Filed Pursuant to Rule 424(b)(3)

Registration Nos. 333-193221

333-193221-01

333-193221-02

333-193221-03

333-193221-04

333-193221-05

POWERSHARES DB MULTI-SECTOR COMMODITY TRUST

POWERSHARES DB ENERGY FUND

POWERSHARES DB OIL FUND

POWERSHARES DB PRECIOUS METALS FUND

POWERSHARES DB GOLD FUND

POWERSHARES DB BASE METALS FUND

SUPPLEMENT DATED JULY 17, 2014 TO

PROSPECTUS DATED MARCH 14, 2014

This Supplement dated July 17, 2014 updates certain information contained in the Prospectus dated March 14, 2014, as supplemented from time-to-time (the “Prospectus”) of PowerShares DB Multi-Sector Commodity Trust (the “Trust”) and PowerShares DB Energy Fund, PowerShares DB Oil Fund, PowerShares DB Precious Metals Fund, PowerShares DB Gold Fund and PowerShares DB Base Metals Fund (collectively, the “Funds”). We also refer to the PowerShares DB Precious Metals Fund as the “DBP Fund.” All capitalized terms used in this Supplement have the same meaning as in the Prospectus.

Prospective investors in the Funds should review carefully the contents of both this Supplement and the Prospectus.

* * * * * * * * * * * * * * * * * * *

All information in the Prospectus is restated pursuant to this Supplement, except as updated hereby.

Neither the Securities and Exchange Commission nor any state securities commission

has approved or disapproved of these securities or determined if this Supplement is

truthful or complete. Any representation to the contrary is a criminal offense.

THE COMMODITY FUTURES TRADING COMMISSION HAS NOT PASSED UPON THE MERITS OF PARTICIPATING IN THIS POOL NOR HAS THE COMMISSION PASSED UPON THE ADEQUACY OR

ACCURACY OF THIS DISCLOSURE DOCUMENT.

DB COMMODITY SERVICES LLC

Managing Owner

| I. | Risk Factor (1) on page 21 of the Prospectus is hereby deleted and replaced, in its entirety, with the following: |

| “(1) | The Value of the Shares of Each Fund Relates Directly to the Value of the Futures Contracts and Other Assets Held by Each Fund and Fluctuations in the Price of These Assets Could Materially Adversely Affect an Investment in Each Fund’s Shares. |

The Shares of each Fund are designed to reflect as closely as possible the changes, positive or negative, in the level of its corresponding Index, over time, through its portfolio of exchange traded futures contracts on its Index Commodities. The value of the Shares of each Fund relates directly to the value of its portfolio, less the liabilities (including estimated accrued but unpaid expenses) of the Fund. The price of the various Index Commodities may fluctuate widely. Several factors may affect the prices of the Index Commodities, including, but not limited to:

| • | Global supply and demand of the Index Commodities which may be influenced by such factors as forward selling by the various commodities producers, purchases made by the commodities’ producers to unwind their hedge positions and production and cost levels in the major markets of the Index Commodities; |

| • | Domestic and foreign interest rates and investors’ expectations concerning interest rates; |

| • | Domestic and foreign inflation rates and investors’ expectations concerning inflation rates; |

| • | Investment and trading activities of mutual funds, hedge funds and commodity funds; and |

| • | Global or regional political, economic or financial events and situations. |

The following two paragraphs apply only to PowerShares DB Precious Metals Fund, or the DBP Fund.

Effective as of August 15, 2014, the daily London silver fix, or the London Silver Fix, which has served as a global benchmark, will be replaced by an electronic silver benchmark operated by the CME Group and Thomson Reuters, or the Replacement Silver Fix. The CME Group will provide the pricing and Thomson Reuters will provide the administration and the governance for the Replacement Silver Fix.

As of the date of this Prospectus, the DBP Fund invests in silver futures contracts that trade on the CME. According to the rules associated with these silver futures contracts, the silver that underlies these futures contracts must be silver that is produced by a list of specific producers. To the extent that these approved producers rely upon the Replacement Silver Fix on and after August 15, 2014 with respect to the pricing of silver, the value of the DBP Fund’s silver futures contracts and the value of the shares of the DBP Fund may be affected adversely to the extent that the Replacement Silver Fix experiences unexpected issues or has inherent design flaws, if any.”

2

| II. | Pages 35-38 of the Prospectus are hereby deleted and replaced, in their entirety, with the following: |

“PERFORMANCE OF POWERSHARES DB ENERGY FUND (TICKER: DBE), A SERIES OF

POWERSHARES DB MULTI-SECTOR COMMODITY TRUST

Name of Pool: PowerShares DB Energy Fund

Type of Pool: Public, Exchange-Listed Commodity Pool

Inception of Trading: January 2007

Aggregate Gross Capital Subscriptions as of May 31, 2014:$1,203,750,244

Net Asset Value as of May 31, 2014:$362,353,050

Net Asset Value per Share as of May 31, 2014:$29.70

Worst Monthly Drawdown: (14.35)% May 2012

Worst Peak-to-Valley Drawdown: (66.18)% June 2008 – February 2009*

Monthly Rate of Return | 2014(%) | 2013(%) | 2012(%) | 2011(%) | 2010(%) | 2009(%) | ||||||

January | (2.85) | 4.68 | 2.50 | 5.35 | (8.46) | (6.19) | ||||||

February | 4.31 | (3.75) | 8.19 | 5.65 | 5.54 | (5.93) | ||||||

March | (0.95) | 3.30 | (1.99) | 5.38 | 2.88 | 5.71 | ||||||

April | 0.82 | (4.43) | (0.43) | 6.24 | 5.48 | (1.34) | ||||||

May | 0.64 | (2.12) | (14.35) | (7.66) | (14.15) | 22.99 | ||||||

June | (0.11) | (1.25) | (3.55) | (0.73) | 3.14 | |||||||

July | 5.47 | 5.50 | 2.04 | 4.09 | 2.26 | |||||||

August | 2.33 | 8.36 | (3.94) | (7.48) | (3.50) | |||||||

September | (3.91) | (1.35) | (11.72) | 7.97 | (0.96) | |||||||

October | (0.21) | (3.68) | 8.44 | 0.02 | 7.99 | |||||||

November | 1.35 | 2.29 | 1.43 | 2.15 | 1.68 | |||||||

December | 2.14 | (0.36) | (2.81) | 8.95 | (0.39) | |||||||

Compound Rate of Return | 1.85% (5 months) | 4.18% | 1.34% | 2.68% | 3.42% | 24.81% |

| * | The Worst Peak-to-Valley Drawdown from June 2008 – February 2009 includes the effect of the $0.44 per Share distribution made to Shareholders of record as of December 17, 2008. |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

PERFORMANCE OF POWERSHARES DB OIL FUND (TICKER: DBO), A SERIES OF

POWERSHARES DB MULTI-SECTOR COMMODITY TRUST

Name of Pool:PowerShares DB Oil Fund

Type of Pool:Public, Exchange-Listed Commodity Pool

Inception of Trading:January 2007

Aggregate Gross Capital Subscriptions as of May 31, 2014:$1,932,658,542

Net Asset Value as of May 31, 2014:$300,590,672

Net Asset Value per Share as of May 31, 2014:$29.47

Worst Monthly Drawdown:(18.21)% May 2012

Worst Peak-to-Valley Drawdown:(65.43)% June 2008 – February 2009*

Monthly Rate of Return | 2014(%) | 2013(%) | 2012(%) | 2011(%) | 2010(%) | 2009(%) | ||||||

January | (2.82) | 5.73 | 0.46 | 3.69 | (8.65) | (5.87) | ||||||

February | 6.65 | (6.15) | 8.47 | 2.60 | 7.48 | (4.30) | ||||||

March | (0.10) | 4.96 | (4.02) | 7.67 | 4.76 | 7.88 | ||||||

April | (0.87) | (4.25) | 1.14 | 6.25 | 4.46 | (1.12) | ||||||

May | 3.69 | (1.93) | (18.21) | (10.43) | (16.47) | 26.94 | ||||||

June | 2.12 | (0.24) | (5.99) | (3.20) | 1.94 | |||||||

July | 5.43 | 1.99 | (0.45) | 4.98 | 3.09 | |||||||

August | 1.97 | 8.31 | (8.79) | (5.14) | (3.12) | |||||||

September | (1.47) | (4.04) | (11.66) | 6.70 | (1.07) | |||||||

October | (1.31) | (5.28) | 14.58 | (0.14) | 8.27 | |||||||

November | (1.88) | 2.67 | 8.17 | 1.66 | 2.94 | |||||||

December | 3.98 | 2.28 | (0.59) | 9.39 | (0.95) | |||||||

Compound Rate of Return | 6.43% (5 months) | 6.54% | (9.00)% | 1.28% | 2.51% | 35.65% |

| * | The Worst Peak-to-Valley Drawdown from June 2008 – February 2009 includes the effect of the $0.12 per Share distribution made to Shareholders of record as of December 17, 2008. |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

See accompanying Footnotes to Performance Information on page 37.

3

PERFORMANCE OF POWERSHARES DB PRECIOUS METALS FUND (TICKER: DBP), A SERIES OF

POWERSHARES DB MULTI-SECTOR COMMODITY TRUST

Name of Pool:PowerShares DB Precious Metals Fund

Type of Pool:Public, Exchange-Listed Commodity Pool

Inception of Trading:January 2007

Aggregate Gross Capital Subscriptions as of May 31, 2014:$1,132,204,896

Net Asset Value as of May 31, 2014:$183,468,702

Net Asset Value per Share as of May 31, 2014:$39.88

Worst Monthly Drawdown:(15.29)% September 2011

Worst Peak-to-Valley Drawdown:(41.35)% August 2011 – December 2013

Monthly Rate of Return | 2014(%) | 2013(%) | 2012(%) | 2011(%) | 2010(%) | 2009(%) | ||||||

January | 2.22 | (0.09) | 12.41 | (7.08) | (1.83) | 6.02 | ||||||

February | 7.57 | (6.12) | (0.58) | 8.60 | 2.92 | 1.97 | ||||||

March | (3.85) | 0.73% | (3.34) | 4.38 | 0.68 | (1.84) | ||||||

April | 0.12 | (9.34) | (1.35) | 13.10 | 5.93 | (3.99) | ||||||

May | (3.81) | (6.11) | (7.10) | (7.05) | 2.01 | 12.91 | ||||||

June | (12.59) | 1.92 | (3.96) | 2.27 | (7.08) | |||||||

July | 6.05 | 0.44 | 9.87 | (5.01) | 2.61 | |||||||

August | 8.64 | 5.99 | 10.31 | 5.95 | 1.17 | |||||||

September | (5.64) | 6.06 | (15.29) | 6.14 | 7.00 | |||||||

October | (0.14) | (3.88) | 7.85 | 5.46 | 1.73 | |||||||

November | (6.42) | 0.12 | 0.08 | 4.66 | 13.44 | |||||||

December | (3.95) | (3.68) | (11.46) | 3.91 | (7.62) | |||||||

Compound Rate of Return | 1.81% (5 months) | (31.40)% | 5.60% | 4.34% | 37.71% | 26.57% |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

PERFORMANCE OF POWERSHARES DB GOLD FUND (TICKER: DGL), A SERIES OF

POWERSHARES DB MULTI-SECTOR COMMODITY TRUST

Name of Pool:PowerShares DB Gold Fund

Type of Pool:Public, Exchange-Listed Commodity Pool

Inception of Trading:January 2007

Aggregate Gross Capital Subscriptions as of May 31, 2014:$1,007,252,662

Net Asset Value as of May 31, 2014:$133,245,273

Net Asset Value per Share as of May 31, 2014:$41.64

Worst Monthly Drawdown:(12.48)% June 2013

Worst Peak-to-Valley Drawdown:(37.04)% August 2011 – December 2013

Monthly Rate of Return | 2014(%) | 2013(%) | 2012(%) | 2011(%) | 2010(%) | 2009(%) | ||||||

January | 3.10 | (1.03) | 10.87 | (6.39) | (1.30) | 4.85 | ||||||

February | 6.74 | (5.22) | (1.74) | 5.58 | 3.15 | 1.48 | ||||||

March | (3.04) | 0.97 | (2.56) | 1.98 | (0.56) | (2.07) | ||||||

April | 0.86 | (7.94) | (0.52) | 8.05 | 5.89 | (3.64) | ||||||

May | (4.03) | (5.63) | (6.23) | (1.41) | 2.79 | 9.53 | ||||||

June | (12.48) | 2.52 | (2.26) | 2.45 | (5.40) | |||||||

July | 7.18 | 0.31 | 8.32 | (5.28) | 2.69 | |||||||

August | 6.36 | 4.54 | 12.25 | 5.56 | (0.26) | |||||||

September | (5.11) | 5.12 | (11.52) | 4.63 | 5.75 | |||||||

October | (0.34) | (3.18) | 6.32 | 3.60 | 3.01 | |||||||

November | (5.76) | (0.56) | 1.28 | 1.98 | 13.39 | |||||||

December | (4.05) | (2.23) | (10.62) | 2.45 | (7.27) | |||||||

Compound Rate of Return | 3.27% (5 months) | (29.81)% | 5.34% | 8.63% | 27.83% | 22.03% |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

See accompanying Footnotes to Performance Information on page 37.

