Exhibit (c)(4)

These materials may not be used or relied upon for any purpose other than as specifically contemplated by a written agreement with Credit Suisse Group AG and/or its Affiliates (hereafter “Credit Suisse”). PRELIMINARY | SUBJECT TO FURTHER REVIEW AND EVALUATION Confidential Project Osprey Board of Directors discussion materials August 29, 2017 PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

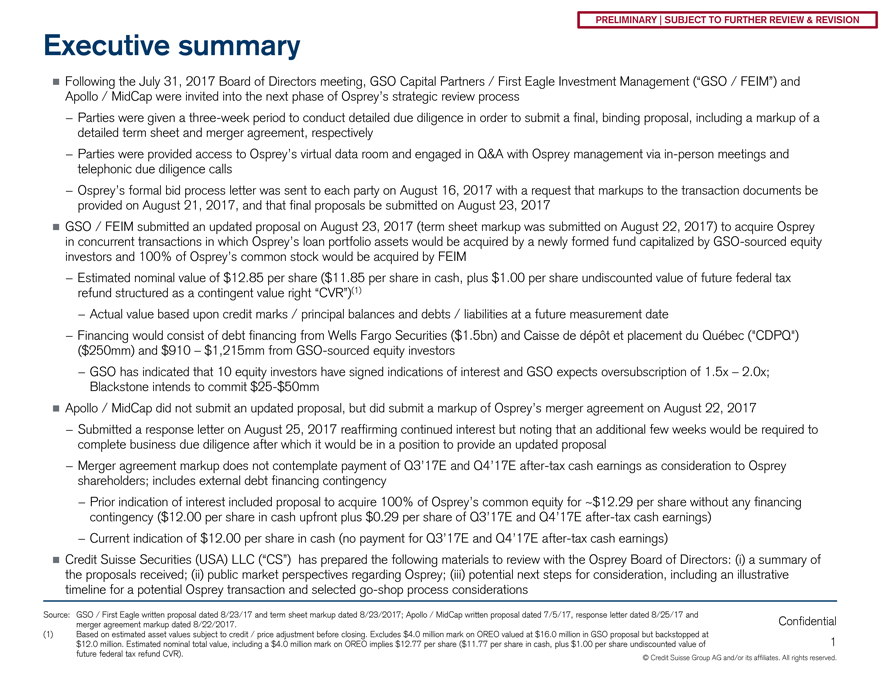

© Credit Suisse Group AG and/or its affiliates. All rights reserved. Confidential 1 ï® Following the July 31, 2017 Board of Directors meeting, GSO Capital Partners / First Eagle Investment Management (“GSO / FEIM”) and Apollo / MidCap were invited into the next phase of Osprey’s strategic review process—Parties were given a three-week period to conduct detailed due diligence in order to submit a final, binding proposal, including a markup of a detailed term sheet and merger agreement, respectively—Parties were provided access to Osprey’s virtual data room and engaged in Q&A with Osprey management viain-person meetings and telephonic due diligence calls—Osprey’s formal bid process letter was sent to each party on August 16, 2017 with a request that markups to the transaction documents be provided on August 21, 2017, and that final proposals be submitted on August 23, 2017 ï® GSO / FEIM submitted an updated proposal on August 23, 2017 (term sheet markup was submitted on August 22, 2017) to acquire Osprey in concurrent transactions in which Osprey’s loan portfolio assets would be acquired by a newly formed fund capitalized byGSO-sourced equity investors and 100% of Osprey’s common stock would be acquired by FEIM—Estimated nominal value of $12.85 per share ($11.85 per share in cash, plus $1.00 per share undiscounted value of future federal tax refund structured as a contingent value right “CVR”)(1)—Actual value based upon credit marks / principal balances and debts / liabilities at a future measurement date—Financing would consist of debt financing from Wells Fargo Securities ($1.5bn) and Caisse de dépôt et placement du Québec (“CDPQ”) ($250mm) and $910 – $1,215mm fromGSO-sourced equity investors—GSO has indicated that 10 equity investors have signed indications of interest and GSO expects oversubscription of 1.5x – 2.0x; Blackstone intends to commit$25-$50mm ï® Apollo / MidCap did not submit an updated proposal, but did submit a markup of Osprey’s merger agreement on August 22, 2017—Submitted a response letter on August 25, 2017 reaffirming continued interest but noting that an additional few weeks would be required to complete business due diligence after which it would be in a position to provide an updated proposal—Merger agreement markup does not contemplate payment of Q3’17E and Q4’17Eafter-tax cash earnings as consideration to Osprey shareholders; includes external debt financing contingency—Prior indication of interest included proposal to acquire 100% of Osprey’s common equity for ~$12.29 per share without any financing contingency ($12.00 per share in cash upfront plus $0.29 per share of Q3’17E and Q4’17Eafter-tax cash earnings)—Current indication of $12.00 per share in cash (no payment for Q3’17E and Q4’17Eafter-tax cash earnings) ï® Credit Suisse Securities (USA) LLC (“CS”) has prepared the following materials to review with the Osprey Board of Directors: (i) a summary of the proposals received; (ii) public market perspectives regarding Osprey; (iii) potential next steps for consideration, including an illustrative timeline for a potential Osprey transaction and selectedgo-shop process considerations Executive summary Source: GSO / First Eagle written proposal dated 8/23/17 and term sheet markup dated 8/23/2017; Apollo / MidCap written proposal dated 7/5/17, response letter dated 8/25/17 and merger agreement markup dated 8/22/2017. (1) Based on estimated asset values subject to credit / price adjustment before closing. Excludes $4.0 million mark on OREO valued at $16.0 million in GSO proposal but backstopped at $12.0 million. Estimated nominal total value, including a $4.0 million mark on OREO implies $12.77 per share ($11.77 per share in cash, plus $1.00 per share undiscounted value of future federal tax refund CVR). PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

© Credit Suisse Group AG and/or its affiliates. All rights reserved. Confidential N:\IBD_Regional_Documents_Repository_AM_Clients\NewStar Financial Inc(NGLD)\Spider\XPAT6\04. Presentations\12. Board Materials—Final Bid Summary (August 2017)\Osprey Board Materials_Aug 29 2017_vF.pptx 2 1. Overview of proposals 2. Public market perspectives 3. Potential next steps Appendix Table of contents PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

Confidential 3 1. Overview of proposals PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

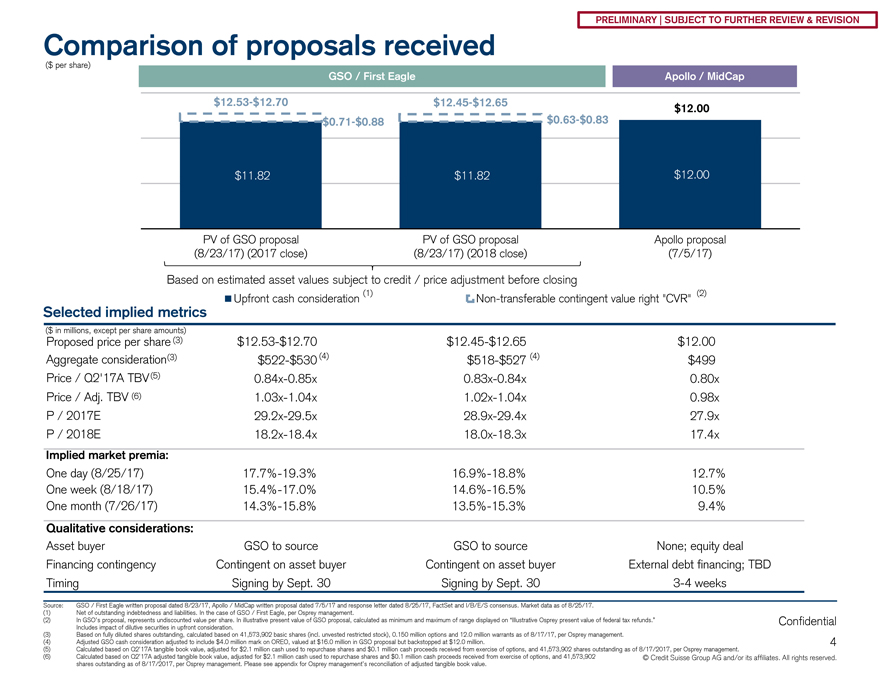

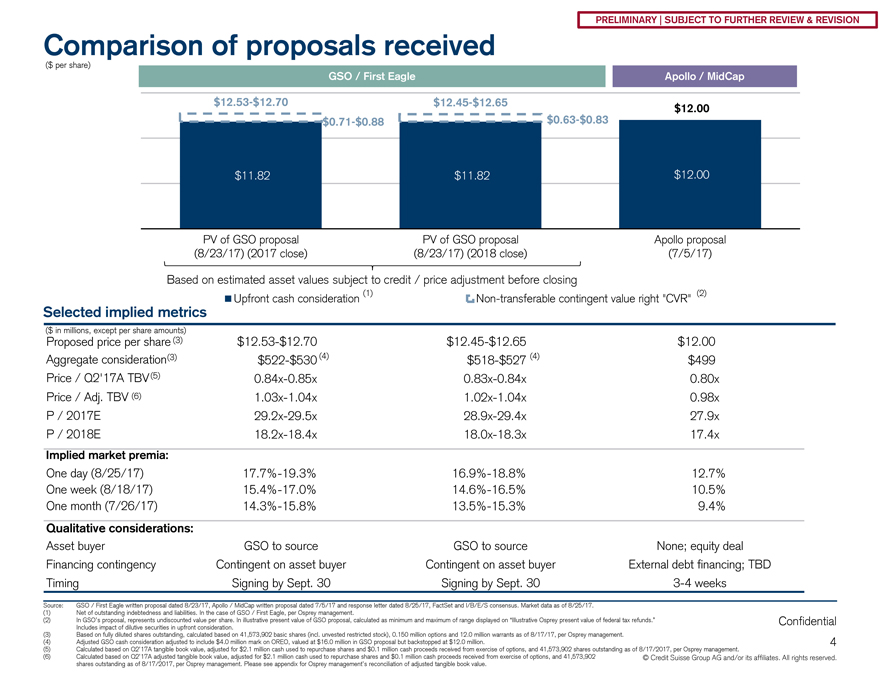

© Credit Suisse Group AG and/or its affiliates. All rights reserved. Confidential Selected implied metrics $11.82 $11.82 $12.00$0.71-$0.88$0.63-$0.83$12.53-$12.70$12.45-$12.65 $12.00 PV of GSO proposal (8/23/17) (2017 close) PV of GSO proposal (8/23/17) (2018 close) Apollo proposal (7/5/17) Upfront cash considerationNon-transferable contingent value right “CVR” 4 Comparison of proposals received Proposed price per share$12.53-$12.70$12.45-$12.65 $12.00 Aggregate consideration$522-$530$518-$527 $499 Price / Q2’17A TBV0.84x-0.85x0.83x-0.84x 0.80x Price / Adj. TBV1.03x-1.04x1.02x-1.04x 0.98x P / 2017E29.2x-29.5x28.9x-29.4x 27.9x P / 2018E18.2x-18.4x18.0x-18.3x 17.4x Implied market premia: One day (8/25/17)17.7%-19.3%16.9%-18.8% 12.7% One week (8/18/17)15.4%-17.0%14.6%-16.5% 10.5% One month (7/26/17)14.3%-15.8%13.5%-15.3% 9.4% Qualitative considerations: Asset buyer GSO to source GSO to source None; equity deal Financing contingency Contingent on asset buyer Contingent on asset buyer External debt financing; TBD Timing Signing by Sept. 30 Signing by Sept. 303-4 weeks Source: GSO / First Eagle written proposal dated 8/23/17, Apollo / MidCap written proposal dated 7/5/17 and response letter dated 8/25/17, FactSet and I/B/E/S consensus. Market data as of 8/25/17. (1) Net of outstanding indebtedness and liabilities. In the case of GSO / First Eagle, per Osprey management. (2) In GSO’s proposal, represents undiscounted value per share. In illustrative present value of GSO proposal, calculated as minimum and maximum of range displayed on “Illustrative Osprey present value of federal tax refunds.” Includes impact of dilutive securities in upfront consideration. (3) Based on fully diluted shares outstanding, calculated based on 41,573,902 basic shares (incl. unvested restricted stock), 0.150 million options and 12.0 million warrants as of 8/17/17, per Osprey management. (4) Adjusted GSO cash consideration adjusted to include $4.0 million mark on OREO, valued at $16.0 million in GSO proposal but backstopped at $12.0 million. (5) Calculated based on Q2’17A tangible book value, adjusted for $2.1 million cash used to repurchase shares and $0.1 million cash proceeds received from exercise of options, and 41,573,902 shares outstanding as of 8/17/2017, per Osprey management. (6) Calculated based on Q2’17A adjusted tangible book value, adjusted for $2.1 million cash used to repurchase shares and $0.1 million cash proceeds received from exercise of options, and 41,573,902 shares outstanding as of 8/17/2017, per Osprey management. Please see appendix for Osprey management’s reconciliation of adjusted tangible book value. GSO / First Eagle Apollo / MidCap (3) (3) (6) (1) ($ in millions, except per share amounts) (2) (4) PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION Based on estimated asset values subject to credit / price adjustment before closing ($ per share) (4) (5)

