March 7, 2008

Via EDGAR & Federal Express

Mr. H. Roger Schwall

Assistant Director

Division of Corporate Finance

United States Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549

Re: Vantage Energy Services, Inc.

Schedule 14A

Filed December 3, 2007

File No. 001-33496

Vantage Drilling Company

Registration Statement on Forms F-4 and F-l

Filed December 3, 2007

File No. 333-147797

Dear Mr. Schwall:

This letter is written pursuant to a conference call conducted Friday, February 22, 2008 among the Securities and Exchange Commission (the “Commission”) and representatives from the above referenced companies concerning certain comments to the letter received from the Commission on February 15, 2008 (the “Staff Letter”) with respect to the proxy statement on Schedule 14A (the “Proxy Statement”) filed by Vantage Energy Services, Inc. (“Vantage Energy”) and the Registration Statement on Forms F-4 and F-l (“Registration Statement”) filed by Vantage Drilling Company (“Vantage Drilling”). Shortly we will be filing electronically Amendment No. 2 to the Proxy Statement and Registration Statement, originally filed on December 3, 2007, and amended on January 23, 2008, which reflects responses to the Staff Letter.

Below is a discussion in response to comments 3 and 5 of the Staff Letter and is intended to support the position of Vantage Energy and Vantage Drilling as presented to the Commission on the conference call and as presented in Amendment No. 1 to the Proxy Statement and Registration Statement. For your convenience and to facilitate your review, we have set forth below comments 3 and 5 contained in the Staff Letter, followed by our discussion and analysis.

General

3. It is unclear to the staff how the transactions contemplated in the registration statement can be legally consummated in their currently proposed form. For example, it is unclear how Vantage Drilling will be able to use funds from the trust account of Vantage Energy to acquire OGIL unless Vantage Drilling first acquires through merger control over the assets of Vantage Energy; but at the same time Vantage Energy cannot meet the 80% requirement with respect to the transaction with Vantage Energy unless it first acquires its assets through the acquisition of OGIL. Please revise or advise.

In response to the Commission’s comment, please see the Discussion and Analysis below.

5. It appears that what is currently described as the “Acquisition Proposal” includes at least two separate and distinct steps and transactions (i.e. the Purchase Agreement and the Merger Agreement) which should be considered as separate proposals to the extent that they should be considered by the shareholders of Vantage Energy at all. In this respect, it currently appears as though the shareholders of Vantage Energy are being asked to approve the acquisition of OGIL by Vantage Drilling, which would not appear to be a transaction upon which such shareholder approval would be necessary. Please revise the proposals consistent with Rule 14a-4 and Rule 14a-5 promulgated under the Exchange Act of 1934, as amended.

In response to the Commission’s comment, please see the Discussion and Analysis below.

Discussion and Analysis

The question proposed by the Commission in item 3, noted above, concerns the ordering of the transactions and the resulting application of the terms pursuant to the stated terms and conditions as set forth in our initial public offering. The Commission notes that if the transactions are considered a step or series of transactions, then the initial acquisition of Vantage Energy by Vantage Drilling would not meet the 80% threshold as required by our initial public offering. However, the proposed structure represents a double dummy acquisition (see discussion below regarding the use and validity of the double dummy acquisition structure) which contemplates the simultaneous or near simultaneous closing of a series of transactions. Furthermore, our initial public offering document contemplated the use of a step or series of transactions for the purpose of satisfying the 80% threshold.

EXCERPT FROM 424B4 FINAL PROSPECTUS OF VANTAGE ENERGY FILED MAY 24, 2007

“In the event we ultimately determine to simultaneously acquire several assets or properties and such assets or properties are owned by different sellers, we may need for each of such sellers to agree that our purchase is contingent on the simultaneous closings of the other acquisitions, which may make it more difficult for us, and delay our ability, to complete the business combination. With multiple acquisitions, we could also face additional risks, including additional burdens and costs with respect to possible multiple negotiations and due diligence investigations (if there are multiple sellers) and the additional risks associated with the subsequent integration of the multiple assets or properties into a single operating entity.”

The question proposed by the Commission in item 5, noted above, concerns the structure of the proposal as presented in our preliminary proxy materials requesting the approval of our stockholders. The proposed structure of the merger represents a double dummy acquisition which contemplates the simultaneous or near simultaneous closing of a series of transactions. Accordingly the double dummy transaction is viewed as a single transaction which we concluded is appropriately presented as a single proposal to the stockholders consistent with Rule 14a-4 and Rule 14a-5 promulgated under the Exchange Act of 1934, as amended. In assessing this conclusion, please consider the discussion of double dummy transactions as summarized in “Background of Double Dummy Acquisitions” and the “Precedent Transactions” summarized below.

Please see Exhibit A, “Proposed Transaction Steps for Merger with OGIL,” attached hereto. Additionally, the double dummy structure was created to meet the requirements of achieving a tax free transfer pursuant to Section 351 of the United States Internal Revenue Code, a summary of which we have attached herewith as Exhibit B.

2

Background of Double Dummy Acquisitions

The double dummy structure was first created in the 1970s. One of the first large corporate deals to use the strategy was Unilever U.S. when it purchased National Starch and Chemical Corp. in 1978. The double dummy creates a permanent holding company at the top. There are numerous examples of proxy statements and joint proxy statements/registration statements that have been declared effective and that are pending whereby similar multi-step securities exchanges and mergers, or multiple mergers, are accomplished through the use of a new holding company which becomes the public vehicle. Since 1996, the number of mergers using the structure totals approximately 104. There have been some very high-profile double-dummy transactions, including Walt Disney's purchase of ABC/Capital Cities, Berkshire Hathaway's purchase of General Re, and Time Warner's purchase of Turner Broadcasting.

The documentation of the proposed business combination and the proposal of such business combination in a single proposal in the proxy statement are appropriate as the business combination is structured as a single integrated transaction, similar to precedent transactions discussed below

A list of the largest double-dummy transactions by deal value includes some of Wall Street's most memorable mergers. |

Year | | Merger Partners | | Deal Value* |

2000 | | AOL/Time Warner | | $164 |

2000 | | SmithKline Beecham/Glaxo Wellcome | | 80 |

1998 | | Daimler-Benz/Chrysler | | 61 |

2001 | | Conoco/Philips Petroleum | | 27 |

2004 | | Kmart/Sears, Roebuck | | 20 |

*In $ billions

Source: Capital IQ

Delaware recently made it easier for companies incorporated within the state to expedite a double dummy acquisition with changes in state law. Delaware no longer requires stockholder approval for the "sale, lease, or exchange" of corporate assets between a parent company and its subsidiaries.

3

PRECEDENT TRANSACTIONS.

A. Oracle/Siebel

The acquisition proposal that was submitted to stockholders at the special meeting of stockholders conducted on January 31, 2006 presented one integrated proposal for the transaction and reads as follows:

“To consider and vote upon the adoption of the Agreement and Plan of Merger, dated as of September 12, 2005, as amended, by and among Oracle Corporation, Siebel Systems, Ozark Holding Inc., Ozark Merger Sub Inc. and Sierra Merger Sub Inc., all Delaware corporations.”

