UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

¨ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2009

Commission File Number: 000-52641

INFRASTRUCTURE MATERIALS CORP.

(Exact name of registrant as specified in its charter)

| Delaware | | 98-0492752 |

| (State of incorporation) | | (I.R.S. Employer Identification No.) |

1135 Terminal Way, Suite 207B Reno, NV 89502 USA |

| (Address of Principal Executive Offices) (Zip Code) |

| |

| 866-448-1073 |

| (Registrant’s telephone number, including area code) |

With a copy to:

Jonathan H. Gardner

Kavinoky Cook LLP

726 Exchange St., Suite 800

Buffalo, NY 14210

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No o

Indicate by check mark whether the registrant ha submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | | Accelerated filer o | | Non-accelerated filer o (Do not check if a smaller reporting company) | | Smaller reporting company þ |

SEC 1296 (04-09) Potential persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a current valid OMB control number.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

The number of shares of registrant’s common stock outstanding as of September 30, 2009 was 60,198,500.

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

INTERIM CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

CONTENTS

| Interim Consolidated Balance Sheets as of September 30, 2009 (unaudited) and June 30, 2009 (audited) | | | 3 | |

| | | | | |

| Interim Consolidated Statements of Operations for the three months ended September 30, 2009 and September 30, 2008, and for the period from inception to September 30, 2009 | | | 4 | |

| | | | | |

| Interim Consolidated Statements of Changes in Stockholders' Equity for the three months ended September 30, 2009 and for the period from inception to September 30, 2009 | | | 5 | |

| | | | | |

| Interim Consolidated Statements of Cash Flows for the three months ended September 30, 2009 and September 30, 2008, and for the period from inception to September 30, 2009 | | | 6 | |

| | | | | |

| Condensed Notes to Interim Consolidated Financial Statements | | | 7 - 23 | |

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Interim Consolidated Balance Sheets as at

September 30, 2009 and June 30, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| | | Sept 30, | | | June 30, | |

| | | 2009 | | | 2009 | |

| | | $ | | | $ | |

| | | (unaudited) | | | (audited) | |

| ASSETS | | | | | | | | |

| Current | | | | | | | | |

| Cash and cash equivalents | | | 268,475 | | | | 420,266 | |

| Short term investments | | | 2,323,170 | | | | 3,116,803 | |

| Prepaid expenses and other receivables | | | 215,362 | | | | 205,482 | |

| | | | | | | | | |

| Total Current Assets | | | 2,807,007 | | | | 3,742,551 | |

Plant and Equipment, net (note 4) | | | 1,102,096 | | | | 1,141,920 | |

| | | | | | | | | |

| Total Assets | | | 3,909,103 | | | | 4,884,471 | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

| Current | | | | | | | | |

| Accounts payable | | | 209,803 | | | | 187,000 | |

| Accrued liabilities | | | 77,152 | | | | 83,901 | |

| | | | | | | | | |

| Total Current Liabilities | | | 286,955 | | | | 270,901 | |

| | | | | | | | | |

| Total Liabilities | | | 286,955 | | | | 270,901 | |

| | | | | | | | | |

Commitments and Contingencies (note 9) | | | | | | | | |

Related Party Transactions (note 10) | | | | | | | | |

| | | | | | | | | |

| STOCKHOLDERS' EQUITY | | | | | | | | |

| Capital Stock (note 6) | | | | | | | | |

| Common stock, $0.0001 par value, 100,000,000 shares authorized, 60,198,500 issued and outstanding (June 30, 2009 – 60,198,500) | | | 6,020 | | | | 6,020 | |

| Additional Paid-in Capital | | | 17,311,646 | | | | 17,224,699 | |

| Deferred Stock Compensation (note 8) | | | - | | | | (187,500 | ) |

| Deficit Accumulated During the Exploration Stage | | | (13,695,518 | ) | | | (12,429,649 | ) |

| | | | | | | | | |

| Total Stockholders' Equity | | | 3,622,148 | | | | 4,613,570 | |

| | | | | | | | | |

| Total Liabilities and Stockholders' Equity | | | 3,909,103 | | | | 4,884,471 | |

See Condensed notes to the Interim Financial Statements

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Interim Consolidated Statements of Operations

For the three months ended September 30, 2009 and September 30, 2008

and the Period from Inception (June 3, 1999) to September 30, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| | | | | | For the | | | For the | |

| | | | | | three month | | | three month | |

| | | Cumulative | | | period ended | | | period ended | |

| | | since | | | Sept 30, | | | Sept 30, | |

| | | inception | | | 2009 | | | 2008 | |

| | | | | | | | | | |

| | | $ | | | $ | | | $ | |

| | | | | | | | | | | | | |

| Revenues | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | |

| Operating Expenses | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| General and administration | | | 6,050,543 | | | | 449,197 | | | | 734,360 | |

| Project expenses | | | 7,167,489 | | | | 785,770 | | | | 631,672 | |

| Amortization | | | 756,648 | | | | 45,255 | | | | 53,005 | |

| | | | | | | | | | | | | |

| Total Operating Expenses | | | 13,974,680 | | | | 1,280,222 | | | | 1,419,037 | |

| | | | | | | | | | | | | |

| Loss from Operations | | | (13,974,680 | ) | | | (1,280,222 | ) | | | (1,419,037 | ) |

| Other income-interest | | | 369,615 | | | | 14,353 | | | | 11,799 | |

| Interest Expense | | | (90,453 | ) | | | - | | | | - | |

| | | | | | | | | | | | | |

| Loss before Income Taxes | | | (13,695,518 | ) | | | (1,265,869 | ) | | | (1,407,238 | ) |

| | | | | | | | | | | | | |

| Provision for income taxes | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | |

| Net Loss | | | (13,695,518 | ) | | | (1265,869 | ) | | | (1,407,238 | ) |

| | | | | | | | | | | | | |

| Loss per Weighted Average Number of Shares | | | | | | | | | | | | |

| Outstanding-Basic and Fully Diluted | | | | | | | (0.02 | ) | | | (0.03 | ) |

| | | | | | | | | | | | | |

| Basic Weighted Average Number of Shares | | | | | | | | | | | | |

| Outstanding During the Periods | | | | | | | | | | | | |

| -Basic and Fully Diluted | | | | | | | 60,198,500 | | | | 48,315,297 | |

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Interim Consolidated Financial Statements of Changes in Stockholders’ Equity

From Inception (June 3, 1999) to September 30, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| | | | | | | | | | | | | | | Deficit | | | | |

| | | | | | | | | | | | | | | Accumulated | | | | |

| | | Common Stock | | | Additional | | | Deferred | | | during the | | | Total | |

| | | Number | | | | | | Paid-in | | | Stock | | | Exploration | | | Stockholders' | |

| | | of Shares | | | Amount | | | Capital | | | Compensation | | | Stage | | | Equity | |

| | | | | | $ | | | $ | | | $ | | | $ | | | $ | |

| For the period from inception (June 3, 1999) through July 1, 2004 | | | 1 | | | | - | | | | 5,895 | | | | | | | | (5,895 | ) | | | - | |

| Net (loss) | | | - | | | | | | | | - | | | | | | | | 910 | | | | (910 | ) |

| Balance, June 30, 2005 (audited) | | | 1 | | | | - | | | | 6,805 | | | | - | | | | (6,805 | ) | | | - | |

| Contribution to additional paid-in capital | | | - | | | | - | | | | 3,024 | | | | | | | | | | | | 3,024 | |

| Cancelled shares | | | (1 | ) | | | - | | | | (1 | ) | | | | | | | | | | | (1 | ) |

| Common shares issued for nil consideration | | | 14,360,000 | | | | 1,436 | | | | (1,436 | ) | | | | | | | - | | | | - | |

| Common shares issued for cash | | | 2,050,000 | | | | 205 | | | | 414,795 | | | | | | | | - | | | | 415,000 | |

| Subscription for stock | | | | | | | | | | | 300,000 | | | | | | | | - | | | | 300,000 | |

| Stock issuance cost | | | - | | | | - | | | | (24,500 | ) | | | | | | | - | | | | (24,500 | ) |

