UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to Section 240.14a-12 |

FBR & CO.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | |

| | (1) | | Amount previously paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

FBR & CO.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Our Shareholders:

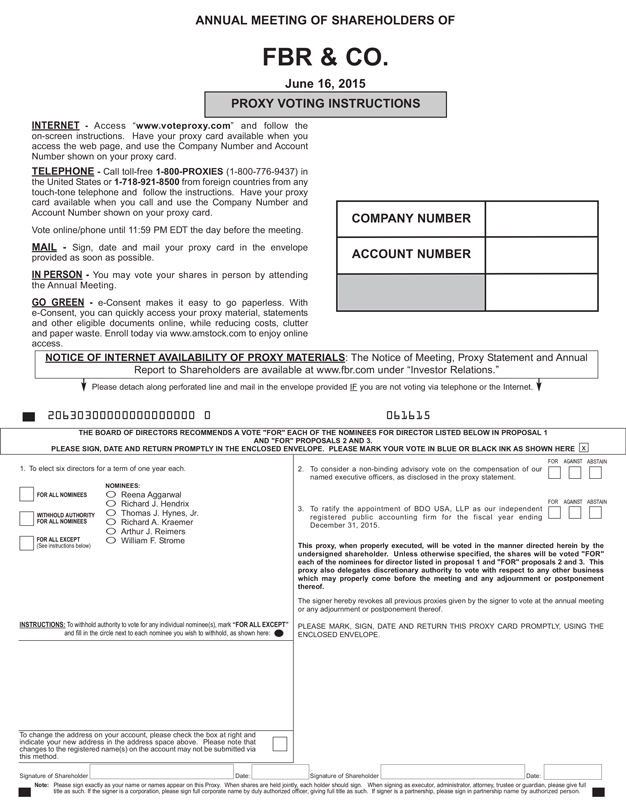

FBR & Co., a Virginia corporation, will hold its annual meeting of shareholders at 1300 North Seventeenth Street, 1st Floor, Arlington, Virginia 22209, on Tuesday, June 16, 2015, at 9:00 a.m., for the following purposes:

| | 1. | To elect six directors for a term of one year each; |

| | 2. | To consider a non-binding advisory vote on the compensation of our named executive officers, as disclosed in the accompanying proxy statement; |

| | 3. | To ratify the appointment of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2015; and |

| | 4. | To transact such other business as may properly come before the annual meeting of shareholders or any adjournment or postponement thereof. |

Only holders of shares of our company’s common stock outstanding at the close of business on the record date, April 24, 2015, are entitled to notice of, and to vote at, the annual meeting of shareholders.

A list of shareholders entitled to vote at the annual meeting will be available at the annual meeting and for the ten day period prior to the annual meeting at our company’s principal executive office, which is located at 1300 North Seventeenth Street, 14th Floor, Arlington, Virginia 22209.

Whether or not you plan to attend the annual meeting, it is important that your shares are represented and voted. You may authorize your proxy over the Internet or by telephone as described on the proxy card attached to the accompanying proxy statement. Alternatively, you may authorize your proxy and instruct the proxies named in the proxy card attached to the accompanying proxy statement how to vote by signing and returning the proxy card in the envelope provided. Once you authorize your proxy, you may revoke your proxy by executing and delivering to us a later dated proxy card, by subsequently authorizing your proxy over the Internet or by telephone, by sending a written revocation of your proxy to our Corporate Secretary at our principal executive office or by attending the annual meeting and voting in person. If you hold your shares in “street name” (i.e., through a bank, broker or other nominee), you will receive from your nominee instructions that you must follow in order to provide voting instructions to your nominee, or you may contact your nominee directly to request these instructions. If you hold your shares in street name, you must follow the instructions you receive from your nominee in order to revoke your voting instructions.

|

| By Order of the Board of Directors, |

|

| Gavin A. Beske |

| Senior Vice President and General Counsel |

Arlington, Virginia

April 28, 2015

|

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS

FOR THE 2015 ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 16, 2015 This notice, our 2015 proxy statement attached to this notice and our 2014 annual report to shareholders are available free of charge on our website at www.fbr.com under “Investor Relations.” |

1300 North Seventeenth Street

Arlington, Virginia 22209

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JUNE 16, 2015

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

The Solicitation of Proxies

The Board of Directors (“Board” or “Board of Directors”) of FBR & Co. (“we,” “us,” “our,” “our company” or “FBR”) is soliciting your proxy in connection with the 2015 annual meeting of shareholders to be held at 1300 North Seventeenth Street, 1st Floor, Arlington, Virginia 22209, on June 16, 2015, at 9:00 a.m. At the annual meeting, shareholders will consider and vote on the proposals described in this proxy statement. The mailing address of our principal executive office is 1300 North Seventeenth Street, Suite 1400, Arlington, Virginia 22209. Our proxy materials, including this proxy statement and the accompanying proxy card, together with the Notice of Annual Meeting of Shareholders and a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2014, are first being mailed to shareholders on or about May 8, 2015.

The solicitation of proxies is being made primarily by the use of standard mail. We will pay the cost of preparing and mailing this proxy statement and accompanying proxy materials, and the cost of any supplementary solicitations, which may be made by standard mail, e-mail, telephone or personally by our directors, officers or employees. None of our directors, officers or employees will receive any additional or special compensation for soliciting your proxy. We have retained D.F. King & Co. to assist in the solicitation of proxies for a fee of $12,000, plus reasonable out-of-pocket expenses. We will, on request, reimburse brokers, banks and other nominees for their reasonable expenses in sending our proxy materials and voting instruction forms to street name holders to obtain their voting instructions.

Who Can Vote

You are entitled to vote your FBR common stock if our records show that you held your shares at the close of business on the record date, April 24, 2015. At the close of business on that date, a total of 7,581,176 shares of FBR common stock were outstanding and entitled to vote. Each share of FBR common stock is entitled to one vote. Cumulative voting is not permitted.

How to Vote

You may authorize your proxy over the Internet or by telephone as described on the proxy card accompanying this proxy statement. Alternatively, you may authorize your proxy and instruct the proxies named in the proxy card how to vote by signing and returning the proxy card in the envelope provided. Once you authorize your proxy, you may revoke your proxy by executing and delivering to us a later dated proxy card, by subsequently authorizing your proxy over the Internet or by telephone, by sending a written revocation of your proxy to our Corporate Secretary at our principal executive office or by attending the annual meeting and voting in person.

If you hold your shares in street name (i.e.,through a bank, broker or other nominee), you will receive from your nominee instructions that you must follow in order to provide voting instructions to your nominee, or you may contact your nominee directly to request these instructions. If you hold your shares in street name, you must follow the instructions you receive from your nominee in order to revoke your voting instructions.

1

Matters to be Presented

At the annual meeting, shareholders will consider and vote on:

| | 1. | The election of six directors for a term of one year each; |

| | 2. | A proposal to consider a non-binding advisory vote on the compensation of our named executive officers, as disclosed in this proxy statement; |

| | 3. | A proposal to ratify the appointment of BDO USA, LLP (“BDO”) as our independent registered public accounting firm for the fiscal year ending December 31, 2015; and |

| | 4. | Such other business as may properly come before the annual meeting of shareholders or any adjournment or postponement thereof. |

We are not now aware of any other matters to be presented at the annual meeting. If any other matters are properly presented at the annual meeting, the proxies will vote your shares, if authorized, in accordance with the recommendation of our Board of Directors or use their own judgment to determine how to vote your shares.

Attending the Annual Meeting in Person

If you would like to attend the annual meeting in person, you will need to bring an account statement or other evidence acceptable to us as proof of ownership of your shares as of the close of business on the record date. If you hold your shares in street name and wish to vote in person at the annual meeting, you will need to contact your nominee and obtain a proxy from your nominee and bring it to the annual meeting.

