Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | |

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12

|

| | | | |

| Allied Nevada Gold Corp. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Table of Contents

2014 Proxy Statement

Table of Contents

March 19, 2014

Dear Fellow Stockholder:

I am pleased to invite you to our Annual Meeting of Stockholders, which will be held on Thursday, May 1, 2014, at 8:00 a.m. (Pacific), at the Winnemucca Convention Center, 50 West Winnemucca Boulevard, Winnemucca, Nevada 89445.

As explained in the enclosed Proxy Statement, at the Annual Meeting, you will be asked to vote (i) for the election of directors, (ii) for the approval, on an advisory basis, of Allied Nevada Gold Corp.'s named executive officer compensation, (iii) ratification of appointment of EKS&H LLLP as our independent registered public accounting firm for 2014, and (iv) for approval of the Allied Nevada Performance and Incentive Pay Plan. Your vote is very important and I encourage you to exercise it.

2013 - A Year of Challenges, Leadership Changes and Successes

On behalf of Allied Nevada's Board of Directors, I would like to take this opportunity to thank you for your continued support of Allied Nevada Gold Corp. throughout 2013, which proved to be a year of challenges. Declining gold prices, disappointing operational performance, and leadership difficulties all contributed to our poor stock performance. As many of you know, I stepped in as Interim President and Chief Executive Officer in March. It quickly became clear that our then Chief Operating Officer, Randy E. Buffington, was the perfect candidate to assume the role of CEO.

On July 8, 2013, Randy, a mining veteran with over 30 years of operating experience, took the helm and has maintained a two-part focus: (1) to improve mine operations at our Hycroft Mine and (2) to develop an economically viable method to process sulphide mineralization - which is the true future of the Company. Under Randy's leadership, mine operations have continued to improve and are now achieving budgeted production on a quarterly basis. In 2013, your Company achieved gold sales of 181,941 ounces, a 59% increase from 2012. And, for the past year, Randy has overseen extensive metallurgical test work, which is the cornerstone of developing an economically viable method for processing the substantial sulphide reserves at Hycroft. The encouraging results of the test work led the Company to progress to the final stages of legitimizing the process by building a pilot plant at Hazen Research, Inc., an independent research lab in Golden, Colorado. To date, the pilot plant results continue to point to a low capital and operating cost solution for processing the sulphide reserves.

2014 - A Look Ahead

Building on our operational improvements in 2013, and with full access to the recently commissioned 21,500 gpm Merrill-Crowe Processing Plant, we expect to sell between 230,000 and 250,000 ounces of gold this year. And, with the test work at Hazen Research, Inc. almost complete, we expect our consultants, M3 Engineering & Technology, to deliver a revised pre-feasibility study in early April 2014, with delivery of a full revised feasibility study later this year. We anticipate this will be our roadmap for achieving the substantially higher production levels that we expect from a conventional mill.

In summary, the performance of the management and operating teams under Randy's leadership gives a renewed sense of pride in what has been accomplished in the past six months and an enthusiasm for what can be achieved over the years to come.

As always, we remain committed to operating in a safe, healthy manner and with continued respect for the environment. We will do everything in our collective power to achieve and surpass your expectations.

Sincerely,

Robert M. Buchan

Executive Chairman

Table of Contents

| | |

| NOTICE OF 2014 ANNUAL MEETING OF STOCKHOLDERS | |  |

| | |

| Date: | | Thursday, May 1, 2014 |

Time: |

|

8:00 a.m. Pacific Daylight Time |

Place: |

|

Winnemucca Convention Center

50 W. Winnemucca Boulevard

Winnemucca, Nevada 89445 |

Agenda: |

|

1. Election of the 9 directors named in the Proxy Statement; |

| | | 2. Advisory vote to approve named executive officer compensation; |

| | | 3. Ratification of appointment of EKS&H LLLP ("EKS&H") as our independent registered public accounting firm for 2014; |

| | | 4. Stockholder approval of the Performance and Incentive Pay Plan; and |

| | | 5. Transaction of other business that may properly come before the Annual Meeting or any adjournment thereof. |

Record Date: |

|

Stockholders of record at the close of business on March 5, 2014, are entitled to notice of and to vote at the meeting. |

Proxy Voting: |

|

Your vote is important. You can vote your shares by completing and returning the proxy card or voting instruction form sent to you. Most Stockholders can also vote their shares over the Internet or by telephone. Please check your proxy card or the information forwarded by your broker, bank, trust or other holder of record to see which options are available to you. You can revoke your proxy at any time prior to its exercise by following the instructions in the Proxy Statement. |

| | |

| | | By order of the Board of Directors, |

| | |

|

| | | Rebecca A. Rivenbark

Vice-President, General Counsel and

Corporate Secretary

March 19, 2014 |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 1, 2014

Our Notice of Meeting, Proxy Statement and Annual Report on Form 10-K are available at

www.edocumentview.com/ANV

Table of Contents

| | |

| TABLE OF CONTENTS | |  |

| | |

2013 PROXY SUMMARY TABLE | | 1 |

FREQUENTLY ASKED QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING | | 2 |

PROPOSAL 1: ELECTION OF DIRECTORS | | 5 |

CORPORATE GOVERNANCE | | 12 |

MANDATE OF THE BOARD OF DIRECTORS | | 12 |

2013 GOVERNANCE COMMITTEE ACTIVITIES | | 12 |

CORPORATE GOVERNANCE GUIDELINES | | 13 |

STRATEGIC PLANNING | | 16 |

COMMUNICATIONS WITH THE BOARD OF DIRECTORS | | 16 |

COMPENSATION OF NON-EMPLOYEE DIRECTORS | | 16 |

BOARD OF DIRECTORS' COMMITTEES | | 18 |

AUDIT COMMITTEE REPORT | | 22 |

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | | 23 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | 24 |

COMPENSATION DISCUSSION AND ANALYSIS | | 27 |

COMPENSATION OBJECTIVES | | 28 |

HOW EXECUTIVE COMPENSATION IS DETERMINED: THE ROLE OF THE COMPENSATION COMMITTEE, MANAGEMENT, CONSULTANTS, STOCKHOLDERS AND PEERS | | 29 |

