ANNUAL INFORMATION FORM

FOR THE YEAR ENDED DECEMBER 31, 2021

DATED AS OF MARCH 29, 2022

SUITE 1640 - 1066 WEST HASTINGS STREET

VANCOUVER, BRITISH COLUMBIA

V6E 3X1

TABLE OF CONTENTS

PRELIMINARY NOTES

In this Annual Information Form (the "AIF"):

(i) references to the "Company" or "Galiano" mean Galiano Gold Inc. and its subsidiaries, unless the context requires otherwise;

(ii) references to the "AGM" mean the Asanko Gold Mine in which the Company holds a 45% interest through a 50:50 joint venture arrangement (the "JV") with a subsidiary of Gold Fields Limited ("Gold Fields");

(iii) the Company uses the United States dollar as its reporting currency and, unless otherwise specified, all dollar amounts are expressed in United States dollars and any references to "$" mean United States dollars and any references to "C$" mean Canadian dollars;

(iv) the Company's financial statements are prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board;

(v) all figures and descriptions as they relate to the JV are on a 100% basis, unless otherwise indicated;

(vi) production results are in metric units, unless otherwise indicated; and

(vii) all information in this AIF is as of December 31, 2021, unless otherwise indicated.

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

The Company cautions readers regarding forward-looking statements found in this AIF and in any other statement made by, or on the behalf of the Company. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects", "estimates", "anticipates", or variations of such words and phrases or statements that certain actions, events or results "may", "could", or "might" occur. Forward-looking statements are made based on management's beliefs, estimates and opinions and are given only as of the date of this AIF. Such statements may constitute "forward-looking information" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities legislation.

Forward-looking statements are statements not based on historical information and which relate to future operations, strategies, financial results or other developments. Forward-looking statements reflect the Company's current views with respect to expectations, beliefs, assumptions, estimates and forecasts about the business of the JV and the Company and the industry and markets in which the JV and the Company operate. Forward-looking statements include, but are not limited to, statements with respect to

the future price of gold;

the operating plans for the AGM under the JV between the Company and Gold Fields;

the estimation of Mineral Resources;

the publication of a Mineral Reserve estimate in the future;

the timing and amount of estimated future production from the AGM, including production rates and gold recovery;

plans to transition from mining to processing stockpiles (and the benefits that may arise therefrom), and with respect to the re-start of mining operations thereafter;

operating costs with respect to the operation of the AGM;

expectations regarding capital expenditures;

the ongoing work programs, including metallurgical testwork, being completed by the Company at the AGM, the timing for the completion thereof and the results therefrom;

estimates regarding the AGM's consumption of key reagents, consumables, critical spares and diesel fuel;

the ability of the AGM to maintain current inventory levels;

the impact of COVID-19 ("COVID-19") and other infectious diseases on the Company's and the AGM's operations;

the timing of the development of new deposits;

success of exploration activities;

permitting timelines;

hedging practices;

currency exchange rate fluctuations;

requirements for additional capital;

government regulation of mining operations;

environmental risks and remediation measures;

unanticipated reclamation expenses;

title disputes or claims; and

limitations on insurance coverage.

Forward-looking statements are not guarantees of future performance and involve risks, uncertainties and assumptions, which are difficult to predict. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward-looking statements made by or on behalf of the Company. The JV and Company's actual future results or performance are subject to certain risks and uncertainties including but not limited to:

mineral resource estimates may change and may prove to be inaccurate;

mineral reserves may not be reinstated;

metallurgical recoveries may not be economically viable;

risks associated with the Company ceasing its mining operations during 2022;

- the Company does not currently have a LOM estimate for the AGM due to the fact that no mineral reserve has been declared;

actual production, costs, returns and other economic and financial performance may vary from the Company's estimates in response to a variety of factors, many of which are not within the Company's control;

AGM has a limited operating history and is subject to risks associated with establishing new mining operations;

sustained increases in costs, or decreases in the availability, of commodities consumed or otherwise used by the Company may adversely affect the Company;

adverse geotechnical and geological conditions (including geotechnical failures) may result in operating delays and lower throughput or recovery, closures or damage to mine infrastructure;

the ability of the Company to treat the number of tonnes planned, recover valuable materials, remove deleterious materials and process ore, concentrate and tailings as planned is dependent on a number of factors and assumptions which may not be present or occur as expected;

the Company's operations may encounter delays in or losses of production due to equipment delays or the availability of equipment;

outbreaks of COVID-19 and other infectious diseases may have a negative impact on global financial conditions, demand for commodities and supply chains and could adversely affect the Company's business, financial condition and results of operations and the market price of the Common Shares;

the Company's operations are subject to continuously evolving legislation, compliance with which may be difficult, uneconomic or require significant expenditures;

the Company may be unsuccessful in attracting and retaining key personnel;

labour disruptions could adversely affect the Company's operations;

the Company's business is subject to risks associated with operating in a foreign country;

risks related to the Company's use of contractors;

the hazards and risks normally encountered in the exploration, development and production of gold;

the Company's operations are subject to environmental hazards and compliance with applicable environmental laws and regulations;

the effects of climate change or extreme weather events may cause prolonged disruption to the delivery of essential commodities which could negatively affect production efficiency;

the Company's operations and workforce are exposed to health and safety risks;

unexpected costs and delays related to, or the failure of the Company to obtain, necessary permits could impede the Company's operations;

the Company's title to exploration, development and mining interests can be uncertain and may be contested;

geotechnical risks associated with the design and operation of a mine and related civil structures;

the Company's properties may be subject to claims by various community stakeholders;

risks related to limited access to infrastructure and water;

the Company's exploration programs may not successfully reinstate mineral reserves;

- risks associated with establishing new mining operations;

the Common Shares may experience price and trading volume volatility;

the Company has never paid dividends;

the Company's revenues are dependent on the market prices for gold, which have experienced significant recent fluctuations;

the Company may not be able to secure additional financing when needed or on acceptable terms;

Company shareholders may be subject to future dilution;

risks related to the control of AGM cashflows and operation through a joint venture;

risks related to changes in interest rates and foreign currency exchange rates;

risks relating to credit rating downgrades;

changes to taxation laws applicable to the Company may affect the Company's profitability;

ability to repatriate funds;

risks related to the Company's internal controls over financial reporting and compliance with applicable accounting regulations and securities laws;

non-compliance with public disclosure obligations could have an adverse effect on the Company's stock price;

the carrying value of the Company's assets may change and these assets may be subject to impairment charges;

risks associated with changes in reporting standards;

the Company's primary asset is held through a joint venture, which exposes the Company to risks inherent to joint ventures, including disagreements with joint venture partners and similar risks;

the Company may be liable for uninsured or partially insured losses;

the Company may be subject to litigation;

damage to the Company's reputation could result in decreased investor confidence and increased challenges in developing and maintaining community relations which may have adverse effects on the business, results of operations and financial conditions of the joint venture and the Company and the Company's share price;

the Company may be unsuccessful in identifying targets for acquisition or completing suitable corporate transactions, and any such transactions may not be beneficial to the Company or its shareholders;

the Company must compete with other mining companies and individuals for mining interests;

risks related to information systems security threats;

the Company's growth, future profitability and ability to obtain financing may be impacted by global financial conditions; and

the risk factors described under the heading "Risk Factors" in, or incorporated by reference in, this AIF.

