Exhibit 99.1

Hampden Bancorp, Inc. Thomas R. Burton, CPA Robert A. Massey, CPA President and Chief Executive Officer Chief Financial Officer Senior Vice President and Treasurer November 11th, 2010 www.hampdenbank.com NASDAQ: HBNK Sandler O’Neill Partners

Certain statements herein constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the beliefs and expectations of management, as well as the assumptions made using information currently available to management. Because these statements reflect the views of management concerning future events, these statements involve risks, uncertainties and assumptions. As a result, actual results may differ from those contemplated by these statements. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words like “believe”, “expect”, “anticipate”, “estimate”, and “intend” or future or conditional verbs such as “will”, “would”, “s hould”, “could”, or “may.” Certain factors that could have a material adverse affect on the operations of the Bank include, but are not limited to, increased competitive pressure among financial service companies, national and regional economic conditions, changes in interest rates, changes in consumer spending, borrowing and savings habits, legislative and regulatory changes, adverse changes in the securities markets, inability of key third-party providers to perform their obligations to Hampden Bank, changes in relevant accounting principles and guidelines and our ability to successfully implement our branch expansion strategy. Additionally, other risks and uncertainties are described in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) which is available through the SEC’s website at www.sec.gov. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reli ance should not be placed on such statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. The Company disclaims any intent or obligation to update any forward-looking statements, whether in response to new information, future events or otherwise.

Bank Overview and Strategy $574 million asset savings institution established in 1852 Strong core deposit base in demographically attractive market Positioned as an alternative to larger regional and local banks: Emphasis on highly customized service, prompt decision-making, access to local senior management team with broad experience in the banking industry January 2007: Completed conversion from a mutual bank holding company to a stock company bank holding company Strong capital base 9.0% owned by Board of Directors and senior management 1 9.0% owned by Hampden Bank ESOP¹ Proactive credit risk management Strategy for future growth: Grow branch network through strategically placed branches in and around current footprint Capitalize on void created by acquisitions of local independent banks Focus on attracting new custom ers and experienced, seasoned employees alienated by larger banks . Leverage current expense structure. Preserve and enhance conservative credit and interest rate risk profile 1 As of September 30, 2010

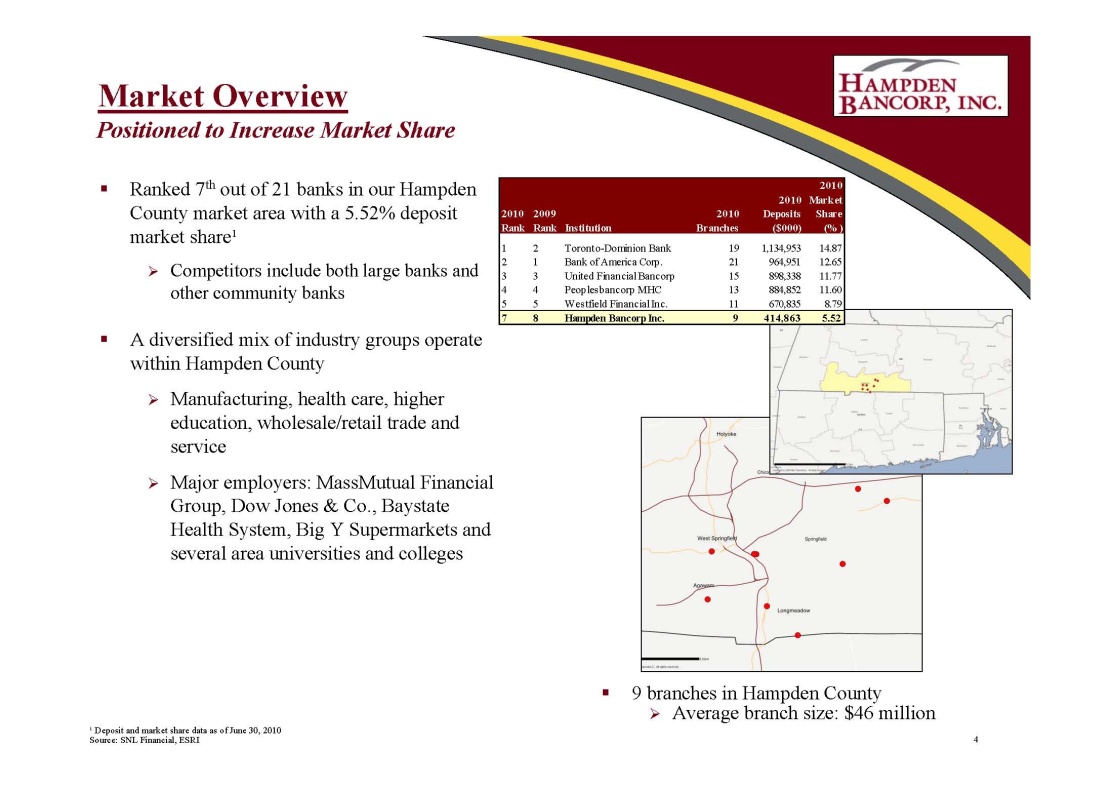

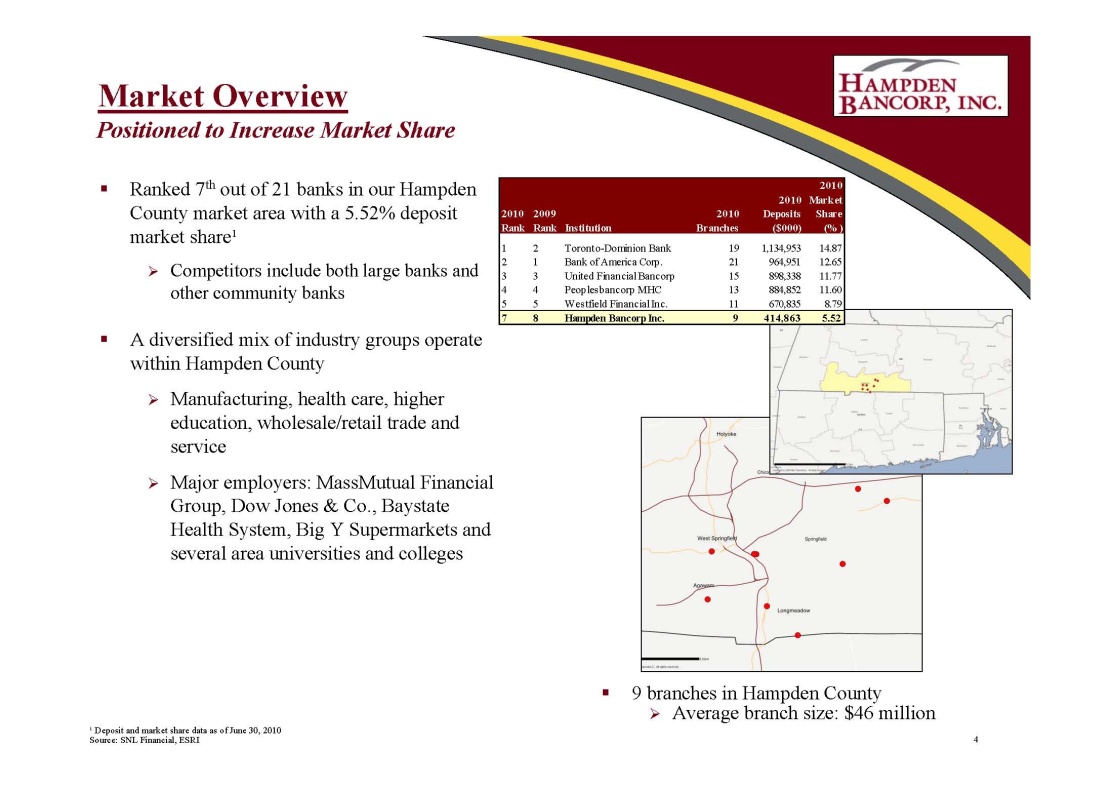

Ranked 7th out of 21 banks in our Hampden County market area with a 5.52% deposit market share¹ Competitors include both large banks and other community banks A diversified mix of industry groups operate within Hampden County Manufacturing, health care, higher education, wholesale/retail trade and service Major employers: MassMutual Financial Group, Dow Jones & Co., Baystate Health System, Big Y Supermarkets and several area universities and colleges Positioned to Increase Market Share Market Overview 2010 Rank 2009 Rank Institution 2010 Branches 2010 Deposits ($000) Market Share (% ) 1 2 Toronto-Dominion Bank 19 1,134,953 14.87 2 1 Bank of America Corp. 21 964,951 12.65 3 3 United Financial Bancorp 15 898,338 11.77 4 4 Peoplesbancorp MHC 13 884,852 11.60 5 5 Westfield Financial Inc. 11 670,835 8.79 7 8 Hampden Bancorp Inc. 9 414,863 5.52 9 branches in Hampden County Average branch size: $46 million ¹ Deposit and market share data as of June 30, 2010 Source: SNL Financial, ESRI 4