4

PERFORMANCE OF POWERSHARES DB BASE METALS FUND (TICKER: DBB), A SERIES OF

POWERSHARES DB MULTI-SECTOR COMMODITY TRUST

Name of Pool:PowerShares DB Base Metals Fund

Type of Pool:Public, Exchange-Listed Commodity Pool

Inception of Trading:January 2007

Aggregate Gross Capital Subscriptions as of May 31, 2014:$1,509,940,977

Net Asset Value as of May 31, 2014:$263,389,547

Net Asset Value per Share as of May 31, 2014:$16.26

Worst Monthly Drawdown:(19.24)% September 2011

Worst Peak-to-Valley Drawdown:(60.29)% July 2007 – January 2009*

Monthly Rate of Return | 2014(%) | 2013(%) | 2012(%) | 2011(%) | 2010(%) | 2009(%) | ||||||

January | (4.83) | 1.41 | 11.27 | 0.62 | (11.50) | (7.37) | ||||||

February | 2.25 | (4.64) | 1.97 | 3.18 | 4.12 | 3.71 | ||||||

March | (2.94) | (5.19) | (5.37) | (3.08) | 8.17 | 12.99 | ||||||

April | 0.76 | (3.65) | 0.30 | (0.57) | (4.12) | 6.48 | ||||||

May | 1.82 | 2.54 | (9.47) | (1.68) | (10.43) | 6.30 | ||||||

June | (6.75) | (0.16) | (0.17) | (5.71) | 3.07 | |||||||

July | 0.43 | (2.03) | 4.35 | 11.17 | 13.82 | |||||||

August | 2.09 | 0.17 | (6.73) | (0.86) | 7.55 | |||||||

September | 1.15 | 10.74 | (19.24) | 9.18 | (0.43) | |||||||

October | 0.00 | (9.19) | 7.81 | 3.32 | 5.97 | |||||||

November | (4.30) | 6.90 | (1.23) | (4.69) | 6.81 | |||||||

December | 4.61 | (0.47) | (6.54) | 13.14 | 7.98 | |||||||

Compound Rate of Return | (3.10)% (5 months) | (12.28)% | 2.19% | (23.18)% | 8.20% | 88.64% |

| * | The Worst Peak-to-Valley Drawdown from July 2007 – January 2009 includes the effect of the $0.96 per Share distribution made to Shareholders of record as of December 19, 2007, and the effect of the $0.28 per Share distribution made to Shareholders of record as of December 17, 2008. |

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

See accompanying Footnotes to Performance Information below.

Footnotes to Performance Information

1. “Aggregate Gross Capital Subscriptions” is the aggregate of all amounts ever contributed to the relevant pool, including investors who subsequently redeemed their investments.

2. “Net Asset Value” is the net asset value of the relevant pool as of May 31, 2014.

3. “Net Asset Value per Share” is the Net Asset Value of the relevant pool divided by the total number of Shares outstanding with respect to such pool as of May 31, 2014.

4. “Worst Monthly Drawdown” is the largest single month loss sustained since inception of trading. “Drawdown” as used in this section of the Prospectus means losses experienced by the relevant pool over the specified period and is calculated on a rate of return basis, i.e., dividing net performance by beginning equity. “Drawdown” is measured on the basis of monthly returns only, and does not reflect intra-month figures. “Month” is the month of the Worst Monthly Drawdown.

5. “Worst Peak-to-Valley Drawdown” is the largest percentage decline in the Net Asset Value per Share over the history of the relevant pool. This need not be a continuous decline, but can be a series of positive and negative returns where the negative returns are larger than the positive returns. “Worst Peak-to-Valley Drawdown” represents the greatest percentage decline from any month-end Net Asset Value per Share that occurs without such month-end Net Asset Value per Share being equaled or exceeded as of a subsequent month-end. For example, if the Net Asset Value per Share of a particular pool declined by $1 in each of January and February, increased by $1 in March and declined again by $2 in April, a “peak-to-valley drawdown” analysis conducted as of the end of April would consider that “drawdown” to be still continuing and to be $3 in amount, whereas if the Net Asset Value per Share had increased by $2 in March, the January-February drawdown would have ended as of the end of February at the $2 level.

6. “Compound Rate of Return” of the relevant pool is calculated by multiplying on a compound basis each of the monthly rates of return set forth in the respective charts above and not by adding or averaging such monthly rates of return. For periods of less than one year, the results are year-to-date.

5

7. The below table reflects both the name of the original Index that each Fund has tracked up to and including December 31, 2010, or Original Index, and the name of the Index that each Fund will track after December 31, 2010, or Renamed Index:

| Fund | Index

| |||||||

Original

| Renamed

| Dates

| ||||||

Inception

| Rename

| |||||||

| PowerShares DB Energy Fund | Deutsche Bank Liquid Commodity Index-Optimum Yield Energy Excess Return™ | DBIQ Optimum Yield Energy Index Excess Return™ | 7/06 | 10/10 | ||||

| PowerShares DB Oil Fund | Deutsche Bank Liquid Commodity Index-Optimum Yield Crude Oil Excess Return™ | DBIQ Optimum Yield Crude Oil Index Excess Return™ | 5/06 | 10/10 | ||||

| PowerShares DB Precious Metals Fund | Deutsche Bank Liquid Commodity Index-Optimum Yield Precious Metals Excess Return™ | DBIQ Optimum Yield Precious Metals Index Excess Return™ | 7/06 | 10/10 | ||||

| PowerShares DB Gold Fund | Deutsche Bank Liquid Commodity Index-Optimum Yield Gold Excess Return™ | DBIQ Optimum Yield Gold Index Excess Return™ | 5/06 | 10/10 | ||||

| PowerShares DB Base Metals Fund | Deutsche Bank Liquid Commodity Index-Optimum Yield Industrial Metals Excess Return™ | DBIQ Optimum Yield Industrial Metals Index Excess Return™ | 7/06 | 10/10 | ||||

Each Fund’s Original Index is identical to the Renamed Index, except with respect to the following non-substantive changes: (i) name of Index and (ii) ticker symbol. The above Inception Dates remain identical. The Rename Date of October 2010 reflects the date on which each Original Index changed its name as reflected in the Renamed Index column above and each such change and became effective in January 3, 2011. Except as provided in the immediately preceding sentence, all prior underlying formulae, data (e.g., closing levels, measure of volatility, all other numerical statistics and measures) and all other characteristics (e.g., Base Date, Index Sponsor, Inception Date, rolling, etc.) with respect to each Original Index is identical to its corresponding Renamed Index.

DBLCI™ and Deutsche Bank Liquid Commodity Index™ are trade marks of the Index Sponsor and are the subject of Community Trade Mark Nos. 3055043 and 3054996. Trade Mark applications in the United States are pending with respect to both the Trust and aspects of each Index. The Fund and the Managing Owner have been licensed to use DBLCI™, Deutsche Bank Liquid Commodity Index™ and DBIQ™.

[Remainder of page left blank intentionally.]

6

III. Pages 48 through 92 of the Prospectus are hereby deleted and replaced, in their entirety, with the following: | ||||||||||

Volatility of the Various Indexes | ||||||||||

The following table1 reflects various measures of volatility2 of the history of each Index as calculated on an excess return basis:

| ||||||||||

| Volatility Type | DBIQ-OY Energy ER™3 | DBIQ-OY CL ER™4 | DBIQ-OY Precious Metals ER™4 | DBIQ-OY GC ER™4 | DBIQ-OY Industrial Metals ER™5 | |||||

Daily volatility over full history | 23.95% | 26.36% | 16.69% | 15.33% | 20.06% | |||||

Average rolling 3 month daily volatility | 22.16% | 24.51% | 15.64% | 14.25% | 18.71% | |||||

Monthly return volatility | 24.60% | 26.10% | 17.22% | 15.75% | 21.25% | |||||

Average annual volatility | 23.07% | 25.29% | 15.48% | 14.28% | 18.06% | |||||

The following table reflects the daily volatility on an annual basis of each Index: | ||||||||||

| Year | DBIQ-OY Energy ER™3 | DBIQ-OY CL ER™4 | DBIQ-OY Precious Metals ER™4 | DBIQ-OY GC ER™4 | DBIQ-OY Industrial Metals ER™5 | |||||

1988 | – | 26.56% | 11.17% | 11.41% | – | |||||

1989 | – | 28.11% | 13.57% | 13.14% | – | |||||

1990 | 44.82% | 40.56% | 16.71% | 17.67% | – | |||||

1991 | 31.03% | 29.57% | 13.63% | 12.63% | – | |||||

1992 | 14.60% | 16.66% | 8.90% | 8.32% | – | |||||

1993 | 15.25% | 17.70% | 16.81% | 14.44% | – | |||||

1994 | 18.05% | 20.13% | 12.08% | 9.60% | – | |||||

1995 | 13.45% | 17.07% | 9.89% | 6.62% | – | |||||

1996 | 23.86% | 31.02% | 7.74% | 6.17% | – | |||||

1997 | 18.29% | 21.51% | 13.51% | 12.60% | 11.99% | |||||

1998 | 23.80% | 27.97% | 14.60% | 12.84% | 14.38% | |||||

1999 | 24.43% | 27.10% | 16.54% | 17.35% | 14.07% | |||||

2000 | 28.21% | 32.19% | 14.01% | 15.02% | 11.78% | |||||

2001 | 27.56% | 29.77% | 13.79% | 14.44% | 12.57% | |||||

2002 | 24.63% | 25.52% | 13.51% | 13.44% | 13.12% | |||||

2003 | 26.34% | 26.59% | 16.17% | 16.66% | 13.86% | |||||

2004 | 28.71% | 30.80% | 19.48% | 16.25% | 20.85% | |||||

2005 | 27.49% | 26.55% | 13.23% | 12.38% | 18.18% | |||||

2006 | 22.01% | 22.01% | 25.97% | 22.81% | 32.26% | |||||

2007 | 19.54% | 21.17% | 14.96% | 13.91% | 20.35% | |||||

2008 | 36.57% | 41.43% | 27.33% | 25.53% | 28.81% | |||||

2009 | 31.28% | 33.56% | 20.44% | 18.40% | 29.14% | |||||

2010 | 18.84% | 20.63% | 15.22% | 13.28% | 23.76% | |||||

2011 | 21.12% | 25.20% | 21.17% | 17.47% | 20.67% | |||||

2012 | 16.54% | 19.36% | 15.35% | 13.46% | 15.48% | |||||

2013 | 10.99% | 12.41% | 20.07% | 18.50% | 13.18% | |||||

20141 | 9.37% | 11.57% | 12.11% | 11.22% | 10.61% | |||||

1As of December 31, 2013. Past Index levels are not necessarily indicative of future Index levels. 2Volatility, for these purposes, means the following: Daily Volatility: The relative rate at which the price of the Index moves up and down, found by calculating the annualized standard deviation of the daily change in price. Monthly Return Volatility: The relative rate at which the price of the Index moves up and down, found by calculating the annualized standard deviation of the monthly change in price. Average Annual Volatility: The average of yearly volatilities for a given sample period. The yearly volatility is the relative rate at which the price of the Index moves up and down, found by calculating the annualized standard deviation of the daily change in price for each business day in the given year. 3As of June 4, 1990. Past Index levels are not necessarily indicative of future Index levels. 4As of December 2, 1988. Past Index levels are not necessarily indicative of future Index levels. 5As of September 3, 1997. Past Index levels are not necessarily indicative of future Index levels. | ||||||||||

7

ENERGY SECTOR DATA

RELATING TO

DBIQ OPTIMUM YIELD ENERGY INDEX EXCESS RETURN™

(DBIQ-OY ENERGY ER™)

