Exhibit (a)(5)(B)

| | | | |

| | EFiled: Sep 10 2015 12:51PM EDT Transaction ID 57846045 Case No. 11490- | |  |

IN THE COURT OF CHANCERY OF THE STATE OF DELAWARE

| | | | |

| DAVID DESJARDINS, Individually and on behalf of all others similarly situated, | | | | |

| | |

Plaintiff, v. | | | | Civil Action No. |

| | |

| MILLENNIAL MEDIA, INC., MICHAEL BARRETT, BOB GOODMAN, THOMAS EVANS, PATRICK KERINS, ROSS LEVINSOHN, WENDA HARRIS MILLARD, JIM THOLEN, AOL, INC., and MARS ACQUISITION SUB, INC., | | | | |

| | |

Defendants. | | | | |

VERIFIED CLASS ACTION COMPLAINT

Plaintiff David Desjardins (“Plaintiff”), by and through his attorneys, alleges upon personal knowledge as to himself, and upon information and belief based upon, among other things, the investigation of counsel as to all other allegations herein, as follows:

SUMMARY OF THE ACTION

1. This is a stockholder class action brought by Plaintiff on behalf of the stockholders of Millennial Media, Inc. (“Millennial Media” or “Company”) against Millennial Media, the board of directors of Millennial Media (“Board” or

“Individual Defendants”), AOL, Inc. (“AOL”), and Mars Acquisition Sub, Inc. (“Merger Sub”) to enjoin the sale of the Company (“Proposed Transaction”) as detailed herein.

2. On September 3, 2015, Millennial Media announced that it had entered into a definitive agreement with AOL (“Merger Agreement”) under which AOL, through Merger Sub, would acquire all of the outstanding shares of Millennial Media in a tender offer involving cash consideration. Under the terms of the Merger Agreement, Millennial Media stockholders will receive $1.75 in cash in exchange for each share of Millennial Media. The Proposed Transaction is expected to close in the fall of 2015.

3. In facilitating the acquisition of Millennial Media by AOL for inadequate consideration and through a flawed process, each of the Defendants (defined herein) breached and/or aided the other Defendants’ breaches of their fiduciary duties.

4. Moreover, the terms of the Proposed Transaction were designed to ensure a transaction with AOL on terms preferential to AOL, and to subvert the interests of Plaintiff and the other public stockholders of Millennial Media. The Board has breached its fiduciary duties by agreeing to preclusive deal protection devices in the Merger Agreement including,inter alia, (a) a “no-shop” provision which prohibits the Company from, among other things, soliciting or negotiating

2

any alternative proposals; (b) a “matching rights” provision which grants AOL the right to revise its proposal in response to a superior alternative proposal; (c) an “information rights” provision that entitles AOL to receive a copy of any alternative proposal as well as the material terms thereof; and (d) a provision that requires the Company to pay a termination fee of $10,257,222 in connection with the Merger Agreement if the Proposed Transaction is terminated under certain circumstances. These provisions substantially and improperly limit the Board’s ability to act with respect to investigating and pursuing superior proposals. Thus, the Board compounded its breaches by agreeing to these unreasonable deal protection devices that preclude other bidders from making a successful competing offer for the Company.

5. For these reasons and as set forth in detail herein, Plaintiff seeks to enjoin the Proposed Transaction or, in the event the Proposed Transaction is consummated, recover damages resulting from the Individual Defendants’ violations of their fiduciary duties.

PARTIES

6. Plaintiff is, and at all relevant times was, a continuous stockholder of Millennial Media.

7. Defendant Millennial Media is a Delaware corporation with its principal executive offices located at 2400 Boston Street, Suite 300, Baltimore,

3

MD 21224.

8. Defendant Patrick Kerins (“Kerins”) has served as Chairman of the Board of the Company and has served as a director of the Company since 2009.