2013 COMPANY PERFORMANCE | | 30 |

2013 COMPENSATION DECISIONS | | 31 |

2013 LONG-TERM EQUITY-BASED AWARDS | | 34 |

2013 PAY-FOR-PERFORMANCE RESULTS | | 36 |

2014 COMPENSATION DECISIONS | | 38 |

CLAWBACK PROVISIONS | | 41 |

EMPLOYMENT AGREEMENTS | | 41 |

EXECUTIVE OFFICER STOCKHOLDING REQUIREMENTS | | 41 |

STOCK OPTION PLAN | | 42 |

TERMINATION/CHANGE OF CONTROL BENEFITS | | 42 |

INTERNAL PAY EQUITY | | 43 |

PERQUISITES AND OTHER PERSONAL BENEFITS | | 43 |

COMPENSATION COMMITTEE REPORT | | 43 |

EXECUTIVE COMPENSATION | | 44 |

REALIZED COMPENSATION OF OUR CURRENT NAMED EXECUTIVE OFFICERS | | 44 |

SUMMARY COMPENSATION TABLE | | 45 |

2013 GRANTS OF PLAN-BASED AWARDS | | 46 |

2013 OPTION EXERCISES AND STOCK VESTED | | 47 |

OUTSTANDING EQUITY AWARDS AT 2013 YEAR-END | | 47 |

EMPLOYMENT AGREEMENTS | | 48 |

PAYMENTS UPON TERMINATION OR CHANGE OF CONTROL | | 49 |

EQUITY COMPENSATION PLANS AS OF DECEMBER 31, 2013 | | 52 |

PROPOSAL 2: ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION | | 53 |

PROPOSAL 3: RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS | | 55 |

PROPOSAL 4: APPROVAL OF THE PERFORMANCE AND INCENTIVE PAY PLAN | | 57 |

IMPORTANT INFORMATION TO KNOW | | 66 |

APPENDIX A – ALLIED NEVADA GOLD CORP. PERFORMANCE AND INCENTIVE PAY PLAN | | A-1 |

Table of Contents

| | |

| 2013 PROXY SUMMARY TABLE | |  |

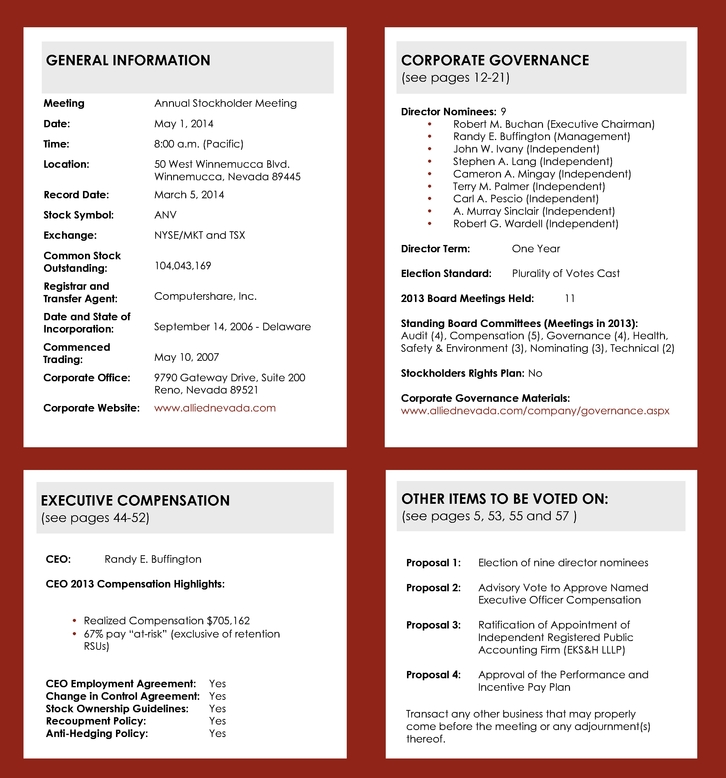

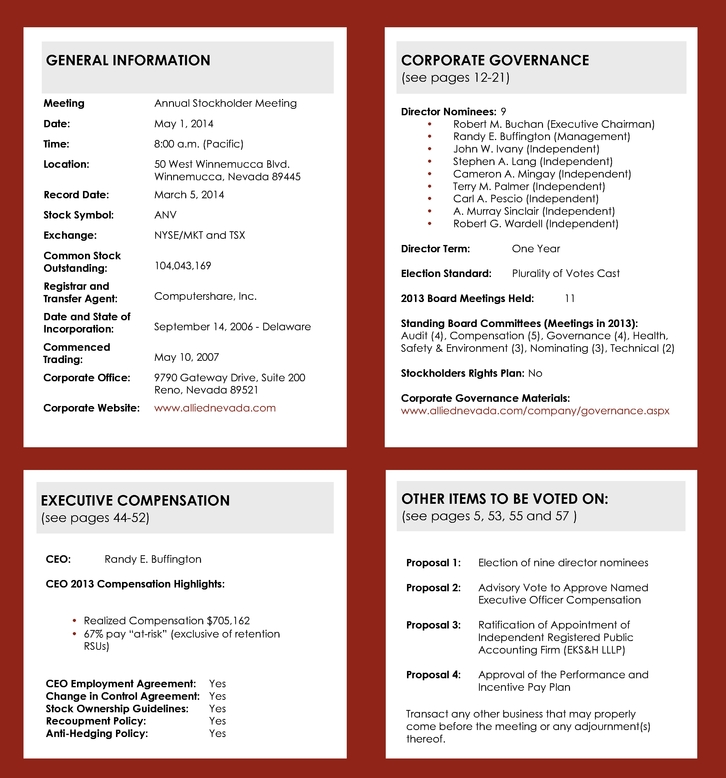

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider. You should read the entire Proxy Statement carefully before voting.

| | | Allied Nevada Gold Corp. | PROXY STATEMENT 1 |

Table of Contents

| | |

| FREQUENTLY ASKED QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING | |  |

| | |

| | WHY DID I RECEIVE THESE PROXY MATERIALS? |

We are providing these proxy materials in connection with the solicitation by the Board of Directors of Allied Nevada Gold Corp. of proxies to be voted at our 2014 Annual Meeting of Stockholders and at any adjournment(s) thereof. The Annual Meeting will take place on May 1, 2014 beginning at 8:00 a.m., Pacific Daylight Time at the Winnemucca Convention Center located at 50 West Winnemucca Boulevard,

Winnemucca, Nevada 89445. The Notice of Annual Meeting and Proxy Statement and a proxy card are being mailed beginning on March 19, 2014. On or about March 19, 2014, we will furnish a Notice of Internet Availability of Proxy Materials to most of our Stockholders containing instructions on how to access the proxy materials on the internet.

| | | | | | | | | | | | |

| | | | | MORE

INFORMATION |

| BOARD

RECOMMENDATION |

| BROKER NON-

VOTES |

| ABSTENTION | | VOTES

REQUIRED

FOR

APPROVAL |

PROPOSAL

1 | | Election of directors | | Page 5 | | FOR each

nominee | | Do not count | | Do not count | | Plurality(1) |

PROPOSAL

2 |

| Approval, on an advisory basis, of named executive officer compensation | | Page 53 | | FOR | | Do not count | | Vote against | | Majority of shares present |

PROPOSAL

3 | | Ratification of EKS&H LLLP as the Company's independent public accountant for 2014 | | Page 55 | | FOR | | Do not count | | Vote against | | Majority of shares present |

PROPOSAL

4 |

| Approval of Performance and Incentive Pay Plan | | Page 57 | | FOR | | Do not count | | Vote against | | Majority of shares present |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | |

- (1)

- Although the director nominees with the highest number of "for" votes cast will be elected at the Annual Meeting, our Corporate Governance Guidelines contain a majority voting policy which requires any nominee for director in an uncontested election to tender his or her resignation to the Board of Directors if that nominee receives a greater number of "withhold" votes than "for" votes in any election. The Board of Director's Governance Committee will consider the resignation offer and recommend to the Board of Directors the action to be taken with respect to the tendered resignation.

Holders of Allied Nevada Gold Corp.'s common stock as of the close of business on March 5, 2014 (the record date) are entitled to vote by proxy or in person at the Annual Meeting. Each share of Allied Nevada common stock has one vote. As of the record date, there were 104,043,169 shares of Allied Nevada's common stock outstanding.

| 2 Allied Nevada Gold Corp. | PROXY STATEMENT | | |

Table of Contents

FREQUENTLY ASKED QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

(1) In Person. You may come to the Annual Meeting and cast your vote there. You may be admitted by bringing your proxy card or, if your shares are held in the name of your broker, bank or other nominee, you must bring an account statement or letter from the nominee indicating that you were the owner of the shares on March 5, 2014.

(2) By Proxy. Before the Annual Meeting, you can give your proxy to vote your shares of Allied Nevada stock in one of the following ways:

| | | | |

BY INTERNET

USING YOUR COMPUTER |

| BY

TELEPHONE

|

| BY

MAILING YOUR PROXY CARD |

|

|

|

|

|

Visit 24/7

www.envisionreports.com/ANV | | Dial toll-free 24/7

1-800-652-VOTE (8683) | | Cast your ballot, sign your proxy

card and send free of postage |

|

|

or by calling the number provided by your

broker, bank or other nominee if your

shares are not registered in your name

|

|

|

The telephone and internet voting procedures are designed to confirm your identity, allow you to give your voting instructions and verify that your instructions have been properly recorded. If you wish to vote by telephone or internet, please follow the instructions included on your notice. If you mail us your properly completed and signed proxy card, or vote by telephone or internet, your shares of Allied Nevada common stock will be voted according to the choices you specify. If you sign and mail your proxy card without marking any choices, your proxy will be voted:

- •

- FOR the election of all nominees for director;

- •

- FOR the approval, on an advisory basis, of Allied Nevada's named executive officer compensation;

- •

- FOR the ratification of EKS&H LLLP as Allied Nevada's independent public accountant for 2014; and

- •

- FOR approval of the Performance and Incentive Pay Plan.

