From the desk of... Highwater Ethanol, LLC CEO Brian Kletscher Highwater Ethanol, LLC October 2024 Volume 1 | Issue 6 Ethanol In This Issue... 1-2 Brian Kletscher 3 Luke Schneider 4 Election of Governors 2025 6 Dillon Imker & Derek Trapp 7 Tom Streifel Our spring started with decent planting conditions, however it turned wet in mid – May and remained wet through the month of June. Crops seemed to struggle in the early part of the growing season. July was warm and the crops took off, we anticipate average to above average corn yield in our growing area. After wrapping up a very successful 2023 Fiscal Year, our first three quarters for fiscal year 2024 have been up and down, with margins improving in the third quarter. Current demand for renewable fuels remains strong and robust as we head into the Fall and Winter. We are excited about the demand now and into the future. We expect that E15 will continue to increase demand in the United States. We encourage you to do your part by using a higher blend of ethanol! Sixteen years in operation has continued to provide a different opportunity every year! Ethanol, dried distillers grain, modified distillers grain and corn oil demand remain strong. We filed our Form 10-Q for the third quarter on September 12, 2024. We reported net income of approximately $4,799,110. The fourth is off to a promising start, The board will discuss if there will be a distribution for the 2024 Fiscal Year in November/December timeframe. We will continue to strive to return money to our investors while maintaining the facility that you can be extremely proud to be part of! We continue to focus on operations to ensure the best efficiencies we can get at your facility. During the third quarter, we produced an average of approximately 3.00 gallons of denatured ethanol per bushel of corn ground. We have maintained these efficiencies since August 2019 due to several factors. We continue to review enzymes, yeast, and other items to ensure the best efficiencies and we are proud of our team for maintaining this production rate! Our efficiencies in corn oil production have continued to improve with adjustments made in the process to boost our production to over 1.05 pounds per bushel ground. We are in the process of adding a fifth fermenter. This project is expected to be online by November 1, 2024 and help improve our efficiency. Highwater Ethanol continues to monitor the following technologies: Sustainable Aviation Fuel {SAF}, Renewable Diesel, Carbon Capture technologies, Solar electrical production, and others. Weighing each technology, improving efficiencies, and lowering our Carbon Index score in the future will be important for Highwater and the ethanol industry. Utilizing the corn that is produced by our area producers remains very important for the entire Ag industry. For the past nine months, we have been operating at an ethanol production

level of approximately 69.5 million gallons per year which is near permitted rates and comparable to 2023. This was accomplished with your current facility with no additional capital expenses. Demand for ethanol continues to increase domestically and export demand has remained stable to improved slightly. We believe that our 2024/2025 Fiscal Years will likely continue to be very interesting for renewable ethanol and renewable Biofuels, and we will continue to work to obtain additional market share for our products. Highwater continues to review opportunities at diversifying our product lines. We market approximately 3.5% - 5.2% of our production as cellulosic ethanol. We received approval in March 2021 from the California Air Resources Board {CARB}. Highwater continues to purchase corn from our area producers. The 2024 corn crop quality and bushels is anticipated to be good. Good quality corn certainly helps us maintain our efficiency. Industry Information. E15 and Exports should be a continued priority in 2024. Exports are needed to support a very efficient U.S Ethanol industry. As production capacity is available in the U.S., we expect exports and domestic use will continue to be the key for the industry in the future. We anticipate and look forward to increased interest from countries including Mexico, Canada, China and Japan, as well as continued interest from Vietnam, Philippines, India and many others. We encourage you to use a higher blend such as E15, E30 or E85! We believe that use of higher blends will reduce our dependence on crude oil and contribute to cleaner air!! Highwater Ethanol supports E10 blend, E15 blend for 2001 and new vehicles and higher blends if you have a flex fuel vehicle. We believe the ethanol industry can respond to meeting the higher blend rates. Highwater Ethanol continues to work with the Minnesota Biofuels Association to promote ethanol use and we are working to move E15 forward in the State of Minnesota. Minnesota currently has over 500 - E15 pumps available as well as many blend pumps to ensure the consumer has a choice. As owners in the ethanol industry, each member should be doing his or her part in using a higher blend of ethanol and asking for the higher blends of ethanol if it is currently not available in your area. We are members of the Renewable Fuels Association and American Coalition for Ethanol. These entities do a great job in representing the ethanol industry at the Federal level. Our Mission Statement: “To successfully operate a bio – energy facility, which will be profitable to our investor owners while contributing to the economic growth in the region. Highwater Ethanol is committed to the present while focusing on the future.” Highwater Ethanol’s Vision Statement: Highwater Ethanol will identify opportunities that position the business to provide sustainable competitive advantages through short and long - term core investments. A few core priorities that were identified include: 1) remain a low cost, efficient and high-quality producer; 2) Review new technology opportunities; 3) Review all opportunities within our core business; and 4) Continue long term distributions when appropriate. We encourage you to visit our web page at highwaterethanol.com. This website will give you markets, weather, investor information and related items. Like us on Facebook! If you are ever passing through the area and would like a tour of your facility, please stop by as we would be very happy to walk you through the facility. Our management team consists of: Luke Schneider, CFO, Derek Trapp Co-Plant/Production Manager, Dillon Imker Co-Plant/Production Manager, Tom Streifel, Risk/Commodity, Todd Horning, Maintenance Manager, Lisa Landkammer, EHS Manager and Mandy Bosacker, Lab Manager. We have positioned our team to be successful in the ethanol industry. Have a safe fall harvest!! We will take care of the present as we focus on the future!!! Brian Kletscher, CEO Highwater Ethanol, LLC 2