8

CLOSING LEVELS TABLES

DBIQ OPTIMUM YIELD ENERGY INDEX EXCESS RETURN™

| CLOSING LEVEL | CHANGES | |||||||

| High1 | Low2 | Annual Index Changes3 | Index Changes Since Inception4 | |||||

19905 | 179.19 | 96.66 | 45.52% | 45.52% | ||||

1991 | 147.42 | 107.20 | -20.99% | 14.98% | ||||

1992 | 137.39 | 110.88 | 9.57% | 25.99% | ||||

1993 | 138.78 | 100.51 | -20.19% | 0.56% | ||||

1994 | 122.19 | 95.20 | 6.96% | 7.56% | ||||

1995 | 119.82 | 102.02 | 11.00% | 19.39% | ||||

1996 | 197.83 | 111.99 | 63.92% | 95.71% | ||||

1997 | 204.30 | 159.71 | -18.40% | 59.71% | ||||

1998 | 160.51 | 97.65 | -36.95% | 0.70% | ||||

1999 | 178.20 | 92.77 | 72.80% | 74.00% | ||||

2000 | 298.97 | 167.50 | 41.06% | 145.44% | ||||

2001 | 278.42 | 192.42 | -16.74% | 104.36% | ||||

2002 | 298.19 | 194.55 | 41.97% | 190.12% | ||||

2003 | 391.72 | 284.31 | 32.29% | 283.81% | ||||

2004 | 715.99 | 383.42 | 54.72% | 493.84% | ||||

2005 | 1037.13 | 582.46 | 55.14% | 821.29% | ||||

2006 | 1074.96 | 812.65 | -10.74% | 722.36% | ||||

2007 | 1112.80 | 709.23 | 34.88% | 1009.21% | ||||

2008 | 1772.65 | 559.38 | -40.45% | 560.50% | ||||

2009 | 862.18 | 518.29 | 25.76% | 730.64% | ||||

2010 | 884.28 | 704.89 | 4.00% | 763.88% | ||||

2011 | 1075.48 | 812.44 | 3.38% | 793.06% | ||||

2012 | 1013.67 | 764.32 | 2.01% | 811.04% | ||||

2013 | 976.99 | 872.41 | 4.77% | 854.50% | ||||

20146 | 987.21 | 909.26 | 2.09% | 874.45% | ||||

THE FUND WILL TRADE WITH A VIEW TO TRACKING THE

DBIQ OPTIMUM YIELD ENERGY INDEX EXCESS RETURN™ OVER TIME.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

DBIQ OPTIMUM YIELD ENERGY INDEX TOTAL RETURN™

| CLOSING LEVEL | CHANGES | |||||||

| High1 | Low2 | Annual Index Changes3 | Index Changes Since Inception4 | |||||

19905 | 183.60 | 97.33 | 51.88% | 51.88% | ||||

1991 | 154.30 | 112.85 | -16.53% | 26.77% | ||||

1992 | 155.82 | 122.35 | 13.48% | 43.86% | ||||

1993 | 160.01 | 118.31 | -17.71% | 18.38% | ||||

1994 | 147.06 | 112.95 | 11.67% | 32.19% | ||||

1995 | 155.68 | 127.46 | 17.38% | 55.17% | ||||

1996 | 270.11 | 146.19 | 72.56% | 167.77% | ||||

1997 | 279.83 | 227.35 | -14.08% | 130.07% | ||||

1998 | 232.17 | 147.51 | -33.81% | 52.29% | ||||

1999 | 282.30 | 141.11 | 81.15% | 175.87% | ||||

2000 | 496.29 | 265.84 | 49.64% | 312.83% | ||||

2001 | 476.58 | 334.41 | -13.77% | 255.97% | ||||

2002 | 527.96 | 339.16 | 44.32% | 413.72% | ||||

2003 | 700.53 | 505.36 | 33.65% | 586.61% | ||||

2004 | 1293.70 | 686.54 | 56.88% | 977.16% | ||||

2005 | 1917.92 | 1056.70 | 60.14% | 1625.00% | ||||

2006 | 2070.40 | 1595.93 | -6.33% | 1515.87% | ||||

2007 | 2285.06 | 1397.07 | 41.00% | 2178.45% | ||||

2008 | 3676.21 | 1165.04 | -39.62% | 1275.66% | ||||

2009 | 1798.15 | 1079.73 | 25.94% | 1632.53% | ||||

2010 | 1845.15 | 1471.50 | 4.14% | 1704.26% | ||||

2011 | 2247.01 | 1697.62 | 3.43% | 1766.13% | ||||

2012 | 2118.34 | 1597.67 | 2.10% | 1805.30% | ||||

2013 | 2044.00 | 1824.93 | 4.83% | 1897.28% | ||||

20146 | 2065.98 | 1902.63 | 2.11% | 1939.34% | ||||

THE FUND WILL NOT TRADE WITH A VIEW TO TRACKING THE

DBIQ OPTIMUM YIELD ENERGY INDEX TOTAL RETURN™ OVER TIME.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

See accompanying Notes and Legends.

9

INDEX COMMODITIES WEIGHTS TABLES

DBIQ OPTIMUM YIELD ENERGY INDEX EXCESS RETURN™

| CL7 | HO7 | LCO7 | XB7 | NG7 | ||||||||||||||||

| High1 | Low2 | High | Low | High | Low | High | Low | High | Low | |||||||||||

19905 | 21.8% | 21.9% | 21.4% | 22.6% | 27.2% | 22.2% | 23.4% | 22.4% | 6.2% | 10.9% | ||||||||||

1991 | 21.8% | 22.5% | 22.8% | 22.7% | 23.8% | 20.0% | 21.5% | 21.8% | 10.1% | 13.1% | ||||||||||

1992 | 21.3% | 22.3% | 23.1% | 23.1% | 21.6% | 21.5% | 21.7% | 22.2% | 12.3% | 10.8% | ||||||||||

1993 | 21.6% | 22.1% | 21.5% | 22.8% | 21.1% | 22.7% | 21.4% | 22.0% | 14.4% | 10.4% | ||||||||||

1994 | 20.6% | 21.7% | 22.4% | 22.5% | 24.7% | 21.9% | 23.0% | 21.8% | 9.3% | 12.1% | ||||||||||

1995 | 22.9% | 24.3% | 21.2% | 22.1% | 23.1% | 23.0% | 23.1% | 21.9% | 9.7% | 8.8% | ||||||||||

1996 | 22.6% | 22.6% | 21.6% | 21.1% | 22.0% | 22.5% | 21.8% | 22.9% | 12.0% | 10.9% | ||||||||||

1997 | 23.2% | 22.5% | 21.6% | 22.6% | 22.2% | 21.6% | 21.4% | 23.1% | 11.4% | 10.1% | ||||||||||

1998 | 22.4% | 22.7% | 22.9% | 23.4% | 21.3% | 21.1% | 23.5% | 22.5% | 9.9% | 10.4% | ||||||||||

1999 | 22.7% | 23.1% | 21.9% | 22.0% | 23.0% | 22.2% | 23.3% | 22.3% | 9.1% | 10.4% | ||||||||||

2000 | 21.8% | 22.9% | 22.5% | 22.2% | 21.2% | 22.8% | 23.2% | 23.2% | 11.4% | 8.9% | ||||||||||

2001 | 23.5% | 22.9% | 22.0% | 22.2% | 21.4% | 21.8% | 22.5% | 22.7% | 10.5% | 10.4% | ||||||||||

2002 | 21.4% | 23.2% | 22.4% | 22.5% | 24.2% | 22.6% | 21.8% | 23.2% | 10.3% | 8.5% | ||||||||||

2003 | 22.7% | 21.2% | 22.6% | 21.5% | 22.3% | 23.2% | 22.3% | 21.8% | 10.2% | 12.3% | ||||||||||

2004 | 23.9% | 22.6% | 23.0% | 22.2% | 23.2% | 21.8% | 21.0% | 22.9% | 8.8% | 10.5% | ||||||||||

2005 | 20.6% | 22.3% | 23.5% | 22.7% | 21.8% | 22.3% | 24.9% | 23.0% | 9.1% | 9.7% | ||||||||||

2006 | 23.3% | 22.8% | 22.7% | 22.7% | 23.2% | 22.9% | 25.3% | 22.8% | 5.5% | 8.7% | ||||||||||

2007 | 22.6% | 22.1% | 22.8% | 23.0% | 22.5% | 22.1% | 23.0% | 22.6% | 9.1% | 10.2% | ||||||||||

2008 | 22.2% | 21.8% | 24.2% | 21.3% | 22.3% | 22.8% | 21.3% | 21.7% | 10.1% | 12.4% | ||||||||||

2009 | 24.5% | 22.7% | 19.4% | 20.7% | 23.9% | 22.8% | 27.5% | 24.3% | 4.7% | 9.6% | ||||||||||

2010 | 22.8% | 22.3% | 23.0% | 23.0% | 23.4% | 23.0% | 23.5% | 23.1% | 7.3% | 8.6% | ||||||||||

2011 | 21.9% | 19.0% | 23.3% | 24.0% | 23.3% | 24.0% | 23.3% | 24.6% | 8.3% | 8.4% | ||||||||||

2012 | 23.9% | 22.8% | 22.6% | 23.1% | 23.2% | 22.7% | 23.2% | 23.0% | 7.0% | 8.3% | ||||||||||

2013 | 23.5% | 22.4% | 21.7% | 21.7% | 22.4% | 22.0% | 24.0% | 22.6% | 8.3% | 11.3% | ||||||||||

20146 | 22.7% | 21.7% | 21.8% | 22.5% | 21.8% | 22.7% | 22.1% | 22.5% | 11.6% | 10.6% | ||||||||||

THE FUND WILL TRADE WITH A VIEW TO TRACKING THE

DBIQ OPTIMUM YIELD ENERGY INDEX EXCESS RETURN™ OVER TIME.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

DBIQ OPTIMUM YIELD ENERGY INDEX TOTAL RETURN™

| CL7 | HO7 | LCO7 | XB7 | NG7 | ||||||||||||||||

| High1 | Low2 | High | Low | High | Low | High | Low | High | Low | |||||||||||

19905 | 21.8% | 21.9% | 21.4% | 22.6% | 27.2% | 22.2% | 23.4% | 22.4% | 6.2% | 10.9% | ||||||||||

1991 | 21.8% | 22.5% | 22.8% | 22.7% | 23.8% | 20.0% | 21.5% | 21.8% | 10.1% | 13.1% | ||||||||||

1992 | 21.3% | 22.3% | 23.2% | 23.1% | 21.6% | 21.5% | 21.5% | 22.2% | 12.5% | 10.8% | ||||||||||

1993 | 21.6% | 22.1% | 21.5% | 22.8% | 21.1% | 22.7% | 21.4% | 22.0% | 14.4% | 10.4% | ||||||||||

1994 | 20.6% | 21.7% | 22.4% | 22.5% | 24.7% | 21.9% | 23.0% | 21.8% | 9.3% | 12.1% | ||||||||||

1995 | 22.9% | 22.9% | 21.2% | 22.4% | 23.1% | 23.1% | 23.1% | 23.3% | 9.7% | 8.4% | ||||||||||

1996 | 22.6% | 22.6% | 21.6% | 21.1% | 22.0% | 22.5% | 21.8% | 22.9% | 12.0% | 10.9% | ||||||||||

1997 | 23.2% | 22.0% | 21.6% | 22.8% | 22.2% | 21.1% | 21.4% | 23.7% | 11.4% | 10.3% | ||||||||||

1998 | 22.4% | 22.7% | 22.9% | 23.4% | 21.3% | 21.1% | 23.5% | 22.5% | 9.9% | 10.4% | ||||||||||

1999 | 22.9% | 23.1% | 22.3% | 22.0% | 22.8% | 22.2% | 23.3% | 22.3% | 8.6% | 10.4% | ||||||||||

2000 | 21.8% | 22.9% | 22.5% | 22.2% | 21.2% | 22.8% | 23.2% | 23.2% | 11.4% | 8.9% | ||||||||||

2001 | 23.5% | 22.9% | 22.0% | 22.2% | 21.4% | 21.8% | 22.5% | 22.7% | 10.5% | 10.4% | ||||||||||

2002 | 21.4% | 23.2% | 22.4% | 22.5% | 24.2% | 22.6% | 21.8% | 23.2% | 10.3% | 8.5% | ||||||||||

2003 | 22.7% | 21.2% | 22.6% | 21.5% | 22.3% | 23.2% | 22.3% | 21.8% | 10.2% | 12.3% | ||||||||||

2004 | 23.9% | 22.6% | 23.0% | 22.2% | 23.2% | 21.8% | 21.0% | 22.9% | 8.8% | 10.5% | ||||||||||

2005 | 20.6% | 22.3% | 23.5% | 22.7% | 21.8% | 22.3% | 24.9% | 23.0% | 9.1% | 9.7% | ||||||||||

2006 | 23.3% | 22.8% | 22.7% | 22.7% | 23.2% | 22.9% | 25.3% | 22.8% | 5.5% | 8.7% | ||||||||||

2007 | 22.6% | 22.1% | 22.8% | 23.0% | 22.5% | 22.1% | 23.0% | 22.6% | 9.1% | 10.2% | ||||||||||

2008 | 22.2% | 21.8% | 24.2% | 21.3% | 22.4% | 22.8% | 21.3% | 21.7% | 10.0% | 12.4% | ||||||||||

2009 | 24.5% | 22.7% | 19.4% | 20.7% | 23.9% | 22.8% | 27.5% | 24.3% | 4.7% | 9.6% | ||||||||||

20106 | 22.8% | 22.3% | 23.0% | 23.0% | 23.4% | 23.0% | 23.5% | 23.1% | 7.3% | 8.6% | ||||||||||

2011 | 21.9% | 19.0% | 23.3% | 24.0% | 23.3% | 24.0% | 23.3% | 24.6% | 8.3% | 8.4% | ||||||||||

2012 | 23.9% | 22.8% | 22.6% | 23.1% | 23.2% | 22.7% | 23.2% | 23.0% | 7.0% | 8.3% | ||||||||||

2013 | 23.5% | 22.4% | 21.7% | 21.7% | 22.4% | 22.0% | 24.0% | 22.6% | 8.3% | 11.3% | ||||||||||

20146 | 22.7% | 21.7% | 21.8% | 22.5% | 21.8% | 22.7% | 22.1% | 22.5% | 11.6% | 10.6% | ||||||||||

THE FUND WILL NOT TRADE WITH A VIEW TO TRACKING THE DBIQ OPTIMUM YIELD ENERGY INDEX TOTAL RETURN™ OVER TIME.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

See accompanying Notes and Legends.

