|

Exhibit (c)(2)

|

PRELIMINARY; SUBJECT TO FURTHER REVIEW & REVISION NewStar Financial Board of Directors discussion materials Confidential / Draft July 31, 2017 PRELIMINARY | SUBJECT TO FURTHER REVIEW AND EVALUATION These materials may not be used or relied upon for any purpose other than as specifically contemplated by a written agreement with Credit Suisse Group AG and/or its Affiliates (hereafter “Credit Suisse”).

|

|

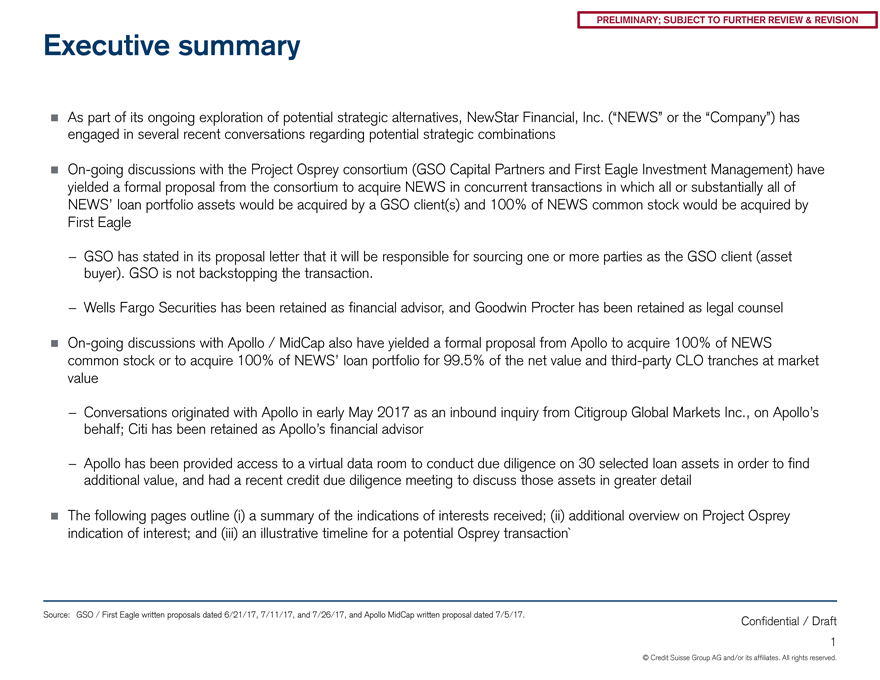

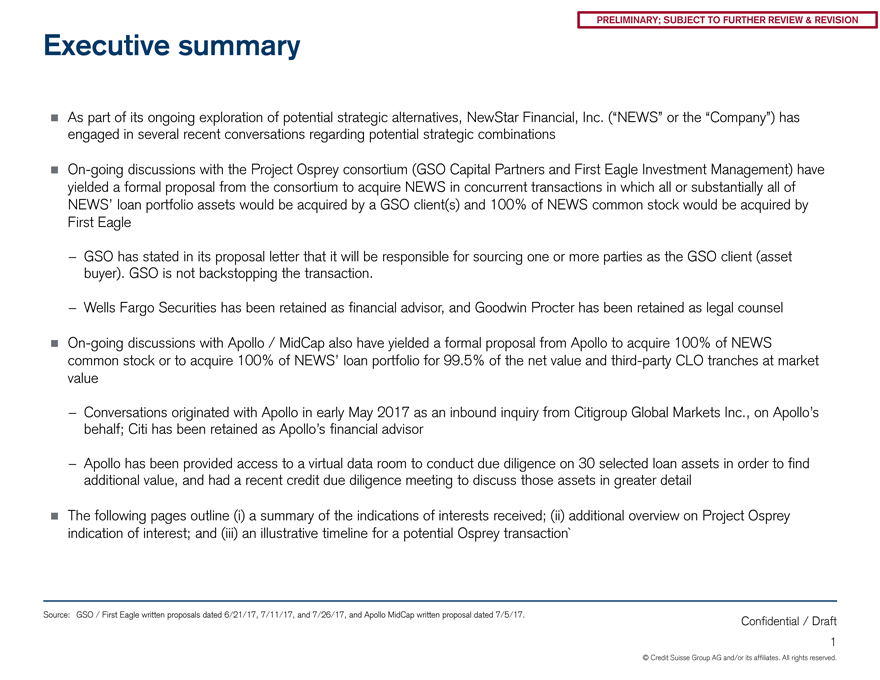

PRELIMINARY; SUBJECT TO FURTHER REVIEW & REVISION Executive summary As part of its ongoing exploration of potential strategic alternatives, NewStar Financial, Inc. (“NEWS” or the “Company”) has engaged in several recent conversations regarding potential strategiccombinations On-going discussions with the Project Osprey consortium (GSO Capital Partners and First Eagle Investment Management) have yielded a formal proposal from the consortium to acquire NEWS in concurrent transactions in which all or substantially all of NEWS’ loan portfolio assets would be acquired by a GSO client(s) and 100% of NEWS common stock would be acquired by First Eagle—GSO has stated in its proposal letter that it will be responsible for sourcing one or more parties as the GSO client (asset buyer). GSO is not backstopping the transaction.—Wells Fargo Securities has been retained as financial advisor, and Goodwin Procter has been retained as legalcounsel On-going discussions with Apollo / MidCap also have yielded a formal proposal from Apollo to acquire 100% of NEWS common stock or to acquire 100% of NEWS’ loan portfolio for 99.5% of the net value and third-party CLO tranches at market value—Conversations originated with Apollo in early May 2017 as an inbound inquiry from Citigroup Global Markets Inc., on Apollo’s behalf; Citi has been retained as Apollo’s financial advisor—Apollo has been provided access to a virtual data room to conduct due diligence on 30 selected loan assets in order to find additional value, and had a recent credit due diligence meeting to discuss those assets in greater detail The following pages outline (i) a summary of the indications of interests received; (ii) additional overview on Project Osprey indication of interest; and (iii) an illustrative timeline for a potential Osprey transaction` Source: GSO / First Eagle written proposals dated 6/21/17, 7/11/17, and 7/26/17, and Apollo MidCap written proposal dated 7/5/17. Confidential / Draft 1 © Credit Suisse Group AG and/or its affiliates. All rights reserved.

