Filed Pursuant to Rule 424(b)(3)

Registration Nos. 333-184947

333-184947-01

333-184947-02

333-184947-03

333-184947-04

333-184947-05

333-184947-06

POWERSHARES DB MULTI-SECTOR COMMODITY TRUST

POWERSHARES DB ENERGY FUND

POWERSHARES DB OIL FUND

POWERSHARES DB PRECIOUS METALS FUND

POWERSHARES DB GOLD FUND

POWERSHARES DB SILVER FUND

POWERSHARES DB BASE METALS FUND

SUPPLEMENT DATED JUNE 18, 2013 TO

PROSPECTUS DATED JANUARY 3, 2013

This Supplement updates certain information contained in the Prospectus dated January 3, 2013, as supplemented from time-to-time (the “Prospectus”) of PowerShares DB Multi-Sector Commodity Trust (the “Trust”), PowerShares DB Energy Fund, PowerShares DB Oil Fund, PowerShares DB Precious Metals Fund, PowerShares DB Gold Fund, PowerShares DB Silver Fund and PowerShares DB Base Metals Fund (collectively, the “Funds”). All capitalized terms used in this Supplement have the same meaning as in the Prospectus.

Prospective investors in the Funds should review carefully the contents of both this Supplement and the Prospectus.

* * * * * * * * * * * * * * * * * * *

All information in the Prospectus is restated pursuant to this Supplement, except as updated hereby.

Neither the Securities and Exchange Commission nor any state securities commission

has approved or disapproved of these securities or determined if this Supplement is

truthful or complete. Any representation to the contrary is a criminal offense.

THE COMMODITY FUTURES TRADING COMMISSION HAS NOT PASSED UPON THE MERITS OF PARTICIPATING IN THIS POOL NOR HAS THE COMMISSION PASSED UPON THE ADEQUACY OR ACCURACY OF THIS DISCLOSURE DOCUMENT.

DB COMMODITY SERVICES LLC

Managing Owner

| I. | Page 16 of the Prospectus is hereby deleted and replaced, in its entirety, with the following: |

BREAKEVEN TABLE

| Dollar Amount and Percentage of Expenses Per Fund | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DBE9 | DBO10 | DBP10 | DGL10 | DBS10 | DBB9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Expense1 | $ | % | $ | % | $ | % | $ | % | $ | % | $ | % | ||||||||||||||||||||||||||||||||||||||||||||||||

Management Fee2 | $ | 0.19 | 0.75 | % | $ | 0.19 | 0.75 | % | $ | 0.19 | 0.75 | % | $ | 0.19 | 0.75 | % | $ | 0.19 | 0.75 | % | $ | 0.19 | 0.75 | % | ||||||||||||||||||||||||||||||||||||

Organization and Offering Expense Reimbursement3 | $ | 0.00 | 0.00 | % | $ | 0.00 | 0.00 | % | $ | 0.00 | 0.00 | % | $ | 0.00 | 0.00 | % | $ | 0.00 | 0.00 | % | $ | 0.00 | 0.00 | % | ||||||||||||||||||||||||||||||||||||

Brokerage Commissions and Fees4 | $ | 0.01 | 0.03 | % | $ | 0.01 | 0.04 | % | $ | 0.01 | 0.04 | % | $ | 0.01 | 0.04 | % | $ | 0.01 | 0.04 | % | $ | 0.01 | 0.03 | % | ||||||||||||||||||||||||||||||||||||

Routine Operational, Administrative and Other Ordinary Expenses5,6 | $ | 0.00 | 0.00 | % | $ | 0.00 | 0.00 | % | $ | 0.00 | 0.00 | % | $ | 0.00 | 0.00 | % | $ | 0.00 | 0.00 | % | $ | 0.00 | 0.00 | % | ||||||||||||||||||||||||||||||||||||

Interest Income7 | $ | (0.01 | ) | (0.05 | )% | $ | (0.01 | ) | (0.05 | )% | $ | (0.01 | ) | (0.05 | )% | $ | (0.01 | ) | (0.05 | )% | $ | (0.01 | ) | (0.05 | )% | $ | (0.01 | ) | (0.05 | )% | ||||||||||||||||||||||||||||||

12-Month Breakeven8 | $ | 0.19 | 0.73 | % | $ | 0.19 | 0.74 | % | $ | 0.19 | 0.74 | % | $ | 0.19 | 0.74 | % | $ | 0.19 | 0.74 | % | $ | 0.19 | 0.73 | % | ||||||||||||||||||||||||||||||||||||

| 1. | The breakeven analysis assumes that the Shares have a constant month-end Fund net asset value and is based on $25.00 as the net asset value per Share. See “Charges” on page 97 for an explanation of the expenses included in the “Breakeven Table.” |

| 2. | From the Management Fee, the Managing Owner will be responsible for paying the fees and expenses of the Administrator, ALPS Distributors and Invesco Distributors. |

| 3. | The Managing Owner is responsible for paying the organization and offering expenses and the continuous offering costs of each Fund. |

| 4. | The actual amount of brokerage commissions and trading fees to be incurred will vary based upon the trading frequency of each Fund and the specific futures contracts traded. |

| 5. | The Managing Owner is responsible for paying all routine operational, administrative and other ordinary expenses of each Fund. |

| 6. | In connection with orders to create and redeem Baskets, Authorized Participants will pay a transaction fee in the amount of $500 per order. Because these transaction fees are de minimis in amount, are charged on a transaction-by-transaction basis (and not on a Basket-by-Basket basis), and are borne by the Authorized Participants, they have not been included in the Breakeven Table. |

| 7. | Interest income currently is estimated to be earned at a rate of 0.05%, based upon the yield on 3-month U.S. Treasury bills as of May 31, 2013. Actual interest income could be higher or lower than the current yield of 3-month U.S. Treasury bills. |

| 8. | You may pay customary brokerage commissions in connection with purchases of the Shares. Because such brokerage commission rates will vary from investor to investor, such brokerage commissions have not been included in the Breakeven Table. Investors are encouraged to review the terms of their brokerage accounts for applicable charges. |

| 9. | Each of DBE and DBB are subject to (i) a Management Fee of 0.75% per annum and (ii) estimated brokerage commissions and fees of 0.03% per annum. DBE and DBB are each subject to fees and expenses in the aggregate amount of approximately 0.78% per annum. DBE and DBB will be successful only if each of their annual returns from the underlying futures contracts, including annual income from 3-month U.S. Treasury bills, exceeds approximately 0.78% per annum. Each of DBE and DBB is expected to earn 0.05% per annum, based upon the yield of 3-month U.S. Treasury bills as of May 31, 2013. Therefore, based upon the difference between the current yield of 3-month U.S. Treasury bills and the annual fees and expenses, each of DBE and DBB would be required to earn approximately 0.73% per annum, in order for an investor to break-even on an investment during the first twelve months of an investment. Actual interest income could be higher or lower than the current yield of 3-month U.S. Treasury bills. |

| 10. | Each of DBO, DBP, DGL and DBS will be subject to (i) a Management Fee of 0.75% per annum and (ii) estimated brokerage commissions and fees of 0.04% per annum. DBO, DBP, DGL and DBS are each subject to fees and expenses in the aggregate amount of approximately 0.79% per annum. DBO, DBP, DGL and DBS will be successful only if each of their annual returns from the underlying futures contracts, including annual income from 3-month U.S. Treasury bills, exceeds approximately 0.79% per annum. Each of DBO, DBP, DGL and DBS is expected to earn 0.05% per annum, based upon the yield of 3-month U.S. Treasury bills as of May 31, 2013. Therefore, based upon the difference between the current yield of 3-month U.S. Treasury bills and the annual fees and expenses, each of DBO, DBP, DGL and DBS would be required to earn approximately 0.74% per annum, in order for an investor to break-even on an investment during the first twelve months of an investment. Actual interest income could be higher or lower than the current yield of 3-month U.S. Treasury bills. |

All references throughout the Prospectus to the Interest Income and the 12-Month Breakeven amounts are hereby deleted and replaced with the revised information as provided in the above Breakeven Table.

2

| II. | Pages 33 through 37 of the Prospectus are hereby deleted and replaced, in their entirety, with the following: |

“PERFORMANCE OF POWERSHARES DB ENERGY FUND(TICKER: DBE), A SERIES OF

POWERSHARES DB MULTI-SECTOR COMMODITY TRUST

Name of Pool: PowerShares DB Energy Fund

Type of Pool: Public, Exchange-Listed Commodity Pool

Inception of Trading: January 2007

Aggregate Gross Capital Subscriptions as of May 31, 2013:$977,045,652

Net Asset Value as of May 31, 2013:$196,235,052

Net Asset Value per Share as of May 31, 2013:$27.25

Worst Monthly Drawdown: (28.36)% October 2008

Worst Peak-to-Valley Drawdown: (66.18)% June 2008 – February 2009*

Monthly Rate of Return | 2013(%) | 2012(%) | 2011(%) | 2010(%) | 2009(%) | 2008(%) | ||||||

January | 4.68 | 2.50 | 5.35 | (8.46) | (6.19) | (1.17) | ||||||

February | (3.75) | 8.19 | 5.65 | 5.54 | (5.93) | 10.62 | ||||||

March | 3.30 | (1.99) | 5.38 | 2.88 | 5.71 | 1.35 | ||||||

April | (4.43) | (0.43) | 6.24 | 5.48 | (1.34) | 10.21 | ||||||

May | (2.12) | (14.35) | (7.66) | (14.15) | 22.99 | 14.95 | ||||||

June | (1.25) | (3.55) | (0.73) | 3.14 | 10.15 | |||||||

July | 5.50 | 2.04 | 4.09 | 2.26 | (12.21) | |||||||

August | 8.36 | (3.94) | (7.48) | (3.50) | (6.72) | |||||||

September | (1.35) | (11.72) | 7.97 | (0.96) | (11.32) | |||||||

October | (3.68) | 8.44 | 0.02 | 7.99 | (28.36) | |||||||

November | 2.29 | 1.43 | 2.15 | 1.68 | (14.60) | |||||||

December | (0.36) | (2.81) | 8.95 | (0.39) | (13.74)** | |||||||

Compound Rate of Return | (2.64)% (5 months) | 1.34% | 2.68% | 3.42% | 24.81% | (40.74)% |

| * | The Worst Peak-to-Valley Drawdown from June 2008 – February 2009 includes the effect of the $0.44 per Share distribution made to Shareholders of record as of December 17, 2008. Please see Footnote **. |

| ** | The December 2008 return of (13.74)% includes the $0.44 per Share distribution made to Shareholders of record as of December 17, 2008. Prior to the December 30, 2008 distribution, the pool’s return for December 2008 was (11.92)%. |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

PERFORMANCE OF POWERSHARES DB OIL FUND(TICKER: DBO), A SERIES OF

POWERSHARES DB MULTI-SECTOR COMMODITY TRUST

Name of Pool:PowerShares DB Oil Fund

Type of Pool:Public, Exchange-Listed Commodity Pool

Inception of Trading:January 2007

Aggregate Gross Capital Subscriptions as of May 31, 2013:$1,899,171,246

Net Asset Value as of May 31, 2013:$401,583,253

Net Asset Value per Share as of May 31, 2013:$25.42

Worst Monthly Drawdown:(29.20)% October 2008

Worst Peak-to-Valley Drawdown:(65.43)% June 2008 – February 2009*

Monthly Rate of Return | 2013(%) | 2012(%) | 2011(%) | 2010(%) | 2009(%) | 2008(%) | ||||||

January | 5.73 | 0.46 | 3.69 | (8.65) | (5.87) | (3.00) | ||||||

February | (6.15) | 8.47 | 2.60 | 7.48 | (4.30) | 10.99 | ||||||

March | 4.96 | (4.02) | 7.67 | 4.76 | 7.88 | 0.30 | ||||||

April | (4.25) | 1.14 | 6.25 | 4.46 | (1.12) | 12.33 | ||||||

May | (1.93) | (18.21) | (10.43) | (16.47) | 26.94 | 12.65 | ||||||

June | (0.24) | (5.99) | (3.20) | 1.94 | 11.73 | |||||||

July | 1.99 | (0.45) | 4.98 | 3.09 | (11.24) | |||||||

August | 8.31 | (8.79) | (5.14) | (3.12) | (5.82) | |||||||

September | (4.04) | (11.66) | 6.70 | (1.07) | (12.79) | |||||||

October | (5.28) | 14.58 | (0.14) | 8.27 | (29.20) | |||||||

November | 2.67 | 8.17 | 1.66 | 2.94 | (15.73) | |||||||

December | 2.28 | (0.59) | 9.39 | (0.95) | (11.79)** | |||||||

Compound Rate of Return | (2.19)% (5 months) | (9.00)% | 1.28% | 2.51% | 35.65% | (41.42)% |

| * | The Worst Peak-to-Valley Drawdown from June 2008 – February 2009 includes the effect of the $0.12 per Share distribution made to Shareholders of record as of December 17, 2008. Please see Footnote **. |

| ** | The December 2008 return of (11.79)% includes the $0.12 per Share distribution made to Shareholders of record as of December 17, 2008. Prior to the December 30, 2008 distribution, the pool’s return for December 2008 was (11.27)%. |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

See accompanying Footnotes to Performance Information on page 36.

