|

|

|

| OMB APPROVAL |

|

| OMB Number: 3235-0570 |

|

| Expires: January 31, 2014 |

|

| Estimated average burden |

|

| hours per response 20.6 |

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21989

|

AGIC Equity & Convertible Income Fund |

(Exact name of registrant as specified in charter) |

|

|

1345 Avenue of the Americas, New York, | New York 10105 |

(Address of principal executive offices) | (Zip code) |

|

|

Lawrence G. Altadonna - 1345 Avenue of the Americas, New York, New York 10105 | |

(Name and address of agent for service) | |

|

Registrant’s telephone number, including area code: 212-739-3371 |

|

Date of fiscal year end: January 31, 2011 |

|

Date of reporting period: January 31, 2011 |

|

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-2001. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Shareholders

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual Report |

|

|

|

|

|

|

|

|

January 31, 2011

NFJ Dividend, Interest & Premium Strategy Fund

AGIC Equity & Convertible Income Fund

|

|

|

|

| Contents |

|

|

|

|

|

|

|

| 2 - 3 | |

| |||

|

| 4 - 9 | |

| |||

|

| 10 - 23 | |

| |||

|

| 24 | |

| |||

|

| 25 | |

| |||

|

| 26 | |

| |||

|

| 27 - 35 | |

| |||

|

| 36 - 37 | |

| |||

|

| 38 | |

| |||

|

| 39 | |

| |||

| Annual Shareholder Meeting Results/Changes |

| 40 |

| |||

| Proxy Voting Policies & Procedures/Changes |

| 41 |

| |||

|

| 42 | |

| |||

|

| 43 | |

| |||

|

| 44 - 45 | |

| |||

|

| 46 |

|

|

|

| NFJ Dividend, Interest & Premium Strategy Fund |

|

1.31.11 | | AGIC Equity & Convertible Income Fund Annual Report | 1 |

Supporting this recovery was the continued accommodative stance by the Federal Reserve (“the Fed”). The Fed revealed plans to purchase up to $900 billion of U.S. Treasury bonds. The goal of this “quantitative easing” was to keep stimulating the economy by lowering interest rates. The Fed maintained its closely watched Federal Funds rate, the interest rate banks charge to lend federal funds to other banks, usually on an overnight basis in the 0.0% to 0.25% range. The discount rate, however, the interest rate charged to banks for direct loans was raised to 0.75% from 0.50%.

|

|

|

| NFJ Dividend, Interest & Premium Strategy Fund |

|

2 | AGIC Equity & Convertible Income Fund Annual Report | 1.31.11 |

|

Twelve Months in Review

For the fiscal period ended January 31, 2011:

|

|

• | The NFJ Dividend, Interest & Premium Strategy Fund rose 16.02% on net asset value (“NAV”) and 28.20% on market price. |

|

|

• | The AGIC Equity & Convertible Income Fund rose 22.56% on NAV and 30.16% on market price. |

In contrast, the Russell 3000 Index, a broad measure of U.S. stock market performance, rose 23.95% during the twelve-month fiscal period. The Russell 1000 Value Index, a measure of large-cap value-style stocks, returned 21.54% and the Russell 1000 Growth Index, a measure of growth style stocks, gained 25.14% during the reporting period. Convertible securities, as reflected by the Merrill Lynch All Convertibles Index, advanced 21.09% during the fiscal period.

For specific information on the Funds and their performance, please review the following pages. If you have any questions regarding the information provided, we encourage you to contact your financial advisor or call the Funds’ shareholder servicing agent at (800) 254-5197. In addition, a wide range of information and resources is available on our website, www.allianzinvestors.com/closedendfunds.

|

|

Receive this report electronically and eliminate paper mailings. To enroll, go to www.allianzinvestors.com/edelivery. |

|

|

Together with Allianz Global Investors Fund Management LLC, the Funds’ investment manager and NFJ Investment Group LLC and Allianz Global Investors Capital LLC, the Funds’ sub-advisers, we thank you for investing with us.

Sincerely,

|

|

|

|

Hans W. Kertess | Brian S. Shlissel |

Chairman | President & Chief Executive Officer |

|

|

|

| NFJ Dividend, Interest & Premium Strategy Fund |

|

1.31.11 | | AGIC Equity & Convertible Income Fund Annual Report | 3 |

|

|

Fund Insights | |

January 31, 2011 (unaudited) | |

For the fiscal year ended January 31, 2011, NFJ Dividend, Interest & Premium Strategy Fund returned 16.02% on net asset value and 28.20% on market price.

During the 12-month review period, investors’ risk appetite returned, supported by a number of factors. In the equity market, the Russell 1000 Value Index, a subset of the broad market measuring value-oriented stocks, advanced strongly during the period. Equities were led by more economically sensitive and commodity-driven sectors such as materials and energy, as well as the consumer discretionary sector. More defensive segments such as utilities and consumer staples underperformed, with health care delivering the lowest returns for the fiscal year. Smaller and mid-size capitalized companies outperformed the largest capitalized firms. The most nimble companies were able to benefit from the improved macroeconomic environment.

Although convertible market sentiment varied throughout the fiscal period, the net result was a solid year. After an impressive return in the fourth quarter of 2010, the Merrill Lynch All Convertibles Index registered another good year of performance advancing 21.09%.

The factors driving fourth quarter and full year performance did not change significantly from earlier in the period. Although several hiccups occurred throughout the period, including mixed economic statistical releases and European sovereign concerns, these risks rose then abated quickly. Ultimately, stronger corporate profitability and an improving economy had the greatest influence on investor sentiment. Improved balance sheets and operating performance of corporations were supplemented by the incredible new corporate issuance volume that bolstered liquidity and reduced high-cost debt. Political risk abated after the November elections, and more accommodative decisions were made in Washington regarding taxes and further monetary policy easing (QE2). These factors also led to a healthy year-end rally in the equity markets and a sell-off in the Treasury market, all of which added to the appetite for convertible and equity investing.

Convertibles moved up in line with their historical equity upside participation during the fourth quarter of the period. Contrary to the first half of the fiscal period whereby credit improvement was the largest driver of performance, equity contribution increased later in the year.

In the convertibles segment of the Fund’s portfolio, positions in the consumer discretionary, industrials and financial industries benefitted performance during the period. Select consumer discretionary issuers moved higher as automobile sales exceeded expectations and production schedules increased. Industrial issuers performed well on improving operating statistics and solid end-market demand. Financial companies gained on an improving global economic outlook and improving credit metrics.

Healthcare and consumer staples industries hindered relative performance during the reporting period. Generic drug manufacturing companies underperformed as international end-markets deteriorated, negatively impacting earnings. Consumer staples issuers were down as investors rotated into higher beta companies.

At the start of the reporting period, levels of implied volatility, as measured by the Chicago Board Options Exchange VIX Index (the “VIX”), trended from the mid 20’s down to the teens before spiking above 45 in May. One of the instances of increased volatility occurred due to the flash crash on May 6, 2010, where there was a chaotic drop in equity prices during afternoon trading. The equity market would regain strength towards the second half of the reporting period, resulting in declining levels of the VIX, which ended the last few months in the mid teens. The average volatility through the period was 22.29.

|

|

|

| NFJ Dividend, Interest & Premium Strategy Fund |

|

4 | AGIC Equity & Convertible Income Fund Annual Report | 1.31.11 |

|

|

|

NFJ Dividend, Interest & Premium Strategy Fund | Fund Insights (continued) |

January 31, 2011 (unaudited) | |

Our outlook for the convertible market is positive. The improvement in corporate earnings witnessed in the third quarter earnings continued in the fourth quarter of 2010. U.S. corporate cash levels are high, debt levels have been reduced and maturities have been extended. In addition, consumers are spending again and labor conditions are improving.