Local, Experienced Management Team Local,ExperiencedManagementTeam19 years with HNBK CFO since 2008; SVP and Treasurer Since 1991 Robert A. Massey, CPA Chief Financial Officer, Senior 12 years with HNBK EVP since 2006; Division Executive for Business Banks since 2001 Education: Western New England College, Bachelor of Science in Business Finance; University of Massachusetts, Masters in Business Administration Glenn S. Welch Executive Vice President and Division Executive for Business Banking 16 years with HNBK President and CEO since 1994 Professional Experience: Managing Partner at KPMG, SEC Reviewing Partner Education: Western New England College, Bachelor of Science in Business Administration Thomas R. Burton, CPA President and Chief Executive Officer Vice President and Treasurer Education: Holyoke Community Col lege, Associate of Science Business Administration; University of Massachusetts, Bachelors in Business Administration; William D. Marsh 15 years with HBNK Senior Vice President and SVP and Division Executive for Related Banks and Financial Services since 2001 Division Executive for Retail Education: Hofstra University; SUNY Cortland; Banking and Financial Services St. Lawrence University, Bachelors in History; Rensselaer Polytechnic Institute, Candidate for: Masters in Business Administration Robert J. Michel 36 years with HBNK Senior Vice President and Division SVP and Division Executive for Related Banks and Mortgage Lending since 1974 Executive for Retail Banking and Education: Western New England College, Bachelor of Science in Business Administration Mortgage Lending 5

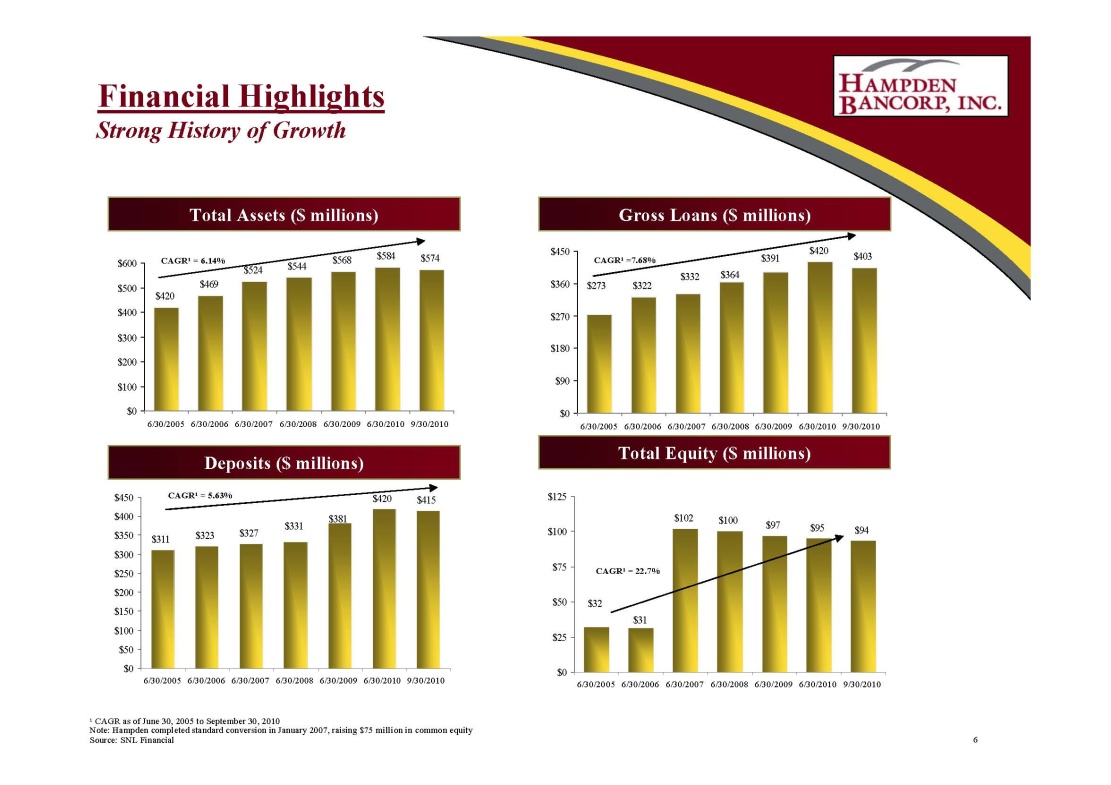

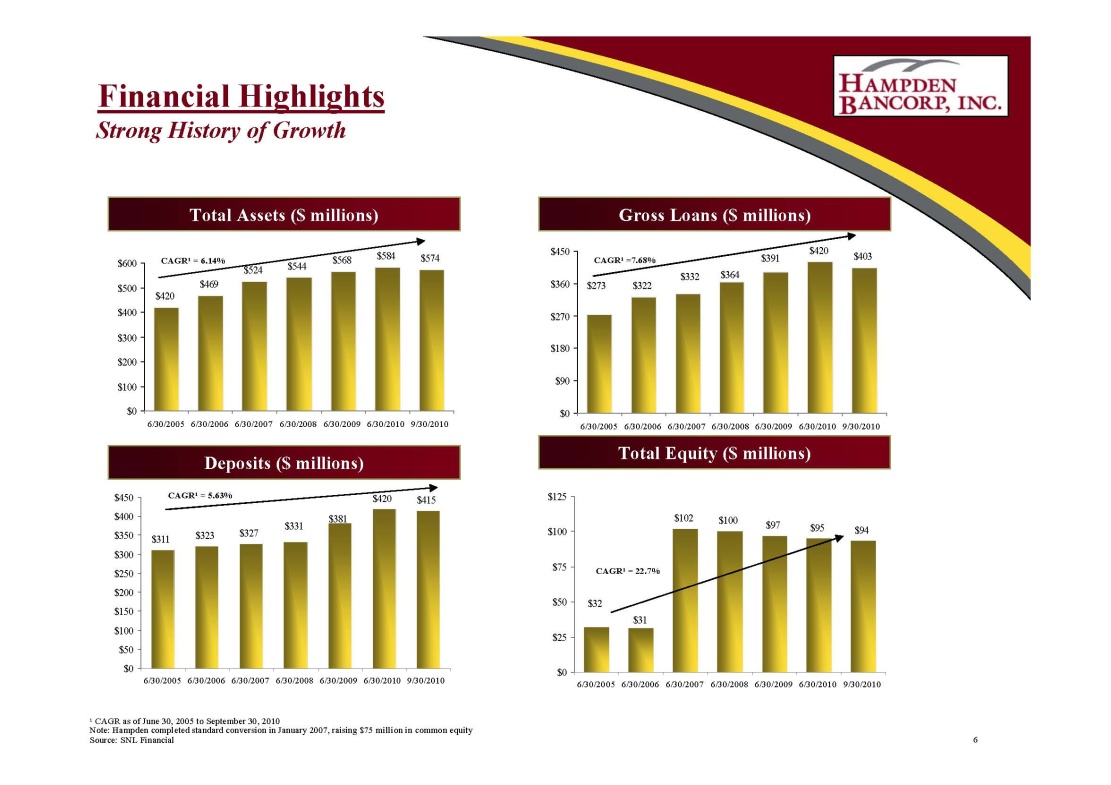

$322 $420 $403 $273 $391 $364$332 $0 $90 $180 $270 $360 $450 6/30/2005 6/30/2006 6/30/2007 6/30/2008 6/30/2009 6/30/2010 9/30/2010 $420 $469 $524 $544 $568 $584 $574 $0 $100 $200 $300 $400 $500 $600 6/30/2005 6/30/2006 6/30/2007 6/30/2008 6/30/2009 6/30/2010 9/30/2010 Financial Highlights Financial Highlights Strong History of Growth Total Assets ($ millions) Gross Loans ($ millions) CAGR¹ = 6.14% CAGR¹ =7.68% Deposits ($ millions) Total Equity ($ millions) $450 $400 $350 $300 $250 $200 $150 $100 $50 $0 6/30/2005 6/30/2006 6/30/2007 6/30/2008 6/30/2009 6/30/2010 9/30/2010 $311 $323 $327 $420 $415 $381$331 CAGR¹ = 5.63% ¹ CAGR as of June 30, 2005 to September 30, 2010 Note: Hampden completed standard conversion in January 2007, raising $75 million in common equity Source: SNL Financial $125 $100 $75 $50 $25 $0 $102 $100 $97 $95 $94 $31 $32 CAGR¹ = 22.7% 6/30/2005 6/30/2006 6/30/2007 6/30/2008 6/30/2009 6/30/2010 9/30/2010 6