The Company does not expect that any other matters will be brought before the Annual Meeting. However, by giving your proxy, you appoint the persons named as proxies as your representatives at the Annual Meeting.

| | |

| | MAY I CHANGE OR REVOKE MY VOTE? |

Yes. You may change your vote or revoke your proxy at any time before the Annual Meeting by:

- •

- notifying our Corporate Secretary, Rebecca A. Rivenbark, at 9790 Gateway Drive, Suite 200, Reno, Nevada 89521, in writing;

- •

- providing another signed proxy that is dated after the proxy you wish to revoke;

- •

- using the telephone or internet voting procedures; or

- •

- attending the Annual Meeting in person.

| | |

| | WILL MY SHARES BE VOTED IF I DO NOT PROVIDE MY PROXY? |

It depends on whether you hold your shares in your own name or in the name of a bank or brokerage firm. If you

hold your shares directly in your own name, they will not be voted unless you provide a proxy or vote in person at

| | | Allied Nevada Gold Corp. | PROXY STATEMENT 3 |

Table of Contents

FREQUENTLY ASKED QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

the Annual Meeting. Brokerage firms generally have the authority to vote customers' unvoted shares on certain "routine" matters. If your shares are held in the name of a broker, bank, or other nominee, such nominee can vote your shares for the ratification of EKS&H LLLP as Allied Nevada's independent public accountant for

2014 if you do not timely provide your proxy because this matter is considered "routine" under the applicable rules. However, no other items are considered "routine" and may not be voted by your broker without your instruction.

| | |

| | WHAT CONSTITUTES A QUORUM? |

Under our By-laws, the holders of at least thirty-three and one-third percent (331/3) of the common stock issued and outstanding and entitled to vote at the Annual Meeting, present in person or represented by proxy, shall constitute a quorum for the transaction of business at the Annual Meeting. Both abstentions and broker non-votes are counted for the purpose of determining the presence of a quorum.

If there is not a quorum at the Annual Meeting, the Stockholders entitled to vote at the Annual Meeting,

whether present in person or represented by proxy, will only have the power to adjourn the Annual Meeting until there is a quorum. The Annual Meeting may be reconvened without additional notice to the Stockholders within 30 days after the date of the prior adjournment if the Company announces the reconvened meeting at the prior adjournment. A quorum must be present at such reconvened meeting to conduct business other than adjournment.

| | |

| | WHAT VOTE IS NEEDED TO APPROVE THE MATTERS SUBMITTED? |

The votes required to approve the matters presented at the Annual Meeting are:

- •

- Election of Directors. Each of our directors is elected individually by a plurality vote of shares of common stock present in person or represented by proxy at the Annual Meeting.

- •

- Advisory Say-On-Pay. An affirmative vote of the holders of a majority of the shares of common stock present and entitled to vote at the Annual Meeting is required to approve this proposal.

- •

- Ratification of EKS&H LLLP as the Company's Independent Auditors for 2014. The appointment of EKS&H as the Company's independent auditors requires the affirmative vote of the holders of a majority of the shares of common stock having voting power present in person or represented by proxy at the Annual Meeting.

- •

- Approval of the Performance and Incentive Pay Plan. Approval of the Performance and Incentive Pay Plan requires the affirmative vote of the holders of a majority of the shares of common stock having voting power present in person or represented by proxy at the Annual Meeting.

| | |

| | WHO CONDUCTS THE PROXY SOLICITATION AND HOW MUCH DOES IT COST? |

Allied Nevada is requesting your proxy for the Annual Meeting and will pay all the costs of requesting Stockholder proxies. The Company hired Georgeson, Inc. to help request proxies. Georgeson's fee for this service is $8,500, plus out-of-pocket expenses. Allied Nevada can request proxies through the mail or personally by telephone, fax or other means and can use directors, officers and other employees of Allied

Nevada to request proxies. Directors, officers and other employees will not receive additional compensation for these services. Allied Nevada will reimburse brokerage houses, other custodians, nominees and fiduciaries for reasonable out-of-pocket expenses for forwarding solicitation materials to the beneficial owners of Allied Nevada common stock.

| 4 Allied Nevada Gold Corp. | PROXY STATEMENT | | |

Table of Contents

| | |

| PROPOSAL 1: ELECTION OF DIRECTORS | |  |

The Board of Directors recommends voting"FOR" the nominees set forth below.

Pursuant to the Company's By-laws, the Board of Directors or the Company's Stockholders are required to fix, from time to time, the number of directors which shall constitute the whole board. The Board of Directors has fixed the number of directors at nine. The Board of Directors, upon the recommendation of the Nominating Committee, proposes the following nine nominees for election as directors to hold office until the next Annual Meeting to be held in 2015 or until their successors, if any, have been duly elected and qualified:

- •

- Robert M. Buchan

- •

- Randy E. Buffington

- •

- John W. Ivany

- •

- Stephen A. Lang

- •

- Cameron A. Mingay

- •

- Terry M. Palmer

- •

- Carl A. Pescio

- •

- A. Murray Sinclair

- •

- Robert G. Wardell

With the exception of Mr. Buffington, who was appointed as a director on July 8, 2013, and Stephen A. Lang, who was appointed as a director on August 1, 2013 pursuant to Article III, Section 3 of the Company's By-Laws, each of the foregoing was elected at the 2013 Annual Meeting to serve until the 2014 Annual Meeting, and has agreed to serve if re-elected.

If any nominee becomes unable to stand for election (which is not anticipated by the Board of Directors), each proxy will be voted for a substitute designated by the Board of Directors or, if no substitute is designated by the Board of Directors prior to or at the Annual Meeting, the Board of Directors will act to reduce the membership of the Board of Directors to the number of individuals nominated.

There is no family relationship between nominees, or between nominees and executive officers.

| | |

| | DIRECTOR SKILLS AND QUALIFICATIONS |

The Board of Directors believes the Board, as a whole, should possess a combination of skills, professional experience and diversity of viewpoints necessary to oversee the Company's business. Accordingly, the Board of Directors and the Nominating Committee consider the qualifications of directors and director candidates individually and in the broader context of the Board of Directors' overall composition and the Company's current and future needs.

As indicated in the section below entitled "Information Concerning Nominees", each nominee possesses a strong and unique background and set of skills, which gives the Board of Directors, as a whole, competence and experience in a wide variety of areas.

In evaluating director candidates, and when considering incumbent directors for re-nomination, the Board of Directors and the Nominating Committee have not formulated any specific minimum qualifications, but rather considered a variety of factors. These include each nominee's independence, financial acumen, personal accomplishments, career specialization, and experience in light of the needs of the Company. For incumbent directors, the factors include past performance on the Board of Directors. Among other

things, the Board of Directors has determined it is important to have individuals who have certain of the following skills and experiences on the Board of Directors:

- •

- Business Ethics

- •

- Business Administration

- •

- Corporate Governance

- •

- Environment/Corporate Responsibility

- •

- Finance/Capital

- •

- Financial Literacy/Expertise

- •

- Government/Public Policy

- •

- International

- •

- Legal

- •

- Mining Industry

- •

- Mining Operations

- •

- Risk Management

- •

- Stockholder Relations

- •

- Talent Management

| | | Allied Nevada Gold Corp. | PROXY STATEMENT 5 |

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

| | |

| | INFORMATION ABOUT NOMINEES |

| | | | |

| ROBERT M. BUCHAN Age: 66 Director of Allied Nevada Since: March 2007 Allied Nevada Committees: • Technical | | Skills and Qualifications: ü Business Ethics ü Business Administration ü Corporate Governance ü Environment/Corporate Responsibility ü Finance/Capital ü Financial ü Literacy/Expertise ü Government/Public Policy ü International ü Mining Industry ü Mining Operations ü Risk Management ü Stockholder Relations ü Talent Management | | Current Public Directorships: • Castle Mountain Mining Company, Chairman Former Directorships: • Touchstone Gold, Chairman (December 2013) • Elgin Mining Inc. (May 2013) • Polyus Gold, Chairman (March 2013) • Angus Mining Inc., Chairman (May 2012) • Foxpoint Capital Corp. (May 2012) • Richmont Mines Inc., Chairman (March 2012) • Samco Gold (January 2012) • Sprott Resources Lending (November 2011) • Rainy Mountain Capital Corp. (September 2011) • Claude Resources Inc. (December 2010) • Forsys Metals Corp. (May 2010) • Extract Resources, Chairman (December 2009) |

Mr. Buchan is the Executive Chairman of the Board of Directors for Allied Nevada and has been since October 2006, Mr. Buchan also served as our Interim President and Chief Executive Officer from March 27, 2013 to July 7, 2013. He was the Chief Executive Officer of Kinross Gold Corporation (a gold mining company) from January 1993 to April 2005. Mr. Buchan is Chairman of the Board of Directors of Castle Mountain Mining Company (a development stage gold mining company) and has been since April 2013.

| | | | |

| RANDY E. BUFFINGTON Age: 54 Director of Allied Nevada Since: July 2013 Allied Nevada Committees: • Technical | | Skills and Qualifications: ü Business Ethics ü Business Administration ü Corporate Governance ü Environment/Corporate Responsibility ü Finance/Capital ü Government/Public Policy ü International ü Mining Industry ü Mining Operations ü Risk Management ü Stockholder Relations ü Talent Management | | Current Public Directorships: • None Former Directorships: • None |

