UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☒ | | Definitive Proxy Statement |

| |

| ☐ | | Definitive Additional Materials |

| |

| ☐ | | Soliciting Material Under§240.14a-12 |

Dynegy Inc.

(Name of Registrant as Specified in its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

JOINT PROXY STATEMENT AND PROSPECTUS

MERGER PROPOSED—YOUR VOTE IS VERY IMPORTANT

January 25, 2018

To the Stockholders of Vistra Energy Corp. and the Stockholders of Dynegy Inc.:

The board of directors (the “Vistra Energy Board”) of Vistra Energy Corp. (“Vistra Energy”) and the board of directors (the “Dynegy Board”) of Dynegy Inc. (“Dynegy”) each has approved an Agreement and Plan of Merger, dated as of October 29, 2017 (the “Merger Agreement”), by and between Vistra Energy and Dynegy, pursuant to which Dynegy will, subject to certain regulatory approvals, stockholder approvals and other customary closing conditions, merge with and into Vistra Energy (the “Merger”), with Vistra Energy continuing as the surviving corporation. The combined company resulting from the Merger will retain the name “Vistra Energy Corp.” and will continue to trade on the New York Stock Exchange (the “NYSE”) under the symbol “VST”.

Pursuant to the terms and subject to the conditions set forth in the Merger Agreement, at the effective time of the Merger, each outstanding share of common stock, par value $0.01 per share, of Dynegy (the “Dynegy Common Stock”) (other than those owned by Vistra Energy or any wholly owned subsidiary of Vistra Energy, or held in treasury by Dynegy or owned by any wholly owned subsidiary of Dynegy, which will be automatically cancelled and cease to exist) will be converted into the right to receive 0.652 newly issued, fully paid and nonassessable shares of common stock, par value $0.01 per share, of Vistra Energy (the “Vistra Energy Common Stock”).

Vistra Energy and Dynegy will each hold a special meeting of its stockholders.

Vistra Energy’s special meeting will be held at 1601 Bryan Street, 11th Floor, Dallas, Texas 75201 on March 2, 2018, at 9:00 a.m., Central Time. At the Vistra Energy special meeting, the holders of Vistra Energy Common Stock will be asked (a) to consider and vote on a proposal to adopt the Merger Agreement (the “Merger Proposal”), (b) to consider and vote on a proposal to approve the issuance of Vistra Energy Common Stock to the Dynegy stockholders (the “Stock Issuance”) in connection with the Merger as contemplated by the Merger Agreement (the “Stock Issuance Proposal”) and (c) to consider and vote on a proposal to approve the adjournment of the Vistra Energy special meeting, if necessary or appropriate, for the purpose of soliciting additional votes for the approval of the Merger Proposal and the Stock Issuance Proposal (the “Vistra Energy Adjournment Proposal”). The Vistra Energy Board recommends that holders of Vistra Energy Common Stock vote “FOR” the Merger Proposal, “FOR” the Stock Issuance Proposal, and “FOR” the Vistra Energy Adjournment Proposal.

Dynegy’s special meeting will be held at the Chase Center, 601 Travis Street, Houston, Texas 77002 on March 2, 2018, at 10:00 a.m., Central Time. At the Dynegy special meeting, the holders of Dynegy Common Stock will be asked (i) to consider and vote on the Merger Proposal, (ii) to consider and vote in an advisory capacity on compensation payable to executive officers of Dynegy in connection with the Merger (the “Dynegy Compensation Proposal”) and (iii) to consider and vote on a proposal to approve the adjournment of the Dynegy special meeting, if necessary or appropriate, for the purpose of soliciting additional votes for the approval of the Merger Proposal (the “Dynegy Adjournment Proposal”). The Dynegy Board unanimously recommends that holders of Dynegy Common Stock vote “FOR” the Merger Proposal, “FOR” the Dynegy Compensation Proposal and “FOR” the Dynegy Adjournment Proposal.

This joint proxy statement and prospectus provides you with detailed information about the special meetings of Vistra Energy and Dynegy, the Merger Agreement, the Merger and the other transactions contemplated by the

Merger Agreement, including the Stock Issuance.A copy of the Merger Agreement is included as Annex A to this joint proxy statement and prospectus. Vistra Energy and Dynegy encourage you to read this joint proxy statement and prospectus, the Merger Agreement and the other annexes to this joint proxy statement and prospectus carefully and in their entirety. In particular, you should carefully consider the discussion in the section of this joint proxy statement and prospectus entitled “Risk Factors” beginning on page 35.

Your vote is very important, regardless of the number of shares you own. The Merger cannot be completed unless stockholders of both Vistra Energy and Dynegy approve certain proposals related to the Merger.

Whether or not you plan to attend the Vistra Energy special meeting or the Dynegy special meeting, as applicable, please submit a proxy to vote your shares as promptly as possible to make sure that your shares are represented at the Vistra Energy special meeting or Dynegy special meeting, as applicable. Please note that the failure to vote your Vistra Energy Common Stock or Dynegy Common Stock, as applicable, is the equivalent of a vote against the Merger Proposal.

Thank you in advance for your continued support.

Sincerely,

| | |

| |  |

Curtis A. Morgan President and Chief Executive Officer Vistra Energy Corp. | | Robert C. Flexon President and Chief Executive Officer Dynegy Inc. |

Neither the U.S. Securities and Exchange Commission (the “SEC”) nor any state securities regulatory agency has approved or disapproved of the securities to be issued in connection with the Merger or passed upon the adequacy or accuracy of this joint proxy statement and prospectus. Any representation to the contrary is a criminal offense.

This joint proxy statement and prospectus is dated January 25, 2018, and is first being mailed to the stockholders of Vistra Energy and the stockholders of Dynegy on or about January 29, 2018.

6555 Sierra Drive

Irving, Texas 75039

NOTICE OF SPECIAL MEETING TO VISTRA ENERGY STOCKHOLDERS

TO BE HELD ON MARCH 2, 2018

To the Stockholders of Vistra Energy:

A special meeting of stockholders of Vistra Energy Corp., a Delaware corporation (“Vistra Energy”), will be held at 1601 Bryan Street, 11th Floor, Dallas, Texas 75201 on March 2, 2018, starting at 9:00 a.m., Central Time, for the following purposes:

| | 1. | to consider and vote on a proposal (the “Merger Proposal”) to adopt the Agreement and Plan of Merger, dated as of October 29, 2017 (the “Merger Agreement”), by and between Vistra Energy and Dynegy Inc., a Delaware corporation (“Dynegy”), as it may be amended from time to time, a copy of which is attached as Annex A to the joint proxy statement and prospectus accompanying this notice, pursuant to which, among other things, Dynegy will merge with and into Vistra Energy, with Vistra Energy continuing as the surviving corporation (the “Merger”); |

| | 2. | to consider and vote on a proposal (the “Stock Issuance Proposal”) to approve the issuance of shares of Vistra Energy Common Stock in connection with the Merger, as contemplated by the Merger Agreement (the “Stock Issuance”); and |

| | 3. | to consider and vote on a proposal to approve the adjournment of the Vistra Energy special meeting, if necessary or appropriate, for the purpose of soliciting additional votes for the approval of the Merger Proposal and the Stock Issuance Proposal (the “Vistra Energy Adjournment Proposal”). |

Vistra Energy will transact no other business at the Vistra Energy special meeting or any adjournment or postponement thereof. These items of business are described in the enclosed joint proxy statement and prospectus. The Vistra Energy board of directors (the “Vistra Energy Board”) has designated the close of business on January 19, 2018 as the record date for the purpose of determining the holders of shares of Vistra Energy’s common stock, par value $0.01 per share (the “Vistra Energy Common Stock”) who are entitled to receive notice of, and to vote at, the Vistra Energy special meeting and any adjournments or postponements of the special meeting, unless a new record date is fixed in connection with any adjournment or postponement of the special meeting. Only holders of record of Vistra Energy Common Stock at the close of business on the record date are entitled to notice of, and to vote at, the Vistra Energy special meeting and at any adjournment or postponement of the special meeting.

The Vistra Energy Board has (i) determined that it is in the best interest of Vistra Energy and the holders of Vistra Energy Common Stock to enter into the Merger Agreement, (ii) declared entry into the Merger Agreement to be advisable, (iii) authorized and approved Vistra Energy’s execution, delivery and performance of the Merger Agreement in accordance with its terms and Vistra Energy’s consummation of the transactions contemplated thereby, including the Merger and the Stock Issuance, (iv) directed that the adoption of the Merger Agreement and the approval of the Stock Issuance be submitted to a vote at a meeting of the holders of Vistra Energy Common Stock and (v) recommended that the holders of Vistra Energy Common Stock adopt the Merger Agreement and approve the Stock Issuance.The Vistra Energy Board recommends that holders of Vistra Energy Common Stock vote “FOR” the Merger Proposal, “FOR” the Stock Issuance Proposal and “FOR” the Vistra Energy Adjournment Proposal.