3

PERFORMANCE OF POWERSHARES DB PRECIOUS METALS FUND(TICKER: DBP), A SERIES

OF POWERSHARES DB MULTI-SECTOR COMMODITY TRUST

Name of Pool:PowerShares DB Precious Metals Fund

Type of Pool:Public, Exchange-Listed Commodity Pool

Inception of Trading:January 2007

Aggregate Gross Capital Subscriptions as of May 31, 2013:$1,045,920,232

Net Asset Value as of May 31, 2013:$247,988,793

Net Asset Value per Share as of May 31, 2013:$45.92

Worst Monthly Drawdown:(18.43)% October 2008

Worst Peak-to-Valley Drawdown:(31.88)% February 2008 – October 2008

Monthly Rate of Return | 2013(%) | 2012(%) | 2011(%) | 2010(%) | 2009(%) | 2008(%) | ||||||

January | (0.09) | 12.41 | (7.08) | (1.83) | 6.02 | 10.18 | ||||||

February | (6.12) | (0.58) | 8.60 | 2.92 | 1.97 | 7.34 | ||||||

March | 0.73% | (3.34) | 4.38 | 0.68 | (1.84) | (7.24) | ||||||

April | (9.34) | (1.35) | 13.10 | 5.93 | (3.99) | (5.36) | ||||||

May | (6.11) | (7.10) | (7.05) | 2.01 | 12.91 | 2.30 | ||||||

June | 1.92 | (3.96) | 2.27 | (7.08) | 3.99 | |||||||

July | 0.44 | 9.87 | (5.01) | 2.61 | (0.88) | |||||||

August | 5.99 | 10.31 | 5.95 | 1.17 | (12.05) | |||||||

September | 6.06 | (15.29) | 6.14 | 7.00 | 2.59 | |||||||

October | (3.88) | 7.85 | 5.46 | 1.73 | (18.43) | |||||||

November | 0.12 | 0.08 | 4.66 | 13.44 | 11.56 | |||||||

December | (3.68) | (11.46) | 3.91 | (7.62) | 6.94* | |||||||

Compound Rate of Return | (19.58)% (5 months) | 5.60% | 4.34% | 37.71% | 26.57% | (3.88)% |

| * | The December 2008 return of 6.94% includes the $0.27 per Share distribution made to Shareholders of record as of December 17, 2008. Prior to the December 30, 2008 distribution, the pool’s return for December 2008 was 7.91%. |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

PERFORMANCE OF POWERSHARES DB GOLD FUND(TICKER: DGL), A SERIES OF

POWERSHARES DB MULTI-SECTOR COMMODITY TRUST

Name of Pool:PowerShares DB Gold Fund

Type of Pool:Public, Exchange-Listed Commodity Pool

Inception of Trading:January 2007

Aggregate Gross Capital Subscriptions as of May 31, 2013:$919,465,487

Net Asset Value as of May 31, 2013:$179,578,850

Net Asset Value per Share as of May 31, 2013:$47.26

Worst Monthly Drawdown:(18.06)% October 2008

Worst Peak-to-Valley Drawdown:(26.80)% February 2008 – October 2008

Monthly Rate of Return | 2013(%) | 2012(%) | 2011(%) | 2010(%) | 2009(%) | 2008(%) | ||||||

January | (1.03) | 10.87 | (6.39) | (1.30) | 4.85 | 9.67 | ||||||

February | (5.22) | (1.74) | 5.58 | 3.15 | 1.48 | 5.14 | ||||||

March | 0.97 | (2.56) | 1.98 | (0.56) | (2.07) | (5.77) | ||||||

April | (7.94) | (0.52) | 8.05 | 5.89 | (3.64) | (5.92) | ||||||

May | (5.63) | (6.23) | (1.41) | 2.79 | 9.53 | 2.54 | ||||||

June | 2.52 | (2.26) | 2.45 | (5.40) | 4.17 | |||||||

July | 0.31 | 8.32 | (5.28) | 2.69 | (1.48) | |||||||

August | 4.54 | 12.25 | 5.56 | (0.26) | (9.22) | |||||||

September | 5.12 | (11.52) | 4.63 | 5.75 | 5.49 | |||||||

October | (3.18) | 6.32 | 3.60 | 3.01 | (18.06) | |||||||

November | (0.56) | 1.28 | 1.98 | 13.39 | 13.29 | |||||||

December | (2.23) | (10.62) | 2.45 | (7.27) | 6.66* | |||||||

Compound Rate of Return | (17.72)% (5 months) | 5.34% | 8.63% | 27.83% | 22.03% | 2.00% |

| * | The December 2008 return of 6.66% includes the $0.26 per Share distribution made to Shareholders of record as of December 17, 2008. Prior to the December 30, 2008 distribution, the pool’s return for December 2008 was 7.52%. |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

See accompanying Footnotes to Performance Information on page 36.

4

PERFORMANCE OF POWERSHARES DB SILVER FUND(TICKER: DBS), A SERIES OF

POWERSHARES DB MULTI-SECTOR COMMODITY TRUST

Name of Pool:PowerShares DB Silver Fund

Type of Pool:Public, Exchange-Listed Commodity Pool

Inception of Trading:January 2007

Aggregate Gross Capital Subscriptions as of May 31, 2013:$520,816,331

Net Asset Value as of May 31, 2013:$37,712,900

Net Asset Value per Share as of May 31, 2013:$37.71

Worst Monthly Drawdown:(28.30)% September 2011

Worst Peak-to-Valley Drawdown:(55.81)% April 2011 – May 2013

Monthly Rate of Return | 2013(%) | 2012(%) | 2011(%) | 2010(%) | 2009(%) | 2008(%) | ||||||

January | 3.81% | 19.37 | (9.59) | (4.06) | 11.40 | 12.83 | ||||||

February | (9.70) | 4.11 | 19.91 | 1.91 | 4.16 | 16.53 | ||||||

March | (0.33) | (6.33) | 12.35 | 6.15 | (0.89) | (12.95) | ||||||

April | (15.25) | (4.74) | 28.28 | 6.20 | (5.23) | (4.05) | ||||||

May | (8.34) | (10.74) | (21.29) | (1.11) | 26.80 | 1.67 | ||||||

June | (0.73) | (9.25) | 1.38 | (13.00) | 3.41 | |||||||

July | 1.05 | 15.23 | (3.92) | 2.46 | 1.68 | |||||||

August | 12.54 | 4.06 | 7.65 | 6.73 | (23.42) | |||||||

September | 10.10 | (28.30) | 12.36 | 11.63 | (10.23) | |||||||

October | (6.72) | 14.33 | 12.61 | (2.45) | (20.75) | |||||||

November | 2.85 | (4.61) | 14.77 | 13.71 | 4.72 | |||||||

December | (9.32) | (15.07) | 9.63 | (9.03) | 8.74* | |||||||

Compound Rate of Return | (27.41)% (5 months) | 7.03% | (11.13)% | 81.95% | 48.10% | (27.16)% |

| * | The December 2008 return of 8.74% includes the $0.22 per Share distribution made to Shareholders of record as of December 17, 2008. Prior to the December 30, 2008 distribution, the pool’s return for December 2008 was 9.92%. |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

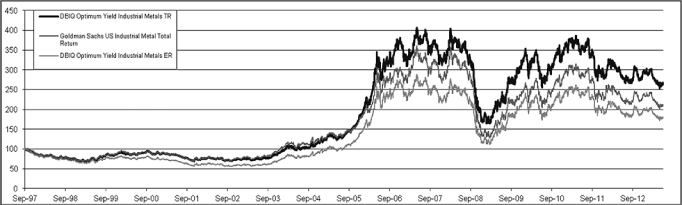

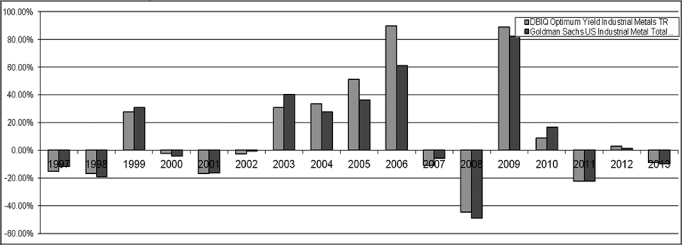

PERFORMANCE OF POWERSHARES DB BASE METALS FUND(TICKER: DBB), A SERIES OF

POWERSHARES DB MULTI-SECTOR COMMODITY TRUST

Name of Pool:PowerShares DB Base Metals Fund

Type of Pool:Public, Exchange-Listed Commodity Pool

Inception of Trading:January 2007

Aggregate Gross Capital Subscriptions as of May 31, 2013:$1,328,359,300

Net Asset Value as of May 31, 2013:$322,256,077

Net Asset Value per Share as of May 31, 2013:$17.33

Worst Monthly Drawdown:(27.29)% October 2008

Worst Peak-to-Valley Drawdown:(60.29)% July 2007 – January 2009*

Monthly Rate of Return | 2013(%) | 2012(%) | 2011(%) | 2010(%) | 2009(%) | 2008(%) | ||||||

January | 1.41 | 11.27 | 0.62 | (11.50) | (7.37) | 8.82 | ||||||

February | (4.64) | 1.97 | 3.18 | 4.12 | 3.71 | 12.16 | ||||||

March | (5.19) | (5.37) | (3.08) | 8.17 | 12.99 | (5.59) | ||||||

April | (3.65) | 0.30 | (0.57) | (4.12) | 6.48 | (0.87) | ||||||

May | 2.54 | (9.47) | (1.68) | (10.43) | 6.30 | (4.54) | ||||||

June | (0.16) | (0.17) | (5.71) | 3.07 | 3.92 | |||||||

July | (2.03) | 4.35 | 11.17 | 13.82 | (4.21) | |||||||

August | 0.17 | (6.73) | (0.86) | 7.55 | (6.74) | |||||||

September | 10.74 | (19.24) | 9.18 | (0.43) | (11.14) | |||||||

October | (9.19) | 7.81 | 3.32 | 5.97 | (27.29) | |||||||

November | 6.90 | (1.23) | (4.69) | 6.81 | (6.46) | |||||||

December | (0.47) | (6.54) | 13.14 | 7.98 | (11.29)** | |||||||

Compound Rate of Return | (9.41)% (5 months) | 2.19% | (23.18)% | 8.20% | 88.64% | (45.73)% |

| * | The Worst Peak-to-Valley Drawdown from July 2007 – January 2009 includes the effect of the $0.96 per Share distribution made to Shareholders of record as of December 19, 2007, and the effect of the $0.28 per Share distribution made to Shareholders of record as of December 17, 2008. Please see Footnote **. |

| ** | The December 2008 return of (11.29)% includes the $0.28 per Share distribution made to Shareholders of record as of December 17, 2008. Prior to the December 30, 2008 distribution, the pool’s return for December 2008 was (9.21)%. |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

See accompanying Footnotes to Performance Information on page 36.

5

Footnotes to Performance Information

1. “Aggregate Gross Capital Subscriptions” is the aggregate of all amounts ever contributed to the relevant pool, including investors who subsequently redeemed their investments.

2. “Net Asset Value” is the net asset value of the relevant pool as of May 31, 2013.

3. “Net Asset Value per Share” is the Net Asset Value of the relevant pool divided by the total number of Shares outstanding with respect to such pool as of May 31, 2013.

4. “Worst Monthly Drawdown” is the largest single month loss sustained since inception of trading. “Drawdown” as used in this section of the Prospectus means losses experienced by the relevant pool over the specified period and is calculated on a rate of return basis, i.e., dividing net performance by beginning equity. “Drawdown” is measured on the basis of monthly returns only, and does not reflect intra-month figures. “Month” is the month of the Worst Monthly Drawdown.

5. “Worst Peak-to-Valley Drawdown” is the largest percentage decline in the Net Asset Value per Share over the history of the relevant pool. This need not be a continuous decline, but can be a series of positive and negative returns where the negative returns are larger than the positive returns. “Worst Peak-to-Valley Drawdown” represents the greatest percentage decline from any month-end Net Asset Value per Share that occurs without such month-end Net Asset Value per Share being equaled or exceeded as of a subsequent month-end. For example, if the Net Asset Value per Share of a particular pool declined by $1 in each of January and February, increased by $1 in March and declined again by $2 in April, a “peak-to-valley drawdown” analysis conducted as of the end of April would consider that “drawdown” to be still continuing and to be $3 in amount, whereas if the Net Asset Value per Share had increased by $2 in March, the January-February drawdown would have ended as of the end of February at the $2 level.