9. Defendant Michael Barrett (“Barrett”) has served as a director of the Company since January 2014.

10. Defendant Bob Goodman (“Goodman”) has served as a director of the Company since 2009.

11. Defendant Thomas Evans (“Evans”) has served as a director of the Company since February 2014.

12. Defendant Ross Levinsohn (“Levinsohn”) has served as a director of the Company since February 2014.

13. Defendant Wenda Harris Millard (“Millard”) has served as a director of the Company since May 2009.

14. Defendant Jim Tholen (“Tholen”) has served as a director of the Company since 2011.

15. Defendants Kerins, Barrett, Goodman, Evans, Levinsohn, Millard, and Tholen are collectively referred to herein as the “Board” or the “Individual Defendants.”

16. Defendant AOL is a Delaware corporation with its principal executive offices located at 770 Broadway, New York, NY 10003.

4

17. Defendant Merger Sub is a Delaware corporation and wholly-owned subsidiary of AOL.

18. Collectively, Millennial Media, AOL, the Individual Defendants, and Merger Sub are referred to herein as the “Defendants.”

CLASS ACTION ALLEGATIONS

19. Plaintiff brings this action on his own behalf and as a class action pursuant to Rule 23 on behalf of all holders of Millennial Media shares who are being and will be harmed by Defendants’ actions described below (“Class”). Excluded from the Class are Defendants herein and any person, firm, trust, corporation or other entity related to or affiliated with any of the Defendants.

20. This action is properly maintainable as a class action because:

a. The Class is so numerous that joinder of all members is impracticable. The Company’s most recent 10-Q indicates that, as of July 31, 2015, there were 141,644,009 common shares of Millennial Media issued and outstanding. The actual number of stockholders of Millennial Media can be ascertained through discovery.

b. There are questions of law and fact that are common to the Class, including:

5

i) whether the Individual Defendants have breached their fiduciary duties with respect to Plaintiff and the other members of the Class in connection with the Proposed Transaction; and

ii) whether Plaintiff and the other members of the Class would suffer irreparable injury were the Proposed Transaction complained of herein consummated.

c. Plaintiff is an adequate representative of the Class, has retained competent counsel experienced in litigation of this nature, and will fairly and adequately protect the interests of the Class.

d. Plaintiff’s claims are typical of the claims of the other members of the Class and Plaintiff does not have any interests adverse to the Class.

e. The prosecution of separate actions by individual members of the Class would create the risk of inconsistent or varying adjudications that would establish incompatible standards of conduct for Defendants, or adjudications that would, as a practical matter, be dispositive of the interests of individual members of the Class who are not parties to the adjudications or would substantially impair or impede those non-party Class members’ ability to protect their interests.

f. Defendants have acted on grounds generally applicable to the Class with respect to the matters complained of herein, thereby making appropriate the relief sought herein with respect to the Class as a whole.

6

SUBSTANTIVE ALLEGATIONS

21. Millennial Media is an independent mobile advertising marketplace delivering products and services to advertisers and developers. Millennial Media offers advertisers a suite of solutions that allow them to reach and connect with their target audiences across screens—from smartphones, tablets and other mobile devices to PCs—with the scale to make significant impact to their business. The Company offers developers the ability to maximize their advertising revenue and acquire new users for their apps. The Company’s advertiser and developer solutions support all major mobile operating systems, including Apple iOS, Android, Windows Phone and BlackBerry. The Company’s proprietary technology and data platform allows advertisers and developers to interact with the Company in the way that suits them best. For clients who want a higher degree of customer service, the Company offers its “managed media” services with dedicated account teams. For the Company’s clients who want to interact with the Company on a more automated basis, the Company offers tools that allow advertisers to buy Millennial Media’s ad supply in a programmatic fashion through the Company’s ad exchange and developers the opportunity to manage and monetize their ad inventory through Millennial Media’s supply side tool.