Quorum Requirement

A majority of the votes entitled to be cast on a matter constitutes a quorum for action on that matter. A quorum is required to conduct the annual meeting. If (i) you have authorized your proxy over the Internet or by telephone or by signing and returning the proxy card and you have not revoked your proxy, or (ii) you attend the annual meeting and vote in person, your shares will be counted for the purpose of determining whether there is a quorum. Abstentions and shares of record held by brokers, banks or nominees that are voted on any matter will be included in determining whether a quorum is present.

Vote Required for Each Matter to be Presented at the Annual Meeting

Proposal 1

If a quorum is present at the annual meeting, directors will be elected by a plurality of the votes cast by the shares entitled to vote in the election of directors. Votes withheld and shares held in street name that are not voted on this proposal (i.e., broker non-votes) will not have an impact on the outcome of the vote on the election of directors.

Proposal 2

The advisory vote on executive compensation is not binding on our company, the Board or the Compensation Committee. However, the Board and the Compensation Committee will review the voting results and take them into consideration when making future decisions regarding compensation of our named executive officers. If a quorum is present at the annual meeting, the advisory vote on executive compensation will be approved if the votes cast in favor of the proposal exceed the votes cast opposing the proposal. Abstentions and broker non-votes will not have an impact on the outcome of the vote on this proposal.

Proposal 3

If a quorum is present at the annual meeting, the ratification of the appointment of BDO as our independent registered public accounting firm for the fiscal year ending December 31, 2015, will be approved if the votes cast in favor of the proposal exceed the votes cast opposing the proposal. Abstentions will not have an impact on the outcome of the vote on this proposal.

2

Board Recommendation

The Board of Directors recommends that you vote “FOR” the election of each nominee for director, “FOR” the approval of the non-binding advisory vote on the compensation of our named executive officers, and “FOR” the ratification of BDO as our independent registered public accounting firm for the fiscal year ending December 31, 2015.

Shareholders should specify their choice for each matter by voting via the Internet or by telephone as described on the enclosed proxy card. Alternatively, shareholders may instruct the proxies named on the enclosed proxy card how to vote by signing and returning the proxy card. All proxies that are signed and returned without specific instructions given will be voted “FOR” the election of all nominees for director, “FOR” the approval of the non-binding advisory vote on the compensation of our named executive officers and “FOR” the ratification of the appointment of BDO.

How Votes Are Counted

As noted above, a majority of the votes entitled to be cast on a matter, represented in person or by proxy, constitutes a quorum for action on that matter. A quorum is required to conduct the annual meeting. If you have returned valid proxy instructions or attend the meeting in person, your shares will be counted for the purpose of determining whether there is a quorum, even if you withhold your vote in the election of directors or abstain from voting on some or all matters introduced at the meeting. Shares held in street name that are voted on routine proposals by brokers, banks or nominees will be counted in determining whether a quorum is present. Shares held in street name that are not voted on any matter will not be included in determining whether a quorum is present.

Voting by Record Holders

If you hold shares in your own name as a holder of record with our transfer agent, American Stock Transfer & Trust Company, you may either vote in favor of all nominees, withhold your vote as to all nominees or withhold your vote as to specific nominees for election to the Board of Directors, and you may vote for, against, or abstain from the approval of the non-binding advisory vote on the compensation of our named executive officers and the ratification of the appointment of BDO as our independent registered public accounting firm for the fiscal year ending December 31, 2015. If you just submit your proxy without voting instructions, the proxies will vote your shares as recommended by our Board of Directors. See “Board Recommendation” above.

Voting By Street Name Holders

If your shares are held in street name by a broker, bank or other nominee, follow the voting instructions you receive from your nominee. If you want to vote in person, you must obtain a legal proxy from your nominee and bring it to the meeting. If you do not submit voting instructions to your nominee, your nominee may still be permitted to vote your shares under the following circumstances:

| | • | | Routine proposals. Although our shares trade on the NASDAQ, the rules of the New York Stock Exchange (the “NYSE”) affect us because most of the shares held in street name are held with NYSE member-brokers. Generally, under the rules of the NYSE, brokers, banks or other nominees have discretionary power to vote indirectly held shares on routine proposals if they have not received the beneficial owner’s voting instructions. The ratification of the appointment of the independent registered public accounting firm is a routine proposal. Therefore, brokers, banks and other nominees that do not receive instructions from street name holders may vote on this proposal in their discretion. |

| | • | | Non-routine proposals. Under the NYSE rules described above, a broker non-vote results when the beneficial owner fails to give voting instructions on a non-routine proposal to its bank, broker or other nominee. When a proposal is not a “routine” matter and the broker, bank or other nominee has not received voting instructions from the beneficial owner of the shares with respect to that proposal, the bank, broker or other nominee cannot vote the shares on that proposal.It is important therefore that |

3

| | you provide instructions to your bank, broker or other nominee with respect to your vote on these non-routine matters. The election of directors and the approval of the non-binding advisory vote on the compensation of our named executive officers are non-routine proposals. |

Revoking Your Proxy

If your shares are held in street name, you must follow the instructions of your broker, bank or other nominee to revoke your voting instructions. If you hold your shares in your own name as a holder of record with our transfer agent, American Stock Transfer & Trust Company, and wish to revoke your proxy instructions, you must advise the Corporate Secretary in writing before the proxies vote your common stock at the meeting, deliver a later dated proxy by Internet, telephone or mail, or attend the meeting and vote your shares in person. Attendance at the meeting, by itself, is not sufficient to revoke your proxy instructions.

Annual Report on Form 10-K for the Fiscal Year Ended December 31, 2014

A copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2014, including our consolidated financial statements and the notes thereto, is enclosed with this proxy statement. Our Annual Report on Form 10-K for the fiscal year ended December 31, 2014 is also available online on our website at www.fbr.com under “Investor Relations.” For additional printed copies of our Annual Report on Form 10-K for the fiscal year ended December 31, 2014, please contact our Investor Relations department in writing at the following address: Investor Relations, c/o FBR & Co., 1300 North Seventeenth Street, Suite 1400, Arlington, Virginia 22209. Shareholders may also contact our Investor Relations department by telephone at (703) 312-9715 or by e-mail at fbrir@fbr.com.

Electronic Delivery of Proxy Materials

You may access this proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2014 on our website at www.fbr.com under “Investor Relations.” If you would like to reduce our costs of printing and mailing proxy materials for next year’s annual meeting of shareholders, you can opt to receive all future proxy statements, proxy cards and Annual Reports on Form 10-K (“proxy materials”) electronically via e-mail or the Internet rather than in printed form. If you hold shares of our common stock in your own name as a holder of record, you may sign up for electronic delivery of future proxy materials by contacting American Stock Transfer & Trust Company and following its procedure. Electronic delivery will continue in future years until you revoke your election by sending a written request to the Corporate Secretary at the following address: Corporate Secretary, c/o FBR & Co., 1300 North Seventeenth Street, Suite 1400, Arlington, Virginia 22209. If your shares are held in street name and you wish to register for electronic delivery of future proxy materials, you should review the information provided in the proxy materials mailed to you by your broker, bank or other nominee. If you have agreed to electronic delivery of proxy materials, but wish to receive printed copies, please contact the Corporate Secretary at the address provided above or your broker, bank or other nominee in accordance with their procedures.

Householding

The rules of the Securities and Exchange Commission (“SEC”) permit companies and intermediaries (such as brokerage firms, banks, broker-dealers or other similar organizations) to satisfy the delivery requirements for proxy materials with respect to two or more shareholders sharing the same address by delivering a single copy of such proxy materials addressed to those shareholders. This practice, commonly referred to as “householding,” is designed to reduce our printing and postage costs. Shareholders who hold shares in street name may contact their intermediaries to request information about householding.