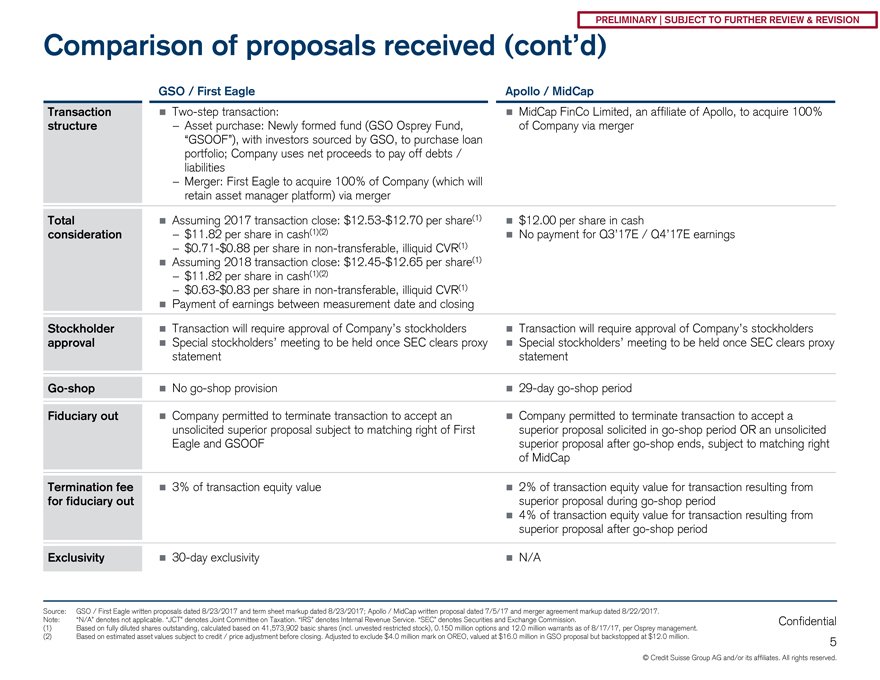

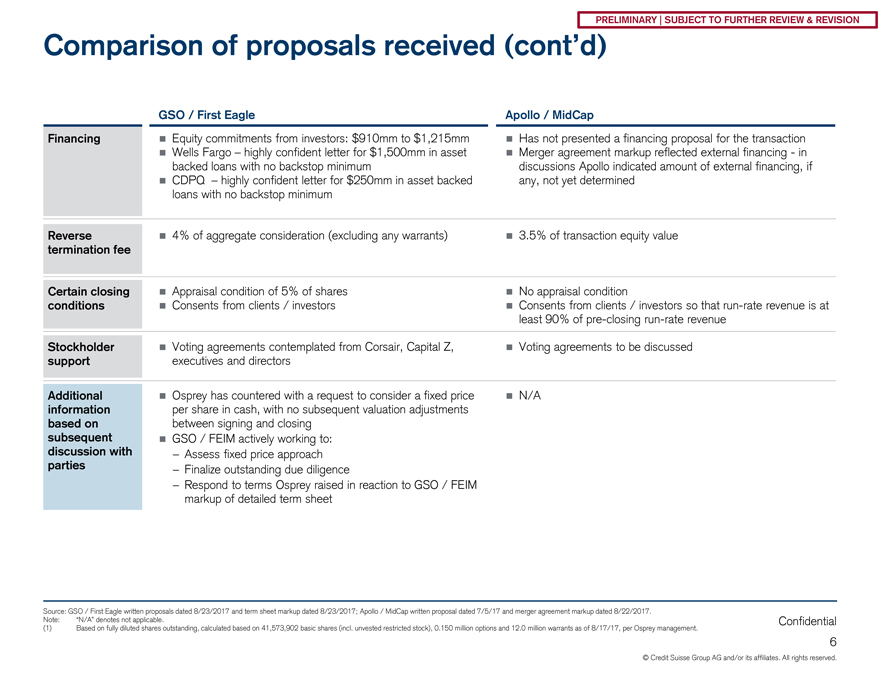

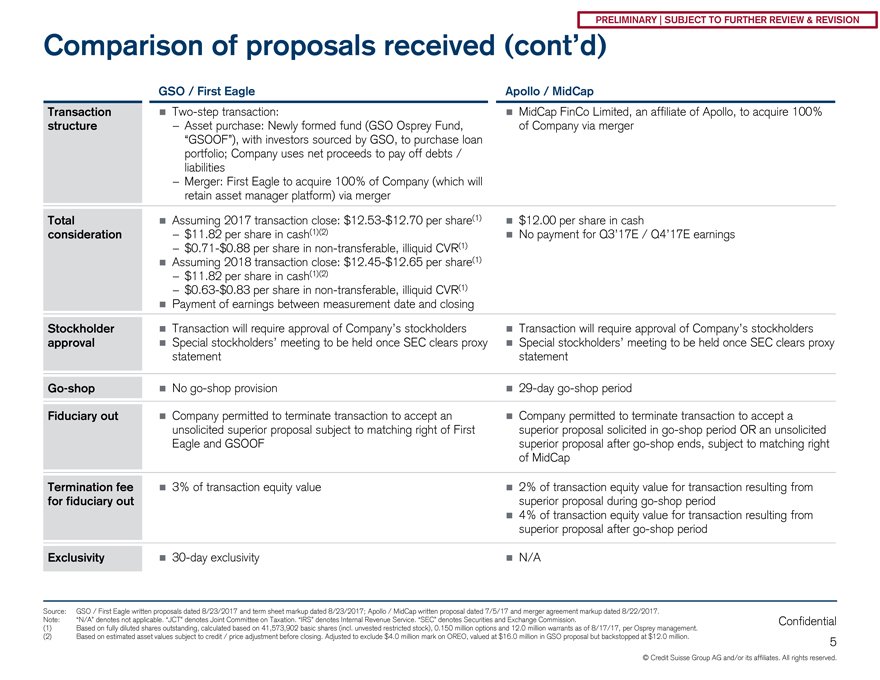

© Credit Suisse Group AG and/or its affiliates. All rights reserved. Confidential Transaction structure 5 Comparison of proposals received (cont’d) Total consideration ï® Assuming 2017 transaction close:$12.53-$12.70 per share(1)—$11.82 per share incash(1)(2)—$0.71-$0.88 per share innon-transferable, illiquid CVR(1) ï® Assuming 2018 transaction close:$12.45-$12.65 per share(1)—$11.82 per share incash(1)(2)—$0.63-$0.83 per share innon-transferable, illiquid CVR(1) ï® Payment of earnings between measurement date and closing ï® $12.00 per share in cash ï® No payment for Q3’17E / Q4’17E earningsGo-shop ï® Nogo-shop provision ï®29-daygo-shop period Termination fee for fiduciary out ï® 3% of transaction equity value ï® 2% of transaction equity value for transaction resulting from superior proposal duringgo-shop period ï® 4% of transaction equity value for transaction resulting from superior proposal aftergo-shop period GSO / First Eagle Apollo / MidCap Stockholder approval ï® Transaction will require approval of Company’s stockholders ï® Special stockholders’ meeting to be held once SEC clears proxy statement ï® Transaction will require approval of Company’s stockholders ï® Special stockholders’ meeting to be held once SEC clears proxy statement Source: GSO / First Eagle written proposals dated 8/23/2017 and term sheet markup dated 8/23/2017; Apollo / MidCap written proposal dated 7/5/17 and merger agreement markup dated 8/22/2017. Note: “N/A” denotes not applicable. “JCT” denotes Joint Committee on Taxation. “IRS” denotes Internal Revenue Service. “SEC” denotes Securities and Exchange Commission. (1) Based on fully diluted shares outstanding, calculated based on 41,573,902 basic shares (incl. unvested restricted stock), 0.150 million options and 12.0 million warrants as of 8/17/17, per Osprey management. (2) Based on estimated asset values subject to credit / price adjustment before closing. Adjusted to exclude $4.0 million mark on OREO, valued at $16.0 million in GSO proposal but backstopped at $12.0 million. PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION ï®Two-step transaction:—Asset purchase: Newly formed fund (GSO Osprey Fund, “GSOOF”), with investors sourced by GSO, to purchase loan portfolio; Company uses net proceeds to pay off debts / liabilities—Merger: First Eagle to acquire 100% of Company (which will retain asset manager platform) via merger ï® MidCap FinCo Limited, an affiliate of Apollo, to acquire 100% of Company via merger Fiduciary out ï® Company permitted to terminate transaction to accept an unsolicited superior proposal subject to matching right of First Eagle and GSOOF ï® Company permitted to terminate transaction to accept a superior proposal solicited ingo-shop period OR an unsolicited superior proposal aftergo-shop ends, subject to matching right of MidCap Exclusivity ï®30-day exclusivity ï® N/A

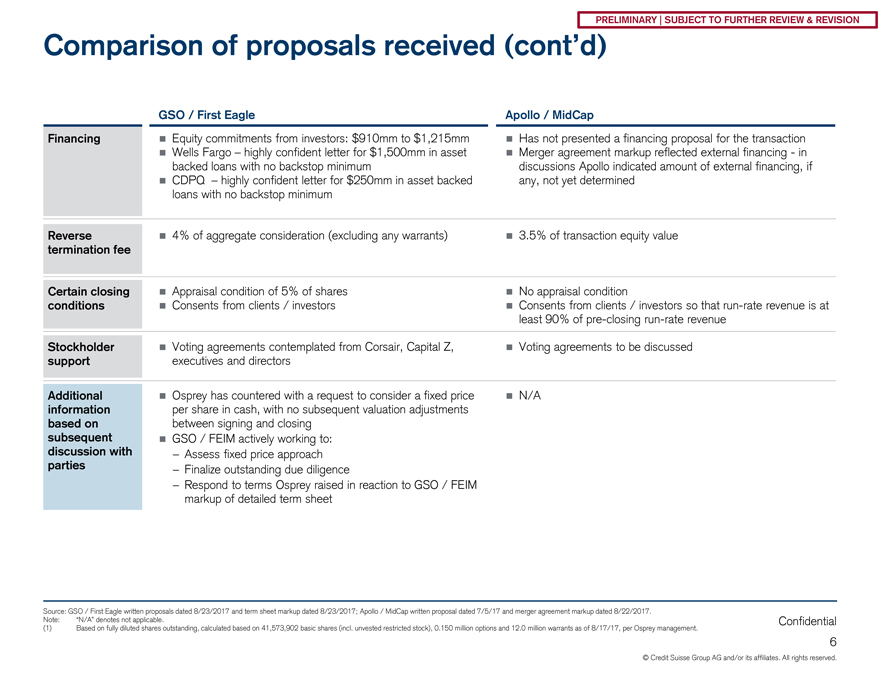

© Credit Suisse Group AG and/or its affiliates. All rights reserved. Confidential 6 Comparison of proposals received (cont’d) Source: GSO / First Eagle written proposals dated 8/23/2017 and term sheet markup dated 8/23/2017; Apollo / MidCap written proposal dated 7/5/17 and merger agreement markup dated 8/22/2017. Note: “N/A” denotes not applicable. (1) Based on fully diluted shares outstanding, calculated based on 41,573,902 basic shares (incl. unvested restricted stock), 0.150 million options and 12.0 million warrants as of 8/17/17, per Osprey management. PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION GSO / First Eagle Apollo / MidCap Financing ï® Equity commitments from investors: $910mm to $1,215mm ï® Wells Fargo – highly confident letter for $1,500mm in asset backed loans with no backstop minimum ï® CDPQ – highly confident letter for $250mm in asset backed loans with no backstop minimum ï® Has not presented a financing proposal for the transaction ï® Merger agreement markup reflected external financing—in discussions Apollo indicated amount of external financing, if any, not yet determined Reverse termination fee ï® 4% of aggregate consideration (excluding any warrants) ï® 3.5% of transaction equity value Certain closing conditions ï® Appraisal condition of 5% of shares ï® Consents from clients / investors ï® No appraisal condition ï® Consents from clients / investors so thatrun-rate revenue is at least 90% ofpre-closingrun-rate revenue Stockholder support ï® Voting agreements contemplated from Corsair, Capital Z, executives and directors ï® Voting agreements to be discussed Additional information based on subsequent discussion with parties ï® Osprey has countered with a request to consider a fixed price per share in cash, with no subsequent valuation adjustments between signing and closing ï® GSO / FEIM actively working to:—Assess fixed price approach—Finalize outstanding due diligence—Respond to terms Osprey raised in reaction to GSO / FEIM markup of detailed term sheet ï® N/A

