QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | |

| Filed by the Registrant ý |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12

|

| | | | |

| Dynegy Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

| | | | |

| | Dynegy Inc.

601 Travis, Suite 1400

Houston, Texas 77002 | | Pat Wood III

Chairman of the Board

|

ANNUAL MEETING—May 18, 2017

March 30, 2017

To our stockholders:

It is my pleasure to invite you to attend the 2017 Annual Meeting of stockholders of Dynegy Inc., which will be held on May 18, 2017, at 10:00 a.m., Central Time. You will be able to attend the 2017 Annual Meeting, vote, and submit your questions during the meeting via live webcast through the linkwww.virtualshareholdermeeting.com/DYN17. You will need the control number included with these proxy materials to attend the Annual Meeting. Only persons who were stockholders of record at the close of business on March 20, 2017 are entitled to notice of, and to vote at, the Annual Meeting.

We intend to take advantage of the Securities and Exchange Commission rules that allow issuers to furnish proxy materials to their stockholders over the internet. We believe that these rules allow us to provide our stockholders with the information they desire while lowering costs of delivery and reducing the environmental impact.

As Dynegy stockholders, your vote is important; please vote your shares as soon as possible. You may vote your shares by internet or telephone (or, if you received a printed set of materials by mail, by returning the accompanying proxy card). Voting in advance of the meeting will not deprive you of your right to participate in the virtual meeting and to vote your shares during the live webcast if you so choose.

Sincerely,

Pat Wood III

Chairman of the Board

| | |

| | Dynegy Inc.

601 Travis, Suite 1400

Houston, Texas 77002

|

NOTICE OF 2017 ANNUAL MEETING OF STOCKHOLDERS

| | |

| Meeting Date: | | May 18, 2017 |

| Time: | | 10:00 a.m. (Central) |

| Via live webcast: | | www.virtualshareholdermeeting.com/DYN17 |

| | | You will need the control number provided on the Notice of Internet Availability of Proxy Materials or your proxy card (if applicable). |

ITEMS OF BUSINESS:

- 1.

- To elect eight directors to serve until the 2018 Annual Meeting of Stockholders;

- 2.

- To approve, on an advisory basis, the compensation of Dynegy's named executive officers as described in this proxy statement;

- 3.

- To act upon a resolution, on an advisory basis, regarding whether the stockholder vote on the compensation of Dynegy's named executive officers should occur every one, two or three years; and

- 4.

- To act upon a proposal to ratify the appointment of Ernst & Young LLP as Dynegy's independent registered public accountants for the fiscal year ending December 31, 2017.

Additionally, if needed, the stockholders may act upon any other matters that may properly come before the meeting (including a proposal to adjourn the meeting to solicit additional proxies) or any reconvened meeting after an adjournment or postponement of the meeting.

The close of business on March 20, 2017 has been fixed as the record date for the determination of stockholders entitled to receive notice of and to vote at the Annual Meeting and any reconvened meeting after an adjournment or postponement of the meeting.

You are cordially invited to attend the meeting.PLEASE VOTE AS SOON AS POSSIBLE.

By Order of the Board of Directors,

Kelly D. Tlachac

Corporate Secretary

March 30, 2017

PROXY SUMMARY INFORMATION

This summary is included to provide an introduction and overview of the information contained in this proxy statement. This is a summary only and does not contain all of the information we have included in our 2017 proxy statement. You should refer to the full Proxy Statement that follows for more information about us and the proposals you are being asked to consider.

| | |

| | | |

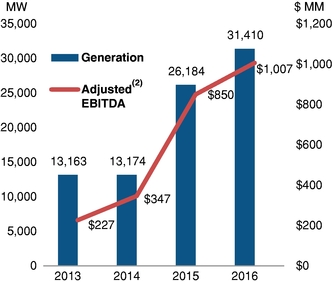

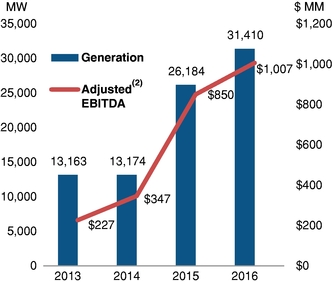

| 2016 BUSINESS HIGHLIGHTS |

| | | |

- •

- Expanded the Company's portfolio by acquiring the Engie US Fossil facilities.

- •

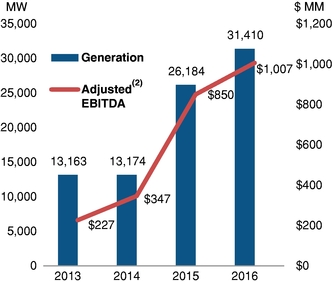

- Achieved $1 billion in Adjusted EBITDA in 2016 with 76% of that total coming from our gas fleet.

- •

- Completed the Illinois Power Generating, or Genco, subsidiary financial restructuring, eliminating $825 million of unsecured Genco bonds.

- •

- Repriced the $2 billion Engie Acquisition term loan, resulting in approximately $100 million in interest savings over the next seven years.

- •

- Continued improvements in safety, with our gas-fired facilities continuing to perform in the top decile for Total Recordable Incident rates, our coal-fired facilities improving by 25% and as of year-end 2016, 70% of our plants (pre-Engie) have either attained the OSHA Voluntary Protection Program, or VPP, certification or are working towards the VPP evaluation and application process.

- •

- Strong reliability performance across the portfolio including setting new production records at four of our six Combined Cycle Gas Turbine facilities in the PJM market.

- •

- Our self-improvement program, PRIDE (Producing Results through Innovation by Dynegy Employees) exceeded the pre-established targets set for 2016, achieving $422 million in balance sheet improvements and $150 million in EBITDA enhancements.

| | |

| | | |

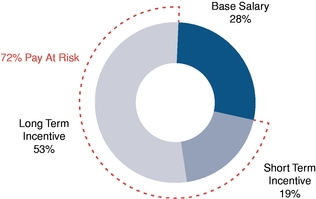

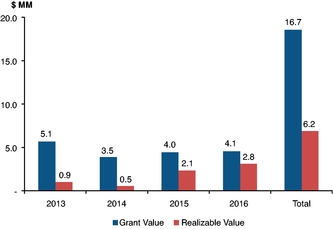

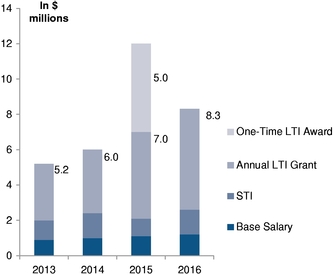

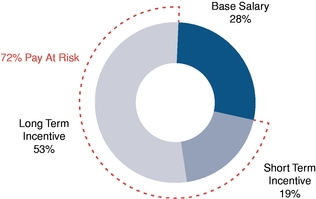

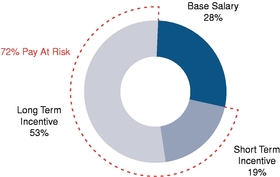

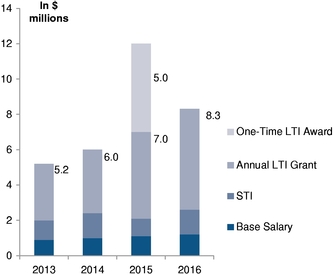

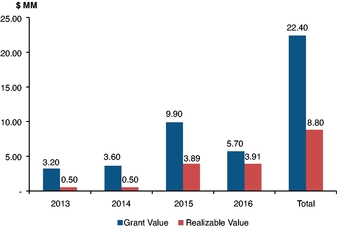

| 2016 COMPENSATION HIGHLIGHTS |

| | | |

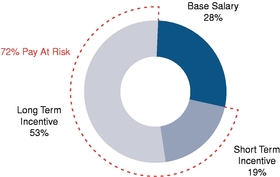

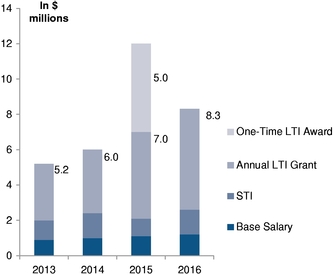

- •

- Based on results relative to our pre-established goals, our short-term incentive, or STI, plan achieved a quantitative result equal to 97% of target.

