From the desk of... Highwater Ethanol, LLC CEO Brian Kletscher Highwater Ethanol, LLC January 2024 Volume 1 | Issue 3 Ethanol In This Issue... 1-2 Brian Kletscher 3 Luke Schneider 4 Lab Expansion 5 Annual Meeting Agenda 6 Dillon Imker & Derek Trapp 7 Tom Streifel Wishing you a Happy and Prosperous New Year!! We are nearing the completion of 15 years of operations at Highwater Ethanol. The time has flown by since our first grind in August 2009. We believe that we have made great progress in our operations. We filed our Form 10-K for the fiscal year ending October 31, 2023, on January 18, 2024. We reported net income of approximately $16.739 million for the 2023 Fiscal Year and net income of approximately $15,919,114 for the 2023 Calendar tax year. Margins remained strong in 2023, down from our record 2022 fiscal year. Highwater Ethanol paid a distribution in December 2021 of $1500/ unit and one of $2300/unit in February 2022 for a total distribution of $3,800/unit for the fiscal year ended October 31, 2022. We paid a distribution of $3200/unit in December 2022 for a total distribution of $3,800/unit for the fiscal year ended October 31, 2023. We also paid a distribution of $3400/unit in December 2023, bringing the total distributions for those periods to $10,400/unit or a total of $49,529,800. We continue to focus on operations to ensure the best efficiencies we can get at your facility. During the 2023 Fiscal Year, we produced an average of 3.033 gallons of denatured ethanol per bushel of corn ground. We have maintained these efficiencies since August 2019 due to a few factors. We continue to review enzymes, yeast, and other items to ensure the best efficiencies and we are proud of our team for maintaining this production rate! Our efficiencies in corn oil production have continued to improve with adjustments made in the process to boost our production to over 1.08 pounds per bushel ground. Please see the table below on additional efficiencies in the past six years. From the Desk of Highwater Ethanol, LLC CEO Brian Kletscher Wishing you a Happy and Prosperous New Year!! We are nearing the completion of 15 years of operations at Highwater Ethanol. The time has flown by since our first grind in August 2009. We believe that we have made great progress in our operations. We filed our Form 10-K for the fiscal year ending October 31, 2023, on January 18, 2024. We reported net income of approximately $16.739 million for the 2023 Fiscal Year and net income of approximately $15,919,114 for the 2023 Calendar tax year. Margins remained strong in 2023, down from our record 2022 fiscal year. Highwater Ethanol paid a distribution in D cember 2021 of $1500/unit and one of $2300/unit in February 2022 for a total dist ibution of $3,800/unit for the fiscal year ended October 31, 2022. We paid a distribution of $3200/unit in December 2022 for a total distribution of $3,800/unit for the fiscal year ended October 31, 2023. We also paid a distribution of $3400/unit