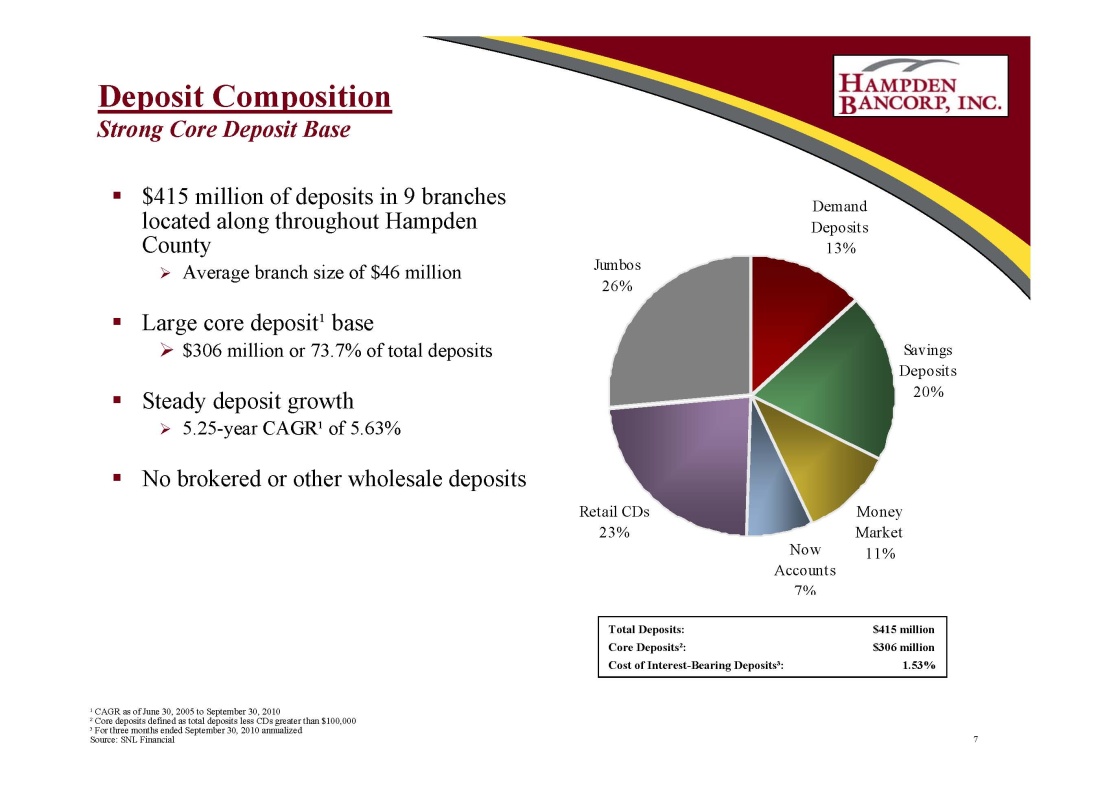

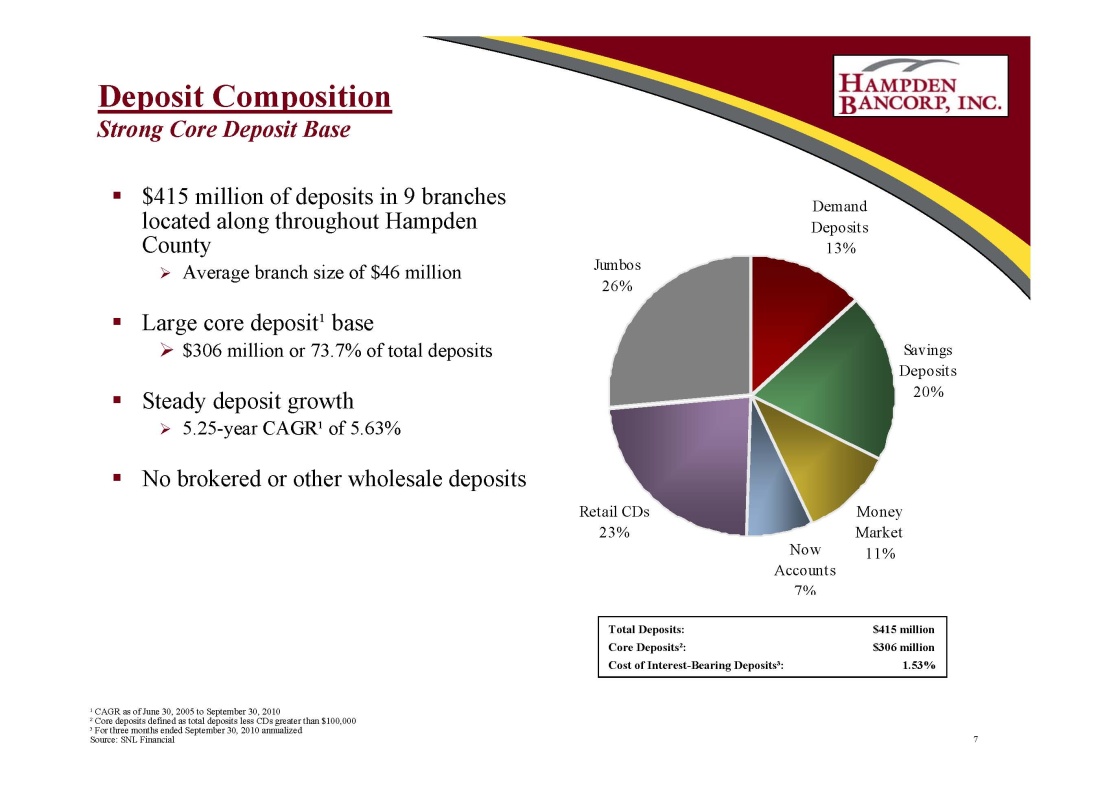

Deposit Composition Demand Deposits 13% Savings Deposits 20% Money Market Retail CDs 23% Jumbos 26% $415 million of deposits in 9 branches located along throughout Hampden County Average branch size of $46 million Large core deposit¹ base $306 million or 73.7% of total deposits Steady deposit growth 5.25-year CAGR¹ of 5.63% No brokered or other wholesale deposits Strong Core Deposit Base Now 11% Accounts 7% Total Deposits: $415 million Core Deposits²: $306 million Cost of Interest-Bearing Deposits³: 1.53% ¹ CAGR as of June 30, 2005 to September 30, 2010 ² Core deposits defined as total deposits less CDs greater than $100,000 ³ For three months ended September 30, 2010 annualized Source: SNL Financial 7