6. “Compound Rate of Return” of the relevant pool is calculated by multiplying on a compound basis each of the monthly rates of return set forth in the respective charts above and not by adding or averaging such monthly rates of return. For periods of less than one year, the results are year-to-date.

7. The below table reflects both the name of the original Index that each Fund has tracked up to and including December 31, 2010, or Original Index, and the name of the Index that each Fund will track after December 31, 2010, or Renamed Index:

| Fund | Index

| |||||||

Original

| Renamed

| Dates

| ||||||

Inception

| Rename

| |||||||

| PowerShares DB Energy Fund | Deutsche Bank Liquid Commodity Index–Optimum Yield Energy Excess Return™ | DBIQ Optimum Yield Energy Index Excess Return™ | 7/06 | 10/10 | ||||

| PowerShares DB Oil Fund | Deutsche Bank Liquid Commodity Index–Optimum Yield Crude Oil Excess Return™ | DBIQ Optimum Yield Crude Oil Index Excess Return™ | 5/06 | 10/10 | ||||

| PowerShares DB Precious Metals Fund | Deutsche Bank Liquid Commodity Index–Optimum Yield Precious Metals Excess Return™ | DBIQ Optimum Yield Precious Metals Index Excess Return™ | 7/06 | 10/10 | ||||

| PowerShares DB Gold Fund | Deutsche Bank Liquid Commodity Index–Optimum Yield Gold Excess Return™ | DBIQ Optimum Yield Gold Index Excess Return™ | 5/06 | 10/10 | ||||

| PowerShares DB Silver Fund | Deutsche Bank Liquid Commodity Index–Optimum Yield Silver Excess Return™ | DBIQ Optimum Yield Silver Index Excess Return™ | 6/06 | 10/10 | ||||

| PowerShares DB Base Metals Fund | Deutsche Bank Liquid Commodity Index–Optimum Yield Industrial Metals Excess Return™ | DBIQ Optimum Yield Industrial Metals Index Excess Return™ | 7/06 | 10/10 | ||||

6

Each Fund’s Original Index is identical to the Renamed Index, except with respect to the following non-substantive changes: (i) name of Index and (ii) ticker symbol. The above Inception Dates remain identical. The Rename Date of October 2010 reflects the date on which each Original Index changed its name as reflected in the Renamed Index column above and each such change and became effective in January 3, 2011. Except as provided in the immediately preceding sentence, all prior underlying formulae, data (e.g., closing levels, measure of volatility, all other numerical statistics and measures) and all other characteristics (e.g., Base Date, Index Sponsor, Inception Date, rolling, etc.) with respect to each Original Index is identical to its corresponding Renamed Index.

DBLCI™ and Deutsche Bank Liquid Commodity Index™ are trade marks of the Index Sponsor and are the subject of Community Trade Mark Nos. 3055043 and 3054996. Trade Mark applications in the United States are pending with respect to both the Trust and aspects of each Index. The Fund and the Managing Owner have been licensed to use DBLCI™, Deutsche Bank Liquid Commodity Index™ and DBIQ™.

[Remainder of page left blank intentionally.]

7

III. Pages 47 through 95 of the Prospectus are hereby deleted and replaced, in their entirety, with the following: | ||||||||||||

Volatility of the Various Indexes | ||||||||||||

The following table1 reflects various measures of volatility2 of the history of each Index as calculated on an excess return basis:

| ||||||||||||

| Volatility Type | DBIQ-OY Energy ER™3 | DBIQ-OY CL ER™4 | DBIQ-OY Precious Metals ER™4 | DBIQ-OY GC ER™4 | DBIQ-OY SI ER™4 | DBIQ-OY Industrial Metals ER™5 | ||||||

Daily volatility over full history | 24.48% | 26.94% | 16.65% | 15.30% | 26.78% | 20.59% | ||||||

Average rolling 3 month daily volatility | 22.80% | 25.21% | 15.51% | 14.13% | 24.95% | 19.26% | ||||||

Monthly return volatility | 25.07% | 26.55% | 17.06% | 15.57% | 28.02% | 21.73% | ||||||

Average annual volatility | 23.66% | 25.91% | 15.58% | 14.39% | 24.52% | 18.61% | ||||||

The following table reflects the daily volatility on an annual basis of each Index: | ||||||||||||

| Year | DBIQ-OY Energy ER™3 | DBIQ-OY CL ER™4 | DBIQ-OY Precious Metals ER™4 | DBIQ-OY GC ER™4 | DBIQ-OY SI ER™4 | DBIQ-OY Industrial Metals ER™5 | ||||||

1988 | – | 26.56% | 11.17% | 11.41% | 10.73% | – | ||||||

1989 | – | 28.11% | 13.57% | 13.14% | 18.53% | – | ||||||

1990 | 44.82% | 40.56% | 16.71% | 17.67% | 19.41% | – | ||||||

1991 | 31.03% | 29.57% | 13.63% | 12.63% | 23.40% | – | ||||||

1992 | 14.60% | 16.66% | 8.90% | 8.32% | 15.67% | – | ||||||

1993 | 15.25% | 17.70% | 16.81% | 14.44% | 28.37% | – | ||||||

1994 | 18.05% | 20.13% | 12.08% | 9.60% | 23.28% | |||||||

1995 | 13.45% | 17.07% | 9.89% | 6.62% | 26.37% | – | ||||||

1996 | 23.86% | 31.02% | 7.74% | 6.17% | 17.62% | – | ||||||

1997 | 18.29% | 21.51% | 13.51% | 12.60% | 24.68% | 11.99% | ||||||

1998 | 23.80% | 27.97% | 14.60% | 12.84% | 29.22% | 14.38% | ||||||

1999 | 24.43% | 27.10% | 16.54% | 17.35% | 21.74% | 14.07% | ||||||

2000 | 28.21% | 32.19% | 14.01% | 15.02% | 14.41% | 11.78% | ||||||

2001 | 27.56% | 29.77% | 13.79% | 14.44% | 17.22% | 12.57% | ||||||

2002 | 24.63% | 25.52% | 13.51% | 13.44% | 17.43% | 13.12% | ||||||

2003 | 26.34% | 26.59% | 16.17% | 16.66% | 20.32% | 13.86% | ||||||

2004 | 28.71% | 30.80% | 19.48% | 16.25% | 35.48% | 20.85% | ||||||

2005 | 27.49% | 26.55% | 13.23% | 12.38% | 21.32% | 18.18% | ||||||

2006 | 22.01% | 22.01% | 25.97% | 22.81% | 41.21% | 32.26% | ||||||

2007 | 19.54% | 21.17% | 14.96% | 13.91% | 21.28% | 20.35% | ||||||

2008 | 36.57% | 41.43% | 27.33% | 25.53% | 43.01% | 28.81% | ||||||

2009 | 31.28% | 33.56% | 20.44% | 18.40% | 31.13% | 29.14% | ||||||

2010 | 18.84% | 20.63% | 15.22% | 13.28% | 26.40% | 23.76% | ||||||

2011 | 21.12% | 25.20% | 21.17% | 17.47% | 39.26% | 20.67% | ||||||

2012 | 16.54% | 19.36% | 15.35% | 13.46% | 25.27% | 15.48% | ||||||

20131 | 11.47% | 14.93% | 19.38% | 18.19% | 24.79% | 15.06% | ||||||

1As of May 31, 2013. Past Index levels are not necessarily indicative of future Index levels. 2Volatility, for these purposes, means the following: Daily Volatility: The relative rate at which the price of the Index moves up and down, found by calculating the annualized standard deviation of the daily change in price. Monthly Return Volatility: The relative rate at which the price of the Index moves up and down, found by calculating the annualized standard deviation of the monthly change in price. Average Annual Volatility: The average of yearly volatilities for a given sample period. The yearly volatility is the relative rate at which the price of the Index moves up and down, found by calculating the annualized standard deviation of the daily change in price for each business day in the given year. 3As of June 4, 1990. Past Index levels are not necessarily indicative of future Index levels. 4As of December 2, 1988. Past Index levels are not necessarily indicative of future Index levels. 5As of September 3, 1997. Past Index levels are not necessarily indicative of future Index levels. | ||||||||||||

8

ENERGY SECTOR DATA

RELATING TO

DBIQ OPTIMUM YIELD ENERGY INDEX EXCESS RETURN™

(DBIQ-OY ENERGY ER™)

9

CLOSING LEVELS TABLES

DBIQ OPTIMUM YIELD ENERGY INDEX EXCESS RETURN™

| CLOSING LEVEL | CHANGES | |||||||

| High1 | Low2 | Annual Index Changes3 | Index Changes Since Inception4 | |||||

19905 | 179.19 | 96.66 | 45.52% | 45.52% | ||||

1991 | 147.42 | 107.20 | -20.99% | 14.98% | ||||

1992 | 137.39 | 110.88 | 9.57% | 25.99% | ||||

1993 | 138.78 | 100.51 | -20.19% | 0.56% | ||||

1994 | 122.19 | 95.20 | 6.96% | 7.56% | ||||

1995 | 119.82 | 102.02 | 11.00% | 19.39% | ||||

1996 | 197.83 | 111.99 | 63.92% | 95.71% | ||||

1997 | 204.30 | 159.71 | -18.40% | 59.71% | ||||

1998 | 160.51 | 97.65 | -36.95% | 0.70% | ||||

1999 | 178.20 | 92.77 | 72.80% | 74.00% | ||||

2000 | 298.97 | 167.50 | 41.06% | 145.44% | ||||

2001 | 278.42 | 192.42 | -16.74% | 104.36% | ||||

2002 | 298.19 | 194.55 | 41.97% | 190.12% | ||||

2003 | 391.72 | 284.31 | 32.29% | 283.81% | ||||

2004 | 715.99 | 383.42 | 54.72% | 493.84% | ||||

2005 | 1037.13 | 582.46 | 55.14% | 821.29% | ||||

2006 | 1074.96 | 812.65 | -10.74% | 722.36% | ||||

2007 | 1112.80 | 709.23 | 34.88% | 1009.21% | ||||

2008 | 1772.65 | 559.38 | -40.45% | 560.50% | ||||

2009 | 862.18 | 518.29 | 25.76% | 730.64% | ||||

2010 | 884.28 | 704.89 | 4.00% | 763.88% | ||||

2011 | 1075.48 | 812.44 | 3.38% | 793.06% | ||||

2012 | 1013.67 | 764.32 | 2.01% | 811.04% | ||||

20136 | 972.19 | 872.41 | -2.28% | 790.30% | ||||

THE FUND WILL TRADE WITH A VIEW TO TRACKING THE

DBIQ OPTIMUM YIELD ENERGY INDEX EXCESS RETURN™ OVER TIME.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND

NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

DBIQ OPTIMUM YIELD ENERGY INDEX TOTAL RETURN™

| CLOSING LEVEL | CHANGES | |||||||

| High1 | Low2 | Annual Index Changes3 | Index Changes Since Inception4 | |||||

19905 | 183.60 | 97.33 | 51.88% | 51.88% | ||||

1991 | 154.30 | 112.85 | -16.53% | 26.77% | ||||

1992 | 155.82 | 122.35 | 13.48% | 43.86% | ||||

1993 | 160.01 | 118.31 | -17.71% | 18.38% | ||||

1994 | 147.06 | 112.95 | 11.67% | 32.19% | ||||

1995 | 155.68 | 127.46 | 17.38% | 55.17% | ||||

1996 | 270.11 | 146.19 | 72.56% | 167.77% | ||||

1997 | 279.83 | 227.35 | -14.08% | 130.07% | ||||

1998 | 232.17 | 147.51 | -33.81% | 52.29% | ||||

1999 | 282.30 | 141.11 | 81.15% | 175.87% | ||||

2000 | 496.29 | 265.84 | 49.64% | 312.83% | ||||

2001 | 476.58 | 334.41 | -13.77% | 255.97% | ||||

2002 | 527.96 | 339.16 | 44.32% | 413.72% | ||||

2003 | 700.53 | 505.36 | 33.65% | 586.61% | ||||

2004 | 1293.70 | 686.54 | 56.88% | 977.16% | ||||

2005 | 1917.92 | 1056.70 | 60.14% | 1625.00% | ||||

2006 | 2070.40 | 1595.93 | -6.33% | 1515.87% | ||||

2007 | 2285.06 | 1397.07 | 41.00% | 2178.45% | ||||

2008 | 3676.21 | 1165.04 | -39.62% | 1275.66% | ||||

2009 | 1798.15 | 1079.73 | 25.94% | 1632.53% | ||||

2010 | 1845.15 | 1471.50 | 4.14% | 1704.26% | ||||

2011 | 2247.01 | 1697.62 | 3.43% | 1766.13% | ||||

2012 | 2118.34 | 1597.67 | 2.10% | 1805.30% | ||||

20136 | 2033.34 | 1824.93 | -2.25% | 1762.46% | ||||

THE FUND WILL NOT TRADE WITH A VIEW TO TRACKING THE

DBIQ OPTIMUM YIELD ENERGY INDEX TOTAL RETURN™ OVER TIME.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

See accompanying Notes and Legends.