in December 2023, bringing the total distributions for those periods to $10,400/unit or a total of $49,529,800. We continue to focus on operations to ensure the best efficiencies we can get at your facility. During the 2023 Fiscal Year, we produced an average of 3.033 gallons of denatured ethanol per bushel of corn ground. We have maintained these efficiencies since August 2019 due to a few factors. We continue to review enzymes, yeast, and other items to ensure the best efficiencies and we are proud of our team for maintaining this production rate! Our efficiencies in corn oil production have continued to improve with adjustments made in the pr cess to boost our production to over 1.08 pounds per bushel ground. Please see the table below on additional efficiencies in the past six years. In March 2022, we received our air emission permit from the Minnesota Pollution Control Agency {MPCA}. The updated permit included an additional fermenter. The Highwater Ethanol Board recently approved adding one additional fermenter to allow us to improve the efficiencies in the plant. This will be constructed during 2024 and become operational in the fall of 2024. Our current permit allows our production rate of undenatured ethanol per year to be 68 million gallons or about 70.2 million gallons of denatured ethanol per year. We continue to review our production rates and current demand for fuel ethanol. We have been operating at our permitted levels during the past year, with good efficiency. We are reviewing future opportunities to increase production through a permit update with MPCA. Margins i the etha ol industry in 2023 remained strong. We continue to monitor the markets and adjust whe needed. Th va iation in ethanol netbacks continued in 2023 with a range of $1.98 - $2.42 - per gallon. We have also seen corn prices vary from $5.06 - $6.91 per bushel on a monthly average. During our 2023 Fiscal Year, we saw demand for ethanol increase domestically by approximately 3 – 5% Corn Corn Avg Ethanol Gallons Ethanol Corn oil Nat Gas Corn Electricity Days Delivered Grind Grind Production Shipped Yield Price Prodtn Ship Prodtn Ship Yield Prod Ship Yield BTU used BTU Gallon Cost KW used KW gallon Operation 2018 20,141,772 20,172,329 56,680 58,943,177 59,282,611 2.922 $1.23 115,824 115,187 56,286 56,288 14.5 14165775 14088020 0.702 1,451,037 24.6 $3.34 43,024,973 0.730 355.9 2019 20,661,721 20,466,769 57,234 61,016,575 61,460,401 2.981 $1.25 111,445 112,878 57,992 58,059 14.0 13404063 13460280 0.655 1,422,233 23.3 $3.63 42,627,817 0.699 357.6 2020 20,885,834 20,311,948 56,833 61,703,648 61,250,648 3.038 $1.23 106,951 107,581 55,022 55,031 13.5 16351210 16418380 0.805 1,382,471 22.4 $3.46 41,751,752 0.677 357.4 2021 20,771,927 21,402,421 60,052 65,173,538 65,512,494 3.045 $1.92 110,540 108,070 59,199 59,124 13.3 21129492 21069280 0.987 1,475,446 22.6 $5.69 43,773,288 0.672 356.4 2022 22,793,376 22,966,900 63,957 69,273,283 69,183,883 3.016 $2.50 109,945 111,768 