- MDXG Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

MiMedx (MDXG) DEF 14ADefinitive proxy

Filed: 4 Oct 12, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |||

MIMEDX GROUP, INC. | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| ||||

| (5) | Total fee paid: | |||

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| ||||

| (3) | Filing Party:

| |||

| ||||

| (4) | Date Filed:

| |||

| ||||

MIMEDX GROUP, INC.

60 Chastain Center Blvd., Suite 60

Kennesaw, GA 30144

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held on October 31, 2012

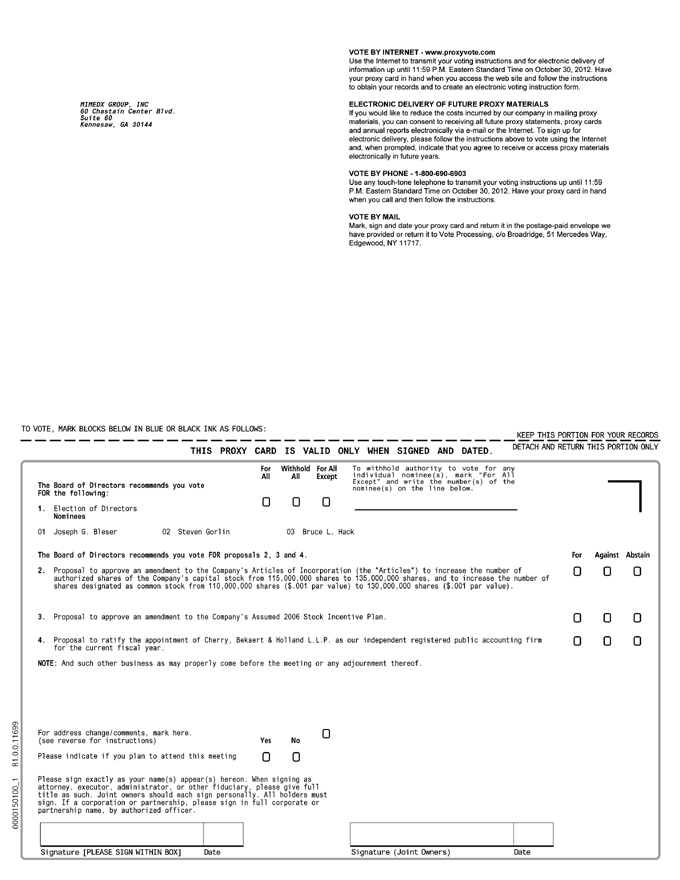

The Annual Meeting of Shareholders of MiMedx Group, Inc. (“MiMedx” or the “Company”) will be held on October 31, 2012, at 2:00 p.m. Eastern Standard Time at the Embassy Suites Hotel, 620 Chastain Road, NW, Kennesaw, Georgia 30144, for the following purposes:

| 1. | To elect three Class II directors; |

| 2. | To approve an amendment to the Company’s Articles of Incorporation (the “Articles”) to increase the number of authorized shares of the Company’s capital stock from 115,000,000 shares to 135,000,000 shares, and to increase the number of shares designated as common stock from 110,000,000 shares ($.001 par value) to 130,000,000 shares ($.001 par value); |

| 3. | To approve an amendment to the Company’s Assumed 2006 Stock Incentive Plan; |

| 4. | To ratify the appointment of Cherry, Bekaert & Holland L.L.P. as our independent registered public accounting firm for the current fiscal year; and |

| 5. | To transact such other business as may properly come before the meeting or any adjournment thereof. |

The Board of Directors has fixed the close of business on September 14, 2012, as the record date for us to determine those shareholders entitled to notice of and to vote at the Annual Meeting of Shareholders.

Shareholders who cannot attend the Annual Meeting may vote their shares over the Internet or by telephone, or by completing and promptly returning the enclosed proxy card or voting instruction form. Internet and telephone voting procedures are described in the enclosed proxy statement and on the proxy card or, if shares are held in “street name,” on the voting instruction form that shareholders receive from their brokerage firm, bank or other nominee in lieu of a proxy card.

Please vote as promptly as possible, whether or not you plan to attend the Annual Meeting. Even though you submit your proxy, you may nevertheless attend the Annual Meeting and vote your shares in person if you wish. If you want to revoke your proxy at a later time for any reason, you may do so in the manner described in the attached proxy statement.

I look forward to welcoming you to the meeting.

| Very truly yours, |

/s/ Roberta L. McCaw |

Roberta L. McCaw |

Secretary |

October 4, 2012

MIMEDX GROUP, INC.

60 Chastain Center Blvd., Suite 60

Kennesaw, GA 30144

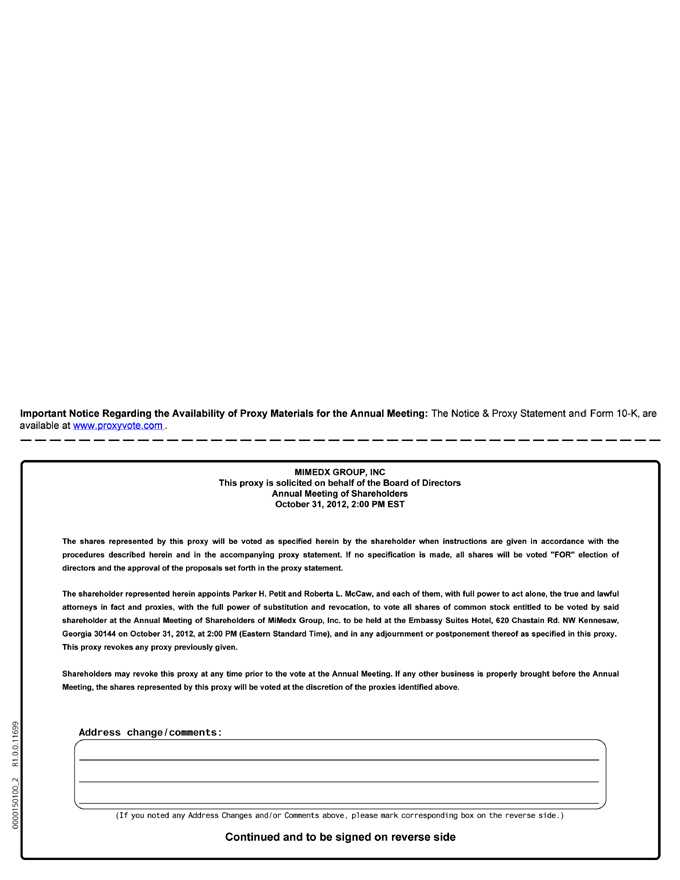

PROXY STATEMENT FOR THE ANNUAL MEETING OF SHAREHOLDERS

To Be Held On October 31, 2012

This Proxy Statement is furnished in connection with the solicitation of proxies to be voted at the Annual Meeting of Shareholders of MiMedx Group, Inc. (“MiMedx” or the “Company”) to be held on October 31, 2012, at 2:00 p.m. Eastern Standard Time at the Embassy Suites Hotel, 620 Chastain Road, NW, Kennesaw, Georgia 30144.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON OCTOBER 31, 2012

The Proxy Statement, form of proxy our 2011 Annual Report on Form 10-K for the year ended December 31, 2011, are available at

http://www.proxyvote.com

This Proxy Statement, our Annual Report on Form 10-K for the year ended December 31, 2011, and the enclosed proxy card are being first sent or given to shareholders on or about September 24, 2012. The enclosed proxy card is solicited by the Company on behalf of our Board of Directors and will be voted at the Annual Meeting of Shareholders and any adjournments thereof.

Shareholders as of the close of business on September 14, 2012, the record date, may vote at the Annual Meeting. As of the record date, 85,452,774 shares of common stock were outstanding and entitled to vote. Shareholders have one vote, non-cumulative, for each share of common stock held on the record date, including shares held directly in their name as “shareholder of record” and shares held in an account with a broker, bank or other nominee (shares held in “street name”). Street name holders generally cannot vote their shares directly and must instead instruct the brokerage firm, bank or nominee how to vote their shares.

This solicitation is being made by mail and may also be made in person or by fax, telephone or Internet by the Company’s officers, directors or employees. The Company will pay all expenses incurred in this solicitation. The Company will request banks, brokerage houses and other institutions, nominees and fiduciaries to forward the soliciting material to beneficial owners and to obtain authorization for the execution of proxies. The Company will, upon request, reimburse these parties for their reasonable expenses in forwarding proxy materials to beneficial owners.