10

All statistics based on data from June 4, 1990 to May 31, 2014.

VARIOUS STATISTICAL MEASURES | DBIQ Optimum Yield Energy ER8 | DBIQ Optimum Yield Energy TR9 | Goldman Sachs US Energy Total Return10 | |||||||||

Annualized Changes to Index Level11 | 9.9 | % | 13.4 | % | 5.9 | % | ||||||

Average rolling 3 month daily volatility12 | 22.2 | % | 22.2 | % | 27.1 | % | ||||||

Sharpe Ratio13 | 0.45 | 0.48 | 0.12 | |||||||||

% of months with positive change14 | 56 | % | 56 | % | 54 | % | ||||||

Average monthly positive change15 | 5.8 | % | 6.0 | % | 7.1 | % | ||||||

Average monthly negative change16 | -4.9 | % | -4.7 | % | -6.3 | % | ||||||

ANNUALIZED INDEX LEVELS17 | DBIQ Optimum Yield Energy ER8 | DBIQ Optimum Yield Energy TR9 | Goldman Sachs US Energy Total Return10 | |||||||||

1 year | 7.4 | % | 7.5 | % | 4.4 | % | ||||||

3 year | -0.7 | % | -0.6 | % | -0.3 | % | ||||||

5 year | 5.4 | % | 5.5 | % | 3.9 | % | ||||||

7 year | 1.7 | % | 2.3 | % | -2.6 | % | ||||||

10 year | 6.8 | % | 8.4 | % | -1.8 | % | ||||||

15 year | 14.8 | % | 17.2 | % | 8.2 | % | ||||||

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

WHILE THE FUND’S OBJECTIVE IS NOT TO GENERATE PROFIT THROUGH ACTIVE PORTFOLIO MANAGEMENT, BUT IS TO TRACK THE INDEX, BECAUSE THE INDEX WAS ESTABLISHED IN OCTOBER 2010, CERTAIN INFORMATION RELATING TO INDEX CLOSING LEVELS MAY BE CONSIDERED TO BE “HYPOTHETICAL.” HYPOTHETICAL INFORMATION MAY HAVE CERTAIN INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW.

NO REPRESENTATION IS BEING MADE THAT THE INDEX WILL OR IS LIKELY TO ACHIEVE ANNUAL OR CUMULATIVE CLOSING LEVELS CONSISTENT WITH OR SIMILAR TO THOSE SET FORTH HEREIN. SIMILARLY, NO REPRESENTATION IS BEING MADE THAT THE FUND WILL GENERATE PROFITS OR LOSSES SIMILAR TO THE FUND’S PAST PERFORMANCE, WHEN AVAILABLE, OR THE HISTORICAL ANNUAL OR CUMULATIVE CHANGES IN THE INDEX CLOSING LEVELS. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY INVESTMENT METHODOLOGIES, WHETHER ACTIVE OR PASSIVE.

ONE OF THE LIMITATIONS OF HYPOTHETICAL INFORMATION IS THAT IT IS GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. TO THE EXTENT THAT INFORMATION PRESENTED HEREIN RELATES TO THE PERIOD JUNE 1990 THROUGH SEPTEMBER 2010, THE INDEX CLOSING LEVELS REFLECT THE APPLICATION OF THE INDEX’S METHODOLOGY, AND SELECTION OF INDEX COMMODITIES, IN HINDSIGHT.

NO HYPOTHETICAL RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THERE ARE NUMEROUS FACTORS, INCLUDING THOSE DESCRIBED UNDER “THE RISKS YOU FACE” HEREIN, RELATED TO THE COMMODITIES MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF THE FUND’S EFFORTS TO TRACK ITS INDEX OVER TIME WHICH CANNOT BE, AND HAVE NOT BEEN, ACCOUNTED FOR IN THE PREPARATION OF SUCH INDEX INFORMATION SET FORTH ON THE FOLLOWING PAGES, ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL PERFORMANCE RESULTS FOR THE FUND. FURTHERMORE, THE INDEX INFORMATION DOES NOT INVOLVE FINANCIAL RISK OR ACCOUNT FOR THE IMPACT OF FEES AND COSTS ASSOCIATED WITH THE FUND.

THE MANAGING OWNER COMMENCED OPERATIONS IN JANUARY 2006. AS MANAGING OWNER, THE MANAGING OWNER AND ITS TRADING PRINCIPALS HAVE BEEN MANAGING THE DAY-TO-DAY OPERATIONS FOR THE FUNDS AND RELATED PRODUCTS AND MANAGING FUTURES TRADING ACCOUNTS. BECAUSE THERE ARE LIMITED ACTUAL TRADING RESULTS TO COMPARE TO THE INDEX CLOSING LEVELS SET FORTH HEREIN, PROSPECTIVE INVESTORS SHOULD BE PARTICULARLY WARY OF PLACING UNDUE RELIANCE ON THE ANNUAL OR CUMULATIVE INDEX RESULTS.

See accompanying Notes and Legends.

11

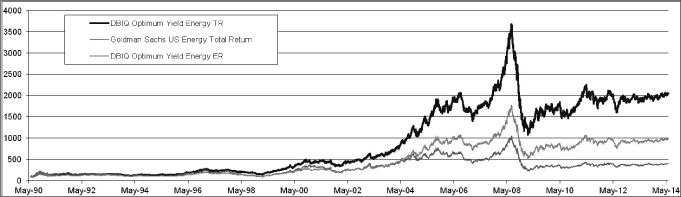

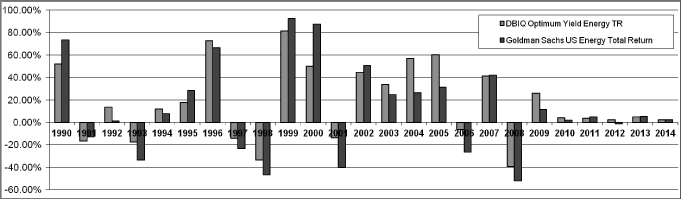

COMPARISON OF DBIQ-OY ENERGY ER, DBIQ-OY ENERGY TR AND GOLDMAN SACHS US ENERGY TOTAL RETURN

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

Each of DBIQ-OY Energy ER, DBIQ-OY Energy TR and Goldman Sachs US Energy Total Return are indices and do not reflect actual trading.

DBIQ-OY Energy TR and Goldman Sachs US Energy Total Return are calculated on a total return basis and do not reflect any fees or expenses.

WHILE THE FUND’S OBJECTIVE IS NOT TO GENERATE PROFIT THROUGH ACTIVE PORTFOLIO MANAGEMENT, BUT IS TO TRACK THE INDEX, BECAUSE THE INDEX WAS ESTABLISHED IN OCTOBER 2010, CERTAIN INFORMATION RELATING TO INDEX CLOSING LEVELS MAY BE CONSIDERED TO BE “HYPOTHETICAL.” HYPOTHETICAL INFORMATION MAY HAVE CERTAIN INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW.

NO REPRESENTATION IS BEING MADE THAT THE INDEX WILL OR IS LIKELY TO ACHIEVE ANNUAL OR CUMULATIVE CLOSING LEVELS CONSISTENT WITH OR SIMILAR TO THOSE SET FORTH HEREIN. SIMILARLY, NO REPRESENTATION IS BEING MADE THAT THE FUND WILL GENERATE PROFITS OR LOSSES SIMILAR TO THE FUND’S PAST PERFORMANCE, WHEN AVAILABLE, OR THE HISTORICAL ANNUAL OR CUMULATIVE CHANGES IN THE INDEX CLOSING LEVELS. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY INVESTMENT METHODOLOGIES, WHETHER ACTIVE OR PASSIVE.

ONE OF THE LIMITATIONS OF HYPOTHETICAL INFORMATION IS THAT IT IS GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. TO THE EXTENT THAT INFORMATION PRESENTED HEREIN RELATES TO THE PERIOD JUNE 1990 THROUGH SEPTEMBER 2010, THE INDEX CLOSING LEVELS REFLECT THE APPLICATION OF THE INDEX’S METHODOLOGY, AND SELECTION OF INDEX COMMODITIES, IN HINDSIGHT.

NO HYPOTHETICAL RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THERE ARE NUMEROUS FACTORS, INCLUDING THOSE DESCRIBED UNDER “THE RISKS YOU FACE” HEREIN, RELATED TO THE COMMODITIES MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF THE FUND’S EFFORTS TO TRACK ITS INDEX OVER TIME WHICH CANNOT BE, AND HAVE NOT BEEN, ACCOUNTED FOR IN THE PREPARATION OF SUCH INDEX INFORMATION SET FORTH ON THE FOLLOWING PAGES, ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL PERFORMANCE RESULTS FOR THE FUND. FURTHERMORE, THE INDEX INFORMATION DOES NOT INVOLVE FINANCIAL RISK OR ACCOUNT FOR THE IMPACT OF FEES AND COSTS ASSOCIATED WITH THE FUND.

THE MANAGING OWNER COMMENCED OPERATIONS IN JANUARY 2006. AS MANAGING OWNER, THE MANAGING OWNER AND ITS TRADING PRINCIPALS HAVE BEEN MANAGING THE DAY-TO-DAY OPERATIONS FOR THE FUNDS AND RELATED PRODUCTS AND MANAGING FUTURES TRADING ACCOUNTS. BECAUSE THERE ARE LIMITED ACTUAL TRADING RESULTS TO COMPARE TO THE INDEX CLOSING LEVELS SET FORTH HEREIN, PROSPECTIVE INVESTORS SHOULD BE PARTICULARLY WARY OF PLACING UNDUE RELIANCE ON THE ANNUAL OR CUMULATIVE INDEX RESULTS.

See accompanying Notes and Legends.

12

COMPARISON OF DBIQ-OY ENERGY TR AND GOLDMAN SACHS US ENERGY TOTAL RETURN

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

Each of DBIQ-OY Energy TR and Goldman Sachs US Energy Total Return are indices and do not reflect actual trading.

DBIQ-OY Energy TR and Goldman Sachs US Energy Total Return are calculated on a total return basis and do not reflect any fees or expenses.

WHILE THE FUND’S OBJECTIVE IS NOT TO GENERATE PROFIT HROUGH ACTIVE PORTFOLIO MANAGEMENT, BUT IS TO TRACK THE INDEX, BECAUSE THE INDEX WAS ESTABLISHED IN OCTOBER 2010, CERTAIN INFORMATION RELATING TO INDEX CLOSING LEVELS MAY BE CONSIDERED TO BE “HYPOTHETICAL.” HYPOTHETICAL INFORMATION MAY HAVE CERTAIN INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW.

NO REPRESENTATION IS BEING MADE THAT THE INDEX WILL OR IS LIKELY TO ACHIEVE ANNUAL OR CUMULATIVE CLOSING LEVELS CONSISTENT WITH OR SIMILAR TO THOSE SET FORTH HEREIN. SIMILARLY, NO REPRESENTATION IS BEING MADE THAT THE FUND WILL GENERATE PROFITS OR LOSSES SIMILAR TO THE FUND’S PAST PERFORMANCE, WHEN AVAILABLE, OR THE HISTORICAL ANNUAL OR CUMULATIVE CHANGES IN THE INDEX CLOSING LEVELS. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY INVESTMENT METHODOLOGIES, WHETHER ACTIVE OR PASSIVE.

ONE OF THE LIMITATIONS OF HYPOTHETICAL INFORMATION IS THAT IT IS GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. TO THE EXTENT THAT INFORMATION PRESENTED HEREIN RELATES TO THE PERIOD JUNE 1990 THROUGH SEPTEMBER 2010, THE INDEX CLOSING LEVELS REFLECT THE APPLICATION OF THE INDEX’S METHODOLOGY, AND SELECTION OF INDEX COMMODITIES, IN HINDSIGHT.