We are already over halfway through our 4th Qtr. and our fiscal year will soon be coming to an end. Our 3rd Quarter, Form 10-Q, report was recently filed on September 12th. Our Net Income for the nine month period was approximately $4.0 million and our Net Income for the three month period was approximately $4.8 million. As you may recall from our last newsletter, we had a net loss through the 2nd quarter. I indicated that crush margins had begun to improve, and we have seen this improvement continue throughout the summer months. We completed our fall shutdown near the end of August and crush margins remain positive, so we anticipate finishing our fiscal year with another positive quarter. Progress on our fermenter project continues and we anticipate completion later this fall. We will also begin filling our bins with new crop corn in the near future. I wish all farmers a safe harvest. Please find below the breakdown of Statement of Operations for both the 3rd Quarter individually and in total for the nine month period. Further details regarding our financial performance can be found in our Form 10-Q filings that are available through our website. Sincerely, Luke Schneider CFO The Financial Insights Luke Schneider 3

Highwater Ethanol, LLC Election of Governors At the Company’s 2024 Annual Meeting, the terms of the Company’s Group II Governors concluded and the Company’s Members elected three incumbent Group II Governors, Mark Pankonin, George Goblish and Luke Spalj, to serve additional three-year terms. In June 2024, Dan Tauer was appointed to fill the vacant Group II Governor position caused by the untimely death of Governor Mark Pankonin. At the 2025 Annual Meeting, the Members of the Company will elect three Governors for the expiring terms of the Group III Governors. The Governors elected at the 2025 Annual Meeting will serve three-year terms, expiring at the Company’s 2028 Annual Meeting. The three Group III Governors are currently – Ron Jorgenson, Russ Derickson, Mike Landuyt. Nominations Nominees for elected Governors must be named by: a) the current Governors; b) a Nominating Committee established by the Governors; or c) through nomination by a Member entitled to vote in the election of Governors. The Company has established a Nominating Committee, which operates under a charter adopted by the Board of Governors in November 2009. Pursuant to the Nominating Committee’s charter, the Nominating Committee’s role is to recommend candidates for election to the Company’s Board of Governors. The Nominating Committee meets in December and/or January to identify and recommend candidates to the full Board of Governors at the January Board meeting. The charter sets forth the process for the Nominating Committee to use in recommending nominees. The Nominating Committee may solicit names of candidates for their consideration from Members. As mentioned above, Members may also nominate persons to be elected Governors of the Company by following the procedures explained in Section 5.3(b) of the Third Amended and Restated Operating Agreement. Section 5.3(b) requires that written notice of a Member’s intent to nominate an individual for governor must be given not less than 120 calendar days before the anniversary date of the release of the Company’s proxy materials to Members in connection with the previous year’s annual meeting. However, if the date of the current year’s meeting is changed by more than 30 days form the anniversary date of the previous year’s meeting, then the deadline is a reasonable time, as determined by the Board of Governors, before the Company releases its proxy materials for the annual meeting of the Company. Therefore, if the 2025 Annual Meeting is held on March 6, 2025, Governor nominations must be submitted by Members by September 27, 2024. Each notice submitted by a Member must include the following: 1) the name and address of record of the Member who intends to make the nomination; 2) a representation that the Member is a holder of record of Units of the Company entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice; 3) the name, age, business and residence addresses, and principal occupation or employment of each nominee; 4) a description of all arrangements or understandings between the Member and each nominee; 5) such other information regarding each nominee proposed by such Member as would be required to be included in a proxy statement filed pursuant to the proxy rules of the Securities and Exchange Commission; and 6 the consent of each nominee to serve as a Governor of the Company if so elected. 4