Forward-looking statements are necessarily based upon estimates and assumptions, which are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the Company's control and many of which, regarding future business decisions, are subject to change. Assumptions underlying the Company's expectations regarding forward-looking statements or information contained in this AIF include, among others:

the Company and Gold Fields will agree on the manner in which the JV will operate the AGM, including agreement on development plans and capital expenditures;

the price of gold will not decline significantly or for a protracted period of time;

the ability of the AGM to continue to operate, produce and ship doré from the AGM site to be refined during the COVID-19 pandemic or any other infectious disease outbreak;

the Company's ability to raise sufficient funds from future equity financings to support its operations, and general business and economic conditions;

the global financial markets and general economic conditions will be stable and prosperous in the future;

the ability of the JV and the Company to comply with applicable governmental regulations and standards;

the mining laws, tax laws and other laws in Ghana applicable to the AGM and the JV will not change, and there will be no imposition of additional exchange controls in Ghana;

the success of the JV and the Company in implementing its development strategies and achieving its business objectives;

the JV will have sufficient working capital necessary to sustain its operations on an ongoing basis and the Company will continue to have sufficient working capital to fund its operations and contributions to the JV; and

the key personnel of the Company and the JV will continue their employment.

The foregoing list of assumptions cannot be considered exhaustive.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. All factors including the risk factors contained in this AIF should be considered carefully and readers should not place undue reliance on the Company's forward-looking statements. The Company undertakes no obligation to update forward-looking information if these beliefs, estimates and opinions or other circumstances should change, except as may be required by applicable law.

GLOSSARY

The Company uses the following defined terms in this AIF:

| 2020 DFS | The technical report entitled the "NI 43-101 Technical Report for the Asanko Gold Mine, Ghana (Amended and Restated)", effective as of December 31, 2019, filed on SEDAR on June 11, 2020 |

2022 Technical Report | The technical report entitled the "NI 43-101 Technical Report for the Asanko Gold Mine, Ashanti Region, Ghana", effective as of February 28, 2022, filed on SEDAR on March 29, 2022. |

AARL | Anglo American Research Laboratories |

AGM | The Asanko Gold Mine located in Ghana, West Africa. The AGM is also known as the "project". The Company's 45% net interest in the AGM is held through a 50:50 JV with Gold Fields, with the Government of Ghana holding a 10% free-carried interest |

AISC/oz (all-in sustaining cost per ounce of gold) | This is a non-IFRS financial measurement which the Company has adopted using World Gold Council's guidance for calculation of this number. AISC/oz includes total cash costs, overhead expenses, sustaining capital expenditure, capitalized stripping costs and reclamation cost accretion for each ounce of gold sold. AISC/oz is intended to assist the comparability of the operations of the JV and Company with those of other gold producers who disclose operating results using the same or similar guidance standards See "Non-IFRS Measures". |

Galiano or the "Company" | Galiano Gold Inc. |

AGGL | Asanko Gold Ghana Limited, a 45% owned Ghanaian affiliate of Galiano. Gold Fields acquired a 45% interest in AGGL effective July 31, 2018, while the Government of Ghana has a 10% free-carried interest in AGGL under Section 8 of the Ghanaian Mining Act |

Au | Chemical symbol for gold |

BCBCA | Business Corporations Act (British Columbia) |

brownfields | A reference to a mining project situated in an existing mining area with the result that environmental approval procedures are generally expedited as contrasted with a "greenfields" project which is a mine proposed for a previously non-mining area or an altogether undisturbed area |

Carbon-in-leach process or "CIL" | A process used to recover dissolved gold inside a cyanide leach circuit. Coarse activated carbon particles are introduced in the leaching circuit and are moved counter-current to the slurry, adsorbing dissolved gold in solution as they pass through the circuit. Loaded carbon is removed from the slurry by screening. Gold is recovered from the loaded carbon by stripping in a caustic cyanide solution followed by electrolysis. CIL is a process similar to CIP (carbon-in-pulp) except that the gold leaching and the gold adsorption are done simultaneously in the same stage compared with CIP where the gold-adsorption stage follows the gold-leaching stage |

CFPOA | Corruption of Foreign Public Officials Act of 1998, a Canadian anti-corruption law applicable to Galiano |

concentrate | A product containing the valuable metal and from which most of the waste material in the ore has been eliminated |

contained ounces | Ounces in the mineralized rock without reduction due to mining loss or processing loss |

CSA | CSA Global Pty Ltd., a geological, mining and management consulting company operating in numerous prominent mining jurisdictions. |

CSR | Corporate social responsibility, meaning the responsibility of the Company to make positive and meaningful contributions to the economic and social development of its host communities, while being a responsible corporate citizen, to mitigate its impact on the environment and to maintain high health and safety performance |

cut-off grade | The lowest grade of mineralized material considered economic; used in the estimation of mineral reserves in a given deposit |

depletion | The decrease in quantity of mineral reserves in a deposit or property resulting from extraction or production during a particular period |

DSFA | The Definitive Senior Facilities Agreement with Red Kite, which was fully drawn for a total of $150 million plus $13.9 million in unpaid interest that was accrued up to May 2016. The DSFA was fully repaid on July 31, 2018 upon the completion of the JV Transaction with Gold Fields |

dilution | An estimate of the amount of waste or low-grade mineralized rock which will be mined with the ore as part of normal mining practices in extracting an ore body |

EPA | The Ghanaian Environmental Protection Agency |

Exchange Act | The United States Securities Exchange Act of 1934, as amended |

FCPA | The Foreign Corrupt Practices Act of 1977, a United States federal law |

Ghana | The Republic of Ghana |

Ghanaian Mining Act | The Ghanaian Minerals and Mining Act of 2006 |

Gold Fields | Gold Fields Limited, the ultimate parent of the affiliates which own a 45% net interest in the AGM and also holds a 9.9% equity interest in Galiano |

g/t Au | Reference to ore grade in terms of grams of gold per tonne (1 g/t is equivalent to one part per million) |

grade | The relative quantity or percentage of metal or mineral content |

hedge | A risk management technique used to manage commodity price, interest rate, foreign currency exchange or other exposures arising from regular business transactions |

hedging | The current purchase or sale of a future interest in a commodity made to secure or protect the future price of a commodity as revenue or cost and secure cash flows |

IFRS | International Financial Reporting Standards |

IT | Information technology |

JV | The Asanko Gold Mine Joint Venture, a 50:50 joint arrangement with Gold Fields within which the AGM is owned and operated. The Company is currently the manager and operator of the JV and has a 45% economic interest in the JV, with Gold Fields also currently holding a 45% economic interest and the remaining 10% representing the government of Ghana's free-carried interest |

JV Transaction | The combination agreement and other definitive agreements with Gold Fields for the formation of the JV for the AGM |

JVA | The Joint Venture Agreement that governs the management of the JV, effective July 31, 2018 |

LOM | Life of mine |

LTIFR | Rolling lost time injury frequency rate per million employee-hours worked |

Moz | Million ounces |

MRE | Mineral resource estimate |

MRev | Mineral reserve estimate |

Mt | Million tonnes |

Mtpa | Mt per annum |

NI 43-101 | National Instrument 43-101 - Standards of Disclosure for Mineral Projects, as adopted by the Canadian Securities Administrators |

NPV | Net present value, the value of projected future cash flow streams discounted to reach a present value |

NCIB | A Normal Course Issuer Bid |

NSR | Net smelter returns, a proxy for the value to be received from refined minerals produced and shipped from the AGM |

NYSE American

| The NYSE American, formerly known as the NYSE MKT and prior to that the NYSE Amex |

ounce | Refers to one troy ounce, which is equal to 31.1035 grams |

PMI | PMI Gold Corp. which was acquired by Galiano in 2014 and which previously developed the Obotan deposit |

Project | The Asanko Gold Mine, also known as the "AGM" |

Q | Refers to a fiscal quarter |

QA/QC | Quality-assurance/quality control |

Qualified Person | An individual who is an engineer or geoscientist with a university degree, or equivalent accreditation, in an area of geosciences, or engineering, relating to mineral exploration or mining who has at least five years of experience in mineral exploration, mine development or operation, or mineral project assessment, or any combination of these, that is relevant to his or her professional degree or area of practice, and who has experience relevant to the subject matter of the mineral project or technical report, and who is in good standing with a professional association, as more fully described in NI 43-101 |

