UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended December 31, 2009

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Commission File Number: 000-52641

INFRASTRUCTURE MATERIALS CORP.

(Exact name of registrant as specified in its charter)

| Delaware | | 98-0492752 |

| (State of incorporation) | | (I.R.S. Employer Identification No.) |

1135 Terminal Way, Suite 207B

Reno, NV 89502 USA

(Address of Principal Executive Offices) (Zip Code)

866-448-1073

(Registrant’s telephone number, including area code)

With a copy to:

Jonathan H. Gardner

Kavinoky Cook LLP

726 Exchange St., Suite 800

Buffalo, NY 14210

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No o

Indicate by check mark whether the registrant ha submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | Accelerated filer o | Non-accelerated filer o | Smaller reporting company þ |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

The number of shares of registrant’s common stock outstanding as of December 31, 2009 was 60,198,500.

INFRASTRUCTURE MATERIALS CORP.

FORM 10-Q

FOR THE QUARTERLY PERIOD ENDED DECEMBER 31, 2009

TABLE OF CONTENTS

| | | | PAGE |

| | PART 1 – FINANCIAL INFORMATION | | |

| | | | |

| Item 1. | Financial Statements (Unaudited) | | 3 |

| | | | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | | 25 |

| | | | |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | | 36 |

| | | | |

| Item 4T. | Controls and Procedures | | 36 |

| | | | |

| | PART II – OTHER INFORMATION | | |

| | | | |

| Item 1. | Legal Proceedings | | 38 |

| | | | |

| Item 1A. | Risk Factors | | 38 |

| | | | |

| Item 2. | Unregistered Sale of Equity Securities and Use of Proceeds | | 42 |

| | | | |

| Item 3. | Defaults Upon Senior Securities | | 42 |

| | | | |

| Item 4. | Submission of Matters to a Vote of Security Holders | | 42 |

| | | | |

| Item 5. | Other Information | | 43 |

| | | | |

| Item 6. | Exhibits and Reports on Form 8-K | | 43 |

| | | | |

| | SIGNATURES | | 44 |

PART 1 – FINANCIAL INFORMATION

ITEM 1 Financial Statements

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

INTERIM CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

CONTENTS

| Interim Consolidated Balance Sheets as of December 31, 2009 (unaudited) and June 30, 2009 (audited) | | 4 |

| | | |

| Interim Consolidated Statements of Operations for the six months and three months ended December 31, 2009 and December 31, 2008, and for the period from inception to December 31, 2009 | | 5 |

| | | |

| Interim Consolidated Statements of Changes in Stockholders' Equity for the six months ended December 31, 2009 and for the period from inception to December 31, 2009 | | 6 |

| | | |

| Interim Consolidated Statements of Cash Flows for the six months ended December 31, 2009 and December 31, 2008, and for the period from inception to December 31, 2009 | | 7 |

| | | |

| Condensed Notes to Interim Consolidated Financial Statements | | 8 - 24 |

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Interim Consolidated Balance Sheets as at

December 31, 2009 and June 30, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| | | Dec 31, | | | June 30, | |

| | | 2009 | | | 2009 | |

| | | $ | | | $ | |

| | | (unaudited) | | | (audited) | |

| ASSETS | | | | | | | | |

| Current | | | | | | | | |

| Cash and cash equivalents | | | 183,394 | | | | 420,266 | |

| Short term investments | | | 1,534,147 | | | | 3,116,803 | |

| Prepaid expenses and other receivables | | | 191,191 | | | | 205,482 | |

| | | | | | | | | |

| Total Current Assets | | | 1,908,732 | | | | 3,742,551 | |

Plant and Equipment, net (note 4) | | | 1,056,983 | | | | 1,141,920 | |

| | | | | | | | | |

| Total Assets | | | 2,965,715 | | | | 4,884,471 | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