Proposals for Shareholder Action

The matters proposed for consideration at the meeting are:

| • | The election of three Class II directors; |

| • | Approval of an amendment to the Company’s Articles of Incorporation (the “Articles”) to increase the number of authorized shares of the Company’s capital stock from 115,000,000 shares to 135,000,000 shares, and to increase the number of shares designated as common stock from 110,000,000 shares ($.001 par value) to 130,000,000 shares ($.001 par value); |

| • | Approval of an amendment to the Company’s Assumed 2006 Stock Incentive Plan; |

| • | Ratification of the appointment of Cherry, Bekaert & Holland L.L.P. as our independent registered public accounting firm for the current fiscal year; and |

| • | The transaction of such other business as may come before the meeting or any adjournment thereof. |

Our Board of Directors recommends that you vote “FOR” the director nominees and the other proposals.

1

Voting

Shareholders of record may vote:

| • | By Mail —To vote by mail using the enclosed proxy card, shareholders will need to complete, sign and date the proxy card and return it promptly in the envelope provided or mail it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. When the proxy card is properly executed, dated, and timely returned, the shares it represents will be voted in accordance with its instructions. |

| • | By Internet —Shareholders may vote over the Internet, by going to “www.proxyvote.com.” Shareholders will need to type in the Company Number and the Account Number indicated on the proxy card and follow the instructions. |

| • | By Telephone —Shareholders may vote over the telephone, by dialing 1-800-690-6903 in the United States or Canada from any touch-tone telephone and following the instructions. Shareholders will need the Company Number and the Account Number indicated on the proxy card. |

| • | By Attending the Meeting in Person —Shareholders may vote by attending the meeting in person and voting. Please contact Wendy Larey at 404.554.8023 or wlarey@mimedx.com in order to obtain directions to the Annual Meeting. |

Internet and telephone voting facilities will close at 11:59 p.m., Eastern Standard Time, on October 30, 2012.

In addition, a large number of banks and brokerage firms participate in online programs that provide eligible beneficial owners who hold their shares in “street name” rather than as a shareholder of record, with the opportunity to vote over the Internet or by telephone. “Street name” shareholders who elected to access the proxy materials electronically over the Internet through an arrangement with their brokerage firm, bank or other nominee should receive instructions from their brokerage firm, bank or other nominee on how to access the shareholder information and voting instructions. If shareholders hold shares in “street name” and the voting instruction form received from the brokerage firm, bank or other nominee does not reference Internet or telephone information, or if you prefer to vote by mail, please complete and return the paper voting instruction form. In order to vote shares held in “street name” in person at the Annual Meeting, a proxy issued in the owner’s name must be obtained from the record holder (typically your brokerage firm, bank or other nominee) and presented at the Annual Meeting.

Shareholders of record and “street name” shareholders who vote over the Internet or by telephone need not return a proxy card or voting instruction form by mail, but may incur costs, such as usage charges, from telephone companies or Internet service providers, for which the shareholder is responsible.

If no instructions are indicated, your proxy will be voted “FOR” the election of the director nominees and the other proposals.

Other Matters

It is not anticipated that any other matters will be considered at the Annual Meeting. If, however, any other matter properly comes before the Annual Meeting, or any adjournment or postponement thereof, the persons named in the proxy will vote the proxy in accordance with their best judgment on any such matter.

2

Revocation of Proxies

Each shareholder sending a proxy will have the power to revoke it at any time before it is exercised. The proxy may be changed or revoked before it is exercised by sending a written revocation or a duly executed proxy bearing a later date to us at our principal offices at 60 Chastain Center Blvd., Suite 60, Kennesaw, Georgia 30144, Attention: Corporate Secretary. The proxy may also be revoked by attending the meeting and voting in person.

Quorum and Vote Required

The presence, in person or by proxy, of a majority of the outstanding shares of common stock entitled to vote is necessary to constitute a quorum at the Annual Meeting and at any adjournments thereof. Directions to withhold authority to vote for directors, abstentions and broker non-votes will be counted for purposes of determining if a quorum is present at the Annual Meeting. If a quorum is not present or represented at the Annual Meeting, the chairman of the meeting or the shareholders holding a majority of the shares of common stock entitled to vote, present in person or represented by proxy, have the power to adjourn the meeting from time to time without notice, other than an announcement at the meeting, until a quorum is present or represented. Directors, officers and employees of the Company may solicit proxies for the reconvened meeting in person or by mail, telephone or telegram. At any such reconvened meeting at which a quorum is present or represented, any business may be transacted that might have been transacted at the meeting as originally scheduled.

Directors are elected by the affirmative vote of the holders of a plurality of the shares of our capital stock present in person or represented by proxy and entitled to vote at the Annual Meeting of Shareholders. The affirmative vote of the holders of a majority of the shares of stock present in person or represented in proxy and entitled to vote is required to approve the other proposals.

Votes cast in person or by proxy, abstentions and broker non-votes will be tabulated by the inspector of election and will be considered in the determination of whether a quorum is present at the Annual Meeting. The inspector of election will treat shares represented by executed proxies that abstain as shares that are present and entitled to vote for purposes of determining the approval of such matter and will have the same effect as a vote against the proposal. If, with respect to any shares, a broker or other nominee submits a proxy card with a broker non-vote on one or more proposals, those shares will not be treated as present and entitled to vote for purposes of determining the approval of any such proposal.

No Appraisal Rights

No appraisal rights are available under Florida law or our Articles of Incorporation or bylaws if you dissent from or vote against any of the proposals presented for consideration, and we do not plan to independently provide any such right to shareholders.

(PROPOSAL 1)

Our bylaws provide that our Board may set the number of directors at no less than three. Our Board currently consists of ten directors who are divided into three classes. At each Annual Meeting the terms of one class of directors expire and persons are elected to that class for terms of three years or until their respective successors are duly elected and qualified or until their earlier death, resignation or removal. Our current Board members, the classes in which they serve and the expiration of their terms as directors are as set forth in the table below:

Class Designation | Directors | Term Expiration | ||

| Class II | Joseph G. Bleser Steven Gorlin Bruce L. Hack | 2012 Annual Meeting of Shareholders | ||

| Class III | J. Terry Dewberry Larry W. Papasan Parker H. Petit | 2013 Annual Meeting of Shareholders | ||

| Class I | Charles R. Evans Charles E. Koob William C. Taylor Neil S. Yeston | 2014 Annual Meeting of Shareholders | ||

3

Based on the recommendation of the Nominating and Corporate Governance Committee of the Board, the Board has nominated Joseph G. Bleser, Steven Gorlin and Bruce L. Hack for election as Class II Directors of the Company at the 2012 Annual Meeting of Shareholders. The Class II Directors’ next term expires at the 2015 Annual Meeting or upon their respective successors being elected and qualified or until their earlier death, resignation, removal or termination. All nominees have consented to serve as directors if elected.

With respect to the election of directors, you may (i) vote “for” all of the nominees, or (ii) “withhold” with respect to some or all nominees. Directors are elected by the affirmative vote of the holders of a plurality of the shares of our capital stock present in person or represented by proxy and entitled to vote at the Annual Meeting of Shareholders. As a result, the three director nominees that receive the most votes will be elected. Broker non-votes will not be counted as votes for or against any nominee or director. In the event that any nominee should become unable or unwilling to serve as a director, it is the intention of the persons named in the proxy to vote for the election of such substitute nominee for the office of director as the Board of Directors may recommend. It is not anticipated that any nominee will become unable or unwilling to serve as a director.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF

THE NOMINEES TO SERVE AS DIRECTORS.

Set forth below is certain information regarding our director nominees and other directors who will continue serving on the Board after the Annual Meeting, including certain individual qualifications and skills of our directors that contribute to the effectiveness of our Board. There are no family relationships among any of our directors or executive officers.

DIRECTORS WHOSE TERMS EXPIRE AT THE 2012 ANNUAL MEETING,

CLASS II

Joseph G. Bleser, age 66, serves on our Board of Directors. He became a Director of MiMedx Group, Inc. in September 2009. He has been the Managing Member of J. Bleser, LLC, a financial consulting firm, since July 1998. Prior to July 1998, Mr. Bleser has over 15 years experience as a Chief Financial Officer and other financial executive positions in various publicly traded companies, including HBO & Company, Allegiant Physician Services, Transcend Services, Inc. and Healthcare.com. Mr. Bleser is formerly a Certified Public Accountant with ten years of experience in public accounting with Arthur Andersen LLC, an international public accounting firm. Mr. Bleser was a member of the Board of Directors and the Corporate Governance Committee and Chairman of the Audit Committee of Transcend Services, Inc. [NASDAQ: TRCR] until it was acquired by Nuance Communications, Inc. in April 2012. Mr. Bleser also served as a Director and Chairman of the Audit Committee of Matria Healthcare, Inc. until it was acquired by Inverness Medical Innovations, Inc. in May 2008. In addition, Mr. Bleser serves on the Board of Directors of a privately held information technology solutions company. Mr. Bleser was nominated as a director due to his extensive financial background and experience as a member of the Audit Committee of other publicly traded companies.