- •

- While the Company met the financial guidance range for Adjusted EBITDA and Free Cash Flow, the range for both metrics was narrowed from the initial range that was established. As a result, the Compensation and Human Resources Committee exercised negative discretion and funded the STI program at 90%—below the quantitative result.

- •

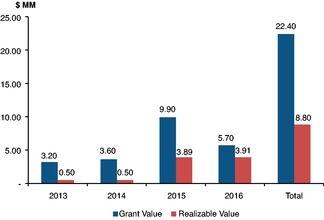

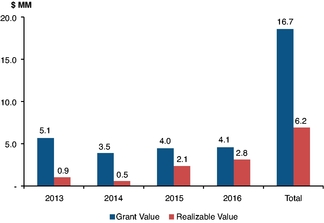

- The Compensation and Human Resources Committee remains committed to performance-based long-term incentive, or LTI, awards, and have maintained the use of performance shares as the largest component of LTI awards for our Named Executive Officers.

- •

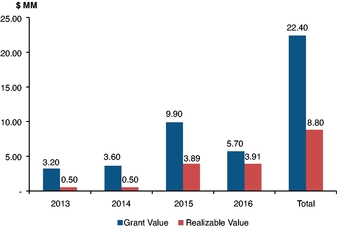

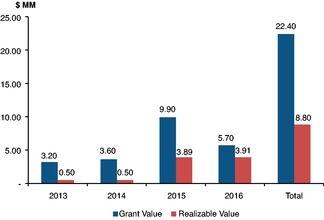

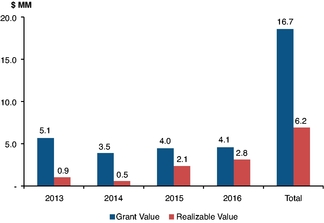

- The PSUs granted in 2013 and 2014 (covering the 2013-2016 and 2014-2016 performance periods respectively) both resulted in no payment, because the Company's total stockholder return, or TSR, performance thresholds were not achieved.

- •

- PSUs granted in 2016 and 2017, include a second performance metric—cumulative Free Cash Flow. This second metric was added to enhance the line of sight for our management team, to further align pay for performance and in response to feedback we received from some of our largest stockholders.

- •

- Our outreach efforts with several of our largest stockholders covered updates to our strategic focus, executive compensation and overall governance practices.

| | |  2017 Proxy Statement i 2017 Proxy Statement i |

Proxy Summary Information

| | | | | | |

| | | | | | | |

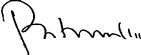

STOCKHOLDER ENGAGEMENT

|

| | | CORPORATE GOVERNANCE HIGHLIGHTS

|

| |

| | | | | | | |

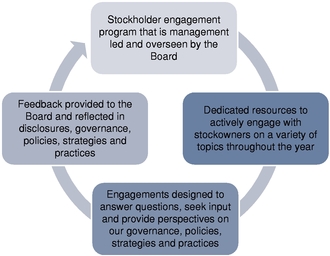

Commitment to Stockholder Engagement

| | | | Our practices include a number of policies and structures that we believe are "best practices" including: • Separation of Chairman of the Board and Chief Executive Officer positions; • Regular meetings of our non-management and independent directors; • Policies prohibiting pledging and hedging transactions involving our common stock by directors and executive officers; • Stock ownership guidelines applicable to directors and officers; • Elimination of employment agreements, except for the CEO; • Majority voting policy; • No excise tax gross-ups; • Change in control and severance benefits that are subject to "double trigger;" • An independent executive compensation consultant hired by and reporting to the Compensation and Human Resources Committee; and • Clawback mechanism in place for incentive awards. | | |

| | | | | | | |

| | | | | | | |

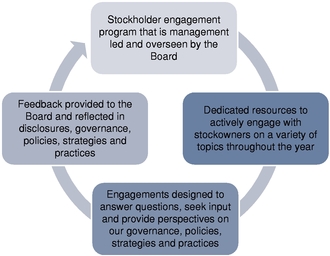

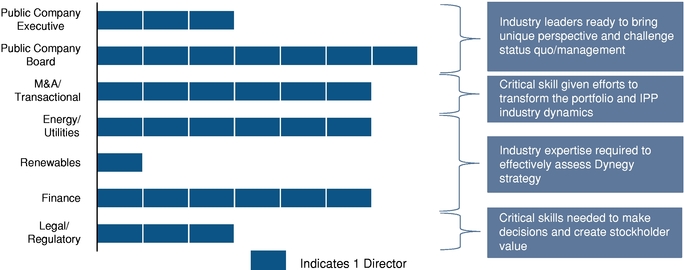

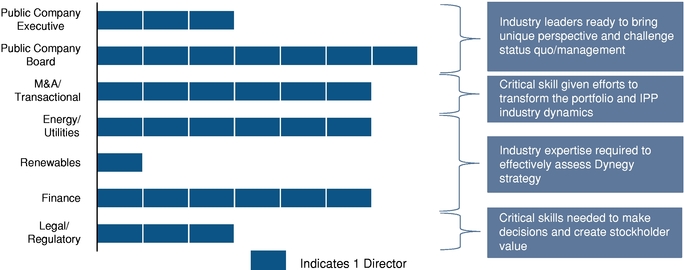

DIRECTOR EXPERTISE

|

| |

| | | | | | | |

Our Directors collectively represent a deep, diverse mix of skills and experiences that are well-suited to our business.

ii  2017 Proxy Statement 2017 Proxy Statement | | |

Proxy Summary Information

| | |  2017 Proxy Statement iii 2017 Proxy Statement iii |

Proxy Summary Information

PROPOSALS FOR STOCKHOLDER ACTION

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | For More

Information

|

| | | Board

Recommendation

|

| |

| | | | | | | | | | | | | |

| Proposal 1: Election of Directors | | | | Page 21 | | | | üFor | | |

Pat Wood III | | | | | | | | | | | | |

Paul M. Barbas | | | | | | | | | | | | |

Richard L. Kuersteiner | | | | | | | | | | | | |

Jeffrey S. Stein | | | | | | | | | | | | |

Hilary E. Ackermann | | | | | | | | | | | | |

Robert C. Flexon | | | | | | | | | | | | |

Tyler G. Reeder | | | | | | | | | | | | |

John R. Sult | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Proposal 2: Advisory Vote on our 2016 Executive Compensation | | | | Page 69 | | | | üFor | | |

| | | | | | | | | | | | | |

| Proposal 3: Advisory Vote on Say-on-Pay Frequency | | | | Page 75 | | | | üFor Annually | | |

| | | | | | | | | | | | | |

| Proposal 4: Ratification of Independent Registered Public Accountants for 2017 | | | | Page 80 | | | | üFor | | |

| | | | | | | | | | | | | |

ANNUAL MEETING INFORMATION

| | | | | | | | |

| Time and Date: | | 10:00 a.m. (CT) on Thursday, May 18, 2017 | | | | |

Virtual Meeting: |

|

Live webcast through the link

www.virtualshareholdermeeting.com/DYN17 |

|

|

|

|

Record Date: |

|

March 20, 2017 |

|

|

|

|

|

|

| | | | | | | | | |

Voting Methods: |

|

|

|

|

|

|

|

|

| | | Attending the

meeting via live

webcast |

| Submitting your proxy

by internet

(http://www.proxyvote.com)

or telephone

1-800-690-6903 |

| If you request a printed copy of the proxy materials, completing, signing, dating and returning the proxy card in the envelope provided | | Scanning this QR code to access the voting site from your mobile device |

Requesting Copies

of Materials: |

|

Current and prospective investors can also access or order free copies of our Annual Report, proxy statement, Notice and other financial information through the Investor Relations section of our web site atwww.dynegy.com, by calling 713-507-6400 or by writing to Investor Relations Department, Dynegy Inc., 601 Travis, Suite 1400, Houston, Texas 77002.

|

iv  2017 Proxy Statement 2017 Proxy Statement | | |

PROXY STATEMENT

GENERAL INFORMATION

Why am I receiving these materials?

The Board of Directors of Dynegy Inc., or the Board, has made these materials available to you over the internet, or has delivered printed versions of these materials to you by mail, in connection with the Board's solicitation of proxies for use at the 2017 Annual Meeting of Stockholders, or the Annual Meeting. The Annual Meeting is scheduled to be held on Thursday, May 18, 2017 at 10:00 a.m., Central Time, via live webcast through the linkwww.virtualshareholdermeeting.com/DYN17. You will need the control number provided on the Notice of Internet Availability of Proxy Materials or your proxy card (if applicable). This solicitation is for proxies for use at the Annual Meeting or at any reconvened meeting after an adjournment or postponement of the Annual Meeting.

