources of capital become limited or unavailable. We may not be successful in exploring for, developing or acquiring additional reserves.

We face uncertainties in estimating proved oil and gas reserves and inaccuracies in our estimates could result in lower than expected reserve quantities and a lower present value of our proved reserves.

Petroleum engineering is a subjective process of estimating underground accumulations of oil and gas that cannot be measured in an exact manner. Estimates of economically recoverable oil and gas reserves and of future net cash flows necessarily depend upon a number of variable factors and assumptions, including:

- •

- historical production from the area compared with production from other similar producing areas;

- •

- the assumed effects of regulations by governmental agencies;

- •

- assumptions concerning future oil and gas prices; and

- •

- assumptions concerning future operating costs, severance and excise taxes, development costs and workover and remedial costs.

13

Because all reserve estimates are to some degree subjective, each of the following items may differ materially from those assumed in estimating proved reserves:

- •

- the quantities of oil and gas that are ultimately recovered;

- •

- the production and operating costs incurred;

- •

- the amount and timing of future development expenditures; and

- •

- future oil and gas sales prices.

As of June 30, 2007, approximately 64% of our proved reserves were either proved undeveloped or proved non-producing. Estimates of proved undeveloped or proved non-producing reserves are even less reliable than estimates of proved developed producing reserves.

Furthermore, different reserve engineers may make different estimates of reserves and cash flows based on the same available data. Our actual production, revenues and expenditures with respect to reserves will likely be different from estimates and the differences may be material. The discounted future net cash flows included in this prospectus should not be considered as the current market value of the estimated oil and gas reserves attributable to our properties. As required by the SEC, the estimated discounted future net cash flows from proved reserves are generally based on prices and costs as of the date of the estimate, while actual future prices and costs may be materially higher or lower. Actual future net cash flows also will be affected by factors such as:

- •

- the amount and timing of actual production;

- •

- supply and demand for oil and gas;

- •

- increases or decreases in consumption; and

- •

- changes in governmental regulations or taxation.

In addition, the 10% discount factor, which is required by the SEC to be used to calculate discounted future net cash flows for reporting purposes, is not necessarily the most appropriate discount factor based on interest rates in effect from time to time and risks associated with us or the oil and gas industry in general.

You should not assume that the present value of future net revenues from our proved reserves referred to in this prospectus is the current market value of our estimated oil and natural gas reserves. In accordance with SEC requirements, we generally base the estimated discounted future net cash flows from our proved reserves on prices and costs on the date of the estimate. Actual future prices and costs may differ materially from those used in the present value estimate. If gas prices decline by $1.00 per Mcf, then our PV-10 as of June 30, 2007 would decrease from $576 million to $497 million.

Our bank lenders can limit our borrowing capabilities, which may materially impact our operations.

At August 6, 2007 our debt outstanding under our credit facility was approximately $84.0 million and we intend to use a portion of the proceeds from this offering to repay the outstanding balance under our credit facility. Our credit facility subjects us to a number of covenants that impose restrictions on us. Our credit facility also provides for periodic redeterminations of our borrowing base, which may affect our borrowing capacity. Redeterminations are based upon a number of factors, including commodity prices and reserve levels. In addition, our bank lenders have substantial flexibility to reduce our borrowing base due to subjective factors. Upon a redetermination, we could be required to repay a portion of our bank debt to the extent our outstanding borrowings at such time exceeds the redetermined borrowing base. We may not have sufficient funds to make such repayments, which could result in a default under the terms of the loan agreement and an acceleration of the loan.

14

We intend to finance our development, acquisition and exploration activities with cash flow from operations, bank borrowings and other financing activities. In addition, we may significantly alter our capitalization to make future acquisitions or develop our properties. These changes in capitalization may significantly increase our level of debt. If we incur additional debt for these or other purposes, the related risks that we now face could intensify. A higher level of debt also increases the risk that we may default on our debt obligations. Our ability to meet our debt obligations and to reduce our level of debt depends on our future performance which is affected by general economic conditions and financial, business and other factors. Our level of debt affects our operations in several important ways, including the following:

- •

- a portion of our cash flow from operations is used to pay interest on borrowings;

- •

- the covenants contained in the agreements governing our debt limit our ability to borrow additional funds, pay dividends, dispose of assets or issue shares of preferred stock and otherwise may affect our flexibility in planning for, and reacting to, changes in business conditions;

- •

- a high level of debt may impair our ability to obtain additional financing in the future for working capital, capital expenditures, acquisitions, general corporate or other purposes;

- •

- a leveraged financial position would make us more vulnerable to economic downturns and could limit our ability to withstand competitive pressures; and

- •

- any debt that we incur under our revolving credit facility will be at variable rates which makes us vulnerable to increases in interest rates.

