SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x | Filed by a Party other than the Registrant o |

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| o | Soliciting Material Pursuant to § 240.14a-12 |

Hampden Bancorp, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

On October 21, 2013, the Company indicated it will mail the following letter to its shareholders:

HAMPDEN BANCORP, INC.

October 21, 2013

Dear Fellow Shareholder:

At our Annual Meeting of Stockholders on November 5, 2013 you will be asked, among other things, to elect four directors to your Board, as well as vote on a stockholder proposal that requests that the Board explore avenues to enhance shareholder value through extraordinary transactions, including selling or merging the Company with other institutions.

As you know a Dallas based hedge fund manager, Johnny Guerry and the fund he controls, MHC Mutual Conversion Fund, L.P. (the “Clover Group”) are seeking to elect his hand-picked nominees to our Board and approve his shareholder resolution in order to advance his stated objective of forcing a sale or merger of Hampden. Your Board of Directors and management team believe this is the wrong path and is not in the best interests of Hampden shareholders. That is why we urge you to use the enclosed BLUE proxy card to vote IN FAVOR of the Board’s nominees and AGAINST the Clover Group’s proposal.

Your Board of Directors has nominated and unanimously recommends a vote IN FAVOR of our highly qualified slate of directors, including Thomas R. Burton, Arlene Putnam, Richard D. Suski, CPA and Linda Silva Thompson.

YOUR VOTE IS IMPORTANT TO PREVENT A FORCED SALE OR MERGER OF HAMPDEN

We believe the Clover Group’s communications grossly misrepresent our performance in order to further its own proposal to force a sale of Hampden Bank. We believe that allowing Clover Group representatives on the Board would adversely affect long-term shareholder value by jeopardizing our progress and forcing a sale at the wrong time.

HAMPDEN BANCORP IS SUCCESSFULLY EXECUTING A STRATEGIC PLAN THAT IS DELIVERING RESULTS

Over the past year, your new management team has been focused on executing a strategy that leverages our competitive strengths as a well-capitalized community bank, while driving efficiency and profitability.

This strategy is working as evidenced by our record first quarter financial results. Specifically:

| ● | Improved Profitability. The Company reported net income of $1.2 million, or $0.22 per fully diluted share, for the first quarter of fiscal 2014. This represents the largest quarter end net income and EPS performance by the Company since its IPO and a 57% increase over the comparable quarter last year. |

| ● | Loan Portfolio Growth. Our loan portfolio growth continued in the first quarter of fiscal 2014, including a 6.8% growth in commercial loans. We are driving this growth by targeting commercial clients attracted to the advantages offered by community-based banking, executing focused home mortgage marketing through our branches, and tailoring programs to capitalize on market opportunities, all without affecting our pricing or underwriting standards. This loan growth does not include a majority of the mortgage loans we originate, which are sold in the secondary market. The Company continues to maintain a conservative loan loss reserve given its loan delinquencies, loan volume, economic conditions and historic charge offs, among other factors. |

| ● | Performance Ratios. A majority of our performance ratios continued to improve in the first fiscal quarter of 2014 from year end fiscal 2013. ROAA increased from 0.46% to 0.72%, ROAE increased from 3.41% to 5.77%, net interest margin decreased from 3.14% to 3.10% and our efficiency ratios decreased from 76.48% to 66.85%. Had it not been for the management restructure at June 30, 2013, our ROAA would have been 0.51%, our ROAE would have been 3.76%, and our efficiency ratio would have been 75.13% at June 30, 2013. |

HAMPDEN BANCORP IS DELIVERING VALUE FOR SHAREHOLDERS

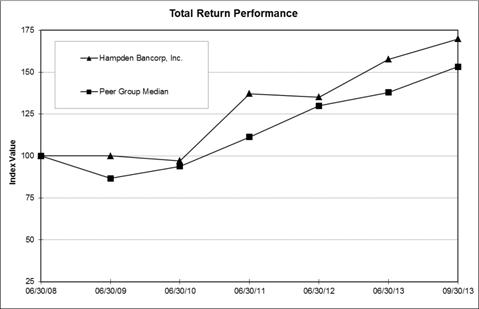

Our stock price has outperformed both the NASDAQ Bank Index and the SNL U.S. Bank Index over the last five years. In addition, our stock price has outperformed the median performance of our peer group stocks over the past five years, as seen below.

| | | Period Ending | |

| Index | 06/30/08 | 06/30/09 | 06/30/10 | 06/30/11 | 06/30/12 | 06/30/13 | 09/30/13 |

| Hampden Bancorp, Inc. | 100.00 | 100.03 | 97.10 | 137.09 | 135.18 | 157.72 | 169.89 |

| Peer Group Median | 100.00 | 86.67 | 93.79 | 111.28 | 129.87 | 137.90 | 153.26 |

Source: SNL Financial LC. The peer group used in the chart above, excluding mutual banking institutions, is the same peer group noted in our proxy statement, and was selected by our independent compensation consultant in order to prepare its compensation analysis for the Board of Directors.

