UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2008 or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-33007

SPECTRA ENERGY CORP

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 20-5413139 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

| 5400 Westheimer Court, Houston, Texas | | 77056 |

| (Address of principal executive offices) | | (Zip Code) |

713-627-5400

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

| Title of Each Class | | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.001 | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yesx No¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes¨ Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yesx No¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

Large accelerated filer x | | Accelerated filer¨ | | Non-accelerated filer ¨ | | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes¨ Nox

Estimated aggregate market value of the common equity held by nonaffiliates of the registrant June 30, 2008: $17,300,000,000

Number of shares of Common Stock, $0.001 par value, outstanding at February 19, 2009: 643,339,758

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the proxy statement for the 2009 Annual Meeting of Shareholders are incorporated by reference in Part III.

SPECTRA ENERGY CORP

FORM 10-K FOR THE YEAR ENDED

DECEMBER 31, 2008

TABLE OF CONTENTS

2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This document includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are based on management’s beliefs and assumptions. These forward-looking statements are identified by terms and phrases such as: anticipate, believe, intend, estimate, expect, continue, should, could, may, plan, project, predict, will, potential, forecast, and similar expressions. Forward-looking statements involve risks and uncertainties that may cause actual results to be materially different from the results predicted. Factors that could cause actual results to differ materially from those indicated in any forward-looking statement include, but are not limited to:

| | • | | state, federal and foreign legislative and regulatory initiatives that affect cost and investment recovery, have an effect on rate structure, and affect the speed at and degree to which competition enters the natural gas industries; |

| | • | | outcomes of litigation and regulatory investigations, proceedings or inquiries; |

| | • | | weather and other natural phenomena, including the economic, operational and other effects of hurricanes and storms; |

| | • | | the timing and extent of changes in commodity prices, interest rates and foreign currency exchange rates; |

| | • | | general economic conditions, which can affect the long-term demand for natural gas and related services; |

| | • | | potential effects arising from terrorist attacks and any consequential or other hostilities; |

| | • | | changes in environmental, safety and other laws and regulations; |

| | • | | results of financing efforts, including the ability to obtain financing on favorable terms, which can be affected by various factors, including credit ratings and general market and economic conditions; |

| | • | | increases in the cost of goods and services required to complete capital projects; |

| | • | | declines in the market prices of equity and debt securities and resulting funding requirements for defined benefit pension plans; |

| | • | | growth in opportunities, including the timing and success of efforts to develop U.S. and Canadian pipeline, storage, gathering, processing and other infrastructure projects and the effects of competition; |

| | • | | the performance of natural gas transmission and storage, distribution, and gathering and processing facilities; |

| | • | | the extent of success in connecting natural gas supplies to gathering, processing and transmission systems and in connecting to expanding gas markets; |

| | • | | the effects of accounting pronouncements issued periodically by accounting standard-setting bodies; |

| | • | | conditions of the capital markets during the periods covered by the forward-looking statements; and |

| | • | | the ability to successfully complete merger, acquisition or divestiture plans; regulatory or other limitations imposed as a result of a merger, acquisition or divestiture; and the success of the business following a merger, acquisition or divestiture. |

In light of these risks, uncertainties and assumptions, the events described in forward-looking statements might not occur or might occur to a different extent or at a different time than Spectra Energy Corp has described. Spectra Energy Corp undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

3

PART I

Item 1. Business.

The terms “we,” “our,” “us,” and “Spectra Energy” as used in this report refer collectively to Spectra Energy Corp and its subsidiaries unless the context suggests otherwise. These terms are used for convenience only and are not intended as a precise description of any separate legal entity within Spectra Energy.

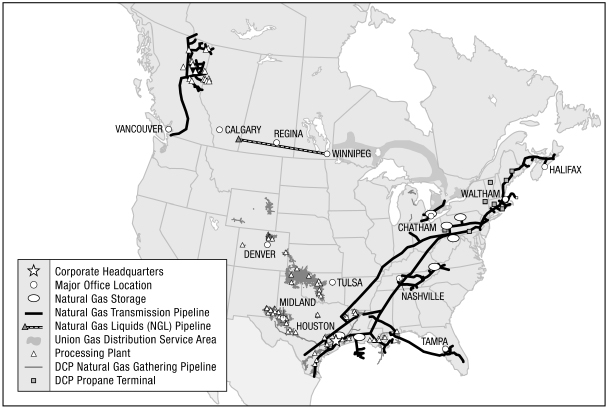

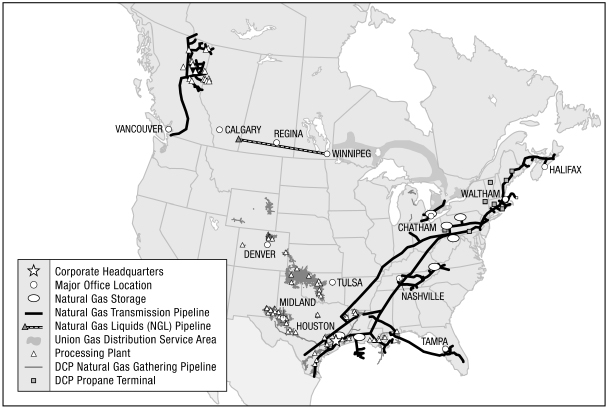

General

Spectra Energy Corp, through its subsidiaries and equity affiliates, owns and operates a large and diversified portfolio of complementary natural gas-related energy assets and is one of North America’s leading natural gas infrastructure companies. For close to a century, we and our predecessor companies have developed critically important pipelines and related energy infrastructure connecting natural gas supply sources to premium markets. We operate in three key areas of the natural gas industry: gathering and processing, transmission and storage, and distribution. Based in Houston, Texas, we provide transportation and storage of natural gas to customers in various regions of the northeastern and southeastern United States, the Maritime Provinces in Canada and the Pacific Northwest in the United States and Canada, and in the province of Ontario, Canada. We also provide natural gas sales and distribution services to retail customers in Ontario, and natural gas gathering and processing services to customers in western Canada. We also have a 50% ownership in DCP Midstream, LLC (DCP Midstream), one of the largest natural gas gatherers and processors in the United States, based in Denver, Colorado.

4

Our natural gas pipeline systems consist of approximately 18,300 miles of transmission pipelines. Our proportional throughput for our pipelines totaled 3,733 trillion British thermal units (TBtu) in 2008 compared to 3,642 TBtu in 2007. These amounts include throughput on wholly owned U.S. and Canadian pipelines and our proportional share of throughput on pipelines that are not wholly owned. Our storage facilities provide approximately 270 billion cubic feet (Bcf) of storage capacity in the United States and Canada.

Spin-off from Duke Energy Corporation

On January 2, 2007, Duke Energy Corporation (Duke Energy) completed the spin-off of Spectra Energy. Duke Energy contributed the natural gas businesses, primarily comprised of the Natural Gas Transmission and Field Services business segments of Duke Energy that were owned through Duke Energy’s then wholly owned subsidiary, Spectra Energy Capital, LLC (Spectra Capital). Duke Energy contributed its ownership interests in Spectra Capital to us and all of our outstanding common stock was distributed to Duke Energy’s shareholders.

Businesses

Subsequent to the reorganization and our spin-off from Duke Energy, we manage our business in four reportable segments: U.S. Transmission, Distribution, Western Canada Transmission & Processing, and Field Services. The remainder of our business operations is presented as “Other” and consists of unallocated corporate costs, wholly owned captive insurance subsidiaries, employee benefit plan assets and liabilities, and other miscellaneous activities. The following sections describe the operations of each of our businesses. For financial information on our business segments, see Part II, Item 8. Financial Statements and Supplementary Data, Note 4 of Notes to Consolidated Financial Statements.