We depend on our senior management team and other key personnel. Accordingly, the loss of any of these individuals could adversely affect our business, financial condition and the results of operations and future growth.

Our success is largely dependent on the skills, experience and efforts of our people. The loss of the services of one or more members of our senior management team or of our other employees with critical skills needed to operate our business could have a negative effect on our business, financial conditions and results of operations and future growth. We have not entered into, and do not expect to enter into, employment agreements or non-competition agreements with any of our key employees, other than T. Scott Martin, our President and Chief Executive Officer. See "Management—Employment Agreements and Other Arrangements." Our ability to manage our growth, if any, will require us to continue to train, motivate and manage our employees and to attract, motivate and retain additional qualified personnel. Competition for these types of personnel is intense and we may not be successful in attracting, assimilating and retaining the personnel required to grow and operate our business profitably.

Market conditions or transportation impediments may hinder our access to oil and gas markets or delay our production.

Market conditions, the unavailability of satisfactory oil and gas processing and transportation may hinder our access to oil and gas markets or delay our production. For example, in areas where we do not own the gathering system, such as in the Hugoton, production may be delayed from time to time while we await connection to the gathering system. The availability of a ready market for our oil and gas production depends on a number of factors, including the demand for and supply of oil and gas and the proximity of reserves to pipelines or trucking and terminal facilities. In addition, the amount of oil and gas that can be produced and sold is subject to curtailment in certain circumstances, such as pipeline interruptions due to scheduled and unscheduled maintenance, excessive pressure, physical damage to the gathering or transportation system or lack of contracted capacity on such systems. The

15

curtailments arising from these and similar circumstances may last from a few days to several months, and we are often provided with limited, if any, notice as to when these circumstances will arise and their duration. As a result, we may not be able to sell our oil and gas production, we may have to transport our production by more expensive means, or we may be required to shut in gas wells or delay initial production until the necessary gathering and transportation systems are available. Any significant curtailment in gathering system or pipeline capacity, or significant delay in construction of necessary gathering and transportation facilities, could adversely affect our business, financial condition and results of operations.

We will require additional capital to fund our future activities. If we fail to obtain additional capital, we may not be able to implement fully our business plan, which could lead to a decline in reserves.

We depend on our ability to obtain financing beyond our cash flow from operations. Historically, we have financed our business plan and operations primarily with internally generated cash flow, bank borrowings, and issuances of common stock. Our future contractual commitments from June 30, 2007 through June 30, 2012 total $95.2 million and include debt obligations, operating lease obligations, and a firm drilling rig lease commitment and other obligations, collectively aggregating approximately $9.0 million through June 30, 2008, an additional $14.4 million through June 30, 2010, and an additional $71.9 million through June 30, 2012. We also require capital to fund our capital budget, including acquisitions, which is expected to be approximately $134 million for 2007. In addition, approximately 64% of our total estimated proved reserves were undeveloped as of June 30, 2007. Recovery of such reserves will require significant capital expenditures and successful drilling operations. We will be required to meet our needs from our internally generated cash flow, debt financings, and equity financings.

If our revenues decrease as a result of lower commodity prices, operating difficulties, declines in reserves or for any other reason, we may have limited ability to obtain the capital necessary to sustain our operations at current levels. We may, from time to time, need to seek additional financing. Our revolving credit facility contains covenants restricting our ability to incur additional indebtedness without the consent of the lender. If we incur additional debt, the related risks that we now face could intensify.

Even if additional capital is needed, we may not be able to obtain debt or equity financing on terms favorable to us, or at all. If cash generated by operations or available under our revolving credit facility is not sufficient to meet our capital requirements, the failure to obtain additional financing could result in a curtailment of our operations relating to exploration and development of our projects, which in turn could lead to a possible loss of properties and a decline in our natural gas reserves.