|

|

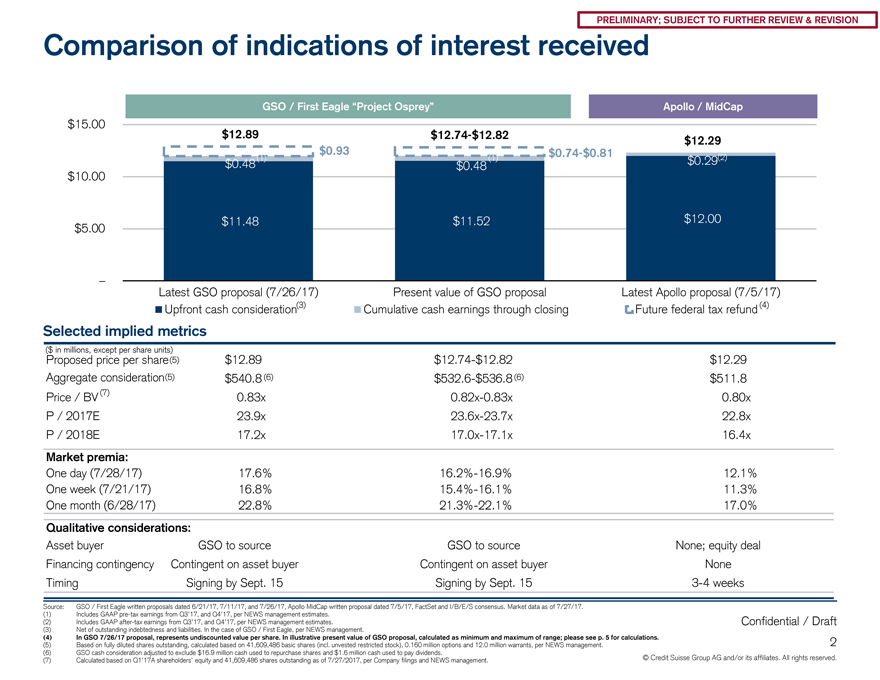

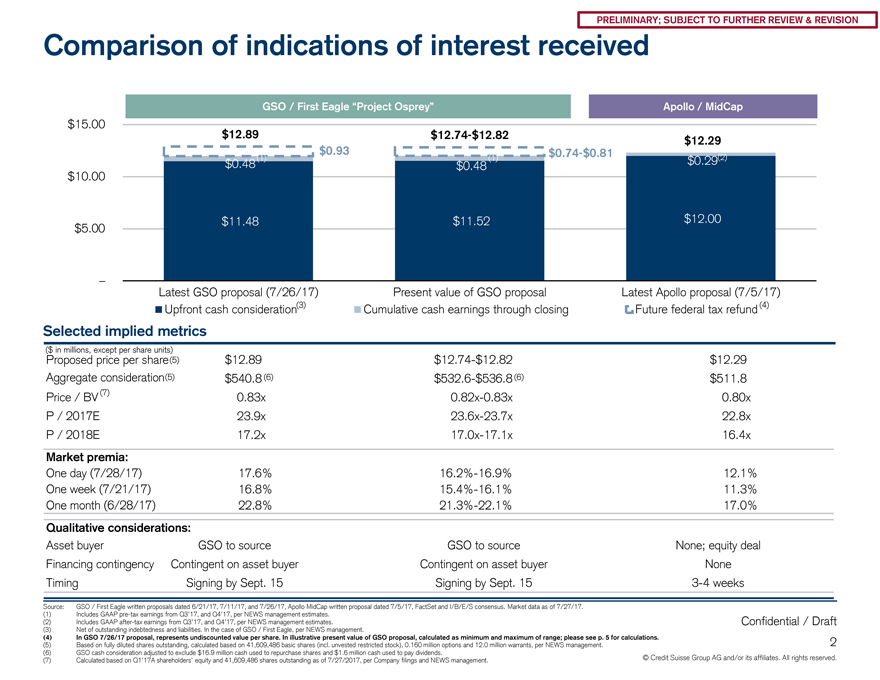

PRELIMINARY; SUBJECT TO FURTHER REVIEW & REVISION Comparison of indications of interest received GSO / First Eagle “Project Osprey”Apollo / MidCap $15.00$12.89$12.74-$12.82$12.29(1)$0.93(1)$0.74-$0.81(2) $0.48$0.48$0.29 $10.00 $5.00$11.48$11.52$12.00 – Latest GSO proposal (7/26/17)Present value of GSO proposalLatest Apollo proposal (7/5/17) Upfront cash consideration(3)Cumulative cash earnings through closingFuture federal tax refund (4) Selected implied metrics ($ in millions, except per share units) Proposed price per share(5)$12.89$12.74-$12.82$12.29 Aggregate consideration(5)$540.8(6)$532.6-$536.8 (6)$511.8 Price / BV(7)0.83x0.82x-0.83x0.80x P /2017E23.9x23.6x-23.7x22.8x P /2018E17.2x17.0x-17.1x16.4x Market premia: One day(7/28/17)17.6%16.2%-16.9%12.1% One week(7/21/17)16.8%15.4%-16.1%11.3% One month(6/28/17)22.8%21.3%-22.1%17.0% Qualitative considerations: Asset buyerGSO to sourceGSO to sourceNone; equity deal Financing contingency Contingent on asset buyerContingent on asset buyerNone TimingSigning by Sept. 15Signing by Sept.153-4 weeks Source:GSO / First Eagle written proposals dated 6/21/17, 7/11/17, and 7/26/17, Apollo MidCap written proposal dated 7/5/17, FactSet and I/B/E/S consensus. Market data as of 7/27/17. (1)Includes GAAPpre-tax earnings from Q3’17, and Q4’17, per NEWS management estimates. (2)Includes GAAPafter-tax earnings from Q3’17, and Q4’17, per NEWS management estimates.Confidential /Draft (3)Net of outstanding indebtedness and liabilities. In the case of GSO / First Eagle, per NEWS management. (4)In GSO 7/26/17 proposal, represents undiscounted value per share. In illustrative present value of GSO proposal, calculated as minimum and maximum of range; please see p. 5 for calculations.2 (5)Based on fully diluted shares outstanding, calculated based on 41,609,486 basic shares (incl. unvested restricted stock), 0.160 million options and 12.0 million warrants, per NEWS management. (6)GSO cash consideration adjusted to exclude $16.9 million cash used to repurchase shares and $1.6 million cash used to pay dividends. (7)Calculated based on Q1’17A shareholders’ equity and 41,609,486 shares outstanding as of 7/27/2017, per Company filings and NEWS management.© Credit Suisse Group AG and/or its affiliates. All rights reserved.