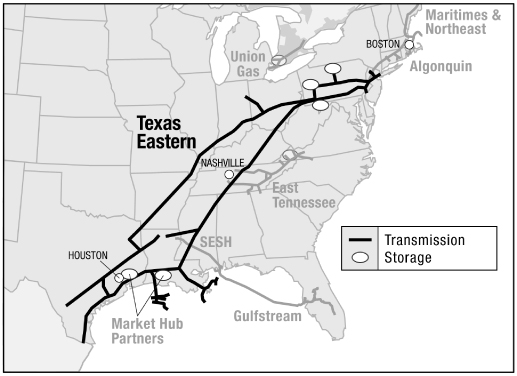

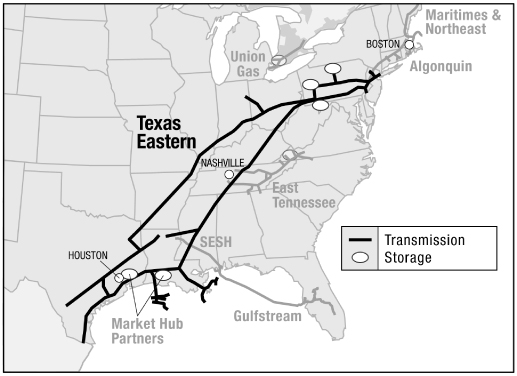

U.S. TRANSMISSION

Our U.S. Transmission business provides transportation and storage of natural gas for customers in various regions of the northeastern and southeastern United States and the Maritime Provinces in Canada. Our U.S. pipeline systems consist of more than 13,800 miles of transmission pipelines with six primary transmission systems: Texas Eastern Transmission, LP (Texas Eastern), Algonquin Gas Transmission, LLC (Algonquin), East Tennessee Natural Gas, LLC (East Tennessee), Maritimes & Northeast Pipeline, L.L.C. and Maritimes & Northeast Pipeline Limited Partnership (collectively, Maritimes & Northeast Pipeline), Gulfstream Natural Gas System, LLC (Gulfstream), and Southeast Supply Header, LLC (SESH), which began operations in September 2008. The pipeline systems in our U.S. Transmission business receive natural gas from major North American producing regions for delivery to their respective markets. U.S. Transmission’s proportional throughput for its pipelines totaled 2,218 TBtu in 2008 compared to 2,202 TBtu in 2007. This includes throughput on wholly owned pipelines and our proportional share of throughput on pipelines that are not wholly owned. A majority of contracted transportation volumes are under long-term firm service agreements. Interruptible services are provided on a short-term or seasonal basis. U.S. Transmission provides storage services through Saltville Gas Storage Company, L.L.C. (Saltville), Market Hub Partners Holding’s (Market Hub’s) Moss Bluff and Egan storage facilities, and Texas Eastern’s facilities. In the course of providing transportation services, U.S. Transmission also processes natural gas on its Texas Eastern system. Demand on the pipeline systems is seasonal, with the highest throughput occurring during colder periods in the first and fourth calendar quarters.

Most of U.S. Transmission’s pipeline and storage operations are regulated by the Federal Energy Regulatory Commission (FERC) and are subject to the jurisdiction of various federal, state and local environmental agencies. FERC is the U.S. agency that regulates the transportation of natural gas in interstate commerce.

In July 2007, we completed our initial public offering (IPO) of Spectra Energy Partners, LP (Spectra Energy Partners), a newly formed, natural gas infrastructure master limited partnership which is part of the U.S. Transmission segment. Subsequent to an additional drop-down of assets into Spectra Energy Partners in 2008, we

5

currently retain an 84% equity interest in Spectra Energy Partners, which owns 100% of East Tennessee, 100% of Saltville, 50% of Market Hub and a 24.5% interest in Gulfstream. Spectra Energy retained a 50% direct ownership interest in Market Hub and a 25.5% direct ownership interest in Gulfstream. Spectra Energy Partners is a separate, publicly traded entity which trades on the New York Stock Exchange under the symbol “SEP.”

Texas Eastern

The Texas Eastern gas transmission system extends approximately 1,700 miles from producing fields in the Gulf Coast region of Texas and Louisiana to Ohio, Pennsylvania, New Jersey and New York. It consists of two parallel systems, one with three large-diameter parallel pipelines and the other with one to three large-diameter pipelines. Texas Eastern’s onshore system consists of approximately 8,700 miles of pipeline and 73 compressor stations (facilities that increase the pressure of gas to facilitate its pipeline transmission). Texas Eastern also owns and operates two offshore Louisiana pipeline systems, which extend approximately 100 miles into the Gulf of Mexico and include approximately 500 miles of Texas Eastern’s pipeline system. Texas Eastern has two joint-venture storage facilities in Pennsylvania and one wholly owned and operated storage field in Maryland. Texas Eastern’s total working capacity in these three fields is 73 Bcf.

6

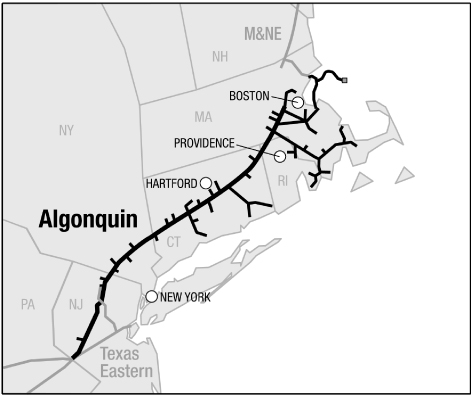

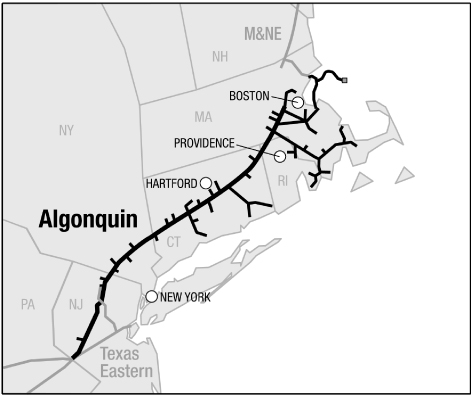

Algonquin

The Algonquin pipeline connects with Texas Eastern’s facilities in New Jersey, and extends approximately 250 miles through New Jersey, New York, Connecticut, Rhode Island and Massachusetts where it connects to Maritimes & Northeast Pipeline. The system consists of approximately 1,100 miles of pipeline with seven compressor stations.

7

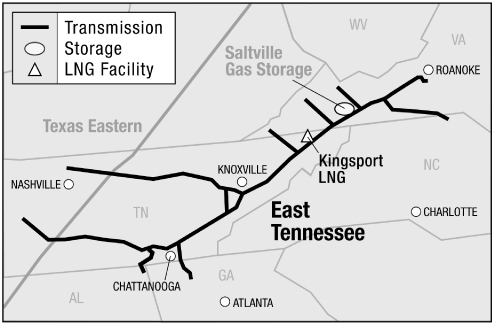

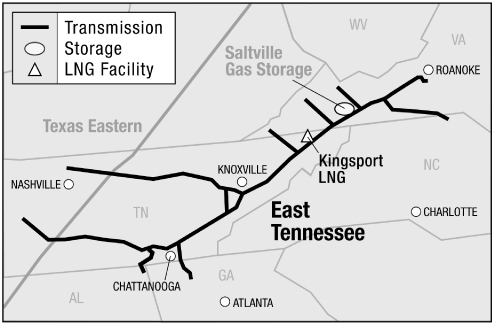

East Tennessee

East Tennessee’s transmission system crosses Texas Eastern’s system at two points in Tennessee and consists of two mainline systems totaling approximately 1,510 miles of pipeline in Tennessee, Georgia, North Carolina and Virginia, with 21 compressor stations. East Tennessee has a liquefied natural gas (LNG, natural gas that has been converted to liquid form) storage facility in Tennessee with a total working capacity of 1 Bcf. East Tennessee also connects to the Saltville storage facilities in Virginia that have a working gas capacity of approximately 5 Bcf.

We have an effective 84% ownership interest in East Tennessee through our ownership of Spectra Energy Partners.

8

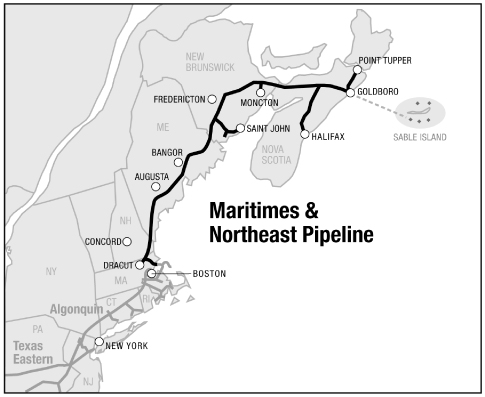

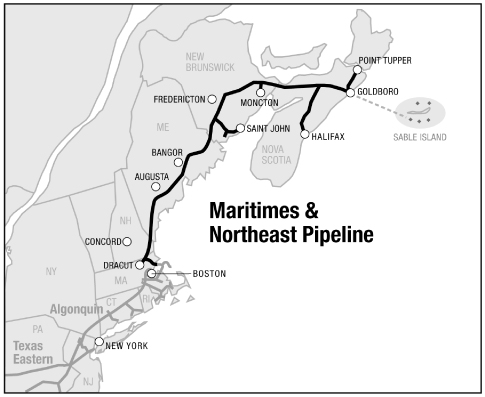

Maritimes & Northeast Pipeline

Maritimes & Northeast Pipeline’s gas transmission system is operated through Maritimes & Northeast Pipeline Limited Partnership (the Canadian portion of this system) and Maritimes & Northeast Pipeline, L.L.C. (the U.S. portion). We have 78% ownership interests in both segments of the system and affiliates of Exxon Mobil Corporation and Emera, Inc. have the remaining interests. The Maritimes & Northeast Pipeline transmission system consists of approximately 900 miles of pipeline from producing fields in Nova Scotia through New Brunswick, Maine, New Hampshire and Massachusetts, connecting to Algonquin in Beverly, Massachusetts. There are seven compressor stations on the system.