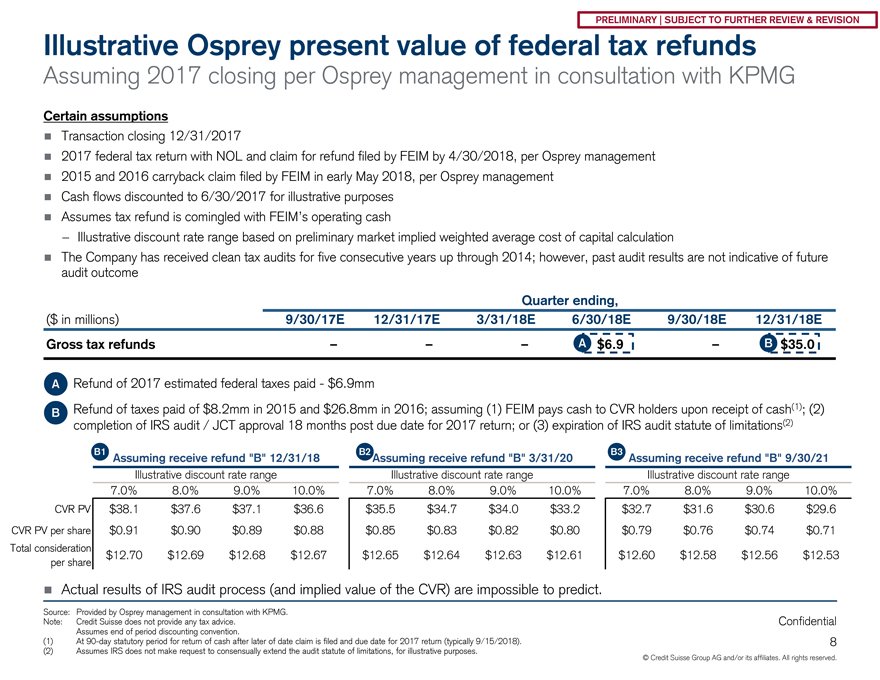

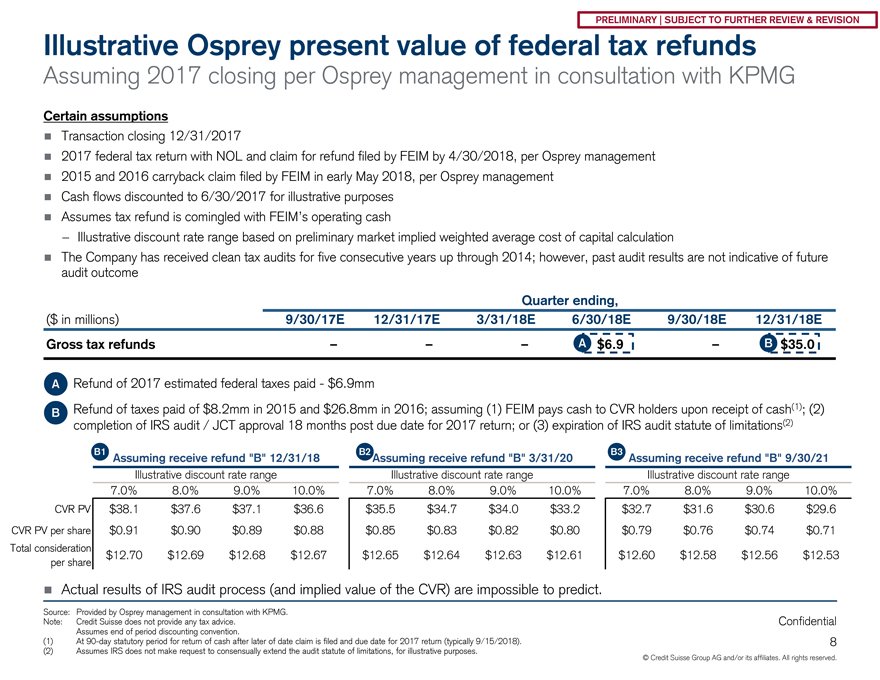

© Credit Suisse Group AG and/or its affiliates. All rights reserved. Confidential 7 ï® As a result of GSO/FEIM transaction structure:—Osprey would recognize a loss of ~$200 million upon closing of transaction—Net operating loss (“NOL”) can be applied to offset 2017 estimated taxable income of ~$26 million—NOL can be carried-back to 2015 and 2016 tax years; taxable income of ~$97 million(1)—Remainder available for carryforward—Federal tax refunds available to Osprey stockholders of record at closing:—Refund of 2017 estimated tax payments paid: $6.9 million(2)—Refund for NOL carryback claims: ~$35.0 million(3) ï® Certain tax considerations:—FEIM assumes responsibility to file federal tax return and distribute associated tax refunds—Timing of tax years included in carryback claim based on transaction closing (prior to 12/31/2017) and filing of 2017 federal income tax return with NOL—Statutory period for return of cash associated with the current year (i.e., 2017), federal income tax refund is 45 days after filing—Statutory period for return of cash associated with the claim for NOL carryback to 2015 and 2016 tax years is 90 days after later of (i) date claim filed for refund and (ii) the Company’s due date for 2017 return (typically September 15, 2018)—Subject to IRS review and potential audit (three-year statute of limitations for audit) and approval of Joint Committee on Taxation (U.S. congressional committee) based on IRS findings / report—Limited visibility on timing of commencement IRS examination / audit, if any, and impossible to predict outcome of such examination / audit—The Company has received clean tax audits for five consecutive years up through 2014; however, past audit results are not indicative of future audit outcome Preliminary Osprey federal tax considerations Per Osprey management in consultation with KPMG Source: Provided by Osprey management in consultation with KPMG. Note: Credit Suisse does not provide any tax advice. (1) Based on Osprey management forecast as of June 2017, Osprey 2015 federal tax return and preliminary 2016 tax return. 2016 tax return to be filed in September 2017. (2) 2017 estimated tax payment to be paid by 9/30/2017. (3) Based on federal tax only: $8.2 million paid against 2015 return and $26.8 million paid against 2016 return. PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

© Credit Suisse Group AG and/or its affiliates. All rights reserved. Confidential Quarter ending, ($ in millions) 9/30/17E 12/31/17E 3/31/18E 6/30/18E 9/30/18E 12/31/18E Gross tax refunds – – – $6.9 – $35.0 8 Illustrative Osprey present value of federal tax refunds Assuming 2017 closing per Osprey management in consultation with KPMG Source: Provided by Osprey management in consultation with KPMG. Note: Credit Suisse does not provide any tax advice. Assumes end of period discounting convention. (1) At90-day statutory period for return of cash after later of date claim is filed and due date for 2017 return (typically 9/15/2018). (2) Assumes IRS does not make request to consensually extend the audit statute of limitations, for illustrative purposes. Certain assumptions ï® Transaction closing 12/31/2017 ï® 2017 federal tax return with NOL and claim for refund filed by FEIM by 4/30/2018, per Osprey management ï® 2015 and 2016 carryback claim filed by FEIM in early May 2018, per Osprey management ï® Cash flows discounted to 6/30/2017 for illustrative purposes ï® Assumes tax refund is comingled with FEIM’s operating cash—Illustrative discount rate range based on preliminary market implied weighted average cost of capital calculation ï® The Company has received clean tax audits for five consecutive years up through 2014; however, past audit results are not indicative of future audit outcome A B ï® Refund of 2017 estimated federal taxes paid—$6.9mm ï® Refund of taxes paid of $8.2mm in 2015 and $26.8mm in 2016; assuming (1) FEIM pays cash to CVR holders upon receipt of cash(1); (2) completion of IRS audit / JCT approval 18 months post due date for 2017 return; or (3) expiration of IRS audit statute of limitations(2) A B ï® Actual results of IRS audit process (and implied value of the CVR) are impossible to predict. PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION Assuming receive refund “B” 12/31/18 Assuming receive refund “B” 3/31/20 Assuming receive refund “B” 9/30/21 Illustrative discount rate range Illustrative discount rate range Illustrative discount rate range 7.0% 8.0% 9.0% 10.0% 7.0% 8.0% 9.0% 10.0% 7.0% 8.0% 9.0% 10.0% CVR PV $38.1 $37.6 $37.1 $36.6 $35.5 $34.7 $34.0 $33.2 $32.7 $31.6 $30.6 $29.6 CVR PV per share $0.91 $0.90 $0.89 $0.88 $0.85 $0.83 $0.82 $0.80 $0.79 $0.76 $0.74 $0.71 Total consideration per share $12.70 $12.69 $12.68 $12.67 $12.65 $12.64 $12.63 $12.61 $12.60 $12.58 $12.56 $12.53 B1 B2 B3

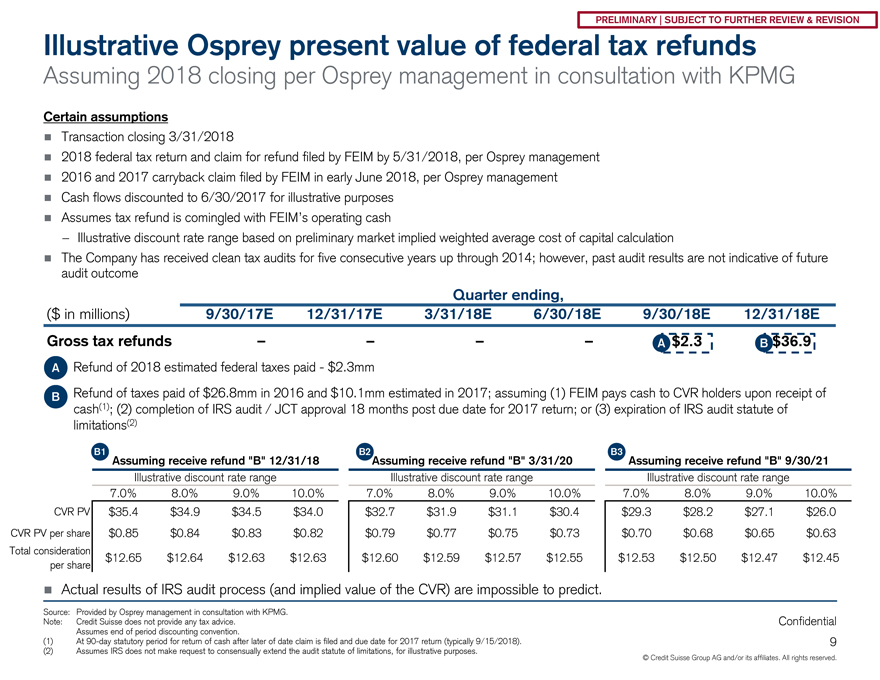

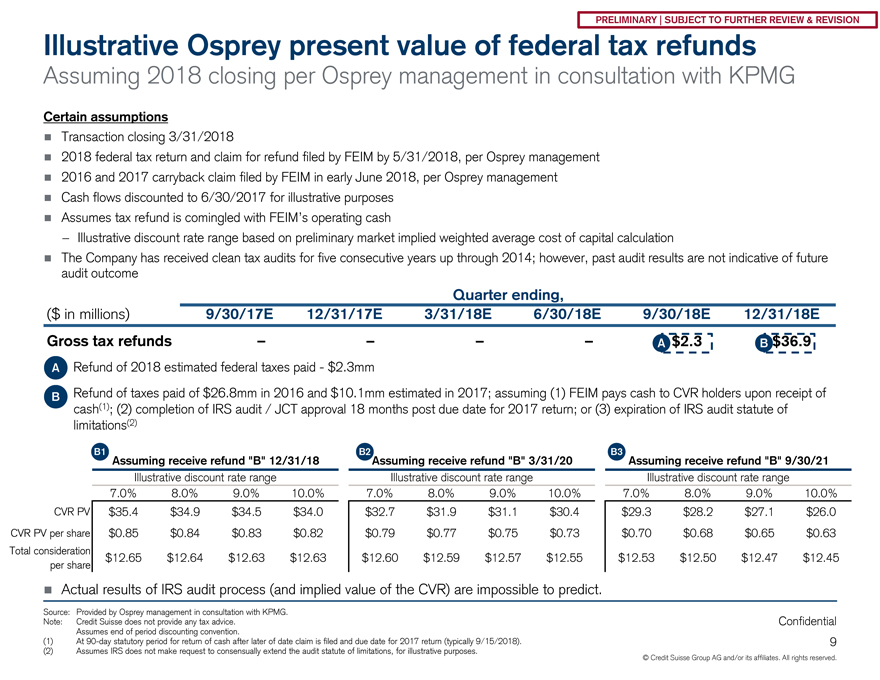

© Credit Suisse Group AG and/or its affiliates. All rights reserved. Confidential 9 Illustrative Osprey present value of federal tax refunds Assuming 2018 closing per Osprey management in consultation with KPMG Certain assumptions ï® Transaction closing 3/31/2018 ï® 2018 federal tax return and claim for refund filed by FEIM by 5/31/2018, per Osprey management ï® 2016 and 2017 carryback claim filed by FEIM in early June 2018, per Osprey management ï® Cash flows discounted to 6/30/2017 for illustrative purposes ï® Assumes tax refund is comingled with FEIM’s operating cash—Illustrative discount rate range based on preliminary market implied weighted average cost of capital calculation ï® The Company has received clean tax audits for five consecutive years up through 2014; however, past audit results are not indicative of future audit outcome ï® Refund of 2018 estimated federal taxes paid—$2.3mm ï® Refund of taxes paid of $26.8mm in 2016 and $10.1mm estimated in 2017; assuming (1) FEIM pays cash to CVR holders upon receipt of cash(1); (2) completion of IRS audit / JCT approval 18 months post due date for 2017 return; or (3) expiration of IRS audit statute of limitations(2) A B PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION ï® Actual results of IRS audit process (and implied value of the CVR) are impossible to predict. Source: Provided by Osprey management in consultation with KPMG. Note: Credit Suisse does not provide any tax advice. Assumes end of period discounting convention. (1) At90-day statutory period for return of cash after later of date claim is filed and due date for 2017 return (typically 9/15/2018). (2) Assumes IRS does not make request to consensually extend the audit statute of limitations, for illustrative purposes. B1 B2 B3 Assuming receive refund “B” 12/31/18 Assuming receive refund “B” 3/31/20 Assuming receive refund “B” 9/30/21 Illustrative discount rate range Illustrative discount rate range Illustrative discount rate range 7.0% 8.0% 9.0% 10.0% 7.0% 8.0% 9.0% 10.0% 7.0% 8.0% 9.0% 10.0% CVR PV $35.4 $34.9 $34.5 $34.0 $32.7 $31.9 $31.1 $30.4 $29.3 $28.2 $27.1 $26.0 CVR PV per share $0.85 $0.84 $0.83 $0.82 $0.79 $0.77 $0.75 $0.73 $0.70 $0.68 $0.65 $0.63 Total consideration per share $12.65 $12.64 $12.63 $12.63 $12.60 $12.59 $12.57 $12.55 $12.53 $12.50 $12.47 $12.45 Quarter ending, ($ in millions) 9/30/17E 12/31/17E 3/31/18E 6/30/18E 9/30/18E 12/31/18E Gross tax refunds – – – – A $2.3 B $36.9

