October 11, 2011

Brad Skinner

Senior Assistant Chief Accountant

United States Securities and Exchange Commission

Division of Corporate Finance

100 F Street Northeast

Washington, DC 20549-7010

| RE: | Allied Nevada Gold Corp. Form 10-K for Fiscal Year Ended December 31, 2010 Filed February 28, 2011 Comment Letter Dated August 23, 2011 File No. 001-33119 |

Dear Mr. Skinner,

In our correspondence to the Staff of the Securities and Exchange Commission (the “Staff”) dated September 6, 2011, the Company undertook to prepare and file an amendment to the Company’s Form 10-K/A for the fiscal year ended December 31, 2010 and Form 10-Qs for the periods ended March 31, 2011 and June 30, 2011. Further to our discussion with Mr. Giugliano of the Staff, we are submitting to the Staff for review certain portions of the proposed disclosure to be included in the Company’s amended filings.

The proposed disclosure that we are submitting to the Staff for review covers the following three portions of our amended filings:

| 1. | the Explanatory Note to be included in our Form 10-K/A for the year ended December 31, 2010; |

| 2. | the unaudited consolidated quarterly statements of income (loss) for the years ended December 31, 2010 and 2009, to be included with our Form 10-K/A for the year ended December 31, 2010; and |

| 3. | the explanation of our non-GAAP measures. |

1. Explanatory Note to be Included in our Form 10-K/A for the Year Ended December 31, 2010.

EXPLANATORY NOTE

Overview

As described below and in Note 2, Allied Nevada Gold Corp. is filing this Amendment No. 2 to our Annual Report on Form 10-K for the year ended December 31, 2010, to reclassify our consolidated statements of income and associated disclosures. This amendment is not a restatement and amends the following financial statements and disclosures:

| ● | consolidated statements of income (loss) for the years ended December 31, 2010 and 2009, and |

| ● | selected financial data as of December 31, 2010 and 2009 |

We amended our disclosure contained in the following sections of Management’s Discussion and Analysis of Financial Condition and Results of Operations:

● | Critical accounting policies |

We modified our disclosure of the following notes to our consolidated financial statements:

● | Note 3: Summary of Significant Accounting Policies, |

● | Note 6: Ore on Leach Pads, and |

● | Note 23: Quarterly financial information |

There have been no changes from the original Form 10-K other than those described above. This Amendment No. 2 does not reflect events occurring after the original filing of the Form 10-K, or modify or update in any way disclosures made in the Form 10-K other than as described above.

Concurrently, we are also filing an amendment to our first and second quarter 2011 Forms 10-Q to amend our financial statements and associated disclosures as of and for the periods ended March 31 and June 30, 2011.

Background

During the fourth quarter of 2011, we determined that our financial statements and related disclosures required amendment to reclassify our income statement presentation and to provide additional information to the users of our financial statements. We determined that the disclosures related to our presentation of cost of sales, our critical accounting policies and our non-GAAP measures needed to be revised and expanded. Accordingly, we made the following changes:

| ● | We reclassified our income statement presentation to report total cost of sales which includes production costs and depreciation and amortization. |

| ● | We renamed our non-GAAP measure “adjusted cash costs” so that the name was not similar to the GAAP measure “cost of sales,” and we changed its calculation so that it did not exclude items that were non-recurring, infrequent, or unusual when it is reasonably likely that such costs would recur within two years or there was a similar charge within the prior two years. |

| ● | We enhanced our disclosures related to work-in-process inventories to discuss how we selected policies and made estimates and to discuss how selecting different policies and estimates would have impacted our financial statements. |

| ● | We modified our disclosure in Note 6: Ore on Leach Pads, to indicate that all production phase stripping costs are included in inventory and that lower of cost or market principles are applied to inventory balances. |

| ● | We enhanced our revenue recognition disclosures to discuss the point at which sales occur in the production process. |

Consistent with the information above, we have revised the following items in this Form 10-K/A:

Part II

Item 6 – Selected Financial Data. (See Item 8)

Item 7 – Management’s Discussion and Analysis of Results of Operations and Financial Condition. We have added an introductory paragraph summarizing the effect of the amendment, we have expanded our discussion of our Results of Operations, we have updated our critical accounting policies and we have modified our non-GAAP measure.