9

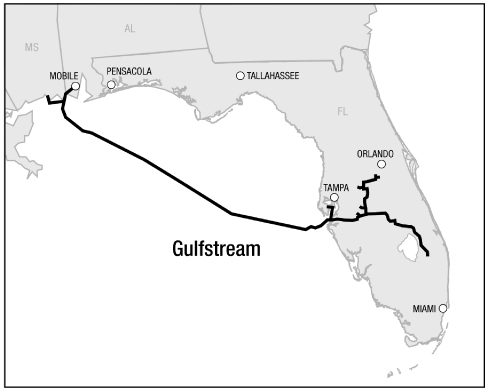

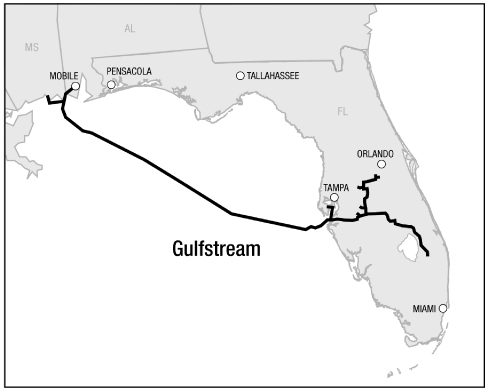

Gulfstream

We have an effective 46% investment in Gulfstream, a 745-mile interstate natural gas pipeline system operated jointly by us and The Williams Companies, Inc. Gulfstream transports natural gas from Mississippi, Alabama, Louisiana, and Texas, crossing the Gulf of Mexico to markets in central and southern Florida. Gulfstream has one compressor station. Gulfstream is owned 25.5% by Spectra Energy, 24.5% by Spectra Energy Partners and 50% by The Williams Companies, Inc. Our investment in Gulfstream is accounted for under the equity method of accounting.

10

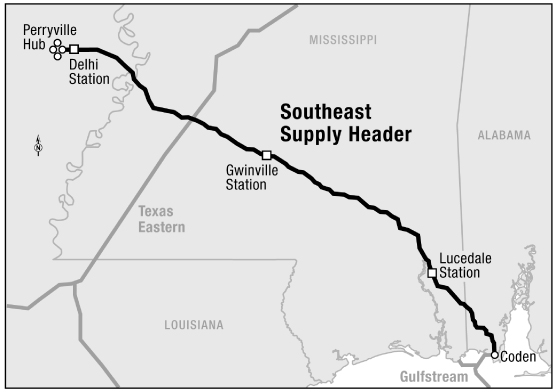

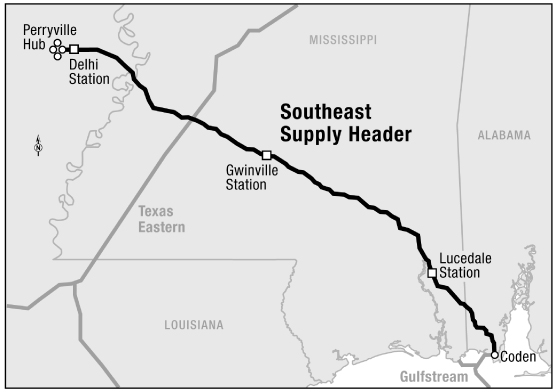

Southeast Supply Header LLC

We have a 50% investment in SESH, a 274-mile interstate natural gas pipeline system with three mainline compressor stations owned and operated jointly by us and CenterPoint Energy, Inc. SESH, which began operations in September 2008, extends from the Perryville Hub in northeastern Louisiana where the emerging shale gas production of eastern Texas and northern Louisiana, along with conventional production, is reached from four major interconnections. SESH extends to Alabama, interconnecting with 14 major north-south pipelines and three high deliverability storage facilities. Our investment in SESH is accounted for under the equity method of accounting.

Market Hub Partners Holding

We have an effective 92% ownership interest in Market Hub, which owns and operates two natural gas storage facilities, Moss Bluff and Egan, with a total storage capacity of approximately 37 Bcf. The Moss Bluff facility consists of three storage caverns located in Southeast Texas and has access to five pipeline systems including the Texas Eastern system. The Egan facility consists of three storage caverns located in South Central Louisiana and has access to seven pipeline systems including the Texas Eastern system. Market Hub is a general partnership in which Spectra Energy and Spectra Energy Partners each have a 50% interest.

Saltville Gas Storage L.L.C.

We have an effective 84% ownership interest in Saltville, through our ownership of Spectra Energy Partners. Saltville owns and operates natural gas storage facilities with a total storage capacity of approximately 5 Bcf. The storage facilities interconnect with East Tennessee’s system. This salt cavern facility offers high deliverability capabilities and is strategically located near markets in Tennessee, Virginia and North Carolina.

11

Competition

Our U.S. Transmission transportation and storage businesses compete with similar facilities that serve our supply and market areas in the transportation and storage of natural gas. The principal elements of competition are rates, terms of service, and flexibility and reliability of service.

The natural gas that we transport in our transmission business competes with other forms of energy available to our customers and end-users, including electricity, coal, propane and fuel oils. Factors that influence the demand for natural gas include price changes, the availability of natural gas and other forms of energy, the level of business activity, long-term economic conditions, conservation, legislation, governmental regulations, the ability to convert to alternative fuels, weather and other factors.

Customers and Contracts

In general, our U.S. Transmission pipelines provide transportation and storage services to local distribution companies (LDCs, companies that obtain a major portion of their revenues from retail distribution systems for the delivery of natural gas for ultimate consumption), electric power generators, exploration and production companies, and industrial and commercial customers, as well as energy marketers. Transportation and storage services are generally provided under firm agreements where customers reserve capacity in pipelines and storage facilities. The vast majority of these agreements provide for fixed reservation charges that are paid monthly regardless of actual volumes transported on the pipelines or injected or withdrawn from our storage facilities plus a small variable component that is based on volumes transported to recover variable costs.

We also provide interruptible transportation and storage services where customers can use capacity if it is available at the time of the request. Interruptible revenues are dependent on the amount of volumes transported or stored and the associated market rates for this interruptible service. New projects placed into service may initially have higher levels of interruptible services at inception. Storage operations also provide a variety of other value-added services including natural gas parking, loaning and balancing services to meet our customers’ needs.

DISTRIBUTION

We provide distribution services in Canada through our subsidiary, Union Gas Limited (Union Gas). Union Gas owns pipeline, storage and compression facilities used in the transportation, storage and distribution of natural gas. Union Gas’ system consists of approximately 37,000 miles of distribution main and service pipelines. Distribution pipelines carry or control the supply of natural gas from the point of local supply to customers. Union Gas’ underground natural gas storage facilities have a working capacity of approximately 155 Bcf in 22 underground facilities located in depleted gas fields. Its transmission system consists of approximately 3,000 miles of high-pressure pipeline and six mainline compressor stations.

Union Gas distributes natural gas to approximately 1.3 million residential, commercial and industrial customers in northern, southwestern and eastern Ontario and provides storage, transportation and related services to utilities and other energy market participants. Union Gas is regulated by the Ontario Energy Board (OEB) pursuant to the provisions of the Ontario Energy Board Act (1998) and is subject to regulation in a number of areas including rates.

12

Union Gas’ storage and transmission system forms an important link in moving natural gas from western Canadian and U.S. supply basins to central Canadian and northeastern U.S. markets.

Competition

As Union Gas’ distribution business is regulated by the OEB, it is not generally subject to third-party competition within its distribution franchise area. However, as a result of a 2006 decision by the OEB, physical bypass of Union Gas’ facilities even within its distribution franchise area may be permitted. In addition, other companies could enter Union Gas’ markets or regulations could change.

Union Gas competes with other forms of energy available to its customers and end-users, including electricity, coal, propane and fuel oils. Factors that influence the demand for natural gas include price changes, the availability of natural gas and other forms of energy, the level of business activity, economic conditions, conservation, legislation, governmental regulations, the ability to convert to alternative fuels, weather and other factors.

In November 2006, the OEB issued a decision on the regulation of rates for gas storage services in Ontario involving, among other things, phase-out of the sharing with customers of margins on Union Gas’ long-term storage transactions. This phase-out will occur over a four-year period that began in 2008, with the share accruing to Union Gas increasing ratably over that period. As a result of its finding that the market for storage services is competitive, the OEB does not regulate the rates for storage services to customers outside Union Gas’ franchise area or the rates for new storage services to customers within its franchise area. For these unregulated services, Union Gas competes against third-party storage providers for storage on the basis of price, terms of service, and flexibility and reliability of service. Existing storage services to customers within Union Gas’ franchise area continue to be provided at cost-based rates and are not subject to third-party competition.