The Proposed Transaction

To complete the acquisition, Oracle formed New Oracle and New Oracle formed Sierra Merger Sub Inc. and Ozark Merger Sub Inc. Upon satisfaction or waiver of the conditions to the transactions specified in the merger agreement, Sierra Merger Sub Inc. merged with and into Siebel Systems, which was referred to in the proxy statement/prospectus as the “Siebel Systems merger,” and Ozark Merger Sub Inc. merged with and into Oracle, which was referred to in the proxy statement/prospectus as the “Oracle merger.” Each of Siebel Systems and Oracle survived its respective merger and became a wholly owned subsidiary of New Oracle, the new public company resulting from the transaction. New Oracle was renamed “Oracle Corporation” upon completion of the transaction and traded under Oracle’s current ticker symbol, “ORCL.” Current Oracle stockholders received shares in New Oracle to replace their existing Oracle shares, and any shares issuable to Siebel Systems stockholders in the transaction were of New Oracle.

By was of illustration of the double dummy acquisition structure in the Oracle/Siebel deal, Oracle formed a new wholly owned subsidiary, Ozark Holding, Inc. Ozark Holding then formed two new wholly owned subsidiaries, Ozark Merger Sub Inc. and Sierra Merger Sub Inc. Upon the closing of the deal, Sierra Merger Sub merged into Siebel, and Ozark Merger Sub merged into Oracle. As part of these mergers, Oracle’s shares were converted into Ozark Holding shares on a one-for-one basis. Siebel shares were converted into cash or Ozark Holding stock at the election of the Siebel shareholders. When the dust settled, both Siebel and Oracle were wholly owned subsidiaries of Ozark Holding. Ozark Holding changed its name to Oracle Corporation, and its shares were listed on Nasdaq.

The conversion of both the Oracle and Siebel stock into Ozark Holding stock qualified for tax free treatment under Section 351. Hence, the deal did not trigger taxes for Oracle shareholders, and Siebel shareholders only paid taxes on the cash portion of the transaction. The deal required shareholder approval by Siebel but not by Oracle because it was effected through a holding company reorganization pursuant to Section 251(g) of the Delaware General Corporation Law, which provides for the merger of a holding company with and into a direct or indirect wholly-owned subsidiary without stockholder approval.

Ozark Holdings is a Delaware corporation.

4

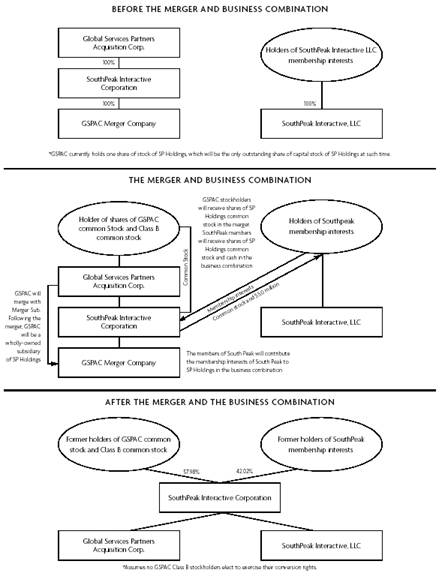

B Global Services Partners Acquisition Corp./SouthPeak Interactive Corporation

The joint proxy statement/prospectus for this transaction is currently pending with the Commission.

The acquisition proposal to be submitted to stockholders at the special meeting presents one integrated proposal for the transaction and reads as follows:

“To vote upon a proposal to adopt the Agreement and Plan of Reorganization, dated January 15, 2008, which is sometimes referred to as the reorganization agreement, by and among GSPAC, SouthPeak Interactive, LLC, or SouthPeak, GSPAC’s wholly-owned subsidiary SouthPeak Interactive Corporation, or SP Holdings, SP Holdings’ wholly-owned subsidiary GSPAC Merger Company, or Merger Sub, and the members of SouthPeak, and to approve the merger of Merger Sub with and into GSPAC, with GSPAC continuing as the surviving corporation, which is sometimes referred as to the merger, the acquisition of SouthPeak by SP Holdings, which is sometimes referred to as the business combination, and the other transactions provided for in the reorganization agreement.”

5

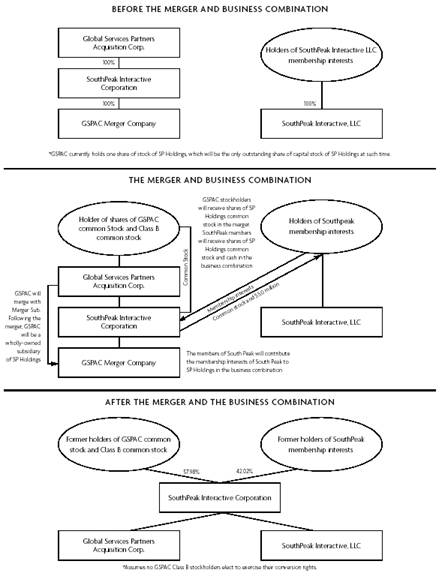

The Proposed Transaction

As contemplated by the reorganization agreement, GSPAC has organized SouthPeak Interactive Corporation, or SP Holdings, solely for the purpose of combining the businesses currently conducted by GSPAC and SouthPeak. To that end, GSPAC Merger Company, a wholly owned subsidiary of SP Holdings, which is sometimes refer to in the proxy statement/prospectus as Merger Sub, will merge with and into GSPAC with GSPAC as the surviving corporation and each share of outstanding GSPAC common stock and Class B common stock will be converted into one share of SP Holdings common stock. Concurrently with the merger of GSPAC and Merger Sub, the members of SouthPeak will contribute all of the outstanding membership interests of SouthPeak to SP Holdings in exchange for $5.0 million and 5,000,000 shares of SP Holdings common stock.

Structure of the Transactions

The Merger

At the effective time of the merger, Merger Sub will be merged with and into GSPAC. GSPAC will survive the merger as a wholly-owned subsidiary of SP Holdings. All of the properties, assets, rights, privileges, immunities, powers, purposes, liabilities and obligations of GSPAC and Merger Sub will become those of GSPAC.

The Business Combination

Simultaneously with the effective time of the merger, the members of SouthPeak will contribute all of the outstanding membership interests of SouthPeak to SP Holdings. Following the closing of the reorganization agreement, SouthPeak will be a wholly-owned subsidiary of SP Holdings. All of the properties, assets, rights, privileges, immunities, powers, purposes, liabilities and obligations of SouthPeak prior to the business combination will remain SouthPeak’s following the closing of the business combination.

The effect of the merger and the business combination is illustrated below:

6

C. Key Hospitality Acquisition Corporation

The proxy statement for this transaction is currently pending with the Commission.