In 2011, we expect companies may use the high cash levels on their balance sheets and future free cash flow to boost shareholder value. Share buybacks, increased dividends and merger and acquisition activity are possible uses of excess cash. We believe these factors should benefit equity and convertible investors.

While we expect credit spread tightening should continue as high yield credit spreads remain above the historical average, positive convertible returns will be dependent on the equity markets going forward. Even though global and economic risk headlines persist, driving a continuation of choppy directional short-term performance, few companies have seen a change in demand or order patterns. We believe fundamentals remain intact and this should provide a positive backdrop for the U.S. equity markets. In such an environment, convertible bonds should benefit from credit spread tightening and higher equity prices, making them an attractive option for total return investors.

|

|

|

| NFJ Dividend, Interest & Premium Strategy Fund |

|

1.31.11 | | AGIC Equity & Convertible Income Fund Annual Report | 5 |

|

|

AGIC Equity & Convertible Income Fund | Fund Insights |

January 31, 2011 (unaudited) | |

For the fiscal year ended January 31, 2011, AGIC Equity & Convertible Income Fund returned 22.56% on net asset value and 30.16% on market price.

Although market sentiment varied throughout the period, the net result for the equity and convertible markets was a solid year.

The factors driving the Fund’s fiscal year end performance did not change significantly from earlier in the period. Although several hiccups occurred throughout the period, including mixed economic statistical releases and European sovereign concerns, these risks rose then abated quickly. Ultimately, stronger corporate profitability and an improving economy had the greatest influence on investor sentiment. Improved balance sheets and operating performance of issuers were supplemented by the incredible new corporate issuance volume that bolstered liquidity and reduced high-cost debt. Political risk abated after the November elections, and more accommodative decisions were made in Washington regarding taxes and further monetary policy easing (QE2). These factors also led to a healthy year-end rally in the equity markets and a sell-off in the Treasury market. All of which added to the appetite for convertible investing.

The equity move higher was broad-based among industries and market capitalizations. Lagging areas of performance included utilities, telecommunications, and healthcare. The best performing sectors were technology, energy and consumer discretionary.

As was the theme throughout the fiscal year, smaller and mid-sized capitalized companies in the Merrill Lynch All Convertibles Index outperformed the largest capitalized firms. The most nimble companies were able to benefit from the improved macroeconomic environment.

Convertibles moved up in line with their historical equity upside participation during the fourth quarter of the reporting period. Unlike the first half of the period, where credit improvement was the bigger driver of returns, equity contributed more later in the year.

The Chicago Board Options Exchange Volatility Index (VIX), a key measure of market expectations of near-term volatility conveyed by S&P 500 stock index option prices, began the fiscal period in the mid twenties, spiked in May and then moved lower with the rising equity market. The VIX’s average volatility was 22.3, and remained in the mid to high teens during the last months of the period.

The Fund’s weakest equity performers were healthcare companies. The market rotated away from the group as inline sales were overshadowed by higher inputs costs and potential pressure on future margins.

Convertible positions in the consumer discretionary, industrials and financial industries contributed positively to performance during the period. Select consumer discretionary issuers were higher as automobile sales exceeded expectations and production schedules increased. Industrial issuers performed well on improving operating statistics and solid end-market demand. Financial companies moved higher on an improving global economic outlook and improving credit metrics.

Convertible positions in the healthcare and consumer staples industries hindered relative performance over the period. Generic drug manufacturing companies underperformed as international end markets deteriorated, negatively impacting earnings. Consumer staples issues declined as investors rotated into higher beta companies.

In 2011, we expect companies may use the high cash levels on their balance sheets and future free cash flow to help boost shareholder value. Share buybacks, increased dividends and merger and acquisition activity are possible uses of excess cash. We believe these factors will benefit investors in the convertible and equity markets.

|

|

|

| NFJ Dividend, Interest & Premium Strategy Fund |

|

6 | AGIC Equity & Convertible Income Fund Annual Report | 1.31.11 |

|

|

|

AGIC Equity & Convertible Income Fund | Fund Insights (continued) |

January 31, 2011 (unaudited) | |

Even though global and economic risk headlines persist, driving a continuation of choppy directional short-term performance, few companies have seen a change in demand or order patterns. We believe fundamentals remain intact and this should provide a positive backdrop for the U.S. equity markets. Convertible bonds should benefit from credit spread tightening and higher equity prices, an attractive option for total return investors.

The Fund’s disciplined approach of focusing on companies that are exceeding expectations and improving their credit statistics may be rewarded should those companies differentiate themselves from their peer group. In this environment, we believe companies that have reasonable earnings visibility should command premium valuations relative to other companies.

The portfolio management team continues to build the Fund’s portfolio one company at a time, by seeking to identify those that are opportunistically capitalizing on change. In addition, we look to maintain our discipline of seeking to identify the best total return candidates with the optimal risk/reward profile.

|

|

|

| NFJ Dividend, Interest & Premium Strategy Fund |

|

1.31.11 | | AGIC Equity & Convertible Income Fund Annual Report | 7 |

|

|

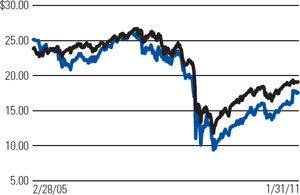

NFJ Dividend, Interest & Premium Strategy Fund | Fund Performance & Statistics |

January 31, 2011 (unaudited) | |

|

|

|

|

|

|

|

|

Total Return(1): |

|

| Market Price |

| NAV | ||

1 Year |

|

| 28.20 | % |

| 16.02 | % |

5 Year |

|

| 3.14 | % |

| 2.50 | % |

Commencement of Operations (2/28/05) to 1/31/11 |

|

| 1.82 | % |

| 3.54 | % |

Commencement of Operations (2/28/05) to 1/31/11

|

|

| Market Price |

|

|

| NAV |

|

|

|

|

|

Market Price/NAV: |

|

|

|

|

Market Price |

|

| $17.60 |

|

NAV |

|

| $19.12 |

|

Discount to NAV |

|

| (7.95)% |

|

Market Price Yield(2) |

|

| 10.23% |

|

|

Investment Allocation |

|

|

(1) | Past performance is no guarantee of future results. Total return is calculated by determining the percentage change in NAV or market price (as applicable) in the specified period. The calculation assumes that all income dividends and capital gain distributions, if any, have been reinvested. Total return does not reflect broker commissions or sales charges in connection with the purchase or sale of Fund shares. Total return for a period of more than one year represents the average annual total return. |

| |

| Performance at market price will differ from its results at NAV. Although market price returns typically reflect investment results over time, during shorter periods returns at market price can also be influenced by factors such as changing views about the Fund, market conditions, supply and demand for the Fund’s shares, or changes in Fund dividends. |

| |

| An investment in the Fund involves risk, including the loss of principal. Total return, market price, market price yield and NAV will fluctuate with changes in market conditions. This data is provided for information purposes only and is not intended for trading purposes. Closed-end funds, unlike open-end funds, are not continuously offered. There is a onetime public offering and once issued, shares of closed-end funds are traded in the open market through a stock exchange. NAV is equal to total assets less total liabilities divided by the number of shares outstanding. Holdings are subject to change daily. |

| |

(2) | Market Price Yield is determined by dividing the annualized current quarterly per share dividend (comprised of net investment income and net capital gains, if any) payable to shareholders by the market price per share at January 31, 2011. |