|

|

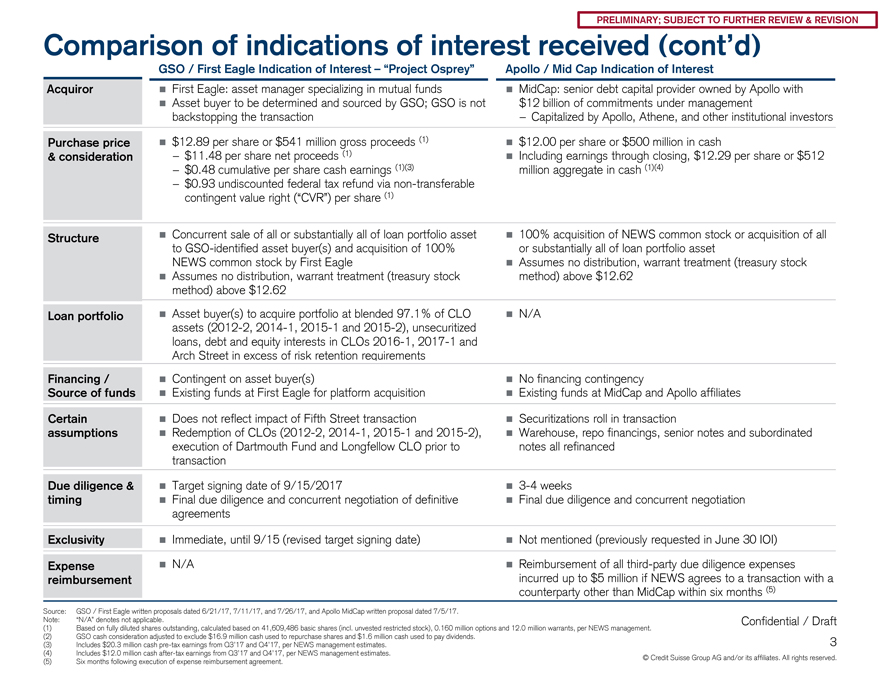

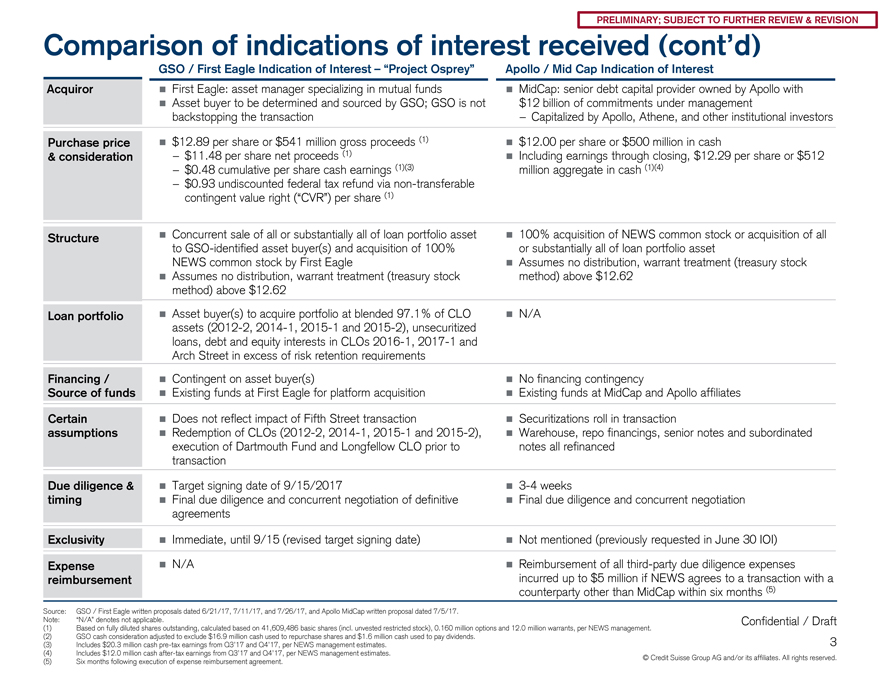

PRELIMINARY; SUBJECT TO FURTHER REVIEW & REVISION Comparison of indications of interest received (cont’d) GSO / First Eagle Indication of Interest – “Project Osprey”Apollo / Mid Cap Indication of Interest Acquiror First Eagle: asset manager specializing in mutual funds MidCap: senior debt capital provider owned by Apollo with Asset buyer to be determined and sourced by GSO; GSO is not$12 billion of commitments under management backstopping the transaction- Capitalized by Apollo, Athene, and other institutional investors Purchase price $12.89 per share or $541 million gross proceeds (1) $12.00 per share or $500 million in cash & consideration-$11.48 per share net proceeds (1) Including earnings through closing, $12.29 per share or $512 -$0.48 cumulative per share cash earnings (1)(3)million aggregate in cash (1)(4) -$0.93 undiscounted federal tax refund vianon-transferable contingent value right (“CVR”) per share (1) Structure Concurrent sale of all or substantially all of loan portfolio asset 100% acquisition of NEWS common stock or acquisition of all toGSO-identified asset buyer(s) and acquisition of 100%or substantially all of loan portfolio asset NEWS common stock by First Eagle Assumes no distribution, warrant treatment (treasury stock Assumes no distribution, warrant treatment (treasury stockmethod) above $12.62 method) above $12.62 Loan portfolio Asset buyer(s) to acquire portfolio at blended 97.1% of CLO N/A assets(2012-2,2014-1,2015-1 and2015-2), unsecuritized loans, debt and equity interests in CLOs2016-1,2017-1 and Arch Street in excess of risk retention requirements Financing / Contingent on asset buyer(s) No financing contingency Source of funds Existing funds at First Eagle for platform acquisition Existing funds at MidCap and Apollo affiliates Certain Does not reflect impact of Fifth Street transaction Securitizations roll in transaction assumptions Redemption of CLOs(2012-2,2014-1,2015-1 and2015-2), Warehouse, repo financings, senior notes and subordinated execution of Dartmouth Fund and Longfellow CLO prior tonotes all refinanced transaction Due diligence & Target signing date of 9/15/20173-4 weeks timing Final due diligence and concurrent negotiation of definitive Final due diligence and concurrent negotiation agreements Exclusivity Immediate, until 9/15 (revised target signing date) Not mentioned (previously requested in June 30 IOI) Expense N/A Reimbursement of all third-party due diligence expenses reimbursementincurred up to $5 million if NEWS agrees to a transaction with a counterparty other than MidCap within six months (5) Source:GSO / First Eagle written proposals dated 6/21/17, 7/11/17, and 7/26/17, and Apollo MidCap written proposal dated 7/5/17. Note:“N/A” denotes not applicable.Confidential / Draft (1)Based on fully diluted shares outstanding, calculated based on 41,609,486 basic shares (incl. unvested restricted stock), 0.160 million options and 12.0 million warrants, per NEWS management. (3) (2)Includes GSO cash $20.3 consideration million cash adjustedpre-tax to earnings exclude $ from 16.9 Q3’17 million and cash Q4’17, used to per repurchase NEWS management shares and estimates. $1.6 million cash used to pay dividends.3 (4)Includes $12.0 million cashafter-tax earnings from Q3’17 and Q4’17, per NEWS management estimates. (5)Six months following execution of expense reimbursement agreement.© Credit Suisse Group AG and/or its affiliates. All rights reserved.

|

|

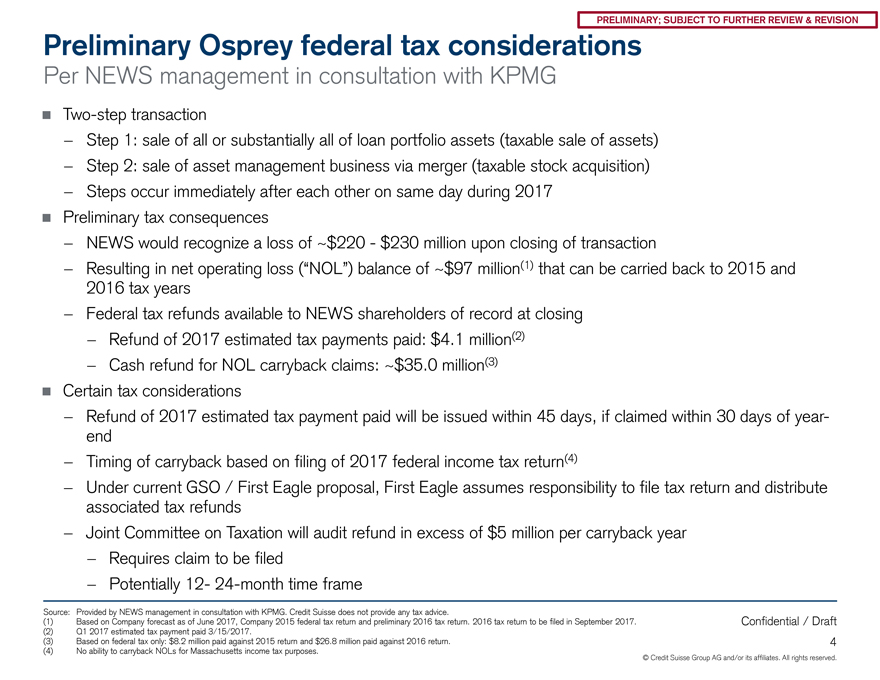

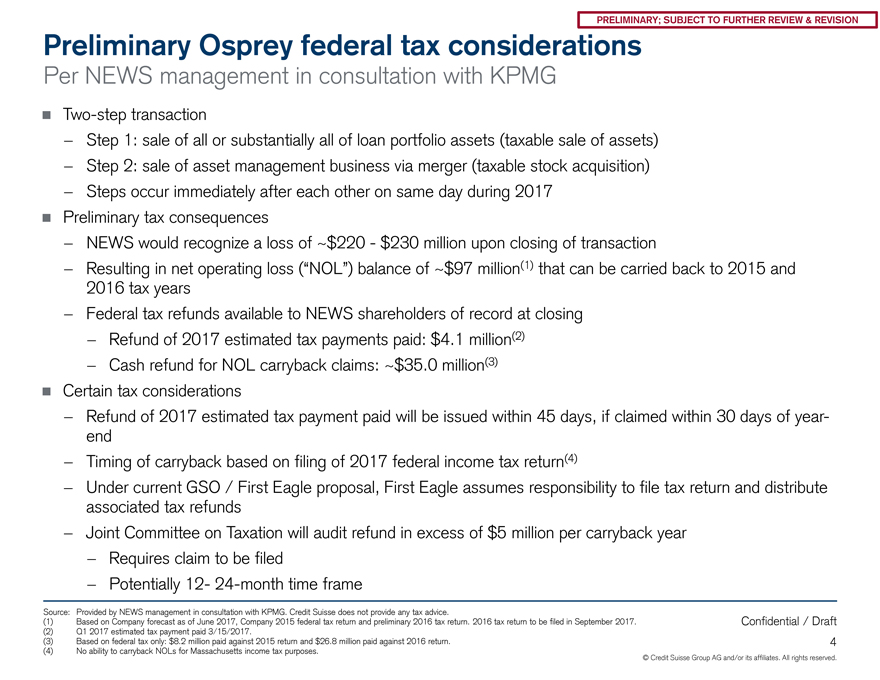

PRELIMINARY; SUBJECT TO FURTHER REVIEW & REVISION Preliminary Osprey federal tax considerations Per NEWS management in consultation withKPMG Two-step transaction—Step 1: sale of all or substantially all of loan portfolio assets (taxable sale of assets)—Step 2: sale of asset management business via merger (taxable stock acquisition)—Steps occur immediately after each other on same day during 2017 Preliminary tax consequences—NEWS would recognize a loss of ~$220—$230 million upon closing of transaction —Resulting in net operating loss (“NOL”) balance of ~$97 million(1) that can be carried back to 2015 and 2016 tax years—Federal tax refunds available to NEWS shareholders of record at closing—Refund of 2017 estimated tax payments paid: $4.1 million(2)—Cash refund for NOL carryback claims: ~$35.0 million(3) Certain tax considerations—Refund of 2017 estimated tax payment paid will be issued within 45 days, if claimed within 30 days ofyear-end—Timing of carryback based on filing of 2017 federal income tax return(4)—Under current GSO / First Eagle proposal, First Eagle assumes responsibility to file tax return and distribute associated tax refunds—Joint Committee on Taxation will audit refund in excess of $5 million per carryback year—Requires claim to be filed—Potentially12-24-month time frame Source: Provided by NEWS management in consultation with KPMG. Credit Suisse does not provide any tax advice. (1) Based on Company forecast as of June 2017, Company 2015 federal tax return and preliminary 2016 tax return. 2016 tax return to be filed in September 2017. Confidential / Draft (2) Q1 2017 estimated tax payment paid 3/15/2017. (3) Based on federal tax only: $8.2 million paid against 2015 return and $26.8 million paid against 2016 return. 4 (4) No ability to carryback NOLs for Massachusetts income tax purposes. © Credit Suisse Group AG and/or its affiliates. All rights reserved.

|

|

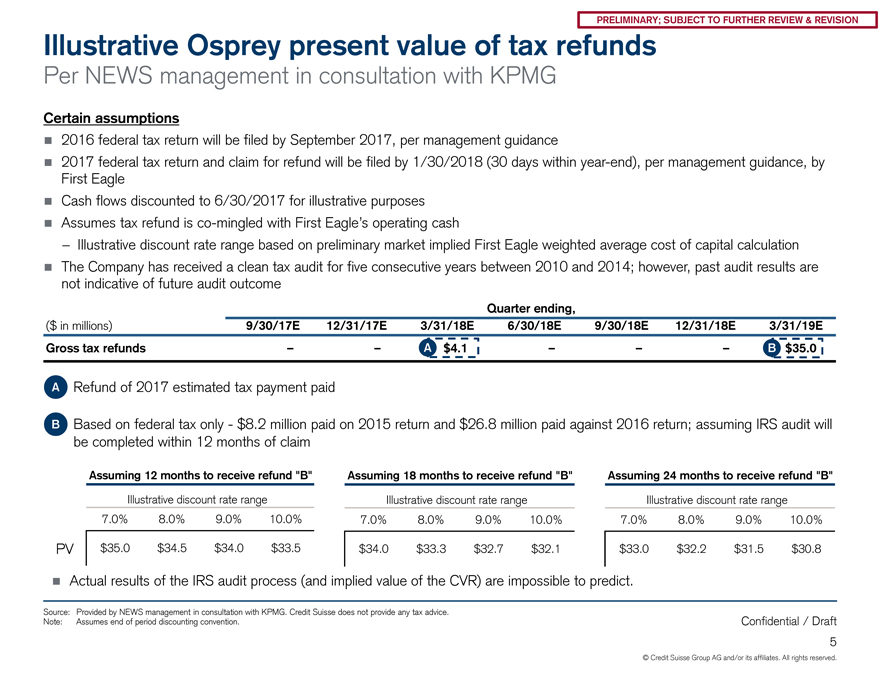

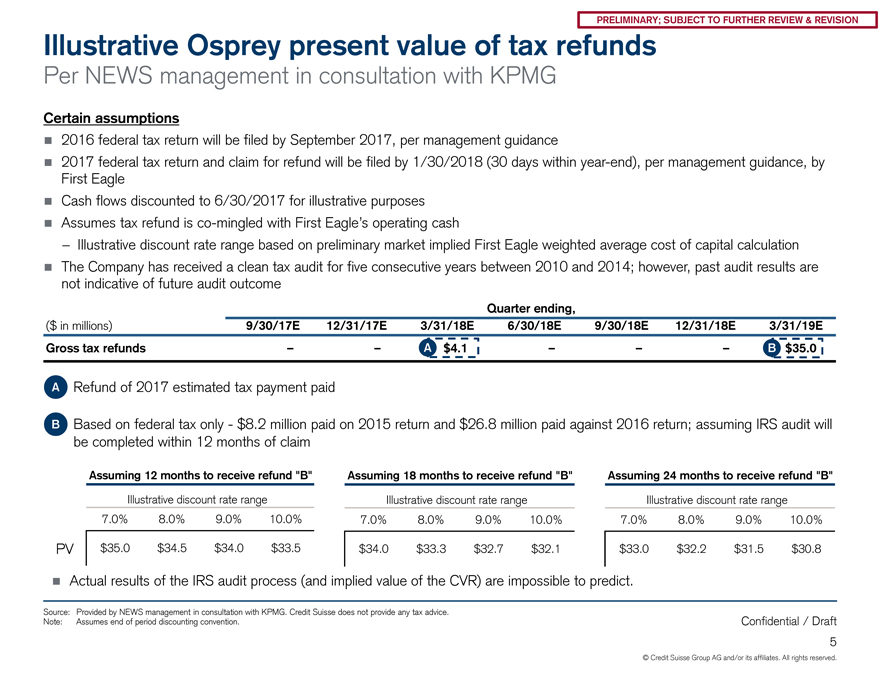

PRELIMINARY; SUBJECT TO FURTHER REVIEW & REVISION Illustrative Osprey present value of tax refunds Per NEWS management in consultation with KPMG Certain assumptions 2016 federal tax return will be filed by September 2017, per management guidance 2017 federal tax return and claim for refund will be filed by 1/30/2018 (30 days withinyear-end), per management guidance, by First Eagle Cash flows discounted to 6/30/2017 for illustrative purposes Assumes tax refund isco-mingled with First Eagle’s operating cash —Illustrative discount rate range based on preliminary market implied First Eagle weighted average cost of capital calculation The Company has received a clean tax audit for five consecutive years between 2010 and 2014; however, past audit results are not indicative of future audit outcome Quarter ending, ($ in millions) 9/30/17E 12/31/17E 3/31/18E 6/30/18E 9/30/18E 12/31/18E 3/31/19E Gross tax refunds – – A $4.1 – – – B $35.0 A Refund of 2017 estimated tax payment paid B Based on federal tax only—$8.2 million paid on 2015 return and $26.8 million paid against 2016 return; assuming IRS audit will be completed within 12 months of claim Assuming 12 months to receive refund “B” Assuming 18 months to receive refund “B” Assuming 24 months to receive refund “B” Illustrative discount rate range Illustrative discount rate range Illustrative discount rate range 7.0% 8.0% 9.0% 10.0% 7.0% 8.0% 9.0% 10.0% 7.0% 8.0% 9.0% 10.0% PV $35.0 $34.5 $34.0 $33.5 $34.0 $33.3 $32.7 $32.1 $33.0 $32.2 $31.5 $30.8 Actual results of the IRS audit process (and implied value of the CVR) are impossible to predict. Source: Provided by NEWS management in consultation with KPMG. Credit Suisse does not provide any tax advice. Note: Assumes end of period discounting convention. Confidential / Draft 5 © Credit Suisse Group AG and/or its affiliates. All rights reserved.

|

|

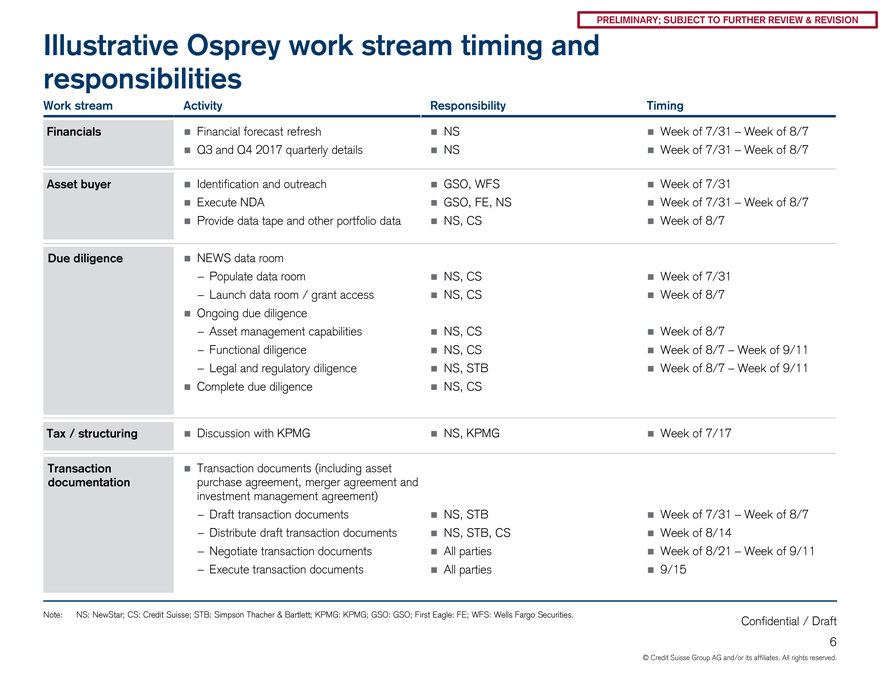

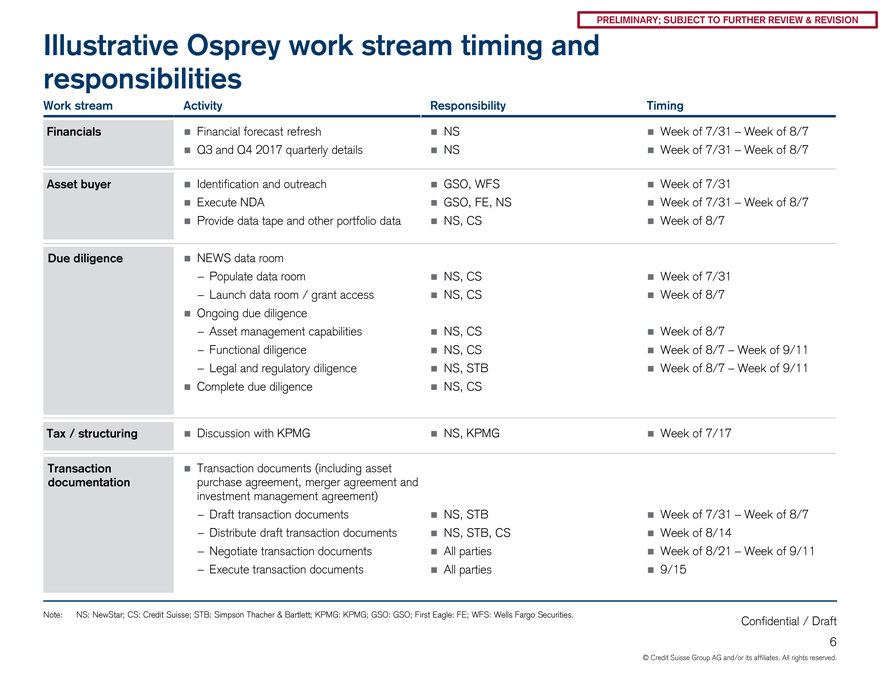

PRELIMINARY; SUBJECT TO FURTHER REVIEW & REVISION Illustrative Osprey work stream timing and responsibilities Work stream Activity Responsibility Timing Financials Financial forecast refresh NS Week of 7/31 – Week of 8/7 Q3 and Q4 2017 quarterly details NS Week of 7/31 – Week of 8/7 Asset buyer Identification and outreach GSO, WFS Week of 7/31 Execute NDA GSO, FE, NS Week of 7/31 – Week of 8/7 Provide data tape and other portfolio data NS, CS Week of 8/7 Due diligence NEWS data room—Populate data room NS, CS Week of 7/31—Launch data room / grant access NS, CS Week of 8/7 Ongoing due diligence—Asset management capabilities NS, CS Week of 8/7—Functional diligence NS, CS Week of 8/7 – Week of 9/11—Legal and regulatory diligence NS, STB Week of 8/7 – Week of 9/11 Complete due diligence NS, CS Tax / structuring Discussion with KPMG NS, KPMG Week of 7/17 Transaction Transaction documents (including asset documentation purchase agreement, merger agreement and investment management agreement)—Draft transaction documents NS, STB Week of 7/31 – Week of 8/7—Distribute draft transaction documents NS, STB, CS Week of 8/14—Negotiate transaction documents All parties Week of 8/21 – Week of 9/11—Execute transaction documents All parties 9/15 Note: NS: NewStar; CS: Credit Suisse; STB: Simpson Thacher & Bartlett; KPMG: KPMG; GSO: GSO; First Eagle: FE; WFS: Wells Fargo Securities. Confidential / Draft 6 © Credit Suisse Group AG and/or its affiliates. All rights reserved.

|

|

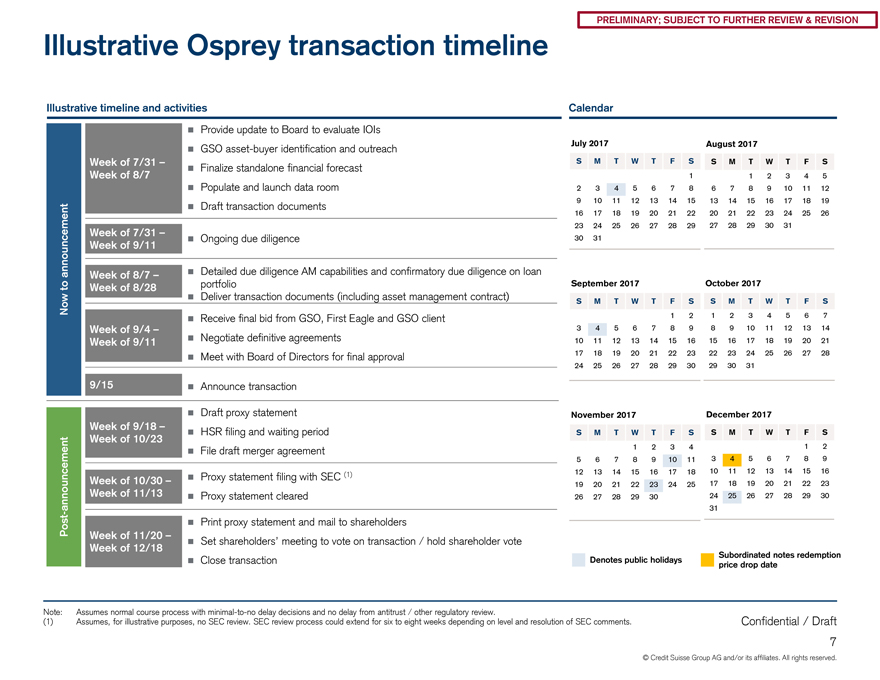

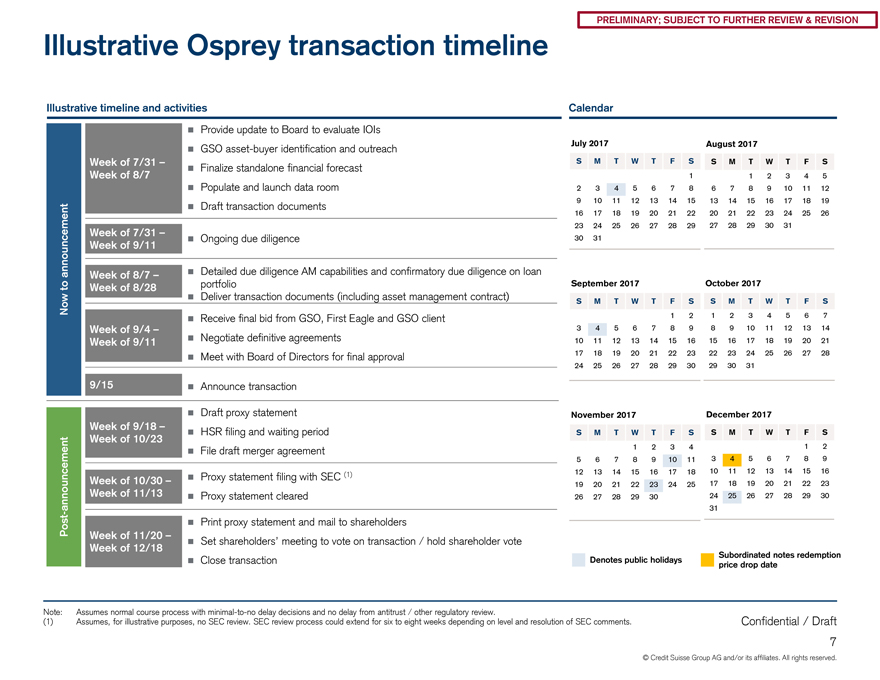

PRELIMINARY; SUBJECT TO FURTHER REVIEW & REVISION Illustrative Osprey transaction timeline Illustrative timeline and activities Calendar Provide update to Board to evaluate IOIs asset-buyer identification and outreach July 2017 August 2017 GSO Week of 7/31 – SM T W T F S SM T W T F S Finalize standalone financial forecast 1 Week of 8/7 12345 Populate and launch data room 234 567 8 6789 10 11 12 Draft transaction documents 9 101112 131415 13 14 15 16 17 18 19 16 17 18 19 20 21 22 20 21 22 23 24 25 26 23 24 25 26 27 28 29 27 28 29 30 31 Week of 7/31 – Ongoing due diligence 30 31 Week of 9/11 announcement Week of 8/7 – Detailed due diligence AM capabilities and confirmatory due diligence on loan to Week of 8/28 portfolio September 2017 October 2017 Deliver transaction documents (including asset management contract) Now SM T W T F S SM T W T F S Receive final bid from GSO, First Eagle and GSO client 12 123 456 7 Week of 9/4 – Negotiate definitive agreements 345 678 9 8 9 10 11 12 13 14 Week of 9/11 10 11 12 13 14 15 16 15 16 17 18 19 20 21 17 18 19 20 21 22 23 22 23 24 25 26 27 28 Meet with Board of Directors for final approval 24 25 26 27 28 29 30 29 30 31 9/15 Announce transaction Draft proxy statement November 2017 December 2017 Week of 9/18 – HSR filing and waiting period SM T W T F S SM T W T F S Week of 10/23 123 4 12 File draft merger agreement 3456789 567 89 10 11 12 13 14 15 16 17 18 10 11 12 13 14 15 16 Proxy statement filing with SEC (1) Week of 10/30 – 19 20 21 22 23 24 25 17 18 19 20 21 22 23 Week of 11/13 Proxy statement cleared 26 27 28 29 30 24 25 26 27 28 29 30 announcement—31 Post Print proxy statement and mail to shareholders Week of 11/20 – Set shareholders’ meeting to vote on transaction / hold shareholder vote Week of 12/18 Subordinated notes redemption Close transaction Denotes public holidays price drop date Note: Assumes normal course process withminimal-to-no delay decisions and no delay from antitrust / other regulatory review. (1) Assumes, for illustrative purposes, no SEC review. SEC review process could extend for six to eight weeks depending on level and resolution of SEC comments. Confidential / Draft 7 © Credit Suisse Group AG and/or its affiliates. All rights reserved.