NO HYPOTHETICAL RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THERE ARE NUMEROUS FACTORS, INCLUDING THOSE DESCRIBED UNDER “THE RISKS YOU FACE” HEREIN, RELATED TO THE COMMODITIES MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF THE FUND’S EFFORTS TO TRACK ITS INDEX OVER TIME WHICH CANNOT BE, AND HAVE NOT BEEN, ACCOUNTED FOR IN THE PREPARATION OF SUCH INDEX INFORMATION SET FORTH ON THE FOLLOWING PAGES, ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL PERFORMANCE RESULTS FOR THE FUND. FURTHERMORE, THE INDEX INFORMATION DOES NOT INVOLVE FINANCIAL RISK OR ACCOUNT FOR THE IMPACT OF FEES AND COSTS ASSOCIATED WITH THE FUND.

THE MANAGING OWNER COMMENCED OPERATIONS IN JANUARY 2006. AS MANAGING OWNER, THE MANAGING OWNER AND ITS TRADING PRINCIPALS HAVE BEEN MANAGING THE DAY-TO-DAY OPERATIONS FOR THE FUNDS AND RELATED PRODUCTS AND MANAGING FUTURES TRADING ACCOUNTS. BECAUSE THERE ARE LIMITED ACTUAL TRADING RESULTS TO COMPARE TO THE INDEX CLOSING LEVELS SET FORTH HEREIN, PROSPECTIVE INVESTORS SHOULD BE PARTICULARLY WARY OF PLACING UNDUE RELIANCE ON THE ANNUAL OR CUMULATIVE INDEX RESULTS.

See accompanying Notes and Legends.

13

NOTES AND LEGENDS:

| 1. | “High” reflects the highest closing level of the Index during the applicable year. |

| 2. | “Low” reflects the lowest closing level of the Index during the applicable year. |

| 3. | “Annual Index Changes” reflect the change to the Index level on an annual basis as of December 31 of each applicable year. |

| 4. | “Index Changes Since Inception” reflects the change of the Index level since inception on a compounded annual basis as of December 31 of each applicable year. |

| 5. | Closing levels as of inception on June 4, 1990. |

| 6. | Closing levels as of May 31, 2014. |

| 7. | The DBIQ Optimum Yield Energy Index Excess Return™ and DBIQ Optimum Yield Energy Index Total Return™ reflect the change in market value of the following underlying index commodities: CL (Light, Sweet Crude Oil), HO (Heating Oil), LCO (Brent Crude Oil), XB (RBOB Gasoline) and NG (Natural Gas) on an Optimum YieldTM basis. |

| 8. | “DBIQ Optimum Yield Energy ER™” is DBIQ Optimum Yield Energy Index Excess Return™. |

| 9. | “DBIQ Optimum Yield Energy TR™” is DBIQ Optimum Yield Energy Index Total Return™. |

| 10. | “Goldman Sachs US Energy Total Return” is Goldman Sachs US Energy Total Return. |

| 11. | “Annualized Changes to Index Level” reflect the change to the applicable index level on an annual basis as of December 31 of each applicable year. |

| 12. | “Average rolling 3 month daily volatility.” The daily volatility reflects the relative rate at which the price of the applicable index moves up and down, which is found by calculating the annualized standard deviation of the daily change in price. In turn, an average of this value is calculated on a 3 month rolling basis. |

| 13. | “Sharpe Ratio” compares the annualized rate of return minus the annualizedrisk-free rate of return to the annualized variability — often referred to as the “standard deviation” — of the monthly rates of return. A Sharpe Ratio of 1:1 or higher indicates that, according to the measures used in calculating the ratio, the rate of return achieved by a particular strategy has equaled or exceeded the risks assumed by such strategy. The risk-free rate of return that was used in these calculations was assumed to be 2.76%. |

| 14. | “% of months with positive change” during the period from inception to May 31, 2014. |

| 15. | “Average monthly positive change” during the period from inception to May 31, 2014. |

| 16. | “Average monthly negative change” during the period from inception to May 31, 2014. |

| 17. | “Annualized Index Levels” reflect the change to the level of the applicable index on an annual basis as of December 31 of each applicable time period (e.g., 1 year, 3, 5 or 7, 10 or 15 years, as applicable). |

WHILE THE FUND’S OBJECTIVE IS NOT TO GENERATE PROFIT THROUGH ACTIVE PORTFOLIO MANAGEMENT, BUT IS TO TRACK THE INDEX, BECAUSE THE INDEX WAS ESTABLISHED IN JULY 2006 (RENAMED OCTOBER 2010), CERTAIN INFORMATION RELATING TO INDEX CLOSING LEVELS MAY BE CONSIDERED TO BE “HYPOTHETICAL.” HYPOTHETICAL INFORMATION MAY HAVE CERTAIN INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW.

NO REPRESENTATION IS BEING MADE THAT THE INDEX WILL OR IS LIKELY TO ACHIEVE ANNUAL OR CUMULATIVE CLOSING LEVELS CONSISTENT WITH OR SIMILAR TO THOSE SET FORTH HEREIN. SIMILARLY, NO REPRESENTATION IS BEING MADE THAT THE FUND WILL GENERATE PROFITS OR LOSSES SIMILAR TO THE FUND’S PAST PERFORMANCE, WHEN AVAILABLE, OR THE HISTORICAL ANNUAL OR CUMULATIVE CHANGES IN THE INDEX CLOSING LEVELS. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY INVESTMENT METHODOLOGIES, WHETHER ACTIVE OR PASSIVE.

14

ONE OF THE LIMITATIONS OF HYPOTHETICAL INFORMATION IS THAT IT IS GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. TO THE EXTENT THAT INFORMATION PRESENTED HEREIN RELATES TO THE PERIOD JUNE 1990 THROUGH JUNE 2006, THE INDEX CLOSING LEVELS REFLECT THE APPLICATION OF THE INDEX’S METHODOLOGY, AND SELECTION OF INDEX COMMODITIES, IN HINDSIGHT.

NO HYPOTHETICAL RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THERE ARE NUMEROUS FACTORS, INCLUDING THOSE DESCRIBED UNDER “THE RISKS YOU FACE” HEREIN, RELATED TO THE COMMODITIES MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF THE FUND’S EFFORTS TO TRACK ITS INDEX OVER TIME WHICH CANNOT BE, AND HAVE NOT BEEN, ACCOUNTED FOR IN THE PREPARATION OF SUCH INDEX INFORMATION SET FORTH ON THE FOLLOWING PAGES, ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL PERFORMANCE RESULTS FOR THE FUND. FURTHERMORE, THE INDEX INFORMATION DOES NOT INVOLVE FINANCIAL RISK OR ACCOUNT FOR THE IMPACT OF FEES AND COSTS ASSOCIATED WITH THE FUND.

THE MANAGING OWNER COMMENCED OPERATIONS IN JANUARY 2006. AS MANAGING OWNER, THE MANAGING OWNER AND ITS TRADING PRINCIPALS HAVE BEEN MANAGING THE DAY-TO-DAY OPERATIONS FOR THE FUNDS AND RELATED PRODUCTS AND MANAGING FUTURES TRADING ACCOUNTS. BECAUSE THERE ARE LIMITED ACTUAL TRADING RESULTS TO COMPARE TO THE INDEX CLOSING LEVELS SET FORTH HEREIN, PROSPECTIVE INVESTORS SHOULD BE PARTICULARLY WARY OF PLACING UNDUE RELIANCE ON THE ANNUAL OR CUMULATIVE INDEX RESULTS.

ALTHOUGH THE INDEX SPONSOR WILL OBTAIN INFORMATION FOR INCLUSION IN OR FOR USE IN THE CALCULATION OF THE INDEX FROM SOURCE(S) WHICH THE INDEX SPONSOR CONSIDERS RELIABLE, THE INDEX SPONSOR WILL NOT INDEPENDENTLY VERIFY SUCH INFORMATION AND DOES NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF THE INDEX OR ANY DATA INCLUDED THEREIN. THE INDEX SPONSOR SHALL NOT BE LIABLE (WHETHER IN NEGLIGENCE OR OTHERWISE) TO ANY PERSON FOR ANY ERROR IN THE INDEX AND THE INDEX SPONSOR IS UNDER NO OBLIGATION TO ADVISE ANY PERSON OF ANY ERROR THEREIN.

UNLESS OTHERWISE SPECIFIED, NO TRANSACTION RELATING TO THE INDEX IS SPONSORED, ENDORSED, SOLD OR PROMOTED BY THE INDEX SPONSOR AND THE INDEX SPONSOR MAKES NO EXPRESS OR IMPLIED REPRESENTATIONS OR WARRANTIES AS TO (A) THE ADVISABILITY OF PURCHASING OR ASSUMING ANY RISK IN CONNECTION WITH ANY SUCH TRANSACTION (B) THE LEVELS AT WHICH THE INDEX STANDS AT ANY PARTICULAR TIME ON ANY PARTICULAR DATE (C) THE RESULTS TO BE OBTAINED BY THE ISSUER OF ANY SECURITY OR ANY COUNTERPARTY OR ANY SUCH ISSUER’S SECURITY HOLDERS OR CUSTOMERS OR ANY SUCH COUNTERPARTY’S CUSTOMERS OR COUNTERPARTIES OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE INDEX OR ANY DATA INCLUDED THEREIN IN CONNECTION WITH ANY LICENSED RIGHTS OR FOR ANY OTHER USE OR (D) ANY OTHER MATTER. THE INDEX SPONSOR MAKES NO EXPRESS OR IMPLIED REPRESENTATIONS OR WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE WITH RESPECT TO THE INDEX OR ANY DATA INCLUDED THEREIN.

WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL THE INDEX SPONSOR HAVE ANY LIABILITY (WHETHER IN NEGLIGENCE OR OTHERWISE) TO ANY PERSON FOR ANY DIRECT, INDIRECT, SPECIAL, PUNITIVE, CONSEQUENTIAL OR ANY OTHER DAMAGES (INCLUDING LOST PROFITS) EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

15

CRUDE OIL SECTOR DATA

RELATING TO

DBIQ OPTIMUM YIELD CRUDE OIL INDEX EXCESS RETURN™

(DBIQ-OY CL ER™)

16

CLOSING LEVELS TABLES

DBIQ OPTIMUM YIELD CRUDE OIL INDEX EXCESS RETURN™

| CLOSING LEVEL | CHANGES | |||||||

| High1 | Low2 | Annual Index Changes3 | Index Changes Since Inception4 | |||||

19885 | 112.02 | 97.53 | 12.02% | 12.02% | ||||

1989 | 192.01 | 110.98 | 71.41% | 92.01% | ||||

1990 | 294.82 | 160.13 | 24.79% | 139.61% | ||||

1991 | 238.71 | 175.06 | -15.63% | 102.15% | ||||

1992 | 224.82 | 189.93 | 0.68% | 103.52% | ||||

1993 | 217.01 | 152.46 | -24.79% | 53.08% | ||||

1994 | 173.31 | 142.13 | 5.59% | 61.64% | ||||

1995 | 202.32 | 157.90 | 25.16% | 102.32% | ||||

1996 | 414.35 | 185.87 | 104.80% | 314.35% | ||||

1997 | 425.66 | 303.27 | -26.65% | 203.93% | ||||

1998 | 302.95 | 171.33 | -40.94% | 79.51% | ||||

1999 | 346.30 | 165.23 | 85.26% | 232.56% | ||||

2000 | 551.67 | 325.69 | 31.04% | 335.79% | ||||

2001 | 532.29 | 390.80 | -3.95% | 318.57% | ||||

2002 | 608.00 | 399.11 | 41.61% | 492.76% | ||||

2003 | 847.48 | 574.29 | 39.55% | 727.21% | ||||

2004 | 1632.10 | 824.87 | 63.83% | 1255.23% | ||||

2005 | 2171.79 | 1319.88 | 42.95% | 1837.28% | ||||

2006 | 2389.01 | 1856.67 | -2.48% | 1789.17% | ||||

2007 | 2523.38 | 1571.31 | 33.12% | 2414.88% | ||||

2008 | 3955.92 | 1188.78 | -41.61% | 1368.33% | ||||

2009 | 2057.94 | 1147.41 | 36.08% | 1898.07% | ||||

2010 | 2169.64 | 1673.17 | 3.20% | 1962.00% | ||||

2011 | 2508.55 | 1642.90 | 1.97% | 2002.66% | ||||

2012 | 2343.44 | 1685.62 | -8.17% | 1830.84% | ||||

2013 | 2108.94 | 1796.69 | 7.08% | 1967.56% | ||||

20146 | 2236.91 | 1944.09 | 6.49% | 2101.76% | ||||

THE FUND WILL TRADE WITH A VIEW TO TRACKING THE DBIQ OPTIMUM YIELD CRUDE OIL INDEX EXCESS RETURN™ OVER TIME. NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