|

|

|

| NFJ Dividend, Interest & Premium Strategy Fund |

|

8 | AGIC Equity & Convertible Income Fund Annual Report | 1.31.11 |

|

|

|

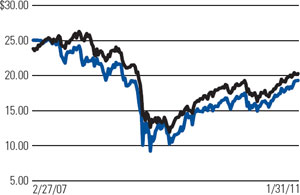

AGIC Equity & Convertible Income Fund | Fund Performance & Statistics |

January 31, 2011 (unaudited) |

|

|

|

|

|

|

|

|

|

Total Return(1): |

|

| Market Price |

| NAV | ||

1 Year |

|

| 30.16 | % |

| 22.56 | % |

3 Year |

|

| 5.12 | % |

| 3.83 | % |

Commencement of Operations (2/27/07) to 1/31/11 |

|

| 2.36 | % |

| 4.18 | % |

Commencement of Operations (2/27/07) to 1/31/11

|

|

| Market Price |

|

|

| NAV |

|

|

|

|

|

Market Price/NAV: |

|

|

|

|

Market Price |

|

| $19.30 |

|

NAV |

|

| $20.28 |

|

Discount to NAV |

|

| (4.83)% |

|

Market Price Yield(2) |

|

| 5.80% |

|

|

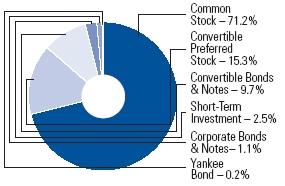

Investment Allocation |

|

|

(1) | Past performance is no guarantee of future results. Total return is calculated by determining the percentage change in NAV or market price (as applicable) in the specified period. The calculation assumes that all income dividends, capital gain and return of capital distributions, if any, have been reinvested. Total return does not reflect broker commissions or sales charges in connection with the purchase or sale of Fund shares. Total return for a period of more than one year represents the average annual total return. |

| |

| Performance at market price will differ from its results at NAV. Although market price returns typically reflect investment results over time, during shorter periods returns at market price can also be influenced by factors such as changing views about the Fund, market conditions, supply and demand for the Fund’s shares, or changes in Fund dividends. |

| |

| An investment in the Fund involves risk, including the loss of principal. Total return, market price, market price yield and NAV will fluctuate with changes in market conditions. This data is provided for information purposes only and is not intended for trading purposes. Closed-end funds, unlike open-end funds, are not continuously offered. There is a onetime public offering and once issued, shares of closed-end funds are traded in the open market through a stock exchange. NAV is equal to total assets less total liabilities divided by the number of shares outstanding. Holdings are subject to change daily. |

| |

(2) | Market Price Yield is determined by dividing the annualized current quarterly per share dividend (comprised of net investment income and net capital gains, if any) payable to shareholders by the market price per share at January 31, 2011. |