Once you have received notice from your intermediary, or us, that they or we will discontinue sending multiple copies to the same address, you will receive only one copy until you are notified otherwise or until you revoke your consent. If you received only one copy of our proxy materials and wish to receive a separate copy for each shareholder at your household, or if you are receiving multiple copies of the proxy materials and wish to receive only one, please notify your intermediary if your shares are held in a brokerage account or us if you hold

4

registered shares. You can notify us by sending a written request to our Corporate Secretary at the following address: Corporate Secretary, c/o FBR & Co., 1300 North Seventeenth Street, Suite 1400, Arlington, Virginia 22209 or calling 703-312-9500.

Shareholder Proposals and Nominations for the 2016 Annual Meeting

Shareholders may submit proposals for inclusion in our proxy statement for our 2016 annual meeting, nominate individuals for election at our 2016 annual meeting of shareholders, and propose other business for consideration by our shareholders at our 2016 annual meeting of shareholders. The following describes certain procedures and deadlines applicable to these shareholder proposals:

| | • | | Shareholder Proposals for Inclusion in 2016 Proxy Statement. Pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), proposals that shareholders seek to have included in the proxy statement for our 2016 annual meeting of shareholders must be received by our Corporate Secretary no later than January 9, 2016. |

| | • | | Other Shareholder Proposals and Nominations. Our Amended and Restated Bylaws, which are available on our website as discussed below, govern the submission of nominations for directors or other business proposals that a shareholder wishes to have considered at a meeting of shareholders, but which matters are not otherwise included in our proxy statement for that meeting. Under our Amended and Restated Bylaws, nominations for director or other business proposals to be addressed at our next annual meeting may be made by a shareholder entitled to vote who has delivered a notice to our Corporate Secretary no later than the close of business on March 18, 2016, and no earlier than February 17, 2016. The notice must contain the information required by our Amended and Restated Bylaws. |

The advance notice provisions of our Amended and Restated Bylaws are in addition to, and separate from, the requirements that a shareholder must meet in order to have a proposal included in the proxy statement under the rules of the SEC. A proxy granted by a shareholder in connection with the 2016 annual meeting will give discretionary authority to the proxies to vote on any matters introduced pursuant to the above advance notice provisions of our Amended and Restated Bylaws, subject to applicable rules of the SEC. Copies of our Amended and Restated Bylaws are available on our website atwww.fbr.com under “Corporate Governance” or may be obtained from the Corporate Secretary at the address referred to above under “Electronic Delivery of Proxy Materials” above.

5

PROPOSAL 1 —

The Board of Directors stands for election at each annual meeting of shareholders. Each director holds office until his or her successor has been duly elected and qualified or the director’s earlier resignation, death or removal. If elected, these directors will serve for a one-year term expiring at the 2016 annual meeting of shareholders. The Nominating and Corporate Governance Committee has recommended for nomination, and the Board of Directors has nominated, each of the nominees listed below under the heading “Nominees for Election as Directors.” All of the nominees are currently serving as members of our Board. Each nominee has agreed to be named in this proxy statement and to serve if elected.

Although we know of no reason why any of the nominees for director listed below would not be able to serve, if unforeseen circumstances (e.g., death or disability) make it necessary for the Board of Directors to propose a substitute nominee for any of the nominees named below, and you have authorized the proxies to vote your shares for the election of the nominees named below, the proxies will vote your shares for that substitute nominee. Proxies cannot be voted at the annual meeting for more than these six nominees, except as described above.

Unless you direct otherwise in the proxy card, the persons named as proxies in the proxy card will vote your proxy for the election of each of the nominees listed below.

|

| Nominees for Election as Directors |

REENA AGGARWAL, age 57, is a member of our Board of Directors, a position she has held since March 2011. Since 2009, Dr. Aggarwal has been the Robert E. McDonough Professor of Business Administration and since 2000, Professor of Finance at Georgetown University’s McDonough School of Business. She has held various positions at Georgetown University’s McDonough School of Business including, Deputy Dean from 2006 to 2008, and Interim Dean from 2004 to 2005. She was a FINRA Academic Fellow in 2007 and 2008, a visiting Professor of Finance at the Massachusetts Institute of Technology’s Sloan School of Management in 2005 and 2006, a Visiting Research Scholar at the International Monetary Fund during 2003 and 2004, an Academic Fellow at the SEC from 1997 through 1999, and a Fulbright Scholar to Brazil in 1990 and 1991. She is the Director of the Center for Financial Markets and Policy at Georgetown University. From 2006 through March 2011, Dr. Aggarwal served as a Trustee of The FBR Funds. She has served as a Trustee of IndexIQ, a mutual fund company, since 2008, and on the board of directors of Brightwood Capital Advisors, LLC, a private equity firm, since 2013. She has served on the advisory board of REAN Cloud, a cloud computing services company, since 2015. She has served on the board of the non-profit Georgetown Social Innovation and Public Service Fund from 2012 to 2014. Dr. Aggarwal has a Master of Management Studies from B.I.T.S. in Pilani, India and a Ph.D. in Finance from the University of Maryland.

Based on Dr. Aggarwal’s expertise on matters relating to public offerings, institutional investors, stock markets, corporate governance and securities market regulations, the Board has determined that Dr. Aggarwal is qualified to serve as a director. In addition, the Board has determined that Dr. Aggarwal’s experience with accounting principles, financial reporting and evaluation of financial results qualifies her as an “audit committee financial expert” for purposes of membership on our Audit Committee.

RICHARD J. HENDRIX, age 49, is our President, a position he has held since our formation in June 2006, and Chief Executive Officer, a position he has held since January 1, 2009. He has served as a director of our company since June 2006 and the Chairman of our Board of Directors since the first meeting of the Board following our 2012 annual meeting of shareholders. From February 2007 through February 2008, Mr. Hendrix served as a Member of the Office of the Chief Executive of Arlington Asset Investment Corp. (“Arlington Asset”), our previous parent company. From April 2004 to February 2007, Mr. Hendrix served as President and Chief

6

Operating Officer of Arlington Asset. Between April 2003 and April 2004, Mr. Hendrix served as Chief Investment Officer of Arlington Asset. Prior to March 2003, Mr. Hendrix served as the President and Chief Operating Officer of FBR Asset Investment Corporation in addition to heading the Real Estate and Diversified Industrials Investment Banking Groups at FBR. Prior to joining FBR in 1999, Mr. Hendrix was a Managing Director of PNC Capital Markets’ (“PNC”) investment banking group. Mr. Hendrix previously also headed PNC’s asset-backed securities business. Mr. Hendrix joined PNC in 1987 and was appointed by PNC to work with FBR in 1997 in connection with a strategic alliance between the two companies. Mr. Hendrix is a member of the Board of Trustees of Flint Hill School. Mr. Hendrix has a Bachelor of Science in finance from Miami University.

Based on Mr. Hendrix’s experience in the financial services industry, prior experience in a number of positions within our company, including as our President and Chief Executive Officer, the Board has determined that Mr. Hendrix is qualified to serve as a director.

THOMAS J. HYNES, JR., age 75, is a member of our Board of Directors, a position he has held since January 2007. Mr. Hynes is Co-Chairman and Chief Executive Officer of Colliers International-Boston, a commercial real estate services firm. Mr. Hynes has been employed by Colliers International-Boston and its predecessor companies since 1965, during which time he has held various offices including being appointed President in 1988 and Chairman in 2007. Mr. Hynes also serves as Chairman of the Board of Trustees of Emmanuel College, a board member and member of the Executive Committee of A Better City, a non-profit membership organization supporting infrastructure investments in the Boston area, director of the Massachusetts Business Roundtable, a non- profit, non-partisan, statewide public affairs organization that represents Massachusetts’ leading industry and business enterprises, where he served as Chairman from 2004 to 2006, member of the Board of Trustees of Nativity Preparatory School, an accredited, tuition-free, Jesuit middle school serving boys of all faiths from low-income families residing in Boston and as a director of the John F. Kennedy Library Foundation. From October 1996 to January 2006, Mr. Hynes served as a director of Prentiss Properties Trust, a publicly-traded real estate investment trust (“REIT”) that was acquired by Brandywine Realty Trust in January 2006.