RAP | Resettlement Action Plan |

RC | Reverse circulation (a method of drilling) |

recovery | The proportion of valuable material obtained during mining or processing, generally expressed as a percentage of the material recovered compared to the total material present |

Red Kite | A special purpose lending vehicle of RK Mine Finance Trust I, the counterparty to the DSFA |

ROM | Run of mine |

royalty | Cash payment or physical payment (in-kind) generally expressed as a percentage of NSR or mine production |

SAG | Semi-autogenous grinding (ore is tumbled to smash against itself) |

SEDAR | System for Electronic Document Analysis and Retrieval available on the Internet at www.sedar.com, (the Canadian securities regulatory filings website) |

SEC | The United States Securities and Exchange Commission |

stripping | In mining, the process of removing overburden or waste rock to expose ore |

SO2 | Sulfur dioxide |

Spot price | The current price of a metal for immediate delivery |

tailings | The material that remains after metals or minerals considered economic have been removed from ore during processing |

Tailings Storage Facility or TSF | A containment area used to deposit tailings from milling |

tonne | Commonly referred to as the metric ton in the United States, is a metric unit of mass equal to 1,000 kilograms; it is equivalent to approximately 2,204.6 pounds, 1.102 short tons (US) or 0.984 long tons (imperial). |

TSX | Toronto Stock Exchange |

U.S. Securities Act | The United States Securities Act of 1933, as amended |

volatility | Propensity for variability. A market or share is considered volatile when it records rapid variations in trading volume and/or price. |

WAD | Weak acid dissociable, often used with reference to cyanide concentration |

GLOSSARY OF CERTAIN TECHNICAL TERMS

As a Canadian issuer, we are required to comply with reporting standards in Canada that require that we make disclosure regarding our mineral properties, including any estimates of mineral reserves and resources, in accordance with NI 43-101. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all resource estimates contained in or incorporated by reference in this AIF have been prepared in accordance with NI 43-101.

This AIF uses the certain technical terms presented below as they are defined in accordance with the CIM Definition Standards on mineral resources and reserves (the "CIM Definition Standards") adopted by the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM Council"), as required by NI 43-101. The following definitions are reproduced from the latest version of the CIM Standards, which were adopted by the CIM Council on May 10, 2014 (the "CIM Definitions"):

feasibility study | A comprehensive technical and economic study of the selected development option for a mineral project that includes appropriately detailed assessments of applicable modifying factors together with any other relevant operational factors and detailed financial analysis that are necessary to demonstrate, at the time of reporting, that extraction is reasonably justified (economically mineable). The results of the study may reasonably serve as the basis for a final decision by a proponent or financial institution to proceed with, or finance, the development of the project. The confidence level of the study will be higher than that of a pre-feasibility study. |

indicated mineral resource | That part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of modifying factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing and is sufficient to assume geological and grade or quality continuity between points of observation. An indicated mineral resource has a lower level of confidence than that applying to a measured mineral resource and may only be converted to a probable mineral reserve. |

inferred mineral resource | That part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and may not be converted to a mineral reserve. It is reasonably expected that the majority of inferred mineral resources could be upgraded to Indicated mineral resources with continued exploration. |

measured mineral resource | That part of a mineral resource for which quantity, grade or quality, densities, shape, and physical characteristics are estimated with confidence sufficient to allow the application of modifying factors to support detailed mine planning and final evaluation of the economic viability of the deposit. Geological evidence is derived from detailed and reliable exploration, sampling and testing and is sufficient to confirm geological and grade or quality continuity between points of observation. A measured mineral resource has a higher level of confidence than that applying to either an indicated mineral resource or an inferred mineral resource. It may be converted to a proven mineral reserve or to a probable mineral reserve. |

mineral reserve | The economically mineable part of a measured and/or indicated mineral Resource. It includes diluting materials and allowances for losses, which may occur when the material is mined or extracted and is defined by studies at Pre-Feasibility or Feasibility level as appropriate that include application of modifying factors. Such studies demonstrate that, at the time of reporting, extraction could reasonably be justified. The reference point at which mineral reserves are defined, usually the point where the ore is delivered to the processing plant, must be stated. It is important that, in all situations where the reference point is different, such as for a saleable product, a clarifying statement is included to ensure that the reader is fully informed as to what is being reported. The public disclosure of a mineral reserve must be demonstrated by a pre-feasibility study or feasibility study. |

mineral resource | A concentration or occurrence of solid material of economic interest in or on the Earth's crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade or quality, continuity and other geological characteristics of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling. |

modifying factors | Considerations used to convert mineral resources to mineral reserves. These include, but are not restricted to, mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors. |

pre-feasibility study | A comprehensive study of a range of options for the technical and economic viability of a mineral project that has advanced to a stage where a preferred mining method, in the case of underground mining, or the pit configuration, in the case of an open pit, is established and an effective method of mineral processing is determined. It includes a financial analysis based on reasonable assumptions on the modifying factors and the evaluation of any other relevant factors which are sufficient for a Qualified Person, acting reasonably, to determine if all or part of the mineral resource may be converted to a mineral reserve at the time of reporting. A pre-feasibility study is at a lower confidence level than a feasibility study. |

probable mineral reserve | The economically mineable part of an Indicated, and in some circumstances, a measured mineral resource. The confidence in the modifying factors applying to a probable mineral reserve is lower than that applying to a proven mineral reserve. |

proven mineral reserve | The economically mineable part of a measured mineral resource. A proven mineral reserve implies a high degree of confidence in the modifying factors. |

CAUTIONARY NOTE TO US INVESTORS REGARDING DISCLOSURE OF RESOURCE ESTIMATES

Disclosure regarding the Company's mineral properties, including with respect to mineral resource estimates included in this Annual Information Form, was prepared in accordance with NI 43-101. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. NI 43-101 differs significantly from the disclosure requirements of the SEC generally applicable to U.S. companies. Accordingly, information contained in this Annual Information Form is not comparable to similar information made public by U.S. companies reporting pursuant to SEC disclosure requirements.

CORPORATE STRUCTURE

Name, Address and Incorporation

The Company was incorporated on September 23, 1999 under the BCBCA. The Company completed the acquisition of PMI Gold Corporation ("PMI") on February 6, 2014 by way of a court approved plan of arrangement transaction. The Company changed its corporate name to Galiano Gold Inc. effective April 30, 2020.

The Company's primary asset is its interest in the JV, which operates the AGM, located on the Asankrangwa gold belt in Ghana.

The Company's common shares trade in Canada on the TSX and in the United States on the NYSE American, each under the symbol "GAU". The Company is a reporting issuer in the provinces of British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island and Newfoundland and Labrador, Northwest Territories, Yukon and Nunavut. The Company's common shares are registered under Section 12(b) of the Exchange Act.

The Company's registered and records office is located at Suite 2600, Three Bentall Centre, 595 Burrard Street, P.O. Box 49314, Vancouver, British Columbia, V7X 1L3. The Company's Canadian head office is located at Suite 1640 - 1066 West Hastings Street, Vancouver, British Columbia, V6E 3X1.

