UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21960

TENNENBAUM OPPORTUNITIES FUND V, LLC

(Exact Name of Registrant as Specified in Charter)

2951 28TH STREET, SUITE 1000

SANTA MONICA, CALIFORNIA 90405

(Address of Principal Executive Offices) (Zip Code)

ELIZABETH GREENWOOD, SECRETARY

TENNENBAUM OPPORTUNITIES FUND V, LLC

2951 28TH STREET, SUITE 1000

SANTA MONICA, CALIFORNIA 90405

(Name and Address of Agent for Service)

Registrant's telephone number, including area code: (310) 566-1000

Copies to:

RICHARD T. PRINS, ESQ.

SKADDEN, ARPS, SLATE, MEAGHER & FLOM LLP

FOUR TIMES SQUARE

NEW YORK, NEW YORK 10036

Date of fiscal year end: DECEMBER 31, 2008

Date of reporting period: JUNE 30, 2008

ITEM 1. REPORTS TO STOCKHOLDERS.

Semi-Annual Shareholder Report

Tennenbaum Opportunities Fund V, LLC

(A Delaware Limited Liability Company)

June 30, 2008

Tennenbaum Opportunities Fund V, LLC

(A Delaware Limited Liability Company)

Semi-Annual Shareholder Report

June 30, 2008

Contents

| Consolidated Portfolio Asset Allocation | 2 |

| | |

| Unaudited Consolidated Financial Statements | |

| | |

| Consolidated Statement of Assets and Liabilities | 3 |

| Consolidated Statement of Investments | 4 |

| Consolidated Statement of Operations | 9 |

| Consolidated Statements of Changes in Net Assets | 10 |

| Consolidated Statement of Cash Flows | 11 |

| Notes to Consolidated Financial Statements | 12 |

| | |

| Supplemental Information | |

| | |

| Consolidating Statement of Assets and Liabilities | 28 |

| Consolidating Statement of Operations | 29 |

| Approval of Investment Management Agreements | 30 |

Tennenbaum Opportunities Fund V, LLC (the “Company”) files a schedule of its investment in Tennenbaum Opportunities Partners V, LP (the “Partnership”) with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. Investments listed in the Consolidated Statement of Investments are held by the Partnership, which also files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Forms N-Q of the Company and the Partnership are available on the SEC’s website at http://www.sec.gov. The Forms N-Q of the Company and the Partnership may also be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A free copy of the proxy voting guidelines of the Company and the Partnership and information regarding how the Company and the Partnership voted proxies relating to portfolio securities during the most recent twelve-month period may be obtained without charge on the SEC’s website at http://www.sec.gov, or by calling the advisor of the Company and the Partnership, Tennenbaum Capital Partners, LLC, at (310) 566-1000. Collect calls for this purpose are accepted.0212-0378483 9/5/2008 5:04 PM

| Tennenbaum Opportunities Fund V, LLC |

| (A Delaware Limited Liability Company) |

| |

| Consolidated Portfolio Asset Allocation (Unaudited) |

| |

| June 30, 2008 |

| | | | | | | | | | | | | | |

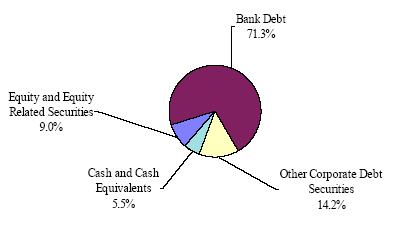

Portfolio Holdings by Investment Type (% of Cash and Investments) | | | | | | |

Portfolio Holdings by Industry (% of Cash and Investments) | | | | | | | |

| | | | | | | | | | | | | | |

| | Telecom Wireline | | | | | | | | | | 19.5% | |

| | Data Processing, Hosting and Related Services | | | | | | 12.0% | |

| | Motor Vehicle Parts Manufacturing | | | | | | | | 9.0% | |

| | Gambling Industries | | | | | | | | | 7.1% | |

| | Newspaper, Periodical, Book, and Directory Publishers | | | | | 6.3% | |

| | Cable Service Carriers | | | | | | | | | 5.8% | |

| | Communications Equipment Manufacturing | | | | | | | 5.3% | |

| | Satellite Telecommunications | | | | | | | | 4.5% | |

| | Offices of Real Estate Agents and Brokers | | | | | | | 4.1% | |

| | Sporting Goods, Hobby and Musical Instrument Stores | | | | | 3.8% | |

| | Glass and Glass Products Manufacturing | | | | | | | 3.5% | |

| | Depository Credit Intermediation | | | | | | | | 2.2% | |

| | Computer and Peripheral Equipment Manufacturing | | | | | | 1.8% | |

| | Miscellaneous | | | | | | | | | | 1.8% | |

| | Architectural, Engineering, and Related Services | | | | | | 1.6% | |

| | Petroleum and Coal Products Manufacturing | | | | | | | 1.6% | |

| | Radio and Television Broadcasting | | | | | | | | 1.3% | |

| | Semiconductor and Other Electronic Component Manufacturing | | | | | 1.2% | |

| | Other Amusement and Recreation Industries | | | | | | | 0.6% | |

| | Plastics Product Manufacturing | | | | | | | | 0.5% | |

| | Motor Vehicle Manufacturing | | | | | | | | 0.4% | |

| | Resin, Synthetic Rubber, and Artificial Synthetic Fibers and Filaments Manufacturing | | 0.3% | |

| | Home Furnishings Stores | | | | | | | | | 0.3% | |

| | Cash and Cash Equivalents | | | | | | | | | 5.5% | |

| | Total | | | | | | | | | | | 100.0% | |

| Tennenbaum Opportunities Fund V, LLC | |

| (A Delaware Limited Liability Company) | |

| | |

| Consolidated Statement of Assets and Liabilities (Unaudited) | |

| | |

| June 30, 2008 | |

| | | | | | |

| | | Cost | | Fair Value | |

Assets | | | | | |

| Investments in: | | | | | |

| Unaffiliated issuers | | $ | 1,160,095,261 | | $ | 1,085,688,763 | |

| Affiliates | | | 225 | | | 225 | |

| Total investments | | | 1,160,095,486 | | | 1,085,688,988 | |

| | | | | | | | |

| Cash and cash equivalents | | | | | | 63,047,263 | |

| Receivable for open trades | | | | | | 25,777,533 | |

| Accrued interest income from investments in unaffiliated issuers | | | | | | 19,897,498 | |

| Deferred debt issuance costs | | | | | | 6,973,048 | |

| Deferred equity placement costs | | | | | | 1,611,900 | |

| Prepaid expenses and other assets | | | | | | 254,396 | |

| Total assets | | | | | | 1,203,250,626 | |

| | | | | | | | |

Liabilities | | | | | | | |

| Credit facility payable | | | | | | 356,634,000 | |

| Payable for investments purchased | | | | | | 80,027,264 | |

| Unrealized depreciation on interest rate swaps | | | | | | 7,632,424 | |

| Equity placement costs payable | | | | | | 2,952,069 | |

| Management and advisory fees payable | | | | | | 2,762,500 | |

| Interest payable | | | | | | 1,902,461 | |

| Futures contracts at fair value | | | | | | 1,106,063 | |

| Accrued expenses and other liabilities | | | | | | 826,837 | |

| Total liabilities | | | | | | 453,843,618 | |

| | | | | | | | |

Preferred stock | | | | | | | |

| Series Z; $500/share liquidation preference; 560 shares authorized, | | | |

| issued and outstanding | | | | | | 280,000 | |

| Accumulated distributions on Series Z preferred stock | | | | | | 11,704 | |

| Total preferred stock | | | | | | 291,704 | |

| | | | | | | | |

Preferred limited partner interests | | | | | | | |

| Series A preferred limited partner interests in Tennenbaum | | | | | | | |

| Opportunities Partners V, LP; $20,000/interest liquidation preference; | | | | | | | |

| 25,000 interests authorized, 5,050 interests issued and outstanding | | | | | | 101,000,000 | |

| Accumulated dividends on Series A preferred limited partner interests | | | | | | 840,923 | |

| Total preferred limited partner interests | | | | | | 101,840,923 | |

| | | | | | | | |

Minority interest | | | | | | | |

| General partner interest in Tennenbaum Opportunities Partners V, LP | | - | |

| | | | | | | | |

Net assets applicable to common shareholders | | �� | | | $ | 647,274,381 | |

| | | | | | | | |

Composition of net assets applicable to common shareholders | | | |

| Common stock, $0.001 par value; unlimited shares authorized, 45,156.3716 | | | | | | | |

| shares issued and outstanding | | | | | $ | 45 | |

| Paid-in capital in excess of par | | | | | | 749,876,298 | |

| Accumulated net investment income | | | | | | 20,298,967 | |

| Accumulated net realized loss | | | | | | (28,892,260 | ) |

| Accumulated net unrealized depreciation | | | | | | (93,996,965 | ) |

| Accumulated dividends to Series Z preferred shareholders | | | | | | (11,704 | ) |

| Net assets applicable to common shareholders | | | | | $ | 647,274,381 | |

| | | | | | | | |

| Common stock, NAV per share | | | | | $ | 14,334.07 | |

| | | | | | | | |

See accompanying notes. | | | | | | | |

| Tennenbaum Opportunities Fund V, LLC | |

| (A Delaware Limited Liability Company) | |

| | |

| Consolidated Statement of Investments (Unaudited) | |

| | |

| June 30, 2008 | |

| | |

| Showing Percentage of Total Cash and Investments of the Company | |

| | | | | | | | |

| | | Principal | | Fair | | Percent of Cash | |

Security | | Amount | | Value | | and Investments | |

| | | | | | | | |

Debt Securities (85.49%) | | | | | | | |

Bank Debt (71.24%) (1) | | | | | | | |

Communications Equipment Manufacturing (5.29%) | | | | | | | |

| Enterasys Network Distribution Ltd., 2nd Lien Term Loan, LIBOR +9.25%, due 2/22/11 | | | | | | | |

| (Acquired 3/9/07, Amortized Cost $2,588,317) - (Ireland) | | $ | 2,614,462 | | $ | 2,536,028 | | | 0.22 | % |

| Enterasys Networks, Inc., 2nd Lien Term Loan, LIBOR +9%, due 2/22/11 | | | | | | | | | | |

| (Acquired 3/9/07, Amortized Cost $11,348,775) | | $ | 11,463,409 | | | 11,119,507 | | | 0.97 | % |

| Mitel Networks Corporation, 1st Lien Term Loan, LIBOR +3.25%, due 8/10/14 | | | | | | | | | | |

| (Acquired 12/13/07, Amortized Cost $49,833,305) | | $ | 53,014,154 | | | 47,050,062 | | | 4.10 | % |