MANAGEMENT COMPENSATION TIED TO PERFORMANCE

We have a very reasonable approach to compensation that is tied directly to the performance of the bank so that management’s interests are aligned with shareholders’. According to our Compensation Committee policies, our CEO and executive officer compensation, including salary compensation and equity compensation, is set approximately at the 50th percentile of a peer group of 20 banks and financial institutions identified by an independent compensation advisor. Our annual cash bonuses are capped at 20% of salary and are only paid if an individual meets financial performance goals that are set for him or her by the Board annually. After our IPO, our shareholders approved our 2008 Equity Incentive Plan, under which directors and executive officers receive equity— this means that if the stock goes down, so does the value of their equity. This is consistent with equity compensation plans for other peer public banking institutions.

THE CLOVER GROUP’S UNNECESSARY PROXY CONTEST

IS NOT IN THE BEST INTERESTS OF SHAREHOLDERS

The Clover Group has forced us into an unnecessary and distracting proxy fight, despite our willingness to listen to their views and address their proposals appropriately.

| ● | Your Board formally considered last year’s shareholder proposal to consider strategic options and determined to continue to implement its strategy. Your Board of Directors takes its fiduciary duties very seriously. It formally considered a shareholder proposal that was substantially the same as that being proposed by the Clover Group, which was approved at last year’s annual meeting. Over a series of meetings, the Board of Directors consulted with two separate investment banks to analyze strategic options for the Company, including continuing to implement the strategic plan currently in effect and a potential sale or merger of the Company. As a result of that review and analysis the Board of Directors determined to continue to focus on building the long-term value of the Company and will continue to periodically evaluate means of enhancing shareholder value, including a sale or merger in the future. We believe the Clover Group’s sole aim in nominating two directors and sponsoring the shareholder proposal is to attempt to force a sale of the Company The Schedule 13D filed by the Clover Group states clearly that “we believe it is in the best interests of Hampden shareholders to sell the bank." In such Schedule 13D the Clover Group indicated that they would expect a strategic buyer to pay somewhere in the range of 1.3x-1.4x tangible book value. Based on the Board of Director’s recent review of strategic options we do not believe the premiums estimated by Clover are realistic and do not believe a sale or merger is in the best interests of shareholders at this time. |

| ● | The Clover Group has Misrepresented Executive Compensation. Based on our regulatory filings, we believe Clover overstated the 2012 amount of Mr. Burton’s total compensation by $150,000 and understated the 2007 amount by $180,000. Accordingly, the change in compensation was actually a decrease of 7%, as opposed to the increase that Clover Group claims in its proxy statement. |

In the Clover Group’s October 16, 2013 letter to stockholders it presents a table showing named executive compensation from 2008 to 2013. Among other things, the letter fails to note that the amounts reflect an increasing number of executives and, in 2013, includes salaries and severance payments for employees who left the company in June.

Your Board and Management are laser focused on serving the best interests of shareholders and continuing to grow the business and improve the performance of Hampden Bank.

VOTE THE BLUE PROXY CARD IN FAVOR OF THE COMPANY’S NOMINEES AND

AGAINST THE CLOVER GROUP’S PROPOSAL

Thank you again for you continued support.

Sincerely,

/s/ Glenn S. Welch

Glenn S. Welch

Chief Executive Officer and President

Your Vote Is Important, No Matter How Many Shares You Own.

If you have questions about how to vote your shares on the BLUE proxy card, or need additional assistance, please contact the firm assisting us in the solicitation of proxies:

D.F. King

48 Wall Street

New York, New York 10005

For shareholder questions: 1-800-735-3591. For banks and brokers: 212-269-5550.

Email: info@dfking.com

Important Information

This material may be deemed to be solicitation material in respect of the solicitation of proxies from the Company’s shareholders in connection with the Company’s 2013 Annual Meeting of Stockholders (the “Annual Meeting”). The Company has filed with the Securities and Exchange Commission (the “SEC”) and mailed to its shareholders a proxy statement in connection with the Annual Meeting (the “Proxy Statement”), and advises its shareholders to read the Proxy Statement and any and all supplements and amendments thereto because they contain important information. Shareholders may obtain a free copy of the Proxy Statement and other documents that the Company files with the SEC at the SEC’s website at www.sec.gov. The Proxy Statement and these other documents may also be obtained upon request addressed to the Secretary of the Company at 19 Harrison Avenue, Springfield, MA 01103.

Certain Information Concerning Participants

The Company, its directors and its executive officers may be deemed to be participants in the solicitation of the Company’s shareholders in connection with the Annual Meeting. Shareholders may obtain information regarding the names, affiliations and interests of such individuals in the Company’s proxy statement related to its 2013 Annual Meeting of Stockholders, filed with the SEC on October 2, 2013.