| Net loss | | | - | | | | - | | | | - | | | | | | | | (87,574 | ) | | | (87,574 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, June 30, 2006 (audited) | | | 16,410,000 | | | | 1,641 | | | | 698,687 | | | | - | | | | (94,379 | ) | | | 605,949 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Common shares issued for cash | | | 3,395,739 | | | | 340 | | | | 548,595 | | | | | | | | - | | | | 548,935 | |

| Common shares issued to agents in lieu of commission for placement of common shares and convertible debentures | | | 1,064,000 | | | | 106 | | | | 265,894 | | | | | | | | - | | | | 266,000 | |

| Common shares issued for acquisition of interests in mineral claims | | | 3,540,600 | | | | 354 | | | | 884,796 | | | | | | | | - | | | | 885,150 | |

| Common shares issued for acquisition of interests in mineral claims | | | 1,850,000 | | | | 185 | | | | 462,315 | | | | | | | | - | | | | 462,500 | |

| Common shares issued for acquisition of interests in a refinery | | | 88,500 | | | | 9 | | | | 22,116 | | | | | | | | - | | | | 22,125 | |

| Common shares issued for purchase of a mill with capital equipments | | | 6,975,000 | | | | 697 | | | | 1,743,053 | | | | | | | | - | | | | 1,743,750 | |

| Stock issuance cost | | | | | | | | | | | (59,426 | ) | | | | | | | | | | | (59,426 | ) |

| Stock based compensation | | | | | | | | | | | 30,026 | | | | | | | | | | | | 30,026 | |

| Net loss for the year ended June 30, 2007 | | | | | | | - | | | | - | | | | | | | | (2,845,424 | ) | | | (2,845,424 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, June 30, 2007 (audited) | | | 33,323,839 | | | | 3,332 | | | | 4,596,056 | | | | - | | | | (2,939,803 | ) | | | 1,659,585 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Common stock issued to consultants | | | 3,000,000 | | | | 300 | | | | 2,249,700 | | | | (1,875,000 | ) | | | - | | | | 375,000 | |

| Stock based compensation | | | | | | | - | | | | 139,272 | | | | | | | | - | | | | 139,272 | |

Conversion of convertible debentures with accrued interest | | | 7,186,730 | | | | 719 | | | | 3,590,801 | | | | - | | | | - | | | | 3,591,520 | |

| Common shares issued for acquisition of | | | | | | | | | | | | | | | | | | | | | | | | |

| interests in mineral claims | | | 175,000 | | | | 18 | | | | 104,982 | | | | | | | | | | | | 105,000 | |

| Common stock issued to a consultant | | | 100,000 | | | | 10 | | | | 57,990 | | | | | | | | | | | | 58,000 | |

| Amortization of deferred stock compensation | | | | | | | | | | | | | | | 562,500 | | | | | | | | 562,500 | |

| Net loss for the year | | | | | | | | | | | | | | | | | | | (3,791,042 | ) | | | (3,791,042 | ) |

| Balance June 30, 2008 (audited) | | | 43,785,569 | | | | 4,379 | | | | 10,738,801 | | | | (1,312,500 | ) | | | (6,730,845 | ) | | | 2,699,835 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Common shares issued for cash (net) | | | 7,040,000 | | | | 704 | | | | 3,372,296 | | | | - | | | | - | | | | 3,373,000 | |

| Common stock issued to a consultant | | | 75,000 | | | | 7 | | | | 43,493 | | | | - | | | | - | | | | 43,500 | |

| Common stock issued on acquisition of a subsidiary | | | 397,024 | | | | 40 | | | | 31,722 | | | | - | | | | - | | | | 31,762 | |

| Common shares issued on warrant exercises | | | 8,900,907 | | | | 890 | | | | 2,224,337 | | | | - | | | | - | | | | 2,225,227 | |

| Stock based compensation | | | | | | | | | | | 814,050 | | | | | | | | | | | | 814,050 | |

| Amortization of deferred stock compensation | | | | | | | | | | | | | | | 1 ,125,000 | | | | | | | | 1 ,125,000 | |

| Net loss for the year | | | | | | | | | | | | | | | | | | | (5,698,804 | ) | | | (5,698,804 | ) |

| Balance June 30, 2009 (audited) | | | 60,198,500 | | | | 6,020 | | | | 17,224,699 | | | | (187,500 | ) | | | (12,429,649 | ) | | | 4,613,570 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock based compensation | | | | | | | | | | | 86,947 | | | | | | | | - | | | | 86,947 | |

| Amortization of deferred stock compensation | | | | | | | | | | | | | | | 187,500 | | | | | | | | 187,500 | |

| Net loss for the three month period | | | | | | | | | | | | | | | | | | | (1,265,869 | ) | | | (1,265,869 | ) |

| Balance September 30, 2009 (unaudited) | | | 60,198,500 | | | | 6,020 | | | | 17,311,646 | | | | - | | | | (13,695,518 | ) | | | 3,622,148 | |

See Condensed notes to the Interim Financial Statements

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Interim Consolidated Statements of Cash Flows

For the three months ended September 30, 2009 and September 30, 2008

and for the period from Inception (June 3, 1999) to September 30, 2009.

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| | | Cumulative | | | | | | | |

| | | Since | | | Sept 30, | | | Sept 30, | |

| | | Inception | | | 2009 | | | 2008 | |

| Cash Flows from Operating Activities | | | | | | | | | |

| Net loss | | | (13,695,518 | ) | | | (1,265,869 | ) | | | (1,407,238 | ) |

| Adjustment for: | | | | | | | | | | | | |

| Amortization | | | 756,648 | | | | 45,255 | | | | 53,005 | |

| Amortization of debt issuance cost | | | 247,490 | | | | - | | | | - | |

| Stock based compensation | | | 1,070,295 | | | | 86,947 | | | | 48,124 | |

| Shares issued for mineral claims, as part of project expenses | | | 1,452,650 | | | | - | | | | - | |

| Shares issued for consultant services expensed | | | 2,351,500 | | | | 187,500 | | | | 324,750 | |

| Shares issued on acquisition of subsidiary | | | 31,762 | | | | - | | | | - | |

| Interest on convertible debentures | | | 90,453 | | | | - | | | | - | |

| Changes in non-cash working capital | | | | | | | | | | | | |

| Prepaid expenses | | | (215,362 | ) | | | (9,880 | ) | | | (47,102 | ) |

| Accounts payable | | | 209,803 | | | | 22,803 | | | | 100,973 | |

| Accrued liabilities | | | 77,593 | | | | (6,749 | ) | | | (103,965 | ) |

| | | | | | | | | | | | | |

| Net cash used in operating activities | | | (7,622,686 | ) | | | (939,993 | ) | | | (1,031,453 | ) |

| | | | | | | | | | | | | |

| Cash Flows from Investing Activities | | | | | | | | | | | | |

| Decrease (Increase) in Short-term investments | | | (2,323,170 | ) | | | 793,633 | | | | - | |

| Acquisition of plant and equipment for cash | | | (95,203 | ) | | | (5,431 | ) | | | (1,858 | ) |

| Proceeds from sale of plant and equipment | | | 2,500 | | | | - | | | | - | |

| | | | | | | | | | | | | |

| Net cash provided (used) in investing activities | | | (2,415,873 | ) | | | 788,202 | | | | (1,858 | ) |

| | | | | | | | | | | | | |

| Cash Flows from Financing Activities | | | | | | | | | | | | |

| Issuance of common shares for cash | | | 4,790,740 | | | | - | | | | 3,520,000 | |

| Issuance of common shares for warrant exercises | | | 2,225,227 | | | | - | | | | - | |

| Issuance of convertible debentures subsequently converted to cash | | | 3,501,067 | | | | - | | | | - | |

| Stock and debenture placement commissions paid in cash | | | (210,000 | ) | | | - | | | | (147,000 | ) |

| | | | | | | | | | | | | |

| Net cash provided by financing activities | | | 10,307,034 | | | | - | | | | 3,373,000 | |