4

Steve Gorlin, age 75, serves as a Director of the Company. He served as Chairman of the Board of Directors and a Director of Alynx Co. (“Alynx”), the Company’s predecessor, during February 2008, and MiMedx Group, Inc. from March 2008 to February 2009. Mr. Gorlin served as Chairman of MiMedx, Inc. from its inception in November 2006 to February 2009. Mr. Gorlin continues to serve as Vice Chairman of the Company. He is presently Executive Chairman of DemeRx, Inc. and has served as its Chairman and Chief Executive Officer since its founding in 2010. Over the past 35 years, Mr. Gorlin has founded several biotechnology and pharmaceutical companies, including Hycor Biomedical, Inc., Theragenics Corporation, CytRx Corporation, Medicis Pharmaceutical Corporation, EntreMed, Inc., MRI Interventions, Inc., DARA BioSciences, Inc. [NasdaqCM:DARA], and Medivation, Inc. [NasdaqGM: MDVN]. Mr. Gorlin served as the Chief Executive Officer of Dara Bio Sciences, Inc. from July 2002 to January 2007, and served as either Chairman or Co-Chairman of the Board of Directors of Dara Bio Sciences, Inc. until August 2012. Mr. Gorlin also currently serves on the Board of Directors of the following private companies: Nano Technology Corporation (China) as the Chairman of the Board of Directors. Mr. Gorlin served for many years on the Business Advisory Council to the Johns Hopkins School of Medicine and presently serves on the boards of The Johns Hopkins Alliance for Science and Technology Development and The Johns Hopkins Bioengineering Advisory Board, as well as the board of the Andrews Foundation for Research and Education. He also founded a number of non-medical related companies, including Perma-Fix, Inc., Pretty Good Privacy, Inc., and Judicial Correction Services, Inc. He started The Touch Foundation, a nonprofit organization for the blind and was a principal financial contributor to the founding of Camp Kudzu for diabetic children. Mr. Gorlin was nominated as a director due to his extensive healthcare business experience and success in founding and nurturing biotechnology and pharmaceutical companies.

Bruce L. Hack, age 63, serves on our Board of Directors. He became a director of MiMedx Group, Inc. in December 2009. Mr. Hack was Vice Chairman of the Board of Directors and Chief Corporate Officer of Activision Blizzard (Nasdaq:ATVI) until 2009. Prior to that, Mr. Hack was Chief Executive Officer of Vivendi Games, from 2004 to 2008, Vice Chairman of the Board of Directors of Universal Music Group, from 1998 to 2001, and Chief Financial Officer of Universal Studios, from 1995 to 1998. From 1982-1994, Mr. Hack held several positions at The Seagram Company, including: Assistant to the Executive Vice President, Sales and Marketing for Seagram USA; Director, Strategic Planning, at The Seagram Company Ltd.; and Chief Financial Officer of Tropicana Products, Inc. Prior thereto, he was a trade negotiator for the U.S. Treasury. Mr. Hack earned a B.A. at Cornell University and an M.B.A. in finance at the University of Chicago. Mr. Hack was nominated as a director due to his business expertise, particularly as it relates to sales and marketing, and experience as a member of the Boards of Directors of other companies, both public and private.

DIRECTORS WHOSE TERMS EXPIRE AT THE 2013 ANNUAL MEETING,

CLASS III

J. Terry Dewberry, age 68, serves on our Board of Directors. He became a Director of MiMedx Group, Inc. in September 2009. Mr. Dewberry is a private investor with significant experience at both the management and board levels in the healthcare industry. He has extensive experience in corporate mergers and takeovers on both the buy and sell sides at sizes up to $5 billion. He has served on the Boards of Directors of several publicly traded healthcare products and services companies, including Respironics, Inc. (Nasdaq:RESP) (1998-2008), Matria Healthcare, Inc. (Nasdaq:MATR) (2006-2008), Healthdyne Information Enterprises, Inc. (1996-2002), Healthdyne Technologies, Inc. (1993-1997), Home Nutritional Services, Inc. (1989-1994) and Healthdyne, Inc. (1981-1996). From March 1992 until March 1996, Mr. Dewberry was Vice Chairman of Healthdyne, Inc. From 1984 to 1992, he served as President and Chief Operating Officer, and Executive Vice President of Healthdyne, Inc. Mr. Dewberry received a Bachelor of Electrical Engineering from Georgia Institute of Technology in 1967 and a Masters of Public Accounting from Georgia State University in 1972. Mr. Dewberry was nominated as a director due to his extensive business and financial background and experience as a member of the Boards of Directors of other publicly traded companies and a member of the Audit Committee of at least one other public company.

5

Larry W. Papasan, age 71, serves on our Board of Directors. He became a Director of Alynx in February 2008 and of MiMedx Group, Inc. in March 2008. He was first elected as a Director of MiMedx, Inc. in April 2007. From July 1991 until his retirement in May 2002, Mr. Papasan served as President of Smith & Nephew Orthopaedics. Mr. Papasan has been a Director and Chairman of the Board of Directors of BioMimetic Therapeutics, Inc. (NasdaqGM:BMTI) since August 2005. BioMimetic Therapeutics, Inc. is developing and commercializing bio-active recombinant protein-device combination products for the healing of musculoskeletal injuries and disease, including orthopedic, periodontal, spine and sports injury applications. Mr. Papasan has been a member of the Board of Directors of Reaves Utility Income Fund (NasdaqCM:UTG), a closed-end management investment company, since February 2003 and of Triumph Bankshares, Inc. (a bank holding company) since April 2005. Mr. Papasan also serves as a director of SSR Engineering, Inc., AxioMed Spine Corporation, BioMedical Tissue Technologies and Cagenix, Inc. Bio Nova Medical, Inc. and Six Fix, Inc. Mr. Papasan was nominated as a director due to his extensive business experience, including experience in the medical device field, as well as experience as a director of several other companies, both public and private.

Parker H. “Pete” Petit,age 73, joined the Company as Chairman of the Board of Directors, Chief Executive Officer and President in February 2009. From May 2008 until he joined the Company, Mr. Petit was the President of The Petit Group, LLC, a private investment company. Prior to that, Mr. Petit was the Chairman and CEO of Matria Healthcare, Inc., (Nasdaq: MATR), which was sold to Inverness Medical Innovations, Inc. in May 2008. Matria Healthcare was a former subsidiary of Healthdyne, Inc., which Mr. Petit founded in 1971. Mr. Petit served as Chairman and CEO of Healthdyne and some of its publicly traded subsidiaries after Healthdyne became a publicly traded company in 1981. Mr. Petit received his bachelor’s degree in Mechanical Engineering and Master of Science degree in Engineering Mechanics from Georgia Tech and an MBA degree in Finance from Georgia State University. At Georgia Tech, Mr. Petit funded a professorial chair for “Engineering in Medicine”, endowed the Petit Institute for Bioengineering and Bioscience, and assisted with the funding of the Biotechnology building which bears his name. At Georgia State University, he assisted with the funding of the Science Center building which also bears his name. In 1994, he was inducted into the Technology Hall of Fame of Georgia. In 2007, he was inducted into the Georgia State Business Hall of Fame. Mr. Petit currently serves as a member of the Board of Directors of the Georgia Research Alliance, which is chartered by the State of Georgia to promote high technology and scientific development in the State. In 2011, Mr. Petit was inducted into the National Academy of Engineering. He serves as a member of the Board of Directors of Intelligent Systems Corporation (NYSE MKT: INS). Mr. Petit was nominated as a director due to his extensive healthcare business experience and leadership success.

DIRECTORS WHOSE TERMS EXPIRE AT THE 2014 ANNUAL MEETING,

CLASS I

Charles R.Evans, age 65, serves on our Board of Directors. Mr. Evans became a director of the Company in September 2012. Mr. Evans has over 30 years of experience in the healthcare industry. He is currently President of the International Health Services Group, an organization he founded to support health services development in underserved areas of the world. He is also currently a senior advisor with Jackson Healthcare, a consortium of companies that provide physician and clinical staffing, anesthesia management and information technology solutions for hospitals, health systems and physician groups. In addition, Mr. Evans is a Fellow in the American College of Healthcare Executives having previously served as Governor of the College from 2004 to 2007 and as Chairman from 2008 to 2011. Previously, Mr. Evans was a senior officer with Healthcare Corporation of America (HCA) and managed various HCA divisions. Mr. Evans currently serves on the Board of Directors of Jackson Healthcare and CareSpot Express Healthcare. Additionally, Mr. Evans serves on the boards of non-profit organizations including MedShare International and MedicalMissions.org, and he is Chairman of the Hospital Charitable Service Awards.