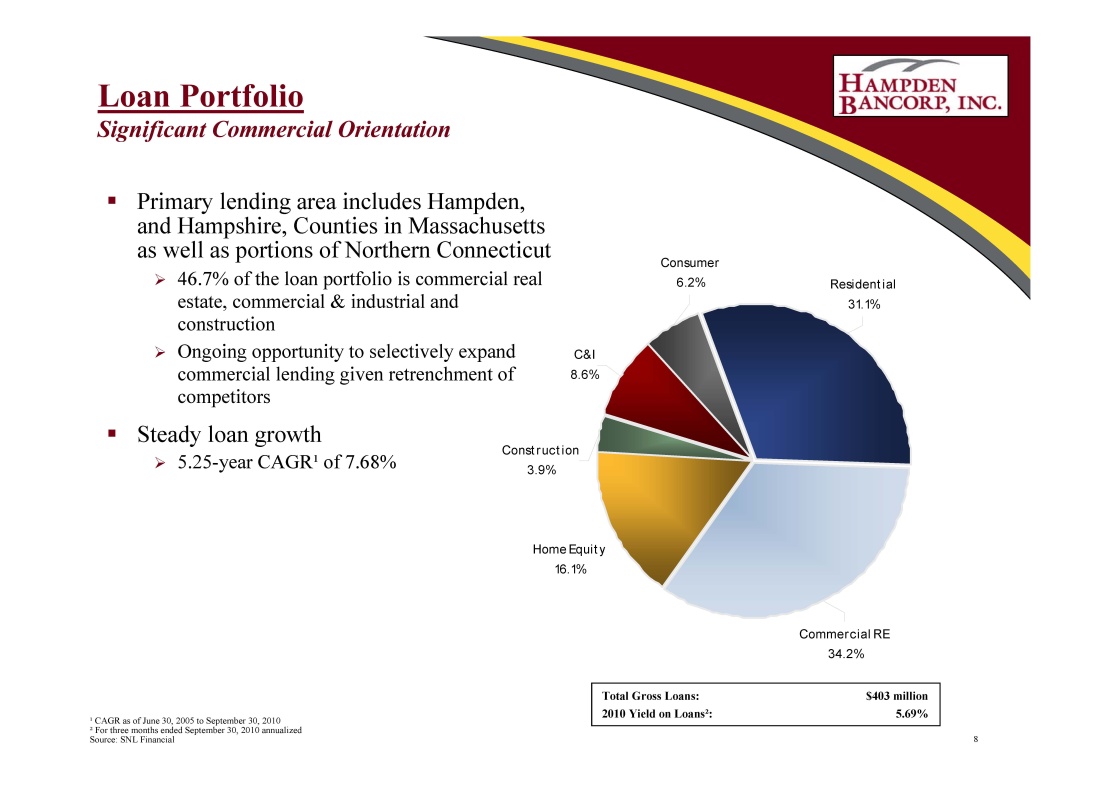

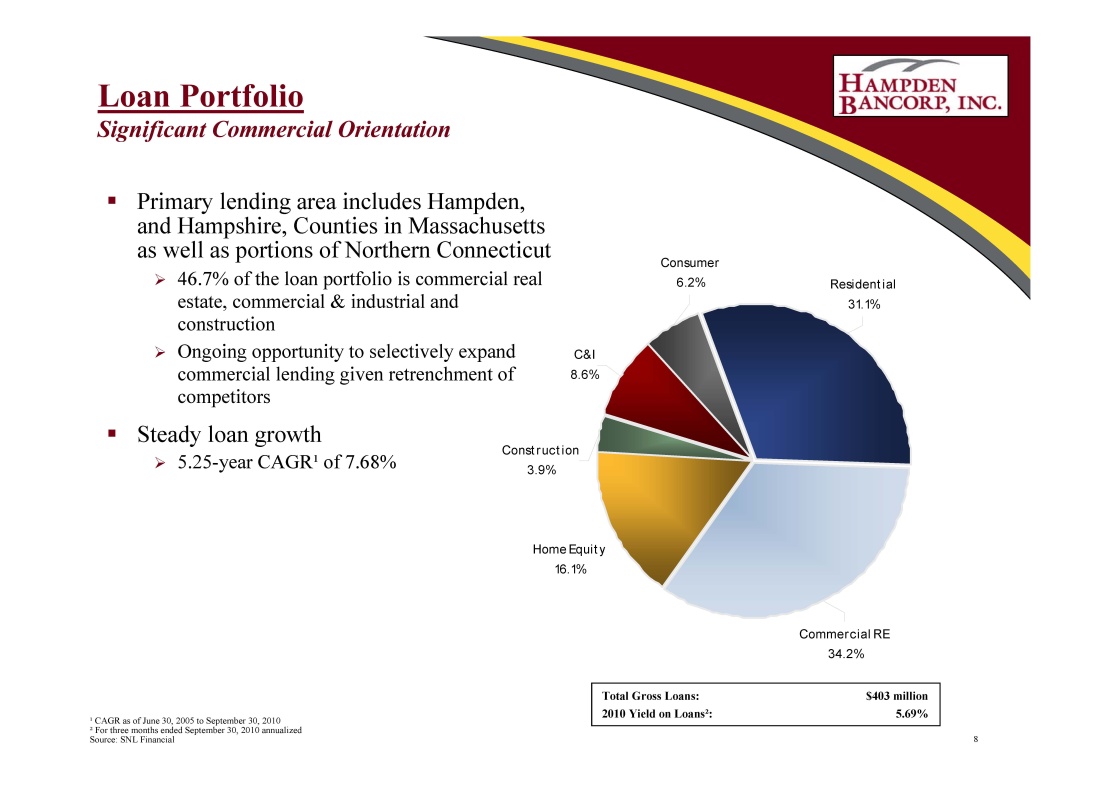

Residential 31.1% Home Equity 16.1% Construction 3.9% C&I 8.6% Consumer 6.2% Loan Portfolio Loan Portfolio Primary lending area includes Hampden, and Hampshire, Counties in Massachusetts as well as portions of Northern Connecticut 46.7% of the loan portfolio is commercial real estate, commercial & industrial and construction Ongoing opportunity to selectively expand commercial lending given retrenchment of competitors Steady loan growth 5.25-year CAGR¹ of 7.68% Significant Commercial Orientation Commercial RE 34.2% Total Gross Loans: $403 million ¹ CAGR as of June 30, 2005 to September 30, 2010 ² For three months ended September 30, 2010 annualized Source: SNL Financial 2010 Yield on Loans²: 5.69% 8