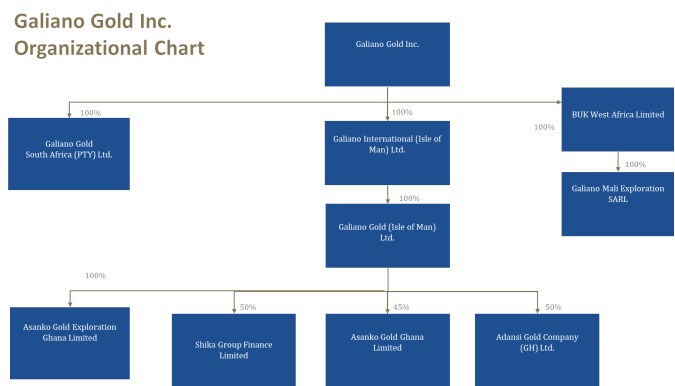

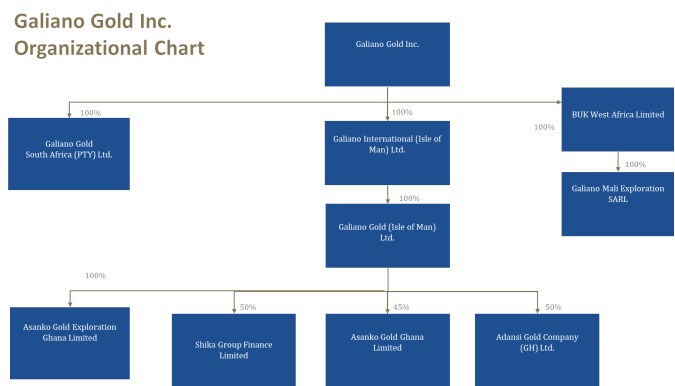

Inter-corporate Relationships

The Company had the following interests in affiliates and subsidiaries as at December 31, 2021:

Affiliate name | Jurisdiction | Interest |

Asanko Gold Ghana Limited | Ghana | 45% |

Adansi Gold Company (GH) Limited | Ghana | 50% |

Asanko Gold Exploration (Ghana) Limited | Ghana | 100% |

Shika Group Finance Limited ("JV Finco") | Isle of Man | 50% |

Galiano Gold South Africa (PTY) Ltd. | South Africa | 100% |

Galiano International (Isle of Man) Inc. | Isle of Man | 100% |

Galiano Gold (Isle of Man) Inc. | Isle of Man | 100% |

BUK West Africa Limited | United Kingdom | 100% |

Galiano Mali Exploration SARL | Mali | 100% |

The Company's inter-corporate relationships with its subsidiaries and affiliates as at December 31, 2021 are illustrated in the chart below:

During 2021, the Company completed a corporate simplification process whereby it migrated its two Barbados subsidiaries from Barbados to the Isle of Man by means of a continuation of these entities, effective February 15, 2021. In addition, the Company had also completed a process in 2021 whereby the Company's technical services were systematically migrated from the Company's Johannesburg office to its Vancouver office, whereupon the Company commenced a process to deregister its South African subsidiary. These simplifications are not expected to have material tax or financial consequences to shareholders but have resulted in some cost savings through elimination of redundant corporate entities and the institution of a more efficient corporate and management structure.

DESCRIPTION AND GENERAL DEVELOPMENT OF THE BUSINESS

Summary

The Company is Canadian-incorporated and headquartered. The Company's vision is focused on building a sustainable business capable of long-term value creation for its stakeholders through a combination of exploration, accretive acquisitions and the disciplined deployment of its financial resources.

The Company's principal asset is its interest in the JV, which owns the AGM located in Ghana, West Africa. The Company holds its 45% interest in the AGM through a 50:50 joint venture arrangement stemming from the completion of the JV Transaction . The Company is currently the operator and manager of the JV. The AGM is a multi-deposit complex, with two main deposits, Nkran and Esaase, and a number of satellite deposits. The mine has been developed in phases. The first phase comprised the construction of a 3 Mtpa CIL ore processing facility and bringing the first pit, Nkran, into production ("Phase 1"). Phase 1 was financed in part by the DSFA with Red Kite in the amount of $150.0 million plus $13.9 million in unpaid interest. Gold production commenced in January 2016, commencement of commercial production was declared on April 1, 2016, and the operation reached steady-state production levels by the end of the second quarter of 2016, which continued through 2021 and into 2022. On March 29, 2022, the Company announced that it would be temporarily deferring mining operations and transitioning to processing existing stockpiles, while technical work to support a Mineral Reserve at the AGM is ongoing. Mining will continue at Akwasiso Cut 3 and Esaase Cut 3 until their depletion (expected in Q2 2022), following which, the process plant is expected to continue to operate at full capacity (5.8 Mtpa) processing a portion of the existing 9.5 Mt of stockpiles.

Fiscal 2019 (Year ended December 31, 2019)

The Esaase bulk sample was completed in January 2019, following which a trial mining operation commenced which was restricted to day shift only, with minimal blasting, and the material being trucked to the processing facility via the haul road.

Effective April 1, 2019, Mr. Greg McCunn joined the Galiano management team as Chief Executive Officer and Director.

In August 2019, the JV partners announced the scope of a LOM plan that was being updated by the JV partners, at that date targeting a remaining mine life of 8-10 years with gold production of 225,000 to 250,000 ounces per year.

On August 29, 2019, the Company received the first of two $10.0 million remaining payments from Gold Fields related to the JV Transaction.

The Nkran Cut 2 pushback was completed in Q4 2019, however, an upper bench slippage occurred in the western wall of the Nkran pit which resulted in a higher reliance on the processing of lower-grade ore from stockpiles and the Esaase pits. This contributed to AISC for the year of $1,112/oz being 5% higher than guidance.

The AGM produced a record 251,044 ounces for the year ended December 31, 2019, exceeding the upper end of 2019 production guidance of 225,000‐245,000 ounces.

During the year ended December 31, 2019, the AGM sold 248,862 ounces of gold at an average realized gold price of $1,376/oz for proceeds of $342.4 million. Revenues of $341.0 million also included $0.8 million of by-product revenue and were presented net of $2.2 million of gold sales related to pre-production activities at Esaase that were capitalized to mineral properties, plant and equipment.

Work associated with the resettlement of the Tetrem village commenced.

In October 2019, the JV entered into a $30.0 million Revolving Credit Facility ("RCF") with Rand Merchant Bank ("RMB"). The term of the RCF is three years, maturing in September 2022 and bears interest on a sliding scale of between LIBOR plus a margin of 4% and LIBOR plus a margin of 3.8%, depending on security granted to RMB. Commitment fees in respect of the undrawn portion of the RCF are on a similar sliding scale of between 1.40% and 1.33%. As at December 31, 2019, the drawn balance under the RCF was $nil.

On October 24, 2019, the Company announced that Ms. Judith Mosely would join the Company's Board effective January 1, 2020. The Company subsequently announced that Mr. Bill Smart resigned from the Board effective December 31, 2019, with Ms. Mosely replacing Mr. Smart on the Company's Board.

On November 12, 2019, the Company received approval from the TSX to commence a NCIB on November 15, 2019 to purchase up to 11,310,386 common shares, representing 5% of the Company's issued and outstanding common shares on the date thereof. During Q4 2019, the Company repurchased and cancelled a total of 1,108,920 common shares under the NCIB program for $1.0 million (average acquisition price of $0.86 per share).

On December 19, 2019, the Company received the final of two $10.0 million payments from Gold Fields based on the achievement of the agreed Esaase development milestone and an additional $10.0 million distribution from the JV. These payments were recorded as redemptions of the previously recognized preference shares.

Following the completion of the work associated with the life-of-mine update, the Company published the 2020 LOM Plan. In light of the results of the 2020 LOM Plan, the Company determined that as at December 31, 2019 the carrying value of the AGM's single cash-generating unit was $289.6 million greater than its recoverable amount. Based on this assessment, a $289.6 million impairment was recorded against the non-current assets of the AGM during the year ended December 31, 2019, of which the Company recognized its interest of $130.3 million (or 45% of $289.6 million) as part of the Company's share of the net loss related to joint venture.

Fiscal 2020 (Year ended December 31, 2020)

During the first half of 2020, Cut 2 of the higher-grade Nkran deposit was depleted as planned and operations at the AGM shifted to Esaase and Akwasiso as the main ore sources.

The higher-grade yield from Nkran, combined with the supportive gold price environment prevailing in 2020, allowed the JV to return $75.0 million to the JV partners ($37.5 million to each of Galiano and Gold Fields, respectively).