Mr. Buffington is our President and Chief Executive Officer having been appointed on July 8, 2013. Prior to his appointment, Mr. Buffington served as our Executive Vice President and Chief Operating Officer from February 2013 until July 2013. Prior to joining Allied Nevada, Mr. Buffington was Senior Vice President of Operations of Coeur Mining, Inc. (formerly Coeur d'Alene Mines Corporation)(a silver mining company) from January 2012 to January 2013. Mr. Buffington also held various positions with Barrick Gold Corporation (a global mining company), including: Managing Director of Zambia from September 2011 to January 2012, General Manager of North American Operations for Barrick Goldstrike Mines, Inc. from August 2009 to September 2011, and General Manager for Barrick Ruby Hill Mine from August 2006 to August 2009.

| 6 Allied Nevada Gold Corp. | PROXY STATEMENT | | |

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

| | | | |

| JOHN W. IVANY Age: 69 Director of Allied Nevada Since: June 2007 Allied Nevada Committees: • Health, Safety and

Environment (Chair) • Nominating (Chair) • Compensation • Corporate Governance | | Skills and Qualifications: ü Business Ethics ü Business Administration ü Corporate Governance ü Environment/Corporate Responsibility ü Finance/Capital ü Government/Public Policy ü International ü Legal ü Mining Industry ü Mining Operations ü Risk Management ü Stockholder Relations ü Talent Management | | Current Public Directorships: • B2 Gold Corp • Eurogas International Ltd. Former Directorships: • Aura Minerals Inc. (May 2012) • Breakwater Resources Ltd. (August 2011) |

Mr. Ivany is a retired mining executive having served as Executive Vice President of Kinross Gold Corp. (a gold mining company) from June 1995 to May 2006. He has served as an advisor to the investment banking company, Canaccord Genuity Corp. since February 2007. He has been a director for B2 Gold Corp. (a gold producing mineral company) since November 2007, and Eurogas International Ltd. (an oil and natural gas exploration company) since August 2008.

| | | | |

| STEPHEN A. LANG Age: 58 Director of Allied Nevada Since: August 2013 Allied Nevada Committees: • Technical (Chair) • Audit | | Skills and Qualifications: ü Business Ethics ü Business Administration ü Corporate Governance ü Environment/Corporate Responsibility ü Finance/Capital ü Financial Literacy/Expertise ü Government/Public Policy ü International ü Mining Industry ü Mining Operations ü Risk Management ü Stockholder Relations ü Talent Management | | Current Public Directorships: • Centerra Gold Inc.; Chairman • International Tower Hill Mines Ltd. Former Directorships: • None |

Mr. Lang is a retired mining executive having served as President and Chief Executive Officer of Centerra Gold Inc. (a Canadian-based gold mining and exploration company) from June 2008 to May 2012. Since May 2012, Mr. Lang has served as Centerra Gold Inc.'s Chairman of the Board. Mr. Lang is also a director for International Tower Hill Mines Ltd. (an advanced exploration stage company) since February 2014. He was a lecturer at the Missouri University of Science and Technology from January 2013 to December 2013.

| | | Allied Nevada Gold Corp. | PROXY STATEMENT 7 |

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

| | | | |

| CAMERON A. MINGAY Age: 62 Director of Allied Nevada Since: March 2007 Allied Nevada Committees: • Corporate Governance (Chair) • Health, Safety and Environment | | Skills and Qualifications: ü Business Ethics ü Business Administration ü Corporate Governance ü Environment/Corporate Responsibility ü Finance/Capital ü Government/Public Policy ü International ü Legal ü Mining Industry ü Risk Management ü Stockholder Relations ü Talent Management | | Current Public Directorships: • Angus Mining Ltd. • Yancoal Canada Resources, Ltd. Former Directorships: • Silver Bear Resources Inc. (June 2011) • European Goldfields Ltd. (January 2010) |

Mr. Mingay is currently a Senior Partner at Cassels Brock & Blackwell LLP and has been for fifteen years. He also serves as outside counsel to the Company. He joined the Board of Directors of Angus Mining Inc. (a precious metals exploration company) in June 2010 and Yancoal Canada Resources, Ltd. (a potash exploration company) in August 2011.

| | | | |

| TERRY M. PALMER Age: 69 Director of Allied Nevada Since: September 2006 Allied Nevada Committees: • Audit (Chair) • Nominating | | Skills and Qualifications: ü Business Ethics ü Business Administration ü Corporate Governance ü Finance/Capital ü Financial Literacy/Expertise ü Government/Public Policy ü International ü Mining Industry ü Risk Management ü Stockholder Relations ü Talent Management | | Current Public Directorships: • Golden Minerals Company • Sunward Resources Ltd. Former Directorships: • Apex Silver Mines Ltd. (March 2009) |

Mr. Palmer has been a Principal Accountant at Marrs, Sevier & Company LLC, a certified public accounting firm, since January 2003. Prior to joining Marrs, Sevier & Company, he worked for Ernst & Young as a partner and Certified Public Accountant from September 1979 to October 2002. Mr. Palmer has been a director for Golden Minerals Company (a mining, exploration and development company) since March 2009, and for Sunward Resources Ltd. (a mining, exploration and development company) since February 2011.

| | | | |

| CARL A. PESCIO Age: 62 Director of Allied Nevada Since: March 2007 Allied Nevada Committees: • Health, Safety and Environment • Technical | | Skills and Qualifications: ü Business Ethics ü Corporate Governance ü Environment/Corporate Responsibility ü Finance/Capital ü Government/Public Policy ü Mining Industry ü Mining Operations ü Stockholder Relations | | Current Public Directorships: • Angus Mining (Namibia) Inc. Former Directorships: • Tornado Gold International (November 2008) |

Mr. Pescio has been an independent mining prospector since 1991. He has 30-plus years of experience in the mining industry, including exploration expertise, as well as mine, process plant design and operation. Mr. Pescio has been a director for Angus Mining (Nambia) Inc. (an exploration stage gold company) since September 2010.

| 8 Allied Nevada Gold Corp. | PROXY STATEMENT | | |

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

| | | | |

| A. MURRAY SINCLAIR Age: 52 Director of Allied Nevada Since: October 2012 Allied Nevada Committees: • Compensation | | Skills and Qualifications: ü Business Ethics ü Business Administration ü Corporate Governance ü Finance/Capital ü Financial Literacy/Expertise ü Government/Public Policy ü International ü Mining Industry ü Risk Management ü Stockholder Relations ü Talent Management | | Current Public Directorships: • Dundee Corporation • Elgin Mining, Inc. • Ram Power Corp. • Kobex Minerals Inc. • PhosCan Chemical Corp. Former Directorships: • Sprott Resource Lending Corp.,(Chairman 2013) • Gabriel Resources (June 2013) • Nebo Capital Corp. (April 2013) • Sprott Resources Lending Corp. (July 2013) • Dundee Capital Markets, Inc. (February 2012) • Denovo Capital Corp. (September 2011) • Twin Butte Energy Ltd. (February 2011) |

Mr. Sinclair has been the Chief Investment Officer of Earlston Investment Corp. (an investment company) since December 2013. Mr. Sinclair co-founded Ionic Management Corp. (a private management company) in 1996 and continues to oversee its operations. In addition, Mr. Sinclair has been a director of Ram Power Corp. (a geothermal power company) since November 2004, Elgin Mining, Inc. (a gold mining company) since February 2007, Dundee Corporation (an asset management company) since June 2012, Kobex Minerals, Inc. (a multi-metal exploration company) since July 2013, and PhosCan Chemical Corp. (a phosphate development company) since October 2013.

| | | | |

| ROBERT G. WARDELL Age: 69 Director of Allied Nevada Since: September 2006 Allied Nevada Committees: • Compensation (Chair) • Audit • Corporate Governance • Nominating | | Skills and Qualifications: ü Business Ethics ü Business Administration ü Corporate Governance ü Finance/Capital ü Financial Literacy/Expertise ü Government/Public Policy ü International ü Mining Industry ü Risk Management ü Stockholder Relations ü Talent Management | | Current Public Directorships: • Nuinsco Resources Limited • Katanga Mining Limited • Elgin Mining Inc. • Viterra, Inc. Former Directorships: • Centric Health Corp. (October 2012) |

Mr. Wardell is a retired finance executive having served as a partner at Deloitte & Touche LLP from 1986 to 2006, and Vice President, Finance and Chief Financial Officer of Victory Nickel Inc. (a nickel development company) from February 2007 to January 2009. Mr. Wardell currently serves on several boards, including Nuinsco Resources Limited (a multi-commodity mineral exploration company) since 2009, Katanga Mining Limited (a copper-cobalt mining company) since July 2006, Elgin Mining, Inc. (a gold mining company) since June 2008, and Viterra, Inc. (a grain handling company) since December 2012.

| | | Allied Nevada Gold Corp. | PROXY STATEMENT 9 |

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

| | | | | | | | | | | | | | | | | | |

SUMMARY OF DIRECTOR

QUALIFICATIONS AND EXPERIENCE |

| ROBERT M.