13

Customers and Contracts

The rates that Union Gas charges for its regulated services are subject to the approval of the OEB. Union Gas’ distribution service area extends throughout northern Ontario from the Manitoba border to the North Bay/ Muskoka area, through southern Ontario from Windsor to just west of Toronto, and across eastern Ontario from Port Hope to Cornwall. Union Gas serves approximately 1.3 million customers in a franchise area with a population of approximately four million and a diversified commercial and industrial base.

Union Gas’ distribution services to power generation and industrial customers are affected by weather, economic conditions and the price of competitive energy sources. Most of Union Gas’ power generation, industrial and large commercial customers, and a portion of residential customers, purchase their natural gas directly from suppliers or marketers. Because Union Gas earns income from the distribution of natural gas and not the sale of the natural gas commodity, gas distribution margins are not affected by the source of customers’ gas supply.

Union Gas also provides natural gas storage and transportation services for other utilities and energy market participants, including large natural gas transmission and distribution companies. A substantial amount of Union Gas’ annual transportation and storage revenue is generated by fixed demand charges. The average term of these contracts is approximately eight years, with the longest contract term being almost 25 years.

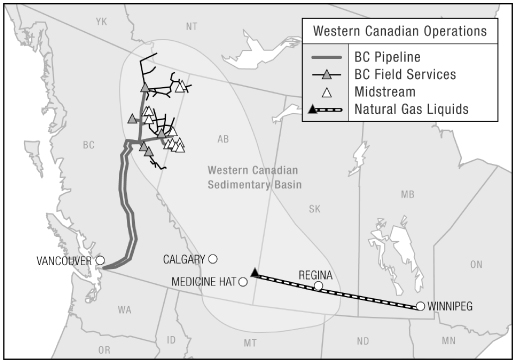

WESTERN CANADA TRANSMISSION & PROCESSING

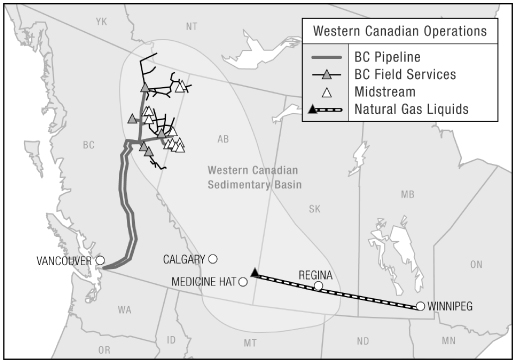

Our Western Canada Transmission & Processing business is comprised of the BC Pipeline and BC Field Services operations, the Midstream operations and the natural gas liquids (NGL) marketing operations.

BC Pipeline and BC Field Services provide natural gas transportation and gas gathering and processing services. BC Pipeline is regulated by the National Energy Board (NEB) under full cost of service regulation, and transports processed natural gas from facilities primarily in northeast British Columbia (BC) to markets in the lower mainland of BC, Alberta and the U.S. Pacific Northwest. The BC Pipeline has approximately 1,800 miles of transmission pipeline in BC and Alberta, as well as 18 mainline compressor stations. Throughput for the BC Pipeline totaled 615 TBtu in 2008 compared to 596 TBtu in 2007.

The BC Field Services business, which is regulated by the NEB under a “light-handed” regulatory model, consists of raw gas gathering pipelines and gas processing facilities, primarily in northeast BC. These facilities provide services to natural gas producers to remove impurities from the raw gas stream including water, carbon dioxide, hydrogen sulfide and other substances. Where required, these facilities also remove various NGLs for subsequent sale by the producers. NGLs are liquid hydrocarbons extracted during the processing of natural gas. Principal commercial NGLs include butanes, propane, natural gasoline and ethane. The BC Field Services business includes five gas processing plants located in BC, 17 field compressor stations and approximately 1,500 miles of gathering pipelines.

The Midstream business provides similar gas gathering and processing services in BC and Alberta and consists of 11 natural gas processing plants and approximately 600 miles of gathering pipelines. In May 2008, we acquired the 24.4 million units of the Spectra Energy Income Fund (the Income Fund) that were held by non-affiliated holders. Prior to the acquisition, the Income Fund indirectly held 54% of our consolidated Midstream operations and we held the remaining 46%.

14

The Empress NGL marketing business provides NGL extraction, fractionation, transportation, storage and marketing services to western Canadian producers and NGL customers throughout Canada and the northern tier of the United States. Assets include, among other things, a majority ownership interest in an NGL extraction plant, an integrated NGL fractionation facility, an NGL transmission pipeline, seven terminals where NGLs are loaded for shipping or transferred into product sales pipelines, two NGL storage facilities and an NGL marketing and gas supply business. The Empress extraction and fractionation plant is located in Empress, Alberta.

Competition

Western Canada Transmission & Processing businesses compete with third-party midstream companies, exploration and production companies, and pipelines in the gathering, processing and transportation of natural gas and the extraction and marketing of NGL products. Western Canada Transmission & Processing competes directly with other pipeline facilities serving its market areas. The principal elements of competition are rates, terms of service, and flexibility and reliability of service. Customer demands for toll certainty and lower cost tailored services have promoted increased competition from other midstream service companies and producers.

Natural gas competes with other forms of energy available to Western Canada Transmission & Processing’s customers and end-users, including electricity, coal and fuel oils. The primary competitive factor is price. Changes in the availability or price of natural gas, NGLs and other forms of energy, the level of business activity, long-term economic conditions, conservation, legislation, governmental regulations, the ability to convert to alternative fuels, weather and other factors affect the demand for natural gas in the areas we serve.

In addition to the fee for service pipeline and gathering and processing businesses, we compete with other NGL extraction facilities at Empress, Alberta for the right to extract and purchase NGLs from natural gas shippers on the TransCanada pipeline system. To extract and acquire NGLs, we must be competitive in the premium or fee we pay to natural gas shippers.

15

Customers & Contracts

BC Pipeline provides: (i) transportation services from the outlet of natural gas processing plants primarily in northeast BC to LDCs, end-use industrial and commercial customers, marketers, and exploration and production companies requiring transportation services to the nearest natural gas trading hub; and (ii) transportation services primarily to downstream markets in the Pacific Northwest (both United States and Canada). The majority of transportation services are provided under firm agreements, which provide for fixed reservation charges that are paid monthly regardless of actual volumes transported on the pipeline, plus a small variable component that is based on volumes transported to recover variable costs. BC Pipeline also provides interruptible transportation services where customers can use capacity if it is available at the time of request and payments under these services are based on volumes transported.

The BC Field Services and Midstream operations in western Canada provide raw natural gas gathering and processing services to exploration and production companies under agreements which are primarily fee-for-service contracts which do not expose us to commodity-price risk. These operations provide both firm and interruptible services.

The NGL extraction operation at Empress, Alberta has capacity to produce approximately 58,000 barrels of NGLs per day comprised of approximately 50% ethane, 32% propane, 12% butanes and 6% condensate. At Empress, we extract and purchase NGLs from natural gas shippers on the TransCanada Pipeline system. In addition to paying shippers a negotiated extraction fee, we keep the shipper whole by returning an equivalent amount of natural gas for the NGLs that were extracted. After NGLs are extracted, we fractionate, or separate, the NGLs into ethane, propane, butanes, and condensate and sell these products into the marketplace. All ethane is sold to Alberta-based petrochemical companies. In addition to paying for natural gas shrinkage, the ethane buyers pay us a negotiated cost-of-service price or a negotiated fixed price. We sell the remaining products—propane, butane and condensate—at market prices and are exposed to the difference between the selling prices and the shrinkage makeup price of natural gas plus the extraction premium and operating costs. The majority of propane is sold to propane retailers. Butane is sold mainly into the motor gasoline refinery market and condensate sales are directed to the crude blending and crude diluent markets. The prices we can obtain for these products is affected by numerous factors including competition, weather, transportation costs and supply and demand factors.

FIELD SERVICES

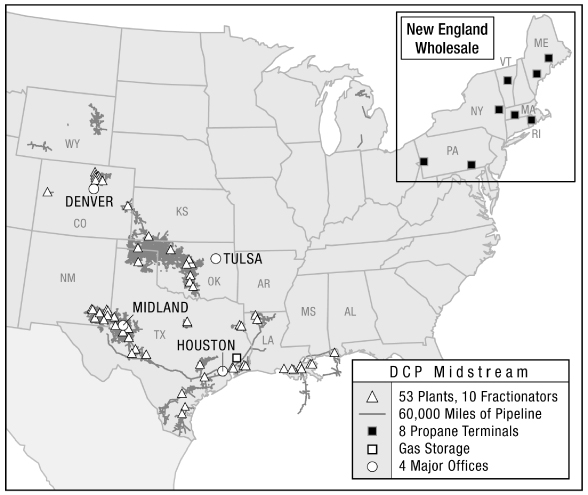

Field Services consists of our 50% investment in DCP Midstream, which is accounted for as an equity investment. DCP Midstream gathers and processes natural gas, and fractionates, markets and trades NGLs. ConocoPhillips owns the remaining 50% interest in DCP Midstream.

