City National Rochdale High Yield Alternative Strategies Fund LLC

City National Rochdale High Yield Alternative Strategies Fund TEI LLC

Annual Report

March 31, 2018

Dear Fellow Shareholders,

The City National Rochdale High Yield Alternative Strategies Fund LLC (“Taxable Fund”) and City National Rochdale High Yield Alternative Strategies Fund Tax Exempt Investors LLC (“TEI Fund”), (collectively “RHYAS”) seek to diversify clients’ traditional stock and bond only portfolios through inclusion of alternative strategies focusing on the fixed income markets. For the one year period ending March 31, 2018, the Taxable Fund returned +9.23% and the TEI Fund returned +9.10%. The comparable benchmark of this strategy, the Credit Suisse Leveraged Loan Index returned +4.64% over the previous year. Year to date ended March 31, 2018, the Taxable Fund returned +3.35% and the TEI Fund returned +3.32%, with the benchmark returning +1.58% over the same period.

The performance over the past year has been positive for the shareholders of the City National Rochdale High Yield Alternative Strategy, representing a rebound in the loan market. From the outset of this strategy, in 2013, we held the belief that a single calendar year could not and should not define the outcome of these strategies. The fund invests in less liquid credit markets, therefore during periods of volatility in the traditional High Yield/Loan Market; investors should expect the potential for additional volatility in this fund. Currently, in terms of holdings, the strategies vary, but the majority hold CLOs of varying vintages. The leveraged loan market is a large and vital part of the institutional finance ecosystem. On average, CLOs constitute approximately 52.5% of the leveraged loan market.

Despite the start of risk retention, in 2017, the US CLO market experienced the second highest primary volume issuance in history with $118 billion in new issuance, representing a 63% increase over 2016 issuance. In addition to new issue activity, in 2017, refinancing and reset activity totaled $125bn and $52bn, respectively. Primary US CLOs spreads are at or near post-crisis tights. Pre-crisis vintage analysis shows low cost liabilities have driven CLO Equity outperformance.

The CLO market continues to be heading in the correct direction with new issues of CLOs increasing and more firms entering the structured credit market.

Outlook

With volume of US $118bn, 2017 was the second largest year for CLO issuance behind just 2014 when US$123.6bn of funds were created. CLOs are the largest buyers of US leveraged loans and a strong market can help US companies to refinance their debt and cut their borrowing costs. Analysts are predicting record US CLO fund issuance in 2018 with little in sight to derail 2017’s strong momentum. This momentum continues as capital markets remain open and investors have become used to the idea that the Federal Reserve will continue to hike rates, but at a pace that is not too aggressive.

Banks are expecting increased US CLO fund issuance after a US court ruled that the funds will shortly be exempt from regulations that require managers to hold some of their deal. The US CLO market cheered a decision by a US Court of appeals in February that the funds will be exempt from Dodd-Frank risk-retention rules, which require managers to hold 5% of their fund. Removing the retention hurdle should help more firms to raise deals, especially smaller managers that lacked the required capital. Banks are also increasing its forecast for US CLO refinancings and resets. Refinancings keep funds’ maturities in place but change the interest rate on one or more debt tranches, whereas resets extend maturities to allow CLOs to stay outstanding longer. Decreasing spreads paid to senior CLO debtholders increases the payout to investors in the most junior tranche, as equity holders receive the interest left over after all other investors are paid.

In today’s market, investment in CLO equity provides an attractive risk/return profile. Current CLO new issue liability costs are at the lowest post-crisis levels. There is significant embedded upside from the widening of loan spreads over the course of the re-investment period and downside protection against tightening of liability costs due to the vibrant market for CLO refinancings and resets. With a supportive macro environment for CLOs, we view this portfolio to be well positioned. We do believe there will continue to be bouts of volatility in the market over the next 12 months, and we see the managers taking advantage of this potential instability.

Sincerely,

Garrett R. D’Alessandro, CFA, CAIA, AIF®

Chief Executive Officer & President

City National Rochdale LLC

Important Disclosures

The performance returns presented may contain figures estimated by the underlying manager which, if subsequently revised by the underlying manager, may change the returns indicated for the applicable period.

The unsubsidized total annual fund operating expense ratio for the City National Rochdale High Yield Alternative Strategies Fund and the City National Rochdale High Yield Alternative Strategies Fund TEI was 1.75% for the fiscal year ended March 31, 2018. Cumulative returns for the fiscal year ended March 31, 2018 for the City National Rochdale High Yield Alternative Strategies Fund and the City National Rochdale High Yield Alternative Strategies Fund TEI was 9.23% and 9.10%, respectively.

Performance quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. The most recent month-end performance can be obtained by calling 800-245-9888.

An investor should consider carefully the Funds’ investment objectives, risks, charges, and expenses. The prospectus contains this and other important information about the investment company, and it may be obtained by calling 800-245-9888. Please read it carefully before investing. RIM Securities LLC, the affiliated broker dealer for City National Rochdale LLC, 400 Park Avenue, New York, NY 10022.

The views expressed herein represent the opinions of City National Rochdale LLC and are subject to change without notice at any time. This information should not in any way be construed to be investment, financial, tax, or legal advice or other professional advice or service, and should not be relied on in making any investment or other decisions. Hedge fund investments are speculative and may entail substantial risks. Investing in small and medium-size companies may carry additional risks such as limited liquidity and increased volatility. Investing in international companies carries risks such as currency fluctuation, interest rate fluctuation, and economic and political instability. Short sales may increase volatility and potential for loss. As with all investments, there is no guarantee that investment objectives will be met.

City National Rochdale LLC, its affiliated companies, or their respective shareholders, directors, officers and/or employees may have long or short positions in the securities discussed herein.

City National Rochdale High Yield Alternative

Strategies Fund TEI LLC and Subsidiary

Consolidated Financial Statements

March 31, 2018

City National Rochdale High Yield Alternative Strategies Fund TEI LLC and Subsidiary

Consolidated Financial Statements

March 31, 2018

TABLE OF CONTENTS

| City National Rochdale High Yield Alternative Strategies Fund TEI LLC and Subsidiary | Page |

| |

Report of Independent Registered Public Accounting Firm | 1 |

| |

Consolidated Financial Statements | |

| |

| Statement of Assets, Liabilities and Members' Capital | 2 |

| Statement of Operations | 3 |

| Statements of Changes in Members' Capital | 4 |

| Statement of Cash Flows | 5 |

| Notes to Consolidated Financial Statements | 6 - 13 |

| Financial Highlights | 14 |

| |

| |

City National Rochdale High Yield Alternative Strategies Master Fund LLC | Page |

| |

Report of Independent Registered Public Accounting Firm | 1 |

| |

Financial Statements | |

| |

| Statement of Assets, Liabilities and Members' Capital | 2 |

| Statement of Operations | 3 |

| Statements of Changes in Members' Capital | 4 |

| Statement of Cash Flows | 5 |

| Schedule of Investments | 6 - 7 |

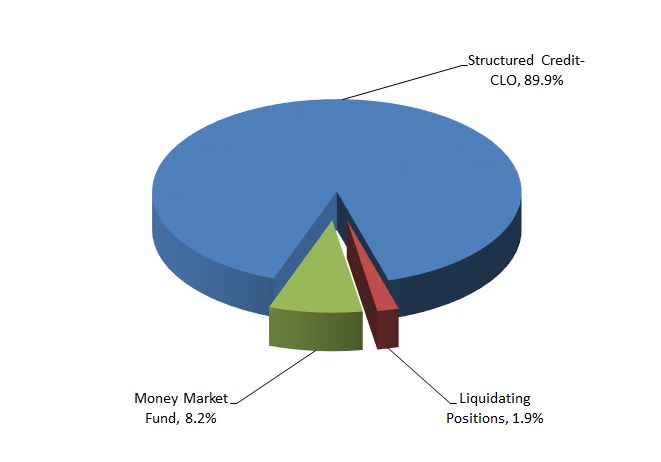

| Strategy Allocation Breakdown | 8 |

| Notes to Financial Statements | 9 - 17 |

| Financial Highlights | 18 |

| |

| Director and Officer Information | |

| |

| Additional Information | |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Managing Member and Board of Directors of

City National Rochdale High Yield Alternative Strategies Fund TEI LLC and Subsidiary

Opinion on the Financial Statements

We have audited the accompanying consolidated statement of assets, liabilities and members’ capital of City National Rochdale High Yield Alternative Strategies Fund TEI LLC and Subsidiary (the “Fund"), as of March 31, 2018, and the related consolidated statements of operations and cash flows for the year then ended, the consolidated statements of changes in members' capital for each of the years in the two-year period then ended, and the consolidated financial highlights for each of the two years in the two-year period then ended, and the related notes (collectively referred to as the “consolidated financial statements”). The consolidated financial highlights for the years ended March 31, 2016, 2015 and 2014 were audited by other auditor’s whose report dated May 27, 2016 expressed an unqualified opinion. In our opinion, the consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Fund as of March 31, 2018, and the consolidated results of their operations and their cash flows for the year then ended, the changes in their members’ capital for each of the years in the two-year period then ended, and the financial highlights for each of the years in the two-year period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund's internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

/s/ EisnerAmper LLP

We have served as the Fund’s auditor since March 3, 2017. We have served as the auditor of one or more City National Rochdale’s investment companies since 2015.

EISNERAMPER LLP

Philadelphia, Pennsylvania

May 29, 2018

| City National Rochdale High Yield Alternative Strategies Fund TEI LLC and Subsidiary | |

| | | | |

| Consolidated Statement of Assets, Liabilities and Members' Capital | |

| | | | |

| March 31, 2018 | |

| | | | |

| | | | |

| ASSETS | | | |

| Investment in City National Rochdale High Yield | | | |

| Alternative Strategies Master Fund LLC | | $ | 16,974,551 | |

| Prepaid expenses | | | 1,041 | |

| Receivable from Adviser | | | 13,816 | |

| | | | | |

| Total Assets | | | 16,989,408 | |

| | | | | |

| LIABILITIES AND MEMBERS' CAPITAL | | | | |

| Liabilities | | | | |

| Professional fees payable | | | 28,500 | |

| Investor servicing fees payable | | | 10,385 | |

| Accrued expenses and other liabilities | | | 3,241 | |

| | | | | |

| Total Liabilities | | | 42,126 | |

| | | | | |

| Total Members' Capital | | $ | 16,947,282 | |

| | | | | |

| | | | | |

| | | | | |

| The accompanying notes are an integral part of these consolidated financial statements. | |

| City National Rochdale High Yield Alternative Strategies Fund TEI LLC and Subsidiary | |

| | | | |

| Consolidated Statement of Operations | |

| | | | |

| Year Ended March 31, 2018 | |

| | | | |

| | | | |

| NET INVESTMENT LOSS ALLOCATED FROM CITY NATIONAL ROCHDALE | |

| HIGH YIELD ALTERNATIVE STRATEGIES MASTER FUND LLC | | | |

| Interest income | | $ | 19,091 | |

| Management fees | | | (125,145 | ) |

| Expenses | | | (131,859 | ) |

| | | | | |

| Net Investment Loss Allocated | | | (237,913 | ) |

| | | | | |

| | | | | |

| FUND EXPENSES | | | | |

| Investor servicing fees (see Note 4) | | | 41,866 | |

| Professional fees | | | 34,483 | |

| Registration fees | | | 9,483 | |

| Custody fees | | | 4,093 | |

| Insurance expense | | | 1,071 | |

| Other fees | | | 2,668 | |

| Total Fund Expenses | | | 93,664 | |

| | | | | |

| Less expenses waived and reimbursed | | | (57,605 | ) |

| | | | | |

| Net Fund Expenses | | | 36,059 | |

| | | | | |

| Net Investment Loss | | | (273,972 | ) |

| | | | | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | | |

| ALLOCATED FROM CITY NATIONAL ROCHDALE HIGH YIELD ALTERNATIVE | |

| STRATEGIES MASTER FUND LLC | | | | |

| Net realized gain on investments | | | 1,589,791 | |

| Net change in unrealized appreciation on investments | | | 189,594 | |

| | | | | |

| Net Realized and Unrealized Gain on Investments | | | 1,779,385 | |

| | | | | |

| Net Increase in Members' Capital Resulting from Operations | | $ | 1,505,413 | |

| | | | | |

| | | | | |

| The accompanying notes are an integral part of these consolidated financial statements. | |

| City National Rochdale High Yield Alternative Strategies Fund TEI LLC and Subsidiary | |

| | | | | | | |

| Consolidated Statements of Changes in Members' Capital | |

| | | | | | | |

| | | | | | | |

| | | Year Ended | | | Year Ended | |

| | | March 31, 2018 | | | March 31, 2017 | |

| FROM OPERATIONS | | | | | | |

| Net investment loss | | $ | (273,972 | ) | | $ | (416,453 | ) |

| Net realized gain on investments | | | 1,589,791 | | | | 1,850,139 | |

| Net change in unrealized appreciation on investments | | | 189,594 | | | | 1,061,569 | |

| | | | | | | | | |

| Net Increase in Members' Capital | | | | | | | | |

| Resulting From Operations | | | 1,505,413 | | | | 2,495,255 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From net investment income | | | (638,828 | ) | | | (441,499 | ) |

| | | | | | | | | |

| DECREASE FROM TRANSACTIONS IN | | | | | | | | |

| IN MEMBERS' CAPITAL | | | | | | | | |

| Proceeds from sales of members' interests | | | 200,000 | | | | - | |

| Redemptions as a result of tender offer | | | (4,644,474 | ) | | | - | |

| Payment of redemptions of members' interests | | | (200,000 | ) | | | - | |

| Taxes paid from members' interests | | | (19,296 | ) | | | (28,667 | ) |

| Net Decrease in Members' Interests | | | (4,663,770 | ) | | | (28,667 | ) |

| | | | | | | | | |

| Total Increase (Decrease) in Members' Capital | | | (3,797,185 | ) | | | 2,025,089 | |

| | | | | | | | | |

| MEMBERS' CAPITAL | | | | | | | | |

| | | | | | | | | |

| Beginning of year | | | 20,744,467 | | | | 18,719,378 | |

| | | | | | | | | |

| End of year | | $ | 16,947,282 | | | $ | 20,744,467 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| The accompanying notes are an integral part of these consolidated financial statements. | |

| City National Rochdale High Yield Alternative Strategies Fund TEI LLC and Subsidiary | |

| | | | |

| Consolidated Statement of Cash Flows | |

| | | | |

| Year Ended March 31, 2018 | |

| | | | |

| | | | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | |

| Net increase in members' capital resulting from operations | | $ | 1,505,413 | |

| Adjustments to reconcile net increase in members' capital resulting | | | | |

| from operations to net cash provided by operating activities: | | | | |

| Net change in unrealized appreciation on investments | | | (189,594 | ) |

| Net realized gain on investments | | | (1,589,791 | ) |

| Sales of investments in Master Fund, net | | | 5,302,598 | |

| Net investment loss allocated from Master Fund | | | 237,913 | |

| Expenses paid by the Master Fund | | | 42,033 | |

| Changes in operating assets and liabilities: | | | | |

| Prepaid expenses | | | 929 | |

| Receivable from Adviser | | | 1,370 | |

| Professional fees payable | | | (3,000 | ) |

| Investor servicing fees payable | | | (2,519 | ) |

| Accrued expenses and other liabilities | | | (2,754 | ) |

| | | | | |

| Net Cash provided by Operating Activities | | | 5,302,598 | |

| | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | |

| Proceeds from sales of members' interests | | | 200,000 | |

| Redemptions as a results of tender offer | | | (4,644,474 | ) |

| Payments of redemptions of members' interests | | | (200,000 | ) |

| Taxes paid from members' interests | | | (19,296 | ) |

| Distributions | | | (638,828 | ) |

| Net Cash used in Financing Activities | | | (5,302,598 | ) |

| | | | | |

| Net Change in Cash | | | - | |

| | | | | |

| CASH | | | | |

| Beginning of year | | | - | |

| | | | | |

| End of year | | $ | - | |

| | | | | |

| | | | | |

| | | | | |

| The accompanying notes are an integral part of these consolidated financial statements. | |

City National Rochdale High Yield Alternative Strategies Fund TEI LLC and Subsidiary

Notes to Consolidated Financial Statements

March 31, 2018

City National Rochdale High Yield Alternative Strategies Fund TEI LLC (the “TEI Fund”) and its subsidiary, Rochdale High Yield Alternative Strategies Fund (Cayman) LDC (the "Offshore Fund") together constitute the "Fund". The TEI Fund is a Delaware limited liability company registered under the Investment Company Act of 1940, as amended, as a closed-end management investment company. The TEI Fund commenced investment operations on July 1, 2007. The TEI Fund’s investment objective is to generate income from investments in higher yielding investments with lower credit quality and higher volatility than the investment grade fixed income securities. “Lower credit quality” in this objective means investments rated below BBB, and “higher volatility” means the fluctuations in principal will be greater than the fluctuations in price associated with investment grade fixed income securities.

The TEI Fund invests substantially all of its investable assets in the Offshore Fund, a Cayman Islands limited duration company with the same investment objective as the TEI Fund. The Offshore Fund in turn invests substantially all of its investable assets in City National Rochdale High Yield Alternative Strategies Master Fund LLC (the “Master Fund”), a registered investment company with the same investment objective as the Offshore Fund and the TEI Fund. The Offshore Fund serves solely as an intermediate entity through which the TEI Fund invests in the Master Fund. The Offshore Fund makes no independent investment decisions and has no investment or other discretion over the investible assets. City National Rochdale LLC (the “Manager” or "Adviser") is the investment adviser to the Master Fund. The Manager is also the adviser to City National Rochdale High Yield Alternative Strategies Fund, LLC, which also invests all of its investable assets with the Master Fund.

The financial statements of the Master Fund are included elsewhere in this report and should be read in conjunction with the TEI Fund’s financial statements. At March 31, 2018, the TEI Fund's beneficial ownership of the Master Fund's net assets was 48.29%.

City National Rochdale High Yield Alternative Strategies Fund TEI LLC and Subsidiary

Notes to Consolidated Financial Statements

March 31, 2018

| 1. | Organization (continued) |

The TEI Fund reserves the right to reject any subscriptions for Interests in the TEI Fund. Generally, initial and additional subscriptions for investment (or "Member Interests") in the TEI Fund by eligible Members may be accepted at such times as the TEI Fund may determine. Each Member must be a qualified investor and subscribe for a minimum initial investment in the TEI Fund of $25,000. Additional investments in the TEI Fund must be made in a minimum amount of $10,000. Brokers selling the TEI Fund may establish higher minimum investment requirements than the TEI Fund. The TEI Fund from time to time may offer to repurchase member interests in the TEI Fund at such times and on such terms as may be determined by the TEI Fund's Board in its complete and absolute discretion. TEI Fund interests must be held for at least six months after initial purchase (or for a second six-month period as described below). Members must hold TEI Fund interests for at least six months before being eligible to request that the TEI Fund repurchase TEI Fund interests during a tender offer. If no such request is made by a Member during a tender offer, such Member must hold TEI Fund interests for a second six-month period before submitting an initial request.

| 2. | Significant Accounting Policies |

The following is a summary of significant accounting policies followed by the TEI Fund.

Basis of Presentation and Use of Estimates

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“US GAAP”). The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates.

Fair Value Measurements

The TEI Fund follows fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion in changes in valuation techniques and related inputs during the period. These standards define fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

City National Rochdale High Yield Alternative Strategies Fund TEI LLC and Subsidiary

Notes to Consolidated Financial Statements

March 31, 2018

| 2. | Significant Accounting Policies (continued) |

Fair Value Measurements (continued)

The fair value hierarchy is organized into three levels based upon the assumptions (referred to as “inputs”) used in pricing the asset or liability. These standards state that “observable inputs” reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from independent sources and “unobservable inputs” reflect an entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability. These inputs are summarized in the three broad levels listed below:

Level 1 - Unadjusted quoted prices in active markets for identical assets or liabilities that the TEI Fund has the ability to access.

Level 2 - Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 - Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the TEI Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in these securities.

For the year ended March 31, 2018, the TEI Fund’s investment consisted entirely of an investment in the Master Fund. The fair value hierarchy of the Master Fund’s investments is disclosed in the notes to the Master Fund’s financial statements, included elsewhere in this report.

City National Rochdale High Yield Alternative Strategies Fund TEI LLC and Subsidiary

Notes to Consolidated Financial Statements

March 31, 2018

| 2. | Significant Accounting Policies (continued) |

Investments Valuation

The net asset value of the TEI Fund is determined as of the close of business at the end of each month. The net asset value of the TEI Fund equals the value of the assets of the TEI Fund, less liabilities, including accrued fees and expenses.

The TEI Fund's investment in the Master Fund represents substantially all of the TEI Fund's assets. All investments owned are carried at fair value, which is the portion of the net asset value of the Master Fund held by the TEI Fund.

The accounting for and valuation of investments by the Master Fund is discussed in the notes to the financial statements for the Master Fund, included elsewhere in this report.

The TEI Fund has not maintained any positions in derivative instruments or directly engaged in hedging activities.

Investment Income Recognition

Purchases and sales of investments in the Master Fund are recorded on a trade-date basis. Interest income is recorded on the accrual basis and dividends are recorded on the ex-dividend date. Realized and unrealized gains and losses are included in the determination of income as allocated from the Master Fund based upon its ownership interest.

Fund Expenses

The direct expenses of the TEI Fund include, but are not limited to, the following: legal fees; accounting and auditing fees; custodial fees; costs of computing the TEI Fund’s net asset value; costs of insurance; registration expenses, expenses of meetings of the Board and members; all costs with respect to communications to members; and other types of expenses as may be approved from time to time by the Board. The TEI Fund, as an investor in the Master Fund, recognizes its share of the fees and expenses of the Master Fund (including a management fee).

Income Taxes

The TEI Fund's tax year end is December 31. The TEI Fund is treated as a partnership for Federal income tax purposes, whereby each Member of the TEI Fund is responsible for the tax liability or benefit relating to such Member’s distributive share of taxable income or loss. Accordingly, no provision for Federal income taxes is reflected in the accompanying financial statements.

City National Rochdale High Yield Alternative Strategies Fund TEI LLC and Subsidiary

Notes to Consolidated Financial Statements

March 31, 2018

| 2. | Significant Accounting Policies (continued) |

Income Taxes (continued)

The TEI Fund has adopted authoritative guidance on uncertain tax positions. The TEI Fund recognizes the effect of tax positions when they are more likely than not of being sustained. Management is not aware of any exposure to uncertain tax positions that could require accrual or which could affect the TEI Fund’s liquidity or future cash flows, or its treatment as a flow through entity, pursuant to relevant income tax regulations. As of March 31, 2018 the TEI Fund’s tax years 2015 through 2017 remain open and subject to examination by relevant taxing authorities.

Distribution Policy

The TEI Fund plans to make periodic distributions of its net investment income and capital gains, if any, to Members. The amount and frequency of distributions is at the sole discretion of the Board. During the year ended March 31, 2018, the TEI Fund distributed $638,828 of net investment income to Members. It also paid $19,296 of taxes on behalf of its Members. The TEI Fund redeemed $200,000 of Members' interests in the year ended March 31, 2018.

Capital Accounts

Net profits or net losses of the TEI Fund for each month are allocated to the capital accounts of Members as of the last day of each month in accordance with Members' respective investment percentage in the TEI Fund. Net profits or net losses are measured as the net change in the value of the net assets of the TEI Fund during each month, before giving effect to any repurchases of interest in the TEI Fund, and excluding the amount of any items to be allocated to the capital accounts of the Members of the TEI Fund, other than in accordance with the each Members' respective investment percentage.

Prior to the end of each quarter, the TEI Fund receives Member contributions with an effective subscription date of the first day of the following month. These contributions are held by the Master Fund and have an effective investment date of the first day of the following month. The Master Fund, in turn, makes contributions to certain Hedge Funds, which have effective subscription dates of the first day of the following month. These amounts are reported as "Contributions received in advance" and "Investments made in advance", respectively.

Cash and Cash Equivalents

The TEI Fund considers all highly liquid investments with a maturity of ninety days or less at time of purchase to be cash equivalents.

City National Rochdale High Yield Alternative Strategies Fund TEI LLC and Subsidiary

Notes to Consolidated Financial Statements

March 31, 2018

| 2. | Significant Accounting Policies (continued) |

Consolidation

The financial statements of the TEI Fund includes the Offshore Fund, its wholly owned subsidiary. All inter-company transactions have been eliminated in consolidation.

Subsequent Events

The TEI Fund has adopted financial reporting rules regarding subsequent events, which requires an entity to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed at the date of the balance sheet. Management has evaluated the Fund’s related events and transactions through the date the financial statements were available to be issued and determined that there were no significant subsequent events that would require adjustments to or additional disclosure in these financial statements.

| 3. | Commitments and Other Related Party Transactions |

The Manager has contractually agreed to waive and/or reimburse the expenses of the TEI Fund and the Master Fund, to the extent needed to limit their combined annual operating expenses to 1.75% of net assets. Prior to January 1, 2017, the annual operating expenses were limited to 2.25% of net assets. To the extent that the Manager reimburses or absorbs fees and expenses, it may seek payment of such amounts for three years after the year in which the expenses were reimbursed or absorbed. The TEI Fund will make no such payment, however, if its total annual operating expenses exceed the expense limits in effect at the time the expenses are to be reimbursed or at the time these payments are proposed. For the year ended March 31, 2018, the Manager waived $57,605 of fees and expenses, which may be recouped by the Manager no later than March 31, 2021.

City National Rochdale High Yield Alternative Strategies Fund TEI LLC and Subsidiary

Notes to Consolidated Financial Statements

March 31, 2018

| 3. | Commitments and Other Related Party Transactions (continued) |

The following is a schedule of when fees may be recouped by the Manager:

City National Rochdale High Yield Alternative Strategies Fund TEI LLC | | Expiration |

| $ | 37,704 | | March 31, 2019 |

| | 38,225 | | March 31, 2020 |

| | 57,605 | | March 31, 2021 |

| $ | 133,534 | | |

No accrual has been made for such contingent liability because of the uncertainty of the reimbursement from the TEI Fund.

| 4. | Investor Servicing Fees |

The TEI Fund pays a fee to RIM Securities, LLC, an affiliate of the Manager, as Distributor to reimburse it for payments made to broker-dealers and certain financial advisers (“Investor Service Providers”) that have agreed to provide ongoing investor services to investors in the TEI Fund that are their customers. This fee is paid quarterly and in an amount, with respect to each Investor Service Provider, not to exceed the lesser of: (i) 0.25% (on an annualized basis) of the aggregate value of outstanding interests held by investors that receive services from the Investment Service Provider, determined as of the last day of the calendar month (before any repurchase of Member interests); or (ii) the Distributor’s actual payments to the Investor Service Providers.

City National Rochdale High Yield Alternative Strategies Fund TEI LLC and Subsidiary

Notes to Consolidated Financial Statements

March 31, 2018

| 5. | Concentration, Liquidity and Off-Balance Sheet Risks |

The Master Fund invests primarily in Hedge Funds that are illiquid securities and not registered under the 1940 Act. Such Hedge Funds invest in actively traded securities, illiquid securities, derivatives and other financial instruments using several investment strategies and investment techniques, including leverage, which may involve significant risks. The Master Fund's concentration and liquidity risks are discussed in the notes to the Master Fund's financial statements which are included elsewhere in this report.

In the normal course of business, the Hedge Funds in which the Master Fund invests trade various derivatives and financial instruments and enter into various investment activities with off-balance sheet risk. The Master Fund's off balance sheet risk in these financial instruments is discussed in the notes to the Master Fund's financial statements which are included elsewhere in this report.

| 6. | Investment Transactions |

For the year ended March 31, 2018, the TEI Fund's assets were invested in the Master Fund, and the TEI Fund had aggregate redemptions of $5,344,631 from the Master Fund.

On March 31, 2017, the TEI Fund offered to purchase up to $6,498,935 of Members’ interests in the Fund properly tendered at a price equal to the net asset value of such interests as of April 30, 2017. For Members’ interests tendered, each security holder received a promissory note entitling the security holder to a cash amount equal to the net asset value of their interests calculated as of April 30, 2017, upon the terms and subject to the conditions set forth in the Offer to Purchase dated March 30, 2017. The offer terminated at 5:00 p.m., Eastern Time, on April 28, 2017. Pursuant to the Offer to Purchase, Members’ interests of $4,644,474 were tendered and accepted by the TEI Fund.