As filed with the Securities and Exchange Commission on December 8, 2008

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21965

Rochdale Core Alternative Strategies Fund LLC

(Exact name of registrant as specified in charter)

570 Lexington Avenue

New York, NY 10022-6837

(Address of principal executive offices) (Zip code)

Kurt Hawkesworth

570 Lexington Avenue

New York, NY 10022-6837

(Name and address of agent for service)

(800) 245-9888

Registrant's telephone number, including area code

Date of fiscal year end: March 31

Date of reporting period: September 30, 2008

Item 1. Reports to Stockholders.

Rochdale Core Alternative Strategies Fund (RCAS)

Rochdale Core Alternative Strategies Fund TEI (RCAS TEI)

Semi-Annual Report

November 28, 2008

Dear Fellow Shareholders,

We are pleased to report the results for the Rochdale Core Alternatives Strategies (RCAS) fund and the Rochdale Core Alternative Strategies Tax Exempt (RCAS TEI) fund. For the six month period ended September 30, 2008, the RCAS fund experienced a decline of -6.82%, as compared with the decline in the S&P 500 during the same period of -10.87%. The RCAS TEI fund experienced a decline of -6.80% during the six months ended September 30, 2008.

Since the inception of RCAS through September 30, 2008, the fund declined -11.53% while the S&P 500 fell -20.39%. The RCAS TEI fund experienced a decline from inception of -11.56%. While the decline in the value of the fund during this period is disappointing in absolute terms, the relative performance of RCAS is understandable when viewed in the context of the extreme, three standard deviation declines that equity markets have experienced this year.

We are living through a unique chapter in the book on US financial history that will certainly end up ignominious. The financial landscape of our banking system is being ploughed into the ground with the failure of many longstanding financial institutions. Let us hope that as bad as the bank losses become, no more major banks experience complete failure. Unfortunately, we have little confidence that this will occur.

The ineptitude, greed and arrogance of some executives in charge of our leading financial institutions has been astonishing. At a great moral and ethical cost to our country, their actions mark a sad end to a period typified by the pursuit of profitability above all else. Mainly because of the excessive- and in some cases unquantifiable- use of leverage, it was hard to predict the extent of the fallout from the mortgage loan losses that are at the center of this crisis. Nonetheless, the demise of some of the leading financial institutions in the US and abroad represents the most significant shock to the financial system in decades.

U.S. stocks, corporate and high yield bonds, as well as commodities all fell dramatically during the 6 months ended September 30, 2008. The declines in international equities

ROCHDALE INVESTMENT MANAGEMENT

570 LEXINGTON AVENUE ● NEW YORK, NEW YORK 10022-6837

TEL 800-245-9888 / 212-702-3500 ● FAX 212-702-3535

WWW.ROCHDALE.COM

November 28, 2008

Page 2

were material as well and there was no major global stock market that avoided the current bear market. In fact, we are now experiencing one of the worst globally synchronized equity market declines in a lifetime. Volatility in the stock market has been historic with drops in company share prices and yields on speculative corporate bonds reaching levels not seen in decades.

The purpose behind the formation of the RCAS fund was to create an additional diversifying element to a balanced client’s portfolio. Despite launching the RCAS fund during one of the worst bear markets in our lifetime, we are satisfied that investment objective has been met. During this very challenging period, we feel the justification for including RCAS in a portfolio has been demonstrated by offering our clients an allocation away from equities. Measured against any equity class, the decline experienced in the RCAS fund has been much less significant, and thus more beneficial, to their overall portfolio.

With a - -16.8% decline in the S&P 500, the month of October 2008 was one of the more negative ever recorded in history. In contrast, the October decline in the RCAS fund was only -3.95% and the RCAS TEI was only - -3.94%. Likewise for the calendar year the fund has delivered far better relative performance, with the S&P 500 and the RCAS fund down -32.84% and -13.38%, respectively. Such outperformance provides clear evidence of the diversifying nature of RCAS in falling equity markets.

RCAS represents a set of investing strategies that are not available using conventional stock and bond management approaches. The multiple manager approach of RCAS generates a lower level of correlation with the equity market during declining periods, yet also participates in the up market periods to generate an attractive level of risk-adjusted return over the full market cycle.

In AIG, we have a dedicated partner that we team with to manage the RCAS Fund. AIG brings extensive operational expertise in the management of hedge funds, with over 18 years of experience operating hedge fund research. Their risk management processes are well established, as is the AIG investment research team. Despite their current corporate financial difficulties, AIG continues to perform their functions for RCAS without interruption. It is important to note that the RCAS fund has no capital invested in any AIG entity. We have partnered with AIG solely for the purpose of gaining access to their world wide global hedge fund research team.

The AIG global hedge fund team provides extensive research on hundreds of hedge funds. From this research and through AIG’s institutional relationships, the RCAS fund is able to identify and gain access to leading hedge funds. This research effort is closely coordinated with Rochdale and we monitor and manage AIG. So far we have not experienced any diminution of service from AIG, and continue to view them as a strong and capable partner that delivers high quality investment research for the RCAS fund. Their research effort provides valuable and robust risk monitoring, hedge fund tracking and has demonstrated, over the first year of operation, to have completed their responsibilities up to our expectations.

November 28, 2008

Page 3

During 2008 RCAS has been severely tested. However, we have come through this extreme volatility reasonably well, delivering good relative performance to the S&P 500. We believe the qualities we have identified as essential to the success of the RCAS fund remain in place. The key benefits include:

| The ability to identify skilled hedge fund managers with the potential to provide strong risk-adjusted performance. |

| The ability to track and monitor each hedge fund in a way that manages the risks inherent in such a complex multiple manager, multiple strategy approach. |

| The skill to optimize a set of managers across various strategies to mitigate excessive volatility. |

| The knowledge to diversify appropriately to minimize manager and strategy risks. |

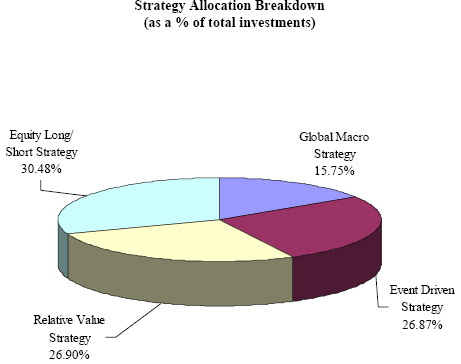

At September 30, 2008, the RCAS fund had investments in 34 managers across the four broad categories of styles. The allocation to each of these managers ranged from between 1% to 9%. The allocation to the four styles was:

| Event Driven | 25.5% |

| Equity Long / Short | 28.9% |

| Relative Value | 25.5% |

| Global Macro | 15.0% |

| Cash | 5.0% |

As we look ahead, our forecast for the economy in 2009 has continued to deteriorate. We believe the consumer is now in the midst of a 1000 day retrenchment, and that the banking industry will require all of 2009 to stabilize. Simply put, this will likely be the worst recession in decades. Indeed, the economy will do well if it is able to generate a positive GDP report by the later part of 2009, at the earliest.

The US cyclical downturn has also migrated around the globe and, for the first time in decades, all the major economies of the world are in a recession. This globally synchronized recession will reverberate back to our domestic economy with lower corporate profits for US companies, making it a strong possibility that stock prices will experience further pressure in the weeks and months ahead.

We appreciate your patience and understanding during the current downtrend in the performance of the RCAS fund. We do though believe the performance of RCAS, while negative, is achieving our objectives. When compared to the declines in the S&P 500, we think an objective assessment will indicate that RCAS has been beneficial to an equity investor’s portfolio.