What is included with these materials?

These materials include our proxy statement for the Annual Meeting and our 2016 Annual Report to Stockholders, or Annual Report, which includes our audited consolidated financial statements. If you received printed versions of these materials, a proxy card for the Annual Meeting is also included.

What items will be voted on at the Annual Meeting?

There are four items that will be voted on at the Annual Meeting:

- 1.

- The election of eight directors to serve until the 2018 Annual Meeting of Stockholders;

- 2.

- A proposal to approve, on an advisory basis, the compensation of Dynegy's named executive officers as described in this proxy statement;

- 3.

- An advisory resolution regarding whether the stockholder vote on the compensation of Dynegy's named executive officers should occur every one, two or three years; and

- 4.

- A proposal to ratify the appointment of Ernst & Young LLP as Dynegy's independent registered public accountants for the fiscal year ending December 31, 2017.

Additionally, if needed, the stockholders may act upon any other matters that may properly come before the meeting (including a proposal to adjourn the meeting to solicit additional proxies) or any reconvened meeting after an adjournment or postponement of the meeting.

What are the Board's voting recommendations?

The persons named as proxies were designated by the Board. Any proxy given pursuant to this solicitation and received prior to the Annual Meeting will be voted as specified in the proxy card. If you return a properly executed proxy card but do not mark any voting selections, then your proxy will be voted as follows in accordance with the recommendations of the Board:

- •

- Proposal 1—FOR the election of eight directors to the Board;

- •

- Proposal 2—FOR approval of the compensation of Dynegy's named executive officers described in this proxy statement;

- •

- Proposal 3—FOR the stockholder vote regarding the compensation of Dynegy's named executive officers to occurANNUALLY; and

- •

- Proposal 4—FOR ratification of the appointment of Ernst & Young LLP as our independent registered public accountants.

| | |  2017 Proxy Statement 1 2017 Proxy Statement 1 |

General Information

Why did I receive a one-page notice in the mail regarding the internet availability of proxy materials instead of a full set of proxy materials?

Pursuant to the rules adopted by the Securities and Exchange Commission, or SEC, we are providing electronic access to our proxy materials over the internet. Accordingly, we sent a Notice of Internet Availability of Proxy Materials, or Notice, to our stockholders of record and beneficial owners, which was first mailed on or about March 30, 2017. Instructions on how to access the proxy materials over the internet are included in the Notice.

Stockholders may also request via the internet to receive a printed set of the proxy materials atwww.proxyvote.com, by sending an email tosendmaterial@proxyvote.com, or calling 1-800-579-1639. In addition, stockholders may request via the internet, telephone or by email to receive proxy materials in printed form on an ongoing basis.

Current and prospective investors can also access or order free copies of our Annual Report, proxy statement, Notice and other financial information through the Investor Relations section of our web site atwww.dynegy.com, by calling 713-507-6400 or by writing to Investor Relations Department, Dynegy Inc., 601 Travis, Suite 1400, Houston, Texas 77002.

How can I get electronic access to the proxy materials?

The Notice provides you with instructions regarding how to:

- •

- View proxy materials for the Annual Meeting on the internet; and

- •

- Instruct us to send our future proxy materials to you electronically by email.

Choosing to receive your future proxy materials by email will save us the cost of printing and mailing documents to you and will reduce the impact of our Annual Meetings on the environment. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it. Internet/telephone voting for the Annual Meeting will close at 11:59 p.m., Eastern Time, on May 17, 2017.

Why did I only receive one set of materials when there is more than one stockholder at my address?

If two or more stockholders share one address, each such stockholder may not receive a separate copy of our Annual Report, proxy statement or Notice. Stockholders who do not receive a separate copy of our Annual Report, proxy statement or Notice and want to receive a separate copy may request to receive a separate copy of, or additional copies of, our Annual Report, proxy statement or Notice via the internet, email or telephone as outlined above. Stockholders who share an address and receive multiple copies of our Annual Report, proxy statement or Notice may also request to receive a single copy by following the instructions above.

What is the quorum requirement for the Annual Meeting?

Under our bylaws, a quorum is a majority of the outstanding shares of our common stock entitled to vote at the meeting, represented in person (through internet access) or by proxy. Abstentions and broker non-votes shall be counted in determining that a quorum is present for the meeting.

2  2017 Proxy Statement 2017 Proxy Statement | | |

General Information

Where is the Annual Meeting?

You are invited to attend the Annual Meeting online through the linkwww.virtualshareholdermeeting.com/DYN17. The Control Number provided on your Notice or proxy card is necessary to access this site.

As of the record date, March 20, 2017, there were outstanding 131,319,688 shares of common stock.

What is the difference between holding shares as a stockholder of record and as a beneficial owner of shares held in street name?

Stockholder of Record. If your shares are registered in your name with our transfer agent, Computershare, you are considered the stockholder of record with respect to those shares, and the Notice was sent directly to you by us.

Beneficial Owner of Shares Held in Street Name. If your shares are held in an account at a brokerage firm, bank, broker dealer or other similar organization, then you are the beneficial owner of shares held in "street name," and the Notice was forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct that organization on how to vote the shares held in your account.

If I am a stockholder of record of Dynegy's shares, how do I vote?

If you are a stockholder of record you may vote by proxy over the internet by following the instructions provided in the Notice, by telephone, or, if you received printed copies of the proxy materials, you may also vote by mail. You may also vote at the Annual Meeting through the linkwww.virtualshareholdermeeting.com/DYN17. The Control Number provided on your Notice or proxy card is necessary to access this site.Please vote as soon as possible.

If I am a beneficial owner of shares held in street name, how do I vote?

If you are a beneficial owner of shares held in street name, please refer to the Notice, proxy card, or voting information form forwarded to you by your broker or other nominee to see what voting options are available to you.Please vote as soon as possible.

What happens if I do not give specific voting instructions?

Stockholder of Record. If you are a stockholder of record and you:

- •

- indicate when voting on the internet or by telephone that you wish to vote as recommended by our Board; or

- •

- if you sign and return a proxy card without giving specific voting instructions,

then the proxy holders will vote your shares in the manner recommended by our Board on Proposals 1-4 in this proxy statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting.

Beneficial Owner of Shares Held in Street Name; "Broker Non-Votes." If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, under the rules of the New York Stock Exchange, or NYSE, the organization that holds your shares may generally vote on routine matters but cannot vote on non-routine matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization that holds your shares will inform our Inspector of Election that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a "broker non-vote." When our Inspector of Election tabulates the votes for any particular matter, broker non-votes will be counted for purposes of determining whether a quorum is present for that matter, but will not otherwise be counted.

| | |  2017 Proxy Statement 3 2017 Proxy Statement 3 |

General Information

For example, please note that brokers may not vote your shares on the election of directors, the proposal regarding named executive officer compensation or the proposal regarding the frequency of the stockholder vote on named executive officer compensation in the absence of your specific instructions as to how to vote. Please provide your broker with voting instructions as soon as possible so that your vote can be counted. We encourage you to provide voting instructions to the organization that holds your shares by carefully following the instructions provided in the Notice.

Which ballot measures are considered "routine" or "non-routine"?

Proposal 4 (Ratification of Appointment of Independent Registered Public Accountants) involves a matter that we believe will be considered routine.

Proposal 1 (Election of Directors), Proposal 2 (Approval of Compensation of our Named Executive Officers) and Proposal 3 (Frequency of the Stockholder Vote on Named Executive Officer Compensation) involve matters that we believe will be considered non-routine.

How are abstentions and broker non-votes treated?

For the purpose of determining whether a quorum is present, abstentions and broker non-votes shall be counted in determining the number of outstanding shares represented in person (through internet access) or by proxy for each matter.

For each "non-routine" proposal, including whether the stockholders have elected the eight director nominees, broker non-votes are not counted.Please note that brokers may not vote your shares on the election of directors, the proposal regarding named executive officer compensation or the proposal regarding the frequency of the stockholder vote on named executive officer compensation in the absence of your specific instructions as to how to vote. Please provide your broker with voting instructions as soon as possible so that your vote can be counted. You cannot abstain in the election of directors—you can only vote FOR the director nominees or WITHHOLD VOTES for such nominees.