Your vote is very important, regardless of the number of shares of Vistra Energy Common Stock you own. The Merger cannot be completed unless stockholders of both Vistra Energy and Dynegy approve certain proposals related to the Merger. Whether or not you plan to attend the Vistra Energy special meeting, please submit a proxy to vote your shares as promptly as possible to make sure that your shares arerepresented at the special meeting. Properly executed proxy cards with no instructions indicated on the proxy card will be voted “FOR” the Merger Proposal, “FOR” the Stock Issuance Proposal and “FOR” the Vistra Energy Adjournment Proposal. Even if you plan to attend the Vistra Energy special meeting in person, Vistra Energy requests that you complete, sign, date and return the enclosed proxy card in the accompanying envelope prior to the special meeting to ensure that your shares will be represented and voted at the special meeting if you are unable to attend.

You may also submit a proxy over the Internet using the Internet address on the enclosed proxy card or by telephone using the toll-free number on the enclosed proxy card. If you submit your proxy through the Internet or by telephone, you will be asked to provide the control number from the enclosed proxy card. If you are not a stockholder of record, but instead hold your shares in “street name” through a broker, bank, trust or other nominee, you must provide a proxy executed in your favor from your broker, bank, trust or other nominee in order to be able to vote in person at the special meeting.

If you do not vote on the Merger Proposal, it will have the same effect as a vote by you against the approval of the Merger Proposal.

If you attend the Vistra Energy special meeting, you may revoke your proxy and vote in person, even if you have previously returned your proxy card or submitted your proxy through the Internet or by telephone. If your Vistra Energy shares are held by a broker, bank, trust or other nominee, and you plan to attend the Vistra Energy special meeting, please bring to the special meeting your statement evidencing your beneficial ownership of your Vistra Energy shares. Please carefully review the instructions in the enclosed joint proxy statement and prospectus and the enclosed proxy card or the information forwarded by your broker, bank, trust or other nominee regarding each of these options.

January 25, 2018

Irving, Texas

By Order of the Vistra Energy Board

Cecily Small Gooch

Senior Vice President, Associate General Counsel, Chief Compliance Officer and Corporate Secretary

Vistra Energy Corp.

601 Travis Street, Suite 1400

Houston, Texas 77002

NOTICE OF SPECIAL MEETING TO DYNEGY STOCKHOLDERS

TO BE HELD ON MARCH 2, 2018

To the Stockholders of Dynegy:

A special meeting of stockholders of Dynegy Inc., a Delaware corporation (“Dynegy”), will be held at the Chase Center, 601 Travis Street, Houston, Texas 77002 on March 2, 2018, starting at 10:00 a.m., Central Time, for the following purposes:

| | 1. | to consider and vote on a proposal (the “Merger Proposal”) to adopt the Agreement and Plan of Merger (the “Merger Agreement”), dated as of October 29, 2017, by and between Vistra Energy Corp., a Delaware corporation (“Vistra Energy”), and Dynegy, as it may be amended from time to time, a copy of which is attached as Annex A to the joint proxy statement and prospectus accompanying this notice, pursuant to which, among other things, Dynegy will merge with and into Vistra Energy, with Vistra Energy continuing as the surviving corporation (the “Merger”); |

| | 2. | to consider and vote on a non-binding advisory vote on compensation payable to executive officers of Dynegy in connection with the Merger (the “Dynegy Compensation Proposal”); and |

| | 3. | to consider and vote on a proposal to approve the adjournment of the Dynegy special meeting, if necessary or appropriate, for the purpose of soliciting additional votes for the approval of the Merger Proposal (the “Dynegy Adjournment Proposal”). |

Dynegy will transact no other business at the Dynegy special meeting or any adjournment or postponement thereof. These items of business are described in the enclosed joint proxy statement and prospectus. The Dynegy board of directors (the “Dynegy Board”) has designated the close of business on January 19, 2018 as the record date for the purpose of determining the holders of shares of Dynegy’s common stock, par value $0.01 per share (the “Dynegy Common Stock”) who are entitled to receive notice of, and to vote at, the Dynegy special meeting and any adjournments or postponements of the special meeting, unless a new record date is fixed in connection with an adjournment or postponement of the special meeting. Only holders of record of Dynegy Common Stock at the close of business on the record date are entitled to notice of, and to vote at, the Dynegy special meeting and at any adjournment or postponement of the special meeting.

The Dynegy Board has unanimously (i) determined that it is in the best interest of Dynegy and holders of Dynegy Common Stock to enter into the Merger Agreement, (ii) declared entry into the Merger Agreement to be advisable, (iii) authorized and approved Dynegy’s execution, delivery and performance of the Merger Agreement in accordance with its terms and Dynegy’s consummation of the transactions contemplated thereby, including the Merger, (iv) directed that the adoption of the Merger Agreement be submitted to a vote at a meeting of the holders of Dynegy Common Stock and (v) recommended that the holders of Dynegy Common Stock adopt the Merger Agreement.The Dynegy Board unanimously recommends that holders of Dynegy Common Stock vote “FOR” the Merger Proposal, “FOR” the Dynegy Compensation Proposal and “FOR” the Dynegy Adjournment Proposal.

Your vote is very important, regardless of the number of shares of Dynegy Common Stock you own. The Merger cannot be completed unless stockholders of both Vistra Energy and Dynegy approve certain proposals related to the Merger. Whether or not you plan to attend the Dynegy special meeting, please submit a proxy to vote your shares as promptly as possible to make sure that your shares are represented

at the special meeting. Properly executed proxy cards with no instructions indicated on the proxy card will be voted “FOR” the Merger Proposal, “FOR” the Dynegy Compensation Proposal and “FOR” the Dynegy Adjournment Proposal. Even if you plan to attend the Dynegy special meeting in person, Dynegy requests that you complete, sign, date and return the enclosed proxy card in the accompanying envelope prior to the special meeting to ensure that your shares will be represented and voted at the special meeting if you are unable to attend.

You may also submit a proxy over the Internet using the Internet address on the enclosed proxy card or by telephone using the toll-free number on the enclosed proxy card. If you submit your proxy through the Internet or by telephone, you will be asked to provide the control number from the enclosed proxy card. If you are not a stockholder of record, but instead hold your shares in “street name” through a broker, bank, trust or other nominee, you must provide a proxy executed in your favor from your broker, bank, trust or other nominee in order to be able to vote in person at the special meeting.

If you do not vote on the Merger Proposal, it will have the same effect as a vote by you against the approval of the Merger Proposal.

If you attend the Dynegy special meeting, you may revoke your proxy and vote in person, even if you have previously returned your proxy card or submitted your proxy through the Internet or by telephone. If your Dynegy shares are held by a broker, bank, trust or other nominee, and you plan to attend the Dynegy special meeting, please bring to the special meeting your statement evidencing your beneficial ownership of your Dynegy shares. Please carefully review the instructions in the enclosed joint proxy statement and prospectus and the enclosed proxy card or the information forwarded by your broker, bank, trust or other nominee regarding each of these options.

January 25, 2018

Houston, Texas

By Order of the Dynegy Board

Pat Wood III

Chairman of the Dynegy Board

ADDITIONAL INFORMATION

This joint proxy statement and prospectus incorporates important business and financial information about Dynegy from other documents that are not included in or delivered with this joint proxy statement and prospectus. This information is available to you without charge upon your request. You can obtain the documents incorporated by reference into this joint proxy statement and prospectus by requesting them from Dynegy as follows:

MacKenzie Partners, Inc.

105 Madison Avenue

New York, NY 10016

Toll Free: (800) 322-2885

Email: proxy@mackenziepartners.com

or

601 Travis Street, Suite 1400

Houston, Texas 77002

Telephone: (713) 507-6466

Attention: Investor Relations

If you would like to request any of the Dynegy documents that are incorporated by reference into this joint proxy statement and prospectus, please do so by February 23, 2018 in order to receive them before the Vistra Energy special meeting and the Dynegy special meeting.

Investors may also consult Vistra Energy’s or Dynegy’s website for more information concerning the Merger and other related transactions described in this joint proxy statement and prospectus. Vistra Energy’s website is www.vistraenergy.com. Dynegy’s website is www.dynegy.com. Each company’s public filings are also available at www.sec.gov. The information contained on Vistra Energy’s and Dynegy’s websites is not part of this joint proxy statement and prospectus. The references to Vistra Energy’s and Dynegy’s websites are intended to be inactive textual references only.