November 28, 2008

Page 4

Presently there is no end in sight for this recession. We are though hopeful that the benefits of current and future monetary and fiscal policy initiatives will bring about stability to the economy by the later part of 2009. And while we do anticipate more turmoil and declines ahead for the equity and bond markets in the near to intermediate term, were this outlook to come to fruition, we believe equity markets could eventually stabilize in the first half of 2009 finally signaling the end of the bear market.

Sincerely,

Garrett R. D’Alessandro, CFA, AIF®

Chief Executive Officer & President

Rochdale Investment Management

See following page for important disclosures

November 28, 2008

Page 5

Important Disclosures

The unsubsidized total annual fund operating expense ratio for the Rochdale Core Alternative Strategies Fund and the Rochdale Core Alternative Strategies Fund TEI is 4.00% and 3.38%, respectively. Cumulative Return at POP (Public Offering Price, reflecting maximum front end sales charge of 2.00%) since inception of July 1, 2007 for the Rochdale Core Alternative Strategies Fund and the Rochdale Core Alternative Strategies Fund TEI is -13.30% and -13.33%, respectively.

Performance quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The most recent month-end performance can be obtained by calling 800-245-9888. Total returns do not reflect sales charges, which, when applied would lower returns.

An investor should consider carefully the fund’s investment objectives, risks, charges and expenses. The prospectus contains this and other important information about the investment company, and it may be obtained by calling 800-245-9888. Please read it carefully before investing. RIM Securities LLC, the affiliate

broker dealer of Rochdale Investment Management LLC 570 Lexington Avenue, New York, NY 10022.

This letter is for informational purposes only and is being furnished on a confidential basis to a limited number of investors. This letter is not an offer to sell, or a solicitation of an offer to buy any security of the Rochdale Core Alternative Strategies Fund or otherwise. Any such offering may be made only by means of a prospectus to be furnished to qualified prospective investors at a later date and any conflicting information contained herein will be superseded in its entirety by such prospectus. Investors should review the prospectus (including, without limitation, the information therein as to the conflicts and risks) prior to making an investment decision. The information contained herein is confidential and may not be reproduced in whole or part or distributed to third parties. Neither Rochdale Investment Management nor any of its affiliates, are authorized to make representations with respect to the treatment of an investment from an investor’s perspective. Investors must rely upon their own examination of the terms of any offering and upon their own representatives and professional advisors, which may include legal counsel and accountants as to the accounting and tax treatment, suitability for such investor, and the legal and other aspects of an investment in the Rochdale Core Alternative Strategies Fund.

November 28, 2008

Page 6

Investing in small and medium-size companies and REITs may carry additional risks such as limited liquidity and increased volatility. Investing in international companies carries risks such as currency fluctuation, interest rate fluctuation, regulatory risks and economic and political instability. Investing in a non-diversified fund involves greater risk than investing in a diversified fund. Short sales may increase volatility and potential for loss. Hedge fund investments are speculative and may entail substantial risks. As with all investments, there is no guarantee that investment objectives will be met.

The Standard & Poor’s (S&P) 500 Index represents 500 large U.S. companies.

Rochdale Core Alternative Strategies

Fund LLC

Financial Statements

September 30, 2008

Rochdale Core Alternative Strategies Fund LLC

Financial Statements

September 30, 2008

| TABLE OF CONTENTS | ||

| Rochdale Core Alternative Strategies Fund LLC | Page | |

| Financial Statements | ||

Statement of Assets, Liabilities and Members' Capital | 2 | |

Statement of Operations | 3 | |

Statement of Changes in Members' Capital | 4 | |

Statement of Cash Flows | 5 | |

Notes to Financial Statements | 6-11 | |

Financial Highlights | 13 | |

Additional Information | 12 | |

| Rochdale Core Alternative Strategies Master Fund LLC | ||

| Page | ||

| Financial Statements | ||

Statement of Assets, Liabilities and Members' Capital | 2 | |

Statement of Operations | 3 | |

Statement of Changes in Members' Capital | 4 | |

Statement of Cash Flows | 5 | |

Strategy Allocation Breakdown | 6 | |

Schedule of Investments | 7-8 | |

Notes to Financial Statements | 9-15 | |

Financial Highlights | 16 | |

Additional Information | 17 |

| Rochdale Core Alternative Strategies Fund LLC | ||||

| Statement of Assets, Liabilities and Members' Capital | ||||

| September 30, 2008 (Unaudited) | ||||

| ASSETS | ||||

| Investment in Rochdale Core Alternative Strategies Master Fund LLC | $ | 18,693,303 | ||

| Prepaid expenses | 15,824 | |||

| Total Assets | 18,709,127 | |||

| LIABILITIES AND MEMBERS' CAPITAL | ||||

| Liabilities | ||||

| Payable to Adviser | 30,842 | |||

| Professional fees payable | 18,140 | |||

| Investor servicing fee payable | 12,031 | |||

| Accrued expenses and other liabilities | 400 | |||

| Total Liabilities | 61,413 | |||

| Total Members' Capital | $ | 18,647,714 | ||

See accompanying notes to financial statements.

2

| Rochdale Core Alternative Strategies Fund LLC | ||||||

| Statement of Operations | ||||||

| Six Months Ended | ||||||

| September 30, 2008 (Unaudited) | ||||||

| NET INVESTMENT LOSS ALLOCATED FROM ROCHDALE | |||

| CORE ALTERNATIVE STRATEGIES MASTER FUND, LLC | |||

| Interest income | $ | 8,875 | |

| Expenses | (156,903) | ||

| Net Investment Loss Allocated | (148,028) | ||

| OPERATING EXPENSES | |||

| Administration fees | 4,105 | ||

| Registration fees | 16,411 | ||

| Professional fees | 19,657 | ||

| Investor servicing fees | 23,896 | ||

| Offering costs | 10,221 | ||

| Custody fees | 600 | ||

| Other expenses | 812 | ||

| Total Operating Expenses | 75,702 | ||

| Less expenses waived and reimbursed (Note 3) | (17,537) | ||

| Net Operating Expenses | 58,165 | ||

| Net Investment Loss | (206,193) | ||

| NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS | |||

| ALLOCATED FROM ROCHDALE CORE ALTERNATIVE STRATEGIES | |||

| MASTER FUND, LLC | |||

| Net realized loss on investments | (84,103) | ||

| Net change in unrealized appreciation/depreciation on investments | (1,057,411) | ||

| Net Realized and Unrealized Loss on Investments | (1,141,514) | ||

| Net Decrease in Members' Capital Resulting From Operations | $ | (1,347,707) | |

See accompanying notes to financial statements.

3

| Rochdale Core Alternative Strategies Fund LLC | ||||||

| Statement of Changes in Members' Capital | ||||||

| Period | ||||||||

| July 1, 2007 | ||||||||

| (Commencement of | ||||||||

| Operations) | ||||||||

| Six Months Ended | through | |||||||

9/30/2008(1) | March 31, 2008 | |||||||

| FROM OPERATIONS | ||||||||

| Net investment loss | $ | (206,193 | ) | $ | (207,973 | ) | ||

| Net realized loss on investments | (84,103 | ) | (32,237 | ) | ||||

| Net change in unrealized appreciation/depreciation on investments | (1,057,411 | ) | (540,556 | ) | ||||

| Net Decrease in Members' Capital Resulting From Operations | (1,347,707 | ) | (780,766 | ) | ||||

| INCREASE FROM TRANSACTIONS IN MEMBERS' CAPITAL | ||||||||

| Proceeds from sales of members' interests | 1,733,187 | 18,943,000 | ||||||

| Total Increase in Members' Capital | 385,480 | 18,162,234 | ||||||

| Balance at beginning of period | 18,262,234 | 100,000 | ||||||

| Balance at end of period | $ | 18,647,714 | $ | 18,262,234 | ||||

| (1) | Unaudited | ||

See accompanying notes to financial statements.