Based on Mr. Hynes’ experience in senior roles in the real estate services industry, his capacity as a director of another public company, and his leadership position as Co-Chairman and Chief Executive Officer of Colliers International-Boston and senior executive officer with other organizations, the Board has determined that Mr. Hynes is qualified to serve as a director.

RICHARD A. KRAEMER, age 71, is a member of our Board of Directors, a position he has held since January 2007. Mr. Kraemer served as Chairman of the Board of Directors of Saxon Capital Inc., a publicly-traded mortgage REIT, from 2001 through December 2006. Mr. Kraemer also served as a trustee and member of the Audit Committee of American Financial Realty Trust, a publicly-traded REIT, from 2002 through March 2008, and as a director of Urban Financial Group, Inc., a bank holding company from 2001 to 2013. Since May 2013, Mr. Kraemer also serves as a director of Stonegate Mortgage Corporation, a publicly-traded mortgage company. Stonegate Mortgage Corporation has been, is and may continue to be an investment banking client of our company. From 1996 to 1999, Mr. Kraemer was Vice Chairman of Republic New York Corporation, a publicly-traded holding company for Republic National Bank. From 1993 to 1996, Mr. Kraemer was Chairman and Chief Executive Officer of Brooklyn Bancorp, a publicly-traded holding company for Crossland Federal Savings Bank.

Based on Mr. Kraemer’s experience in the accounting, banking, and financial services industries, and his leadership position as a senior executive and director in multiple public companies, the Board has determined that Mr. Kraemer is qualified to serve as a director. In addition, the Board has determined that Mr. Kraemer’s experience with accounting principles, financial reporting and evaluation of financial results qualifies him as an “audit committee financial expert” for purposes of membership on our Audit Committee.

ARTHUR J. REIMERS, age 60, is a member of our Board of Directors, a position he has held since January 2007. Since July 2008, Mr. Reimers has been the Board’s Lead Director. From 2001 to present, Mr. Reimers has

7

acted as an independent investor and business consultant. Mr. Reimers joined Goldman, Sachs & Co. as an investment banker in 1981 and in 1990 became a partner of the firm. Upon Goldman, Sachs & Co.’s initial public offering in 1998, he became a Managing Director and served in that capacity until his retirement in 2001. From 1991 through 1996 Mr. Reimers served as co-head of Goldman, Sachs & Co.’s Investment Banking Advisory Business in Europe. From 1996 through 1999, Mr. Reimers served as a co-head of Goldman, Sachs & Co.’s Healthcare Group, Investment Banking Division. Mr. Reimers served as Chairman of the Board of Directors of Rotech Healthcare, Inc., a publicly-traded healthcare company, a position he held from March 2002 until September 2013. From September 2011 to June 2014, Mr. Reimers served as a member of the Board of Directors of Cumulus Media, Inc., a publicly-traded media company. In addition to these public companies, Mr. Reimers is an investor and Board Member of a number of private companies. Mr. Reimers serves on the board of The Connecticut Coalition for Achievement Now, an education reform advocacy organization. Mr. Reimers is currently an assistant adjunct professor at Miami University and sits on the investment committee of the Miami University Foundation. Mr. Reimers has a Bachelor of Science from Miami University and a Masters of Business Administration with High Distinction from the Harvard Business School. Currently Mr. Reimers is a Fellow at Harvard University as part of Harvard’s Advanced Leader Initiative.

Based on Mr. Reimers experience in the financial services industry, as a director of multiple publicly traded companies, his leadership position as Chairman of the Board of Directors of Rotech Healthcare, Inc., and as a Partner and Managing Director of Goldman Sachs & Co., the Board has determined that Mr. Reimers is qualified to serve as a director. In addition, the Board has determined that Mr. Reimers’ experience with accounting principles, financial reporting and evaluation of financial results qualifies him as an “audit committee financial expert” for purposes of membership on our Audit Committee.

WILLIAM F. STROME, age 60, is a member of our Board of Directors, a position he has held since October 2014. Mr. Strome currently serves as a director of the Merle E. Gilliand & Olive Lee Gilliand Foundation, a position he has held since February of 2014. Mr. Strome is currently a nominee for election as a director of The ExOne Company. Mr. Strome previously served as Senior Vice President, Finance & Administration, of RTI International Metals, Inc. (“RTI”), from November 2007 until his retirement in April 2014. He led RTI’s strategic planning activities, acquisition and divestiture initiatives, and capital procurement as well as investor relations and treasury functions. He was also responsible for RTI’s information technology and insurance functions. Both The ExOne Company and RTI have been, and may continue to be, investment banking clients of our company. In 2006 and 2007, prior to joining RTI, Mr. Strome was a principal at Laurel Mountain Partners where he focused on raising acquisition financing for its principal portfolio company — Liberty Waste Services. From 2001 to 2006 Mr. Strome was a Senior Managing Director in FBR’s Investment Banking group. From 1981 to 1997 he served as Deputy General Counsel and Corporate Secretary at PNC Financial Services Group, Inc. and from 1997 to 2001 he served as a Managing Director of PNC’s capital markets broker-dealer, focusing on mergers and acquisitions as well as strategic advisory services. Mr. Strome holds an undergraduate degree in Economics from Northwestern University and a J.D. and M.B.A. from the University of Pittsburgh.

Based on Mr. Strome’s experience as a senior executive officer of a publicly traded industrial company, his experience as a Senior Managing Director and Group Head in the investment banking industry, and his corporate governance experience as Deputy General Counsel and Corporate Secretary of a publicly-traded banking corporation, the Board has determined that Mr. Strome is qualified to serve as a director. In addition, the Board has determined that Mr. Strome’s experience with accounting principles, financial reporting and evaluation of financial results qualifies him as an “audit committee financial expert” for purposes of membership on our Audit Committee.

8

If a quorum is present at the annual meeting, directors will be elected by a plurality of the votes cast by the shares entitled to vote in the election of directors. Votes withheld and broker non-votes will not have an impact on the outcome of the vote on this proposal.

Recommendation Regarding Proposal 1:

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE “FOR” EACH NOMINEE FOR ELECTION

TO OUR BOARD OF DIRECTORS.

9

PROPOSAL 2 —

|

| ADVISORY VOTE ON EXECUTIVE COMPENSATION |

We are requesting that our shareholders approve, by advisory vote, the compensation of our named executive officers, as such compensation is reflected in our “Compensation Discussion and Analysis” beginning on page 31 and our executive compensation tables beginning on page 41. This proposal, commonly referred to as the “Say-on-Pay” vote, is required by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”). While the Say-on-Pay vote is advisory, and therefore not binding on the Board, the Compensation Committee will consider the results of any significant vote against the compensation of the named executive officers and determine whether any actions are necessary or advisable to address the concerns expressed by shareholders. At our 2011 annual meeting, approximately 94% of our shareholders voted in favor of holding an annual, non-binding Say-on-Pay vote. In accordance with the recommendation of our company’s shareholders at the 2011 annual meeting, the Board of Directors has determined to seek a shareholder advisory vote on executive compensation annually.

As described in “Compensation Discussion and Analysis — Principles and Objectives of Our Compensation Program,” our executive compensation policies, plans and programs are based on the philosophy that executive and shareholder financial interests should be closely aligned. Accordingly, our executive compensation program is designed to assist us in attracting and retaining key executive officers and to further motivate these officers to promote our growth and continue both our short-term and long-term profitability. Please refer to the disclosures under “Compensation Discussion and Analysis,” the compensation tables and other narrative executive compensation disclosures in this proxy statement for a more detailed description of our executive compensation philosophy and objectives.