| Net Change in Cash | | | 268,475 | | | | (151,791 | ) | | | 2,339,689 | |

| Cash- beginning of period | | | - | | | | 420,266 | | | | 1,553,855 | |

| | | | | | | | | | | | | |

| Cash - end of period | | | 268,475 | | | | 268,475 | | | | 3,893,544 | |

| | | | | | | | | | | | | |

| Supplemental Cash Flow Information | | | | | | | | | | | | |

| Interest paid | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | |

| Income taxes paid | | | - | | | | - | | | | - | |

See Condensed notes to the Interim Financial Statements

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

September 30, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with the instructions to Form 10-Q and therefore do not include all information and footnotes necessary for a fair presentation of financial position, results of operations and cash flows in conformity with U.S. generally accepted accounting principles (GAAP); however, such information reflects all adjustments (consisting solely of normal recurring adjustments), which are, in the opinion of management, necessary for a fair statement of the results for the interim periods. The condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and Notes thereto together with management’s discussion and analysis of financial condition and results of operations contained in the Company’s annual report on Form 10-K for the year ended June 30, 2009. In the opinion of management, the accompanying condensed consolidated financial statements reflect all adjustments of a normal recurring nature considered necessary to fairly state the financial position of the Company at September 30, 2009 and June 30, 2009, the results of its operations for the three-months periods ended September 30, 2009 and September 30, 2008, and its cash flows for the three-months periods ended September 30, 2009 and September 30, 2008. In addition, some of the Company’s statements in this quarterly report on Form 10-Q may be considered forward-looking and involve risks and uncertainties that could significantly impact expected results. The results of operations for the three-month period ended September 30, 2009 are not necessarily indicative of results to be expected for the full year.

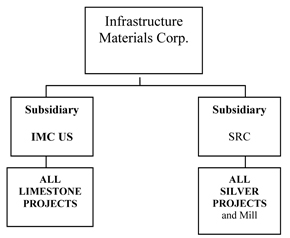

The consolidated financial statements include the accounts of the Company and its subsidiaries, Infrastructure Materials Corp US and Silver Reserve Corp. All material inter-company accounts and transactions have been eliminated.

| 2. | Exploration Stage Activities |

The Company's financial statements are presented on a going concern basis, which contemplates the realization of assets and satisfaction of liabilities in the normal course of business.

The Company is in the exploration stage and has not yet realized revenues from its planned operations. The Company has incurred a cumulative loss of $13,695,518 from inception to September 30, 2009. The Company has funded operations through the issuance of capital stock and convertible debentures. In May and June of 2006, the Company closed a private placement of its common stock for gross proceeds of $415,000. During the year ended June 30, 2007 the Company raised $848,935 (including $300,000 received in the prior year as stock subscriptions) through private placement of its common stock for cash. The Company also issued Convertible Debentures in the amount of $1,020,862 during the year ended June 30, 2006 and issued Convertible Debentures in the amount of $2,480,205 during the year ended June 30, 2007. During the three-month period ended September 30, 2008 the Company completed private placements of common stock for proceeds of $3,373,000 net of cash expenses. During the three-month period ended March 31, 2009 as a result of warrant exercises the Company issued common stock for proceeds of $2,225,227. Management's plan is to continue raising additional funds through future equity or debt financing until it achieves profitable operations from production of minerals or metals on its properties, if feasible.

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

September 30, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

On December 1, 2008, the Company amended its Certificate of Incorporation to change its name from “Silver Reserve Corp.” to “Infrastructure Materials Corp.”

The Company operates with the intent of exploration and extraction of limestone, silver and other metals in the States of Nevada and Idaho.

The Company is an exploration stage mining company and has not yet realized any revenue from its operations. It is primarily engaged in the acquisition and exploration of mining properties. Mineral property exploration costs are expensed as incurred. Mineral property payments are capitalized only if the Company is able to allocate any economic value beyond proven and probable reserves. When it has been determined that a mineral property can be economically developed as a result of establishing proven and probable reserves, the costs incurred to develop such property will be capitalized. For the purpose of preparing financial information, the Company is unable to allocate any economic value beyond proven and probable reserves and hence all property payments are considered to be impaired and accordingly written off to project expense. All costs associated with a property that has the potential to add to the Company’s proven and probable reserves are expensed until a final feasibility study demonstrating the existence of proven and probable reserves is completed. No costs have been capitalized in the periods covered by these financial statements. Once capitalized, such costs will be amortized using the units-of-production method over the estimated life of the probable reserve.

Mineral property acquisition costs also will be capitalized in accordance with the FASB Emerging Issues Task Force ("EITF") Issue 04-2 when management has determined that probable future benefits consisting of a contribution to future cash inflows have been identified and that adequate financial resources are available or are expected to be available as required to meet the terms of property acquisition and budgeted exploration and development expenditures. Mineral property payments are expensed as incurred if the criteria for capitalization is not met.

To date, mineral property exploration costs have been expensed as incurred. As of the date of these financial statements, the Company has incurred only property payments and exploration costs which have been expensed. To date the Company has not established any proven or probable reserves on its mineral properties.

In November of 2008, the Company expanded its business focus to include the exploration and, if warranted, development of cement grade limestone properties, also located in the States of Nevada and Idaho. The Company acquired as a wholly-owned subsidiary Infrastructure Materials Corp US (“IMC US”), a Nevada Corporation, pursuant to a Share Exchange Agreement (the “Agreement”) between the Company, IMC US and Todd D. Montgomery dated as of November 7, 2008. Mr. Montgomery was the sole shareholder of IMC US, in addition to serving as the Company’s Chief Executive Officer and as a member of its Board of Directors.

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

September 30, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| 3. | Nature of Operations-Cont’d. |

The Agreement was approved by the disinterested members of the Company’s Board of Directors on November 6, 2008. Under the terms of the Agreement, the Company acquired all of the issued and outstanding stock of IMC US in exchange for 397,024 shares of the Company’s common stock at the agreed price of $0.50 per share. The transaction was measured at the fair value, being the market value of the equity instruments delivered on the transaction date. The fair value of the Company’s 397,024 shares issued at closing was measured at $31,762.

| | | $ | |

| Fair value of assets acquired | | | - | |

| Consideration given | | | 31,762 | |

| Goodwill on acquisition | | | 31,762 | |

Subsequent to the acquisition of IMC US, it was determined that the Goodwill was impaired.

IMC US controls eight limestone Projects in Nevada, made up of 619 mineral claims covering 12,789 acres. IMC US and has leased 100% of the Mineral Rights on an additional 1,120 acres and 50% of the Mineral Rights on 6,740 acres. In addition IMC US controls one limestone project in Idaho consisting of 63 mineral claims covering 1,302 acres. The Company does not consider the claims or mineral rights to be material at this time and has expensed this cost to project expense. The Company’s assessment of the claims and mineral rights may change after exploration of the claims. Subsequent to the period covered by this report, an additional 371 mineral claims in Lincoln County and 79 mineral claims in Pershing County, Nevada were recorded.

On December 18, 2008, the Company incorporated a second wholly owned subsidiary in the State of Delaware under its former name, “Silver Reserve Corp.”,(sometimes referred to as “Silver Reserve”). The Company assigned all fourteen of its silver/base metal projects in Nevada to this subsidiary. The fourteen claim groups contained 545 claims covering 11,259 acres and has 9 patented claims. The Company does not consider the claims to be material at this time and has expensed this cost to project expense. The Company’s assessment of the claims may change after exploration of the claims.