Total Communications Equipment Manufacturing | | | | | | 60,705,597 | | | | |

| | | | | | | | | | | |

Cable Service Carriers (5.85%) | | | | | | | | | | |

| Bresnan Communications, LLC, 2nd Lien Term Loan, LIBOR +4.5%, due 3/29/14 | | | | | | | | | | |

| (Acquired 11/22/06, Amortized Cost $20,196,094) | | $ | 19,750,000 | | | 18,404,531 | | | 1.60 | % |

| Primacom AG, Mezzanine Term Loan, EURIBOR + 3.5% Cash + 7% PIK, due 11/21/17 | | | | | | | | | | |

(Acquired 12/28/07, Amortized Cost $44,684,200) - (Germany) (3) | | € | 30,351,296 | | | 48,774,836 | | | 4.25 | % |

Total Cable Service Carriers | | | | | | 67,179,367 | | | | |

| | | | | | | | | | | |

Computer and Peripheral Equipment Manufacturing (1.77%) | | | | | | | | | | |

| Palm, Inc., Tranche B Term Loan, LIBOR +3.5%, due 4/24/14 | | | | | | | | | | |

| (Acquired 12/13/07, Amortized Cost $27,305,563) | | $ | 30,339,514 | | | 20,327,475 | | | 1.77 | % |

| | | | | | | | | | | |

Data Processing, Hosting and Related Services (11.64%) | | | | | | | | | | |

| GXS Worldwide, Inc., 1st Lien Term Loan, LIBOR +4%, due 3/31/13 | | | | | | | | | | |

(Acquired 10/12/07, Amortized Cost $24,210,933) (9) | | $ | 24,705,033 | | | 24,087,407 | | | 2.10 | % |

| GXS Worldwide, Inc., 2nd Lien Term Loan, LIBOR + 7.5%, due 9/30/13 | | | | | | | | | | |

(Acquired 10/12/07, Amortized Cost $59,360,204) (9) | | $ | 60,264,167 | | | 58,606,902 | | | 5.10 | % |

| Terremark Worldwide, Inc., 1st Lien Term Loan, LIBOR + 3.75%, due 7/31/12 | | | | | | | | | | |

| (Acquired 8/1/07, Amortized Cost $15,131,546) | | $ | 15,131,546 | | | 14,450,627 | | | 1.26 | % |

| Terremark Worldwide, Inc., 2nd Lien Term Loan, | | | | | | | | | | |

| LIBOR + 3.25% Cash + 4.5% PIK, due 1/31/13 | | | | | | | | | | |

| (Acquired 8/1/07, Amortized Cost $38,185,339) | | $ | 38,403,688 | | | 36,541,109 | | | 3.18 | % |

Total Data Processing, Hosting and Related Services | | | | | | 133,686,045 | | | | |

| | | | | | | | | | | |

Gambling Industries (3.15%) | | | | | | | | | | |

| Gateway Casinos, Inc., 2nd Lien Term Loan, LIBOR+5.50%, due 3/31/15 | | | | | | | | | | |

| (Acquired 5/30/08, 6/5/08, 6/12/08 and 6/26/08, Amortized Cost $27,327,500) | | $ | 38,500,000 | | | 26,565,000 | | | 2.31 | % |

| Tropicana Entertainment, Term Loan, Prime + 3.25%, due 1/03/12 | | | | | | | | | | |

| (Acquired 12/7/07 and 12/11/07, Amortized Cost $9,612,500) | | $ | 10,000,000 | | | 9,676,560 | | | 0.84 | % |

Total Gambling Industries | | | | | | 36,241,560 | | | | |

| | | | | | | | | | | |

Motor Vehicle Parts Manufacturing (8.96%) | | | | | | | | | | |

| EaglePicher Corporation, 1st Lien Tranche B Term Loan, LIBOR +4.5%, 12/31/12 | | | | | | | | | | |

| (Acquired 12/31/07, Amortized Cost $23,842,594) | | $ | 23,842,594 | | | 23,703,520 | | | 2.06 | % |

| EaglePicher Corporation, 2nd Lien Term Loan, LIBOR +7.5%, 12/31/13 | | | | | | | | | | |

| (Acquired 12/31/07, Amortized Cost $21,000,000) | | $ | 21,000,000 | | | 21,157,500 | | | 1.84 | % |

| Visteon Corporation, 1st Lien Term Loan, LIBOR +3%, due 6/13/13 | | | | | | | | | | |

| (Acquired 11/16/07, 11/20/07, 12/14/07, 12/19/07, and 12/20/07, | | | | | | | | | | |

| Amortized Cost $61,610,533) | | $ | 71,627,582 | | | 58,085,528 | | | 5.06 | % |

Total Motor Vehicle Parts Manufacturing | | | | | | 102,946,548 | | | | |

| | | | | | | | | | | |

Motor Vehicle Manufacturing (-0.41%) | | | | | | | | | | |

| General Motors Corporation, Revolver, LIBOR+1.5%, due 7/20/11 | | | | | | | | | | |

| (Acquired 9/26/07, 9/27/07, 10/18/07, 11/07/07, 12/04/07, | | | | | | | | | | |

| and 12/14/07, Amortized Cost $(2,655,850)) | | $ | 32,000,000 | | | (4,720,000 | ) | | -0.41 | % |

| | | | | | | | | | | |

Newspaper, Periodical, Book, and Directory Publishers (6.27%) | | | | | | | | | | |

| Tribune Company, Tranche X Term Loan, LIBOR +2.75%, due 5/18/09 | | | | | | | | | | |

(Acquired 12/11/07, 12/12/07, 12/14/07, and 12/17/07, Amortized Cost $71,818,750) (9) | | $ | 75,000,000 | | | 72,031,275 | | | 6.27 | % |

| Tennenbaum Opportunities Fund V, LLC | |

| (A Delaware Limited Liability Company) | |

| | |

| Consolidated Statement of Investments (Unaudited) (Continued) | |

| | |

| June 30, 2008 | |

| | |

| Showing Percentage of Total Cash and Investments of the Company | |

| | | | | | | | |

| | | Principal | | Fair | | Percent of Cash | |

Security | | Amount | | Value | | and Investments | |

| | | | | | | | |

Debt Securities (continued) | | | | | | | |

Offices of Real Estate Agents and Brokers (3.13%) | | | | | | | |

| Realogy Corporation, Revolver, LIBOR + 2.25%, due 4/10/13 | | | | | | | |

| (Acquired 6/28/07, 7/9/07, 7/13/07, and 8/17/07, Amortized Cost $6,453,750) | | $ | 30,000,000 | | $ | 3,475,000 | | | 0.30 | % |

| Realogy Corporation, Term Loan B, LIBOR + 3%, due 10/10/13 | | | | | | | | | | |

| (Acquired 7/17/07, 7/18/07, 7/19/07, 8/15/07, 8/16/07, 9/5/07, | | | | | | | | | | |

| 9/12/07, 10/26/07, and 12/06/07, Amortized Cost $17,118,462) | | $ | 18,329,834 | | | 15,645,815 | | | 1.36 | % |

| Realogy Corporation, Delayed Draw Term Loan, LIBOR +3%, due 10/10/13 | | | | | | | | | | |

| (Acquired 10/09/07, Amortized Cost $18,758,250) | | $ | 19,850,000 | | | 16,943,384 | | | 1.47 | % |

