Via EDGAR & EMAIL

Mr. H. Roger Schwall

Assistant Director

Division of Corporate Finance

United States Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549

Re: | | Vantage Energy Services, Inc. |

| | Schedule 14A |

| | Filed December 3, 2007 |

| | File No. 001-33496 |

| | |

| | Vantage Drilling Company |

| | Registration Statement on Forms F-4 and F-l |

| | Filed December 3, 2007 |

| | File No. 333-147797 |

Dear Mr. Schwall:

This letter is written pursuant to a conference call conducted Wednesday, April 30, 2008, among the Securities and Exchange Commission (the “Commission”) and legal counsel for the above referenced companies regarding certain concerns the Commission has expressed in comment number 2 in the letter received from the Commission on April 28, 2008 (the “Staff Letter”) with respect to the proxy statement on Schedule 14A (the “Proxy Statement”) filed by Vantage Energy Services, Inc. (“Vantage Energy”) and the Registration Statement on Forms F-4 and F-l (“Registration Statement”) filed by Vantage Drilling Company (“Vantage Drilling”). On May 5, 2008, we electronically filed Amendment No. 3 to the Proxy Statement and Registration Statement, originally filed on December 3, 2007, amended on January 23, 2008, and further amended on April 3, 2008, which reflects responses to the Staff Letter.

Courtesy copies of Amendment No. 3 have been provided to the Commission.

By our correspondence letter dated and filed May 5, 2008, in connection with the Staff Letter, we have provided a response to all comments contained in the Staff Letter, including

comment number 2. This letter is intended to provide the Commission additional information regarding the legality and viability of the proposed transaction structure as described in the Proxy Statement and Registration Statement by analogy to a recent transaction with a similar structure by a special purpose acquisition company.

Discussion and Analysis

The question proposed by the Commission concerns the ability of Vantage Drilling to use funds from the trust account of Vantage Energy to acquire OGIL without first acquiring, through a merger, control over the assets of Vantage Energy. The Commission suggests that at the time of the transaction Vantage Energy would not meet the 80% requirement unless it first acquires assets through the acquisition of OGIL.