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

September 30, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| 4. | Plant and Equipment, Net |

Plant and equipment are recorded at cost less accumulated depreciation. Depreciation is provided commencing in the month following acquisition using the following annual rate and method:

| Computer equipment | | | 30 | % | declining balance method |

| Office furniture and fixtures | | | 20 | % | declining balance method |

| Leasehold improvements | | 3 years | | straight line method |

| Plant and Machinery | | | 15 | % | declining balance method |

| Tools | | | 25 | % | declining balance method |

| Vehicles | | | 20 | % | declining balance method |

| Consumables | | | 50 | % | declining balance method |

| Molds | | | 30 | % | declining balance method |

| Mobile Equipment | | | 20 | % | declining balance method |

| Factory Buildings | | | 5 | % | declining balance method |

| | | Sep 30, 2009 | | | Accumulated | | | June 30, 2009 | | | Accumulated | |

| | | Cost | | | Depreciation | | | Cost | | | Depreciation | |

| | | $ | | | $ | | | $ | | | $ | |

| | | | | | | | | | | | | | | |

| Office, furniture and fixtures | | | 18,830 | | | | 9,034 | | | | 18,830 | | | | 8,506 | |

| Computer equipment | | | 12,001 | | | | 4,090 | | | | 6,571 | | | | 3,405 | |

| Leasehold improvements | | | 16,230 | | | | 16,168 | | | | 16,230 | | | | 14,815 | |

| Plant and Machinery | | | 1,514,511 | | | | 592,761 | | | | 1,514,677 | | | | 557,350 | |

| Tools | | | 6,724 | | | | 3,515 | | | | 6,725 | | | | 3,281 | |

| Vehicles | | | 76,406 | | | | 27,162 | | | | 76,407 | | | | 24,276 | |

| Consumables | | | 64,197 | | | | 56,005 | | | | 64,197 | | | | 54,835 | |

| Molds | | | 900 | | | | 594 | | | | 900 | | | | 569 | |

| Mobile Equipment | | | 73,927 | | | | 36,228 | | | | 73,927 | | | | 34,244 | |

| Factory Buildings | | | 74,849 | | | | 10,922 | | | | 74,849 | | | | 10,112 | |

| | | | 1,858,575 | | | | 756,479 | | | | 1,853,313 | | | | 711,393 | |

| | | | | | | | | | | | | | | | | |

| Net carrying amount | | | | | | | 1,102,096 | | | | 1,141,920 | | | | | |

| Amortization charges | | | | | | | 45,255 | | | | 214,204 | | | | | |

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

September 30, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

During the years ended June 30, 2006 and June 30, 2007, the Company issued convertible debentures for $1,020,862 and $2,480,205 respectively, for a total of $3,501,067. During the quarter ended December 31, 2007, all holders of the Company’s convertible debentures exercised their conversion rights. Under the terms of the convertible debentures, the holders converted the principal amount of their convertible debentures into “units” at $0.50 per unit, where each unit consisted of a share of the Company’s common stock (a “Share”) and a warrant to purchase a Share at a purchase price of $0.75 per Share. An aggregate of 7,002,134 Shares and an aggregate of 7,002,134 Share purchase warrants were issued upon conversion of the principal amount.

The convertible debentures had a maturity of December 31, 2007 and an interest rate of 2% per annum. Pursuant to the terms of the convertible debentures, the Company had the option of paying interest in shares or in cash. The Company elected to pay interest in Shares, which were restricted upon issuance. An aggregate of 184,596 Shares were issued upon the conversion of the convertible debentures as payment of interest converted at one share for each $0.49 of interest. The Shares issued upon conversion of the convertible debentures and the Shares underlying the warrants were subject to “lock-up” agreements limiting the re-sale of the Shares following exercise. All such restrictions have expired.

| 6. | Issuance of common shares and warrants |

Year ended June 30, 2009

The Company issued 25,000 common shares to Endeavor Holdings, Inc. on July 1, August 1 and September 1, of 2008 for a total of 75,000 common shares valued at $43,500 in accordance with the terms of the contract dated March 3, 2008. The contract was terminated on October 1, 2008.

On August 12, 2008, the Company announced that it entered into a non-binding letter of intent (the “LOI”) dated as of August 12, 2008 to acquire, as a wholly-owned subsidiary, Infrastructure Materials Corp US (“IMC US”), a Nevada corporation. The Company completed the acquisition of all of the outstanding shares of IMC US on November 7, 2008. IMC US holds limestone mineral properties in the United States, and is actively engaged in acquiring additional limestone mineral properties. Todd Montgomery, a director and chief executive officer of the Company, was the sole shareholder of IMC US. The transaction was approved by the disinterested members of the Company’s Board of Directors.

Under the terms of the Share Exchange Agreement, Mr. Montgomery received 397,024 Shares of the Company at an agreed value of $0.50 per Share which was accounted at the fair value on the date of transaction, in exchange for all of the outstanding shares of IMC US. The transaction was measured at the fair value, being the market value of the equity instruments delivered on the transaction date. The fair value of the Company’s 397,024 Shares issued was measured at $31,762. IMC US owns certain limestone mineral claims in the States of Nevada and Idaho which the Company does not consider material at this time and has expensed this cost to project expense. The Company’s assessment of the claims may change after exploration of the claims.

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

September 30, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| 6. | Issuance of common shares and warrants-cont’d |

During February 2009, the Company issued a total of 8,900,907 Shares upon the exercise of warrants at $0.25 per Share. On December 11, 2008 the Company’s Board of Directors approved an offer to all warrant holders of the Company to reduce the exercise price of such warrants from $0.75 per Share to $0.25 per share if the warrants were exercised prior to February 28, 2009.

Warrants

During the year ended June 30, 2007, the Company issued 700,214 broker warrants at an exercise price of $0.50 to purchase convertible debentures as part of the commission due the agents who placed the offering of common shares and convertible debentures. These warrants represented an amount equal to 10% of the convertible debentures placed. The expiry date of the above listed broker warrants, was extended by the Board of Directors from the original expiry of June 30, 2007 to December 31, 2007 and further extended to December 31, 2008 and further extended to December 31, 2009.

During the year ended June 30, 2008, all holders of the Company’s convertible debentures exercised their conversion rights. Under the terms of the convertible debentures, the holders converted the principal amount of their convertible debentures into “Units” at $0.50 per Unit, where each Unit consisted of a Share and a warrant to purchase a Share at a purchase price of $0.75 per Share. An aggregate of 7,002,134 Shares and an aggregate of 7,002,134 share purchase warrants were issued upon conversion of the principal amount. The expiry date of these warrants was extended to December 31, 2009 by a resolution of the Board of Directors on June 18, 2008.

During the year ended June 30, 2009, the Company completed the private placement of 7,040,000 “Units” at $0.50 per Unit with accredited investors, as that term is defined in Regulation D promulgated under the Securities Act of 1933, as amended (the “Securities Act”). Each one Unit consists of one Share and one half of a Share purchase warrant (a “Warrant”). Each full Warrant entitled the holder to purchase one share at $0.75 on or before September 1, 2010. The private placement was exempt from registration under the Securities Act pursuant to an exemption afforded by Regulation S promulgated thereunder (“Regulation S”). All of the investors were non-U.S. Persons as that term is defined under Regulation S and executed subscription agreements containing the representations and covenants required for the exemption under Regulation S. The Company paid a commission of $147,000 and issued 294,000 broker warrants to purchase Units at $0.50 per Unit in connection with the private placement. The Units have the same terms as those sold to investors. The broker warrants expire on September 1, 2010.

On December 11, 2008, the Board of Directors approved a resolution which reduced the exercise price of all unexercised warrants from $0.75 per Share to $0.25 per Share, only if the warrants were exercised prior to February 28, 2009.

The Company received elections to purchase 8,900,907 common shares under the exercise of warrants at $0.25 per share. This exercise price of $0.25 per Share was part of the one time offer to all warrant holders approved by the Board of Directors on December 11, 2008 that provided that the exercise price be reduced from $0.75 per share to $0.25 per share if the warrants were exercised prior to February 28, 2009. The Company received $2,225,227 and issued 8,900,907 common shares.