4

| Rochdale Core Alternative Strategies Fund LLC | |||||

| Statement of Cash Flows | |||||

| Six Months Ended | |||||

| September 30, 2008 (Unaudited) | |||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||

| Net decrease in members' capital resulting from operations | $ | (1,347,707 | ) | |

| Adjustments to reconcile net decrease in members' capital resulting | ||||

| from operations to net cash used in operating activities | ||||

| Net change in unrealized depreciation on investments | 1,057,411 | |||

| Realized loss on investments | 84,103 | |||

| Purchases of investments in Master Fund | (1,733,187 | ) | ||

| Net investment loss allocated from Master Fund | 148,028 | |||

| Expenses paid by the Master Fund | 56,703 | |||

| Changes in operating assets and liabilities | ||||

| Decrease in fund investments made in advance | 582,522 | |||

| Decrease in prepaid expenses | 16,929 | |||

| Decrease in payable to Adviser | (3,146 | ) | ||

| Decrease in professional fees payable | (11,271 | ) | ||

| Increase in investor servicing payable | 744 | |||

| Decrease in accrued expenses and other liabilities | (1,794 | ) | ||

| Decrease in contributions received in advance | (582,522 | ) | ||

| Net Cash Used in Operating Activities | (1,733,187 | ) | ||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||

| Capital contributions | 1,733,187 | |||

| Net Cash Provided by Financing Activities | 1,733,187 | |||

| Net Change in Cash and Cash Equivalents | - | |||

| CASH AND CASH EQUIVALENTS | ||||

| Balance at beginning of period | - | |||

| Balance at end of period | $ | - | ||

See accompanying notes to financial statements.

5

Rochdale Core Alternative

Strategies Fund LLC

Notes to Financial Statements (Unaudited)

1. Organization

Rochdale Core Alternative Strategies Fund LLC (the “Fund”) is a Delaware limited liability company registered under the Investment Company Act of 1940, as amended, as a closed-end management investment company. The Fund’s investment objective is to seek long-term growth of principal across varying market conditions with low volatility. “Low volatility” in this objective means the past monthly net asset value fluctuations of the Fund net asset value that are no greater than the rolling 10-year annualized standard deviation of the monthly ups and downs of the higher of: (1) the return of the Lehman Brothers Aggregate Bond Index plus 3% or (2) half of the return of the Standard & Poor’s 500-stock Index. The Fund commenced investment operations on July 1, 2007.

The Fund invests substantially all of its investable assets in Rochdale Core Alternative Strategies Master Fund LLC (the “Master Fund”), a registered investment company with the same investment objective as the Fund. Rochdale Investment Management LLC (the “Manager”, "Adviser" or “Rochdale”) is the investment adviser to the Master Fund. The Manager is also the adviser to Rochdale Core Strategies Fund TEI, LLC, which also invests all of its investable assets with the Master Fund. The Manager delegates sub-investment advisory responsibilities to AIG Global Investment Corp. (the “Sub-Adviser”) with respect to the Master Fund.

The financial statements of the Master Fund are included elsewhere in this report and should be read in conjunction with the Fund’s financial statements. At September 30, 2008, the Fund's beneficial ownership of the Master Fund's net assets was 35.31%.

The Fund reserves the right to reject any subscriptions for Interests in the Fund. Generally, initial and additional subscriptions for investment (or "Member Interests") in the Fund by eligible members may be accepted at such times as the Fund may determine.

Each member must be a qualified investor and subscribe for a minimum initial investment in the Fund of $25,000. Additional investments in the Fund must be made in a minimum amount of $10,000. Brokers selling the Fund may establish higher minimum investment requirements than the Fund. The Fund from time to time may offer to repurchase members' interest in the Fund at such times and on such terms as may be determined by the Fund's Board in its complete and absolute discretion. Fund interests must be held for 12 months to be eligible for repurchase on a semi-annual basis.

6

Rochdale Core Alternative

Strategies Fund LLC

Notes to Financial Statements (Unaudited)

2. Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Fund. These policies are in conformity with accounting principles generally accepted in the United States of America and are consistently followed by the Fund.

Portfolio Valuation

The net asset value of the Fund is determined as of the close of business at the end of each month. The net asset value of the Fund equals the value of the assets of the Fund, respectively, less liabilities, including accrued fees and expenses.

The Fund's investment in the Master Fund represents substantially all of the Fund's assets. All investments owned are carried at fair value which is the portion of the net asset value of the Master Fund held by the Fund.

The accounting for and valuation of investments by the Master Fund is discussed in the notes to the financial statements for the Master Fund, which are an intergral part of these financial statements.

In September 2006, FASB issued Statement on Financial Accounting Standards (SFAS) No. 157, "Fair Value Measurements." This standard establishes a single authoritative definition of fair value, sets out a framework measuring fair value and requires additional disclosures about fair value measurements. SFAS No. 157 applies to fair value measurements already required or permitted by existing standards. SFAS No. 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. The changes to current generally accepted accounting principles from the application of this statement relate to the definition of fair value, the methods used to measure fair value, and the expanded disclosures about fair value measurements. Management has determined that SFAS No. 157 had no material impact on the Funds’ financial statements. Please refer to the Schedule of Investments in the Master Fund for SFAS No. 157 disclosures.

In March 2008, Statement of Financial Accounting Standards No. 161, "Disclosures about Derivative Instruments and Hedging Activities" ("SFAS 161") was issued and is effective for fiscal years beginning after November 15, 2008. SFAS 161 is intended to improve financial reporting for derivative instruments by requiring enhanced disclosure that enables investors to understand how and why an entity uses derivatives, how derivatives are accounted for, and how derivative instruments affect an entity's results of operations and financial position. Management is currently evaluating the implications of SFAS 161.

7

Rochdale Core Alternative

Strategies Fund LLC

Notes to Financial Statements (Unaudited)

2. Significant Accounting Policies (continued)

Income Recognition and Security Transactions

Interest income is recorded on an accrual basis. Investments are recorded on the effective date of the subscription in the Master Fund. The Fund, as an investor in the Master Fund, recognizes its share of the income, realized and unrealized gains and losses of the Master Fund.

Organization Expenses

Expenses incurred by the Fund in connection with the organization were expensed as incurred. The Manager has agreed to reimburse the Master Fund for these expenses, subject to potential recovery, see Note 3. All reimbursements are recorded by the Fund through an allocation from the Master Fund. Also reflected in the Fund’s organizational expenses were its pro-rata share of the expenses incurred in connection with the organization of the Master Fund.

Fund Expenses

The expenses of the Fund include, but are not limited to, the following: legal fees; accounting and auditing fees; custodial fees; costs of computing the Fund's net asset value; costs of insurance; registration expenses; expenses of meetings of the Board and members; all costs with respect to communications to members; and other types of expenses as may be approved from time to time by the Board. The Fund, as an investor in the Master Fund, recognizes its share of the fees and expenses of the Master Fund.

Income Taxes

The Fund's tax year end is December 31st. The Fund intends to be treated as a partnership for Federal income tax purposes, whereby each member is responsible for the tax liability or benefit relating to such member’s distributive share of taxable income or loss. Accordingly, no provision for Federal income taxes is reflected in the accompanying financial statements.

