UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

FOR ANNUAL AND TRANSITION REPORTS

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2006 or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 1-33007

SPECTRA ENERGY CORP

(Exact name of registrant as specified in its charter)

| | |

Delaware | | 20-5413139 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

5400 Westheimer Court, Houston, Texas | | 77056 |

(Address of principal executive offices) | | (Zip Code) |

713-627-5400

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

Common Stock, par value $0.001 | | New York Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes¨ Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yesx No¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer (as defined in Rule 12b-2 of the Securities Exchange Act of 1934).

Large accelerated filer¨ Accelerated filer¨ Non-accelerated filerx

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). Yes¨ Nox

Estimated aggregate market value of the common equity held by nonaffiliates of the registrant at March 28, 2007: $16,267,000,000. The Registrant had no outstanding common equity held by nonaffiliates at June 30, 2006.

Number of shares of Common Stock, $0.001 par value, outstanding at March 28, 2007: 631,465,000

SPECTRA ENERGY CORP

FORM 10-K FOR THE YEAR ENDED

DECEMBER 31, 2006

TABLE OF CONTENTS

2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This document includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are based on management’s beliefs and assumptions. These forward-looking statements are identified by terms and phrases such as “anticipate,” “believe,” “intend,” “estimate,” “expect,” “continue,��� “should,” “could,” “may,” “plan,” “project,” “predict,” “will,” “potential,” “forecast,” and similar expressions. Forward-looking statements involve risks and uncertainties that may cause actual results to be materially different from the results predicted. Factors that could cause actual results to differ materially from those indicated in any forward-looking statement include, but are not limited to:

| | • | | state, federal and foreign legislative and regulatory initiatives that affect cost and investment recovery, have an effect on rate structure, and affect the speed at and degree to which competition enters the natural gas industries; |

| | • | | the outcomes of litigation and regulatory investigations, proceedings or inquiries; |

| | • | | the weather and other natural phenomena, including the economic, operational and other effects of hurricanes and storms; |

| | • | | the timing and extent of changes in commodity prices, interest rates and foreign currency exchange rates; |

| | • | | general economic conditions, including any potential effects arising from terrorist attacks and any consequential hostilities or other hostilities; |

| | • | | changes in environmental, safety and other laws and regulations; |

| | • | | the results of financing efforts, including the ability to obtain financing on favorable terms, which can be affected by various factors, including credit ratings and general economic conditions; |

| | • | | declines is the market prices of equity securities and resulting funding requirements for defined benefit pension plans; |

| | • | | growth in opportunities, including the timing and success of efforts to develop domestic and international pipeline, storage, gathering, processing and other infrastructure projects and the effects of competition; |

| | • | | the performance of natural gas transmission and storage, distribution, and gathering and processing facilities; |

| | • | | the extent of success in connecting natural gas supplies to gathering, processing and transmission systems and in connecting to expanding gas markets; |

| | • | | the effect of accounting pronouncements issued periodically by accounting standard-setting bodies; |

| | • | | conditions of the capital markets and equity markets during the periods covered by the forward-looking statements; |

| | • | | the ability to successfully complete merger, acquisition or divestiture plans, regulatory or other limitations imposed as a result of a merger, acquisition or divestiture; and the success of the business following a merger, acquisition or divestiture; and |

| | • | | the ability to operate effectively as a stand-alone, publicly-traded company. |

In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than Spectra Energy Corp has described. Spectra Energy Corp undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

3

PART I

Item 1. Business.

General

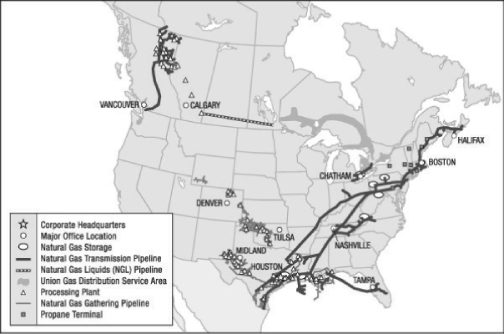

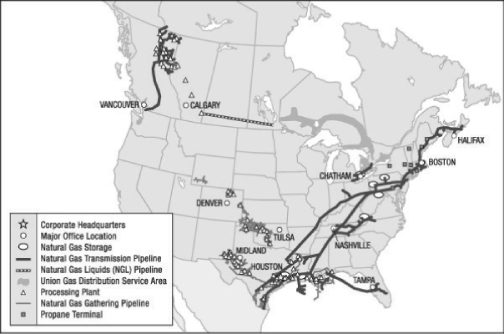

Spectra Energy Corp (Spectra Energy) owns and operates a large and diversified portfolio of complementary natural gas-related energy assets and is one of North America’s premier midstream natural gas companies. For close to a century, Spectra Energy and its predecessor companies have developed critically important pipelines and related energy infrastructure connecting natural gas supply sources to premium markets. Spectra Energy operates in three key areas of the natural gas industry: transmission and storage, distribution and gathering and processing. The midstream sector of the natural gas industry is the link between the production of natural gas and the delivery of its components to end-use markets, and consists of the transmission and storage and the gathering and processing areas of the industry. Based in Houston, Texas, Spectra Energy provides transportation and storage of natural gas to customers in various regions of the Eastern and Southeastern United States, the Maritimes Provinces and the Pacific Northwest in the United States and Canada and in the province of Ontario in Canada. It also provides natural gas sales and distribution service to retail customers in Ontario, and natural gas gathering and processing services to customers in Western Canada. Spectra Energy also has a 50% ownership in DCP Midstream, LLC, (DCP Midstream), formerly Duke Energy Field Services, LLC, one of the largest natural gas gatherers and processors in the United States. Spectra Energy’s operations are subject to various federal, state, provincial and local laws and regulations.

Spectra Energy’s pipeline systems consist of approximately 17,500 miles of transmission pipelines. The pipeline systems receive natural gas from major North American producing regions for delivery to markets primarily in the Mid-Atlantic, New England and Southeastern states, the Maritimes Provinces, Ontario, Alberta and the Pacific Northwest. For 2006, Spectra Energy’s proportional throughput for its pipelines totaled 3,248 trillion British thermal units (TBtu), compared to 3,410 TBtu in 2005. These amounts include throughput on wholly-owned U.S. and Canadian pipelines and Spectra Energy’s proportional share of throughput on pipelines that are not wholly-owned. Spectra Energy’s storage facilities provide approximately 265 Bcf of storage capacity in the United States and Canada.

DCP Midstream gathers, compresses, processes, transports, trades and markets, and stores natural gas. DCP Midstream also fractionates, transports, gathers, treats, processes, trades and markets, and stores natural gas liquids, or NGLs. DCP Midstream is 50% owned by ConocoPhillips and 50% owned by Spectra Energy. DCP Midstream gathers raw natural gas through gathering systems located in major natural gas producing regions: Permian Basin, Mid-Continent, East Texas-North Louisiana, Gulf Coast, South, Central and Rocky Mountain.

4

Recent Developments

Spin-off from Duke Energy

On January 2, 2007, Duke Energy Corporation (Duke Energy) completed the spin-off of its natural gas businesses, primarily comprised of the Natural Gas Transmission and Field Services business segments of Duke Energy that were owned through Duke Energy’s wholly-owned subsidiary, Duke Capital LLC (now Spectra Energy Capital, LLC). Spectra Energy Capital, LLC (Spectra Energy Capital) was contributed by Duke Energy to Spectra Energy and all of the outstanding common stock of Spectra Energy was distributed to the Duke Energy shareholders. The Duke Energy shareholders received one share of Spectra Energy common stock for every two shares of Duke Energy common stock, resulting in the issuance of approximately 631 million shares of Spectra Energy on January 2, 2007.