88,007 88,034 13.7 21963118 22014500 0.956 1,537,005 22.2 $7.05 45,062,919 0.651 359.1 2023 24,068,606 23,030,655 63,832 69,840,780 69,740,130 3.033 $2.14 109,321 109,311 86,038 85,966 13.5 24,878,261 24,908,340 1.080 1,540,388 22.1 $5.94 44,925,054 0.643 360.8 -- Dry Distillers -- Modified Distillers In arch 2022, we received our air emission permit from the Minnesota Pollution Control Agency {MPCA}. The updated permit included an additional fermenter. The Highwater Ethanol Board recently approved adding one additional fermenter to allow us to improve the efficiencies in the plant. This will be constructed during 2024 and become operational in the fall of 2024. Our current permit allows our production rate of undenatured ethanol per year to be 68 million gallons or about 70.2 million gallons of denatured ethanol per year. We continue to review our production rates and current demand for fuel ethanol. We have been op rati g at ur permitted levels during the past year, with good efficiency. We are reviewing future opportunities to increase production through a permit update with MPCA.

Margins in the ethanol industry in 2023 remained strong. We continue to monitor the markets and adjust when needed. The variation in ethanol netbacks continued in 2023 with a range of $1.98 - $2.42 - per gallon. We have also seen corn prices vary from $5.06 - $6.91 per bushel on a monthly average. During our 2023 Fiscal Year, we saw demand for ethanol increase domestically by approximately 3 – 5% and export demand has remained stable to improved slightly. We believe that our 2024 Fiscal Year will likely be a very interesting year for renewable ethanol and renewable biofuels and will continue to work to obtain additional market share for our products. We continue to market approximately 3.5% - 5.2% of our production as cellulosic ethanol. This was tested out and approval received in March 2021 by the California Air Resources Board {CARB}. We look forward to producing these products now and into the future. What is in store for renewable fuels in the future? We have seen many different technologies over the years. Sustainable Aviation fuel is a technology that everyone is watching, the Federal government and State of Minnesota government are certainly promoting this to be part of the renewable fuel mix. What will be the right technology, can we be cost competitive, and can we meet timelines? Those are all questions that we are asking. Will this technology be bankable, will lenders be interested in financing these projects, we have many questions and short amount of time to figure this out. Is CO2 sequestration in the future for all industries in the United States, is this going to be sustainable long term, are there other products that can be produce from CO2? Again, many questions, little direction on the technologies that will again be available. Highwater continues to purchase corn from our area producers. The 2023 corn crop quality and bushels have been