| 2101 - 885 West Georgia Street | Hovslagargatan 5 |

|

| Vancouver, B.C. Canada V6C 3E8 | SE-111 48 Stockholm, Sweden | |

| Tel: +1 604 689 78 42 | Tel: +46 8 545 074 70 | |

| Fax: +1 604 689 42 50 | Fax: +46 8 545 074 71 |

NEWS RELEASE

Lundin Mining Signs Agreement to Acquire Interest in Union Resources Limited

August 22, 2005 (TSX: LUN; O-List Stockholmsbörsen: LUMI) … Lundin Mining Corporation ("Lundin Mining" or the "Company") is pleased to announce that its wholly owned subsidiary, Lundin Mining AB, has signed an Agreement to acquire up to a 19.9% interest in Union Resources Limited ("Union"), a publicly traded Australian mining company. Union discovered and is now managing a bankable feasibility study (BFS) over the world class Mehdiabad zinc/lead/ silver deposit located in central Iran, on behalf of a joint venture between Union and Iranian Government and private interests.

Under the Joint Venture agreement Union's beneficial interest effective March 2005 is 38%. However, by providing the majority of funding UCL is targeting a majority position.

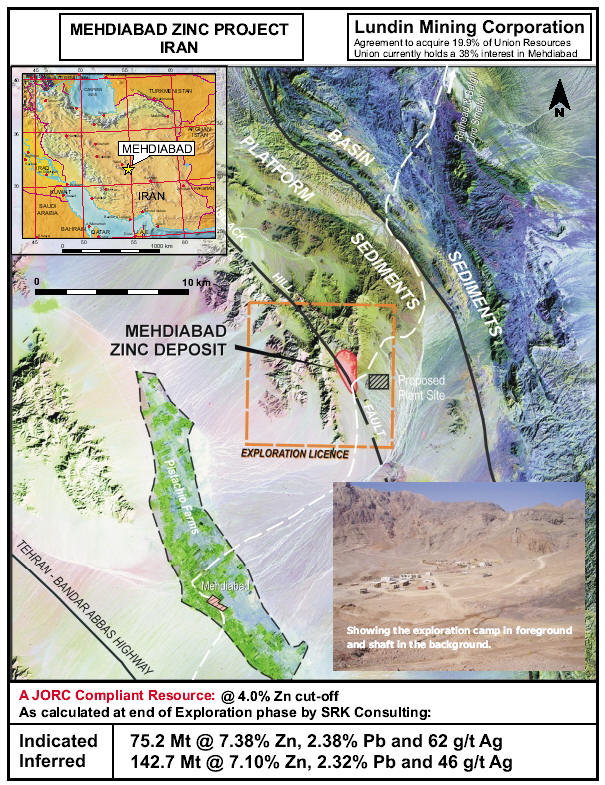

Mehdiabad is considered one of the world's largest known undeveloped zinc/lead/silver deposits, comparable in size with other giant zinc projects such as Century and Red Dog. The BFS being conducted by Aker Kvaerner Australia is expected to be completed in early 2006. Please see attached map.

The following independent resource estimate (2001), carried out by SRK Consulting on behalf of Union is based on approximately 36,000 metres of diamond drilling.

| Mehdiabad Resource Estimate* | |||||||

| Category | Million | Zn % | Pb % | Ag g/t | Contained Zn | Contained Pb | Contained AG |

| Tonnes | (Tonnes) | (Tonnes) | (Ounces) | ||||

| Indicated | 75.2 | 7.38 | 2.38 | 62 | 5.5 million | 1.8 million | 149.9 million |

| Inferred | 142.7 | 7.10 | 2.32 | 46 | 10.1 million | 3.3 million | 210.8 million |

*4.0% Zn cut-off

Since this initial resource estimate, a further 15,000 metres of in fill diamond drilling has been completed to upgrade the resource likely to be mined in the first 10 years of mining to the Indicated and Measured categories.

The known resource covers an area of 2.5 kilometres by 1.5 kilometres and is open to the north and south. Preliminary results from the BFS estimate that 33% of the resource is oxide with the remaining 67% sulphide. Mine life is estimated at greater than 30 years.