For more information, see “Where You Can Find More Information and Incorporation by Reference” beginning on page 309.

i

ABOUT THIS JOINT PROXY STATEMENT AND PROSPECTUS

This joint proxy statement and prospectus, which forms part of a registration statement on FormS-4 (Registration Statement No. 333-222049) filed by Vistra Energy with the SEC constitutes a prospectus of Vistra Energy for purposes of the Securities Act of 1933, as amended (the “Securities Act”), with respect to the offering and sale of Vistra Energy Common Stock to be issued to holders of Dynegy Common Stock pursuant to the Merger Agreement, as such agreement may be amended or modified from time to time. This joint proxy statement and prospectus also constitutes a proxy statement for Vistra Energy and Dynegy, respectively, for purposes of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Delaware law. In addition, it constitutes a notice of special meeting to the Vistra Energy stockholders with respect to the Vistra Energy special meeting and a notice of special meeting to the Dynegy stockholders with respect to the Dynegy special meeting.

You should rely only on the information contained in or incorporated by reference into this joint proxy statement and prospectus. No one has been authorized to provide you with information that is different from that contained in, or incorporated by reference into, this joint proxy statement and prospectus. This joint proxy statement and prospectus is dated January 25, 2018, and you should not assume that the information contained in, or incorporated by reference into, this joint proxy statement and prospectus is accurate as of any date other than that date (or, in the case of documents incorporated by reference, their respective dates). Neither the mailing of this joint proxy statement and prospectus to Vistra Energy’s stockholders or Dynegy’s stockholders nor the Stock Issuance pursuant to the Merger Agreement will create any implication to the contrary.

Certain industry and market data and other statistical information used throughout this joint proxy statement and prospectus are based on independent industry publications, government publications, reports by market research firms or other published independent sources, including certain data published by ERCOT, the PUCT and NYMEX. Neither Vistra Energy nor Dynegy commissioned any of these publications, reports or other sources.

Some Vistra Energy-related data is also based on good faith estimates, which are derived from Vistra Energy’s review of internal surveys, as well as the independent sources listed above. Industry publications, reports and other sources generally state that they have obtained information from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information. While Vistra Energy and Dynegy believe that each of these publications, reports and other sources is reliable, neither party has independently investigated or verified the information contained or referred to therein or makes any representation as to the accuracy or completeness of such information. Forecasts are particularly likely to be inaccurate, especially over long periods of time, and what assumptions were used in preparing such forecasts are often unknown. Statements regarding industry and market data and other statistical information used throughout this joint proxy statement involve risks and uncertainties and are subject to change based on various factors, including those discussed under the headings “Cautionary Statement Regarding Forward-Looking Statements” and “Risk Factors.”

This joint proxy statement and prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any securities, or the solicitation of a proxy, in any jurisdiction in which or to any person to whom it is unlawful to make any such offer or solicitation in such jurisdiction. Information contained in this joint proxy statement and prospectus regarding Vistra Energy has been provided by Vistra Energy and information contained in this joint proxy statement and prospectus regarding Dynegy has been provided by Dynegy.

ii

TABLE OF CONTENTS

iii

iv

v

DEFINED TERMS

Unless stated otherwise, when the following terms and abbreviations appear in the text of this joint proxy statement and prospectus, they have the meanings indicated below:

| | |

| Apollo Entities | | collectively, certain affiliates of Apollo Management Holdings L.P. |

| |

| Brookfield Entities | | collectively, certain affiliates of Brookfield Asset Management Private Institutional Capital Adviser (Canada), L.P. |

| |

| CAISO | | the California Independent System Operator. |

| |

| CCGT | | combined cycle gas turbine. |

| |

| CFTC | | United States Commodity Futures Trading Commission. |

| |

| Chapter 11 Cases | | cases being heard in the US Bankruptcy Court for the District of Delaware (Bankruptcy Court) concerning voluntary petitions for relief under Chapter 11 of the US Bankruptcy Code (Bankruptcy Code) filed on April 29, 2014 by the Debtors. On the Plan Effective Date, the TCEH Debtors (together with the Contributed EFH Debtors) emerged from the Chapter 11 Cases. |

| |

| CME | | Chicago Mercantile Exchange. |

| |

| CO2 | | carbon dioxide. |

| |

| Code | | the Internal Revenue Code of 1986, as amended. |

| |

| Contributed EFH Debtors | | certain EFH Debtors that became subsidiaries of Vistra Energy on the Plan Effective Date. |

| |

| CSAPR | | Cross-State Air Pollution Rule issued by the EPA in July 2011. |

| |

| Debtors | | EFH Corp. and the majority of its direct and indirect subsidiaries, including EFIH, EFCH and TCEH but excluding the Oncor Ring-Fenced Entities. Prior to the Plan Effective Date, also included the TCEH Debtors and the Contributed EFH Debtors. |

| |

| Delta Transaction | | Dynegy’s acquisition, completed on February 7, 2017, through Dynegy’s indirect wholly owned subsidiary Atlas Power Finance, LLC, of the GSENA Thermal Assets from International Power S.A. |

| |

| DGCL | | Delaware General Corporation Law. |

| |

| DIP Facility | | TCEH’s $3.375 billion debtor-in-possession financing facility, which was repaid in August 2016. |

| |

| DIP Roll Facilities | | TCEH’s $4.250 billion debtor-in-possession and exit financing facilities, which was converted to the Vistra Operations Credit Facilities on the Plan Effective Date. |

| |

| Dynegy | | Dynegy Inc., and/or its subsidiaries, depending on context. |

| |

| Dynegy Adjournment Proposal | | the proposal to approve the adjournment of the Dynegy special meeting, if necessary or appropriate, for the purpose of soliciting additional votes for the approval of the Merger Proposal. |

| |

| Dynegy Board | | the board of directors of Dynegy. |

| |

| Dynegy Common Stock | | the common stock, par value $0.01 per share, of Dynegy. |

1

| | |

| |

| Dynegy Compensation Proposal | | the non-binding advisory proposal to approve compensation arrangements for certain Dynegy executive officers in connection with the Merger Agreement, the Merger and the transactions contemplated by the Merger Agreement. |

| |

| Dynegy Investor Rights Agreement | | the investor rights agreement, dated as of February 8, 2017, by and between Dynegy and Terawatt, as amended on September 5, 2017. |

| |

| Dynegy Stockholder Support Agreements | | collectively, the Merger Support Agreement, dated as of October 29, 2017, by and between Vistra Energy and certain affiliates of Oaktree and the Merger Support Agreement, dated as of October 29, 2017, by and between Vistra Energy and Terawatt. |

| |

| EFCH | | Energy Future Competitive Holdings Company LLC, a direct, wholly owned subsidiary of EFH Corp. and, prior to the Plan Effective Date, the indirect parent of the TCEH Debtors, depending on context. |

| |

| EFH Corp. | | Energy Future Holdings Corp. and/or its subsidiaries, depending on context, whose major subsidiaries include Oncor and, prior to the Plan Effective Date, included the TCEH Debtors and the Contributed EFH Debtors. |

| |

| EFH Debtors | | EFH Corp. and its subsidiaries that are Debtors in the Chapter 11 Cases, including EFIH and EFIH Finance Inc., but excluding the TCEH Debtors and the Contributed EFH Debtors. |

| |

| EFH Shared Services Debtors | | collectively: (a) EFH Corporate Services; (b) Dallas Power and Light Company, Inc.; (c) EFH CG Holdings Company LP; (d) EFH CG Management Company LLC; (e) Lone Star Energy Company, Inc.; (f) Lone Star Pipeline Company, Inc.; (g) Southwestern Electric Service Company, Inc.; (h) Texas Electric Service Company, Inc.; (i) Texas Energy Industries Company, Inc.; (j) Texas Power and Light Company, Inc.; (k) Texas Utilities Company, Inc.; (l) Texas Utilities Electric Company, Inc.; and (m) TXU Electric Company, Inc. |

| |

| EFIH | | Energy Future Intermediate Holding Company LLC, a direct, wholly owned subsidiary of EFH Corp. and the direct parent of Oncor Holdings. |

| |

| Emergence | | emergence of the TCEH Debtors and the Contributed EFH Debtors from the Chapter 11 Cases as subsidiaries of a newly formed company, Vistra Energy, on the Plan Effective Date. |

| |

| EPA | | U.S. Environmental Protection Agency. |

| |

| ERCOT | | Electric Reliability Council of Texas, Inc., the ISO and the regional coordinator of various electricity systems within Texas. |