6

Charles E. (“Chuck”) Koob, age 67, serves on our Board of Directors. He became a Director of Alynx in February 2008, and of MiMedx Group, Inc. in March 2008. He was first elected as a Director of MiMedx, Inc. in April 2007. Mr. Koob joined the law firm of Simpson Thacher & Bartlett, LLP in 1970 and became a partner in 1977. He retired from that firm on January 1, 2007. While at that firm, Mr. Koob was the co-head of the Litigation Department and served on the Firm’s Executive Committee. Mr. Koob specialized in competition, trade regulation and antitrust issues. Throughout his 37-year tenure, he represented clients before the Federal Trade Commission, the Antitrust Division of the Department of Justice, and numerous state and foreign competition authorities. His résumé includes the representation of Virgin Atlantic Airways, Archer Daniels Midland, and Kohlberg Kravis Roberts and Co. He received his B.A. from Rockhurst College in 1966 and his J.D. from Stanford Law School in 1969. Mr. Koob serves on the board of Stanford Hospital and Clinics. He also serves on the boards of a private medical device company and a drug development company. Mr. Koob was nominated as a director due to his 37 years of legal expertise in representing both publicly traded and privately held businesses.

William C. Taylor,age 44, became our President and Chief Operating Officer in September 2009. He became a Director of the Company in October 2011. He is an operating executive with more than 20 years’ experience in healthcare product design, development and manufacturing. From 2001 through 2008, Mr. Taylor was President and CEO of Facet Technologies, LLC, a Matria Healthcare, Inc. subsidiary, focused on medical device design, development, and manufacturing for OEM clients, such as Abbott, Bayer, BD, LifeScan (J&J), Roche, and Flextronics. Over his 14 year career at Facet and its predecessor company, he held various management positions, beginning with R&D, QA & Regulatory Affairs and progressing through General Management. Mr. Taylor was instrumental in growing the design and manufacturing business from $14 million in revenue to over $40 million at the time the company was sold to Matria Healthcare in March 2008. As President, he led the company to the number one market position in Microsampling and grew it to over $85 million in revenue. He also led the company as CEO for 18 months after it was sold to a private equity company. Mr. Taylor started his career in healthcare at Miles, Inc., Diagnostics Division (now Bayer Healthcare) as an engineering co-op, and then progressed to project management and senior mechanical engineering positions. A graduate of Purdue University, Mr. Taylor holds a Bachelor of Science degree in Mechanical Engineering and is co-inventor on eight patents. He currently serves on the Advisory Board of the Georgia Tech Institute for Bioengineering and Bioscience. Mr. Taylor was nominated as a director due to his extensive experience as an operating executive in the medical device sector.

Neil S. Yeston, M.D., age 69, serves on our Board of Directors. Dr. Yeston became a director of the Company in September 2012. Dr. Yeston currently serves as Active Senior Staff, Department of Surgery at Hartford Hospital. During his association with Hartford Hospital, Dr. Yeston previously served in various roles including Vice President of Academic Affairs, Director of Corporate Compliance, Vice President of Quality Management and Director of the Section on Critical Care Medicine, Department of Surgery. Dr. Yeston has formerly served as Professor of Surgery at the University of Connecticut and the Assistant Dean, Medical Education at the University of Connecticut School of Medicine. Prior to his associations with Hartford Hospital and the University of Connecticut, Dr. Yeston served with Boston University Medical Center in various positions including the Vice Chairman Department of Surgery, Associate Professor of Anesthesiology, Director Progressive Care Unit and Associate Professors of Surgery. Dr. Yeston was appointed as a director because of his in-depth understanding of healthcare issues from the perspective of the practitioner, academician, administrator and executive.

Board of Directors Leadership Structure

Our Board of Directors has carefully considered the benefits and risks in combining the role of Chairman of the Board of Directors and Chief Executive Officer and has determined that Mr. Petit is the most qualified and appropriate individual to lead our Board of Directors as its Chairman. The Board of Directors believes there are efficiencies of having the Chief Executive Officer also serve in the role of Chairman of the Board of Directors. As our Chief Executive Officer, Mr. Petit is responsible for the day-to-day operation of the Company and for the implementation of the Company’s strategy. Mr. Petit serves as a bridge between management and our Board of Directors, ensuring that both groups act with a common purpose. Our Board of Directors further noted that the combined role of Chairman of the Board of Directors and Chief Executive Officer facilitates centralized leadership in one person so that there is no ambiguity about accountability. Our Board of Directors also considered Mr. Petit’s knowledge regarding our operations and the industries and markets in which we compete and his ability to promote communication, to synchronize activities between our Board of Directors and our senior management and to provide consistent leadership to both our Board of Directors and our Company.

In determining whether to combine the roles of Chairman of the Board of Directors and Chief Executive Officer, our Board of Directors closely considered our current system for ensuring significant independent oversight of management, including the following: (1) only three members of our Board of Directors, Mr. Petit, Mr. Taylor and Mr. Gorlin, also serve as employees; (2) each director serving on our Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee is independent and (3) the Compensation Committee annually evaluates the Chief Executive Officer’s performance and has the authority to retain independent compensation advisors.

7

The Board of Directors has not designated a lead independent director.

Director Independence

We are not a “listed company” under SEC rules and are therefore not required to comply with the director independence requirements of any securities exchange. However, in determining whether our directors are independent, we apply the standards set forth in the rules of the NYSE MKT. The Company qualifies as a “smaller reporting company” as that term is defined in Item 10(f)(1) of Regulation S-K because its public float as of the last business day of the Company’s second fiscal quarter in 2010 and 2011 was less than $75.0 million. As a result, the rules of the NYSE MKT require that at least 50% of the members of our Board of Directors be independent, which means that they are not officers or employees of the Company and are free of any relationship that would interfere with the exercise of their independent judgment. The Board of Directors has determined that six of its current ten directors, Joseph G. Bleser, J. Terry Dewberry, Charles R. Evans, Bruce L. Hack, Larry W. Papasan and Neil S. Yeston are “independent,” as defined by the listing standards of the NYSE MKT, Section 10A(m)(3) of the Exchange Act, and the rules and regulations of the SEC. In addition, the Board determined Kurt M. Eichler who served as a director in 2011 was “independent” under these same listing standards.

However, since the Company’s public float exceeded $75.0 million for the second quarter 2012, the Company no longer qualifies as a “smaller reporting company” beginning in 2013 and must comply with the larger company rules including the provisions of Sarbanes-Oxley Act and the Dodd-Frank Wall Street Reform Act of 2010 that are applicable to larger reporting companies.

Board of Directors Risk Oversight

The Board as a whole is responsible for overseeing the Company’s risk exposure as part of determining a business strategy that generates long-term shareholder value. Each of the Board’s standing committees focuses on risk areas associated with its area of responsibility.

Meetings and Committees of the Board of Directors

During the year ended December 31, 2011, there were seven meetings of the Board of Directors, two of which were telephonic meetings. Bruce L. Hack attended fewer than 75% of the aggregate total number of the meetings of the Board of Directors during the year ended December 31, 2011.

In addition to other single purpose committees established from time to time to assist the Board of Directors with particular tasks, the Company’s Board of Directors has the following standing committees: an Audit Committee, a Nominating and Corporate Governance Committee and a Compensation Committee.

We strongly encourage each of our directors to attend in person each annual meeting of shareholders whenever attendance does not unreasonably conflict with the director’s other business and personal commitments. Seven of our ten then-current directors attended our 2011 Annual meeting of Shareholders.

Audit Committee and Audit Committee Financial Expert

We are not a “listed company” under SEC rules and are therefore not required to have an audit committee comprised of independent directors. However, our goal is to comply with the rules of the NYSE MKT , which require that as a “smaller reporting company,” as that term is defined in Item 10(f)(1) of Regulation S-K, the Audit Committee of the Board of Directors be comprised of at least two members, all of whom qualify as “independent” under the criteria set forth in Rule 10A-3 of the Exchange Act.

8

We established an Audit Committee comprised of three independent members of our Board of Directors in April 2008. We currently have four members on our Audit Committee; J. Terry Dewberry (Chairman), Joseph G. Bleser, Larry W. Papasan and Charles R. Evans, each of whom satisfies the independence standards of the NYSE MKT rules for audit committee members. The Board of Directors has determined that Mr. Dewberry is an “audit committee financial expert” within the meaning of Item 407(d)(5)(ii) of Securities and Exchange Commission (“SEC”) Regulation S-K. The current charter for the Audit Committee is posted on our website atwww.mimedx.com. The Audit Committee held seven meetings during the year ended December 31, 2011.