During 2020, the Company also announced its focused exploration strategy for the AGM, aimed at improving the JV's five-year business plan

Five targets were identified for further exploration work that management believed at that time had the potential to replace depletion:

Nkran South - located 1.3km south of the Nkran pit, which targeted extensions to mineralization identified in soil and Versatile Time Domain Electromagnetic ("VTEM") geochemistry anomalies.

Akwasiso - located 5km northeast of the processing plant, which targeted extensions of the ore body to the north and south as well as upgrading of inferred resources.

Abore - located 13km north of the processing plant on the Esaase haul road, targeting upgrading of inferred resources and extensions to the ore body to the north and south.

Midras South - located 5km south west of the processing plant, previously explored in 2015 and 2017 with no stated resources, which targeted the definition of the ore body as well as extensions to the south and at depth.

Adubiaso - located 5km northwest of the processing plant, which targeted the upgrading of inferred resources.

Additionally, four high priority targets that are in close proximity to the processing plant and are believed by management to be capable of being augmented into the mine plan from 2023 onwards were identified for further exploration.

Miradani Central - located along trend and approximately 2km southwest of Tontokrom, previous trenching by the prior operator indicated multiple wide zones of mineralization.

Kaniago West - located 6km northwest of the processing plant, a 5,000 meter drill program was completed by the previous operator. The 2020 program targeted resource definition of the target with extensions along strike and at depth.

Mepease - located 8km southwest of the processing plant, Central West concessions host a cluster of targets with a 10,000 meter drill program.

Mirdani North - located 10km southwest of the processing plant, drilled in 2019. Prior small scale mining operations have left a shallow pit, approximately 400m x 150m with known mineralization extending at depth and along strike.

In accordance with this strategy, during 2020, the Company completed exploration programs at Abore, Nkran Cut 3, Akwasiso and Miradani North the results of which are incorporated into the updated MRE effective as of February 28, 2022 as described in the 2022 Technical Report. For more details on the exploration results from the programs undertaken in 2020 please refer to the MD&A for the year ended December 31, 2020, which is filed on the Company's profile at www.sedar.com.

On April 30, 2020, Paul Wright was appointed as Chair of the Board, following the resignation of Colin Steyn.

On April 30, 2020, the shareholders of the Company approved amendments to the Company's Articles of Incorporation, including a name change from Asanko Gold Inc. to Galiano Gold Inc., and on May 4, 2020, the Company commenced trading under the symbol "GAU" on both the TSX and the NYSE American.

During Q2 2020, the Company filed a preliminary base shelf prospectus and subsequently filed a prospectus supplement qualifying an at-the-market offering ("ATM") of up to $50 million. As of December 31, 2021, the Company had not issued any common shares under the Offering.

On July 30, 2020, the Company's then Executive Vice President and Chief Operating Officer, Mr. Joe Zvaipa passed away from complications related to COVID-19.

On August 17, 2020, the Company announced that Mr. Matt Badylak had been appointed Executive Vice President and Chief Operating Officer. Following the appointment of Mr. Badylak, the Company initiated a process whereby the majority of the Company's technical services have been systematically migrated from the Company's Johannesburg office to Vancouver, which completed on Feb 28, 2021.

During 2020, the Company repurchased and cancelled 2,758,063 common shares for $2.3 million (average acquisition price of $0.83 per share) under the NCIB program that was initiated in 2019.

During 2020, the AGM produced 249,904 ounces of gold, exceeding the upper end of 2020 production guidance of 225,000‐245,000 ounces, at an AISC/oz of $1,115 (below revised guidance as of Q3 2020 of $1,150/oz).

During the year ended December 31, 2020, the AGM sold 243,807 ounces of gold at an average realized gold price of $1,711/oz for gold proceeds of $417.2 million. Revenues of $418.1 million also included $0.9 million of by-product revenue.

Fiscal 2021 (Year ended December 31, 2021) and events in 2022 to date

On February 25, 2022, the Company reported detecting an increase in gold grades in tailings product leaving the processing facility at the AGM. The assays indicated total gold grades of approximately 0.40g/t in tailings product, which is higher than the historic and expected total gold grade in tailings of approximately 0.10g/t. Consequently, gold recovery has been negatively impacted. The 2020 DFS describes areas of the Esaase pit that were expected to yield lower recovery, and it is possible that material mined from these areas may be causing the lower recovery. However, given the volume and consistency of the material yielding lower recovery, the Company is working to better understand the cause(s), magnitude and impact of the observed lower recovery. The Company has initiated a work program designed to ascertain the cause of the elevated grade in the tailings product, and it currently carrying out this work program.

On March 29, 2022, the Company reported updated Measured and Indicated Mineral Resource estimates of 66.4 million tonnes ("Mt") at 1.36 g/t gold for 2.9 million ounces ("Moz") gold contained at the AGM, effective February 28, 2022, which was disclosed in the 2022 Technical Report, which is available on the Company's profile at www.sedar.com. For further information regarding the updated Mineral Resource Estimate, please see the "Mineral Properties" section of this AIF. As of this date, the Company was not in a position to declare Mineral Reserves on the AGM property as a result of current metallurgical uncertainty of the material mined from Esaase (as described above). The Company expects to provide an update to its estimated Mineral Reserves following the conclusion of the metallurgical testwork currently underway at the AGM. Highlights to the updated Mineral Resource Estimate include:

- Measured Mineral Resources of 23.6Mt at 1.06 g/t for 0.8Moz gold contained and Indicated Mineral Resources of 42.7Mt at 1.53 g/t for 2.1Moz gold contained.

A maiden Indicated Mineral Resource of 7.1Mt at 1.28 g/t for 293,000oz of contained gold at Miradani North, contributing to 10% of the overall resource base.

A 68% increase (329,000oz) in Indicated Mineral Resource contained gold at Nkran, after accounting for the mined depletion of 101,000oz.

- A 60% increase (132,000oz) in Indicated Mineral Resource contained gold at Abore.

The AGM continues to display a significant property-wide MRE of 2.9 million ounces of contained gold in Measured and Indicated Mineral Resources, which now comprises six satellite deposits augmenting the cornerstone Nkran and Esaase deposits. Additions to the total MRE exceeded mined depletion but could not fully offset a decrease in overall gold grade in Measured and Indicated Mineral Resources (1.70 g/t to 1.36 g/t) and resultant contained metal in the Esaase Mineral Resource. For further information regarding the updated Mineral Resource Estimate, please see the "Mineral Properties" section of this AIF.

The changes at Esaase resulted primarily from updates to the geological models used in the MRE. The remodeling work for Esaase yielded Measured and Indicated Mineral Resources totaling 22.6 Mt at a grade of 1.26 g/t, representing decreases of 25% in grade and 25% in tonnes, post depletion, from the previous estimate (please see the 2020 DFS for further information regarding the Company’s prior MRE). The Esaase deposit remains the largest portion of the total AGM Mineral Resources, contributing to approximately a third of its total tonnes and contained gold ounces. For further information regarding the updated Mineral Resource Estimate, please see the "Mineral Properties" section of this AIF.

On March 29, 2022, the Company further announced that it planned to temporarily defer mining operations at the AGM and to transition to processing existing stockpiles while technical work to support a Mineral Reserve at the AGM is ongoing. Mining will continue at Akwasiso Cut 3 and Esaase Cut 3 until their depletion (expected in Q2 2022). Following this, the process plant is expected to continue to operate at full capacity (5.8 Mtpa) processing a portion of the existing 9.5 Mt of stockpiles. The Company believes that temporarily transitioning to processing stockpiles will provide the opportunity to:

Preserve the higher grade Mineral Resources at the AGM until the metallurgical recovery at Esaase is better understood.

Advance further exploration activities at near-mine targets with the aim of enhancing the short-term operating plan.

Develop additional initiatives with the aim of maximizing the value from all deposits on the land package, including: additional testwork to further the understanding of metallurgy and geometallurgy at Esaase, evaluating process optimization, and optimizing mine sequencing.