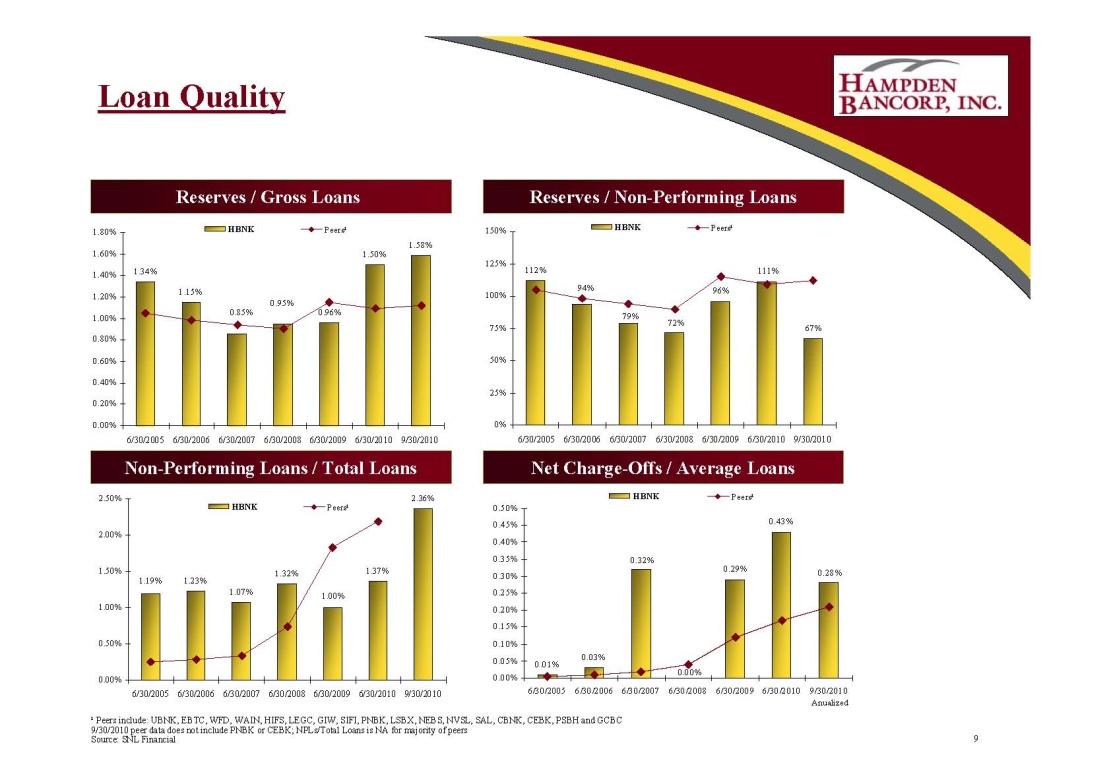

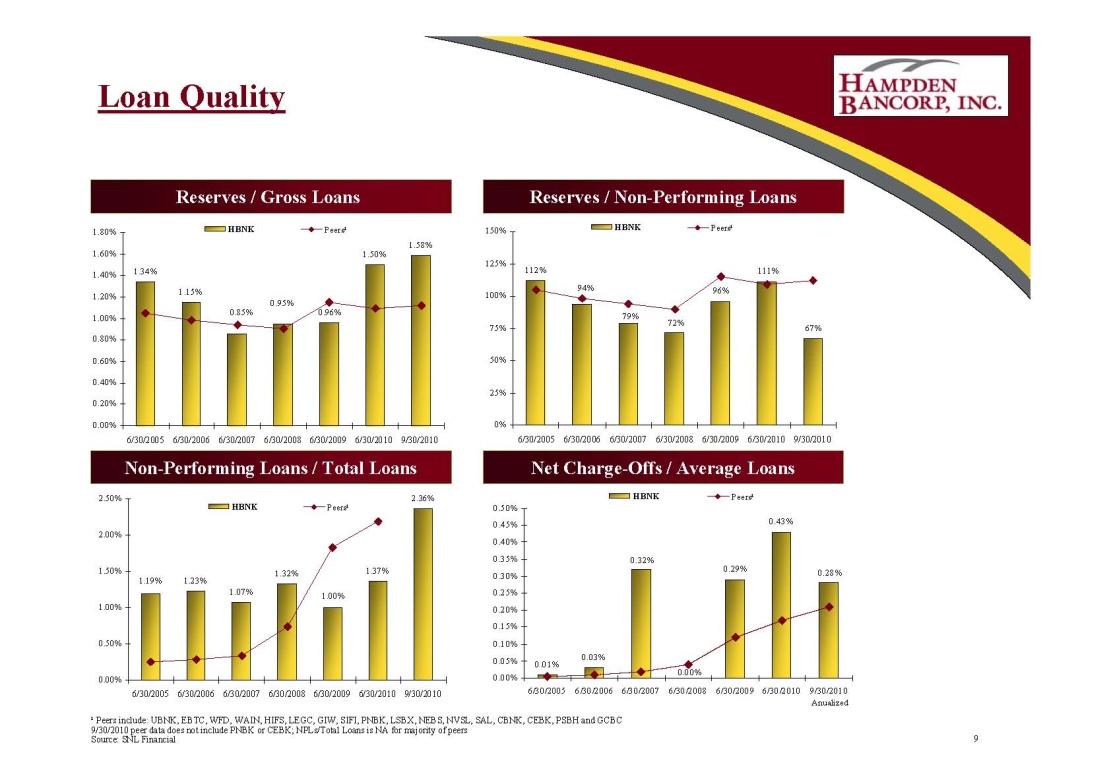

Loan Quality 1.34% 1.15% 1.50% 1.58% 0.96% 0.85% 0.95% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 1.80% 6/30/2005 6/30/2006 6/30/2007 6/30/2008 6/30/2009 6/30/2010 9/30/2010 HBNK Peers¹ Reserves / Gross Loans Reserves / Non-Performing Loans 112% 67% 72% 111% 79% 96% 94% 0% 25% 50% 75% 100% 125% 150% 6/30/2005 6/30/2006 6/30/2007 6/30/2008 6/30/2009 6/30/2010 9/30/2010 HBNK Peers¹ Non-Performing Loans / Total Loans Net Charge-Offs / Average Loans 1.23% 1.07% 1.32% 1.37% 2.36% 1.19% 1.00% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% HBNK Peers¹ 0.01% 0.03% 0.43% 0.29% 0.32% 0.00% 0.28% 0.00% 0.05% 0.10% 0.15% 0.20% 0.25% 0.30% 0.35% 0.40% 0.45% 0.50% HBNK Peers¹ 6/30/2005 6/30/2006 6/30/2007 6/30/2008 6/30/2009 6/30/2010 9/30/2010 6/30/2005 6/30/2006 6/30/2007 6/30/2008 6/30/2009 6/30/2010 9/30/2010 Anuali zed ¹ Peers include: UBNK, EBTC, WFD, WAIN, HIFS, LEGC, GIW, SIFI, PNBK, LSBX, NEBS, NVSL, SAL, CBNK, CEBK, PSBH and GCBC 9/30/2010 peer data does not include PNBK or CEBK; NPLs/Total Loans is NA for majority of peers Source: SNL Financial 9

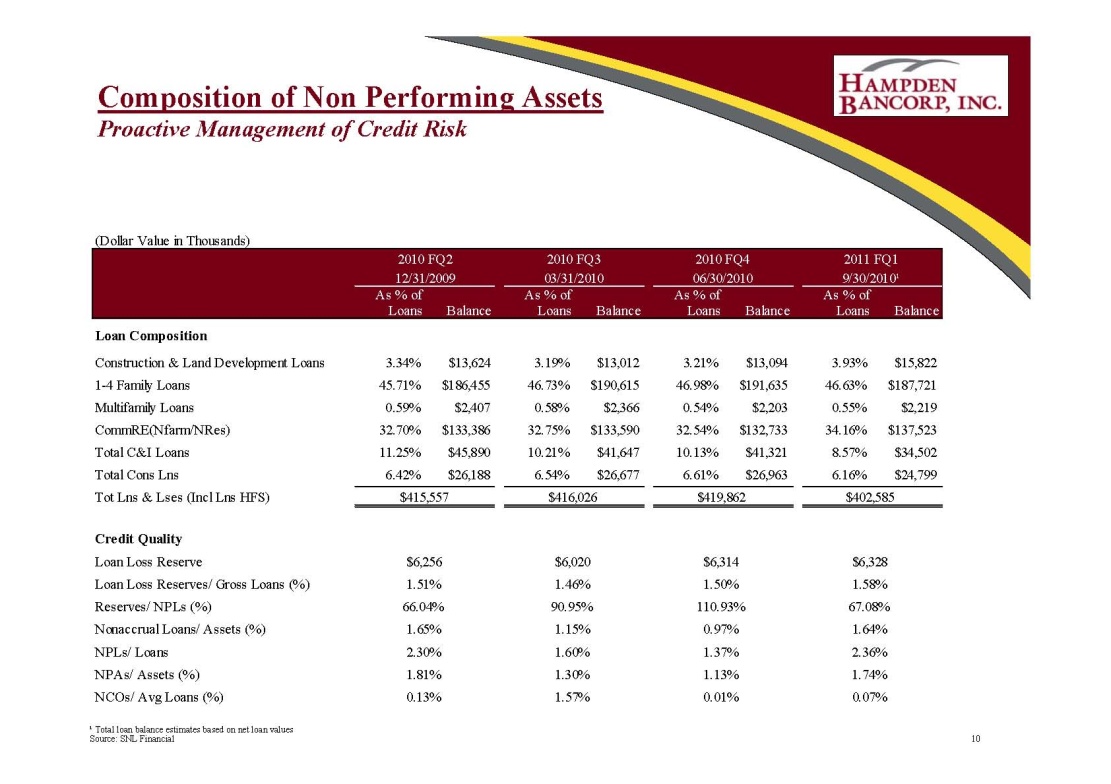

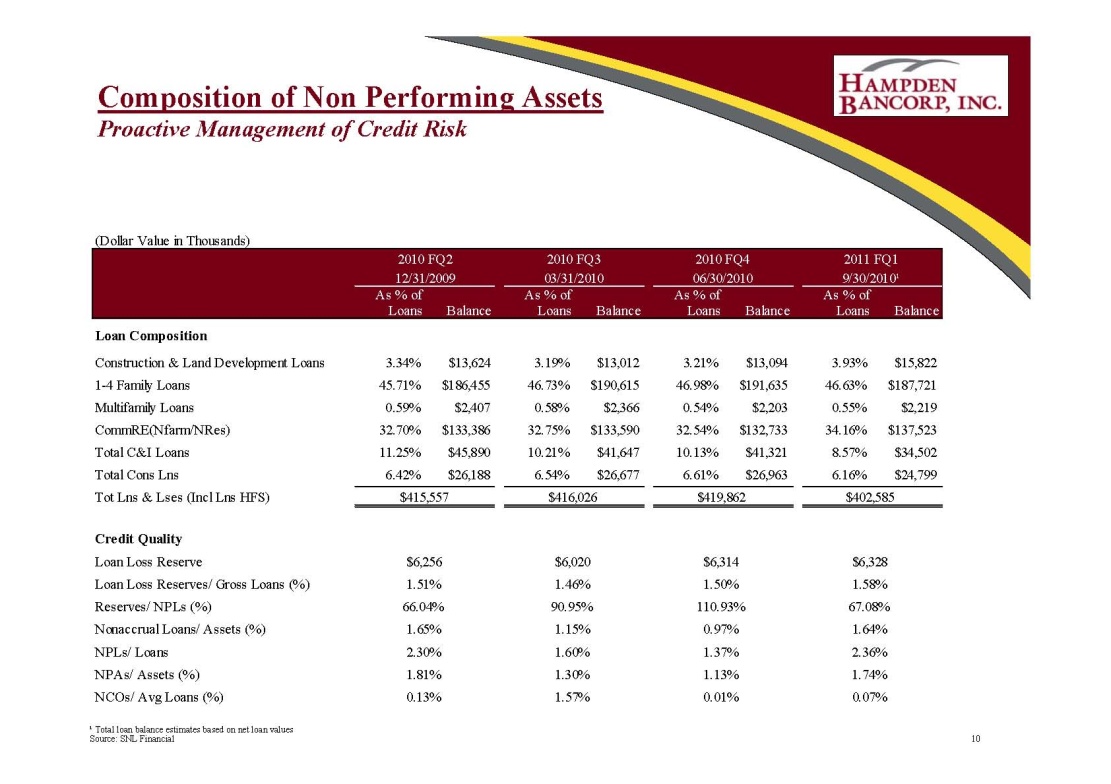

Composition of Non Performing Assets Proactive Management of Credit Risk (Dollar Value in Thousands) 2010 FQ2 2010 FQ3 2010 FQ4 2011 FQ1 12/31/2009 03/31/2010 06/30/2010 9/30/2010¹ As % of As % of As % of As % of Loans Balance Loans Balance Loans Balance Loans Balance Loan Composition Construction & Land Development Loans 3.34% $13,624 3.19% $13,012 3.21% $13,094 3.93% $15,822 1-4 Family Loans 45.71% $186,455 46.73% $190,615 46.98% $191,635 46.63% $187,721 Multifamily Loans 0.59% $2,407 0.58% $2,366 0.54% $2,203 0.55% $2,219 CommRE(Nfarm/NRes) 32.70% $133,386 32.75% $133,590 32.54% $132,733 34.16% $137,523 Total C&I Loans 11.25% $45,890 10.21% $41,647 10.13% $41,321 8.57% $34,502 Total Cons Lns 6.42% $26,188 6.54% $26,677 6.61% $26,963 6.16% $24,799 Tot Lns & Lses (Incl Lns HFS) $415,557 $416,026 $419,862 $40 2,585 Credit Quality Loan Loss Reserve $6,256 $6,020 $6,314 $6,328 Loan Loss Reserves/ Gross Loans (%) 1.51% 1.46% 1.50% 1.58% Reserves/ NPLs (%) 66.04% 90.95% 110.93% 67.08% Nonaccrual Loans/ Assets (%) 1.65% 1.15% 0.97% 1.64% NPLs/ Loans 2.30% 1.60% 1.37% 2.36% NPAs/ Assets (%) 1.81% 1.30% 1.13% 1.74% NCOs/ Avg Loans (%) 0.13% 1.57% 0.01% 0.07% ¹ Total loan balance estimates based on net loan values Source: SNL Financial 10