7

| B. | The Company is Poised for Growth |

22. A press release dated March 9, 2015 announced Millennial Media’s fourth quarter and full year 2014 results. Millennial Media Chief Executive Officer Barrett assessed the quarter as follows:

Millennial Media ended 2014 on a high note. We successfully completed our acquisition of Nexage, added several key management personnel, and exceeded our fourth quarter revenue expectations. Through these accomplishments, we’ve entered 2015 with a stronger, more complete set of tools to help us execute on our full-stack marketplace vision and make mobile simple for our partners. We’ve already begun inventory integrations to our owned and operated programmatic exchange, The Millennial Media Exchange powered by Nexage, which will enable hundreds of mobile ad buyers to transact with thousands of developers and publishers. Supported by the foundation of our managed media business, we expect to accelerate our programmatic platform capabilities and revenue production during 2015.

23. Millennial Media announced its first quarter 2015 financial results in a May 5, 2015 press release. Barrett assessed the quarter as follows:

Millennial Media is entering its second quarter with a strong foundation. First quarter results exceeded guidance across the board and we’re seeing early success through our Nexage integration. Combined with solid revenues from our Managed Media business, the pieces of our owned and operated programmatic exchange are fully assembled and we’re executing on our full-stack, independent marketplace vision. We believe we are well positioned in the growing mobile ad ecosystem and expect to accelerate our programmatic platform capabilities and revenue production throughout 2015.

24. Millennial Media announced its second quarter 2015 financial results in an August 10, 2015 press release. Barrett assessed the quarter as follows:

8

We have built a strong, comprehensive mobile ad marketplace, with what we believe are the right tools and talent to help meet the needs of our dynamic market. Clearly however, revenue is ramping more slowly than we had hoped. We are evaluating strategic opportunities to maximize the value of our capabilities in this rapidly evolving ecosystem.

25. In light of these factors, the Company is well-positioned to enjoy long-term growth in its market when the Company begins to convert its revenue into earnings.

| C. | The Proposed Transaction |

26. On September 3, 2015, Millennial Media issued a press release announcing the Proposed Transaction:

AOL today announced its continued investment in cross platform programmatic technology for marketers and publishers by signing an agreement to acquire Millennial Media, Inc. (NYSE: MM), a leading end-to-end mobile platform, for $1.75 per share of Millennial Media common stock.

Following AOL’s recent acquisition by Verizon, which operates the nation’s largest and most reliable wireless network, and its global enterprise-level partnership with Microsoft, today’s announcement further strengthens AOL’s mobile capabilities and underlines its position as the first global mobile media technology company. AOL now operates scaled global content brands, a scaled global content delivery network, a scaled global programmatic advertising platform and a subscription services platform.

With the acquisition of Millennial Media, AOL will:

| | • | | Add a leading supply-side platform for app monetization with over 65,000 apps to its publisher suite of offering |

9

| | • | | Add significant mobile brand advertising scale across ONE by AOL |

| | • | | Have access to approximately 1 billion global active unique users and robust addressable and cross-screen targeting capabilities |

| | • | | Accelerate its mobile position in key international markets, including Singapore, Japan, UK, France and Germany |

| | • | | Add world-class engineering, sales and product talent that specialize in mobile to AOL |

“AOL is well positioned as consumers spend more and more time on mobile devices, and as advertisers, agencies and publishers become more reliant on programmatic monetization tools,” said Bob Lord, President, AOL. “As we continue to invest in our platforms and technology, the acquisition of Millennial Media accelerates our competitive mobile offering in ONE by AOL and enhances our current publisher offering with an ‘all in’ monetization platform for app developers.”

“By joining AOL, we will be adding additional mobile expertise to AOL’s growing technology assets,” said Michael Barrett, President & CEO of Millennial Media. “I am excited by what this acquisition means for our shareholders, our employees and our partners.”