DBIQ OPTIMUM YIELD CRUDE OIL INDEX TOTAL RETURN™

| CLOSING LEVEL | CHANGES | |||||||

| High1 | Low2 | Annual Index Changes3 | Index Changes Since Inception4 | |||||

19885 | 112.73 | 97.60 | 12.73% | 12.73% | ||||

1989 | 209.87 | 111.81 | 86.17% | 109.87% | ||||

1990 | 341.64 | 182.36 | 34.76% | 182.82% | ||||

1991 | 295.24 | 208.42 | -10.88% | 152.05% | ||||

1992 | 288.22 | 237.02 | 4.27% | 162.81% | ||||

1993 | 281.69 | 202.92 | -22.45% | 103.80% | ||||

1994 | 235.88 | 190.71 | 10.24% | 124.67% | ||||

1995 | 297.36 | 219.85 | 32.36% | 197.36% | ||||

1996 | 641.10 | 274.37 | 115.60% | 541.10% | ||||

1997 | 659.34 | 493.93 | -22.77% | 395.14% | ||||

1998 | 495.55 | 292.68 | -37.99% | 207.03% | ||||

1999 | 620.64 | 284.23 | 94.21% | 496.27% | ||||

2000 | 1035.63 | 584.55 | 39.02% | 728.92% | ||||

2001 | 1030.69 | 768.08 | -0.53% | 724.54% | ||||

2002 | 1217.32 | 786.82 | 43.96% | 1087.00% | ||||

2003 | 1713.97 | 1154.40 | 40.99% | 1573.50% | ||||

2004 | 3334.95 | 1670.29 | 66.12% | 2679.95% | ||||

2005 | 4541.88 | 2707.94 | 47.56% | 4002.06% | ||||

2006 | 5203.49 | 3969.14 | 2.34% | 4097.88% | ||||

2007 | 5859.72 | 3499.36 | 39.16% | 5741.98% | ||||

2008 | 9281.23 | 2799.96 | -40.80% | 3358.41% | ||||

2009 | 4853.73 | 2703.20 | 36.28% | 4612.97% | ||||

2010 | 5119.70 | 3948.54 | 3.34% | 4770.26% | ||||

2011 | 5927.09 | 3882.20 | 2.02% | 4868.75% | ||||

2012 | 5538.20 | 3984.72 | -8.09% | 4466.53% | ||||

2013 | 4989.66 | 4250.26 | 7.14% | 4792.56% | ||||

20146 | 5294.13 | 4600.45 | 6.51% | 5110.95% | ||||

THE FUND WILL NOT TRADE WITH A VIEW TO TRACKING THE DBIQ OPTIMUM YIELD CRUDE OIL INDEX TOTAL RETURN™ OVER TIME. NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

See accompanying Notes and Legends.

17

INDEX COMMODITIES WEIGHTS TABLES

DBIQ OPTIMUM YIELD CRUDE OIL INDEX EXCESS RETURN™

| CL7 | ||||

| High1 | Low2 | |||

19885 | 100% | 100% | ||

1989 | 100% | 100% | ||

1990 | 100% | 100% | ||

1991 | 100% | 100% | ||

1992 | 100% | 100% | ||

1993 | 100% | 100% | ||

1994 | 100% | 100% | ||

1995 | 100% | 100% | ||

1996 | 100% | 100% | ||

1997 | 100% | 100% | ||

1998 | 100% | 100% | ||

1999 | 100% | 100% | ||

2000 | 100% | 100% | ||

2001 | 100% | 100% | ||

2002 | 100% | 100% | ||

2003 | 100% | 100% | ||

2004 | 100% | 100% | ||

2005 | 100% | 100% | ||

2006 | 100% | 100% | ||

2007 | 100% | 100% | ||

2008 | 100% | 100% | ||

2009 | 100% | 100% | ||

2010 | 100% | 100% | ||

2011 | 100% | 100% | ||

2012 | 100% | 100% | ||

2013 | 100% | 100% | ||

20146 | 100% | 100% | ||

THE FUND WILL TRADE WITH A VIEW TO TRACKING THE

DBIQ OPTIMUM YIELD CRUDE OIL INDEX EXCESS RETURN™ OVER TIME.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND

NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

DBIQ OPTIMUM YIELD CRUDE OIL INDEX TOTAL RETURN™

| CL7 | ||||

| High1 | Low2 | |||

19885 | 100% | 100% | ||

1989 | 100% | 100% | ||

1990 | 100% | 100% | ||

1991 | 100% | 100% | ||

1992 | 100% | 100% | ||

1993 | 100% | 100% | ||

1994 | 100% | 100% | ||

1995 | 100% | 100% | ||

1996 | 100% | 100% | ||

1997 | 100% | 100% | ||

1998 | 100% | 100% | ||

1999 | 100% | 100% | ||

2000 | 100% | 100% | ||

2001 | 100% | 100% | ||

2002 | 100% | 100% | ||

2003 | 100% | 100% | ||

2004 | 100% | 100% | ||

2005 | 100% | 100% | ||

2006 | 100% | 100% | ||

2007 | 100% | 100% | ||

2008 | 100% | 100% | ||

2009 | 100% | 100% | ||

2010 | 100% | 100% | ||

2011 | 100% | 100% | ||

2012 | 100% | 100% | ||

2013 | 100% | 100% | ||

20146 | 100% | 100% | ||

THE FUND WILL NOT TRADE WITH A VIEW TO TRACKING THE

DBIQ OPTIMUM YIELD CRUDE OIL INDEX TOTAL RETURN™ OVER TIME.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND

NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

See accompanying Notes and Legends.

18

All statistics based on data from December 2, 1988 to May 31, 2014.

VARIOUS STATISTICAL MEASURES | DBIQ Optimum Yield Crude Oil ER8 | DBIQ Optimum Yield Crude Oil TR9 | Goldman Sachs Crude Oil Total Return Index10 | |||||||||||

Annualized Changes to Index Level11 | 12.9 | % | 16.8 | % | 10.5 | % | ||||||||

Average rolling 3 month daily volatility12 | 24.5 | % | 24.5 | % | 29.9 | % | ||||||||

Sharpe Ratio13 | 0.53 | 0.56 | 0.25 | |||||||||||

% of months with positive change14 | 56 | % | 57 | % | 56 | % | ||||||||

Average monthly positive change15 | 6.3 | % | 6.6 | % | 7.8 | % | ||||||||

Average monthly negative change16 | -5.2 | % | -5.0 | % | -6.8 | % | ||||||||

ANNUALIZED INDEX LEVELS17 | DBIQ Optimum Yield Crude Oil ER8 | DBIQ Optimum Yield Crude Oil TR9 | Goldman Sachs Crude Oil Total Return Index10 | |||||||||||

1 year | 16.2 | % | 16.2 | % | 10.5 | % | ||||||||

3 year | -0.7 | % | -0.7 | % | 29.9 | % | ||||||||

5 year | 4.2 | % | 4.3 | % | 0.25 | |||||||||

7 year | 2.6 | % | 3.2 | % | 56 | % | ||||||||

10 year | 7.0 | % | 8.7 | % | 7.8 | % | ||||||||

15 year | 16.1 | % | 18.5 | % | -6.8 | % | ||||||||

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

WHILE THE FUND’S OBJECTIVE IS NOT TO GENERATE PROFIT THROUGH ACTIVE PORTFOLIO MANAGEMENT, BUT IS TO TRACK THE INDEX, BECAUSE THE INDEX WAS ESTABLISHED IN MAY 2006 (RENAMED OCTOBER 2010), CERTAIN INFORMATION RELATING TO INDEX CLOSING LEVELS MAY BE CONSIDERED TO BE “HYPOTHETICAL.” HYPOTHETICAL INFORMATION MAY HAVE CERTAIN INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW.

NO REPRESENTATION IS BEING MADE THAT THE INDEX WILL OR IS LIKELY TO ACHIEVE ANNUAL OR CUMULATIVE CLOSING LEVELS CONSISTENT WITH OR SIMILAR TO THOSE SET FORTH HEREIN. SIMILARLY, NO REPRESENTATION IS BEING MADE THAT THE FUND WILL GENERATE PROFITS OR LOSSES SIMILAR TO THE FUND’S PAST PERFORMANCE, WHEN AVAILABLE, OR THE HISTORICAL ANNUAL OR CUMULATIVE CHANGES IN THE INDEX CLOSING LEVELS. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY INVESTMENT METHODOLOGIES, WHETHER ACTIVE OR PASSIVE.

ONE OF THE LIMITATIONS OF HYPOTHETICAL INFORMATION IS THAT IT IS GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. TO THE EXTENT THAT INFORMATION PRESENTED HEREIN RELATES TO THE PERIOD DECEMBER 1988 THROUGH APRIL 2006, THE INDEX CLOSING LEVELS REFLECT THE APPLICATION OF THE INDEX’S METHODOLOGY, AND SELECTION OF INDEX COMMODITIES, IN HINDSIGHT.

NO HYPOTHETICAL RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THERE ARE NUMEROUS FACTORS, INCLUDING THOSE DESCRIBED UNDER “THE RISKS YOU FACE” HEREIN, RELATED TO THE COMMODITIES MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF THE FUND’S EFFORTS TO TRACK ITS INDEX OVER TIME WHICH CANNOT BE, AND HAVE NOT BEEN, ACCOUNTED FOR IN THE PREPARATION OF SUCH INDEX INFORMATION SET FORTH ON THE FOLLOWING PAGES, ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL PERFORMANCE RESULTS FOR THE FUND. FURTHERMORE, THE INDEX INFORMATION DOES NOT INVOLVE FINANCIAL RISK OR ACCOUNT FOR THE IMPACT OF FEES AND COSTS ASSOCIATED WITH THE FUND.

THE MANAGING OWNER COMMENCED OPERATIONS IN JANUARY 2006. AS MANAGING OWNER, THE MANAGING OWNER AND ITS TRADING PRINCIPALS HAVE BEEN MANAGING THE DAY-TO-DAY OPERATIONS FOR THE FUNDS AND RELATED PRODUCTS AND MANAGING FUTURES TRADING ACCOUNTS. BECAUSE THERE ARE LIMITED ACTUAL TRADING RESULTS TO COMPARE TO THE INDEX CLOSING LEVELS SET FORTH HEREIN, PROSPECTIVE INVESTORS SHOULD BE PARTICULARLY WARY OF PLACING UNDUE RELIANCE ON THE ANNUAL OR CUMULATIVE INDEX RESULTS.

See accompanying Notes and Legends.

19

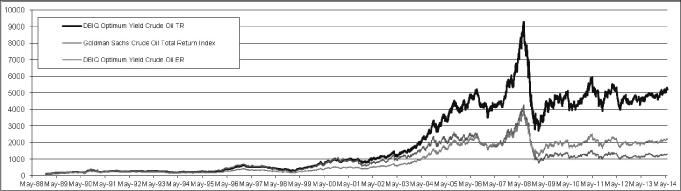

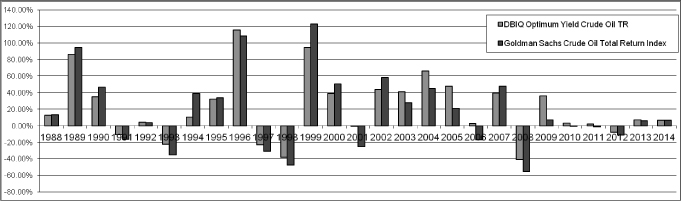

| COMPARISON OF DBIQ-OY CL ER, DBIQ-OY CL TR AND GOLDMAN SACHS CRUDE OIL TOTAL RETURN INDEX |

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

Each of DBIQ-OY CL ER, DBIQ-OY CL TR and Goldman Sachs Crude Oil Total Return Index are indices and do not reflect actual trading. DBIQ-OY CL TR and Goldman Sachs Crude Oil Total Return Index are calculated on a total return basis and do not reflect any fees or expenses.

WHILE THE FUND’S OBJECTIVE IS NOT TO GENERATE PROFIT THROUGH ACTIVE PORTFOLIO MANAGEMENT, BUT IS TO TRACK THE INDEX, BECAUSE THE INDEX WAS ESTABLISHED IN MAY 2006 (RENAMED OCTOBER 2010), CERTAIN INFORMATION RELATING TO INDEX CLOSING LEVELS MAY BE CONSIDERED TO BE “HYPOTHETICAL.” HYPOTHETICAL INFORMATION MAY HAVE CERTAIN INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW.

NO REPRESENTATION IS BEING MADE THAT THE INDEX WILL OR IS LIKELY TO ACHIEVE ANNUAL OR CUMULATIVE CLOSING LEVELS CONSISTENT WITH OR SIMILAR TO THOSE SET FORTH HEREIN. SIMILARLY, NO REPRESENTATION IS BEING MADE THAT THE FUND WILL GENERATE PROFITS OR LOSSES SIMILAR TO THE FUND’S PAST PERFORMANCE, WHEN AVAILABLE, OR THE HISTORICAL ANNUAL OR CUMULATIVE CHANGES IN THE INDEX CLOSING LEVELS. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY INVESTMENT METHODOLOGIES, WHETHER ACTIVE OR PASSIVE.