|

|

|

| NFJ Dividend, Interest & Premium Strategy Fund |

|

1.31.11 | | AGIC Equity & Convertible Income Fund Annual Report | 9 |

|

|

Schedule of Investments | |

January 31, 2011 | |

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

|

|

|

|

| Value |

| ||

COMMON STOCK—69.9% |

|

|

|

|

|

|

| |||

|

|

| Aerospace & Defense—2.1% |

|

|

|

|

|

|

|

| 387 |

| Lockheed Martin Corp. |

|

|

|

| $ | 30,797,240 |

|

| 100 |

| Northrop Grumman Corp. |

|

|

|

|

| 6,930,000 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 37,727,240 |

|

|

|

|

|

|

|

|

| |||

|

|

| Capital Markets—1.4% |

|

|

|

|

|

|

|

| 420 |

| Ameriprise Financial, Inc. (a) |

|

|

|

|

| 25,893,000 |

|

|

|

|

|

|

|

|

| |||

|

|

| Chemicals—0.8% |

|

|

|

|

|

|

|

| 135 |

| Lubrizol Corp. |

|

|

|

|

| 14,507,100 |

|

|

|

|

|

|

|

|

| |||

|

|

| Commercial Banks—3.2% |

|

|

|

|

|

|

|

| 456 |

| PNC Financial Services Group, Inc. (a) |

|

|

|

|

| 27,354,000 |

|

| 918 |

| Wells Fargo & Co. (a) |

|

|

|

|

| 29,748,592 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 57,102,592 |

|

|

|

|

|

|

|

|

| |||

|

|

| Commercial Services & Supplies—2.1% |

|

|

|

|

|

|

|

| 486 |

| Pitney Bowes, Inc. |

|

|

|

|

| 11,797,652 |

|

| 1,500 |

| RR Donnelley & Sons Co. (a) |

|

|

|

|

| 26,580,000 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 38,377,652 |

|

|

|

|

|

|

|

|

| |||

|

|

| Communications Equipment—0.5% |

|

|

|

|

|

|

|

| 200 |

| Harris Corp. |

|

|

|

|

| 9,308,000 |

|

|

|

|

|

|

|

|

| |||

|

|

| Diversified Financial Services—0.6% |

|

|

|

|

|

|

|

| 236 |

| JP Morgan Chase & Co. |

|

|

|

|

| 10,605,256 |

|

|

|

|

|

|

|

|

| |||

|

|

| Diversified Telecommunication Services—2.5% |

|

|

|

|

|

|

|

| 750 |

| AT&T, Inc. (a) |

|

|

|

|

| 20,640,000 |

|

| 150 |

| CenturyLink, Inc. |

|

|

|

|

| 6,486,000 |

|

| 530 |

| Verizon Communications, Inc. (a) |

|

|

|

|

| 18,878,600 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 46,004,600 |

|

|

|

|

|

|

|

|

| |||

|

|

| Electric Utilities—1.8% |

|

|

|

|

|

|

|

| 600 |

| Edison International (a) |

|

|

|

|

| 21,768,000 |

|

| 152 |

| Entergy Corp. |

|

|

|

|

| 10,952,086 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 32,720,086 |

|

|

|

|

|

|

|

|

| |||

|

|

| Energy Equipment & Services—1.7% |

|

|

|

|

|

|

|

| 421 |

| Diamond Offshore Drilling, Inc. (a) |

|

|

|

|

| 30,204,252 |

|

|

|

|

|

|

|

|

| |||

|

|

| Food & Staples Retailing—0.2% |

|

|

|

|

|

|

|

| 600 |

| SUPERVALU, Inc. |

|

|

|

|

| 4,374,000 |

|

|

|

|

|

|

|

|

| |||

|

|

| Food Products—1.2% |

|

|

|

|

|

|

|

| 39 |

| Bunge Ltd. |

|

|

|

|

| 2,657,317 |

|

| 633 |

| Kraft Foods, Inc. —Cl. A (a) |

|

|

|

|

| 19,363,038 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 22,020,355 |

|

|

|

|

|

|

|

|

| |||

|

|

| Health Care Equipment & Supplies—1.9% |

|

|

|

|

|

|

|

| 400 |

| Baxter International, Inc. (a) |

|

|

|

|

| 19,396,000 |

|

| 368 |

| Medtronic, Inc. (a) |

|

|

|

|

| 14,109,424 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 33,505,424 |

|

|

|

|

|

|

|

|

| |||

|

|

| Household Durables—0.8% |

|

|

|

|

|

|

|

| 200 |

| Stanley Black & Decker, Inc. |

|

|

|

|

| 14,536,000 |

|

|

|

|

|

|

|

|

| |||

|

|

| Household Products—1.8% |

|

|

|

|

|

|

|

| 504 |

| Kimberly-Clark Corp. |

|

|

|

|

| 32,649,812 |

|

|

|

|

|

|

|

|

| |||

|

|

|

| NFJ Dividend, Interest & Premium Strategy Fund |

|

10 | AGIC Equity & Convertible Income Fund Annual Report | 1.31.11 |

|

|

|

NFJ Dividend, Interest & Premium Strategy Fund | Schedule of Investments |

January 31, 2011 | |

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

|

|

|

|

| Value |

| ||

|

|

| Industrial Conglomerates—1.8% |

|

|

|

|

|

|

|

| 1,653 |

| General Electric Co. (a) |

|

|

|

| $ | 33,295,790 |

|

|

|

|

|

|

|

|

| |||

|

|

| Insurance—5.2% |

|

|

|

|

|

|

|

| 800 |

| Allstate Corp. (a) |

|

|

|

|

| 24,912,000 |

|

| 1,104 |

| Lincoln National Corp. (a) |

|

|

|

|

| 31,827,824 |

|

| 200 |

| MetLife, Inc. |

|

|

|

|

| 9,154,000 |

|

| 490 |

| Travelers Cos, Inc. (a) |

|

|

|

|

| 27,567,400 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 93,461,224 |

|

|

|

|

|

|

|

|

| |||

|

|

| IT Services—0.7% |

|

|

|

|

|

|

|

| 75 |

| International Business Machines Corp. |

|

|

|

|

| 12,150,000 |

|

|

|

|

|

|

|

|

| |||

|

|

| Media—2.1% |

|

|

|

|

|

|

|

| 1,300 |

| CBS Corp. —Cl. B |

|

|

|

|

| 25,779,000 |

|

| 399 |

| Time Warner, Inc. |

|

|

|

|

| 12,532,825 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 38,311,825 |

|

|

|

|

|

|

|

|

| |||

|

|

| Metals & Mining—1.2% |

|

|

|

|

|

|

|

| 200 |

| Freeport-McMoRan Copper & Gold, Inc. (a) |

|

|

|

|

| 21,750,000 |

|

|

|

|

|

|

|

|

| |||

|

|

| Multi-Utilities—1.2% |

|

|

|

|

|

|

|

| 750 |

| Ameren Corp. (a) |

|

|

|

|

| 21,277,500 |

|

|

|

|

|

|

|

|

| |||

|

|

| Office Electronics—1.2% |

|

|

|

|

|

|

|

| 2,125 |

| Xerox Corp. (a) |

|

|

|

|

| 22,567,500 |

|

|

|

|

|

|

|

|

| |||

|

|

| Oil, Gas & Consumable Fuels—14.9% |

|

|

|

|

|

|

|

| 200 |

| Cenovus Energy, Inc. |

|

|

|

|

| 6,922,000 |

|

| 1,000 |

| Chesapeake Energy Corp. (a) |

|

|

|

|

| 29,530,000 |

|

| 307 |

| Chevron Corp. (a) |

|

|

|

|

| 29,171,989 |

|

| 800 |

| ConocoPhillips (a) |

|

|

|

|

| 57,168,000 |

|

| 400 |

| EnCana Corp. |

|

|

|

|

| 12,908,000 |

|

| 900 |

| Marathon Oil Corp. (a) |

|

|

|

|

| 41,130,000 |

|

| 550 |

| Royal Dutch Shell PLC —Cl. A - ADR (a) |

|

|

|

|

| 39,044,500 |

|

| 900 |

| Total SA - ADR (a) |

|

|

|

|

| 52,893,000 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 268,767,489 |

|

|

|

|

|

|

|

|

| |||

|

|

| Pharmaceuticals—8.2% |

|

|

|

|

|

|

|

| 1,200 |

| GlaxoSmithKline PLC - ADR (a) |

|

|

|

|

| 43,596,000 |

|

| 369 |

| Johnson & Johnson |

|

|

|

|

| 22,032,298 |

|

| 3,000 |

| Pfizer, Inc. (a) |

|

|

|

|

| 54,660,000 |

|

| 800 |

| Sanofi-Aventis S.A. - ADR |

|

|

|

|

| 27,528,000 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 147,816,298 |

|

|

|

|

|

|

|

|

| |||

|

|

| Real Estate Investment Trust—0.4% |

|

|

|

|

|

|

|

| 400 |

| Annaly Capital Management, Inc. |

|

|

|

|

| 7,132,000 |

|

|

|

|

|

|

|

|

| |||

|

|

| Semiconductors & Semiconductor Equipment—3.3% |

|

|

|

|

|

|

|

| 2,790 |

| Intel Corp. (a) |

|

|

|

|

| 59,873,400 |

|

|

|

|

|

|

|

|

| |||

|

|

| Software—2.0% |

|

|

|

|

|

|

|

| 986 |

| Microsoft Corp. |

|

|

|

|

| 27,331,305 |

|

| 461 |

| Symantec Corp. (b) |

|

|

|

|

| 8,112,716 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 35,444,021 |

|

|

|

|

|

|

|

|

| |||

|

|

| Textiles, Apparel & Luxury Goods—0.5% |

|

|

|

|

|

|

|

| 100 |

| VF Corp. |

|

|

|

|

| 8,272,000 |

|

|

|

|

|

|

|

|

| |||

|

|

|

| NFJ Dividend, Interest & Premium Strategy Fund |

|

1.31.11 | | AGIC Equity & Convertible Income Fund Annual Report | 11 |

|

|

NFJ Dividend, Interest & Premium Strategy Fund | Schedule of Investments |

January 31, 2011 | |

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

|

|

|

|

| Value |

| ||

|

|

| Thrifts & Mortgage Finance—2.2% |

|

|

|

|

|

|

|

| 2,000 |

| Hudson City Bancorp, Inc. (a) |

|

|

|

| $ | 21,960,000 |

|

| 1,000 |

| New York Community Bancorp, Inc. (a) |

|

|

|

|

| 18,320,000 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 40,280,000 |

|

|

|

|

|

|

|

|

| |||

|

|

| Tobacco—2.4% |

|

|

|

|

|

|

|

| 780 |

| Altria Group, Inc. (a) |

|

|

|

|

| 18,342,502 |

|

| 800 |

| Reynolds American, Inc. (a) |

|

|

|

|

| 25,448,000 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 43,790,502 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Common Stock (cost—$1,379,217,606) |