According to eMarketer, 69% of mobile ad spend will be bought and sold programmatically (more than $14 billion), and programmatic video will reach $4 billion by 2016. Furthermore, Cowen & Company expects mobile display and video advertising to grow from approximately $3.8 billion in 2015 to $9.2 billion in 2018 at a compound annual growth rate of 35%.

Founded in 2006, Millennial Media is headquartered in Baltimore, MD and has additional U.S. offices in Atlanta, Boston, New York and San Francisco, and international offices in Hamburg, London, Paris, Singapore and Tokyo. Millennial Media’s portfolio of assets includes acquisitions of TapMetrics, Condaptive, Metaresolver, Jumptap and Nexage.

10

The transaction will take the form of a tender offer followed by a merger, with Millennial Media becoming a wholly owned subsidiary of AOL upon completion. The transaction is subject to customary regulatory approvals and other closing conditions, and is expected to close this fall.

Goldman, Sachs & Co. served as AOL’s financial advisor on the transaction, and Wachtell, Lipton, Rosen & Katz served as AOL’s legal advisor.

LUMA Partners served as Millennial Media’s financial advisor on the transaction, and Goodwin Procter LLP served as Millennial Media’s legal advisor.

27. The Company’s stockholders will receive $1.75 in cash in exchange for each common share of Millennial Media. The Proposed Transaction’s price represents a 30.6 percent premium over Millennial Media’s $1.34 closing share price on January 2, 2015, the last day of trading prior to the announcement of the Proposed Transaction. As recently as August 3, 2015, Millennial Media traded at a valuation greater than the consideration offered by the Proposed Transaction.

28. The consideration is inadequate because, among other things, the intrinsic value of the Company’s common shares is materially in excess of the amount offered in the Proposed Transaction. In short, the Proposed Transaction undervalues Millennial Media.

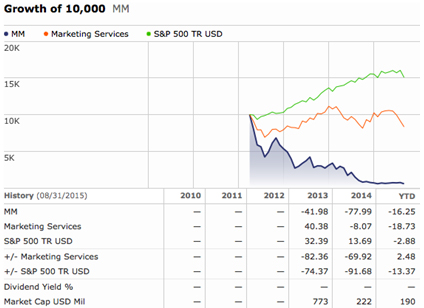

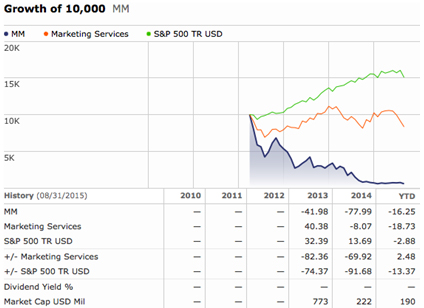

29. Millennial Media shares have underperformed relative those of the Company’s peers. Below is a chart depicting the relative growth of $10,000

11

worth of Millennial Media shares versus $10,000 invested in shares of other companies in the same industry purchased in 2010.

30. Even after the announcement of the Proposed Transaction, Millennial Media continues to be undervalued according to the Company’s price-book ratio and trailing twelve months price-sales ratio. According toMorningstar.com, as of September 4, 2015, Millennial Media has a price-book ratio of 1.1 compared to an industry average of 11.7. As of the same date, Millennial Media has a trailing twelve months price-sales ratio of 0.8 compared to an industry average of 1.1 according toMorningstar.com.

31. In sum, the Proposed Transaction comes at the most opportune time, at a time when the Company is positioned for growth in the Company’s stock price.

32. As these indicators make clear, Millennial Media, if properly exposed

12

to the market for corporate control, would bring a price materially in excess of the amount offered in the Proposed Transaction.

| E. | The Preclusive Deal Protection Devices |

33. The Proposed Transaction is also unfair because, as part of the Merger Agreement, the Individual Defendants agreed to certain onerous and preclusive deal protection devices that operate conjunctively to make the Proposed Transaction afait accompli and ensure that no competing offers will emerge for the Company.