BUCHAN |

| RANDY E.

BUFFINGTON |

| JOHN W.

IVANY |

| STEPHEN A.

LANG |

| CAMERON A.

MINGAY |

| TERRY M.

PALMER |

| CARL A.

PESCIO |

| A. MURRAY

SINCLAIR |

| ROBERT G.

WARDELL |

| BUSINESS ETHICS experience is crucial to the success of our business and the well being of our employees, management, Board of Directors, and stockholders. | | ■ | | ■ | | ■ | | ■ | | ■ | | ■ | | ■ | | ■ | | ■ |

BUSINESS ADMINISTRATION experience is important because directors with business administration experience tend to possess strong leadership qualities necessary to develop and motivate those qualities in others. |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

|

|

|

■ |

|

■ |

CORPORATE GOVERNANCE experience supports our goals of a strong Board of Directors, management accountability, transparency and protection of stockholder interests. |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

ENVIRONMENT/CORPORATE RESPONSIBILITY experience strengthens the Board of Directors' oversight and assures that strategic business imperatives and long-term value creation are achieved within a responsible business model. |

|

|

|

■ |

|

■ |

|

|

|

■ |

|

|

|

■ |

|

|

|

|

FINANCE/CAPITAL experience is important in evaluating our financial statements and capital structure. |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

FINANCIAL LITERACY/EXPERTISE is important because it assists our directors in understanding and overseeing our financial reporting and internal controls. |

|

■ |

|

|

|

|

|

■ |

|

|

|

■ |

|

|

|

■ |

|

■ |

GOVERNMENT/PUBLIC POLICY experience is relevant as the Company operates in a heavily regulated industry that is directly affected by governmental actions. |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

INTERNATIONAL experience is important to understanding and reviewing our business and strategy. |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

|

|

|

■ |

|

■ |

LEGAL experience is valuable in assisting the Board of Directors with its responsibilities to oversee the Company's legal and compliance matters. |

|

|

|

|

|

■ |

|

|

|

■ |

|

|

|

|

|

|

|

|

MINING INDUSTRY experience and knowledge of gold and silver mining is relevant to understanding the Company's business strategy. |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

MINING OPERATIONS experience gives directors a practical understanding of developing, implementing, and assessing the Company's business strategy and operating plan. |

|

■ |

|

■ |

|

■ |

|

■ |

|

|

|

|

|

■ |

|

|

|

|

RISK MANAGEMENT experience assures directors will respond to and provide oversight of the risks facing the Company. |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

|

|

|

■ |

|

■ |

STOCKHOLDER RELATIONS experience is valuable as it allows directors to develop and build trust with our stockholders. |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

TALENT MANAGEMENT experience is valuable in helping the Company attract, motivate and retain top candidates. |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

|

■ |

|

|

|

■ |

|

■ |

| 10 Allied Nevada Gold Corp. | PROXY STATEMENT | | |

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

In the election for directors, the nine nominees receiving the highest number of "for" votes cast in person or by proxy will be elected. A "withhold" vote for a nominee is the equivalent of abstaining. Abstentions and broker non-votes are not counted as votes cast for the purposes of, and therefore will have no impact as to, the election of directors. Although the director nominees with the highest number of "for" votes cast will be elected at the Annual Meeting, our Corporate Governance Guidelines contain a majority voting policy which requires any nominee for director in an uncontested election to tender his or her resignation to

the Board of Directors if that nominee receives a greater number of "withhold" votes than "for" votes in any election. The Board of Directors' Governance Committee will consider the resignation offer and recommend to the Board of Directors the action to be taken with respect to the tendered resignation. The Board of Directors will act upon the Governance Committee's recommendation no later than 90 days following certification of the Stockholder vote. A complete copy of our Corporate Governance Guidelines is posted on our website atwww.alliednevada.com.

| | |

| | PROXY TABULATION REPORT FOR THE 2013 ANNUAL MEETING |

Below is a Proxy Tabulation Report setting forth the votes cast for last year's nominees at the Company's 2013 Annual Meeting:

| | | | | | | | | | | | | |

| | Director |

|

| For |

|

| Withheld |

|

| Broker

Non-Votes |

| |

| | Robert M. Buchan | | | 47,323,097 | | | 14,358,987 | | | 7,017,081 | | |

| | Scott A. Caldwell(1) | | | 25,691,375 | | | 35,990,709 | | | 7,017,081 | | |

| | John W. Ivany | | | 55,033,336 | | | 6,648,748 | | | 7,017,081 | | |

| | Cameron A. Mingay | | | 45,061,780 | | | 16,620,304 | | | 7,017,081 | | |

| | Terry M. Palmer | | | 55,068,183 | | | 6,613,901 | | | 7,017,081 | | |

| | Carl A. Pescio | | | 56,656,973 | | | 5,025,111 | | | 7,017,081 | | |

| | A. Murray Sinclair | | | 32,679,911 | | | 29,002,173 | | | 7,017,081 | | |

| | Robert G. Wardell | | | 54,775,976 | | | 6,906,108 | | | 7,017,081 | | |

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | | |

- (1)

- Mr. Caldwell was not presented for re-election to the Board of Directors following cessation of his employment by Allied Nevada.

| | | Allied Nevada Gold Corp. | PROXY STATEMENT 11 |

Table of Contents

| | |

| CORPORATE GOVERNANCE | |  |

| | |

| | MANDATE OF THE BOARD OF DIRECTORS |

Our Board of Directors passed a Mandate of the Board of Directors ("Mandate") formally setting down the purpose and responsibilities of the Board of Directors. Per the Mandate, the Board of Directors is responsible for the oversight and supervision of the management of the Company's business and for acting in the best interests of the Company and Stockholders with the objective of enhancing Stockholder value. The Board of Directors discharges its responsibilities directly and through its Audit, Corporate Governance, Nominating, Health, Safety and Environment, and Technical Committees.

The Board of Directors meets at least quarterly to review business operations, corporate governance, environmental, health and safety compliance, and

financial results of the Company. Meetings of the Board of Directors also include regular meetings of the independent members of the Board of Directors without management present. The Board of Directors met either in person or telephonically eleven times during the year ended December 31, 2013, and passed two unanimous written consent resolutions. All directors attended at least 90% of the meetings of the Board of Directors and of the committees of which they were members.

It is our policy to encourage all directors to attend the Annual Meeting. With the exception of Mr. Lang, who was not yet a director, all of our then current directors attended our 2013 Annual Meeting in person.

| | |

| | 2013 GOVERNANCE COMMITTEE ACTIVITIES |

A core activity of the Corporate Governance Committee ("Governance Committee") of the Board of Directors is to periodically review and assess the adequacy of the Company's corporate governance principles and develop and recommend to the Board of Directors additional or revised principles as appropriate. In 2013, the Governance Committee engaged in a number of initiatives in order to fulfill this mandate pursuant to its Charter.

Board Composition

The Governance Committee initiated the review of the composition of the Board of Directors, which identified the value in appointing an additional director. Ultimately, the Nominating Committee determined that Stephen A. Lang was the best candidate for the director position and Mr. Lang was appointed to the Board of Directors in August 2013.

Technical Committee

The Governance Committee, in consultation with the Board of Directors and management, recommended the creation of a Technical Committee to provide oversight with respect to technical and scientific matters. The Technical Committee was formed in October 2013, Mr. Lang was appointed as the Chair and a mandate was adopted by the Board of Directors.

Director Evaluation

The Governance Committee prepared and delivered a director self-evaluation, the purpose of which was to

provide the Board of Directors with information to evaluate the performance of the Board of Directors and to improve the Board of Directors' and committee processes and effectiveness. The Governance Committee then reviewed the results and identified a number of initiatives in response to the items raised in the evaluations, some of which have already been implemented, including those set out below.

Committee Charter Review

The Governance Committee provided the chair of each Board committee with a copy of its committee charter and requested that each chair assess the adequacy of their committee charter and recommend any revisions. No revisions were requested.