The unavailability or high cost of drilling rigs, equipment, supplies, personnel, and oilfield services could adversely affect our ability to execute our exploration and development plans on a timely basis and within our budget.

Our industry is cyclical, and from time to time there is a shortage of drilling rigs, equipment, supplies or qualified personnel. During these periods, the costs and delivery times of rigs, equipment, and supplies are substantially greater. As a result of historically strong prices of oil and gas, the demand for oilfield and drilling services has risen, and the costs of these services are increasing. For example, average day rates for land-based rigs have increased substantially during the last two years. We are particularly sensitive to higher rig costs and drilling rig availability, as we presently have two rigs under contract, with one rig under contract on a month-to-month basis. If the unavailability or high cost of drilling rigs, equipment, supplies, or qualified personnel were particularly severe in the areas where we operate, we could be materially and adversely affected.

16

We may incur losses as a result of title deficiencies.

We purchase working and revenue interests in the natural gas and oil leasehold interests upon which we will perform our exploration activities from third parties or directly from the mineral fee owners. The existence of a material title deficiency can render a lease worthless and can adversely affect our results of operations and financial condition. Title insurance covering mineral leaseholds is not generally available and, in all instances, we forego the expense of retaining lawyers to examine the title to the mineral interest to be placed under lease or already placed under lease until the drilling block is assembled and ready to be drilled. As is customary in our industry, we rely upon the judgment of natural gas and oil lease brokers, in-house landmen or independent landmen who perform the field work in examining records in the appropriate governmental offices and abstract facilities before attempting to acquire or place under lease a specific mineral interest. We, in some cases, perform curative work to correct deficiencies in the marketability of the title to us. The work might include obtaining affidavits of heirship or causing an estate to be administered. We obtain title opinions for specific drilling locations prior to the commencement of drilling. In cases involving more serious title problems, the amount paid for affected natural gas and oil leases can be generally lost, and the target area can become undrillable.

Competition in the oil and gas industry is intense, and many of our competitors have resources that are greater than ours.

We operate in a highly competitive environment for acquiring prospects and productive properties, marketing oil and gas and securing equipment and trained personnel. As a relatively small oil and gas company, many of our competitors, major and large independent oil and gas companies, possess and employ financial, technical and personnel resources substantially greater than ours. Those companies may be able to develop and acquire more prospects and productive properties than our financial or personnel resources permit. Our ability to acquire additional prospects and discover reserves in the future will depend on our ability to evaluate and select suitable properties and consummate transactions in a highly competitive environment. Also, there is substantial competition for capital available for investment in the oil and gas industry. Larger competitors may be better able to withstand sustained periods of unsuccessful drilling and absorb the burden of changes in laws and regulations more easily than we can, which would adversely affect our competitive position. We may not be able to compete successfully in the future in acquiring prospective reserves, developing reserves, marketing hydrocarbons, attracting and retaining quality personnel and raising additional capital.

Operating hazards, natural disasters or other interruptions of our operations including, with respect to our Texas and Louisiana operations, those from hurricanes, could result in potential liabilities, which may not be fully covered by our insurance.

The oil and gas business involves certain operating hazards such as:

- •

- well blowouts;

- •

- cratering;

- •

- explosions;

- •

- uncontrollable flows of oil, gas or well fluids;

- •

- fires;

- •

- pollution; and

- •

- releases of toxic gas.

17

In addition, our operations in Texas and Louisiana are especially susceptible to damage from natural disasters such as hurricanes and involve increased risks of personal injury, property damage and marketing interruptions. The occurrence of one of these operating hazards may result in injury, loss of life, suspension of operations, environmental damage and remediation and/or governmental investigations and penalties. The payment of any of these liabilities could reduce, or even eliminate, the funds available for exploration, development, and acquisition, or could result in a loss of our properties.

Our insurance policies provide limited coverage for losses or liabilities relating to pollution, with broader coverage for sudden and accidental occurrences. Our insurance might be inadequate to cover our liabilities. Insurance costs are expected to continue to increase over the next few years, and we may decrease coverage and retain more risk to mitigate future cost increases. If we incur substantial liability, and the damages are not covered by insurance or are in excess of policy limits, then our business, results of operations and financial condition may be materially adversely affected.