| |

| Exchange Act | | Securities Exchange Act of 1934, as amended. |

| |

| Exchange Ratio | | 0.652 validly issued, fully paid and nonassessable shares of Vistra Energy Common Stock per share of Dynegy Common Stock. |

| |

| Federal and State Income Tax Allocation Agreements | | prior to the Plan Effective Date, EFH Corp. and certain of its subsidiaries (including EFCH, EFIH and TCEH, but not including Oncor Holdings and Oncor) were parties to a Federal and State Income Tax Allocation Agreement, executed in May 2012 but effective as of January 2010. The Agreement was rejected by the TCEH Debtors and the Contributed EFH Debtors on the Plan Effective Date. |

| |

| FERC | | U.S. Federal Energy Regulatory Commission. |

2

| | |

| |

| GAAP | | generally accepted accounting principles. |

| |

| GHG | | greenhouse gas. |

| |

| GSENA | | GDF SUEZ Energy North America, Inc. |

| |

| GSENA Thermal Assets | | carved-out assets of GSENA that Dynegy acquired on February 7, 2017 pursuant to the Delta Transaction. |

| |

| GW | | gigawatt. |

| |

| GWh | | gigawatt-hours. |

| |

| HSR Act | | Hart-Scott-Rodino Antitrust Improvements Act of 1976. |

| |

| IPH | | IPH, LLC. |

| |

| IPP | | independent power producer. |

| |

| IRS | | U.S. Internal Revenue Service. |

| |

| ISO | | independent system operator. |

| |

| ISO-NE | | Independent System Operator New England. |

| |

| LIBOR | | London Interbank Offered Rate, an interest rate at which banks can borrow funds, in marketable size, from other banks in the London interbank market. |

| |

| load | | demand to electricity. |

| |

| Luminant | | certain subsidiaries of Vistra Energy engaged in competitive market activities consisting of electricity generation and wholesale energy sales and purchases as well as commodity risk management, all largely in Texas. |

| |

| market heat rate | | heat rate is a measure of the efficiency of converting a fuel source to electricity. Market heat rate is the implied relationship between wholesale electricity prices and natural gas prices and is calculated by dividing the wholesale market price of electricity, which is based on the price offer of the marginal supplier in ERCOT (generally natural gas plants), by the market price of natural gas. |

| |

| Merger | | the proposed merger of Dynegy with and into Vistra Energy, with Vistra Energy as the surviving corporation. |

| |

| Merger Agreement | | the Agreement and Plan of Merger, dated as of October 29, 2017, by and between Vistra Energy and Dynegy, as it may be amended or modified from time to time, a copy of which is attached as Annex A to this joint proxy statement and prospectus. |

| |

| Merger Proposal | | the proposal by each of Vistra Energy and Dynegy to adopt the Merger Agreement. |

| |

| MISO | | Midcontinent Independent System Operator, Inc. |

| |

| MMBtu | | million British thermal units. |

| |

| MW | | megawatts. |

| |

| MWh | | megawatt-hours. |

| |

| NERC | | North American Electricity Reliability Corporation. |

| |

| NOx | | nitrogen oxide. |

3

| | |

| |

| NYISO | | New York Independent System Operator. |

| |

| NY/NE | | ISO-NE/NYISO. |

| |

| NYMEX | | New York Mercantile Exchange, a commodity derivatives exchange. |

| |

| NYPSC | | New York Public Service Commission. |

| |

| NYSE | | New York Stock Exchange. |

| |

| NRC | | U.S. Nuclear Regulatory Commission. |

| |

| Oaktree Entities | | collectively, certain affiliates of Oaktree Capital Management, L.P. |

| |

| Oncor | | Oncor Electric Delivery Company LLC, a direct, majority-owned subsidiary of Oncor Holdings and an indirect subsidiary of EFH Corp., that is engaged in regulated electricity transmission and distribution activities. |

| |

| Oncor Holdings | | Oncor Electric Delivery Holdings Company LLC, a direct, wholly owned subsidiary of EFIH and the direct majority owner of Oncor, and/or its subsidiaries, depending on context. |

| |

| ORDC | | Operating Reserve Demand Curve, pursuant to which wholesale electricity prices in the ERCOT real-time market increase automatically as available operating reserves decrease below defined threshold levels. |

| |

| PJM | | PJM Interconnection, LLC. |

| |

| Plan Effective Date | | October 3, 2016, the date the TCEH Debtors and the Contributed EFH Debtors completed their reorganization under the Bankruptcy Code and emerged from the Chapter 11 Cases. |

| |

| Plan of Reorganization or Plan | | Third Amended Joint Plan of Reorganization filed by the Debtors in August 2016 and confirmed by the Bankruptcy Court in August 2016 solely with respect to the TCEH Debtors and the Contributed EFH Debtors. |

| |

| PPAs | | power purchase agreements. |

| |

| PrefCo | | Vistra Preferred Inc. |

| |

| PrefCo Preferred Stock Sale | | as part of the Spin-Off, the contribution of certain of the assets of the Predecessor and its subsidiaries by a subsidiary of TEX Energy LLC to PrefCo in exchange for all of PrefCo’s authorized preferred stock, consisting of 70,000 shares, par value $0.01 per share. |

| |

| PUCT | | Public Utility Commission of Texas. |

| |

| PURA | | Public Utility Regulatory Act. |

| |

| RCT | | Railroad Commission of Texas, which has oversight of lignite mining activity in Texas, among other things. |

| |

| REP | | retail electric provider. |

| |

| RSU | | restricted stock units. |

| |

| RTO | | Regional Transmission Organization. |

| |

| S&P | | Standard & Poor’s Ratings (a credit rating agency). |

| |

| SEC | | U.S. Securities and Exchange Commission. |

| |

| Securities Act | | Securities Act of 1933, as amended. |

4

| | |

| |

| SG&A | | selling, general and administrative. |

| |

| Settlement Agreement | | Amended and Restated Settlement Agreement among the Debtors, the Sponsor Group, settling TCEH first lien creditors, settling TCEH second lien creditors, settling TCEH unsecured creditors and the official committee of unsecured creditors of TCEH (collectively, the Settling Parties), approved by the Bankruptcy Court in December 2015. |

| |

| SO2 | | sulfur dioxide. |

| |

| Spin-Off | | the tax-free spin-off from EFH Corp. executed pursuant to the Plan of Reorganization on the Plan Effective Date by the TCEH Debtors and the Contributed EFH Debtors. |

| |

| Sponsor Group | | collectively, certain investment funds affiliated with Kohlberg Kravis Roberts & Co. L.P., TPG Global, LLC (together with its affiliates, TPG) and GS Capital Partners, an affiliate of Goldman, Sachs & Co., that have an ownership interest in Texas Energy Future Holdings Limited Partnership, a limited partnership controlled by the Sponsor Group, that owns substantially all of the common stock of EFH Corp. |

| |

| Stock Issuance | | the issuance of Vistra Energy Common Stock to holders of Dynegy Common Stock, in connection with the Merger, as contemplated by the Merger Agreement. |

| |

| Stock Issuance Proposal | | the proposal by Vistra Energy to approve the Stock Issuance. |

| |

| Tax Matters Agreement | | Tax Matters Agreement, dated as of the Plan Effective Date, by and among EFH Corp., EFIH, EFIH Finance Inc. and EFH Merger Co. LLC. |

| |

| Tax Receivable Agreement | | Tax Receivable Agreement, containing certain rights (TRA Rights) to receive payments from Vistra Energy related to certain tax benefits, including those it realized as a result of certain transactions entered into at Emergence. |

| |

| TCEH or Predecessor | | Texas Competitive Electric Holdings Company LLC, a direct, wholly owned subsidiary of EFCH, and, prior to the Plan Effective Date, the parent company of the TCEH Debtors, depending on context, that were engaged in electricity generation and wholesale and retail energy market activities, and whose major subsidiaries included Luminant and TXU Energy. |

| |

| TCEH Debtors | | the subsidiaries of TCEH that were Debtors in the Chapter 11 Cases. |

| |

| TCEH Senior Secured Facilities | | collectively, the TCEH First Lien Term Loan Facilities, TCEH First Lien Revolving Credit Facility and TCEH First Lien Letter of Credit Facility with a total principal amount of $22.616 billion. The claims arising under these facilities were discharged in the Chapter 11 Cases on the Plan Effective Date pursuant to the Plan of Reorganization. |

| |

| TCEQ | | Texas Commission on Environmental Quality. |

| |

| Terawatt | | Terawatt Holdings, LP, a Delaware limited partnership affiliated with Energy Capital Partners III, LLC. |

| |

| TRA Payment | | an amount payable in accordance with the Tax Receivable Agreement. |

| |

| TWh | | terawatt-hours. |

| |

| TXU Energy | | TXU Energy Retail Company LLC, a direct, wholly owned subsidiary of Vistra Energy that is a REP in competitive areas of ERCOT and is engaged in the retail sale of electricity to residential and business customers. |

