SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

|

ALLIED NEVADA GOLD CORP. |

| (Name of Registrant As Specified In Its Charter) |

|

| NOT APPLICABLE |

| (Name of Person(s) Filing Proxy Statement if other than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | (3) | | Filing Party: |

| | | | |

| | (4) | | Date Filed: |

| | | | |

| | |

| | Allied Nevada Gold Corp. 9790 Gateway Drive, Suite 200 Reno, Nevada 89521 Phone: (775) 358-4455 | Facsimile: (775) 358-4458 |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

NOTICE IS HEREBY GIVEN THAT the 2012 annual meeting of stockholders (the “Annual Meeting”) of Allied Nevada Gold Corp., a Delaware corporation (the “Company”), will be held at the Winnemucca Convention Center, 50 West Winnemucca Blvd., Winnemucca, NV 89445 on May 3, 2012, at 8:00 A.M. Pacific Time, for the following purposes:

| | 1. | To elect directors to hold office until the next Annual Meeting of stockholders; |

| | 2. | To approve, on an advisory basis, the Company’s named executive officer compensation for fiscal 2011; |

| | 3. | To ratify the appointment of Ehrhardt, Keefe, Steiner & Hottman PC as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2012; and |

| | 4. | To transact such other business as may properly come before the Annual Meeting or any adjournment or adjournments thereof. |

All stockholders are cordially invited to attend the Annual Meeting. The proxies are solicited by the Board of Directors. The return of the proxy will not affect your right to vote in person if you do attend the Annual Meeting. Any proxy may be revoked at any time prior to its exercise at the Annual Meeting.

Beneficial Stockholders. If your shares are held in the name of a broker, bank or other holder of record, follow the voting instructions you receive from the holder of record to vote your shares.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on May 3, 2012. Our Proxy Statement and our Annual Report to stockholders for the fiscal year ended December 31, 2011 are attached. Financial and other information concerning the Company is contained in our fiscal 2011 Annual Report to stockholders. The Proxy Statement and our fiscal 2011 Annual Report to stockholders are available on our website at www.alliednevada.com.

|

| By order of the Board of Directors, |

|

/s/ Scott A. Caldwell |

| Scott A. Caldwell |

| President and Chief Executive Officer |

TABLE OF CONTENTS

-i-

ALLIED NEVADA GOLD CORP.

9790 Gateway Drive, Suite 200

Reno, Nevada 89521

PROXY STATEMENT

The enclosed proxy is solicited by the Board of Directors of Allied Nevada Gold Corp., a Delaware corporation (the “Company”, “Allied Nevada”, “we”, “our”, or “us”), for use at the annual meeting of stockholders (the “Annual Meeting”) to be held at 8:00 a.m. local time on May 3, 2012, at the Winnemucca Convention Center, 50 West Winnemucca Blvd., Winnemucca, NV 89445, and any adjournment or adjournments thereof. The Company will announce the final results of the voting of the Annual Meeting on a Form 8-K that will be filed with the U.S. Securities and Exchange Commission (“SEC”) within four business days following the Annual Meeting.

On or about April 4, 2012, we will also mail this Proxy Statement and the enclosed proxy card to each stockholder entitled to vote at the Annual Meeting.

The Board of Directors does not intend to bring any matters before the Annual Meeting other than the matters specifically referred to in the foregoing notice, nor does the Board of Directors know of any matter that anyone else proposes to present for action at the Annual Meeting. However, if any other matters properly come before the Annual Meeting, the persons named in the accompanying proxy or their duly constituted substitutes acting at the Annual Meeting will be deemed authorized to vote or otherwise act thereon in accordance with their judgment on such matters.

When your proxy card is returned properly signed, the shares represented will be voted in accordance with your directions. In the absence of instructions, the shares represented at the Annual Meeting by the enclosed proxy will be voted in favor of the matters set forth in the accompanying Notice of Annual Meeting.

Voting Rights

Only stockholders of record at the close of business on March 20, 2012, the record date, are entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement thereof. At the close of business on March 20, 2012, we had 89,679,055 shares of common stock outstanding and no shares of preferred stock outstanding.

Each stockholder of record is entitled to one vote for each share of common stock held on the record date on all matters. Dissenters’ rights are not applicable to any of the matters being voted upon.

How to Vote Your Shares

YOUR VOTE IS IMPORTANT. Your shares can be voted at the Annual Meeting only if you are present in person or represented by proxy. Whether or not you expect to attend the Annual Meeting, please take the time to vote your proxy.

Stockholders of record, or “registered stockholders,” can vote by proxy in the following three ways:

| | |

By Telephone: | | Call the toll-free number indicated on the enclosed proxy and follow the recorded instructions. |

| |

By Internet: | | Go to the website indicated on the enclosed proxy and follow the instructions provided. |

| |

By Mail: | | Mark your vote, date, sign and return the enclosed proxy in the postage-paid return envelope provided. |

If your shares are held beneficially in “street” name through a nominee such as a brokerage firm, financial institution or other holder of record, your vote is controlled by that firm, institution or holder. If you are a beneficial owner of shares, you will need to obtain a proxy from the institution that holds your shares and follow the voting instructions on that form. Your vote by proxy may also be cast by telephone or Internet, as well as by mail, if your brokerage firm or financial institution offers such voting alternatives. Please follow the specific instructions provided by your nominee on your voting instruction card. The Internet and telephone facilities will close at 11:59 p.m. PDT on May 3, 2012. Scott A. Caldwell and Stephen M. Jones are the proxy holders. Any proxy may be revoked at any time prior to its exercise at the Annual Meeting by notifying the Company in writing, Attention: Rebecca A. Rivenbark, Corporate Secretary, by delivering a duly executed proxy bearing a later date or by attending the Annual Meeting and voting in person.

Even if you have given your proxy, you still may vote in person if you attend the Annual Meeting. Please note, however, that if your shares are held beneficially through a broker, bank or other nominee and you wish to vote at the Annual Meeting, you must obtain a proxy issued in your name from the record holder. Directions to the Annual Meeting can be found atwww.alliednevada.com.

1

Votes Required to Approve Matters Presented at the Annual Meeting

The votes required to approve the matters presented at the Annual Meeting are as follows:

| | • | | Our directors shall be elected by a majority vote of shares of common stock present in person or represented by proxy at the Annual Meeting; |

| | • | | The non-binding advisory vote on our executive compensation requires the affirmative vote of the holders of a majority of the shares of common stock having voting power present in person or represented by proxy at the Annual Meeting; and |

| | • | | Ratification of the appointment of Ehrhardt Keefe Steiner & Hottman PC as our independent auditors requires the affirmative vote of the holders of a majority of the shares of common stock having voting power present in person or represented by proxy at the Annual Meeting. |

Effect of Broker Non-votes and Abstentions

Generally, a broker non-vote occurs when a broker, bank or other nominee holding shares in “street name” for a beneficial owner does not vote the shares on a proposal because the broker, bank or other nominee does not have discretionary voting power with respect to that proposal and has not received voting instructions from the beneficial owner. A nominee is entitled to vote shares held for a beneficial owner on “routine” matters without instructions from the beneficial owner of those shares. However, absent instructions from the beneficial owner of such shares, a nominee is not entitled to vote shares held for a beneficial owner on certain “non-routine” matters.

The only “routine” proposal to be acted upon at our Annual Meeting and with respect to which a broker or nominee will be permitted to exercise voting discretion is the ratification of the appointment of Ehrhardt Keefe Steiner & Hottman PC as our independent auditors. All other proposals being acted on, including the election of our directors and the advisory vote on executive compensation, are “non-routine” matters. Therefore, if you do not give your bank, broker or other nominee specific voting instructions on such proposals, no votes will be cast on your behalf and a broker non-vote will occur. If you hold your shares in street name, it is critical that you cast your vote if you want it to count on all matters to be decided at the Annual Meeting.