| Current | | | | | | | | |

| Accounts payable | | | 130,497 | | | | 187,000 | |

| Accrued liabilities | | | 156,706 | | | | 83,901 | |

| | | | | | | | | |

| Total Current Liabilities | | | 287,203 | | | | 270,901 | |

| | | | | | | | | |

| Total Liabilities | | | 287,203 | | | | 270,901 | |

| | | | | | | | | |

Commitments and Contingencies (note 9) | | | | | | | | |

| | | | | | | | | |

Related Party Transactions (note 10) | | | | | | | | |

| | | | | | | | | |

| STOCKHOLDERS' EQUITY | | | | | | | | |

| Capital Stock (note 6) | | | | | | | | |

| Common stock, $0.0001 par value, 100,000,000 shares authorized, 60,198,500 issued and outstanding (June 30, 2009 – 60,198,500) | | | 6,020 | | | | 6,020 | |

| Additional Paid-in Capital | | | 17,392,021 | | | | 17,224,699 | |

| Deferred Stock Compensation (note 8) | | | - | | | | (187,500 | ) |

| Deficit Accumulated During the Exploration Stage | | | (14,719,529 | ) | | | (12,429,649 | ) |

| | | | | | | | | |

| Total Stockholders' Equity | | | 2,678,512 | | | | 4,613,570 | |

| | | | | | | | | |

| Total Liabilities and Stockholders' Equity | | | 2,965,715 | | | | 4,884,471 | |

See Condensed notes to the Interim Financial Statements

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Interim Consolidated Statements of Operations

For the six months and three months ended December 31, 2009 and December 31, 2008 and the Period from Inception (June 3, 1999) to December 31, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| | | | | | For the | | | For the | | | For the | | | For the | |

| | | | | | six months | | | six months | | | three months | | | three months | |

| | | Cumulative | | | ended | | | ended | | | ended | | | ended | |

| | | since | | | Dec 31, | | | Dec 31, | | | Dec 31, | | | Dec 31, | |

| | | inception | | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

| | | $ | | | $ | | | $ | | | $ | | | $ | |

| | | | | | | | | | | | | | | | | | | | | |

| Operating Expenses | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| General and administration | | | 6,479,656 | | | | 878,310 | | | | 1,851,144 | | | | 429,114 | | | | 1,116,784 | |

| Project expenses | | | 7,728,572 | | | | 1,346,853 | | | | 1,197,178 | | | | 561,082 | | | | 565,506 | |

| Amortization | | | 801,761 | | | | 90,368 | | | | 106,333 | | | | 45,113 | | | | 53,328 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Operating Expenses | | | 15,009,989 | | | | 2,315,531 | | | | 3,154,655 | | | | 1,035,309 | | | | 1,735,618 | |

| | | | | | | | | | | | | | | | | | | | | |

| Loss from Operations | | | (15,009,989 | ) | | | (2,315,531 | ) | | | (3,154,655 | ) | | | (1,035,309 | ) | | | (1,735,618 | ) |

| Other income-interest | | | 380,913 | | | | 25,651 | | | | 26,312 | | | | 11,298 | | | | 14,513 | |

| | | | | | | | | | | | | | | | | | | | | |

| Interest Expense | | | (90,453 | ) | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | |

| Loss before Income Taxes | | | (14,719,529 | ) | | | (2,289,880 | ) | | | (3,128,343 | ) | | | (1,024,011 | ) | | | (1,721,105 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Provision for income taxes | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | |

| Net Loss | | | (14,719,529 | ) | | | (2,289,880 | ) | | | (3,128,343 | ) | | | (1,024,011 | ) | | | (1,721,105 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Loss per Weighted Average Number of Shares Outstanding | | | | | | | | | | | | | | | | | | | | |

| -Basic and Fully Diluted | | | | | | | (0.04 | ) | | | (0.06 | ) | | | (0.02 | ) | | | (0.03 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Basic Weighted Average Number of Shares Outstanding During the Periods | | | | | | | | | | | | | | | | | | | | |

| -Basic and Fully Diluted | | | | | | | 60,198,500 | | | | 49,726,609 | | | | 60,198,500 | | | | 51,137,920 | |

See Condensed notes to the Interim Financial Statements

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Interim Consolidated Financial Statements of Changes in Stockholders’ Equity