5

| | |

| U.S. or United States | | United States of America. |

| |

| Vistra Energy or Successor | | Vistra Energy Corp., formerly known as TCEH Corp., and/or its subsidiaries, depending on context. On the Plan Effective Date, the TCEH Debtors and the Contributed EFH Debtors emerged from Chapter 11 and became subsidiaries of Vistra Energy Corp. |

| |

| Vistra Energy Adjournment Proposal | | the proposal to approve the adjournment of the Vistra Energy special meeting, if necessary or appropriate, for the purpose of soliciting additional votes for the approval of the Merger Proposal and the Stock Issuance Proposal. |

| |

| Vistra Energy Board | | the board of directors of Vistra Energy. |

| |

| Vistra Energy Common Stock | | the common stock, par value $0.01 per share, of Vistra Energy. |

| |

| Vistra Energy Stockholder Support Agreement | | the Merger Support Agreement, dated as of October 29, 2017, by and between Dynegy, the Apollo Entities, the Brookfield Entities and the Oaktree Entities, as it may be amended or modified from time to time. |

| |

| Vistra Operations Credit Facilities | | Vistra Operations Company LLC’s $5.360 billion senior secured financing facilities. |

| |

| VOLL | | value of lost load. |

6

QUESTIONS AND ANSWERS

The following questions and answers are intended to address briefly some commonly asked questions regarding the Merger Agreement, the Merger, the Stock Issuance and the other transactions contemplated by the Merger Agreement. Vistra Energy and Dynegy urge you to read carefully this entire joint proxy statement and prospectus, including the annexes and the other documents referred to or incorporated by reference into this joint proxy statement and prospectus, because the information in this section does not provide all of the information that might be important to you.

About the Merger

| Q: | What are the proposed transactions for which the holders of Vistra Energy Common Stock are being asked to vote? |

| A: | The holders of Vistra Energy Common Stock are being asked to consider and vote on the Merger Proposal and the Stock Issuance Proposal. The approval of the Merger Proposal and the Stock Issuance Proposal by the holders of Vistra Energy Common Stock is a condition to the effectiveness of the Merger. |

| Q: | What is the proposed transaction for which the holders of Dynegy Common Stock are being asked to vote? |

| A: | The holders of Dynegy Common Stock are being asked to consider and vote on the Merger Proposal and the Dynegy Compensation Proposal. The approval of the Merger Proposal by the holders of Dynegy Common Stock is a condition to the effectiveness of the Merger. |

| Q: | Why are Vistra Energy and Dynegy proposing the Merger? |

| A: | The Vistra Energy Board and the Dynegy Board believe that the Merger will provide a number of significant potential strategic benefits and opportunities that will be in the best interests of their respective stockholders. To review the reasons for the Merger in greater detail, see “The Merger—Recommendation of the Vistra Energy Board and Its Reasons for the Merger” beginning on page 78 and “The Merger—Dynegy’s Reasons for the Merger; Recommendation of the Dynegy Board” beginning on page 82. |

| Q: | What happens if the market price of Vistra Energy Common Stock or Dynegy Common Stock changes before the closing of the Merger? |

| A: | Changes in the market price of Vistra Energy Common Stock or the market price of Dynegy Common Stock at or prior to the effective time of the Merger will not change the number of shares of Vistra Energy Common Stock that holders of Dynegy Common Stock will receive because the Exchange Ratio is fixed at 0.652 shares of Vistra Energy Common Stock per share of Dynegy Common Stock. |

| Q: | Are there any conditions to completion of the Merger? |

| A: | Yes. In addition to the approval of the Merger Proposal and the Stock Issuance Proposal, as described herein, there are a number of conditions that must be satisfied or waived for the Merger to be consummated. For a description of all of the conditions to the Merger, see “The Merger Agreement—Conditions to Completion of the Merger” beginning on page 139. |

For Vistra Energy Stockholders

| Q: | When and where is the Vistra Energy special meeting? |

| A: | The special meeting of Vistra Energy stockholders will be held at 1601 Bryan Street, 11th Floor, Dallas, Texas 75201 on March 2, 2018, starting at 9:00 a.m., Central Time. |

7

| Q: | What matters will be voted on at the Vistra Energy special meeting? |

| A: | You will be asked to consider and vote on the following proposals: |

| | • | | the Stock Issuance Proposal; and |

| | • | | the Vistra Energy Adjournment Proposal. |

Vistra Energy will transact no other business at the Vistra Energy special meeting or any adjournment or postponement thereof.

| Q: | How does the Vistra Energy Board recommend that I vote on the proposals? |

| A: | After careful consideration, the Vistra Energy Board (i) determined that it is in the best interest of Vistra Energy and the holders of Vistra Energy Common Stock to enter into the Merger Agreement, (ii) declared entry into the Merger Agreement to be advisable, (iii) authorized and approved Vistra Energy’s execution, delivery and performance of the Merger Agreement in accordance with its terms and Vistra Energy’s consummation of the transactions contemplated thereby, including the Merger and the Stock Issuance, (iv) directed that the adoption of the Merger Agreement and the approval of the Stock Issuance be submitted to a vote at a meeting of the holders of Vistra Energy Common Stock and (v) recommended that the holders of Vistra Energy Common Stock adopt the Merger Agreement and approve the Stock Issuance. The Vistra Energy Board recommends that holders of Vistra Energy Common Stock vote “FOR” the Merger Proposal, “FOR” the Stock Issuance Proposal and “FOR” the Vistra Energy Adjournment Proposal. For a more complete description of the recommendation of the Vistra Energy Board, see “The Merger—Recommendation of the Vistra Energy Board and Its Reasons for the Merger” beginning on page 78. |

| Q: | What will happen to my shares of Vistra Energy Common Stock? |

| A: | Nothing. You will continue to own the same shares of Vistra Energy Common Stock that you own prior to the effective time of the Merger. As a result of the Stock Issuance, however, the overall ownership percentage of the Vistra Energy stockholders in the combined company will be diluted. |

| Q: | Do the Vistra Energy directors and executive officers have any interests in the Merger? |

| A: | Yes. In connection with the consummation of the Merger, Vistra Energy’s directors and executive officers have interests in the Merger that may be different from, or in addition to, those of the stockholders of Vistra Energy generally. The Vistra Energy Board was aware of these interests and considered them, among other things, in reaching its decision to approve the Merger Agreement, the Merger and the other transactions contemplated by the Merger Agreement, including the Stock Issuance. These interests are described in more detail in “The Merger—Interests of Vistra Energy’s Directors and Executive Officers in the Merger” beginning on page 125. |

| Q: | What constitutes a quorum? |

| A: | Vistra Energy’s bylaws provide that a majority of the voting power of the stock outstanding and entitled to vote at the Vistra Energy special meeting, present in person or represented by proxy, shall constitute a quorum at each meeting of Vistra Energy stockholders. |

| Q: | What vote is required for holders of Vistra Energy Common Stock to approve the Merger Proposal? |

| A: | Approval of the Merger Proposal will require the affirmative vote of the holders of a majority of the outstanding Vistra Energy Common Stock entitled to vote at the Vistra Energy special meeting, which is the only vote of holders of securities of Vistra Energy required for such approval. Only holders of Vistra Energy Common Stock at the close of business on the record date will be entitled to vote on the Merger Proposal. |

8

| Q: | What vote is required for Vistra Energy stockholders to approve the Stock Issuance Proposal? |

| A: | Approval of the Stock Issuance Proposal by a majority of the votes cast on such proposal at the Vistra Energy special meeting, as required by Sections 312.03(b), 312.03(c) and 312.07 of the NYSE Listed Company Manual, is the only vote of holders of securities of Vistra Energy required for such approval. Only holders of Vistra Energy Common Stock at the close of business on the record date will be entitled to vote on the Stock Issuance Proposal. |

| Q: | What vote is required for Vistra Energy stockholders to approve the Vistra Energy Adjournment Proposal? |

| A: | Approval of the Vistra Energy Adjournment Proposal will require the affirmative vote of the holders of a majority of the Vistra Energy Common Stock present in person or represented by proxy and entitled to vote at the Vistra Energy special meeting, which is the only vote of holders of securities of Vistra Energy required for such approval. Only holders of Vistra Energy Common Stock at the close of business on the record date will be entitled to vote on the Vistra Energy Adjournment Proposal. |

| A: | For the Merger Proposal, you may vote “FOR,” “AGAINST” or “ABSTAIN.” If you abstain or fail to return your proxy card, or fail to instruct your broker, bank, trust or other nominee to vote, it will have the same effect as a vote “AGAINST” the Merger Proposal. |

For the Stock Issuance Proposal, you may vote “FOR,” “AGAINST” or “ABSTAIN.” For purposes of the Stock Issuance Proposal, provided a quorum is present, a failure to vote, or a failure to instruct your bank, broker, trust or other nominee to vote, will have no effect on the outcome of a vote on the Stock Issuance Proposal. Under the NYSE rules, an abstention from voting will be considered as a vote cast and, accordingly, will have the same effect as a vote “AGAINST” the Stock Issuance Proposal.