The transaction proposal to be submitted to stockholders at the special meeting of stockholders presents one integrated proposal for the transaction and reads as follows:

“the merger proposal – to complete the merger, Key has formed Cay Clubs, Inc., or New Key, and New Key has formed New Key Merger Sub Inc., or New Key Merger Sub, and Key Merger Sub LLC, or Cay Merger Sub. Upon satisfaction or waiver of the conditions to the transactions specified in the merger agreement, Cay Merger Sub will merge with and into Cay Clubs, which we refer to in this proxy statement as the “Cay Merger,” and New Key Merger Sub will merge with and into Key, which we refer to in this proxy statement as the “Key Merger.” Each of Cay Clubs and Key will survive its respective merger and become a wholly-owned

7

subsidiary of New Key, the new public company resulting from the transaction. Current Key stockholders will receive shares in New Key to replace their current Key shares, and any shares issuable to Cay Clubs’ members in the transaction will be shares of New Key. As consideration for such merger, New Key will issue 26,666,667 shares of its common stock to Cay Clubs’ members (which, based on the closing price of the Key common stock on August 1, 2007 of $7.42 per share would have an aggregate value of $197,866,669), in exchange for all of the membership interests of Cay Clubs outstanding immediately prior to the merger. In addition, upon satisfaction of certain performance criteria, New Key may be required to issue an additional 32,000,000 shares of common stock, (which, based on the closing price of the Key common stock on August 1, 2007 of $7.42 per share would have an aggregate value of $237,440,000) which will be placed in escrow at closing, all as further described in Proposal 1 – The Merger Proposal (“Proposal 1”)”

The Proposed Transaction

Structure of the Merger

The merger agreement provides for the merger of New Key Merger Sub, a wholly-owned subsidiary of New Key, with and into Key, with Key surviving the merger as a wholly-owned subsidiary of New Key, and for the merger after the Key Merger of Cay Merger Sub, another wholly-owned subsidiary of New Key, with and into Cay Clubs, with Cay Clubs surviving the merger as a wholly-owned subsidiary of New Key.

Following the merger, (i) Cay Clubs will become a wholly-owned subsidiary of New Key and the sole operations of New Key, (ii) Key will become a wholly-owned subsidiary of New Key (with no operations), and (iii) each stockholder will become a stockholder of New Key.

Please note that for purposes of the discussion in the proxy statement the registrant often refers to certain actions of Key or New Key that will be undertaken at or after the closing of the merger. Notwithstanding the use of the term “Key” or “New Key” with respect to such actions, such actions will be undertaken by Key or New Key as appropriate to consummate the merger and the transactions described therein. In addition, the use of the word “merger” in certain circumstances in the proxy statement means the entire business combination between Cay Clubs and Key and/or New Key, as appropriate as described therein.

It is intended that, for United States federal income tax purposes, the series of mergers (as defined in the proxy statement) shall qualify as exchanges described in Section 351 of the Internal Revenue Code of 1986.

D. Niagara Mohawk Holdings, Inc.

The merger proposal that was submitted to stockholders at the special meeting of stockholders conducted on January 19, 2001 presented one integrated proposal for the transaction and reads as follows:

8

“You will be asked to consider and vote on a proposal to adopt the Agreement and Plan of Merger and Scheme of Arrangement, dated as of September 4, 2000, by and among National Grid Group plc, Niagara Mohawk Holdings, Inc., New National Grid plc and Grid Delaware, Inc., as amended by the First Amendment to the Agreement and Plan of Merger and Scheme of Arrangement, dated as of December 1, 2000 (the “Merger Agreement”), pursuant to which Niagara Mohawk would become a wholly owned subsidiary of New National Grid and a sister company of National Grid. The merger cannot occur until, among other things, the Merger Agreement is adopted by holders of a majority of shares of Niagara Mohawk’s common stock outstanding on the record date.”

The Proposed Transaction

The merger agreement contemplated a scheme of arrangement and a merger which, taken together, resulted in the creation of New National Grid, a new holding company for National Grid Group, and the acquisition by New National Grid of Niagara Mohawk. The scheme of arrangement involved cancelling and exchanging National Grid Group’s existing shares for shares of New National Grid, with National Grid Group becoming a wholly owned subsidiary of New National Grid. The merger contemplated that Grid Delaware, Inc., a wholly owned subsidiary of New National Grid, would merge into Niagara Mohawk with Niagara Mohawk surviving as a wholly owned subsidiary of New National Grid. It was intended that the scheme of arrangement and merger taken together would qualify as a tax free transaction within the meaning of Section 351 of the Internal Revenue Code of 1986, as amended. The scheme of arrangement was implement ed prior to the merger.

E. Enova Corporation

The business combination proposal that was submitted to stockholders at the special meeting of stockholders conducted on March 11, 1997 presented one integrated proposal for the transaction and reads as follows:

“to consider and vote upon a proposal to approve the principal terms of a business combination of Enova and Pacific Enterprises as set forth in the Agreement and Plan of Merger and Reorganization (the “Merger Agreement”) by and among Enova, Pacific Enterprises, Mineral Energy Company (“New Holding Company”), G Mineral Energy Sub (“Enova Sub”) and B Mineral Energy Sub (“Pacific Enterprises Sub”), providing for the merger of Enova Sub with and into Enova and the merger of Pacific Enterprises Sub with and into Pacific Enterprises, as a result of which each of Enova and Pacific Enterprises will become subsidiaries of New Holding Company. Enova and Pacific Enterprises will select a new name for the holding company prior to completing the business combination. Approval by the Enova shareholders of the principal terms of the business combination will be deemed to be approva l and ratification of all transactions contemplated by the Merger Agreement, a copy of which is attached as Annex A to the Joint Proxy Statement/Prospectus.”

9

The Proposed Transaction

The Business Combination

The Merger Agreement provided for the business combination of Pacific Enterprises and Enova to be effected by (a) a merger of a subsidiary of New Holding Company with and into Pacific Enterprises, with Pacific Enterprises remaining as the surviving corporation and becoming a subsidiary of New Holding Company, and (b) a merger of another subsidiary of New Holding Company with and into Enova, with Enova remaining as the surviving corporation and also becoming a subsidiary of New Holding Company. In the Pacific Enterprises merger, each share of Pacific Enterprises Common Stock (other than shares owned by Enova, Pacific Enterprises, New Holding Company or any of their wholly owned subsidiaries and shares as to which dissenters’ rights are perfected) were canceled and converted into the right to receive 1.5038 shares of New Holding Company Common Stock. In the Enova merger, each share of Enova Common Stock (other than shares owned by Enova, Pacific Enterprises, New Holding Company or any of their wholly owned subsidiaries and shares as to which dissenters’ rights are perfected) were canceled and converted into the right to receive one share of New Holding Company Common Stock. Shares of Pacific Enterprises and Southern California Gas Preferred Stock and SDG&E Preference Stock were not converted in the business combination and remained outstanding without any change in their respective rights, preferences and privileges. These shares continued to be administered by their respective issuers following the completion of the business combination in a manner consistent with past practice.

Exchange of Stock Certificates

As soon as practicable after the completion of the business combination, there were mailed to holders of Pacific Enterprises and Enova Common Stock a letter of transmittal and instructions for surrendering their stock certificates in exchange for certificates representing New Holding Company Common Stock. Holders of certificates which prior to the completion of the business combination represented shares of Pacific Enterprises Common Stock or Enova Common Stock (including SDG&E Common Stock certificates that represent shares of Enova Common Stock) were not entitled to receive any payment of dividends or other distributions on, or payment for any fractional share with respect to, such shares until certificates therefor had been surrendered for certificates representing shares of New Holding Company Common Stock. Holders of shares of Pacific Enterprises Common Stock or Enova Common Stock were advised not to submit certificates representing their shares for exchange until a form of letter of transmittal and instructions therefor were received.