10

INDEX COMMODITIES WEIGHTS TABLES

DBIQ OPTIMUM YIELD ENERGY INDEX EXCESS RETURN™

| CL7 | HO7 | LCO7 | XB7 | NG7 | ||||||||||||||||

| High1 | Low2 | High | Low | High | Low | High | Low | High | Low | |||||||||||

19905 | 21.8% | 21.9% | 21.4% | 22.6% | 27.2% | 22.2% | 23.4% | 22.4% | 6.2% | 10.9% | ||||||||||

1991 | 21.8% | 22.5% | 22.8% | 22.7% | 23.8% | 20.0% | 21.5% | 21.8% | 10.1% | 13.1% | ||||||||||

1992 | 21.3% | 22.3% | 23.1% | 23.1% | 21.6% | 21.5% | 21.7% | 22.2% | 12.3% | 10.8% | ||||||||||

1993 | 21.6% | 22.1% | 21.5% | 22.8% | 21.1% | 22.7% | 21.4% | 22.0% | 14.4% | 10.4% | ||||||||||

1994 | 20.6% | 21.7% | 22.4% | 22.5% | 24.7% | 21.9% | 23.0% | 21.8% | 9.3% | 12.1% | ||||||||||

1995 | 22.9% | 24.3% | 21.2% | 22.1% | 23.1% | 23.0% | 23.1% | 21.9% | 9.7% | 8.8% | ||||||||||

1996 | 22.6% | 22.6% | 21.6% | 21.1% | 22.0% | 22.5% | 21.8% | 22.9% | 12.0% | 10.9% | ||||||||||

1997 | 23.2% | 22.5% | 21.6% | 22.6% | 22.2% | 21.6% | 21.4% | 23.1% | 11.4% | 10.1% | ||||||||||

1998 | 22.4% | 22.7% | 22.9% | 23.4% | 21.3% | 21.1% | 23.5% | 22.5% | 9.9% | 10.4% | ||||||||||

1999 | 22.7% | 23.1% | 21.9% | 22.0% | 23.0% | 22.2% | 23.3% | 22.3% | 9.1% | 10.4% | ||||||||||

2000 | 21.8% | 22.9% | 22.5% | 22.2% | 21.2% | 22.8% | 23.2% | 23.2% | 11.4% | 8.9% | ||||||||||

2001 | 23.5% | 22.9% | 22.0% | 22.2% | 21.4% | 21.8% | 22.5% | 22.7% | 10.5% | 10.4% | ||||||||||

2002 | 21.4% | 23.2% | 22.4% | 22.5% | 24.2% | 22.6% | 21.8% | 23.2% | 10.3% | 8.5% | ||||||||||

2003 | 22.7% | 21.2% | 22.6% | 21.5% | 22.3% | 23.2% | 22.3% | 21.8% | 10.2% | 12.3% | ||||||||||

2004 | 23.9% | 22.6% | 23.0% | 22.2% | 23.2% | 21.8% | 21.0% | 22.9% | 8.8% | 10.5% | ||||||||||

2005 | 20.6% | 22.3% | 23.5% | 22.7% | 21.8% | 22.3% | 24.9% | 23.0% | 9.1% | 9.7% | ||||||||||

2006 | 23.3% | 22.8% | 22.7% | 22.7% | 23.2% | 22.9% | 25.3% | 22.8% | 5.5% | 8.7% | ||||||||||

2007 | 22.6% | 22.1% | 22.8% | 23.0% | 22.5% | 22.1% | 23.0% | 22.6% | 9.1% | 10.2% | ||||||||||

2008 | 22.2% | 21.8% | 24.2% | 21.3% | 22.3% | 22.8% | 21.3% | 21.7% | 10.1% | 12.4% | ||||||||||

2009 | 24.5% | 22.7% | 19.4% | 20.7% | 23.9% | 22.8% | 27.5% | 24.3% | 4.7% | 9.6% | ||||||||||

2010 | 22.8% | 22.3% | 23.0% | 23.0% | 23.4% | 23.0% | 23.5% | 23.1% | 7.3% | 8.6% | ||||||||||

2011 | 21.9% | 19.0% | 23.3% | 24.0% | 23.3% | 24.0% | 23.3% | 24.6% | 8.3% | 8.4% | ||||||||||

2012 | 23.9% | 22.8% | 22.6% | 23.1% | 23.2% | 22.7% | 23.2% | 23.0% | 7.0% | 8.3% | ||||||||||

20136 | 22.8% | 22.4% | 22.3% | 21.7% | 23.2% | 22.0% | 23.2% | 22.6% | 8.4% | 11.3% | ||||||||||

THE FUND WILL TRADE WITH A VIEW TO TRACKING THE

DBIQ OPTIMUM YIELD ENERGY INDEX EXCESS RETURN™ OVER TIME.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE,

SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

DBIQ OPTIMUM YIELD ENERGY INDEX TOTAL RETURN™

| CL7 | HO7 | LCO7 | XB7 | NG7 | ||||||||||||||||

| High1 | Low2 | High | Low | High | Low | High | Low | High | Low | |||||||||||

19905 | 21.8% | 21.9% | 21.4% | 22.6% | 27.2% | 22.2% | 23.4% | 22.4% | 6.2% | 10.9% | ||||||||||

1991 | 21.8% | 22.5% | 22.8% | 22.7% | 23.8% | 20.0% | 21.5% | 21.8% | 10.1% | 13.1% | ||||||||||

1992 | 21.3% | 22.3% | 23.2% | 23.1% | 21.6% | 21.5% | 21.5% | 22.2% | 12.5% | 10.8% | ||||||||||

1993 | 21.6% | 22.1% | 21.5% | 22.8% | 21.1% | 22.7% | 21.4% | 22.0% | 14.4% | 10.4% | ||||||||||

1994 | 20.6% | 21.7% | 22.4% | 22.5% | 24.7% | 21.9% | 23.0% | 21.8% | 9.3% | 12.1% | ||||||||||

1995 | 22.9% | 22.9% | 21.2% | 22.4% | 23.1% | 23.1% | 23.1% | 23.3% | 9.7% | 8.4% | ||||||||||

1996 | 22.6% | 22.6% | 21.6% | 21.1% | 22.0% | 22.5% | 21.8% | 22.9% | 12.0% | 10.9% | ||||||||||

1997 | 23.2% | 22.0% | 21.6% | 22.8% | 22.2% | 21.1% | 21.4% | 23.7% | 11.4% | 10.3% | ||||||||||

1998 | 22.4% | 22.7% | 22.9% | 23.4% | 21.3% | 21.1% | 23.5% | 22.5% | 9.9% | 10.4% | ||||||||||

1999 | 22.9% | 23.1% | 22.3% | 22.0% | 22.8% | 22.2% | 23.3% | 22.3% | 8.6% | 10.4% | ||||||||||

2000 | 21.8% | 22.9% | 22.5% | 22.2% | 21.2% | 22.8% | 23.2% | 23.2% | 11.4% | 8.9% | ||||||||||

2001 | 23.5% | 22.9% | 22.0% | 22.2% | 21.4% | 21.8% | 22.5% | 22.7% | 10.5% | 10.4% | ||||||||||

2002 | 21.4% | 23.2% | 22.4% | 22.5% | 24.2% | 22.6% | 21.8% | 23.2% | 10.3% | 8.5% | ||||||||||

2003 | 22.7% | 21.2% | 22.6% | 21.5% | 22.3% | 23.2% | 22.3% | 21.8% | 10.2% | 12.3% | ||||||||||

2004 | 23.9% | 22.6% | 23.0% | 22.2% | 23.2% | 21.8% | 21.0% | 22.9% | 8.8% | 10.5% | ||||||||||

2005 | 20.6% | 22.3% | 23.5% | 22.7% | 21.8% | 22.3% | 24.9% | 23.0% | 9.1% | 9.7% | ||||||||||

2006 | 23.3% | 22.8% | 22.7% | 22.7% | 23.2% | 22.9% | 25.3% | 22.8% | 5.5% | 8.7% | ||||||||||

2007 | 22.6% | 22.1% | 22.8% | 23.0% | 22.5% | 22.1% | 23.0% | 22.6% | 9.1% | 10.2% | ||||||||||

2008 | 22.2% | 21.8% | 24.2% | 21.3% | 22.4% | 22.8% | 21.3% | 21.7% | 10.0% | 12.4% | ||||||||||

2009 | 24.5% | 22.7% | 19.4% | 20.7% | 23.9% | 22.8% | 27.5% | 24.3% | 4.7% | 9.6% | ||||||||||

2010 | 22.8% | 22.3% | 23.0% | 23.0% | 23.4% | 23.0% | 23.5% | 23.1% | 7.3% | 8.6% | ||||||||||

2011 | 21.9% | 19.0% | 23.3% | 24.0% | 23.3% | 24.0% | 23.3% | 24.6% | 8.3% | 8.4% | ||||||||||

2012 | 23.9% | 22.8% | 22.6% | 23.1% | 23.2% | 22.7% | 23.2% | 23.0% | 7.0% | 8.3% | ||||||||||

20136 | 22.8% | 22.4% | 22.3% | 21.7% | 23.2% | 22.0% | 23.2% | 22.6% | 8.4% | 11.3% | ||||||||||

THE FUND WILL NOT TRADE WITH A VIEW TO TRACKING THE DBIQ OPTIMUM YIELD ENERGY INDEX TOTAL RETURN™ OVER TIME.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND

NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

See accompanying Notes and Legends.

11

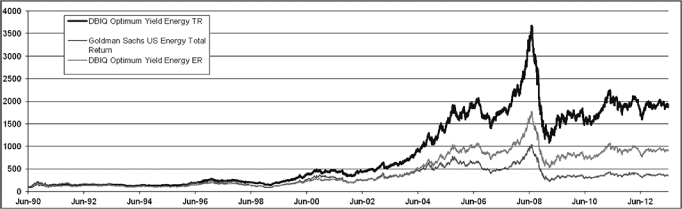

All statistics based on data from June 4, 1990 to May 31, 2013.

VARIOUS STATISTICAL MEASURES | DBIQ Optimum Yield Energy ER8 | DBIQ Optimum Yield Energy TR9 | Goldman Sachs US Energy Total Return10 | |||||||||

Annualized Changes to Index Level11 | 10.0% | 13.6% | 5.6% | |||||||||

Average rolling 3 month daily volatility12 | 22.8% | 22.8% | 27.9% | |||||||||

Sharpe Ratio13 | 0.44 | 0.47 | 0.10 | |||||||||

% of months with positive change14 | 55% | 56% | 54% | |||||||||

Average monthly positive change15 | 5.9% | 6.1% | 7.3% | |||||||||

Average monthly negative change16 | -5.0% | -4.8% | -6.5% | |||||||||

ANNUALIZED INDEX LEVELS17 | DBIQ Optimum Yield Energy ER8 | DBIQ Optimum Yield Energy TR9 | Goldman Sachs US Energy Total Return10 | |||||||||

1 year | 7.0% | 7.1% | 2.5% | |||||||||

3 year | 5.8% | 5.9% | 4.5% | |||||||||

5 year | -10.5% | -10.3% | -17.5% | |||||||||

7 year | -1.4% | -0.1% | -8.1% | |||||||||

10 year | 10.9% | 12.8% | 0.3% | |||||||||

15 year | 13.1% | 15.8% | 6.2% | |||||||||

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

WHILE THE FUND’S OBJECTIVE IS NOT TO GENERATE PROFIT THROUGH ACTIVE PORTFOLIO MANAGEMENT, BUT IS TO TRACK THE INDEX, BECAUSE THE INDEX WAS ESTABLISHED IN JULY 2006 (RENAMED OCTOBER 2010), CERTAIN INFORMATION RELATING TO INDEX CLOSING LEVELS MAY BE CONSIDERED TO BE “HYPOTHETICAL.” HYPOTHETICAL INFORMATION MAY HAVE CERTAIN INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW.

NO REPRESENTATION IS BEING MADE THAT THE INDEX WILL OR IS LIKELY TO ACHIEVE ANNUAL OR CUMULATIVE CLOSING LEVELS CONSISTENT WITH OR SIMILAR TO THOSE SET FORTH HEREIN. SIMILARLY, NO REPRESENTATION IS BEING MADE THAT THE FUND WILL GENERATE PROFITS OR LOSSES SIMILAR TO THE FUND’S PAST PERFORMANCE, WHEN AVAILABLE, OR THE HISTORICAL ANNUAL OR CUMULATIVE CHANGES IN THE INDEX CLOSING LEVELS. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY INVESTMENT METHODOLOGIES, WHETHER ACTIVE OR PASSIVE.