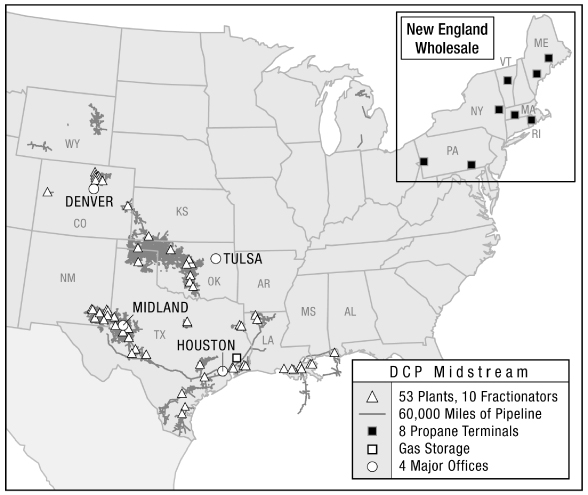

DCP Midstream operates in 27 states in the United States. DCP Midstream’s gathering systems include connections to several interstate and intrastate natural gas and NGL pipeline systems and one natural gas storage facility. DCP Midstream gathers raw natural gas through gathering systems located in nine major natural gas producing regions: Mid-Continent, Rocky Mountain, East Texas-North Louisiana, Barnett Shale, Gulf Coast, South Texas, Central Texas, Antrim Shale and Permian Basin. DCP Midstream owns or operates approximately 60,000 miles of gathering and transmission pipeline, with approximately 38,000 active receipt points.

16

DCP Midstream’s natural gas processing operations separate raw natural gas that has been gathered on its own systems and third-party systems into condensate, NGLs and residue gas. DCP Midstream processes the raw natural gas at 53 natural gas processing facilities.

The NGLs separated from the raw natural gas are either sold and transported as NGL raw mix, or further separated through a fractionation process into their individual components (ethane, propane, butane, and natural gasoline) and then sold as components. DCP Midstream fractionates NGL raw mix at six processing facilities that it owns and operates and at four third-party-operated facilities in which it has an ownership interest. In addition, DCP Midstream operates a propane wholesale marketing business.

The residue gas separated from the raw natural gas is sold at market-based prices to marketers and end-users, including large industrial customers and natural gas and electric utilities serving individual consumers. DCP Midstream also stores residue gas at its 8 Bcf natural gas storage facility located in Southeast Texas.

DCP Midstream uses NGL trading and storage at the Mont Belvieu, Texas and Conway, Kansas NGL market centers to manage its price risk and to provide additional services to its customers. Asset-based gas trading and marketing activities are supported by ownership of the Spindletop storage facility and various intrastate pipelines which provide access to market centers/hubs such as Katy, Texas and the Houston Ship Channel. DCP Midstream undertakes these NGL and gas trading activities through the use of fixed-forward sales, basis and spread trades, storage opportunities, put/call options, term contracts and spot market trading.

17

DCP Midstream’s operating results are significantly affected by changes in average NGL and crude oil prices, which increased approximately 12% and 18%, respectively, in 2008 compared to 2007. DCP Midstream closely monitors the risks associated with these price changes. See Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Quantitative and Qualitative Disclosures About Market Risk for a discussion of DCP Midstream’s exposure to changes in commodity prices.

Competition

In gathering and processing natural gas and in marketing and transporting natural gas and NGLs, DCP Midstream competes with major integrated oil companies, major interstate and intrastate pipelines, national and local natural gas gatherers, and brokers, marketers and distributors of natural gas supplies. Competition for natural gas supplies is based primarily on the reputation, efficiency and reliability of operations, the availability of gathering and transportation to high-demand markets, the pricing arrangement offered by the gatherer/processor and the ability of the gatherer/processor to obtain a satisfactory price for the producer’s residue gas and extracted NGLs. Competition for sales to customers is based primarily upon reliability, services offered and price of delivered natural gas and NGLs.

Customers and Contracts

DCP Midstream sells NGLs to a variety of customers ranging from large, multi-national petrochemical and refining companies to small regional retail propane distributors. Substantially all of DCP Midstream’s NGL sales are made at market-based prices, including approximately 40% of its NGL production that is committed to ConocoPhillips and its affiliate, Chevron Phillips Chemical Company LLC, under existing contracts that have primary terms that are effective until January 1, 2015. In 2008, ConocoPhillips and Chevron Phillips Chemical Company LLC, combined, represented approximately 21% of DCP Midstream’s consolidated revenues.

The residual natural gas (primarily methane) that results from processing raw natural gas is sold at market-based prices to marketers and end-users. End-users include large industrial companies, natural gas distribution companies and electric utilities. DCP Midstream purchases or takes custody of substantially all of its raw natural gas from producers, principally under the following types of contractual arrangements. Of the gas that is gathered and processed, more than 70% of volumes are under percentage-of-proceeds contracts.

| | • | | Percentage-of-proceeds arrangements. In general, DCP Midstream purchases natural gas from producers, transports and processes it and then sells the residue natural gas and NGLs in the market. The payment to the producer is an agreed upon percentage of the proceeds from those sales. DCP Midstream’s revenues from these arrangements correlate directly with the price of natural gas and NGLs. |

| | • | | Fee-based arrangements. DCP Midstream receives a fee or fees for the various services it provides including gathering, compressing, treating, processing or transporting natural gas. The revenue DCP Midstream earns from these arrangements is directly related to the volume of natural gas that flows through its systems and is not directly dependent on commodity prices. |

| | • | | Keep-whole and wellhead purchase arrangement. DCP Midstream gathers or purchases raw natural gas from producers for processing and then markets the NGLs. DCP Midstream keeps the producer whole by returning an equivalent amount of natural gas after the processing is complete. DCP Midstream is exposed to the frac-spread, which is the price difference between NGLs and natural gas prices, representing the theoretical gross margin for processing liquids from natural gas. |

As defined by the terms of the above arrangements, DCP Midstream also sells condensate, which is generally similar to crude oil and is produced in association with natural gas gathering and processing.

18

Supplies and Raw Materials

We purchase a variety of manufactured equipment and materials for use in operations and expansion projects. The primary equipment and materials utilized in operations and project execution processes are steel pipe, compression engines, valves, fittings, polyethylene plastic pipe, gas meters and other consumables.

We operate a North American supply chain management network with employees dedicated to this function in the United States and Canada. Our supply chain management group uses economies-of-scale to maximize the efficiency of supply networks where applicable. DCP Midstream performs its own supply chain management function.

The recent sharp declines in both economic activity and consumer prices are beginning to impact the costs of certain materials used in our maintenance and expansion projects. Specialty steel prices, in particular, have declined 10-15% from recent highs, and the effect is being seen in lower prices for steel pipe and related materials. The ultimate impact of consumer prices will depend upon the length and depth of the worldwide contraction in economic activity.

There can be no assurance that the ability to obtain sufficient equipment and materials will not be adversely affected by unforeseen developments. In addition, the price of equipment and materials may vary, perhaps substantially, from year to year.

Regulations

Most of our U.S. gas transmission pipeline and storage operations are regulated by the FERC. The FERC regulates natural gas transportation in U.S. interstate commerce including the establishment of rates for services. The FERC also regulates the construction of U.S. interstate pipelines and storage facilities including extension, enlargement and abandonment of facilities. In addition, certain operations are subject to oversight by state regulatory commissions.

The FERC may propose and implement new rules and regulations affecting interstate natural gas transmission and storage companies, which remain subject to the FERC’s jurisdiction. These initiatives may also affect certain transportation of gas by intrastate pipelines.

Our U.S. Transmission and the DCP Midstream operations are subject to the jurisdiction of the Environmental Protection Agency (EPA) and various other federal, state and local environmental agencies. See “Environmental Matters” for a discussion of environmental regulation. Our U.S. interstate natural gas pipelines and certain of DCP Midstream’s gathering and transmission pipelines are also subject to the regulations of the U.S. Department of Transportation concerning pipeline safety.

The natural gas transmission and distribution, and approximately two-thirds of the storage operations in Canada are subject to regulation by the NEB or the provincial agencies in Canada, such as the OEB. These agencies have jurisdiction similar to the FERC for regulating rates, the terms and conditions of service, the construction of additional facilities and acquisitions. Our BC Field Services business in Western Canada is regulated by the NEB pursuant to a framework for light-handed regulation under which the NEB acts on a complaints-basis for rates associated with that business. Similarly, the rates charged by the Midstream operations for gathering and processing services in Western Canada are regulated on a complaints-basis by applicable provincial regulators. The Empress NGL businesses are not under any form of rate regulation.

The intrastate natural gas and NGL pipelines owned by DCP Midstream are subject to state regulation. To the extent that the natural gas intrastate pipelines provide services under Section 311 of the Natural Gas Policy Act of 1978, they are also subject to FERC regulation. The natural gas gathering and processing activities of DCP Midstream are not subject to FERC regulation.