As part of its duties, the Audit Committee:

| • | Oversees the accounting and financial reporting processes of the Company and the audits of the Company’s financial statements; |

| • | Reviews the Company’s financial statements with management and the Company’s outside auditors, and recommends to the Board of Directors whether the audited financial statements should be included in the Company’s Annual Report on Form 10-K; |

| • | Establishes policies and procedures to take, or recommends that the full Board of Directors take, appropriate action to oversee the independence of the outside auditors; |

| • | Establishes policies and procedures for the engagement of the outside auditors to provide permitted non-audit services; |

| • | Takes responsibility for the appointment, compensation, retention, and oversight of the work of the Company’s outside auditors and recommends their selection and engagement; |

| • | Ensures that the outside auditors report directly to the Audit Committee; |

| • | Reviews the performance of the outside auditors and takes direct responsibility for hiring and, if appropriate, replacing any outside auditor failing to perform satisfactorily; |

| • | Provides, as part of any proxy filed pursuant to SEC regulations, the report required by SEC regulations; and |

| • | Establishes procedures for handling complaints received by the Company regarding accounting, internal accounting controls, or auditing matters. |

Compensation Committee

We established our Compensation Committee in April 2008. Currently, its membership consists of Joseph G. Bleser (Chairman), Larry W. Papasan and Neil S. Yeston. In 2011, Kurt M. Eichler served as a member and as Chairman of the Compensation Committee. The Compensation Committee held three meetings during the year ended December 31, 2011. All members of the Compensation Committee meet the independence standards of the NYSE MKT rules for compensation committee members. Pursuant to its charter, the Compensation Committee is responsible for establishing the Company’s overall compensation philosophy and programs and exercising the authority of the Board of Directors in the administration of all compensation plans and programs. The Compensation Committee also is charged with reviewing the performance of the Company’s Chief Executive Officer, reviewing and approving compensation arrangements for and contractual arrangements with the Company’s executive officers, and reviewing and recommending to the full Board of Directors for approval contractual incentive and equity-based compensation plans and directors’ compensation. The Compensation Committee is authorized to delegate responsibilities to sub-committees of the Compensation Committee as necessary or appropriate. The current charter for the Compensation Committee is posted on our website atwww.mimedx.com. The Committee establishes compensation for executive officers and directors based on peer data, the Company’s resources and, with respect to executive officers, the qualifications and experience of the executive. With respect to compensation of executive officers other than the Chairman and Chief Executive Officer, the Committee considers recommendations of the Chairman and Chief Executive Officer.

9

Nominating and Corporate Governance Committee; Procedures by which Security Holders May Recommend Nominees to the BoardofDirectors

We established our Nominating and Corporate Governance Committee in April 2008. Its membership currently consists of Larry W. Papasan (Chairman), J. Terry Dewberry and Bruce L. Hack. Mr. Eichler also served as a member of the Nominating and Corporate Governance Committee in 2011. The charter for this Committee requires that it annually present to the Board of Directors a list of individuals, who meet the criteria for Board of Directors membership, recommended for nomination for election to the Board of Directors at the annual meeting of shareholders and also consider suggestions received from shareholders regarding director nominees in accordance with any procedures adopted from time to time by the Nominating and Corporate Governance Committee. All of the Committee members meet the independence requirements of the NYSE MKT rules for nominating and corporate governance committee members. The charter for the Nominating and Corporate Governance Committee is posted on our website atwww.mimedx.com. The Nominating and Corporate Governance Committee held two meetings during the year ended December 31, 2011.

No material changes have been made to the procedures by which our shareholders may recommend nominees to our Board of Directors since we last described these procedures in the Form 10-K/A filed with the SEC on July 29, 2008. However our Nominating and Corporate Governance Committee adopted a formal policy consistent with those procedures and our bylaws in March 2010.

Evaluation of Director Candidates

In evaluating and recommending director candidates, the Nominating and Corporate Governance Committee takes into consideration such factors as it deems appropriate based on current needs. These factors may include leadership skills, business judgment, relevant expertise and experience, whether the candidate has a general understanding of marketing, finance, and other disciplines relevant to the success of a publicly-traded company in today’s business environment, relevant regulatory experience, decision-making ability, interpersonal skills, community activities and relationships, and the interrelationship between the candidate’s experience and business background and other Board members’ experience and business background, as well as the candidate’s ability to devote the required time and effort to serving on the Board of Directors.

To date, nominees for appointment and election to our Board of Directors have been selected pursuant to an informal process. Each person selected has been based upon a recommendation made to the Nominating and Corporate Governance Committee or the Board of Directors (prior to formation of that Committee). The Nominating and Corporate Governance Committee has not established a policy for consideration of diversity in its nominating process.

In accordance with our bylaws, the Nominating and Corporate Governance Committee will consider for nomination candidates recommended by shareholders if the shareholders comply with the following requirements. If a shareholder wishes to recommend a director candidate to the Board of Directors for consideration as a nominee to the Board of Directors, such shareholder must submit in writing to the Secretary of the Company:

| • | the name, age and address of each proposed nominee; |

| • | the principal occupation of each proposed nominee; |

| • | the nominee’s qualifications to serve as a director; |

| • | such other information relating to such nominee as required to be disclosed in solicitation of proxies for the election of directors pursuant to the rules and regulations of the SEC; |

10

| • | the name and residence address of the notifying shareholder; |

| • | the number of shares owned by the notifying shareholder, and |

| • | the nominee’s written consent to being named a nominee and serving as a director if elected. |

This information must be delivered or mailed to the Secretary of the Company: (a) in the case of an annual meeting of shareholders that is called for a date that is within 30 days before or after the anniversary date of the immediately preceding annual meeting of shareholders, not less than 120 days prior to such anniversary date; and (b) in the case of an annual meeting of shareholders that is called for a date that is not within 30 days before or after the anniversary date of the immediately preceding annual meeting of shareholders, or in the case of a special meeting of shareholders, not later than the close of business on the tenth day following the day on which the notice of meeting is mailed or public disclosure of the date of the meeting is made, whichever occurs first.

A shareholder making any proposal shall also comply with all applicable requirements of the Exchange Act.

Candidates properly submitted for consideration by shareholders will receive the same consideration as candidates presented by other persons. Nominations or proposals not made in accordance herewith may be disregarded by the chairman of the meeting in his discretion, and upon his instructions all votes cast for each such nominee or for such proposal may be disregarded.

Shareholder Communications with the Board of Directors

MiMedx shareholders may communicate with the Board of Directors, or individual specified directors, in writing addressed to:

Board of Directors

c/o Corporate Secretary

60 Chastain Center Blvd.

Suite 60

Kennesaw, Georgia 30144

The Corporate Secretary will review each shareholder communication. The Corporate Secretary will forward to (i) the entire Board of Directors, (ii) the non-management members of the Board of Directors, if so addressed, or (iii) the members of a Board of Directors committee, if the communication relates to a subject matter clearly within that committee’s area of responsibility, each communication that (a) relates to the Company’s business or governance, (b) is not offensive and is legible in form and reasonably understandable in content and (c) does not merely relate to a personal grievance against MiMedx or a team member or further a personal interest not shared by other shareholders generally.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that applies to our Chief Executive Officer (our principal executive officer), Chief Financial Officer (our principal accounting officer), controller, and persons performing similar functions. A copy is posted on our website atwww.mimedx.com. In the event that we amend any of the provisions of the Code of Business Conduct and Ethics that require disclosure under applicable law, SEC rules or applicable listing standards, we intend to disclose the amendment on our website.

Any waiver of the Code of Business Conduct and Ethics for any executive officer or director must be approved by the Board of Directors and will be disclosed on a Form 8-K filed with the SEC, along with the reasons for the waiver.

11

In addition to Messrs. Petit, Taylor and Gorlin, who are also directors, the following persons currently serve as our executive officers:

Michael J. Senken, age 54, joined the Company as Chief Financial Officer in January 2010. Prior to joining the Company he was the Vice President and Chief Financial Officer of Park ‘N Fly, Inc. from August 2007 to September 2009. From August 2005 to August 2007, Mr. Senken was Vice President and Chief Financial Officer of Patient Portal Technologies (OTCBB:PPRG). From June 2005 to August 2005, Mr. Senken was a consultant for JC Jones LLC. From 2002 to 2004, Mr. Senken was Senior Vice President and General Manager-Broadband Consumer Lifestyle for Philips Consumer Electronics. Prior thereto, Mr. Senken was employed by Philips Broadband Networks, serving as Senior Vice President and General Manager from 1996-2002, as Vice President and Chief Financial Officer from 1986 to 2002, and as Controller from 1983 to 1986. From 1980 to 1983, Mr. Senken was an auditor for Philips Electronics North America.

Roberta L. McCaw, age 56, was appointed General Counsel and Secretary in September 2009. Ms. McCaw is a lawyer in private practice and had been a consultant to the Company since January 2009. From February 2006 through May 2008, Ms. McCaw served as Senior Vice President, General Counsel and Secretary of Matria Healthcare, Inc., a publicly traded healthcare and medical device company. She previously served as Vice President — Legal, General Counsel and Secretary of Matria from April 1998 to February 2006. She was Assistant General Counsel and Assistant Secretary of Matria from December 1997 to April 1998, and Assistant General Counsel of Matria from July 1996 to December 1997. Prior to joining Matria, Ms. McCaw was a partner in a Connecticut-based law firm. She is a graduate of the University of Connecticut School of Law. Prior to law school, Ms. McCaw studied accounting at Miami University and Cleveland State University, and worked as a Certified Public Accountant.