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

September 30, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| 6. | Issuance of common shares and warrants-cont’d |

| | | Number of | | | | | | | |

| | | Warrants | | | Exercise | | | | |

| | | Granted | | | Prices | | | Expiry Date | |

| | | | | | $ | | | | |

| | | | | | | | | | | |

| Outstanding at June 30, 2007 and average exercise price | | | 700,214 | | | | 0.50 | | | | | |

| Granted in year 2007-2008 | | | 7,002,134 | | | | 0.75 | | | Dec 31, 2009 | |

| Exercised in year 2007-2008 | | | - | | | | - | | | | | |

| Expired in year 2007-2008 | | | - | | | | - | | | | | |

| Cancelled | | | - | | | | - | | | | | |

| Outstanding at June 30, 2008 and average exercise price | | | 7,702,348 | | | | 0.73 | | | | | |

| Granted in year 2008-2009 | | | 3,520,000 | | | | 0.75 | | | Sept 1, 2010 | |

| Granted in year 2008-2009 | | | 294,000 | | | | 0.50 | | | Sept 1, 2010 | |

| | | | | | | | | | | | | |

| Exercised in year 2008-2009 | | | (8,900,907 | ) | | | 0.75 | | | | | |

| Expired in year 2008-2009 | | | - | | | | - | | | | | |

| Cancelled | | | - | | | | - | | | | | |

| | | | | | | | | | | | | |

| Outstanding at June 30, 2009 and average exercise price | | | 2,615,441 | | | | 0.66 | | | | | |

| Granted during three months ended Sept 30, 2009 | | | - | | | | - | | | | | |

| Exercised during three months ended Sept 30, 2009 | | | - | | | | - | | | | | |

| Expired during three months ended Sept 30, 2009 | | | - | | | | - | | | | | |

| Cancelled during three months ended Sept 30, 2009 | | | - | | | | - | | | | | |

| Outstanding at Sept 30, 2009 and average exercise price | | | 2,615,441 | | | | 0.66 | | | | | |

Three month period ended September 30, 2009

There were no securities issued during this period.

| 7. | Stock Based Compensation |

In April of 2006, the Board of Directors approved an employee stock option plan ("2006 Stock Option Plan"), the purpose of which is to enhance the Company's stockholder value and financial performance by attracting, retaining and motivating the Company's officers, directors, key employees, consultants and its affiliates and to encourage stock ownership by such individuals by providing them with a means to acquire a proprietary interest in the Company's success through stock ownership.

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

September 30, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| 7. | Stock Based Compensation-Cont’d |

Under the 2006 Stock Option Plan, officers, directors, employees and consultants who provide services to the Company may be granted options to acquire common shares of the Company at the fair market value of the stock on the date of grant. Options may have a term of up to 10 years. The total number of shares reserved for issuance under the 2006 Stock Option Plan is 5,000,000.

Three months ended September 30, 2009

On September 14, 2009 the Board terminated the consulting services agreement with Scott Koyich effective as of October 15, 2009 and resolved to extend the expiry of his options from his termination date to October 15, 2010.

For the three month period ended September 30, 2009, the Company recognized in the financial statements, stock-based compensation costs as per the following details. The fair value of each option used for the purpose of estimating the stock compensation is based on the grant date using the Black-Scholes option pricing model with the following weighted average assumptions.

The expected term calculation is based upon the expected term the option is to be held, which is the full term of the option. The risk-free interest rate is based upon the U.S. Treasury yield in effect at the time of grant for an instrument with a maturity that is commensurate with the expected term of the stock options. The dividend yield of zero is based on the fact that the Company has never paid cash dividends on its common stock and has no present intention to pay cash dividends. The expected forfeiture rate of 0% is based on the vesting of stock options in a short period of time.

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

September 30, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| 7. | Stock Based Compensation-Cont’d |

| Date of grant | | 10-Apr | | | 17-Apr | | | 24-Jan | | | 2-Apr | | | 23-Jun | | | 7-Aug | | | 11-Dec | | | 11-Dec | | | 11-Dec | | | 19-Dec | | | 1-Jan | | | 3-Feb | | | 5-Jun | | | | |

| | | 2007 | | | 2007 | | | 2008 | | | 2008 | | | 2008 | | | 2008 | | | 2008 | | | 2008 | | | 2008 | | | 2008 | | | 2009 | | | 2009 | | | 2009 | | | Total | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Risk free rate | | | 4.50 | % | | | 4.50 | % | | | 5.00 | % | | | 5.00 | % | | | 5.00 | % | | | 5.00 | % | | | 2.95 | % | | | 2.95 | % | | | 2.95 | % | | | 2.95 | % | | | 2.95 | % | | | 2.95 | % | | | 2.95 | % | | | |

| Volatility factor | | | 50 | % | | | 50 | % | | | 50 | % | | | 90.86 | % | | | 111.64 | % | | | 112.99 | % | | | 149.96 | % | | | 149.96 | % | | | 149.96 | % | | | 166.69 | % | | | 168.45 | % | | | 170.57 | % | | | 155.95 | % | | | |

| Expected dividends | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | - | |

| Forfeiture rate | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | - | |

| Expected life | | 5 years | | | 5 years | | | 5 years | | | 5 years | | | 5 years | | | 5 years | | | 5 years | | | 5 years | | | 5 years | | | 1-4 years | | | 5 years | | | 5 years | | | 5 years | | | | - | |

| Exercise price | | $ | 0.50 | | | $ | 0.50 | | | $ | 0.60 | | | $ | 0.35 | | | $ | 0.52 | | | $ | 0.46 | | | $ | 0.15 | | | $ | 0.25 | | | $ | 0.25 | | | $ | 0.30 | | | $ | 0.15 | | | $ | 0.31 | | | $ | 0.47 | | | | - | |

| Total number of options granted | | | 1,850,000 | | | | 50,000 | | | | 50,000 | | | | 400,000 | | | | 250,000 | | | | 50,000 | | | | 1,950,000 | | | | 50,000 | | | | 50,000 | | | | 1,950,000 | | | | 300,000 | | | | 150,000 | | | | 50,000 | | | | 7,150,000 | |

| Grant date fair value | | $ | 0.07 | | | $ | 0.07 | | | $ | 0.29 | | | $ | 0.25 | | | $ | 0.42 | | | $ | 0.38 | | | $ | 0.14 | | | $ | 0.13 | | | $ | 0.45 | | | $ | 0.18-$0.27 | | | $ | 0.14 | | | $ | 0.29 | | | $ | 0.43 | | | | - | |

| Total number of options cancelled/forfeited | | | (1,850,000 | ) | | | (50,000 | ) | | | (50,000 | ) | | | (216,667 | ) | | | (250,000 | ) | | | (50,000 | ) | | | (25,000 | ) | | | (50,000 | ) | | | (50,000 | ) | | | | | | | ( | ) | | | | | | | | | | | (591,667 | ) |

| Stock-based compensation cost expensed during the three month period ended Sept 30, 2009 | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 67,534 | | | | | | | $ | 2,788 | | | | | | | | | | | $ | 11,135 | | | $ | 5,490 | | | | 86,947 | |

| Unexpended Stock-based compensation cost deferred over the vesting period | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 57,633 | | | | | | | | | | | | | | | | | | | $ | 14,561 | | | $ | 14,661 | | | $ | 86,855 | |

· Options originally issued on April 10, 2007 and January 24, 2008 with an exercise price of $0.50 and $0.60 respectively were cancelled and reissued with an exercise price of $0.30 on December 19, 2008 with all other terms of the original grant remaining the same.

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

September 30, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

The following table summarizes the options outstanding as at September 30, 2009:

| Outstanding, beginning of year | | | 4,639,583 | |

| Granted/re-issued | | | - | |

| Forfeited/Cancelled | | | (81,250 | ) |

| | | | | |

| Outstanding at September 30, 2009 | | | 4,558,333 | |

As of September 30, 2009, there was $86,855 of unrecognized expenses related to non-vested stock-based compensation arrangements granted. The stock-based compensation expense for the three-month period ended September 30, 2009 was $86,947.

| 8. | Deferred Stock Compensation |

The Company issued 1,500,000 Shares each to two consultants, for a total of 3,000,000 Shares valued at $2,250,000. The Shares issued to the consultants are considered “restricted” and cannot be resold unless an exemption from registration is available, such as the exemption afford by Rule 144 promulgated under the Securities Act. The Company expensed proportionate consulting expenses of $187,500 during the three months ended September 30, 2009 and $1,125,000 during the year ended June 30, 2009. Consulting expenses were completely expensed by the end of September 30, 2009 and are no longer reflected as a deferred stock compensation expense under shareholders’ equity in the balance sheet.

| 9. | Commitments and Contingencies |

On August 1, 2006, the Company acquired the Pansy Lee Claims from Anglo Gold Mining Inc. in exchange for 1,850,000 shares of the Company’s common stock. The Company’s interest was acquired pursuant to an Asset Purchase Agreement dated August 1, 2006 (the “Pansy Lee Purchase Agreement”). Pursuant to the Pansy Lee Purchase Agreement, in the event that any one or more claims becomes a producing claim, the Company’s revenue is subject to a 2% net smelter return royalty where net smelter returns are based upon gross revenue. Gross revenue would be calculated after commercial production commences and includes the aggregate of the following amounts: revenue received by the Company from arm’s length purchasers of all mineral products produced from the property, the fair market value of all products sold by the Company to persons not dealing with the Company at arms length and the Company’s share of the proceeds of insurance on products. From such revenue, the Company would be permitted to deduct: sales charges levied by any sales agent on the sale of products; transportation costs for products; all costs, expenses and charges of any nature whatsoever which are either paid or incurred by the Company in connection with the refinement and beneficiation of products after leaving the property and all insurance costs and taxes.