A “broker non-vote” occurs when a broker, bank or other holder of record holding shares for a beneficial owner does not vote on a particular proposal because that record holder does not have discretionary voting power for that particular proposal and has not received voting instructions from the beneficial owner. Broker non-votes are counted for purposes of determining whether or not a quorum exists for the transaction of business. However, broker non-votes will not be treated as votes cast and, therefore, will have no effect on any items being acted on at the Annual Meeting. Abstentions are also counted for purposes of determining whether or not a quorum exists for the transaction of business. A “withhold” vote for a director nominee is the equivalent of an abstention, and will have no effect on the voting results of the election of directors (Proposal One). However, an abstention will have the effect of a vote against the advisory vote on executive compensation and the ratification of the appointment of our independent auditors (Proposals Two and Three).

Quorum

Under our By-laws, the holders of at least thirty-three and one-third percent of the common stock issued and outstanding and entitled to vote at the Annual Meeting, present in person or represented by proxy, shall constitute a quorum for the transaction of business at the Annual Meeting. Both abstentions and broker non-votes are counted for the purpose of determining the presence of a quorum.

If there is not a quorum at the Annual Meeting, the stockholders entitled to vote at the Annual Meeting, whether present in person or represented by proxy, will only have the power to adjourn the Annual Meeting until there is a quorum. The Annual Meeting may be reconvened without additional notice to the stockholders within 30 days after the date of the prior adjournment if we announce the reconvened meeting at the prior adjournment. A quorum must be present at such reconvened meeting.

2

Solicitation

We will bear the expense of preparing, printing and mailing this proxy statement and the proxies we solicit. Proxies may be solicited by mail, telephone, personal contact and electronic means and may also be solicited by our directors and officers in person, by the Internet, by telephone or by facsimile transmission, without additional remuneration. The Company has retained Georgeson Inc. to aid in the solicitation of brokers, banks, intermediaries and other institutional holders in the United States and Canada for a fee of $8,500.00. All costs of the solicitation will be borne by the Company. We will also request brokerage firms, banks, nominees, custodians and fiduciaries to forward proxy materials to the beneficial owners of shares of our common stock as of the record date and will reimburse them for the cost of forwarding the proxy materials in accordance with customary practice. Your cooperation in promptly voting your shares and submitting your proxy by the Internet or telephone, or by completing and returning the enclosed proxy card (if you received your proxy materials in the mail), will help to avoid additional expense.

Availability of Proxy Statement and Annual Report on Form 10-K

Our Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2011 are available at www.sec.gov and on our website atwww.alliednevada.com. The Company is not including the information contained on or available through its website as a part of, or incorporating such information by reference into, this Proxy Statement. We will mail to all stockholders of record as of March 20, 2012, a copy of this Proxy Statement and a copy of our Annual Report on Form 10-K for fiscal year 2011, including the consolidated financial statements, schedules and exhibits. Additionally, and in accordance with SEC rules, you may access our Proxy Statement at www.proxyvote.com, which does not have “cookies” that identify visitors to the site. We will mail without charge, upon written request, a copy of our Annual Report on Form 10-K for fiscal year 2011, including the consolidated financial statements, schedules and list of exhibits, and any particular exhibit specifically requested. Requests should be sent to: Allied Nevada Gold Corp., 9790 Gateway Drive, Suite 200, Reno, Nevada 89521, Attention: Tracey Thom, VP, Investor Relations.

3

PROPOSAL ONE:

ELECTION OF DIRECTORS

Pursuant to the Company’s By-laws, the Board of Directors or the Company’s stockholders are required to fix, from time to time, the number of directors which shall constitute the whole board. The Board of Directors has elected to fix the number of directors which constitute the whole board at eight directors. The Board of Directors, upon the recommendation of the Nominating Committee, proposes the following eight nominees for election as directors to hold office until the next Annual Meeting to be held in 2013 or until their successors, if any, have been duly elected and qualified. Each of the following is currently a director, having been elected at the 2011 Annual Meeting to serve until the 2012 Annual Meeting, and has agreed to serve if re-elected:

If any nominee becomes unable to stand for election (which is not anticipated by the Board), each proxy will be voted for a substitute designated by the Board or, if no substitute is designated by the Board prior to or at the Annual Meeting, the Board will act to reduce the membership of the Board to the number of individuals nominated.

There is no family relationship between any nominee and any other nominee or any executive officer of ours. The information set forth below concerning the nominees has been furnished to us by the nominees.

Director Skills and Qualifications

The Board of Directors believes that the Board of Directors, as a whole, should possess a combination of skills, professional experience and diversity of viewpoints necessary to oversee the Company’s business. Accordingly, the Board of Directors and the Nominating Committee consider the qualifications of directors and director candidates individually and in the broader context of the Board of Directors’ overall composition and the Company’s current and future needs. As indicated in the table below under the heading “Information Concerning Nominees”, each nominee brings a strong and unique background and set of skills to the Board of Directors, giving the Board of Directors, as a whole, competence and experience in a wide variety of areas, including board service, corporate governance, compensation, executive management, private equity, finance, mining, operations, marketing, government, law, and health, safety, environmental and social responsibility.

In evaluating director candidates, and considering incumbent directors for renomination, the Board of Directors and the Nominating Committee have not formulated any specific minimum qualifications, but rather consider a variety of factors. These include each nominee’s independence, financial acumen, personal accomplishments, career specialization, and experience in light of the needs of the Company. For incumbent directors, the factors include past performance on the Board of Directors. Among other things, the Board of Directors has determined that it is important to have individuals who have certain of the following skills and experiences on the Board of Directors:

| | • | | Leadership experience, as directors with experience in significant leadership positions possess strong abilities to motivate and manage others and to identify and develop leadership qualities in others; |

| | • | | Knowledge of our industry, particularly mining of gold and silver, which is relevant to understanding the Company’s business and strategy; |

| | • | | Operations experience, as it gives directors a practical understanding of developing, implementing and assessing the Company’s business strategy and operating plan; |

| | • | | Legal experience, to assist the Board of Directors with its responsibilities to oversee the Company’s legal and compliance matters; |

| | • | | Risk management experience, to provide oversight of the risks facing the Company; |

| | • | | Financial/accounting experience, with particularly knowledge of finance and financial reporting processes, to understand and evaluate the Company’s capital structure and financial statements; |

| | • | | Government/regulatory experience, to direct the Company’s operations in a heavily regulated industry that is directly affected by governmental actions; |

4

| | • | | Strategic planning experience, to review the Company’s strategies and monitor their implementation and results; |

| | • | | Talent management experience, to help the Company attract, motivate and retain top candidates for positions at the Company; |

| | • | | International experience, which is particularly important in the resource industry, where it is common for companies to have prospects and properties in multiple jurisdictions, and is valuable given the Company’s listings in Canada and the United States; and |

| | • | | Public company board service, as directors who have experience serving on other public company boards generally are well prepared to fulfill the Board of Directors’ responsibilities of overseeing and providing insight and guidance to management. |

Information Concerning Nominees

The following sets forth information as to each nominee for election, including his or her age (as of the Record Date), and background, including his or her principal occupation during the past five years, current directorships, skills and qualifications:

| | | | |

NAME, AGE | | PRINCIPAL OCCUPATION, BUSINESSOR EMPLOYMENT AND REASONSFOR SELECTIONASA DIRECTOR | | DIRECTOR OF ALLIED NEVADA SINCE |