For each proposal other than the election of directors an abstention will have the same effect as a vote AGAINST such proposal.

4  2017 Proxy Statement 2017 Proxy Statement | | |

General Information

What is the voting requirement to approve each of the proposals?

The following table sets forth the voting requirement with respect to each of the proposals:

| | | | |

| Proposal 1— | | Election of eight directors to serve until the 2018 Annual Meeting of Stockholders | | Eight persons have been nominated by the Board for election to serve as directors for one-year terms. Please read "Designated Director" below for information regarding the increase of directors from seven to eight. The holders of our common stock are entitled to vote on the election of the directors. The directors are elected by a plurality of the shares of common stock represented in person (through internet access) or by proxy and entitled to vote on the election of directors, subject to our majority voting policy discussed below. This means that the eight individuals nominated for election to the Board who receive the most FOR votes among votes properly cast in person (through internet access) or by proxy will be elected. Each holder of our common stock is entitled to one vote for each share held and does not have cumulative voting rights. Only FOR or WITHHELD votes are counted in determining whether a plurality has been cast in favor of a director nominee. You cannot abstain in the election of directors and broker non-votes are not counted. A WITHHELD vote will have the same effect as a vote AGAINST the election of a director nominee under our majority voting policy, which is described below. |

|

|

|

|

Majority voting policy: In an uncontested election, any director nominee who receives a greater number of votes WITHHELD for his or her election than votes FOR such election must offer his or her resignation to the Board promptly following certification of the stockholder vote. The Corporate Governance and Nominating Committee, or Nominating Committee, is required to recommend to the Board whether such offered resignation should be accepted or rejected. The Board will determine whether to accept or reject the resignation offer and will promptly disclose its decision making process and decision regarding an offered resignation in a document furnished to or filed with the SEC. Please read our Amended and Restated Corporate Governance Guidelines posted in the "About Dynegy" "Governance" sections of our web site atwww.dynegy.com for more information regarding our majority voting policy. |

| | |  2017 Proxy Statement 5 2017 Proxy Statement 5 |

General Information

| | | | |

Proposal 2— |

|

Act upon a proposal to approve, on an advisory basis, the compensation of Dynegy's named executive officers as described in this proxy statement |

|

The affirmative vote of a majority of the shares of common stock represented in person (through internet access) or by proxy at the meeting and entitled to vote is required to approve, on an advisory basis, the compensation of Dynegy's named executive officers. Each holder of our common stock is entitled to one vote for each share held. Abstentions will have the same effect as a vote AGAINST this proposal. Broker non-votes are not counted. |

Proposal 3— |

|

Act upon a proposal, on an advisory basis, regarding whether the frequency of the stockholder vote on the compensation of Dynegy's named executive officers should occur every one, two or three years |

|

The form of proxy allows stockholders to vote to recommend, on an advisory basis, a stockholder vote on the compensation of Dynegy's named executive officers every one, two or three years or to abstain from voting. The frequency (every one, two or three years) that receives the highest number of votes from the holders of shares of common stock represented in person or by proxy at the meeting and entitled to vote will be deemed to be the choice of the stockholders. Each holder of our common stock is entitled to one vote for each share held. Abstentions and broker non-votes are not counted. |

Proposal 4— |

|

Ratification of the appointment of Ernst & Young LLP as Dynegy's independent registered public accountants for the fiscal year ending December 31, 2017 |

|

The affirmative vote of a majority of the shares of common stock represented in person (through internet access) or by proxy at the meeting and entitled to vote is required to ratify the choice of independent registered public accountants. Each holder of our common stock is entitled to one vote for each share held. Abstentions will have the same effect as a vote AGAINST this proposal. |

May I change my vote after I have voted?

You may revoke your proxy and change your vote at any time before the final vote at the Annual Meeting by:

- •

- Executing and submitting a revised proxy (including a telephone or internet vote, which must be received by 11:59 p.m., Eastern Time, on May 17, 2017);

- •

- Sending written notice of revocation to our Corporate Secretary at the address provided below (which must be received by 11:59 p.m., Eastern Time, on May 17, 2017); or

- •

- Voting at the Annual Meeting through the linkwww.virtualshareholdermeeting.com/DYN17. The Control Number provided on your Notice or proxy card is necessary to access this site.

In the absence of a revocation, shares represented by proxies will be voted at the Annual Meeting.

Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within Dynegy or to third parties, except:

- •

- As necessary to meet applicable legal requirements;

- •

- To allow for the tabulation and certification of votes; and

- •

- To facilitate a proxy solicitation.

6  2017 Proxy Statement 2017 Proxy Statement | | |

General Information

Who is paying the cost of this proxy solicitation?

We will bear the cost of soliciting proxies. Proxies may be solicited by mail or facsimile, or by our directors, officers or employees, without extra compensation, in person or by telephone. We have retained Morrow Sodali LLC, 470 West Ave., Stamford, Connecticut 06902, to assist in the solicitation of proxies for a fee of approximately $9,000 plus out-of-pocket expenses and telephone solicitation expenses. We will reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding solicitation material to the beneficial owners of our common stock.

What if I have questions about the proposals?

Questions concerning the proposals to be acted upon at the Annual Meeting should be directed to:

Dynegy Inc.

Attention: Investor Relations Department

601 Travis, Suite 1400, Houston, Texas 77002

713.507.6400

OR

MORROW SODALI LLC

470 West Ave.

Stamford, CT 06902

1.800.662.5200

How can I find out if I am a stockholder of record entitled to vote?

For a period of at least ten days before the Annual Meeting, a complete list of stockholders of record entitled to vote at the Annual Meeting will be available during ordinary business hours at our principal executive office, 601 Travis Street, Suite 1400, Houston, TX 77002, for inspection by stockholders of record for proper purposes. The list of stockholders will also be available at the Annual Meeting through the linkwww.virtualshareholdermeeting.com/DYN17. The Control Number provided on your Notice or proxy card is necessary to access this site.

| | |  2017 Proxy Statement 7 2017 Proxy Statement 7 |

REFERENCES TO DYNEGY AND COMMON STOCK

Unless otherwise indicated, references to "Dynegy," the "Company," "we," "our," and "us" in the biographical and compensation information for directors and executive officers below refers to Board membership, employment and compensation with respect to Dynegy Inc.

INCORPORATION BY REFERENCE

To the extent that this proxy statement is incorporated by reference into any other filing by us under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, or the Exchange Act, the sections of this proxy statement entitled "Compensation and Human Resources Committee Report" and "Audit Committee Report" will not be deemed incorporated unless specifically provided otherwise in such filing, to the extent permitted by the rules of the SEC. Information contained on or connected to our web site is not incorporated by reference into this proxy statement and should not be considered part of this proxy statement or any other filing that we make with the SEC.

8  2017 Proxy Statement 2017 Proxy Statement | | |

CORPORATE GOVERNANCE

CORPORATE GOVERNANCE OVERVIEW

| | | | | | | | |

| | | | | | | | | |

| | | Effective Board Leadership and Independent Oversight | | | | • 6 out of 8 Directors are independent (CEO is sole member of management serving on the Board) • Average tenure of ~4 years; average age of ~57 years • Separate Chairman and CEO roles • All members of the Audit, Compensation & HR and Corporate Governance & Nominating Committees are independent • Corporate Governance & Nominating Committee reviews annually the composition of the Board, ensuring the Board reflects an appropriate balance of knowledge, experience, skills and expertise | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | Regular Board Engagement | | | | • Formal in-person board meetings each quarter, including an annual strategic planning meeting, and frequent telephonic meetings on emerging matters in the interim • Regular, no less than quarterly, informal "no paper" Board calls with Management team • Committee Chairs have regular engagement with management liaison (e.g. Audit Chair with CFO and Chief Accounting Officer) | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | Focus on Stockholder Rights | | | | • Annual election of all Directors with a majority voting policy • No cumulative voting; each common share entitled to one vote • Stockholders ability to call a special meeting (20% ownership threshold) • Directors can be removed with or without cause • Stockholder may act by majority written consent • No stockholder rights plan • Annual advisory vote to approve executive compensation • Mergers and other business combinations may be approved by a simple majority vote • Routine assessment by Corporate Governance & Nominating Committee of overall corporate governance profile and potential enhancements thereto | | |

| | | | | | | | | |

| | | | | | | | | |

CORPORATE GOVERNANCE GUIDELINES

Our Corporate Governance Guidelines govern the qualifications and conduct of the Board. The Corporate Governance Guidelines address, among other things:

- •

- Our prohibition against directors and executive officers holding our securities in a margin account or pledging our securities, absent Company approval;

- •

- Our prohibition against directors and executive officers engaging in any hedging transaction with respect to our securities held by them;

- •

- The independence and other qualifications of our Board members, with respect to which we require that at least 75% of our Board members be independent of Dynegy and our management;

| | |  2017 Proxy Statement 9 2017 Proxy Statement 9 |

Corporate Governance

- •

- The requirement that any director nominee in an uncontested election who receives a greater number of votes "withheld" for his or her election than votes "for" such election must offer his or her resignation to the Board;

- •

- The separation of Chairman of the Board, or Chairman, and Chief Executive Officer positions;

- •

- The regular meetings of our non-management and independent directors;

- •

- The nomination of persons for election to our Board;

- •

- The evaluation of performance of our Board and its committees;

- •

- Our expectation that our Board members will attend all annual stockholder meetings;

- •

- Compensation of our Board and stock ownership guidelines for non-management directors;

- •

- The approval of the compensation of the Chief Executive Officer;

- •

- The review of development and succession plans for the Chief Executive Officer and other executive officers; and

- •

- The review of performance based compensation of our senior executives following a restatement that impacts the achievement of performance targets relating to that compensation.

BOARD RISK OVERSIGHT

The Board has ultimate responsibility for protecting stockholder value. Among other things, the Board is responsible for understanding the risks to which we are exposed, approving management's strategy to manage these risks, establishing policies that monitor and manage defined risks and measuring management's performance against the strategy. The Board's oversight responsibility for managing risk is detailed in our Risk Policy Statement.

The Risk Policy Statement provides a structure around risk and defines the risks that we accept in the normal course of business. The Risk Policy Statement, in some instances, requires that separate policy documentation be in place including Interest Rate Risk and Investment Policy, Disclosure Controls and Procedures Policy, Risk Management and Insurance Policy, Credit Risk Policy, Investment Policy (Employee Benefit Plans), and Commodity Risk Policy. Although not mandated by the Risk Policy Statement, our Delegation of Authority policy and the Code of Business Conduct and Ethics are complementary and critical to the risk management process. Our Executive Management Team is responsible for managing the above risks and reports on such matters to the applicable Board committees. Further, our Ethics and Compliance Office reports functionally to the Audit Committee Chairman and meets regularly with the Audit Committee. The Risk Policy Statement can be amended with the approval of our Audit Committee on behalf of the Board.

10  2017 Proxy Statement 2017 Proxy Statement | | |

Corporate Governance

| | | | | | | | |

| | | | | | | | | |

| | | FULL BOARD

|

| |

| | | The full Board oversees risks primarily associated with our commercial and operating performance and our environmental, health and safety performance. The full Board also receives quarterly updates from all Board committees, and they provide guidance to individual committee activities as appropriate.

|

| |

| | | | | | | | | |

| | | Audit Committee | | | | • Oversees the risks associated with the integrity of our financial statements and our compliance with legal and regulatory requirements. • Discusses policies with respect to risk assessment and risk management, including major financial risk exposure and the steps management has taken to monitor and control such exposures. • Reviews with management, internal auditors, and external auditors the accounting policies, the system of internal control over financial reporting and the quality and appropriateness of disclosure and content in the financial statements or other external financial communications. • Performs oversight of the business ethics and compliance program, reviews the programs and policies designed to assure compliance with our Code of Business Conduct and Ethics and applicable laws and regulations and monitors the results of the compliance efforts. | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | Compensation and Human Resources Committee | | | | • Oversees risks primarily associated with our ability to attract, motivate and retain quality talent, particularly executive talent, and disclosure of our executive compensation philosophies, strategies and activities. • Assesses and monitors risk related to our compensation programs and reviews certain policies to ensure that the appropriate controls exist to mitigate any identified risk. The Compensation Committee conducted a risk assessment in 2016 to reaffirm that our incentive programs do not encourage excessive risk-taking. This involved a review of a set of risk assessment considerations related to our STI and LTI programs. Following this review, the Compensation Committee concluded that our incentive programs collectively foster cooperation and focus award opportunities on measures that are aligned with our business strategy and the interests of our stockholders and do not encourage excessive risk-taking behaviors. | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | Corporate Governance and Nominating Committee | | | | • Oversees risks primarily associated with our ability to attract, motivate and retain quality directors. • Oversees our corporate governance programs and practices and our compliance therewith. • Evaluates the performance of the Board, its committees and management annually and considers risk management effectiveness as part of the evaluation. | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | Finance and Commercial Oversight Committee | | | | • Oversees risks primarily with respect to our capital structure, financing and treasury matters. • Oversees management's process for the identification, evaluation and mitigation of our financial and commercial related risks. • Oversees our commodity risk monitored by our risk control group and receives regular reporting regarding commodity risk management effectiveness. | | |

| | | | | | | | | |

| | |  2017 Proxy Statement 11 2017 Proxy Statement 11 |

Corporate Governance

DIRECTOR NOMINATION PROCESS AND QUALIFICATION REVIEW OF DIRECTOR NOMINEES

Depth and Breadth of Director Skills and Qualifications

Our Directors collectively represent a deep, diverse mix of skills and experiences that are well-suited to our business.

Experience or Expertise

Process

Our director nominees are approved by the Board after considering the recommendation of the Corporate Governance and Nominating Committee, or Nominating Committee. A copy of the Nominating Committee's charter is available athttps://www.dynegy.com/investors/governance/board-committes.

Our Certificate of Incorporation provides that the number of our directors shall be fixed from time to time exclusively by our Board. The Board has fixed the number of our directors currently at eight, subject to adjustment by the Board in accordance with our Certificate of Incorporation.

The Nominating Committee reviews annually the composition of the Board as a whole and recommends, if necessary, measures to be taken so that the Board reflects the appropriate balance of knowledge, experience, skills, expertise and diversity required for the Board as a whole and contains at least the minimum number of independent directors required by applicable laws and regulations. The Nominating Committee is responsible for ensuring that the composition of the Board accurately reflects the needs of our business and, in furtherance of this goal, proposing the nomination of directors for purposes of obtaining the appropriate members and skills. The Nominating Committee identifies nominees in various ways. The committee considers the current directors that have expressed an interest in and that continue to satisfy the criteria for serving on the Board as set forth in our Corporate Governance Guidelines. Other nominees that may be proposed by current directors, members of management or by stockholders are also considered. From time to time, the committee engages a professional firm to identify and evaluate potential director nominees.

Qualifications

All director nominees, whether proposed by a stockholder or otherwise, are evaluated in accordance with the qualifications set forth in our Corporate Governance Guidelines. These guidelines require that directors possess the highest personal and professional ethics, integrity and values and be committed to representing the long-term interests of our stockholders at large. They must also have an inquisitive and objective perspective, practical wisdom, mature judgment and sufficient personal resources such that any director compensation to be received from the Company would not be sufficiently meaningful to impact their judgment in reviewing matters coming before the Board. Finally, they must be able to work compatibly with the other members of the Board and otherwise have the experience and skills necessary to enable them to serve as productive

12  2017 Proxy Statement 2017 Proxy Statement | | |

Corporate Governance

members of the Board. Directors also must be willing to devote sufficient time to carrying out their fiduciary duties and other responsibilities effectively and should be committed to serve on the Board for an extended period of time. For additional information, please read our Corporate Governance Guidelines.

In connection with the director nominations for the 2017 Annual Meeting, the Nominating Committee also considered the nominees' (1) experience in the energy industry and understanding of the energy and commodity markets, (2) experience in finance and commercial risk management, (3) publicly traded company and board experience, (4) knowledge in the areas of laws and regulations related to environmental, health, safety, regulatory and other key industry issues, (5) strategic planning skills, (6) knowledge of corporate governance issues coupled with an appreciation of their practical application, and (7) accounting expertise, including audit, internal controls and risk management.