Forward-Looking Statements

This letter contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the beliefs and expectations of management, as well as the assumptions made using information currently available to management. Because these statements reflect the views of management concerning future events, these statements involve risks, uncertainties and assumptions. As a result, actual results may differ from those contemplated by these statements. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words like “believe”, “expect”, “anticipate”, “estimate”, and “intend” or future or conditional verbs such as “will”, “would”, “should”, “could”, or “may.” Certain factors that could have a material adverse effect on the operations of Hampden Bank include, but are not limited to, increased competitive pressure among financial service companies, national and regional economic conditions, changes in interest rates, changes in consumer spending, borrowing and savings habits, legislative and regulatory changes, monetary and fiscal policies of the U.S. Government, including policies of the U.S. Treasury and Federal Reserve Board, adverse changes in the securities markets, inability of key third-party providers to perform their obligations to Hampden Bank and changes in relevant accounting principles and guidelines. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company disclaims any obligation to update any forward-looking statements, whether in response to new information, future events or otherwise.

EACH STOCKHOLDER, WHETHER HE OR SHE PLANS TO ATTEND THE MEETING, IS REQUESTED TO SIGN, DATE AND RETURN THIS BLUE PROXY CARD WITHOUT DELAY IN THE ENCLOSED POSTAGE-PAID ENVELOPE. ANY PROXY GIVEN BY THE STOCKHOLDER MAY BE REVOKED AT ANY TIME BEFORE IT IS EXERCISED. A PROXY MAY BE REVOKED BY FILING WITH OUR SECRETARY A WRITTEN REVOCATION OR A DULY EXECUTED PROXY BEARING A LATER DATE. ANY STOCKHOLDER PRESENT AT THE MEETING MAY REVOKE HIS OR HER PROXY AND VOTE PERSONALLY ON EACH MATTER BROUGHT BEFORE THE MEETING. HOWEVER, IF YOU ARE A STOCKHOLDER WHOSE SHARES ARE NOT REGISTERED IN YOUR OWN NAME, YOU WILL NEED ADDITIONAL DOCUMENTATION FROM YOUR RECORD HOLDER IN ORDER TO VOTE PERSONALLY AT THE MEETING.

PROXY SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

FOR THE ANNUAL MEETING OF

STOCKHOLDERS TO BE HELD

NOVEMBER 5, 2013

The undersigned, revoking any previous proxies relating to these shares, hereby acknowledges receipt of the Notice and Proxy Statement dated October 2, 2013, and hereby appoints Glenn S. Welch and Craig W. Kaylor and each of them, with power of substitution, proxies and agents of the undersigned to vote at the Annual Meeting of Stockholders of Hampden Bancorp, Inc. (the "Company"), to be held at the Sheraton Springfield Monarch Place Hotel, One Monarch Place, Springfield, MA 01144 on November 5, 2013 at 10:00 a.m. and at any adjournment(s) thereof, all shares of common stock of the Company which undersigned would be entitled to vote if personally present for the following matters. Without limiting the general authorization given by this Proxy, the proxies are, and each of them is, instructed to vote or act as follows on the proposals set forth in the Proxy.

The Board of Directors recommends a vote "FOR" proposals 1, 2, and 3; for holding an advisory vote on the compensation of our named executive officers EVERY YEAR; and "AGAINST" proposal 5.

| 1. | To elect the following individuals as Directors of the Company for a term of three years as described in the enclosed Proxy Statement; |

1. Thomas R. Burton

2. Arlene Putnam

3. Richard D. Suski

4. Linda Silva Thompson

| o FOR | o WITHHOLD | o FOR ALL EXCEPT |

INSTRUCTION: To withhold your vote for any one or more nominees, mark "For All Except" above and write that (those) nominee's name(s) below:

| 2. | To ratify the appointment of Wolf & Company, P.C. as the Company's independent auditors for the year ending June 30, 2014. |

| o FOR | o AGAINST | o ABSTAIN |

| 3. | To approve, on an advisory basis, the compensation of the Company's named executive officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission. |

| o FOR | o AGAINST | o ABSTAIN |

| 4. | To approve, on an advisory basis, the frequency of holding a vote on the compensation of the Company's named executive officers. |

o EVERY YEAR | o EVERY TWO YEARS | o EVERY THREE YEARS | o ABSTAIN |

| 5. | If properly presented at the Annual Meeting, to vote upon a proposal submitted by a shareholder of the Company requesting that the Board of Directors explore avenues to enhance shareholder value through an extra-ordinary transaction (defined here as a transaction not in the ordinary course of business operations) including, but not limited to, selling or merging the Company with another institution. |

| o FOR | o AGAINST | o ABSTAIN |

In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting.

PLEASE CHECK BOX IF YOU PLAN TO ATTEND THE MEETING. p

This Proxy, when properly executed, will be voted in the manner directed herein by the undersigned stockholder. If no direction is made, this proxy will be voted FOR Proposals 1, 2, and 3; for holding an advisory vote on the compensation of our named executive officers EVERY YEAR; and "AGAINST" proposal 5, and in accordance with the proxy holders' discretion respecting any other matters as may properly come before the annual meeting. The undersigned acknowledges receipt of the Notice of Annual Meeting of Stockholders and the related Proxy Statement.

7