|

|

|

|

| 1,263,724,918 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

|

|

|

CONVERTIBLE PREFERRED STOCK—13.2% |

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Credit Rating |

|

|

|

| |

|

|

|

|

|

|

|

|

| ||

|

|

| Airlines—0.3% |

|

|

|

|

|

|

|

| 123 |

| Continental Airlines Finance Trust II, 6.00%, 11/15/30 |

|

| Caa1/CCC |

|

| 4,837,009 |

|

|

|

|

|

|

|

|

| |||

|

|

| Automobiles—0.6% |

|

|

|

|

|

|

|

| 190 |

| General Motors Co., 4.75%, 12/1/13 |

|

| NR/NR |

|

| 10,331,663 |

|

|

|

|

|

|

|

|

| |||

|

|

| Banks—0.4% |

|

|

|

|

|

|

|

| 147 |

| Barclays Bank PLC, 10.00%, 3/15/11 |

|

|

|

|

|

|

|

|

|

| (Teva Pharmaceuticals Industries Ltd.)(c) |

|

| A1/A+ |

|

| 7,322,335 |

|

|

|

|

|

|

|

|

| |||

|

|

| Capital Markets—0.7% |

|

|

|

|

|

|

|

| 188 |

| AMG Capital Trust I, 5.10%, 4/15/36 |

|

| NR/BB |

|

| 9,432,696 |

|

|

|

| Lehman Brothers Holdings, Inc. (c)(d)(e), |

|

|

|

|

|

|

|

| 630 |

| 6.00%, 10/12/10, Ser. GIS (General Mills, Inc.) |

|

| WR/NR |

|

| 2,028,488 |

|

| 98 |

| 28.00%, 3/6/09, Ser. RIG (Transocean, Inc.) |

|

| WR/NR |

|

| 1,331,778 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 12,792,962 |

|

|

|

|

|

|

|

|

| |||

|

|

| Commercial Banks—0.9% |

|

|

|

|

|

|

|

| 75 |

| Fifth Third Bancorp, 8.50%, 6/30/13, Ser. G (f) |

|

| Ba1/BB |

|

| 11,429,375 |

|

| 6 |

| Wells Fargo & Co., 7.50%, 3/15/13, Ser. L (f) |

|

| Baa3/A- |

|

| 5,733,750 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 17,163,125 |

|

|

|

|

|

|

|

|

| |||

|

|

| Commercial Services & Supplies—0.4% |

|

|

|

|

|

|

|

| 161 |

| United Rentals, Inc., 6.50%, 8/1/28 |

|

| Caa1/CCC |

|

| 7,322,708 |

|

|

|

|

|

|

|

|

| |||

|

|

| Diversified Financial Services—3.7% |

|

|

|

|

|

|

|

| 189 |

| 2010 Swift Mandatory Common Exchange Security Trust, |

|

|

|

|

|

|

|

|

|

| 6.00%, 12/31/13 (g) |

|

| NR/NR |

|

| 2,598,026 |

|

|

|

| Bank of America Corp., |

|

|

|

|

|

|

|

| 10 |

| 7.25%, 1/30/13, Ser. L (f) |

|

| Ba3/BB+ |

|

| 9,409,750 |

|

| 189 |

| 10.00%, 2/3/11, Ser. GILD (Gilead Sciences Inc.)(c) |

|

| A2/A |

|

| 6,460,969 |

|

| 134 |

| 10.00%, 2/24/11, Ser. SLB (Schlumberger Ltd.)(c) |

|

| A2/A |

|

| 9,648,907 |

|

| 74 |

| Citigroup, Inc., 7.50%, 12/15/12 |

|

| NR/NR |

|

| 10,185,944 |

|

|

|

| Credit Suisse Securities USA LLC, |

|

|

|

|

|

|

|

| 173 |

| 7.00%, 7/27/11 (Target Corp.)(c) |

|

| Aa2/A |

|

| 9,527,110 |

|

| 340 |

| 8.00%, 9/20/11 (Bristol-Myers Squibb Co.)(c) |

|

| Aa2/A |

|

| 8,780,500 |

|

| 140 |

| JP Morgan Chase & Co., 7.00%, 7/25/11 |

|

|

|

|

|

|

|

|

|

| (McDonald’s Corp.)(c) |

|

| Aa3/A+ |

|

| 10,354,869 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 66,966,075 |

|

|

|

|

|

|

|

|

| |||

|

|

|

| NFJ Dividend, Interest & Premium Strategy Fund |

|

12 | AGIC Equity & Convertible Income Fund Annual Report | 1.31.11 |

|

|

|

NFJ Dividend, Interest & Premium Strategy Fund | Schedule of Investments |

January 31, 2011 | |

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

|

| Credit Rating |

| Value |

| |||

|

|

| Electric Utilities—0.4% |

|

|

|

|

|

|

|

|

|

| NextEra Energy, Inc., |

|

|

|

|

|

|

|

| 50 |

| 7.00%, 9/1/13 |

|

| NR/NR |

| $ | 2,462,750 |

|

| 88 |

| 8.375%, 6/1/12 |

|

| NR/NR |

|

| 4,416,340 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 6,879,090 |

|

|

|

|

|

|

|

|

| |||

|

|

| Food Products—1.0% |

|

|

|

|

|

|

|

| 157 |

| Archer-Daniels-Midland Co., 6.25%, 6/1/11 |

|

| NR/BBB+ |

|

| 6,569,440 |

|

| 114 |

| Bunge Ltd., 4.875%, 12/1/11 (f) |

|

| Ba1/BB |

|

| 11,212,255 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 17,781,695 |

|

|

|

|

|

|

|

|

| |||

|

|

| Household Durables—0.8% |

|

|

|

|

|

|

|

| 98 |

| Newell Financial Trust I, 5.25%, 12/1/27 |

|

| WR/BB |

|

| 4,194,036 |

|

| 93 |

| Stanley Black & Decker, Inc., 4.75%, 11/17/15 |

|

| Baa3/BBB+ |

|

| 10,824,373 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 15,018,409 |

|

|

|

|

|

|

|

|

| |||

|

|

| Insurance—0.9% |

|

|

|

|

|

|

|

| 460 |

| American International Group, Inc., 8.50%, 2/15/11 |

|

| Baa2/NR |

|

| 2,969,257 |

|

| 66 |

| Assured Guaranty Ltd., 8.50%, 6/1/12 |

|

| NR/NR |

|

| 3,968,250 |

|

| 274 |

| XL Group PLC, 10.75%, 8/15/11 |

|

| Baa2/BBB- |

|

| 8,658,505 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 15,596,012 |

|

|

|

|

|

|

|

|

| |||

|

|

| Multi-Utilities—0.6% |

|

|

|

|

|

|

|

| 244 |

| AES Trust III, 6.75%, 10/15/29 |

|

| B3/B+ |

|

| 11,899,875 |

|

|

|

|

|

|

|

|

| |||

|

|

| Oil, Gas & Consumable Fuels—1.4% |

|

|

|

|

|

|

|

| 140 |

| Apache Corp., 6.00%, 8/1/13 |

|

| NR/NR |

|

| 9,168,144 |

|

| 45 |

| ATP Oil & Gas Corp., 8.00%, 10/1/14 (f)(g)(h) |

|

| NR/NR |

|

| 4,363,425 |

|

| 115 |

| Chesapeake Energy Corp., 5.00%, 12/31/49 |

|

| NR/B |

|

| 11,380,050 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 24,911,619 |

|

|

|

|

|

|

|

|

| |||

|

|

| Real Estate Investment Trust—1.1% |

|

|

|

|

|

|

|

| 177 |

| Alexandria Real Estate Equities, Inc., 7.00%, 4/20/13 (f) |

|

| NR/NR |

|

| 4,420,000 |

|

| 602 |

| FelCor Lodging Trust, Inc., 1.95%, 12/31/49, Ser. A (f) |

|

| Caa3/CCC- |

|

| 15,849,144 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 20,269,144 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Convertible Preferred Stock (cost-—$263,800,753) |