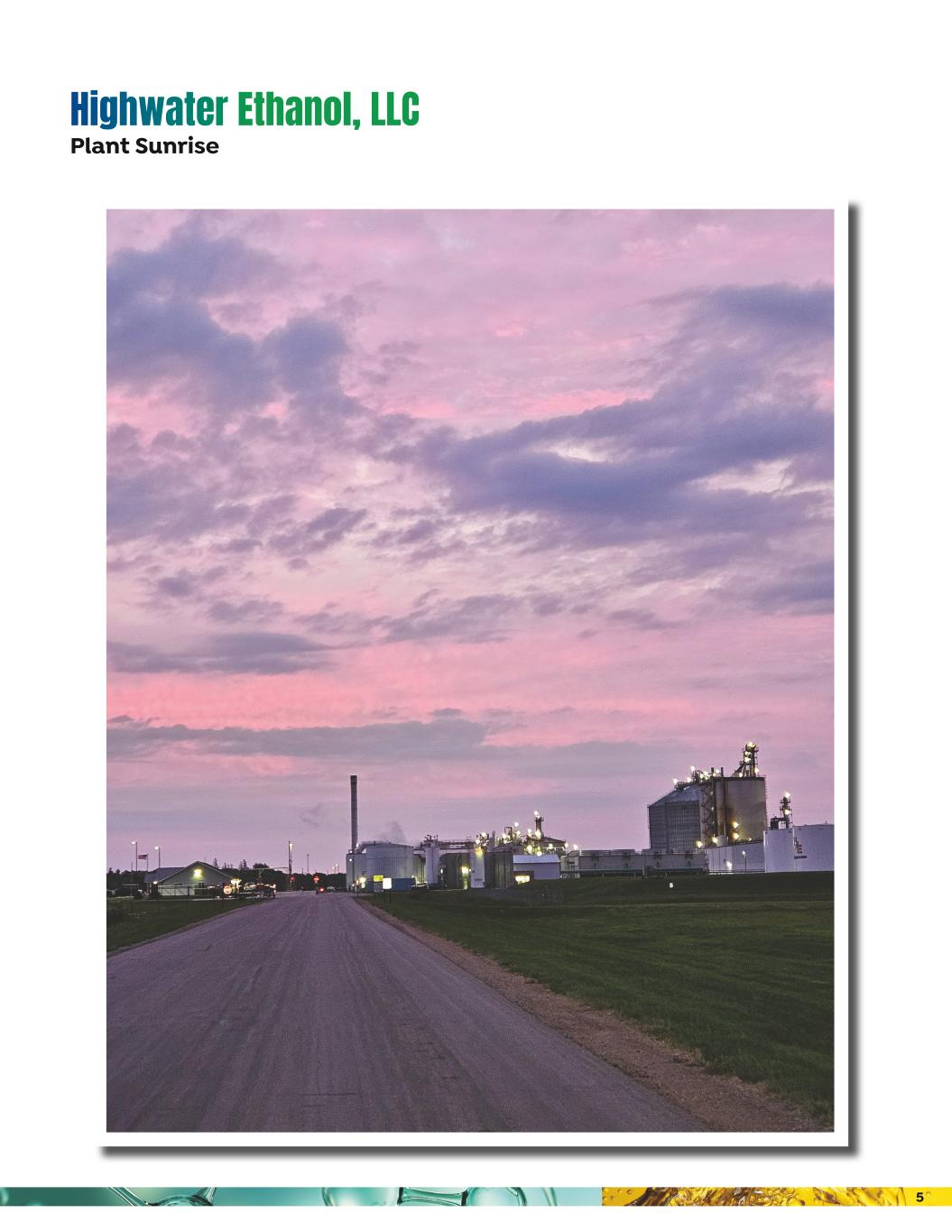

Highwater Ethanol, LLC Plant Sunrise 5

Co-Plant Managers Dillon Imker & Derek Trapp As Fall approaches, we are looking forward to cooler weather. The hot temperatures made for some challenging times, but the team at Highwater was able to manage the heat making for optimal fermentation. With an abundance of rain earlier this year, we have been reminded of how fast the weather can change. With minimal moisture this summer we are fortunate to have our holding ponds onsite allowing us to hold 20 million gallons of water. With ample storage onsite, it makes weathering the dry periods easier. The plant has been running well throughout the summer. We have maintained production of 193,000 gallons of Denatured Ethanol per day. We have seen a slight decrease in our efficiency over the last year with our average gallons of Denatured Ethanol per bushel of corn dropping to right around 3.0 from 3.01 gallons of Ethanol per bushel of corn. Corn oil continues to be a great co – product for Highwater. Over the last year we have been able to average 1.05 pounds per bushel of corn. Current corn oil prices have fluctuated near $0.45 per pound. We are making progress on our 5th fermenter that we are hoping to have online later this year. At the end of August, Brown Tank finished erecting the tank. Now that the ferm is up the structure, piping and electrical will begin. If progress continues to go well, we hope to start utilizing ferm 5 in November. Adding another fermenter will increase our fermentation time from 56 hours to 70 hours. The additional time is expected to help us increase our yield and give us the opportunity to look at different fermentation ingredients. We were able to get the tie- in points for our 5th ferm installed during the week of August 19th when we shut the plant down for our Fall outage. Some high priorities during our outage consist of tank cleaning and repairs. We hope to inspect all moving parts to stay ahead of any repairs that will be needed in the future. We had over 100 contractors onsite to help our team complete everything on our shutdown list. It made for a busy 3 days. All went well and we started the plant up on August 22nd. We have our next shutdowns scheduled for April and August of 2025. As we continue to work through 2024, we look forward to the opportunities this year brings. Dillon Imker & Derek Trapp 6