Robert M. Buchan* Age: 64 | | Businessman; Chief Executive Officer of Kinross Gold Corporation from January 1993 to April 2005; Executive Chairman of the Board of Allied Nevada from October 2006 to present; Mr. Buchan’s one-year term as a director will expire at the next Annual Meeting; Chairman and Director of Polyus Gold (a large Russian gold company) from June 2008 to May 2009 and Chairman from July 2011 to present; Director of Elgin Mining (formerly Phoenix Coal) (an exploration and development company) from June 2008 to present, President and CEO from March 2010 to July 2011, and Chairman from June 2008 to March 2012; Director of Touchstone Gold (a gold-focused mineral exploration company in Northern Colombia) from June 2011 to present and Chairman from June 2011 to March 2012; Director of Richmont Mines, Inc., (a Quebec-based gold company) from January 2012 to present and Chairman from January 2012 to March 2012. Previously, Chairman of Angus Mining (Namibia) Inc. (an exploration stage gold company) from June 2010 to March 2012; Director of Foxpoint Capital Corp. (a capital pool company) from December 2009 to March 2012; Director of Rockwater Capital (a diversified financial services company) from August 2004 to March 2007; Chairman of Katanga Mining Limited (a large-scale copper-cobalt mining company) from November 2005 to June 2007; Chairman of Extract Resources (a mining exploration company) from January 2008 to December 2009; Director of Quest Capital Corp. (a financial investment firm) from April 2005 to December 2007 (Executive Chairman from April 2005 to January 2007); Director of Forsys Metals Corp. (a uranium development and exploration company) from November 2009 to May 2010; Director of Claude Resources Inc. (a gold mining company) from November 2009 to December 2010; Director of Sprott Resources Lending (a natural resources lending company) from April 2011 to November 2011; Director of Samco Gold (a gold mining company) from June 2011 to January 2012; Chairman of Rainy Mountain Capital Corp. (a capital pool company) from October 2009 to September 2011. Through his experience as the Chief Executive Officer of Kinross Gold Corporation, as well as senior executive and board positions at other public companies in the resource industry, Mr. Buchan brings to the Board leadership experience, industry knowledge, operations experience, risk management experience, financial/accounting experience, government /regulatory experience, strategic planning experience, talent management experience, international experience, public company board experience and a wealth of contacts in North American capital markets. | | March 1, 2007 |

5

| | | | |

NAME, AGE | | PRINCIPAL OCCUPATION, BUSINESSOR EMPLOYMENT AND REASONSFOR SELECTIONASA DIRECTOR | | DIRECTOR OF ALLIED NEVADA SINCE |

Scott A. Caldwell Age: 55 | | President and Chief Executive Officer of Allied Nevada from September 2006 to present (Chief Financial Officer of Allied Nevada from September 2006 to April 2007); formerly with Kinross Gold Corporation as Executive Vice President and Chief Operating Officer from March 2003 to August 2006; Director of Atacama Pacific Gold Corporation (a gold mining company) from October 2011 to present. Mr. Caldwell’s one-year term as a director expires at the next Annual Meeting. Mr. Caldwell brings to the Board leadership experience, industry knowledge, operations experience, legal experience, risk management experience, financial/accounting experience, government/regulatory experience, strategic planning experience, talent management experience, international experience, and public company board service through his various executive and board positions, including Executive Vice President and Chief Operating Officer of Kinross Gold Corporation and senior executive and Board positions at Echo Bay Mines Ltd. | | September 22, 2006 |

| | |

John W. Ivany* Age: 67 | | Retired executive; Advisor to Canaccord Genuity Corp. from February 2007 to present. Mr. Ivany’s one-year term as a director expires at the next Annual Meeting. Director of Breakwater Resources Ltd. (a mining and metals company) from June 2007 to August 2011; Director of B2 Gold Corp. (a gold producing mineral company) from November 2007 to present; Director of Eurogas International Ltd. (an oil and natural gas exploration company) from August 2008 to present; and Director of Aura Minerals Inc. (a mid-tier gold-copper production company) from September 2009 to present. Through Mr. Ivany’s experience as a senior executive and board member of public companies in the resource industry, as well as his experience in the financial services industry, Mr. Ivany brings to the Board leadership experience, industry knowledge, legal experience, risk management experience, financial/accounting experience, government/regulatory experience, strategic planning experience, talent management experience, international experience and public company board experience. Mr. Ivany is the Chair of Allied Nevada’s Nominating Committee and a member of the Compensation, Corporate Governance, and Health, Safety and Environment Committees. | | June 27, 2007 |

| | |

Cameron A. Mingay* Age: 60 | | Lawyer; Senior Partner, Cassels Brock & Blackwell LLP from July 1999 to present. Mr. Mingay’s one-year term as a director expires at the next Annual Meeting. Director of Silver Bear Resources Inc. (a silver mining company) from March 2007 to June 2011; Director of European Goldfields (a gold mining development company) from May 2008 to January 2010; Director of Angus Mining (Namibia) Ltd. (an exploration stage gold company) from June 2010 to present. | | March 22, 2007 |

6

| | | | |

NAME, AGE | | PRINCIPAL OCCUPATION, BUSINESSOR EMPLOYMENT AND REASONSFOR SELECTIONASA DIRECTOR | | DIRECTOR OF ALLIED NEVADA SINCE |

| | As outside Canadian counsel to the Company and a number of other public and private companies in the resource industry, and through his position as a member of the board of a number of companies, Mr. Mingay provides industry knowledge, legal experience, risk management experience, government/regulatory experience, and public company governance and board experience. Mr. Mingay serves on Allied Nevada’s Corporate Governance Committee as its Chair, and is a member of its Health, Safety and Environment Committee. | | |

| | |

Terry M. Palmer* Age: 67 | | Accountant; Principal, Marrs, Sevier & Company LLC (a certified public accounting firm) from January 2003 to present; Ernst & Young as a Partner and Certified Public Accountant from September 1979 to October 2002. Mr. Palmer’s one-year term as a director expires at the next Annual Meeting. Director of Golden Minerals Company (successor to Apex Silver Mines Limited) (a mining, exploration and development company) from October 2004 to present; Director of Sunward Resources Ltd. (a mining, exploration and development company) from February 2011 to present. Mr. Palmer’s experience as a CPA, as well as his experience as the chairman of the audit committees of several public companies, allows Mr. Palmer to bring to the Board industry knowledge, financial/accounting experience, strategic planning experience, talent management experience, public company board experience, and international experience. Mr. Palmer serves as the Chair of Allied Nevada’s Audit Committee. | | September 22, 2006 |

| | |

Carl Pescio* Age: 60 | | Self-employed mining prospector since 1991. Mr. Pescio’s one-year term as a director expires at the next Annual Meeting. Director of Angus Mining (Namibia) Inc. (an exploration stage gold company) from September 2010 to present; Director of Tornado Gold International (a gold mining company) from April 2004 to November 2008. Mr. Pescio, through his extensive experience as an independent mining prospector and his service as a director of other resource companies, brings to the board industry experience, public company board experience, and government/regulatory experience. Mr. Pescio is a member of Allied Nevada’s Health, Safety and Environment Committee | | March 1, 2007 |

| | |

D. Bruce Sinclair Age: 60 | | Retired executive; Chief Executive Officer and director of WaveRider Communications Inc. (an internet access product company) from June 1998 to June 2005 (director until March 2006). Mr. Sinclair’s one-year term as a director expires at the next Annual Meeting. Director of Virsare Inc. (a geothermal drilling services company) from January 2006 to March 2010; Director of Harris Steel Group (a steel product manufacturing) from July 2006 to March 2007. Through his experience as a senior executive and board member of public companies, Mr. Sinclair brings to the Board leadership experience, operations experience, risk management experience, financial/accounting experience, strategic planning experience, talent management experience, international experience, and public company board service. Mr. Sinclair is the Chair of Allied Nevada’s Compensation Committee, and a member of the Audit Committee. | | June 27, 2007 |