a blessing for this area. Good quality corn certainly helps us maintain our efficiencies. Although we again experienced dry conditions in our corn growing area this year, the yield was better than anticipated, we expect that we will have adequate bushels to maintain our ethanol production. Industry Information. E15 and exports should be a continued priority in 2024. Exports are needed to support a very efficient U.S Ethanol industry. As production capacity is available in the U.S., we expect that exports and domestic use will continue to be the key for the industry in the future. We anticipate and look forward to increased interest from countries including Mexico, Canada, China, and Japan with the on-going trade agreements, as well as continued interest from Vietnam, Philippines, India, and many others. We encourage you to use a higher blend such as E15, E30 or E85! We believe that use of higher blends will continue to reduce our dependence on crude oil and contribute to cleaner air!! Highwater Ethanol continues to support E10 and E15 blends for 2001 and new vehicles and higher blends if you have a flex fuel vehicle. We believe the ethanol industry can respond to meeting the higher blend rates. Highwater Ethanol continues to work with the Minnesota Biofuels Association to promote ethanol use and we are working to move E15 forward in the State of Minnesota. Minnesota currently has over 483 - E15 pumps available as well as many blend pumps to ensure the consumer has a choice. As owners in the ethanol industry, each member should be doing his or her part in using a higher blend of ethanol and asking for the higher blends of ethanol if it is currently not available in your area. We are members of the Renewable Fuels Association and American Coalition for Ethanol. These entities do a great job in representing the ethanol industry at the federal level. Our Mission Statement: “To successfully operate a bio – energy facility, which will be profitable to our investor owners while contributing to the economic growth in the region. Highwater Ethanol is committed to the present while focusing on the future.” Highwater Ethanol’s Vision Statement: Highwater Ethanol will identify opportunities that position the business to provide sustainable competitive advantages through short and long - term core investments. A few core priorities that were identified include: 1) remain a low cost, efficient and high-quality producer; 2) Review new technology opportunities; 3) Review all opportunities within our core business; and 4) Continue long term distributions when appropriate. We encourage you to visit our web page at highwaterethanol.com. This website will give you markets, weather, investor information and related items. Like us on Facebook! If you are ever passing through the area and would like a tour of your facility, please stop by as we would be very happy to walk you through the facility. Our management team consists of: Luke Schneider, CFO, Derek Trapp