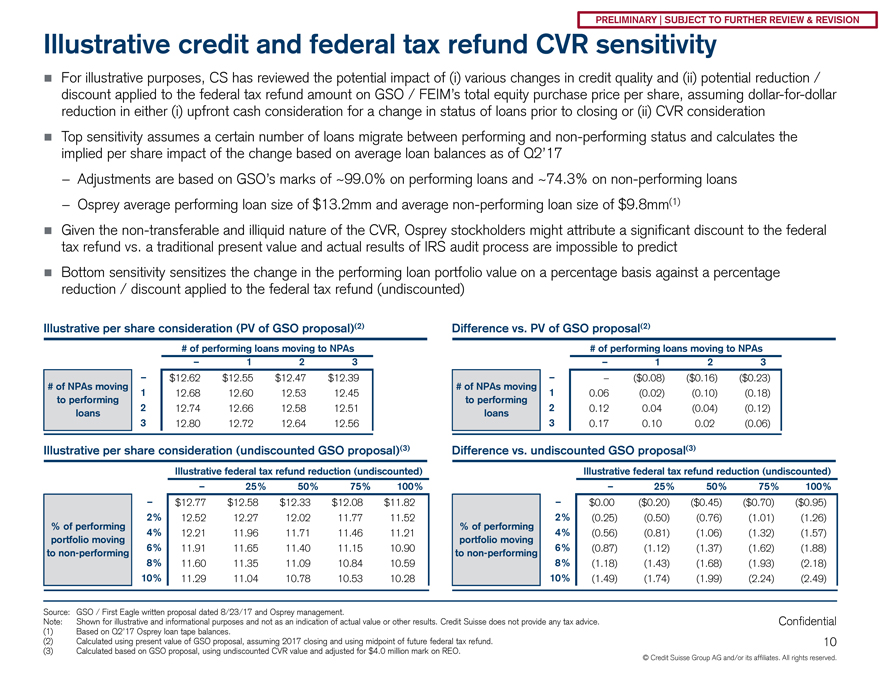

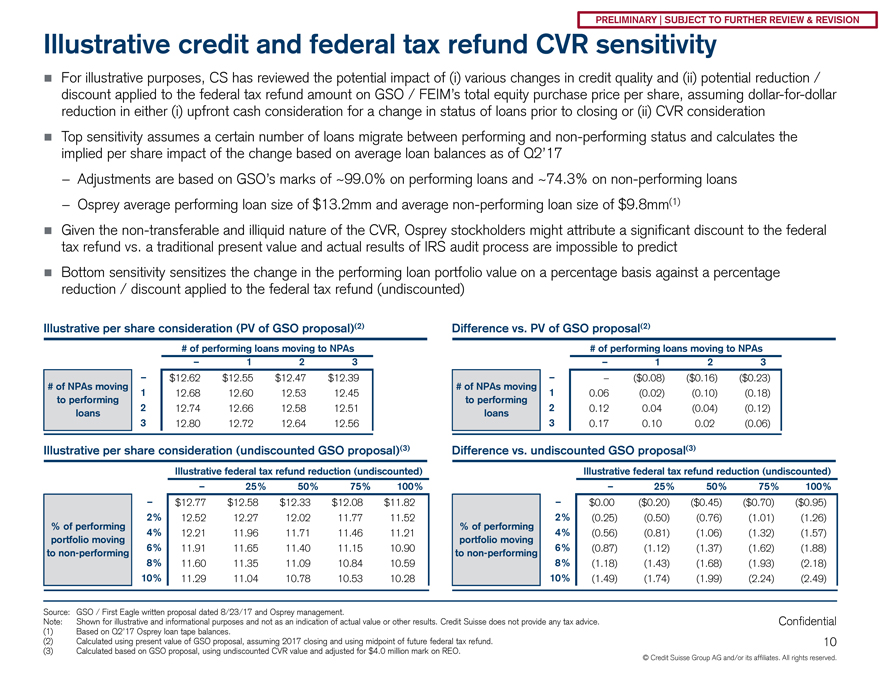

© Credit Suisse Group AG and/or its affiliates. All rights reserved. Confidential 10 ï® For illustrative purposes, CS has reviewed the potential impact of (i) various changes in credit quality and (ii) potential reduction / discount applied to the federal tax refund amount on GSO / FEIM’s total equity purchase price per share, assumingdollar-for-dollar reduction in either (i) upfront cash consideration for a change in status of loans prior to closing or (ii) CVR consideration ï® Top sensitivity assumes a certain number of loans migrate between performing andnon-performing status and calculates the implied per share impact of the change based on average loan balances as of Q2’17—Adjustments are based on GSO’s marks of ~99.0% on performing loans and ~74.3% onnon-performing loans—Osprey average performing loan size of $13.2mm and averagenon-performing loan size of $9.8mm(1) ï® Given thenon-transferable and illiquid nature of the CVR, Osprey stockholders might attribute a significant discount to the federal tax refund vs. a traditional present value and actual results of IRS audit process are impossible to predict ï® Bottom sensitivity sensitizes the change in the performing loan portfolio value on a percentage basis against a percentage reduction / discount applied to the federal tax refund (undiscounted) Illustrative per share consideration (PV of GSO proposal)(2) Difference vs. PV of GSO proposal(2) Illustrative credit and federal tax refund CVR sensitivity Source: GSO / First Eagle written proposal dated 8/23/17 and Osprey management. Note: Shown for illustrative and informational purposes and not as an indication of actual value or other results. Credit Suisse does not provide any tax advice. (1) Based on Q2’17 Osprey loan tape balances. (2) Calculated using present value of GSO proposal, assuming 2017 closing and using midpoint of future federal tax refund. (3) Calculated based on GSO proposal, using undiscounted CVR value and adjusted for $4.0 million mark on REO. Illustrative per share consideration (undiscounted GSO proposal)(3) Difference vs. undiscounted GSO proposal(3) PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION # of performing loans moving to NPAs #### – 1 2 3 – – ($0.08) ($0.16) ($0.23) 1 0.06 (0.02) (0.10) (0.18) 2 0.12 0.04 (0.04) (0.12) 3 0.17 0.10 0.02 (0.06) # of NPAs moving to performing loans # of performing loans moving to NPAs ### – 1 2 3 – $12.62 $12.55 $12.47 $12.39 1 12.68 12.60 12.53 12.45 2 12.74 12.66 12.58 12.51 3 12.80 12.72 12.64 12.56 # of NPAs moving to performing loans Illustrative federal tax refund reduction (undiscounted) #### – 25% 50% 75% 100% – $12.77 $12.58 $12.33 $12.08 $11.82 2% 12.52 12.27 12.02 11.77 11.52 4% 12.21 11.96 11.71 11.46 11.21 6% 11.91 11.65 11.40 11.15 10.90 8% 11.60 11.35 11.09 10.84 10.59 10% 11.29 11.04 10.78 10.53 10.28 % of performing portfolio moving tonon-performing Illustrative federal tax refund reduction (undiscounted) ##### – 25% 50% 75% 100% – $0.00 ($0.20) ($0.45) ($0.70) ($0.95) 2% (0.25) (0.50) (0.76) (1.01) (1.26) 4% (0.56) (0.81) (1.06) (1.32) (1.57) 6% (0.87) (1.12) (1.37) (1.62) (1.88) 8% (1.18) (1.43) (1.68) (1.93) (2.18) 10% (1.49) (1.74) (1.99) (2.24) (2.49) % of performing portfolio moving tonon-performing

Confidential 11 2. Public market perspectives PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