7

| | | | |

NAME, AGE | | PRINCIPAL OCCUPATION, BUSINESSOR EMPLOYMENT AND REASONSFOR SELECTIONASA DIRECTOR | | DIRECTOR OF ALLIED NEVADA SINCE |

Robert G. Wardell* Age: 67 | | Accountant; Chairman of the Board of Nuinsco Resources Limited (a multi-commodity mineral exploration company) from March 2009 to present; Vice President, Finance and Chief Financial Officer of Victory Nickel Inc. (a nickel development company) from February 2007 to January 2009; Deloitte & Touche LLP, from 1966 to May 2006 (serving as a Partner from 1986 to 2006). Mr. Wardell’s one-year term as a director expires at the next Annual Meeting. | | June 27, 2007 |

| | |

| | Director of Katanga Mining Limited (a large-scale copper-cobalt mining company) from July 2006 to present; Director of Elgin Mining Inc. (formerly Phoenix Coal, Inc.) (an exploration and development company) from June 2008 to present; Director of Centric Health Corp. (a Canadian healthcare company) from June 2009 to present. Through his experience as a Chartered Accountant and as a senior executive and Chief Financial Officer at Victory Nickel Inc., Mr. Wardell brings to the Board leadership experience, industry knowledge, financial/accounting experience, strategic planning experience, talent management experience, public company board experience, and international experience. Mr. Wardell is a member of Allied Nevada’s Compensation, Corporate Governance, Nominating and Audit Committees. | | |

| * | Denotes a director of issuers with a class of securities registered under Section 12 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (or which otherwise are required to file periodic reports under the Exchange Act). |

There are no family relationships among any of the above directors or executive officers of Allied Nevada.

None of the above directors have entered into any arrangements or understandings with any other person pursuant to which they were, or are to be, elected as a director of Allied Nevada or a nominee of any other person.

Vote Required and Board of Directors Recommendation

In the election for directors, the eight nominees receiving the highest number of “for” votes cast in person or by proxy will be elected. A “withhold” vote for a nominee is the equivalent of abstaining. Abstentions and broker non-votes are not counted as votes cast for the purposes of, and therefore will have no impact as to, the election of directors. Although the director nominees with the highest number of “for” votes cast will be elected at the Annual Meeting, our Corporate Governance Guidelines contain a majority voting policy which requires any nominee for director in an uncontested election to tender his or her resignation to the Board of Directors if that nominee receives a greater number of “withhold” votes than “for” votes in any election. The Board of Director’s Governance Committee will consider the resignation offer and recommend to the Board of Directors the action to be taken with respect to the tendered resignation. The Board of Directors will act upon the Governance Committee’s recommendation no later than 90 days following certification of the stockholder vote. A complete copy of our Corporate Governance Guidelines is posted on our website atwww.alliednevada.com.

THE BOARD OF DIRECTORS RECOMMENDS VOTING “FOR”

THE ELECTION OF THE NOMINEES FOR DIRECTOR

8

CORPORATE GOVERNANCE

Board of Directors; Mandate of the Board of Directors

Our Board of Directors has adopted a Mandate of the Board of Directors (“Mandate”) formally setting down the purpose and responsibilities of the Board of Directors, which was amended and restated on March 21, 2012, to more accurately reflect appropriate board practices. Under our Majority Voting Policy in an uncontested election (i.e., an election where the only nominees are those recommended by the Board), any nominee for director who receives a greater number of votes “WITHHELD” from his or her election than votes “FOR” such election shall promptly tender his resignation to the Board for consideration in accordance with the procedures described in the Majority Voting Policy attached to our Corporate Governance Guidelines. The Mandate is provided on our website atwww.alliednevada.com.

The Mandate directs that the Board of Directors is responsible for the oversight and supervision of the management of the Company’s business and for acting in the best interests of the Company and its stockholders with the objective of enhancing stockholder value. The Board of Directors will discharge its responsibilities directly and through its committees, currently consisting of the Compensation Committee, Audit Committee, Corporate Governance Committee, Nominating Committee and the Health, Safety and Environment Committee. The Board of Directors shall meet at least quarterly to review the business operations, corporate governance, environmental and health and safety compliance and financial results of the Company. Meetings of the Board of Directors shall also include regular meetings of the independent members of the Board of Directors without management being present.

The Board of Directors met seven times during the fiscal year ended December 31, 2011. All directors attended at least 75% of the meetings of the Board of Directors and of the committees of which they were members. It is our policy to encourage all directors to attend the Annual Meeting, and all of our directors attended our 2011 Annual Meeting in person.

Allied Nevada’s Board of Directors has five standing committees: a Compensation Committee, an Audit Committee, a Health, Safety and Environment Committee, a Nominating Committee and a Corporate Governance Committee. A brief description of the composition and functions of each committee follows.

Compensation Committee

The primary responsibilities of the Compensation Committee are to:

| | • | | Conduct an annual review of all compensation elements for our executive officers and make recommendations to the Board of Directors (for its subsequent ratification) regarding executive compensation, and prepare an annual report on executive compensation containing a discussion and analysis to be included in the annual Compensation Discussion and Analysis (“CD&A”) for inclusion in this Proxy Statement and the Annual Report on Form 10-K; |

| | • | | Oversee the drafting of the CD&A and prepare and sign the related compensation committee report; |

| | • | | Annually review and approve performance measures and targets for executive officers participating in the annual cash incentive plan and in our equity-based awards program and determine achievement of performance goals after the annual measurement period to permit incentive payouts under the plan and vesting of equity-based awards; |

| | • | | Make recommendations to the Board of Directors regarding compensation of non-employee directors; and |

| | • | | Review and approve corporate goals and objectives relevant to the compensation of the chief executive officer and other executive officers to ensure that such compensation goals and objectives are aligned with the Company’s objectives and stockholder interests. |

The Compensation Committee has the authority to retain any advisors, counsel and consultants as the committee deems necessary in order to carry out these functions. In accordance with the terms of the Compensation Committee’s Charter, our President and Chief Executive Officer is not present during meetings of the Compensation Committee at which his compensation is being discussed. The Compensation Committee has authority to delegate any or all of its responsibilities to a subcommittee of the Compensation Committee, as permitted by the laws and regulations that govern its actions. For more information related to the policies and practices of the Compensation Committee, including the role of compensation consultants and our Chief Executive Officer in recommending the amount of director and executive pay, see the “Compensation Discussion and Analysis” section of this Proxy Statement.

Allied Nevada’s Compensation Committee is chaired by D. Bruce Sinclair. Its other members are Robert G. Wardell and John W. Ivany. Each member of our Compensation Committee is “independent” within the listing standards of the NYSE Amex and Canadian standards as per Canadian National Instrument 58-101, “Corporate Governance” (“NI 58-101”). The Compensation Committee met three times during the fiscal year ended December 31, 2011. The written charter of the Compensation Committee is available on our website atwww.alliednevada.com.