8

Rochdale Core Alternative

Strategies Fund LLC

Notes to Financial Statements (Unaudited)

2. Significant Accounting Policies (continued)

Income Taxes (continued)

Effective September 30, 2007, the Fund adopted Financial Accounting Standards Board (FASB) Interpretation No. 48 (FIN 48), “Accounting for Uncertainty in Income Taxes.” FIN 48 requires the evaluation of tax positions taken on previously filed tax returns or expected to be taken on future returns. These positions must meet a “more likely than not” standard that, based on the technical merits, have a more than fifty percent likelihood of being sustained upon examination.

The Fund has reviewed the current tax year and major jurisdictions and concluded that the adoption of FIN 48 resulted in no effect to the Fund’s financial position or results of operations. There is no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken on the tax return for the year-end December 31, 2007. The Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change during the year ending December 31, 2008.

Distribution Policy

The Fund has no present intention of making periodic distributions of its net investment income or capital gains, if any, to members. The amount and frequency of distributions, if any, will be at the sole discretion of the Board.

Deferred Offering Costs

Offering Costs will be charged to members’ capital in proportion to the value of respective member interests sold during the offering period.

Capital Accounts

The initial seeding of the Fund occurred on January 30, 2007. The financial statements presented "Net Asset Value per Unit" amounts to reflect the seed money contributed. At July 1, 2007, the Commencement of Operations, the Fund revised the presentation to show only the total balances of membership interests for all members ("Members' Interests"). Net profits or net losses of the Fund for each month will be allocated to the capital accounts of members as of the last day of each month in accordance with each members' respective investment percentage in the Fund. Net profits or net losses will be measured as the net change in the value of the net assets of the Fund during each month, before giving effect to any repurchases of interest in the Fund, and excluding the amount of any items to be allocated to the capital accounts of the members of the Fund, other than in accordance with the members' respective investment percentages.

9

Rochdale Core Alternative

Strategies Fund LLC

Notes to Financial Statements (Unaudited)

2. Significant Accounting Policies (continued)

Capital Accounts (continued)

Prior to the end of each quarter and year end, the Fund receives member contributions with an effective subscription date of first day of the following month. These contributions are held by the Master Fund and have an effective investment date of first day of the following month. The Master Fund, in turn, makes contributions to certain Investment Funds, which have effective subscription dates of first day of the following month. These amounts are reported as "Contributions received in advance" and "Investments made in advance", respectively.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of expenses during the reporting period. Actual results could differ from those estimates.

3. Commitments and Other Related Party Transactions

The Manager has contractually agreed to waive and/or reimburse the expenses of the Fund and the Master Fund, to the extent needed to limit their combined annual operating expenses to 2.25% of net assets. To the extent that the Manager reimburses or absorbs fees and expenses, it may seek payment of such amounts for three years after the year in which the expenses were reimbursed or absorbed. The Fund will make no such payment, however, if its total annual operating expenses exceed the expense limits in effect at the time the expenses are to be reimbursed or at the time these payments are proposed. For the six months ended September 30, 2008, the Manager waived $17,537 of fees and expenses, which may be recouped by the Manager no later than March 31, 2012.

At September 30, 2008, the Advisor may recapture a portion of the below amounts no later than the dates as stated below:

| March 31, | |||

Fund | 2011 | 2012 | |

| Rochdale Core Alternative Strategies Fund LLC | $122,293 | $17,537 | |

4. Investor Servicing Fees

The Fund will pay a fee to RIM Securities, LLC, an affiliate of the Manager, as Distributor, to reimburse it for payments made to broker-dealers and certain financial advisers (“Investor Service Providers”) that have agreed to provide ongoing investor services to investors in the Fund that are their customers. This fee will be paid quarterly and will

10

Rochdale Core Alternative

Strategies Fund LLC

Notes to Financial Statements (Unaudited)

4. Investor Servicing Fees (continued)

be in an amount, with respect to each Investor Service Provider, not to exceed the lesser of: (i) 0.25% (on an annualized basis) of the aggregate value of outstanding member interests held by investors that receive services from the Investment Service Provider, determined as of the last day of the calendar month (before any repurchase of member interests); or (ii) the Distributor’s actual payments to the Investment Service Provider.

5. Concentration and Liquidity Risks

The Master Fund invests primarily in Alternative Investment Funds that are illiquid securities and not registered under the 1940 Act. Such Alternative Investment Funds invest in actively traded securities, illiquid securities, derivatives and other financial instruments using several investment strategies and investment techniques, including leverage, which may involve significant risks. The Master Fund's concentration and liquidity risks are discussed in the notes to the Master Fund's financial statements which are attached elsewhere in this report and are an integral part of these financial statements.

6. Financial Instruments With Off-Balance Sheet Risk

In the normal course of business, the Investment Funds in which the Master Fund invests trade various derivatives and financial instruments and enter into various investment activities with off balance sheet risk. The Master Fund's off balance sheet risk in these financial instruments is discussed in the notes to the Master Fund's financial statements which are attached elsewhere in this report and are an integral part of these financial statements.

7. Investment Transactions

For the six months ended September 30, 2008, the Fund's assets were invested in the Master Fund and the Fund made aggregate purchases of $1,983,187 and aggregate sales of $250,000 in the Master Fund.

11

| Rochdale Core Alternative Strategies Fund LLC | |||||||||

| Financial Highlights | |||||||||

| Period | |||||||||

| July 1, 2007 | |||||||||

| (Commencement | |||||||||

| of | |||||||||

| Six Months | Operations) | ||||||||

| Ended | through | ||||||||

9/30/2008(1) | March 31, 2008 | ||||||||

| TOTAL RETURN | |||||||||

| Total Return before incentive fee | (6.82) | % | (5.05) | % | |||||

| Incentive fee | 0.00 | % | 0.00 | % | |||||

| Total Return after incentive fee | (6.82) | % | (5.05) | % | |||||

| RATIOS/SUPPLEMENTAL DATA | |||||||||

| Net Assets, end of period (000's) | $ | 18,648 | $ | 18,262 | |||||

| Portfolio Turnover | 3.46 | % | 1.39 | % | |||||

| RATIO OF NET INVESTMENT LOSS TO AVERAGE NET ASSETS | |||||||||

| Net investment loss, before waivers and reimbursements | (2.34) | % | (2.86) | % | |||||

| Net investment loss, after waivers and reimbursements | (2.16) | % | (1.80) | % | |||||

| RATIO OF EXPENSES TO AVERAGE NET ASSETS, BEFORE | |||||||||

| INCENTIVE FEE | |||||||||

| Operating expenses, before waivers and reimbursements | 2.43 | % | 3.31 | % | |||||

| Operating expenses, after waivers and reimbursements | 2.25 | % | 2.25 | % | |||||

| RATIO OF EXPENSES TO AVERAGE NET ASSETS, NET OF WAIVERS | |||||||||

| AND REIMBURSEMENTS AFTER INCENTIVE FEE | |||||||||

| Operating expenses, after waivers and reimbursements | 2.25 | % | 2.25 | % | |||||

| Incentive fee | 0.00 | % | 0.00 | % | |||||

| Total Operating expenses, after waivers and reimbursements after incentive fee | 2.25 | % | 2.25 | % | |||||

| (1) | Unaudited | ||||||||

| The Fund commenced investment operations on July 1, 2007. Total return is calculated for all members taken as a whole and an individual member's return may vary from these Fund returns based on the timing of capital transactions. Total return before and after incentive fee are not annualized for the periods shown above. | |||||||||

| Portfolio turnover represents the Master Fund's portfolio turnover for the periods shown above. The Ratios of net investment loss to average net assets and ratios of expenses to average net assets are annualized. The ratios of expenses to average net assets do not include expenses of the Investment Funds in which the Master Fund invests. | |||||||||

| The expense ratios are calculated for all members taken as a whole. The computation of such ratios based on the amount of expenses assessed to an individual member's capital may vary from these ratios based on the timing of capital transactions. | |||||||||

12

Rochdale Core Alternative

Strategies Fund LLC

Additional Information

Proxy Voting Policies and Procedures

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, will be available (i) without charge, upon request, by calling 1-800-245-9888; and (ii) on the SEC’s website at www.sec.gov.