Total Offices of Real Estate Agents and Brokers | | | | | | 36,064,199 | | | | |

| | | | | | | | | | | |

Petroleum and Coal Products Manufacturing (1.63%) | | | | | | | | | | |

| Building Materials Corporation of America, 2nd Lien Term Loan, LIBOR + 5.75%, due 9/15/14 | | | | | | |

| (Acquired 6/11/08 and 6/12/08, Amortized Cost $19,287,788) | | $ | 23,382,501 | | | 18,725,478 | | | 1.63 | % |

| | | | | | | | | | | |

Radio and Television Broadcasting (1.32%) | | | | | | | | | | |

| Newport Television LLC, Term Loan B, LIBOR + 5%, due 9/14/16 | | | | | | | | | | |

| (Acquired 5/1/08 and 5/29/08, Amortized Cost $14,467,655) | | $ | 15,898,522 | | | 15,202,961 | | | 1.32 | % |

| | | | | | | | | | | |

Resin, Synthetic Rubber, and Artificial Synthetic Fibers and Filaments Manufacturing (0.30%) | | | |

| Solutia, Inc., Senior Secured Term Loan B, LIBOR + 5%, due 2/28/14 | | | | | | | | | | |

| (Acquired 03/03/08, Amortized Cost $3,226,563) | | $ | 3,545,673 | | | 3,459,247 | | | 0.30 | % |

| | | | | | | | | | | |

Satellite Telecommunications (1.80%) | | | | | | | | | | |

| WildBlue Communications, Inc., 1st Lien Delayed Draw Term Loan, | | | | | | | | | | |

| LIBOR + 4.0% Cash + 2.5% PIK, due 12/31/09 | | | | | | | | | | |

| (Acquired 6/28/07, Amortized Cost $11,325,570) | | $ | 11,322,217 | | | 10,761,201 | | | 0.94 | % |

| WildBlue Communications, Inc., 2nd Lien Delayed Draw Term Loan, | | | | | | | | | | |

| LIBOR + 5% Cash + 4.5% PIK, due 8/15/11 | | | | | | | | | | |

| (Acquired 6/28/07, Amortized Cost $10,667,663) | | $ | 10,681,945 | | | 9,822,048 | | | 0.86 | % |

Total Satellite Telecommunications | | | | | | 20,583,249 | | | | |

| | | | | | | | | | | |

Semiconductor and Other Electronic Component Manufacturing (1.18%) | | | | | | |

| Isola USA Corporation, 1st Lien Term Loan, LIBOR + 4.75%, due 12/18/12 | | | | | | | | | | |

| (Acquired 1/24/08, Amortized Cost $13,564,144) | | $ | 15,446,703 | | | 13,593,099 | | | 1.18 | % |

| | | | | | | | | | | |

Sporting Goods, Hobby and Musical Instrument Stores (0.90%) | | | | | | | | | | |

| Toys R Us, Real Estate Term Loan, LIBOR +3%, due 12/9/08 | | | | | | | | | | |

| (Acquired 10/18/06, Amortized Cost $11,031,875) | | $ | 11,000,000 | | | 10,381,250 | | | 0.90 | % |

| | | | | | | | | | | |

Telecom Wireline (18.46%) | | | | | | | | | | |

| Cavalier Telephone Corporation, Senior Secured 1st Lien Term Loan, | | | | | | | | | | |

| LIBOR + 6.25% Cash + 1% PIK, due 12/31/12 | | | | | | | | | | |

| (Acquired 4/18/08 and 4/24/08, Amortized Cost $1,872,956) | | $ | 2,400,249 | | | 1,992,206 | | | 0.17 | % |

| Global Crossing Limited, Tranche B Term Loan, LIBOR + 6.25%, due 5/9/12 | | | | | | | | | | |

| (Acquired 6/4/07, Amortized Cost $29,603,366) | | $ | 30,151,977 | | | 28,719,758 | | | 2.50 | % |

| Hawaiian Telcom Communications Inc., Tranche C Term Loan, LIBOR + 2.25%, due 4/30/12 | | | | | | |

| (Acquired 4/22/08, 4/25/08, 4/28/08, 4/30/08, 5/15,08 and 5/19/08, Amortized Cost $6,041,036) | | $ | 7,781,522 | | | 6,406,784 | | | 0.56 | % |

| Hawaiian Telcom Communications Inc., Revolver, LIBOR + 2.25%, due 4/30/12 | | | | | | |

| (Acquired 5/9/08 and 5/16/08, Cost $(1,644,383)) | | $ | 8,097,801 | | | (1,629,682 | ) | | -0.14 | % |

| Integra Telecom, Inc., 2nd Lien Term Loan, LIBOR + 7%, due 2/28/14 | | | | | | | | | | |

(Acquired 8/1/06, Amortized Cost $26,120,454) (9) | | $ | 27,208,806 | | | 24,896,057 | | | 2.17 | % |

| Tennenbaum Opportunities Fund V, LLC | |

| (A Delaware Limited Liability Company) | |

| | |

| Consolidated Statement of Investments (Unaudited) (Continued) | |

| | |

| June 30, 2008 | |

| | |

| Showing Percentage of Total Cash and Investments of the Company | |

| | | | | | | | |

| | | Principal | | | | | |

| | | Amount | | Fair | | Percent of Cash | |

Security | | or Shares | | Value | | and Investments | |

| | | | | | | | |

Debt Securities (Continued) | | | | | | | |

Telecom Wireline (Continued) | | | | | | | |

| Integra Telecom, Inc., Term Loan, LIBOR + 10% PIK, due 8/31/14 | | | | | | | |

(Acquired 9/05/07, Amortized Cost $38,447,563) (9) | | $ | 38,767,563 | | $ | 35,472,321 | | | 3.09 | % |

| Interstate Fibernet, Inc., 1st Lien Term Loan, LIBOR + 4%, due 7/31/13 | | | | | | | | | | |

(Acquired 8/01/07, Amortized Cost $29,579,498) (9) | | $ | 30,415,936 | | | 28,317,237 | | | 2.47 | % |

| Interstate Fibernet, Inc., 2nd Lien Term Loan, LIBOR + 7.5%, due 7/31/14 | | | | | | | | | | |

(Acquired 7/31/07, Amortized Cost $32,752,265) (9) | | $ | 32,752,265 | | | 31,777,885 | | | 2.77 | % |

| NEF Telecom Company BV, 2nd Lien Tranche D Term Loan, | | | | | | | | | | |

| EURIBOR + 5.5%, due 2/16/17 | | | | | | | | | | |

(Acquired 8/29/07, Amortized Cost $5,607,877) - (Netherlands) (3), (9) | | € | 4,103,088 | | | 6,222,000 | | | 0.54 | % |

| NEF Telecom Company BV, Mezzanine Term Loan, EURIBOR + 10% PIK, due 8/16/17 | | | | | | | | | | |

(Acquired 8/29/07, Amortized Cost $47,999,670) - (Netherlands) (3), (9) | | € | 34,983,538 | | | 49,728,921 | | | 4.33 | % |

Total Telcom Wireline | | | | | | 211,903,487 | | | | |

| | | | | | | | | | | |

Total Bank Debt (Cost $847,682,325) | | | | | | 818,310,837 | | | | |

| | | | | | | | | | | |

Other Corporate Debt Securities (14.25%) | | | | | | | | | | |

Architectural, Engineering, and Related Services (1.64%) | | | | | | | | | | |

| Alion Science & Technology Corporation, Senior Notes, 10.25%, due 2/1/15 | | $ | 26,625,000 | | | 18,808,166 | | | 1.64 | % |

| | | | | | | | | | | |

Gambling Industries (3.93%) | | | | | | | | | | |

| Harrah's Operating Company Inc., Senior Notes, 10.75%, due 2/1/16 | | $ | 31,872,000 | | | 27,382,829 | | | 2.38 | % |

| Harrah's Operating Company Inc., Senior Notes, 5.375%, due 12/15/13 | | $ | 28,222,000 | | | 17,763,209 | | | 1.55 | % |

Total Gambling Industries | | | | | | 45,146,038 | | | | |

| | | | | | | | | | | |

Home Furnishings Stores (0.28%) | | | | | | | | | | |

Linens 'n Things, Inc., Senior Secured Notes, LIBOR + 5.625%, due 1/15/14 (4) | | $ | 9,189,000 | | | 3,170,205 | | | 0.28 | % |

| | | | | | | | | | | |

Motor Vehicle Manufacturing (0.34%) | | | | | | | | | | |

| Fleetwood Enterprises, Convertible Bond, 5.0%, due 12/15/23 | | $ | 4,080,000 | | | 3,906,600 | | | 0.34 | % |

| | | | | | | | | | | |

Offices of Real Estate Agents and Brokers (0.94%) | | | | | | | | | | |

| Realogy Corporation, Senior Subordinated Notes, 12.375%, due 4/15/15 | | $ | 13,099,000 | | | 6,466,321 | | | 0.56 | % |

| Realogy Corporation, Senior Notes, 10.5%, due 4/15/14 | | $ | 6,284,000 | | | 4,352,864 | | | 0.38 | % |

Total Offices of Real Estate Agents and Brokers | | | | | | 10,819,185 | | | | |

| | | | | | | | | | | |

Other Amusement and Recreation Industries (0.57%) | | | | | | | | | | |

| Bally Total Fitness Holdings, Inc., Senior Subordinated Notes, | | | | | | | | | | |

| 14% Cash or 15.625% PIK, due 10/1/13 | | | | | | | | | | |

(Acquired 10/01/07, Amortized Cost $13,413,634) (5) | | $ | 13,097,333 | | | 6,548,667 | | | 0.57 | % |

| | | | | | | | | | | |

Plastics Product Manufacturing (0.47%) | | | | | | | | | | |

| Pliant Corporation, Senior Secured 2nd Lien Notes, 11.125%, due 9/1/09 | | $ | 6,365,000 | | | 5,410,250 | | | 0.47 | % |

| | | | | | | | | | | |

Satellite Telecommunications (2.77%) | | | | | | | | | | |

| Satelites Mexicanos, Senior Secured FRN, LIBOR + 8.75%, due 11/30/11 | | | | | | | | | | |

| (Acquired 3/13/08, 3/20/08, 3/24/08, 3/28/08, 3/31/08, 4/1/08, 4/3/08, 4/29/08, 5/13/08, | | | | | | |