As the AGM was not in a position to declare mineral reserves as a result of current metallurgical uncertainty of the material mined from Esaase, the Company considered this to represent an indicator of impairment of the mineral properties, plant and equipment (“MPP&E”) of the AGM. Accordingly, the Company assessed the recoverable amount of the AGM, and determined that the carrying value of the AGM’s single cash generating unit exceeded its fair value, and an impairment charge of $153.2 million was recognized for the year ended December 31, 2021 (the Company’s share of which was $68.9 million). In addition, as a result of lower expected recovery, the AGM also recorded a $22.8 million write-down of stockpile inventory to net realizable value.

The Company recorded its share of the AGM's net losses for the year ended December 31, 2021 of $51.5 million, which reduced the carrying value of the Company's investment in the AGM JV to $7.6 million as at December 31, 2021. Furthermore, the value attributed to the Company's preference shares was $72.4 million (compared to the par value of $132.4 million) as at December 31, 2021.

The Company's management considered that the above noted impairment considerations identified at the JV level were also applicable to the carrying value of the Company's equity investment in the AGM JV. When considering the capital structure of the JV, specifically the face value of the preference shares, management concluded that the fair value attributed to the preference shares was indicative that no additional value would be available to equity interests in the JV. Accordingly, management estimated the recoverable amount of the Company's equity investment in the JV to be nil at December 31, 2021 and as a result recognized an impairment charge of $7.6 million for the year ended December 31, 2021.

During 2021, the company continued to focus on the operation of the AGM, sourcing the majority of its ore from the Esaase deposit, with additional mining commencing at Akwasiso Cut 3. Despite under performance of the mine, a positive gold price environment enabled the JV to return $5 million to the Company.

During 2021, the AGM produced 210,241 ounces of gold, below revised production guidance of 215,000‐220,000 ounces, at an AISC/oz of $1,431 (in line with revised guidance as of Q3 2021 of $1,350 - $1,450/oz). The AGM sold 216,076 ounces of gold at an average realized gold price of $1,767/oz for gold proceeds of $381.7 million. Revenues of $382.4 million also included $0.7 million of by-product revenue.

At the AGM the following exploration programs were undertaken during the year to evaluate the current and potential mineralization of each project to improve the mineral resource estimate and to assess the broader potential of each project.

Dynamite Hill Extension - During 2021, 30 holes were completed totaling 6,110m

Miradani North - located 10km south-west of the processing plant and was initially drilled in 2019 with no stated resources. Prior small-scale mining operations have left a shallow pit, approximately 400m x 150m with detected mineralization extending at depth and along strike. Phase 3 drilling was completed in Q2 2021, with 19,609m completed in 83 holes over three phases of drilling from Q1 2019 to Q2 2021.

Abore - located 13km north of the processing plant along the Esaase haul road. Drill holes were designed to upgrade existing resources and extensions to the ore body to the north and south. During 2021, 39 holes were completed with 5,458m drilled at Abore North and West, with the intent of fully testing the mineralization to the north and west. Mineralization remains open to testing at depth, with several high-grade shoots identified during drilling, plunging steeply to the north.

Midras South - located 5km southwest of the processing plant, previously explored in 2015 and 2017 and currently has no stated resources. During 2021, 19 holes were completed totaling 3,724m

Kaniago West - located 5km northwest of the processing plant and previously explored by the predecessor owner. During the year, 27 holes were completed for a total 4,508m

For more details on the exploration results from the programs undertaken in 2021 please refer to the MD&A for the year ended December 31, 2021, available on the Company's profile at www.sedar.com.

On July 1, 2021, the AGM received its full Cyanide Code Certification after completion of an independent third-party cyanide management audit. The AGM has aligned its approach to cyanide management at all operations with the International Cyanide Management Code for the Manufacture, Transport and Use of Cyanide in the Production of Gold (the "Cyanide Code"), which is recognized as an international best practice.

During Q2 2021, the Company announced that Greg McCunn had stepped down as CEO and as a director of the Company. Matt Badylak, the Company's COO, was appointed to the position of CEO and also joined the Company's Board of Directors.

During Q3 2021, the Company appointed Ms. Dawn Moss to the Board of Directors as a Non-Executive Director effective September 15, 2021. Ms. Moss is a senior mining executive with more than 25 years of leadership experience with publicly traded companies on the TSX and the NYSE.

On March 23, 2022, the Company announced that Fausto Di Trapani had stepped down as CFO of the Company to pursue another opportunity. Following Mr. Di Trapani's departure, the Company intends to appoint Matt Freeman, current SVP Finance, as its new CFO, in line with the Company’s succession plan.

COVID-19

The JV continues to operate in all material respects with ongoing monitoring and physical distancing protocols in place in accordance with the Ghanaian Ministry of Health Guidelines. The AGM has established additional protocols and procedures to manage any confirmed cases of COVID-19, including contact tracing, rapid testing and isolation of affected persons. The AGM has a polymerase chain reaction testing machine capable of processing up to 40 samples per day which is in the process of being certified by the Ghana health authorities. Additionally, dedicated on-site accommodations are available to isolate infected and suspected-to-be-infected individuals, limiting on-site cross contamination and expediting return to work timelines. As a result, though there have been several confirmed cases of COVID-19 among the operational personnel at the AGM, to date the AGM's operations have been able to continue uninterrupted in all material respects with the majority of confirmed cases cleared and those employees resuming normal duties after completing a two-week isolation. The AGM has provided vaccine education training to its employees and vaccination roll-out is ongoing.

The Company's offices in Vancouver and Accra are observing local regulations with restrictions and protocols in place.

The AGM's primary refiner, based in South Africa, continues to receive shipments and refine gold doré from the AGM at pre-pandemic levels.

Specialized Skill and Knowledge

Various aspects of the mining business of the JV and Company require specialized skills and knowledge, including skills and knowledge in the areas of permitting, geology, drilling, metallurgy, logistical planning, mine design, engineering, construction, health and safety and implementation of exploration programs as well as finance, governance, risk management and accounting. Much of the specialized skill and knowledge is provided by the management and operations team of the Company and JV. The JV and Company also retains outside consultants with additional specialized skills and knowledge, as required. In the event that the Company loses access to this specialized skill and knowledge, it is possible that delays and increased costs may be experienced by the JV and the Company in locating and/or retaining skilled and knowledgeable employees and consultants in order to proceed with its planned exploration and development at its mineral properties.

Competitive Conditions

Galiano and the JV compete with other mineral resource companies for financing, for the acquisition of new mineral properties, for the recruitment and retention of qualified employees and other personnel, as well as operating supplies. Many of the mineral resource companies with which Galiano and the JV compete have greater financial and technical resources. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development.

Cycles

The mining business is subject to mineral price cycles. The marketability of minerals is also affected by worldwide economic cycles. At the present time, the significant demand for minerals in many countries is driving commodity prices, but it is difficult to assess how long such demand may continue. Fluctuations in supply and demand in various regions throughout the world are common.

The JV's revenues may be significantly affected by changes in commodity demand and prices. The ability of the JV to fund ongoing exploration and development is impacted by the sale of gold produced by the mine and the proceeds of such sales. As market fluctuations affect the price of gold, proceeds from the sale of the gold produced by the JV can be affected accordingly. As well, the ability of the JV and Company to continue development, exploration and increased production is affected by the availability of financing which, in turn, is affected by the strength of the economy and other general economic factors.

Economic Dependence

In connection with the JV Transaction, the Company entered into a services agreement with the JV whereby the Company will remain manager and operator of the AGM. In consideration for the Company's services as manager and operator, the JV pays the Company an annual service fee of $6.5 million (adjusted annually for inflation). Other than the JV service fee, the Company has no current direct sources of revenue and any free cash flows generated by the AGM are no longer within the Company's exclusive control as the disposition of cash from the JV is governed by the JVA. The JVA provides that "Distributable Cash" will be calculated and distributed quarterly, if available. Further information regarding the definition of "Distributable Cash" is included in the section "Control of AGM cash flows and Operation through a Joint Venture".