34. The Merger Agreement contains a “no-shop” provision. Pursuant to Section 6.4(a) of the Merger Agreement, Millennial Media and its subsidiaries must immediately cease and cause to be terminated any existing discussions or negotiations with any person or its representatives with respect to any acquisition proposal. Specifically, Section 6.4(a) provides that:

Except as otherwise provided for in this Agreement, the Company agrees that it and its subsidiaries shall, and that it shall use its reasonable best efforts to cause its and their respective Representatives to, immediately cease any discussions or negotiations with any persons that may be ongoing with respect to a Competing Proposal and, until the earlier of the Effective Time or the date, if any, on which this Agreement is terminated pursuant to Section 8.1, not, directly or indirectly: (i) solicit, initiate or knowingly facilitate or encourage any Competing Proposal; (ii) participate in any negotiations regarding, or furnish to any person any nonpublic information with respect to, any Competing Proposal; (iii) engage in discussions with any person with respect to any Competing Proposal; (iv) approve or recommend any Competing Proposal; (v) enter into any letter of intent or similar document or any agreement or

13

commitment providing for any Competing Proposal; (vi) take any action to make the provisions of any “fair price,” “moratorium,” “control share acquisition,” “business combination” or other similar anti-takeover statute or regulation (including any transaction under, or a third party becoming an “interested stockholder” under, Section 203 of the DGCL), or any restrictive provision of any applicable anti-takeover provision in the Restated Certificate of Incorporation or By-laws of the Company, inapplicable to any person other than Parent and its Affiliates or to any transactions constituting or contemplated by a Competing Proposal; or (vii) resolve or agree to do any of the foregoing. The Company shall promptly after the date hereof instruct each person that has executed a confidentiality agreement (other than the Confidentiality Agreement) relating to a Competing Proposal or potential Competing Proposal with or for the benefit of the Company promptly to return to the Company or destroy all information, documents, and materials relating to the Competing Proposal or to the Company or its businesses, operations or affairs heretofore furnished by the Company or any of its Representatives to such person or any of its Representatives in accordance with the terms of any confidentiality agreement with such person, and shall use reasonable best efforts to enforce, and not waive without Parent’s prior written consent, any standstill or similar provision in any confidentiality or other agreement with such person; provided that if the Company Board determines in good faith, after consultation with its outside legal advisors, that it would be inconsistent with the directors’ exercise of their fiduciary duties under applicable Law not to do so, the Company may waive any standstill or similar provisions in its agreements to the extent necessary to permit a person to make, on a confidential basis to the Company Board, a Competing Proposal, conditioned upon such person agreeing to disclosure of such Competing Proposal to Parent and Acquisition Sub, in each case as contemplated by and subject to compliance with this Section 6.4.

35. In addition, the Merger Agreement contains a “matching rights” provision that serves as a deterrent to any alternative acquisition proposals. Pursuant to Section 6.4(d) of the Merger Agreement, the Company may not revise or withdraw the Board’s recommendation of the Proposed Transaction or terminate

14

the Merger Agreement for a superior proposal without first providing AOL with advance notice of the same, including the material terms and conditions of such proposal, as well as at least three business days to renegotiate the terms of its own proposal. Further, any amendment to the financial terms or other material terms of the alternative proposal requires a new notice period of three business days before an adverse recommendation change is made. Specifically, Section 6.4(d) provides, in relevant part, that:

Notwithstanding anything to the contrary contained in this Agreement, at any time prior to the Acceptance Time, if (i) an event, fact, circumstance, development, change or occurrence (an “Intervening Event”) that materially affects the business, assets or operations of the Company that is unknown to the Company Board as of the date of this Agreement and reasonably should not have been known as of the date of this Agreement, becomes known to the Company Board or (ii) the Company receives a Competing Proposal which the Company Board concludes in good faith, after consultation with outside legal and financial advisors, constitutes a Superior Proposal after giving effect to all of the adjustments to the terms of this Agreement which may be offered by Parent, the Company Board may effect a Change of Recommendation if the Company Board has concluded in good faith, after consultation with the Company’s outside legal advisors, that the failure of the Company Board to make such Change of Recommendation would be inconsistent with the directors’ exercise of their fiduciary duties under applicable Law; provided, however, that such action may be only be taken (A) if the Company shall have (x) fully complied with this Section 6.4 and (y) first provided prior written notice to Parent in advance of its intention to make a Change of Recommendation and the reasons therefor, including the terms of any Competing Proposal with respect to which the Change of Recommendation relates and the identity of the person making such Competing Proposal (it being understood that the delivery of such notice shall not, in and of itself, be deemed a Change in Recommendation) and (B) at a time that is after the third (3rd)

15

Business Day following the Company’s delivery to Parent of such notice, during which time Parent shall be entitled to deliver to the Company one or more proposals for amendments to this Agreement and, if requested by Parent, the Company shall negotiate with the Parent in good faith with respect thereto, if the Company Board determines in good faith, after consultation with the Company’s outside legal advisors, taking into account all amendments or revisions to this Agreement proposed by Parent, that the failure of the Company Board to effect such Change of Recommendation still would be inconsistent with the directors’ exercise of their fiduciary duties under applicable Law. Any material amendment to a Competing Proposal to which such Change of Recommendation relates, including any revision to price, shall require the Company to deliver to Parent a new notice and again comply with the requirements of this Section 6.4(d) with respect to such revised Competing Proposal.

36. Moreover, the Merger Agreement contains an additional “information rights” provision. Pursuant to Section 6.4(b) of the Merger Agreement, promptly after the receipt by Millennial Media of any request for information or other inquiry that Millennial Media reasonably believes could lead to any proposal or other transaction, Millennial Media must provide AOL with the material terms and conditions of any such request or inquiry, the identity of the person making any such request or inquiry, and copies of any written offer, proposal or request, or inquiry. Specifically, Section 6.4(b) provides, in relevant part:

From and after the execution of this Agreement, the Company shall notify Parent promptly (but in any event within 24 hours) of the receipt of any Competing Proposal, and (A) if it is in writing, deliver to Parent a copy of such Competing Proposal and any related draft agreements and other written material setting forth the terms and conditions of such Competing Proposal or (B) if oral, provide to Parent a detailed summary of the material terms and conditions

16

thereof including the identity of the person making such competing proposal. The Company shall keep Parent reasonably informed on a prompt and timely basis of the status and material details of any such Competing Proposal and with respect to any material change to the terms of any such Competing Proposal within 24 hours of such material change.

Thus, AOL can easily match any competing offer because it is granted unfettered access to the offer, in its entirety, and has significant matching rights that eliminate any leverage that the Company has in receiving a competing offer.

37. Section 8 provides that under specified circumstances, including if Millennial Media terminates the Merger Agreement to approve or recommend a superior proposal, Millennial Media pay a termination fee of $10,257,222 in connection with the Merger Agreement if the Proposed Transaction is terminated under certain circumstances, which all but ensures that no competing offer will be forthcoming.

38. This provision, coupled with the “no-shop” provision, “matching rights” provision, and “information rights” provision, all but ensures that no competing offer will be forthcoming.

39. Ultimately, these preclusive deal protection provisions improperly restrain the Company’s ability to solicit or engage in negotiations with any third party regarding a proposal to acquire all or a significant interest in the Company. The circumstances under which the Board may respond to an unsolicited writtenbona fide proposal for an alternative transaction that constitutes or would

17

reasonably constitute a superior proposal are too narrowly circumscribed to provide an effective “fiduciary out” under the circumstances.

FIRST CAUSE OF ACTION

(Against the Individual Defendants for Breach of Fiduciary Duties)

40. Plaintiff repeats and realleges each allegation set forth herein.

41. The Individual Defendants have violated fiduciary duties owed to stockholders of Millennial Media.

42. By the acts, transactions, and courses of conduct alleged herein, the Individual Defendants have failed to obtain a fair price for the stockholders of Millennial Media.