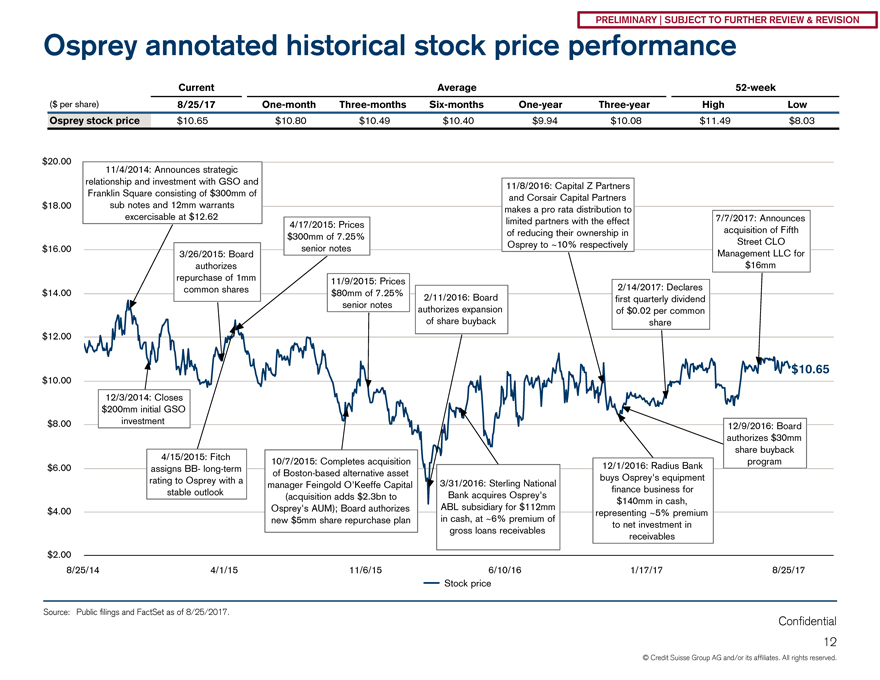

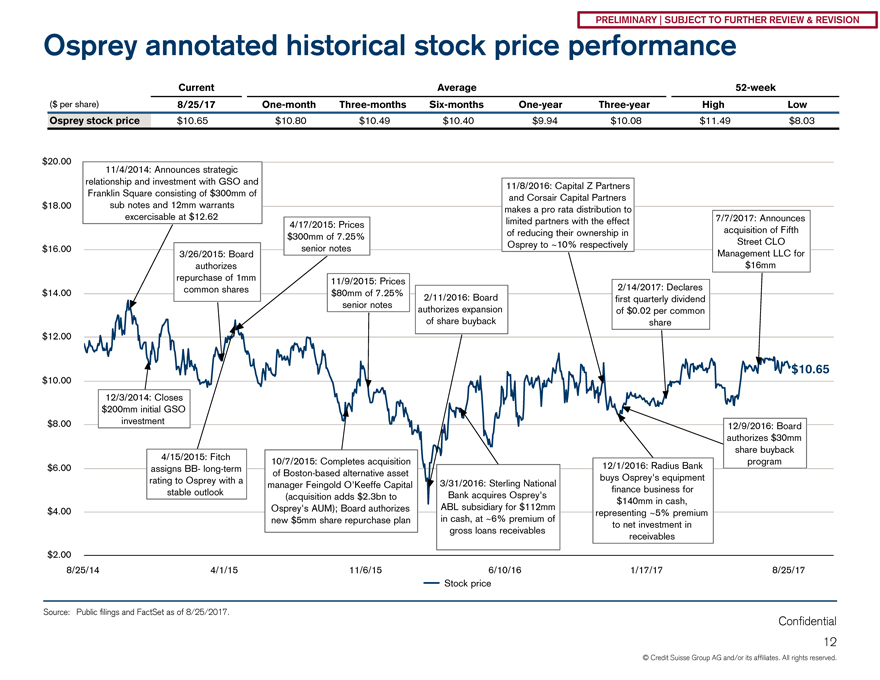

© Credit Suisse Group AG and/or its affiliates. All rights reserved. Confidential Osprey annotated historical stock price performance 12 Source: Public filings and FactSet as of 8/25/2017. Current Average52-week ($ per share) 8/25/17One-month Three-monthsSix-monthsOne-year Three-year High Low Osprey stock price $10.65 $10.80 $10.49 $10.40 $9.94 $10.08 $11.49 $8.03 8/25/14 4/1/15 11/6/15 6/10/16 1/17/17 8/25/17 $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 $14.00 $16.00 $18.00 $20.00 7/7/2017: Announces acquisition of Fifth Street CLO Management LLC for $16mm 11/4/2014: Announces strategic relationship and investment with GSO and Franklin Square consisting of $300mm of sub notes and 12mm warrants excercisable at $12.62 12/3/2014: Closes $200mm initial GSO investment 3/26/2015: Board authorizes repurchase of 1mm common shares 10/7/2015: Completes acquisition of Boston-based alternative asset manager Feingold O’Keeffe Capital (acquisition adds $2.3bn to Osprey’s AUM); Board authorizes new $5mm share repurchase plan 4/15/2015: Fitch assignsBB- long-term rating to Osprey with a stable outlook 4/17/2015: Prices $300mm of 7.25% senior notes 11/9/2015: Prices $80mm of 7.25% senior notes 2/11/2016: Board authorizes expansion of share buyback 3/31/2016: Sterling National Bank acquires Osprey’s ABL subsidiary for $112mm in cash, at ~6% premium of gross loans receivables 12/1/2016: Radius Bank buys Osprey’s equipment finance business for $140mm in cash, representing ~5% premium to net investment in receivables 12/9/2016: Board authorizes $30mm share buyback program 2/14/2017: Declares first quarterly dividend of $0.02 per common share 11/8/2016: Capital Z Partners and Corsair Capital Partners makes a pro rata distribution to limited partners with the effect of reducing their ownership in Osprey to ~10% respectively $10.65 Stock price PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

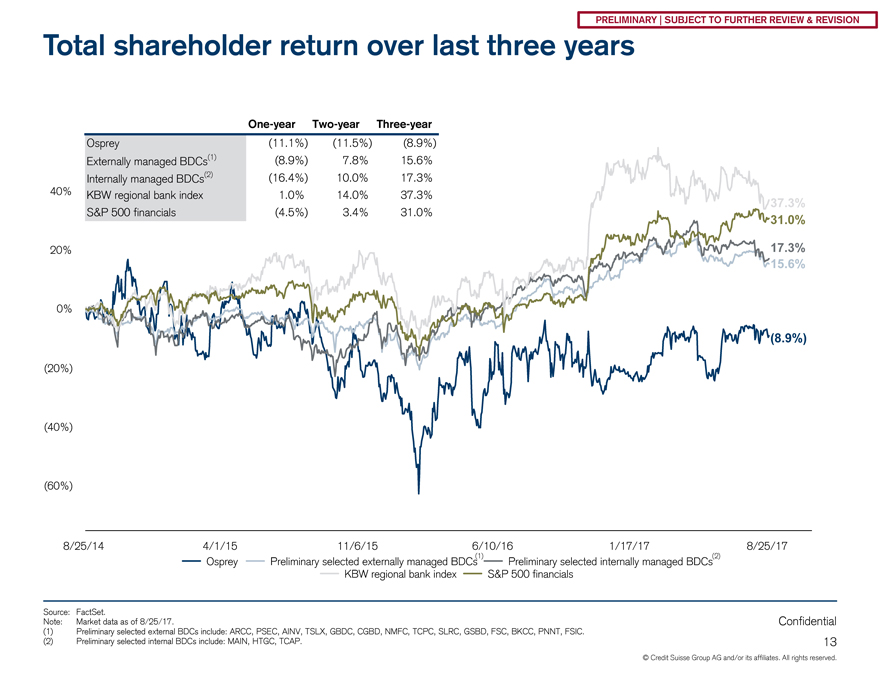

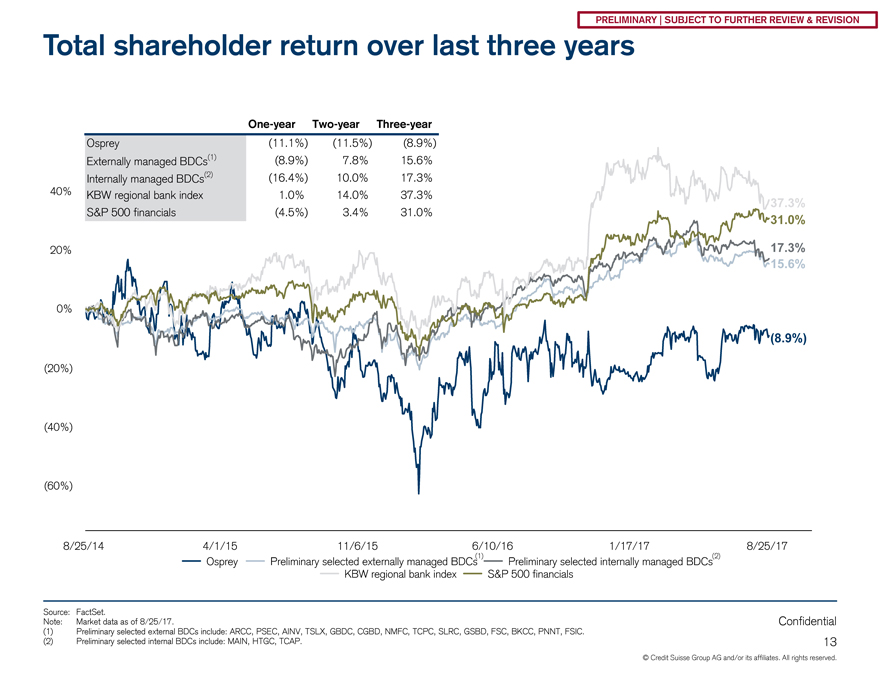

© Credit Suisse Group AG and/or its affiliates. All rights reserved. Confidential 13 Total shareholder return over last three years Source: FactSet. Note: Market data as of 8/25/17. (1) Preliminary selected external BDCs include: ARCC, PSEC, AINV, TSLX, GBDC, CGBD, NMFC, TCPC, SLRC, GSBD, FSC, BKCC, PNNT, FSIC. (2) Preliminary selected internal BDCs include: MAIN, HTGC, TCAP. (1) (2)One-yearTwo-year Three-year Osprey (11.1%) (11.5%) (8.9%) Externally managed BDCs(1) (8.9%) 7.8% 15.6% Internally managed BDCs(2) (16.4%) 10.0% 17.3% KBW regional bank index 1.0% 14.0% 37.3% S&P 500 financials (4.5%) 3.4% 31.0% PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION 40% 20% 0% (20%) (40%) (60%) 8/25/14 4/1/15 11/6/15 6/10/16

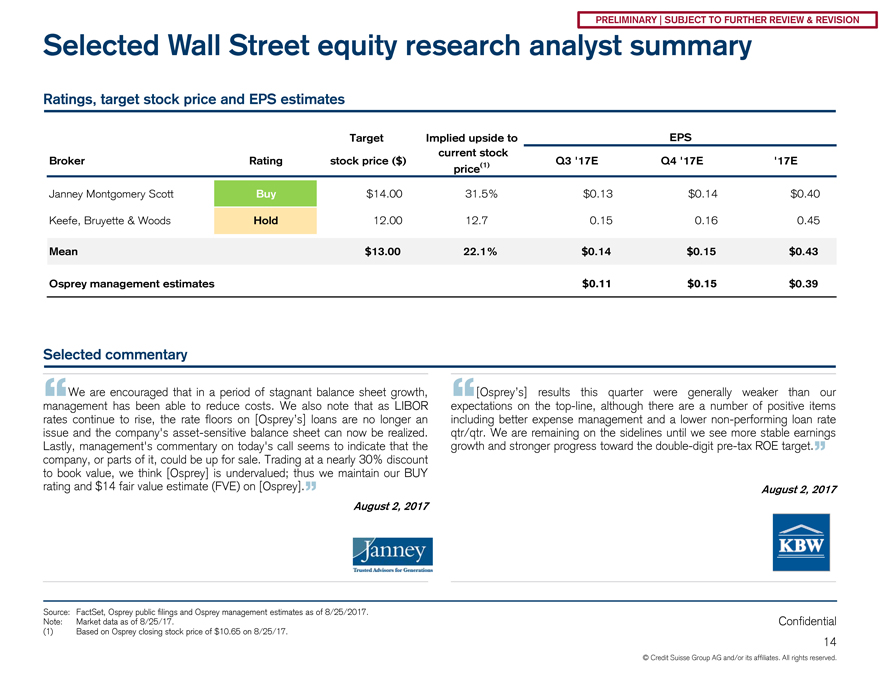

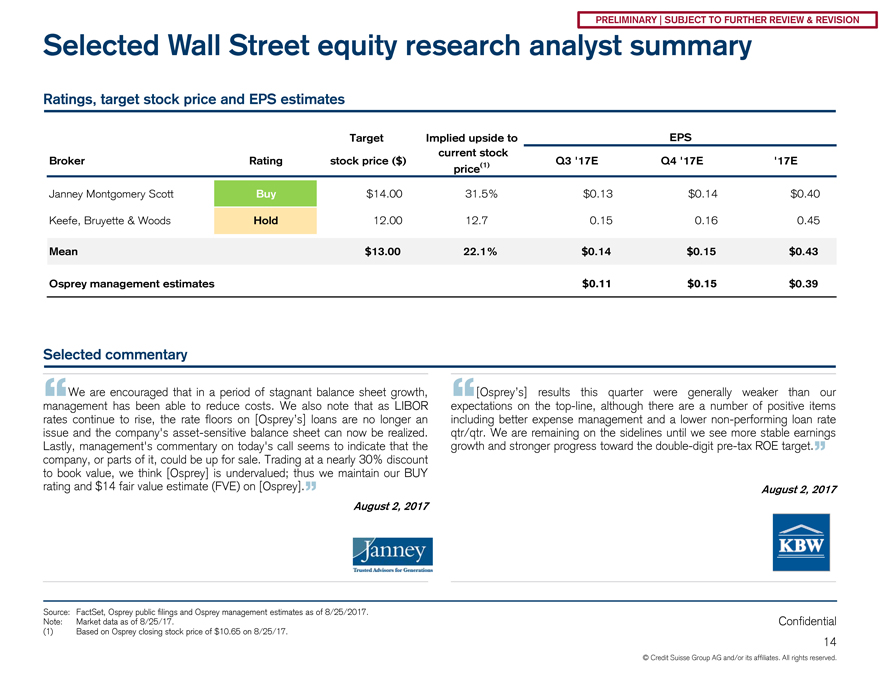

© Credit Suisse Group AG and/or its affiliates. All rights reserved. Confidential Ratings, target stock price and EPS estimates Selected commentary 14 Selected Wall Street equity research analyst summary Source: FactSet, Osprey public filings and Osprey management estimates as of 8/25/2017. Note: Market data as of 8/25/17. (1) Based on Osprey closing stock price of $10.65 on 8/25/17. Target Implied upside to Broker Rating stock price ($) current stock price(1) Q3 ‘17E Q4 ‘17E ‘17E Janney Montgomery Scott Buy $14.00 31.5% $0.13 $0.14 $0.40 Keefe, Bruyette & Woods Hold 12.00 12.7 0.15 0.16 0.45 Mean $13.00 22.1% $0.14 $0.15 $0.43 Osprey management estimates $0.11 $0.15 $0.39 EPS “We are encouraged that in a period of stagnant balance sheet growth, management has been able to reduce costs. We also note that as LIBOR rates continue to rise, the rate floors on [Osprey’s] loans are no longer an issue and the company’s asset-sensitive balance sheet can now be realized. Lastly, management’s commentary on today’s call seems to indicate that the company, or parts of it, could be up for sale. Trading at a nearly 30% discount to book value, we think [Osprey] is undervalued; thus we maintain our BUY rating and $14 fair value estimate (FVE) on [Osprey].” August 2, 2017 PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION “[Osprey’s] results this quarter were generally weaker than our expectations on thetop-line, although there are a number of positive items including better expense management and a lowernon-performing loan rate qtr/qtr. We are remaining on the sidelines until we see more stable earnings growth and stronger progress toward the double-digitpre-tax ROE target.” August 2, 2017

Confidential 15 3. Potential next steps PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