For the Vistra Energy Adjournment Proposal, you may vote “FOR,” “AGAINST” or “ABSTAIN.” For purposes of the Vistra Energy Adjournment Proposal, provided a quorum is present, a failure to vote, or a failure to instruct your bank, broker, trust or other nominee to vote, will have no effect on the outcome of a vote on the Vistra Energy Adjournment Proposal. An abstention from voting will have the same effect as a vote “AGAINST” the Vistra Energy Adjournment Proposal.

Properly executed proxy cards with no instructions indicated on the proxy card will be voted “FOR” the Merger Proposal, “FOR” the Stock Issuance Proposal and “FOR” the Vistra Energy Adjournment Proposal.

| Q: | Who is entitled to vote at the Vistra Energy special meeting? |

| A: | All holders of Vistra Energy Common Stock as of the close of business on January 19, 2018, the record date for the Vistra Energy special meeting, are entitled to vote at the Vistra Energy special meeting, unless a new record date is fixed for any adjournment or postponement of the Vistra Energy special meeting. As of the record date, there were 428,425,233 issued and outstanding shares of Vistra Energy Common Stock. Each holder of record of Vistra Energy Common Stock on the record date is entitled to one vote per share. |

| Q: | What happens if I sell my Vistra Energy Common Stock before the Vistra Energy special meeting? |

| A: | The record date for the Vistra Energy special meeting is earlier than the date of the Vistra Energy special meeting. If you sell your shares of Vistra Energy Common Stock after Vistra Energy’s record date but before the date of the Vistra Energy special meeting, you will retain any right to vote at the Vistra Energy special meeting. |

| Q: | How do I submit a proxy or vote my shares? |

| A: | You may submit your proxy either by telephone, through the Internet or by mailing the enclosed proxy card, or you may vote in person at the Vistra Energy special meeting. If you hold your shares in more than one account, please be sure to submit a proxy with respect to each proxy card you receive. |

9

To submit your proxy by telephone, dial the toll-free telephone number set forth on the enclosed proxy card using a touch tone phone and follow the recorded instructions. You will be asked to provide the control number from the enclosed proxy card.

To submit your proxy through the Internet, visit the website set forth on the enclosed proxy card. You will be asked to provide the control number from the enclosed proxy card.

Your proxy card will indicate the deadline for submitting proxies by telephone or through the Internet.

To submit your proxy by mail, complete, date and sign the enclosed proxy card and return it as promptly as practicable in the enclosed prepaid envelope. If you sign and return your proxy card, but do not mark the boxes showing how you wish to vote, your shares will be voted “FOR” the Merger Proposal, “FOR” the Stock Issuance Proposal and “FOR” the Vistra Energy Adjournment Proposal.

Stockholders of record will be able to vote in person at the Vistra Energy special meeting. If you intend to vote in person, please bring proper identification, together with proof that you are a record owner of shares. If you are not a stockholder of record, but instead hold your shares in “street name” through a broker, bank, trust or other nominee, you must provide a proxy executed in your favor from your broker, bank, trust or other nominee in order to be able to vote in person at the Vistra Energy special meeting. For more information, please read the question and answer referencing “street name” shares below.

| Q: | If my shares are held in “street name” by my broker, bank, trust or other nominee, will my broker, bank, trust or other nominee vote my shares for me? |

| A: | No. Unless you instruct your broker, bank, trust or other nominee to vote your shares held in street name, your shares will NOT be voted. If you hold your shares in a stock brokerage account or if your shares are held by a broker, bank, trust or other nominee (that is, in “street name”), you must provide your broker, bank, trust or other nominee with instructions on how to vote your shares. You should follow the procedures provided by your broker, bank, trust or other nominee regarding the voting of your shares. |

| Q: | How can I revoke or change my vote? |

| A: | You may revoke your proxy at any time before the vote is taken at the Vistra Energy special meeting in any of the following ways: |

| | • | | submitting a later proxy by telephone or through the Internet prior to the telephone or Internet voting deadline indicated on your proxy card; |

| | • | | filing with the Corporate Secretary of Vistra Energy, before the taking of the vote at the Vistra Energy special meeting, a written notice of revocation bearing a later date than the proxy card you wish to revoke; |

| | • | | duly executing a later dated proxy card relating to the same shares and delivering it to the Corporate Secretary of Vistra Energy before the taking of the vote at the Vistra Energy special meeting; or |

| | • | | voting in person at the Vistra Energy special meeting. |

Your attendance at the Vistra Energy special meeting does not automatically revoke your previously submitted proxy. If you have instructed your broker, bank, trust or other nominee to vote your shares, the options described above for revoking your proxy do not apply. Instead, you must follow the directions provided by your broker, bank, trust or other nominee to change your vote.

| Q: | Will a proxy solicitor be used? |

| A: | Yes. Vistra Energy has engaged D.F. King & Co., Inc. to assist in the solicitation of proxies for the Vistra Energy special meeting, and Vistra Energy estimates it will pay D.F. King & Co., Inc. a fee of approximately $12,500, plus telecom charges and reimbursement for reasonable out-of-pocket expenses and disbursements incurred in connection with the proxy solicitation. Vistra Energy has also agreed to |

10

| | indemnify D.F. King & Co., Inc. against certain losses, costs and expenses. In addition to mailing proxy solicitation material, Vistra Energy’s directors, officers and employees may also solicit proxies in person, by telephone or by any other electronic means of communication deemed appropriate. No additional compensation will be paid to Vistra Energy’s directors, officers or employees for such services. |

| Q: | What else do I need to do now? |

| A: | You are urged to read this joint proxy statement and prospectus carefully and in its entirety, including its annexes and the information incorporated by reference herein, and to consider how the Merger may affect you. Even if you plan to attend the Vistra Energy special meeting, please vote promptly. |

For Dynegy Stockholders

| Q: | What will I receive for my Dynegy Common Stock in the Merger? |

| A: | Under the terms of the Merger Agreement, you will receive 0.652 shares of Vistra Energy Common Stock for each share of Dynegy Common Stock owned by you immediately prior to the completion of the Merger. |

| Q: | How will I receive the merger consideration if the Merger is completed? |

| A: | For the Dynegy stockholders, you will receive a letter of transmittal with detailed written instructions for exchanging shares for the merger consideration. If you are not a stockholder of record, but instead hold your shares in “street name” through a broker, bank, trust or other nominee, you will receive instructions from your broker, bank, trust or other nominee as to how to effect the surrender of your “street name” shares in exchange for the merger consideration. |

| Q: | When and where is the Dynegy special meeting? |

| A: | The special meeting of Dynegy stockholders will be held at the Chase Center, 601 Travis Street, Houston, Texas 77002 on March 2, 2018, starting at 10:00 a.m., Central Time. |

| Q: | What matters will be voted on at the Dynegy special meeting? |

| A: | You will be asked to consider and vote on the following proposals: |

| | • | | the Dynegy Compensation Proposal; and |

| | • | | the Dynegy Adjournment Proposal. |

Dynegy will transact no other business at the Dynegy special meeting or any adjournment or postponement thereof.

| Q: | How does the Dynegy Board recommend that I vote on the proposals? |

| A: | The Dynegy Board has unanimously (i) determined that it is in the best interest of Dynegy and holders of Dynegy Common Stock to enter into the Merger Agreement, (ii) declared entry into the Merger Agreement to be advisable, (iii) authorized and approved Dynegy’s execution, delivery and performance of the Merger Agreement in accordance with its terms and Dynegy’s consummation of the transactions contemplated thereby, including the Merger, (iv) directed that the adoption of the Merger Agreement be submitted to a vote at a meeting of the holders of Dynegy Common Stock and (v) recommended that the holders of Dynegy Common Stock adopt the Merger Agreement. The Dynegy Board unanimously recommends that |