Succession Planning

The Governance Committee requested that the Chief Executive Officer engage the senior executive management team in the preparation of a succession plan for the Company, with the view of ensuring that succession and emergency plans are in place for the Chief Executive Officer and executive officer positions. A succession plan was then presented to the Governance Committee and ultimately to the Board of Directors for approval in February 2014. The plan outlines how the Company would mitigate the adverse risk and exposure in case of departure of one or more key employees. This plan will be used as a critical part of the performance evaluations and employee development.

| 12 Allied Nevada Gold Corp. | PROXY STATEMENT | | |

Table of Contents

CORPORATE GOVERNANCE

| | |

| | CORPORATE GOVERNANCE GUIDELINES |

Independence of Directors

If the nominees for director are elected, the Board of Directors will have a majority of directors who meet the criteria for independence required under applicable laws, rules and regulations and the guidelines established by the Board of Directors. The Board of Directors is responsible for reviewing, on an annual basis, whether directors satisfy this independence requirement. Our Board of Directors has determined that the following directors are "independent" as required by NYSE MKT listing standards and NI 58-101: Messrs. Palmer, Pescio, Ivany, Mingay, Wardell, Lang and Sinclair. Messrs. Buchan and Buffington are not considered independent as they hold executive positions within the Company.

Election of Directors by Stockholders

The directors are elected each year by the Stockholders at the Annual Meeting. The Board of Directors, upon the recommendation of the Nominating Committee, propose a slate of nominees to the Stockholders for election to the Board of Directors at such meeting. Between annual meetings of Stockholders, the Board of Directors may elect directors to serve until the next such meeting. As noted above, upon recommendation by the Nominating Committee, the Board of Directors appointed Randy E. Buffington to the Board of Directors on July 8, 2013 and Stephen A. Lang to the Board of Directors on August 1, 2013. Under the Company's Majority Voting Policy, any director in an uncontested election who receives a greater number of "WITHHELD" votes than "FOR" votes, shall promptly tender his resignation to the Board for consideration in accordance with the procedures described in the Majority Voting Policy.

Board Leadership Structure

Our Board of Directors does not have a standing policy regarding the separation of the roles of Chief Executive Officer and Chairman of the Board of Directors. Rather, the Board of Directors selects the Chairman of the Board of Directors in the manner and upon the criteria that it deems best for the Company at the time of selection. Currently, the position of Chief Executive Officer and Chairman are separate, with Randy E. Buffington serving as our Chief Executive Officer and Robert M. Buchan serving as our Executive Chairman of the Board of Directors.

The Board of Directors believes such separation is appropriate at this time, as it enhances the accountability of the Chief Executive Officer to the Board of Directors and strengthens the independence of the Board of Directors from management. In addition, separating these roles allows Mr. Buffington to focus his efforts on running our business and managing the day-to-day challenges faced by our Company, while allowing the Board of Directors to benefit from Mr. Buchan's extensive experience in leadership roles at a number of successful public companies and his knowledge and expertise in both the Canadian and U.S. capital markets, as well as his ability to support the other members of the Board of Directors and work with the executive team.

As the Executive Chairman of the Board of Directors, Mr. Buchan is responsible for the leadership, management, development and effective functioning of the Board of Directors and he acts in an advisory capacity to Mr. Buffington in matters concerning the interests of the Company and the Board of Directors, including those related to the Company's capital market relationships, strategic direction and merger and acquisition strategy.

Board's Role in Risk Oversight

The Company's management is charged with the day-to-day management of risks the Company faces, and the Board of Directors and its committees are responsible for oversight of financial and operational risk management. The Board of Directors is responsible for creating and amending a risk-management policy against which management is expected to measure its decisions. Risk-management strategies are implemented through the Company's finance department, led by the Chief Financial Officer. Ongoing communication between the Board of Directors, the committees of the Board of Directors and the management team ensures risk-management is addressed and monitored effectively and in a timely manner. The Board of Directors encourages and challenges management to think beyond financial and analytic models and to take into consideration broader and more varied types of risks, however unlikely they may seem, with the view of mitigating those risks where possible. When necessary, the Board of Directors may engage outside advisors to assist management in effectively identifying and responding to long-term or

| | | Allied Nevada Gold Corp. | PROXY STATEMENT 13 |

Table of Contents

CORPORATE GOVERNANCE

strategic risks which may be better observed from an outside point of view.

Our Board leadership structure promotes effective oversight of the Company's risk management by providing the Chief Executive Officer and other members of senior management with the responsibility to assess and manage the Company's day-to-day risk exposure and providing the Board of Directors with the responsibility to oversee these efforts of management.

Risk Assessment Regarding Compensation Policies and Practices

Allied Nevada recently conducted an assessment of its compensation policies and practices, including executive compensation programs, to evaluate the potential risks associated with these policies and practices. Management reviewed and discussed the findings of the assessment with the Compensation Committee and concluded that the Company's compensation programs are designed with an appropriate balance of risk and reward and do not encourage excessive or unnecessary risk-taking behavior. As a result, Allied Nevada does not believe that risks relating to its compensation policies and practices for its employees are reasonably likely to have a material adverse effect on the Company.

The following is a list of risk-limiting characteristics of the Company's compensation policies and practices:

- •

- with the exception of special awards for extraordinary effort, share-based awards to each employee are limited to a fixed maximum specified in the incentive plan and executive officers receive a fixed base salary each year;

- •

- share-based awards are made based on a review of a variety of indicators of performance, thus diversifying the risk associated with any single indicator of performance;

- •

- as of 2009, share-based awards are no longer made in the form of stock options, which may provide an asymmetrical incentive to take unnecessary or excessive risk to increase Company stock price; and

- •

- the Compensation Committee approves all management compensation after reviewing executive and corporate performance and competitive benchmarking data.

Service on Other Boards

The Company recognizes that directors benefit from service on boards of other companies, so long as such service does not conflict with the interests of the Company. Except in unusual circumstances approved by the Board of Directors, a director should not serve on the boards of more than five other public companies in addition to the Company's Board of Directors.

Company Loans and Corporate Opportunities

The Company has not made, and will not make, any personal loans or extensions of credit to directors or executive officers. Directors will make business opportunities related to the Company's business available to the Company, if considered corporate opportunities under Delaware law, before pursuing the opportunity for the director's own or another's account.

Director Orientation and Continuing Education

The Governance Committee establishes and oversees director orientation and continuing education programs. Such programs are the responsibility of the Chief Executive Officer and are administered by the Chief Financial Officer of the Company. Director orientation and on-going training includes presentations by senior management to familiarize directors with the Company's strategic plans, significant financial, accounting and risk management issues, compliance programs, Code of Business Conduct and Ethics for Senior Financial Officers, and Code of Business Conduct and Ethics.

All directors are encouraged to avail themselves of educational opportunities as appropriate to enable them to perform their duties as directors. The Company holds at least one Board meeting at its Hycroft Mine in order to facilitate visits to the Company's operating mine at least once every year.

In 2013, all directors visited the Hycroft Mine and were briefed on the Company's operations, as well as given a tour of the operations.

Director Stock Ownership Guidelines

All directors are encouraged to have a significant long-term financial interest in the Company. To encourage alignment of the interests of the directors and our Stockholders, each director is expected to beneficially own, or acquire within three years of becoming a director, shares of common stock of the

| 14 Allied Nevada Gold Corp. | PROXY STATEMENT | | |

Table of Contents

CORPORATE GOVERNANCE

Company or deferred share or phantom units, having a market value of three times the annual cash retainer payable under the Company's director compensation policy. As of December 31, 2013, all directors were in compliance with the stock ownership holding guidelines.

Access to Management and Independent Advisors

Directors have full and free access to officers and employees of the Company. Any meetings or contacts a director wishes to initiate may be arranged through the Chief Executive Officer or the Chief Financial Officer. The directors will use their judgment to ensure that any such contact is not disruptive to the business operations of the Company. The Board of Directors and its committees, acting as a group or committee, have the power to hire independent legal, financial or other advisors as each may deem necessary.

Executive Sessions

At each regularly scheduled Board of Directors' meeting, time is set aside for non-management directors to meet in an executive session at which management is excluded. At least once per year, time is allotted for independent directors to meet in an executive session. The Chair of the Governance Committee presides at such sessions.

Annual Performance Evaluation

The Board of Directors is committed to regular assessments of its effectiveness, its committees and individual directors. The Board of Directors conducts an annual self-evaluation to determine whether it, its committees and individual directors are functioning effectively. The Board of Directors has adopted an evaluation that includes self-evaluation, evaluation of other directors, committees and the Board of Directors as a whole. The Governance Committee uses the results of these evaluations to make recommendations to continuously improve the effectiveness of the Board of Directors.