First run economics suggest an operating cost well within the lowest quartile of producing zinc mines worldwide. The draft BFS contemplates production reaching 500,000 tonnes per annum of zinc metal and 180,000 tonnes per annum lead and silver concentrates upon full development which could potentially feed 5% of world zinc demand. Open pit mining and acid leach processing are proposed for the first several years of development. Pilot testing of an oxide plant is currently underway.

Union discovered the Mehdiabad deposit in 2000. The deposit is cretaceous carbonate hosted and is terminated on the west side by a major fault (up to 200 metres @ 5% zinc). On the east side, the deposit outcrops on a ridge where results of up to 78 metres @ 8% zinc have been reported. Good infrastructure exists in the area including a 400 kV transmission line less than 30 kilometres from site and ready access to port by rail.

The project has enjoyed the support of the Government from the beginning and development is welcomed and encouraged. This major project will provide substantial local employment as well as industry diversification.

Lundin Mining Corporation

News Release

Page 2

Karl-Axel Waplan, President of Lundin Mining, commented, "This is a low-cost, low -risk-to-Lundin-Mining opportunity to participate in the development of a truly world-class zinc/lead/silver deposit. Such rich zinc ore bodies available and ready for development at a time of strong zinc demand are few and far between. The project enjoys excellent fiscal terms and appears to have the full support of the Government of Iran. Our review shows that the work carried out to date is thorough and professional."

"An important key advantage of this very robust project is the proposed on-site processing, avoiding costly smelting, added Mr. Waplan."

Pursuant to the Agreement with Union, Lundin Mining, through its wholly owned subsidiary, has agreed to make the following investments in Union:

(a) a subscription for 76,000,000 ordinary shares of Union at a price of Australian $0.03 per ordinary share expected to close on or about August 23 , 2005 subject to a number of conditions usual to subscriptions of this type;

(b) subject to the obtaining of the approval of Union shareholders, a subscription for an additional 75,000,000 ordinary shares at a price of Australian $0.03 per ordinary share and options to purchase an additional 151,000,000 ordinary shares at an option exercise price of Australian $0.10 per ordinary share exercisable up to and including March 31, 2009.

Union has advised Lundin Mining that it will be undertaking a rights offering of up to 101,403,711 ordinary shares and 101,403,711 options on identical terms to the subscription terms described in (b) above in which Lundin Mining will not be entitled to participate.

Lundin Mining's total investment in Union will be Australian $4,530,000 and will result in Lundin Mining owning slightly less than 19.9% of the issued shares of Union. Upon completion of its investment in Union, Lundin Mining will be entitled to two seats on the board of directors of Union.

The Mehdiabad resource estimate is compliant with Australasian JORC code but not as of yet reconciled to Canadian National Instrument 43-101 standards. The technical information contained in this news release has been reviewed by Mr. Rob Murdoch who is a Corporate Member of the Australasian Institute of Mining and Metallurgy. Mr. Murdoch is a Competent Person as defined in the Australasian Code for Reporting of Identified Mineral Resources and Ore Reserves. Mr. Murdoch is Managing Director of Union.

Lundin Mining is a Canadian mining and exploration company with a primary focus in Europe. The main asset of the company is the Zinkgruvan mine, located about 200 kilometres southwest of Stockholm, Sweden. The mine has been producing zinc, lead and silver on a continuous basis since 1857. Zinkgruvan has consistently ranked in the lowest cost quartile among zinc mines in the world. Lundin Mining also owns the Galmoy zinc mine in Ireland and the Storliden zinc/copper mine in the Skellefte District of northern Sweden. The Company also holds a large copper/gold exploration project in the Norrbotten Mining District of northern Sweden.

ON BEHALF OF THE BOARD

"Karl-Axel Waplan"

President and CEO

For further information, please contact:

Sophia Shane, Investor Relations - North America: (604) 689-7842 or

Karl-Axel Waplan, President & CEO : +46-705 -10 42 39