Co-Plant/Production Manager, Dillon Imker Co-Plant/Production Manager, Tom Streifel, Risk/ Commodity, Todd Horning, Maintenance Manager, Lisa Landkammer, EHS Manager and Mandy Bosacker, Lab Manager. We have positioned our team to be successful in the ethanol industry. A reminder that our 2024 Annual Members’ Meeting is scheduled for Thursday, March 7, 2024, at 9:30 a.m. at the Lamberton American Legion, 110 South Main Street, Lamberton, MN. Watch your mail in the near future; you should be receiving your 10-K and Proxy Statement for the 2024 Annual Meeting. Please take the time to send in your proxy card. Your K-1 tax information will be mailed in early/mid-February. Have a safe winter!!! We will take care of the present as we focus on the future!!! Brian Kletscher, CEO Highwater Ethanol, LLC 2

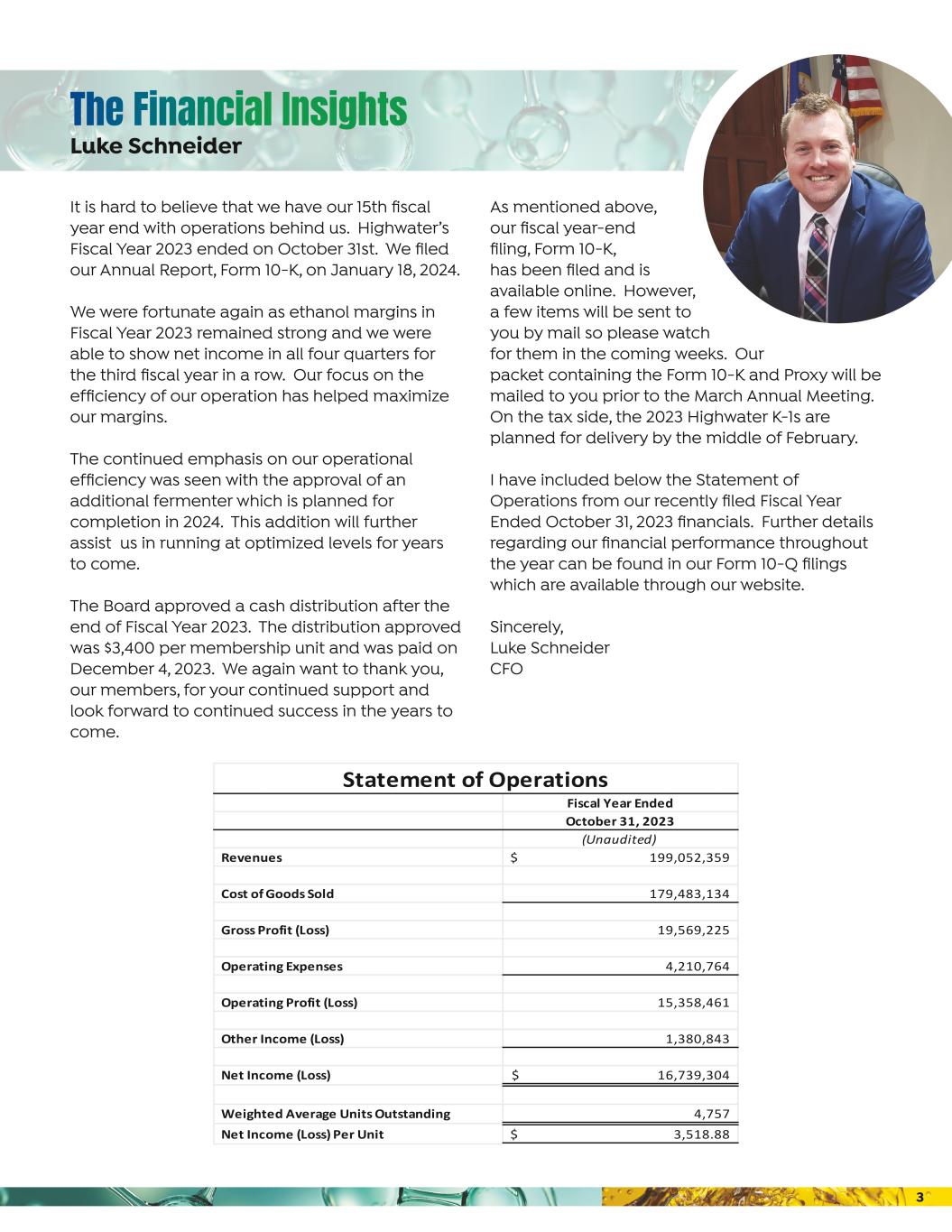

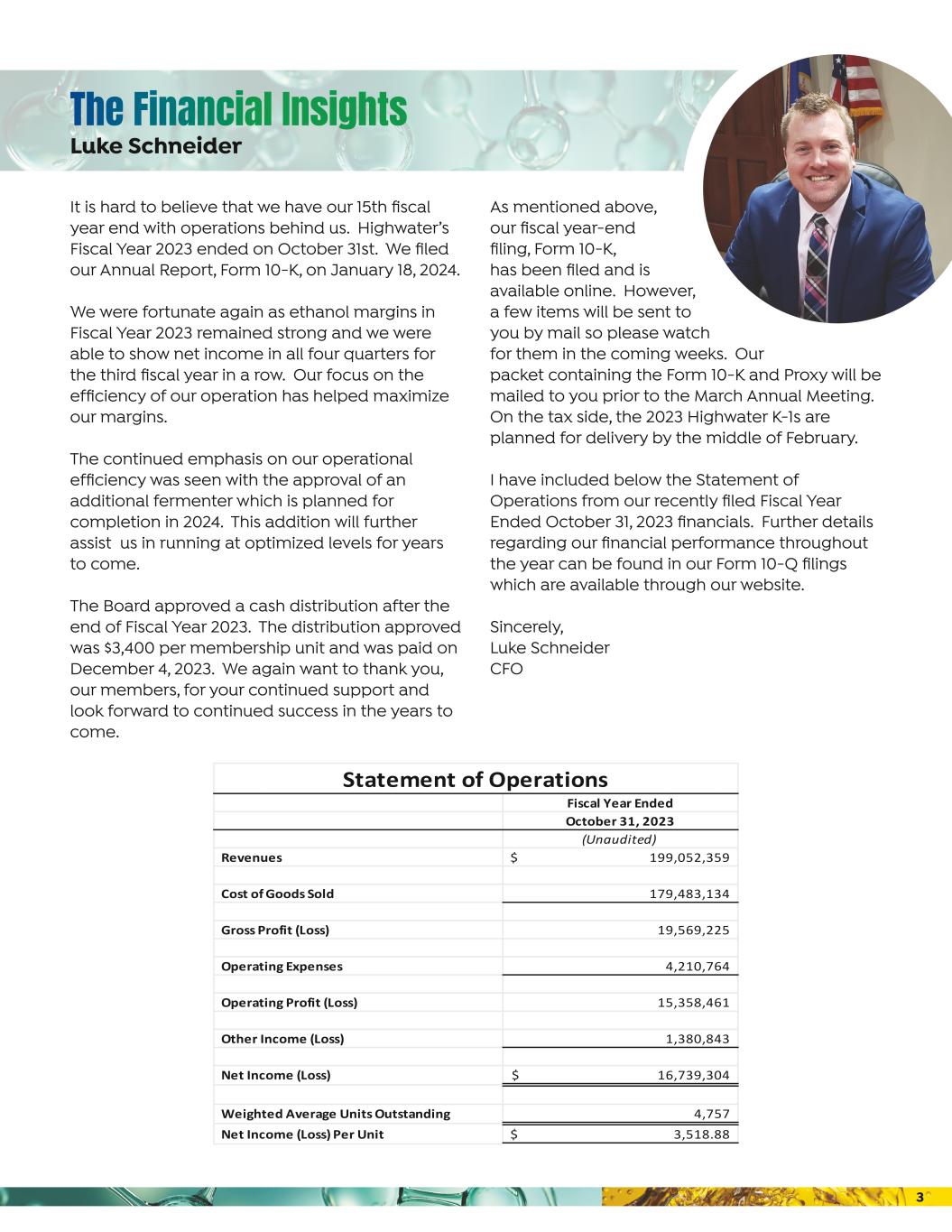

It is hard to believe that we have our 15th fiscal year end with operations behind us. Highwater’s Fiscal Year 2023 ended on October 31st. We filed our Annual Report, Form 10-K, on January 18, 2024. We were fortunate again as ethanol margins in Fiscal Year 2023 remained strong and we were able to show net income in all four quarters for the third fiscal year in a row. Our focus on the efficiency of our operation has helped maximize our margins. The continued emphasis on our operational efficiency was seen with the approval of an additional fermenter which is planned for completion in 2024. This addition will further assist us in running at optimized levels for years to come. The Board approved a cash distribution after the end of Fiscal Year 2023. The distribution approved was $3,400 per membership unit and was paid on December 4, 2023. We again want to thank you, our members, for your continued support and look forward to continued success in the years to come. As mentioned above, our fiscal year-end filing, Form 10-K, has been filed and is available online. However, a few items will be sent to you by mail so please watch for them in the coming weeks. Our packet containing the Form 10-K and Proxy will be mailed to you prior to the March Annual Meeting. On the tax side, the 2023 Highwater K-1s are planned for delivery by the middle of February. I have included below the Statement of Operations from our recently filed Fiscal Year Ended October 31, 2023 financials. Further details regarding our financial performance throughout the year can be found in our Form 10-Q filings which are available through our website. Sincerely, Luke Schneider CFO The Financial Insights Luke Schneider It is hard to believe that we have our 15th fiscal year end with operations behind us. Highwater’s Fiscal Year 2023 ended on October 31st. We filed our Annual Report, Form 10-K, on January 18, 2024. We were fortunate again as ethanol margins in Fiscal Year 2023 remained strong and we were able to show net income in all four quarters for the third fiscal year in a row. Our focus on the efficiency