|

|

|

|

| 239,091,721 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

|

|

|

Principal |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| ||

CONVERTIBLE BONDS & NOTES—12.6% |

|

|

|

|

|

|

| |||

|

|

| Building Products—0.3% |

|

|

|

|

|

|

|

| $5,875 |

| Griffon Corp., 4.00%, 1/15/17 (g)(h) |

|

| NR/NR |

|

| 6,073,281 |

|

|

|

|

|

|

|

|

| |||

|

|

| Capital Markets—0.2% |

|

|

|

|

|

|

|

| 3,980 |

| Ares Capital Corp., 5.75%, 2/1/16 (g)(h) |

|

| NR/BBB |

|

| 4,109,350 |

|

|

|

|

|

|

|

|

| |||

|

|

| Computers & Peripherals—0.6% |

|

|

|

|

|

|

|

| 315 |

| EMC Corp., 1.75%, 12/1/13 |

|

| NR/A- |

|

| 511,875 |

|

| 1,250 |

| NetApp, Inc., 1.75%, 6/1/13 |

|

| NR/NR |

|

| 2,220,313 |

|

| 6,500 |

| SanDisk Corp., 1.50%, 8/15/17 |

|

| NR/BB- |

|

| 7,109,375 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 9,841,563 |

|

|

|

|

|

|

|

|

| |||

|

|

| Construction & Engineering—0.1% |

|

|

|

|

|

|

|

| 635 |

| MasTec, Inc., 4.00%, 6/15/14 |

|

| NR/NR |

|

| 783,431 |

|

|

|

|

|

|

|

|

| |||

|

|

|

| NFJ Dividend, Interest & Premium Strategy Fund |

|

1.31.11 | | AGIC Equity & Convertible Income Fund Annual Report | 13 |

|

|

NFJ Dividend, Interest & Premium Strategy Fund | Schedule of Investments |

January 31, 2011 | |

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

|

| Credit Rating |

| Value |

| |||

|

|

| Diversified Telecommunication Services—0.3% |

|

|

|

|

|

|

|

| $ 4,905 |

| tw telecom, Inc., 2.375%, 4/1/26 |

|

| B3/B- |

| $ | 5,493,600 |

|

|

|

|

|

|

|

|

| |||

|

|

| Electrical Equipment—1.2% |

|

|

|

|

|

|

|

| 8,780 |

| EnerSys, 3.375%, 6/1/38 (i) |

|

| B2/BB |

|

| 10,031,150 |

|

| 2,000 |

| General Cable Corp., 4.50%, 11/15/29 (i) |

|

| B2/B |

|

| 2,505,000 |

|

| 10,000 |

| JA Solar Holdings Co., Ltd., 4.50%, 5/15/13 |

|

| NR/NR |

|

| 9,675,000 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 22,211,150 |

|

|

|

|

|

|

|

|

| |||

|

|

| Energy Equipment & Services—0.2% |

|

|

|

|

|

|

|

| 3,500 |

| Newpark Resources, Inc., 4.00%, 10/1/17 |

|

| NR/CCC+ |

|

| 3,228,750 |

|

|

|

|

|

|

|

|

| |||

|

|

| Hotels, Restaurants & Leisure—0.9% |

|

|

|

|

|

|

|

| 3,495 |

| International Game Technology, 3.25%, 5/1/14 |

|

| Baa2/BBB |

|

| 4,067,306 |

|

| 1,402 |

| Mandalay Resort Group, 1.054%, 3/21/33, FRN (d)(e) |

|

| Caa1/CCC+ |

|

| 1,513,970 |

|

| 9,295 |

| MGM Resorts International, 4.25%, 4/15/15 (g)(h) |

|

| Caa1/CCC+ |

|

| 10,329,069 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 15,910,345 |

|

|

|

|

|

|

|

|

| |||

|

|

| Household Durables—0.4% |

|

|

|

|

|

|

|

| 6,820 |

| Lennar Corp., 2.00%, 12/1/20 (g)(h) |

|

| B3/B+ |

|

| 7,050,175 |

|

|

|

|

|

|

|

|

| |||

|

|

| Insurance—0.1% |

|

|

|

|

|

|

|

| 2,000 |

| American Equity Investment Life Holding Co., |

|

|

|

|

|

|

|

|

|

| 3.50%, 9/15/15 (g)(h) |

|

| NR/NR |

|

| 2,390,000 |

|

|

|

|

|

|

|

|

| |||

|

|

| Internet—0.2% |

|

|

|

|

|

|

|

| 2,500 |

| Symantec Corp., 1.00%, 6/15/13 |

|

| NR/BBB |

|

| 2,906,250 |

|

|

|

|

|

|

|

|

| |||

|

|

| Internet Software & Services—0.2% |

|

|

|

|

|

|

|

| 4,200 |

| Equinix, Inc., 2.50%, 4/15/12 |

|

| NR/B- |

|

| 4,378,500 |

|

|

|

|

|

|

|

|

| |||

|

|

| IT Services—0.4% |

|

|

|

|

|

|

|

| 6,325 |

| Alliance Data Systems Corp., 1.75%, 8/1/13 |

|

| NR/NR |

|

| 6,933,781 |

|

|

|

|

|

|

|

|

| |||

|

|

| Lodging—0.1% |

|

|

|

|

|

|

|

| 1,000 |

| Gaylord Entertainment Co., 3.75%, 10/1/14 (g)(h) |

|

| NR/NR |

|

| 1,392,500 |

|

|

|

|

|

|

|

|

| |||

|

|

| Machinery—1.0% |

|

|

|

|

|

|

|

| 6,035 |

| AGCO Corp., 1.25%, 12/15/36 |

|

| NR/BB+ |

|

| 8,283,038 |

|

| 3,500 |

| Navistar International Corp., 3.00%, 10/15/14 |

|

| NR/B |

|

| 5,114,375 |

|

| 1,790 |

| Titan International, Inc., 5.625%, 1/15/17 (g)(h) |

|

| NR/B+ |

|

| 3,797,037 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 17,194,450 |

|

|

|

|

|

|

|

|

| |||

|

|

| Media—0.2% |

|

|

|

|

|

|

|

| 7,160 |

| Liberty Media LLC, 3.50%, 1/15/31 |

|

| B1/BB- |

|

| 4,027,500 |

|

|

|

|

|

|

|

|

| |||

|

|

| Metals & Mining—0.7% |

|

|

|

|

|

|

|

| 4,805 |

| Steel Dynamics, Inc., 5.125%, 6/15/14 |

|

| NR/BB+ |

|

| 6,126,375 |

|

| 3,000 |

| United States Steel Corp., 4.00%, 5/15/14 |

|

| Ba2/BB |

|

| 5,808,750 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 11,935,125 |

|

|

|

|

|

|

|

|

| |||

|

|

| Multiline Retail—0.1% |

|

|

|

|

|

|

|

| 1,940 |

| Saks, Inc., 2.00%, 3/15/24 |

|

| B3/B+ |

|

| 2,109,750 |

|

|

|

|

|

|

|

|

| |||

|

|

| Oil, Gas & Consumable Fuels—1.4% |

|

|

|

|

|

|

|

| 8,100 |

| Alpha Natural Resources, Inc., 2.375%, 4/15/15 |

|

| NR/BB |

|

| 10,276,875 |

|

| 7,475 |

| Peabody Energy Corp., 4.75%, 12/15/41 |

|

| Ba3/B+ |

|

| 9,511,938 |

|

| 3,855 |

| Western Refining, Inc., 5.75%, 6/15/14 |

|

| NR/CCC+ |

|

| 5,204,250 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 24,993,063 |

|

|

|

|

|

|

|

|

| |||

|

|

|

| NFJ Dividend, Interest & Premium Strategy Fund |

|

14 | AGIC Equity & Convertible Income Fund Annual Report | 1.31.11 |

|

|

|

NFJ Dividend, Interest & Premium Strategy Fund | Schedule of Investments |

January 31, 2011 | |

|

|

|

|

|

|

|

|

|

|

|

Principal |

|

|

| Credit Rating |

| Value |

| |||

|

|

| Pharmaceuticals—0.3% |

|

|

|

|

|

|

|

| $ 1,860 |

| Valeant Pharmaceuticals International, Inc., |

|

|

|

|

|

|

|

|

|

| 5.375%, 8/1/14 (g)(h) |

|

| NR/NR |

| $ | 4,903,425 |

|

|

|

|

|

|

|

|

| |||

|

|

| Real Estate Investment Trust—1.0% |

|

|

|

|

|

|

|

| 3,125 |

| Boston Properties LP, 3.75%, 5/15/36 |

|

| NR/A- |

|

| 3,593,750 |

|

| 8,800 |

| Developers Diversified Realty Corp., 1.75%, 11/15/40 |

|

| NR/NR |

|

| 9,240,000 |

|

| 5,000 |

| Health Care REIT, Inc., 4.75%, 12/1/26 |

|

| Baa2/BBB- |

|

| 5,500,000 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 18,333,750 |

|

|

|

|

|

|

|

|

| |||

|

|

| Road & Rail—0.2% |

|

|

|

|

|

|

|

| 2,000 |

| Hertz Global Holdings, Inc., 5.25%, 6/1/14 |

|

| NR/B- |

|

| 3,877,500 |

|

|

|

|

|

|

|

|

| |||

|

|

| Semiconductors & Semiconductor Equipment—0.1% |

|

|

|

|

|

|

|

| 2,030 |

| SunPower Corp., 4.75%, 4/15/14 |

|

| NR/NR |

|

| 1,936,112 |

|

|

|

|

|

|

|

|

| |||

|

|

| Software—1.5% |

|

|

|

|

|

|

|

| 2,000 |

| Cadence Design Systems, Inc., 2.625%, 6/1/15 (g)(h) |

|

| NR/NR |

|

| 2,635,000 |

|

| 3,000 |

| Concur Technologies, Inc., 2.50%, 4/15/15 (g)(h) |

|

| NR/NR |

|

| 3,555,000 |

|

| 5,000 |

| Lawson Software, Inc., 2.50%, 4/15/12 |

|

| NR/NR |

|

| 5,287,500 |

|

| 7,500 |

| Nuance Communications, Inc., 2.75%, 8/15/27 |

|

| NR/B- |

|

| 9,356,250 |

|

| 4,000 |

| Salesforce.com, Inc., 0.75%, 1/15/15 (g)(h) |

|

| NR/NR |

|

| 6,565,000 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 27,398,750 |

|

|

|

|

|

|

|

|

| |||

|

|

| Telecommunications—0.4% |

|

|

|

|

|

|

|

| 6,000 |

| Ciena Corp., 4.00%, 3/15/15 (g)(h) |

|

| NR/NR |

|

| 7,875,000 |

|

|

|

|

|

|

|

|

| |||

|

|

| Thrifts & Mortgage Finance—0.5% |

|

|

|

|

|

|

|

| 8,020 |

| MGIC Investment Corp., 5.00%, 5/1/17 |

|

| NR/CCC+ |

|

| 8,661,600 |

|

| 1,000 |

| The PMI Group, Inc., 4.50%, 4/15/20 |

|

| NR/CCC+ |

|

| 817,500 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| 9,479,100 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Convertible Bonds & Notes (cost—$218,536,288) |