Prior to the distribution by Duke Energy, Spectra Energy Capital implemented an internal reorganization in which the operations and assets of Spectra Energy Capital that were not associated with the natural gas businesses, were contributed by Spectra Energy Capital to Duke Energy or its subsidiaries. The contribution to Duke Energy, made in December 2006, included the following operations:

| | • | | International Energy business segment; |

| | • | | Crescent Resources (a real estate business); |

| | • | | The remaining portion of Spectra Energy Capital’s business formerly known as Duke Energy North America (DENA), which included unregulated power plant development and operations, and the marketing and trading of various energy services and commodities; and |

| | • | | Other miscellaneous operations, such as a fiber optic communications network and a project development services partnership, that were not associated with the natural gas operations of Spectra Energy. |

Following this internal reorganization and the distribution by Duke Energy to Spectra Energy, Spectra Energy Capital is a direct, wholly-owned subsidiary of Spectra Energy. All of the operating assets, liabilities and operations of Spectra Energy are held by Spectra Energy Capital, except for employee benefit plan assets and liabilities that were contributed by Duke Energy directly to Spectra Energy in a separation transaction. As a result of these spin-off steps, Spectra Energy Capital is treated as the predecessor entity for financial statement purposes. Accordingly, this Form 10-K includes the audited consolidated financial statements of Spectra Energy Capital. References throughout this document to the Consolidated Financial Statements or notes thereto are referring to the statements of Spectra Energy Capital.

5

Businesses of Spectra Energy

As of December 31, 2006, Spectra Energy’s businesses were reported by Spectra Energy Capital primarily in its Natural Gas Transmission and Field Services segments. As a result of the reorganization and spin-off of Spectra Energy from Duke Energy on January 2, 2007, Spectra Energy now manages its business in four reportable segments: U.S. Transmission, Western Canada Transmission & Processing, Distribution and Field Services. The first three segments are primarily included in Spectra Energy Capital’s Natural Gas Transmission segment and DCP Midstream is reported in the Field Services segment of Spectra Energy Capital. The remainder of Spectra Energy’s business operations is expected to be presented as “Other,” and consists of unallocated corporate costs, a wholly-owned captive insurance subsidiary, employee benefit plan assets and liabilities and other miscellaneous businesses.

The following sections describe the business and operations of each of Spectra Energy’s businesses. (For more information on the operating outlook of Spectra Energy and its segments, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations, Introduction—Executive Overview and Economic Factors for Duke Energy’s Business.” For financial information on Spectra Energy Capital’s business segments, see Note 3 to the Consolidated Financial Statements, “Business Segments.”)

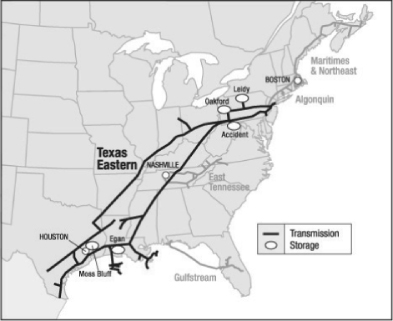

U.S. GAS TRANSMISSION

Spectra Energy’s U.S. Gas Transmission business provides transportation and storage of natural gas for customers in various regions of the Eastern and Southeastern United States and the Maritimes Provinces in the United States and Canada. Spectra Energy’s U.S. pipeline systems consist of more than 12,800 miles of transmission pipelines with five primary transmission systems: Texas Eastern Transmission, L.P. (Texas Eastern), Algonquin Gas Transmission, LLC (Algonquin), East Tennessee Natural Gas, LLC (East Tennessee), Maritimes & Northeast Pipeline, LLC and Maritimes & Northeast Pipeline, L.P. (collectively, Maritimes & Northeast Pipeline), and Gulfstream Natural Gas System, LLC (Gulfstream). These pipeline systems receive natural gas from major North American producing regions for delivery to markets. For 2006, U.S. gas transmission’s proportional throughput for its pipelines totaled 1,930 TBtu, compared to 1,953 TBtu in 2005. This includes throughput on wholly owned pipelines and its proportional share of throughput on pipelines that are not wholly owned. A majority of contracted transportation volumes are under long-term firm service agreements with local distribution company (LDC) customers in the pipelines’ market areas. Firm transportation services are also provided to gas marketers, producers, other pipelines, electric power generators and a variety of end-users, and both firm and interruptible transportation services are provided to various customers on a short-term or seasonal basis. In the course of providing transportation services, U.S. Gas Transmission also processes natural gas on its Texas Eastern system. Demand on the pipeline systems is seasonal, with the highest throughput occurring during colder periods in the first and fourth calendar quarters.

6

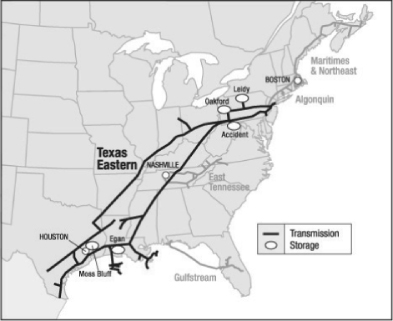

Texas Eastern

The Texas Eastern gas transmission system extends approximately 1,700 miles from producing fields in the Gulf Coast region of Texas and Louisiana to Ohio, Pennsylvania, New Jersey and New York. It consists of two parallel systems, one with three large-diameter parallel pipelines and the other with one to three large-diameter pipelines. Texas Eastern’s onshore system consists of approximately 8,600 miles of pipeline and 73 compressor stations (facilities that increase the pressure of gas to facilitate its pipeline transmission). Texas Eastern also owns and operates two offshore Louisiana pipeline systems, which extend approximately 100 miles into the Gulf of Mexico and include approximately 500 miles of Texas Eastern’s pipeline system and has an ownership interest in a processing plant in Southern Louisiana. Texas Eastern has two joint-venture storage facilities in Pennsylvania and one wholly-owned and operated storage field in Maryland. Texas Eastern’s total working capacity in these three fields is 75 billion cubic feet (Bcf). Texas Eastern is connected with two storage facilities through Market Hub Partners operations in Texas and Louisiana.

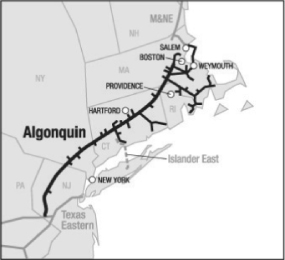

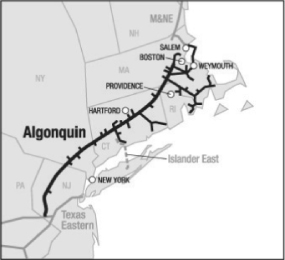

Algonquin

The Algonquin pipeline connects with Texas Eastern’s facilities in New Jersey, and extends approximately 250 miles through New Jersey, New York, Connecticut, Rhode Island and Massachusetts where it connects to the Maritimes & Northeast Pipeline. The system consists of approximately 1,100 miles of pipeline with six compressor stations.

7

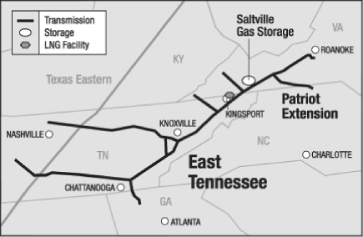

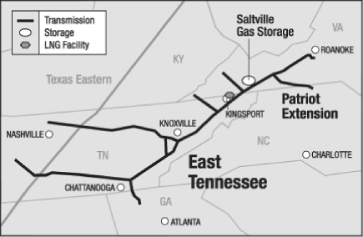

East Tennessee

East Tennessee’s transmission system crosses Texas Eastern’s system at two points in Tennessee and consists of two mainline systems totaling approximately 1,400 miles of pipeline in Tennessee, Georgia, North Carolina and Virginia, with 18 compressor stations. East Tennessee has a liquefied natural gas (LNG) storage facility in Tennessee with a total working capacity of 1.2 Bcf. East Tennessee also connects to Saltville Gas Storage Company L.L.C. (Saltville), a subsidiary of Spectra Energy, and other storage facilities in Virginia that have a working gas capacity of approximately 5 Bcf.

Maritimes & Northeast Pipeline

Maritimes & Northeast Pipeline transmission system is operated primarily through Spectra Energy’s 77.53% investments in Maritimes & Northeast Pipeline, LP and Maritimes & Northeast Pipeline, LLC. Maritimes & Northeast Pipeline transmission system extends approximately 900 miles from producing fields in Nova Scotia through New Brunswick, Maine, New Hampshire and Massachusetts, connecting to Algonquin in Beverly, Massachusetts. There are two compressor stations on the system.