of our operation has helped m ximize our margins. The continued emphasis on our operational efficiency was seen with the approval of an additional fermenter which is planned for completion in 2024. This addition will further assist us in running at optimized levels for years to come. The Board approved a cash distribution after the end of Fiscal Year 2023. The distribution approved was $3,400 p r membership unit and was paid on December 4, 2023. We again want to thank you, our members, for your cont ued support and look forward to c ntinued success in the years to come. As mentioned above, our fiscal year-end filing, Form 10-K, has been filed and is available online. However, a few items will be sent to you by mail so please watch for them in the coming weeks. Our packet containing the Form 10-K and Proxy will be mailed to you prior to the March Annual Meeting. On the tax side, the 2023 Highwat r K-1s are planned for delivery by the middle of February. I have included below the Statement of Operations from our recently filed Fiscal Year Ended October 31, 2023 financials. Further detail regarding our financial performance throughout the year can be found in our Form 10-Q filings which are available through our website. Sincerely, Luke Schneider CFO Fiscal Year Ended October 31, 2023 (Unaudited) Revenues 199,052,359$ Cost of Goods Sold 179,483,134 Gross Profit (Loss) 19,569,225 Operating Expenses 4,210,764 Operating Profit (Loss) 15,358,461 Other Income (Loss) 1,380,843 Net Income (Loss) 16,739,304$ Weighted Average Units Outstanding 4,757 Net Income (Loss) Per Unit 3,518.88$ Statement of Operations 3

Highwater Ethanol, LLC Lab Expansion 4

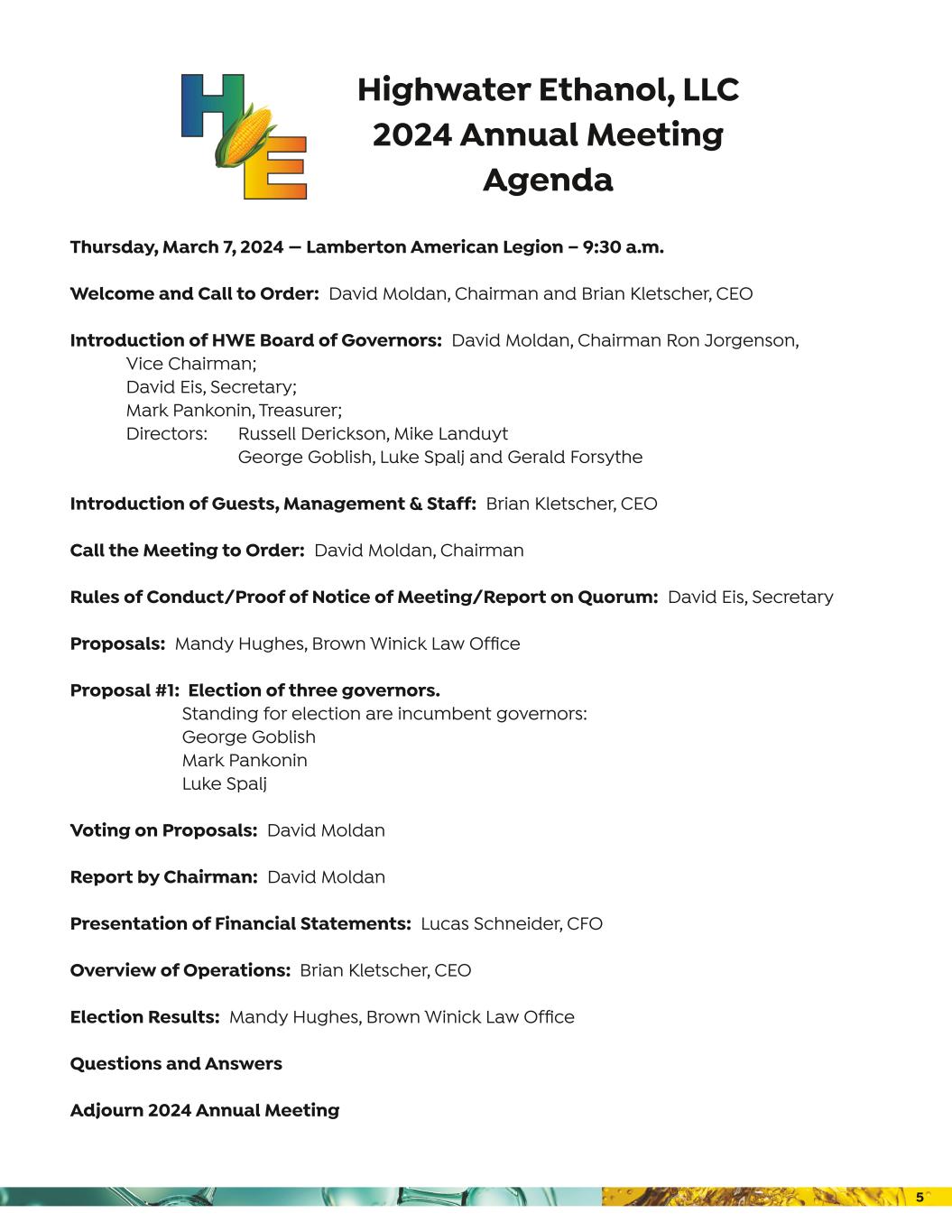

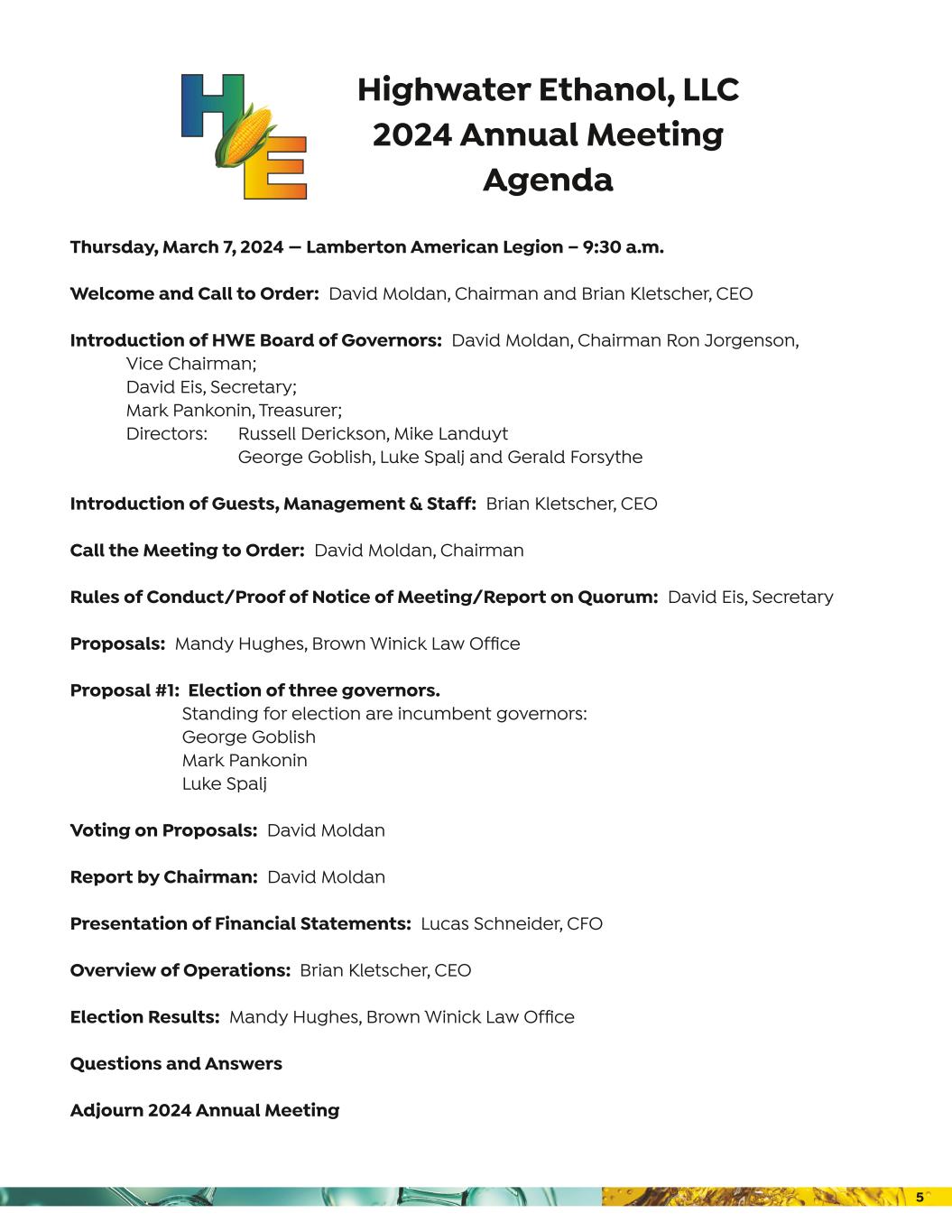

Thursday, March 7, 2024 — Lamberton American Legion – 9:30 a.m. Welcome and Call to Order: David Moldan, Chairman and Brian Kletscher, CEO Introduction of HWE Board of Governors: David Moldan, Chairman Ron Jorgenson, Vice Chairman; David Eis, Secretary; Mark Pankonin, Treasurer; Directors: Russell Derickson, Mike Landuyt George Goblish, Luke Spalj and Gerald Forsythe Introduction of Guests, Management & Staff: Brian Kletscher, CEO Call the Meeting to Order: David Moldan, Chairman Rules of Conduct/Proof of Notice of Meeting/Report on Quorum: David Eis, Secretary Proposals: Mandy Hughes, Brown Winick Law Office Proposal #1: Election of three governors. Standing for election are incumbent governors: George Goblish Mark Pankonin Luke Spalj Voting on Proposals: David Moldan Report by Chairman: David Moldan Presentation of Financial Statements: Lucas Schneider, CFO Overview of Operations: Brian Kletscher, CEO Election Results: Mandy Hughes, Brown Winick Law Office Questions and Answers Adjourn 2024 Annual Meeting Highwater Ethanol, LLC 2024 Annual Meeting Agenda 5