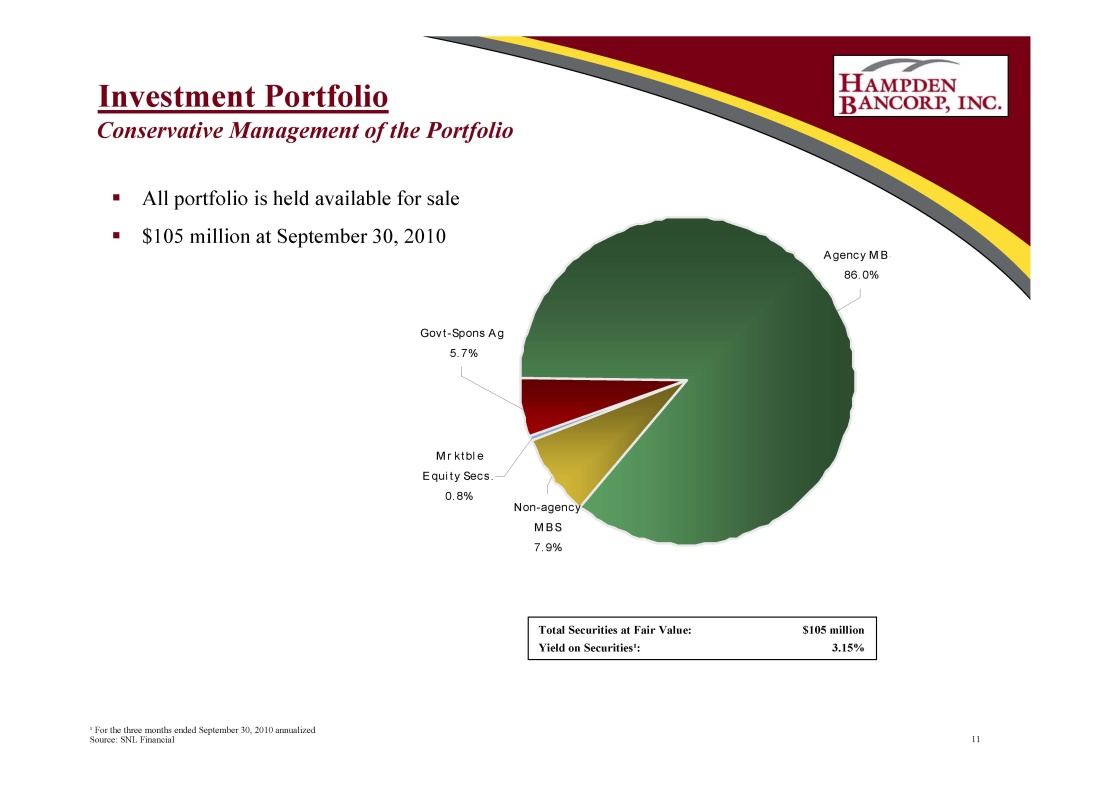

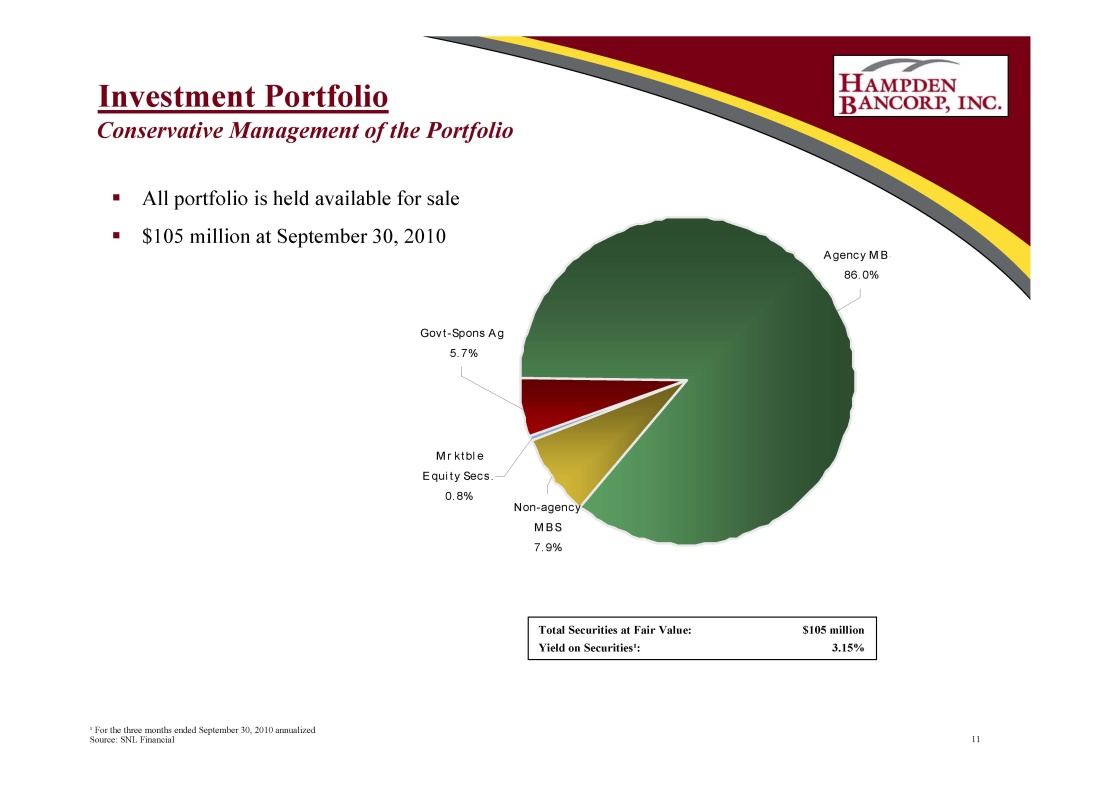

Investment Portfolio Conservative Management of the Portfolio Govt-Spons Ag 5. 7% Non-agency MBS 7.9% Mrktble Equity Secs. 0.8% Agency MBS 86.0% All portfolio is held available for sale $105 million at September 30, 2010 Total Securities at Fair Value: $105 million Yield on Securities¹: 3.15% ¹ For the three months ended September 30, 2010 annualized Source: SNL Financial 11