10

SECTION 351.–TRANSFER TO CORPORATION CONTROLLED BY TRANSFEROR 26 CFR 1.351-1: TRANSFER TO CORPORATION CONTROLLED BY TRANSFEROR. REV. RUL. 2003-51

Section 351(a) provides that no gain or loss shall be recognized if property is transferred to a corporation by one or more persons solely in exchange for stock in such corporation and immediately after the exchange such person or persons are in control (as defined in § 368(c)) of the corporation. As used in section 351, the phrase ‘‘one or more persons’’ includes individuals, trusts, estates, partnerships, associations, companies, or corporations (see section 7701(a)(1)).

Section 368(c) defines control to mean the ownership of stock possessing at least 80 percent of the total combined voting power of all classes of stock entitled to vote and at least 80 percent of the total number of shares of all other classes of stock of the corporation.

Section 1.351-1(a)(1) of the Income Tax Regulations provides that the phrase “immediately after the exchange” does not necessarily require simultaneous exchanges by two or more persons, but comprehends a situation where the rights of the parties have been previously defined and the execution of the agreement proceeds with an expedition consistent with orderly procedure.

The transactions contemplated in the Share Purchase Agreement, as amended, have been structured to fit within the framework of transfers to a controlled corporation under Section 351. The Share Purchase Agreement previously defines the rights of the parties. The transferors are F3 Capital and existing security holders of Vantage Energy, and the controlled corporation is Vantage Drilling, a newly formed Cayman Islands exempted company.

Section 351 is designed to accommodate multiple parties performing simultaneous or near simultaneous transfers of property to a controlled corporation and taking in the aggregate sufficient equity in the controlled corporation to establish the fact that the parties’investment is continuing. A transaction described under § 351 “lacks a distinguishing characteristic of a sale, in that, instead of the transaction having the effect of terminating or extinguishing the beneficial interests of the transferors in the transferred property, . . . the transferors continue to be beneficially interested in the transferred property and have dominion over it by virtue of their control of the new corporate owner of it.” American Compress & Warehouse Co. v. Bender, 70 F.2d 655, 657 (5th Cir.), cert. denied, 293 U.S. 607 (1934).

In Rev. Rul. 70-140, 1970-1 C.B. 73, A, an individual, owns all of the stock of corporation X and operates a business similar to that of X through a sole proprietorship. Pursuant to an agreement between A and Y, an unrelated, widely held corporation, A transfers all of the assets of the sole proprietorship to X in exchange for additional shares of X stock. A then transfers all his X stock to Y solely in exchange for voting common stock of Y. The ruling reasons that because the two steps of the transaction are parts of a prearranged plan, they may not be considered independently of each other for Federal income tax purposes. Similarly, both the transfer by F3 Capital of the shares of OGIL to Vantage Drilling in exchange for units of Vantage Drilling, and the simultaneous transfer by Vantage Energy’s stockholders of their Vantage Energy securities in exchange for securities of Vantage Drilling are two steps, but are part of a prearranged plan and may not be considered independently of one another for federal income tax purposes.

11

Unless otherwise cited herein, conclusions above are taken from Rev. Rul 2003-51: Section 351.–Transfer to Corporation Controlled by Transferor, 26 CFR 1.351-1: Transfer to corporation controlled by transferor. A full copy of this Revenue ruling is attached hereto as Exhibit B.

12

If you have any questions or concerns, please contact the undersigned at (212) 370-1300 or via facsimile at (212) 370-7889.

| | | | | Sincerely, |

| | | | | | |

| | | | | /s/ Chris Celano |

| | | | | Chris Celano |

| | | | | Ellenoff Grossman & Schole LLP |

| | | | | Counsel to Vantage Energy and Vantage Drilling |

cc: | Paul A. Bragg |

| Douglas Smith |

| Chris DeClaire |

| Laura Svetlik |

| Edward Bartimmo |

| |

13

Exhibit A

| 14 Vantage Energy Services, Inc. Proposed Transaction Steps for Merger with OGIL This document was not intended or written to be used, and it cannot be used, for the purpose of avoiding U.S. federal, state or local tax penalties. |

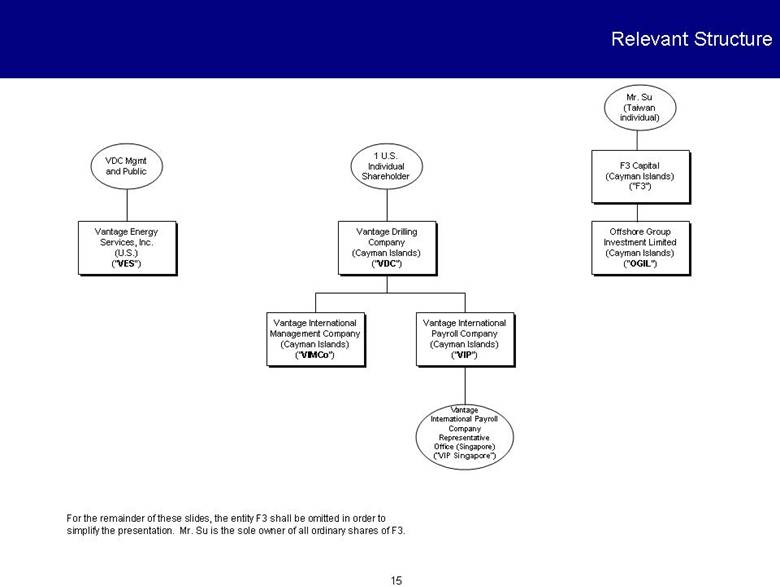

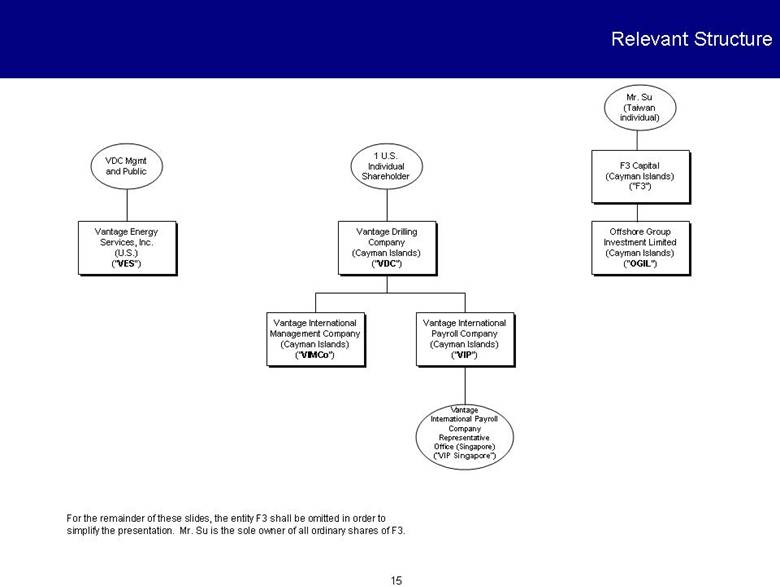

| 15 Relevant Structure Vantage Drilling Company (Cayman Islands) (“VDC”) 1 U.S. Individual Shareholder Vantage International Payroll Company (Cayman Islands) (“VIP”) Vantage International Management Company (Cayman Islands) (“VIMCo”) Offshore Group Investment Limited (Cayman Islands) (“OGIL”) Vantage Energy Services, Inc. (U.S.) (“VES”) VDC Mgmt and Public Vantage International Payroll Company Representative Office (Singapore) (“VIP Singapore”) Mr. Su (Taiwan individual) F3 Capital (Cayman Islands) (“F3”) For the remainder of these slides, the entity F3 shall be omitted in order to simplify the presentation. Mr. Su is the sole owner of all ordinary shares of F3. |