8

Gulfstream

Spectra Energy also has a 50% investment in Gulfstream, a 691-mile interstate natural gas pipeline system owned and operated jointly by Spectra Energy and The Williams Companies, Inc. Gulfstream has a capacity to transport 1.1 Bcf/day from Mississippi and Alabama, crossing the Gulf of Mexico to markets in central and southern Florida. Gulfstream has one compressor station.

Storage Services

Spectra Energy, through its subsidiary Market Hub Partners (MHP), owns and operates two natural gas storage facilities, Moss Bluff and Egan, with a total storage capacity of approximately 35 Bcf. The Moss Bluff facility consists of three storage caverns located in Southeast Texas and has access to five pipeline systems including the Texas Eastern system. The Egan facility consists of three storage caverns located in South Central Louisiana and has access to eight pipeline systems including the Texas Eastern system. MHP markets natural gas storage services to pipelines, LDCs, producers, end users and natural gas marketers. Texas Eastern and East Tennessee also provide firm and interruptible open-access storage services. Storage is offered as a stand-alone unbundled service or as part of a no-notice bundled service with transportation. East Tennessee also connects to Saltville Gas Storage Company L.L.C., a subsidiary of Spectra Energy. These underground reservoir and salt cavern storage facilities are located in Virginia and provide storage services to customers in the Southeastern United States.

Customers and Contracts

In general, Spectra Energy’s U.S. pipelines provide transportation services to LDC’s, electric power generators, industrial and commercial customers, as well as energy marketers. Transportation and storage services are provided under firm agreements where customers reserve capacity in pipelines and storage facilities. The vast majority of these agreements provide for fixed reservation charges that are paid monthly regardless of actual volumes transported on Spectra Energy’s pipelines or injected or withdrawn from our storage by customers plus a small variable component that is based on volumes transported to recover variable costs.

Spectra Energy also provides interruptible transportation and storage service agreements where customers can use capacity if it is available at the time of the request and payments under these services are based on volumes transported or stored. These U.S. operations also provide a variety of other value-added services including natural gas parking, loaning and balancing services to meet customers’ needs. These services are provided in accordance with tariffs that govern the provision of services and are approved by the appropriate regulatory agency that has jurisdiction over those systems.

9

Competition

Spectra Energy’s U.S. transportation and storage businesses compete with similar facilities that serve its supply and market areas in the transportation and storage of natural gas. The principal elements of competition are rates, terms of service and flexibility and reliability of service.

The natural gas that Spectra Energy transports in its transmission business competes with other forms of energy available to its customers and end-users, including electricity, coal, propane and fuel oils. Several factors influence the demand for natural gas including price changes, the availability of natural gas and other forms of energy, the level of business activity, conservation, legislation, governmental regulations, the ability to convert to alternative fuels, weather and other factors.

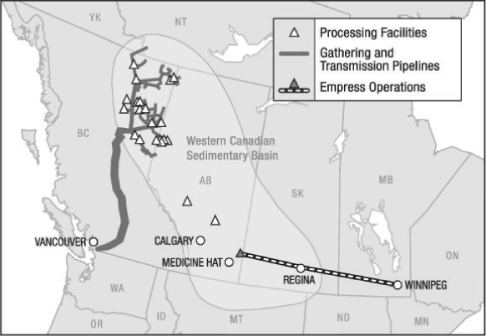

WESTERN CANADA TRANSMISSION & PROCESSING

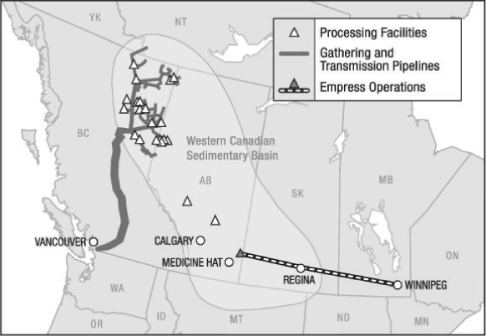

Spectra Energy’s Western Canada Transmission & Processing business is comprised of the BC Pipeline and Field Services operations, the Midstream operations and the NGL Marketing operations.

BC Pipeline and Field Services provide natural gas transportation and gas gathering and processing services. BC Pipeline is regulated by the National Energy Board (NEB) under full cost of service regulation, and transports processed natural gas from facilities primarily in northeast British Columbia (BC) to markets in the lower mainland of BC and the US Pacific Northwest. The BC Pipeline has approximately 1,800 miles of transmission pipeline in British Columbia and Alberta, as well as 18 mainline compressor stations. For 2006, throughput for the BC Pipeline totaled 579 TBtu, compared to 619 TBtu in 2005. Total transmission capacity is approximately 2.0 Bcf per day.

The BC Field Services business, which is regulated by the NEB under a “light-handed” regulatory model, consists of raw gas gathering pipelines and gas processing facilities, primarily in northeast BC. These facilities provide services to natural gas producers to remove impurities from the raw gas stream including water, carbon dioxide, hydrogen sulfide and other substances. Where required, these facilities also remove various NGLs for subsequent sale. The BC Field Services business includes five gas processing plants located in British Columbia, 22 field compressor stations, and more than 1,800 miles of gathering pipelines.

The Midstream business provides similar gas gathering and processing services in BC and Alberta through Spectra Energy’s 46% interest in Spectra Energy Income Fund (Income Fund), formerly Duke Energy Income Fund, a Canadian Income Trust. The Midstream business consists of 13 natural gas processing plants and approximately 1,000 miles of gathering pipelines. Total processing capacity is approximately 870 MMcf per day.

The Empress NGL Marketing business provides NGL extraction, fractionation, transportation, storage and marketing services to both western Canadian producers and NGL customers throughout Canada and the northern tier of the U.S. Assets include, among other things, a majority ownership interest in an NGL extraction plant, an integrated NGL fractionation facility, an NGL transmission pipeline, seven terminals along the pipeline, two NGL storage facilities, and an NGL marketing and gas supply business. Total processing capacity of the Empress system is approximately 2.4 Bcf of gas per day. The Empress system is located in Western and Central Canada.

10

Competition

Western Canada Transmission & Processing businesses compete with third-party midstream companies, exploration and production companies and pipelines in the transportation of natural gas. The Company competes directly with other pipeline facilities serving its market areas. The principal elements of competition are rates, terms of service, and flexibility and reliability of service. Customer demands for toll certainty and lower cost tailored services have promoted increased competition from other midstream service companies and producers. Spectra Energy believes it is able to offer a very competitive service offering along all of these dimensions due to its scale, geographical presence in important supply and market areas, financial stability and flexibility, and the strength of stakeholder relationships. Moreover, the presence of our existing pipeline assets, right of way, customer base and operations enables Spectra Energy to more quickly and cost effectively add capacity and service for customers in core markets. Spectra Energy’s reputation for customer service, project execution, stakeholder relations, reliability and predictable rates further enhance its competitive advantage. Taken as a whole, Spectra Energy believes its service offerings are among the most competitive in the sector.

Natural gas competes with other forms of energy available to our customers and end-users, including electricity, coal and fuel oils. The primary competitive factor is price. Changes in the availability or price of natural gas and other forms of energy, the level of business activity, conservation, legislation, governmental regulations, the ability to convert to alternative fuels, weather and other factors affect the demand for natural gas in the areas served by Spectra Energy.

Customers & Contracts

Spectra Energy’s BC Pipeline provides: (i) transportation services from the outlet of natural gas processing plants in Northeast BC to LDCs, end use industrial and commercial customers, and exploration and production companies requiring transportation services to the nearest liquid natural gas trading hub; and (ii) transportation services primarily to downstream markets in the Pacific Northwest (both United States and Canada.) Major customer segments include local distribution companies, electric power generators, exploration and production companies, gas marketers, and industrial and commercial end users.

The largest portion of Spectra Energy’s business in Western Canada is represented by the BC Field Services and Midstream operations providing raw natural gas gathering and processing services to exploration and production companies under firm agreements which are primarily fee for service contracts. These operations provide both firm and interruptible service. Although both operations gather and process raw natural gas from the Western Canadian Sedimentary basin, they are significantly different in size and infrastructure within their respective regions.