We established our Compensation Committee in April 2008. Its membership currently consists of Joseph G. Bleser, Larry W. Papasan and Neil S. Yeston. In 2011, Kurt M. Eichler also served as a member and as Chairman of the Compensation Committee. The Board of Directors has determined that each of the members and former member is “independent,” as described above. The charter for the Compensation Committee is posted on our website athttp://www.mimedx.com/investors/corporate-governance/.

The following table summarizes the compensation paid by the Company for services in all capacities rendered to the Company during the years ended December 31, 2011 and 2010, by the individual who served as our principal executive officer during the 12 months ended December 31, 2011, and by each of the two other most highly compensated executive officers serving as executive officers at the end of 2011. These individuals are referred to collectively as our Named Executive Officers.

Summary Compensation Table

Name and Principal Position | Reporting Period | Salary $ | Bonus $ | Stock Awards $ | Option Awards $ | All Other Compensation | Total $ | |||||||||||||||||||||

Parker H. “Pete” Petit, | ||||||||||||||||||||||||||||

Chairman of Board of | YE 12/31/2011 | 325,000 | — | — | 696,500 | 1,021,500 | ||||||||||||||||||||||

Directors and CEO | YE 12/31/2010 | 308,558 | — | 410,000 | 718,558 | |||||||||||||||||||||||

William C. Taylor, | ||||||||||||||||||||||||||||

President and Chief | YE 12/31/2011 | 300,000 | — | — | 352,850 | 652,850 | ||||||||||||||||||||||

Operating Officer | YE 12/31/2010 | 288,365 | — | 532,000 | 820,365 | |||||||||||||||||||||||

Michael J. Senken, | ||||||||||||||||||||||||||||

VP and Chief | YE 12/31/2011 | 198,269 | — | — | 213,950 | — | 412,219 | |||||||||||||||||||||

Financial Officer | YE 12/31/2010 | 160,846 | — | — | 287,500 | — | 448,346 | |||||||||||||||||||||

12

| (1) | The Company follows the provisions of ASC topic 718 “Compensation – Stock compensation,” which requires the use of the fair-value based method to determine compensation for all arrangements under which employees and others receive shares of stock or equity instruments. The assumptions made in the valuation of our option awards is disclosed in Note 11 to our consolidated financial statements contained in our Annual Report on Form 10-K for the year ended December 31, 2011. |

Narrative to Summary Compensation Table

We have no employment agreements with any of our Named Executive Officers. In addition to receiving a base salary as established by the Compensation Committee of the Board, beginning in calendar year 2011, each of our Named Executive Officers is entitled to participate in the Company’s Management Incentive Plan (“MIP”), with a targeted base bonus equal to a specified percentage of his base salary. Payment of bonuses under the MIP is contingent on certain performance measures as established by the Compensation Committee on an annual basis. Each of the Executive Officers also is eligible for awards under the Company’s 2006 Assumed Stock Incentive Plan as may be granted by the Compensation Committee or the Board in their sole discretion. For additional information regarding the plan, see “Approval of Amendment of Assumed 2006 Stock Incentive Plan (Proposal 3).” The material terms of our compensation arrangements with each of our Named Executive Officers is described below:

| • | On February 23, 2010, the Compensation Committee approved an increase in Mr. Petit’s annual base salary from $225,000 to $325,000 effective March 1, 2010. On February 23, 2012, the Compensation Committee approved an increase in Mr. Petit’s annual base salary to $425,000 to be effective on April 1, 2012. However, Mr. Petit requested that his salary be held to the same salary as the President and Chief Operating Officer, therefore Mr. Petit’s salary was increased to $360,000 effective April 1, 2012. Effective October 1, 2012, Mr. Petit’s salary was increased to $425,000 in line with the Compensation Committee’s prior approval. During 2011, Mr. Petit was an eligible participant in the 2011 MiMedx MIP with a targeted base bonus equal to 50% of Mr. Petit’s 2011 annual base salary to be earned based upon the Company’s consolidated 2011 Earnings Before Interest, Taxes, Depreciation, Amortization and Share-Based Compensation (“MiMedx EBITDA”). Mr. Petit did not earn any amount of the 2011 MIP. For 2012, Mr. Petit is an eligible participant in the 2012 MiMedx MIP with a targeted base bonus equal to 50% of Mr. Petit’s 2012 annual base salary to be earned based upon a combination of the Company’s consolidated 2012 MiMedx EBITDA (85% of Mr. Petit’s targeted base bonus is based upon 2012 MiMedx EBITDA) and Mr. Petit’s individual performance (15% of Mr. Petit’s targeted base bonus is based upon individual performance, provided a threshold level of 2012 MiMedx EBITDA is achieved). |

| • | On February 23, 2010, the Compensation Committee approved an increase in Mr. Taylor’s base salary from $225,000 to $300,000 effective March 31, 2010. During 2011, Mr. Taylor was an eligible participant in the 2011 MiMedx MIP with a targeted base bonus equal to 50% of Mr. Taylor’s 2011 annual base salary to be earned based upon the Company’s consolidated 2011 MiMedx EBITDA. Mr. Taylor did not earn any amount of the 2011 MIP. For 2012, Mr. Taylor is an eligible participant in the 2012 MiMedx MIP with a targeted base bonus equal to 50% of Mr. Taylor’s 2012 annual base salary to be earned based upon a combination of the Company’s consolidated 2012 MiMedx EBITDA (85% of Mr. Taylor’s targeted base bonus is based upon 2012 MiMedx EBITDA) and Mr. Taylor’s individual performance (15% of Mr. Taylor’s targeted base bonus is based upon individual performance, provided a threshold level of 2012 MiMedx EBITDA is achieved). |

| • | On March 18, 2011, the Compensation Committee approved an increase in Mr. Senken’s base salary from $170,000 to $200,000 effective January 15, 2011, the anniversary date of his employment. On February 23, 2012 the Compensation Committee approved a further increase in Mr. Senken’s base salary to $250,000 effective April 1, 2012. During 2011, Mr. Senken was an eligible participant in the 2011 MiMedx MIP with a targeted base bonus equal to 40% of Mr. Senken’s 2011 annual base salary to be earned based upon a combination of the Company’s consolidated 2011 MiMedx EBITDA (75% of Mr. Senken’s targeted base bonus was based upon 2011 MiMedx EBITDA) and Mr. Senken’s individual performance (25% of Mr. Senken’s targeted base bonus was based upon individual performance, provided a threshold level of 2011 MiMedx EBITDA was achieved). Mr. Senken did not earn any amount of the 2011 MIP. For 2012, Mr. Senken is an eligible participant in the 2012 MiMedx MIP with a targeted base bonus equal to 40% of Mr. Senken’s 2012 annual base salary to be earned based upon a combination of the Company’s consolidated 2012 MiMedx EBITDA (75% of Mr. Senken’s targeted base bonus is based upon 2012 MiMedx EBITDA) and Mr. Senken’s individual performance (25% of Mr. Senken’s targeted base bonus is based upon individual performance, provided a threshold level of 2012 MiMedx EBITDA is achieved). |

13

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

The following table shows the number of shares covered by exercisable and unexercisable options held by our Named Executive Officers on December 31, 2011. We have not made any equity awards under incentive plans and no equity incentive plan awards were outstanding on December 31, 2011.

| Name | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Option Exercise Price ($) | Option Expiration Date | ||||||||||||