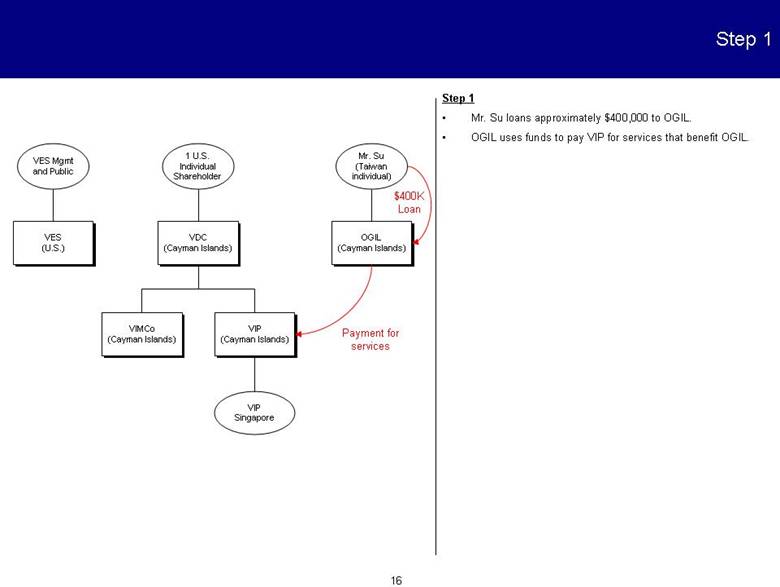

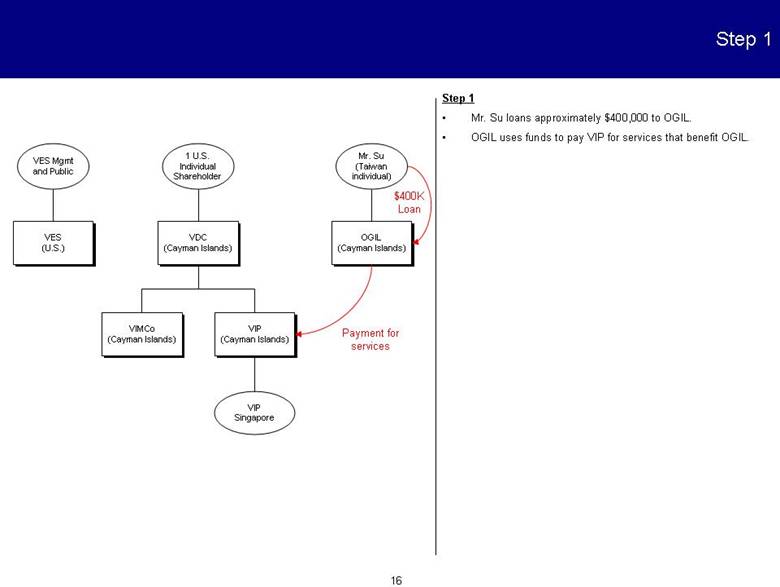

| 16 Step 1 VDC (Cayman Islands) 1 U.S. Individual Shareholder VIP (Cayman Islands) VIMCo (Cayman Islands) OGIL (Cayman Islands) VES (U.S.) VES Mgmt and Public Step 1 • Mr. Su loans approximately $400,000 to OGIL. • OGIL uses funds to pay VIP for services that benefit OGIL. $400K Loan VIP Singapore Mr. Su (Taiwan individual) Payment for services |

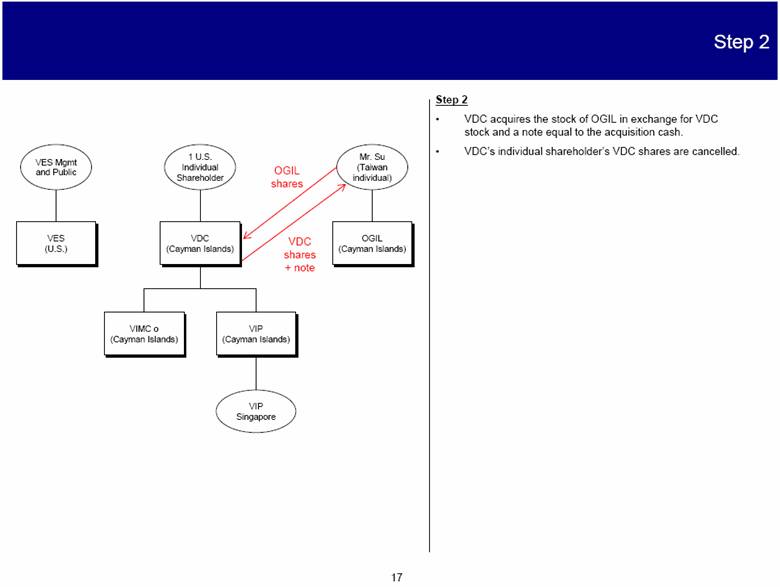

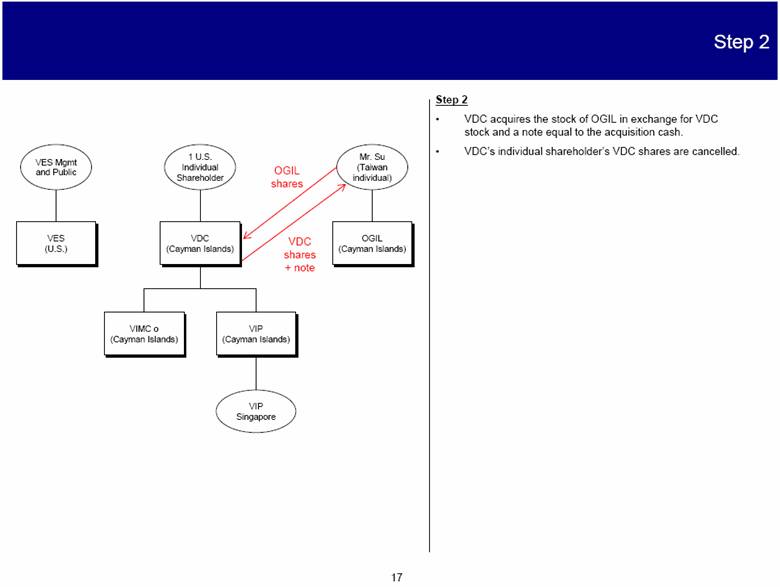

| 17 Step 2 VDC (Cayman Islands) 1 U.S. Individual Shareholder VIP (Cayman Islands) VIMC o (Cayman Islands) OGIL (Cayman Islands) VES (U.S.) VES Mgmt and Public Step 2 • VDC acquires the stock of OGIL in exchange for VDC stock and a note equal to the acquisition cash. • VDC’s individual shareholder’s VDC shares are cancelled. VIP Singapore Mr. Su (Taiwan individual) OGIL shares VDC shares + note |