9

The following compensation consultants were engaged by the Company or the Compensation Committee during 2011 and 2012:

| | • | | In 2011, Mercer was engaged by management and instructed to review the then-current compensation levels of our Chief Executive Officer and Chief Financial Officer and to provide a report summarizing relevant peer group data as to compensation levels. Mercer’s review with respect to 2011 compensation included benchmarking the base salary, annual cash incentive potential, total cash (base salary plus cash potential) and long-term equity-based incentives of the Chief Executive Officer, Chief Financial Officer and the other named executive officers. Total fees paid were $42,380. |

| | • | | In 2011, Hewitt and Associates (now “Meridian Compensation Partners”) was engaged by the Compensation Committee to review directors’ compensation and to make recommendations. Total fees paid were $16,055. |

| | • | | In 2012, Mercer was independently engaged by the Compensation Committee and instructed to review the then-current compensation levels of our Chief Executive Officer and Chief Financial Officer and to provide a report summarizing relevant peer group data as to compensation levels. Mercer’s review with respect to 2011 compensation included benchmarking the base salary, annual cash incentive potential, total cash (base salary plus cash potential) and long-term equity-based incentives of the Chief Executive Officer, Chief Financial Officer and the other named executive officers. The Compensation Committee’s engagement for 2012 with Mercer is independent of all management oversight. Invoicing, scope of work and reporting are directed through the chairman of the Compensation Committee exclusively. |

Compensation Committee Interlocks and Insider Participation

No member of Allied Nevada’s Compensation Committee was, during the fiscal year ended December 31, 2011, or currently is, an officer or employee of Allied Nevada or any of its subsidiaries or affiliates. No executive officer of Allied Nevada was during 2011, or currently is, a director or a member of the Compensation Committee of another entity having an executive officer who is a director or a member of our Compensation Committee.

Audit Committee

Allied Nevada’s separately-designated, standing Audit Committee was established by the Board of Directors in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (“Exchange Act”). The Audit Committee is chaired by Terry M. Palmer, and its other members are Robert G. Wardell and D. Bruce Sinclair. Each member of our Audit Committee is “independent” within the meaning of the NYSE Amex listing standards, as defined in Rule 10A-3(b)(1) under the Exchange Act and in National Instrument 52-110 “Audit Committees” (“NI 52-110”). Additionally, the Board of Directors has determined that Mr. Palmer qualifies as Allied Nevada’s “Audit Committee Financial Expert” as defined in accordance with Section 407 of the Sarbanes-Oxley Act of 2002 and that each member of the Audit Committee is “financially literate” in accordance with NI 52-110. The written charter of the Audit Committee was amended and restated on February 23, 2012, and is available on our website atwww.alliednevada.com. The Audit Committee met a total of five times during the fiscal year ended December 31, 2011. The Audit Committee, in accordance with the Audit Committee Charter, which was amended and restated on February 23, 2012, by our Board of Directors, assists the Board of Directors in overseeing the Company’s:

| | • | | accounting and financial reporting processes; |

| | • | | integrity of financial statements; |

| | • | | compliance with legal and regulatory requirements; |

| | • | | business practices and ethical standards; and |

| | • | | appointment of an independent auditor and for the compensation, retention and oversight of the work of the independent auditor. |

The Audit Committee is also responsible for the review and approval of transactions with related persons.See “Certain Relationships and Related Party Transactions—Procedures for Approval of Transactions with Related Persons.”

Nominating Committee

During 2011, the Board of Directors established a Nominating Committee, which consists of the following “independent” directors within the meaning of the NYSE Amex listing standards and NI 58-101: John W. Ivany and Robert G. Wardell. The Nominating Committee is chaired by John W. Ivany. The Nominating Committee identifies criteria for service as a director, reviews candidates and recommends appropriate candidates for positions on the Board of Directors. Additional information about the Nominating Committee’s role can be found in the Nominating Committee Charter, which was amended and restated on February 23,

10

2012, on the Company’s website atwww.alliednevada.com. The Nominating Committee did not meet in fiscal year 2011. The Committee met on February 14, 2012 and conducted its meeting to recommend its slate of directors for election at the Company’s 2012 Annual Meeting.

Director Nomination Process

The Nominating Committee will consider director candidates who are suggested by directors, management, stockholders and search firms hired by the Company to identify and evaluate qualified candidates. With respect to nominees for director proposed by stockholders, the Nominating Committee will consider such nominees if such proposals are submitted in accordance with the procedures set forth below under the heading “Stockholder Proposals.” The Nominating Committee evaluates all director candidates in the same manner, regardless of whether such candidate was suggested by directors, management, stockholders or a search firm.

From time to time, the Nominating Committee may recommend highly qualified candidates who it believes will enhance the strength, independence and effectiveness of Allied Nevada’s Board of Directors. The Nominating Committee seeks to achieve a Board of Directors that represents a diverse mix of skills, experience, diversity, perspectives, talents and backgrounds necessary to oversee the Company’s business. For information concerning the board membership criteria that the Nominating Committee and Board of Directors consider important and the process by which the Nominating Committee evaluates director candidates, see the section entitled “Proposal One: Election of Directors.”

Health, Safety and Environment Committee

Allied Nevada’s Health, Safety and Environment Committee is comprised of John Ivany (Chair), Carl Pescio and Cameron Mingay. The Committee’s general mandate is oversight of the development and implementation of policies and best practices of Allied Nevada relating to health and safety issues in order to ensure compliance with applicable laws and the safety of our employees. On a regular and on-going basis, the Committee monitors the effectiveness of Allied Nevada’s environmental policies, assists management with implementing and maintaining appropriate health and safety programs, and obtains periodic reports on such programs. The Committee meets on as-needed basis and, formally, no less than two times per year.

The Committee routinely reports its activities and findings to the entire Board of Directors. Allied Nevada’s entire Board of Directors, which includes all members of the Health, Safety and Environment Committee meets at Allied Nevada’s operating mine site, Hycroft, at least once annually, to review, analyze, and discuss Allied’s health and safety programs.

Moreover, at each and every meeting of the Board of Directors, whether a formally noticed meeting or not, the Board always discusses the Company’s health, safety and environmental performance.

Corporate Governance Committee

The Corporate Governance Committee of the Board of Directors (the “Governance Committee”) is composed entirely of directors who are “independent” within the meaning of the NYSE Amex listing standards and NI 58-101. The Governance Committee is chaired by Cameron A. Mingay, and its other members are John W. Ivany and Robert G. Wardell. In 2011, the Corporate Governance Committee held numerous informal telephonic working sessions and consulted regularly with each other in the discharge of the Governance Committee’s mandate.

The Governance Committee is responsible for recommending appropriate governance practices for Allied Nevada in light of corporate governance guidelines set forth by the U.S. and Canadian securities regulatory authorities, the NYSE Amex, the Toronto Stock Exchange and other industry practices. Additional information about the Governance Committee’s role can be found in the Corporate Governance Committee Charter on the Company’s website at www.alliednevada.com under the Corporate Responsibility section.

2011 Corporate Governance Activities

A core activity of the Governance Committee is to periodically review and assess the adequacy of the Company’s corporate governance principles and develop and recommend to the Board of Directors additional or revised principles as appropriate. In 2011, the Governance Committee engaged in a number of initiatives in order to fulfil this mandate pursuant to its Charter.

| | (i) | Director Questionnaire Review |

The Governance Committee prepared and delivered a director questionnaire, the purpose of which was to provide the Board of Directors with information to evaluate the Board’s performance and to improve Board and committee processes and effectiveness. The Governance Committee then reviewed the results contained therein and identified a number of initiatives in response to the items raised in the questionnaires, some of which have already been implemented, including those set out below.

11

Building on the positive review of the 2010 strategic retreat reported in the director questionnaires, the Governance Committee initiated a directors site visit to the Company’s operating Hycroft Mine site in September 2011, to further provide the directors with operational knowledge and education.

| | (iii) | Risk Management Plan |

The Governance Committee assisted in the development of the Company’s risk management mitigation plan in December 2011, to assist the Board of Directors with its risk oversight role.

The Governance Committee assisted in the review and analysis of the Company’s succession plan in December 2011, ensuring that succession and emergency plans are in place for CEO and executive officer positions.

Corporate Governance Guidelines

To ensure the Board of Directors acts effectively to achieve its Mandate, the Board of Directors has adopted a set of Corporate Governance Guidelines to provide the framework for the governance of the Company. The guidelines reflect best practices in a number of areas, some of which are summarized below. A copy of the Company’s Corporate Governance Guidelines can be found on our website atwww.alliednevada.com.