Portfolio Holding Disclosure

The Fund will file its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q will be available on the SEC’s website at www.sec.gov, and may also be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-732-0330.

13

Rochdale Core Alternative Strategies

Master Fund LLC

Financial Statements

September 30, 2008

Rochdale Core Alternative Strategies

Master Fund LLC

Financial Statements

September 30, 2008

| TABLE OF CONTENTS | ||

| Page | ||

| Financial Statements | ||

Statement of Assets, Liabilities and Members' Capital | 2 | |

Statement of Operations | 3 | |

Statement of Changes in Members' Capital | 4 | |

Statement of Cash Flows | 5 | |

Strategy Allocation Breakdown | 6 | |

Schedule of Investments | 7-8 | |

Notes to Financial Statements | 9-15 | |

Financial Highlights | 16 | |

Additional Information | 17 |

| Rochdale Core Alternative Strategies Master Fund LLC | ||||

| Statement of Assets, Liabilities and Members' Capital | ||||

| September 30, 2008 (Unaudited) | ||||

| ASSETS | ||||

| Investments, at fair value (cost $54,905,000) | $ | 50,347,869 | ||

| Cash | 3,192,002 | |||

| Interest receivable | 5,133 | |||

| Prepaid Expenses | 2,657 | |||

| Total Assets | 53,547,661 | |||

| LIABILITIES AND MEMBERS' CAPITAL | ||||

| Liabilities | ||||

| Management fees payable | 114,860 | |||

| Contributions received in advance | 400,000 | |||

| Accrued professional fees payable | 42,931 | |||

| Accrued expenses and other liabilities | 52,838 | |||

| Total Liabilities | 610,629 | |||

| Total Members' Capital | $ | 52,937,032 | ||

See accompanying notes to financial statements.

2

| Rochdale Core Alternative Strategies Master Fund LLC | ||||||

| Statement of Operations | ||||||

| Six Months Ended | ||||||

| September 30, 2008 (Unaudited) | ||||||

| INVESTMENT INCOME | |||

| Interest income | $ | 24,757 | |

| EXPENSES | |||

| Management fees | 334,213 | ||

| Professional fees | 34,375 | ||

| Administration fees | 51,098 | ||

| Directors' fees | 9,070 | ||

| Custody fees | 2,888 | ||

| Other expenses | 6,041 | ||

| Total Expenses | 437,685 | ||

| Net Investment Loss | (412,928) | ||

| REALIZED AND UNREALIZED LOSS | |||

| ON INVESTMENTS | |||

| Net realized loss from investment transactions | (229,961) | ||

| Net change in unrealized appreciation/depreciation of investments | (3,018,666) | ||

| Net Realized and Unrealized Loss from Investments | (3,248,627) | ||

| Net Decrease in Members' Capital Resulting from Operations | $ | (3,661,555) |

See accompanying notes to financial statements.

3

| Rochdale Core Alternative Strategies Master Fund LLC |

Statement of Changes in Members' Capital |

| Period | |||||||||

| July 1, 2007 | |||||||||

| (Commencement of | |||||||||

| Operations) | |||||||||

| Six Months Ended | through | ||||||||

9/30/2008(1) | March 31, 2008 | ||||||||

| FROM OPERATIONS | |||||||||

| Net investment loss | $ | (412,928 | ) | $ | (503,316 | ) | |||

| Net realized loss on investments | (229,961 | ) | (86,230 | ) | |||||

| Net change in unrealized appreciation/depreciation on investments | (3,018,666 | ) | (1,538,464 | ) | |||||

| Net Decrease in Members' Capital Resulting From Operations | (3,661,555 | ) | (2,128,010 | ) | |||||

| INCREASE FROM TRANSACTIONS IN MEMBERS' CAPITAL | |||||||||

| Proceeds from sales of members' interests | 7,650,625 | 50,875,972 | |||||||

| Total Increase in Members' Capital | 3,989,070 | 48,747,962 | |||||||

| Balance at beginning of period | 48,947,962 | 200,000 | |||||||

| Balance at end of period | $ | 52,937,032 | $ | 48,947,962 | |||||

(1) Unaudited | |||||||||

See accompanying notes to financial statements.

4

| Rochdale Core Alternative Strategies Master Fund LLC | |||||

| Statement of Cash Flows | |||||

| Six Months Ended | |||||

| September 30, 2008 (Unaudited) | |||||

| CASH FLOW FROM OPERATING ACTIVITIES | ||||

| Net decrease in members' capital resulting from operations | $ | (3,661,555 | ) | |

| Adjustments to reconcile net decrease in members' capital | ||||

| resulting from operations to net cash used in operating activities | ||||

| Purchases of investments | (9,250,000 | ) | ||

| Sales of investments | 1,758,810 | |||

| Net change in unrealized depreciation on investments | 3,018,666 | |||

| Net realized loss from investments | 229,961 | |||

| Change in Operating Assets and Liabilities | ||||

| Decrease in fund investments made in advance | 4,000,000 | |||

| Increase in prepaid expenses | (2,657 | ) | ||

| Decrease in interest receivable | 785 | |||

| Increase in management fees payable | 13,876 | |||

| Decrease in contributions received in advance | (1,529,522 | ) | ||

| Decrease in professional fees payable | (25,958 | ) | ||

| Increase in accrued expense and other liabilities | 11,999 | |||

| Net Cash Used in Operating Activities | (5,435,595 | ) | ||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||

| Capital contributions | 7,650,625 | |||

| Net Cash Provided by Financing Activities | 7,650,625 | |||

| Net Change in Cash and Cash Equivalents | 2,215,030 | |||

| CASH AND CASH EQUIVALENTS | ||||

| Beginning of period | 976,972 | |||

| End of period | $ | 3,192,002 | ||

See accompanying notes to financial statements.

5

ROCHDALE CORE ALTERNATIVE STRATEGIES MASTER FUND LLC

See accompanying notes to financial statements.

6

| Rochdale Core Alternative Strategies Master Fund LLC | ||||||||||

| Schedule of Investments | ||||||||||

| September 30, 2008 (Unaudited) | ||||||||||

| Percentage of | Redemptions | ||||||||||||

| Investment Funds: | Members' Capital | Cost | Fair Value | Permitted | |||||||||