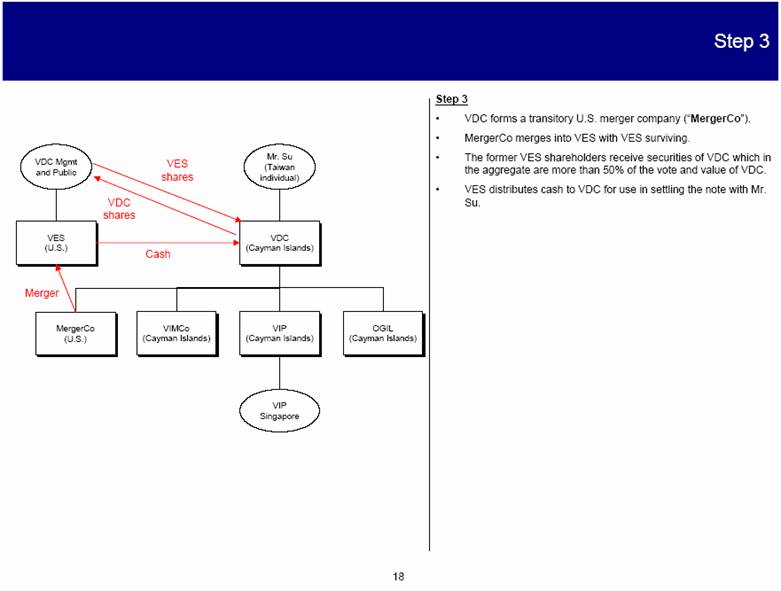

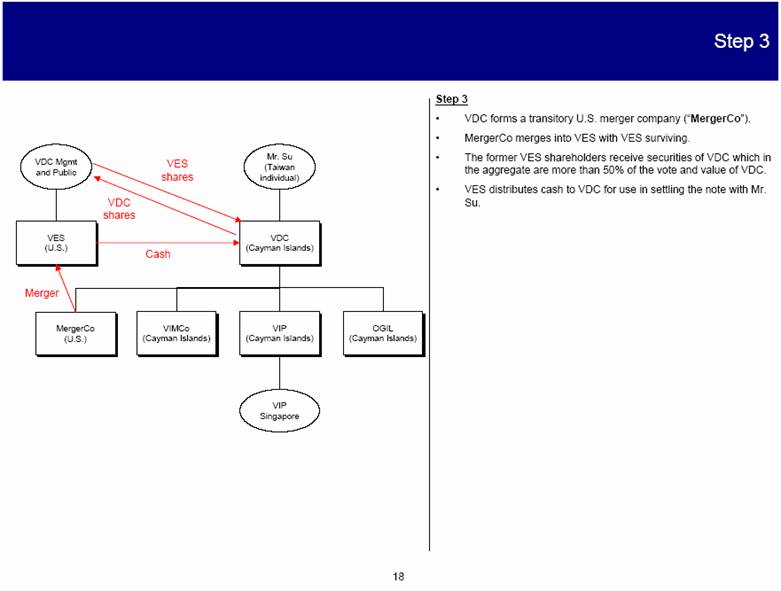

| 18 Step 3 VDC (Cayman Islands) VIP (Cayman Islands) VIMCo (Cayman Islands) OGIL (Cayman Islands) VES (U.S.) VDC Mgmt and Public Step 3 • VDC forms a transitory U.S. merger company (“MergerCo”). • MergerCo merges into VES with VES surviving. • The former VES shareholders receive securities of VDC which in the aggregate are more than 50% of the vote and value of VDC. • VES distributes cash to VDC for use in settling the note with Mr. Su. Merger VIP Singapore MergerCo (U.S.) VDC shares VES shares Mr. Su (Taiwan individual) Cash |

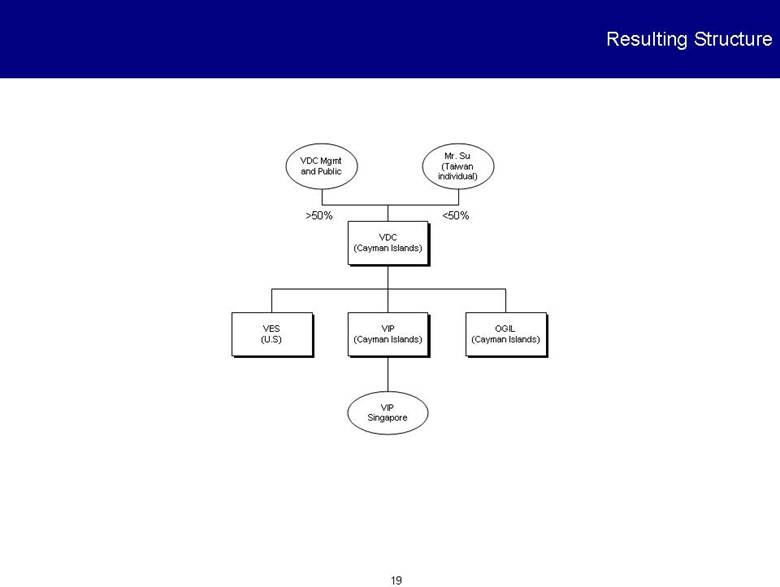

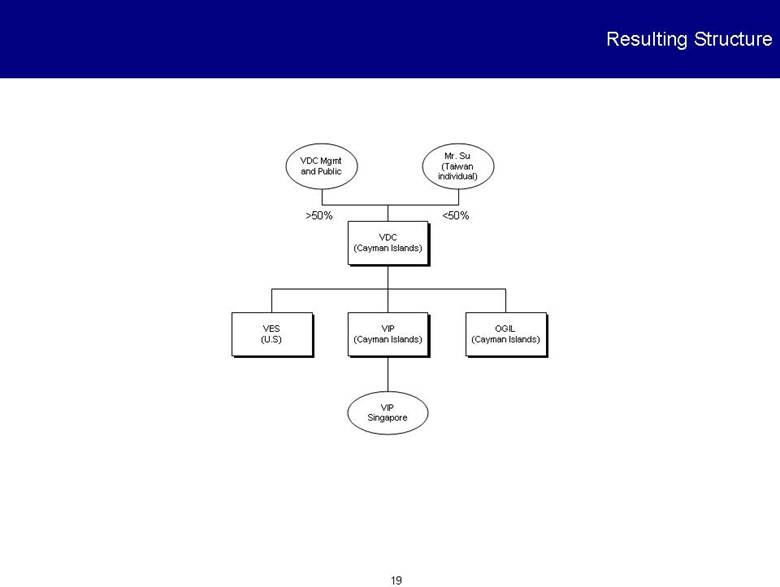

| 19 Resulting Structure VDC (Cayman Islands) VIP (Cayman Islands) VES (U.S) OGIL (Cayman Islands) VDC Mgmt and Public Mr. Su (Taiwan individual) VIP Singapore >50% <50% |