11

The NGLs extraction operation at Empress, Alberta produces approximately 50,000 barrels of NGLs per day comprised of approximately 50% ethane, 32% propane, 12% butanes and 6% condensate. All ethane is sold to Alberta-based petrochemical companies, the majority of propane is sold to propane wholesalers, butane is sold mainly into the motor gasoline refinery market, and condensate sales are directed to the crude blending market.

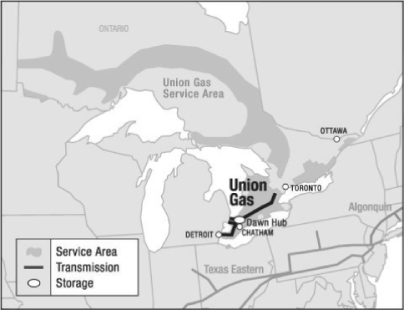

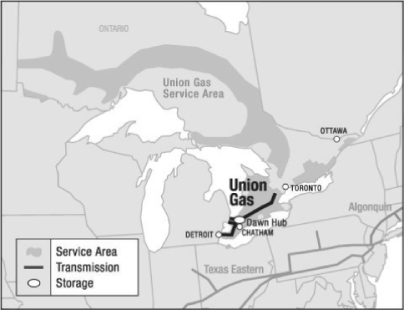

DISTRIBUTION

Spectra Energy provides retail distribution services in Canada through its subsidiary, Union Gas Limited (Union Gas). Union Gas owns primarily pipeline, storage and compression facilities used in the transportation, storage and distribution of natural gas. Union Gas’ system consists of approximately 22,000 miles of distribution pipelines. Union Gas’ underground natural gas storage facilities have a working capacity of approximately 150 Bcf in 20 underground facilities located in depleted gas fields. Its transmission system consists of approximately 3,000 miles of high-pressure transmission pipeline and six mainline compressor stations.

Union Gas distributes natural gas to approximately 1.3 million residential, commercial and industrial customers in Northern, Southwestern and Eastern Ontario and provides storage, transportation and related services to utilities and other industry participants in the gas markets of Ontario, Quebec and the Central and Eastern United States. Union Gas is regulated by the Ontario Energy Board (OEB) pursuant to the provisions of the Ontario Energy Board Act (1998) and is subject to regulation in a number of areas including rates.

Union Gas provides natural gas storage and transportation services for other utilities and energy market participants in Ontario, Quebec and the United States. Its storage and transmission system forms an important link in moving natural gas from Western Canadian and U.S. supply basins to Central Canadian and Northeastern U.S. markets. Transportation and storage customers are primarily Canadian natural gas transmission and distribution companies. A substantial amount of Union Gas’ annual transportation and storage revenue is generated by fixed demand charges under contracts with remaining terms of up to 11 years and an average outstanding term of 3.9 years.

Union Gas’ distribution services to power generation and industrial customers are affected by weather, economic conditions and the price of competitive energy sources. Most of Union Gas’ power generation, industrial and large commercial customers, and a portion of residential customers, purchase their natural gas directly from suppliers or marketers. Because Union Gas earns income from the distribution of natural gas and not the sale of the natural gas commodity, gas distribution margins are not affected by the source of customers’ gas supply.

12

Competition

Union Gas is a regulated entity and is not generally subject to third-party competition within its distribution franchise area, although a recent decision of the OEB has permitted physical bypass of Union Gas’ facilities even within its distribution franchise area. In addition, other companies could enter Union Gas’ markets or regulations could change.

Customers and Contracts

The rates that Union Gas charges for its regulated services are subject to the approval of the OEB. Union Gas’ distribution service area extends throughout Northern Ontario from the Manitoba border to the North Bay/Muskoka area, through Southern Ontario from Windsor to just west of Toronto, and across Eastern Ontario from Port Hope to Cornwall. Union Gas’ franchise area has a population of approximately four million people and a diversified commercial and industrial base.

Union Gas also provides natural gas storage and transportation services for other utilities and energy market participants in Ontario, Quebec and the United States. Transportation and storage customers include large Canadian natural gas transmission and distribution companies.

FIELD SERVICES

Field Services includes Spectra Energy’s investment in DCP Midstream. Field Services gathers, compresses, processes, transports, trades and markets, and stores natural gas. DCP Midstream also fractionates, transports, gathers, treats, processes, trades and markets, and stores NGLs. In July 2005, Spectra Energy Capital completed the disposition of its 19.7% interest in DCP Midstream, which resulted in Spectra Energy Capital and ConocoPhillips becoming equal 50% owners in DCP Midstream. Additionally, the disposition transaction included the acquisition of ConocoPhillips’ interest in the Empress System and the transfer of the Canadian Midstream operations of Field Services to Spectra Energy Capital. Subsequent to the closing of the DCP Midstream disposition transaction, effective July 1, 2005, DCP Midstream was no longer consolidated into Spectra Energy Capital’s consolidated financial statements and is accounted for as an equity method investment. The Canadian Midstream operations and the Empress System were transferred to Spectra Energy’s Western Canada Transmission & Processing segment. Additionally, in February 2005, DCP Midstream sold its wholly-owned subsidiary, Texas Eastern Products Pipeline Company, LLC, the general partner of TEPPCO Partners L.P., and Spectra Energy sold its limited partner interest in TEPPCO Partners L.P., in each case to the same unrelated third party.

In 2005, DCP Midstream formed DCP Midstream Partners, LP a master limited partnership. DCP Midstream Partners, LP (DCPLP) completed an initial public offering in December 2005. As a result, DCP Midstream has a 42% ownership interest in DCPLP, consisting of a 40% limited partner ownership interest and a 2% general partner ownership interest. DCP Midstream owns 100% of the general partner of DCPLP and, therefore, consolidates DCPLP in its financial statements.

DCP Midstream operates in 16 states in the United States (Alabama, Arkansas, Colorado, Kansas, Louisiana, Maine, Massachusetts, Mississippi, New Mexico, New York, Oklahoma, Pennsylvania, Texas, Rhode Island, Vermont and Wyoming). DCP Midstream’s gathering systems include connections to several interstate and intrastate natural gas and NGL pipeline systems and one natural gas storage facility. DCP Midstream gathers raw natural gas through gathering systems located in seven major natural gas producing regions: Permian Basin, Mid-Continent, East Texas-North Louisiana, Gulf Coast, South, Central, and Rocky Mountain. DCP Midstream owns or operates approximately 56,000 miles of gathering and transmission pipe, with approximately 34,000 active receipt points.

13

DCP Midstream’s natural gas processing operations separate raw natural gas that has been gathered on its own systems and third-party systems into condensate, NGLs and residue gas. DCP Midstream processes the raw natural gas at 53 natural gas processing facilities.

The NGLs separated from the raw natural gas are either sold and transported as NGL raw mix, or further separated through a fractionation process into their individual components (ethane, propane, butane, and natural gasoline) and then sold as components. DCP Midstream fractionates NGL raw mix at six processing facilities that it owns and operates and at four third-party-operated facilities in which it has an ownership interest. In addition, DCP Midstream operates a propane wholesale marketing business. DCP Midstream sells NGLs to a variety of customers ranging from large, multi-national petrochemical and refining companies to small, regional retail propane distributors. Substantially all of its NGL sales are at market-based prices.

The residue gas separated from the raw natural gas is sold at market-based prices to marketers and end-users, including large industrial customers and natural gas and electric utilities serving individual consumers. DCP Midstream markets residue gas directly or through its wholly-owned gas marketing company and its affiliates. DCP Midstream also stores residue gas at its 8 Bcf natural gas storage facility.

DCP Midstream uses NGL trading and storage at the Mont Belvieu, Texas and Conway, Kansas NGL market centers to manage its price risk and to provide additional services to its customers. Asset-based gas trading and marketing activities are supported by ownership of the Spindletop storage facility and various intrastate pipelines which provide access to market centers/hubs such as Katy, Texas, and the Houston Ship Channel. DCP Midstream undertakes these NGL and gas trading activities through the use of fixed forward sales, basis and spread trades, storage opportunities, put/call options, term contracts and spot market trading. DCP Midstream believes there are additional opportunities to grow its services with its customer base.