|

|

|

|

| 226,766,201 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

|

|

|

YANKEE BOND—0.2% |

|

|

|

|

|

|

| |||

|

|

| Marine—0.2% |

|

|

|

|

|

|

|

| 3,090 |

| DryShips, Inc., 5.00%, 12/1/14 (cost-$3,476,922) |

|

| NR/NR |

|

| 3,024,337 |

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

|

|

|

SHORT-TERM INVESTMENTS—4.4% |

|

|

|

|

|

|

| |||

|

|

| Time Deposits—4.4% |

|

|

|

|

|

|

|

| 15,068 |

| Citibank-London, 0.03%, 2/1/11, |

|

|

|

|

| 15,068,176 |

|

| 8,250 |

| Royal Bank of Canada-Toronto, 0.03%, 2/1/11, |

|

|

|

|

| 8,249,846 |

|

| 56,721 |

| Societe Generale-Paris, 0.03%, 2/1/11, |

|

|

|

|

| 56,720,898 |

|

|

|

|

|

|

|

|

| |||

|

|

| Total Short Term Investments (cost—$80,038,920) |

|

|

|

|

| 80,038,920 |

|

|

|

|

|

|

|

|

| |||

|

|

| Total Investments, before call options written |

|

|

|

|

|

|

|

|

|

| (cost—$1,945,070,489)—100.3% |

|

|

|

|

| 1,812,646,097 |

|

|

|

|

|

|

|

|

| |||

|

|

|

| NFJ Dividend, Interest & Premium Strategy Fund |

|

1.31.11 | | AGIC Equity & Convertible Income Fund Annual Report | 15 |

|

|

NFJ Dividend, Interest & Premium Strategy Fund | Schedule of Investments |

January 31, 2011 | |

|

|

|

|

|

|

|

|

Shares |

|

|

| Value |

| ||

CALL OPTIONS WRITTEN (b)—(1.1)% |

|

|

|

| |||

|

|

| Morgan Stanley Cyclical Flex Index, |

|

|

|

|

| 350 |

| strike price $1060, expires 2/4/11 |

| $ | (393,204 | ) |

|

|

| Morgan Stanley Cyclical Index, |

|

|

|

|

| 400 |

| strike price $1060, expires 2/19/11 |

|

| (892,000 | ) |

| 400 |

| strike price $1070, expires 2/19/11 |

|

| (660,000 | ) |

|

|

| NASDAQ 100 Flex Index, |

|

|

|

|

| 100 |

| strike price $2275, expires 2/4/11 |

|

| (197,524 | ) |

| 125 |

| strike price $2275, expires 2/11/11 |

|

| (389,108 | ) |

| 100 |

| strike price $2350, expires 3/11/11 |

|

| (215,736 | ) |

|

|

| NASDAQ 100 Index, |

|

|

|

|

| 125 |

| strike price $2275, expires 2/19/11 |

|

| (537,500 | ) |

| 100 |

| strike price $2375, expires 3/19/11 |

|

| (197,000 | ) |

|

|

| New York Stock Exchange Arca Mini Oil Flex Index, |

|

|

|

|

| 5,500 |

| strike price $60.50, expires 2/11/11 |

|

| (2,312,365 | ) |

| 5,000 |

| strike price $63, expires 2/25/11 |

|

| (1,147,200 | ) |

| 4,500 |

| strike price $64, expires 3/4/11 |

|

| (810,225 | ) |

| 6,000 |

| strike price $65, expires 3/11/11 |

|

| (853,680 | ) |

| 5,000 |

| strike price $66.50, expires 3/25/11 |

|

| (337,100 | ) |

|

|

| New York Stock Exchange Arca Mini Oil Index, |

|

|

|

|

| 13,500 |

| strike price $65, expires 3/19/11 |

|

| (2,126,250 | ) |

|

|

| Philadelphia Stock Exchange KBW Bank Flex Index, |

|

|

|

|

| 6,500 |

| strike price $52.50, expires 2/4/11 |

|

| (523,055 | ) |

| 6,500 |

| strike price $56, expires 2/25/11 |

|

| (186,550 | ) |

| 5,500 |

| strike price $56.50, expires 3/4/11 |

|

| (173,085 | ) |

| 6,000 |

| strike price $57.50, expires 3/4/11 |

|

| (106,800 | ) |

|

|

| Philadelphia Stock Exchange KBW Bank Index, |

|

|

|

|

| 14,500 |

| strike price $55, expires 3/19/11 |

|

| (1,268,750 | ) |

|

|

| Standard & Poor’s 500 Flex Index, |

|

|

|

|

| 550 |

| strike price $1260, expires 2/4/11 |

|

| (1,476,794 | ) |

| 300 |

| strike price $1265, expires 2/11/11 |

|

| (781,137 | ) |

| 300 |

| strike price $1270, expires 2/11/11 |

|

| (669,675 | ) |

| 250 |

| strike price $1300, expires 3/4/11 |

|

| (365,897 | ) |

| 300 |

| strike price $1305, expires 3/11/11 |

|

| (446,949 | ) |

| 300 |

| strike price $1310, expires 3/11/11 |

|

| (388,179 | ) |

|

|

| Standard & Poor’s 500 Index, |

|

|

|

|

| 550 |

| strike price $1285, expires 2/19/11 |

|

| (965,250 | ) |

| 300 |

| strike price $1305, expires 3/19/11 |

|

| (517,500 | ) |

| 300 |

| strike price $1315, expires 3/19/11 |

|

| (391,500 | ) |

|

|

|

|

| |||

|

|

| Total Call Options Written (premiums received—$14,849,891) |

|

| (19,330,013 | ) |

|

|

|

|

| |||

|

|

| Total Investments, net of call options written |

|

|

|

|

|

|

| (cost—$1,930,220,598)—99.2% |

|

| 1,793,316,084 |

|

|

|

|

|

| |||

|

|

| Other assets less other liabilities—0.8% |

|

| 14,356,184 |

|

|

|

|

|

| |||

|

|

| Net Assets—100.0% |

| $ | 1,807,672,268 |

|

|

|

|

|

| |||

|

|

|

| NFJ Dividend, Interest & Premium Strategy Fund |

|

16 | AGIC Equity & Convertible Income Fund Annual Report | 1.31.11 |