Controlled Risk/Relative Value: | |||||||||||||

| Blackthorn Partners, LP | 3.76 | $ | 2,000,000 | $ | 1,991,769 | Quarterly | |||||||

| FrontPoint Utility and Energy Fund, L.P. | 2.54 | 1,500,000 | 1,345,479 | Quarterly | |||||||||

| Ionic Capital LLC | 3.97 | 2,000,000 | 2,102,748 | Quarterly | |||||||||

| Loomis Sayles Consumer Discretionary Hedge Fund, L.P. | 2.30 | 1,350,000 | 1,215,103 | Monthly | |||||||||

| Menta Global, LP | 1.59 | 1,000,000 | 840,599 | Monthly | |||||||||

| Polygon Global Opportunities Fund LP | 2.99 | 2,200,000 | 1,583,510 | Semi-Annual | |||||||||

| Stark Investments Limited Partnership | 4.10 | 2,550,000 | 2,169,243 | Annual | |||||||||

| SuttonBrook Capital Partners LP | 4.33 | 2,450,000 | 2,293,780 | Quarterly | |||||||||

| 25.58 | 15,050,000 | 13,542,231 | |||||||||||

| Equity (Long/Short): | |||||||||||||

| AlphaGen RhoCas Fund Ltd. | 2.60 | 1,750,000 | 1,376,107 | Monthly | |||||||||

| Andor Global Fund, LP | 1.88 | 1,000,000 | 995,996 | Quarterly | |||||||||

| Clovis Capital Partners Institutional, L.P. | 3.55 | 2,075,000 | 1,879,023 | Quarterly | |||||||||

| Galleon Diversified Fund, Ltd. | 3.71 | 2,075,000 | 1,963,374 | Quarterly | |||||||||

| Hunter Global Investors Fund I, L.P. | 3.82 | 2,075,000 | 2,020,911 | Quarterly | |||||||||

| Loch Capital Fund I LP | 3.26 | 1,610,000 | 1,724,886 | Quarterly | |||||||||

| Peconic Triumph Fund II | 2.48 | 1,250,000 | 1,314,463 | Quarterly | |||||||||

| Seligman Health Spectrum Plus Fund LLC | 3.41 | 1,750,000 | 1,802,173 | Quarterly | |||||||||

| SLS Investors, L.P. | 2.43 | 1,825,000 | 1,287,954 | Quarterly | |||||||||

| Tantallon Fund, L.P. | 1.85 | 1,360,000 | 980,200 | Monthly | |||||||||

| 28.99 | 16,770,000 | 15,345,087 | |||||||||||

| Event Driven: | |||||||||||||

| Bennelong Asia Pacific Multi Strategy Equity Fund, LP | 2.74 | 1,400,000 | 1,450,139 | Monthly | |||||||||

| Brencourt Multi Strategy, L.P. | 3.55 | 2,225,000 | 1,875,818 | Quarterly | |||||||||

| Brigade Leveraged Capital Structures Fund LP | 4.17 | 2,300,000 | 2,205,025 | Quarterly | |||||||||

| Castlerigg Partners LP | 3.51 | 2,225,000 | 1,859,127 | Quarterly | |||||||||

| GoldenTree High Yield Partners, LP | 3.59 | 2,150,000 | 1,901,448 | Quarterly | |||||||||

| King Street Capital, L.P. | 4.84 | 2,475,000 | 2,562,706 | Quarterly | |||||||||

| Satellite Fund II, L.P. | 3.16 | 2,050,000 | 1,673,851 | Annual | |||||||||

| 25.56 | 14,825,000 | 13,528,114 | |||||||||||

| Macro: | |||||||||||||

| ARCIM Commodity Fund, LP | 1.47 | 750,000 | 775,251 | Quarterly | |||||||||

| Auriel Global Macro Fund L.P. | 0.95 | 750,000 | 503,436 | Monthly | |||||||||

| Camcap Resources LP | 1.02 | 750,000 | 541,404 | Quarterly | |||||||||

| Caxton Global Investments (USA) LLC | 2.70 | 1,400,000 | 1,431,486 | Annual | |||||||||

| Dynamic Domestic Fund, LP | 1.40 | 750,000 | 740,653 | Monthly | |||||||||

| Episode, L.P. | 1.61 | 1,000,000 | 853,388 | Monthly | |||||||||

| Grinham Diversified Fund (US) LP | 1.46 | 750,000 | 775,171 | Monthly | |||||||||

| Robeco Transtrend Diversified Fund LLC | 1.96 | 1,000,000 | 1,036,239 | Monthly | |||||||||

| Sunrise Commodities Fund LP | 2.41 | 1,110,000 | 1,275,409 | Monthly | |||||||||

| 14.98 | 8,260,000 | 7,932,437 | |||||||||||

| Total Investments | 95.11 | $ | 54,905,000 | $ | 50,347,869 | ||||||||

| Redemption restrictions exist for Investment Funds whereby the Investment Managers may suspend redemption either in their sole discretion or other factors. Such factors include the magnitude of redemptions requested, portfolio valuations issues or market conditions. Redemptions are currently suspended for Polygon Global Opportunities Fund as it is liquidated. | |||||||||||||

See accompanying notes to financial statements.

7

Rochdale Core Alternative Strategies Master Fund LLC

FAS 157 - Summary of Fair Value Exposure

September 30, 2008

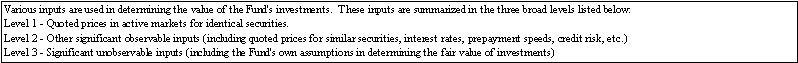

| The Fund adopted the provisions of Statement of Financial Accounting Standards No. 157, "Fair Value Measurements" (SFAS 157), effective with the beginning of the Fund's fiscal | |||||||

| year. SFAS 157 establishes a hierarchy that prioritizes the inputs to valuation techniques giving the highest priority to readily available unadjusted quoted prices in active markets for | |||||||

| identical assets (level 1 measurements) and the lowest priority to unobservable inputs (level 3 measurements) when market prices are not readily available or reliable. |

| The following is a summary of the inputs used to value the Fund's net assets as of September 30, 2008: | |||||||

| Description | Investments in Securities | Other Financial Instruments * | |||||

| Level 1 - Quoted prices | $ - | $ - | |||||

| Level 2 - Other significant observable inputs | - | - | |||||

| Level 3 - Significant unobservable inputs | 50,347,869 | - | |||||

| Total | $ 50,347,869 | $ - | |||||

| Following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value. | |||||||

Investments in Securities | Other Financial Instruments | ||||||

| Balance as of 3/31/08 | $ 46,105,306 | $ - | |||||

| Accrued discounts / premiums | - | - | |||||

| Realized gain (loss) | (229,961) | - | |||||

| Change in unrealized appreciation (depreciation) | (3,018,666) | - | |||||

| Net purchases (sales/paydowns) | 7,491,190 | - | |||||

| Transfers in and / or out of Level 3 * | - | - | |||||

| Balance as of 09/30/08 | $ 50,347,869 | $ - | |||||

| * The information used in the above reconciliation represents fiscal year to date activity for any Investment Securities identified as using Level 3 inputs at either the beginning | |||||||

| or end of the current fiscal period. Transfers in or out of Level 3 represents either the beginning value (for transfers in) or ending value (for transfers out) of any Security or | |||||||

| Instrument where a change in the pricing level occurred from the beginning to the end of the period. | |||||||

See accompanying notes to financial statements.

8

Rochdale Core Alternative Strategies

Master Fund LLC

Notes to Financial Statements (Unaudited)

1. Organization

Rochdale Core Alternative Strategies Master Fund LLC (the "Master Fund") is a closed-end, non-diversified management investment company that was organized as a limited liability company under the laws of the State of Delaware on September 11, 2006 and serves as a master fund in a master feeder structure. Interests in the Master Fund are issued solely in private placement transactions that do not involve any "public offering" within the meaning of Section 4(2) of the Securities Act of 1933, as amended (the "1933 Act"). Investments in the Master Fund may be made only by U.S. and foreign investment companies, common or commingled trust funds, organizations or trusts described in Sections 401(a) or 501(a) of the Internal Revenue Code of 1986, as amended, or similar organizations or entities that are "accredited investors" within the meaning of Regulation D under the 1933 Act. The Master Fund is a registered investment company under the Investment Company Act of 1940.

Rochdale Investment Management LLC (the “Manager”, "Adviser" or “Rochdale”) is the investment adviser to the Master Fund. The Manager delegates sub-investment advisory responsibilities to AIG Global Investment Corp. (the “Sub-Adviser”) with respect to the Master Fund.

