As filed with the Securities and Exchange Commission on December 8, 2011

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21965

Rochdale Core Alternative Strategies Fund LLC

(Exact name of registrant as specified in charter)

570 Lexington Avenue

New York, NY 10022-6837

(Address of principal executive offices) (Zip code)

Kurt Hawkesworth

570 Lexington Avenue

New York, NY 10022-6837

(Name and address of agent for service)

(800) 245-9888

Registrant's telephone number, including area code

Date of fiscal year end: March 31

Date of reporting period: September 30, 2011

Item 1. Reports to Stockholders.

Rochdale Core Alternative Strategies Fund (RCAS)

Rochdale Core Alternative Strategies Fund TEI (RCAS TEI)

Semi-Annual Report

September 30, 2011

Dear Fellow Shareholders,

The Rochdale Core Alternative Strategies Fund (“RCAS”) continues to successfully meet Rochdale’s objective of diversifying clients’ traditional stock and bond only portfolios through the inclusion of alternative strategies. For the six months ended September 30, 2011, the Fund returned -6.81% Taxable and -6.80% TEI, respectively. In the context of the 14.7% decline in the S&P 500 over the same period, this performance strongly demonstrates the underlying value of RCAS which is designed to be hedged at all times across a variety of different investment asset classes as to have a lower correlation to the S&P 500 compared with unhedged equity investments. Over a full market cycle, the Fund seeks to capture no more than 50% of the downside volatility during equity market declines and to provide a better total risk adjusted return than either the stock or bond market.

Economic & Market Summary

Leading indicators are signaling the growing likelihood of a fresh U.S. economic downturn. For now, actual production and consumption have been consistent with a slow growth outlook, but a sluggish labor market employment, deteriorating confidence, and policy ineffectiveness, all point to greater challenges ahead. Across the Atlantic, we believe a recession in southern Europe is already occurring and will likely migrate north, raising the risks to U.S. economic growth and corporate profits. While we are cautious that Europe’s leaders will do all that is necessary to avoid an acute banking crisis, structural impediments, austerity and a stagnant long-term growth outlook means that problems will linger for some time. We do not see a comprehensive solution forthcoming, therefore, our outlook is for a long chronic period where Europe will move through the process of deleveraging and debt crisis management by addressing problems as they come in an uncertain piecemeal fashion.

The complexity of these risks has resulted in the most challenging period for investors since the 2008 crisis and we remain concerned that the uncertainty ahead is still not being adequately priced into the financial markets. Until real credible actions reduce the risks of debt contagion from Europe, we cannot fully rule out a more than average negative shock which would lead to lower equity prices ahead. Furthermore, while the latest U.S. production, employment, and consumption data may be consistent with slow but positive growth, these are, by large, coincidental indicators. In contrast, the majority of forward looking indicators we monitor are signaling broad weakness or further deterioration ahead. For investors, markets are therefore likely to remain highly volatile over the foreseeable future. When considering the risks ahead, we believe the portfolio diversification aspects of RCAS continue to make the Fund an appropriate allocation for clients seeking growth of principal with low volatility.

Current Portfolio Dynamics and Performance

We are closely monitoring each strategy and continue to build a portfolio of managers that complement each other. Capital to each manager is allocated based on a combination of factors including prospective outlook for the strategy, anticipated volatility level, and the covariance with other managers. Managers are generally allocated 1% to 6% of total assets. As of September 30, 2011, RCAS has exposure to thirty-three different investment managers over three broad alternative investment strategies. While each of the various strategies has experienced their own special challenges, all managed to record strong relative performance over the period.

570 Lexington Avenue, New York, NY 10022-6837 | Tel. 800-245-9888/212-702-3500 | Fax 212-702-3535 | www.rochdale.com

San Francisco | Orlando | Dallas | Richmond

| Investment Style | Allocation | Number of Managers |

| Event/Multi-Strategy | 33.6% | 13 |

| Equity Long/Short | 46.6% | 12 |

| Global Macro | 16.2% | 8 |

| Cash | 3.6% | _ |

| Total | 100.0% | 33 |

Global Macro returned approximately -8.64% for the six months ended September 30, 2011, as markets grew more pessimistic about U.S. and global outlooks, and rising Euro concerns. In particular, commodity managers encountered difficulty as markets became split between fundamental and macro-related factors, with the latter being more prominent. Our Event/Multi-Strategy returned -2.05% for the six months ended September 30, 2011. Credit strategies were among the largest detractors of performance. Our equity long/short strategies ended the period down -6.27%. While overall equities were down 14%, our hedged outperformed. Over the period, all managers took down their risk with most managers waiting for more clarity on the overall macro picture before forming any strong directional views going forward.

Investment Outlook

Rochdale has come to appreciate the benefits of having a more flexible and dynamic approach to investing included within our clients’ portfolios. We expect higher global equity volatility will likely continue for the foreseeable future, making investments solely in traditional stocks act in a highly correlated manner. In such an environment, the value of RCAS lies in its ability to bring lower correlated equity exposure to client portfolios, thereby improving overall portfolio diversification.

Looking forward, we have an optimistic inner voice that is cautiously bullish on riskier assets, and a pessimistic inner voice telling us to remain disciplined and patient. Simply, the complexity of factors at work in the outlook has created too wide a dispersion of potential outcomes for anyone at this point to be fully confident on the path ahead. Therefore allocating a portion of each client’s portfolio to a dynamic and hedged approach seems necessary in today’s environment.

Sincerely,

Garrett R. D’Alessandro, CFA, CAIA, AIF®

Chief Executive Officer & President

Rochdale Investment Management LLC

570 Lexington Avenue, New York, NY 10022-6837 | Tel. 800-245-9888/212-702-3500 | Fax 212-702-3535 | www.rochdale.com

San Francisco | Orlando | Dallas | Richmond

Important Disclosures

The performance returns presented may contain figures estimated by the underlying manager which, if subsequently revised by the underlying manager, may change the returns indicated for the applicable period.

The unsubsidized total annual fund operating expense ratio for the Rochdale Core Alternative Strategies Fund and the Rochdale Core Alternative Strategies Fund TEI is 2.39% and 2.20%, respectively. Cumulative Return at POP (Public Offering Price, reflecting maximum front end sales charge of 2.00%) since inception of July 1, 2007 for the Rochdale Core Alternative Strategies Fund and the Rochdale Core Alternative Strategies Fund TEI is -0.11% and -0.11%, respectively. Performance quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. The most recent month-end performance can be obtained by calling 800-245-9800.

An investor should consider carefully the Funds’ investment objectives, risks, charges, and expenses. The prospectus contains this and other important information about the investment company, and it may be obtained by calling 800-245-9888. Please read it carefully before investing. RIM Securities LLC, the affiliated broker dealer for Rochdale Investment Management LLC, 570 Lexington Avenue, New York, NY 10022.

The views expressed herein represent the opinions of Rochdale Investment Management and are subject to change without notice at anytime. This information should not in any way be construed to be investment, financial, tax, or legal advice or other professional advice or service, and should not be relied on in making any investment or other decisions. Hedge fund investments are speculative and may entail substantial risks. Investing in small and medium-size companies may carry additional risks such as limited liquidity and increased volatility. Investing in international companies carries risks such as currency fluctuation, interest rate fluctuation, and economic and political instability. Short sales may increase volatility and potential for loss. As with all investments, there is no guarantee that investment objectives will be met.

Rochdale Investment Management, its affiliated companies, or their respective shareholders, directors, officers and/or employees may have long or short positions in the securities discussed herein.

570 Lexington Avenue, New York, NY 10022-6837 | Tel. 800-245-9888/212-702-3500 | Fax 212-702-3535 | www.rochdale.com

San Francisco | Orlando | Dallas | Richmond

Rochdale Core Alternative Strategies Fund LLC

Financial Statements

September 30, 2011

Rochdale Core Alternative Strategies Fund LLC

Financial Statements

September 30, 2011

| TABLE OF CONTENTS | |

| Rochdale Core Alternative Strategies Fund LLC | Page |

| Financial Statements | |

| Statement of Assets, Liabilities and Members' Capital | 2 |

| Statement of Operations | 3 |

| Statements of Changes in Members' Capital | 4 |

| Statement of Cash Flows | 5 |

| Notes to Financial Statements | 6 - 12 |

| Financial Highlights | 13 |

| Rochdale Core Alternative Strategies Master Fund LLC | Page |

| Financial Statements | |

| Statement of Assets, Liabilities and Members' Capital | 2 |

| Statement of Operations | 3 |

| Statements of Changes in Members' Capital | 4 |

| Statement of Cash Flows | 5 |

| Schedule of Investments | 6 - 8 |

| Notes to Financial Statements | 9 - 17 |

| Financial Highlights | 18 |

| Additional Information |

Rochdale Core Alternative Strategies Fund LLC

Statement of Assets, Liabilities and Members' Capital

September 30, 2011 (Unaudited)

| ASSETS | ||||

| Investment in Rochdale Core Alternative Strategies Master Fund LLC | $ | 20,340,266 | ||

| Investments made in advance (see Note 2) | 250,000 | |||

| Prepaid expenses | 10,139 | |||

| Receivable from Adviser | 2,466 | |||

| Total Assets | 20,602,871 | |||

| LIABILITIES AND MEMBERS' CAPITAL | ||||

| Liabilities | ||||

| Contributions received in advance (see Note 2) | 250,000 | |||

| Incentive fee payable | 195 | |||

| Professional fees payable | 17,116 | |||

| Investor servicing fee payable | 13,278 | |||

| Accrued expenses and other liabilities | 2,969 | |||

| Total Liabilities | 283,558 | |||

| Total Members' Capital | $ | 20,319,313 | ||

The accompanying notes are an integral part of these financial statements

2

Rochdale Core Alternative Strategies Fund LLC

Statement of Operations

Six Months Ended September 30, 2011 (Unaudited)

| NET INVESTMENT LOSS ALLOCATED FROM ROCHDALE | ||||

| CORE ALTERNATIVE STRATEGIES MASTER FUND, LLC | ||||

| Interest income | $ | 754 | ||

| Expenses | (175,837 | ) | ||

| Net Investment Loss Allocated | (175,083 | ) | ||

| FUND EXPENSES | ||||

| Administration fees | 4,902 | |||

| Registration fees | 9,655 | |||

| Professional fees | 28,159 | |||

| Investor servicing fees (see Note 4) | 26,669 | |||

| Insurance expense | 1,069 | |||

| Custody fees | 600 | |||

| Total Fund Expenses | 71,054 | |||

| Less expenses waived and reimbursed (see Note 3) | (6,942 | ) | ||

Less incentive fees adjustment (see Note 3)(1) | (10,267 | ) | ||

| Net Fund Expenses | 53,845 | |||

| Net Investment Loss | (228,928 | ) | ||

| NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | ||||

| ALLOCATED FROM ROCHDALE CORE ALTERNATIVE STRATEGIES | ||||

| MASTER FUND, LLC | ||||

| Net realized gain on investments | 50,518 | |||

| Net change in unrealized appreciation/depreciation on investments | (1,302,737 | ) | ||

| Net Realized and Unrealized Loss on Investments | (1,252,219 | ) | ||

| Net Decrease in Members' Capital Resulting from Operations | $ | (1,481,147 | ) | |

(1) Reflects calendar year end adjustment.

The accompanying notes are an integral part of these financial statements

3

Rochdale Core Alternative Strategies Fund LLC

Statements of Changes in Members' Capital

| Six Months Ended | Year Ended | |||||||

September 30, 2011 (1) | March 31, 2011 | |||||||

| FROM OPERATIONS | ||||||||

| Net investment loss | $ | (228,928 | ) | $ | (460,393 | ) | ||

| Net realized gain (loss) on investments | 50,518 | (428,734 | ) | |||||

| Net change in unrealized appreciation/depreciation on investments | (1,302,737 | ) | 2,192,225 | |||||

| Net Increase (Decrease) in Members' Capital Resulting From Operations | (1,481,147 | ) | 1,303,098 | |||||

| INCREASE (DECREASE) FROM TRANSACTIONS IN MEMBERS' CAPITAL | ||||||||

| Proceeds from sales of members' interests | 1,140,020 | 2,415,039 | ||||||

| Payments for purchases of members' interests | (284,443 | ) | (1,694,039 | ) | ||||

| Net Proceeds of Members' Interests | 855,577 | 721,000 | ||||||

| Total Increase (Decrease) in Members' Capital | (625,570 | ) | 2,024,098 | |||||

| MEMBERS' CAPITAL | ||||||||

| Beginning of period | 20,944,883 | 18,920,785 | ||||||

| End of period | $ | 20,319,313 | $ | 20,944,883 | ||||

(1) Unaudited.

The accompanying notes are an integral part of these financial statements

4

Rochdale Core Alternative Strategies Fund LLC

Statement of Cash Flows

Six Months Ended September 30, 2011 (Unaudited)

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||

| Net decrease in members' capital resulting from operations | $ | (1,481,147 | ) | |

| Adjustments to reconcile net decrease in members' capital resulting | ||||

| from operations to net cash used in operating activities: | ||||

| Net change in unrealized appreciation/depreciation on investments | 1,302,737 | |||

| Net realized gain on investments | (50,518 | ) | ||

| Purchases of investments in Master Fund | (1,140,020 | ) | ||

| Sales of investments in Master Fund | 284,443 | |||

| Net investment loss allocated from Master Fund | 175,083 | |||

| Expenses paid by the Master Fund | 78,206 | |||

| Changes in operating assets and liabilities: | ||||

| Investments made in advance | 100,000 | |||

| Prepaid expenses | 4,886 | |||

| Receivable from Adviser | 4,266 | |||

| Contributions received in advance | (100,000 | ) | ||

| Distribution payable | (2,451 | ) | ||

| Incentive fee payable | (10,268 | ) | ||

| Professional fees payable | (11,262 | ) | ||

| Investor servicing payable | (12,014 | ) | ||

| Accrued expenses and other liabilities | 31 | |||

| Net Cash used in Operating Activities | (858,028 | ) | ||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||

| Proceeds from sales of members' interests | 1,140,020 | |||

| Payments for purchases of members' interests | (284,443 | ) | ||

| Net Cash Flows from Financing Activities | 855,577 | |||

| Net Change in Cash and Cash Equivalents | (2,451 | ) | ||

| CASH AND CASH EQUIVALENTS | ||||

| Balance at beginning of period | 2,451 | |||

| Balance at end of period | $ | - | ||

The accompanying notes are an integral part of these financial statements

5

Rochdale Core Alternative Strategies Fund LLC

Notes to Financial Statements (Unaudited)

| 1. | Organization |

Rochdale Core Alternative Strategies Fund LLC (the “Fund”) is a Delaware limited liability company registered under the Investment Company Act of 1940, as amended, as a closed-end management investment company. The Fund commenced investment operations on July 1, 2007. The Fund’s investment objective is to seek long-term growth of principal across varying market conditions with low volatility. “Low volatility” in this objective means the past monthly net asset value fluctuations of the Fund net asset value that are no greater than the rolling 10-year annualized standard deviation of the monthly ups and downs of the higher of: (1) the return of the Barclays Capital Aggregate Bond Index plus 3% or (2) half of the return of the Standard & Poor’s 500-stock Index.

The Fund invests substantially all of its investable assets in Rochdale Core Alternative Strategies Master Fund LLC (the “Master Fund”), a registered investment company with the same investment objective as the Fund. Rochdale Investment Management LLC (the “Manager”, "Adviser" or “Rochdale”) is the investment adviser to the Master Fund. The Manager is also the adviser to Rochdale Core Strategies Fund TEI, LLC, which also invests substantially all of its investable assets with the Master Fund. The Manager delegates sub-investment advisory responsibilities to PineBridge Investments (the “Sub-Adviser”) with respect to the Master Fund.

The Sub-Adviser has investment discretion to manage the assets of the Master Fund and is responsible for identifying prospective Hedge Funds, performing due diligence and review of those Hedge Funds and their Hedge Fund Managers, selecting Hedge Funds, allocating and reallocating the Master Fund’s assets among Hedge Funds, and providing risk management services, subject to the general supervision of the Manager.

The financial statements of the Master Fund are included elsewhere in this report and should be read in conjunction with the Fund’s financial statements. At September 30, 2011, the Fund's beneficial ownership of the Master Fund's net assets was 36.49%.

The Fund reserves the right to reject any subscriptions for Interests in the Fund. Generally, initial and additional subscriptions for investment (or "Member Interests") in the Fund by eligible Members may be accepted at such times as the Fund may determine. Each Member must be a qualified investor and subscribe for a minimum initial investment in the Fund of $25,000. Additional investments in the Fund must be made in a minimum amount of $10,000. Brokers selling the Fund may establish higher minimum investment requirements than the Fund. The Fund from time to time may offer to repurchase members' interests in the Fund at such times and on such terms as may be determined by the Fund's Board in its complete and absolute discretion. Fund interests must be held for at least six months after initial purchase (or for a second six-month period as described below). Members must hold Fund interests for at least six months before being eligible to request that the Fund repurchase Fund interests during a tender offer. If no such request is made by a Member during a tender offer, such Member must hold Fund interests for a second six-month period before submitting an initial request.

6

Rochdale Core Alternative Strategies Fund LLC

Notes to Financial Statements (Unaudited)

| 2. | Significant Accounting Policies |

The following is a summary of significant accounting policies followed by the Fund.

Basis of Presentation and Use of Estimates

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates.

Fair Value Measurements

The Fund follows fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion in changes in valuation techniques and related inputs during the period. These standards define fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Management has determined that these standards have no material impact on the Fund’s financial statements. The fair value hierarchy is organized into three levels based upon the assumptions (referred to as “inputs”) used in pricing the asset or liability. These standards state that “observable inputs” reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from independent sources and “unobservable inputs” reflect an entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability. These inputs are summarized in the three broad levels listed below:

Level 1 - Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access.

Level 2 - Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 - Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in these securities.

7

Rochdale Core Alternative Strategies Fund LLC

Notes to Financial Statements (Unaudited)

| 2. | Significant Accounting Policies (continued) |

Fair Value Measurements (continued)

For the six months ended September 30, 2011, the Fund’s investment consisted entirely of an investment in the Master Fund. The fair value hierarchy of the Master Fund’s investments is disclosed in the notes to the Master Fund’s financial statements, included elsewhere in this report.

In May 2011, the Financial Accounting Standards Board (“FASB”) issued “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements” in GAAP and the International Financial Reporting Standards (“IFRS”). This requirement amends FASB Fair Value Measurements and Disclosures, to establish common requirements for measuring fair value and for disclosing information about fair value measurements in accordance with GAAP and IFRS. This requirement is effective for fiscal years beginning after December 15, 2011 and for interim periods within those fiscal years. Management is currently evaluating the impact of these amendments and does not believe they will have a material impact on the Fund’s financial statements.

Investments Valuation

The net asset value of the Fund is determined as of the close of business at the end of each month. The net asset value of the Fund equals the value of the assets of the Fund, less liabilities, including accrued fees and expenses.

The Fund's investment in the Master Fund represents substantially all of the Fund's assets. All investments owned are carried at fair value, which is the portion of the net asset value of the Master Fund held by the Fund.

The accounting for and valuation of investments by the Master Fund is discussed in the notes to the financial statements for the Master Fund, which are an integral part of these financial statements.

The Fund has not maintained any positions in derivative instruments or directly engaged in hedging activities.

Investment Income Recognition

Purchases and sales of investments in the Master Fund are recorded on a trade-date basis. Interest income is recorded on the accrual basis and dividends are recorded on the ex-dividend date. Realized and unrealized gains and losses are included in the determination of income as allocated from the Master Fund based upon its ownership interest.

8

Rochdale Core Alternative Strategies Fund LLC

Notes to Financial Statements (Unaudited)

| 2. | Significant Accounting Policies (continued) |

Fund Expenses

The direct expenses of the Fund include, but are not limited to, the following: legal fees; accounting and auditing fees; custodial fees; costs of computing the Fund's net asset value; costs of insurance; registration expenses; expenses of meetings of the Board and members; all costs with respect to communications to members; and other types of expenses as may be approved from time to time by the Board. The Fund, as an investor in the Master Fund, recognizes its share of the fees and expenses of the Master Fund (including a management fee and incentive fee).

Income Taxes

The Fund's tax year end is December 31. The Fund intends to be treated as a partnership for Federal income tax purposes, whereby each Member is responsible for the tax liability or benefit relating to such Member’s distributive share of taxable income or loss. Accordingly, no provision for Federal income taxes is reflected in the accompanying financial statements.

The Fund has adopted authoritative guidance on uncertain tax positions. The Fund recognizes the effect of tax positions when they are more likely than not of being sustained. Management is not aware of any exposure to uncertain tax positions that could require accrual or which could affect the Fund’s liquidity or future cash flows, or its treatment as a flow through entity, pursuant to relevant income tax regulations. As of September 30, 2011, the Fund’s tax years 2007 through 2010 remain open and subject to examination by relevant taxing authorities.

Distribution Policy

The Fund has no present intention of making periodic distributions of its net investment income or capital gains, if any, to Members. The amount and frequency of distributions, if any, will be at the sole discretion of the Board.

Capital Accounts

Net profits or net losses of the Fund for each month are allocated to the capital accounts of Members as of the last day of each month in accordance with each Members' respective investment percentage in the Fund. Net profits or net losses are measured as the net change in the value of the net assets of the Fund during each month, before giving effect to any repurchases of interest in the Fund, and excluding the amount of any items to be allocated to the capital accounts of the Members of the Fund, other than in accordance with the Members' respective investment percentages.

9

Rochdale Core Alternative Strategies Fund LLC

Notes to Financial Statements (Unaudited)

| 2. | Significant Accounting Policies (continued) |

Capital Accounts (continued)

Prior to the end of each quarter and year end, the Fund receives Member contributions with an effective subscription date of the first day of the following month. These contributions are held by the Master Fund and have an effective investment date of first day of the following month. The Master Fund, in turn, makes contributions to certain Hedge Funds, which have effective subscription dates of the first day of the following month. These amounts are reported as "Contributions received in advance" and "Investments made in advance", respectively.

Cash and Cash Equivalents

The Fund considers all highly liquid investments with a maturity of ninety days or less at time of purchase to be cash equivalents.

Subsequent Events

In preparing these financial statements, the Fund has evaluated events after September 30, 2011 and determined that there were no significant subsequent events that would require adjustment to or additional disclosure in these financial statements.

| 3. | Commitments and Other Related Party Transactions |

The Manager has contractually agreed to waive and/or reimburse the expenses of the Fund and the Master Fund, to the extent needed to limit their combined annual operating expenses to 2.25% of net assets. To the extent that the Manager reimburses or absorbs fees and expenses, it may seek payment of such amounts for three years after the year in which the expenses were reimbursed or absorbed. The Fund will make no such payment, however, if its total annual operating expenses exceed the expense limits in effect at the time the expenses are to be reimbursed or at the time these payments are proposed. For the six months ended September 30, 2011, the Manager waived $6,942 of fees and expenses, which may be recouped by the Manager no later than March 31, 2015.

The following is a schedule of when fees may be recouped by the Manager:

| Amount | Expiration | |||

| $ | 28,519 | March 31, 2012 | ||

| 9,020 | March 31, 2013 | |||

| 27,673 | March 31, 2014 | |||

| 6,942 | March 31, 2015 | |||

| $ | 72,154 | |||

No accrual has been made for such contingent liability because of the uncertainty of the reimbursement from the Fund.

10

Rochdale Core Alternative Strategies Fund LLC

Notes to Financial Statements (Unaudited)

| 3. | Commitments and Other Related Party Transactions (continued) |

The Sub-Adviser is entitled to receive a performance-based incentive fee equal to 10% of the net profits (taking into account net realized and unrealized gains or losses and net investment income or loss), if any, in excess of the non-cumulative “Preferred Return,” subject to reduction of that excess for prior losses that have not been previously offset against net profits (the “Incentive Fee”). The Incentive Fee will be accrued monthly and is generally payable annually on a calendar year basis. The Preferred Return is an annual return equal to the 3-year Treasury constant maturity rate as reported by the Board of Governors of the Federal Reserve System as of the last business day of the prior calendar year plus 2%.

| 4. | Investor Servicing Fees |

The Fund pays a fee to RIM Securities, LLC, an affiliate of the Manager, as Distributor, to reimburse it for payments made to broker-dealers and certain financial advisers (“Investor Service Providers”) that have agreed to provide ongoing investor services to investors in the Fund that are their customers. This fee is paid quarterly and in an amount, with respect to each Investor Service Provider, not to exceed the lesser of: (i) 0.25% (on an annualized basis) of the aggregate value of outstanding interests held by investors that receive services from the Investment Service Provider, determined as of the last day of the calendar month (before any repurchase of Member interests); or (ii) the Distributor’s actual payments to the Investment Service Provider.

| 5. | Concentration, Liquidity and Off-Balance Sheet Risks |

The Master Fund invests primarily in Hedge Funds that are illiquid securities and not registered under the 1940 Act. Such Hedge Funds invest in actively traded securities, illiquid securities, derivatives and other financial instruments using several investment strategies and investment techniques, including leverage, which may involve significant risks. The Master Fund's concentration and liquidity risks are discussed in the notes to the Master Fund's financial statements which are attached elsewhere in this report and are an integral part of these financial statements.

In the normal course of business, the Hedge Funds in which the Master Fund invests trade various derivatives and financial instruments and enter into various investment activities with off balance sheet risk. The Master Fund's off balance sheet risk in these financial instruments is discussed in the notes to the Master Fund's financial statements which are attached elsewhere in this report and are an integral part of these financial statements.

| 6. | Investment Transactions |

For the six months ended September 30, 2011, the Fund's assets were invested in the Master Fund and the Fund made aggregate purchases of $1,140,020 and aggregate sales of $284,443 in the Master Fund.

11

Rochdale Core Alternative Strategies Fund LLC

Notes to Financial Statements (Unaudited)

| 7. | Issuer Tender Offer |

The Fund offered to purchase up to $3,000,000 of Interests in the Fund thereof properly tendered by Members at a price equal to the net asset value of Interests as of December 30, 2011. For Interests tendered, the Member will receive a promissory note entitling the Member to a cash amount equal to at least 90% of the net asset value calculated on December 30, 2011, of the Interests tendered and accepted for purchase by the Fund, upon the terms and subject to the conditions set forth in the Offer to Purchase dated August 15, 2011. The offer terminated at 5:00 p.m., Eastern Time, on September 12, 2011.

| 8. | Proxy Results |

On June 3, 2011, a special meeting of Members was held to consider approving Garrett D’Alessandro as a member of the Board of Directors of the Fund. The following table illustrates the specifics of the vote:

| For | Against | Abstain | ||

| 4,246.69 | – | – |

On August 12, 2011, a special meeting of Members was held to consider approving Jay C. Nadel, Daniel A. Hanwacker and Susan Henshaw Jones as members of the Board of Directors of the Fund since three Independent Directors recently resigned from the Board of Directors of the Fund, two of which had met or were approaching the Fund’s retirement age of 75. The following table illustrates the specifics of the vote:

| For | Against | Abstain | ||

| 4,246.69 | – | – |

12

Rochdale Core Alternative Strategies Fund LLC

Financial Highlights

| Period from | ||||||||||||||||||||

| July 1, 2007 | ||||||||||||||||||||

| (Commencement | ||||||||||||||||||||

| of | ||||||||||||||||||||

| Six Months Ended | Year Ended | Year Ended | Year Ended | Operations) through | ||||||||||||||||

September 30, 2011 (1) | March 31, 2011 | March 31, 2010 | March 31, 2009 | March 31, 2008 | ||||||||||||||||

| TOTAL RETURN | ||||||||||||||||||||

| Total Return before incentive fee | (6.85 | %) | 6.76 | % | 8.74 | % | (11.68 | %) | (5.05 | %) | ||||||||||

| Incentive fee | 0.04 | % | (0.09 | %) | (0.01 | %) | 0.00 | % | 0.00 | % | ||||||||||

| Total Return after incentive fee | (6.81 | %) | 6.67 | % | 8.73 | % | (11.68 | %) | (5.05 | %) | ||||||||||

| RATIOS/SUPPLEMENTAL DATA | ||||||||||||||||||||

| Net Assets, end of period ($000's) | $ | 20,319 | $ | 20,945 | $ | 18,921 | $ | 17,676 | $ | 18,262 | ||||||||||

| Portfolio Turnover | 7.13 | % | 20.32 | % | 20.91 | % | 19.34 | % | 1.39 | % | ||||||||||

| RATIO OF NET INVESTMENT LOSS TO AVERAGE NET ASSETS | ||||||||||||||||||||

| Net investment loss, before waivers and reimbursements | (2.22 | %) | (2.47 | %) | (2.29 | %) | (2.28 | %) | (2.86 | %) | ||||||||||

| Net investment loss, after waivers and reimbursements | (2.15 | %) | (2.33 | %) | (2.24 | %) | (2.13 | %) | (1.80 | %) | ||||||||||

| RATIO OF EXPENSES TO AVERAGE NET ASSETS, BEFORE | ||||||||||||||||||||

| INCENTIVE FEE | ||||||||||||||||||||

| Operating expenses, before waivers and reimbursements | 2.32 | % | 2.39 | % | 2.30 | % | 2.40 | % | 3.31 | % | ||||||||||

| Operating expenses, after waivers and reimbursements | 2.25 | % | 2.25 | % | 2.25 | % | 2.25 | % | 2.25 | % | ||||||||||

| RATIO OF EXPENSES TO AVERAGE NET ASSETS, NET OF WAIVERS | ||||||||||||||||||||

| AND REIMBURSEMENTS AFTER INCENTIVE FEE | ||||||||||||||||||||

| Operating expenses, after waivers and reimbursements | 2.25 | % | 2.25 | % | 2.25 | % | 2.25 | % | 2.25 | % | ||||||||||

| Incentive fee | (0.10 | %) | 0.09 | % | 0.01 | % | 0.00 | % | 0.00 | % | ||||||||||

| Total Operating expenses, after waivers and reimbursements, after incentive fee | 2.15 | % | 2.34 | % | 2.26 | % | 2.25 | % | 2.25 | % | ||||||||||

Total return is calculated for all Members taken as a whole and an individual Member's return may vary from these Fund returns based on the timing of capital transactions. The total return for periods less than one year are not annualized.

Portfolio turnover represents the Master Fund's portfolio turnover for the periods above. The ratios of net investment loss to average net assets and ratios of expenses to average net assets are annualized for periods of less than one year. The ratios of expenses to average net assets do not include expenses of the Hedge Funds in which the Master Fund invests.

The expense ratios are calculated for all Members taken as a whole. The computation of such ratios based on the amount of expenses assessed to an individual Member's capital may vary from these ratios based on the timing of capital transactions.

(1) Unaudited.

The accompanying notes are an integral part of these financial statements

13

Rochdale Core Alternative Strategies Master Fund LLC

Financial Statements

September 30, 2011

Rochdale Core Alternative Strategies Master Fund LLC

Financial Statements

September 30, 2011

| TABLE OF CONTENTS | |

| Page | |

| Financial Statements | |

| Statement of Assets, Liabilities and Members' Capital | 2 |

| Statement of Operations | 3 |

| Statements of Changes in Members' Capital | 4 |

| Statement of Cash Flows | 5 |

| Schedule of Investments | 6 - 8 |

| Notes to Financial Statements | 9 - 17 |

| Financial Highlights | 18 |

| Additional Information | |

Rochdale Core Alternative Strategies Master Fund LLC

Statement of Assets, Liabilities and Members' Capital

September 30, 2011 (Unaudited)

| ASSETS | ||||

| Investments, at fair value (cost $52,689,366) | $ | 56,512,967 | ||

| Receivable for fund investments sold | 156,330 | |||

| Prepaid expenses | 179 | |||

| Total Assets | 56,669,476 | |||

| LIABILITIES AND MEMBERS' CAPITAL | ||||

| Liabilities | ||||

| Management fees payable | 121,878 | |||

| Contributions received in advance (see Note 2) | 685,000 | |||

| Accrued professional fees payable | 39,698 | |||

| Accrued expenses and other liabilities | 87,538 | |||

| Total Liabilities | 934,114 | |||

| Total Members' Capital | $ | 55,735,362 | ||

The accompanying notes are an integral part of these financial statements

2

Rochdale Core Alternative Strategies Master Fund LLC

Statement of Operations

Six Months Ended September 30, 2011 (Unaudited)

| INVESTMENT INCOME | ||||

| Interest income | $ | 2,092 | ||

| Investment Income | 2,092 | |||

| EXPENSES | ||||

| Management fees (see Note 4) | 369,315 | |||

| Professional fees | 48,498 | |||

| Administration fees | 53,562 | |||

| Directors' fees | 8,690 | |||

| Custody fees | 3,400 | |||

| Other expenses | 2,679 | |||

| Total Expenses | 486,144 | |||

| Net Investment Loss | (484,052 | ) | ||

| REALIZED AND UNREALIZED GAIN (LOSS) | ||||

| ON INVESTMENTS | ||||

| Net realized gain on investments | 159,856 | |||

| Net change in unrealized appreciation/depreciation on investments | (3,590,252 | ) | ||

| Net Realized and Unrealized Loss on Investments | (3,430,396 | ) | ||

| Net Decrease in Members' Capital Resulting from Operations | $ | (3,914,448 | ) | |

The accompanying notes are an integral part of these financial statements

3

Rochdale Core Alternative Strategies Master Fund LLC

Statements of Changes in Members' Capital

| Six Months Ended | Year Ended | |||||||

September 30, 2011 (1) | March 31, 2011 | |||||||

| FROM OPERATIONS | ||||||||

| Net investment loss | $ | (484,052 | ) | $ | (968,025 | ) | ||

| Net realized gain (loss) on investments | 159,856 | (1,165,122 | ) | |||||

| Net change in unrealized appreciation/depreciation on investments | (3,590,252 | ) | 6,330,075 | |||||

| Net Increase (Decrease) in Members' Capital Resulting From Operations | (3,914,448 | ) | 4,196,928 | |||||

| INCREASE (DECREASE) FROM TRANSACTIONS IN MEMBERS' CAPITAL | ||||||||

| Proceeds from sales of members' interests | 2,225,042 | 6,139,018 | ||||||

| Payments for purchases of members' interests | (1,565,317 | ) | (8,961,701 | ) | ||||

| Net Proceeds of (Payments for) Members' Interests | 659,725 | (2,822,683 | ) | |||||

| Total Increase (Decrease) in Members' Capital | (3,254,723 | ) | 1,374,245 | |||||

| MEMBERS' CAPITAL | ||||||||

| Beginning of period | 58,990,085 | 57,615,840 | ||||||

| End of period | $ | 55,735,362 | $ | 58,990,085 | ||||

(1) Unaudited. | ||||||||

The accompanying notes are an integral part of these financial statements

4

Rochdale Core Alternative Strategies Master Fund LLC

Statement of Cash Flows

Six Months Ended September 30, 2011 (Unaudited)

| CASH FLOW FROM OPERATING ACTIVITIES | ||||

| Net decrease in members' capital resulting from operations | $ | (3,914,448 | ) | |

| Adjustments to reconcile net decrease in members' capital | ||||

| resulting from operations to net cash used in operating activities: | ||||

| Purchases of investments | (18,044,219 | ) | ||

| Sales of investments | 15,922,553 | |||

| Net change in unrealized appreciation/depreciation on investments | 3,590,252 | |||

| Net realized gain on investments | (159,856 | ) | ||

| Change in Operating Assets and Liabilities: | ||||

| Receivable for fund investments sold | 1,949,197 | |||

| Prepaid expenses | (83 | ) | ||

| Interest receivable | 87 | |||

| Management fees payable | 60,094 | |||

| Contributions received in advance | (40,000 | ) | ||

| Professional fees payable | (26,527 | ) | ||

| Accrued expense and other liabilities | 3,225 | |||

| Net Cash used in Operating Activities | (659,725 | ) | ||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||

| Proceeds from sales of members' interests | 2,225,042 | |||

| Payments for purchases of members' interests | (1,565,317 | ) | ||

| Net Cash from Financing Activities | 659,725 | |||

| Net Change in Cash and Cash Equivalents | - | |||

| CASH AND CASH EQUIVALENTS | ||||

| Beginning of period | - | |||

| End of period | $ | - | ||

The accompanying notes are an integral part of these financial statements

5

Rochdale Core Alternative Strategies Master Fund LLC

Schedule of Investments

September 30, 2011 (Unaudited)

| Redemptions | ||||||||||||||||||||

| Percentage of | Notice Period | |||||||||||||||||||

Long-Term Investment Funds 1: | Members' Capital | Cost | Fair Value | Frequency | # of Days | |||||||||||||||

Equity Long / Short Strategy: | ||||||||||||||||||||

| Absolute Partners Fund LLC | 3.18 | % | $ | 1,750,000 | $ | 1,770,978 | Monthly | 90 | ||||||||||||

| Alphagen Rhocas | 2.98 | 1,750,000 | 1,663,925 | Monthly | 30 | |||||||||||||||

| Blackthorn Partners, LP | 3.64 | 1,620,085 | 2,026,921 | Monthly | 45 | |||||||||||||||

| Clovis Capital Partners Institutional, LP | 4.37 | 2,575,000 | 2,438,937 | Quarterly | 45 | |||||||||||||||

| Criterion Institutional Partners, LP | 4.77 | 2,250,000 | 2,659,246 | Monthly | 45 | |||||||||||||||

| Hunter Global Investors Fund I LP | 4.26 | 2,575,000 | 2,372,624 | Quarterly | 30 | |||||||||||||||

| LAE Fund L.P. | 2.43 | 1,500,000 | 1,356,496 | Monthly | 30 | |||||||||||||||

| Newbrook Capital Partners, L.P. | 4.74 | 2,500,000 | 2,639,817 | Quarterly | 45 | |||||||||||||||

| Sandler Associates | 5.35 | 2,500,000 | 2,981,942 | Quarterly | 30 | |||||||||||||||

| Seligman Health Spectrum Plus Fund LLC | 3.77 | 1,750,000 | 2,099,494 | Monthly | 30 | |||||||||||||||

| Standard Global Equity Partners SA, LP | 4.93 | 2,500,000 | 2,750,348 | Quarterly | 45 | |||||||||||||||

| Standard Pacific Pan-Asia Fund, L.P. | 2.18 | 1,250,000 | 1,213,128 | Quarterly | 45 | |||||||||||||||

| 46.60 | 24,520,085 | 25,973,856 | ||||||||||||||||||

Event / Multi-Strategy: | ||||||||||||||||||||

| Bennelong Asia Pacific Multi Strategy Equity Fund, LP | 0.24 | 165,549 | 132,192 | ** | ** | |||||||||||||||

| Brencourt Multi Strategy Arbitrage, LP | 0.44 | 107,621 | 246,710 | ** | ** | |||||||||||||||

| Brigade Leveraged Capital Structures Fund LP | 3.71 | 1,626,511 | 2,068,844 | Quarterly | 60 | |||||||||||||||

| Canyon Value Realization Fund, LP | 3.84 | 2,000,000 | 2,140,151 | Annually | 100 | |||||||||||||||

| Castlerigg Partners | 0.11 | 82,790 | 58,274 | ** | ** | |||||||||||||||

| GoldenTree Partners LP | 5.01 | 2,150,000 | 2,793,072 | Quarterly | 90 | |||||||||||||||

| HBK Fund II L.P. | 6.04 | 3,000,000 | 3,366,760 | Quarterly | 90 | |||||||||||||||

| King Street Capital LP | 0.13 | 45,951 | 70,914 | ** | ** | |||||||||||||||

| OZ Asia Domestic Partners, LP | 4.17 | 2,250,000 | 2,322,499 | Annually | 45 | |||||||||||||||

| Polygon Global Opportunities Fund, LP | 0.45 | 566,648 | 252,603 | * | * | |||||||||||||||

Stark Select Asset Fund LLC 2 | 0.30 | 167,865 | 169,202 | ** | ** | |||||||||||||||

| SuttonBrook Capital Partners, LP | 4.08 | 2,195,933 | 2,275,114 | Monthly | 30 | |||||||||||||||

| York Capital Management, LP | 5.07 | 3,000,000 | 2,822,882 | Quarterly | 45 | |||||||||||||||

| 33.59 | 17,358,868 | 18,719,217 | ||||||||||||||||||

Global Macro Strategy: | ||||||||||||||||||||

| Blenheim Commodity Fund, LLC | 3.05 | 1,500,000 | 1,698,768 | Monthly | 65 | |||||||||||||||

| Boronia Diversified Fund (U.S.) LP | 1.55 | 750,000 | 862,129 | Monthly | 30 | |||||||||||||||

| CamCap Resources, LP | 1.72 | 1,250,000 | 959,118 | Quarterly | 60 | |||||||||||||||

| Caxton Global Investments (USA) LLC | 0.07 | 33,077 | 39,108 | ** | ** | |||||||||||||||

| Dynamic | 1.50 | 609,606 | 833,038 | Monthly | 30 | |||||||||||||||

| MKP Opportunity Partners, LP | 2.57 | 1,250,000 | 1,433,002 | Monthly | 60 | |||||||||||||||

| Robeco Transtrend Diversified Fund LLC | 2.83 | 1,500,000 | 1,579,395 | Monthly | 5 | |||||||||||||||

| Sunrise Commodities Fund | 2.88 | 1,110,000 | 1,607,606 | Monthly | 15 | |||||||||||||||

| 16.17 | 8,002,683 | 9,012,164 | ||||||||||||||||||

Total Long-Term Investment Funds: | 96.36 | % | $ | 49,881,636 | $ | 53,705,237 | ||||||||||||||

Short-Term Investment: | ||||||||||||||||||||

Money Market Fund: | ||||||||||||||||||||

First American Government Obligations Fund, 0.00% 3 | 5.04 | % | $ | 2,807,730 | $ | 2,807,730 | ||||||||||||||

| Total Investments | 101.40 | % | $ | 52,689,366 | $ | 56,512,967 | ||||||||||||||

The accompanying notes are an integral part of these financial statements

6

Rochdale Core Alternative Strategies Master Fund LLC

Schedule of Investments, Continued

September 30, 2011 (Unaudited)

1. All investments are non-income producing.

2. This Fund is a side pocket of Stark Investments Limited Partnership.

3. 7-Day Yield.

* Redemption restrictions exist for Hedge Funds whereby the Hedge Fund Managers may suspend redemption either in their sole discretion or other factors. Such factors include the magnitude of redemptions requested, portfolio valuation issues or market conditions. Redemptions are currently suspended for Polygon Global Opportunities Fund, LP, as the fund is in the process of being liquidated or restructured.

** Special Investments have been established for Bennelong Asia Pacific Multi Strategy Equity Fund, LP, Brencourt Multi Strategy Arbitrage, LP, Castlerigg Partners, King Street Capital LP, Stark Select Asset Fund LLC and Caxton Global Investments (USA) LLC. These investments are long-term and illiquid.

Equity Long / Short Strategy. Equity investing involves the purchase and / or sale of listed or unlisted equity and equity-related financial instruments usually based on fundamental research and analysis. Hedge Fund Managers may invest opportunistically in several sectors or they may be sector specialists. These Hedge Fund Managers may be globally or regionally focused. Hedge Fund Managers may also have a style bias, such as growth or value. The average holding period of Hedge Fund Managers may vary as well between long-term or short-term trading. Some Hedge Fund Managers may also take a top-down thematic approach while others utilize a bottoms-up approach pursuant to which individual securities are selected.

Event / Multi-Strategy. Multi-strategy investing is an investment strategy that focuses on the securities of companies undergoing some material structural changes. These changes can come in the form of mergers, acquisitions, spin offs, Dutch tender offers, share buybacks and other reorganizations. This strategy also seeks to exploit relative value inefficiencies across the capital structure or among closely related markets, generally without assuming an unhedged exposure to any particular market or financial instrument.

Global Macro Strategy. Macro strategies take long, short and relative value positions in financial instruments based on a top-down fundamental and technical analysis of capital market conditions. Hedge Fund Managers begin evaluating opportunities based on economic and/or technical factors, working their way down to regional, country and industry specific analysis. The Hedge Fund Managers make judgements about the expected future price direction of asset classes and express that opinion by taking long or short positions in a variety of instruments. Investments are usually made in a wide variety of global futures, cash instruments and other financial instruments, including stocks, bonds, currencies, derivatives and commodities.

The accompanying notes are an integral part of these financial statements

7

Rochdale Core Alternative Strategies Master Fund LLC

Schedule of Investments, Continued

September 30, 2011 (Unaudited)

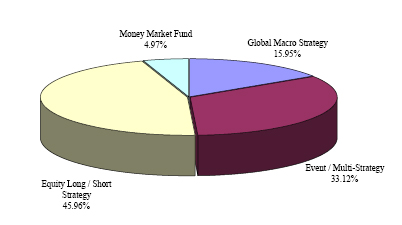

Strategy Allocation Breakdown

(as a % of total investments)

The accompanying notes are an integral part of these financial statements

8

Rochdale Core Alternative Strategies Master Fund LLC

Notes to Financial Statements (Unaudited)

| 1. | Organization |

Rochdale Core Alternative Strategies Master Fund LLC (the "Master Fund") is a closed-end, non-diversified management Investment Company that was organized as a limited liability company under the laws of the State of Delaware on September 11, 2006 and serves as a master fund in a master feeder structure. Interests in the Master Fund are issued solely in private placement transactions that do not involve any "public offering" within the meaning of Section 4(2) of the Securities Act of 1933, as amended (the "1933 Act"). Investments in the Master Fund may be made only by U.S. and foreign investment companies, common or commingled trust funds, organizations or trusts described in Sections 401(a) or 501(a) of the Internal Revenue Code of 1986, as amended, or similar organizations or entities that are "accredited investors" within the meaning of Regulation D under the 1933 Act. The Master Fund is a registered investment company under the Investment Company Act of 1940.

Rochdale Investment Management LLC (the “Manager”, "Adviser" or “Rochdale”) is the investment adviser to the Master Fund. The Manager delegates sub-investment advisory responsibilities to PineBridge Investments (the “Sub-Adviser”) with respect to the Master Fund.

The Master Fund seeks to achieve its objective by investing substantially all of its assets in the securities of privately placed investment vehicles, typically referred to as hedge funds (“Hedge Funds" or "Investment Funds”), that pursue a variety of “absolute return” investment strategies. “Absolute return” refers to a broad class of investment strategies that attempt to consistently generate positive returns regardless of market conditions.

The Master Fund’s investment objective is to seek long-term growth of principal across varying market conditions with low volatility. “Low volatility” in this objective means the past monthly net asset value fluctuations of the Master Fund’s net asset value that is no greater than the rolling 10-year annualized standard deviation of the monthly ups and downs of the higher of: (1) the return of the Barclays Capital Aggregate Bond Index plus 3% or (2) half of the return of the Standard & Poor’s 500-stock Index. Master Fund investments generally fall within the following broadly defined investment fund strategies: equity long/short, event/multi-strategy driven and global macro.

| 2. | Significant Accounting Policies |

The following is a summary of significant accounting policies followed by the Master Fund.

9

Rochdale Core Alternative Strategies Master Fund LLC

Notes to Financial Statements (Unaudited)

| 2. | Significant Accounting Policies (continued) |

Basis of Presentation and Use of Estimates

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates.

Investments Valuation

Investments are carried at fair value. The fair value of alternative investments has been estimated using the Net Asset Value (“NAV”) as reported by the management of the respective alternative investment fund. Financial Accounting Standards Board (FASB) guidance provides for the use of NAV as a “Practical Expedient” for estimating fair value of alternative investments. NAV reported by each alternative investment fund is used as a practical expedient to estimate the fair value of the Master Fund’s interest therein and their classification within Level 2 or 3 is based on the Master Fund’s ability to redeem its interest in the near term and liquidate the underlying portfolios.

The Master Fund has not maintained any positions in derivative instruments or directly engaged in hedging activities.

Fair Value Measurements

The Master Fund follows fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion in changes in valuation techniques and related inputs during the period. These standards define fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fair value hierarchy is organized into three levels based upon the assumptions (referred to as “inputs”) used in pricing the asset or liability. These standards state that “observable inputs” reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from independent sources and “unobservable inputs” reflect an entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability. These inputs are summarized in the three broad levels listed below:

Level 1 - Unadjusted quoted prices in active markets for identical assets or liabilities that the Master Fund has the ability to access.

10

Rochdale Core Alternative Strategies Master Fund LLC

Notes to Financial Statements (Unaudited)

| 2. | Significant Accounting Policies (continued) |

Fair Value Measurements (continued)

Level 2 - Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 - Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Master Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in these securities. See Note 3.

Investment Income Recognition

Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on the accrual basis and dividends are recorded on the ex-dividend date. Realized and unrealized gains and losses are included in the determination of income.

Fund Expenses

The expenses of the Master Fund include, but are not limited to, the following: legal fees; accounting and auditing fees; custodial fees; management fees; an incentive fee; costs of computing the Master Fund's net asset value; costs of insurance; registration expenses; due diligence, including travel and related expenses; expenses of meetings of the Board and members; all costs with respect to communications to members; and other types of expenses as may be approved from time to time by the Board.

Income Taxes

The Master Fund’s tax year end is December 31. The Master Fund is treated as a partnership for Federal income tax purposes. Each Member is responsible for the tax liability or benefit relating to such Member’s distributive share of taxable income or loss. Accordingly, no provision for Federal income taxes is reflected in the accompanying financial statements.

11

Rochdale Core Alternative Strategies Master Fund LLC

Notes to Financial Statements (Unaudited)

| 2. | Significant Accounting Policies (continued) |

Income Taxes (continued)

The Master Fund has adopted authoritative guidance on uncertain tax positions. The Master Fund recognizes the effect of tax positions when they are more likely than not of being sustained. Management is not aware of any exposure to uncertain tax positions that could require accrual or which could affect its liquidity or future cash flows. As of

September 30, 2011, the Master Fund’s tax years 2007 through 2010 remain open and subject to examination by relevant taxing authorities.Subsequent Events

In preparing these financial statements, the Master Fund has evaluated events after September 30, 2011 and determined that there were no significant subsequent events that would require adjustment to or additional disclosure in these financial statements.

Capital Accounts

Net profits or net losses of the Master Fund for each month are allocated to the capital accounts of Members as of the last day of each month in accordance with Members' respective investment percentages of the Master Fund. Net profits or net losses are measured as the net change in the value of the net assets of the Master Fund during a fiscal period, before giving effect to any repurchases of interest in the Master Fund, and excluding the amount of any items to be allocated to the capital accounts of the Members of the Master Fund, other than in accordance with the Members' respective investment percentages.

Prior to the end of each quarter and year end, the Master Fund receives Member contributions with an effective subscription date of the first day of the following month.

The Master Fund, in turn, makes contributions to certain Hedge Funds, which have effective subscription dates of the first day of the following month. These amounts are reported as "Contributions received in advance" and "Investments made in advance", respectively.

| 3. | Investments |

The following alternative and temporary investments were measured at fair value as of September 30, 2011 using the practical expedient:

| Quoted Prices in | |||||||||||||||||

| Active Markets | Significant Other | Significant | |||||||||||||||

for Identical Assets | Observable Inputs | Unobservable Inputs | |||||||||||||||

| Description | (Level 1) | (Level 2) | (Level 3) | Total | |||||||||||||

| Alternative Investments | $ | - | $ | 34,183,042 | $ | 19,522,195 | $ | 53,705,237 | |||||||||

| Short-Term Investment | 2,807,730 | - | - | 2,807,730 | |||||||||||||

| Total Investments | $ | 2,807,730 | $ | 34,183,042 | $ | 19,522,195 | $ | 56,512,967 | |||||||||

12

Rochdale Core Alternative Strategies Master Fund LLC

Notes to Financial Statements (Unaudited)

| 3. | Investments (continued) |

The following is a reconciliation of the beginning and ending balances for Level 3 investments during the six months ended September 30, 2011:

| Alternative | |||||

| Investments | |||||

| Balance, March 31, 2011 | $ | 22,394,146 | |||

| Total Realized Gains/(Losses) | 101,407 | ||||

| Change in Unrealized Gains/Losses | (1,284,876 | ) | |||

| Purchases | 250,000 | ||||

| Sales | (1,938,482 | ) | |||

| Transfers in and/or out of Level 3 | - | ||||

| Balance, September 30, 2011 | $ | 19,522,195 | |||

Net unrealized gains relating to Level 3 alternative investments still held at September 30, 2011 are $1,576,183.

There were no significant transfers into or out of Level 1, 2 or 3 fair value measurements during the reporting period, as compared to their classification from the most recent annual report.

In May 2011, the Financial Accounting Standards Board (“FASB”) issued “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements” in GAAP and the International Financial Reporting Standards (“IFRS”). This requirement amends FASB Fair Value Measurements and Disclosures, to establish common requirements for measuring fair value and for disclosing information about fair value measurements in accordance with GAAP and IFRS. This requirement is effective for fiscal years beginning after December 15, 2011 and for interim periods within those fiscal years.

Management is currently evaluating the impact of these amendments and does not believe they will have a material impact on the Master Fund’s financial statements.

| 4. | Commitments and Other Related Party Transactions |

Management and Incentive Fees

Under the supervision of the Master Fund’s Board and pursuant to an investment management agreement (“Investment Management Agreement”), Rochdale Investment Management LLC, an investment adviser registered under the Investment Advisers Act of 1940, as amended, serves as the Manager for the Master Fund. The Manager is authorized, subject to the approval of the Master Fund’s Board, to retain one or more other organizations, including its affiliates, to provide any or all of the services required to be provided by the Manager to the Master Fund or to assist in providing these services.

13

Rochdale Core Alternative Strategies Master Fund LLC

Notes to Financial Statements (Unaudited)

| 4. | Commitments and Other Related Party Transactions (continued) |

Management and Incentive Fees (continued)

The Manager has engaged the Sub-Adviser to provide sub-investment advisory services. The Sub-Adviser has investment discretion to manage the assets of the Master Fund and is responsible for identifying prospective Hedge Funds, performing due diligence and review of those Hedge Funds and their Hedge Fund Managers, selecting Hedge Funds, allocating and reallocating the Master Fund’s assets among Hedge Funds, and providing risk management services, subject to the general supervision of the Manager.

The investment management fee is shared by the Manager and the Sub-Adviser. The Master Fund will pay the Manager an investment management fee at an annual rate equal to 1.25% of the Master Fund’s month-end net assets, including assets attributable to the Manager (or its affiliates) and before giving effect to any repurchases by the Master Fund of Member interests. The investment management fee is accrued monthly. The investment management fee will be paid to the Manager out of the Master Fund’s assets.

The Manager will pay a fee to the Sub-Adviser at a rate equal to 60% of the amount of the fee earned by the Manager pursuant to the Investment Management Agreement.

The Sub-Adviser through the feeder funds is entitled to receive a performance-based incentive fee equal to 10% of the net profits (taking into account net realized and unrealized gains or losses and net investment income or loss), if any, in excess of the non-cumulative “Preferred Return,” subject to reduction of that excess for prior losses that have not been previously offset against net profits (the “Incentive Fee”). The Incentive Fee will be accrued monthly and is generally payable annually on a calendar year basis. The Preferred Return is an annual return equal to the 3-year Treasury constant maturity rate as reported by the Board of Governors of the Federal Reserve System as of the last business day of the prior calendar year plus 2%.

Expense Reimbursement

The Manager has contractually agreed to waive and/or reimburse the Master Fund’s expenses to the extent needed to limit the Master Fund’s annual operating expenses combined with the annual operating expenses of Rochdale Core Alternative Strategies Fund LLC or Rochdale Core Alternative Strategies Fund TEI LLC (the “Feeder Funds”) to 2.25% of net assets for each Feeder Fund. To the extent that the Manager reimburses or absorbs fees and expenses, it may seek payment of such amounts for three years after the year in which the expenses were reimbursed or absorbed. A Feeder Fund will make no such payment, however, if its total annual operating expenses exceed the expense limits in effect at the time the expenses are to be reimbursed or at the time these payments are proposed.

14

Rochdale Core Alternative Strategies Master Fund LLC

Notes to Financial Statements (Unaudited)

| 4. | Commitments and Other Related Party Transactions (continued) |

Expense Reimbursement (continued)

Amounts receivable as a result of these reimbursements in the Rochdale Core Alternative Strategies Fund LLC were $6,942. There were no amounts receivable or payable as a

result of these reimbursements in the Rochdale Core Alternative Strategies Fund TEI LLC and Subsidiary.| 5. | Investment Risks and Uncertainties |

Alternative Investments consist of non-traditional, not readily marketable investments, some of which may be structured as offshore limited partnerships, venture capital funds, hedge funds, private equity funds and common trust funds. The underlying investments of such funds, whether invested in stock or other securities, are generally not currently traded in a public market and typically are subject to restrictions on resale. Values determined by investment managers and general partners of underlying securities that are thinly traded or not traded in an active market may be based on historical cost, appraisals, a review of the investees’ financial results, financial condition and prospects, together with comparisons to similar companies for which quoted market prices are available or other estimates that require varying degrees of judgment.

Investments are carried at fair value provided by the respective alternative investment’s management. Because of the inherent uncertainty of valuations, the estimated fair values may differ significantly from the values that would have been used had a ready market for such investments existed or had such investments been liquidated, and those differences could be material.

| 6. | Concentration, Liquidity and Off-Balance Sheet Risk |

The Master Fund invests primarily in Hedge Funds that are not registered under the 1940 Act and invest in and actively trade securities and other financial instruments using different strategies and investment techniques, including leverage, which may involve significant risks. These Hedge Funds may invest a high percentage of their assets in specific sectors of the market in order to achieve a potentially greater investment return. As a result, the Hedge Funds may be more susceptible to economic, political, and regulatory developments in a particular sector of the market, positive or negative, and may experience increased volatility of the Hedge Funds' net asset value.

Various risks are also associated with an investment in the Master Fund, including risks relating to the multi-manager structure of the Master Fund, risks relating to compensation arrangements and risks relating to limited liquidity, as described below.

Redemption restrictions exist for Hedge Funds whereby the Hedge Fund Managers may suspend redemption either in their sole discretion or other factors. Such factors include the magnitude of redemptions requested, portfolio valuation issues or market conditions.

15

Rochdale Core Alternative Strategies Master Fund LLC

Notes to Financial Statements (Unaudited)

| 6. | Concentration, Liquidity and Off-Balance Sheet Risk (continued) |

Redemptions are currently restricted for certain Hedge Funds with a fair value at September 30, 2011 aggregating $969,003 as noted in the Schedule of Investments.

In the normal course of business, the Hedge Funds in which the Master Fund invests trade various financial instruments and enter into various investment activities with off-balance sheet risk. These include, but are not limited to, short selling activities, writing option contracts, contracts for differences, and interest rate, credit default and total return equity swap contracts. The Master Fund's risk of loss in these Hedge Funds is limited to the value of its own investments reported in these financial statements by the Master Fund. The Master Fund itself does not invest directly in securities with off-balance sheet risk.

| 7. | Investment Transactions |

For the six months ended September 30, 2011, the aggregate purchases (excluding short-term securities) were $4,500,000 and sales of investments were $4,003,349.

| 8. | Issuer Tender Offer |

The Master Fund offered to purchase up to $8,000,000 of Interests in the Master Fund properly tendered at a price equal to the net asset value of Interests as of December 30, 2011. For Interests tendered, the security holder will receive a promissory note entitling the security holder to a cash amount equal to at least 90% of the net asset value calculated on December 30, 2011, of the Interests tendered and accepted for purchase by the Master Fund, upon the terms and subject to the conditions set forth in the Offer to Purchase dated August 15, 2011. The offer terminated at 5:00 p.m., Eastern Time, on September 12, 2011.

| 9. | Proxy Results |

On June 3, 2011, a special meeting of Members was held to consider approving Garrett D’Alessandro as a member of the Board of Directors of the Master Fund. The following table illustrates the specifics of the vote:

| For | Against | Abstain | ||

12,023.57 | – | – |

16

Rochdale Core Alternative Strategies Master Fund LLC

Notes to Financial Statements (Unaudited)

| 9. | Proxy Results (continued) |

On August 12, 2011, a special meeting of Members was held to consider approving Jay C. Nadel, Daniel A. Hanwacker and Susan Henshaw Jones as members of the Board of Directors of the Master Fund since three Independent Directors recently resigned from the Board of Directors of the Master Fund, two of which had met or were approaching the Master Fund’s retirement age of 75. The following table illustrates the specifics of the vote:

| For | Against | Abstain | ||

12,023.57 | – | – |

17

Rochdale Core Alternative Strategies Master Fund LLC

Financial Highlights

| Period from | ||||||||||||||||||||

| July 1, 2007 | ||||||||||||||||||||

| (Commencement | ||||||||||||||||||||

| of | ||||||||||||||||||||

| Six Months Ended | Year Ended | Year Ended | Year Ended | Operations) through | ||||||||||||||||

September 30, 2011 (1) | March 31, 2011 | March 31, 2010 | March 31, 2009 | March 31, 2008 | ||||||||||||||||

| TOTAL RETURN - NET | (6.58 | %) | 7.32 | % | 9.16 | % | (11.14 | %) | (5.01 | %) | ||||||||||

| RATIOS/SUPPLEMENTAL DATA | ||||||||||||||||||||

| Net Assets, end of period ($000's) | $ | 55,735 | $ | 58,990 | $ | 57,616 | $ | 50,359 | $ | 48,948 | ||||||||||

| Portfolio Turnover | 7.13 | % | 20.32 | % | 20.91 | % | 19.34 | % | 1.39 | % | ||||||||||

| Ratio of Net Investment Loss to Average Net Assets | (1.64 | %) | (1.67 | %) | (1.83 | %) | (1.55 | %) | (1.57 | %) | ||||||||||

| Ratio of Expenses to Average Net Assets | 1.65 | % | 1.68 | % | 1.69 | % | 1.67 | % | 1.86 | % | ||||||||||

Total return is calculated for all Members taken as a whole and an individual Member's return may vary from these Fund returns based on the timing of capital transactions. The total return for periods less than one year are not annualized.

The ratios of net investment loss to average net assets and ratios of expenses to average net assets are annualized for periods of less than one year. The ratios of expenses to average net assets do not include expenses of the Hedge Funds in which the Master Fund invests.

The expense ratios are calculated for all Members taken as a whole. The computation of such ratios based on the amount of expenses assessed to an individual Member's capital may vary from these ratios based on the timing of capital transactions.

The ratios above do not include the proportionate share of income or loss from their investments in other funds.

(1) Unaudited.

The accompanying notes are an integral part of these financial statements

18

Additional Information

Proxy Voting Policies and Procedures

A description of the policies and procedures that the Master Fund uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, will be available (i) without charge, upon request, by calling 1-800-245-9888; and (ii) on the SEC’s website at www.sec.gov.

Portfolio Holdings Disclosure

The Master Fund will file its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q will be available on the SEC’s website at www.sec.gov, and may also be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-732-0330.

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable for semi-annual reports.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

The following table provides information as of September 30, 2011:

Name | Title | Length of Service | Business Experience During Past 5 Years | Role of Portfolio Manager |

| Carl Acebes | Chairman and Director | Dec ’06 – Present | Founder and Co-Chief Investment Officer of Rochdale Investment Management LLC. Founder of Rochdale Securities Corporation and the Rochdale Corporation. | Heads the team of investment professionals and is intricately involved in the firm’s day to day investment management and research work. |

| Garrett R. D’Alessandro | President, Vice Chairman and Board Member | Dec ’06 – Present Since 2011 Since 2011 | President, CEO, Co-Chief Investment Officer and Director of Research of Rochdale Investment Management LLC. | Directs portfolio management strategies and investment research efforts and determines companies that satisfy the firm’s criteria for inclusion in client portfolios. |