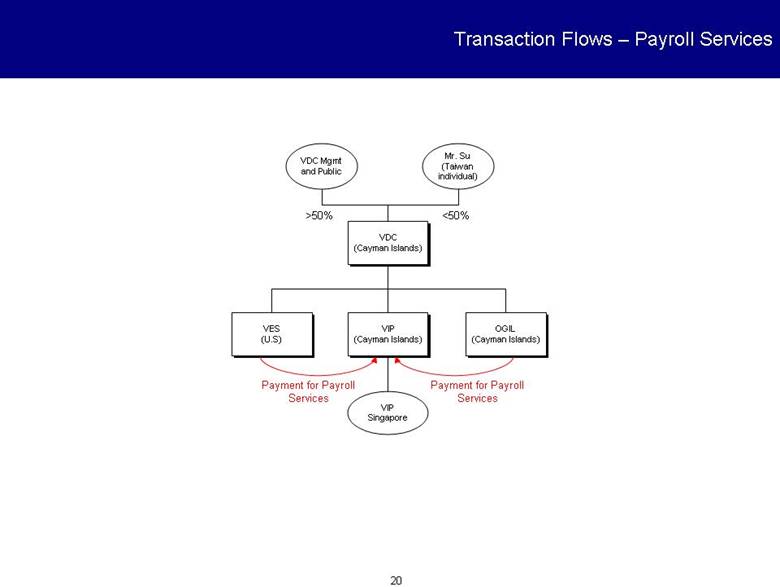

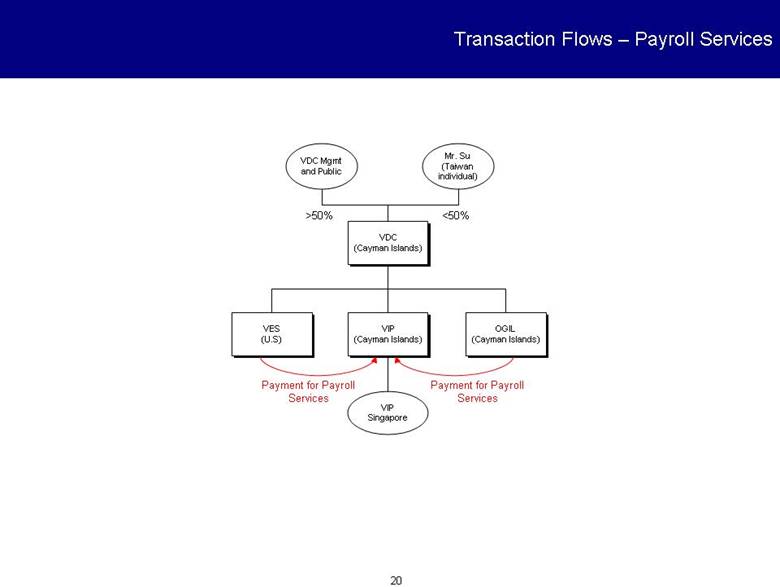

| 20 Transaction Flows – Payroll Services VDC (Cayman Islands) VIP (Cayman Islands) VES (U.S) OGIL (Cayman Islands) VDC Mgmt and Public Mr. Su (Taiwan individual) VIP Singapore Payment for Payroll Services Payment for Payroll Services >50% <50% |

Exhibit B

Section 351.–Transfer to Corporation Controlled by Transferor

26 CFR 1.351-1: Transfer to corporation controlled by transferor.

Rev. Rul. 2003-51

ISSUE

Whether a transfer of assets to a corporation (the “first corporation”) in exchange for an amount of stock in the first corporation constituting control satisfies the control requirement of § 351 of the Internal Revenue Code if, pursuant to a binding agreement entered into by the transferor with a third party prior to the exchange, the transferor transfers the stock of the first corporation to another corporation (the “second corporation”) simultaneously with the transfer of assets by the third party to the second corporation, and immediately thereafter, the transferor and the third party are in control of the second corporation.

FACTS

Corporation W, a domestic corporation, engages in businesses A, B, and C. The fair market values of businesses A, B, and C are $40x, $30x, and $30x, respectively. X, a domestic corporation unrelated to W, also engages in business A through its wholly owned domestic subsidiary, Y. The fair market value of X’s Y stock is $30x. W and X desire to consolidate their business A operations within a new corporation in a holding company structure. Pursuant to a prearranged binding agreement with X, W forms a domestic corporation, Z, by transferring all of its business A assets to Z in exchange for all of the stock of Z (the “first transfer”). Immediately thereafter, W contributes all of its Z stock to Y in exchange for stock of Y (the “second transfer”). Simultaneous with the second transfer, X contributes $30x to Y to meet the capital needs of business A after the restructuring in exchange for additional stock of Y (the “third transfer”). After the second and third transfers, Y transfers the $30x and its business A assets to Z (the “fourth transfer”). After the second and third transfers, W and X own 40 percent and 60 percent, respectively, of the outstanding stock of Y. Viewed separately, each of the first transfer, the combined second and third transfers, and fourth transfer qualifies as a transfer described in § 351.

LAW

Section 351(a) provides that no gain or loss shall be recognized if property is transferred to a corporation by one or more persons solely in exchange for stock in such corporation and immediately after the exchange such person or persons are in control (as defined in § 368(c)) of the corporation.

21

Section 368(c) defines control to mean the ownership of stock possessing at least 80 percent of the total combined voting power of all classes of stock entitled to vote and at least 80 percent of the total number of shares of all other classes of stock of the corporation.

Section 1.351-1(a)(1) of the Income Tax Regulations provides that the phrase “immediately after the exchange” does not necessarily require simultaneous exchanges by two or more persons, but comprehends a situation where the rights of the parties have been previously defined and the execution of the agreement proceeds with an expedition consistent with orderly procedure.

Courts have held that the control requirement of § 351 is not satisfied where, pursuant to a binding agreement entered into by the transferor prior to the transfer of property to the corporation in exchange for stock, the transferor loses control of the corporation by a taxable sale of all or part of that stock to a third party who does not also transfer property to the corporation in exchange for stock. See, e.g., S. Klein on the Square, Inc. v. Commissioner, 188 F.2d 127 (2d Cir.), cert. denied, 342 U.S. 824 (1951); Hazeltine Corp. v. Commissioner, 89 F.2d 513 (3d Cir. 1937); Intermountain Lumber Co. v. Commissioner, 65 T.C. 1025 (1976). The Service has reached the same conclusion when addressing similar facts. See Rev. Rul. 79-194, 1979-1 C.B. 145; Rev. Rul. 79-70, 1979-1 C.B. 144; Rev. Rul. 70-522, 1970-2 C.B. 81.

In Rev. Rul. 70-140, 1970-1 C.B. 73, A, an individual, owns all of the stock of corporation X and operates a business similar to that of X through a sole proprietorship. Pursuant to an agreement between A and Y, an unrelated, widely held corporation, A transfers all of the assets of the sole proprietorship to X in exchange for additional shares of X stock. A then transfers all his X stock to Y solely in exchange for voting common stock of Y. The ruling reasons that because the two steps of the transaction are parts of a prearranged plan, they may not be considered independently of each other for Federal income tax purposes. The ruling concludes that A’s receipt of the X stock in exchange for the sole proprietorship assets is transitory and without substance for tax purposes because it is apparent that the assets of the sole proprietorship are transferred to X to enable Y to acquire those assets without the recognition of gain to A. Accordingly, the ruling treats A as transferring its sole proprietorship assets directly to Y in a transfer to which § 351 does not apply, and Y as transferring these assets to X, independently of A’s transfer of the X stock to Y in exchange for Y voting stock. The exchange by A of the stock of X solely for voting stock of Y constitutes an exchange to which § 354 applies. See also § 1.1361-5(b)(3), Example 9.