Amortized Cost $30,332,729) (5) | | $ | 32,685,360 | | | 31,786,513 | | | 2.77 | % |

| | | | | | | | | | | |

Sporting Goods, Hobby and Musical Instrument Stores (2.88%) | | | | | | | | | | |

| Michaels Stores, Inc., Senior Notes, 11.375%, due 11/01/16 | | $ | 38,000,000 | | | 30,290,180 | | | 2.64 | % |

| Michaels Stores, Inc., Senior Unsecured Notes, 10%, due 11/01/14 | | $ | 3,133,000 | | | 2,723,016 | | | 0.24 | % |

Total Sporting Goods, Hobby and Musical Instrument Stores | | | | | | 33,013,196 | | | | |

| Tennenbaum Opportunities Fund V, LLC | |

| (A Delaware Limited Liability Company) | |

| | |

| Consolidated Statement of Investments (Unaudited) (Continued) | |

| | |

| June 30, 2008 | |

| | |

| Showing Percentage of Total Cash and Investments of the Company | |

| | | | | | | | |

| | | Principal | | | | | |

| | | Amount | | Fair | | Percent of Cash | |

Security | | or Shares | | Value | | and Investments | |

| | | | | | | | |

Other Corporate Debt Securities (Continued) | | | | | | | |

Telecom Wireline (0.43%) | | | | | | | |

| Hawaiian Telcom Communications, Senior FRN, LIBOR + 5.50%, due 5/1/13 | | $ | 12,870,000 | | $ | 4,890,600 | | | 0.43 | % |

| | | | | | | | | | | |

Total Other Corporate Debt Securities (Cost $178,019,714) | | | | | | 163,499,420 | | | | |

| | | | | | | | | | | |

Total Debt Securities (Cost $1,025,702,039) | | | | | | 981,810,257 | | | | |

| | | | | | | | | | | |

Equity Securities (9.05%) | | | | | | | | | | |

Data Processing, Hosting, and Related Services (0.42%) | | | | | | | | | | |

| GXS Holdings, Inc., Common Stock | | | | | | | | | | |

(Acquired 3/28/08, Cost $2,510,633) (4), (5), (10) | | | 2,510,633 | | | 4,569,353 | | | 0.40 | % |

| GXS Holdings, Inc., Series A Preferred Stock | | | | | | | | | | |

(Acquired 3/28/08, Cost $100,425) (4), (5), (10) | | | 100,425 | | | 182,774 | | | 0.02 | % |

Total Data Processing, Hosting, and Related Services | | | | | | 4,752,127 | | | | |

| | | | | | | | | | | |

Depository Credit Intermediation (2.26%) | | | | | | | | | | |

| Doral GP Ltd., GP Interest | | | | | | | | | | |

(Acquired 7/12/07, Cost $225) (2), (4), (5), (7) | | | 100 | | | 225 | | | 0.00 | % |

| Doral Holdings, LP Interest | | | | | | | | | | |

(Acquired 7/12/07, Cost $24,911,825) (4), (5) | | | 24,911,825 | | | 25,998,000 | | | 2.26 | % |

Total Depository Credit Intermediation | | | | | | 25,998,225 | | | | |

| | | | | | | | | | | |

Glass and Glass Products Manufacturing (3.51%) | | | | | | | | | | |

Owens Corning, Inc., Common Stock (4) | | | 1,772,334 | | | 40,320,599 | | | 3.51 | % |

| | | | | | | | | | | |

Motor Vehicle Manufacturing (0.47%) | | | | | | | | | | |

Fleetwood Enterprises, Inc., Common Stock (4) | | | 2,046,038 | | | 5,360,620 | | | 0.47 | % |

| | | | | | | | | | | |

Telcom Wireline (0.63%) | | | | | | | | | | |

| NEF Kamchia Co-Investment Fund, LP Interest | | | | | | | | | | |

(Acquired 7/31/07, Amortized Cost $8,963,704) (3), (4), (5), (9) | | | 6,550,500 | | | 7,258,620 | | | 0.63 | % |

| | | | | | | | | | | |

Miscellaneous Securities (1.76%) (6) | | | 1,729,952 | | | 20,188,540 | | | 1.76 | % |

| | | | | | | | | | | |

Total Equity Securities (Cost $134,393,447) | | | | | | 103,878,731 | | | | |

| | | | | | | | | | | |

Total Investments (Cost $1,160,095,486) | | | | | | 1,085,688,988 | | | | |

| | | | | | | | | | | |

Cash and Cash Equivalents (5.50%) | | | | | | | | | | |

| Citicorp, Commercial Paper, 2.20%, 7/8/08 | | $ | 12,000,000 | | | 11,994,867 | | | 1.03 | % |

| Nestle Cap, Commercial Paper, 2.52%, 7/1/08 | | $ | 11,000,000 | | | 11,000,000 | | | 0.95 | % |

| Wells Fargo, Certificate of Deposit, 2.5%, 7/11/08 | | $ | 17,000,000 | | | 17,000,000 | | | 1.48 | % |

| Wells Fargo Overnight Repo, 1.7%, | | | | | | | | | | |

| Collateralized by FHLB Discount Notes and FNMA Discount Notes | | $ | 2,161,753 | | | 2,161,753 | | | 0.19 | % |

| Cash Denominated in Foreign Currency (Cost $96) | | € | 61 | | | 96 | | | 0.00 | % |

| Cash Held on Account at Various Institutions | | $ | 20,890,547 | | | 20,890,547 | | | 1.81 | % |

Total Cash and Cash Equivalents (8) | | | | | | 63,047,263 | | | | |

| | | | | | | | | | | |

Total Cash and Investments | | | | | $ | 1,148,736,251 | | | 100.00 | % |

| Tennenbaum Opportunities Fund V, LLC |

| (A Delaware Limited Liability Company) |

| |

| Consolidated Statement of Investments (Unaudited) (Continued) |

| |

| June 30, 2008 |

| |

| Showing Percentage of Total Cash and Investments of the Company |

Notes to Statement of Investments:

(1) | Investments in bank debt generally are bought and sold among institutional investors in transactions not subject to registration under the Securities Act of 1933. Such transactions are generally subject to contractual restrictions, such as approval of the agent or borrower. |

(2) | Affiliated issuer - as defined under the Investment Company Act of 1940 (ownership of 5% or more of the outstanding voting securities of this issuer). |

(3) | Principal amount denominated in euros. Amortized cost and fair value converted from euros to U.S. dollars. |

(4) | Non-income producing security. |

(6) | Miscellaneous Securities is comprised of one or more unrestricted security positions that have not previously been publicly disclosed. |

(7) | Not a controlling position. |

(8) | Cash and cash equivalents include $61,879,801 segregated for certain unfunded commitments. |

(9) | Priced by an independent third-party pricing service. |

(10) | Priced by the Investment Manager. |

Aggregate purchases and aggregate sales of investment securities, other than Government securities, totaled $414,304,070 and $143,016,571 respectively. Aggregate purchases includes securities received as payment in-kind. Aggregate sales includes principal paydowns on debt securities.

The total value of restricted securities as of June 30, 2008 was $894,654,989 or 77.9% of total cash and investments of the Company.

Futures contracts and swaps at June 30, 2008 were as follows:

| | | Number of | | | |

| | | Contracts or | | Fair | |

Instrument | | Notional Amount | | Value | |

| | | | | | |

Futures Contracts | | | | | |

| 90 Day Euro Dollar Future, Expire 12/14/09 | | | 255 | | $ | (557,813 | ) |

| 90 Day Euro Dollar Future, Expire 3/15/10 | | | 255 | | | (548,250 | ) |

Total Futures Contracts (Cost ($1,106,063)) | | | | | | (1,106,063 | ) |

| | | | | | | | |

Swaps | | | | | | | |

| US Dollar Interest Rate Swap, Expire 4/14/12 | | $ | 22,000,000 | | | (7,632,424 | ) |

| | | | | | | | |

Total Swaps and Futures Contracts | | | | | $ | (8,738,487 | ) |

| | | | | | | | |

See accompanying notes. |

| |

| (A Delaware Limited Liability Company) | |

| | |

| Consolidated Statement of Operations (Unaudited) | |

| | |

| Six Months Ended June 30, 2008 | |

| | | | |

Investment income | | | |

| Interest income from unaffiliated issuers | | $ | 47,862,723 | |

| Dividend income | | | 160,317 | |

| Other Income | | | 48,859 | |

| Total interest and related investment income | | | 48,071,899 | |

| | | | | |

Operating expenses | | | | |

| Management and advisory fees | | | 16,575,000 | |

| Interest expense | | | 7,034,230 | |

| Commitment fees | | | 490,126 | |

| Amortization of deferred debt issuance costs | | | 479,459 | |

| Legal fees, professional fees and due diligence expenses | | | 414,408 | |

| Insurance expense | | | 156,172 | |

| Director fees | | | 88,500 | |

| Custody fees | | | 69,968 | |

| Other operating expenses | | | 230,660 | |

| Total expenses | | | 25,538,523 | |

| | | | | |

Net investment income | | | 22,533,376 | |

| | | | | |

Net realized and unrealized loss | | | | |

| Net realized loss from investments in unaffiliated issuers on: | | | | |

| Investments | | | (21,199,832 | ) |

| Foreign currency | | | 1,074,590 | |

| Net realized loss from investments in unaffiliated issuers | | | (20,125,242 | ) |

| | | | | |

| Net change in net unrealized appreciation (depreciation) on: | | | | |

| Investments | | | (46,271,847 | ) |

| Foreign currency | | | (1,019,285 | ) |

| Net change in net unrealized depreciation | | | (47,291,132 | ) |

| Net realized and unrealized loss | | | (67,416,374 | ) |

| | | | | |

| Distributions to Series A preferred limited partners | | | (3,107,874 | ) |

| Distributions to Series Z preferred shareholders | | | (27,497 | ) |

| Net change in accumulated distributions to Series A preferred limited partners | | | 908,755 | |