The Master Fund seeks to achieve its objective by investing substantially all of its assets in the securities of privately placed investment vehicles, typically referred to as hedge funds (“Hedge Funds" or "Investment Funds”), that pursue a variety of “absolute return” investment strategies. “Absolute return” refers to a broad class of investment strategies that attempt to consistently generate positive returns regardless of market conditions.

The Fund’s investment objective is to seek long-term growth of principal across varying market conditions with low volatility. “Low volatility” in this objective means the past monthly net asset value fluctuations of the Fund net asset value that is no greater than the rolling 10-year annualized standard deviation of the monthly ups and downs of the higher of: (1) the return of the Lehman Brothers Aggregate Bond Index plus 3% or (2) half of the return of the Standard & Poor’s 500-stock Index. Fund investments generally fall within the following broadly defined investment fund strategies: equity, event driven, macro and controlled risk/relative value.

2. Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Master Fund. These policies are in conformity with accounting principles generally accepted in the United States of America.

9

Rochdale Core Alternative Strategies

Master Fund LLC

Notes to Financial Statements (Unaudited)

2. Significant Accounting Policies (continued)

Portfolio Valuation

The net asset value of the Master Fund is determined as of the close of business at the end of each month in accordance with the valuation principles set forth below or as may be determined from time to time pursuant to policies established by the Board.

The net asset value of the Master Fund equals the value of the Master Fund's assets less the Master Fund's liabilities, including accrued fees and expenses. The Master Fund's investments are considered to be illiquid and can only be redeemed periodically. The Board has approved procedures pursuant to which the Master Fund values its investments at fair value.

In accordance with these procedures, the fair value of investments, as of each month-end ordinarily is the value determined as of such month-end for each Investment Fund in accordance with each Investment Fund's valuation policies and reported at the time of the Master Fund's valuation.

As a general matter, the fair value of the Master Fund's interest in an Investment Fund will represent the amount that the Master Fund could reasonably expect to receive from an Investment Fund if the Master Fund's ownership interest was redeemed at the time of valuation, based on information reasonably available at the time the valuation is made and that the Master Fund believes to be reliable. In the event that an Investment Fund does not report a month-end value to the Master Fund on a timely basis, or the Adviser concludes that the value provided by the Investment Fund does not represent the fair value of the Master Fund's interests in the Investment Fund, the Master Fund would determine the fair value of such Investment Fund based on the most recent value reported by the Investment Fund, as well as any other relevant information available at such time.

Considerable judgment is required to interpret the factors used to develop estimates of fair value. Accordingly, the estimates may not be indicative of the amounts the Master Fund could realize in a current market exchange and the differences could be material to the financial statements. The use of different factors or estimation methodologies could have a significant effect on the estimated fair value. The values assigned to these investments are based on available information and do not necessarily represent amounts that might ultimately be realized, as such amounts depend on future circumstances and cannot reasonably be determined until the individual investments are actually liquidated.

10

Rochdale Core Alternative Strategies

Master Fund LLC

Notes to Financial Statements (Unaudited)

2. Significant Accounting Policies (continued)

Portfolio Valuation (continued)

In September 2006, FASB issued Statement on Financial Accounting Standards (SFAS) No. 157, "Fair Value Measurements." This standard establishes a single authoritative definition of fair value, sets out a framework measuring fair value and requires additional disclosures about fair value measurements. SFAS No. 157 applies to fair value measurements already required or permitted by existing standards. SFAS No. 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. The changes to current generally accepted accounting principles from the application of this Statement relate to the definition of fair value, the methods used to measure fair value, and the expanded disclosures about fair value measurements. Management has determined that SFAS No. 157 had no material impact on the Funds’ financial statements.

In March 2008, Statement of Financial Accounting Standards No. 161, "Disclosures about Derivative Instruments and Hedging Activities" ("SFAS 161") was issued and is effective for fiscal years beginning after November 15, 2008. SFAS 161 is intended to improve financial reporting for derivative instruments by requiring enhanced disclosure that enables investors to understand how and why an entity uses derivatives, how derivatives are accounted for, and how derivative instruments affect an entity's results of operations and financial position. Management is currently evaluating the implications of SFAS 161.

Income Recognition and Security Transactions

Interest income is recorded on an accrual basis. Dividend income is recorded on the ex-dividend date. Realized gains and losses from Investment Fund transactions are calculated on the identified cost basis. Investments are recorded on the effective date of the subscription in the Investment Fund.

Organization Expenses

Expenses incurred by the Master Fund in connection with the organization were expensed as incurred.

11

Rochdale Core Alternative Strategies

Master Fund LLC

Notes to Financial Statements (Unaudited)

2. Significant Accounting Policies (continued)

Fund Expenses

The expenses of the Master Fund include, but are not limited to, the following: legal fees; accounting and auditing fees; custodial fees; costs of computing the Master Fund's net asset value; costs of insurance; registration expenses; due diligence, including travel and related expenses; expenses of meetings of the Board and members; all costs with respect to communications to members; and other types of expenses as may be approved from time to time by the Board.

Income Taxes

The Fund tax year end is December 31. The Master Fund intends to be treated as a partnership for Federal income tax purposes. Each member is responsible for the tax liability or benefit relating to such member’s distributive share of taxable income or loss. Accordingly, no provision for Federal income taxes is reflected in the accompanying financial statements.

Effective September 30, 2007, the Master Fund adopted Financial Accounting Standards Board (FASB) Interpretation No. 48 (FIN 48), “Accounting for Uncertainty in Income Taxes”. FIN 48 requires the evaluation of tax positions taken on previously filed tax returns or expected to be taken on future returns. These positions must meet a “more likely than not” standard that, based on the technical merits, have a more than fifty percent likelihood of being sustained upon examination.

The Master Fund has reviewed the current tax year and major jurisdictions and concluded that the adoption of FIN 48 resulted in no effect to the Fund’s financial position or results of operations. There is no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken on the tax return for the year-end December 31, 2007. The Master Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change during the tax year ending December 31, 2008.

Deferred Offering Costs

Offering Costs will be charged to members’ capital in proportion to the respective value of member's interest sold during the offering period.

12

Rochdale Core Alternative Strategies

Master Fund LLC

Notes to Financial Statements (Unaudited)

2. Significant Accounting Policies (continued)

Capital Accounts

The initial seeding of the Fund occurred on January 30, 2007. The financial statements presented "Net Asset Value per Unit" amounts to reflect the seed money contributed. At July 1, 2007, the Commencement of Operations, the Fund revised the presentation to show only the total balances of membership interests for all members ("Members' Interests"). Net profits or net losses of the Master Fund for each month will be allocated to the capital accounts of members as of the last day of each month in accordance with members' respective investment percentages of the Master Fund. Net profits or net losses will be measured as the net change in the value of the net assets of the Master Fund during a fiscal period, before giving effect to any repurchases of interest in the Master Fund, and excluding the amount of any items to be allocated to the capital accounts of the members of the Master Fund, other than in accordance with the members' respective investment percentages.

Prior to the end of each quarter and year end, the Master Fund receives member contributions with an effective subscription date of first day of the following month. The Master Fund, in turn, makes contributions to certain Investment Funds, which have effective subscription dates of first day of the following month. These amounts are reported as "Contributions received in advance" and "Investments made in advance", respectively.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of expenses during the reporting period. Actual results could differ from those estimates.