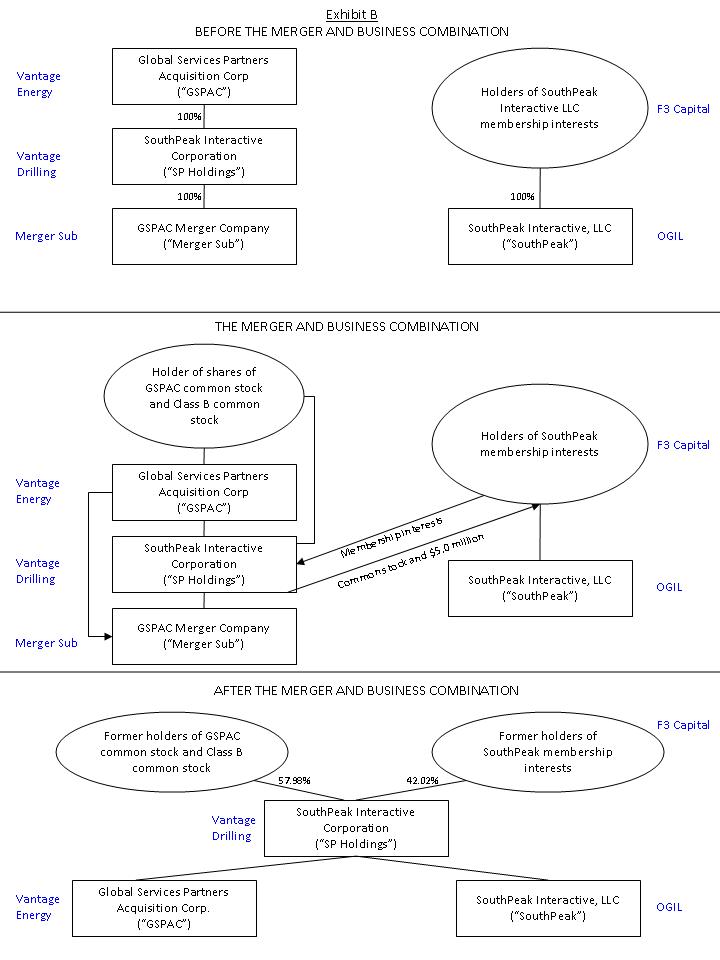

The proposed structure represents a double dummy acquisition which contemplates simultaneous or near simultaneous exchanges of property, and qualifies under Section 351 of the Internal Revenue Code of 1986, as amended. As illustrated below, there is precedent for the proposed structure of the transaction as described in the Proxy Statement and Registration Statement. Where appropriate, footnotes have been added to the description of the precedent transaction in order to highlight the corresponding mechanics and terms that this precedent transaction and the proposed transaction described in the Proxy Statement and Registration Statement share in common. To maintain consistent terminology between these transactions, the proposed exchange of Vantage Drilling shares for shares of OGIL will be referred to in the footnotes below as the “business combination” and the merger among Vantage Drilling, Vantage Energy and a transitory merger subsidiary of Vantage Drilling will be referred to as the “merger.”

PRECEDENT SPAC TRANSACTION.

Global Services Partners Acquisition Corp. (“GSPAC”) /

SouthPeak Interactive Corporation (“Southpeak”)

The Definitive joint proxy statement/prospectus for this transaction was filed with the Commission on April 11, 2008. The filings for this business combination were reviewed and cleared by the Commission.

GSPAC was formed as a vehicle to effect a merger, capital stock exchange, asset acquisition or other similar business combination with an unidentified operating business. Since the consummation of its initial public offering, GSPAC’s activity has been limited to identifying targets for a business combination.(1)

By acquiring the membership interests of SouthPeak through the issuance of stock and the payment of cash from a newly-formed holding company called “SP Holdings”, the business

(1) Vantage Energy was formed as a special purpose acquisition company with activity limited thus far to indentifying targets and negotiating the purchase thereof.

combination and the merger discussed below, based on the disclosure in the GSPAC proxy statement, were structured to meet the requirements of a tax-free exchange under Section 351 of the Internal Revenue Code.(2)

Merger Sub, a wholly owned subsidiary of SP Holdings, is a Delaware corporation formed in January 2008 for the sole purpose of effecting the merger and the business combination. Upon the terms and conditions set forth in the reorganization agreement, Merger Sub will be merged with and into GSPAC and the separate existence of Merger Sub will cease. GSPAC will be the surviving corporation. All of the properties, assets, rights, privileges, immunities, powers, purposes, liabilities and obligations of Merger Sub will become those of GSPAC.(3)

Upon the consummation of the business combination, $5.0 million from GSPAC’s trust account will be used to pay the cash portion of the consideration paid to the members of SouthPeak. The balance remaining in the trust account will be released to SP Holdings and used to pay amounts, if any, to the GSPAC stockholders exercising their conversion rights, expenses and fees related to the merger and to fund the business combination, provide working capital and fund future acquisitions, if any.(4)

SP Holdings was formed solely for the purpose of effecting the merger and the business combination. To date, SP Holdings has not conducted any activities other than those incident to its formation, the execution of the reorganization agreement and the preparation of the applicable filings under the U.S. securities laws and regulatory filings made in connection with the merger and the business combination. Immediately upon completion of the merger and the business combination, the members of SouthPeak and the former GSPAC stockholders will hold 42.02% and 57.98%, respectively, of SP Holdings common stock.(5)

Under the terms of the reorganization agreement, Merger Sub will merge with and into GSPAC and, as a result of the merger; GSPAC will become a wholly-owned subsidiary of SP Holdings. Each share of GSPAC common stock outstanding immediately prior to the merger will be automatically converted into one share of SP Holdings common stock (except for those shares of GSPAC common stock held by stockholders who elect conversion). SP Holdings will assume

(2) By acquiring the ordinary shares of OGIL through the issuance of ordinary shares and a promissory note (to be paid ultimately in cash) from Vantage Drilling, a newly-formed holding company, our business combination and the merger together is intended to constitute a tax-free exchange under Section 351.