| Net change in reserve for dividends to Series Z preferred shareholders | | | 16,172 | |

| | | | | |

Net decrease in net assets applicable to common shareholders | | | | |

resulting from operations | | $ | (47,093,442 | ) |

| | | | | |

See accompanying notes. | | | | |

| |

| (A Delaware Limited Liability Company) | |

| | |

| Consolidated Statements of Changes in Net Assets | |

| | | | | | |

| | | | | Year Ended | |

| | | | | December 31, 2007 | |

| | | | | | |

| Total common shareholder committed capital | | $ | 1,105,000,000 | | $ | 1,105,000,000 | |

| | | | | | | | |

| Net assets applicable to common shareholders, beginning of period | | $ | 694,367,823 | | $ | 145,281,047 | |

| | | | | | | | |

| Common shareholders contributions | | | - | | | 628,500,000 | |

| Equity placement and offering costs charged to paid-in capital | | | - | | | (5,166,100 | ) |

| Common shareholders contributions, net | | | - | | | 623,333,900 | |

| | | | | | | | |

| Net investment income | | | 22,533,376 | | | 454,615 | |

| Net realized loss on investments and foreign currency | | | (20,125,242 | ) | | (8,617,135 | ) |

| Net change in net unrealized appreciation (depreciation) | | | | | | | |

| on investments and foreign currency | | | (47,291,132 | ) | | (47,924,422 | ) |

| Distributions to Series A preferred limited partners from | | | | | | | |

| net investment income | | | (3,107,874 | ) | | (1,846,664 | ) |

| Distributions to Series Z preferred shareholders from | | | | | | | |

| net investment income | | | (27,497 | ) | | - | |

| Net change in accumulated distributions to Series A preferred | | | | | | | |

| limited partners | | | 908,755 | | | (1,727,436 | ) |

| Net change in reserve for dividends to Series Z preferred | | | | | | | |

| shareholders | | | 16,172 | | | (22,711 | ) |

| Net decrease in net assets applicable to common | | | | | | | |

| shareholders resulting from operations | | | (47,093,442 | ) | | (59,683,753 | ) |

| | | | | | | | |

| Distributions to common shareholders from: | | | | | | | |

| Returns of capital | | | - | | | (14,563,371 | ) |

| | | | | | | | |

| Net assets applicable to common shareholders, end of period | | | | | | | |

| (including accumulated net investment income of $20,298,967 at | | | | | | | |

| June 30, 2008 and distributions in excess of net investment income | | | | | | | |

| of $7,793 at December 31, 2007) | | $ | 647,274,381 | | $ | 694,367,823 | |

| | | | | | | | |

See accompanying notes. | | | | | | | |

| |

| (A Delaware Limited Liability Company) | |

| | |

| Consolidated Statement of Cash Flows (Unaudited) | |

| | |

| Six Months Ended June 30, 2008 | |

| | | | |

Operating activities | | | |

| Net decrease in net assets applicable to common shareholders | | | |

| resulting from operations | | $ | (47,093,442 | ) |

| Adjustments to reconcile net decrease in net assets applicable to common | | | | |

| shareholders resulting from operations to net cash used in operating activities: | | | | |

| Net realized loss on investments and foreign currency | | | 20,125,242 | |

| Net change in net unrealized depreciation | | | 46,271,848 | |

| Distributions paid to Series A preferred limited partners | | | 3,107,874 | |

| Dividends paid to Series Z shareholders | | | 27,497 | |

| Net change in accumulated distributions to Series A preferred limited partners | | | (908,755 | ) |

| Net change in reserve for dividends to Series Z preferred shareholders | | | (16,172 | ) |

| Income from paid in-kind capitalization | | | (6,837,191 | ) |

| Accretion of original issue discount | | | (176,293 | ) |

| Accretion of market discount | | | (2,334,167 | ) |

| Amortization of deferred debt issuance costs | | | 479,459 | |

| Amortization of rating agency fees | | | 89,107 | |

| Changes in assets and liabilities: | | | | |

| Purchases of investments | | | (407,466,879 | ) |

| Proceeds from sales, maturities and paydowns of investments | | | 143,016,571 | |

| Increase in accrued interest income - unaffiliated issuers | | | (13,462,968 | ) |

| Increase in receivable for investments sold | | | (2,126,585 | ) |

| Increase in prepaid expenses and other assets | | | (140,606 | ) |

| Decrease in payable for investments purchased | | | (15,629,202 | ) |

| Decrease in interest payable | | | (1,047,120 | ) |

| Decrease in accrued expenses and other liabilities | | | (3,245,824 | ) |

| Net cash used in operating activities | | | (287,367,606 | ) |

| | | | | |

Financing activities | | | | |

| Proceeds from issuance of common shares | | | 221,000,000 | |

| Payments for equity placement costs | | | (1,163,954 | ) |

| Proceeds from issuance of Series A preferred limited partner interests in | | | | |

| Tennenbaum Opportunities Partners V, LP | | | 25,000,000 | |

| Redemptions of Series A preferred limited partner interests in | | | | |

| Tennenbaum Opportunities Partners V, LP | | | (100,000,000 | ) |

| Distributions paid to Series A preferred limited partners | | | (3,107,874 | ) |

| Dividends paid to Series Z preferred shareholders | | | (27,497 | ) |

| Net cash provided by financing activities | | | 141,700,675 | |

| | | | | |

| Net increase in cash and cash equivalents | | | (145,666,931 | ) |

| Cash and cash equivalents at beginning of period | | | 208,714,194 | |

| Cash and cash equivalents at end of period | | $ | 63,047,263 | |

| | | | | |

Supplemental disclosures | | | | |

| Interest payments | | $ | 8,385,464 | |

| Non-cash financing activities: | | | | |

| Equity placement and offering costs | | | 4,444,046 | |

| | | | | |

| | | | | |

See accompanying notes. | | | | |

Tennenbaum Opportunities Fund V, LLC

(A Delaware Limited Liability Company)

Notes to Consolidated Financial Statements (Unaudited)

June 30, 2008

1. Organization and Nature of Operations

Tennenbaum Opportunities Fund V, LLC (the “Company”), a Delaware Limited Liability Company, is registered as a nondiversified, closed-end management investment company under the Investment Company Act of 1940 (the “1940 Act”). The Company was formed to acquire a portfolio of investments consisting primarily of bank loans, distressed debt, stressed high yield debt, mezzanine investments and public equities. The stated objective of the Company is to achieve high total returns while minimizing losses.

The Company’s Certificate of Formation was filed with the Delaware Secretary of State on September 27, 2006. The Company has elected to be treated as a regulated investment company (“RIC”) for U.S. federal income tax purposes. As a RIC, the Company will not be taxed on its income to the extent that it distributes such income each year and satisfies other applicable income tax requirements.

The Company’s investment operations commenced and initial funding was received on October 10, 2006. On December 15, 2006, the Company contributed substantially all of its assets totaling $145,565,245 to Tennenbaum Opportunities Partners, LP, a Delaware Limited Partnership (the “Partnership”), in exchange for 100% of the Partnership’s common limited partner interests in a non-taxable transaction. The contributed assets consisted of investments of $109,052,546 (including unrealized gain $1,232,304), cash of $49,518,680 and other liabilities over assets of $13,005,981. The Partnership is also registered as a nondiversified, closed-end management investment company under the 1940 Act, but has elected to be treated as a partnership for U.S. federal income tax purposes. The Partnership’s Certificate of Limited Partnership was filed with the Delaware Secretary of State on September 29, 2006. Following the asset transfer, all portfolio activity has been conducted by and in the Partnership.

These consolidated financial statements include the accounts of the Company and the Partnership. All significant intercompany transactions and balances have been eliminated in the consolidation.

The General Partner of the Partnership is SVOF/MM, LLC (“SVOF/MM”). The managing member of SVOF/MM is Tennenbaum Capital Partners, LLC (“TCP”), which serves as the Investment Manager of both the Company and the Partnership. Babson Capital Management LLC serves as Co-Manager of both the Company and the Partnership. Substantially all of the equity interests in the General Partner are owned directly or indirectly by TCP, Babson Capital Management LLC and employees of TCP. The Company, the Partnership, TCP, SVOF/MM and their members and affiliates may be considered related parties.

Tennenbaum Opportunities Fund V, LLC

(A Delaware Limited Liability Company)

Notes to Consolidated Financial Statements (Unaudited) (Continued)

June 30, 2008

1. Organization and Nature of Operations (continued)

Company management consists of the Investment Manager and the Board of Directors. Partnership management consists of the General Partner and the Board of Directors. The Investment Manager and the General Partner direct and execute the day-to-day operations of the Company and the Partnership, respectively, subject to oversight from the respective Board of Directors, which sets the broad policies for the Company and performs certain functions required by the 1940 Act in the case of the Partnership. The Board of Directors of the Partnership has delegated investment management of the Partnership’s assets to the Investment Manager and the Co-Manager. Each Board of Directors consists of three persons, two of whom are independent. The holders of the preferred interests voting separately as a class will be entitled to elect two of the Directors. The remaining directors will be subject to election by holders of common interests and preferred interests voting together as a single class.