ONE OF THE LIMITATIONS OF HYPOTHETICAL INFORMATION IS THAT IT IS GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. TO THE EXTENT THAT INFORMATION PRESENTED HEREIN RELATES TO THE PERIOD DECEMBER 1988 THROUGH APRIL 2006, THE INDEX CLOSING LEVELS REFLECT THE APPLICATION OF THE INDEX’S METHODOLOGY, AND SELECTION OF INDEX COMMODITIES, IN HINDSIGHT.

NO HYPOTHETICAL RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THERE ARE NUMEROUS FACTORS, INCLUDING THOSE DESCRIBED UNDER “THE RISKS YOU FACE” HEREIN, RELATED TO THE COMMODITIES MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF THE FUND’S EFFORTS TO TRACK ITS INDEX OVER TIME WHICH CANNOT BE, AND HAVE NOT BEEN, ACCOUNTED FOR IN THE PREPARATION OF SUCH INDEX INFORMATION SET FORTH ON THE FOLLOWING PAGES, ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL PERFORMANCE RESULTS FOR THE FUND. FURTHERMORE, THE INDEX INFORMATION DOES NOT INVOLVE FINANCIAL RISK OR ACCOUNT FOR THE IMPACT OF FEES AND COSTS ASSOCIATED WITH THE FUND.

THE MANAGING OWNER COMMENCED OPERATIONS IN JANUARY 2006. AS MANAGING OWNER, THE MANAGING OWNER AND ITS TRADING PRINCIPALS HAVE BEEN MANAGING THE DAY-TO-DAY OPERATIONS FOR THE FUNDS AND RELATED PRODUCTS AND MANAGING FUTURES TRADING ACCOUNTS. BECAUSE THERE ARE LIMITED ACTUAL TRADING RESULTS TO COMPARE TO THE INDEX CLOSING LEVELS SET FORTH HEREIN, PROSPECTIVE INVESTORS SHOULD BE PARTICULARLY WARY OF PLACING UNDUE RELIANCE ON THE ANNUAL OR CUMULATIVE INDEX RESULTS.

See accompanying Notes and Legends.

20

| COMPARISON OF DBIQ-OY CL TR AND GOLDMAN SACHS CRUDE OIL TOTAL RETURN INDEX |

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

Each of DBIQ-OY CL TR and Goldman Sachs Crude Oil Total Return Index are indices and do not reflect actual trading. DBIQ-OY CL TR and Goldman Sachs Crude Oil Total Return Index are calculated on a total return basis and do not reflect any fees or expenses.

WHILE THE FUND’S OBJECTIVE IS NOT TO GENERATE PROFIT THROUGH ACTIVE PORTFOLIO MANAGEMENT, BUT IS TO TRACK THE INDEX, BECAUSE THE INDEX WAS ESTABLISHED IN MAY 2006 (RENAMED OCTOBER 2010), CERTAIN INFORMATION RELATING TO INDEX CLOSING LEVELS MAY BE CONSIDERED TO BE “HYPOTHETICAL.” HYPOTHETICAL INFORMATION MAY HAVE CERTAIN INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW.

NO REPRESENTATION IS BEING MADE THAT THE INDEX WILL OR IS LIKELY TO ACHIEVE ANNUAL OR CUMULATIVE CLOSING LEVELS CONSISTENT WITH OR SIMILAR TO THOSE SET FORTH HEREIN. SIMILARLY, NO REPRESENTATION IS BEING MADE THAT THE FUND WILL GENERATE PROFITS OR LOSSES SIMILAR TO THE FUND’S PAST PERFORMANCE, WHEN AVAILABLE, OR THE HISTORICAL ANNUAL OR CUMULATIVE CHANGES IN THE INDEX CLOSING LEVELS. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY INVESTMENT METHODOLOGIES, WHETHER ACTIVE OR PASSIVE.

ONE OF THE LIMITATIONS OF HYPOTHETICAL INFORMATION IS THAT IT IS GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. TO THE EXTENT THAT INFORMATION PRESENTED HEREIN RELATES TO THE PERIOD DECEMBER 1988 THROUGH APRIL 2006, THE INDEX CLOSING LEVELS REFLECT THE APPLICATION OF THE INDEX’S METHODOLOGY, AND SELECTION OF INDEX COMMODITIES, IN HINDSIGHT.

NO HYPOTHETICAL RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THERE ARE NUMEROUS FACTORS, INCLUDING THOSE DESCRIBED UNDER “THE RISKS YOU FACE” HEREIN, RELATED TO THE COMMODITIES MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF THE FUND’S EFFORTS TO TRACK ITS INDEX OVER TIME WHICH CANNOT BE, AND HAVE NOT BEEN, ACCOUNTED FOR IN THE PREPARATION OF SUCH INDEX INFORMATION SET FORTH ON THE FOLLOWING PAGES, ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL PERFORMANCE RESULTS FOR THE FUND. FURTHERMORE, THE INDEX INFORMATION DOES NOT INVOLVE FINANCIAL RISK OR ACCOUNT FOR THE IMPACT OF FEES AND COSTS ASSOCIATED WITH THE FUND.

THE MANAGING OWNER COMMENCED OPERATIONS IN JANUARY 2006. AS MANAGING OWNER, THE MANAGING OWNER AND ITS TRADING PRINCIPALS HAVE BEEN MANAGING THE DAY-TO-DAY OPERATIONS FOR THE FUNDS AND RELATED PRODUCTS AND MANAGING FUTURES TRADING ACCOUNTS. BECAUSE THERE ARE LIMITED ACTUAL TRADING RESULTS TO COMPARE TO THE INDEX CLOSING LEVELS SET FORTH HEREIN, PROSPECTIVE INVESTORS SHOULD BE PARTICULARLY WARY OF PLACING UNDUE RELIANCE ON THE ANNUAL OR CUMULATIVE INDEX RESULTS.

See accompanying Notes and Legends.

21

| NOTES AND LEGENDS: |

| 1. | “High” reflects the highest closing level of the Index during the applicable year. |

| 2. | “Low” reflects the lowest closing level of the Index during the applicable year. |

| 3. | “Annual Index Changes” reflect the change to the Index level on an annual basis as of December 31 of each applicable year. |

| 4. | “Index Changes Since Inception” reflects the change of the Index level since inception on a compounded annual basis as of December 31 of each applicable year. |

| 5. | Closing levels as of inception on December 2, 1988. |

| 6. | Closing levels as of May 31, 2014. |

| 7. | The DBIQ Optimum Yield Crude Oil Index Excess Return™ and DBIQ Optimum Yield Crude Oil Index Total Return™ reflect the change in market value of CL (Light, Sweet Crude Oil) on an Optimum YieldTM basis. |

| 8. | “DBIQ-OY CL ER™” is DBIQ Optimum Yield Crude Oil Index Excess Return™. |

| 9. | “DBIQ-OY CL TR™” is DBIQ Optimum Yield Crude Oil Index Total Return™. |

| 10. | “Goldman Sachs Crude Oil Total Return Index” is Goldman Sachs Crude Oil Total Return Index. |

| 11. | “Annualized Changes to Index Level” reflect the change to the applicable index level on an annual basis as of December 31 of each applicable year. |

| 12. | “Average rolling 3 month daily volatility.” The daily volatility reflects the relative rate at which the price of the applicable index moves up and down, which is found by calculating the annualized standard deviation of the daily change in price. In turn, an average of this value is calculated on a 3 month rolling basis. |

| 13. | “Sharpe Ratio” compares the annualized rate of return minus the annualizedrisk-free rate of return to the annualized variability — often referred to as the “standard deviation” — of the monthly rates of return. A Sharpe Ratio of 1:1 or higher indicates that, according to the measures used in calculating the ratio, the rate of return achieved by a particular strategy has equaled or exceeded the risks assumed by such strategy. The risk-free rate of return that was used in these calculations was assumed to be 3.03%. |

| 14. | “% of months with positive change” during the period from inception to May 31, 2014. |

| 15. | “Average monthly positive change” during the period from inception to May 31, 2014. |

| 16. | “Average monthly negative change” during the period from inception to May 31, 2014. |

| 17. | “Annualized Index Levels” reflect the change to the level of the applicable index on an annual basis as of December 31 of each applicable time period (e.g., 1 year, 3, 5 or 7, 10 or 15 years, as applicable). |

WHILE THE FUND’S OBJECTIVE IS NOT TO GENERATE PROFIT THROUGH ACTIVE PORTFOLIO MANAGEMENT, BUT IS TO TRACK THE INDEX, BECAUSE THE INDEX WAS ESTABLISHED IN MAY 2006 (RENAMED OCTOBER 2010), CERTAIN INFORMATION RELATING TO INDEX CLOSING LEVELS MAY BE CONSIDERED TO BE “HYPOTHETICAL.” HYPOTHETICAL INFORMATION MAY HAVE CERTAIN INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW.

NO REPRESENTATION IS BEING MADE THAT THE INDEX WILL OR IS LIKELY TO ACHIEVE ANNUAL OR CUMULATIVE CLOSING LEVELS CONSISTENT WITH OR SIMILAR TO THOSE SET FORTH HEREIN. SIMILARLY, NO REPRESENTATION IS BEING MADE THAT THE FUND WILL GENERATE PROFITS OR LOSSES SIMILAR TO THE FUND’S PAST PERFORMANCE, WHEN AVAILABLE, OR THE HISTORICAL ANNUAL OR CUMULATIVE CHANGES IN THE INDEX CLOSING LEVELS. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY INVESTMENT METHODOLOGIES, WHETHER ACTIVE OR PASSIVE.

ONE OF THE LIMITATIONS OF HYPOTHETICAL INFORMATION IS THAT IT IS GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. TO THE EXTENT THAT INFORMATION PRESENTED HEREIN RELATES TO THE PERIOD DECEMBER 1988 THROUGH APRIL 2006, THE INDEX CLOSING LEVELS REFLECT THE APPLICATION OF THE INDEX’S METHODOLOGY, AND SELECTION OF INDEX COMMODITIES, IN HINDSIGHT.

22

NO HYPOTHETICAL RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THERE ARE NUMEROUS FACTORS, INCLUDING THOSE DESCRIBED UNDER “THE RISKS YOU FACE” HEREIN, RELATED TO THE COMMODITIES MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF THE FUND’S EFFORTS TO TRACK ITS INDEX OVER TIME WHICH CANNOT BE, AND HAVE NOT BEEN, ACCOUNTED FOR IN THE PREPARATION OF SUCH INDEX INFORMATION SET FORTH ON THE FOLLOWING PAGES, ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL PERFORMANCE RESULTS FOR THE FUND. FURTHERMORE, THE INDEX INFORMATION DOES NOT INVOLVE FINANCIAL RISK OR ACCOUNT FOR THE IMPACT OF FEES AND COSTS ASSOCIATED WITH THE FUND.

THE MANAGING OWNER COMMENCED OPERATIONS IN JANUARY 2006. AS MANAGING OWNER, THE MANAGING OWNER AND ITS TRADING PRINCIPALS HAVE BEEN MANAGING THE DAY-TO-DAY OPERATIONS FOR THE FUNDS AND RELATED PRODUCTS AND MANAGING FUTURES TRADING ACCOUNTS. BECAUSE THERE ARE LIMITED ACTUAL TRADING RESULTS TO COMPARE TO THE INDEX CLOSING LEVELS SET FORTH HEREIN, PROSPECTIVE INVESTORS SHOULD BE PARTICULARLY WARY OF PLACING UNDUE RELIANCE ON THE ANNUAL OR CUMULATIVE INDEX RESULTS.

ALTHOUGH THE INDEX SPONSOR WILL OBTAIN INFORMATION FOR INCLUSION IN OR FOR USE IN THE CALCULATION OF THE INDEX FROM SOURCE(S) WHICH THE INDEX SPONSOR CONSIDERS RELIABLE, THE INDEX SPONSOR WILL NOT INDEPENDENTLY VERIFY SUCH INFORMATION AND DOES NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF THE INDEX OR ANY DATA INCLUDED THEREIN. THE INDEX SPONSOR SHALL NOT BE LIABLE (WHETHER IN NEGLIGENCE OR OTHERWISE) TO ANY PERSON FOR ANY ERROR IN THE INDEX AND THE INDEX SPONSOR IS UNDER NO OBLIGATION TO ADVISE ANY PERSON OF ANY ERROR THEREIN.