Co-Plant Managers Dillon Imker & Derek Trapp Happy New Year! It’s hard to believe we are looking at our 15th year of operation. With some excellent margins in 2023 Highwater was able to close out the fiscal year with approximately $16.7 million in net income. This doesn’t happen without a great team. We are very fortunate to have many seasoned members on our team helping Highwater remain successful. The weather forecast has left us with some more than favorable temperatures. This has given us the opportunity to finish some work outside before the temperatures dip and the wind blows. We continue to operate the plant to produce 195,000 gallons of Denatured Ethanol per day. At this rate we are right below our permit of 70.2 million Denatured ethanol gallons per year. For the fiscal year we averaged 3.03 gallons of Denatured Ethanol per bushel of corn. Some opportunities we are looking at for 2024 is adding an additional Fermenter. We currently have four fermenters and by adding a fifth fermenter we will be able increase our fermentation time from 56 hours to 72 hours. The additional fermentation time will help us increase our yield and give us the opportunity to look at different fermentation ingredients. Corn oil continues to be a great co – product for Highwater. The price of corn oil has been around 0.55 cents per pound which is down a little from last year at this time. Although the price is down, we have been able to increase our yield to 1.07 lbs./ bu. for 2023. This is up from our 2022 average of 0.95 lbs./bu. As we work into the new year a few items at the top of our list include planning for our spring shutdown, Carbon intensity and moving into our new Lab. We are planning for a spring shutdown that will take place on April 8th. During our spring shutdown we will inspect all the equipment and make tie ins for our new Fermenter. Carbon intensity continues to drive the projects at Highwater as we are looking to make the right decisions for the future. Every decision made can affect our CI score and in return increase or decrease our profits per gallon of Ethanol. We have been working with ECO Engineers focusing on projects that can bring better returns per gallon. We are also looking forward to moving into our new Lab. We are planning on making the transition later this month. Some benefits of our new lab are increased room for equipment, testing and storage for all inventory. As we work through 2024, we look forward to the opportunities this year brings. Dillon Imker & Derek Trapp 6

We stated in the last quarterly newsletter that Highwater was on track to have a good year. Reading through Brian and Luke’s report you see indeed it was a respectable year. The commodity guys did their part, mostly staying ahead of the markets. This job is much easier when you have margins to work with. So, it has been nearly 15 years here and I would say we have made steady progress achieving the goals set forth. We have a consistent base of customers that deliver corn as well as feed customers taking off our production. It is a sense of satisfaction to hear farmers say they like delivering here via clean, fairly fast unloading and competitive prices. Forward margins are typically not as good this time of year. However, we believe that we are well positioned to ride out a temporary rough time. Many times over the past 15 years have had a poor outlook and per usual, it changes. Happy New Year Tom Commodity Manager Tom Streifel Lighted Parade - Lamberton - Brian Kletscher Highwater Ethanol - Loose Gravel Music Festival Tour Group at Highwater Ethanol 7