19

Environmental Matters

We are subject to various U.S. federal, state and local laws and regulations, as well as Canadian national and provincial regulations, with regard to air and water quality, hazardous and solid waste disposal and other environmental matters. These regulations often impose substantial testing and certification requirements.

Environmental laws and regulations affecting us include, but are not limited to:

| | • | | The Clean Air Act (CAA) and the 1990 amendments to the CAA, as well as state laws and regulations affecting air emissions (including State Implementation Plans related to existing and new national ambient air quality standards), which may limit new sources of air emissions. Our natural gas processing, transmission and storage assets are considered sources of air emissions, and are thereby subject to the CAA. Owners and/or operators of air emission sources, such as us, are responsible for obtaining permits for existing and new sources of air emissions, and for annual compliance and reporting. |

| | • | | The Federal Water Pollution Control Act (Clean Water Act), which requires permits for facilities that discharge wastewaters into the environment. The Oil Pollution Act (OPA), was enacted in 1990 and amends parts of the Clean Water Act and other statutes as they pertain to the prevention of and response to oil spills. OPA imposes certain spill prevention, control and countermeasure requirements. Although we are primarily a natural gas business, OPA affects our business primarily because of the presence of liquid hydrocarbons (condensate) in our offshore pipelines. |

| | • | | The Comprehensive Environmental Response, Compensation and Liability Act (CERCLA), which imposes liability for remediation costs associated with environmentally contaminated sites. Under CERCLA, any individual or entity that currently owns or in the past owned or operated a disposal site can be held liable and required to share in remediation costs, as well as transporters or generators of hazardous substances sent to a disposal site. Because of the geographical extent of our operations, we have disposed of waste at many different sites. |

| | • | | The Solid Waste Disposal Act, as amended by the Resource Conservation and Recovery Act, which requires certain solid wastes, including hazardous wastes, to be managed pursuant to a comprehensive regulatory regime. As part of our business, we generate solid waste within the scope of these regulations and therefore must comply with such regulations. |

| | • | | The Toxic Substances Control Act, which requires that polychlorinated biphenyl (PCB) contaminated materials be managed in accordance with a comprehensive regulatory regime. Because of the historical use of lubricating oils containing PCBs, the internal surfaces of some of our pipeline systems are contaminated with PCBs, and liquids and other materials removed from these pipelines must be managed in compliance with such regulations. |

| | • | | The National Environmental Policy Act, which requires federal agencies to consider potential environmental effects in their decisions, including site approvals. Many of our capital projects require federal agency review, and therefore the environmental effect of proposed projects is a factor in determining whether we will be permitted to complete proposed projects. |

| | • | | The Fisheries Act (Canada), which regulates activities near any body of water in Canada. |

| | • | | The Environmental Management Act (British Columbia), the Environmental Protection and Enhancement Act (Alberta), and the Environmental Protection Act (Ontario) are each provincial laws governing various aspects, including permitting and site remediation obligations, of our facilities and operations in those provinces. |

| | • | | The Canadian Environmental Protection Act, which among other things, will govern the reduction of greenhouse gas (GHG) emissions from our operations in Canada. Regulations to be promulgated under the Act will set emission-intensity reduction targets and deadlines for fixed emission caps for nitrogen oxides, sulphur oxides, volatile organic compounds and particulate matter. |

20

| | • | | The Alberta Climate Change and Emissions Management Act, which, pursuant to regulations that came into effect in 2007, requires certain facilities to meet annual reductions in emission intensity targets starting in 2007. The Act was applicable in 2008 to our Empress facility in Alberta. |

For more information on environmental matters, including possible liability and capital costs, see Item 8. Financial Statements and Supplementary Data, Notes 5 and 18 of Notes to Consolidated Financial Statements.

Except to the extent discussed in Notes 5 and 18, compliance with international, federal, state and local provisions regulating the discharge of materials into the environment, or otherwise protecting the environment, is incorporated into the routine cost structure of our various business units and is not expected to have a material adverse effect on our competitive position, consolidated results of operations, financial position or cash flows.

Geographic Regions

For a discussion of our Canadian operations and the risks associated with them, see Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, Quantitative and Qualitative Disclosures About Market Risk—Foreign Currency Risk, and Notes 4 and 20 of Notes to Consolidated Financial Statements.

Employees

We had approximately 5,200 employees as of December 31, 2008, including approximately 3,400 employees outside of the United States, all in Canada. In addition, DCP Midstream, our joint venture with ConocoPhillips, employed approximately 2,700 employees as of such date. Approximately 1,500 of our employees, all of whom are located in Canada, are subject to collective bargaining agreements governing their employment with us. Approximately 60% of those employees are covered under agreements that have expired or will expire by December 31, 2009.

21

Executive and Other Officers

The following table sets forth information regarding our executive and other officers.

| | | | |

Name | | Age | | Position |

| Gregory L. Ebel | | 44 | | President and Chief Executive Officer, Director |

| J. Patrick Reddy | | 56 | | Chief Financial Officer |

| Dorothy M. Ables | | 51 | | Chief Administrative Officer |

| John R. Arensdorf | | 58 | | Chief Communications Officer |

| Alan N. Harris | | 55 | | Chief Development and Operations Officer |

| Allen C. Capps | | 38 | | Vice President and Treasurer |

| Sabra L. Harrington | | 46 | | Vice President and Controller |

Gregory L. Ebel assumed his position as President and Chief Executive Officer on January 1, 2009. He previously served as Group Executive and Chief Financial Officer from January 2007. Mr. Ebel served as President of Union Gas from January 2005 until January 2007. Prior to then, Mr. Ebel served as Vice President, Investor & Shareholder Relations of Duke Energy from November 2002 until January 2005.

J. Patrick Reddy joined Spectra Energy in January 2009 as Chief Financial Officer. Mr. Reddy served as Senior Vice President and Chief Financial Officer at Atmos Energy Corporation from September 2000 to December 2008.

Dorothy M. Ables served as Vice President of Audit Services and as Chief Ethics and Compliance Officer from January 2007 until assuming her current position as Chief Administrative Officer in November 2008. Ms. Ables served as Vice President of Audit Services from April 2006 to December 2006 and Vice President, Audit Services and Chief Compliance Officer for Duke Energy Corporation from February 2004 to March 2006. Prior to then, Ms. Ables served as Senior Vice President and Chief Financial Officer at Duke Energy Gas Transmission from December 2002 to January 2004.

John R. Arensdorf assumed his current position in November 2008. He previously served as Vice President, Investor Relations from January 2007. Prior to then, Mr. Arensdorf served as General Manager, Investor Relations at Duke Energy from April 2006 to December 2006; General Manager, Internal Controls from November 2004 to April 2006; and Vice President, Investor Relations from May 2001 to November 2004.

Alan N. Harris assumed his position as Chief Development Officer and Chief Operations Officer in November 2008. He previously served as Group Executive and Chief Development Officer since January 2007. Mr. Harris served as Group Vice President and Chief Financial Officer of Duke Energy Gas Transmission from February 2004 to January 2007 and Executive Vice President of Duke Energy Gas Transmission from January 2003 until February 2004. Mr. Harris currently serves on the Board of Directors of DCP Midstream Partners, LP.

Allen C. Capps joined Spectra Energy in December 2007. Prior to then, Mr. Capps served as Director of Finance of EPCO, Inc. from April 2006. Mr. Capps served as Interim Controller of TEPPCO Partners, LP from June 2005 to April 2006; Director of Technical Accounting and Compliance from April 2004 until June 2005; and Manager of Technical Accounting and Compliance from April 2003 until April 2004.

Sabra L. Harrington served as Vice President, Financial Strategy of Duke Energy Gas Transmission from February 2006 until assuming her current position in January 2007. Prior to then, Ms. Harrington served as Vice President and Controller of Duke Energy Gas Transmission from August 2003 until February 2006.

In addition to the above executive and other officers, Fred J. Fowler served as President and Chief Executive Officer until his retirement on December 31, 2008.

22

Additional Information

We were incorporated on July 28, 2006 as a Delaware corporation. Our principal executive offices are located at 5400 Westheimer Court, Houston, Texas 77056 and our telephone number is 713-627-5400. We electronically file various reports with the Securities and Exchange Commission (SEC), including annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxies and amendments to such reports. The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov. Additionally, information about us, including our reports filed with the SEC, is available through our web site at http://www.spectraenergy.com. Such reports are accessible at no charge through our web site and are made available as soon as reasonably practicable after such material is filed with or furnished to the SEC. Our website and the information contained on that site, or connected to that site, are not incorporated by reference into this report.

Item 1A. Risk Factors.

Discussed below are the more significant risk factors relating to Spectra Energy.

Reductions in demand for natural gas and low market prices of commodities adversely affect our operations and cash flows.