Environmental liabilities may expose us to significant costs and liabilities.

We could incur significant environmental costs and liabilities in our oil and natural gas operations due to the handling of petroleum hydrocarbons and generated wastes, the occurrence of air emissions and water discharges from work-related activities, and the legacy of pollution from historical industry operations and waste disposal practices. Environmental liabilities may arise in both the exploration and production of oil and gas as well as in connection with our gas gathering operations. Failure to comply with applicable environmental laws and regulations may result in the assessment of administrative, civil and criminal penalties, imposition of remedial obligations, and the issuance of injunctions limiting or preventing some or all of our operations. Moreover, joint and several, strict liability may be incurred under these environmental laws and regulations in connection with spills, leaks or releases of petroleum hydrocarbons and wastes on, under or from our properties and facilities, many of which have been used for exploration, production or development activities for many years, oftentimes by third parties not under our control. Private parties, including the owners of properties upon which we conduct drilling and production activities as well as facilities where our petroleum hydrocarbons or wastes are taken for reclamation or disposal, may also have the right to pursue legal actions to enforce compliance as well as to seek damages for non-compliance with environmental laws and regulations or for personal injury or property damage. In addition, changes in environmental laws and regulations occur frequently, and any such changes that result in more stringent and costly waste handling, storage, transport, disposal, or remediation requirements could have a material adverse effect on our operations or financial position. We may not be able to recover some or any of these costs from insurance. See "Business—Environmental Regulation."

Our growth strategy could fail or present unanticipated problems for our business in the future, which could adversely affect our ability to make acquisitions or realize anticipated benefits of those acquisitions.

Our growth strategy may include acquiring oil and gas businesses and properties. We may not be able to identify suitable acquisition opportunities or finance and complete any particular acquisition successfully.

Furthermore, acquisitions involve a number of risks and challenges, including:

- •

- diversion of management's attention;

- •

- the need to integrate acquired operations;

- •

- potential loss of key employees of the acquired companies;

- •

- potential lack of operating experience in a geographic market of the acquired business; and

- •

- an increase in our expenses and working capital requirements.

18

Any of these factors could adversely affect our ability to achieve anticipated levels of cash flows from the acquired businesses or realize other anticipated benefits of those acquisitions.

Risks Related to this Offering and Our Common Stock

We are controlled by principal stockholders whose interests may differ from your interests and who will be able to exert significant influence over corporate decisions.

Yorktown Energy Partners V, L.P. and Yorktown Energy Partners VI, L.P., or collectively, Yorktown, own approximately 61.2% of our outstanding common stock. After giving effect to our initial public offering, Yorktown will continue to beneficially own approximately 52.0% of our outstanding common stock ( % if the over-allotment option is exercised in full). In addition, two Yorktown representatives serve on our board of directors, and our directors, officers and their affiliates will beneficially own or control approximately 61.0% of our common stock outstanding ( % if the over-allotment option is exercised in full). See "Security Ownership of Certain Beneficial Owners and Management." As a result of this ownership, Yorktown will have the ability to nominate all our directors and will have the ability to control the vote in any election of directors. Yorktown will also have control over our decisions to enter into significant corporate transactions and, in its capacity as our majority stockholder, will have the ability to prevent any transactions that it does not believe are in Yorktown's best interest. As a result, Yorktown will be able to control, directly or indirectly and subject to applicable law, all matters affecting us, including the following:

- •

- any determination with respect to our business direction and policies, including the appointment and removal of officers;

- •

- any determinations with respect to mergers, business combinations or dispositions of assets;

- •

- our capital structure;

- •

- compensation, option programs and other human resources policy decisions;

- •

- changes to other agreements that may adversely affect us; and

- •

- the payment of dividends on our common stock.

Yorktown may also have an interest in pursuing transactions that, in their judgment, enhance the value of their respective equity investments in our company, even though those transactions may involve risks to you as a minority stockholder. In addition, circumstances could arise under which their interests could be in conflict with the interests of our other stockholders or you, a minority stockholder. Also, Yorktown and its affiliates have and may in the future make significant investments in other companies, some of which may be competitors. Yorktown and its affiliates are not obligated to advise us of any investment or business opportunities of which they are aware, and they are not restricted or prohibited from competing with us.