11

| | holders of Dynegy Common Stock vote “FOR” the Merger Proposal, “FOR” the Dynegy Compensation Proposal and “FOR” the Dynegy Adjournment Proposal. For a more complete description of the recommendation of the Dynegy Board, see “The Merger—Dynegy’s Reasons for the Merger; Recommendation of the Dynegy Board” beginning on page 82. |

| Q: | Do the Dynegy directors and executive officers have any interests in the Merger? |

| A: | Yes. In connection with the consummation of the Merger, Dynegy’s directors and executive officers have interests in the Merger that may be different from, or in addition to, those of the stockholders of Dynegy generally. The Dynegy Board was aware of these interests and considered them, among other things, in reaching its decision to approve the Merger Agreement, the Merger and the other transactions contemplated by the Merger Agreement. These interests are described in more detail in “The Merger—Interests of Dynegy’s Directors and Executive Officers in the Merger” beginning on page 126. |

| Q: | What constitutes a quorum? |

| A: | Dynegy’s bylaws provide that a majority of the outstanding shares entitled to vote at a meeting, represented in person or by proxy, shall constitute a quorum. |

| Q: | What vote is required for Dynegy stockholders to approve the Merger Proposal? |

| A: | Approval of the Merger Proposal will require the affirmative vote of the holders of a majority of the outstanding Dynegy Common Stock entitled to vote at the Dynegy special meeting, which is the only vote of holders of securities of Dynegy that is required to approve the Merger Proposal. Only holders of Dynegy Common Stock at the close of business on the record date will be entitled to vote on the Merger Proposal. |

| Q: | What vote is required for Dynegy stockholders to approve the Dynegy Compensation Proposal? |

| A: | Approval of the Dynegy Compensation Proposal, which is a non-binding, advisory vote, will require the affirmative vote of the holders of a majority of the Dynegy Common Stock present in person or represented by proxy and entitled to vote at the Dynegy special meeting, which is the only vote of holders of securities of Dynegy required for such approval. Only holders of Dynegy Common Stock at the close of business on the record date will be entitled to vote on the Dynegy Compensation Proposal. |

| Q: | What vote is required for Dynegy stockholders to approve the Dynegy Adjournment Proposal? |

| A: | Approval of the Dynegy Adjournment Proposal will require the affirmative vote of the holders of a majority of the Dynegy Common Stock present in person or represented by proxy and entitled to vote at the Dynegy special meeting, which is the only vote of holders of securities of Dynegy required for such approval. Only holders of Dynegy Common Stock at the close of business on the record date will be entitled to vote on the Dynegy Adjournment Proposal. |

| A: | For the Merger Proposal, you may vote “FOR,” “AGAINST” or “ABSTAIN.” If you abstain or fail to return your proxy card, or fail to instruct your broker, bank, trust or other nominee to vote, it will have the same effect as a vote “AGAINST” the Merger Proposal. |

For the Dynegy Compensation Proposal, you may vote “FOR,” “AGAINST” or “ABSTAIN.” For purposes of the Dynegy Compensation Proposal, provided a quorum is present, a failure to vote, or a failure to instruct your bank, broker, trust or other nominee to vote, will have no effect on the outcome of a vote on the Dynegy Compensation Proposal. An abstention from voting will have the same effect as a vote “AGAINST” the Dynegy Compensation Proposal.

12

For the Dynegy Adjournment Proposal, you may vote “FOR,” “AGAINST” or “ABSTAIN.” For purposes of the Dynegy Adjournment Proposal, provided a quorum is present, a failure to vote, or a failure to instruct your bank, broker, trust or other nominee to vote, will have no effect on the outcome of a vote on the Dynegy Adjournment Proposal. An abstention from voting will have the same effect as a vote “AGAINST” the Dynegy Adjournment Proposal.

Properly executed proxy cards with no instructions indicated on the proxy card will be voted “FOR” the Merger Proposal, “FOR” the Dynegy Compensation Proposal and “FOR” the Dynegy Adjournment Proposal.

| Q: | Who is entitled to vote at the Dynegy special meeting? |

| A: | All holders of Dynegy Common Stock as of the close of business on January 19, 2018, the record date for the Dynegy special meeting, are entitled to vote at the Dynegy special meeting, unless a new record date is fixed for any adjournment or postponement of the Dynegy special meeting. As of the record date, there were 144,384,491 issued and outstanding shares of Dynegy Common Stock. Each holder of record of Dynegy Common Stock on the record date is entitled to one vote per share. |

| Q: | What happens if I sell my Dynegy Common Stock before the Dynegy special meeting? |

| A: | The record date for the Dynegy special meeting is earlier than the date of the Dynegy special meeting and the date that the Merger is expected to be completed. If you sell your Dynegy Common Stock after Dynegy’s record date but before the date of the Dynegy special meeting, you will retain any right to vote at the Dynegy special meeting, but you will have transferred your right to receive the merger consideration. For Dynegy stockholders, in order to receive the merger consideration, you must hold your Dynegy Common Stock through completion of the Merger. |

| Q: | How do I submit a proxy or vote my shares? |

| A: | You may submit your proxy either by telephone, through the Internet or by mailing the enclosed proxy card, or you may vote in person at the Dynegy special meeting. If you hold your shares in more than one account, please be sure to submit a proxy with respect to each proxy card you receive. |

To submit your proxy by telephone, dial the toll-free telephone number set forth on the enclosed proxy card using a touch tone phone and follow the recorded instructions. You will be asked to provide the control number from the enclosed proxy card.

To submit your proxy through the Internet, visit the website set forth on the enclosed proxy card. You will be asked to provide the control number from the enclosed proxy card.

Your proxy card will indicate the deadline for submitting proxies by telephone or through the Internet.

To submit your proxy by mail, complete, date and sign the enclosed proxy card and return it as promptly as practicable in the enclosed prepaid envelope. If you sign and return your proxy card, but do not mark the boxes showing how you wish to vote, your shares will be voted “FOR” the Merger Proposal, “FOR” the Dynegy Compensation Proposal and “FOR” the Dynegy Adjournment Proposal.

Stockholders of record will be able to vote in person at the Dynegy special meeting. If you intend to vote in person, please bring proper identification, together with proof that you are a record owner of shares. If you are not a stockholder of record, but instead hold your shares in “street name” through a broker, bank, trust or other nominee, you must provide a proxy executed in your favor from your broker, bank, trust or other nominee in order to be able to vote in person at the Dynegy special meeting. For more information, please read the question and answer referencing “street name” shares below.

13

| Q: | If my shares are held in “street name” by my broker, bank, trust or other nominee, will my broker, bank, trust or other nominee vote my shares for me? |

| A: | No. Unless you instruct your broker, bank, trust or other nominee to vote your shares held in street name, your shares will NOT be voted. If you hold your shares in a stock brokerage account or if your shares are held by a broker, bank, trust or other nominee (that is, in “street name”), you must provide your broker, bank, trust or other nominee with instructions on how to vote your shares. You should follow the procedures provided by your broker, bank, trust or other nominee regarding the voting of your shares. |

| Q: | How can I revoke or change my vote? |

| A: | You may revoke your proxy at any time before the vote is taken at the Dynegy special meeting in any of the following ways: |

| | • | | submitting a later proxy by telephone or through the Internet prior to the telephone or Internet voting deadline indicated on your proxy card; |

| | • | | filing with the Corporate Secretary of Dynegy, before the taking of the vote at the Dynegy special meeting, a written notice of revocation bearing a later date than the proxy card you wish to revoke; |

| | • | | duly executing a later dated proxy card relating to the same shares and delivering it to the Corporate Secretary of Dynegy before the taking of the vote at the Dynegy special meeting; or |

| | • | | voting in person at the Dynegy special meeting. |

Your attendance at the Dynegy special meeting does not automatically revoke your previously submitted proxy. If you have instructed your broker, bank, trust or other nominee to vote your shares, the options described above for revoking your proxy do not apply. Instead, you must follow the directions provided by your broker, bank, trust or other nominee to change your vote.

| Q: | Will a proxy solicitor be used? |

| A: | Yes. Dynegy has engaged MacKenzie Partners, Inc. to assist in the solicitation of proxies for the Dynegy special meeting, and Dynegy estimates it will pay MacKenzie Partners, Inc. a fee of approximately $35,000 plus reimbursement for reasonable out-of-pocket expenses and disbursements incurred in connection with the proxy solicitation. Dynegy has also agreed to indemnify MacKenzie Partners, Inc. against certain losses, costs and expenses. In addition to mailing proxy solicitation material, Dynegy’s directors, officers and employees may also solicit proxies in person, by telephone or by any other electronic means of communication deemed appropriate. No additional compensation will be paid to Dynegy’s directors, officers or employees for such services. |

| Q: | What else do I need to do now? |

| A: | You are urged to read this joint proxy statement and prospectus carefully and in its entirety, including its annexes and the information incorporated by reference herein, and to consider how the Merger affects you. Even if you plan to attend the Dynegy special meeting, please vote promptly. |