Environmental Protection

The JV's properties are subject to stringent laws and regulations governing environmental quality. Such laws and regulations can increase the cost of planning, designing, installing and operating facilities on the JV's properties. However, it is anticipated that, absent the occurrence of an extraordinary event, compliance with existing laws and regulations governing the release of emissions in the environment or otherwise relating to the protection of the environment, will not have a material effect upon the JV's current operations, capital expenditures, earnings or competitive position.

Employees

At December 31, 2021, the JV had approximately 516 full-time employees workers and 26 temporary workers employed across its site operations and corporate and regional offices. At the same time, the Company had 16 full-time employees employed at its corporate office. Opportunities to minimize ongoing and future operating and capital costs are being explored, including rationalizing the AGM workforce to account for the deferral of mining and stockpile processing.

Foreign Operations

All of the JV's mine development operations are currently conducted in Ghana, a foreign jurisdiction, and as such, the JV's operations are exposed to various levels of political, economic and other such risks and uncertainties such as: military repression; extreme fluctuations in currency exchange rates; high rates of inflation; labour unrest; war or civil unrest; expropriation and nationalization; renegotiation or nullification of existing concessions, licenses, permits and contracts; illegal mining; changes in taxation policies; restrictions on foreign exchange and repatriation; changes to export regulations and changing political conditions, currency controls and governmental regulations that favour or require the awarding of contracts to local contractors or require foreign contractors to employ citizens of, or purchase supplies from, a particular jurisdiction.

In the past, Ghana has been subject to political instability, changes and uncertainties, which if such instability were to recur, may cause changes to existing governmental regulations affecting mineral exploration and mining activities. Furthermore, Ghana's status as a developing country may make it more difficult for the JV or the Company to obtain any required financing for its projects.

The JV's operations and properties are subject to a variety of governmental regulations governing worker health and safety, employment standards, waste disposal, protection of historic and archaeological sites, mine development, protection of endangered and protected species and other matters.

The JV's mineral exploration and development activities in Ghana may be adversely affected in varying degrees by changing government regulations relating to the mining industry or shifts in political conditions that increase the costs related to the JV's activities or the maintenance of its properties.

Changes, if any, in mining or investment policies or shifts in political attitude may adversely affect the operations and financial condition of the JV and the Company. Operations may be affected in varying degrees by government regulations with respect to, but not limited to, restrictions on production, price controls, export controls, currency remittance, income and other taxes, expropriation of property, foreign investment, maintenance of claims, environmental legislation, land use, land claims of local people, water use and mine safety.

Failure to comply strictly with applicable laws, regulations and local practices relating to mineral right applications and tenure could result in loss, reduction or expropriation of entitlements, or the imposition of additional local or foreign parties as joint venture partners with carried or other interests.

The occurrence of these various factors and uncertainties cannot be accurately predicted and could have an adverse effect on the operations and financial condition of the JV and the Company. Future changes in applicable laws and regulations or changes in their enforcement or regulatory interpretation could negatively impact current or planned exploration and development activities on the AGM or in respect of any other projects in which the JV or the Company becomes involved. Any failure to comply with applicable laws and regulations, even if inadvertent, could result in the interruption of exploration and development operations or material fines, penalties or other liabilities.

Free Carried Interest to the Ghanaian Government

Section 43.1 of the Ghanaian Mining Act (Government Participation in Mining Lease) provides: Where a mineral right is for mining or exploitation, the Government shall acquire a ten percent free carried interest in the rights and obligations of the mineral operations in respect of which financial contribution shall not be paid by Government.

In order to achieve this legislative objective, 10% of the common shares of AGGL, the Company's Ghanaian affiliate which owns the Obotan and Esaase properties, have been issued into the name of the Government of Ghana. The government has a nominee on the Board of the JV. There is no shareholder agreement between AGGL and any of its shareholders and the 10% ownership stake of the Government of Ghana represents a capital non-contributing interest where the Ghanaian Government is entitled to 10% of declared dividends from the net profit of AGGL, but does not have to contribute to its capital investment (but does in effect suffer its share of operating losses which need to be recovered before dividends accrue). The Government of Ghana is not a party to nor subject to any JV agreements between the Company and Gold Fields.

Ghanaian Mining Royalties and Taxes

On March 19, 2010, the government of Ghana amended section 25 of the Ghanaian Mining Act which stipulates the royalty rates on mineral extraction payable by mining companies in Ghana. The Ghanaian Mining Act now requires the holder of a mining lease, restricted mining lease, or small-scale mining license to pay a royalty in respect of minerals obtained from its mining operations to Ghana at the rate of 5% of the total revenue earned from minerals obtained by the holder.

Changes to the Ghanaian tax system were announced and substantively enacted during the year ended March 31, 2012. Corporate tax rates rose from 25% to 35% and capital deductions were reduced from an 80% deduction in year one to a straight-line depreciation of 20% per year over 5 years. Tax losses in Ghana are carried forward for up to 5 years, and to the extent they are not utilised within 5 years, they expire.

Effective August 1, 2018, the Ghanaian government introduced a non-refundable 5% levy on goods and services that attract VAT, and then in 2021 an additional non-refundable 1% levy was introduced to help offset the impacts of COVID-related support in the country.

Changes that may give rise to increased exposure to tax expense, could affect the amount of "Distributable Cash" available to the JV partners, as defined and governed by the JVA (refer to "Control of AGM cash flows and Operation through a Joint Venture").

Sustainability policy

The JV believes that a comprehensive sustainability program is integral to meeting its strategic objectives as it will assist the JV to positively support relationships with its stakeholders, improve its risk management, reduce the AGM's cost of production and both directly and indirectly benefit the communities that the JV and the Company operate in, beyond the life of the JV's mines.

The approach of the JV to its sustainability program is based on the following principles:

Complying with its corporate governance principles, national and international laws, industry codes and being a responsible corporate citizen.

Mitigating its impact on the environment, for example by use of an Independent Tailings Review Panel.

Maintaining a high-level Health and Safety performance.

Actively identifying opportunities to make a positive and meaningful contribution to the communities that the JV operates in beyond the life of the JV's mines.

Contributing to the economic and social development of the JV's host country.

Developing its employees.

Adhering to the values of the JV and the Company and demonstrating them in its behavior.

The JV follows the following guidelines with respect to its approach on sustainability:

Embrace the Global Reporting Initiative in the Sustainability reporting of the Company and the JV.

Work to align the JV's business with selected United Nations Sustainable Development Goals

Regularly engage with stakeholders and take into consideration their perspectives, concerns, customs and cultural heritage before acting.

Work closely with landowners prior to commencing activities on the ground, and negotiate fair compensation for such activities where appropriate.

Hire and develop local, regional and national residents and use goods and services from the JV's local communities wherever possible, without compromising the JV's quality and efficiency standards.

Uphold fundamental human rights and do not interfere or take sides in politics or social issues.

Work with unified local committees to identify and prioritize community development projects intended to promote long-lasting livelihood improvements.

Do not tolerate any unethical behavior by any stakeholder involved in the JV's business.

Social and Environmental Corporate Governance

The Company published its 2020 annual sustainability report on October 21, 2021. This report summarized the JV's performance highlights in the areas of health and safety, environmental stewardship, climate change adaptation, governance, human rights, contributing to community, our people, and stakeholder engagement. The report outlines the JV's sustainability goals at the AGM for 2021, some of which were impacted by COVID‐19. The report is available on the Company's website at www.galianogold.com and has also been distributed electronically to local and national stakeholders in Ghana.

The Company has various feedback mechanisms in place at the AGM and the stakeholder communities which enable the JV's workforce, local residents, other groups and individuals to come forward to raise issues of concern. These concerns are then fully investigated by the JV and subsequently addressed.