Each nominee brings a strong and unique background and set of skills to the Board, giving the Board as a whole competence and experience in a wide variety of areas, including energy, wholesale power generation and marketing, commodities, risk management, strategic planning, legal, corporate governance and board service, executive management, regulatory and policy development, accounting and finance, operations, and economics. For information concerning each director's various qualifications, attributes, skills and experience of our director nominees considered important by the Board in determining that such nominee should serve as a director as well as each nominee's principal occupation, directorships and additional biographical information, please read "Depth and Breadth of Director Skills and Qualifications" above and "Proposal 1—Election of Directors—Information on Director Nominees."

Designated Director

In 2016, we entered into a Stock Purchase Agreement with Terawatt Holdings, LP, a limited partnership affiliated with Energy Capital Partners III, LLC ("Terawatt"). Pursuant to the Stock Purchase Agreement, on February 7, 2016 (the "Closing Date"), we sold and issued to Terawatt 13,711,152 shares of Dynegy's common stock, for an aggregate purchase price equal to $150 million. On the Closing Date, Atlas Power Finance, LLC, a wholly owned subsidiary of Dynegy, completed the previously announced acquisition (the "Engie Acquisition"), of all of the issued and outstanding common stock of GDF Suez Energy North America, Inc. We used the consideration from the common stock issuance to fund a portion of the purchase price payable to seller in the Engie Acquisition.

On the Closing Date, Terawatt and/or its affiliates beneficially owned approximately 15% of our common stock. Concurrently with such sale and issuance, Dynegy and Terawatt entered into an Investor Rights Agreement. Under the Investor Rights Agreement, Terawatt has the right to nominate 1 individual (the "Designated Director"), for election to our Board until such time that (1) Terawatt and its affiliates to which it has transferred its shares in accordance with the Investor Rights Agreement cease to hold, collectively, at least 10% of the then-outstanding shares of our common stock, or (2) Terawatt materially breaches its standstill obligations under the Investor Rights Agreement. Pursuant to the Stock Purchase Agreement and the Investor Rights Agreement, on the Closing Date, the Board increased its size from seven to eight and appointed Mr. Tyler G. Reeder, as the Designated Director, to fill the newly created vacancy.

Diversity

The Board does not have a formal policy with respect to Board nominee diversity. In recommending proposed nominees to the full Board, the Nominating Committee is charged with building and maintaining a board that has an ideal mix of talent and experience to achieve our business objectives in the current environment. In particular, the Nominating Committee is focused on relevant subject matter expertise, depth of knowledge in key areas that are important to us, and diversity of age, thought, background, perspective and experience so as to facilitate robust debate and broad thinking on strategies and tactics pursued by us.

| | |  2017 Proxy Statement 13 2017 Proxy Statement 13 |

Corporate Governance

Future director nominations

For purposes of the 2018 Annual Meeting, the Nominating Committee will consider any director nominations from a stockholder received by the Corporate Secretary by the close of business on February 17, 2018, but not before the close of business on January 18, 2018. See "Future Stockholder Proposals" below for more information. Any such nomination must be accompanied in writing by all information relating to such person that is required under the federal securities laws, including such person's written consent to be named in the proxy statement as a nominee and to serve as a director if elected. The nominating stockholder must also submit its name and address, as well as that of the beneficial owner if applicable, and the number of shares of our common stock that are owned beneficially and of record by such stockholder and such beneficial owner. Finally, the nominating stockholder must discuss the nominee's qualifications to serve as a director as described in our Corporate Governance Guidelines

AFFIRMATIVE DETERMINATIONS REGARDING DIRECTOR INDEPENDENCE AND OTHER MATTERS

The Board previously determined that each of the following directors who served in 2016 is "independent" as such term is defined in the NYSE Listed Company Standards:

Pat Wood III

Hilary E. Ackermann

Paul M. Barbas

Richard L. Kuersteiner

Jeffrey S. Stein

John R. Sult

The Board has also determined that each member of the Audit Committee, the Compensation and Human Resources Committee, or Compensation Committee, and the Nominating Committee meets the independence requirements applicable to those committees prescribed by the NYSE and the SEC. The Board has further determined that more than one of the members of the Audit Committee, including its current Chairman, Mr. Sult, are "audit committee financial experts" as such term is defined in Item 407(d) of the SEC's Regulation S-K.

The Nominating Committee reviewed the answers to annual questionnaires completed by the directors and nominees as well as the above described legal standards for Board and committee member independence and the criteria applied to determine "audit committee financial expert" status. On the basis of this review, the Nominating Committee made its recommendation to the full Board and the Board made its independence and "audit committee financial expert" determinations after consideration of the Nominating Committee's recommendation and a review of the materials made available to the Nominating Committee.

14  2017 Proxy Statement 2017 Proxy Statement | | |

Corporate Governance

BOARD LEADERSHIP STRUCTURE; SEPARATION OF POSITIONS OF CHAIRMAN AND CHIEF EXECUTIVE OFFICER

As discussed in our Corporate Governance Guidelines, the Board believes the position of Chairman should be held by a non-management director and not the Chief Executive Officer. Mr. Flexon, as President and Chief Executive Officer, is responsible for setting the strategic direction for the Company and the day-to-day leadership and performance of the Company, while Mr. Wood, as Chairman, provides overall leadership to the Board in its oversight function. As such, he serves as the presiding director of executive sessions of the non-management and independent directors.

DIRECTORS' MEETINGS AND COMMITTEES OF THE BOARD

Our Board held 16 meetings during 2016. Each director attended at least 94% of the total number of meetings of the Board and the total number of meetings held by all committees on which he or she served during the period for which he or she has been a director. Under our Corporate Governance Guidelines, directors who are not members of a particular committee are entitled to attend meetings of each such committee.

The following table reflects the members of each of the committees of the Board and the number of meetings held during 2016.

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Name | | | | Audit

|

| | | Compensation &

Human

Resources

|

| | | Corporate

Governance &

Nominating

|

| | | Finance &

Commercial

Oversight(3)

|

| |

| | | | | | | | | | | | | | | | | | | |

Robert C. Flexon | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Pat Wood III(1) | | | | | | | | | | | | X | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Hilary E. Ackermann | | | | X | | | | | | | | | | | |  | | |

| | | | | | | | | | | | | | | | | | | |

Paul M. Barbas | | | | X | | | |  | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Richard L. Kuersteiner | | | | | | | | X | | | |  | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Jeffrey S. Stein | | | | | | | | X | | | | X | | | | X | | |

| | | | | | | | | | | | | | | | | | | |

John R. Sult(2) | | | |  | | | | | | | | | | | | X | | |

| | | | | | | | | | | | | | | | | | | |

Number of Meetings | | | | 8 | | | | 6 | | | | 3 | | | | 4 | | |

| | | | | | | | | | | | | | | | | | | |

- (1)

- As Chairman of the Board, Mr. Wood is an ex officio member of the Audit, Compensation and Finance committees and has a standing invitation to attend all such committee meetings. He also serves as the presiding director of executive sessions of the non-management and independent directors.

- (2)

- Designated Audit Committee Financial Expert.