Item 8 – Financial Statements and Supplementary Data. As described in the explanatory note, we have amended our consolidated income statements and selected financial data as of and for the years ended December 31, 2010 and 2009. We have also added Note 2, explaining the amendment, and renumbered the remaining notes. Conforming changes have also been made to Note 3 (Summary of significant accounting policies), Note 5 (Inventories), Note 6

(Ore on leach pads), and Note 23 (Quarterly financial information). Additionally, we included unaudited consolidated quarterly statements of income for the years ended December 31, 2010 and 2009, respectively, as supplementary data.

Part III

This Amendment No. 2 does not include Part III. For the information set forth in Part III, see Amendment No. 1 to our Annual Report on Form 10-K, filed with the Securities and Exchange Commission on April 29, 2011.

Part IV

Item 15 – Exhibits and Financial Statement Schedules. (See Item 8)

Our independent auditors, Ehrhardt, Keefe, Steiner & Hottman PC, have updated their consent to the date of this filing on the consolidated financial statements, and we have provided new Rule 13a-14(a) and Section 1350 certifications from our chief executive officer and chief financial officer. Except to the extent relating to the amendment of our consolidated financial statements and selected financial data described above, the consolidated financial statements and other disclosures in this Form 10-K/A are unchanged.

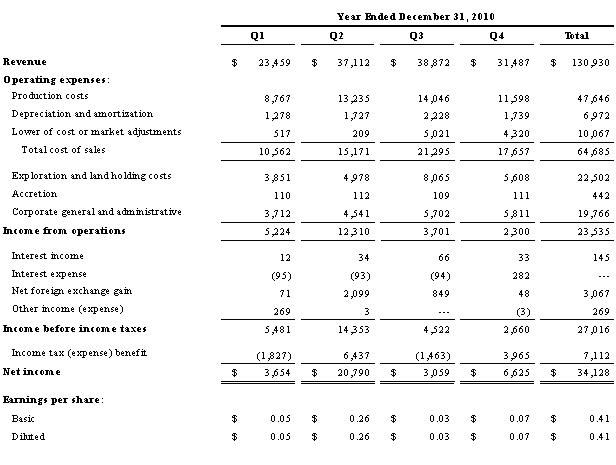

2. Unaudited Consolidated Quarterly Statements of Income (loss) for the Years Ended December 31, 2010 and 2009.

Supplementary Data

ALLIED NEVADA GOLD CORP.

CONSOLIDATED QUARTERLY STATEMENTS OF INCOME (LOSS) (Unaudited)

(US dollars in thousands, except per share amounts)

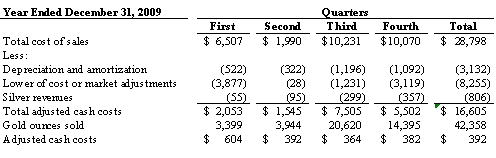

ALLIED NEVADA GOLD CORP.

CONSOLIDATED QUARTERLY STATEMENTS OF INCOME (LOSS) (Unaudited)

(US dollars in thousands, except per share amounts)

3. Explanation of our Non-GAAP Measures.

Non-GAAP Measure

Adjusted Cash Costs

“Adjusted cash costs” is a non-GAAP measure, calculated on a per ounce of gold sold basis, and includes all direct and indirect operating cash costs related directly to the physical activities of producing gold, including mining, processing, third party refining expenses, on-site administrative and support costs, royalties, and mining production taxes, less lower of cost or market adjustments and by-product revenue earned from silver sales. Adjusted cash costs provide management and investors with a measure to assess the Company’s performance against other precious metals companies and performance of the mining operations over multiple periods. Non-GAAP measures do not have any standardized meaning prescribed by GAAP and, therefore, may not be comparable to similar measures presented by other companies. Accordingly, the above measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP.

The table below presents a reconciliation between non-GAAP adjusted cash costs to costs of sales (GAAP) for the year ended December 31, 2010 (in thousands, except ounces sold and adjusted cash costs):

The table below presents a reconciliation between non-GAAP adjusted cash costs to costs of sales (GAAP) for the year ended December 31, 2009 (in thousands, except ounces sold and adjusted cash costs):

There were no comparable measures for the year ended December 31, 2008 as the Company did not have any sales in that year.

If you should have any questions or comments regarding our proposed disclosure, please contact us.

| | Sincerely, |

| | |

| | /s/ Hal Kirby |

| | Hal Kirby |

| | Executive Vice President and Chief Financial Officer |