Management Succession

The Governance Committee makes an annual report to the Board of Directors on succession planning, which

includes policies and principles for Chief Executive Officer selection and performance review, as well as policies regarding succession in the event of an emergency or the retirement of the Chief Executive Officer. The entire Board of Directors works with the Governance Committee to evaluate and nominate potential successors to the Chief Executive Officer. As stated previously, as part of the Company's succession planning, the Chief Executive Officer prepares and maintains an active succession plan for his direct reports, which is presented to the Board and the Governance Committee for approval.

Code of Business Conduct and Ethics

The Company has adopted a Code of Business Conduct and Ethics that applies to all directors, officers and employees of the Company, including its Chief Executive Officer, Chief Financial Officer, and persons performing similar functions. The Code of Business Conduct and Ethics reaffirms the Company's high standards of business conduct. The Code of Business Conduct and Ethics is part of the Company's continuing effort to ensure that it complies with all applicable laws, has an effective program to prevent and detect violations of law, and conducts its business with fairness, honesty and integrity. In the unlikely event of a waiver, any such waivers of this code for directors or officers will be approved by the Audit Committee and such waiver will be promptly disclosed to Stockholders as required by law. There were no such waivers in 2013. The Code of Business Conduct and Ethics is located on our website atwww.alliednevada.com.

Code of Conduct and Ethics for Senior Financial Officers

As required by applicable U.S. federal securities laws, all senior financial officers are subject to the Code of Conduct and Ethics for Senior Financial Officers setting forth various restrictions and obligations for our senior financial officers. This code is posted on our website atwww.alliednevada.com.

| | | Allied Nevada Gold Corp. | PROXY STATEMENT 15 |

Table of Contents

CORPORATE GOVERNANCE

The Board of Directors recognizes the importance of long-term strategic planning. In order to develop and investigate strategic opportunities with a view to

continuing to grow and strengthen the Company's position going forward, the Board of Directors engages in a series of meetings with a focus on strategic planning.

| | |

| | COMMUNICATIONS WITH THE BOARD OF DIRECTORS |

Stockholders who wish to communicate with the Board of Directors may do so by directing correspondence to the Chairman of the Governance Committee, c/o Allied Nevada Gold Corp., 9790 Gateway Drive, Suite 200, Reno, Nevada 89521, who will arrange for forwarding the correspondence as appropriate. Such correspondence should prominently display the fact

that it is a Stockholder-director communication. The Board of Directors has requested items unrelated to the duties and responsibilities of the Board, such as junk mail and mass mailings, business solicitations, advertisements and other commercial communications, surveys, questionnaires, resumes or other job inquiries, not be forwarded.

| | |

| | COMPENSATION OF NON-EMPLOYEE DIRECTORS |

Pursuant to the compensation program for our non-employee directors, each non-employee member of our Board of Directors received the following compensation for Board of Director services, as applicable, for the period beginning on April 1, 2013 through March 31, 2014:

- •

- $100,000 per year for service as Chairman of the Board;

- •

- $60,000 per year for service as Audit Committee Chair;

- •

- $45,000 per year for services as chairman of other committees;

- •

- $35,000 per year for services as non-chairman directors;

- •

- $5,000 per year per committee for service as committee member; and

- •

- An annual award of equity in the form of Deferred Share Units ("DSUs") having an aggregate value equal to $150,000 at the time of grant.

In 2011, the DSU Plan was approved by our Stockholders. In June 2012, the Company adopted the DSU Plan after receiving a favorable tax ruling from a Canadian taxation authority. Each DSU has the same value of one share of Allied Nevada common stock to be issued when a director leaves the Board. Historically, annual awards of $150,000 in value were granted and issued to each eligible director on the date of their election to the Board at the Annual Meeting, which vest over the director's one year service period.

In February 2014, the Board of Directors reduced the 2014 DSU award value to $100,000.

| 16 Allied Nevada Gold Corp. | PROXY STATEMENT | | |

Table of Contents

CORPORATE GOVERNANCE

2013 Compensation of Non-Employee Directors

The table below sets forth information regarding compensation earned by non-employee directors for their service to the Company during the year ended December 31, 2013.

| | | | | | | |

Name |

| Fees Earned or

Paid in Cash

($)(1) |

| Stock Awards

($)(2) |

| Total

($) | |

Robert M. Buchan(3) | | 100,000 | | — | | 100,000 | |

John W. Ivany | | 65,000 | | 150,000 | | 215,000 | |

Stephen A. Lang | | 17,916 | | 100,000 | | 117,916 | |

Cameron A. Mingay | | 50,000 | | 150,000 | | 200,000 | |

Terry M. Palmer | | 65,000 | | 150,000 | | 215,000 | |

Carl A. Pescio | | 41,250 | | 150,000 | | 191,250 | |

A. Murray Sinclair | | 42,917 | | 150,000 | | 192,917 | |

Robert G. Wardell | | 60,000 | | 150,000 | | 210,000 | |

| | | | | | | | |

| | | | | | | | |

- (1)

- Fees earned or paid in cash represent 2013 earnings for annual retainer fees, chairmanships of the Board and its committees, and services as committee members. Robert M. Buchan receives compensation for his service as Chairmain of the Board and is not compensated for services he provides to committees of the Board.

- (2)

- In 2013, except for Robert M. Buchan and Stephen A. Lang, the Company granted 15,060 DSUs to each non-employee director which had a grant date fair value of $150,000. Robert M. Buchan was not granted any DSUs in 2013 as he was employed as our CEO at the time the annual DSU grants were made. In August 2013, Stephen A. Lang was granted 10,040 DSUs, which represents the directors' annual service award appropriately prorated for the date he was appointed a board member. Amounts shown do not reflect actual compensation realized, but represent the total grant date fair value for awards granted, computed in accordance with Financial Accounting Standards Board Codification Topic 718, excluding estimated forfeitures. For information on how stock awards are valued refer to the Notes to Consolidated Financial Statements in our Annual Report on Form 10-K for the year ended December 31, 2013.

- (3)

- Robert M. Buchan served as the Company's CEO from March 27, 2013 to July 8, 2013, during which time he was compensated as an executive officer employee of the Company. For information on Mr. Buchan's compensation earned during such time refer to the Compensation Discussion and Analysis and Executive Compensation sections of this Proxy Statement.

Outstanding Awards of Non-Employee Directors

The table below sets forth the total number of outstanding Deferred Phantom Units ("DPUs"), Deferred Share Units, ("DSUs"), Options, and Restricted Share Units ("RSUs") for each non-employee director as of December 31, 2013.

| | | | | | | | | |

Name |

| DSUs

(#) |

| DPUs

(#) |

| Options(1)

(#) |

| RSUs

(#) | |

Robert M. Buchan | | 5,300 | | 41,356 | | 300,000 | | 495,116 | |

John W. Ivany | | 20,360 | | 41,356 | | 100,000 | | — | |

Stephen A. Lang | | 10,040 | | — | | — | | — | |

Cameron A. Mingay | | 20,360 | | 41,356 | | — | | — | |

Terry M. Palmer | | 20,360 | | 41,356 | | — | | — | |

Carl A. Pescio | | 20,360 | | 41,356 | | 100,000 | | — | |

A. Murray Sinclair | | 17,268 | | — | | — | | — | |

Robert G. Wardell | | 20,360 | | 41,356 | | — | | — | |

| | | | | | | | | | |

| | | | | | | | | | |

- (1)

- All outstanding options expire in July 2017 and are exerciseable for $4.35.

| | | Allied Nevada Gold Corp. | PROXY STATEMENT 17 |

Table of Contents

CORPORATE GOVERNANCE

| | |

| | BOARD OF DIRECTORS' COMMITTEES |

The Board of Directors has the following standing, permanent committees:

Terry A. Palmer (Chairperson)

Robert G. Wardell

Stephen A. Lang

Meetings in 2013: 4

Allied Nevada's separately-designated, standing Audit Committee was established by the Board of Directors in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Each member of our Audit Committee is "independent" within the meaning of the NYSE MKT listing standards, as defined in Rule 10A-3(b)(1) under the Exchange Act and in National Instrument 52-110 "Audit Committees" ("NI 52-110").