UNLESS OTHERWISE SPECIFIED, NO TRANSACTION RELATING TO THE INDEX IS SPONSORED, ENDORSED, SOLD OR PROMOTED BY THE INDEX SPONSOR AND THE INDEX SPONSOR MAKES NO EXPRESS OR IMPLIED REPRESENTATIONS OR WARRANTIES AS TO (A) THE ADVISABILITY OF PURCHASING OR ASSUMING ANY RISK IN CONNECTION WITH ANY SUCH TRANSACTION (B) THE LEVELS AT WHICH THE INDEX STANDS AT ANY PARTICULAR TIME ON ANY PARTICULAR DATE (C) THE RESULTS TO BE OBTAINED BY THE ISSUER OF ANY SECURITY OR ANY COUNTERPARTY OR ANY SUCH ISSUER’S SECURITY HOLDERS OR CUSTOMERS OR ANY SUCH COUNTERPARTY’S CUSTOMERS OR COUNTERPARTIES OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE INDEX OR ANY DATA INCLUDED THEREIN IN CONNECTION WITH ANY LICENSED RIGHTS OR FOR ANY OTHER USE OR (D) ANY OTHER MATTER. THE INDEX SPONSOR MAKES NO EXPRESS OR IMPLIED REPRESENTATIONS OR WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE WITH RESPECT TO THE INDEX OR ANY DATA INCLUDED THEREIN.

WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL THE INDEX SPONSOR HAVE ANY LIABILITY (WHETHER IN NEGLIGENCE OR OTHERWISE) TO ANY PERSON FOR ANY DIRECT, INDIRECT, SPECIAL, PUNITIVE, CONSEQUENTIAL OR ANY OTHER DAMAGES (INCLUDING LOST PROFITS) EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

23

PRECIOUS METALS SECTOR DATA

RELATING TO

DBIQ OPTIMUM YIELD PRECIOUS METALS INDEX EXCESS RETURN™

(DBIQ-OY PRECIOUS METALS ER™)

24

CLOSING LEVELS TABLES

DBIQ OPTIMUM YIELD PRECIOUS METALS INDEX EXCESS RETURN™

| CLOSING LEVEL | CHANGES | |||||||

| High1 | Low2 | Annual Index Changes3 | Index Changes Since Inception4 | |||||

19885 | 99.45 | 94.47 | -5.10% | -5.10% | ||||

1989 | 95.07 | 78.33 | -10.54% | -15.10% | ||||

1990 | 88.33 | 70.07 | -12.51% | -25.72% | ||||

1991 | 75.34 | 62.42 | -15.60% | -37.30% | ||||

1992 | 64.28 | 56.55 | -9.44% | -43.22% | ||||

1993 | 71.31 | 55.38 | 18.49% | -32.72% | ||||

1994 | 68.95 | 61.70 | -6.24% | -36.92% | ||||

1995 | 65.86 | 60.00 | -4.13% | -39.53% | ||||

1996 | 65.24 | 54.89 | -9.22% | -45.11% | ||||

1997 | 55.35 | 43.82 | -17.28% | -54.59% | ||||

1998 | 48.63 | 40.62 | -7.08% | -57.81% | ||||

1999 | 45.88 | 37.10 | -1.70% | -58.53% | ||||

2000 | 44.35 | 36.32 | -11.36% | -63.24% | ||||

2001 | 37.53 | 33.78 | -2.66% | -64.22% | ||||

2002 | 42.57 | 35.33 | 18.95% | -57.43% | ||||

2003 | 50.84 | 39.24 | 19.06% | -49.32% | ||||

2004 | 57.55 | 46.00 | 6.35% | -46.10% | ||||

2005 | 64.36 | 50.94 | 16.97% | -36.95% | ||||

2006 | 89.86 | 63.88 | 21.19% | -23.60% | ||||

2007 | 93.76 | 72.62 | 20.64% | -7.82% | ||||

2008 | 111.75 | 70.48 | -4.17% | -11.67% | ||||

2009 | 125.88 | 80.96 | 27.73% | 12.83% | ||||

2010 | 156.43 | 106.48 | 38.64% | 56.43% | ||||

2011 | 209.23 | 142.98 | 5.13% | 64.46% | ||||

2012 | 193.25 | 160.55 | 6.30% | 74.82% | ||||

2013 | 178.48 | 120.93 | -30.30% | 21.85% | ||||

20146 | 138.62 | 123.93 | 2.07% | 24.37% | ||||

THE FUND WILL TRADE WITH A VIEW TO TRACKING THE DBIQ OPTIMUM YIELD PRECIOUS METALS INDEX EXCESS RETURN™ OVER TIME.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

DBIQ OPTIMUM YIELD PRECIOUS METALS INDEX TOTAL RETURN™

| CLOSING LEVEL | CHANGES | |||||||

| High1 | Low2 | Annual Index Changes3 | Index Changes Since Inception4 | |||||

19885 | 99.52 | 95.05 | -4.49% | -4.49% | ||||

1989 | 98.10 | 83.59 | -2.82% | -7.18% | ||||

1990 | 97.35 | 81.17 | -5.51% | -12.30% | ||||

1991 | 89.20 | 77.58 | -10.84% | -21.81% | ||||

1992 | 80.34 | 72.71 | -6.21% | -26.66% | ||||

1993 | 93.75 | 71.94 | 22.16% | -10.41% | ||||

1994 | 93.57 | 85.44 | -2.11% | -12.31% | ||||

1995 | 93.31 | 84.23 | 1.38% | -11.10% | ||||

1996 | 96.38 | 84.72 | -4.43% | -15.04% | ||||

1997 | 86.39 | 71.19 | -12.91% | -26.00% | ||||

1998 | 80.52 | 68.46 | -2.45% | -27.81% | ||||

1999 | 81.29 | 65.38 | 3.05% | -25.61% | ||||

2000 | 80.04 | 68.62 | -5.96% | -30.05% | ||||

2001 | 73.58 | 65.10 | 0.81% | -29.48% | ||||

2002 | 85.28 | 69.70 | 20.93% | -14.72% | ||||

2003 | 102.89 | 78.85 | 20.29% | 2.58% | ||||

2004 | 117.90 | 93.42 | 7.84% | 10.62% | ||||

2005 | 136.03 | 104.80 | 20.74% | 33.56% | ||||

2006 | 193.51 | 135.42 | 27.17% | 69.85% | ||||

2007 | 216.92 | 161.55 | 26.12% | 114.21% | ||||

2008 | 260.94 | 166.06 | -2.83% | 108.15% | ||||

2009 | 297.04 | 190.78 | 27.92% | 166.26% | ||||

2010 | 369.64 | 251.28 | 38.83% | 269.64% | ||||

2011 | 494.63 | 337.88 | 5.18% | 288.80% | ||||

2012 | 456.90 | 379.70 | 6.39% | 313.64% | ||||

2013 | 422.32 | 286.27 | -30.26% | 188.46% | ||||

20146 | 328.18 | 293.40 | 2.09% | 194.49% | ||||

THE FUND WILL NOT TRADE WITH A VIEW TO TRACKING THE DBIQ OPTIMUM YIELD PRECIOUS METALS INDEX TOTAL RETURN™ OVER TIME. NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

See accompanying Notes and Legends.

25

INDEX COMMODITIES WEIGHTS TABLES

DBIQ OPTIMUM YIELD PRECIOUS METALS INDEX EXCESS RETURN™

| GC7 | SI7 | |||||||

| High1 | Low2 | High | Low | |||||

19885 | 80.0% | 79.6% | 20.0% | 20.4% | ||||

1989 | 79.7% | 80.9% | 20.3% | 19.1% | ||||

1990 | 81.2% | 80.0% | 18.8% | 20.0% | ||||

1991 | 80.9% | 80.5% | 19.1% | 19.5% | ||||

1992 | 78.8% | 80.1% | 21.2% | 19.9% | ||||

1993 | 77.3% | 80.3% | 22.7% | 19.7% | ||||

1994 | 76.6% | 81.7% | 23.4% | 18.3% | ||||

1995 | 78.7% | 82.3% | 21.3% | 17.7% | ||||

1996 | 79.9% | 79.8% | 20.1% | 20.2% | ||||

1997 | 77.8% | 77.0% | 22.2% | 23.0% | ||||

1998 | 75.9% | 78.5% | 24.1% | 21.5% | ||||

1999 | 80.0% | 77.2% | 20.0% | 22.8% | ||||

2000 | 80.1% | 80.4% | 19.9% | 19.6% | ||||

2001 | 82.1% | 81.0% | 17.9% | 19.0% | ||||

2002 | 80.7% | 79.5% | 19.3% | 20.5% | ||||

2003 | 78.6% | 80.4% | 21.4% | 19.6% | ||||

2004 | 79.7% | 77.9% | 20.3% | 22.1% | ||||

2005 | 79.3% | 81.2% | 20.7% | 18.8% | ||||

2006 | 76.1% | 79.6% | 23.9% | 20.4% | ||||

2007 | 81.1% | 80.1% | 18.9% | 19.9% | ||||

2008 | 78.4% | 81.4% | 21.6% | 18.6% | ||||

2009 | 80.2% | 80.9% | 19.8% | 19.1% | ||||

2010 | 78.2% | 81.8% | 21.8% | 18.2% | ||||

2011 | 77.4% | 79.3% | 22.6% | 20.7% | ||||

2012 | 78.9% | 82.1% | 21.1% | 17.9% | ||||

2013 | 79.7% | 80.5% | 20.3% | 19.5% | ||||

20146 | 81.1% | 80.7% | 18.9% | 19.3% | ||||

THE FUND WILL TRADE WITH A VIEW TO TRACKING THE DBIQ OPTIMUM YIELD PRECIOUS METALS INDEX EXCESS RETURN™ OVER TIME.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

DBIQ OPTIMUM YIELD PRECIOUS METALS INDEX TOTAL RETURN™

| GC7 | SI7 | |||||||

| High1 | Low2 | High | Low | |||||

19885 | 80.0% | 79.6% | 20.0% | 20.4% | ||||

1989 | 79.5% | 80.2% | 20.5% | 19.8% | ||||

1990 | 81.2% | 79.8% | 18.8% | 20.2% | ||||

1991 | 80.9% | 79.6% | 19.1% | 20.4% | ||||

1992 | 79.1% | 80.1% | 20.9% | 19.9% | ||||

1993 | 77.1% | 80.3% | 22.9% | 19.7% | ||||

1994 | 77.0% | 81.7% | 23.0% | 18.3% | ||||

1995 | 77.8% | 82.3% | 22.2% | 17.7% | ||||

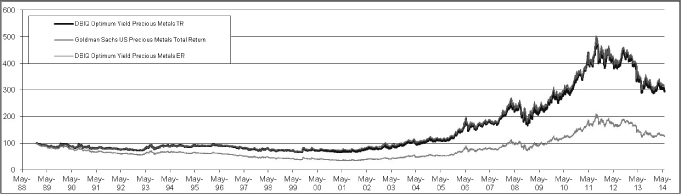

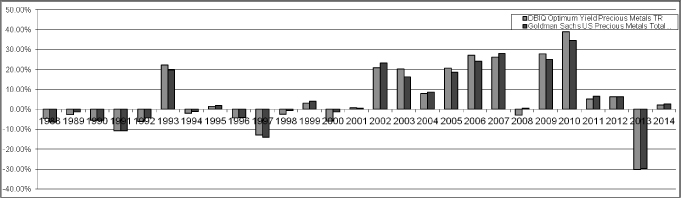

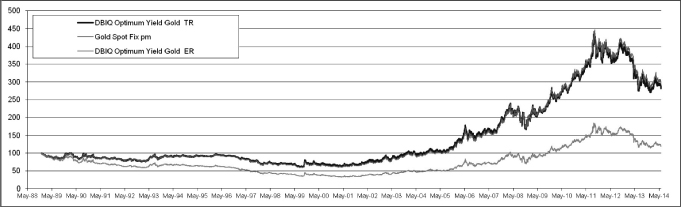

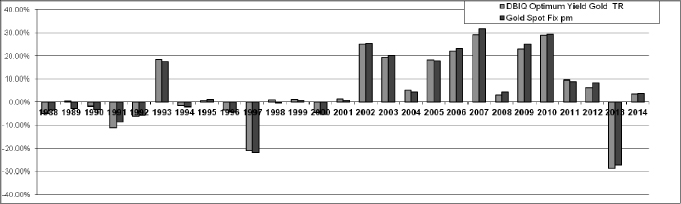

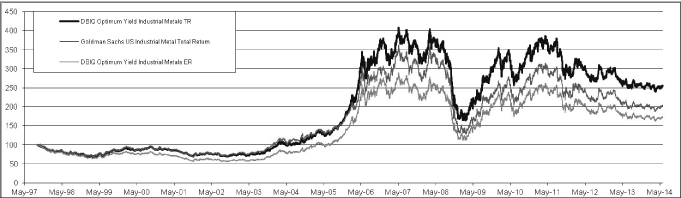

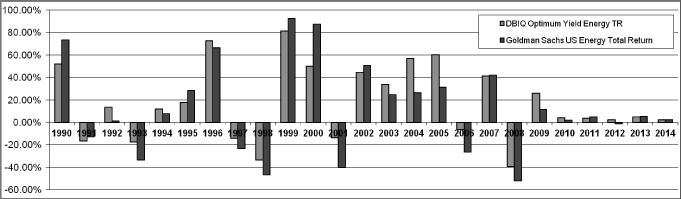

1996 | 79.9% | 80.1% | 20.1% | 19.9% | ||||