DCP Midstream’s operating results are significantly impacted by changes in average NGL and crude oil prices, which increased approximately 10% and 15%, respectively, in 2006 compared to 2005. DCP Midstream closely monitors the risks associated with these price changes. (See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Quantitative and Qualitative Disclosures About Market Risk” for a discussion of DCP Midstream’s exposure to changes in commodity prices.)

Competition

In gathering and processing natural gas and in marketing and transporting natural gas and NGLs, DCP Midstream competes with major integrated oil companies, major interstate and intrastate pipelines, national and local natural gas gatherers, and brokers, marketers and distributors of natural gas supplies. Competition for natural gas supplies is based primarily on the reputation, efficiency and reliability of operations, the availability of gathering and transportation to high-demand markets, the pricing arrangement offered by the gatherer/

14

processor and the ability of the gatherer/processor to obtain a satisfactory price for the producer’s residue gas and extracted NGLs. Competition for sales to customers is based primarily upon reliability, services offered, and price of delivered natural gas and NGLs.

Customers and Contracts

DCP Midstream sells NGLs to a variety of customers ranging from large, multi-national petrochemical and refining companies to small regional retail propane distributors. Substantially all of DCP Midstream’s NGL sales are made at market-based prices, including approximately 40% of its NGL production that is committed to ConocoPhillips and its affiliate, Chevron Phillips Chemical Company, LLC under existing contracts that have primary terms that expire on December 31, 2014. In 2006, ConocoPhillips and Chevron Phillips Chemical Company LLC, combined, represented approximately22% of DCP Midstream’s consolidated revenues.

The residual natural gas (primarily methane) that results from processing raw natural gas is sold at market-based prices to marketers and end-users. End-users include large industrial companies, natural gas distribution companies and electric utilities.

DCP Midstream purchases or takes custody of substantially all of its raw natural gas from producers, principally under the following types of contractual arrangements:

| | • | | Percentage-of-proceeds arrangements. In general, DCP Midstream purchases natural gas from producers, transports and processes it and then sells the residue natural gas and NGLs in the market. The payment to the producer is an agreed upon percentage of the proceeds from those sales. DCP Midstream’s revenues correlate directly with the price of natural gas and NGLs. |

| | • | | Fee-based arrangements. DCP Midstream receives a fee or fees for the various services it provides including gathering, compressing, treating, processing or transporting natural gas. The revenue DCP Midstream earns is directly related to the volume of natural gas that flows through its systems and is not directly dependent on commodity prices. |

| | • | | Keep-whole. DCP Midstream gathers raw natural gas from producers for processing and then markets the NGLs. DCP Midstream keeps the producer whole by returning an equivalent amount of natural gas after the processing is complete. DCP Midstream is exposed to the “frac spread” which is the value difference between the NGLs extracted and the natural gas returned to the producer. |

As defined by the terms of the above arrangements, DCP Midstream sells condensate, which is generally similar to crude oil and is produced in association with natural gas gathering and processing.

Supplies and Raw Materials

Spectra Energy purchases a variety of manufactured equipment and materials for use in operations and expansion projects. The primary equipment and materials utilized in operations and project execution processes are steel pipe, compression, valves, fittings and other consumables.

Spectra Energy operates a North American supply chain management network with employees dedicated to this function in the United States and Canada. The supply chain management group uses the scale of the Spectra Energy group to maximize the efficiency of supply networks where applicable.

The recovery in global economic growth, particularly in the North American energy sector, and rising international demand have led to increased demand levels and increased costs of steel used in certain of the manufactured equipment required by Spectra Energy’s operations. While some of these increases in price and supplier capacity will be offset through the use of strategic supplier contracts, Spectra Energy expects stable to rising prices and constant to extended lead times for many of these products in 2007 through 2009 compared to the previous three year period. The increasing costs and extended lead times are expected to primarily affect the expansion project execution process.

There can be no assurance that the ability to obtain sufficient equipment and materials will not be adversely affected by unforeseen developments. In addition, the price of equipment and materials may vary, perhaps substantially, from year to year.

15

Regulations

Most of Spectra Energy’s U.S. gas transmission pipeline and storage operations are regulated by the Federal Energy Regulatory Commission (FERC). The FERC regulates natural gas transportation in U.S. interstate commerce including the establishment of rates for services. The FERC also regulates the construction of U.S. interstate pipelines and storage facilities including extension, enlargement or abandonment of such facilities. In addition, certain operations are subject to oversight by state regulatory commissions.

FERC regulations restrict U.S. interstate pipelines from sharing transmission or customer information with energy affiliates and require that U.S. interstate pipelines function independently of their energy affiliates.

The FERC may propose and implement new rules and regulations affecting interstate natural gas transmission companies, which remain subject to the FERC’s jurisdiction. These initiatives may also affect certain transportation of gas by intrastate pipelines.

Spectra Energy’s U.S. gas transmission operations are subject to the jurisdiction of the Environmental Protection Agency (EPA) and state and local environmental agencies. For a discussion of environmental regulation, please see the section entitled “Environmental Matters.” Spectra Energy’s U.S. interstate natural gas pipelines are also subject to the regulations of the Department of Transportation (DOT) concerning pipeline safety.

The natural gas transmission, storage and distribution operations in Canada are subject to regulation by the NEB and provincial agencies in Canada, such as the OEB. These agencies have jurisdiction similar to the FERC for regulating rates, regulating the operations of facilities and construction of any additional facilities. Spectra Energy’s BC Field Services business in Western Canada is regulated by the NEB pursuant to a framework for light-handed regulation under which the NEB acts on a complaints basis for rates associated with that business. Similarly, the rates charged by our midstream operations for gathering and processing services in Western Canada are regulated on a complaints basis by applicable provincial regulators. The Empress NGL businesses are not under any form of rate regulation.

The intrastate natural gas and NGL pipelines owned by DCP Midstream are subject to state regulation. To the extent that the natural gas intrastate pipelines provide services under Section 311 of the Natural Gas Policy Act of 1978, they are also subject to FERC regulation. The interstate natural gas pipeline owned and operated by DCP Midstream is subject to FERC regulation, but its natural gas gathering and processing activities are not subject to FERC regulation.

DCP Midstream is subject to the jurisdiction of the EPA and state and local environmental agencies. For more information, see “Environmental Matters.” DCP Midstream’s natural gas transmission pipelines and some gathering pipelines are also subject to the regulations of the DOT, and in some cases, state agencies, concerning pipeline safety.

Environmental Matters

Spectra Energy is subject to federal, state, provincial and local laws and regulations with regard to air and water quality, hazardous and solid waste disposal and other environmental matters. These regulations often impose substantial testing and certification requirements.

Environmental laws and regulations affecting Spectra Energy include, but are not limited to:

| | • | | The Clean Air Act, or CAA, and the 1990 amendments to the CAA, as well as state laws and regulations affecting air emissions (including State Implementation Plans related to existing and new national ambient air quality standards), which may limit new sources of air emissions. Spectra Energy’s natural gas processing, transmission, and storage assets are considered sources of air emissions, and thus are subject to the CAA. Owners and/or operators of air emission sources, such as Spectra Energy, are responsible for obtaining permits for existing and new sources of air emissions, and for annual compliance and reporting. |