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

September 30, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| 9. | Commitments and Contingencies – Cont’d |

Effective as of September 1, 2007, the Company entered into an agreement with Brehnam Trading Corp. (“Brehnam”) for a term of 24 months to provide consulting services on financial matters, business growth and development, and general business matters. The Company paid Brehnam 1,500,000 Shares earned in equal installments of 375,000 shares on December 1, 2007, June 1, 2008, December 1, 2008 and June 1, 2009. Such 1,500,000 Shares were tendered in one certificate upon execution of the agreement and are deemed to be in Brenham’s possession and were issued as “restricted” and may not be re-sold unless an exemption from registration is available such as the exemption afforded by Rule 144 promulgated under the Securities Act. On July 6, 2009 the consulting period was amended and extended to August 30, 2011 without further compensation.

Effective as of September 1, 2007, the Company entered into an agreement with Costa View Inc. (“Costa”) for a term of 24 months to provide consulting services on financial public relations, business promotion, business growth and development, including mergers and acquisitions, and general business matters. The Company paid Costa 1,500,000 Shares earned in equal installments of 375,000 shares on December 1, 2007, June 1, 2008, December 1, 2008 and June 1, 2009. Such 1,500,000 Shares were tendered in one certificate upon execution of the agreement and are deemed to be in Costa’s possession and were issued as “restricted” and may not be re-sold unless an exemption from registration is available such as the exemption afforded by Rule 144 promulgated under the Securities Act. On July 6, 2009 the consulting period was amended and extended to August 30, 2011 without further compensation.

On September 14, 2007 the Company accepted a proposal from Lumos & Associates to complete the regulatory permitting process for the Company’s Mill in Mina, Nevada. The total consideration to be paid under the contract is approximately $350,000. The permitting process is being carried out in twelve stages. The completion date has not been determined. The Company is required to authorize in writing each stage of the work before the work proceeds. As at September 30, 2009, the Company had authorized and paid Lumos and Associates $269,260 (June 30, 2009 - $134,181).

On April 4, 2008, the Company entered into a Consultant Agreement with Lumos and Associates, to facilitate the completion exploration drilling “Notices of Intent” and Plans of Operation in compliance with the requirements of the United States Bureau of Land Management. The Company estimates the costs of each Notice of Intent plan to range from $3,000 to $4,000. Plans of Operation will be priced separately. As at September 30, 2009 the Company had paid $37,710 relating to this contract.

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

September 30, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| 9. | Commitments and Contingencies – Cont’d |

On May 1, 2008, the Company entered into a Consulting Services Agreement with Lance Capital Ltd. (“Lance”), at $12,500 per month to provide personnel to carry out administration services for the Company. On November 1, 2008, the Consulting Services Agreement was amended to reduce the monthly fee to $10,000 for the months of December 2008 and January 2009 and thereafter to $7,500. On October 6, 2009 the Company informed Lance Capital Ltd. of its decision to terminate the agreement with two months notice. It is the Company’s intention to consolidate the administrative duties being provided by Lance into its Reno, Nevada office. It is anticipated that the transition will be completed by mid-February 2010 and Lance has agreed to continue providing its services for the duration as required. Refer to “Subsequent events” in this Report.

On May 20, 2008, the Company entered into an option agreement (the “Option Agreement”) with Nevada Eagle Resources, LLC and Steve Sutherland (together, the “Optionees”) effective as of May 1, 2008 (the “Date of Closing”), to acquire 25 mineral claims located in Elko County, Nevada and known as the “Medicine Claims.” During the term of the Option Agreement, the Company has the exclusive right to explore and develop, if warranted, the Medicine Claims. The Company paid $10,000 to the Optionees upon execution of the Option Agreement. The Option Agreement requires the Company to make additional payments as follows: $15,000 on the first anniversary of the Date of Closing, $30,000 on the second anniversary of the Date of Closing, $60,000 on the third anniversary of the Date of Closing and $80,000 on each anniversary of the Date of Closing thereafter until the tenth anniversary of the Date of Closing. The Optionees may elect to receive payment in cash or in shares of the Company’s common stock. Upon making the final payment on the tenth anniversary of the Date of Closing, the Company will have earned a 100% undivided interest in the Medicine Claims. On April 7, 2009, the Company amended the Option Agreement. This amendment reduced the option payment due on May 1, 2009 from $15,000 to $10,000 and increased the payment due May 1, 2010 from $30,000 to $35,000.

Pursuant to the Option Agreement, the Medicine Claims are subject to a 3% net smelter return (“NSR”) royalty payable to the Optionees. The payments made during the term of the Option Agreement are to be applied as advance NSR royalty payments. Beginning on the eleventh anniversary of the Date of Closing, the Company is required to make annual advance royalty payments of $80,000. At such time as the Medicine Claims are in production, if ever, the Company shall make annual royalty payments equal to the greater of the actual 3% NSR or $80,000. The Company may terminate the Option Agreement at any time before the option is fully exercised upon 60 days notice to the Optionees. The Company does not consider the Medicine Claims to be material assets at this time; however this assessment may change upon further exploration.

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

September 30, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| 9. | Commitments and Contingencies – Cont’d |

Effective as of June 23, 2008, the Company appointed Mason Douglas as the President of the Company. Mr. Douglas is also a director of the Company. In connection with the appointment, the Company entered into a consulting services agreement with a corporation that is controlled by Mr. Douglas (the “Consulting Agreement”). The Consulting Agreement has a term of one year and is then automatically renewable. Either party may terminate the Consulting Agreement upon 90 days notice to the other party. During the term of the Consulting Agreement the Company will pay the corporation a fee of $8,500 per month and reimburse related business expenses. Mr. Douglas does not receive a salary from the Company.

On December 8, 2008 IMC US entered into a Mineral Rights Lease Agreement (the “Lease Agreement”) with the Earl Edgar Mineral Trust (the “Lessor”) to lease certain mineral rights in Elko County, Nevada. The term of the Lease Agreement is ten years and will automatically renew on the same terms and conditions for additional ten-year periods, provided the Company is conducting exploration, development or mining either on the surface or underground at the property. The rent is to be paid each year on January 1st.

$1.00 per net acre was paid upon execution of the Lease Agreement. On January 1, of each year commencing in 2010 and extending for so long as the Lease Agreement is in effect the Company is obligated to make the following payments during:

| 2010 | | $1.00 per net acre |

| 2011 | | $2.00 per net acre |

| 2012 | | $2.00 per net acre |

| 2013 | | $3.00 per net acre |

| 2014 | | $3.00 per net acre |

| 2015 | | $4.00 per net acre |

| 2016 | | $4.00 per net acre |

| 2017 | | $5.00 per net acre in each year for the duration of the Lease Agreement. |

The Lease Agreement covers 100% of the mineral rights on 1,120 acres (“Property A”) and 50% of the mineral rights on 6,740 acres (“Property B”).

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

September 30, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| 9. | Commitments and Contingencies – Cont’d |

The Lessor is entitled to receive a Royalty of $0.50 per ton for material mined and removed from Property A and $0.25 per ton for material mined and removed from Property B during the term of the Lease Agreement and any renewal thereof.

On April 9, 2009 the Board of Directors approved an Amendment to Mineral Lease Agreement (the “Amendment”), effective December 8, 2008 between IMC US and the Earl Edgar Mineral Trust, Warner Whipple, Trustee, such amendment to be effective as of December 8, 2008. The Amendment provides for Standard Steam LLC to carry out exploration for geothermal energy sources on the leased mineral rights property after obtaining the written consent of the Company. The Amendment also provides for other cooperation with Standard Steam LLC regarding mineral rights on the properties which the Company holds a 50% interest in the mineral rights.