Independence of Directors

The Board of Directors will have a majority of directors who meet the criteria for independence required under any applicable laws, rules and regulations and the guidelines established by the Board of Directors. The Board of Directors is responsible for reviewing, on an annual basis, whether directors satisfy this independence requirement. Our Board of Directors has determined that the following directors are “independent” as required by NYSE Amex listing standards and NI 58-101: Mr. Palmer, Mr. Ivany, Mr. Mingay, Mr. Wardell and Mr. Sinclair.

Election of Directors by Stockholders

The directors will be elected each year by the stockholders at the Annual Meeting. The Board of Directors, upon the recommendation of the Nominating Committee, will propose a slate of nominees to the stockholders for election to the Board of Directors at such meeting. Between annual meetings of stockholders, the Board of Directors may elect directors to serve until the next such meeting. On February 23, 2012, we amended our Corporate Governance Guidelines to adopt a Majority Voting Policy under which any director in an uncontested election receives a greater number of “WITHHELD” votes than “FOR” votes, shall promptly tender his resignation to the Board for consideration in accordance with the procedures described in the Majority Voting Policy.

Board Leadership Structure

Our Board of Directors does not have a standing policy regarding the separation of the roles of Chief Executive Officer and Chairman of the Board of Directors. Rather, the Board of Directors selects the Chairman of the Board of Directors in the manner and upon the criteria that it deems best for the Company at the time of selection. Currently, the position of Chief Executive Officer and Chairman are separate, with Scott Caldwell serving as our Chief Executive Officer and Robert Buchan serving as our Chairman.

The Board of Directors believes such separation is appropriate at this time, as it enhances the accountability of the Chief Executive Officer to the Board of Directors and strengthens the independence of the Board of Directors from management. In addition, separating these roles allows Mr. Caldwell to focus his efforts on running our business and managing the day-to-day challenges faced by our Company, while allowing the Board of Directors to benefit from Mr. Buchan’s extensive experience in leadership roles at a number of successful public companies and his knowledge and expertise in both the Canadian and U.S. capital markets, as well as his ability to support the other members of the Board of Directors and work with the executive team.

As the Executive Chairman, Mr. Buchan is responsible for the leadership, management, development and effective functioning of the Board of Directors and he acts in an advisory capacity to Mr. Caldwell in matters concerning the interests of the Company and the Board of Directors, including those related to the Company’s capital market relationships, strategic direction and merger and acquisition strategy.

Board’s Role in Risk Oversight

The Company management is charged with the day-to-day management of risks the Company faces, and the Board of Directors and its committees are responsible for oversight of financial and operational risk management. The Board of Directors is responsible for creating and amending a risk-management policy against which management is expected to measure its decisions. Risk-

12

management strategies are implemented through the Company’s finance department, led by the Chief Financial Officer. Ongoing communication between the Board of Directors, the Audit Committee and the management team ensures risk-management is addressed and monitored effectively and in a timely manner. The Board of Directors encourages and challenges management to think beyond financial and analytic models and to take into consideration broader and more varied types of risks, however unlikely they may seem, with the view to mitigating those risks where possible. When necessary, the Board of Directors may engage outside advisors to assist management in effectively identifying long-term or strategic risks which may be better observed from an outside point of view.

Our Board leadership structure promotes effective oversight of the company’s risk management for the same reasons that the structure is most effective for the Company, that is, by providing the Chief Executive Officer and other members of senior management with the responsibility to assess and manage the Company’s day-to-day risk exposure and providing the Board of Directors with the responsibility to oversee these efforts of management.

Risk Assessment Regarding Compensation Policies and Practices

We recently conducted an assessment of our compensation policies and practices, including our executive compensation programs, to evaluate the potential risks associated with these policies and practices. We reviewed and discussed the findings of the assessment with the Compensation Committee and concluded that our compensation programs are designed with an appropriate balance of risk and reward and do not encourage excessive or unnecessary risk-taking behavior. As a result, we do not believe that risks relating to our compensation policies and practices for our employees are reasonably likely to have a material adverse effect on the Company.

In conducting this review, we noted the following risk-limiting characteristics of our compensation policies and practices:

| | • | | awards to each employee are limited to a fixed maximum specified in the incentive plan and our senior executive officers receive a fixed salary each year; |

| | • | | awards are made based on a review of a variety of indicators of performance, thus diversifying the risk associated with any single indicator of performance; |

| | • | | as of 2009, awards are no longer made in the form of stock options, which may provide an asymmetrical incentive to take unnecessary or excessive risk to increase Company stock price; and |

| | • | | members of the Compensation Committee, in their discretion, approve all final decisions concerning management compensation after reviewing executive and corporate performance and competitive benchmarking data. |

Service on Other Boards

The Company recognizes that directors benefit from service on boards of other companies, so long as such service does not conflict with the interests of the Company. Except in unusual circumstances approved by the Board of Directors, a director should not serve on more than five other boards of public companies in addition to the Company’s Board of Directors.

Company Loans and Corporate Opportunities

The Company has not made, and will not make, any personal loans or extensions of credit to directors or executive officers. Directors will make business opportunities related to the Company’s business, if considered corporate opportunities under Delaware law, available to the Company before pursuing the opportunity for the director’s own or another’s account.

Director Orientation and Continuing Education

The Governance Committee establishes and oversees director orientation and continuing education programs. Such programs are the responsibility of the Chief Executive Officer and are administered by the Chief Financial Officer of the Company. Director orientation and on-going training includes presentations by senior management to familiarize directors with the Company’s strategic plans, its significant financial, accounting and risk management issues, its compliance programs, its Code of Business Conduct and Ethics for Senior Financial Officers, and its Code of Business Conduct and Ethics.

All directors are encouraged to avail themselves of educational opportunities as appropriate to enable them to perform their duties as directors. Each director is encouraged to visit the Company’s operating site at least once every two years.

In 2011, all directors visited the Hycroft Mine site and were briefed on the Company’s operations.

13

Director Stock Ownership Guidelines

All directors are encouraged to have a significant long-term financial interest in the Company. To encourage alignment of the interests of the directors and the stockholders, each director is expected to beneficially own, or acquire within three years of becoming a director, shares of common stock of the Company or deferred share or phantom units, having a market value of three times the annual cash retainer payable under the Company’s director compensation policy. As of December 31, 2011, all directors were in compliance with the stockholding guidelines.

Access to Management and Independent Advisors

Directors have full and free access to officers and employees of the Company. Any meetings or contacts that a director wishes to initiate may be arranged through the Chief Executive Officer or the Chief Financial Officer. The directors will use their judgment to ensure that any such contact is not disruptive to the business operations of the Company.

The Board of Directors and its committees has the power, acting as a group or committee, to hire independent legal, financial or other advisors as it may deem necessary.

In Camera Sessions

Ateach regularly scheduled Board of Directors meeting, time is set aside for non-management directors to meet in anin camera session. At least one time per year, time is allotted for independent directors to meet in anin camera session. The Chairman of the Corporate Governance Committee or lead independent director presides at such sessions.

Annual Performance Evaluation

The Board of Directors is committed to regular assessments of its effectiveness, its committees and the individual directors, and as such, the Board of Directors conducts an annual self-evaluation to determine whether it, its committees and the individual directors are functioning effectively. The Board of Directors has adopted a questionnaire for directors that involves self-evaluation, evaluation of other directors, committees and the Board of Directors as a whole. The Corporate Governance Committee uses the results of these evaluations to make recommendations with a view to continuously improve the effectiveness of the Board of Directors.