16

| | • | | The Federal Water Pollution Control Act, which requires permits for facilities that discharge wastewaters into the environment. The Oil Pollution Act (OPA), was enacted in 1990 and amends parts of the Clean Water Act and other statutes as they pertain to the prevention of and response to oil spills. OPA imposes certain spill prevention, control and countermeasure requirements. Although Spectra Energy is primarily a natural gas business, OPA affects its business primarily because of the presence of liquid hydrocarbons (condensate) in its offshore pipelines. |

| | • | | The Comprehensive Environmental Response, Compensation and Liability Act, or CERCLA, which imposes liability for remediation costs associated with environmentally contaminated sites. Under CERCLA, any individual or entity that currently owns or in the past owned or operated a disposal site can be held liable and required to share in remediation costs, as well as transporters or generators of hazardous substances sent to a disposal site. Because of the geographical extent of its operations, Spectra Energy has disposed of waste at many different sites. |

| | • | | The Solid Waste Disposal Act, as amended by the Resource Conservation and Recovery Act, which requires certain solid wastes, including hazardous wastes, to be managed pursuant to a comprehensive regulatory regime. As part of its business, Spectra Energy generates solid waste within the scope of these regulations and therefore must comply with such regulations. |

| | • | | The Toxic Substances Control Act, which requires that polychlorinated biphenyl (PCB) contaminated materials be managed in accordance with a comprehensive regulatory regime. Because of the historic use of lubricating oils containing PCBs, the internal surfaces of some of Spectra Energy’s pipeline systems are contaminated with PCBs and liquids and other materials removed from these pipelines must be managed in compliance with such regulations. |

| | • | | The National Environmental Policy Act, which requires federal agencies to consider potential environmental impacts in their decisions, including siting approvals. Many of Spectra Energy’s projects require federal agency review, and therefore the environmental effect of proposed projects is a factor in determining whether Spectra Energy will be permitted to complete proposed projects. |

| | • | | The Fisheries Act (Canada), which regulates activities near any body of water in Canada. |

| | • | | The Environmental Management Act (British Columbia); The Environmental Protection and Enhancement Act (Alberta); and The Environmental Protection Act (Ontario), are each provincial laws governing various aspects, including permitting and site remediation obligations, of Spectra Energy’s facilities and operations in those provinces. |

(For more information on environmental matters involving Spectra Energy, including possible liability and capital costs, see Notes4 and16 to the Consolidated Financial Statements, “Regulatory Matters,” and “Commitments and Contingencies—Environmental,” respectively.)

Except to the extent discussed in Note4 to the Consolidated Financial Statements, “Regulatory Matters,” and Note16 to the Consolidated Financial Statements, “Commitments and Contingencies—Environmental Matters,” compliance with federal, state, provincial and local provisions regulating the discharge of materials into the environment, or otherwise protecting the environment, is incorporated into the routine cost structure of Spectra Energy’s various business units and is not expected to have a material adverse effect on the competitive position, consolidated results of operations, cash flows or financial position of Spectra Energy.

Geographic Regions

For a discussion of Spectra Energy’s foreign operations and the risks associated with them, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations, Quantitative and Qualitative Disclosures About Market Risk—Foreign Currency Risk,” and Notes 3 and 7 to the Consolidated Financial Statements, “Business Segments” and “Risk Management and Hedging Activities, Credit Risk, and Financial Instruments,” respectively.

Employees

Spectra Energy had approximately 4,950 employees as of December 31, 2006, including approximately3,250 employees outside of the United States, all in Canada. In addition, DCP Midstream, Spectra Energy’s joint venture with ConocoPhillips, employed approximately 2,300 employees as of such date. Approximately1,500 of Spectra Energy’s employees, all of whom are located in Canada, are subject to collective bargaining agreements governing their employment with Spectra Energy. Spectra Energy reached agreements with all bargaining units with agreements subject to renewal in 2006.

17

Additional Information

Spectra Energy was incorporated on July 28, 2006 as a Delaware corporation. Its principal executive offices are located at 5400 Westheimer Court, Houston, Texas 77056 and its telephone number is 713-627-5400. Spectra Energy electronically files reports with the Securities and Exchange Commission (SEC), including annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxies and amendments to such reports. The public may read and copy any materials that Spectra Energy files with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov. Additionally, information about Spectra Energy, including its reports filed with the SEC, is available through Spectra Energy’s web site at http://www.spectraenergy.com. Such reports are accessible at no charge through Spectra Energy’s web site and are made available as soon as reasonably practicable after such material is filed with or furnished to the SEC. Spectra Energy’s website and the information contained on that site, or connected to that site, are not incorporated by reference into this report.

Glossary

Terms used to describe Spectra Energy’s business are defined below.

Accrual Model of Accounting (Accrual Model). An accounting term used by Spectra Energy Capital to refer to contracts for which there is generally no recognition in the Consolidated Statements of Operations for any changes in fair value until the service is provided or the associated delivery period occurs or there is hedge ineffectiveness. As discussed further in Note 1 to the Consolidated Financial Statements, “Summary of Significant Accounting Policies,” this term is applied to derivative contracts that are accounted for as cash flow hedges, fair value hedges, and normal purchases or sales, as well as to non-derivative contracts used for commodity risk management purposes. As this term is not explicitly defined within U.S. Generally Accepted Accounting Principles (GAAP), Spectra Energy Capital’s application of this term could differ from that of other companies.

Allowance for Funds Used During Construction (AFUDC). An accounting convention of regulators that represents the estimated composite interest costs of debt and a return on equity funds used to finance construction. The allowance is capitalized in the property accounts and included in income.

British Thermal Unit (Btu). A standard unit for measuring thermal energy or heat commonly used as a gauge for the energy content of natural gas and other fuels.

Cubic Foot (cf). The most common unit of measurement of gas volume; the amount of natural gas required to fill a volume of one cubic foot under stated conditions of temperature, pressure and water vapor.

Derivative. A financial instrument or contract in which its price is based on the value of underlying securities, equity indices, debt instruments, commodities or other benchmarks or variables. Often used to hedge risk, derivatives involve the trading of rights or obligations, but not the direct transfer of property. Gains or losses on derivatives are often settled on a net basis.

Distribution. The system of lines, transformers, switches and mains that connect natural gas transmission systems to customers.

Energy Marketing. Identification and execution of physical energy related transactions, generally with customized provisions to meet the needs of the customer or supplier, throughout the supply chain.

Environmental Protection Agency (EPA). The U.S. agency that is responsible for researching and setting national standards for a variety of environmental programs, and delegates to states the responsibility for issuing permits and for monitoring and enforcing compliance.

Federal Energy Regulatory Commission (FERC). The U.S. agency that regulates the transportation of electricity and natural gas in interstate commerce and authorizes the buying and selling of energy commodities at market-based rates.

Forward Contract. A contract in which the buyer is obligated to take delivery, and the seller is obligated to deliver a specified amount of a commodity with a predetermined price formula on a specified future date, at which time payment is due in full.

Fractionation/Fractionate. The process of separating liquid hydrocarbons from natural gas into propane, butane, ethane and other related products.

18

Futures Contract. A contract, usually exchange traded, in which the buyer is obligated to take delivery and the seller is obligated to deliver a fixed amount of a commodity at a predetermined price on a specified future date.

Gathering System. Pipeline, processing and related facilities that access production and other sources of natural gas supplies for delivery to mainline transmission systems.

Liquefied Natural Gas (LNG). Natural gas that has been converted to a liquid by cooling it to minus 260 degrees Fahrenheit.

Liquidity. The ease with which assets or products can be traded without dramatically altering the current market price.

Local Distribution Company (LDC). A company that obtains the major portion of its revenues from the operations of a retail distribution system for the delivery of gas for ultimate consumption.

Mark-to-Market Model of Accounting (MTM Model). An accounting term used by Spectra Energy Capital to refer to derivative contracts for which an asset or liability is recognized at fair value and the change in the fair value of that asset or liability is recognized in the Consolidated Statements of Operations. As discussed further in Note 1 to the Consolidated Financial Statements, “Summary of Significant Accounting Policies,” this term is applied to trading and undesignated non-trading derivative contracts. As this term is not explicitly defined within U.S. GAAP, Spectra Energy Capital’s application of this term could differ from that of other companies.

Natural Gas. A naturally occurring mixture of hydrocarbon and non-hydrocarbon gases found in porous geological formations beneath the earth’s surface, often in association with petroleum. The principal constituent is methane.

Natural Gas Liquids (NGLs). Liquid hydrocarbons extracted during the processing of natural gas. Principal commercial NGLs include butanes, propane, natural gasoline and ethane.

No-notice Bundled Service. A pipeline delivery service which allows customers to receive or deliver gas on demand without making prior nominations to meet service needs and without paying daily balancing and scheduling penalties.

Origination. Identification and execution of physical energy related transactions, generally with customized provisions to meet the needs of the customer or supplier, throughout the supply chain.

Option. A contract that gives the buyer a right but not the obligation to purchase or sell an underlying asset at a specified price at a specified time.

Portfolio. A collection of assets, liabilities, transactions or trades.

Residue Gas. Gas remaining after the processing of natural gas.

Swap. A contract to exchange cash flows in the future according to a prearranged formula.

Throughput. The amount of natural gas or NGLs transported through a pipeline system.