ONE OF THE LIMITATIONS OF HYPOTHETICAL INFORMATION IS THAT IT IS GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. TO THE EXTENT THAT INFORMATION PRESENTED HEREIN RELATES TO THE PERIOD JUNE 1990 THROUGH JUNE 2006, THE INDEX CLOSING LEVELS REFLECT THE APPLICATION OF THE INDEX’S METHODOLOGY, AND SELECTION OF INDEX COMMODITIES, IN HINDSIGHT.

NO HYPOTHETICAL RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THERE ARE NUMEROUS FACTORS, INCLUDING THOSE DESCRIBED UNDER “THE RISKS YOU FACE” HEREIN, RELATED TO THE COMMODITIES MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF THE FUND’S EFFORTS TO TRACK ITS INDEX OVER TIME WHICH CANNOT BE, AND HAVE NOT BEEN, ACCOUNTED FOR IN THE PREPARATION OF SUCH INDEX INFORMATION SET FORTH ON THE FOLLOWING PAGES, ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL PERFORMANCE RESULTS FOR THE FUND. FURTHERMORE, THE INDEX INFORMATION DOES NOT INVOLVE FINANCIAL RISK OR ACCOUNT FOR THE IMPACT OF FEES AND COSTS ASSOCIATED WITH THE FUND.

THE MANAGING OWNER COMMENCED OPERATIONS IN JANUARY 2006. AS MANAGING OWNER, THE MANAGING OWNER AND ITS TRADING PRINCIPALS HAVE BEEN MANAGING THE DAY-TO-DAY OPERATIONS FOR THE FUNDS AND RELATED PRODUCTS AND MANAGING FUTURES TRADING ACCOUNTS. BECAUSE THERE ARE LIMITED ACTUAL TRADING RESULTS TO COMPARE TO THE INDEX CLOSING LEVELS SET FORTH HEREIN, PROSPECTIVE INVESTORS SHOULD BE PARTICULARLY WARY OF PLACING UNDUE RELIANCE ON THE ANNUAL OR CUMULATIVE INDEX RESULTS.

See accompanying Notes and Legends.

12

COMPARISON OF DBIQ-OY ENERGY ER, DBIQ-OY ENERGY TR AND GOLDMAN SACHS US ENERGY TOTAL RETURN

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

Each of DBIQ-OY Energy ER, DBIQ-OY Energy TR and Goldman Sachs US Energy Total Return are indices and do not reflect actual trading.

DBIQ-OY Energy TR and Goldman Sachs US Energy Total Return are calculated on a total return basis and do not reflect any fees or expenses.

WHILE THE FUND’S OBJECTIVE IS NOT TO GENERATE PROFIT THROUGH ACTIVE PORTFOLIO MANAGEMENT, BUT IS TO TRACK THE INDEX, BECAUSE THE INDEX WAS ESTABLISHED IN JULY 2006 (RENAMED OCTOBER 2010), CERTAIN INFORMATION RELATING TO INDEX CLOSING LEVELS MAY BE CONSIDERED TO BE “HYPOTHETICAL.” HYPOTHETICAL INFORMATION MAY HAVE CERTAIN INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW.

NO REPRESENTATION IS BEING MADE THAT THE INDEX WILL OR IS LIKELY TO ACHIEVE ANNUAL OR CUMULATIVE CLOSING LEVELS CONSISTENT WITH OR SIMILAR TO THOSE SET FORTH HEREIN. SIMILARLY, NO REPRESENTATION IS BEING MADE THAT THE FUND WILL GENERATE PROFITS OR LOSSES SIMILAR TO THE FUND’S PAST PERFORMANCE, WHEN AVAILABLE, OR THE HISTORICAL ANNUAL OR CUMULATIVE CHANGES IN THE INDEX CLOSING LEVELS. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY INVESTMENT METHODOLOGIES, WHETHER ACTIVE OR PASSIVE.

ONE OF THE LIMITATIONS OF HYPOTHETICAL INFORMATION IS THAT IT IS GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. TO THE EXTENT THAT INFORMATION PRESENTED HEREIN RELATES TO THE PERIOD JUNE 1990 THROUGH JUNE 2006, THE INDEX CLOSING LEVELS REFLECT THE APPLICATION OF THE INDEX’S METHODOLOGY, AND SELECTION OF INDEX COMMODITIES, IN HINDSIGHT.

NO HYPOTHETICAL RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THERE ARE NUMEROUS FACTORS, INCLUDING THOSE DESCRIBED UNDER “THE RISKS YOU FACE” HEREIN, RELATED TO THE COMMODITIES MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF THE FUND’S EFFORTS TO TRACK ITS INDEX OVER TIME WHICH CANNOT BE, AND HAVE NOT BEEN, ACCOUNTED FOR IN THE PREPARATION OF SUCH INDEX INFORMATION SET FORTH ON THE FOLLOWING PAGES, ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL PERFORMANCE RESULTS FOR THE FUND. FURTHERMORE, THE INDEX INFORMATION DOES NOT INVOLVE FINANCIAL RISK OR ACCOUNT FOR THE IMPACT OF FEES AND COSTS ASSOCIATED WITH THE FUND.

THE MANAGING OWNER COMMENCED OPERATIONS IN JANUARY 2006. AS MANAGING OWNER, THE MANAGING OWNER AND ITS TRADING PRINCIPALS HAVE BEEN MANAGING THE DAY-TO-DAY OPERATIONS FOR THE FUNDS AND RELATED PRODUCTS AND MANAGING FUTURES TRADING ACCOUNTS. BECAUSE THERE ARE LIMITED ACTUAL TRADING RESULTS TO COMPARE TO THE INDEX CLOSING LEVELS SET FORTH HEREIN, PROSPECTIVE INVESTORS SHOULD BE PARTICULARLY WARY OF PLACING UNDUE RELIANCE ON THE ANNUAL OR CUMULATIVE INDEX RESULTS.

See accompanying Notes and Legends.

13

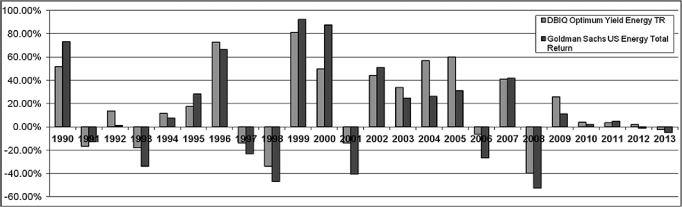

COMPARISON OF DBIQ-OY ENERGY TR AND GOLDMAN SACHS US ENERGY TOTAL RETURN

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

Each of DBIQ-OY Energy TR and Goldman Sachs US Energy Total Return are indices and do not reflect actual trading.

DBIQ-OY Energy TR and Goldman Sachs US Energy Total Return are calculated on a total return basis and do not reflect any fees or expenses.

WHILE THE FUND’S OBJECTIVE IS NOT TO GENERATE PROFIT THROUGH ACTIVE PORTFOLIO MANAGEMENT, BUT IS TO TRACK THE INDEX, BECAUSE THE INDEX WAS ESTABLISHED IN JULY 2006 (RENAMED OCTOBER 2010), CERTAIN INFORMATION RELATING TO INDEX CLOSING LEVELS MAY BE CONSIDERED TO BE “HYPOTHETICAL.” HYPOTHETICAL INFORMATION MAY HAVE CERTAIN INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW.

NO REPRESENTATION IS BEING MADE THAT THE INDEX WILL OR IS LIKELY TO ACHIEVE ANNUAL OR CUMULATIVE CLOSING LEVELS CONSISTENT WITH OR SIMILAR TO THOSE SET FORTH HEREIN. SIMILARLY, NO REPRESENTATION IS BEING MADE THAT THE FUND WILL GENERATE PROFITS OR LOSSES SIMILAR TO THE FUND’S PAST PERFORMANCE, WHEN AVAILABLE, OR THE HISTORICAL ANNUAL OR CUMULATIVE CHANGES IN THE INDEX CLOSING LEVELS. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY INVESTMENT METHODOLOGIES, WHETHER ACTIVE OR PASSIVE.

ONE OF THE LIMITATIONS OF HYPOTHETICAL INFORMATION IS THAT IT IS GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. TO THE EXTENT THAT INFORMATION PRESENTED HEREIN RELATES TO THE PERIOD JUNE 1990 THROUGH JUNE 2006, THE INDEX CLOSING LEVELS REFLECT THE APPLICATION OF THE INDEX’S METHODOLOGY, AND SELECTION OF INDEX COMMODITIES, IN HINDSIGHT.

NO HYPOTHETICAL RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THERE ARE NUMEROUS FACTORS, INCLUDING THOSE DESCRIBED UNDER “THE RISKS YOU FACE” HEREIN, RELATED TO THE COMMODITIES MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF THE FUND’S EFFORTS TO TRACK ITS INDEX OVER TIME WHICH CANNOT BE, AND HAVE NOT BEEN, ACCOUNTED FOR IN THE PREPARATION OF SUCH INDEX INFORMATION SET FORTH ON THE FOLLOWING PAGES, ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL PERFORMANCE RESULTS FOR THE FUND. FURTHERMORE, THE INDEX INFORMATION DOES NOT INVOLVE FINANCIAL RISK OR ACCOUNT FOR THE IMPACT OF FEES AND COSTS ASSOCIATED WITH THE FUND.

THE MANAGING OWNER COMMENCED OPERATIONS IN JANUARY 2006. AS MANAGING OWNER, THE MANAGING OWNER AND ITS TRADING PRINCIPALS HAVE BEEN MANAGING THE DAY-TO-DAY OPERATIONS FOR THE FUNDS AND RELATED PRODUCTS AND MANAGING FUTURES TRADING ACCOUNTS. BECAUSE THERE ARE LIMITED ACTUAL TRADING RESULTS TO COMPARE TO THE INDEX CLOSING LEVELS SET FORTH HEREIN, PROSPECTIVE INVESTORS SHOULD BE PARTICULARLY WARY OF PLACING UNDUE RELIANCE ON THE ANNUAL OR CUMULATIVE INDEX RESULTS.

See accompanying Notes and Legends.

14

NOTES AND LEGENDS:

| 1. | “High” reflects the highest closing level of the Index during the applicable year. |

| 2. | “Low” reflects the lowest closing level of the Index during the applicable year. |

| 3. | “Annual Index Changes” reflect the change to the Index level on an annual basis as of December 31 of each applicable year. |

| 4. | “Index Changes Since Inception” reflects the change of the Index level since inception on a compounded annual basis as of December 31 of each applicable year. |

| 5. | Closing levels as of inception on June 4, 1990. |

| 6. | Closing levels as of May 31, 2013. |

| 7. | The DBIQ Optimum Yield Energy Index Excess Return™ and DBIQ Optimum Yield Energy Index Total Return™ reflect the change in market value of the following underlying index commodities: CL (Light, Sweet Crude Oil), HO (Heating Oil), LCO (Brent Crude Oil), XB (RBOB Gasoline) and NG (Natural Gas) on an Optimum YieldTM basis. |

| 8. | “DBIQ Optimum Yield Energy ER™” is DBIQ Optimum Yield Energy Index Excess Return™. |

| 9. | “DBIQ Optimum Yield Energy TR™” is DBIQ Optimum Yield Energy Index Total Return™. |

| 10. | “Goldman Sachs US Energy Total Return” is Goldman Sachs US Energy Total Return. |

| 11. | “Annualized Changes to Index Level” reflect the change to the applicable index level on an annual basis as of December 31 of each applicable year. |

| 12. | “Average rolling 3 month daily volatility.” The daily volatility reflects the relative rate at which the price of the applicable index moves up and down, which is found by calculating the annualized standard deviation of the daily change in price. In turn, an average of this value is calculated on a 3 month rolling basis. |

| 13. | “Sharpe Ratio” compares the annualized rate of return minus the annualized risk-free rate of return to the annualized variability — often referred to as the “standard deviation” — of the monthly rates of return. A Sharpe Ratio of 1:1 or higher indicates that, according to the measures used in calculating the ratio, the rate of return achieved by a particular strategy has equaled or exceeded the risks assumed by such strategy. The risk-free rate of return that was used in these calculations was assumed to be 2.91%. |

| 14. | “% of months with positive change” during the period from inception to May 31, 2013. |

| 15. | “Average monthly positive change” during the period from inception to May 31, 2013. |

| 16. | “Average monthly negative change” during the period from inception to May 31, 2013. |

| 17. | “Annualized Index Levels” reflect the change to the level of the applicable index on an annual basis as of December 31 of each applicable time period (e.g., 1 year, 3, 5 or 7, 10 or 15 years, as applicable). |

WHILE THE FUND’S OBJECTIVE IS NOT TO GENERATE PROFIT THROUGH ACTIVE PORTFOLIO MANAGEMENT, BUT IS TO TRACK THE INDEX, BECAUSE THE INDEX WAS ESTABLISHED IN JULY 2006 (RENAMED OCTOBER 2010), CERTAIN INFORMATION RELATING TO INDEX CLOSING LEVELS MAY BE CONSIDERED TO BE “HYPOTHETICAL.” HYPOTHETICAL INFORMATION MAY HAVE CERTAIN INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW.