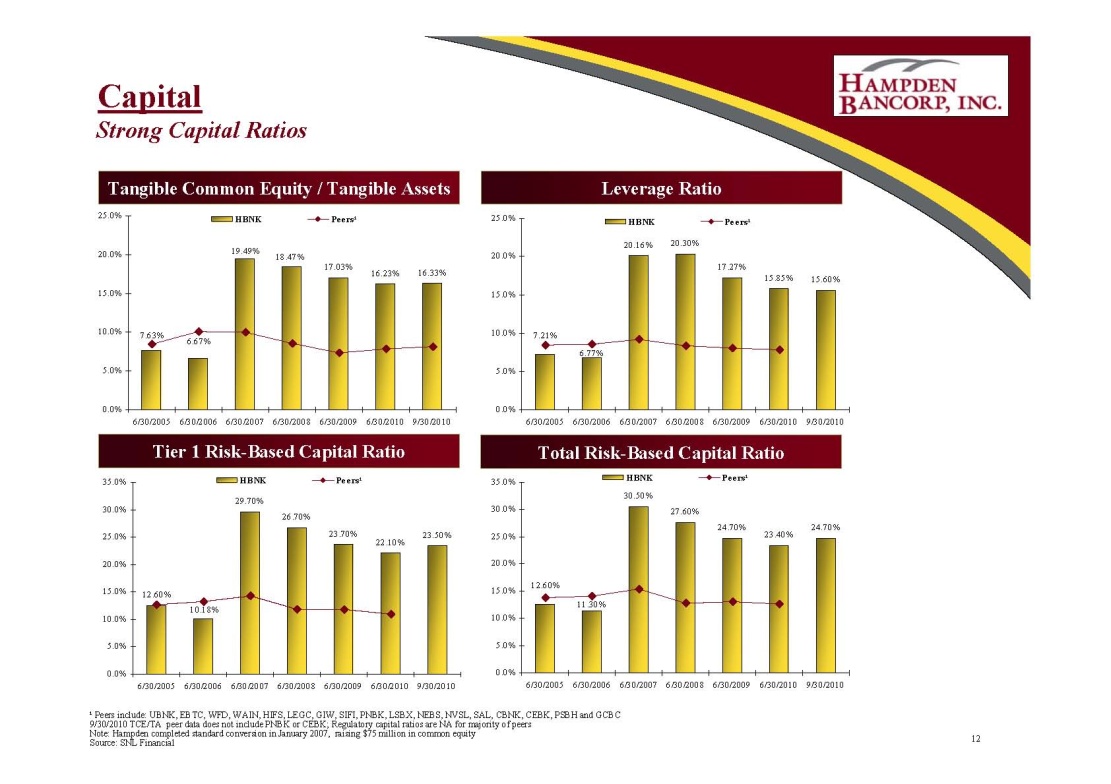

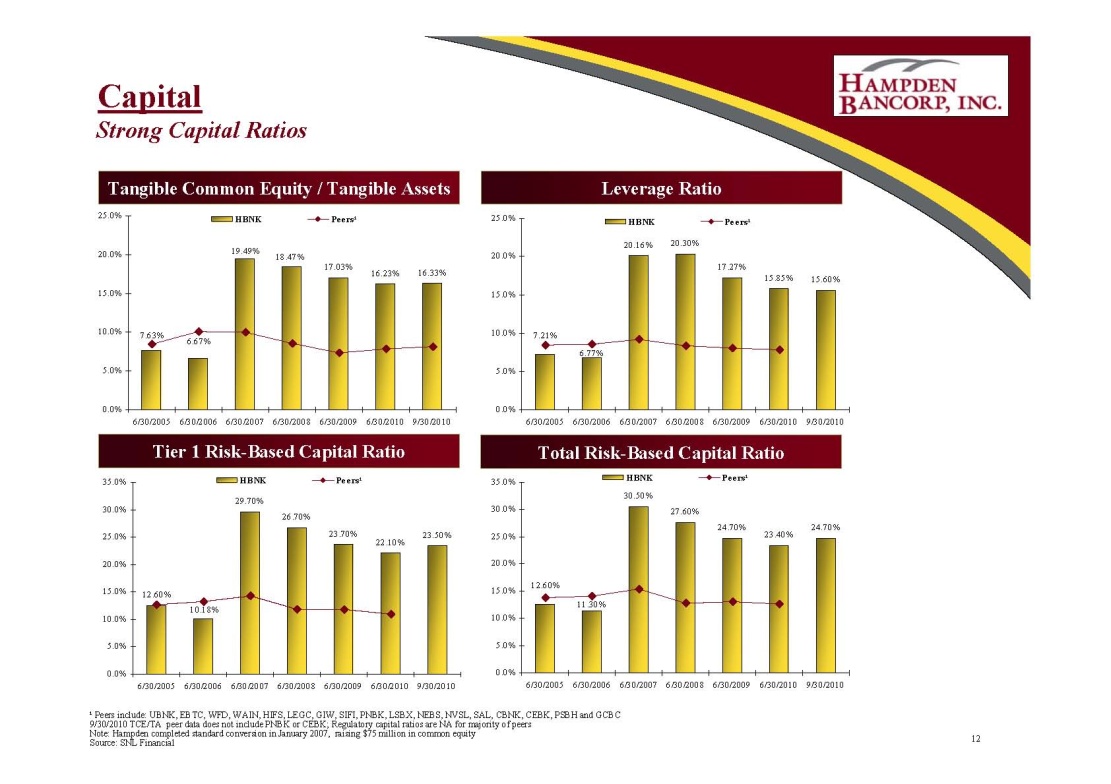

Capital Strong Capital Ratios 17.03% 16.23% 16.33% 7.63% 18.47% 19.49% 6.67% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 6/30/2005 6/30/2006 6/30/2007 6/30/2008 6/30/2009 6/30/2010 9/30/2010 HBNK Peers¹ Tangible Common Equity / Tangible Assets Leverage Ratio Tier 1 Risk-Based Capital Ratio Total Risk-Based Capital Ratio 20.16% 20.30% 17.27% 15.85% 15.60% 6.77% 7.21% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 6/30/2005 6/30/2006 6/30/2007 6/30/2008 6/30/2009 6/30/2010 9/30/2010 HBNK Peers¹ 29.70% 26.70% 23.70% 22.10% 23.50% 10.18% 12.60% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% HBNK Peers¹ 30.50% 27.60% 24.70% 23.40% 24.70% 11.30% 12.60% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% HBNK Peers¹ 6/30/2005 6/30/2006 6/30/2007 6/30/2008 6/30/2009 6/30/2010 9/30/2010 6/30/2005 6/30/2006 6/30/2007 6/30/2008 6/30/2009 6/30/201 0 9/30/2010 ¹ Peers include: UBNK, EBTC, WFD, WAIN, HIFS, LEGC, GIW, SIFI, PNBK, LSBX, NEBS, NVSL, SAL, CBNK, CEBK, PSBH and GCBC 9/30/2010 TCE/TA peer data does not include PNBK or CEBK; Regulatory capital ratios are NA for majority of peers Note: Hampden completed standard conversion in January 2007, raising $75 million in common equity 12 Source: SNL Financial