Transmission System. An interconnected group of natural gas pipelines and associated facilities for transporting natural gas in bulk between points of supply and delivery points to industrial customers, LDCs, or for delivery to other natural gas transmission systems.

Volatility. An annualized measure of the fluctuation in the price of an energy contract.

19

Executive Officers

The following table sets forth information regarding Spectra Energy’s executive officers. Each of the individuals set forth below assumed their current position immediately before Spectra Energy’s listing on the New York Stock Exchange.

| | | | | | |

Name | | | | Age | | Position |

| | | |

Fred J. Fowler | | | | 61 | | President and Chief Executive Officer, Director |

Martha B. Wyrsch | | | | 49 | | President and Chief Executive Officer – Spectra Energy Transmission, Director |

Gregory L. Ebel | | | | 42 | | Group Executive and Chief Financial Officer |

William S. Garner, Jr. | | | | 57 | | Group Executive, General Counsel and Secretary |

Alan N. Harris | | | | 53 | | Group Executive and Chief Development Officer |

Keith A. Crane | | | | 42 | | Vice President and Treasurer |

Sabra L. Harrington | | | | 44 | | Vice President and Controller |

Fred J. Fowler served as Group Executive and President of Duke Energy Gas from April 2006 until assuming his current position. Prior to then, Mr. Fowler served as President and Chief Operating Officer of Duke Energy Corporation from November 2002 until April 2006. Mr. Fowler served as Group Vice President of PanEnergy from 1996 until the PanEnergy merger in 1997, when he was named Group Vice President, Energy Transmission.

Martha B. Wyrsch served as President of Duke Energy Gas Transmission from March 2005 until assuming her current position. Ms. Wyrsch served as Group Vice President and General Counsel of Duke Energy Corporation from January 2004 until March 2005. Prior to then, Ms. Wyrsch served as Senior Vice President, Legal Affairs for Duke Energy Corporation from February 2003 until January 2004; Senior Vice President, Legal Affairs for Duke Energy Business Services from January 2003 until February 2003 and Senior Vice President and General Counsel of Duke Energy Field Services from February 2001 until January 2003.

Gregory L. Ebel served as President of Union Gas from January 2005 until assuming his current position. Prior to then, Mr. Ebel served as Vice President, Investor & Shareholder Relations of Duke Energy Corporation from November 2002 until January 2005. Mr. Ebel joined Duke Energy as Managing Director of Mergers and Acquisitions in connection with the company’s acquisition of Westcoast Energy. He served in that position from March 2002 until November 2002. At Westcoast Energy, Mr. Ebel served as Vice President of Strategic Development from March 1999 until March 2002.

William S. Garner, Jr. served as Group Vice President, Corporate Development of Duke Energy Gas Transmission from March 2006 until assuming his current position. Prior to joining Duke Energy, Mr. Garner served as managing director at Petrie Parkman & Co., a company which provides investment banking and advisory services to the energy industry and institutional investors. He served in this position from March 2000 until March 2006.

Alan N. Harris served as Group Vice President and Chief Financial Officer of Duke Energy Gas Transmission from February 2004 until assuming his current position. Prior to then, Mr. Harris served as Executive Vice President of Duke Energy Gas Transmission from January 2003 until February 2004; Senior Vice President, Strategic Development & Planning from March 2002 until January 2003 and Vice President, Controller & Strategic Planning from April 1999 until March 2002.

Keith A. Crane was hired in October 2006 by Duke Energy Gas Transmission to become Vice President and Treasurer of Spectra Energy in connection with the spin off. Prior to joining Duke Energy, Mr. Crane was an independent financial consultant from June 2005 to October 2006; from January 2005 to June 2005, he was engaged in charitable work for the Houston Heights Association, a historic neighborhood preservation organization. From March 2003 until January 2005 he was treasurer for Entergy-Koch, LP a private energy trading and gas transportation company and parent of Entergy-Koch Trading, LP and from August 2001 to March 2003 he was Treasurer of both Entergy-Koch, LP and Entergy-Koch Trading, LP.

20

Sabra L. Harrington served as Vice President, Financial Strategy of Duke Energy Gas Transmission from February 2006 until assuming her current position. Prior to then, Ms. Harrington served as Vice President and Controller of Duke Energy Gas Transmission from August 2003 until February 2006. From March 2002 until August 2003, Ms. Harrington served as Controller of Duke Energy Gas Transmission and from April 1999 until March 2002, she served as Director, Gas Accounting, Forecasts, Budgets and Reporting.

Item 1A. Risk Factors.

The risk factors discussed herein relate specifically to risks associated with Spectra Energy subsequent to its spin-off from Duke Energy in January 2007. Accordingly, risks associated with operations that were distributed to Duke Energy on December 30, 2006 are not discussed in this section.

Reductions in demand for natural gas, or low levels in the market prices of commodities affects Spectra Energy’s operations and cash flows.

Declines in demand for natural gas as a result of economic downturns in Spectra Energy’s franchised gas service territory may reduce overall gas deliveries and reduce Spectra Energy’s cash flows, especially if its industrial customers reduce production and, therefore, consumption of gas. Spectra Energy’s gas gathering and processing businesses may experience a decline in the volume of natural gas gathered and processed at their plants, resulting in lower revenues and cash flows, as lower economic output reduces energy demand.

Lower demand for natural gas and lower prices for natural gas and natural gas liquids result from multiple factors that affect the markets where Spectra Energy transports, stores, distributes, gathers, and processes natural gas including:

| | • | | weather conditions, including abnormally mild winter or summer weather that cause lower energy usage for heating or cooling purposes, respectively; |

| | • | | supply of and demand for energy commodities, including any decreases in the production of natural gas which could negatively affect Spectra Energy’s processing business due to lower throughput; |

| | • | | capacity and transmission service into, or out of, Spectra Energy’s markets; and |

| | • | | petrochemical demand for natural gas liquids. |

The lack of availability of natural gas resources may cause customers to contract with alternative suppliers, which could materially adversely affect Spectra Energy’s sales, earnings, and cash flows.

Spectra Energy’s natural gas businesses are dependent on the continued availability of natural gas production and reserves. Prices for natural gas, regulatory limitations, or a shift in supply sources due to importing of foreign liquefied natural gas could adversely affect development of additional reserves and production that is accessible by Spectra Energy’s pipeline, gathering, processing and distribution assets. Lack of commercial quantities of natural gas available to these assets will cause customers to contract with alternative suppliers, thereby reducing their reliance on Spectra Energy’s services, which in turn would materially adversely affect Spectra Energy’s sales, earnings and cash flows.

Investments and projects located in Canada expose Spectra Energy to fluctuations in currency rates that may adversely affect cash flows and results of operations.

Spectra Energy is exposed to foreign currency risk from investments and operations in Canada. As of December 31, 2006, a 10% devaluation in the currency exchange rate of the Canadian dollar would result in an estimated net loss on the translation of Canadian currency earnings of approximately $25 million. The balance sheet would be negatively affected by approximately $460 million currency translation through the cumulative translation adjustment in accumulated other comprehensive income.

Natural gas gathering and processing operations are subject to commodity price risk which could result in economic losses in earnings and cash flows.

Spectra Energy has gathering and processing operations that consist of contracts to buy and sell commodities, including contracts for natural gas, natural gas liquids and other commodities that are settled by the

21

delivery of the commodity or cash. Spectra Energy’s major commodity market risk is natural gas liquids prices, due primarily to its investment in DCP Midstream. Natural gas liquids prices historically track oil prices. At historical natural gas liquid-to-oil prices, a $1 per barrel move in oil prices would affect Spectra Energy’s pre-tax earnings from DCP Midstream by approximately $15 million.

With respect to the Empress system, a $1 change in the difference between the Btu-equivalent price of propane (used as a proxy for Empress’ NGL production) and the price of natural gas in Alberta, Canada (which represents theoretical gross margin for processing liquids from the gas and is commonly called the frac-spread) would affect Spectra Energy’s pre-tax earnings by approximately $25 million.

If prices of commodities significantly deviate from historical prices, if the price volatility or distribution of those changes deviates from historical norms, or if the correlation between natural gas liquids and oil prices deviates from historical norms, Spectra Energy’s approach to price risk management may not protect it from significant losses. In addition, adverse changes in energy prices may result in economic losses in earnings, cash flows and the balance sheet.