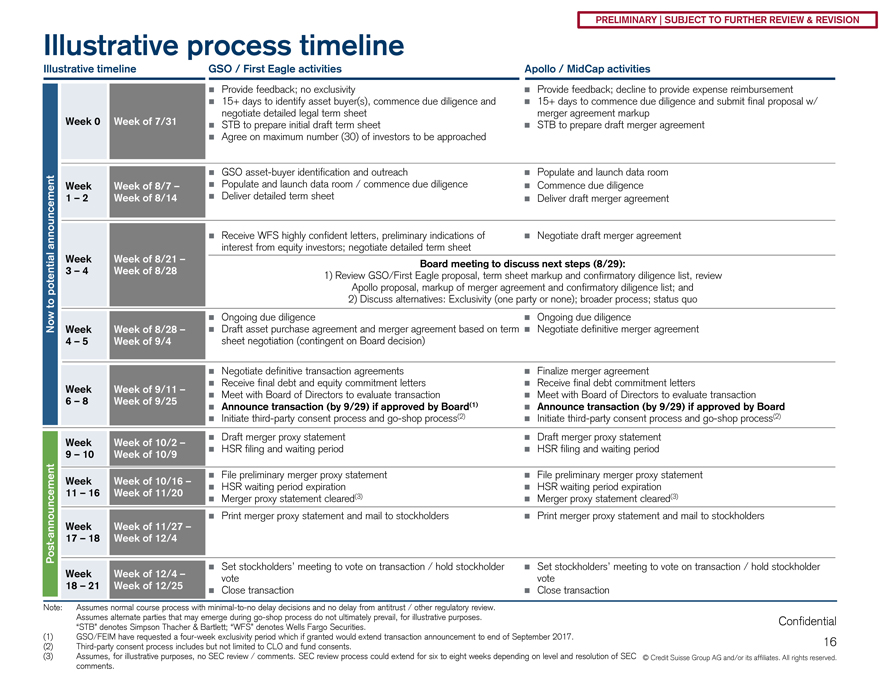

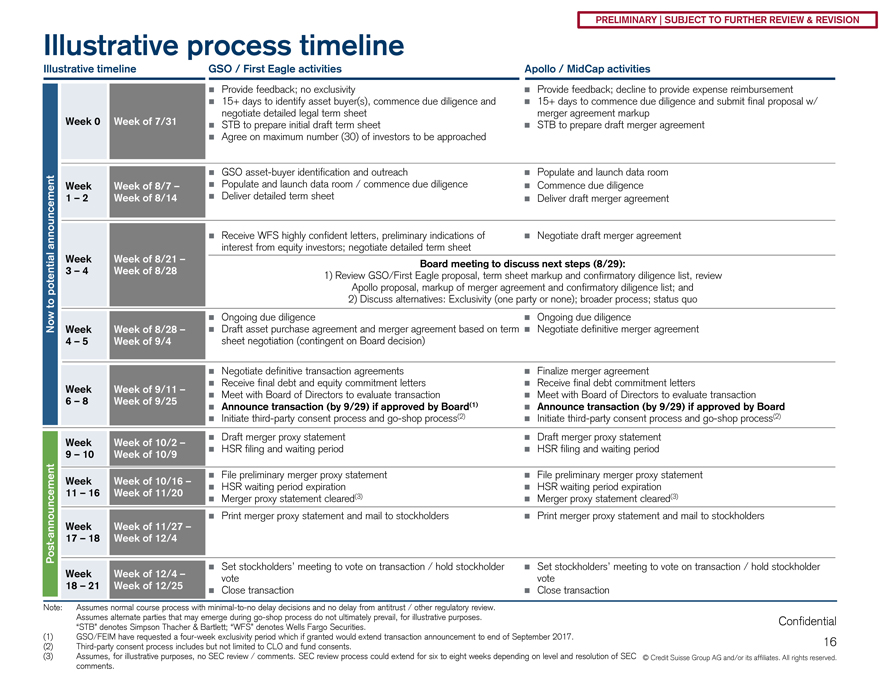

© Credit Suisse Group AG and/or its affiliates. All rights reserved. Confidential Illustrative process timeline Illustrative timeline Now to potential announcement ï® Provide feedback; no exclusivity ï® 15+ days to identify asset buyer(s), commence due diligence and negotiate detailed legal term sheet ï® STB to prepare initial draft term sheet ï® Agree on maximum number (30) of investors to be approached ï® Ongoing due diligence ï® Draft asset purchase agreement and merger agreement based on term sheet negotiation (contingent on Board decision) ï® Negotiate definitive transaction agreements ï® Receive final debt and equity commitment letters ï® Meet with Board of Directors to evaluate transaction ï® Announce transaction (by 9/29) if approved by Board(1) ï® Initiate third-party consent process andgo-shop process(2) Note: Assumes normal course process withminimal-to-no delay decisions and no delay from antitrust / other regulatory review. Assumes alternate parties that may emerge duringgo-shop process do not ultimately prevail, for illustrative purposes. “STB” denotes Simpson Thacher & Bartlett; “WFS” denotes Wells Fargo Securities. (1) GSO/FEIM have requested a four-week exclusivity period which if granted would extend transaction announcement to end of September 2017. (2) Third-party consent process includes but not limited to CLO and fund consents. (3) Assumes, for illustrative purposes, no SEC review / comments. SEC review process could extend for six to eight weeks depending on level and resolution of SEC comments. Week of 7/31 Week of 8/28 – Week of 9/4 Post-announcement Week of 10/2 – Week of 10/9 ï® Draft merger proxy statement ï® HSR filing and waiting period PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION GSO / First Eagle activities Apollo / MidCap activities ï® Provide feedback; decline to provide expense reimbursement ï® 15+ days to commence due diligence and submit final proposal w/ merger agreement markup ï® STB to prepare draft merger agreement ï® Ongoing due diligence ï® Negotiate definitive merger agreement Week of 8/7 – Week of 8/14 ï® GSO asset-buyer identification and outreach ï® Populate and launch data room / commence due diligence ï® Deliver detailed term sheet ï® Populate and launch data room ï® Commence due diligence ï® Deliver draft merger agreement ï® File preliminary merger proxy statement ï® HSR waiting period expiration ï® Merger proxy statement cleared(3) ï® Set stockholders’ meeting to vote on transaction / hold stockholder vote ï® Close transaction Week of 10/16 – Week of 11/20 Week of 12/4 – Week of 12/25 Week 0 Week 1 – 2 Week 4 – 5 Week 9 – 10 Week 11 – 16 Week 18 – 21 Week of 9/11 – Week of 9/25 Week 6 – 8 Week of 8/21 – Week of 8/28 Board meeting to discuss next steps (8/29): 1) Review GSO/First Eagle proposal, term sheet markup and confirmatory diligence list, review Apollo proposal, markup of merger agreement and confirmatory diligence list; and 2) Discuss alternatives: Exclusivity (one party or none); broader process; status quo Week 3 – 4 ï® Finalize merger agreement ï® Receive final debt commitment letters ï® Meet with Board of Directors to evaluate transaction ï® Announce transaction (by 9/29) if approved by Board ï® Initiate third-party consent process andgo-shop process(2) ï® Draft merger proxy statement ï® HSR filing and waiting period ï® File preliminary merger proxy statement ï® HSR waiting period expiration ï® Merger proxy statement cleared(3) ï® Receive WFS highly confident letters, preliminary indications of interest from equity investors; negotiate detailed term sheet ï® Print merger proxy statement and mail to stockholders Week of 11/27 – Week of 12/4 Week 17 – 18 ï® Print merger proxy statement and mail to stockholders ï® Set stockholders’ meeting to vote on transaction / hold stockholder vote ï® Close transaction 16 ï® Negotiate draft merger agreement

© Credit Suisse Group AG and/or its affiliates. All rights reserved. Confidential 17 ï®Go-shops are not infrequent in going private and certain other processes ï® Valuation / termination fee ï® Duration ofgo-shop period ï® Impact on broader Osprey process timing / potential delays ï® Due diligence requirements Certaingo-shop process considerations PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

Confidential 18 Appendix PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

Confidential 19 A. Supplemental financial information PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

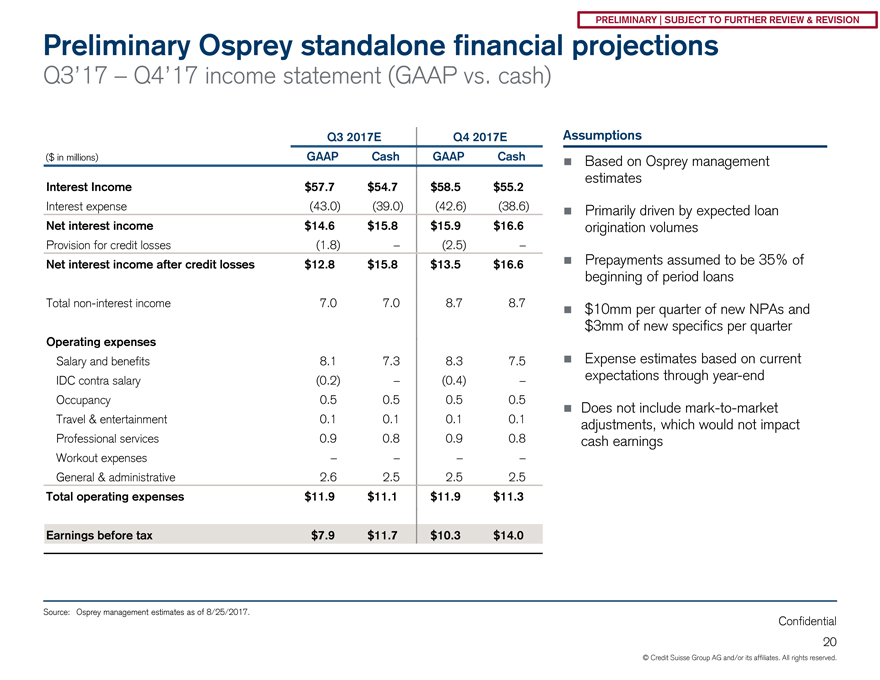

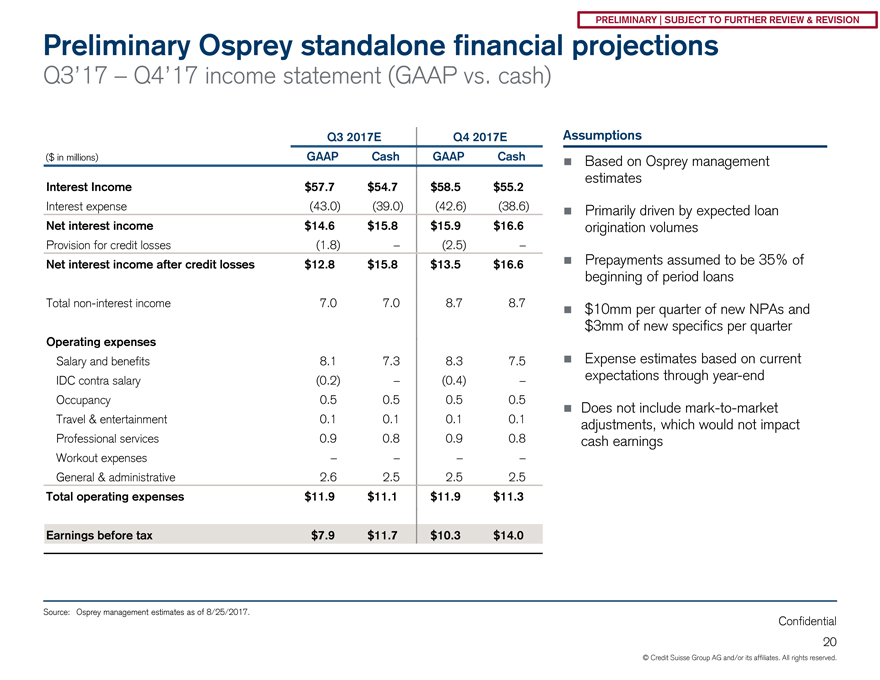

© Credit Suisse Group AG and/or its affiliates. All rights reserved. Confidential 20 Preliminary Osprey standalone financial projections Q3’17 – Q4’17 income statement (GAAP vs. cash) Source: Osprey management estimates as of 8/25/2017. Assumptions ï® Based on Osprey management estimates ï® Primarily driven by expected loan origination volumes ï® Prepayments assumed to be 35% of beginning of period loans ï® $10mm per quarter of new NPAs and $3mm of new specifics per quarter ï® Expense estimates based on current expectations throughyear-end ï® Does not includemark-to-market adjustments, which would not impact cash earnings Q3 2017E Q4 2017E ($ in millions) GAAP Cash GAAP Cash Interest Income $57.7 $54.7 $58.5 $55.2 Interest expense (43.0) (39.0) (42.6) (38.6) Net interest income $14.6 $15.8 $15.9 $16.6 Provision for credit losses (1.8) – (2.5) – Net interest income after credit losses $12.8 $15.8 $13.5 $16.6 Totalnon-interest income 7.0 7.0 8.7 8.7 Operating expenses Salary and benefits 8.1 7.3 8.3 7.5 IDC contra salary (0.2) – (0.4) – Occupancy 0.5 0.5 0.5 0.5 Travel & entertainment 0.1 0.1 0.1 0.1 Professional services 0.9 0.8 0.9 0.8 Workout expenses – – – – General & administrative 2.6 2.5 2.5 2.5 Total operating expenses $11.9 $11.1 $11.9 $11.3 Earnings before tax $7.9 $11.7 $10.3 $14.0 PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