3. Commitments and Other Related Party Transactions

Management and Incentive Fees

Under the supervision of the Master Fund’s Board and pursuant to an investment management agreement (“Investment Management Agreement”), Rochdale Investment Management LLC, an investment adviser registered under the Investment Advisers Act of 1940, as amended, serves as the Manager for the Master Fund. The Manager is authorized, subject to the approval of the Master Fund’s Board, to retain one or more other organizations, including its affiliates, to provide any or all of the services required to be provided by the Manager to the Master Fund or to assist in providing these services.

13

Rochdale Core Alternative Strategies

Master Fund LLC

Notes to Financial Statements (Unaudited)

3. Commitments and Other Related Party Transactions (continued)

Management and Incentive Fees (continued)

The Manager entered into a sub-investment management agreement with AIG Global Investment Corp. (the “Sub-Adviser”). The Sub-Adviser has investment discretion to manage the assets of the Master Fund and is responsible for identifying prospective Hedge Funds, performing due diligence and review of those Hedge Funds and their Hedge Fund Managers, selecting Hedge Funds, allocating and reallocating the Master Fund’s assets among Hedge Funds, and providing risk management services, subject to the general supervision of the Manager.

The investment management fee is shared by the Manager and the Sub-Adviser. The Master Fund will pay the Manager an investment management fee at an annual rate equal to 1.25% of the Master Fund’s month-end net assets, including assets attributable to the Manager (or its affiliates) and before giving effect to any repurchases by the Master Fund of member interests. The investment management fee will accrue monthly and will be payable at the end of each quarter. The investment management fee will be paid to the Manager out of the Master Fund’s assets. The Manager will pay a fee to the Sub-Adviser at a rate equal to 60% of the amount of the fee earned by the Manager pursuant to the Investment Management Agreement.

The Sub-Adviser is entitled to receive a performance-based incentive fee equal to 10% of the net profits(taking into account net realized and unrealized gains or losses and net investment income or loss), if any, in excess of the non-cumulative “Preferred Return,” subject to reduction of that excess for prior losses that have not been previously offset against net profits (the “Incentive Fee”). The Incentive Fee will be accrued monthly and is generally payable annually. The Preferred Return is an annual return equal to the 3-year Treasury constant maturity rate as reported by the Board of Governors of the Federal Reserve System as of the last business day of the prior calendar year plus 2%.

Expense Reimbursement

The Manager has contractually agreed to waive and/or reimburse the Master Fund’s expenses to the extent needed to limit the Master Fund’s annual operating expenses combined with the annual operating expenses of Rochdale Core Alternative Strategies Fund LLC or Rochdale Core Alternative Strategies Fund TEI LLC (the “Feeder Funds”) to 2.25% of net assets for each feeder fund. To the extent that the Manager reimburses or absorbs fees and expenses, it may seek payment of such amounts for three years after the year in which the expenses were reimbursed or absorbed. A Fund will make no such payment, however, if its total annual operating expenses exceed the expense limits in effect at the time the expenses are to be reimbursed or at the time these payments are proposed.

14

Rochdale Core Alternative Strategies

Master Fund LLC

Notes to Financial Statements (Unaudited)

4. Concentration and Liquidity Risks

The Master Fund invests primarily in Investment Funds that are not registered under the 1940 Act and invest in and actively trade securities and other financial instruments using different strategies and investment techniques, including leverage, which may involve significant risks. These Investment Funds may invest a high percentage of their assets in specific sectors of the market in order to achieve a potentially greater investment return. As a result, the Investment Funds may be more susceptible to economic, political, and regulatory developments in a particular sector of the market, positive or negative, and may experience increased volatility of the Investment Funds' net asset value.

Various risks are also associated with an investment in the Master Fund, including risks relating to the multi-manager structure of the Master Fund, risks relating to compensation arrangements and risks relating to limited liquidity, as described below.

Redemption restrictions exist for Investment Funds whereby the Investment Managers may suspend redemption either in their sole discretion or other factors. Such factors include the magnitude of redemptions requested, portfolio valuations issues or market conditions. Redemptions are currently restricted for one Investment Funds.

5. Financial Instruments with Off-Balance Sheet Risk

In the normal course of business, the Investment Funds in which the Master Fund invests trade various financial instruments and enter into various investment activities with off-balance sheet risk. These include, but are not limited to, short selling activities, writing option contracts, contracts for differences, and interest rate, credit default and total return equity swaps contracts. The Master Fund's risk of loss in these Investment Funds is limited to the value of these investments reported by the Master Fund. The Master Fund itself does not invest directly in securities with off-balance sheet risk.

6. Investment Transactions

For the six months ended September 30, 2008, the aggregate purchases (excluding short-term securities) were $9,250,000 and sales of investments were $1,758,810.

15

| Rochdale Core Alternative Strategies Master Fund LLC | |||||||

| Financial Highlights | |||||||

| Period | |||||||||||

| July 1, 2007 | |||||||||||

| (Commencement of | |||||||||||

| Six Months | Operations) | ||||||||||

| Ended | through | ||||||||||

9/30/2008(1) | March 31, 2008 | ||||||||||

| Total Return | (6.53) | % | (5.01) | % | |||||||

| RATIOS/SUPPLEMENTAL DATA | |||||||||||

| Net Assets, end of period (000's) | $ 52,937 | $ 48,948 | |||||||||

| Portfolio Turnover | 3.46 | % | 1.39 | % | |||||||

| RATIO OF NET INVESTMENT LOSS TO AVERAGE NET ASSETS | (1.54) | % | (1.57) | % | |||||||

| RATIO OF EXPENSES TO AVERAGE NET ASSETS | 1.64 | % | 1.86 | % | |||||||

| (1) | Unaudited | ||||||||||

| The Fund was seeded on January 30, 2007 and commenced investment operations on July 1, 2007. Total return is calculated for all members taken as a whole and an individual member's return may vary from these Fund returns based on the timing of capital transactions. Total returns are not annualized for the periods shown above. | |||||||

| Portfolio turnover represents the Fund's portfolio turnover for the periods shown above. The Ratios of net investment loss to average net assets and ratios of expenses to average net assets are annualized. The ratios of expenses to average net assets do not include expenses of the Investment Funds in which the Fund invests. | |||||||

| The expense ratios are calculated for all members taken as a whole. The computation of such ratios based on the amount of expenses assessed to an individual member's capital may vary from these ratios based on the timing of capital transactions. | |||||||

16

Rochdale Core Alternative Strategies

Master Fund LLC

Additional Information

Proxy Voting Policies and Procedures

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, will be available (i) without charge, upon request, by calling 1-800-245-9888; and (ii) on the SEC’s website at www.sec.gov.

Portfolio Holdings Disclosure

The Fund will file its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q will be available on the SEC’s website at www.sec.gov, and may also be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-732-0330.

17

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable for semi-annual reports.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

The registrant’s nominating committee charter does not contain any procedures by which shareholders may recommend nominees to the registrant’s board of directors.

Item 11. Controls and Procedures.

| (a) | The registrant’s President/Chief Executive Officer and Treasurer/Chief Financial Officer have reviewed the registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the registrant and by the registrant’s service provider. |

| (b) | There were no changes in the registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting. |

Item 12. Exhibits.

| (a) | (1) Any code of ethics or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. Not Applicable |

| (2) A separate certification for each principal executive and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith. | |

| (3) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable. |

| (b) | Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. Furnished herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) Rochdale Core Alternative Strategies Fund LLC

By (Signature and Title) /s/ Garrett R. D’Alessandro

Garrett R. D’Alessandro, President

Date 12/08/08

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title) /s/ Garrett R. D’Alessandro

Garrett R. D’Alessandro, President

Date 12/08/08

By (Signature and Title) /s/ Edmund Towers

Edmund Towers, Treasurer

Date 12/08/08