In accordance with Rule 14a-21(a) of the Exchange Act, we are asking our shareholders to approve the following advisory resolution:

RESOLVED, that the compensation paid to our named executive officers, as disclosed pursuant to the compensation disclosure rules of the SEC, including the Compensation Discussion and Analysis, the compensation tables and other narrative compensation disclosure in this proxy statement, is hereby APPROVED.

Rationale for the Resolution

The Board of Directors believes that the policies and practices described in our “Compensation Discussion and Analysis” beginning on page 31 of this proxy statement are effective in achieving our goal of linking compensation decisions to both corporate and individual performance, with a focus on rewarding financial results, as well as rewarding the individual performance and accomplishments of our executive officers in light of their respective duties and responsibilities, the impact of their actions on our strategic initiatives, and their overall contribution to the culture, strategic direction, stability and performance of our company. Our company is committed to responsible compensation practices and seeks to balance the need to compensate its executives fairly and competitively based on their performance while assuring that their compensation reflects principles of risk management and performance metrics that reward long-term contributions to sustained profitability. We believe that the performance factors described in our “Compensation Discussion and Analysis” have resulted in compensation for our named executive officers that reflects our compensation philosophy and framework. We have designed our compensation programs to foster an entrepreneurial results-focused culture that we believe is critical to the success of our company and to the long-term growth of shareholder value.

We urge shareholders to read the Compensation Discussion and Analysis, as well as the Supplemental Compensation Table and related compensation tables and narrative, appearing on pages 31 through 53 of this proxy statement, which provide detailed information on our company’s compensation policies and practices and the compensation of our named executive officers.

10

This advisory vote, which is non-binding on our Board of Directors and the Compensation Committee, is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers as disclosed in this proxy statement in accordance with SEC rules. Although non-binding, our Board of Directors and the Compensation Committee value the opinions of our shareholders and will consider the voting results, along with other relevant factors, when evaluating our executive compensation program and when making future decisions regarding compensation of our named executive officers, as appropriate. Abstentions and shares held in street name that are not voted on this proposal (i.e. broker non-votes) will not have an impact on the outcome of the vote on this proposal.

Recommendation Regarding Proposal 2:

OUR BOARD OF DIRECTORS RECOMMENDS

A VOTE “FOR” APPROVAL OF THE ADVISORY RESOLUTION APPROVING THE

COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS AS DISCLOSED IN THIS PROXY

STATEMENT.

11

PROPOSAL 3 —

|

| RATIFICATION OF THE APPOINTMENT OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

The Audit Committee of our Board of Directors has appointed BDO USA, LLP (“BDO”) as our independent registered public accounting firm to audit our company’s and its subsidiaries’ financial statements for the fiscal year ending December 31, 2015.

Although shareholder approval is not legally required, the Audit Committee has voted to recommend that the shareholders ratify the appointment of BDO as our independent registered public accounting firm for the fiscal year ending December 31, 2015. In the event that our shareholders do not ratify the appointment, the Audit Committee will consider other accounting firms but we anticipate that no change in our independent registered public accounting firm would be made for 2015 due to the difficulty of making any change so long after the beginning of the current year. However, any such vote would be considered in connection with the appointment of our independent registered public accounting firm for 2016. A representative of BDO plans to be present at the annual meeting, will have the opportunity to make a statement if he or she desires to do so, and is expected to be available to respond to appropriate questions.

If a quorum is present at the annual meeting, the proposal to ratify the appointment of BDO as our independent registered public accounting firm for the fiscal year ending December 31, 2015 will be approved if the votes cast in favor of the proposal exceed the votes cast opposing the proposal. Abstentions will not have an impact on the outcome of the vote on this proposal.

Recommendation Regarding Proposal 3:

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

THE RATIFICATION OF THE APPOINTMENT OF BDO AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2015.

The independent registered public accounting firm of our company and its subsidiaries from the beginning of fiscal year 2013 through the date of filing of the company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2014 was PricewaterhouseCoopers LLP (“PwC”). Aggregate fees for professional services rendered to us and our subsidiaries by PwC for the years ended December 31, 2014 and 2013 were as follows (in thousands):

| | | | | | | | |

| | | Year Ended December 31, | |

Fee Type | | 2014 | | | 2013 | |

Audit Fees | | $ | 85 | | | $ | 921 | |

Audit-Related Fees | | | — | | | | 25 | |

Tax Fees | | | — | | | | — | |

All Other Fees | | | 4 | | | | 2 | |

| | | | | | | | |

Total | | $ | 89 | | | $ | 948 | |

| | | | | | | | |

12

The independent registered public accounting firm of our company and its subsidiaries beginning with our second fiscal quarter ended June 30, 2014 was BDO. We incurred no fees for professional services rendered to us and our subsidiaries by BDO for the year ended December 31, 2013. Aggregate fees for professional services rendered to us and our subsidiaries by BDO for the year ended December 31, 2014 were as follows (in thousands):

| | | | |

Fee Type | | Year Ended December 31, 2014 | |

Audit Fees | | $ | 476 | |

Audit-Related Fees | | | 26 | |

Tax Fees | | | — | |

All Other Fees | | | — | |

| | | | |

Total | | $ | 502 | |

| | | | |

Audit Fees

Audit Fees represent the aggregate fees billed for each of the last two fiscal years for professional services rendered by each of PwC and BDO for the audit of our consolidated financial statements, the audit of the financial statements of our subsidiaries, the audit of the effectiveness of our internal control over financial reporting, the review of the financial statements included in our Quarterly Reports on Form 10-Q, and other services that are provided by each of PwC and BDO in connection with the statutory and regulatory filings that we and our subsidiaries are required to make, issuances of consents, and assistance with and review of documents filed with the SEC.

Audit-Related Fees

Audit-Related Fees represent the aggregate fees billed for each of the last two fiscal years for professional services rendered by each of PwC and BDO for the audit of our employee’s 401(k) benefit plan.

All Other Fees

All Other Fees represent the aggregate fees billed in each of the last two fiscal years for products and services provided by each of PwC and BDO other than the services reported in “Audit Fees,” “Audit-Related Fees” and “Tax Fees” in the table above. In 2014 and in 2013, the amount relates to fees paid to PwC in connection with a license for accounting research software.

|

| Audit Committee Pre-Approval Policies and Procedures |

It is the Audit Committee’s policy to review and, if appropriate, pre-approve all audit and non-audit services provided by the independent registered public accounting firm. The Audit Committee pre-approved all of the services provided by each of PwC and BDO to our company and our subsidiaries during the fiscal year ended December 31, 2014.

Change in Auditors

On April 16, 2014, the Audit Committee of our Board of Directors approved the dismissal of PwC as our independent registered public accounting firm and the engagement of BDO as our independent registered public accounting firm effective upon completion of PwC’s review of our company’s financial statements for the quarter ended March 31, 2014.

The audit reports of PwC on our consolidated financial statements as of and for the years ended December 31, 2013 and 2012 did not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope, or accounting principles. The audit reports of PwC on the effectiveness of internal control over financial reporting as of December 31, 2013 and 2012 did not contain any

13

adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, scope, or accounting principles. During the fiscal years ended December 31, 2013 and 2012, and through April 16, 2014, there were no (a) disagreements with PwC on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which, if not resolved to the satisfaction of PwC, would have caused it to make reference to the subject matter of the disagreements in connection with its reports; or (b) reportable events (as described in Item 304(a)(1)(v) of Regulation S-K).

During the fiscal years ended December 31, 2013 and 2012, and through April 16, 2014, we did not consult with BDO with respect to (a) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might have been rendered on our company’s consolidated financial statements; or (b) any matters that were either the subject of a disagreement (as that term is used in Item 304(a)(1)(iv) of Regulation S-K and the related instructions to Item 304 of Regulation S-K) or a reportable event (as described in Item 304(a)(1)(v) of Regulation S-K).