Parker H. Petit | 725,000 | — | $ | 0.73 | 2/23/2019 | |||||||||||

| — | 62,500 | (1) | 0.50 | 7/30/2014 | ||||||||||||

| 75,000 | 150,000 | (2) | 1.65 | 2/22/2020 | ||||||||||||

| 33,333 | 66,667 | (3) | 1.20 | 5/10/2020 | ||||||||||||

| — | 125,000 | (4) | 1.35 | 1/4/2021 | ||||||||||||

| — | 300,000 | (5) | 1.23 | 3/17/2021 | ||||||||||||

| — | 500,000 | (6) | 1.05 | 6/28/2021 | ||||||||||||

| — | 200,000 | (7) | 1.10 | 12/13/2021 | ||||||||||||

| — | 800,000 | (8) | 1.25 | 2/22/2022 | ||||||||||||

William C. Taylor | 7,500 | 2,500 | (9) | 0.50 | 7/30/2019 | |||||||||||

| 562,500 | 187,500 | (10) | 0.70 | 9/21/2019 | ||||||||||||

| 116,655 | 233,345 | (2) | 1.65 | 2/22/2020 | ||||||||||||

| — | 75,000 | (4) | 1.35 | 1/4/2021 | ||||||||||||

| — | 225,000 | (5) | 1.23 | 3/17/2021 | ||||||||||||

| — | 125,000 | (11) | 1.18 | 8/2/2021 | ||||||||||||

| — | 115,000 | (7) | 1.10 | 12/13/2021 | ||||||||||||

| 600,000 | (8) | 1.25 | 2/22/2022 | |||||||||||||

Michael J. Senken | 50,000 | 100,000 | (12) | 0.87 | 1/14/2020 | |||||||||||

| 33,333 | 66,667 | (2) | 1.65 | 2/22/2020 | ||||||||||||

| 8,333 | 16,667 | (3) | 1.20 | 5/10/2020 | ||||||||||||

| — | 50,000 | (4) | 1.35 | 1/4/2021 | ||||||||||||

| — | 110,000 | (5) | 1.23 | 3/17/2021 | ||||||||||||

| — | 175,000 | (7) | 1.10 | 12/13/2021 | ||||||||||||

| — | 150,000 | (8) | 1.25 | 2/22/2022 | ||||||||||||

| (1) | The unexercisable portion of this option vests and becomes exercisable on July 31, 2012. |

| (2) | The unexercisable portion of this option vests and becomes exercisable in equal installments on each of February 23, 2012 and 2013. |

| (3) | The unexercisable portion of this option vests and becomes exercisable in equal installments on each of May 11, 2012, and 2013. |

| (4) | The unexercisable portion of this option vests and becomes exercisable in equal installments on each of January 5, 2012, 2013 and 2014. |

| (5) | The unexercisable portion of this option vests and becomes exercisable in equal installments on each of March 18, 2012, 2013 and 2014. |

| (6) | The unexercisable portion of this option vests and becomes exercisable in equal installments on each of June 29, 2012, 2013 and 2014. |

| (7) | The unexercisable portion of this option vests and becomes exercisable in equal installments on each of December 14, 2012, 2013 and 2014. |

| (8) | The unexercisable portion of this option vests and becomes exercisable in equal installments on each of February 23, 2013, 2014 and 2015. |

| (9) | Mr. Taylor received these options for consulting services prior to his appointment as President and Chief Operating Officer. |

| (10) | The unexercisable portion of this option vests and becomes exercisable on September 22, 2012. |

14

| (11) | The unexercisable portion of this option vests and becomes exercisable in equal installments on each of August 3, 2012, 2013 and 2014. |

| (12) | The unexercisable portion of this option vests and becomes exercisable in equal installments on each of January 15, 2012 and 2013 |

During 2011, Mr. Petit exercised 275,000 options at an exercise price of $0.73, and 187,500 options with an exercise price of $0.50.

Below is a description of the Company’s equity-based incentive plans:

MiMedx Group, Inc. Assumed 2006 Stock Incentive Plan

MiMedx, Inc. adopted its 2006 Stock Incentive Plan effective November 27, 2006 (the “Plan”). The Plan was assumed by Alynx, Co. in a merger transaction (the “Merger”), and thereafter by MiMedx Group, Inc. In July 2008, the Plan was renamed the “MiMedx Group, Inc. Assumed 2006 Stock Incentive Plan.” The Plan is administered by the Compensation Committee. See “Approval of Amendment of Assumed 2006 Stock Incentive Plan (Proposal 3)” below for additional information regarding the Plan.

Assumption of the SpineMedica Corp. Stock Option Plans

Each stock option to purchase shares of SpineMedica Corp.’s common stock (each a “SpineMedica Stock Option”) that was outstanding immediately prior to the acquisition of SpineMedica Corp., whether or not then vested or exercisable (each, an “Assumed Option”), as adjusted, was assumed by MiMedx, Inc. when it acquired SpineMedica Corp., by Alynx, Co. upon consummation of the Merger, and thereafter by MiMedx Group, Inc.

MiMedx, Inc. 2005 Assumed Stock Plan (formerly the SpineMedica Corp. 2005 Employee, Director and Consultant Stock Plan)

MiMedx, Inc. assumed the SpineMedica Corp. 2005 Employee, Director, and Consultant Stock Plan (the “2005 Assumed Plan”) in connection with its acquisition of SpineMedica Corp. in July 2007. Following MiMedx, Inc.’s acquisition of SpineMedica Corp., the Board of Directors of MiMedx, Inc. declared that no awards (as defined in the 2005 Assumed Plan) would be issued under the 2005 Assumed Plan. The 2005 Assumed Plan was assumed by Alynx, Co. in the Merger and thereafter by MiMedx Group, Inc. The 2005 Assumed Plan is administered by the Compensation Committee. All share amounts in this section represent numbers of shares of MiMedx Group, Inc. common stock. As of December 31, 2011, options to acquire 365,000 shares are outstanding under the 2005 Assumed Plan.

MiMedx, Inc. Assumed 2007 Stock Plan (formerly the SpineMedica Corp. 2007 Stock Incentive Plan)

MiMedx, Inc. assumed the SpineMedica Corp. 2007 Stock Incentive Plan (the “2007 Assumed Plan”) in connection with its acquisition of SpineMedica Corp. in July 2007. Following MiMedx, Inc.’s acquisition of SpineMedica Corp., the Board of Directors of MiMedx, Inc. declared that no awards (as defined in the 2007 Assumed Plan) shall be issued under the 2007 Assumed Plan. The 2007 Assumed Plan was assumed by Alynx, Co. in the Merger and thereafter by MiMedx Group, Inc. The 2007 Assumed Plan is administered by the Compensation Committee. All share amounts in this section represent numbers of shares of MiMedx Group, Inc. common stock. As of December 31, 2011, options to acquire 10,000 shares are outstanding under the 2007 Assumed Plan.

15

Potential Payments upon Termination or Change in Control

The Company has entered into change-in-control severance agreements with each of the Named Executive Officers. The agreements provide for compensation to the executive in the event the executive’s employment with the Company is terminated following the consummation of a “change-in-control” for reasons other than the executive’s death, disability or for “Cause” (as defined in the respective agreements), or if the executive voluntarily terminates employment for “Good Reason” (as defined in the respective agreements). The compensation payable under the agreements is a lump sum severance payment equal to a multiple of the executive’s annual base salary and targeted base bonus as of the date of the change-in-control. The multiple applicable to Mr. Petit is three. The multiple applicable to Mr. Taylor is one and a half and the multiple applicable to Mr. Senken is one. In addition, following termination of employment, the executives are entitled to receive for a period of three years in the case of Mr. Petit, 18 months in the case of Mr. Taylor and one year in the case of Mr. Senken life, health insurance coverage (subject to a COBRA election), and certain other fringe benefits equivalent to those in effect at the date of termination and will be entitled to receive additional amounts, if any, relating to any excise taxes imposed on the executive as a result of Section 280G of the Code. The agreements require the executive to comply with certain covenants that preclude the executive from competing with the Company or soliciting customers or employees of the Company for a period following termination of employment equal to the period for which fringe benefits are continued under the applicable agreement. The agreements expire three years after a change in control of the Company or any successor to the Company.

Upon a “change in control,” as defined in the 2006 Stock Incentive Plan and subject to any requirements of Section 409A of the Internal Revenue Code of 1986, as amended (the (“Code”), all outstanding awards vest and become exercisable.

Upon a Corporate Transaction (as defined in the 2005 Assumed Plan) and subject to any Code Section 409A requirements, with respect to outstanding options the administrator (currently the Compensation Committee) shall (i) make appropriate provision for the continuation of such options by substituting on an equitable basis for the shares then subject to such options either the consideration payable with respect to the outstanding shares of common stock in connection with the Corporate Transaction or securities of any successor or acquiring entity, or (ii) upon written notice to the participants, provide that all options must be exercised, within a specified number of days of the date of such notice, at the end of which period the options shall terminate, or (iii) terminate all options in exchange for a cash payment equal to the excess of the fair market value of the shares subject to such options over the exercise price thereof. With respect to outstanding stock grants, the administrator shall either (i) make appropriate provisions for the continuation of such stock grants by substituting on an equitable basis for the shares then subject to such stock grants either the consideration payable with respect to the outstanding shares of common stock in connection with the Corporate Transaction or securities of any successor or acquiring entity, or (ii) upon written notice to the participants, provide that all stock grants must be accepted (to the extent then subject to acceptance) within a specified number of days of the date of such notice, at the end of which period the offer of the stock grants shall terminate, or (iii) terminate all stock grants in exchange for a cash payment equal to the excess of the fair market value of the shares subject to such stock grants over the purchase price thereof, if any. In addition, in the event of a Corporate Transaction, the administrator may waive any or all Company repurchase rights with respect to outstanding stock grants.