Effective as of January 1, 2009, the Company entered into a Consulting Agreement with Scott Koyich (the “Consultant”) for a period of six months, which was extended on June 29, 2009 to December 31, 2009 to provide consulting services with respect to financial public relations, business promotion, business growth and development. On September 14, 2009 this agreement was terminated, effective as of October 15, 2009. The Consultant was paid $5,000 per month for his services during the term of the Agreement and was granted options to acquire 300,000 Shares of the Company at $0.15 per share for a term of five years. These options vested at the rate of 50,000 options per month and all options had vested by the termination of the agreement. The expiry of the options was extended to October 15, 2010.

On February 23, 2009, the Board of Directors approved a drilling contract with Harris Exploration Drilling and Associates Inc. dated February 25, 2009 to carry out up to 30,000 feet of drilling programs in Nevada. The Company will pay $12.00 per foot for drilling plus various other costs related to mobilization and demobilization, travel, down time and moving time, plus other costs dependant on conditions and supplies. The Company paid a $25,000 refundable deposit upon execution of the contract to be applied to the final invoice. During the three month period ended September 30, 2009, the Company paid Harris Exploration Drilling $154,099 to complete 5,830 feet of drilling. During the year ended June 30, 2009 the Company paid Harris Exploration Drilling $223,265 to complete 10,495 feet of drilling.

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

September 30, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| 9. | Commitments and Contingencies – Cont’d |

On April 24, 2009, IMC US entered into a consulting agreement with PHW Consulting (“PHW). PHW is to provide collection, analysis and interpretation of data pertaining to mineral claims in Clark and Lincoln counties of Nevada owned by IMC US. PHW is also required to write and submit a Canadian National Instrument 43-101 (“NI 43-101”) compliant Technical Report on the Blue Nose Project in Lincoln County. The cost is $15,000 for such NI 43-101 compliant technical report plus $500.00 per day and out of pocket expenses for data collection, analysis and interpretation As of September 30, 2009 the Company has paid $12,943 for data collection and out of pocket expenses.

On May 25, 2009, IMC US hired Lumos & Associates to conduct base line studies for the Blue Nose Project located in Lincoln County, Nevada with the intention of determining if a suitable plant site can be located including analysis of rail and road access and environmental considerations that could impede development. The total consideration to be paid under the contract is approximately $74,500. The Company has to authorize each phase of the work. The Company paid Lumos & Associates $13,288 during the three-months ended September 30, 2009 and $9,952 during the year ended June 30, 2009.

On August 7, 2009, the Company resolved to conduct research and employ experts to provide an opinion on the merits of limestone properties in Manitoba, Canada, held by Infrastructure Materials Corp. Canada, which is controlled by Todd Montgomery, the Company’s CEO and a Director. The Company also will commission a market study to determine the market for cement that could be serviced from a cement plant in the location of such properties and the anticipated demand for cement looking forward five to twenty years. It is anticipated that the cost of this analysis costs will be approximately $50,000 to $75,000.

On August 7, 2009 the Company entered into an agreement with Watts, Griffis and McOuat, Consulting Geologists and Engineers to prepare a valuation report of certain cement grade limestone properties in Manitoba, Canada. The valuation date of the properties will be September 1, 2009. The Company paid a $10,000 CAD refundable deposit upon execution of the contract to be applied to the final invoice. The cost of such report is estimated to be between $15,000 and $25,000. The Company incurred costs of $1,647 CAD during the three months ended September 30, 2009.

On September 30, 2009, the Company entered into an agreement with Railroad Industries Incorporated to prepare a market analysis for Portland Cement, Cement Clinker and Limestone aggregate in Manitoba, Canada. The cost for the study is estimated to be between $18,550 and $26,600, depending on the number of hours required.

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

September 30, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| 9. | Commitments and Contingencies – Cont’d |

Maintaining Claims in Good Standing

The Company is required to pay to the Department of Interior Bureau of Land Management (“BLM”) on or before August 31st of each year, a fee in the amount of $140.00 per mineral claim held by the Company. The total amount paid on August 31, 2009 was $172,620 for 1,233 claims held by the Company at that date.

The Company is also required to pay annual fees to Counties in which the claims are held. At August 31, 2009, the Company paid $12,356 to nine Counties.

The Company also holds 9 patented claims and 2 leased patented claims. A patented claim is fee simple title to the property. Patented claims are subject to taxes assessed by the local community based on assessment rates set annually.

| 10. | Related Party Transactions |

Three months ended September 30, 2009

Roger Hall, a Director of the Company, received $46,125 in connection with services he performed for the Company as a senior geologist.

Joanne Hughes served as Corporate Secretary and received $10,789.

Mason Douglas, President and a member of the Company’s Board of Directors, received $25,500.

Three months ended September 30, 2008

Roger Hall, a Director of the Company, received $56,316 in connection with services he performed for the Company as a senior geologist.

Janet Shuttleworth, former Treasurer and Corporate Secretary, was paid $14,585.

Joanne Hughes, Corporate Secretary, received $4,110 from July 1, 2008 to July 30, 2008 (date of resignation).

Mason Douglas, President, was paid $25,500.

The Company has reviewed subsequent events up to October 26, 2009. Subsequent events are as follows:

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

September 30, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

On October 6, 2009, the Company informed Lance Capital Ltd. (“Lance”), of its intention to terminate its Consulting Services Agreement with Lance with two months notice, pending acceptance of the termination by Lance. It is the Company’s intention to consolidate the administrative duties being provided by Lance into its Reno, Nevada office. It is anticipated that the transition will be completed by mid February 2010 and Lance has agreed to continue providing its services for the duration as required.

On October 15, 2009, Roger Hall was appointed Vice President-Exploration of IMC US. Mr. Hall is also a member of the Company’s Board of Directors.

On October 22, 2009, Randal Ludwar resigned from his position as Chief Financial Officer of the Company. Mr. Ludwar will remain a member of the Company’s Board of Directors. There were no disagreements between Mr. Ludwar and the Company’s management as to operations, policies or financial reporting.

On October 22, 2009, Rakesh Malhotra was appointed Chief Financial Officer of the Company.

Subsequent to three months ended September 30, 2009, the Company recorded an additional 371 mineral claims in Lincoln County and 79 mineral claims in Pershing County, Nevada.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATION

FOR THE THREE MONTH PERIOD ENDED SEPTEMBER 30, 2009

PLAN OF OPERATIONS

We will require additional capital to implement development of our claim groups and to bring the mill to operation. We expect to raise this capital through a public offering, private placements of our securities or through loans or some combination of the foregoing.

Discussion of Operations and Financial Condition

Three Month Period ended September 30, 2009

The Company has no source of revenue and we continue to operate at a loss. We expect our operating losses to continue for so long as we remain in an exploration stage and perhaps thereafter. As at September 30, 2009, we had accumulated losses of $13,695,518. Our ability to emerge from the exploration stage and conduct mining operations is dependent, in large part, upon our raising additional equity financing. We are continuing our efforts to raise capital and are moving forward with development of our assets.

In November of 2008, the Company substantially changed its business focus to the exploration and development of cement grade limestone properties located in the States of Nevada and Idaho. This followed a period of research and analysis by management earlier in 2008 with respect to the growing need for repair and upgrading of basic infrastructure in North America. The Company determined that infrastructure investment would increase and with it the demand for cement. The Company projected that areas such as Nevada and California would have a significant shortfall in cement production. As a result of this research, the Company set out to acquire cement grade limestone properties in strategic locations that could supply these areas. The stimulus and infrastructure investments announced by the Obama Administration further strengthened the Company’s conclusions. Current proposals by governments to create jobs through large scale expenditures in infrastructure only enhance the Company’s opportunity.

The Company’s major endeavor over the three months ended September 30, 2009 has been its effort to pursue exploration activities on our limestone Projects as well as secure a sale of our silver properties and milling facility.

We have identified and recorded 619 claims on BLM land covering eight Projects. On private land we acquired 100% of the Mineral Rights on 1,120 acres and 50% of the Mineral Rights on 6,740 acres all of which have potential for cement grade limestone. Exploration on these limestone properties indicates that the Morgan Hill Project and the Blue Nose Project have potential for development of a substantial cement grade limestone resource. Our efforts going forward through our fiscal year 2009/2010 will be concentrated on development of these two Projects and the search for other limestone deposits in strategic locations that can service areas with a shortage of cement production.