Our regulated businesses are generally economically stable and are not significantly affected in the short term by changing commodity prices. However, all of our businesses can be negatively affected in the long term by sustained downturns or sluggishness in the economy, which could affect long-term demand and market prices for natural gas and NGLs, all of which are beyond our control and could impair the ability to meet long-term goals.

Most of our revenues are based on regulated tariff rates, which include the recovery of certain fuel costs. However, lower overall economic output would cause a decline in the volume of natural gas transported and distributed or gathered and processed at our plants, resulting in lower earnings and cash flows. This decline would primarily affect distribution revenues in the short term. Transmission revenues could be affected by long-term economic declines that could result in the non-renewal of long-term contracts at the time of expiration. Lower demand for natural gas and lower prices for natural gas and NGLs could result from multiple factors that affect the markets where we operate, including:

| | • | | weather conditions, including abnormally mild winter or summer weather that cause lower energy usage for heating or cooling purposes, respectively; |

| | • | | supply of and demand for energy commodities, including any decreases in the production of natural gas which could negatively affect our processing business due to lower throughput; |

| | • | | capacity and transmission service into, or out of, our markets; and |

| | • | | petrochemical demand for NGLs. |

The lack of availability of natural gas resources may cause customers to seek alternative energy resources, which could materially adversely affect our revenues, earnings and cash flows.

Our natural gas businesses are dependent on the continued availability of natural gas production and reserves. Prices for natural gas, regulatory limitations, or a shift in supply sources could adversely affect development of additional reserves and production that are accessible by our pipeline, gathering, processing and distribution assets. Lack of commercial quantities of natural gas available to these assets could cause customers to seek alternative energy resources, thereby reducing their reliance on our services, which in turn would materially adversely affect our revenues, earnings and cash flows.

23

Investments and projects located in Canada expose us to fluctuations in currency rates that may adversely affect our results of operations, cash flows and compliance with debt covenants.

We are exposed to foreign currency risk from investments and operations in Canada. An average 10% devaluation in the Canadian dollar exchange rate during 2008 would have resulted in an estimated net loss on the translation of local currency earnings of approximately $42 million on our Consolidated Statement of Operations. In addition, if a 10% devaluation had occurred on December 31, 2008, the Consolidated Balance Sheet would be negatively impacted by $523 million through a cumulative translation adjustment in Accumulated Other Comprehensive Income. At December 31, 2008, one U.S. dollar translated into 1.22 Canadian dollars.

In addition, we maintain credit facilities that typically include financial covenants which limit the amount of debt that can be outstanding as a percentage of total capital for Spectra Energy or of a specific subsidiary. Failure to maintain these covenants could preclude us from issuing commercial paper or letters of credit or borrowing under our revolving credit facilities and could require other affiliates to immediately pay down any outstanding drawn amounts under other revolving credit agreements, which could adversely affect cash flow or restrict business. Foreign currency fluctuations have a direct impact on our ability to maintain certain of these financial covenants.

Natural gas gathering and processing operations are subject to commodity price risk, which could result in losses in our earnings and reduced cash flows.

We have gathering and processing operations that consist of contracts to buy and sell commodities, including contracts for natural gas, NGLs and other commodities that are settled by the delivery of the commodity or cash. We are primarily exposed to market price fluctuations of NGL prices in the Field Services segment and to frac-spreads in the Empress operations in Canada. Since NGL prices historically track crude oil prices, we disclose our NGL price sensitivities in terms of crude oil price changes. Based on a sensitivity analysis as of December 31, 2008, at our forecasted NGL-to-oil price relationships, a $10 per barrel move in oil prices would affect our annual pre-tax earnings by approximately $120 million in 2009 ($110 million from Field Services and $10 million from U.S. Transmission). However, NGL prices lagged oil prices during oil’s unprecedented upward price movement in the first half of 2008. Assuming crude oil prices average approximately $50 per barrel, each 1% change in the price relationship between NGLs and crude oil would change our annual pre-tax earnings by approximately $8 million. At crude oil prices above $50 per barrel, the impact of a 1% change in the NGL-to-oil price relationship would increase, and at crude oil prices below $50 per barrel, the impact of a 1% change in the NGL-to-oil price relationship would decrease.

With respect to the frac-spread risk related to Empress processing and NGL marketing activities in Western Canada, as of December 31, 2008, a $0.50 change in the difference between the Btu-equivalent price of propane (used as a proxy for Empress’ NGL production) and the price of natural gas in Alberta, Canada would affect our pre-tax earnings by approximately $16 million on an annual basis in 2009.

These hypothetical calculations consider estimated production levels, but do not consider other potential effects that might result from such changes in commodity prices. The actual effect of commodity price changes on our earnings could be significantly different than these estimates.

Our business is subject to extensive regulation that affects our operations and costs.

Our U.S. assets and operations are subject to regulation by various federal, state and local authorities, including regulation by the FERC and by various authorities under federal, state and local environmental laws. Our natural gas assets and operations in Canada are also subject to regulation by federal, provincial and local authorities including the NEB and the OEB and by various federal and provincial authorities under environmental laws. Regulation affects almost every aspect of our business, including, among other things, the ability to determine terms and rates for services provided by some of our businesses, make acquisitions, construct, expand and operate facilities, issue equity or debt securities, and pay dividends.

24

In addition, regulators in both the U.S. and Canada have taken actions to strengthen market forces in the gas pipeline industry, which have led to increased competition. In a number of key markets, natural gas pipeline and storage operators are facing competitive pressure from a number of new industry participants, such as alternative suppliers as well as traditional pipeline competitors. Increased competition driven by regulatory changes could have a material effect on our business, earnings, financial condition and cash flows.

Execution of our capital projects subjects us to construction risks, increases in labor and material costs and other risks that may adversely affect our financial results.

A significant portion of our growth is accomplished through the construction of new pipelines and storage facilities as well as the expansion of existing facilities. Construction of these facilities is subject to various regulatory, development, operational and market risks, including:

| | • | | the ability to obtain necessary approvals and permits by regulatory agencies on a timely basis and on acceptable terms; |

| | • | | the availability of skilled labor, equipment, and materials to complete expansion projects; |

| | • | | potential changes in federal, state and local statutes and regulations, including environmental requirements, that prevent a project from proceeding or increase the anticipated cost of the project; |

| | • | | impediments on our ability to acquire rights-of-way or land rights on a timely basis and on acceptable terms; |

| | • | | the ability to construct projects within anticipated costs, including the risk of cost overruns resulting from inflation or increased costs of equipment, materials or labor, weather, geologic conditions or other factors beyond our control, that may be material; and |

| | • | | general economic factors that affect the demand for natural gas infrastructure. |

Any of these risks could prevent a project from proceeding, delay its completion or increase its anticipated costs. As a result, new facilities may not achieve their expected investment return, which could adversely affect our results of operations, financial position or cash flows.

Gathering and processing, transmission and storage, and distribution activities involve numerous risks that may result in accidents or otherwise affect our operations.

There are a variety of hazards and operating risks inherent in natural gas gathering and processing, transmission and storage, and distribution activities, such as leaks, explosions and mechanical problems that could cause substantial financial losses. In addition, these risks could result in significant injury, loss of human life, significant damage to property, environmental pollution and impairment of operations, any of which could result in substantial losses. For pipeline and storage assets located near populated areas, including residential areas, commercial business centers, industrial sites and other public gathering areas, the level of damage resulting from these risks could be greater. We do not maintain insurance coverage against all of these risks and losses, and any insurance coverage we might maintain may not fully cover the damages caused by those risks and losses. Therefore, should any of these risks materialize, it could have a material adverse effect on our business, earnings, financial condition and cash flows.

We are subject to numerous environmental laws and regulations, compliance with which requires significant capital expenditures, can increase our cost of operations, and may affect or limit our business plans, or expose us to environmental liabilities.

We are subject to numerous environmental laws and regulations affecting many aspects of our present and future operations, including air emissions, water quality, wastewater discharges, solid waste and hazardous waste. These laws and regulations can result in increased capital, operating and other costs. These laws and regulations generally require us to obtain and comply with a wide variety of environmental licenses, permits,

25

inspections and other approvals. Compliance with environmental laws and regulations can require significant expenditures, including expenditures for cleanup costs and damages arising out of contaminated properties, and failure to comply with environmental regulations may result in the imposition of fines, penalties and injunctive measures affecting our operating assets. In addition, changes in environmental laws and regulations or the enactment of new environmental laws or regulations could result in a material increase in our cost of compliance with such laws and regulations. We may not be able to obtain or maintain from time to time all required environmental regulatory approvals for our operating assets or development projects. If there is a delay in obtaining any required environmental regulatory approvals, if we fail to obtain or comply with them or if environmental laws or regulations change or are administered in a more stringent manner, the operation of facilities or the development of new facilities could be prevented, delayed or become subject to additional costs. No assurance can be made that the costs that will be incurred to comply with environmental regulations in the future will not have a material adverse effect.