- (3)

- Mr. Reeder joined the Board in February 2017 and is a current member of the Finance Committee.

| | |

| | Committee Chair

|

| | |  2017 Proxy Statement 15 2017 Proxy Statement 15 |

Corporate Governance

COMMITTEES

Committee Composition

The current members of each of the committees of the Board, as well as the current Chair of each of the committees of the Board, are identified below.

| | |

Audit Committee

Chair:

John R. Sult

Members:

Paul Barbas

Hilary Ackermann | | Independence & Financial Expertise:

Each member of the Audit Committee is independent as such term is defined in the NYSE and SEC rules. The Board has determined that each member of the Audit Committee possesses the necessary level of financial literacy required to enable him or her to serve effectively as an Audit Committee member, and all members qualify as Audit Committee Financial Experts, including our designated Financial Expert, Mr. Sult, our Audit Committee Chair. No Audit Committee member serves on more than three audit committees of public companies, including our Audit Committee.Role & Primary Responsibilities:

We maintain an Internal Audit department to provide management and the Audit Committee with ongoing assessments of our risk management processes, system of internal controls and our internal control over financial reporting compliance activities. The Audit Committee, among other duties, assists the Board in its oversight of: the integrity of our financial statements, including a discussion of the quality of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements; recommending to the Board the filing of our audited financial statements; our disclosure controls and procedures and internal control over financial reporting; our compliance with legal and regulatory requirements and Code of Business Conduct and Ethics; the evaluation, appointment and retention of our independent registered public accountant, including a review of their qualifications, services, independence, fees and performance; the performance of our internal audit function; the performance of our business ethics and compliance function; and enterprise risk management process, policies and procedures. The Audit Committee reviews in advance and pre-approves, explicitly, audit and permissible non-audit services provided to us by our independent registered public accountant. For more information regarding the Audit Committee's approval procedures, please read "Audit Committee Pre-Approval Policy" below. Further, the Audit Committee provides an open venue of communication between management, the internal audit function, ethics and compliance function, independent registered public accountants and Board. The Audit Committee meets with the Internal Audit department, Ethics and Compliance Office and Ernst & Young LLP, or EY, with and without management present, to discuss the results of their examinations and evaluations. Our independent registered public accountants, EY are responsible for auditing our consolidated financial statements and the effectiveness of our internal control over financial reporting in accordance with standards of the Public Company Accounting Oversight Board (United States) and issuing their reports based on that audit. Charter:

https://www.dynegy.com/investors/governance/board-committes. |

16  2017 Proxy Statement 2017 Proxy Statement | | |

Corporate Governance

| | |

Compensation &

Human Resources Committee

Chair:

Paul Barbas

Members:

Dick Kuersteiner

Jeffrey Stein | | Independence:

Each member of the Compensation Committee is independent as such term is defined in the NYSE and SEC rules.Role & Primary Responsibilities:

The purpose of the Compensation Committee is to, among other duties, assist our Board in fulfilling the Board's oversight responsibilities on matters relating to executive compensation, oversee our overall compensation strategy and our equity based compensation plans, prepare the annual Compensation and Compensation Committee report required by SEC rules and review and discuss with our management the Compensation Discussion and Analysis to be included in our annual proxy statement to stockholders. The Compensation Committee does not assist the Board with respect to director compensation, which is the responsibility of the Nominating Committee. For more information regarding the role and scope of authority of the Compensation Committee in determining executive compensation, please read "Compensation Discussion and Analysis" below. The Compensation Committee may delegate specific responsibilities to one or more subcommittees to the extent permitted by law, NYSE listing standards and our governing documents. The Compensation Committee has retained Meridian Compensation Partners, LLC, or Meridian, as its independent compensation consultant. Meridian reports directly to the Compensation Committee. For a discussion of the role of the independent compensation consultant retained by the Compensation Committee in recommending executive compensation and the participation of our Chief Executive Officer in the review of the compensation of other executives that report to the Chief Executive Officer, please read "Compensation Discussion and Analysis" below. Charter:

https://www.dynegy.com/investors/governance/board-committes. |

| | |

Corporate

Governance &

Nominating

Committee

Chair:

Dick Kuersteiner

Members:

Jeffrey Stein

Pat Wood | | Independence:

Each member of the Nominating Committee is independent as such term is defined in the NYSE rules.Role & Primary Responsibilities:

The Nominating Committee is responsible for identifying director nominees, assisting the Board with respect to director compensation, developing and reviewing our Corporate Governance Guidelines, succession planning and overseeing the evaluation of the Board and management. Charter:

https://www.dynegy.com/investors/governance/board-committes. |

| | |

Finance &

Commercial

Oversight

Committee

Chair:

Hilary Ackermann

Members:

Tyler Reeder*

Jeffrey Stein

John R. Sult

* Joined February

2017 | | Role & Primary Responsibilities:

The Finance Committee is responsible for oversight of the Company's capital structure, financing and treasury matters and oversight of management's process for the identification, evaluation. management and mitigation of financial and commercial related risks, including commodity risks, to the Company.Charter:

https://www.dynegy.com/investors/governance/board-committes. |

| | |  2017 Proxy Statement 17 2017 Proxy Statement 17 |

Corporate Governance

STOCK OWNERSHIP GUIDELINES

We have stock ownership guidelines for directors, members of the executive management team and other officers. We believe that a significant ownership stake by directors and officers leads to a stronger alignment of interests between directors, officers and stockholders. These guidelines, which were developed with the assistance of an independent compensation consultant, support our corporate governance focus and provide further alignment of interests among our directors and executive officers and stockholders.

Directors

Each compensated non-management director is expected to own a meaningful amount of Dynegy common stock; specifically, it is expected that within three years of joining the Board, a non-management director shall own at least the number of shares equivalent to three times their annual cash retainer. For purposes of this guideline: (1) each share of common stock owned on any date (a "measuring date") by a director shall be deemed to have a value equal to the greater of (a) the trading price of a share of the Company's common stock as of the date the applicable share was granted to the director or (b) the trading price of a share of the Company's common stock as of the measuring date; and (2) shares owned outright, phantom stock units, shares or units of restricted stock and shares subject to deferred compensation shall be counted as shares of common stock owned by the director (with the value thereof determined in accordance with clause (1) above).

Officers

The shares counted for purposes of our officers' common stock ownership guidelines include shares owned outright, unvested restricted stock units, or RSUs, stock options (vested, in-the-money), and other share based equivalents that we may use from time to time. The holding requirements are expressed as a multiple of base salary and vary by level, specifically for the Chief Executive Officer and Executive Vice President levels they are as follows:

| | |

| |

|

|---|

| | | |

| Chief Executive Officer | | 5 × annual base salary |

| | | |

| Executive Vice President | | 3 × annual base salary |

| | | |

Upon our emergence from bankruptcy on October 1, 2012 (the "Effective Date") and pursuant to the terms of our Plan of Reorganization, all outstanding equity awards of the Company as of the Effective Date were cancelled. As such, the stock ownership guidelines for our executives are subject to a mandatory five-year compliance period that started on the Effective Date, and executives are encouraged to accumulate one-fifth of their holding requirement during each year of the five-year period and may not sell any shares until executives have successfully met the holding requirement. The Nominating Committee will monitor each executive's progress toward the required holding requirement on an annual basis. At the end of the five-year period, if any executive fails to attain the required level of common stock ownership, action may be taken, in the discretion of the Nominating Committee considering all factors it deems relevant, including awarding annual incentive cash bonuses in the form of restricted shares or requiring an executive to refrain from disposing of any vested shares and shares realized from any option exercise.

GOVERNANCE DOCUMENTS

The following governance documents are posted in the "About Dynegy" "Governance" sections of our web site atwww.dynegy.com and are available upon request to our Corporate Secretary:

- •

- Third Amended and Restated Certificate of Incorporation;

- •

- Seventh Amended and Restated Bylaws;

- •

- Corporate Governance Guidelines;

- •

- Code of Business Conduct and Ethics;

18  2017 Proxy Statement 2017 Proxy Statement | | |

Corporate Governance

- •

- Code of Ethics for Senior Financial Professionals;

- •

- Related Party Transactions Policy;

- •

- Complaint and Reporting Procedures for Accounting and Auditing Matters (Whistleblower Policy);

- •

- Policy for Communications with Directors;

- •

- Audit Committee Charter;

- •

- Compensation and Human Resources Committee Charter;

- •

- Corporate Governance and Nominating Committee Charter; and

- •

- Finance and Commercial Oversight Committee Charter.

CODE OF BUSINESS CONDUCT AND ETHICS

Our Code of Business Conduct and Ethics applies to all of our directors, officers and employees. The key principles of this code include acting legally and ethically, notifying appropriate persons upon becoming aware of issues, obtaining confidential advice and dealing fairly with our stakeholders.

CODE OF ETHICS FOR SENIOR FINANCIAL PROFESSIONALS

Our Code of Ethics for Senior Financial Professionals applies to our Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer and other designated senior financial professionals. The key principles of this code include acting legally and ethically, promoting honest business conduct and providing timely and meaningful financial disclosures to our stockholders.