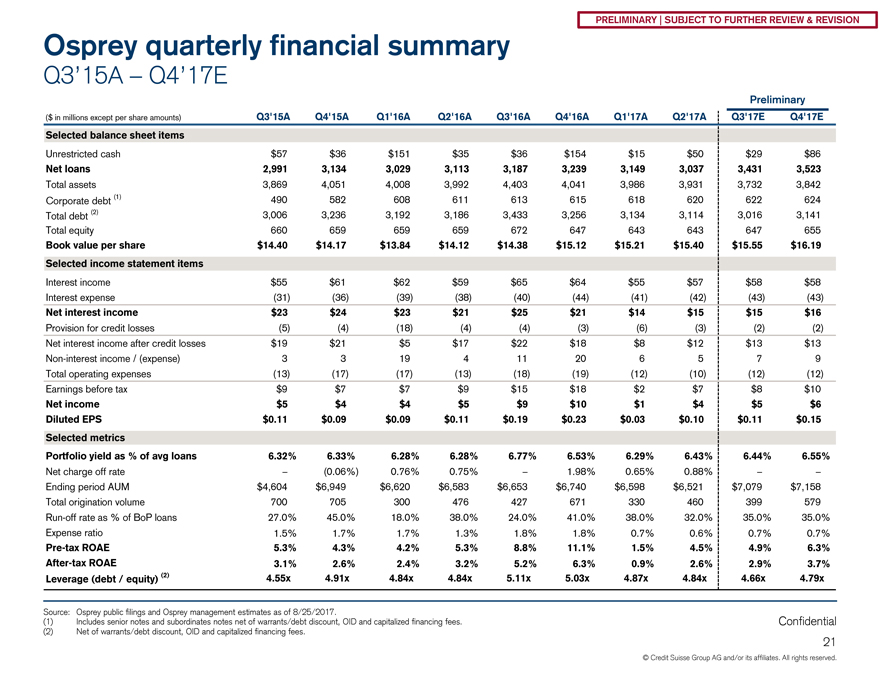

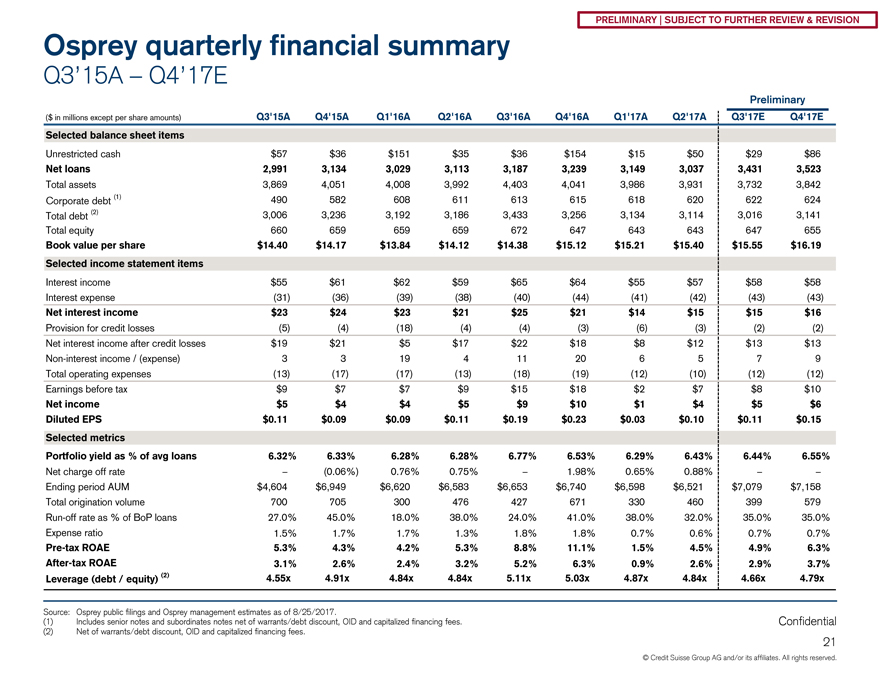

© Credit Suisse Group AG and/or its affiliates. All rights reserved. Confidential 21 Osprey quarterly financial summary Q3’15A – Q4’17E Source: Osprey public filings and Osprey management estimates as of 8/25/2017. (1) Includes senior notes and subordinates notes net of warrants/debt discount, OID and capitalized financing fees. (2) Net of warrants/debt discount, OID and capitalized financing fees. ($ in millions except per share amounts) Q3’15A Q4’15A Q1’16A Q2’16A Q3’16A Q4’16A Q1’17A Q2’17A Q3’17E Q4’17E Selected balance sheet items Unrestricted cash $57 $36 $151 $35 $36 $154 $15 $50 $29 $86 Net loans 2,991 3,134 3,029 3,113 3,187 3,239 3,149 3,037 3,431 3,523 Total assets 3,869 4,051 4,008 3,992 4,403 4,041 3,986 3,931 3,732 3,842 Corporate debt (1) 490 582 608 611 613 615 618 620 622 624 Total debt (2) 3,006 3,236 3,192 3,186 3,433 3,256 3,134 3,114 3,016 3,141 Total equity 660 659 659 659 672 647 643 643 647 655 Book value per share $14.40 $14.17 $13.84 $14.12 $14.38 $15.12 $15.21 $15.40 $15.55 $16.19 Selected income statement items Interest income $55 $61 $62 $59 $65 $64 $55 $57 $58 $58 Interest expense (31) (36) (39) (38) (40) (44) (41) (42) (43) (43) Net interest income $23 $24 $23 $21 $25 $21 $14 $15 $15 $16 Provision for credit losses (5) (4) (18) (4) (4) (3) (6) (3) (2) (2) Net interest income after credit losses $19 $21 $5 $17 $22 $18 $8 $12 $13 $13Non-interest income / (expense) 3 3 19 4 11 20 6 5 7 9 Total operating expenses (13) (17) (17) (13) (18) (19) (12) (10) (12) (12) Earnings before tax $9 $7 $7 $9 $15 $18 $2 $7 $8 $10 Net income $5 $4 $4 $5 $9 $10 $1 $4 $5 $6 Diluted EPS $0.11 $0.09 $0.09 $0.11 $0.19 $0.23 $0.03 $0.10 $0.11 $0.15 Selected metrics Portfolio yield as % of avg loans 6.32% 6.33% 6.28% 6.28% 6.77% 6.53% 6.29% 6.43% 6.44% 6.55% Net charge off rate – (0.06%) 0.76% 0.75% – 1.98% 0.65% 0.88% – – Ending period AUM $4,604 $6,949 $6,620 $6,583 $6,653 $6,740 $6,598 $6,521 $7,079 $7,158 Total origination volume 700 705 300 476 427 671 330 460 399 579Run-off rate as % of BoP loans 27.0% 45.0% 18.0% 38.0% 24.0% 41.0% 38.0% 32.0% 35.0% 35.0% Expense ratio 1.5% 1.7% 1.7% 1.3% 1.8% 1.8% 0.7% 0.6% 0.7% 0.7%Pre-tax ROAE 5.3% 4.3% 4.2% 5.3% 8.8% 11.1% 1.5% 4.5% 4.9% 6.3%After-tax ROAE 3.1% 2.6% 2.4% 3.2% 5.2% 6.3% 0.9% 2.6% 2.9% 3.7% Leverage (debt / equity) (2) 4.55x 4.91x 4.84x 4.84x 5.11x 5.03x 4.87x 4.84x 4.66x 4.79x Preliminary PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

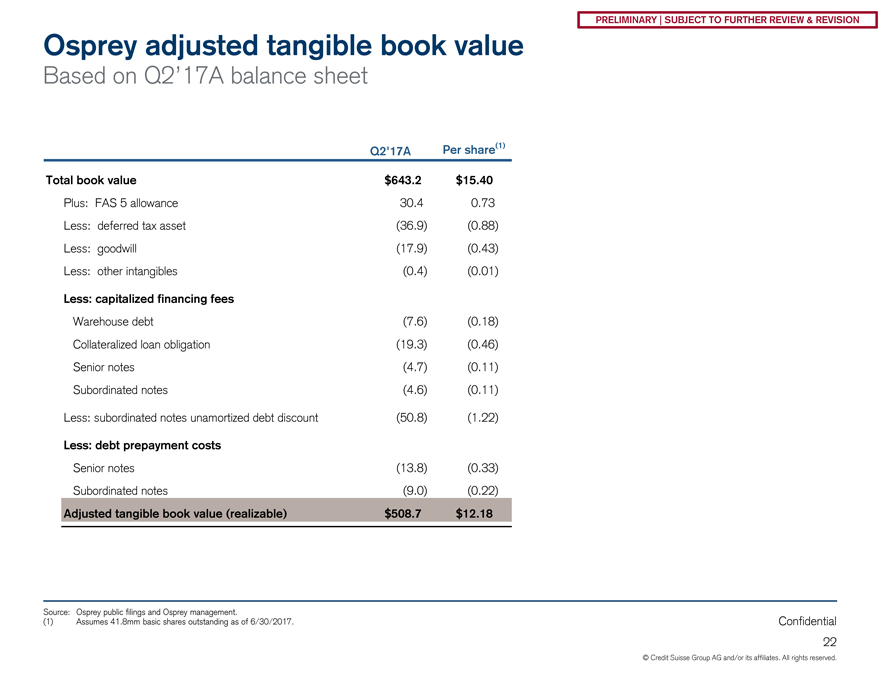

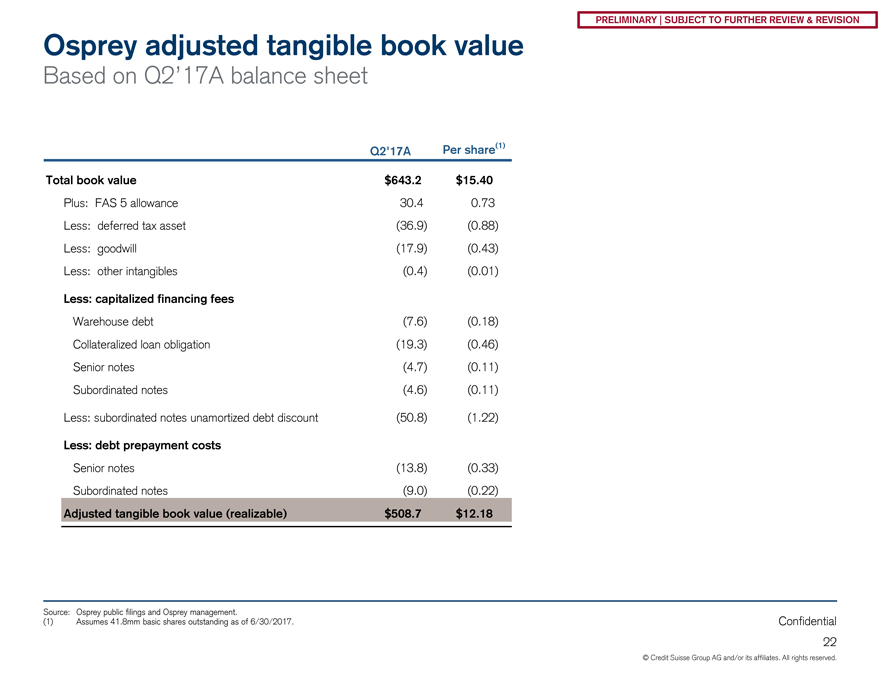

© Credit Suisse Group AG and/or its affiliates. All rights reserved. Confidential 22 Osprey adjusted tangible book value Based on Q2’17A balance sheet Source: Osprey public filings and Osprey management. (1) Assumes 41.8mm basic shares outstanding as of 6/30/2017. PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION Q2’17A Per share(1) Total book value $643.2 $15.40 Plus: FAS 5 allowance 30.4 0.73 Less: deferred tax asset (36.9) (0.88) Less: goodwill (17.9) (0.43) Less: other intangibles (0.4) (0.01) Less: capitalized financing fees Warehouse debt (7.6) (0.18) Collateralized loan obligation (19.3) (0.46) Senior notes (4.7) (0.11) Subordinated notes (4.6) (0.11) Less: subordinated notes unamortized debt discount (50.8) (1.22) Less: debt prepayment costs Senior notes (13.8) (0.33) Subordinated notes (9.0) (0.22) Adjusted tangible book value (realizable) $508.7 $12.18

Confidential 23 B. Supplemental information PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