|

|

PRELIMINARY; SUBJECT TO FURTHER REVIEW & REVISION Potential strategic alternatives As previously discussed, potential strategic alternatives for the Company to enhance value include:—Status quo—Sale of the Company—Sale of assets with or without contract Confidential / Draft 8 © Credit Suisse Group AG and/or its affiliates. All rights reserved.

|

|

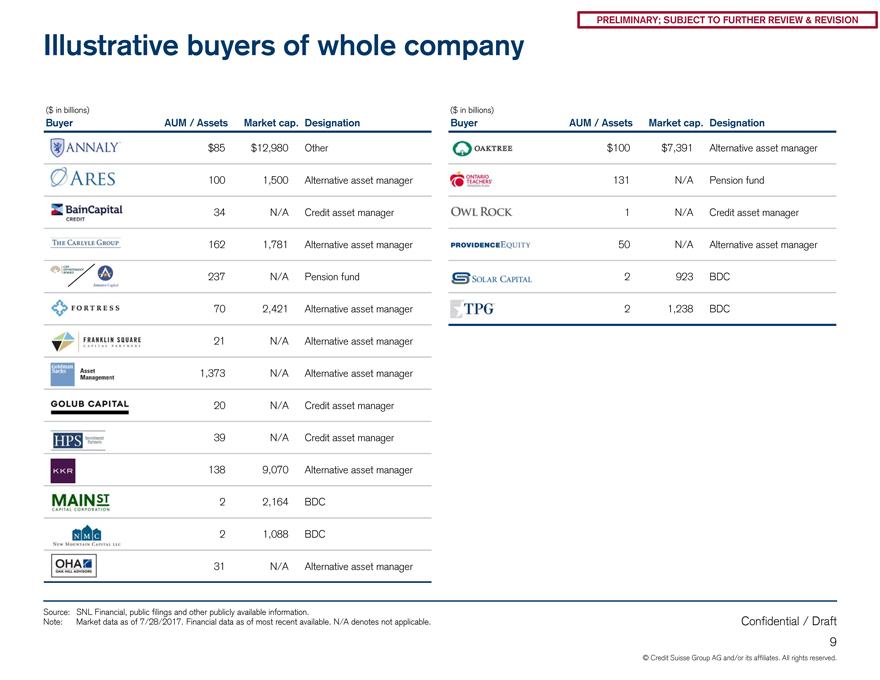

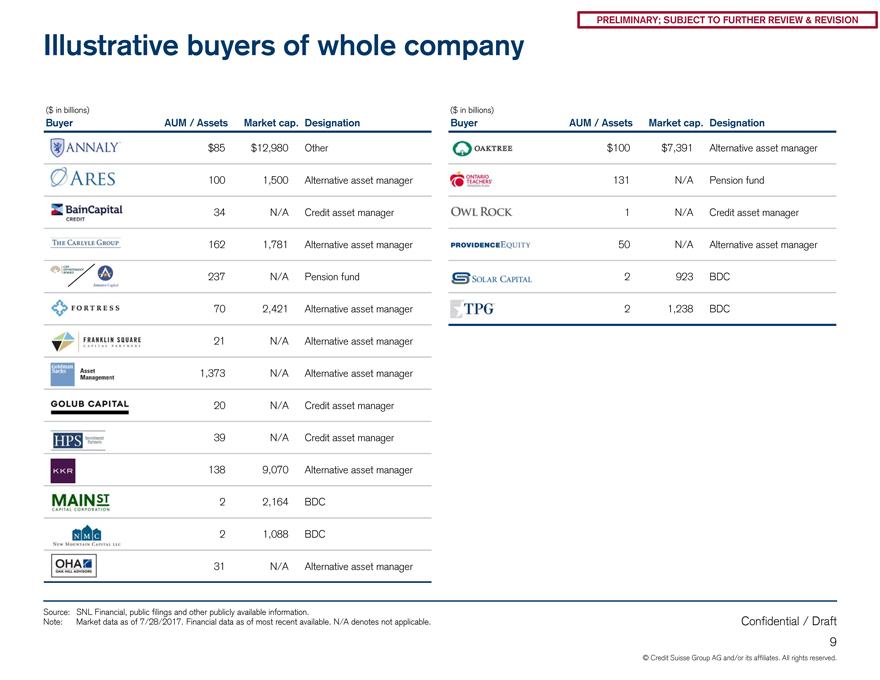

PRELIMINARY; SUBJECT TO FURTHER REVIEW & REVISION Illustrative buyers of whole company ($ in billions)($ in billions) BuyerAUM / AssetsMarket cap.DesignationBuyerAUM / AssetsMarket cap.Designation $85$12,980Other$100$7,391Alternative asset manager 1001,500Alternative asset manager131N/APension fund 34N/ACredit asset manager1N/ACredit asset manager 1621,781Alternative asset manager50N/AAlternative asset manager 237N/APension fund2923BDC 702,421Alternative asset manager21,238BDC 21N/AAlternative asset manager 1,373N/AAlternative asset manager 20N/ACredit asset manager 39N/ACredit asset manager 1389,070Alternative asset manager 22,164BDC 21,088BDC 31N/AAlternative asset manager Source:SNL Financial, public filings and other publicly available information. Note:Market data as of 7/28/2017. Financial data as of most recent available. N/A denotes not applicable.Confidential / Draft 9 © Credit Suisse Group AG and/or its affiliates. All rights reserved.