14

OUR BOARD OF DIRECTORS, ITS COMMITTEES AND CORPORATE GOVERNANCE

|

| Independence of our Board of Directors |

Our Corporate Governance Guidelines specify that an “independent” director is a director who meets the independence requirements of the NASDAQ listing standards, as then in effect, and of such additional guidelines as our Board may have adopted or may adopt in the future. These standards provide a baseline for determining the independence of members of the Board. The independence standards used by our Board are detailed in our Corporate Governance Guidelines, which are available on our website at www.fbr.com under “Investor Relations.”

In making affirmative independence determinations, the Board broadly considers all relevant facts and circumstances, including, among other factors, the extent to which we make charitable contributions to tax exempt organizations with which the director, or director’s immediate family member, is affiliated. Using these criteria, the Board has affirmatively determined that the following directors have had no material relationship with our company and are independent under the NASDAQ listing standards and our Corporate Governance Guidelines: Dr. Aggarwal, Mr. Hynes, Mr. Kraemer, Mr. Reimers and Mr. Strome. There were no other transactions, relationships or arrangements not otherwise disclosed herein that were considered by the Board when determining whether each director and nominee for director is independent.

|

| Board Leadership Structure, Lead Director and Role in Risk Oversight |

Board Leadership Structure. The Board has the authority to select the leadership structure it considers appropriate for us. In making leadership structure determinations, the Board considers many factors, including the specific needs of our business and what is in the best interests of our shareholders. Our current leadership structure consists of a combined Chairman of the Board and Chief Executive Officer position, an independent Lead Director, an active and involved Board of Directors, a majority of whom are independent, and Board committees chaired by independent directors. The Board does not have a fixed policy regarding whether the same person should serve as both the Chief Executive Officer and Chairman of the Board, and the Board believes that flexibility on this point best serves our company by allowing us to employ a leadership structure that is most appropriate under the circumstances at any given time. On June 5, 2012, the Board of Directors elected Mr. Hendrix, our Chief Executive Officer and President, as the Chairman of the Board at its first meeting following our 2012 annual meeting of shareholders. This created a unified leadership structure with Mr. Hendrix executing the strategic direction set by our entire Board. We believe the strength of our independent Lead Director position as set forth in our Corporate Governance Guidelines, as well as the oversight exercised by the independent members of our Board of Directors through the work of the committees of the Board of Directors discussed below, makes this the best board leadership structure for our company at this time.

Lead Director. Our Corporate Governance Guidelines provide that the Board shall have an independent director serve as Lead Director. The Board of Directors has appointed Arthur J. Reimers as our Lead Director. Our Lead Director is responsible for presiding over non-committee meetings of the non-management directors and executive sessions of the independent directors. Our Lead Director also may facilitate communication by the non-management directors with the Chairman of the Board and management, although all directors have access to management and employees of our company.

Board Role in Risk Oversight. The Audit Committee, which assists the Board in fulfilling its financial oversight responsibilities, has oversight of our company’s risk management framework. The Audit Committee regularly meets with the Director of Risk Management to review our company’s risk profile, its policies regarding market and credit risk limits and operations, and its risk tolerance levels and capital targets and limits, and regularly meets with the General Counsel to discuss legal and regulatory risk issues. The Chairman of the Audit Committee reports to the Board on a quarterly basis regarding our company’s risk management profile.

15

Furthermore, the other committees of the Board are responsible for oversight of the risks within their areas of responsibility, and regularly report to the full Board. The Compensation Committee considers the risks associated with overall compensation and how effective our compensation policies are in linking pay to performance and aligning the interests of our executives and shareholders, and the Nominating and Corporate Governance Committee reviews the conflict of interest policies as set forth in our Statement of Business Principles as they concern directors and reviews with management procedures for implementing and monitoring compliance with the conflict of interest policies. Our Board of Directors believes that its majority independent composition and the role that our independent directors perform provide effective corporate governance at the board of directors level. The current leadership model, when combined with the oversight responsibilities of our independent directors and our overall corporate governance structure, strikes an appropriate balance between strong and consistent leadership and independent oversight of our business and affairs.

|

| Board Meetings and Executive Sessions of Our Independent Directors |

The Board of Directors held a total of eight (8) meetings during 2014. Each of the directors attended at least 75% of the total number of meetings of the Board held during such period in which he or she was a director and of the committees on which he or she served during such period.

In accordance with our Corporate Governance Guidelines and the NASDAQ Marketplace Rules, our independent directors (excluding any non-management director who does not qualify as an independent director under our Corporate Governance Guidelines and the NASDAQ Marketplace Rules as then in effect) are required to meet at least annually in executive session. The independent directors led by Mr. Reimers, our Lead Director, met in executive session four (4) times in 2014.

The Board has established three standing committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. From time to time the Board of Directors may, as permitted by our company’s Amended and Restated Bylaws, establish other standing or special committees to discharge specific duties delegated to such committees by the Board.

Standing committee membership and the number of meetings of each committee during 2014 are described below.

2014 Board Committee Assignments

| | | | | | | | | | | | |

Name | | Audit | | | Compensation | | | Nominating and

Corporate

Governance(1) | |

Reena Aggarwal | | | X | | | | X | | | | | |

Richard J. Hendrix | | | | | | | | | | | | |

Thomas J. Hynes, Jr. | | | | | | | X | | | | Chair | |

Adam J. Klein (retired June 3, 2014) | | | | | | | | | | | | |

Richard A. Kraemer | | | Chair | | | | | | | | X | |

Thomas S. Murphy, Jr (retired June 3, 2014) | | | | | | | | | | | X | |

Arthur J. Reimers (Lead Director) | | | X | | | | Chair | | | | X | |

William F. Strome(2) (elected October 13, 2014) | | | X | | | | X | | | | | |

Number of Meetings in 2014 | | | 8 | | | | 4 | | | | 4 | |

| (1) | Mr. Hynes was a member of the Nominating and Corporate Governance Committee and became chair of the committee upon the retirement of Mr. Murphy, the committee’s previous chair, as of June, 3 2014. |

| (2) | On April 21, 2015, the Board appointed William F. Strome to the Board’s Audit Committee and its Compensation Committee. |

Audit Committee

The members of the Audit Committee are Mr. Kraemer, serving as Chairman of the committee, Dr. Aggarwal and Mr. Reimers.

16

The Audit Committee assists and represents the Board of Directors in discharging the Board’s oversight responsibilities relating to: (1) the accounting and financial reporting practices, and internal control systems, of our company and its subsidiaries; (2) the reliability and integrity of our company’s financial statements, accounting policies, and financial reporting and disclosure practices; (3) our company’s compliance with legal and regulatory requirements, including our company’s policies and procedures regarding such requirements; (4) the independent auditor’s qualifications, independence and performance; and (5) the staffing, qualifications and performance of our company’s internal audit function. The Board has determined that each member of the Audit Committee is and was independent according to the independence standards set forth in the NASDAQ listing standards and our Corporate Governance Guidelines. The Board has determined that Messrs. Kraemer and Reimers and Dr. Aggarwal are qualified as “audit committee financial experts,” within the meaning of the SEC regulations, and possess related financial management expertise, within the meaning of the listing standards of the NASDAQ. The Audit Committee met eight times in 2014. The Board of Directors has adopted a written charter for the Audit Committee, a current copy of which is available to shareholders on our website at www.fbr.com under “Corporate Governance.” For additional information on our Audit Committee, please refer to the “Audit Committee Report” beginning on page 55 of this proxy statement.