Company Structure

As of June 30, 2008, the total maximum capitalization of the consolidated Company was approximately $2.21 billion, consisting of $1.105 billion of common equity commitments, $369 million of preferred limited partner interests in the Partnership (the “Series A Preferred”), $736 million under a senior secured revolving credit facility issued by the Partnership (the “Senior Facility”) and $280,000 in Series Z preferred stock of the Company. The contributed common equity, preferred equity and the amount drawn under the Senior Facility are used to purchase Partnership investments and to pay certain fees and expenses of the Partnership and the Company. Most of these investments are included in the collateral for the Senior Facility.

The Company will liquidate and distribute its assets and will be dissolved on October 10, 2016, subject to up to two one-year extensions if requested by the Investment Manager and approved by the outstanding common shares. The Partnership will liquidate and distribute its assets and will be dissolved on October 10, 2016, subject to up to two one-year extensions if requested by the General Partner and approved by the Company as the holder of the common limited partner interests in the Partnership. However, the Operating Agreement and Partnership Agreement will prohibit liquidation of the Company and the Partnership, respectively, prior to October 10, 2016 if the Series A Preferred are not redeemed in full prior to such liquidation.

Tennenbaum Opportunities Fund V, LLC

(A Delaware Limited Liability Company)

Notes to Consolidated Financial Statements (Unaudited) (Continued)

June 30, 2008

1. Organization and Nature of Operations (continued)

Common Equity

As of June 30, 2008, investors had committed to purchase $1.105 billion of the Company’s common shares on dates specified by the Company over a period ending on or prior to April 10, 2009. The Company accepted initial commitments of $725 million in October 2006 (the “First Close”) and received 20% of this initial commitment at its inception of operations on October 10, 2006. The Company accepted additional commitments of $260 million on February 22, 2007 (the “Second Close”), and received an initial 20% of these additional commitments on or about February 26, 2007. The Company accepted a final commitment of $120 million on or about July 2, 2007 (the “Third Close”), and received an initial 20% of this third commitment on or about July 6, 2007. The Company has called and received additional common shareholder contributions as follows:

| | Call Date | Share Issuance Date | Percent of Commitment |

| | June 28 / July 2, 2007 | August 1, 2007 | 10% |

| | July 27, 2007 | August 31, 2007 | 20% |

| | November 29, 2007 | January 2, 2008 | 10% |

| | December 28, 2007 | February 1, 2008 | 10% |

In order to ensure that the appropriate portion of the organizational, offering and operational expenses (excluding interest and preferred dividends) of the Company and the Partnership through the dates of the Second Close and the Third Close (each, a “Close”) was borne by the subscribers to the respective Close, the price per share of the initial drawdown in respect of the Second Close and the Third Close was net asset value plus a premium of approximately $873.88 and $1,815.34, respectively, and distributions in the aggregate amount of these premia ($308.50 and $148.24 per share, respectively) were declared to the Company’s common shareholders of record prior to the issuance of the new shares in the respective Close. The aggregate effect of the premia received on the net asset value of the Company before the aforementioned distributions is reflected in the Financial Highlights as an increase from capital stock transactions of $456.74 per share, which was entirely offset by the aforementioned distributions.

As of June 30, 2008, the ratio of called to committed capital was 0.70:1.

Preferred Limited Partner Interests

At June 30, 2008, the Partnership had 5,050 Series A preferred limited partner interests (the “Series A Preferred”) issued and outstanding with a liquidation preference of

Tennenbaum Opportunities Fund V, LLC

(A Delaware Limited Liability Company)

Notes to Consolidated Financial Statements (Unaudited) (Continued)

June 30, 2008

1. Organization and Nature of Operations (continued)

$20,000 per interest. The Series A Preferred are redeemable at the option of the Partnership, subject to certain limitations, and, during the ramp-up period, may be reissued. Additionally, under certain conditions, the Partnership may be required to either redeem certain of the Series A Preferred or repay indebtedness, at the Company’s option. Such conditions would include a failure by the Partnership to maintain adequate collateral as required by its credit facility agreement or by the Statement of Preferences of the Series A Preferred, or a failure by the Partnership to maintain sufficient asset coverage as required by the 1940 Act. At June 30, 2008, the Partnership was in full compliance with such requirements. The Series A Preferred accrue dividends at an annual rate equal to LIBOR plus 0.65%, or in the case of any holders of Series A Preferred that are CP Conduits (as defined in the Senior Facility credit agreement), the higher of (i) LIBOR plus 0.65% or (ii) the CP Conduit’s cost of funds rate plus 0.65%, subject to certain limitations and adjustments.

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”). In the opinion of the Investment Manager and the General Partner, the consolidated financial results of the Company included herein contain all adjustments necessary to present fairly the consolidated financial position of the Company as of June 30, 2008, the consolidated results of its operations and its consolidated cash flows for the six months then ended, and the consolidated changes in net assets for the six months then ended and for the year ended December 31, 2007. The following is a summary of the significant accounting policies of the Company and the Partnership.

Investment Valuation

All of the Company’s investments are generally held by the Partnership. Management values investments held by the Partnership at fair value based upon the principles and methods of valuation set forth in policies adopted by the Partnership’s Board of Directors and in conformity with procedures set forth in the Senior Facility and Statement of Preferences for the Series A Preferred. Fair value is defined as the price that would be received to sell an investment in an orderly transaction between market participants at the measurement date.

Investments listed on a recognized exchange or market quotation system, whether U.S. or foreign, are valued for financial reporting purposes as of the last business day of the

Tennenbaum Opportunities Fund V, LLC

(A Delaware Limited Liability Company)

Notes to Consolidated Financial Statements (Unaudited) (Continued)

June 30, 2008

2. Summary of Significant Accounting Policies (continued)

reporting period using the closing price on the date of valuation. Liquid investments not listed on a recognized exchange or market quotation system are valued by an approved nationally recognized pricing service or by using bid prices on the date of valuation as supplied by approved broker-dealers.

Semi-liquid investments, illiquid investments, and investments for which market quotations are determined to be unreliable are valued using valuations obtained from independent third party pricing or valuation services, or are valued internally by the Investment Manager under guidelines adopted by the Board of Directors and subject to their approval.

Investments valued internally by the Investment Manager are limited to 5% of the Total Capitalization of the Partnership, as defined in the Senior Facility. Generally, to increase objectivity in valuing the Partnership’s assets, the Investment Manager will utilize external measures of value, such as public markets or third-party transactions, whenever possible. The Investment Manager’s valuation is not based on long-term work-out value, immediate liquidation value, nor incremental value for potential changes that may take place in the future. The values assigned to investments that are valued by the Investment Manager are based on available information and do not necessarily represent amounts that might ultimately be realized, as these amounts depend on future circumstances and cannot reasonably be determined until the individual investments are actually liquidated.

Statement of Financial Accounting Standards No. 157, Fair Value Measurements (“FAS 157”), establishes a hierarchy that prioritizes the inputs used to measure fair value. The level category in which an investment falls is based on the lowest level input that is significant to the valuation of the investment in its entirety. At June 30, 2008, the investments of the Partnership were categorized as follows:

| Level | | Basis for Determining Fair Value | | Aggregate Value |

| 1 | | Quoted prices in active markets for identical assets | | $ 65,869,758 |

| 2 | | Other observable market inputs* | | 952,411,973 |

| 3 | | Independent third-party pricing sources that employ significant unobservable inputs | | 62,655,129 |

| 3 | | Internal valuations with significant unobservable inputs | | 4,752,128 |

* E.g. quoted prices in inactive markets or quotes for comparable securities

Tennenbaum Opportunities Fund V, LLC

(A Delaware Limited Liability Company)

Notes to Consolidated Financial Statements (Unaudited) (Continued)

June 30, 2008

2. Summary of Significant Accounting Policies (continued)

Changes in investments categorized as Level 3 during the six months ended June 30, 2008 were as follows:

| | | Independent Third Party Valuation | | Investment Manager Valuation | |

| Beginning balance | | $ | 65,950,305 | | $ | 10,216,550 | |

| Net realized and unrealized gains (losses) | | | (3,664,932 | ) | | 2,141,069 | |

| Net acquisitions and dispositions | | | 369,756 | | | (7,605,491 | ) |

| Net transfers in/out of category | | | - | | | - | |

| Ending balance | | $ | 62,655,129 | | $ | 4,752,128 | |

| | | | | | | | |

| Net change in unrealized gains (losses) during the period on investments still held at period end (included in net realized and unrealized gains/losses, above) | | $ | (3,664,932 | ) | $ | 2,141,069 | |

Investment Transactions

The Partnership records investment transactions on the trade date, except for private transactions that have conditions to closing, which are recorded on the closing date. The cost of investments purchased is based upon the purchase price plus those professional fees which are specifically identifiable to the investment transaction. Realized gains and losses on investments are recorded based on the specific identification method, which typically allocates the highest cost inventory to the basis of investments sold.

Cash and Cash Equivalents

Cash consists of amounts held in accounts with brokerage firms and the custodian bank. Cash equivalents consist of highly liquid investments with an original maturity of three months or less. For purposes of reporting cash flows, cash consists of the cash held with brokerage firms and the custodian bank, and cash equivalents maturing within 90 days.

Repurchase Agreements

In connection with transactions in repurchase agreements, it is the Partnership’s policy that its custodian take possession of the underlying collateral securities, the fair value of which is required to exceed the principal amount of the repurchase transaction, including accrued interest, at all times. If the seller defaults, and the fair value of the collateral declines, realization of the collateral by the Partnership may be delayed or limited.