In Rev. Rul. 77-449, 1977-2 C.B. 110, amplified by Rev. Rul. 83-34, 1983-1 C.B. 79, and Rev. Rul. 83-156, 1983-2 C.B. 66, a corporation transfers assets to a wholly owned subsidiary, which in turn transfers, as part of the same plan, the same assets to its own wholly owned subsidiary. The ruling states that the transfers should be viewed separately for purposes of § 351. Because each transfer satisfies the requirements of § 351, no gain or loss is recognized by the transferor.

22

In Rev. Rul. 83-34, corporation P owns 80 percent of the stock of a subsidiary, S1. An unrelated corporation owns the remaining 20 percent. P transfers assets to S1 solely in exchange for additional shares of S1 stock. As part of the same plan, S1 transfers the same assets to S2, a newly formed corporation of which S1 will be an 80 percent shareholder. An unrelated corporation will own the remaining 20 percent of the S2 stock. Citing Rev. Rul. 77-449, the ruling concludes that the transfers should be viewed separately for purposes of § 351 and that each transfer satisfies the requirements of § 351.

In Rev. Rul. 84-111, 1984-2 C.B. 88, Situation 1, a partnership transfers all of its assets to a newly formed corporation in exchange for all the outstanding stock of the corporation and the assumption by the corporation of the partnership’s liabilities. The partnership then terminates by distributing all the stock of the corporation to the partners in proportion to their partnership interests. The steps undertaken by the partnership were parts of a plan to transfer the partnership operations to a corporation organized for valid business reasons in exchange for its stock and were not devices to avoid or evade recognition of gain. The ruling concludes that, under § 351, the partnership recognizes no gain or loss on the transfer of its assets to the corporation in exchange for the corporation’s stock and the corporation’s assumption of the partnership’s liabilities, notwithstanding the partnership’s subsequent distribution of the corporation’s stock to the partners and consequent loss of control within the meaning of § 368(c) of the corporation.

ANALYSIS

As described above, if the first transfer were viewed as separate from each of the other transfers, the first transfer would satisfy the technical requirements of a transfer under § 351 because W transfers property to Z in exchange for stock in Z and, immediately after the exchange, W is in control of Z. However, because the first and second transfers are undertaken pursuant to a prearranged binding agreement, it is necessary to determine whether the second transfer causes the first transfer to fail to satisfy the control requirement of § 351.

“Section 351 has been described as a deliberate attempt by Congress to facilitate the incorporation of ongoing businesses and to eliminate any technical constructions which are economically unsound.” Hempt Bros., Inc. v. United States, 490 F.2d 1172, 1177 (3d Cir.), cert. denied, 419 U.S. 826 (1974). Section 351(a) is intended to apply to “certain transactions where gain or loss may have accrued in a constitutional sense, but where in a popular and economic sense there has been a mere change in the form of ownership and the taxpayer has not really ‘cashed in’ on the theoretical gain, or closed out a losing venture.” Portland Oil Co. v. Commissioner, 109 F.2d 479, 488 (1st Cir.), cert. denied, 310 U.S. 650 (1940). See S. Rep. No. 67-275, at 12 (1921) (explaining that the predecessor to § 351 was enacted in 1921 to “permit business to go forward with the readjustments required by existing conditions”). A transaction described under § 351 “lacks a distinguishing characteristic of a sale, in that,

23

instead of the transaction having the effect of terminating or extinguishing the beneficial interests of the transferors in the transferred property, . . . the transferors continue to be beneficially interested in the transferred property and have dominion over it by virtue of their control of the new corporate owner of it.” American Compress & Warehouse Co. v. Bender, 70 F.2d 655, 657 (5th Cir.), cert. denied, 293 U.S. 607 (1934).

As described above, courts have held that the control requirement of § 351 is not satisfied where, pursuant to a binding agreement entered into by the transferor prior to the transfer of property to the corporation in exchange for stock, the transferor loses control of the corporation by a taxable sale of all or part of that stock to a third party that does not also transfer property to the corporation in exchange for stock. Treating a transfer of property that is followed by such a prearranged sale of the stock received as a transfer described in § 351 is not consistent with Congress’ intent in enacting § 351 to facilitate the rearrangement of the transferor’s interest in its property. Treating a transfer of property that is followed by a nontaxable disposition of the stock received as a transfer described in § 351 is not necessarily inconsistent with the purposes of § 351. Accordingly, the control requirement may be satisfied in such a case, even if the stock received is transferred pursuant to a binding commitment in place upon the transfer of the property in exchange for stock. For example, in Rev. Rul. 84-111, Situation 1, the partnership’s transfer of property to the transferee corporation qualified as a transfer described in § 351, even though the partnership relinquished control of the transferee corporation within the meaning of § 368(c) pursuant to a prearranged plan to transfer the transferee stock.

In Rev. Rul. 70-140, the transfer of assets to the transferor’s wholly owned subsidiary followed by an exchange of stock of the wholly owned subsidiary for stock of another corporation was recast as a direct transfer of assets to the unrelated, widely held corporation in a taxable transaction. In Rev. Rul. 70-140, there was no alternative form of transaction that would have qualified for nonrecognition treatment. In contrast, in this case, W’s transfer of the business A assets to Z was not necessary for W and X to combine their business A assets in a holding company structure in a manner that would have qualified for nonrecognition of gain or loss under § 351. A transfer of W’s business A assets to Y in exchange for Y stock as part of a plan that included X’s transfer of $30x to Y in exchange for Y stock, and Y’s transfer of the business A assets and $30x to Z in exchange for all of the Z stock, would have qualified as successive transfers described in § 351. See Rev. Rul. 83-34; Rev. Rul. 77-449. Accordingly, in these circumstances, Rev. Rul. 70-140 is distinguishable.

In this case, even though the first transfer is followed by a transfer of the stock received, treating the first transfer as a transfer described in § 351 is not inconsistent with the purposes of § 351. Accordingly, the second transfer will not cause the first transfer to fail to satisfy the control requirement of § 351.

24

HOLDING

A transfer of assets to the first corporation in exchange for an amount of stock in the first corporation constituting control satisfies the control requirement of § 351 even if, pursuant to a binding agreement entered into by the transferor with a third party prior to the exchange, the transferor transfers the stock of the first corporation to the second corporation simultaneously with the transfer of assets by the third party to the second corporation, and immediately thereafter, the transferor and the third party are in control of the second corporation.

EFFECT ON OTHER REVENUE RULINGS

Rev. Rul. 79-194, 1979-1 C.B. 145, Rev. Rul. 79-70, 1979-1 C.B. 144, Rev. Rul. 70-522, 1970-2 C.B. 81, and Rev. Rul. 70-140, 1970-1 C.B. 73, are distinguished.

DRAFTING INFORMATION

The principal author of this revenue ruling is Lisa K. Leong of the Office of Associate Chief Counsel (Corporate). For further information regarding this revenue ruling, contact Ms. Leong at (202) 622-7530 (not a toll-free call).

25