Compensation Committee

The members of the Compensation Committee are Mr. Reimers, serving as Chairman of the committee, Mr. Hynes and Dr. Aggarwal. The Board has determined that each member of the Compensation Committee is independent according to the independence standards set forth in the NASDAQ listing standards and our Corporate Governance Guidelines. The Compensation Committee reviews and approves our compensation plans, policies and programs and makes recommendations concerning those plans, policies and programs and concerning executive officer compensation. The Compensation Committee also considers and evaluates “Say-on-Pay” resolutions and recommends to the Board of Directors the frequency with which “Say-on-Pay” resolutions should be voted on by the shareholders. The Compensation Committee met four times in 2014. The Board of Directors has adopted a written charter for the Compensation Committee, a current copy of which is available to shareholders on our website at www.fbr.com under “Investor Relations.” For additional information on the Compensation Committee’s processes and procedures for the consideration and determination of executive and director compensation, please refer to “Compensation Discussion and Analysis” and “Compensation Committee Report” beginning on page 31 and page 54, respectively, of this proxy statement.

Nominating and Corporate Governance Committee

The members of the Nominating and Corporate Governance Committee are Mr. Hynes, serving as Chairman of the committee, Mr. Kraemer and Mr. Reimers. Mr. Murphy served as Chairman of the Nominating and Corporate Governance Committee until his retirement on June 3, 2014. The Board has determined that each member of the Nominating and Corporate Governance Committee is independent according to the independence standards set forth in the NASDAQ listing standards and our Corporate Governance Guidelines. The Nominating and Corporate Governance Committee assists the Board of Directors in identifying individuals qualified to become Board members and recommending to the Board the director nominees for election at the annual meeting of shareholders, plays a leadership role in shaping the governance of our company and recommends to the Board corporate governance guidelines for our company, and oversees the evaluation of the Board. The Nominating and Corporate Governance Committee met four times in 2014. The Board of Directors has adopted a written charter for the Nominating and Corporate Governance Committee, a current copy of which is available to shareholders on our website at www.fbr.com under “Investor Relations.”

We review our compensation practices to determine whether the risks arising from our compensation policies and practices would be reasonably likely to have a material adverse effect on our company. As part of this process, our management risk committee looks at how we allocate capital to each business unit and the internal monitoring and control systems in place for each business unit, and whether, in light of the foregoing, our incentive compensation arrangements with regard to each business unit has any features that might encourage

17

inappropriate or excessive risk-taking that could threaten the value of our company. Our management risk committee has reviewed plan documentation, eligibility criteria, payout formulas and payment history, and how evaluation of business risk affects incentive plan performance measures and compensation decisions. Our management risk committee has discussed the results of this analysis with our Human Resources Group and our Executive Committee, and summarized the results for our Board of Directors.

Based upon these reviews, we have not identified any risks arising from our compensation policies and practices that are reasonably likely to have a material adverse effect on our company.

We are a financial institution that engages in significant trading and capital market activities that are subject to market and other risks. The company employs risk management practices, including trading limits, marking-to-market positions, stress testing and employment of models. The Compensation Committee understands and appreciates that equity incentive compensation can promote high-risk behavior if the incentives it creates for short-term performance are not properly aligned with the interests of our company over the long-term. The Compensation Committee believes that the structure of our company’s long-term equity incentive compensation appropriately mitigates the risk by directly aligning the recipients’ interests with those of our company. We use judgment and discretion rather than rely solely on formulaic results and do not use highly leveraged incentives that drive risky short-term behavior. Instead, we reward consistent and longer-term performance. Our long-term equity incentive compensation rewards long-term stock performance.

It is the intention that, going forward, the Compensation Committee will continue to evaluate any new incentive arrangements for our named executive officers and will be involved in the design and assessment of our incentive arrangements to the extent appropriate or required under applicable law.

|

| Availability of Corporate Governance Materials |

Shareholders may view our corporate governance materials, including our Articles of Amendment to the Amended and Restated Articles of Incorporation, Amended and Restated Bylaws, Corporate Governance Guidelines, Statement of Business Principles and the charters of each of the committees of our Board of Directors, on our website at www.fbr.com under “Investor Relations.”

Our corporate governance materials may be obtained free of charge by submitting a written request to the Corporate Secretary, c/o FBR & Co., 1300 North Seventeenth Street, Suite 1400, Arlington, Virginia 22209.

We have not adopted a code of ethics that applies only to our principal executive officer, principal financial officer and principal accounting officer, because our Board of Directors has adopted a Statement of Business Principles that is broadly written and covers these officers and their activities. Our Statement of Business Principles is available on our website at www.fbr.com under “Investor Relations.”

As noted above and as described in its charter, our Nominating and Corporate Governance Committee’s responsibilities include identifying and recommending director candidates for nomination to serve on our Board of Directors. Our Corporate Governance Guidelines also contain information concerning the responsibilities of the Nominating and Corporate Governance Committee with respect to identifying and evaluating director candidates.

Director Candidate Recommendations and Nominations by Shareholders

A shareholder may nominate a person for election to the Board of Directors in compliance with applicable Virginia law and our Amended and Restated Bylaws. No persons were nominated by shareholders for election to the Board of Directors at the upcoming annual meeting in accordance with this policy. Our Amended and

18

Restated Bylaws require that any such nominations for our 2016 annual meeting of shareholders must be received by us no earlier than February 17, 2016 and no later than March 18, 2016. Any such notice must satisfy the other requirements with respect to such proposals and nominations contained in our Amended and Restated Bylaws. If a shareholder fails to meet the requirements or deadlines described in our policy, such nominations will be considered out of order and will not be acted upon at our 2016 annual meeting of shareholders.

Process for Identifying and Evaluating Director Candidates

The Nominating and Corporate Governance Committee evaluates all director candidates in accordance with the director qualification standards described in our Corporate Governance Guidelines, a copy of which is available on our website at www.fbr.com under “Investor Relations.” The committee may identify potential directors in a number of ways. It may consider recommendations made by current or former directors or members of executive management. The Nominating and Corporate Governance Committee has in the past retained, and may retain in the future, search firms to identify candidates. It may also identify potential directors through contacts in the business, civic, academic, legal and non-profit communities. If a shareholder recommends a candidate for director in good faith, our Nominating and Corporate Governance Committee will consider that candidate. The committee evaluates any candidate’s qualifications to serve as a member of the Board based on the skills and characteristics of individual Board members, as well as the composition of the Board as a whole. The committee, in consultation with the Chief Executive Officer, periodically reviews the criteria for composition of the Board and evaluates potential new candidates for Board membership. The Nominating and Corporate Governance Committee then makes recommendations to the Board. The committee also takes into account criteria applicable to Board committees.

The Nominating and Corporate Governance Committee reviews annually the composition of the Board as a whole and reviews available information about the characteristics of Board members, including their independence, professional experience, education, judgment, integrity, skill, differences of viewpoint and other qualities or attributes that contribute to board heterogeneity, as well as their gender, race and ethnicity and ability to commit sufficient time and attention to the activities of the Board, in the context of the Board’s needs. While we do not have a policy regarding diversity, the Nominating and Corporate Governance Committee does consider diversity when evaluating a candidate’s qualifications for the Board. The committee evaluates any properly submitted shareholder nominations no differently than other nominations.

|

| Communications with the Board of Directors |

Shareholders wishing to communicate with the Board of Directors should send any communication in writing to the Corporate Secretary, c/o FBR & Co., 1300 North Seventeenth Street, Suite 1400, Arlington, Virginia 22209. Any such communication must state the number of shares of our company’s common stock beneficially owned by the shareholder making the communication. The Corporate Secretary will forward such communication to the full Board of Directors, a committee of the Board of Directors, the Lead Director or to any other individual director or directors, as appropriate. If a communication is unduly hostile, threatening, illegal or similarly inappropriate, the Corporate Secretary is authorized by the Board to discard the communication or take appropriate legal action regarding the communication.

|

| Director Attendance at the Annual Meeting |

The Board of Directors has not adopted a formal policy regarding director attendance at annual meetings but encourages director attendance at annual meetings. Five directors standing for election attended the 2014 annual meeting of shareholders.

|

| Contributions to Charitable Entities |

In 2014, we did not make charitable contributions to any charitable organization in which any of our directors served as an executive officer.