(3) Vantage Drilling will create a wholly owned subsidiary under Delaware law to be used solely for the purpose of effecting the merger and the business combination. The merger subsidiary will be merged with and into Vantage Energy and the separate existence of the merger sub will cease. Vantage Energy will be the surviving corporation.

(4) Upon the consummation of the business combination, $56.0 million (plus closing adjustments as described in the Proxy Statement and Registration Statement) from Vantage Energy’s trust fund will be used to pay the promissory note portion of the consideration to the members of OGIL. The balance remaining in the trust fund will be released to Vantage Drilling and used to pay amounts, if any, to Vantage Energy’s stockholders who elect to exercise their conversion rights, expenses and fees related to the business combination and merger, and to provide working capital.

(5) Vantage Drilling was formed solely for the purpose of effecting the merger and the business combination. To date, Vantage Drilling has not conducted any activities other than those incident to its formation, the execution of the share purchase agreement and merger agreement and the preparation of the applicable filings under the U.S. securities laws. Immediately upon completion of the merger and the business combination, F3 Capital and the former Vantage Energy stockholders will hold approximately 44% and 56%, respectively, of Vantage Drilling’s shares.

the outstanding GSPAC warrants, the terms and conditions of which will not change, except that upon exercise, the holders of such warrants will receive shares of SP Holdings’s common stock.(6)

Simultaneously with the merger, the members of SouthPeak will contribute all of the outstanding membership interests of SouthPeak to SP Holdings. Following the closing of the business combination, SouthPeak will be a wholly-owned subsidiary of SP Holdings. All of the properties, assets, rights, privileges, immunities, powers, purposes, liabilities and obligations of SouthPeak prior to the business combination will remain SouthPeak’s following the closing of the business combination. In consideration of the contribution of all of the outstanding membership interests of SouthPeak, the members of SouthPeak will receive $5.0 million in cash and 5,000,000 shares of SP Holdings common stock for approximately $30.9 million of total consideration based on the closing price of GSPAC’s Class B common stock on December 28, 2007.(7)

Effective Time of the Merger and Closing of the Business Combination

The closing of the business combination and the effective time of the merger, which will occur simultaneously and are conditioned on each other, will occur at the time the parties duly file a certificate of merger with the Secretary of State of the State of Delaware (or at such later time as may be agreed by the parties and specified in the certificate of merger) and the members of SouthPeak contribute the outstanding membership interests of SouthPeak to SP Holdings and SP Holdings issues and pays to the members of SouthPeak shares of SP Holdings common stock and $5.0 million in cash for approximately $30.9 million in total consideration, based on the closing price of GSPAC’s common stock on December 28, 2007.(8)

Transaction Consideration

Merger Consideration

If the business combination occurs, at the effective time of the merger:

(6) Under the terms of the merger agreement, the merger subsidiary will merge with and into Vantage Energy and, as a result of the merger, Vantage Energy will become a wholly-owned subsidiary of Vantage Drilling. Each share of Vantage Energy’s common stock outstanding immediately prior to the merger will be automatically converted into one share of Vantage Drilling’s common stock (except for those shares of Vantage Energy held by holders who properly elect conversion). Vantage Drilling will issue warrants in exchange for the outstanding Vantage Energy warrants, the terms and conditions of which will not change, except that upon exercise, the holders of such warrants will receive ordinary shares of Vantage Drilling.

(7) Simultaneously with the merger, F3 Capital will contribute all of the ordinary shares of OGIL to Vantage Drilling. Following the closing of the business combination, OGIL will be a wholly-owned subsidiary of Vantage Drilling. All of the properties, assets, rights, privileges, immunities, powers, purposes, liabilities and obligations of OGIL prior to the business combination will remain OGIL’s following the closing of the business combination. In consideration of the contribution of all of the ordinary shares of OGIL, F3 Capital will receive a promissory note in the amount of $56.0 million (plus closing adjustments) and 33,333,333 units of Vantage Drilling for approximately $331 million of total consideration.