We have completed the evaluation of all our silver/base metal projects and determined that the Pansy Lee, Medicine and Silver Queen Projects provide the best opportunity for development of resources that could go to production. Based on results obtained, we have decided to abandon the Como Project, thereby reducing the Projects to 14. Permitting of the Red Rock mill site at Mina, Nevada is progressing.

As of November 7, 2008, the Company acquired Infrastructure Materials Corp US (“IMC US”), a Nevada corporation, as a wholly-owned subsidiary pursuant to a Share Exchange Agreement (the “Agreement”) between the Company, IMC US and Todd D. Montgomery. Mr. Montgomery was the sole shareholder of IMC US in addition to serving as the Company’s Chief Executive Officer and as a member of its Board of Directors. The Agreement was approved by the disinterested members of the Company’s Board of Directors on November 6, 2008. Under the terms of the Agreement, the Company acquired all of the issued and outstanding stock of IMC US in exchange for 397,024 shares of the Company’s common stock at agreed price of $0.50 per share. The transaction was measured at the fair value, being the market value of the equity instruments delivered on the transaction date. The fair value of the Company’s 397,024 shares issued was measured at $31,762. As of the date of this report, the Company does not consider the mineral claims acquired pursuant to the Agreement to be material. Our assessment may change after exploration of the claims.

On December 1, 2008, the Company amended its Certificate of Incorporation to change its name from Silver Reserve Corp. to “Infrastructure Materials Corp.”

On December 18, 2008, the Company incorporated a second wholly owned subsidiary in the State of Delaware under its former name “Silver Reserve Corp.” (“SRC”). On March 27, 2009, the Company assigned all of its silver/base metal projects to SRC and on March 27, 2009 the Company assigned its interest in the Milling Facility at Mina, Nevada to SRC.

The following diagram illustrates the Company’s present structure and ownership of its mineral properties and Milling Facility:

Stock Based Compensation

On December 11, 2008, the Company authorized the issuance of 1,950,000 options to purchase common shares of the Company, at an exercise price of $0.15 per shares. These options were granted for a term of 5 years. These options vest at the rate of 1/12th per month until fully vested. On the same date, the Company also cancelled 250,000 options granted on June 23, 2008 with an exercise price of $0.52.

On December 19, 2008, the Company approved the reduction of the exercise price of 1,950,000 outstanding options held by directors and consultants of the Company issued at prices of $0.50 and $0.60 per share to $0.30 per share with all other terms of the grant remaining the same.

On January 1, 2009, the Board granted options to one consultant to purchase 300,000 common shares at an exercise price of $0.15 per share. These options were granted in accordance with the terms of the Company’s 2006 Stock Option Plan and vested at the rate of 50,000 options per month commencing January 1, 2009. On September 14, 2009 the consultant’s agreement was terminated effective October 15, 2009. All of the consultant’s options had vested by the termination of the agreement and the expiry of these options was extended to October 15, 2010.

On February 3, 2009, the Board granted options to two contract employees to purchase 50,000 and 100,000 common shares respectively, for a total of 150,000 common shares at an exercise price of $0.31 per share. These options were granted in accordance with the terms of the Company’s 2006 Stock Option Plan and vest at the rate of 1/12 each month until fully vested. The options granted are for a term of 5 years.

SELECTED FINANCIAL INFORMATION

| | | Three months ended | | | Three months ended | |

| | | Sept. 30, 2009 | | | Sept. 30, 2008 | |

| | | | | | | |

| Revenues | | $ | Nil | | | $ | Nil | |

| Net Loss | | $ | 1,265,869 | | | $ | 1,407,238 | |

| Loss per share-basic and diluted | | $ | (0.02 | ) | | $ | (0.03 | ) |

| | | As at | | | As at | |

| | | Sept. 30, 2009 | | | June 30, 2009 | |

| | | | | | | |

| Total Assets | | $ | 3,909,103 | | | $ | 4,884,471 | |

| Total Liabilities | | $ | 286,955 | | | $ | 270,901 | |

| Cash dividends declared per share | | $ | Nil | | | $ | Nil | |

The total assets as of September 30, 2009 include cash and cash equivalents for $268,475, short term investments for $2,323,170, prepaid expenses and other receivables for $215,362 and capital assets for $1,102,096. As of June 30, 2009 total assets includes cash and cash equivalents of $420,266, short-term investments of $3,116,803, prepaid expenses of $205,482 and capital assets of $1,141,920.

Revenues

No revenue was generated by the Company’s operations during the three-month periods ended September 30, 2009 and September 30, 2008.

Net Loss

The Company is an exploration stage mining company and has not yet realized any revenue from its operations. It is primarily engaged in the acquisition and exploration of mining properties. Mineral property exploration costs are expensed as incurred. Mineral property payments are capitalized only if the Company is able to allocate any economic value beyond proven and probable reserves. When it has been determined that a mineral property can be economically developed as a result of establishing proven and probable reserves, the costs incurred to develop such property will be capitalized. For the purpose of preparing financial information, the Company is unable to allocate any economic value beyond proven and probable reserves and hence all property payments are considered to be impaired and accordingly written off to project expense. All costs associated with a property that has the potential to add to the Company’s proven and probable reserves are expensed until a final feasibility study demonstrating the existence of proven and probable reserves is completed. No costs have been capitalized in the periods covered by these financial statements. Once capitalized, such costs will be amortized using the units-of-production method over the estimated life of the probable reserve.

Mineral property acquisition costs will be capitalized in accordance with the FASB Emerging Issues Task Force ("EITF") Issue 04-2 when management has determined that probable future benefits consisting of a contribution to future cash inflows have been identified and that adequate financial resources are available or are expected to be available as required to meet the terms of property acquisition and budgeted exploration and development expenditures. Mineral property payments are expensed as incurred if the criteria for capitalization is not met.

To date, mineral property exploration costs have been expensed as incurred. As of the date of these financial statements, the Company has incurred only property payments and exploration costs which have been expensed. To date the Company has not established any proven or probable reserves on its mineral properties.

The Company’s expenses are reflected in the Statements of Operation under the category of Operating Expenses.

The significant components of expense that have contributed to the total operating expense are discussed as follows:

(a) General and Administrative Expense

Included in operating expenses for the three-month period ended September 30, 2009 is general and administrative expense of $449,198, as compared with $734,360 for the three-month period ended September 30, 2008. General and administrative expense represents approximately 35% of the total operating expense for the three-month period ended September 30, 2009 and approximately 52% of the total operating expense for the three-month period ended September 30, 2008. General and administrative expense represents professional, consulting, office and general and other miscellaneous costs incurred during the three-month periods ended September 30, 2009 and September 30, 2008. General and administrative expense decreased by $285,163 in the current three month period, as compared to the similar three month period for the prior year. The decrease in this expense is mainly due to a decrease in consulting fees of $167,250, and a decrease in due diligence costs of $107,145.

(b) Project Expense

Included in operating expenses for the three-month period ended September 30, 2009 is project expense of $785,770 as compared with $631,672 for the three-month period ended September 30, 2008. Project expense is a significant expense and it represents approximately 61% of the total operating expense for the three-month period ended September 30, 2009 and approximately 45% of the total operating expense for the three-month period ended September 30, 2008.

Liquidity and Capital Resources

The following table summarizes the Company’s cash flow and cash in hand for the three-month period:

| | | Sept. 30, 2009 | | | Sept. 30, 2008 | |

| | | | | | | |

| Cash and cash equivalent | | $ | 268,475 | | | $ | 3,893,544 | |

| Working capital | | $ | 2,520,052 | | | $ | 3,748,782 | |

| Cash used in operating activities | | $ | (939,993 | ) | | $ | (1,031,453 | ) |

| Cash provided (used) in investing activities | | $ | 788,202 | | | $ | (1,858 | ) |

| Cash provided by financing activities | | $ | nil | | | $ | 3,373,000 | |

As at September 30, 2009 the Company had working capital of $2,520,052 as compared to $3,748,782 as at September 30, 2008.

Off-Balance Sheet Arrangement

The Company had no off-balance sheet arrangement as of September 30, 2009 and September 30, 2008.

Contractual Obligations and Commercial Commitments