Tennenbaum Opportunities Fund V, LLC

(A Delaware Limited Liability Company)

Notes to Consolidated Financial Statements (Unaudited) (Continued)

June 30, 2008

2. Summary of Significant Accounting Policies (continued)

Investments in Restricted Securities

The Partnership may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold to institutional investors in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and additional expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Statement of Investments. Restricted securities, including any restricted investments in affiliates, are valued in accordance with the investment valuation policies discussed above.

Investments in Foreign Securities

The Partnership may invest in securities traded in foreign countries and denominated in foreign currencies. At June 30, 2008, the Partnership had foreign currency denominated investments with an aggregate market value of approximately 9.8% of the Company’s consolidated cash and investments. Such positions were converted at the closing rate in effect at June 30, 2008 and reported in U.S. dollars. Purchases and sales of investments and income and expense items denominated in foreign currencies, when they occur, are translated into U.S. dollars on the respective dates of such transactions. As such, foreign security positions and transactions are susceptible to foreign currency as well as overall market risk. The Company reports that portion of the results of operations resulting from foreign exchange rates on investments separately from the gains or losses arising from changes in market prices of investments held. During the six months ended June 30, 2008, such fluctuations from foreign exchange rates were largely offset by fluctuations in the value of foreign currency advances under the Partnership’s credit facility.

Securities of foreign companies and foreign governments may involve special additional risks and considerations not typically associated with investing in U.S. companies and securities of the U.S. government. These risks include, among other things, revaluation of currencies, less reliable information about issuers, different securities transactions clearance and settlement practices, and potential future adverse political and economic developments. Moreover, securities of some foreign companies and foreign governments and their markets may be less liquid and their prices more volatile than those of securities of comparable U.S. companies and the U.S. government.

Derivatives

In order to mitigate certain interest rate risks, the Partnership has entered into certain interest rate swaps and eurodollar futures contracts. All derivatives are recognized as either assets or liabilities in the statement of assets and liabilities. The transactions entered

Tennenbaum Opportunities Fund V, LLC

(A Delaware Limited Liability Company)

Notes to Consolidated Financial Statements (Unaudited) (Continued)

June 30, 2008

2. Summary of Significant Accounting Policies (continued)

into are accounted for using the mark-to-market method with the resulting change in fair value recognized in earnings for the current period.

Valuations of futures contracts and interest rate swaps at June 30, 2008 were determined as follows:

| Level | | Basis for Determining Fair Value | | Aggregate Value |

| 1 | | Quoted prices in active markets for identical instruments | | $ (1,106,063) |

| 2 | | Other observable market inputs | | (7,632,424) |

Debt Issuance Costs

Costs of $8,501,709 were incurred in connection with placing the Partnership’s Senior Facility. These costs are being deferred and are amortized on a straight-line basis over eight years, the estimated life of the Senior Facility. The impact of utilizing the straight-line amortization method versus the effective-interest method is not expected to be material to the operations of the Company or the Partnership.

Equity Placement and Offering Costs

Placement and offering costs in 2006 and 2007 for the Company’s common equity were $1,245,000 and $5,796,512, respectively. As of June 30, 2008, $5,241,100 of the costs have been charged to paid-in capital and $188,512 of the costs have been expensed; the remaining amount will be charged to paid-in capital in connection with future capital calls.

Organization Costs

Organization costs of $0.19 million were incurred in connection with the formation of the Company and the Partnership; $0.16 million were expensed to operations in 2006 and $0.03 million were expensed to operations in 2007.

The majority of the Partnership’s high yield and distressed debt securities are purchased at a considerable discount to par as a result of the underlying credit risks and financial results of the issuer and due to general market factors that influence the financial markets as a whole. GAAP requires that discounts on corporate (investment grade) bonds, municipal bonds and treasury bonds be amortized using the effective-interest or constant-yield method. The process of accreting the purchase discount of a debt security to par over the holding period results in accounting entries that increase the cost basis of the investment

Tennenbaum Opportunities Fund V, LLC

(A Delaware Limited Liability Company)

Notes to Consolidated Financial Statements (Unaudited) (Continued)

June 30, 2008

2. Summary of Significant Accounting Policies (continued)

and record a noncash income accrual to the statement of operations. The Partnership considers it prudent to follow GAAP guidance that requires the Investment Manager to consider the collectibility of interest when making accruals. AICPA Statement of Position 93-1 discusses financial accounting and reporting for high yield debt securities and notes for which, because of the credit risks associated with high yield and distressed debt securities, income recognition must be carefully considered and constantly evaluated for collectibility.

Accordingly, when accounting for purchase discounts, management recognizes discount accretion income when it is probable that such amounts will be collected and when such amounts can be estimated. A reclassification entry is recorded to reflect purchase discounts on all realized investments. For income tax purposes, the economic gain resulting from the sale of debt securities purchased at a discount is allocated between interest income and realized gains.

Distributions to Common Interestholders

Distributions to the Company’s common shareholders are recorded on the ex-dividend date. The amount to be paid by the Partnership as a distribution to the Company is determined by the General Partner, which has provided the Investment Manager with criteria for such distributions, and is generally based upon the estimated taxable earnings of the Company. The amount to be paid by the Company as a distribution to its shareholders is determined by its Board of Directors, which has provided the Investment Manager with criteria for such distributions, and is generally based upon amounts received from the Partnership, less any Company-level expenses and dividends to Series Z Preferred Shareholders. Net realized capital gains are distributed at least annually. The Company has distributed $14,563,371 to the common shareholders since inception.

Income Taxes

The Company intends to comply with the applicable provisions of the Internal Revenue Code of 1986, as amended, pertaining to regulated investment companies and to make distributions of taxable income sufficient to relieve it from substantially all federal

income and excise taxes. Accordingly, no provision for income taxes is required in the consolidated financial statements. The Partnership’s income or loss is reported in the Partners’ income tax returns. As of June 30, 2008, all tax years of the Company and the Partnership since inception remain subject to examination by federal and state tax authorities. No such examinations are currently pending.

Tennenbaum Opportunities Fund V, LLC

(A Delaware Limited Liability Company)

Notes to Consolidated Financial Statements (Unaudited) (Continued)

June 30, 2008

2. Summary of Significant Accounting Policies (continued)

Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from accounting principles generally accepted in the United States. Capital accounts within the financial statements are adjusted at year-end for permanent book and tax differences. These adjustments are primarily due to returns of capital, non-deductible expenses, and differing treatments for short-term realized gains, and have no impact on net assets or the results of operations. Temporary differences are attributable to differing book and tax treatments for the timing of the recognition of gains and losses on certain investment transactions and the timing of the deductibility of certain expenses, and will reverse in subsequent periods.

Cost and unrealized appreciation (depreciation) for U.S. federal income tax purposes of the investments of the Company at June 30, 2008 were as follows:

| Unrealized appreciation | | $ | 15,409,498 | |

| Unrealized depreciation | | | (97,448,419 | ) |

| Net unrealized depreciation | | | (82,038,921 | ) |

| | | | | |

| Cost | | $ | 1,160,095,486 | |

Distributions and the net change in accumulated distributions to holders of the Series A Preferred Interests are treated as ordinary income for federal tax purposes.

Use of Estimates

The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Although management believes these estimates and assumptions to be reasonable and accurate, actual results could differ from those estimates.

Recent Accounting Pronouncements

On January 1, 2008, the Company adopted Statement of Financial Accounting Standards No. 157, Fair Value Measurements (“FAS 157”), which defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles, and expands disclosures about fair value measurements. The adoption of FAS 157 did not have a material impact on the Company’s financial statements.

Tennenbaum Opportunities Fund V, LLC

(A Delaware Limited Liability Company)

Notes to Consolidated Financial Statements (Unaudited) (Continued)

June 30, 2008

3. Allocations and Distributions

Distributions made to the common shareholders of the Company are based on distributions received from the Partnership, less any Company-level expenses and dividends to Series Z preferred shareholders. As set forth in the Partnership Agreement, distributions made to the Company and the General Partner with respect to any accounting period out of the total cumulative investment return of the Partnership are determined as follows:

a) First, 100% to the Company until the amount distributed to the Company, together with amounts previously distributed to the Company, equals an 8% annual weighted-average return on undistributed called capital attributable to the Company (the “Hurdle”);

b) Second, 100% to the General Partner until the cumulative amount of such distributions equals 25% of all amounts previously distributed to the Company pursuant to clause (a) above (the “Catch-up Amount”); and

c) All remaining amounts: (i) 80% to the Company and (ii) 20% to the General Partner.

The timing of distributions is determined by the General Partner, which has provided the Investment Manager with certain criteria for such distributions. The timing of distributions to the common shareholders of the Company is determined by its Board of Directors, which has provided the Investment Manager with certain criteria for such distributions. For purposes of determining whether the Hurdle has been exceeded and whether the General Partner has received the Catch-up Amount, the performance of the Partnership includes the performance of the Company for periods prior to the inception of the Partnership.

Net investment income or loss, realized gain or loss on investments and appreciation or depreciation on investments for the period is allocated to the Company and the General Partner in a manner consistent with that used to determine distributions. As of June 30, 2008, the Partnership’s cumulative annualized return did not exceed the Hurdle; accordingly, no allocation to the General Partner was made.

The Company’s Series Z share dividend rate is fixed at 8% per annum.