(8) The closing of the business combination and the effective time of the merger, which will occur simultaneously and which are conditioned on each other, will occur at the time the parties duly file a certificate of merger with the Secretary of State of the State of Delaware (or at such later time as may be agreed by the parties and specified in the certificate of merger). F3 Capital will contribute the ordinary shares of OGIL to Vantage Drilling and Vantage Drilling will issue to F3 Capital a promissory note and units of Vantage Drilling.

· Each share of GSPAC common stock issued and outstanding as of the effective time of the merger (other than common stock held by stockholders electing to exercise their conversion rights) will be converted into and exchanged for one share of SP Holdings common stock.(9)

· Each option, warrant or other right to purchase shares of GSPAC securities then outstanding shall be converted into one substantially equivalent option, warrant or other right to purchase SP Holdings securities.(10)

Business Combination Consideration

In exchange for their contribution of all of the outstanding membership interests of SouthPeak, SP Holdings will issue and pay to the members of SouthPeak 5,000,000 shares of SP Holdings common stock and $5.0 million in cash for approximately $30.9 million in total consideration, based on the closing price of GSPAC’s Class B common stock on December 28, 2007.(11)

Attached as Exhibit “A” is an illustration of the precedent transaction. Attached as Exhibit “B” is the same illustration, only annotated with the names of the Vantage entities in order to approximate a direct comparison.

Conclusion

In both the precedent transaction and the proposed transaction, there is (i) a business combination component comprised of the owners of the target exchanging securities of the target for securities and cash, or a promise to pay cash, from a newly-formed holding company, and (ii) a merger component whereby the newly-formed holding company creates a transitory merger subsidiary and merges that subsidiary with and into the SPAC. The end result of both the precedent and the proposed transaction is that the SPAC and the target become wholly owned subsidiaries of the newly-formed holding company.

Although the newly-formed holding company does not complete the merger with the SPAC prior to the acquisition and gain control of its assets, the precedent transaction and the proposed transaction use funds from the SPAC’s trust account to facilitate the acquisition of the target. The precedent transaction uses cash from the trust fund as partial consideration, while the proposed transaction will use a promissory note as partial consideration, such note to be paid

(9) Each share of Vantage Energy common stock issued and outstanding as of the effective time of the merger (other than shares of common stock held by stockholders electing to exercise their conversion rights) will be converted into and exchanged for one share of Vantage Drilling’s common stock.

(10) Each option, warrant or other right to purchase shares of Vantage Energy then outstanding shall be converted into one substantially equivalent option, warrant or other right to purchase Vantage Drilling’s shares.

(11) In exchange for F3 Capital’s contribution of all of the ordinary shares of OGIL, Vantage Drilling will issue and pay to F3 Capital a promissory note in the amount of $56.0 million (plus closing adjustments) and 33,333,333 units of Vantage Drilling for approximately $331 million of total consideration.

post closing from the trust account. Further, in both the precedent transaction and the proposed transaction, the SPAC satisfies the 80% requirement, notwithstanding the fact that the SPAC did not previously acquire the assets of the target. It is imperative to note that the closing of the business combination and the effective time of the merger must occur simultaneously and are conditioned on each other in both transactions. The satisfaction of the conditions precedent in the transaction documents occurs simultaneously in order to enable the closings of the business combination and the effective time of the merger to occur simultaneously.

If you have any questions or concerns, please contact the undersigned at (281) 404-4700 or via facsimile at (281) 404-4749.

| | Sincerely, |

| | |

| | /s/ Chris Celano |

| | Chris Celano, General Counsel |

cc: | Paul A. Bragg |

| Douglas Smith |

| Chris DeClaire |

| Laura Svetlik |

| Edward Bartimmo |

| Bryan Brown |