|

|

|

AGIC Equity & Convertible Income Fund | Schedule of Investments |

January 31, 2011 | |

|

|

|

|

|

|

|

|

Shares |

|

|

| Value |

| ||

COMMON STOCK—71.7% |

|

|

|

| |||

|

|

| Aerospace & Defense—1.3% |

|

|

|

|

| 74 |

| L-3 Communications Holdings, Inc. |

| $ | 5,813,975 |

|

|

|

|

|

| |||

|

|

| Auto Components—1.7% |

|

|

|

|

| 206 |

| Johnson Controls, Inc. (a) |

|

| 7,912,179 |

|

|

|

|

|

| |||

|

|

| Automobiles—1.6% |

|

|

|

|

| 458 |

| Ford Motor Co. (a)(b) |

|

| 7,309,885 |

|

|

|

|

|

| |||

|

|

| Beverages—4.6% |

|

|

|

|

| 121 |

| Coca-Cola Co. |

|

| 7,604,850 |

|

| 127 |

| Molson Coors Brewing Co. —Cl. B |

|

| 5,966,551 |

|

| 114 |

| PepsiCo, Inc. |

|

| 7,331,340 |

|

|

|

|

|

| |||

|

|

|

|

|

| 20,902,741 |

|

|

|

|

|

| |||

|

|

| Biotechnology—1.4% |

|

|

|

|

| 164 |

| Gilead Sciences, Inc. (b) |

|

| 6,294,320 |

|

|

|

|

|

| |||

|

|

| Commercial Services & Supplies—0.5% |

|

|

|

|

| 52 |

| Avery Dennison Corp. |

|

| 2,168,098 |

|

|

|

|

|

| |||

|

|

| Communications Equipment—5.7% |

|

|

|

|

| 39 |

| Aviat Networks, Inc. (b) |

|

| 200,479 |

|

| 284 |

| Cisco Systems, Inc. (b) |

|

| 6,010,830 |

|

| 156 |

| Harris Corp. |

|

| 7,236,970 |

|

| 158 |

| Qualcomm, Inc. (a) |

|

| 8,541,714 |

|

| 61 |

| Research In Motion Ltd. (b) |

|

| 3,593,888 |

|

|

|

|

|

| |||

|

|

|

|

|

| 25,583,881 |

|

|

|

|

|

| |||

|

|

| Computers & Peripherals—5.5% |

|

|

|

|

| 24 |

| Apple, Inc. (a)(b) |

|

| 7,974,020 |

|

| 344 |

| EMC Corp. (a)(b) |

|

| 8,567,138 |

|

| 53 |

| International Business Machines Corp. (a) |

|

| 8,537,400 |

|

|

|

|

|

| |||

|

|

|

|

|

| 25,078,558 |

|

|

|

|

|

| |||

|

|

| Diversified Financial Services—0.8% |

|

|

|

|

| 84 |

| JP Morgan Chase & Co. |

|

| 3,765,972 |

|

|

|

|

|

| |||

|

|

| Diversified Telecommunication Services—1.7% |

|

|

|

|

| 48 |

| Frontier Communications Corp. |

|

| 444,635 |

|

| 202 |

| Verizon Communications, Inc. |

|

| 7,195,240 |

|

|

|

|

|

| |||

|

|

|

|

|

| 7,639,875 |

|

|

|

|

|

| |||

|

|

| Electric Utilities—0.9% |

|

|

|

|

| 54 |

| Entergy Corp. |

|

| 3,911,758 |

|

|

|

|

|

| |||

|

|

| Electronic Equipment, Instruments & Components—1.8% |

|

|

|

|

| 149 |

| Amphenol Corp. —Cl. A |

|

| 8,245,660 |

|

|

|

|

|

| |||

|

|

| Energy Equipment & Services—5.0% |

|

|

|

|

| 69 |

| Diamond Offshore Drilling, Inc. |

|

| 4,940,819 |

|

| 124 |

| National Oilwell Varco, Inc. (a) |

|

| 9,126,650 |

|

| 97 |

| Schlumberger Ltd. (a) |

|

| 8,605,333 |

|

|

|

|

|

| |||

|

|

|

|

|

| 22,672,802 |

|

|

|

|

|

| |||

|

|

| Health Care Equipment & Supplies—2.6% |

|

|

|

|

| 111 |

| Baxter International, Inc. |

|

| 5,387,239 |

|

| 20 |

| Intuitive Surgical, Inc. (b) |

|

| 6,603,510 |

|

|

|

|

|

| |||

|

|

|

|

|

| 11,990,749 |

|

|

|

|

|

| |||

|

|

|

| NFJ Dividend, Interest & Premium Strategy Fund |

|

1.31.11 | | AGIC Equity & Convertible Income Fund Annual Report | 17 |

|

|

AGIC Equity & Convertible Income Fund | Schedule of Investments |

January 31, 2011 | |

|

|

|

|

|

|

|

|

Shares |

|

|

| Value |

| ||

|

|

| Health Care Providers & Services—3.4% |

|

|

|

|

| 101 |

| McKesson Corp. |

| $ | 7,554,585 |

|

| 126 |

| Medco Health Solutions, Inc. (b) |

|

| 7,670,214 |

|

|

|

|

|

| |||

|

|

|

|

|

| 15,224,799 |

|

|

|

|

|

| |||

|

|

| Hotels, Restaurants & Leisure—1.5% |

|

|

|

|

| 94 |

| McDonald’s Corp. |

|

| 6,888,145 |

|

|

|

|

|

| |||

|

|

| Household Products—1.7% |

|

|

|

|

| 121 |

| Procter & Gamble Co. |

|

| 7,663,982 |

|

|

|

|

|

| |||

|

|

| Independent Power Producers & Energy Traders—1.4% |

|

|

|

|

| 92 |

| Constellation Energy Group, Inc. |

|

| 2,967,000 |

|

| 154 |

| NRG Energy, Inc. (b) |

|

| 3,195,479 |

|

|

|

|

|

| |||

|

|

|

|

|

| 6,162,479 |

|

|

|

|

|

| |||

|

|

| Industrial Conglomerates—3.1% |

|

|

|

|

| 290 |

| General Electric Co. |

|

| 5,843,802 |

|

| 310 |

| Textron, Inc. (a) |

|

| 8,157,787 |

|

|

|

|

|

| |||

|

|

|

|

|

| 14,001,589 |

|

|

|

|

|

| |||

|

|

| Insurance—1.7% |

|

|

|

|

| 53 |

| MetLife, Inc. |

|

| 2,434,232 |

|

| 87 |

| Prudential Financial, Inc. |

|

| 5,351,370 |

|

|

|

|

|

| |||

|

|

|

|

|

| 7,785,602 |

|

|