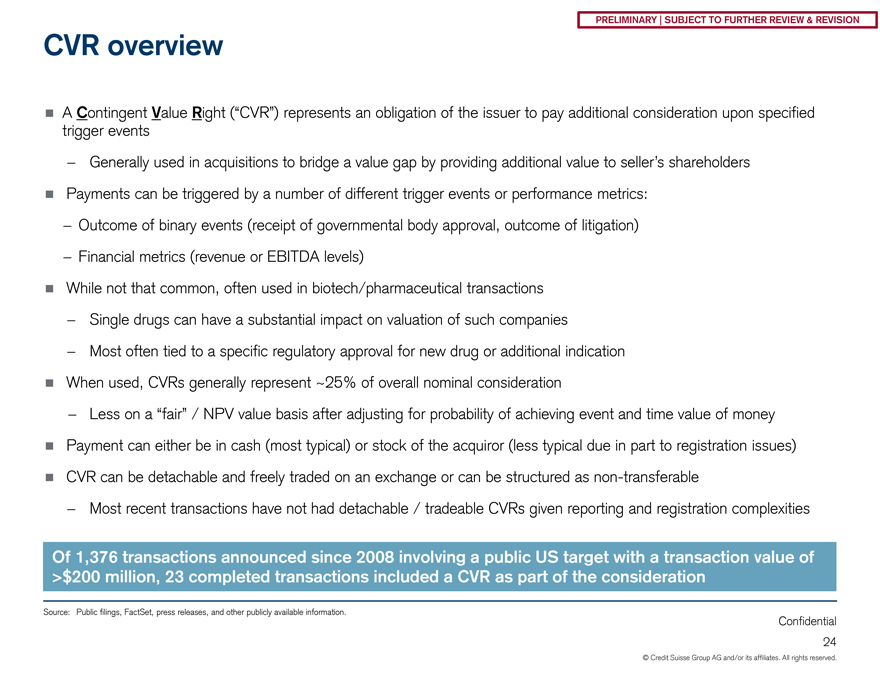

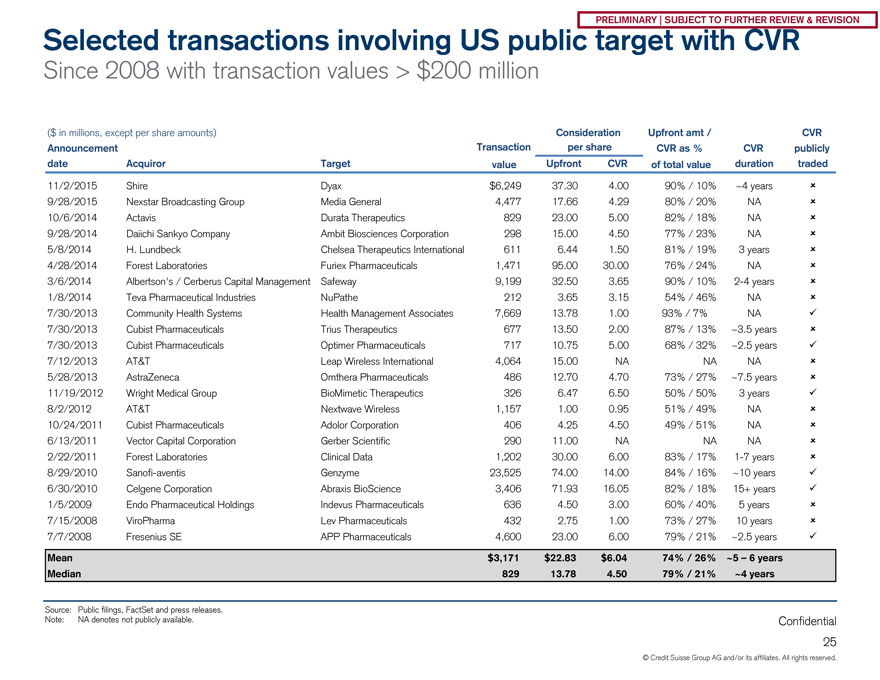

© Credit Suisse Group AG and/or its affiliates. All rights reserved. Confidential ï® A Contingent Value Right (“CVR”) represents an obligation of the issuer to pay additional consideration upon specified trigger events—Generally used in acquisitions to bridge a value gap by providing additional value to seller’s shareholders ï® Payments can be triggered by a number of different trigger events or performance metrics:—Outcome of binary events (receipt of governmental body approval, outcome of litigation)—Financial metrics (revenue or EBITDA levels) ï® While not that common, often used in biotech/pharmaceutical transactions—Single drugs can have a substantial impact on valuation of such companies—Most often tied to a specific regulatory approval for new drug or additional indication ï® When used, CVRs generally represent ~25% of overall nominal consideration—Less on a “fair” / NPV value basis after adjusting for probability of achieving event and time value of money ï® Payment can either be in cash (most typical) or stock of the acquiror (less typical due in part to registration issues) ï® CVR can be detachable and freely traded on an exchange or can be structured asnon-transferable—Most recent transactions have not had detachable / tradeable CVRs given reporting and registration complexities 24 CVR overview Source: Public filings, FactSet, press releases, and other publicly available information. PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION Of 1,376 transactions announced since 2008 involving a public US target with a transaction value of >$200 million, 23 completed transactions included a CVR as part of the consideration

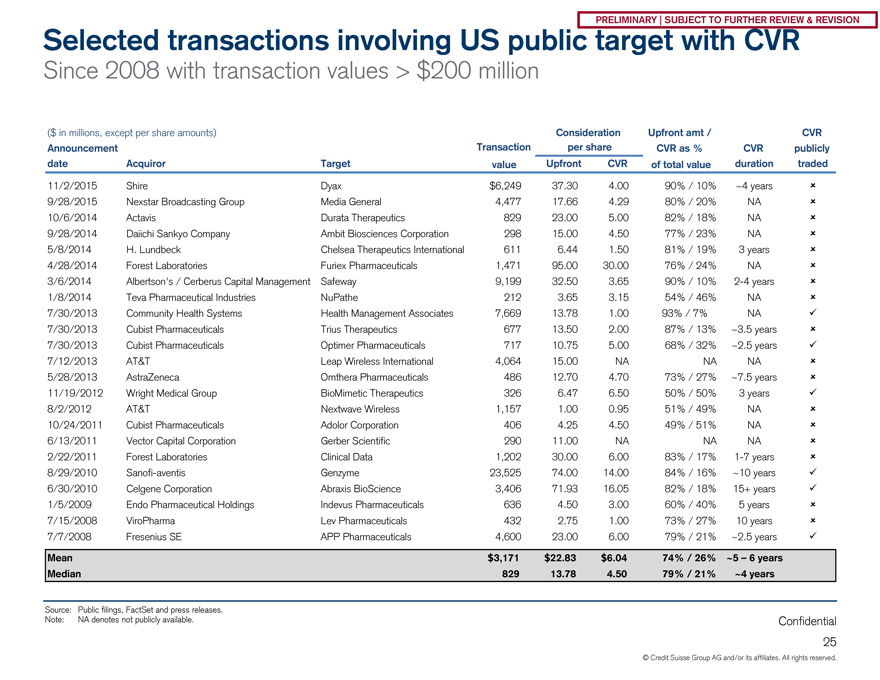

© Credit Suisse Group AG and/or its affiliates. All rights reserved. Confidential Source: Public filings, FactSet and press releases. Note: NA denotes not publicly available. Selected transactions involving US public target with CVR Since 2008 with transaction values $200 million ($ in millions, except per share amounts) Consideration Upfront amt / CVR Announcement Transaction per share CVR as % CVR publicly date Acquiror Target value Upfront CVR of total value duration traded 11/2/2015 Shire Dyax $6,249 37.30 4.00 90% / 10% ~4 years iƒ» 9/28/2015 Nexstar Broadcasting Group Media General 4,477 17.66 4.29 80% / 20% NA iƒ» 10/6/2014 Actavis Durata Therapeutics 829 23.00 5.00 82% / 18% NA iƒ» 9/28/2014 Daiichi Sankyo Company Ambit Biosciences Corporation 298 15.00 4.50 77% / 23% NA iƒ» 5/8/2014 H. Lundbeck Chelsea Therapeutics International 611 6.44 1.50 81% / 19% 3 years iƒ» 4/28/2014 Forest Laboratories Furiex Pharmaceuticals 1,471 95.00 30.00 76% / 24% NA iƒ» 3/6/2014 Albertson’s / Cerberus Capital Management Safeway 9,199 32.50 3.65 90% / 10%2-4 years iƒ» 1/8/2014 Teva Pharmaceutical Industries NuPathe 212 3.65 3.15 54% / 46% NA iƒ» 7/30/2013 Community Health Systems Health Management Associates 7,669 13.78 1.00 93% / 7% NA iƒ¼ 7/30/2013 Cubist Pharmaceuticals Trius Therapeutics 677 13.50 2.00 87% / 13% ~3.5 years iƒ» 7/30/2013 Cubist Pharmaceuticals Optimer Pharmaceuticals 717 10.75 5.00 68% / 32% ~2.5 years iƒ¼i 7/12/2013 AT&T Leap Wireless International 4,064 15.00 NA NA NA iƒ» 5/28/2013 AstraZeneca Omthera Pharmaceuticals 486 12.70 4.70 73% / 27% ~7.5 years iƒ» 11/19/2012 Wright Medical Group BioMimetic Therapeutics 326 6.47 6.50 50% / 50% 3 years iƒ¼ 8/2/2012 AT&T Nextwave Wireless 1,157 1.00 0.95 51% / 49% NA iƒ» 10/24/2011 Cubist Pharmaceuticals Adolor Corporation 406 4.25 4.50 49% / 51% NA iƒ» 6/13/2011 Vector Capital Corporation Gerber Scientific 290 11.00 NA NA NA iƒ» 2/22/2011 Forest Laboratories Clinical Data 1,202 30.00 6.00 83% / 17% 1-7 years iƒ» 8/29/2010 Sanofi-aventis Genzyme 23,525 74.00 14.00 84% / 16% ~10 years iƒ¼ 6/30/2010 Celgene Corporation Abraxis BioScience 3,406 71.93 16.05 82% / 18% 15+ years iƒ¼ 1/5/2009 Endo Pharmaceutical Holdings Indevus Pharmaceuticals 636 4.50 3.00 60% / 40% 5 years iƒ» 7/15/2008 ViroPharma Lev Pharmaceuticals 432 2.75 1.00 73% / 27% 10 years iƒ» 7/7/2008 Fresenius SE APP Pharmaceuticals 4,600 23.00 6.00 79% / 21% ~2.5 years iƒ¼ Mean $3,171 $22.83 $6.04 74% / 26% ~5 – 6 years Median 829 13.78 4.50 79% / 21% ~4 years PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION 25

© Credit Suisse Group AG and/or its affiliates. rights Confidential Copyright © 2017 All reserved. N:\IBD_Regional_Documents_Repository_AM_Clients\NewStar Financial Inc(NGLD)\Spider\XPAT6\04. Presentations\12. Board Materials—Final Bid Summary (August 2017)\Osprey Board Materials_Aug 29 2017_vF.pptx Credit Suisse does not provide any tax advice. Any tax statement herein regarding any U.S. federal tax is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding any penalties. Any such statement herein was written to support the marketing or promotion of the transaction(s) or matter(s) to which the statement relates. Each taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor. These materials have been provided to you by Credit Suisse in connection with an actual or potential mandate or engagement and may not be used or relied upon for any purpose other than as specifically contemplated by a written agreement with Credit Suisse. In addition, these materials may not be disclosed, in whole or in part, or summarized or otherwise referred to except as agreed in writing by Credit Suisse. The information used in preparing these materials was obtained from or through you or your representatives or from public sources. Credit Suisse assumes no responsibility for independent verification of such information and has relied on such information being complete and accurate in all material respects. To the extent such information includes estimates and forecasts of future financial performance (including estimates of potential cost savings and synergies) prepared by or reviewed or discussed with the managements of your company and/or other potential transaction participants or obtained from public sources, we have assumed that such estimates and forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of such managements (or, with respect to estimates and forecasts obtained from public sources, represent reasonable estimates). These materials were designed for use by specific persons familiar with the business and the affairs of your company and Credit Suisse assumes no obligation to update or otherwise revise these materials. Nothing contained herein should be construed as tax, accounting or legal advice. You (and each of your employees, representatives or other agents) may disclose to any and all persons, without limitation of any kind, the tax treatment and tax structure of the transactions contemplated by these materials and all materials of any kind (including opinions or other tax analyses) that are provided to you relating to such tax treatment and structure. For this purpose, the tax treatment of a transaction is the purported or claimed U.S. federal income tax treatment of the transaction and the tax structure of a transaction is any fact that may be relevant to understanding the purported or claimed U.S. federal income tax treatment of the transaction. These materials have been prepared by Credit Suisse (“CS”) and its affiliates for use by CS. Accordingly, any information reflected or incorporated herein, or in related materials or in ensuing transactions, may be shared in good faith by CS and its affiliates with employees of CS, its affiliates and agents in any location. Credit Suisse has adopted policies and guidelines designed to preserve the independence of its research analysts. Credit Suisse’s policies prohibit employees from directly or indirectly offering a favorable research rating or specific price target, or offering to change a research rating or price target, as consideration for or an inducement to obtain business or other compensation. Credit Suisse’s policies prohibit research analysts from being compensated for their involvement in investment banking transactions. 26 CREDIT SUISSE SECURITIES (USA) LLC Eleven Madison Avenue New York, NY 10010-3629 +1 212 325 2000 www.credit-suisse.com PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION