Third Quarter 2019 Results October 17, 2019 Exhibit 99.2

Forward-Looking Statement Certain statements contained in this presentation are forward-looking in nature. These include all statements about People's United Financial, Inc. (“People’s United”) plans, objectives, expectations and other statements that are not historical facts, and usually use words such as "expect," "anticipate," "believe," "should" and similar expressions. Such statements represent management's current beliefs, based upon information available at the time the statements are made, with regard to the matters addressed. All forward-looking statements are subject to risks and uncertainties that could cause People's United’s actual results or financial condition to differ materially from those expressed in or implied by such statements. Factors of particular importance to People’s United include, but are not limited to: (1) changes in general, international, national or regional economic conditions; (2) changes in interest rates; (3) changes in loan default and charge-off rates; (4) changes in deposit levels; (5) changes in levels of income and expense in non-interest income and expense related activities; (6) changes in accounting and regulatory guidance applicable to banks; (7) price levels and conditions in the public securities markets generally; (8) competition and its effect on pricing, spending, third-party relationships and revenues; (9) the successful integration of acquisitions; and (10) changes in regulation resulting from or relating to financial reform legislation. People's United does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

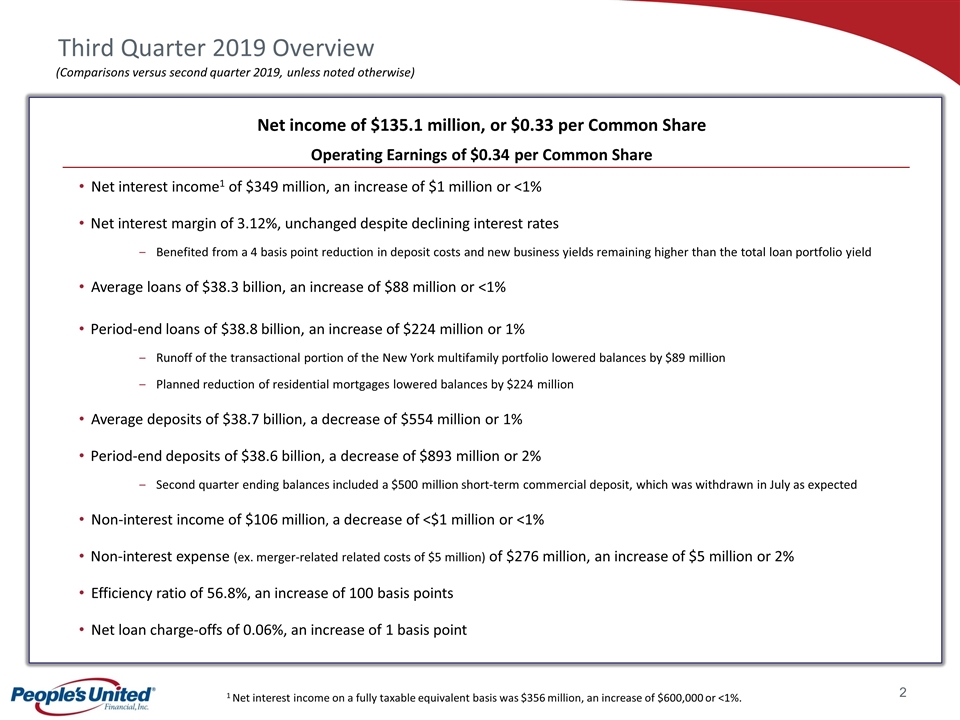

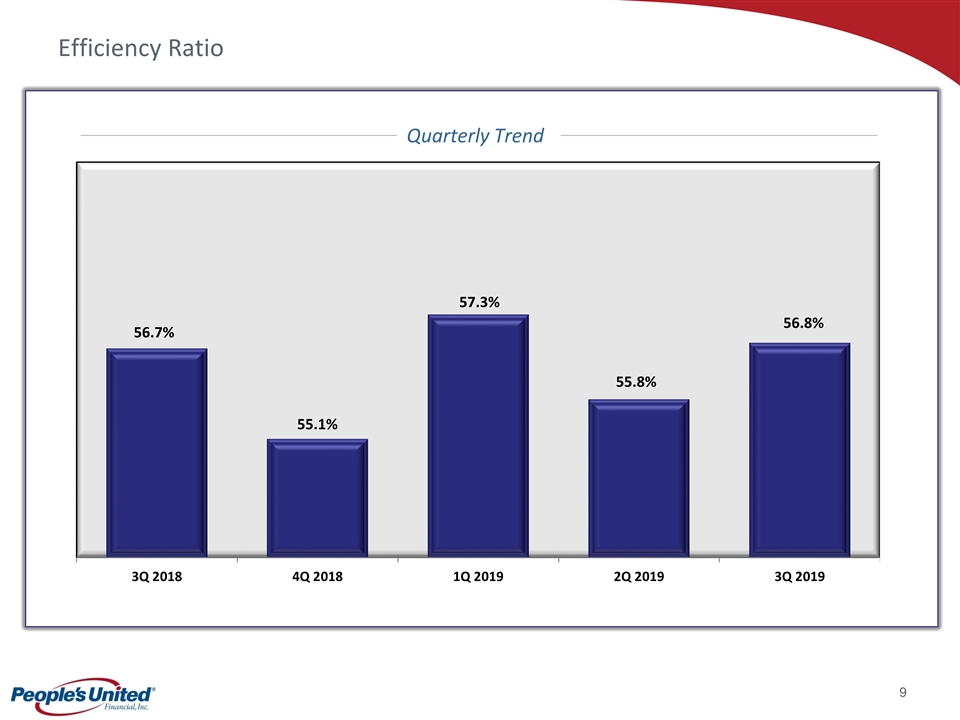

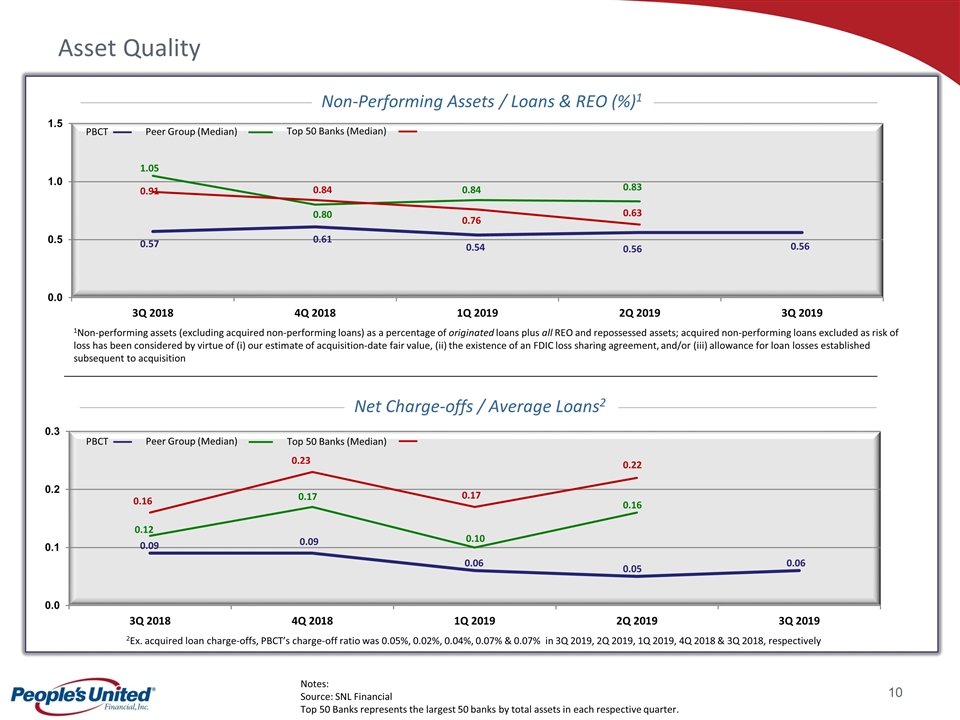

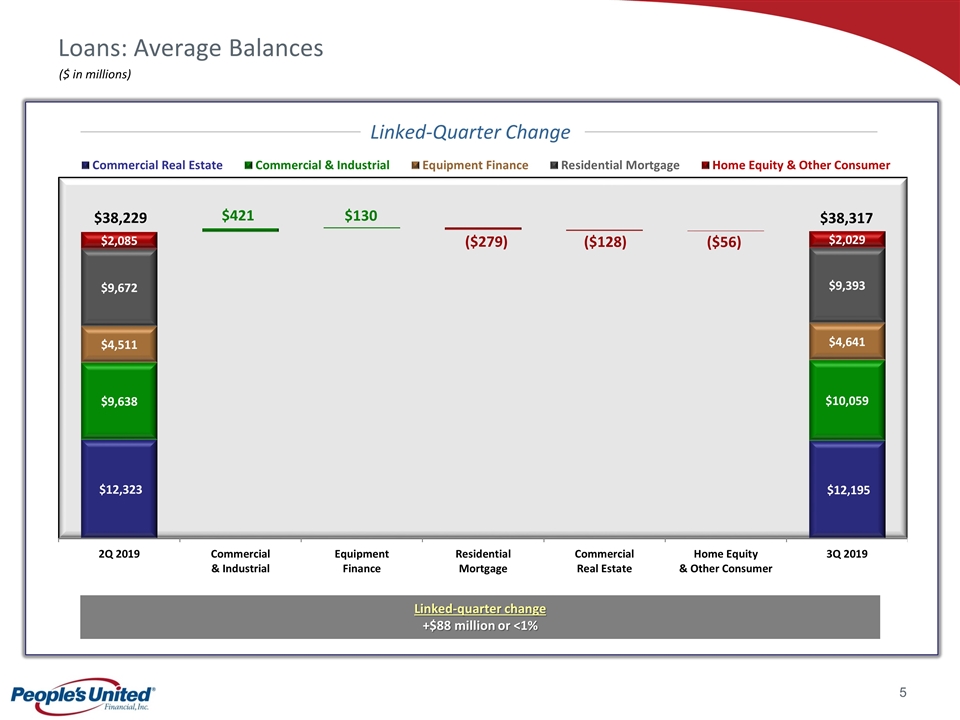

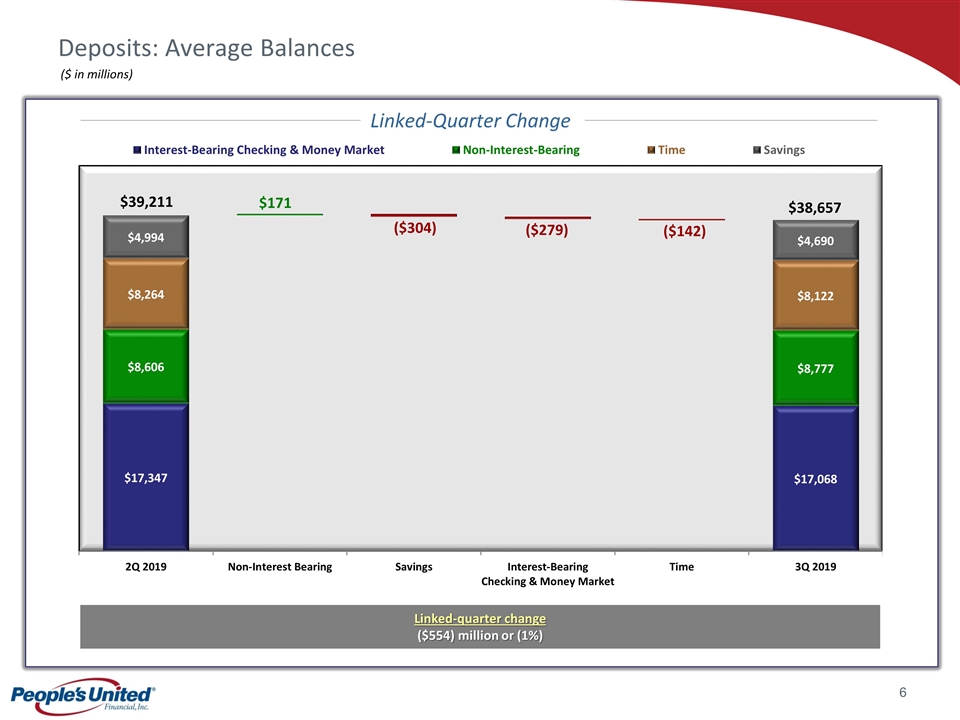

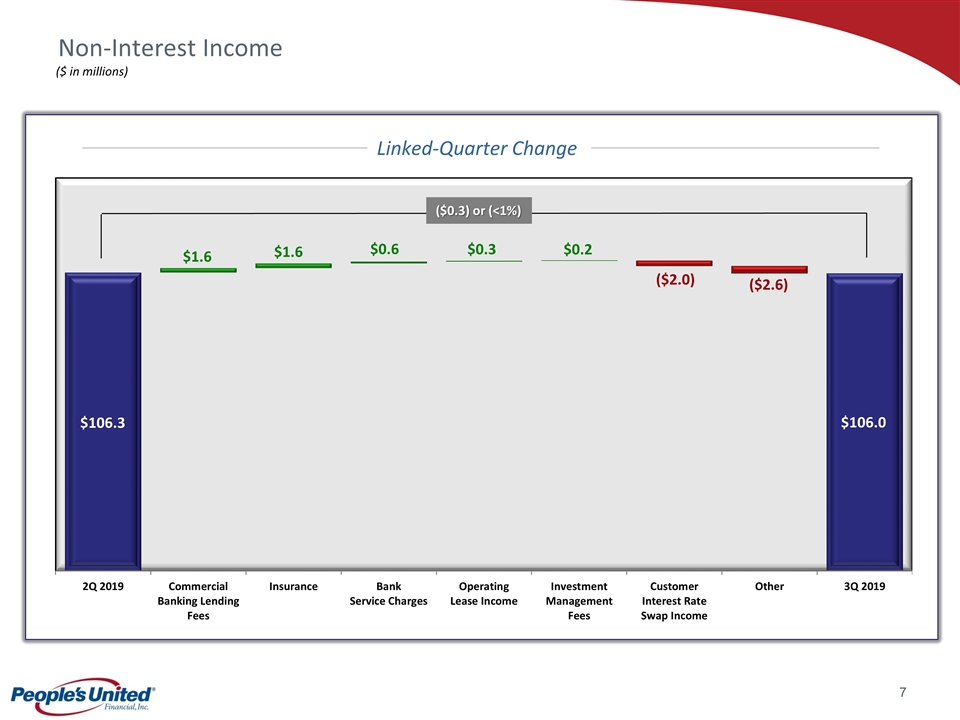

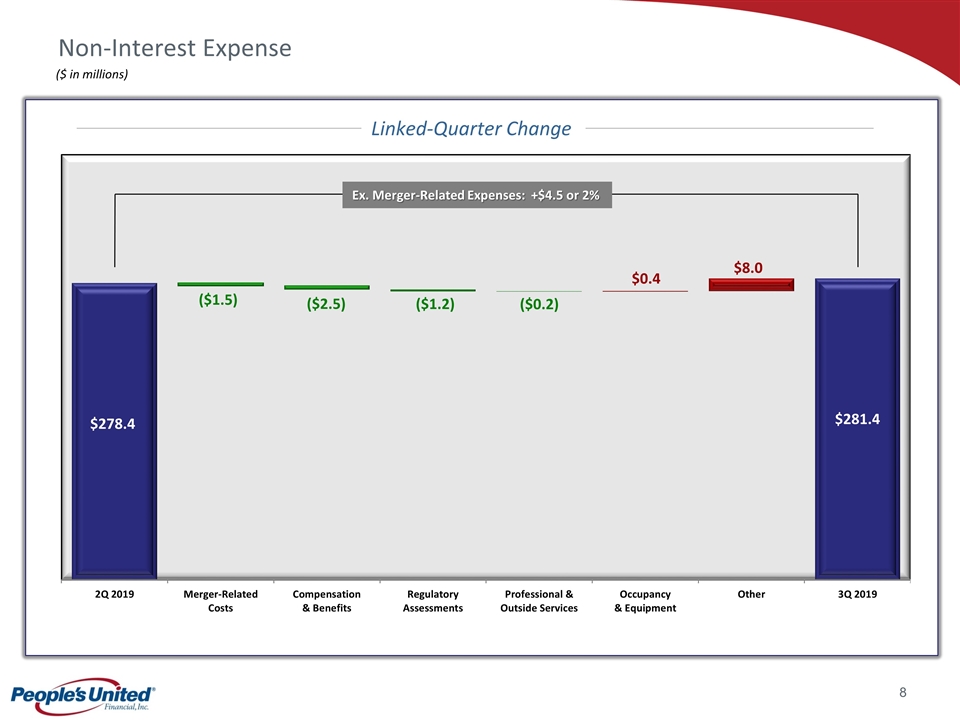

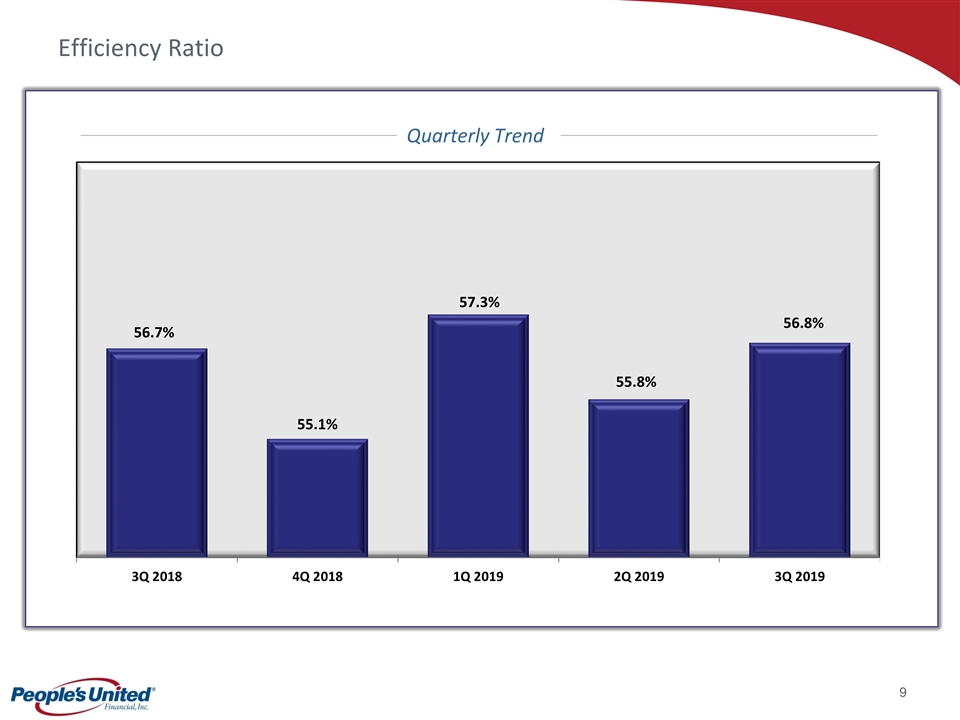

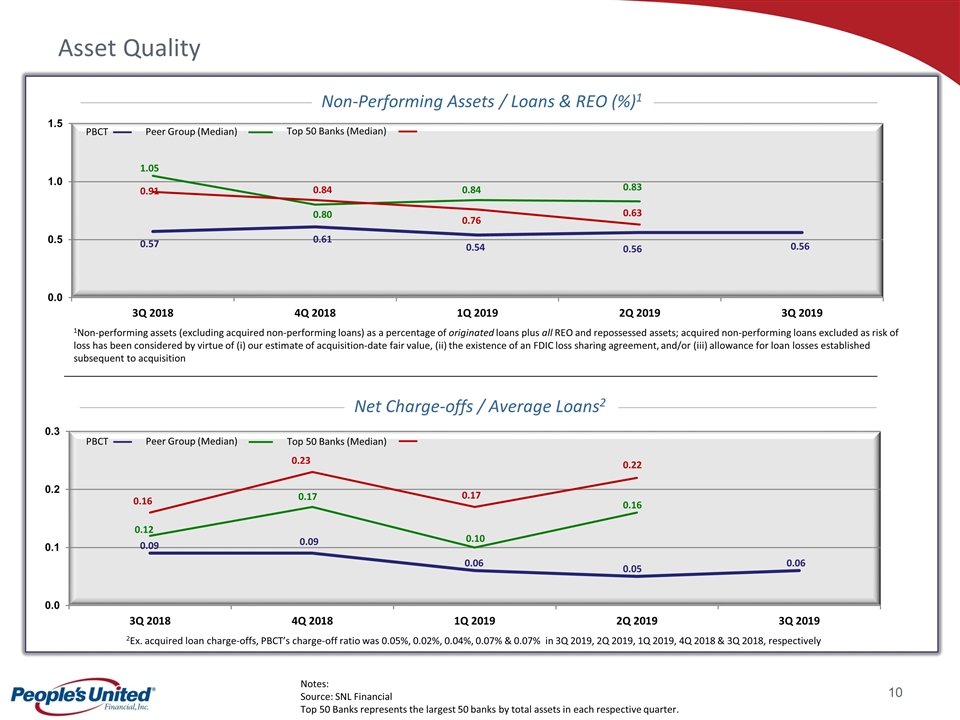

1 Net interest income on a fully taxable equivalent basis was $356 million, an increase of $600,000 or <1%. Third Quarter 2019 Overview Net income of $135.1 million, or $0.33 per Common Share Operating Earnings of $0.34 per Common Share Net interest income1 of $349 million, an increase of $1 million or <1% Net interest margin of 3.12%, unchanged despite declining interest rates Benefited from a 4 basis point reduction in deposit costs and new business yields remaining higher than the total loan portfolio yield Average loans of $38.3 billion, an increase of $88 million or <1% Period-end loans of $38.8 billion, an increase of $224 million or 1% Runoff of the transactional portion of the New York multifamily portfolio lowered balances by $89 million Planned reduction of residential mortgages lowered balances by $224 million Average deposits of $38.7 billion, a decrease of $554 million or 1% Period-end deposits of $38.6 billion, a decrease of $893 million or 2% Second quarter ending balances included a $500 million short-term commercial deposit, which was withdrawn in July as expected Non-interest income of $106 million, a decrease of <$1 million or <1% Non-interest expense (ex. merger-related related costs of $5 million) of $276 million, an increase of $5 million or 2% Efficiency ratio of 56.8%, an increase of 100 basis points Net loan charge-offs of 0.06%, an increase of 1 basis point (Comparisons versus second quarter 2019, unless noted otherwise)

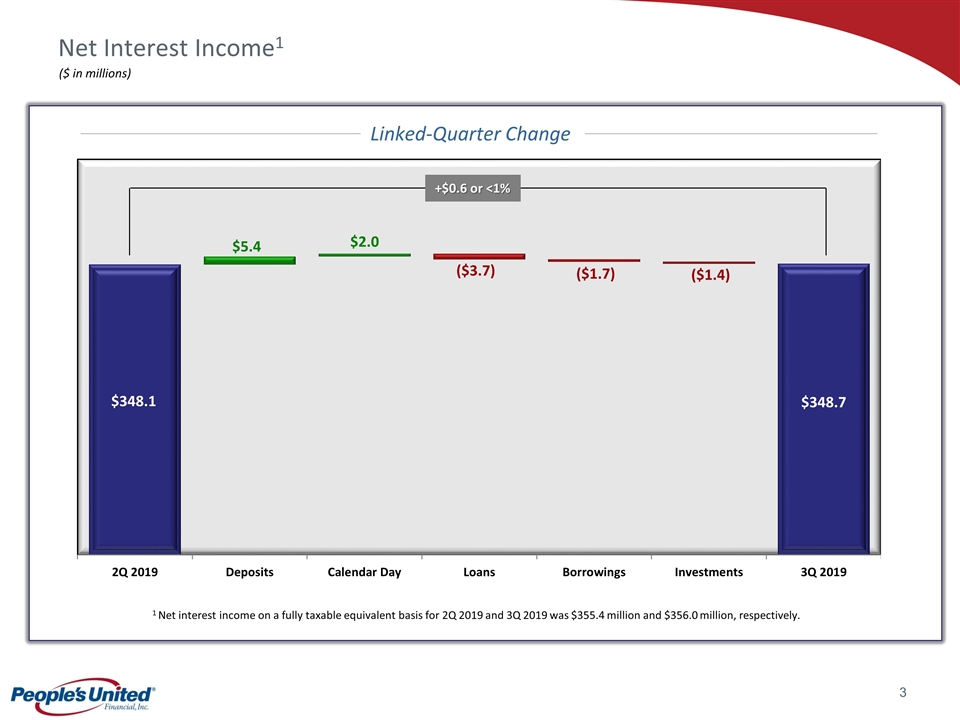

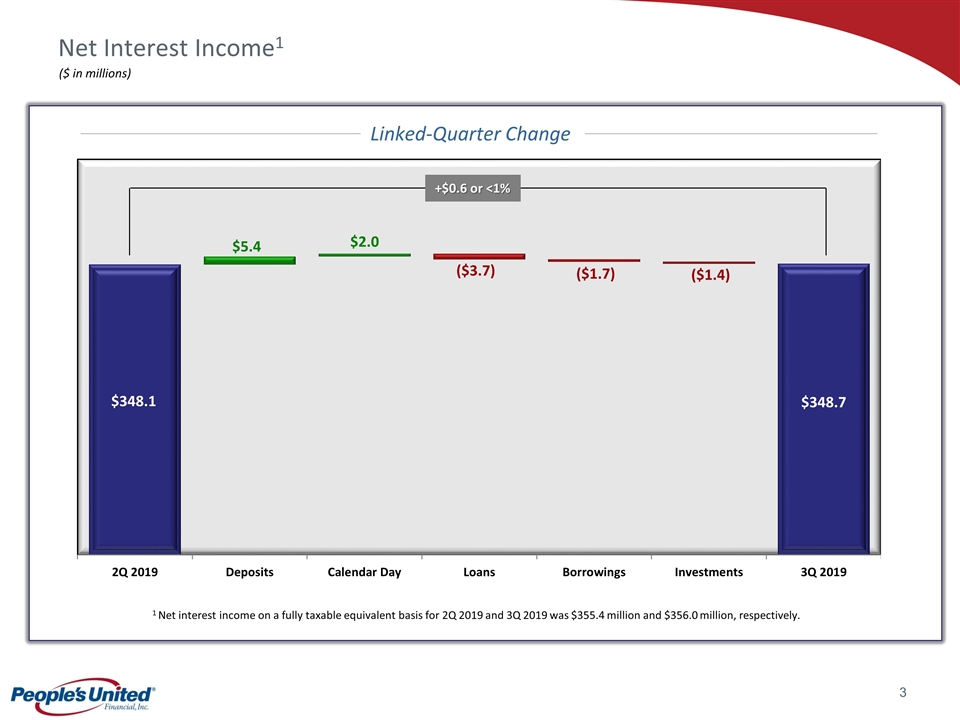

Net Interest Income1 ($ in millions) $348.1 $348.7 1 Net interest income on a fully taxable equivalent basis for 2Q 2019 and 3Q 2019 was $355.4 million and $356.0 million, respectively. +$0.6 or <1% Linked-Quarter Change $5.4 $2.0 ($3.7) ($1.7) ($1.4)

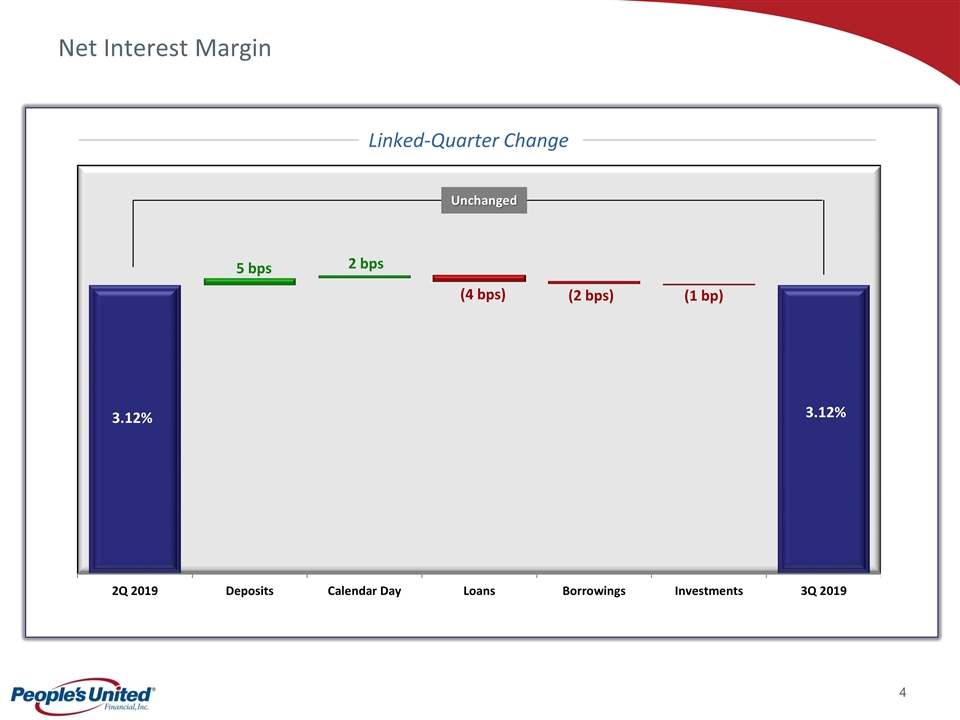

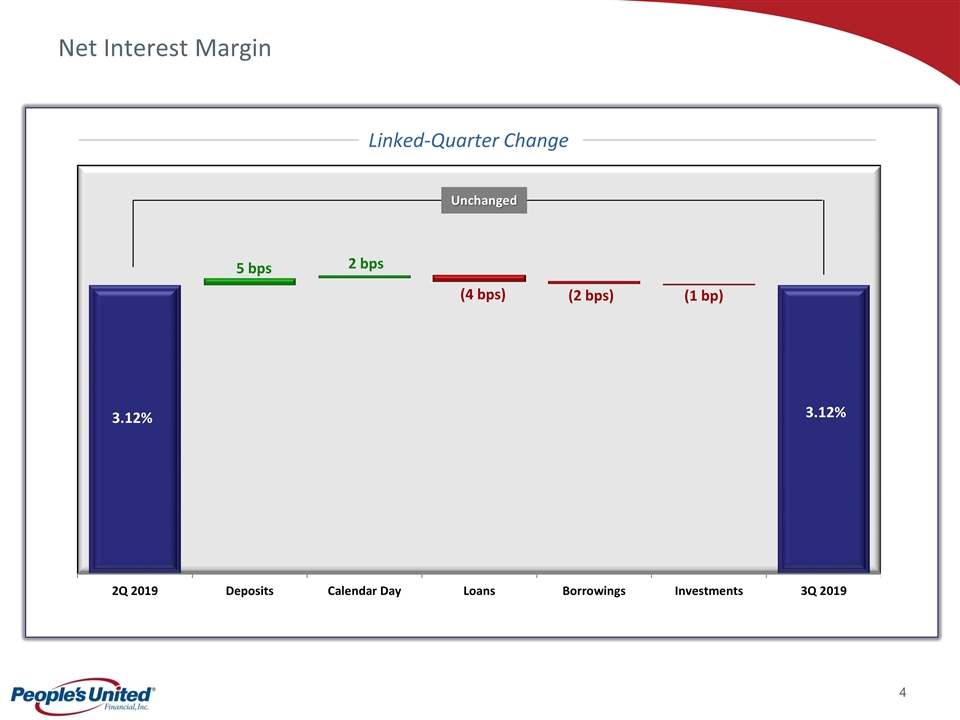

Net Interest Margin 3.12% 3.12% Unchanged Linked-Quarter Change 5 bps 2 bps (4 bps) (2 bps) (1 bp)

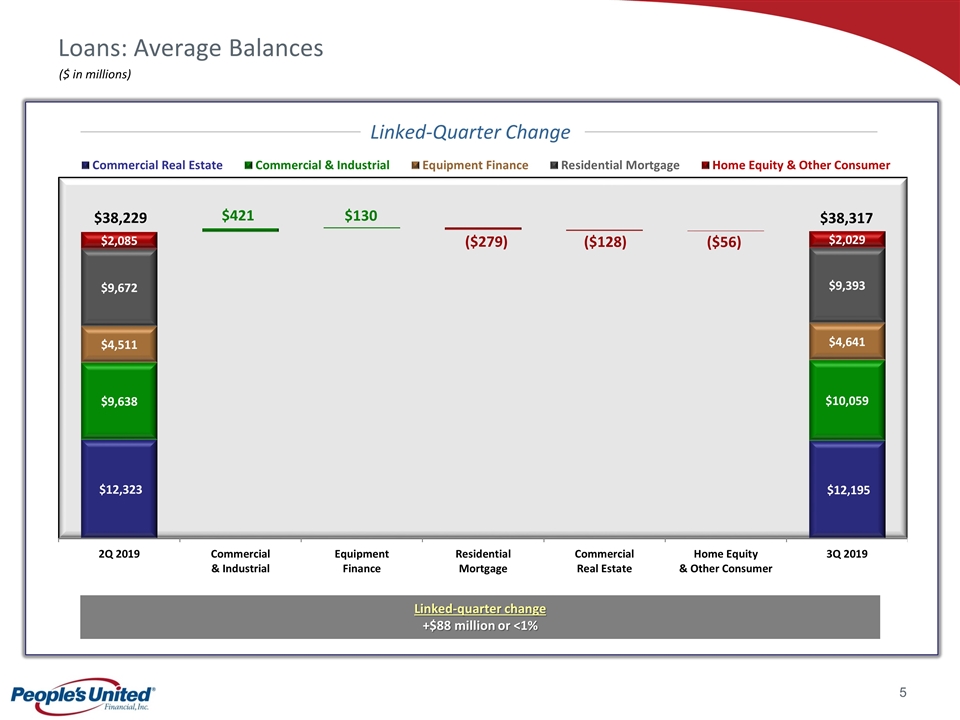

Loans: Average Balances $38,317 ($ in millions) $38,229 Linked-Quarter Change Linked-quarter change +$88 million or <1% $421 ($279) $130 ($128) ($56)

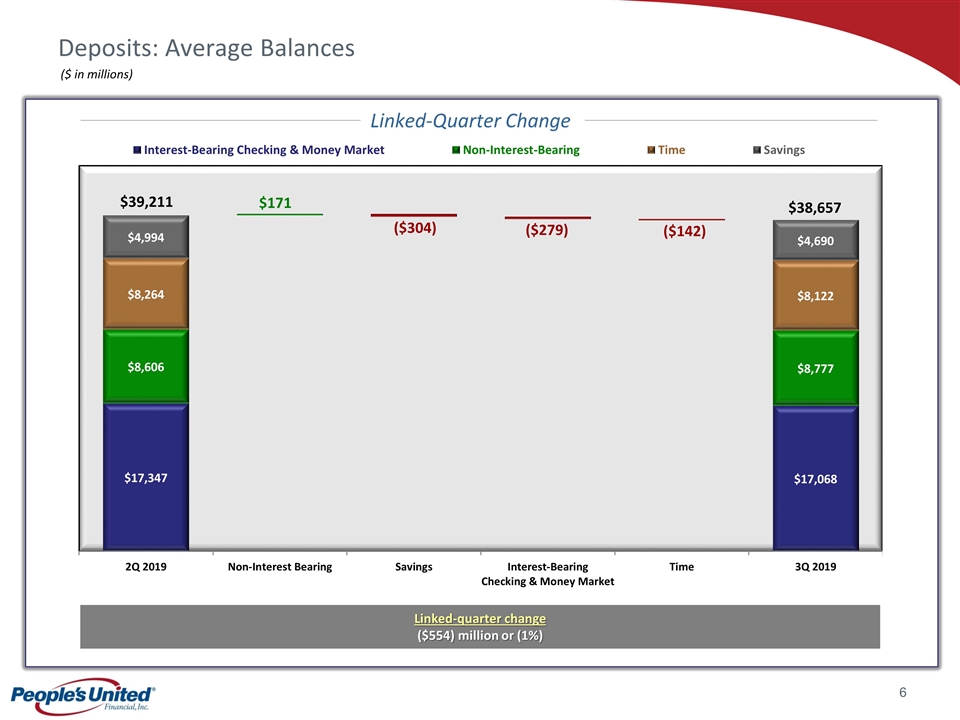

Deposits: Average Balances ($ in millions) $38,657 $39,211 Linked-Quarter Change Linked-quarter change ($554) million or (1%) $171 ($304) ($279) ($142)

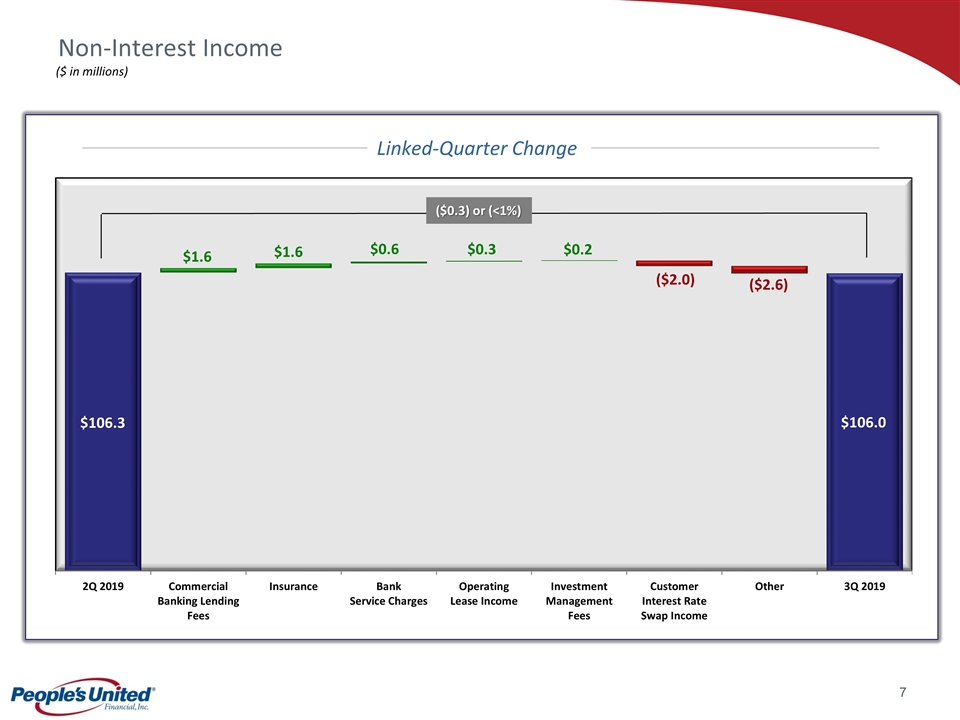

Non-Interest Income ($ in millions) $106.3 $106.0 ($0.3) or (<1%) Linked-Quarter Change $1.6 $1.6 $0.6 ($2.0) ($2.6) $0.3 $0.2

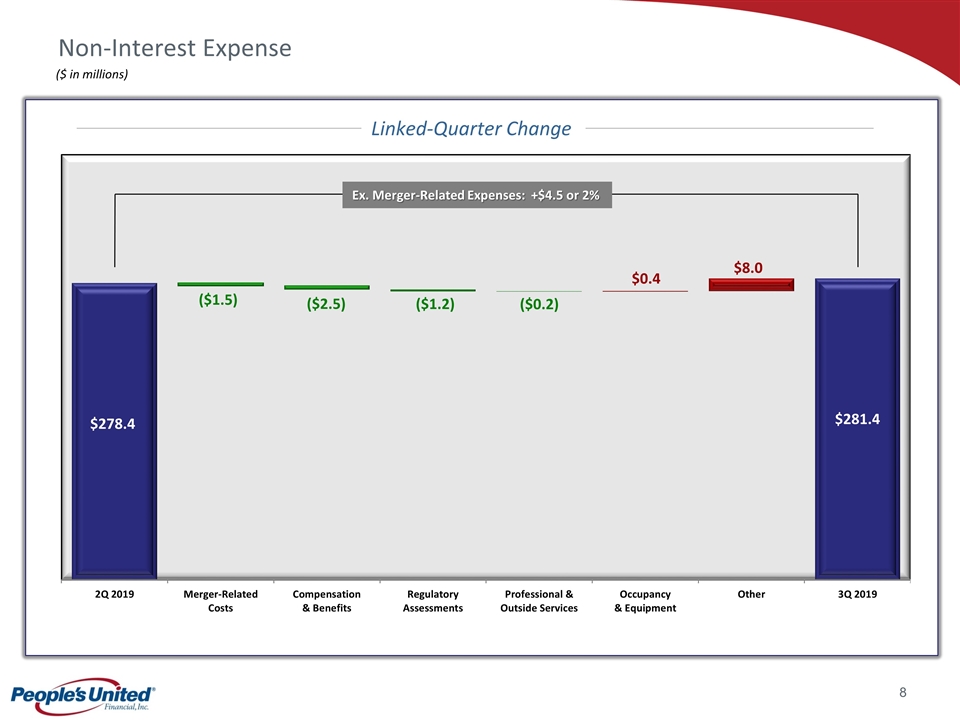

Non-Interest Expense ($ in millions) $281.4 $278.4 Ex. Merger-Related Expenses: +$4.5 or 2% Linked-Quarter Change ($1.5) $0.4 ($2.5) ($1.2) ($0.2) $8.0

Efficiency Ratio Quarterly Trend

Asset Quality 1Non-performing assets (excluding acquired non-performing loans) as a percentage of originated loans plus all REO and repossessed assets; acquired non-performing loans excluded as risk of loss has been considered by virtue of (i) our estimate of acquisition-date fair value, (ii) the existence of an FDIC loss sharing agreement, and/or (iii) allowance for loan losses established subsequent to acquisition Notes: Source: SNL Financial Top 50 Banks represents the largest 50 banks by total assets in each respective quarter. 2Ex. acquired loan charge-offs, PBCT’s charge-off ratio was 0.05%, 0.02%, 0.04%, 0.07% & 0.07% in 3Q 2019, 2Q 2019, 1Q 2019, 4Q 2018 & 3Q 2018, respectively PBCT Peer Group (Median) Top 50 Banks (Median) PBCT Peer Group (Median) Top 50 Banks (Median) Non-Performing Assets / Loans & REO (%)1 Net Charge-offs / Average Loans2

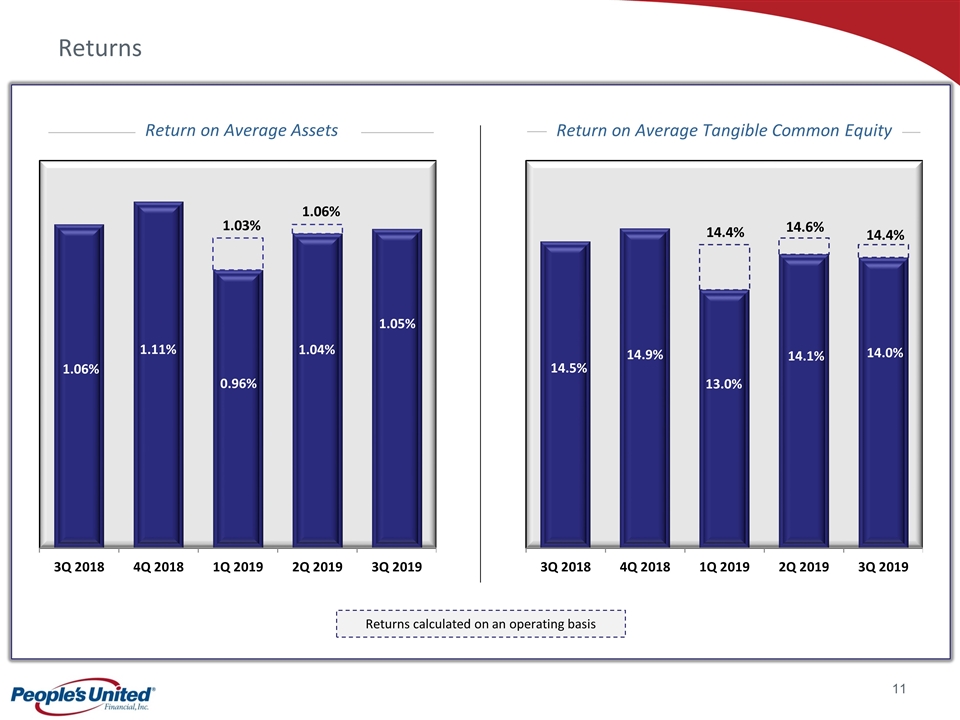

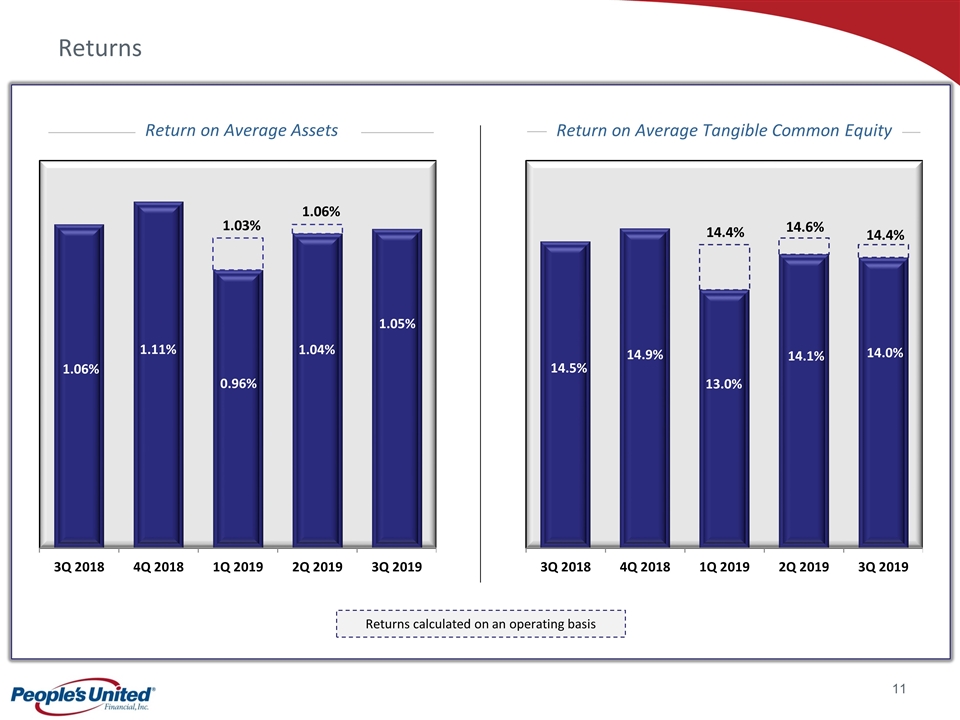

Returns Return on Average Assets Return on Average Tangible Common Equity Returns calculated on an operating basis 14.4% 1.03% 14.6% 1.06% 14.4%

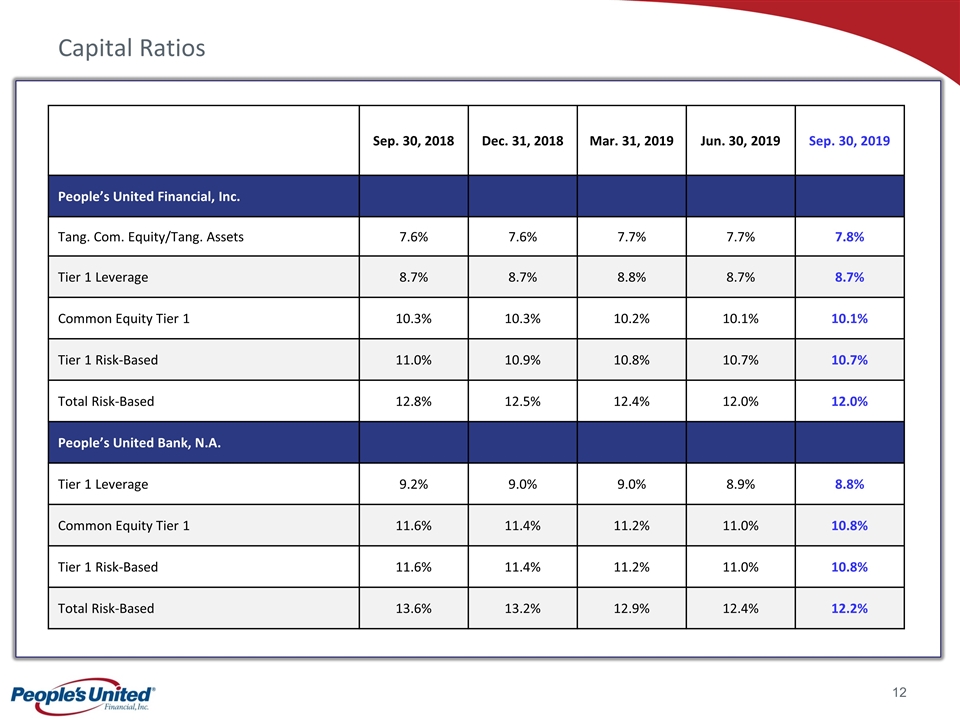

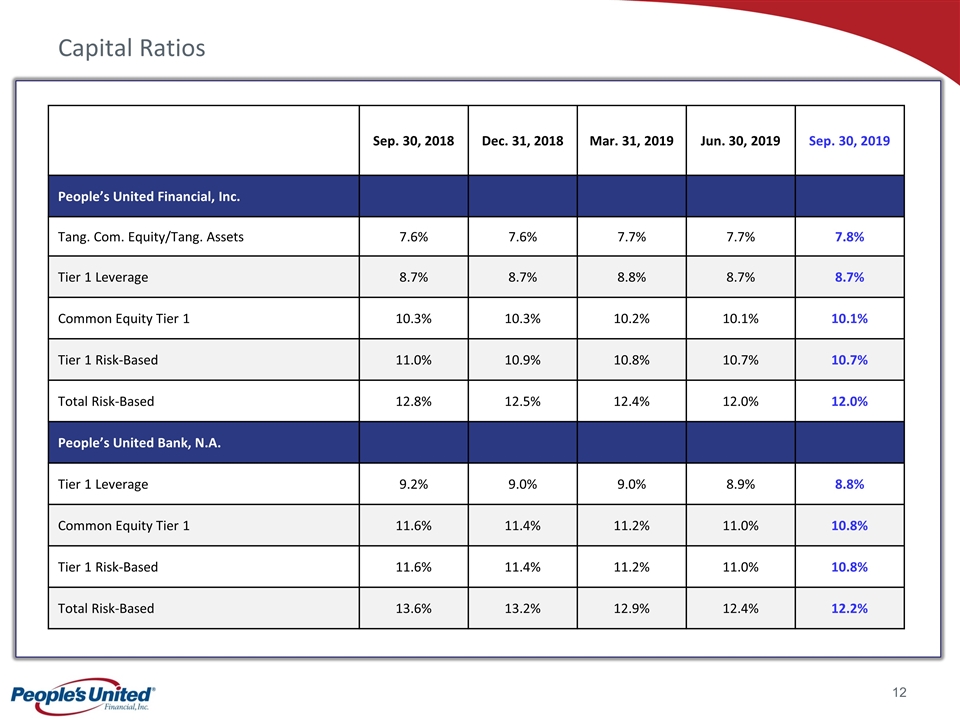

Capital Ratios Sep. 30, 2018 Dec. 31, 2018 Mar. 31, 2019 Jun. 30, 2019 Sep. 30, 2019 People’s United Financial, Inc. Tang. Com. Equity/Tang. Assets 7.6% 7.6% 7.7% 7.7% 7.8% Tier 1 Leverage 8.7% 8.7% 8.8% 8.7% 8.7% Common Equity Tier 1 10.3% 10.3% 10.2% 10.1% 10.1% Tier 1 Risk-Based 11.0% 10.9% 10.8% 10.7% 10.7% Total Risk-Based 12.8% 12.5% 12.4% 12.0% 12.0% People’s United Bank, N.A. Tier 1 Leverage 9.2% 9.0% 9.0% 8.9% 8.8% Common Equity Tier 1 11.6% 11.4% 11.2% 11.0% 10.8% Tier 1 Risk-Based 11.6% 11.4% 11.2% 11.0% 10.8% Total Risk-Based 13.6% 13.2% 12.9% 12.4% 12.2%

Appendix

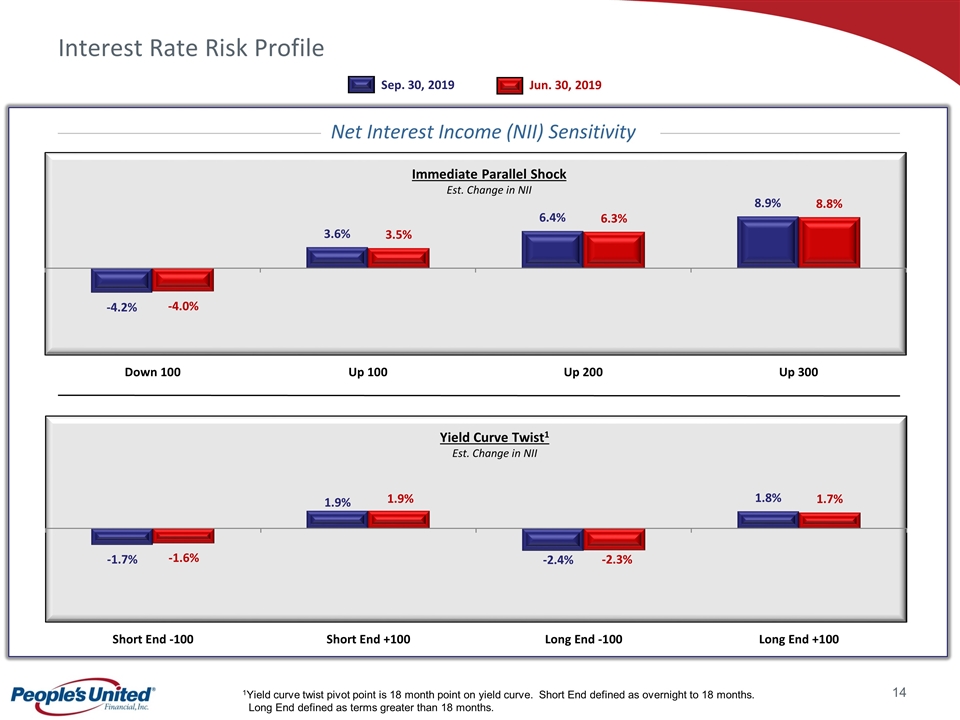

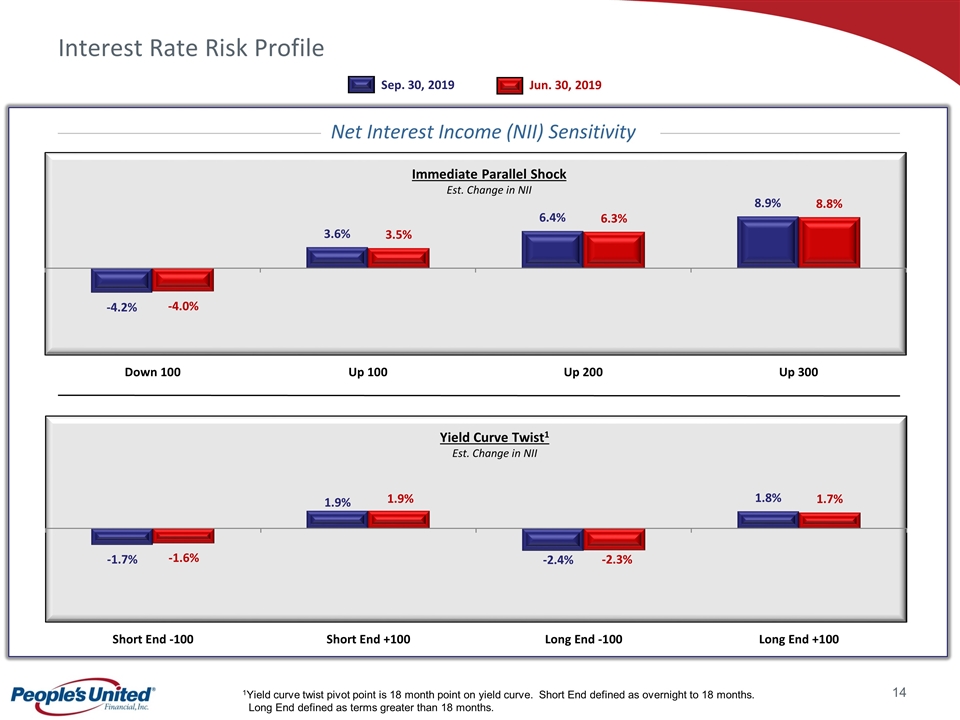

Interest Rate Risk Profile 1Yield curve twist pivot point is 18 month point on yield curve. Short End defined as overnight to 18 months. Long End defined as terms greater than 18 months. Immediate Parallel Shock Est. Change in NII Yield Curve Twist1 Est. Change in NII Sep. 30, 2019 Jun. 30, 2019 Net Interest Income (NII) Sensitivity

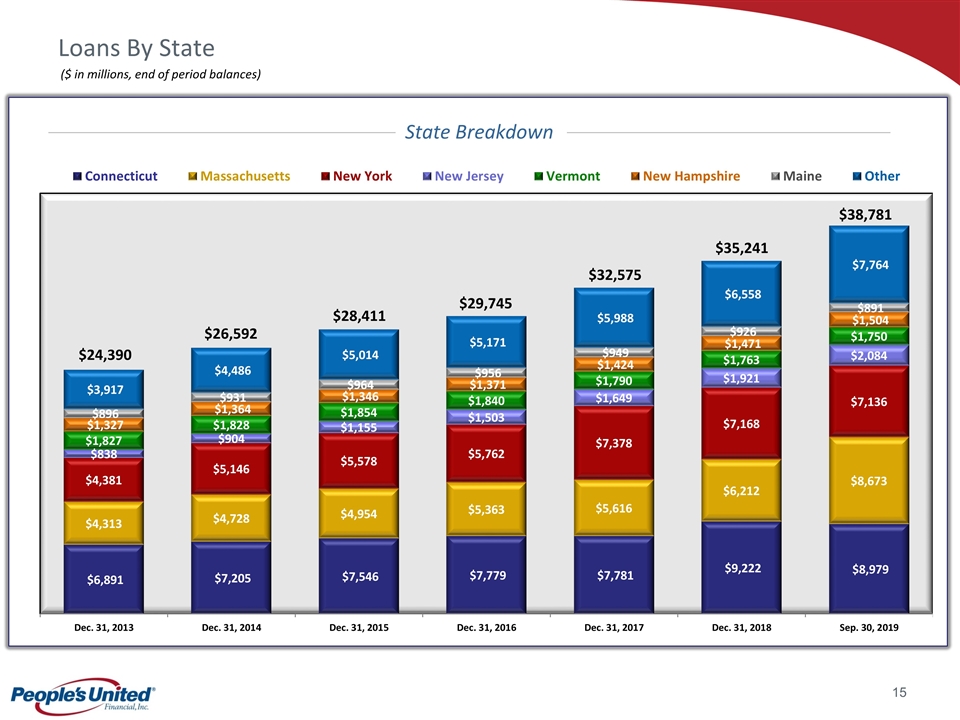

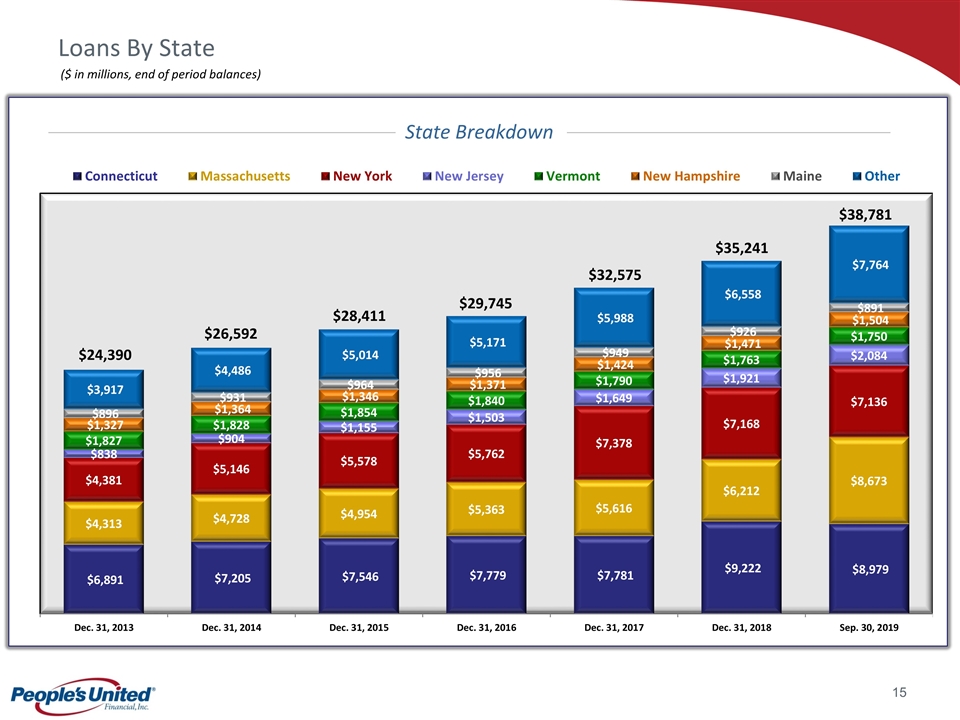

Loans By State $24,390 $26,592 $29,745 $32,575 $28,411 ($ in millions, end of period balances) State Breakdown $35,241 $38,781

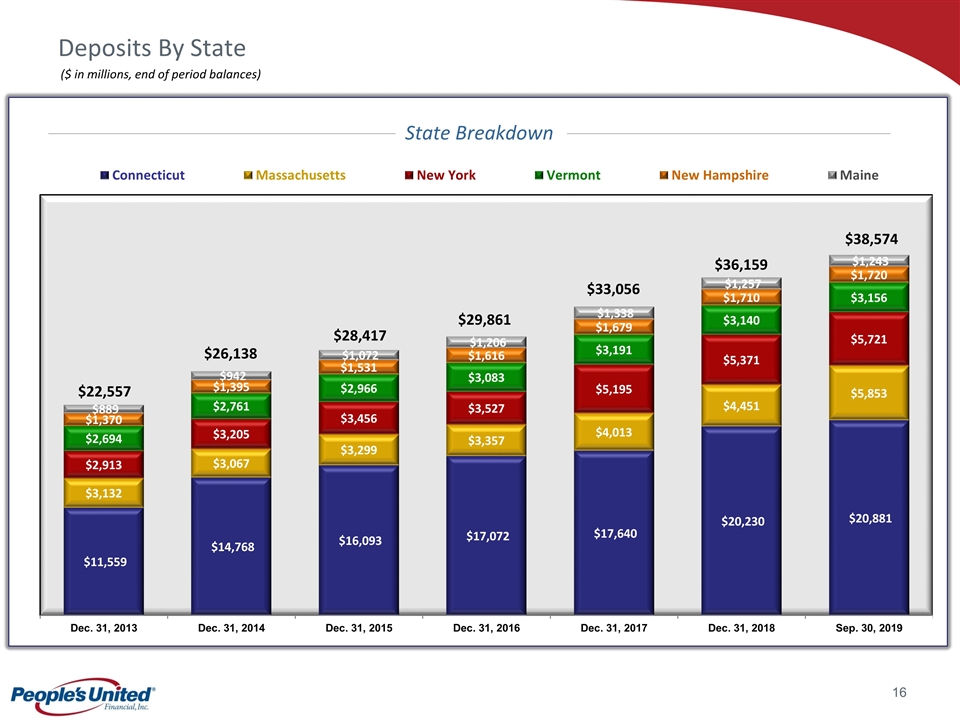

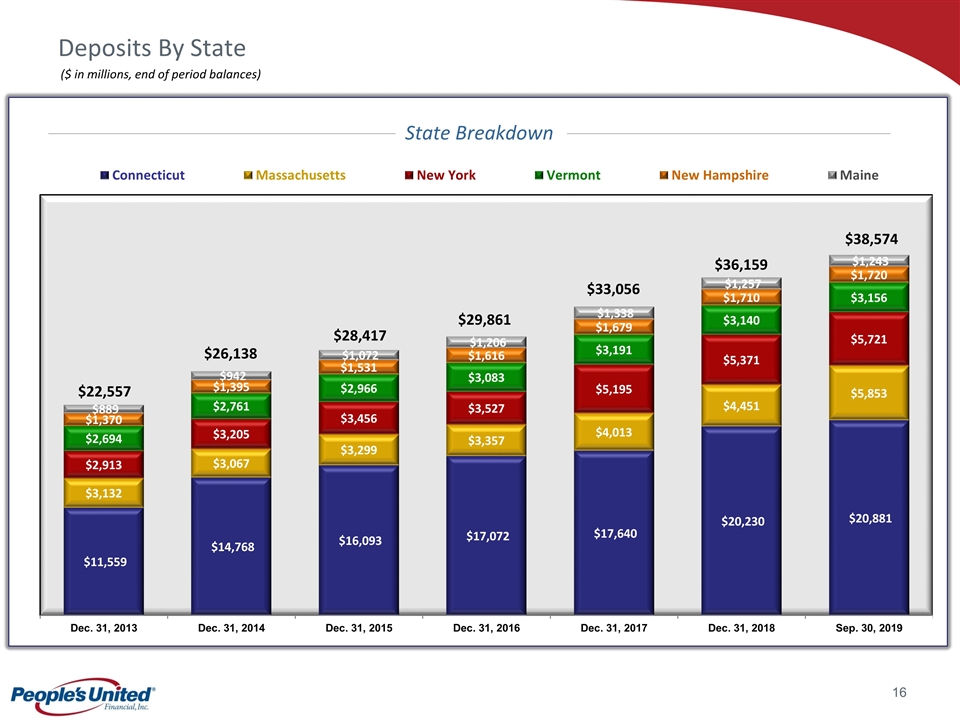

Deposits By State $22,557 $26,138 $29,861 $33,056 $28,417 ($ in millions, end of period balances) State Breakdown $36,159 $38,574

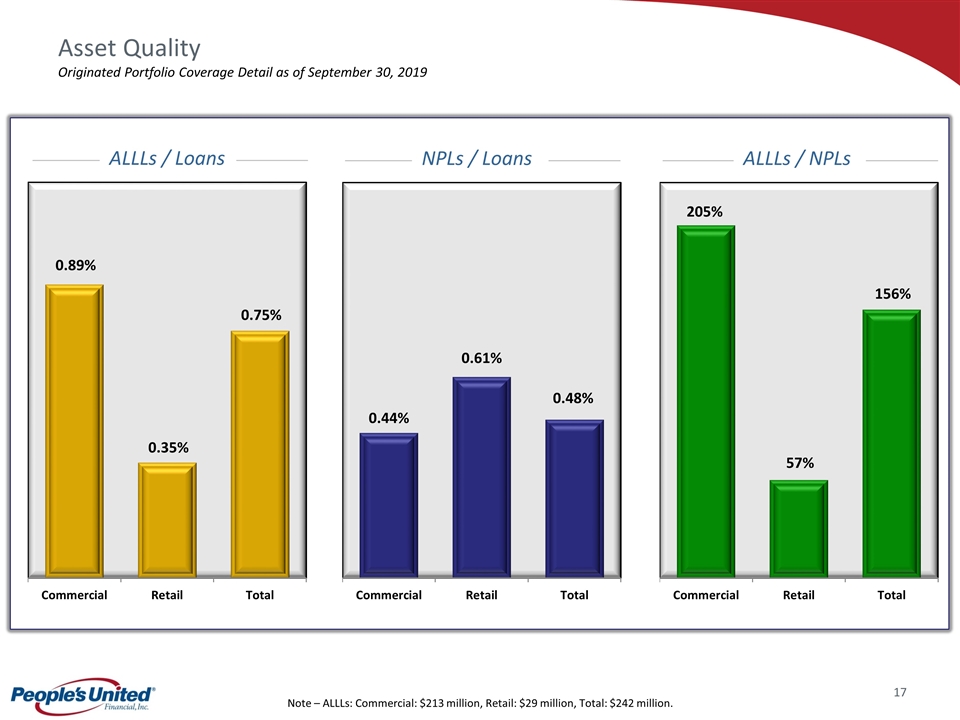

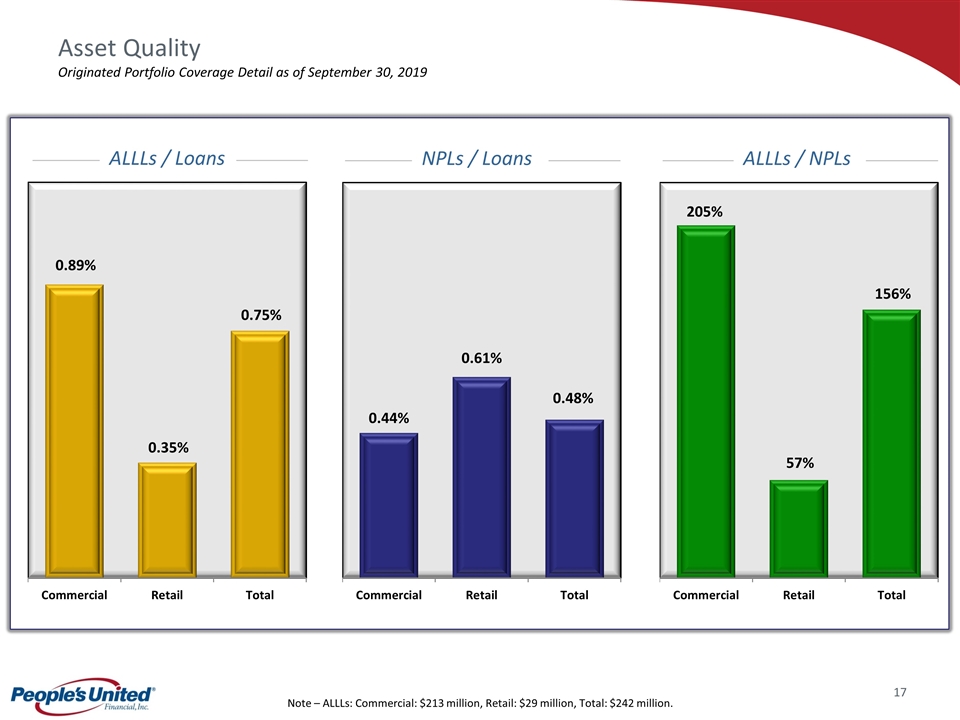

Asset Quality Originated Portfolio Coverage Detail as of September 30, 2019 Note – ALLLs: Commercial: $213 million, Retail: $29 million, Total: $242 million. ALLLs / Loans NPLs / Loans ALLLs / NPLs

Peer Group Firm Ticker City State 1 Associated Banc-Corp ASB Green Bay WI 2 BankUnited Inc. BKU Miami Lakes FL 3 Citizens Financial Group, Inc. CFG Providence RI 4 Comerica Inc. CMA Dallas TX 5 First Horizon National Corp. FHN Memphis TN 6 F.N.B. Corp. FNB Pittsburgh PA 7 Huntington Bancshares, Inc. HBAN Columbus OH 8 KeyCorp KEY Cleveland OH 9 M&T Bank Corp. MTB Buffalo NY 10 New York Community Bancorp NYCB Westbury NY 11 Signature Bank SBNY New York NY 12 Sterling Bancorp STL Montebello NY 13 Valley National Bancorp VLY Wayne NJ 14 Webster Financial Corp. WBS Waterbury CT 15 Zions Bancorp. ZION Salt Lake City UT

For more information, investors may contact: Andrew S. Hersom (203) 338-4581 andrew.hersom@peoples.com