Spectra Energy’s business is subject to extensive regulation that affects operations and costs.

Spectra Energy’s U.S. assets and operations are subject to regulation by federal, state and local authorities, including regulation by the Federal Energy Regulatory Commission and by various authorities under federal, state and local environmental laws. The majority of Spectra Energy’s Canadian natural gas assets are subject to federal and provincial regulation including the National Energy Board and the Ontario Energy Board and likewise by federal and provincial environmental laws. Regulation affects almost every aspect of Spectra Energy’s business, including, among other things, the ability to determine terms and rates for services provided by some of its businesses; make acquisitions, issue equity or debt securities; and pay dividends.

In addition, regulators have taken actions to strengthen market forces in the gas pipeline industry, which have led to increased competition. In a number of key markets, interstate pipelines are facing competitive pressure from a number of new industry participants, such as alternative suppliers as well as traditional pipeline competitors. Increased competition driven by regulatory changes could have a material impact on Spectra Energy’s business, financial condition and operating results.

Transmission and storage, distribution, and gathering and processing activities involve numerous risks that may result in accidents or otherwise affect operations.

There are a variety of hazards and operating risks inherent in natural gas transmission and storage, distribution, and gathering and processing activities, such as leaks, explosions and mechanical problems that could cause substantial financial losses. In addition, these risks could result in loss of human life, significant damage to property, environmental pollution, and impairment of operations, any of which could result in substantial losses to Spectra Energy. For pipeline and storage assets located near populated areas, including residential areas, commercial business centers, industrial sites and other public gathering areas, the level of damage resulting from these risks could be greater. Spectra Energy does not maintain insurance coverage against all of these risks and losses, and any insurance coverage it might maintain may not fully cover the damages caused by those risks and losses for which it does maintain insurance. Therefore, should any of these risks materialize, it could have a material adverse effect on Spectra Energy’s business, financial condition and results of operations.

Spectra Energy is subject to numerous environmental laws and regulations, compliance with which requires significant capital expenditures, can increase cost of operations, and may affect or limit business plans, or expose Spectra Energy to environmental liabilities.

Spectra Energy is subject to numerous environmental laws and regulations affecting many aspects of its present and future operations, including air emissions, water quality, wastewater discharges, solid waste and hazardous waste. These laws and regulations can result in increased capital, operating, and other costs. These laws and regulations generally require Spectra Energy to obtain and comply with a wide variety of environmental licenses, permits, inspections and other approvals. Compliance with environmental laws and regulations can

22

require significant expenditures, including expenditures for clean up costs and damages arising out of contaminated properties, and failure to comply with environmental regulations may result in the imposition of fines, penalties and injunctive measures affecting operating assets. Spectra Energy may not be able to obtain or maintain from time to time all required environmental regulatory approvals for its operating assets or development projects. If there is a delay in obtaining any required environmental regulatory approvals, if Spectra Energy fails to obtain and comply with them or if environmental laws or regulations change and become more stringent, the operation of facilities or the development of new facilities could be prevented, delayed or become subject to additional costs. No assurance can be made that the costs that will be incurred to comply with environmental regulations in the future will not have a material effect.

Spectra Energy’s Canadian businesses may be subject to the Kyoto Protocol. If Canada does implement a program to reduce greenhouse gas emissions, Spectra Energy may be obligated to reduce emissions and/or purchase emission credits. Due to the substantial uncertainty regarding what plan, if any, Canada will implement and whether this plan will apply to Spectra Energy’s facilities, Spectra Energy cannot estimate the potential effect of greenhouse gas regulation in Canada on business, financial condition, or results of operations.

Spectra Energy is involved in numerous legal proceedings, the outcome of which are uncertain, and resolution adverse to Spectra Energy could negatively affect cash flows, financial condition or results of operations.

Spectra Energy is subject to numerous legal proceedings. Litigation is subject to many uncertainties, and Spectra Energy cannot predict the outcome of individual matters with assurance. It is reasonably possible that the final resolution of some of the matters in which Spectra Energy is involved could require additional expenditures, in excess of established reserves, over an extended period of time and in a range of amounts that could have a material effect on cash flows and results of operations.

Spectra Energy relies on access to short-term money markets and longer-term capital markets to finance capital requirements and support liquidity needs, and access to those markets can be adversely affected, which could adversely affect cash flows or restrict businesses.

Spectra Energy’s business is financed to a large degree through debt. The maturity and repayment profile of debt used to finance investments often does not correlate to cash flows from assets. Accordingly, Spectra Energy relies on access to both short-term money markets and longer-term capital markets as a source of liquidity for capital requirements not satisfied by the cash flow from operations and to fund investments originally financed through debt. If Spectra Energy is not able to access capital at competitive rates, its ability to finance operations and implement its strategy may be adversely affected. Restrictions on Spectra Energy’s ability to access financial markets may also affect its ability to execute its business plan as scheduled. An inability to access capital may limit Spectra Energy’s ability to pursue improvements or acquisitions that it may otherwise rely on for future growth.

Spectra Energy maintains revolving credit facilities to provide back-up for commercial paper programs and/or letters of credit at various entities. These facilities typically include financial covenants which limit the amount of debt that can be outstanding as a percentage of the total capital for the specific entity. Failure to maintain these covenants at a particular entity could preclude that entity from issuing commercial paper or letters of credit or borrowing under the revolving credit facility and could require other affiliates to immediately pay down any outstanding drawn amounts under other revolving credit agreements which could adversely affect cash flow or restrict businesses.

Spectra Energy may be unable to secure long-term transportation agreements, which could expose transportation volumes and revenues to increased volatility.

In the future, Spectra Energy may be unable to secure long-term transportation agreements for its gas transmission business as a result of economic factors, lack of commercial gas supply to its systems, increased competition, or changes in regulation. Without long-term transportation agreements, Spectra Energy’s revenues and contract volumes will be exposed to increased volatility and Spectra Energy cannot provide assurance that its pipelines will be utilized at similar levels or operate profitably. The inability to secure these agreements would materially adversely affect business, financial condition or results of operations.

23

Native land claims have been asserted in British Columbia and Alberta which could affect future access to public lands, the success of which claims could have a significant adverse affect on Spectra Energy’s natural gas production and processing.

Certain aboriginal groups have claimed aboriginal and treaty rights over a substantial portion of public lands on which Spectra Energy’s facilities in British Columbia and Alberta, and the gas supply areas served by those facilities, are located. The existence of these claims, which range from the assertion of rights of limited use to aboriginal title, has given rise to some uncertainty regarding access to public lands for future development purposes. Such claims, if successful, could have a significant adverse effect on natural gas production in British Columbia and Alberta which could have a material adverse effect on the volume of natural gas processed at Spectra Energy’s facilities and of natural gas liquids and other products transported in the associated pipelines. Spectra Energy cannot predict the outcome of these claims or the impact they may ultimately have on business and operations.

If Spectra Energy or its rated subsidiaries are unable to maintain an investment grade credit rating, liquidity may be adversely affected and the cost of borrowing may increase. Spectra Energy cannot be sure that Spectra Energy or its rated subsidiaries will obtain or maintain investment grade credit ratings.

Spectra Energy’s senior unsecured long-term debt is currently rated investment grade by various rating agencies. If the rating agencies were to rate Spectra Energy or its rated subsidiaries below investment grade, such entity’s borrowing costs would increase, perhaps significantly. In addition, the entity would likely be required to pay a higher interest rate in future financings, and its potential pool of investors and funding sources would likely decrease. Furthermore, if Spectra Energy’s short-term debt rating were to be below tier 2 (e.g. A-2/P-2, S&P and Moody’s respectively), access to the commercial paper market could be significantly limited. There are requirements for Spectra Energy to post collateral or a letter of credit if its S&P credit rating falls below BBB—. Any downgrade or other event negatively affecting the credit ratings of Spectra Energy’s subsidiaries could make their costs of borrowing higher or access to funding sources more limited, which in turn could increase Spectra Energy’s need to provide liquidity in the form of capital contributions or loans to such subsidiaries, thus reducing the liquidity and borrowing availability of the consolidated group.