NO REPRESENTATION IS BEING MADE THAT THE INDEX WILL OR IS LIKELY TO ACHIEVE ANNUAL OR CUMULATIVE CLOSING LEVELS CONSISTENT WITH OR SIMILAR TO THOSE SET FORTH HEREIN. SIMILARLY, NO REPRESENTATION IS BEING MADE THAT THE FUND WILL GENERATE PROFITS OR LOSSES SIMILAR TO THE FUND’S PAST PERFORMANCE, WHEN AVAILABLE, OR THE HISTORICAL ANNUAL OR CUMULATIVE CHANGES IN THE INDEX CLOSING LEVELS. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY INVESTMENT METHODOLOGIES, WHETHER ACTIVE OR PASSIVE.

15

ONE OF THE LIMITATIONS OF HYPOTHETICAL INFORMATION IS THAT IT IS GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. TO THE EXTENT THAT INFORMATION PRESENTED HEREIN RELATES TO THE PERIOD JUNE 1990 THROUGH JUNE 2006, THE INDEX CLOSING LEVELS REFLECT THE APPLICATION OF THE INDEX’S METHODOLOGY, AND SELECTION OF INDEX COMMODITIES, IN HINDSIGHT.

NO HYPOTHETICAL RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THERE ARE NUMEROUS FACTORS, INCLUDING THOSE DESCRIBED UNDER “THE RISKS YOU FACE” HEREIN, RELATED TO THE COMMODITIES MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF THE FUND’S EFFORTS TO TRACK ITS INDEX OVER TIME WHICH CANNOT BE, AND HAVE NOT BEEN, ACCOUNTED FOR IN THE PREPARATION OF SUCH INDEX INFORMATION SET FORTH ON THE FOLLOWING PAGES, ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL PERFORMANCE RESULTS FOR THE FUND. FURTHERMORE, THE INDEX INFORMATION DOES NOT INVOLVE FINANCIAL RISK OR ACCOUNT FOR THE IMPACT OF FEES AND COSTS ASSOCIATED WITH THE FUND.

THE MANAGING OWNER COMMENCED OPERATIONS IN JANUARY 2006. AS MANAGING OWNER, THE MANAGING OWNER AND ITS TRADING PRINCIPALS HAVE BEEN MANAGING THE DAY-TO-DAY OPERATIONS FOR THE FUNDS AND RELATED PRODUCTS AND MANAGING FUTURES TRADING ACCOUNTS. BECAUSE THERE ARE LIMITED ACTUAL TRADING RESULTS TO COMPARE TO THE INDEX CLOSING LEVELS SET FORTH HEREIN, PROSPECTIVE INVESTORS SHOULD BE PARTICULARLY WARY OF PLACING UNDUE RELIANCE ON THE ANNUAL OR CUMULATIVE INDEX RESULTS.

ALTHOUGH THE INDEX SPONSOR WILL OBTAIN INFORMATION FOR INCLUSION IN OR FOR USE IN THE CALCULATION OF THE INDEX FROM SOURCE(S) WHICH THE INDEX SPONSOR CONSIDERS RELIABLE, THE INDEX SPONSOR WILL NOT INDEPENDENTLY VERIFY SUCH INFORMATION AND DOES NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF THE INDEX OR ANY DATA INCLUDED THEREIN. THE INDEX SPONSOR SHALL NOT BE LIABLE (WHETHER IN NEGLIGENCE OR OTHERWISE) TO ANY PERSON FOR ANY ERROR IN THE INDEX AND THE INDEX SPONSOR IS UNDER NO OBLIGATION TO ADVISE ANY PERSON OF ANY ERROR THEREIN.

UNLESS OTHERWISE SPECIFIED, NO TRANSACTION RELATING TO THE INDEX IS SPONSORED, ENDORSED, SOLD OR PROMOTED BY THE INDEX SPONSOR AND THE INDEX SPONSOR MAKES NO EXPRESS OR IMPLIED REPRESENTATIONS OR WARRANTIES AS TO (A) THE ADVISABILITY OF PURCHASING OR ASSUMING ANY RISK IN CONNECTION WITH ANY SUCH TRANSACTION (B) THE LEVELS AT WHICH THE INDEX STANDS AT ANY PARTICULAR TIME ON ANY PARTICULAR DATE (C) THE RESULTS TO BE OBTAINED BY THE ISSUER OF ANY SECURITY OR ANY COUNTERPARTY OR ANY SUCH ISSUER’S SECURITY HOLDERS OR CUSTOMERS OR ANY SUCH COUNTERPARTY’S CUSTOMERS OR COUNTERPARTIES OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE INDEX OR ANY DATA INCLUDED THEREIN IN CONNECTION WITH ANY LICENSED RIGHTS OR FOR ANY OTHER USE OR (D) ANY OTHER MATTER. THE INDEX SPONSOR MAKES NO EXPRESS OR IMPLIED REPRESENTATIONS OR WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE WITH RESPECT TO THE INDEX OR ANY DATA INCLUDED THEREIN.

WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL THE INDEX SPONSOR HAVE ANY LIABILITY (WHETHER IN NEGLIGENCE OR OTHERWISE) TO ANY PERSON FOR ANY DIRECT, INDIRECT, SPECIAL, PUNITIVE, CONSEQUENTIAL OR ANY OTHER DAMAGES (INCLUDING LOST PROFITS) EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

16

CRUDE OIL SECTOR DATA

RELATING TO

DBIQ OPTIMUM YIELD CRUDE OIL INDEX EXCESS RETURN™

(DBIQ-OY CL ER™)

17

CLOSING LEVELS TABLES

DBIQ OPTIMUM YIELD CRUDE OIL INDEX EXCESS RETURN™

| CLOSING LEVEL | CHANGES | |||||||

| High1 | Low2 | Annual Index Changes3 | Index Changes Since Inception4 | |||||

19885 | 112.02 | 97.53 | 12.02% | 12.02% | ||||

1989 | 192.01 | 110.98 | 71.41% | 92.01% | ||||

1990 | 294.82 | 160.13 | 24.79% | 139.61% | ||||

1991 | 238.71 | 175.06 | -15.63% | 102.15% | ||||

1992 | 224.82 | 189.93 | 0.68% | 103.52% | ||||

1993 | 217.01 | 152.46 | -24.79% | 53.08% | ||||

1994 | 173.31 | 142.13 | 5.59% | 61.64% | ||||

1995 | 202.32 | 157.90 | 25.16% | 102.32% | ||||

1996 | 414.35 | 185.87 | 104.80% | 314.35% | ||||

1997 | 425.66 | 303.27 | -26.65% | 203.93% | ||||

1998 | 302.95 | 171.33 | -40.94% | 79.51% | ||||

1999 | 346.30 | 165.23 | 85.26% | 232.56% | ||||

2000 | 551.67 | 325.69 | 31.04% | 335.79% | ||||

2001 | 532.29 | 390.80 | -3.95% | 318.57% | ||||

2002 | 608.00 | 399.11 | 41.61% | 492.76% | ||||

2003 | 847.48 | 574.29 | 39.55% | 727.21% | ||||

2004 | 1632.10 | 824.87 | 63.83% | 1255.23% | ||||

2005 | 2171.79 | 1319.88 | 42.95% | 1837.28% | ||||

2006 | 2389.01 | 1856.67 | -2.48% | 1789.17% | ||||

2007 | 2523.38 | 1571.31 | 33.12% | 2414.88% | ||||

2008 | 3955.92 | 1188.78 | -41.61% | 1368.33% | ||||

2009 | 2057.94 | 1147.41 | 36.08% | 1898.07% | ||||

2010 | 2169.64 | 1673.17 | 3.20% | 1962.00% | ||||

2011 | 2508.55 | 1642.90 | 1.97% | 2002.66% | ||||

2012 | 2343.44 | 1685.62 | -8.17% | 1830.84% | ||||

20136 | 2046.24 | 1796.69 | -1.85% | 1795.19% | ||||

THE FUND WILL TRADE WITH A VIEW TO TRACKING THE DBIQ OPTIMUM YIELD CRUDE OIL INDEX EXCESS RETURN™ OVER TIME.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE,

SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

DBIQ OPTIMUM YIELD CRUDE OIL INDEX TOTAL RETURN™

| CLOSING LEVEL | CHANGES | |||||||

| High1 | Low2 | Annual Index Changes3 | Index Changes Since Inception4 | |||||

19885 | 112.73 | 97.60 | 12.73% | 12.73% | ||||

1989 | 209.87 | 111.81 | 86.17% | 109.87% | ||||

1990 | 341.64 | 182.36 | 34.76% | 182.82% | ||||

1991 | 295.24 | 208.42 | -10.88% | 152.05% | ||||

1992 | 288.22 | 237.02 | 4.27% | 162.81% | ||||

1993 | 281.69 | 202.92 | -22.45% | 103.80% | ||||

1994 | 235.88 | 190.71 | 10.24% | 124.67% | ||||

1995 | 297.36 | 219.85 | 32.36% | 197.36% | ||||

1996 | 641.10 | 274.37 | 115.60% | 541.10% | ||||

1997 | 659.34 | 493.93 | -22.77% | 395.14% | ||||

1998 | 495.55 | 292.68 | -37.99% | 207.03% | ||||

1999 | 620.64 | 284.23 | 94.21% | 496.27% | ||||

2000 | 1035.63 | 584.55 | 39.02% | 728.92% | ||||

2001 | 1030.69 | 768.08 | -0.53% | 724.54% | ||||

2002 | 1217.32 | 786.82 | 43.96% | 1087.00% | ||||

2003 | 1713.97 | 1154.40 | 40.99% | 1573.50% | ||||

2004 | 3334.95 | 1670.29 | 66.12% | 2679.95% | ||||

2005 | 4541.88 | 2707.94 | 47.56% | 4002.06% | ||||

2006 | 5203.49 | 3969.14 | 2.34% | 4097.88% | ||||

2007 | 5859.72 | 3499.36 | 39.16% | 5741.98% | ||||

2008 | 9281.23 | 2799.96 | -40.80% | 3358.41% | ||||

2009 | 4853.73 | 2703.20 | 36.28% | 4612.97% | ||||

2010 | 5119.70 | 3948.54 | 3.34% | 4770.26% | ||||

2011 | 5927.09 | 3882.20 | 2.02% | 4868.75% | ||||

2012 | 5538.20 | 3984.72 | -8.09% | 4466.53% | ||||

20136 | 4839.85 | 4250.26 | -1.82% | 4383.52% | ||||

THE FUND WILL NOT TRADE WITH A VIEW TO TRACKING THE DBIQ OPTIMUM YIELD CRUDE OIL INDEX TOTAL RETURN™ OVER TIME.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

See accompanying Notes and Legends.

18

INDEX COMMODITIES WEIGHTS TABLES

DBIQ OPTIMUM YIELD CRUDE OIL INDEX EXCESS RETURN™

| CL7 | ||||

| High1 | Low2 | |||

19885 | 100% | 100% | ||

1989 | 100% | 100% | ||

1990 | 100% | 100% | ||

1991 | 100% | 100% | ||

1992 | 100% | 100% | ||

1993 | 100% | 100% | ||

1994 | 100% | 100% | ||

1995 | 100% | 100% | ||

1996 | 100% | 100% | ||

1997 | 100% | 100% | ||

1998 | 100% | 100% | ||

1999 | 100% | 100% | ||

2000 | 100% | 100% | ||

2001 | 100% | 100% | ||

2002 | 100% | 100% | ||

2003 | 100% | 100% | ||

2004 | 100% | 100% | ||

2005 | 100% | 100% | ||

2006 | 100% | 100% | ||

2007 | 100% | 100% | ||

2008 | 100% | 100% | ||

2009 | 100% | 100% | ||

2010 | 100% | 100% | ||

2011 | 100% | 100% | ||

2012 | 100% | 100% | ||

20136 | 100% | 100% | ||

THE FUND WILL TRADE WITH A VIEW TO TRACKING THE

DBIQ OPTIMUM YIELD CRUDE OIL INDEX EXCESS RETURN™ OVER TIME.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND

NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

DBIQ OPTIMUM YIELD CRUDE OIL INDEX TOTAL RETURN™

| CL7 | ||||

| High1 | Low2 | |||

19885 | 100% | 100% | ||

1989 | 100% | 100% | ||

1990 | 100% | 100% | ||

1991 | 100% | 100% | ||

1992 | 100% | 100% | ||

1993 | 100% | 100% | ||

1994 | 100% | 100% | ||

1995 | 100% | 100% | ||

1996 | 100% | 100% | ||

1997 | 100% | 100% | ||

1998 | 100% | 100% | ||

1999 | 100% | 100% | ||

2000 | 100% | 100% | ||

2001 | 100% | 100% | ||

2002 | 100% | 100% | ||

2003 | 100% | 100% | ||

2004 | 100% | 100% | ||

2005 | 100% | 100% | ||

2006 | 100% | 100% | ||

2007 | 100% | 100% | ||

2008 | 100% | 100% | ||

2009 | 100% | 100% | ||

2010 | 100% | 100% | ||

2011 | 100% | 100% | ||

2012 | 100% | 100% | ||

20136 | 100% | 100% | ||

THE FUND WILL NOT TRADE WITH A VIEW TO TRACKING THE

DBIQ OPTIMUM YIELD CRUDE OIL INDEX TOTAL RETURN™ OVER TIME.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND

NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

See accompanying Notes and Legends.