19

|

| Compensation Committee Interlocks and Insider Participation |

During the last completed fiscal year, Dr. Aggarwal and Messrs. Hynes and Reimers served on the Compensation Committee. None of these directors served, during the last fiscal year or in any prior year, as one of our officers or employees. None of our executive officers served on the compensation committee or board of directors of any company that employed any member of the Board of Directors (including the Compensation Committee).

|

| Compensation of Non-Employee Directors |

As compensation for serving on our Board of Directors, each director who is not an employee of our company or an employee of any of our affiliates receives a retainer of $135,000 per year, provided that (i) the Lead Director receives a retainer of $185,000 per year and (ii) the Chairman of the Audit Committee receives a retainer of $160,000 per year. In each case, the retainer is paid, at the director’s election, in cash and/or equity-based compensation granted under our Amended and Restated 2006 Long-Term Incentive Plan (“2006 LTIP”), provided that no less than 50% of the retainer must be paid in equity. Non-employee directors may, at their choice, receive options, restricted shares of common stock (“RS”) and/or restricted stock units (“RSUs”) as their equity-based compensation. Each RSU generally represents the right to receive the economic equivalent of one share of our common stock.

Executive officers that served as members of our Board of Directors at any time during 2014 (Mr. Hendrix) and affiliates of Crestview Advisors, L.L.C. (“Crestview”) who had been designated to serve on our Board of Directors pursuant to the terms of the Voting Agreement (defined below) (Messrs. Klein and Murphy) did not receive any compensation in 2014 for their services as members of our Board of Directors. Mr. Hendrix is eligible to participate in our 2006 LTIP. Messrs. Klein and Murphy were not granted any equity-based compensation under our 2006 LTIP in 2014 and are no longer members of our Board of Directors.

The annual compensation period for non-employee directors is the year between annual meetings of our shareholders. Options, RS or RSUs are granted annually at the time of the annual meeting. We pay the cash portion of the annual retainer in equal quarterly payments in arrears instead of in a single annual amount in advance.

In 2014, each non-employee director (other than Messrs. Klein, Murphy and Strome) earned (i) apro rata amount of the cash portion of his or her 2013-2014 annual retainer, if any, and (ii) apro rata amount of the cash portion of his or her 2014-2015 annual retainer, if any. On June 3, 2014, each then non-employee director (Mr. Strome was not a member of the Board of Directors at that time) became entitled to receive his or her 2014-2015 annual retainer, as follows: Dr. Aggarwal, one-half of her 2014-2015 annual retainer in RS granted on June 3, 2014, and one-half in cash payable as set forth above; Mr. Hynes, one-half of his 2014-2015 annual retainer in RSUs granted on June 3, 2014, and one-half in cash payable as set forth above; Mr. Kraemer, one-half of his 2014-2015 annual retainer in RSUs granted on June 3, 2014, and one-half in cash payable as set forth above; and Mr. Reimers, all of his 2014-2015 annual retainer in RS granted on June 3, 2014. Accordingly, on June 3, 2014, Dr. Aggarwal was granted 2,577 RS and was scheduled to be paid $67,500 in cash, Mr. Hynes was granted 2,577 RSUs and was scheduled to be paid $67,500 in cash, Mr. Kraemer was granted 3,055 RSUs and was scheduled to be paid $80,000 in cash, and Mr. Reimers was granted 7,064 RS. Upon his election to the Board of Directors on October 13, 2014, Mr. Strome was awarded a grant of 2,500 RSUs as a new director grant, and elected to receive one-half of thepro rata portion of his 2014-2015 annual retainer in cash, and one-half in RSUs. Accordingly Mr. Strome was granted an aggregate of 4,458 RSUs and was scheduled to receive $50,625 in cash payable as set forth above.

The unvested RSUs granted to Messrs. Hynes, Kraemer and Strome each represent the right to receive one share of common stock, which right will vest in full on June 3, 2015 (“vested RSUs”). Vested RSUs convert to shares of our company’s common stock one year from the date the director ceases to be a director. The RS granted to Dr. Aggarwal and Mr. Reimers each represent one share of common stock that will vest on June 3, 2015. The number of shares subject to the RSUs granted to Messrs. Kraemer and Hynes, and the number of RS granted to

20

Dr. Aggarwal and Mr. Reimers, was determined using the closing price of our company’s stock on the close of trading on June 2, 2014, the trading day immediately preceding the date of grant. The number of shares subject to the RSUs granted to Mr. Strome was determined using the closing price of our company’s stock on the close of trading on October 10, 2014, the trading day immediately preceding the date of grant.

For information on the valuation of RS and RSUs, please refer to Note 9 in the notes to our consolidated financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2014.

While we do not pay our non-employee directors per meeting-attendance fees, we reimburse our non-employee directors for their reasonable out-of-pocket expenses incurred in attending meetings of our Board of Directors and its committees and corporate events that directors may be asked to attend.

|

| Non-Employee Director Compensation Table for 2014 |

The following table contains compensation information for our non-employee directors for the year ended December 31, 2014.

| | | | | | | | | | | | | | | | | | | | |

Name | | Fees Earned

or Paid in

Cash

($)(1) | | | Restricted Stock/

Restricted

Stock

Unit

Awards

($)(2)(3) | | | Option

Awards

($)(3) | | | All Other

Compensation

($) | | | Total ($) | |

Reena Aggarwal(5) | | | 67,500 | | | | 67,492 | | | | — | | | | — | | | | 134,992 | |

Thomas J. Hynes, Jr.(4)(5) | | | 16,875 | | | | 67,492 | | | | — | | | | — | | | | 84,367 | |

Adam J. Klein(6) | | | — | | | | — | | | | — | | | | — | | | | — | |

Richard A. Kraemer(5) | | | 80,000 | | | | 80,010 | | | | — | | | | — | | | | 160,010 | |

Thomas S. Murphy, Jr.(6) | | | — | | | | — | | | | — | | | | — | | | | — | |

Arthur J. Reimers(5)(7) | | | — | | | | 185,006 | | | | — | | | | — | | | | 185,006 | |

William F. Strome(5)(8) | | | — | | | | 115,239 | | | | — | | | | — | | | | 115,239 | |

| (1) | Includes the cash portion, if any, of each director’s (i) 2013-2014 annual retainer for the time between January 1, 2014 and the 2014 annual meeting of our shareholders and (ii) 2014-2015 annual retainer for the time between the 2014 annual meeting of our shareholders and December 31, 2014. |

| (2) | Includes the aggregate grant date fair value of the portion of the 2014-2015 annual retainer that each non-employee director elected to receive in RS or RSUs. |

| (3) | Amounts relating to stock-based awards represent the aggregate grant date fair value of the stock-based award computed in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718. The discussion of the assumptions used for purposes of the valuation of the stock options, RS and RSUs granted for fiscal year 2014 appears in Note 9 in the notes to our consolidated financial statements included in our 2014 Annual Report on Form 10-K. |

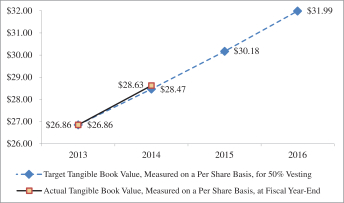

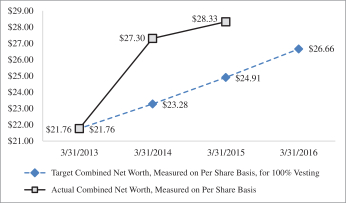

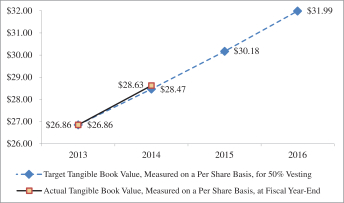

| (4) | Mr. Hynes elected to receive 100% equity compensation for his 2013-2014 annual retainer, all of which was paid in June 2013. Cash compensation received in 2014 was for the cash compensation portion of his 2014-2015 annual retainer. |