For Both Vistra Energy Stockholders and Dynegy Stockholders

| Q: | When is the Merger expected to be completed? |

| A: | Vistra Energy and Dynegy expect to complete the Merger by the end of the second quarter of 2018, although Vistra Energy and Dynegy cannot assure completion by any particular date, if at all. Because the Merger is subject to a number of conditions, including regulatory approvals and the approval of the Merger Proposal and the Stock Issuance Proposal by the requisite vote of the holders of Vistra Energy Common |

14

| | Stock and the approval of the Merger Proposal by the holders of Dynegy Common Stock, the exact timing of the Merger cannot be determined at this time and Vistra Energy and Dynegy cannot guarantee that the Merger will be completed at all. |

| Q: | Following the Merger, what percentage of Vistra Energy Common Stock will the continuing Vistra Energy stockholders and former Dynegy stockholders own? |

| A: | Following the completion of the Merger: |

| | • | | continuing holders of Vistra Energy Common Stock are expected to own 79% of the combined company’s fully diluted equity; and |

| | • | | former holders of Dynegy Common Stock are expected to own the remaining 21% of the combined company’s fully diluted equity. |

| Q: | What happens if the Merger is not completed? |

| A: | If the Merger Proposal and the Stock Issuance Proposal are not approved by holders of Vistra Energy Common Stock, if the Merger Proposal is not approved by holders of Dynegy Common Stock or if the Merger is not completed for any other reason, holders of Dynegy Common Stock will not have their Dynegy Common Stock exchanged for Vistra Energy Common Stock in connection with the Merger. Instead, each of Dynegy and Vistra Energy would remain a separate company. Under certain circumstances, Vistra Energy may be required to pay Dynegy a termination fee and/or an expense amount or Dynegy may be required to pay Vistra Energy a termination fee and/or expense amount, as described under “The Merger Agreement—Effect of Termination; Termination Fees and Expense Reimbursement” beginning on page 155. |

| Q: | Am I entitled to exercise dissenters’ or appraisal rights? |

| A: | No. No dissenters’ or appraisal rights will be available with respect to the Merger, the Stock Issuance or any of the other transactions contemplated by the Merger Agreement. |

| Q: | Are there any risks associated with the Merger that I should consider in deciding how to vote? |

| A: | Yes. A number of risks related to the Merger are discussed in this joint proxy statement and prospectus and described in the section entitled “Risk Factors” beginning on page 35. |

| Q: | What are the material U.S. federal income tax consequences of the Merger to holders of Dynegy Common Stock? |

| A: | Assuming that the Merger is completed as currently contemplated, Vistra Energy and Dynegy intend for the Merger to qualify as a “reorganization” within the meaning of Section 368(a) of the Code. It is a condition to the obligation of Vistra Energy to complete the Merger that Vistra Energy receive the written opinion of Simpson Thacher & Bartlett LLP (or other Vistra Energy tax advisor reasonably satisfactory to Vistra Energy), dated as of the closing date, to the effect that the Merger will qualify as a “reorganization” within the meaning of Section 368(a) of the Code, and it is a condition to the obligation of Dynegy to complete the Merger that Dynegy receive the written opinion of Skadden, Arps, Slate, Meagher & Flom LLP (or other Dynegy tax advisor reasonably satisfactory to Dynegy), dated as of the closing date, to the effect that the Merger will qualify as a “reorganization” within the meaning of Section 368(a) of the Code. Provided that the Merger qualifies as a reorganization within the meaning of Section 368(a) of the Code, a U.S. holder (as defined under “Material U.S. Federal Income Tax Consequences”) of Dynegy Common Stock will not recognize any gain or loss for U.S. federal income tax purposes upon the exchange of Dynegy Common Stock for shares of Vistra Energy Common Stock in the Merger (other than gain or loss with respect to any cash received in lieu of a fractional share of Vistra Energy Common Stock). |

15

The particular consequences of the Merger to each Dynegy stockholder depend on such stockholder’s particular facts and circumstances. Dynegy stockholders should consult their tax advisors to understand fully the consequences to them of the Merger given their specific circumstances. For more information, see “Material U.S. Federal Income Tax Consequences” beginning on page 161.

| Q: | How can I obtain additional information about Vistra Energy and Dynegy? |

| A: | Vistra Energy and Dynegy each files annual, quarterly and current reports, proxy statements and other information with the SEC. Each company’s filings with the SEC may be accessed on the Internet at http://www.sec.gov. Copies of the documents filed by Vistra Energy with the SEC will be available free of charge on Vistra Energy’s website at www.vistraenergy.com or by contacting Vistra Energy Investor Relations at investor@vistraenergy.com or at (214) 812-0046. Copies of the documents filed by Dynegy with the SEC will be available free of charge on Dynegy’s website at www.dynegy.com or by contacting Dynegy Investor Relations at ir@dynegy.com or at (713) 507-6466. The information provided on each company’s website is not part of this joint proxy statement and prospectus and is not incorporated by reference into this joint proxy statement and prospectus. For a more detailed description of the information available and information incorporated by reference, please see “Where You Can Find More Information and Incorporation by Reference” on page 309. |

| Q: | Who can answer my questions? |

| A: | If you have any questions about the Merger, the Stock Issuance or the other matters to be voted on at the Vistra Energy special meeting or the Dynegy special meeting, how to submit your proxy, or need additional copies of this joint proxy statement and prospectus, the enclosed proxy card or voting instructions, you should contact Vistra Energy’s and Dynegy’s respective proxy solicitors, as follows: |

| | |

If you are a Vistra Energy stockholder: D.F. King & Co., Inc. 48 Wall Street New York, NY 10005 Toll Free: (866) 406-2283 Email: vst@dfking.com | | If you are a Dynegy stockholder: MacKenzie Partners, Inc. 105 Madison Avenue New York, NY 10016 Toll Free: (800) 322-2885 Email: proxy@mackenziepartners.com |

16

SUMMARY

The following summary highlights selected information in this joint proxy statement and prospectus and may not contain all the information that may be important to you with respect to the Merger Agreement, the Merger, the Vistra Energy special meeting or the Dynegy special meeting. Accordingly, you are encouraged to read this joint proxy statement and prospectus, including its annexes and the information incorporated by reference herein, carefully and in its entirety. Each item in this summary includes a page reference directing you to a more complete description of that topic. See also “Where You Can Find More Information and Incorporation by Reference” on page 309 of this joint proxy statement and prospectus.

The Companies

Vistra Energy Corp.(Page 180)

Vistra Energy Corp.

6555 Sierra Drive

Irving, Texas 75039

Telephone: (214) 812-4600

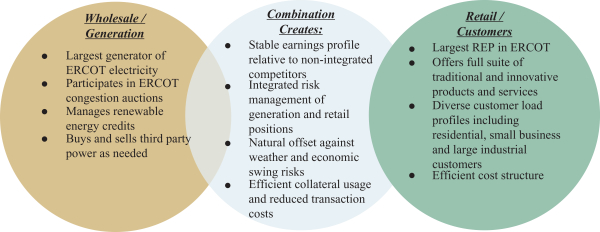

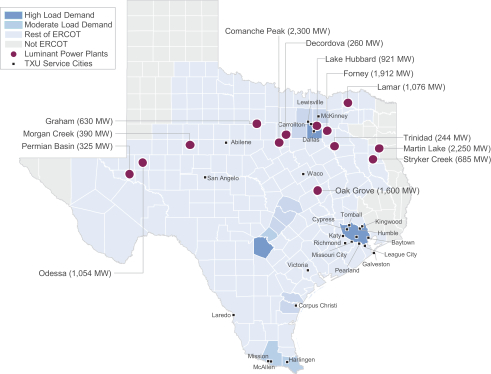

Vistra Energy is a premier Texas-based energy company focused on the competitive energy and power generation markets through operation as the largest retailer and generator of electricity in the growing Texas market. Its integrated portfolio of competitive businesses consists primarily of TXU Energy and Luminant. TXU Energy sells retail electricity and value-added services (primarily through its market-leading TXU Energy™ brand) to approximately 1.7 million residential and business customers in Texas. Luminant generates and sells electricity and related products from its diverse fleet of generation facilities totaling approximately 13,600 MW of generation in Texas, including 2,300 MW fueled by nuclear power, 3,800 MW fueled by coal, and 7,500 MW fueled by natural gas, and is a large purchaser of renewable power including wind and solar-generated electricity. Vistra Energy is currently developing one of the largest solar facilities in Texas by capacity.

The Vistra Energy Common Stock is listed on the NYSE, trading under the symbol “VST”.