19

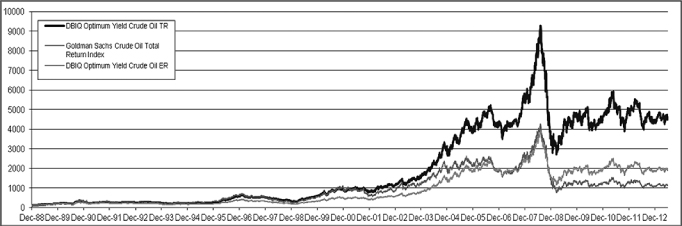

All statistics based on data from December 2, 1988 to May 31, 2013.

VARIOUS STATISTICAL MEASURES | DBIQ Optimum Yield Crude Oil ER8 | DBIQ Optimum Yield Crude Oil TR9 | Goldman Sachs Crude Oil Total Return Index10 | |||||||||||

Annualized Changes to Index Level11 | 12.8% | 16.8% | 10.3% | |||||||||||

Average rolling 3 month daily volatility12 | 25.2% | 25.2% | 30.7% | |||||||||||

Sharpe Ratio13 | 0.51 | 0.54 | 0.23 | |||||||||||

% of months with positive change14 | 56% | 57% | 56% | |||||||||||

Average monthly positive change15 | 6.4% | 6.7% | 7.9% | |||||||||||

Average monthly negative change16 | -5.3% | -5.2% | -7.0% | |||||||||||

ANNUALIZED INDEX LEVELS17 | DBIQ Optimum Yield Crude Oil ER8 | DBIQ Optimum Yield Crude Oil TR9 | Goldman Sachs Crude Oil Total Return Index10 | |||||||||||

1 year | 3.5% | 3.6% | 1.0% | |||||||||||

3 year | 1.7% | 1.8% | -0.3% | |||||||||||

5 year | -11.1% | -10.9% | -21.4% | |||||||||||

7 year | -2.1% | -0.8% | -10.4% | |||||||||||

10 year | 11.4% | 13.3% | 0.3% | |||||||||||

15 year | 14.4% | 17.1% | 7.5% | |||||||||||

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

WHILE THE FUND’S OBJECTIVE IS NOT TO GENERATE PROFIT THROUGH ACTIVE PORTFOLIO MANAGEMENT, BUT IS TO TRACK THE INDEX, BECAUSE THE INDEX WAS ESTABLISHED IN MAY 2006 (RENAMED OCTOBER 2010), CERTAIN INFORMATION RELATING TO INDEX CLOSING LEVELS MAY BE CONSIDERED TO BE “HYPOTHETICAL.” HYPOTHETICAL INFORMATION MAY HAVE CERTAIN INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW.

NO REPRESENTATION IS BEING MADE THAT THE INDEX WILL OR IS LIKELY TO ACHIEVE ANNUAL OR CUMULATIVE CLOSING LEVELS CONSISTENT WITH OR SIMILAR TO THOSE SET FORTH HEREIN. SIMILARLY, NO REPRESENTATION IS BEING MADE THAT THE FUND WILL GENERATE PROFITS OR LOSSES SIMILAR TO THE FUND’S PAST PERFORMANCE, WHEN AVAILABLE, OR THE HISTORICAL ANNUAL OR CUMULATIVE CHANGES IN THE INDEX CLOSING LEVELS. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY INVESTMENT METHODOLOGIES, WHETHER ACTIVE OR PASSIVE.

ONE OF THE LIMITATIONS OF HYPOTHETICAL INFORMATION IS THAT IT IS GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. TO THE EXTENT THAT INFORMATION PRESENTED HEREIN RELATES TO THE PERIOD DECEMBER 1988 THROUGH APRIL 2006, THE INDEX CLOSING LEVELS REFLECT THE APPLICATION OF THE INDEX’S METHODOLOGY, AND SELECTION OF INDEX COMMODITIES, IN HINDSIGHT.

NO HYPOTHETICAL RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THERE ARE NUMEROUS FACTORS, INCLUDING THOSE DESCRIBED UNDER “THE RISKS YOU FACE” HEREIN, RELATED TO THE COMMODITIES MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF THE FUND’S EFFORTS TO TRACK ITS INDEX OVER TIME WHICH CANNOT BE, AND HAVE NOT BEEN, ACCOUNTED FOR IN THE PREPARATION OF SUCH INDEX INFORMATION SET FORTH ON THE FOLLOWING PAGES, ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL PERFORMANCE RESULTS FOR THE FUND. FURTHERMORE, THE INDEX INFORMATION DOES NOT INVOLVE FINANCIAL RISK OR ACCOUNT FOR THE IMPACT OF FEES AND COSTS ASSOCIATED WITH THE FUND.

THE MANAGING OWNER COMMENCED OPERATIONS IN JANUARY 2006. AS MANAGING OWNER, THE MANAGING OWNER AND ITS TRADING PRINCIPALS HAVE BEEN MANAGING THE DAY-TO-DAY OPERATIONS FOR THE FUNDS AND RELATED PRODUCTS AND MANAGING FUTURES TRADING ACCOUNTS. BECAUSE THERE ARE LIMITED ACTUAL TRADING RESULTS TO COMPARE TO THE INDEX CLOSING LEVELS SET FORTH HEREIN, PROSPECTIVE INVESTORS SHOULD BE PARTICULARLY WARY OF PLACING UNDUE RELIANCE ON THE ANNUAL OR CUMULATIVE INDEX RESULTS.

See accompanying Notes and Legends.

20

| COMPARISON OF DBIQ-OY CL ER, DBIQ-OY CL TR AND GOLDMAN SACHS CRUDE OIL TOTAL RETURN INDEX |

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

Each of DBIQ-OY CL ER, DBIQ-OY CL TR and Goldman Sachs Crude Oil Total Return Index are indices and do not reflect actual trading. DBIQ-OY CL TR and Goldman Sachs Crude Oil Total Return Index are calculated on a total return basis and do not reflect any fees or expenses.

WHILE THE FUND’S OBJECTIVE IS NOT TO GENERATE PROFIT THROUGH ACTIVE PORTFOLIO MANAGEMENT, BUT IS TO TRACK THE INDEX, BECAUSE THE INDEX WAS ESTABLISHED IN MAY 2006 (RENAMED OCTOBER 2010), CERTAIN INFORMATION RELATING TO INDEX CLOSING LEVELS MAY BE CONSIDERED TO BE “HYPOTHETICAL.” HYPOTHETICAL INFORMATION MAY HAVE CERTAIN INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW.

NO REPRESENTATION IS BEING MADE THAT THE INDEX WILL OR IS LIKELY TO ACHIEVE ANNUAL OR CUMULATIVE CLOSING LEVELS CONSISTENT WITH OR SIMILAR TO THOSE SET FORTH HEREIN. SIMILARLY, NO REPRESENTATION IS BEING MADE THAT THE FUND WILL GENERATE PROFITS OR LOSSES SIMILAR TO THE FUND’S PAST PERFORMANCE, WHEN AVAILABLE, OR THE HISTORICAL ANNUAL OR CUMULATIVE CHANGES IN THE INDEX CLOSING LEVELS. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY INVESTMENT METHODOLOGIES, WHETHER ACTIVE OR PASSIVE.

ONE OF THE LIMITATIONS OF HYPOTHETICAL INFORMATION IS THAT IT IS GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. TO THE EXTENT THAT INFORMATION PRESENTED HEREIN RELATES TO THE PERIOD DECEMBER 1988 THROUGH APRIL 2006, THE INDEX CLOSING LEVELS REFLECT THE APPLICATION OF THE INDEX’S METHODOLOGY, AND SELECTION OF INDEX COMMODITIES, IN HINDSIGHT.

NO HYPOTHETICAL RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THERE ARE NUMEROUS FACTORS, INCLUDING THOSE DESCRIBED UNDER “THE RISKS YOU FACE” HEREIN, RELATED TO THE COMMODITIES MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF THE FUND’S EFFORTS TO TRACK ITS INDEX OVER TIME WHICH CANNOT BE, AND HAVE NOT BEEN, ACCOUNTED FOR IN THE PREPARATION OF SUCH INDEX INFORMATION SET FORTH ON THE FOLLOWING PAGES, ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL PERFORMANCE RESULTS FOR THE FUND. FURTHERMORE, THE INDEX INFORMATION DOES NOT INVOLVE FINANCIAL RISK OR ACCOUNT FOR THE IMPACT OF FEES AND COSTS ASSOCIATED WITH THE FUND.

THE MANAGING OWNER COMMENCED OPERATIONS IN JANUARY 2006. AS MANAGING OWNER, THE MANAGING OWNER AND ITS TRADING PRINCIPALS HAVE BEEN MANAGING THE DAY-TO-DAY OPERATIONS FOR THE FUNDS AND RELATED PRODUCTS AND MANAGING FUTURES TRADING ACCOUNTS. BECAUSE THERE ARE LIMITED ACTUAL TRADING RESULTS TO COMPARE TO THE INDEX CLOSING LEVELS SET FORTH HEREIN, PROSPECTIVE INVESTORS SHOULD BE PARTICULARLY WARY OF PLACING UNDUE RELIANCE ON THE ANNUAL OR CUMULATIVE INDEX RESULTS.

See accompanying Notes and Legends.

21

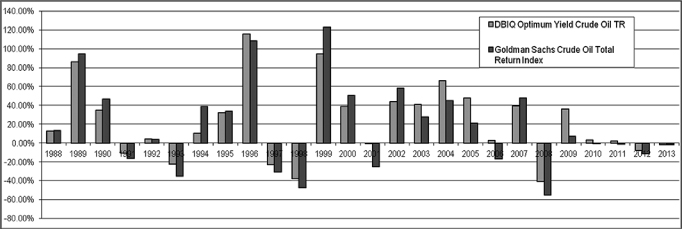

| COMPARISON OF DBIQ-OY CL TR AND GOLDMAN SACHS CRUDE OIL TOTAL RETURN INDEX |

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

Each of DBIQ-OY CL TR and Goldman Sachs Crude Oil Total Return Index are indices and do not reflect actual trading. DBIQ-OY CL TR and Goldman Sachs Crude Oil Total Return Index are calculated on a total return basis and do not reflect any fees or expenses.

WHILE THE FUND’S OBJECTIVE IS NOT TO GENERATE PROFIT THROUGH ACTIVE PORTFOLIO MANAGEMENT, BUT IS TO TRACK THE INDEX, BECAUSE THE INDEX WAS ESTABLISHED IN MAY 2006 (RENAMED OCTOBER 2010), CERTAIN INFORMATION RELATING TO INDEX CLOSING LEVELS MAY BE CONSIDERED TO BE “HYPOTHETICAL.” HYPOTHETICAL INFORMATION MAY HAVE CERTAIN INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW.

NO REPRESENTATION IS BEING MADE THAT THE INDEX WILL OR IS LIKELY TO ACHIEVE ANNUAL OR CUMULATIVE CLOSING LEVELS CONSISTENT WITH OR SIMILAR TO THOSE SET FORTH HEREIN. SIMILARLY, NO REPRESENTATION IS BEING MADE THAT THE FUND WILL GENERATE PROFITS OR LOSSES SIMILAR TO THE FUND’S PAST PERFORMANCE, WHEN AVAILABLE, OR THE HISTORICAL ANNUAL OR CUMULATIVE CHANGES IN THE INDEX CLOSING LEVELS. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY INVESTMENT METHODOLOGIES, WHETHER ACTIVE OR PASSIVE.

ONE OF THE LIMITATIONS OF HYPOTHETICAL INFORMATION IS THAT IT IS GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. TO THE EXTENT THAT INFORMATION PRESENTED HEREIN RELATES TO THE PERIOD DECEMBER 1988 THROUGH APRIL 2006, THE INDEX CLOSING LEVELS REFLECT THE APPLICATION OF THE INDEX’S METHODOLOGY, AND SELECTION OF INDEX COMMODITIES, IN HINDSIGHT.