There has been no public market for our common stock, and our stock price may fluctuate significantly.

There is currently no public market for our common stock, and an active trading market may not develop or be sustained after the sale of all of the shares covered by this prospectus. The market price of our common stock could fluctuate significantly as a result of:

- •

- our operating and financial performance and prospects;

- •

- quarterly variations in the rate of growth of our financial indicators, such as net income per share, net income and revenues;

- •

- changes in revenue or earnings estimates or publication of research reports by analysts about us or the exploration and production industry;

19

- •

- liquidity and registering our common stock for public resale;

- •

- actual or unanticipated variations in our reserve estimates and quarterly operating results;

- •

- changes in oil and gas prices;

- •

- speculation in the press or investment community;

- •

- sales of our common stock by our stockholders;

- •

- increases in our cost of capital;

- •

- changes in applicable laws or regulations, court rulings and enforcement and legal actions;

- •

- changes in market valuations of similar companies;

- •

- adverse market reaction to any increased indebtedness we incur in the future;

- •

- additions or departures of key management personnel;

- •

- actions by our stockholders;

- •

- general market and economic conditions, including the occurrence of events or trends affecting the price of natural gas; and

- •

- domestic and international economic, legal, and regulatory factors unrelated to our performance.

If a trading market develops for our common stock, stock markets in general experience volatility that often is unrelated to the operating performance of particular companies. These broad market fluctuations may adversely affect the trading price of our common stock.

The market price of our common stock could be adversely affected by sales of substantial amounts of our common stock in the public markets.

We have recently filed a registration statement to register 8,000,000 shares of our common stock in an underwritten initial public offering. The sale of the shares of common stock in this public offering or the issuance of a large number of shares of our common stock in connection with future acquisitions, equity financings or otherwise, could cause the market price of our common stock to decline significantly. After the completion of our initial public offering, we will have approximately 52.9 million shares of common stock issued and outstanding, including approximately 31.5 million shares of our common stock held or controlled by our executive officers and directors which are or will be eligible for sale under Rule 144 after the expiration of the 180-day lock-up period that is applicable to our executive officers, directors, and certain of our stockholders following the completion of our initial public offering. All of the 8,000,000 shares of the common stock sold in our initial public offering will be freely tradable without restriction or further registration under the Securities Act by persons other than our "affiliates"(within the meaning of Rule 144 under the Securities Act) immediately upon completion of our initial public offering. Additionally, we may file one or more registration statements with the Securities and Exchange Commission providing for the registration of up to approximately 3.6 million additional shares of our common stock issued or reserved for issuance under our employee plans, all of which will be eligible for sale without further registration under the Securities Act.

We do not anticipate paying any dividends on our common stock in the foreseeable future.

We do not expect to declare or pay any cash or other dividends in the foreseeable future on our common stock, as we intend to use cash flow generated by operations to expand our business. Our credit facility will restrict our ability to pay cash dividends on our common stock, and we may also enter into credit agreements or other borrowing arrangements in the future that restrict our ability to declare or pay cash dividends on our common stock.

20

You may experience dilution of your ownership interests due to the future issuance of additional shares of our common stock.

We may in the future issue our previously authorized and unissued securities, resulting in the dilution of the ownership interests of our present stockholders and purchasers of common stock offered hereby. We are currently authorized to issue 125,000,000 shares of common stock and 10,000,000 shares of preferred stock with preferences and rights as determined by our board of directors. The potential issuance of such additional shares of common stock may create downward pressure on the trading price of our common stock. We may also issue additional shares of our common stock or other securities that are convertible into or exercisable for common stock in connection with the hiring of personnel, future acquisitions, future public offerings or private placements of our securities for capital raising purposes, or for other business purposes.

Provisions under Delaware law, our certificate of incorporation and bylaws could delay or prevent a change in control of our company, which could adversely affect the price of our common stock.

The existence of some provisions under Delaware law, our certificate of incorporation and bylaws could delay or prevent a change in control of our company, which could adversely affect the price of our common stock. For example, our certificate of incorporation and bylaws provide that no stockholder shall have the right to call a special meeting of the stockholders. In addition, Delaware law imposes restrictions on mergers and other business combinations between us and any holder of 15% or more of our outstanding common stock.

We will incur increased costs as a result of being a public company.