Upon a “change in control,” as defined in the 2007 Assumed Plan and subject to any Code Section 409A requirements, all options and SARs outstanding as of the date of such change in control shall become fully exercisable, whether or not then otherwise exercisable. Any restrictions, performance criteria and/or vesting conditions applicable to any restricted award shall be deemed to have been met, and such awards shall become fully vested, earned and payable to the fullest extent of the original grant of the applicable award. Notwithstanding the foregoing, in the event of a merger, share exchange, reorganization, sale of all or substantially all of the assets of the Company, the administrator (currently the Compensation Committee) may, in its sole and absolute discretion, determine that any or all awards granted pursuant to the 2007 Assumed Plan shall not vest or become exercisable on an accelerated basis, if the Company or the surviving or acquiring corporation shall have taken such action, including but not limited to the assumption of awards granted under the 2007 Assumed Plan or the grant of substitute awards, as the administrator determines appropriate to protect the rights and interest of participants under the 2007 Assumed Plan.

16

The following table sets forth in tabular form the potential post-employment payments due to the Named Executive Officers under the agreements discussed above, assuming the triggering event for the payments occurred on the last business day of the year ended December 31, 2011.

| Executive | Cash Severance | Estimated Benefits | Estimated Value of Accelerated Equity Awards | Estimated 280G Tax Gross-Ups | Retirement Plans | |||||||||||||||

| (1)(2) | (2)(3) | (4) | (2) | |||||||||||||||||

Parker H. Petit | $ | 1,462,500 | $ | 45,525 | $ | 861,625 | $ | 817,055 | $ | — | ||||||||||

William C. Taylor | $ | 675,000 | $ | 22,763 | $ | 344,650 | $ | N/A | $ | — | ||||||||||

Michael J. Senken | $ | 280,000 | $ | 17,382 | $ | 254,250 | $ | N/A | $ | — | ||||||||||

| (1) | Includes a) annual base salary as of December 31, 2011, plus b) annual targeted bonus for the year ended December 31, 2011, times the multiple applicable to the named executive. |

| (2) | Payable only in the event the executive’s employment is terminated without cause or for “good reason” within three years of following a change in control |

| (3) | Includes a) the estimated value of medical, dental, vision and life insurance, plus b) the employer’s cost of FICA for the duration of the severance period. |

| (4) | Includes the accelerated value of unvested stock options as of December 31, 2011, which are in-the-money based on the December 31, 2011, stock price. |

17

EQUITY COMPENSATION PLAN INFORMATION

The following table provides information about our equity compensation plans of MiMedx as of December 31, 2011:

| A | B | C | ||||||||||

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted average exercise price of outstanding options, warrants and rights reflected in column (A) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (A)* | |||||||||

Equity compensation plans approved by security holders | 10,333,583 | $ | 1.17 | 2,541,417 | ||||||||

Equity compensation plans not approved by security holders | — | — | — | |||||||||

|

|

|

|

|

| |||||||

Total | 10,333,583 | $ | 1.17 | 2,541,417 | ||||||||

|

|

|

|

|

| |||||||

The following table provides information concerning compensation of our directors for the year ended December 31, 2011. The compensation reported is for services as directors. Only those directors who received compensation for such services during the year ended December 31, 2011, are listed.

Name | Fees Earned or Paid in Cash (1) | Stock Awards $ | Option Awards $ | Non-Equity Incentive Plan Compensation | Change in Pension Value and Nonqualified Deferred Compensation Earnings | All Other Compensation | Total $ | |||||||||||||||||||||

Kurt M. Eichler | $ | 56,194 | — | 8,850 | (2)(3) | — | — | — | 65,044 | |||||||||||||||||||

Larry W. Papasan | $ | 64,195 | — | 8,850 | (2)(4) | — | — | — | 73,045 | |||||||||||||||||||

Charles E. Koob | $ | 42,694 | — | 8,850 | (2)(5) | — | — | — | 51,544 | |||||||||||||||||||

Andrew K. Rooke, Jr. | $ | 37,694 | — | 8,850 | (2)(4) | — | — | — | 46,544 | |||||||||||||||||||

Joseph G. Bleser | $ | 69,070 | — | 8,850 | (6) | — | — | — | 77,914 | |||||||||||||||||||

J. Terry Dewberry | $ | 71,945 | — | 8,850 | (6) | — | — | — | 80,789 | |||||||||||||||||||

Bruce L. Hack | $ | 37,694 | — | 8,850 | (6) | — | — | — | 46,538 | |||||||||||||||||||

Steve Gorlin | $ | — | — | 8,850 | (7) | — | — | — | 8,843 | |||||||||||||||||||

| (1) | Amount represents fees paid in during the year ended December 31, 2011. |

| (2) | Annual stock option grant of 15,000 shares which vests in equal installments on December 14, 2012, 2013 and 2014. |

| (3) | Mr. Eichler has an aggregate of 30,000 options outstanding and no outstanding stock awards as of December 31, 2011. |

| (4) | Named director has an aggregate of 80,000 options outstanding and no outstanding stock awards as of December 31, 2011. |

18

| (5) | Mr. Koob has an aggregate of 130,000 options outstanding and no outstanding stock awards as of December 31, 2011. |

| (6) | Named director has an aggregate of 65,000 options outstanding and no outstanding stock awards as of December 31, 2011. |

| (7) | Mr. Gorlin has an aggregate of 110,000 options outstanding and not outstanding stock awards as of December 31, 2011. |

| (8) | The Company follows the provisions of ASC topic 718 “Compensation – Stock compensation” which requires the use of the fair-value based method to determine compensation for all arrangements under which employees and others receive shares of stock or equity instruments. The assumptions made in the valuation of our option awards is disclosed in Note 11 to our consolidated financial statements contained in our Annual Report on Form 10-K for the year ended December 31, 2011. |

Our compensation policy for our non-employee directors, as revised effective May 11, 2010, is as follows:

| • | an annual cash retainer of $25,000 for service as a member of the Board; |

| • | an annual cash retainer of $10,500 for service as a chairman of the Audit Committee; |

| • | an annual cash retainer of $7,500 for service as a chairman of the Compensation Committee; |

| • | an annual cash retainer of $5,000 for service as a chairman of the Nominating and Governance Committee; |

| • | an annual cash retainer of $2,500 for service as a non-chairman member of a Board committee; and |

| • | meeting attendance fees of $1,000 per Board of Directors or committee meeting attended in person and $1,000 per Board of Directors or committee meeting attended telephonically. |

Each non-employee director also receives a grant of 45,000 options to purchase our common stock upon being first elected or appointed to the Board of Directors. In addition, on the date of the annual meeting of the shareholders, each non-employee director who has been a director for at least 12 months receives a grant of options to purchase 15,000 shares of our common stock. The options vest in three equal installments on each anniversary of the grant date. Directors who are employees of the Company receive no compensation for their service as directors or as members of board committees.

The following table sets forth certain information regarding our capital stock, beneficially owned as of September 14, 2012, by each person known to us to beneficially own more than 5% of our common stock, each Named Executive Officer and director, and all directors and executive officers as a group. We calculated beneficial ownership according to Rule 13d-3 of the Exchange Act as of that date. Unless otherwise indicated below, the address of those identified in the table is MiMedx Group, Inc., 60 Chastain Center Blvd., Suite 60, Kennesaw, Georgia 30144.

Name and address of beneficial owner | Number of Shares (1) | Percentage Ownership (1) | ||||||

Parker H. “Pete” Petit (2) | 13,879,419 | 15.35 | % | |||||

ADEC Private Equity Investments, LLC (3) | 5,536,832 | 6.48 | % | |||||

Charles E. Koob (4) | 1,564,653 | 1.83 | % | |||||

William C. Taylor (5) | 1,234,999 | 1.43 | % | |||||

Steve Gorlin (6) | 1,126,645 | 1.32 | % | |||||

19

Name and address of beneficial owner | Number of Shares (1) | Percentage Ownership (1) | ||||||

Kurt M. Eichler (7) | 723,406 | * | ||||||

Bruce L. Hack (8) | 696,768 | * | ||||||

Roberta McCaw (9) | 410,223 | * | ||||||

Michael J. Senken (10) | 236,664 | * | ||||||

Andrew K. Rooke, Jr. (11) | 214,666 | * | ||||||

Larry W. Papasan (12) | 183,668 | * | ||||||

Joseph G. Bleser (13) | 109,585 | * | ||||||

J. Terry Dewberry (14) | 66,666 | * | ||||||

Total Directors and Executive Officers (12 persons)(15) | 20,447,362 | 22.06 | % | |||||

| * | Less than 1% |

| (1) | Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to shares beneficially owned. Unless otherwise specified, reported ownership refers to both voting and investment power. Stock options, warrants and convertible securities which are exercisable within 60 days are deemed to be beneficially owned. On September 14, 2012, there were 85,452,774 shares of common stock issued and outstanding, net of 50,000 shares of common stock held in treasury. |