|

|

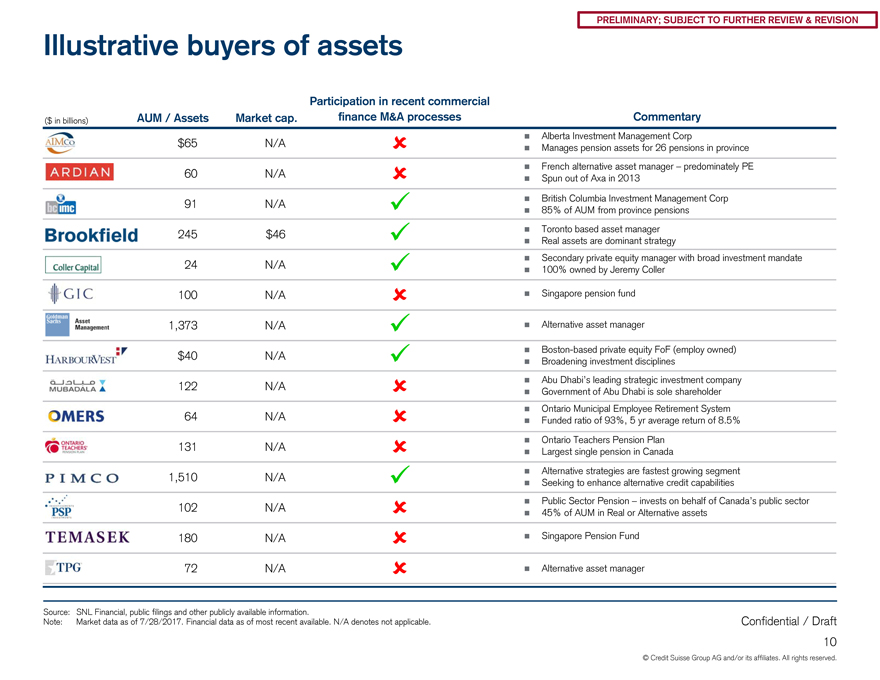

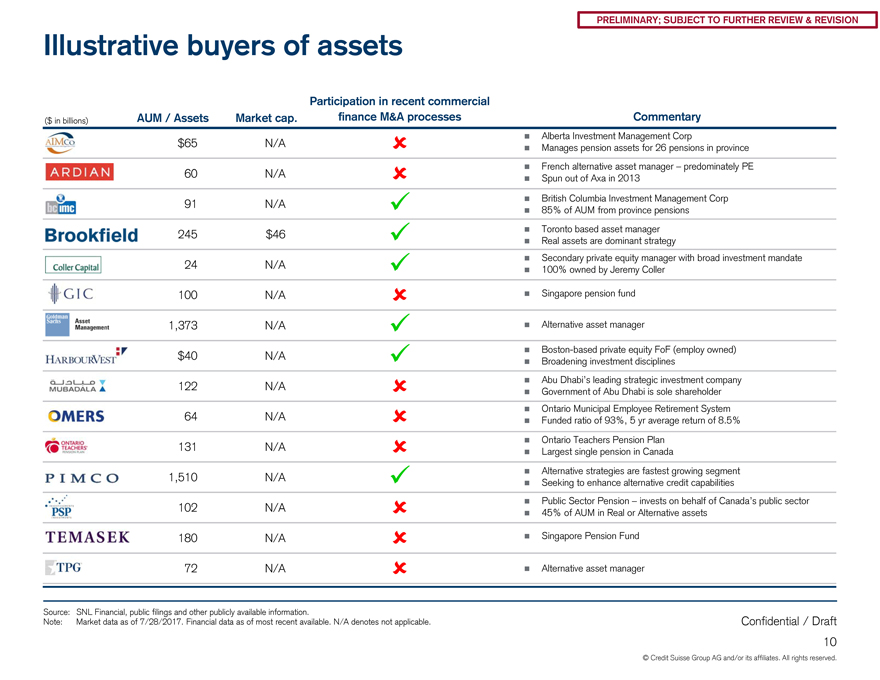

PRELIMINARY; SUBJECT TO FURTHER REVIEW & REVISION Illustrative buyers of assets Participation in recent commercial ($ in billions)AUM / AssetsMarket cap.finance M&A processesCommentary Alberta Investment Management Corp $65N/A Manages pension assets for 26 pensions in province French alternative asset manager – predominately PE 60N/A Spun out of Axa in 2013 British Columbia Investment Management Corp 91N/A 85% of AUM from province pensions Toronto based asset manager 245$46 Real assets are dominant strategy Secondary private equity manager with broad investment mandate 24N/A 100% owned by Jeremy Coller 100N/A Singapore pension fund 1,373N/A Alternative asset manager Boston-based private equity FoF (employ owned) $40N/A Broadening investment disciplines Abu Dhabi’s leading strategic investment company 122N/A Government of Abu Dhabi is sole shareholder Ontario Municipal Employee Retirement System 64N/A Funded ratio of 93%, 5 yr average return of 8.5% Ontario Teachers Pension Plan 131N/A Largest single pension in Canada Alternative strategies are fastest growing segment 1,510N/A Seeking to enhance alternative credit capabilities Public Sector Pension – invests on behalf of Canada’s public sector 102N/A 45% of AUM in Real or Alternative assets 180N/A Singapore Pension Fund 72N/A Alternative asset manager Source:SNL Financial, public filings and other publicly available information. Note:Market data as of 7/28/2017. Financial data as of most recent available. N/A denotes not applicable.Confidential / Draft 10 © Credit Suisse Group AG and/or its affiliates. All rights reserved.

|

|

PRELIMINARY; SUBJECT TO FURTHER REVIEW & REVISION Appendix Confidential / Draft 11

|

|

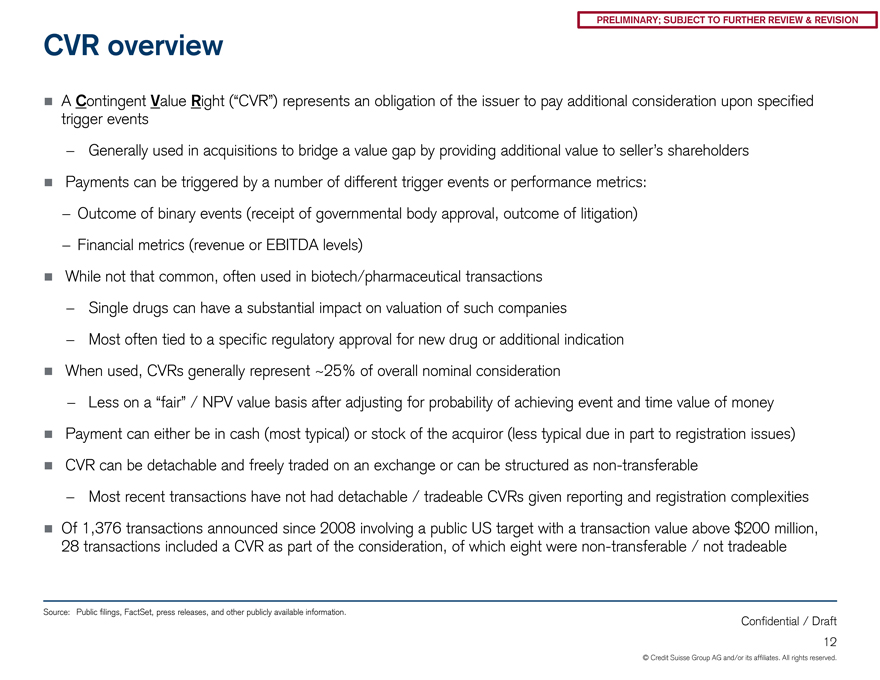

PRELIMINARY; SUBJECT TO FURTHER REVIEW & REVISION CVR overview A Contingent Value Right (“CVR”) represents an obligation of the issuer to pay additional consideration upon specified trigger events—Generally used in acquisitions to bridge a value gap by providing additional value to seller’s shareholders Payments can be triggered by a number of different trigger events or performance metrics:—Outcome of binary events (receipt of governmental body approval, outcome of litigation)—Financial metrics (revenue or EBITDA levels) While not that common, often used in biotech/pharmaceutical transactions—Single drugs can have a substantial impact on valuation of such companies—Most often tied to a specific regulatory approval for new drug or additional indication When used, CVRs generally represent ~25% of overall nominal consideration—Less on a “fair” / NPV value basis after adjusting for probability of achieving event and time value of money Payment can either be in cash (most typical) or stock of the acquiror (less typical due in part to registration issues) CVR can be detachable and freely traded on an exchange or can be structured asnon-transferable—Most recent transactions have not had detachable / tradeable CVRs given reporting and registration complexities Of 1,376 transactions announced since 2008 involving a public US target with a transaction value above $200 million, 28 transactions included a CVR as part of the consideration, of which eight werenon-transferable / not tradeable Source: Public filings, FactSet, press releases, and other publicly available information. Confidential / Draft 12 © Credit Suisse Group AG and/or its affiliates. All rights reserved.