The Company has adopted the International Council for Mining and Metals health and safety injury classification and methodology with an objective to provide a more accurate picture of the Company and JV's safety behaviour as well as assist in benchmarking more directly against respective peers for health and safety performance going forward.

Galiano completed an independent human rights impact assessment in Q4 2021 and the results of this study indicate that the Company is applying appropriate governance, monitoring systems, and mitigation measures to protect its employees, contractors and stakeholder communities. The Company will be taking additional steps to align with evolving international best practices in human rights and will be reporting on this progress in the Company's annual sustainability report.

The Company has also formed an independent review panel to advise the Company on how to effectively manage and mitigate risks with respect to the AGM's tailings storage facility. This panel includes renowned experts in geochemistry, hydrology and geotechnical and geological engineering and compliments the existing managerial and technical skill sets at the AGM, Galiano, as well as the contracted Engineer-of-Record to oversee the tailings management facility. The independent tailings review panel made a visit to the AGM in Q3 2021 to physically inspect the tailings management facility.

Work continued on progressing the development of the Company's Climate Change Adaptation Plan. A working group has been created at both management and operational levels to assess the Company's current climate change footprint and energy efficiencies, establish more robust monitoring practices, analyze physical and transitional risks in order to mitigate future negative impacts of climate change, and explore energy mix diversification opportunities. In collaboration with its JV partner, the Company also undertook an International Council of Mining and Metals ("ICMM") Performance Expectations readiness self-assessment exercise, as well as a Carbon Disclosure Project reporting readiness assessment in order to prepare the Company for more advanced climate change reporting and target setting. A climate change adaptation plan includes analysis and planning across the following areas:

- Risk and opportunity assessment

- Adaptation planning and actions

- Awareness, engagement and objective setting, and

- Monitoring, evaluation and reporting.

- This will also support the Company's future efforts towards alignment with the ICMM Mining Principles.

On July 1, 2021, the AGM received its full Cyanide Code Certification after completion of an independent third-party cyanide management audit. The AGM has aligned its approach to cyanide management at all operations with the International Cyanide Management Code for the Manufacture, Transport and Use of Cyanide in the Production of Gold (the "Cyanide Code"), which is recognized as an international best practice. Furthermore, the AGM has fully integrated the Cyanide Code principles and standards of practice into its Health, Safety and Environmental Management Systems to protect human health and reduce the potential for environmental impacts. Certification under the Cyanide Code is a significant achievement for the AGM and reflects the Company's ongoing commitment to adhering to international mining industry best practices.

Environmental Policy

Galiano and the JV work diligently to provide safe, responsible and profitable operations whilst ensuring sustainable natural resources development for the benefit of its employees, shareholders and host communities. The Company and the JV also work diligently to protect and conserve the natural environment for future generations.

In adopting the following principles, the JV intends to drive continuous improvement and excellence in environmental performance:

The JV will communicate its commitment to excellence in environmental performance to its employees, contractors, government agencies and the community.

The JV will comply with host country laws and regulations, and will augment these with appropriate international guidelines and best practice environmental management.

The JV will allocate the necessary resources to ensure it meets its reclamation and environmental obligations.

The JV strives to prevent pollution of air, land and water, and will implement appropriate waste management practices.

The JV strives to be energy efficient as well as pursue for opportunities for renewable energy sources .

The JV will explore opportunities with government agencies and communities to remediate and mitigate historic mining impacts on acquired properties.

The JV will develop and utilize an Environmental Management System that ensures prioritization, planning, implementation, monitoring, review and transparent reporting.

The JV will routinely set and review environmental targets and performance for each project and report on progress to its employees, shareholders, government agencies and the community.

MINERAL PROPERTIES

The Asanko Gold Mine

The AGM is operated in a 50:50 joint venture with Gold Fields, however, all amounts and descriptions within this "Mineral Properties" section as they relate to the AGM are on a 100% basis, unless otherwise indicated.

For a complete description of the Asanko Gold Mine (the "AGM") see the report entitled "NI 43-101 Technical Report for the Asanko Gold Mine, Ashanti Region, Ghana" effective as of February 28, 2022 (the "AGM Technical Report"), prepared by Richard Miller, P.Eng., Greg Collins, MAusIMM (CP), Eric Chen, P.Geo., Alan Eslake, FAusIMM, Mario E. Rossi, FAusIMM, Malcolm Titley, MAIG and Benoni Owusu Ansah, P.E (the "QPs").

The information contained in this section has been derived from the AGM Technical Report, is subject to certain assumptions, qualifications and procedures described in the AGM Technical Report and is qualified in its entirety by the full text of the AGM Technical Report. Reference should be made to the full text of the AGM Technical Report available for viewing under the Company's profile on SEDAR at www.sedar.com.

All capitalized terms used in the summary below that are not otherwise defined shall have the meanings ascribed thereto in the AGM Technical Report.

1 PROPERTY DESCRIPTION AND LOCATION

1.1 Project Location and Area

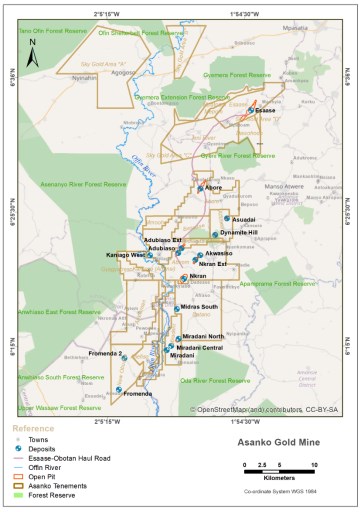

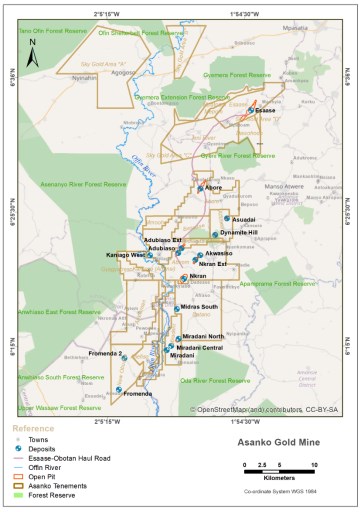

The AGM tenements are in the Amansie West and South Districts, of the Ashanti Region of Ghana, approximately 250 km NW of the capital Accra and some 50 km to 80 km south west of the regional capital Kumasi. The AGM areas are accessed from the town of Obuasi, northward towards Kumasi on the Kumasi-Dunkwa highway to the Anwiankwanta junction. The AGM is accessed by travelling 35 km south to Anwiankwanta Junction, and then west into the Project area on surfaced and un-surfaced all weather roads. The concessions cover an area of approximately 476 km2 between latitudes 6º 19'40" N and 6º 28' 40" N; and longitudes 2º 00' 55" W and 1º 55' 00" W.

Figure 1-1 Location of the AGM in Ghana, West Africa

Source: CJM, 2014

Figure 1-2 Location of the AGM Tenements

Source: Asanko Gold, 2021

The AGM concessions are owned 100% by Asanko Gold Ghana Limited ("AGGL"). The legal status of the mineral properties in Ghana in which AGGL has an interest have been verified by AGGL and by an independent legal entity, Kimathi Partners Corporate Attorneys based in Accra. As at December 31, 2021, all mineral tenements were in good standing with the Government of Ghana. Furthermore, it has been confirmed that the properties are lawfully accessible for evaluation and also mineral production.

AGGL holds 7 mining leases, 9 prospecting licences and 1 reconnaissance licence which collectively make up the AGM property and span over a 40 km length of the Asankrangwa Belt. The AGM is made up of a series of contiguous concessions in the Obotan and Esaase area. These concessions cover a total area of 476 km2.

1.2 Agreements, Royalties and Encumbrances