43. As alleged herein, the Individual Defendants have initiated a process to sell Millennial Media that undervalues the Company. In addition, by agreeing to the Proposed Transaction, the Individual Defendants have capped the price of Millennial Media at a price that does not adequately reflect the Company’s true value. The Individual Defendants also failed to sufficiently inform themselves of Millennial Media’s value, or disregarded the true value of the Company. Furthermore, any alternate acquiror will be faced with engaging in discussions with a management team and Board that are committed to the Proposed Transaction.

44. As a result of the actions of Defendants, Plaintiff and the Class will

18

suffer irreparable injury in that they have not and will not receive a fair price for their equity interest in Millennial Media. Unless the Individual Defendants are enjoined by the Court, they will continue to breach their fiduciary duties owed to Plaintiff and the members of the Class, all to the irreparable harm of the members of the Class.

45. Plaintiff and the members of the Class have no adequate remedy at law. Only through the exercise of this Court’s equitable powers can Plaintiff and the Class be fully protected from immediate and irreparable injury, which the Individual Defendants’ actions threaten to inflict.

SECOND CAUSE OF ACTION

(Against Millennial Media, AOL, and Merger Sub for Aiding and

Abetting the Individual Defendants’ Breaches of Fiduciary Duty)

46. Plaintiff repeats and realleges each allegation set forth herein.

47. Millennial Media, AOL, and Merger Sub are acting with knowledge of, or with reckless disregard to, the fact that the Individual Defendants are in breach of their fiduciary duties to the stockholders of Millennial Media, and are participating in such breaches of fiduciary duties.

48. Millennial Media, AOL, and Merger Sub knowingly aided and abetted the Individual Defendants’ wrongdoing alleged herein. In so doing, Millennial Media, AOL, and Merger Sub have rendered substantial assistance in order to effectuate the Individual Defendants’ plan to consummate the Proposed

19

Transaction in breach of their fiduciary duties.

49. Plaintiff has no adequate remedy at law.

PRAYER FOR RELIEF

WHEREFORE, Plaintiff demands relief in his favor and in favor of the Class and against Defendants as follows:

A. Declaring that this action is properly maintainable as a Class action and certifying Plaintiff as Class representative;

B. Enjoining Defendants, their agents, counsel, employees, and all persons acting in concert with them from consummating the Proposed Transaction, unless and until the Company adopts and implements a procedure or process to obtain a merger agreement providing the best available terms for stockholders;

C. Rescinding, to the extent already implemented, the Proposed Transaction or any of the terms thereof, or granting Plaintiff and the Class rescissory damages;

D. Directing the Individual Defendants to account to Plaintiff and the Class for all damages suffered as a result of the wrongdoing;

E. Awarding Plaintiff the costs and disbursements of this action, including reasonable attorney’ and experts’ fees; and

F. Granting such other and further equitable relief as this Court may deem just and proper.

20

| | | | | | |

| Dated: September 10, 2015 | | | | | | RIGRODSKY & LONG, P.A. |

| | | |

| | | | By: | | /s/ Brian D. Long |

| | | | | | Seth D. Rigrodsky (#3147) |

| | | | | | Brian D. Long (#4347) |

| | | | | | Gina M. Serra (#5387) |

| | | | | | Jeremy J. Riley (#5791) |

| | | | | | 2 Righter Parkway, Suite 120 |

| | | | | | Wilmington, DE 19803 |

| | | | | | (302) 295-5310 |

| | | |

| | | | | | Attorneys for Plaintiff |

|

| OF COUNSEL: |

|

BROWER PIVEN

A PROFESSIONAL CORPORATION |

Brian C. Kerr 475 Park Avenue South, 33rd Floor New York, NY 10016 (212) 501-9000 |

21