NO HYPOTHETICAL RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THERE ARE NUMEROUS FACTORS, INCLUDING THOSE DESCRIBED UNDER “THE RISKS YOU FACE” HEREIN, RELATED TO THE COMMODITIES MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF THE FUND’S EFFORTS TO TRACK ITS INDEX OVER TIME WHICH CANNOT BE, AND HAVE NOT BEEN, ACCOUNTED FOR IN THE PREPARATION OF SUCH INDEX INFORMATION SET FORTH ON THE FOLLOWING PAGES, ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL PERFORMANCE RESULTS FOR THE FUND. FURTHERMORE, THE INDEX INFORMATION DOES NOT INVOLVE FINANCIAL RISK OR ACCOUNT FOR THE IMPACT OF FEES AND COSTS ASSOCIATED WITH THE FUND.

THE MANAGING OWNER COMMENCED OPERATIONS IN JANUARY 2006. AS MANAGING OWNER, THE MANAGING OWNER AND ITS TRADING PRINCIPALS HAVE BEEN MANAGING THE DAY-TO-DAY OPERATIONS FOR THE FUNDS AND RELATED PRODUCTS AND MANAGING FUTURES TRADING ACCOUNTS. BECAUSE THERE ARE LIMITED ACTUAL TRADING RESULTS TO COMPARE TO THE INDEX CLOSING LEVELS SET FORTH HEREIN, PROSPECTIVE INVESTORS SHOULD BE PARTICULARLY WARY OF PLACING UNDUE RELIANCE ON THE ANNUAL OR CUMULATIVE INDEX RESULTS.

See accompanying Notes and Legends.

22

| NOTES AND LEGENDS: |

| 1. | “High” reflects the highest closing level of the Index during the applicable year. |

| 2. | “Low” reflects the lowest closing level of the Index during the applicable year. |

| 3. | “Annual Index Changes” reflect the change to the Index level on an annual basis as of December 31 of each applicable year. |

| 4. | “Index Changes Since Inception” reflects the change of the Index level since inception on a compounded annual basis as of December 31 of each applicable year. |

| 5. | Closing levels as of inception on December 2, 1988. |

| 6. | Closing levels as of May 31, 2013. |

| 7. | The DBIQ Optimum Yield Crude Oil Index Excess Return™ and DBIQ Optimum Yield Crude Oil Index Total Return™ reflect the change in market value of CL (Light, Sweet Crude Oil) on an Optimum YieldTM basis. |

| 8. | “DBIQ-OY CL ER™” is DBIQ Optimum Yield Crude Oil Index Excess Return™. |

| 9. | “DBIQ-OY CL TR™” is DBIQ Optimum Yield Crude Oil Index Total Return™. |

| 10. | “Goldman Sachs Crude Oil Total Return Index” is Goldman Sachs Crude Oil Total Return Index. |

| 11. | “Annualized Changes to Index Level” reflect the change to the applicable index level on an annual basis as of December 31 of each applicable year. |

| 12. | “Average rolling 3 month daily volatility.” The daily volatility reflects the relative rate at which the price of the applicable index moves up and down, which is found by calculating the annualized standard deviation of the daily change in price. In turn, an average of this value is calculated on a 3 month rolling basis. |

| 13. | “Sharpe Ratio” compares the annualized rate of return minus the annualized risk-free rate of return to the annualized variability — often referred to as the “standard deviation” — of the monthly rates of return. A Sharpe Ratio of 1:1 or higher indicates that, according to the measures used in calculating the ratio, the rate of return achieved by a particular strategy has equaled or exceeded the risks assumed by such strategy. The risk-free rate of return that was used in these calculations was assumed to be 3.19%. |

| 14. | “% of months with positive change” during the period from inception to May 31, 2013. |

| 15. | “Average monthly positive change” during the period from inception to May 31, 2013. |

| 16. | “Average monthly negative change” during the period from inception to May 31, 2013. |

| 17. | “Annualized Index Levels” reflect the change to the level of the applicable index on an annual basis as of December 31 of each applicable time period (e.g., 1 year, 3, 5 or 7, 10 or 15 years, as applicable). |

WHILE THE FUND’S OBJECTIVE IS NOT TO GENERATE PROFIT THROUGH ACTIVE PORTFOLIO MANAGEMENT, BUT IS TO TRACK THE INDEX, BECAUSE THE INDEX WAS ESTABLISHED IN MAY 2006 (RENAMED OCTOBER 2010), CERTAIN INFORMATION RELATING TO INDEX CLOSING LEVELS MAY BE CONSIDERED TO BE “HYPOTHETICAL.” HYPOTHETICAL INFORMATION MAY HAVE CERTAIN INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW.

NO REPRESENTATION IS BEING MADE THAT THE INDEX WILL OR IS LIKELY TO ACHIEVE ANNUAL OR CUMULATIVE CLOSING LEVELS CONSISTENT WITH OR SIMILAR TO THOSE SET FORTH HEREIN. SIMILARLY, NO REPRESENTATION IS BEING MADE THAT THE FUND WILL GENERATE PROFITS OR LOSSES SIMILAR TO THE FUND’S PAST PERFORMANCE, WHEN AVAILABLE, OR THE HISTORICAL ANNUAL OR CUMULATIVE CHANGES IN THE INDEX CLOSING LEVELS. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY INVESTMENT METHODOLOGIES, WHETHER ACTIVE OR PASSIVE.

ONE OF THE LIMITATIONS OF HYPOTHETICAL INFORMATION IS THAT IT IS GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. TO THE EXTENT THAT INFORMATION PRESENTED HEREIN RELATES TO THE PERIOD DECEMBER 1988 THROUGH APRIL 2006, THE INDEX CLOSING LEVELS REFLECT THE APPLICATION OF THE INDEX’S METHODOLOGY, AND SELECTION OF INDEX COMMODITIES, IN HINDSIGHT.

23

NO HYPOTHETICAL RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THERE ARE NUMEROUS FACTORS, INCLUDING THOSE DESCRIBED UNDER “THE RISKS YOU FACE” HEREIN, RELATED TO THE COMMODITIES MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF THE FUND’S EFFORTS TO TRACK ITS INDEX OVER TIME WHICH CANNOT BE, AND HAVE NOT BEEN, ACCOUNTED FOR IN THE PREPARATION OF SUCH INDEX INFORMATION SET FORTH ON THE FOLLOWING PAGES, ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL PERFORMANCE RESULTS FOR THE FUND. FURTHERMORE, THE INDEX INFORMATION DOES NOT INVOLVE FINANCIAL RISK OR ACCOUNT FOR THE IMPACT OF FEES AND COSTS ASSOCIATED WITH THE FUND.

THE MANAGING OWNER COMMENCED OPERATIONS IN JANUARY 2006. AS MANAGING OWNER, THE MANAGING OWNER AND ITS TRADING PRINCIPALS HAVE BEEN MANAGING THE DAY-TO-DAY OPERATIONS FOR THE FUNDS AND RELATED PRODUCTS AND MANAGING FUTURES TRADING ACCOUNTS. BECAUSE THERE ARE LIMITED ACTUAL TRADING RESULTS TO COMPARE TO THE INDEX CLOSING LEVELS SET FORTH HEREIN, PROSPECTIVE INVESTORS SHOULD BE PARTICULARLY WARY OF PLACING UNDUE RELIANCE ON THE ANNUAL OR CUMULATIVE INDEX RESULTS.

ALTHOUGH THE INDEX SPONSOR WILL OBTAIN INFORMATION FOR INCLUSION IN OR FOR USE IN THE CALCULATION OF THE INDEX FROM SOURCE(S) WHICH THE INDEX SPONSOR CONSIDERS RELIABLE, THE INDEX SPONSOR WILL NOT INDEPENDENTLY VERIFY SUCH INFORMATION AND DOES NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF THE INDEX OR ANY DATA INCLUDED THEREIN. THE INDEX SPONSOR SHALL NOT BE LIABLE (WHETHER IN NEGLIGENCE OR OTHERWISE) TO ANY PERSON FOR ANY ERROR IN THE INDEX AND THE INDEX SPONSOR IS UNDER NO OBLIGATION TO ADVISE ANY PERSON OF ANY ERROR THEREIN.

UNLESS OTHERWISE SPECIFIED, NO TRANSACTION RELATING TO THE INDEX IS SPONSORED, ENDORSED, SOLD OR PROMOTED BY THE INDEX SPONSOR AND THE INDEX SPONSOR MAKES NO EXPRESS OR IMPLIED REPRESENTATIONS OR WARRANTIES AS TO (A) THE ADVISABILITY OF PURCHASING OR ASSUMING ANY RISK IN CONNECTION WITH ANY SUCH TRANSACTION (B) THE LEVELS AT WHICH THE INDEX STANDS AT ANY PARTICULAR TIME ON ANY PARTICULAR DATE (C) THE RESULTS TO BE OBTAINED BY THE ISSUER OF ANY SECURITY OR ANY COUNTERPARTY OR ANY SUCH ISSUER’S SECURITY HOLDERS OR CUSTOMERS OR ANY SUCH COUNTERPARTY’S CUSTOMERS OR COUNTERPARTIES OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE INDEX OR ANY DATA INCLUDED THEREIN IN CONNECTION WITH ANY LICENSED RIGHTS OR FOR ANY OTHER USE OR (D) ANY OTHER MATTER. THE INDEX SPONSOR MAKES NO EXPRESS OR IMPLIED REPRESENTATIONS OR WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE WITH RESPECT TO THE INDEX OR ANY DATA INCLUDED THEREIN.

WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL THE INDEX SPONSOR HAVE ANY LIABILITY (WHETHER IN NEGLIGENCE OR OTHERWISE) TO ANY PERSON FOR ANY DIRECT, INDIRECT, SPECIAL, PUNITIVE, CONSEQUENTIAL OR ANY OTHER DAMAGES (INCLUDING LOST PROFITS) EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

24

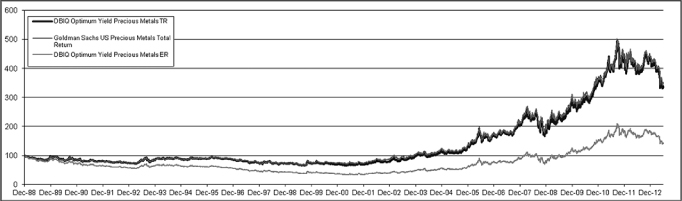

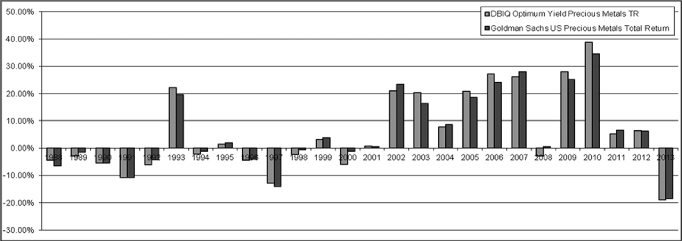

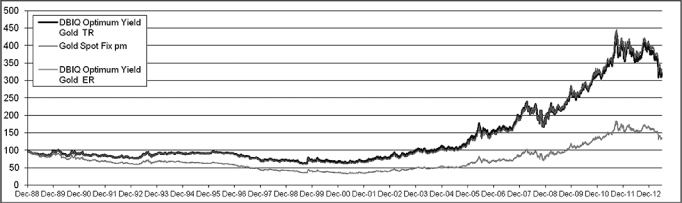

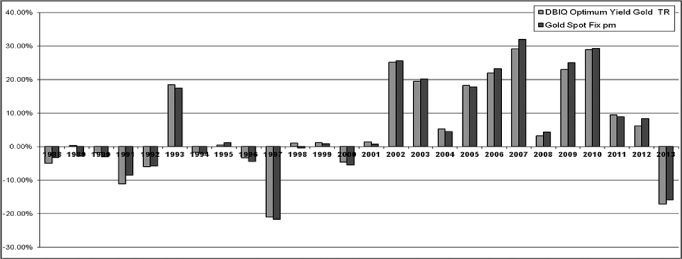

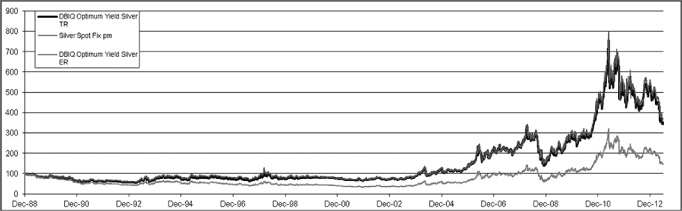

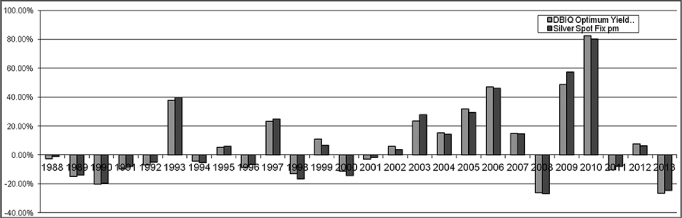

PRECIOUS METALS SECTOR DATA

RELATING TO

DBIQ OPTIMUM YIELD PRECIOUS METALS INDEX EXCESS RETURN™

(DBIQ-OY PRECIOUS METALS ER™)

25

CLOSING LEVELS TABLES