Management Succession

The Governance Committee makes an annual report to the Board of Directors on succession planning, which includes policies and principles for CEO selection and performance review as well as policies regarding succession in the event of an emergency or the retirement of the CEO. The entire Board of Directors works with the Governance Committee to evaluate and nominate potential successors to the CEO. The CEO is responsible for maintaining an active succession plan for his direct reports. On an annual basis, this succession plan is reviewed by the Governance Committee.

Code of Business Conduct and Ethics

The Company has adopted a Code of Business Conduct and Ethics that applies to all directors, officers and employees of the Company, including its CEO, CFO, and persons performing similar functions. The Code of Business Conduct and Ethics reaffirms the Company’s high standards of business conduct. The Code of Business Conduct Ethics is part of the Company’s continuing effort to ensure that it complies with all applicable laws, has an effective program to prevent and detect violations of law, and conducts its business with fairness, honesty and integrity. In the unlikely event of a waiver, any such waivers of this code for directors or officers will be approved by the Audit Committee and such waiver will be promptly disclosed to stockholders as required by law. The Code Ethics is located on the Company’s internet website atwww.alliednevada.com. There were no such waivers in 2011.

Code of Business Conduct of Ethics for Senior Financial Officers

As required by applicable U.S. federal securities laws, all senior financial officers are subject to the Code of Business Conduct of Ethics for Senior Financial Officers setting forth various restrictions and obligations for our senior financial officers. These provisions were previously contained within our broader Code of Business Conduct and Ethics.

NEO Stockholding Requirements

The Board of Directors has adopted a requirement that the Chief Executive Officer shall be required to hold Company securities equal in value to three times his base salary and that named executive officers hold security interests equal in value to their respective salary. The Company believes this measure will support the Company’s objective of aligning the interests of its Chief Executive Officer and named executive officers with the interests of the Company’s stockholders. Common Stock, Restricted Share Unit awards, and vested Performance Share Unit awards qualify towards the stockholding requirements. Executive officers have a three-year period to become compliant with these requirements. Executive officers are not permitted to speculate or to purchase or sell financial instruments to hedge or offset their economic exposure in the Company’s securities or otherwise to effect a decrease in the economic value of their holdings in the Company’s equity securities. As of December 31, 2011, all Executive officers were in compliance with the stockholding requirements.

14

Strategic Planning

The Board of Directors recognizes the importance of long-term strategic planning. In order to develop and investigate strategic opportunities with a view to continuing to grow and strengthen the Company’s position going forward, the Board of Directors engages in a series of meetings with a focus on strategic planning.

Communications with Board of Directors

Stockholders who wish to communicate with the Board of Directors, or specific individual directors, may do so by directing correspondence to the Chairman of the Corporate Governance Committee, c/o Allied Nevada Gold Corp., 9790 Gateway Drive, Suite 200, Reno, Nevada 89521, who will arrange for forwarding the correspondence as appropriate. Such correspondence should prominently display the fact that it is a stockholder-director communication. The Board has requested that items unrelated to the duties and responsibilities of the Board, such as junk mail and mass mailings, business solicitations, advertisements and other commercial communications, surveys and questionnaires, and resumes or other job inquiries, not be forwarded.

Compensation of Non-Employee Directors

Pursuant to the compensation program for our non-employee directors, each non-employee member of our Board of Directors received the following cash compensation for Board of Director services, as applicable, for the period ending on March 31, 2011:

| | • | | $95,000 per year for service as Chairman of the Board; |

| | • | | $50,000 per year for service as Audit Committee Chairman; |

| | • | | $35,000 per year for services as chairman of other committees; |

| | • | | $25,000 per year for services as non-chairman directors; |

| | • | | $5,000 per year per committee for service as committee member; and |

| | • | | $1,000 for each board meeting attended. |

Pursuant to the compensation program for our non-employee directors, each non-employee member of our Board of Directors received the following compensation for Board of Director services, as applicable, for the period beginning on April 1, 2011 through March 31, 2012:

| | • | | $100,000 per year for service as Chairman of the Board; |

| | • | | $60,000 per year for service as Audit Committee Chairman; |

| | • | | $45,000 per year for services as chairman of other committees; |

| | • | | $35,000 per year for services as non-chairman directors; |

| | • | | $5,000 per year per committee for service as committee member; and |

| | • | | An annual award of equity in the form of Deferred Share Units (“DSU”) having an aggregate value equal to $150,000. |

In addition, the Deferred Phantom Unit (“DPU”) Plan was adopted by the Board of Directors in 2009 as an alternative to granting stock options or stock awards in order to align the interests of the Directors with those of the shareholders. Under the DPU Plan, eligible Directors received a grant of DPUs on the last day of each fiscal quarter, or such other date recommended by the Compensation Committee and confirmed by the Board. Each DPU has the same value as one Allied Nevada common share. DPUs must be retained until the director leaves the Board, at which time the cash value of the DPUs will be paid out. In 2011, amendments to the DPU plan were approved by the shareholders to provide the Company the option to settle, at the Board’s sole discretion, all DPU obligations in stock, subject to the receipt of an advance tax ruling from the Canada Revenue Agency. The amended 2009 DPU plan has been frozen for further awards.

In 2011 the Deferred Share Unit Plan (“DSU”) was approved by stockholders. Under the DSU Plan, annual awards of $150,000 in value shall be automatically granted and issued to each eligible Director on the date of their re-election to the Board at the Annual Meeting. Eligible Directors may elect annually to take the equity remuneration in the form of cash as long as they have met the minimum shareholding requirements of three times annual compensation.

15

Fiscal 2011 Compensation of Non-Employee Directors Table

The table below sets forth information regarding compensation earned by non-employee directors as compensation for their service to the Company during the fiscal year ended December 31, 2011. As noted above, the Board of Directors’ compensation increased in April 2011. As a result, fees earned for the first quarter of 2011 were based on the preceding year’s compensation schedule.

| | | | | | | | | | | | | | | | |

Name(1) | | Fees Earned ($) | | | Stock Awards ($)(2) | | | All Other

Compensation ($) | | | Total ($) | |

Robert Buchan(3) | | | 98,500 | | | | 189,765 | | | | — | | | | 288,265 | |

John W. Ivany | | | 52,250 | | | | 189,765 | | | | — | | | | 242,015 | |

Cameron Mingay | | | 48,500 | | | | 189,765 | | | | — | | | | 238,265 | |

Terry M. Palmer | | | 58,500 | | | | 189,765 | | | | — | | | | 248,265 | |

Carl Pescio(3) | | | 39,750 | | | | 189,765 | | | | — | | | | 229,515 | |

D. Bruce Sinclair(3) | | | 48,500 | | | | 189,765 | | | | — | | | | 238,265 | |

Robert G. Wardell | | | 48,500 | | | | 189,765 | | | | — | | | | 238,265 | |

| (1) | As of December 31, 2011, the following non-employee directors had the following number of equity-based awards outstanding: |

| | • | | Mr. Buchan had 300,000 restricted stock units granted on July 3, 2007, which were fully vested as of 12/31/2011. In addition, Mr. Buchan had 150,000 restricted stock units granted on July 1, 2010, of which 50,000 vested on July 1, 2011, leaving 100,000 unvested as of 12/31/2011. 50,000 of such unvested restricted stock units will vest on each of 7/1/2012 and 7/1/2013. In addition, Mr. Buchan has 300,000 options with an exercise price of $4.35, and 50,000 options with an exercise price of $6.34, all of which were vested as of 12/31/2011. |

| | • | | Mr. Ivany had 100,000 options with an exercise price of $4.35, all of which were vested as of 12/31/2011. |

| | • | | Mr. Mingay had 40,000 options with an exercise price of $6.34, all of which were vested as of 12/31/2011. |

| | • | | Mr. Palmer had no options as of 12/31/2011. |

| | • | | Mr. Pescio had 100,000 options with an exercise price of $4.35 and 50,000 options with an exercise price of $6.34, all of which were vested as of 12/31/2011. |

| | • | | Mr. Sinclair had 16,667 options with an exercise price of $6.34, all of which were vested as of 12/31/2011. |

| | • | | Mr. Wardell had no options as of 12/31/2011. |

| (2) | In 2011, the Company granted an aggregate of 6,267 DPUs to each of Robert Buchan, John W. Ivany, Cameron A. Mingay, Robert G. Wardell, Carl Pescio, D. Bruce Sinclair and Terry M. Palmer, for a total of 43,869 DPUs granted to all non-employee directors during 2011. The aggregate fair value of the current year awards as of December 31, 2011 was $1,328,353 and the fair value on a per-director basis was $189,765. Including the grants of DPUs since inception of the program, as of December 31, 2011, the Company has granted to its directors a total of 281,869 DPUs with an aggregate fair value of $8,534,993. This represents 40,267 DPU awards per director, each with a fair value of $1,219,285. |

| (3) | The Company provides a voluntary option to non-executive directors to participate in the Company’s Health Plan. Mr. Buchan was a participant in 2011. |