COMPLAINT AND REPORTING PROCEDURES FOR ACCOUNTING AND AUDITING MATTERS

Our Complaint and Reporting Procedures for Accounting and Auditing Matters provide for (1) the receipt, retention and treatment of complaints, reports and concerns regarding accounting, internal accounting controls or auditing matters, and (2) the confidential, anonymous submission of complaints, reports and concerns by employees regarding questionable accounting or auditing matters, in each case relating to Dynegy. Complaints may be made through a toll free "Integrity Helpline" telephone number, operated by an independent third party, and a dedicated email address. Complaints received are logged by the Ethics and Compliance Office, communicated to the chairman of our Audit Committee and investigated, under the supervision of our Audit Committee, by our Internal Audit department or Ethics and Compliance Office. In accordance with applicable law, these procedures prohibit us from taking adverse action against any person submitting a good faith complaint, report or concern.

POLICY FOR COMMUNICATIONS WITH DIRECTORS

Our Policy for Communications with Directors provides a means for stockholders and other interested parties to communicate with the Board. Under this policy, stockholders and other interested parties may communicate with the Board or specific members of the Board by sending a letter to Dynegy Inc., Communications with Directors, Attn: Corporate Secretary, Dynegy Inc., 601 Travis, Suite 1400, Houston, Texas 77002.

DIRECTOR ATTENDANCE AT ANNUAL MEETINGS

As detailed in our Corporate Governance Guidelines, Board members are requested and encouraged to attend the Annual Meeting. All of the members of the Board then in office attended last year's annual meeting held on May 20, 2016.

| | |  2017 Proxy Statement 19 2017 Proxy Statement 19 |

Corporate Governance

CHARITABLE CONTRIBUTIONS

During 2016, we did not make any contributions to any charitable organization in which an independent director served as an executive officer.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our executive officers, directors and persons who own more than 10% of our equity securities to file reports of ownership and changes in ownership with the SEC and the NYSE. Executive officers, directors and greater than 10% stockholders are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file.

Based solely upon a review of the copies of such forms furnished to us in 2016 and upon written representations that no Forms 5 were required, we believe that all persons subject to these reporting requirements filed the required reports on a timely basis, except for the following reports which were late due to administrative error: one report for one transaction for each of Messrs. Mario Alonso, Henry Jones and Marty Daley.

REVIEW AND APPROVAL OF TRANSACTIONS WITH RELATED PERSONS

Our Board adopted a written policy relating to the approval of transactions with related parties. In general, for purposes of this policy, a related party transaction is a transaction to which we are a party, or a material amendment to any such transaction, and with respect to which a related party is directly, or to our knowledge, indirectly, a party. Under our policy, a "related party" is an executive officer, director or nominee for director of ours, a person known to us to be the beneficial owner of more than 5% of our voting securities, an immediate family member of an executive officer, director, nominee for director or 5% stockholder, and any entity owned or controlled by any of the foregoing individuals or in which any such individual serves as an executive officer or general partner or, together with any other such individuals, owns 10% or more of the equity interests of such an entity. Our policy requires the Audit Committee or, at the Board's discretion, a majority of directors disinterested from the transaction, to review and approve related party transactions. In reviewing and approving any related party transaction or material amendments to any such transaction, the Audit Committee must satisfy itself that it has been fully informed as to the related party's relationship and interest and as to the material facts of the transaction and must determine that the related party transaction is fair to us.

A copy of our related party transactions policy is available on our web site athttps://www.dynegy.com/investors/leadership-governance/corporate-governance/governance-documents.

CERTAIN TRANSACTIONS AND OTHER MATTERS

Mr. Reeder has no direct or indirect material interest in any transaction required to be disclosed by us pursuant to Item 404(a) of Regulation S-K, other than (1) the PIPE Stock Purchase Agreement, the Investor Rights Agreement and the transactions contemplated thereby, (2) the Amended and Restated Interim Sponsors Agreement, dated as of June 14, 2016 by and among Dynegy, certain affiliated investment funds of Energy Capital Partners, Atlas Power, LLC, a wholly owned subsidiary of Dynegy, and Terawatt, and the transactions contemplated thereby, (3) the Stock Purchase Agreement, dated August 21, 2014 as amended, the EquiPower Agreement, by and among certain affiliated investment funds of Energy Capital Partners, EquiPower Resources Corp., Dynegy Resource II, LLC and Dynegy, and the transactions contemplated thereby, and (4) the Stock Purchase Agreement and Agreement and Plan of Merger, dated August 21, 2014, the Brayton Agreement, by and among Dynegy Resource III, LLC, Dynegy Resources III-A, LLC, certain affiliated investment funds of Energy Capital Partners, Brayton Point Holdings, LLC and Dynegy, and the transactions contemplated thereby.

20  2017 Proxy Statement 2017 Proxy Statement | | |

PROPOSAL 1—ELECTION OF DIRECTORS

DIRECTORS

Eight directors are to be elected at the Annual Meeting by the holders of common stock to each serve a one-year term. The directors are elected by a plurality of the shares of common stock represented in person (through internet access) or by proxy and entitled to vote on the election of directors, subject to our majority voting policy discussed below. This means that the eight individuals nominated for election to the Board as directors who receive the mostFOR votes among votes properly cast in person (through internet access) or by proxy will be elected. OnlyFOR orWITHHELD votes are counted in determining whether a plurality has been cast in favor of a director nominee. Under our Certificate of Incorporation, stockholders do not have cumulative voting rights. If you withhold authority to vote with respect to the election of some or all of the director nominees, your shares will not be voted with respect to those nominees indicated.

Under our majority voting policy, in an uncontested election, any director nominee who receives a greater number of votesWITHHELD for his or her election than votesFOR such election must offer his or her resignation to the Board promptly following certification of the stockholder vote.

Broker non-votes are not counted for purposes of election of directors. You cannot abstain in the election of directors.

Unless you withhold authority to vote or instruct otherwise, a properly executed proxy will be votedFOR the election of the nominees listed below as the proxies may determine. Although the Board does not contemplate that any of the nominees will be unable to serve, if such a situation arises prior to the Annual Meeting, the persons appointed as proxies will vote for the election of such other persons that may be nominated by the Board.

| | |  2017 Proxy Statement 21 2017 Proxy Statement 21 |

Proposal 1—Election of Directors

INFORMATION ON DIRECTOR NOMINEES

All of the nominees for director are currently directors of Dynegy. Below is biographical information regarding the nominees, including their names, ages, business experience and qualifications to serve as a director, other directorships, if any, and the length of their service as a director of Dynegy.

| | |

| | | |

| | | |

Robert C. Flexon, 58

Director since 2011

| | President and Chief Executive Officer Current Public Directorship: Westmoreland Coal Company Prior Experience: • UGI Corporation—Chief Financial Officer • Foster Wheeler AG—Chief Executive Officer, Board Director • NRG Energy—Chief Financial Officer, Chief Operating Officer • Hercules and ARCO—various financial roles Mr. Flexon, who oversaw Dynegy's turnaround in 2012, brings executive management and operating experience in many areas of the energy business, including wholesale power generation. Mr. Flexon also has a broad background in accounting and finance, and significant corporate financial expertise and management experience as a result of his service as a chief financial officer and other senior financial leadership positions. Mr. Flexon has served as President and Chief Executive Officer since July 2011 and a director of Dynegy since June 2011. Prior to joining Dynegy, Mr. Flexon served as the Chief Financial Officer of UGI Corporation, a distributor and marketer of energy products and related services from February 2011 to July 2011. Mr. Flexon was the Chief Executive Officer of Foster Wheeler AG from June to October 2010 and the President and Chief Executive Officer of Foster Wheeler USA from November 2009 to May 2010. Prior to joining Foster Wheeler, Mr. Flexon was Executive Vice President and Chief Financial Officer of NRG Energy, Inc. from February to November 2009. Mr. Flexon previously served as Executive Vice President and Chief Operating Officer of NRG Energy from March 2008 to February 2009 and as its Executive Vice President and Chief Financial Officer from 2004 to 2008. Prior to joining NRG Energy, Mr. Flexon held executive positions with Hercules, Inc. and various key positions, including General Auditor, with Atlantic Richfield Company. Mr. Flexon holds a Bachelor of Science degree in Accounting from Villanova University. Mr. Flexon served on the public board of directors of Foster Wheeler from 2006 until 2009 and from May to October 2010 and is currently serving on the Boards of Westmoreland Coal Company and Genesys Works-Houston, an organization that transforms the lives of disadvantaged high school students through meaningful work experience. |

| | | |

| | | |

22  2017 Proxy Statement 2017 Proxy Statement | | |