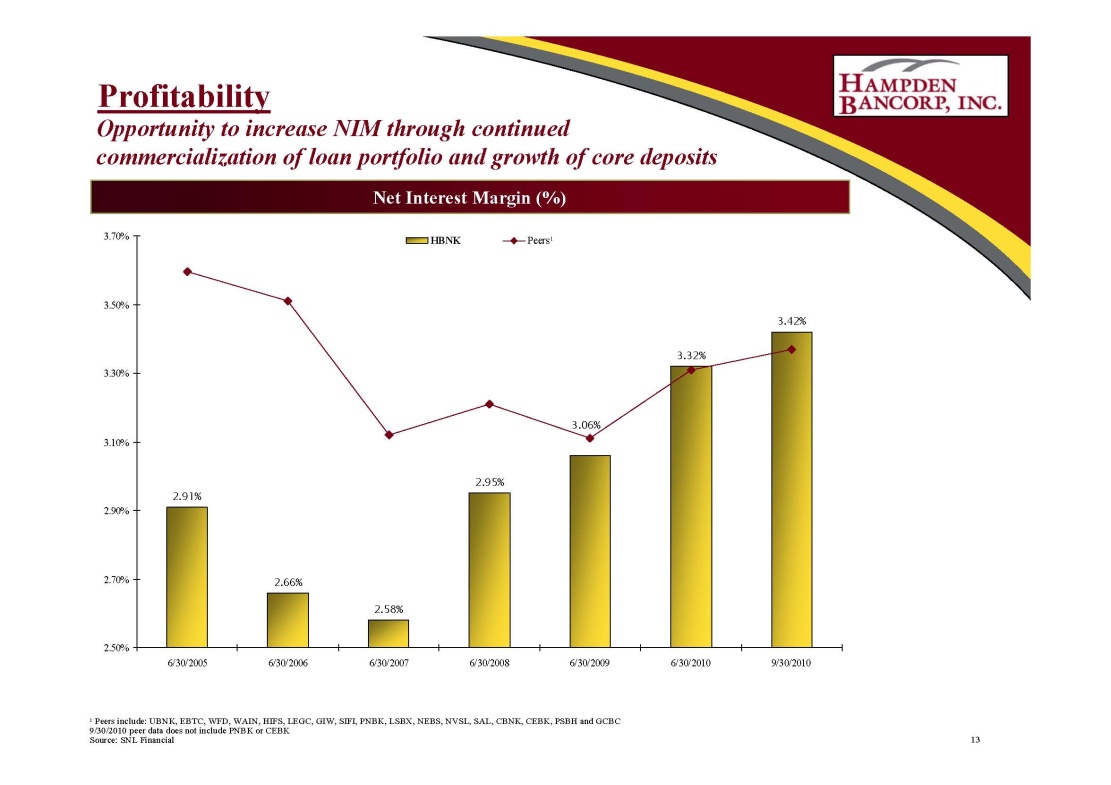

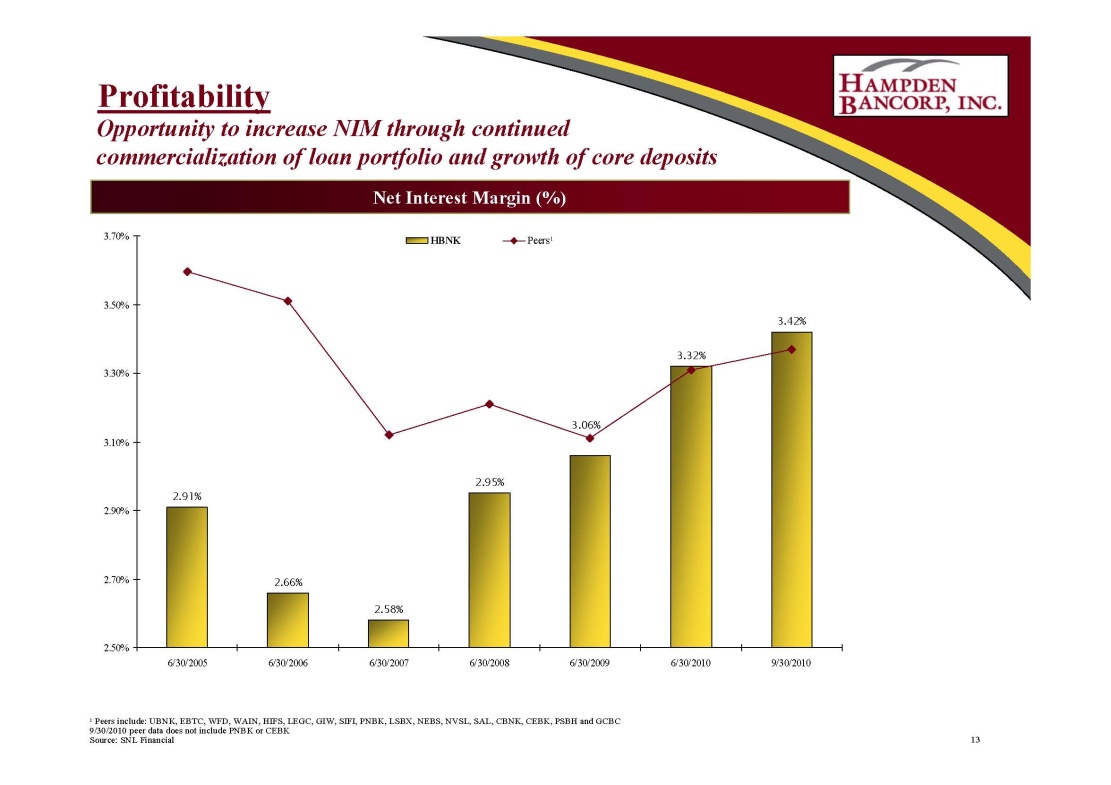

Profitability Opportunity to increase NIM through continued commercialization of loan portfolio and growth of core deposits 2.91% 2.66% 2.58% 2.95% 3.32% 3.42% 3.06% 2.50% 2.70% 2.90% 3.10% 3.30% 3.50% 3.70% HBNK Peers¹ Net Interest Margin (%) 6/30/2005 6/30/2006 6/30/2007 6/30/2008 6/30/2009 6/30/2010 9/30/2010 ¹ Peers include: UBNK, EBTC, WFD, WAIN, HIFS, LEGC, GIW, SIFI, PNBK, LSBX, NEBS, NVSL, SAL, CBNK, CEBK, PSBH and GCBC 9/30/2010 peer data does not include PNBK or CEBK Source: SNL Financial 13

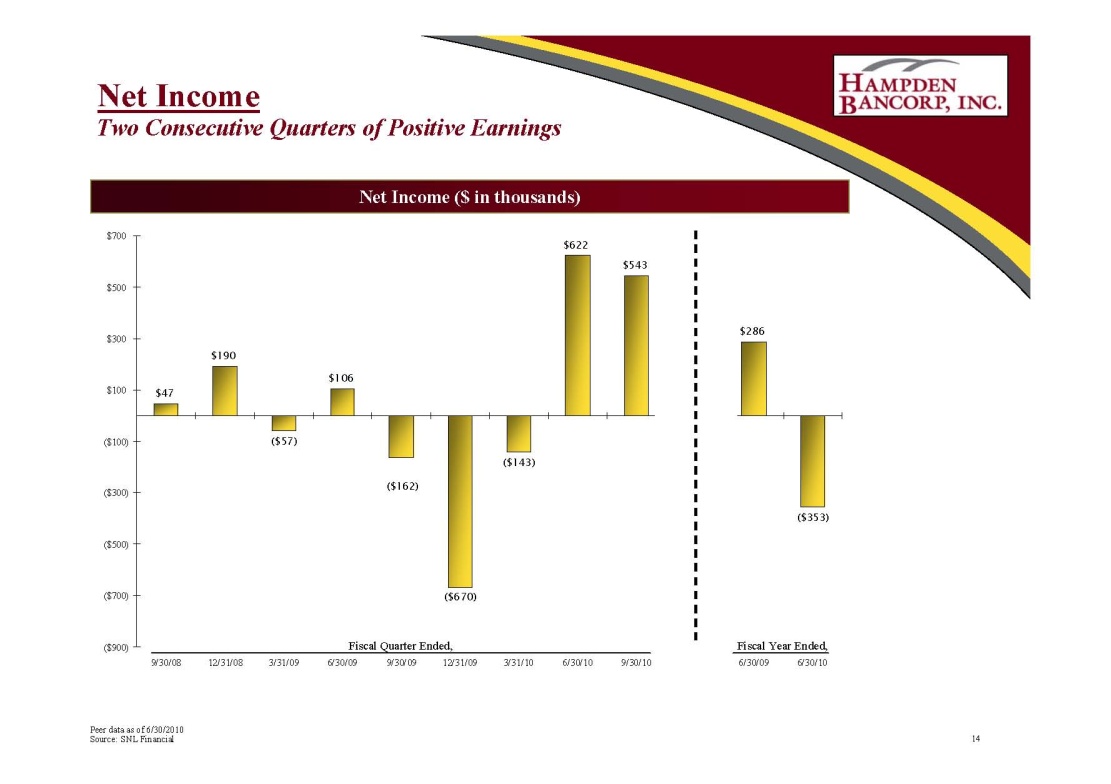

Net Income Two Consecutive Quarters of Positive Earnings Net Income ($ in thousands) $47 $190 ($57) $106 ($143) $622 $543 $286 ($353) ($162) ($500) ($300) ($100) $100 $300 $500 $700 ($700) ($670) Fiscal Quarter Ended, Fiscal Year Ended, 9/30/08 12/31/08 3/31/09 6/30/09 9/30/09 12/31/09 3/31/10 6/30/10 9/30/10 6/30/09 6/30/10 ($900) Peer data as of 6/30/2010 Source: SNL Financial 14

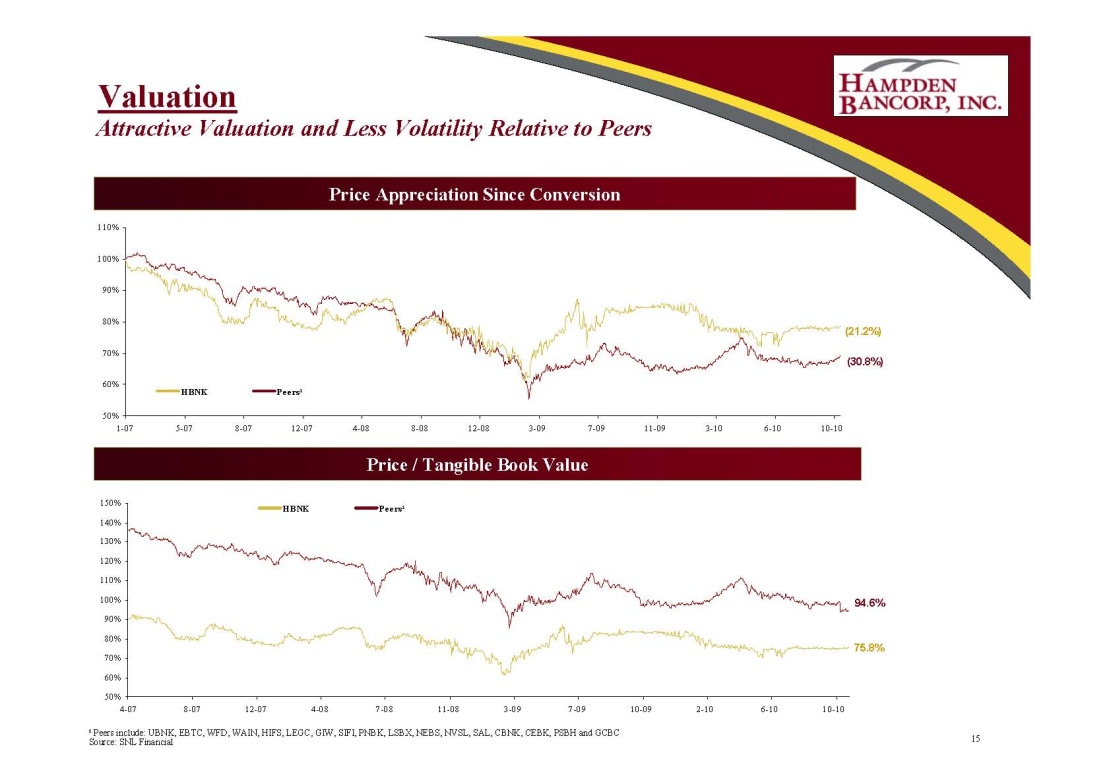

Valuation Price Appreciation Since Conversion Price / Tangible Book Value 50% 60% 70% 80% 90% 100% 110% 1-07 5-07 8-07 12-07 4-08 8-08 12-08 3-09 7-09 11-09 3-10 6-10 10-10 HBNK Peers¹¹ Peers include: UBNK, EBTC, WFD, WAIN, HIFS, LEGC, GIW, SIFI, PNBK, LSBX, NEBS, NVSL, SAL, CBNK, CEBK, PSBH and GCBC Source: SNL Financial (21.2%) (30.8%) Attractive Valuation and Less Volatility Relative to Peers 50% 60% 70% 80% 90% 100% 110% 120% 130% 140% 150% 4-07 8-07 12-07 4-08 7-08 11-08 3-09 7-09 10-09 2-10 6-10 10-10 75.8% 94.6% HBNK Peers¹ 15

Investment Summary Strong core deposit base in demographically attractive market, with growth opportunity Deep capital base Proactive risk management Experienced management team Current attractive valuation relative to peers 16