Additionally, the Board of Directors determined that Mr. Palmer qualifies as Allied Nevada's "Audit Committee Financial Expert" as defined in accordance with Section 407 of the Sarbanes-Oxley Act of 2002 and that each member of the Audit Committee is

"financially literate" in accordance with NI 52-110. The Audit Committee, in accordance with the Audit Committee Charter, assists the Board of Directors in overseeing the Company's:

- •

- accounting and financial reporting processes;

- •

- integrity of financial statements;

- •

- compliance with legal and regulatory requirements;

- •

- business practices and ethical standards; and

- •

- appointment of an independent auditor and the compensation, retention and oversight of the work of the independent auditor.

The Audit Committee is also responsible for the review and approval of transactions with related persons. See "Certain Relationships and Related Party Transactions—Procedures for Approval of Transactions with Related Persons."

The written charter of the Audit Committee is available on our website atwww.alliednevada.com.

Robert G. Wardell (Chairperson)

John W. Ivany

A. Murray Sinclair

Meetings in 2013: 5

The primary responsibilities of the Compensation Committee are to:

- •

- Conduct an annual review of all compensation elements for our executive officers and make recommendations to the independent directors who are members of the Board of Directors (for their subsequent ratification) regarding executive compensation, and prepare an annual report on executive compensation containing a discussion and analysis to be included in the annual Compensation Discussion and Analysis ("CD&A") for inclusion in this Proxy Statement and incorporated by reference in the Annual Report on Form 10-K;

- •

- Oversee the drafting of the CD&A and prepare and sign the related compensation committee report;

- •

- Annually review and approve performance measures and targets for executive officers participating in the annual cash-based and equity-based awards program and determine achievement of performance goals after the annual measurement period to permit incentive payouts under the plan and vesting of equity-based awards;

- •

- Annually review and approve any other special performance-based awards;

- •

- Make recommendations to the Board of Directors regarding compensation of non-employee directors; and

- •

- Review and approve corporate goals and objectives relevant to the compensation of the chief executive officer and other executive officers to ensure that such compensation goals and objectives are aligned with the Company's objectives and Stockholder interests.

| 18 Allied Nevada Gold Corp. | PROXY STATEMENT | | |

Table of Contents

CORPORATE GOVERNANCE

The Compensation Committee has the authority to retain advisors, counsel and consultants as it deems necessary in order to carry out these functions. In accordance with the terms of the Compensation Committee's Charter, the Company's President and Chief Executive Officer is not present during meetings of the Compensation Committee at which his compensation is discussed. The Compensation Committee has authority to delegate any or all of its responsibilities to a subcommittee of the Compensation Committee, as permitted by the laws and regulations that govern its actions.

In 2013, the Compensation Committee met to review the independence of the compensation consultant, Mercer, Inc. The Compensation Committee considered six competitively neutral independence factors. Mercer, in turn, submitted its independent qualifications and confirmed its independence as part of the annual agreement with the Compensation Committee. As a result, Mercer's engagement was determined to be independent.

Compensation Committee Interlocks and Insider Participation

No member of Allied Nevada's Compensation Committee was, during the year ended December 31, 2013, or currently is, an officer or employee of Allied Nevada or any of its subsidiaries or affiliates. No executive officer of Allied Nevada was during 2013, or currently is, a director or a member of the Compensation Committee of another entity having an executive officer who is a director or a member of our Compensation Committee.

Each member of our Compensation Committee is "independent" within the listing standards of the NYSE MKT and Canadian standards pursuant to Canadian National Instrument 58-101, "Corporate Governance" ("NI 58-101").

The written charter of the Compensation Committee is available on our website atwww.alliednevada.com.

John W. Ivany (Chairperson)

Robert G. Wardell

Terry M. Palmer

Meetings in 2013: 3

Each member of the Nominating Committee is "independent" within the meaning of the NYSE MKT listing standards and NI 58-101. The Nominating Committee identifies criteria for service as a director, reviews candidates and recommends appropriate candidates for positions on the Board of Directors.

The Committee met on January 28, 2014 and conducted its meeting to recommend its slate of directors for election at the Company's 2014 Annual Meeting.

Director Nomination Process

The Nominating Committee will consider director candidates who are suggested by directors, management, Stockholders, and search firms hired by the Company to identify and evaluate qualified candidates. With respect to nominees for director proposed by Stockholders, the Nominating Committee will consider such nominees if such proposals are

submitted in accordance with the procedures set forth below in "Stockholder Proposals." The Nominating Committee evaluates all director candidates in the same manner, regardless of whether such candidate was suggested by directors, management, Stockholders or a search firm.

From time to time, the Nominating Committee may recommend highly qualified candidates who it believes will enhance the strength, independence and effectiveness of Allied Nevada's Board of Directors. The Nominating Committee seeks to achieve a Board of Directors that represents a diverse mix of skills, experience, diversity, perspectives, talents and backgrounds necessary to oversee the Company's business. For information concerning the board membership criteria that the Nominating Committee and Board of Directors consider important and the process by which the Nominating Committee evaluates director candidates, see the section entitled "Proposal One: Election of Directors."

Additional information about the Nominating Committee's role can be found in the Nominating Committee Charter on our website atwww.alliednevada.com.

| | | Allied Nevada Gold Corp. | PROXY STATEMENT 19 |

Table of Contents

CORPORATE GOVERNANCE

Stephen A. Lang (Chairperson)

Robert M. Buchan

Randy E. Buffington

Carl Pescio

Meetings in 2013: 2

The Technical Committee has the following responsibilities:

- •

- Regularly review with management the key technical and operational issues and initiatives in connection with the development, construction and operational activities of the Company's Hycroft Mine;

- •

- Annually review and recommend to the Board the goals and objectives that the Chief Executive Officer is expected to attain in advancing the Company's mineral properties, assess the Chief Executive Officer's performance in light of these goals and objectives and make recommendations to the Board;

- •

- Review recommendations of the Chief Executive Officer with respect to the acquisition or disposal of mineral properties;

- •

- Review the technical information included in the Annual Report on Form 10-K, in accordance with applicable rules and regulations; and

- •

- Provide an independent technology resource to members of the Board, as required from time to time, by verbal or written reports, and by meetings with the Board, if necessary.

Members of the Technical Committee are appointed and removed by the Board of Directors. Meetings of the Technical Committee are held at least quarterly and as required. The chair of the Technical Committee reports regularly to the Board of Directors on the business of the Technical Committee. The Technical Committee may, in appropriate circumstances, engage external advisors and set and pay their compensation.

The Technical Committee annually reviews its mandate and reports to the Board on its adequacy. The Corporate Governance Committee annually supervises the performance and assessment of the Technical Committee and its members.

Nothing contained in the Technical Committee's mandate is intended to expand applicable standards of conduct under statutory or regulatory requirements for the directors of the Company or the members of the Technical Committee.

|

| HEALTH, SAFETY AND ENVIRONMENT COMMITTEE |

|

John W. Ivany (Chairperson)

Cameron A. Mingay

Carl Pescio

Meetings in 2013: 3

The Health, Safety and Environment Committee (the "HSE Committee") has a general mandate to oversee the development and implementation of policies and best practices of Allied Nevada relating to health, safety and environmental issues in order to ensure compliance with applicable laws and the safety of our employees. On a regular and on-going basis, the HSE Committee monitors the effectiveness of Allied Nevada's environmental policies, assists management with implementing and maintaining appropriate health and safety programs, and obtains periodic reports on such programs.

The HSE Committee meets on an as-needed basis and, formally, no less than two times per year. Moreover, at all meetings of the Board of Directors, the Board always discusses the Company's health, safety and environmental performance.

The HSE Committee routinely reports its activities and findings to the entire Board of Directors. Allied Nevada's entire Board of Directors, which includes all members of the HSE Committee, meets at Allied Nevada's operating mine site, Hycroft, at least once annually, to review, analyze, and discuss the Company's health, safety and environmental programs.

For additional information about our HSE Committee, the written Charter is available on our website atwww.alliednevada.com.

| 20 Allied Nevada Gold Corp. | PROXY STATEMENT | | |

Table of Contents

CORPORATE GOVERNANCE

|

| CORPORATE GOVERNANCE COMMITTEE |

|

Cameron A. Mingay (Chairperson)

Robert G. Wardell

John W. Ivany

Meetings in 2013: 4

The Corporate Governance Committee is responsible for recommending appropriate governance practices to Allied Nevada in light of corporate governance guidelines set forth by the U.S. and Canadian securities regulatory authorities, the NYSE MKT, the Toronto Stock Exchange and other industry practices.

The Corporate Governance Committee is composed entirely of directors who are "independent" within the meaning of the NYSE MKT listing standards and NI 58-101.