While Canada is a signatory to the United Nations-sponsored Kyoto Protocol, which prescribes specific targets to reduce GHG emissions for developed countries for the 2008-2012 period, the Canadian federal government has confirmed it will not achieve the targets within the timeframes specified. Instead, the federal government in 2008 outlined a regulatory framework mandating GHG reductions from large final emitters. The framework requires GHG emissions intensity reductions of 18% beginning in 2010, with further reductions of 2% per year thereafter. Regulatory design details from the Government of Canada associated with the framework remain forthcoming. We expect a number of our assets and operations will be affected by pending federal climate change regulations, but the materiality of any potential compliance costs is unknown at this time as the final form of the regulation and compliance options has yet to be determined by policymakers.

In 2007, the Province of Alberta adopted legislation which requires existing large emitters (facilities releasing 100,000 tons or more of GHG emissions annually) to reduce their annual emissions intensity by 12% beginning July 1, 2007. In 2008, two of our facilities were subject to this regulation. The regulation has not had a material impact on our consolidated results of operations, financial position or cash flows.

Due to the substantial uncertainty of the Canadian federal and provincial policies, we cannot estimate the potential effects of GHG regulation in Canada on business, earnings, financial condition and cash flows. When policies become sufficiently certain to support a meaningful assessment, we will do so.

We are involved in numerous legal proceedings, the outcome of which are uncertain, and resolutions adverse to us could negatively affect our results of operations, financial condition and cash flows.

We are subject to numerous legal proceedings. Litigation is subject to many uncertainties, and we cannot predict the outcome of individual matters with assurance. It is reasonably possible that the final resolution of some of the matters in which we are involved could require additional expenditures, in excess of established reserves, over an extended period of time and in a range of amounts that could have a material effect on our cash flows and results of operations.

We rely on access to short-term and long-term capital markets to finance capital requirements and support liquidity needs, and access to those markets can be adversely affected, particularly if we or our rated subsidiaries are unable to maintain an investment-grade credit rating, which could adversely affect our cash flows or restrict business.

Our business is financed to a large degree through debt. The maturity and repayment profile of debt used to finance investments often does not correlate to cash flows from assets. Accordingly, we rely on access to both short-term and long-term capital markets as a source of liquidity for capital requirements not satisfied by the cash flows from operations and to fund investments originally financed through debt. Our senior unsecured long-term debt is currently rated investment-grade by various rating agencies. If the rating agencies were to rate us or our rated subsidiaries below investment-grade, our borrowing costs would increase, perhaps significantly. In addition, we would likely be required to pay a higher interest rate in future financings, and our potential pool of investors and funding sources could decrease.

26

We maintain revolving credit facilities to provide back-up for commercial paper programs for borrowings and/or letters of credit at various entities. These facilities typically include financial covenants which limit the amount of debt that can be outstanding as a percentage of the total capital for the specific entity. Failure to maintain these covenants at a particular entity could preclude that entity from issuing commercial paper or letters of credit or borrowing under the revolving credit facility and could require other affiliates to immediately pay down any outstanding drawn amounts under other revolving credit agreements, which could adversely affect cash flow or restrict businesses. Furthermore, if our short-term debt rating were to be below tier 2 (e.g. A-2/P-2, S&P and Moody’s, respectively), access to the commercial paper market could be significantly limited, although this would not affect our ability to draw under the credit facilities.

If we are not able to access capital at competitive rates, our ability to finance operations and implement our strategy may be adversely affected. Restrictions on our ability to access financial markets may also affect our ability to execute our business plan as scheduled. An inability to access capital may limit our ability to pursue improvements or acquisitions that we may otherwise rely on for future growth. Any downgrade or other event negatively affecting the credit ratings of our subsidiaries could make their costs of borrowing higher or access to funding sources more limited, which in turn could increase our need to provide liquidity in the form of capital contributions or loans to such subsidiaries, thus reducing the liquidity and borrowing availability of the consolidated group.

Conditions in the general credit markets have deteriorated since the third quarter of 2008, with widening credit spreads and a lack of liquidity, including certain debt markets being substantially closed. There can be no assurances that this credit crisis will not worsen or impact the availability and cost of debt financing, including any refinancings of the obligations described above.

We may be unable to secure long-term transportation agreements, which could expose our transportation volumes and revenues to increased volatility.

In the future, we may be unable to secure long-term transportation agreements for our gas transmission business as a result of economic factors, lack of commercial gas supply to our systems, increased competition or changes in regulation. Without long-term transportation agreements, our revenues and contract volumes would be exposed to increased volatility. The inability to secure these agreements would materially adversely affect our business, earnings, financial condition and cash flows.

Market based natural gas storage operations are subject to commodity price volatility, which could result in variability in our earnings and cash flows.

We have market based rates for some of our storage operations and sell our storage services based on natural gas market spreads and volatility. If natural gas market spreads or volatility deviate from historical norms or there is significant growth in the amount of storage capacity available to natural gas markets relative to demand, our approach to managing our market-based storage contract portfolio may not protect us from significant variations in storage revenues.

Native land claims have been asserted in British Columbia and Alberta, which could affect future access to public lands, and the success of these claims could have a significant adverse effect on natural gas production and processing.

Certain aboriginal groups have claimed aboriginal and treaty rights over a substantial portion of public lands on which our facilities in British Columbia and Alberta, and the gas supply areas served by those facilities, are located. The existence of these claims, which range from the assertion of rights of limited use to aboriginal title, has given rise to some uncertainty regarding access to public lands for future development purposes. Such claims, if successful, could have a significant adverse effect on natural gas production in British Columbia and Alberta, which could have a material adverse effect on the volume of natural gas processed at our facilities and of NGLs and other products transported in the associated pipelines. We cannot predict the outcome of these claims or the effect they may ultimately have on our business and operations.

27

Protecting against potential terrorist activities requires significant capital expenditures and a successful terrorist attack could adversely affect our business.

Acts of terrorism and any possible reprisals as a consequence of any action by the United States and its allies could be directed against companies operating in the United States. This risk is particularly great for companies, like ours, operating in any energy infrastructure industry that handles volatile gaseous and liquid hydrocarbons. The potential for terrorism has subjected our operations to increased risks that could have a material adverse effect on our business. In particular, we may experience increased capital and operating costs to implement increased security for our facilities and pipelines, such as additional physical facility and pipeline security, and additional security personnel. Moreover, any physical damage to high profile facilities resulting from acts of terrorism may not be covered, or covered fully, by insurance. We may be required to expend material amounts of capital to repair any facilities, the expenditure of which could adversely affect our cash flows and business.

Poor investment performance of our pension plan holdings and other factors affecting pension plan costs could unfavorably affect our earnings, financial position and liquidity.

Our costs of providing non-contributory defined benefit pension plans are dependent upon a number of factors, such as the rates of return on plan assets, discount rates, the level of interest rates used to measure the required minimum funding levels of the plans, future government regulation and our required or voluntary contributions made to the plans. Without sustained growth in the pension plan investments over time to increase the value of our plan assets, and depending upon the other factors impacting our costs as listed above, we could be required to fund our plans with significant amounts of cash. Such cash funding obligations could have a material effect on our earnings and cash flows.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

At December 31, 2008, we had over 100 primary facilities located in the United States and Canada. We generally own sites associated with our major pipeline facilities, such as compressor stations. However, we generally operate our transmission facilities—transmission and distribution pipelines—using rights of way pursuant to easements to install and operate pipelines, but we do not own the land. Except as described in Part II, Item 8. Financial Statements and Supplementary Data, Note 15 of Notes to Consolidated Financial Statements, none of our properties were secured by mortgages or other material security interests at December 31, 2008.

Our corporate headquarters are located at 5400 Westheimer Court, Houston, Texas 77056, which is a leased facility. The lease expires in April 2018.We also maintain major offices in Calgary, Alberta; Vancouver, British Columbia; Chatham, Ontario; Waltham, Massachusetts; Tampa, Florida; Halifax, Nova Scotia; Toronto, Ontario; and Nashville, Tennessee. For a description of our material properties, see Item 1. Business. Our property, plant and equipment includes buildings, technical equipment and other equipment capitalized under capital lease agreements. For more details, refer to Note 13 of Notes to Consolidated Financial Statements.

Item 3. Legal Proceedings.

For information regarding legal proceedings, including regulatory and environmental matters, see Notes 5 and 18 of Notes to Consolidated Financial Statements.

Item 4. Submission of Matters to a Vote of Security Holders.

None.

28

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Our common stock is traded on the New York Stock Exchange under the symbol “SE.” As of February 19, 2009, there were approximately 155,000 holders of record of our common stock and approximately 494,000 beneficial owners.

Common Stock Data by Quarter

| | | | | | | | | |

2008 | | Dividends Per

Common Share | | Stock Price Range(a) |

| | | High | | Low |

First Quarter | | $ | 0.23 | | $ | 26.26 | | $ | 21.41 |