AUDIT COMMITTEE REPORT

The following is the report of the Audit Committee with respect to the Company’s audited financial statements for the year ended December 31, 2011.

The Company’s management has primary responsibility for the Company’s internal controls and preparing our consolidated financial statements. Our independent registered public accounting firm, Ehrhardt Keefe Steiner & Hottman PC, is responsible for performing an independent audit of the Company’s consolidated financial statements and of its internal control over financial reporting in accordance with the standards of the Public Company Accounting Oversight Board (PCAOB). The purpose of the Audit Committee is to assist the Board of Directors in its general oversight of the Company’s financial reporting, internal controls and audit functions.

The Audit Committee has reviewed and discussed the Company’s audited financial statements with management. The Audit Committee has also discussed with Ehrhardt Keefe Steiner & Hottman PC, the Company’s independent registered accounting firm, the matters required to be discussed by the statement on Auditing Standards No. 61, as amended, as adopted by the PCAOB in Rule 3200T. The Audit Committee has received the written disclosures and the letter from Ehrhardt Keefe Steiner & Hottman PC required by the applicable requirements of the PCAOB, regarding Ehrhardt Keefe Steiner & Hottman PC’s communication with the Audit Committee concerning independence and has discussed with Ehrhardt Keefe Steiner& Hottman PC its independence from the Company. The Audit Committee has also reviewed and discussed the Company’s compliance with Section 404 of the Sarbanes-Oxley Act of 2002.

16

Based upon the review and discussions referred to above, the Audit Committee has recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2011 for filing with the SEC.

AUDIT COMMITTEE

Terry M. Palmer, Chairman

Robert G. Wardell

D. Bruce Sinclair

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Provision of Legal Services

Cameron Mingay, an Allied Nevada director who was appointed in March 2007, is a partner at Cassels Brock & Blackwell LLP (“Cassels Brock”) of Toronto, Ontario, Canada, which since June 2007 has served as outside counsel to Allied Nevada in connection with Canadian securities law matters. Allied Nevada paid Cassels Brock an aggregate of $595,000 for legal services during the year ended December 31, 2011. In addition, $31,000 was owed to Cassels Brock as of December 31, 2011. Cameron Mingay is considered independent under the rules of AMEX as the billings to Allied Nevada in proportion to the total billings of Cassels Brock was less than 1%.

Procedures for Approval of Transactions with Related Persons

The Company’s written policy for the review of transactions with related persons requires review, approval or ratification of all transactions in which Allied Nevada is a participant and in which an Allied Nevada director, executive officer, a significant stockholder or an immediate family member of any of the foregoing persons has a direct or indirect material interest, subject to certain categories of transactions that are deemed to be pre-approved under the policy. As set forth in the policy, the pre-approved transactions include employment of executive officers, director compensation (in general, where such transactions are required to be reported in the Company’s proxy statement pursuant to SEC compensation disclosure requirements), as well as transactions in the ordinary course of business where the aggregate amount involved is expected to be less than $5,000. All related party transactions are to be reported for review by the Audit Committee of the Board of Directors. Transactions deemed to be pre-approved are not required to be separately presented to the Audit for formal approval; however, those transactions must be submitted to the Audit Committee for review at its next following meeting.

Following its review, the Audit Committee will determine whether these transactions are in, or not inconsistent with, the best interests of Allied Nevada and our stockholders, taking into consideration whether the transactions are on terms no less favorable to Allied Nevada than those available with other parties and the related person’s interest in the transaction. If a related party transaction is to be ongoing, the Audit Committee may establish guidelines for the Company’s management to follow in its ongoing dealings with the related person.

17

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Security Ownership of Certain Beneficial Owners

The following table sets forth certain information regarding beneficial ownership of the Company’s common stock, as of March 20, 2012, by each person known by us to be the beneficial owner of more than 5% of the Company’s outstanding common stock. The percentage of beneficial ownership is based on 89,646,988 shares of the Company’s common stock outstanding as of March 20, 2012. Except as indicated in the footnotes to this table and pursuant to applicable community property laws, to our knowledge, each stockholder named in the table has sole voting and investment power with respect to the shares set forth opposite such stockholder’s name. The information provided in this table is based on our records and information filed with the SEC, unless otherwise noted.

| | | | | | | | |

| | | Common Stock | |

Name and Address of Beneficial Owner | | Number of Allied

Nevada Shares

Beneficially Owned(1) | | | Percentage of

Class | |

Royce & Associates, LLC2 | | | 7,190,479 | | | | 8.0 | |

Goodman & Company, Investment Counsel Ltd3 | | | 6,670,559 | | | | 7.4 | |

Carl Pescio and Janet Pescio4 | | | 5,450,000 | | | | 6.1 | |

Van Eck Associates Corporation5 | | | 4,997,182 | | | | 5.6 | |

| (1) | Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. In accordance with Rule 13d-3(d)(1) under the Exchange Act, the applicable ownership total for each person is based on the number of shares of common stock held by such person as of March 20, 2012, plus any securities to which such person has the right to acquire beneficial ownership within 60 days of March 20, 2012, including those securities held by such person exercisable for or convertible into common stock within 60 days after March 20, 2012. Unless otherwise noted, each of the persons is the record owner of the common stock beneficially held by such person. |

| (2) | The address of Royce & Associates, LLC is 745 Fifth Avenue, New York, New York 10151. The information is based on the amended Schedule 13G filed with the SEC by Royce & Associates, LLC on January 5, 2012. |

| (3) | The address of Goodman & Company, Investment Counsel Ltd., is One Adelaide Street East, 29th Floor, Toronto, Ontario, Canada M5C 2V9. The information is based on the Schedule 13G filed with the SEC by Goodman & Company, Investment Counsel Ltd. on January 10, 2012. |

| (4) | Carl Pescio is a director of the Company. The address of Carl and Janet Pescio is c/o Allied Nevada Gold Corp., 9790 Gateway Drive, Suite 200, Reno, Nevada 89521. Shares are beneficially owned by Carl Pescio and his wife, Janet Pescio. |

| (5) | The address of Van Eck Associates Corporation is 335 Madison Avenue, 19th Floor, New York, New York 10017. The information is based on the Schedule 13G filed with the SEC by Van Eck Associates Corporation on February 14, 2012. |

18

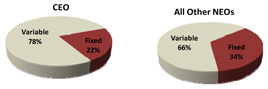

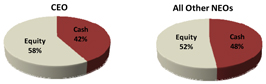

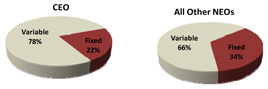

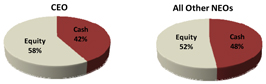

Security Ownership of Management