This newsletter contains forward-looking statements that involve future events, our future performance and our expected future operations and actions. In some cases, you can identify forward-looking statements by the use of words such as “may,” “will,” “should,” “anticipate,” “believe,” “expect,” “plant,” “future,” “intend,” “could,” “estimate,” “predict,” “hope,” “potential,” “continue,” or the negative of these terms or other similar expressions. These forward-looking statements are only our predictions and involve numerous assumptions, risks and uncertainties, including, but not limited to those listed below and those business risks and factors described in our filings with the Securities and Exchange Commission (“SEC”). Changes in our business strategy, capital improvements or development plans; Changes in plant production capacity or technical difficulties in operating the plant; Changes in the environmental regulations that apply to our plant site and operations; Changes in general economic conditions or the occurrence of certain events causing an economic impact in the agriculture, oil or grains; Changes in federal and/or state laws (including the elimination of any federal and/or state ethanol tax incentives); Overcapacity within the ethanol industry; Changes and advances in ethanol production technology; Competition in the ethanol industry and from alternative fuel additives; Lack of transportation, storage and blending infrastructure preventing ethanol from reaching high demand markets; Volatile commodity and financial markets; and the results of our hedging transactions and other risk management strategies. Our actual results or actions could and likely will differ materially from those anticipated in the forward-looking statements for many reasons, including the reasons described in these communications. We are not under any duty to update the forward-looking statements contained in this newsletter. We cannot guarantee future results, levels of activity, performance or achievements. We caution you not to put undue reliance on any forward-looking statements, which speak only as of the date of this communication. You should read this newsletter with the understanding that our actual results may be materially different from what we currently expect. We qualify all of our forward-looking statements by these cautionary statements. Highwater Ethanol, LLC 24500 US Highway 14 Lamberton, Minnesota 56152 info@highwaterethanol.com www.highwaterethanol.com 507.752.6160 PRST STD U.S. POSTAGE PAID MN MAIL