|

|

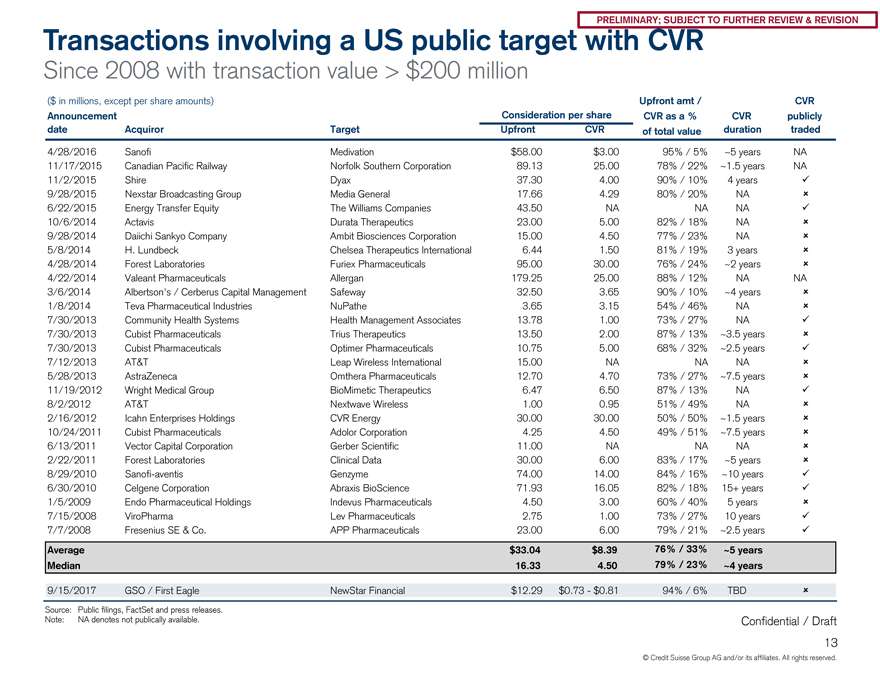

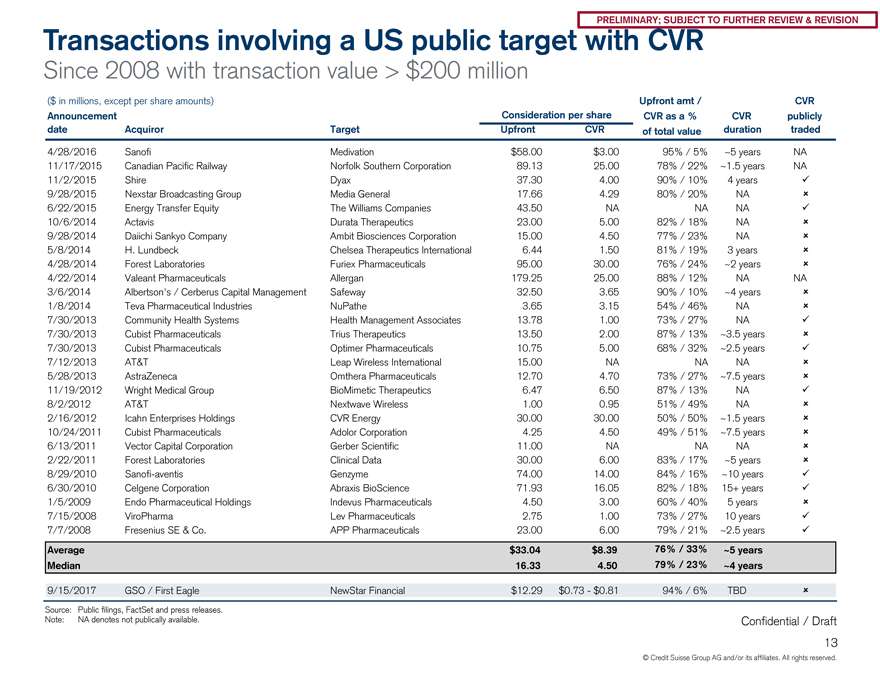

PRELIMINARY; SUBJECT TO FURTHER REVIEW & REVISION Transactions involving a US public target with CVR Since 2008 with transaction value > $200 million ($ in millions, except per share amounts)Upfront amt /CVR AnnouncementConsideration per shareCVR as a %CVRpublicly dateAcquirorTargetUpfrontCVRof total valuedurationtraded 4/28/2016SanofiMedivation$58.00$3.0095% / 5%~5 yearsNA 11/17/2015Canadian Pacific RailwayNorfolk Southern Corporation89.1325.0078% /22%~1.5 yearsNA 11/2/2015ShireDyax37.304.0090% /10%4 years 9/28/2015Nexstar Broadcasting GroupMedia General17.664.2980% /20%NA 6/22/2015Energy Transfer EquityThe Williams Companies43.50NANANA 10/6/2014ActavisDurata Therapeutics23.005.0082% /18%NA 9/28/2014Daiichi Sankyo CompanyAmbit Biosciences Corporation15.004.5077% /23%NA 5/8/2014H. LundbeckChelsea Therapeutics International6.441.5081% /19%3 years 4/28/2014Forest LaboratoriesFuriex Pharmaceuticals95.0030.0076% /24%~2 years 4/22/2014Valeant PharmaceuticalsAllergan179.2525.0088% /12%NANA 3/6/2014Albertson’s / Cerberus Capital ManagementSafeway32.503.6590% /10%~4 years 1/8/2014Teva Pharmaceutical IndustriesNuPathe3.653.1554% /46%NA 7/30/2013Community Health SystemsHealth Management Associates13.781.0073% /27%NA 7/30/2013Cubist PharmaceuticalsTrius Therapeutics13.502.0087% /13%~3.5 years 7/30/2013Cubist PharmaceuticalsOptimer Pharmaceuticals10.755.0068% /32%~2.5 years 7/12/2013 AT&TLeap Wireless International15.00NANANA 5/28/2013AstraZenecaOmthera Pharmaceuticals12.704.7073% /27%~7.5 years 11/19/2012Wright Medical GroupBioMimetic Therapeutics6.476.5087% /13%NA 8/2/2012AT&TNextwave Wireless1.000.9551% /49%NA 2/16/2012Icahn Enterprises HoldingsCVR Energy30.0030.0050% /50%~1.5 years 10/24/2011Cubist PharmaceuticalsAdolor Corporation4.254.5049% /51%~7.5 years 6/13/2011Vector Capital CorporationGerber Scientific11.00NANANA 2/22/2011Forest LaboratoriesClinical Data30.006.0083% /17%~5 years 8/29/2010Sanofi-aventisGenzyme74.0014.0084% /16%~10 years 6/30/2010Celgene CorporationAbraxis BioScience71.9316.0582% /18%15+ years 1/5/2009Endo Pharmaceutical HoldingsIndevus Pharmaceuticals4.503.0060% /40%5 years 7/15/2008ViroPharmaLev Pharmaceuticals2.751.0073% /27%10 years 7/7/2008Fresenius SE & Co.APP Pharmaceuticals23.006.0079% /21%~2.5 years Average$33.04$8.3976% / 33%~5 years Median16.334.5079% / 23%~4 years 9/15/2017GSO / First EagleNewStar Financial$12.29$0.73—$0.8194% / 6%TBD Source:Public filings, FactSet and press releases. Note:NA denotes not publically available.Confidential / Draft 13 © Credit Suisse Group AG and/or its affiliates. All rights reserved.

|

|

Credit Suisse does not provide any tax advice. Any tax statement herein regarding any U.S. federal tax is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding any penalties. Any such statement herein was written to support the marketing or promotion of the transaction(s) or matter(s) to which the statement relates. Each taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor. These materials have been provided to you by Credit Suisse in connection with an actual or potential mandate or engagement and may not be used or relied upon for any purpose other than as specifically contemplated by a written agreement with Credit Suisse. In addition, these materials may not be disclosed, in whole or in part, or summarized or otherwise referred to except as agreed in writing by Credit Suisse. The information used in preparing these materials was obtained from or through you or your representatives or from public sources. Credit Suisse assumes no responsibility for independent verification of such information and has relied on such information being complete and accurate in all material respects. To the extent such information includes estimates and forecasts of future financial performance (including estimates of potential cost savings and synergies) prepared by or reviewed or discussed with the managements of your company and/or other potential transaction participants or obtained from public sources, we have assumed that such estimates and forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of such managements (or, with respect to estimates and forecasts obtained from public sources, represent reasonable estimates). These materials were designed for use by specific persons familiar with the business and the affairs of your company and Credit Suisse assumes no obligation to update or otherwise revise these materials. Nothing contained herein should be construed as tax, accounting or legal advice. You (and each of your employees, representatives or other agents) may disclose to any and all persons, without limitation of any kind, the tax treatment and tax structure of the transactions contemplated by these materials and all materials of any kind (including opinions or other tax analyses) that are provided to you relating to such tax treatment and structure. For this purpose, the tax treatment of a transaction is the purported or claimed U.S. federal income tax treatment of the transaction and the tax structure of a transaction is any fact that may be relevant to understanding the purported or claimed U.S. federal income tax treatment of the transaction. These materials have been prepared by Credit Suisse (“CS”) and its affiliates for use by CS. Accordingly, any information reflected or incorporated herein, or in related materials or in ensuing transactions, may be shared in good faith by CS and its affiliates with employees of CS, its affiliates and agents in any location. Credit Suisse has adopted policies and guidelines designed to preserve the independence of its research analysts. Credit Suisse’s policies prohibit employees from directly or indirectly offering a favorable research rating or specific price target, or offering to change a research rating or price target, as consideration for or an inducement to obtain business or other compensation. Credit Suisse’s policies prohibit research analysts from being compensated for their involvement in investment banking transactions. CREDIT SUISSE SECURITIES (USA) LLC Eleven Madison Avenue New York, NY 10010-3629 +1 212 325 2000 www.credit-suisse.com Confidential / Draft 14 Copyright © 2017 Credit Suisse Group AG and/or its affiliates. All rights reserved.