4. Management Fees and Other Expenses

Pursuant to the advisory agreements, the Investment Manager is entitled to receive an annual management and advisory fee, payable monthly in arrears, equal to 1.50% of the sum of the maximum amount of the Series A Preferred, the maximum amount available under the Senior Facility, and the total committed common equity, subject to reduction by

Tennenbaum Opportunities Fund V, LLC

(A Delaware Limited Liability Company)

Notes to Consolidated Financial Statements (Unaudited) (Continued)

June 30, 2008

4. Management Fees and Other Expenses (continued)

(i) returns of contributed common equity after the ramp-up period, (ii) the amount of the Senior Facility commitment when the Senior Facility is no longer outstanding and (iii) the amount of the Series A Preferred when less than $1 million in liquidation value of preferred securities is outstanding. For purposes of computing the management fee, total committed capital at June 30, 2008 was $2.21 billion, consisting of $1.105 billion of common equity commitments, $369 million of Series A Preferred, and $736 million of debt. In addition, the General Partner is entitled to an allocation as discussed in Note 3, above. As compensation for its services, the Co-Manager receives a portion of the management fees paid to the Investment Manager. The Co-Manager also receives a portion of any allocation paid to the General Partner.

The Company and the Partnership pay all respective expenses incurred in connection with the business of the Company and the Partnership, including fees and expenses of outside contracted services, such as custodian, administrative, legal, audit and tax preparation fees, costs of valuing investments, insurance costs, brokers’ and finders’ fees relating to investments and any other transaction costs associated with the purchase and sale of investments of the Partnership.

5. Senior Secured Revolving Credit Facility

The Partnership has entered into a credit agreement with certain lenders, which provides for a senior secured revolving credit facility (the “Senior Facility”) pursuant to which amounts may be drawn up to $736 million. The Senior Facility matures December 15,, 2014, subject to extension by the lenders at the request of the Partnership for one 364-day period.

Advances under the Senior Facility bear interest at LIBOR or EURIBOR plus 0.35% per annum, except in the case of loans from CP Conduits, which bear interest at the higher of (i) LIBOR or EURIBOR (as applicable) plus 0.35% or (ii) the CP Conduit’s cost of funds plus 0.35%, subject to certain limitations. Short-term advances under the swingline facility bear interest at the LIBOR Market Index Rate plus 0.35% per annum or the main refinancing rate as set by the European Central Bank for such period, plus 0.85% per annum. In addition to amounts due on outstanding debt, the Senior Facility accrues commitment fees of 0.15% per annum on the unused portion of the Senior Facility, or 0.20% per annum when less than $147,200,000 in borrowings are outstanding.

Foreign currency advances are reported in US dollars using the closing rate in effect on the date of valuation. At June 30, 2008, outstanding borrowings included €68,000,000 (US $107,134,000), and interest payable included €9,099 (US $14,335).

Tennenbaum Opportunities Fund V, LLC

(A Delaware Limited Liability Company)

Notes to Consolidated Financial Statements (Unaudited) (Continued)

June 30, 2008

6. Commitments, Concentration of Credit Risk and Off-Balance Sheet Risk

The Partnership conducts business with brokers and dealers that are primarily headquartered in New York and Los Angeles and are members of the major securities exchanges. Banking activities are conducted with a firm headquartered in the New York area.

In the normal course of business, the Partnership’s securities activities involve executions, settlement and financing of various securities transactions resulting in receivables from, and payables to, brokers, dealers and the Partnership’s custodian. These activities may expose the Company and the Partnership to risk in the event such parties are unable to fulfill contractual obligations. Management does not anticipate any losses from counterparties with whom it conducts business.

Consistent with standard business practice, the Company and the Partnership enter into contracts that contain a variety of indemnifications. The maximum exposure of the Company and the Partnership under these arrangements is unknown. However, the Company and the Partnership expect the risk of loss to be remote.

The Statement of Investments may include certain unfunded or partially funded loan commitments. These commitments are reflected at fair value and may be drawn up to the principal amount shown.

7. Series Z Preferred Capital

In addition to the Partnership’s Series A Preferred described in Note 1, the Company had 560 Series Z preferred shares issued and outstanding as of December 31, 2007. The Series Z preferred shares have a liquidation preference of $500 per share plus accumulated but unpaid dividends and pay dividends at an annual rate equal to 8% of liquidation preference. The Series Z preferred shares are redeemable at any time at the option of the Company and may only be transferred with the consent of the Company.

Tennenbaum Opportunities Fund V, LLC

(A Delaware Limited Liability Company)

Notes to Consolidated Financial Statements (Unaudited) (Continued)

June 30, 2008

8. Shareholders’ Capital

Issuances of common stock during the six months ended June 30, 2008 and during the year ended December 31, 2007 were as follows:

| | | Six Months Ended June 30, 2008 | | Year Ended December 31, 2007 | |

| Number of shares issued | | | 14,462.6732 | | | 23,443.6984 | |

| Number of shares subscribed and | | | | | | | |

| pending issuance | | | - | | | 14,462.6732 | |

| Less: Number of shares subscribed in prior year | | | (14,462.6732 | ) | | - | |

| Net increase | | | - | | | 37,906.3716 | |

| | | | | | | | |

| Gross proceeds from share issuance | | $ | 221,000,000 | | $ | 407,500,000 | |

| Subscription receivable for common shares | | | - | | | 221,000,000 | |

| Less: Proceeds from shares subscribed in prior year | | | (221,000,000 | ) | | - | |

| Equity placement and offering costs | | | - | | | (5,166,100 | ) |

| Net proceeds | | $ | - | | $ | 623,333,900 | |

Tennenbaum Opportunities Fund V, LLC

(A Delaware Limited Liability Company)

Notes to Consolidated Financial Statements (Unaudited) (Continued)

June 30, 2008

9. Financial Highlights | | | | | | | |

| | | | | | | | |

| | | | | | | October 10, 2006 | |

| | | | | Year Ended | | (Inception) | |

| | | | | December 31, 2007 | | December 31, 2006 | |

Per Common Share(1) | | | | | | | |

| Net asset value, beginning of period | | $ | 15,376.96 | | $ | 20,038.77 | | $ | 20,000.00 | |

| | | | | | | | | | | |

| Equity placement costs charged to paid-in capital | | | - | | | (355.40 | ) | | (10.34 | ) |

| | | | | | | | | | | |

| Investment operations: | | | | | | | | | | |

| Net investment income | | | 499.01 | | | (666.61 | ) | | (111.27 | ) |

| Net realized and unrealized gain (loss) | | | (1,492.95 | ) | | (2,506.47 | ) | | 164.16 | |

| Distributions to Series A preferred limited partners | | | (68.82 | ) | | (79.02 | ) | | - | |

| Distributions to Series Z preferred shareholders | | | (0.61 | ) | | | | | | |

| Net change in accumulated distributions to Series A | | | | | | | | | | |

| preferred limited partners | | | 20.12 | | | (74.10 | ) | | (3.07 | ) |

| Net change in reserve for dividends to Series Z preferred | | | | | | | | | | |

| shareholders | | | 0.36 | | | (1.36 | ) | | (0.71 | ) |

| | | | | | | | | | | |

| Total from investment operations | | | (1,042.89 | ) | | (3,327.56 | ) | | 49.11 | |

| | | | | | | | | | | |

| Net increase from capital stock transactions | | | - | | | 456.74 | | | - | |

| | | | | | | | | | | |

| Distributions to common shareholders from capital returns | | | - | | | (1,435.59 | ) | | - | |

| | | | | | | | | | | |

| Net asset value, end of period | | $ | 14,334.07 | | $ | 15,376.96 | | $ | 20,038.77 | |

| | | | | | | | | | | |

Return on invested assets (2), (3) | | | (2.6 | %) | | (3.3 | %) | | 3.2 | % |

| | | | | | | | | | | |

Total return to common shareholders (2), (4) | | | (6.8 | %) | | (19.2 | %) | | 0.2 | % |

Tennenbaum Opportunities Fund V, LLC

(A Delaware Limited Liability Company)

Notes to Consolidated Financial Statements (Unaudited) (Continued)

June 30, 2008

| | | | | | | |

| | | | | | | | |

| | | Six Months | | | | October 10, 2006 | |

| | | June 30, 2008 | | Year Ended | | (Inception) | |

| | | (Unaudited) | | December 31, 2007 | | December 31, 2006 | |

| | | | | | | | |

Ratios and Supplemental Data: | | | | | | | |

| Ending net assets attributable to common shareholders | | $ | 647,274,381 | | $ | 694,367,823 | | $ | 145,281,047 | |

Net investment income (loss) / average common shareholder equity (5), (6) | | | 6.8 | % | | 0.1 | % | | (3.3 | %) |

| | | | | | | | | | | |

| Expenses and General Partner allocation/average common shareholder equity | | | | | | | | | | |

Operating expenses (5), (6) | | | 7.7 | % | | 11.7 | % | | 14.3 | % |

| General Partner interest allocation | | | 0.0 | % | | 0.0 | % | | 0.0 | % |

| Total expenses and General Partner interest allocation | | | 7.7 | % | | 11.7 | % | | 14.3 | % |

| | | | | | | | | | | |

Portfolio turnover rate (2) | | | 15.1 | % | | 42.7 | % | | 6.1 | % |

| Weighted-average debt outstanding | | $ | 353,454,271 | | $ | 125,714,977 | | $ | 4,253,012 | |

| Weighted-average interest rate | | | 4.0 | % | | 5.5 | % | | 5.7 | % |

| Weighted-average number of shares | | | 45,156.3716 | | | 19,776.0839 | | | 7,250.0000 | |

Average debt per share (7) | | $ | 7,827 | | $ | 6,357 | | $ | 587 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Annualized Inception to Date Performance Data as of June 30, 2008: | | | | | | | | | | |