Commodity Manager Tom Streifel Harvest time again; where farmers reap the rewards of their labor and favors from Mother Nature. The US corn crop was better than average. The southern and eastern coastal states saw dry conditions in June-July thus yields in their area were down 20-40% from last year. However, the garden spot this year was Missouri through Illinois where record yields will be common. Our area will be a mixed bag or as one producer said he can expect the yield monitor to show zero to 250 in the same round. Excessive water early in the growing season has left some ugly marks across fields in our trade area. But, fields that were well drained and properly fertilized will likely reap respectable yields. Overall, we expect our region’s corn supply should be similar to one year ago. According to the latest USDA report, US corn carryout stocks will increase from 1.867 billion bushels a year ago to 2.073 BB this marketing year. Stocks above the magical number of 2.0 billion imply we have too much. On the flipside, once stocks dip below 1.4 BB, it is considered tight. The stocks to use ratio this year is forecast at 13.9% vs 2 years ago was 10%. Seems like a small percentage yet the difference is sub $4.00 corn now vs $6 - 7 two years ago. How long do prices stay depressed? The answer is the usual; until some part of the world experiences a poor crop. Ironic that wheat prices soared to $13 when the Ukraine / Russia war broke out. Seems that war today is more intense than ever, yet wheat dipped below $5.00 late summer. In other words, commodity prices are often influenced by trader’s perception rather than reality. Politics also plays a role in that perception of what is to come. Ironic that politicians will take credit for a weakening crude oil price, claiming they are helping consumers lower their energy costs, when in reality an eroding crude oil market is often a sign of a weakening economy. Our margins were respectable through the summer. It does not really matter if corn is $4 or $6 for our margins, but the price movement can create problems as well as opportunity. Thus far we have been able to avoid the land mines with forward positions, which have become fruitful in this eroding price environment. The ethanol industry as a whole still has the same situation, regardless if corn is high or low priced, where at least 92% of the US capacity needs to operate to meet the demand obligations. Margins will likely swing when gasoline demand is strong as it was this summer to now softening as the driving season winds down. The challenge for this fall and winter is how the US sheds off the other 8% of production. Highwater is an efficient and debt-free plant, which has allowed us to run with positive cash flow margins. 7

Highwater Ethanol, LLC 24500 US Highway 14 Lamberton, Minnesota 56152 info@highwaterethanol.com www.highwaterethanol.com 507.752.6160 PRST STD U.S. POSTAGE PAID MN MAIL This newsletter contains forward-looking statements that involve future events, our future performance and our expected future operations and actions. In some cases, you can identify forward-looking statements by the use of words such as “may,” “will,” “should,” “anticipate,” “believe,” “expect,” “plant,” “future,” “intend,” “could,” “estimate,” “predict,” “hope,” “potential,” “continue,” or the negative of these terms or other similar expressions. These forward-looking statements are only our predictions and involve numerous assumptions, risks and uncertainties, including, but not limited to those listed below and those business risks and factors described in our filings with the Securities and Exchange Commission (“SEC”). Changes in our business strategy, capital improvements or development plans; Changes in plant production capacity or technical difficulties in operating the plant; Changes in the environmental regulations that apply to our plant site and operations; Changes in general economic conditions or the occurrence of certain events causing an economic impact in the agriculture, oil or grains; Changes in federal and/or state laws (including the elimination of any federal and/or state ethanol tax incentives); Overcapacity within the ethanol industry; Changes and advances in ethanol production technology; Competition in the ethanol industry and from alternative fuel additives; Lack of transportation, storage and blending infrastructure preventing ethanol from reaching high demand markets; Volatile commodity and financial markets; and the results of our hedging transactions and other risk management strategies. Our actual results or actions could and likely will differ materially from those anticipated in the forward-looking statements for many reasons, including the reasons described in these communications. We are not under any duty to update the forward-looking statements contained in this newsletter. We cannot guarantee future results, levels of activity, performance or achievements. We caution you not to put undue reliance on any forward-looking statements, which speak only as of the date of this communication. You should read this newsletter with the understanding that our actual results may be materially different from what we currently expect. We qualify all of our forward-looking statements by these cautionary statements