From Inception (June 3, 1999) to December 31, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| | | | | | | | | | | | | | | Deficit | | | | |

| | | | | | | | | | | | | | | Accumulated | | | | |

| | | Common Stock | | | Additional | | | Deferred | | | during the | | | Total | |

| | | Number | | | | | | Paid-in | | | Stock | | | Exploration | | | Stockholders' | |

| | | of Shares | | | Amount | | | Capital | | | Compensation | | | Stage | | | Equity | |

| | | | | | $ | | | $ | | | $ | | | $ | | | $ | |

| For the period from inception (June 3, 1999) through July 1, 2004 | | | 1 | | | | - | | | | 5,895 | | | | | | | | (5,895 | ) | | | - | |

| Net (loss) | | | - | | | | - | | | | 910 | | | | | | | | (910 | ) | | | - | |

| Balance, June 30, 2005 (audited) | | | 1 | | | | - | | | | 6,805 | | | | - | | | | (6,805 | ) | | | - | |

| Contribution to additional paid-in capital | | | - | | | | - | | | | 3,024 | | | | | | | | | | | | 3,024 | |

| Cancelled shares | | | (1 | ) | | | - | | | | (1 | ) | | | | | | | | | | | (1 | ) |

| Common shares issued for nil consideration | | | 14,360,000 | | | | 1,436 | | | | (1,436 | ) | | | | | | | - | | | | - | |

| Common shares issued for cash | | | 2,050,000 | | | | 205 | | | | 414,795 | | | | | | | | - | | | | 415,000 | |

| Subscription for stock | | | | | | | | | | | 300,000 | | | | | | | | - | | | | 300,000 | |

| Stock issuance cost | | | - | | | | - | | | | (24,500 | ) | | | | | | | - | | | | (24,500 | ) |

| Net loss | | | - | | | | - | | | | - | | | | | | | | (87,574 | ) | | | (87,574 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, June 30, 2006 (audited) | | | 16,410,000 | | | | 1,641 | | | | 698,687 | | | | - | | | | (94,379 | ) | | | 605,949 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Common shares issued for cash | | | 3,395,739 | | | | 340 | | | | 548,595 | | | | | | | | - | | | | 548,935 | |

| Common shares issued to agents in lieu of commission for placement of common shares and convertible debentures | | | 1,064,000 | | | | 106 | | | | 265,894 | | | | | | | | - | | | | 266,000 | |

| Common shares issued for acquisition of interests in mineral claims | | | 3,540,600 | | | | 354 | | | | 884,796 | | | | | | | | - | | | | 885,150 | |

| Common shares issued for acquisition of interests in mineral claims | | | 1,850,000 | | | | 185 | | | | 462,315 | | | | | | | | - | | | | 462,500 | |

| Common shares issued for acquisition of interests in a refinery | | | 88,500 | | | | 9 | | | | 22,116 | | | | | | | | - | | | | 22,125 | |

| Common shares issued for purchase of a mill with capital equipments | | | 6,975,000 | | | | 697 | | | | 1,743,053 | | | | | | | | - | | | | 1,743,750 | |

| Stock issuance cost | | | | | | | | | | | (59,426 | ) | | | | | | | | | | | (59,426 | ) |

| Stock based compensation | | | | | | | | | | | 30,026 | | | | | | | | | | | | 30,026 | |

| Net loss for the year ended June 30, 2007 | | | | | | | - | | | | - | | | | - | | | | (2,845,424 | ) | | | (2,845,424 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, June 30, 2007 (audited) | | | 33,323,839 | | | | 3,332 | | | | 4,596,056 | | | | - | | | | (2,939,803 | ) | | | 1,659,585 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Common stock issued to consultants | | | 3,000,000 | | | | 300 | | | | 2,249,700 | | | | (1,875,000 | ) | | | - | | | | 375,000 | |

| Stock based compensation | | | | | | | - | | | | 139,272 | | | | | | | | - | | | | 139,272 | |

| Conversion of convertible debentures with accrued interest | | | 7,186,730 | | | | 719 | | | | 3,590,801 | | | | - | | | | - | | | | 3,591,520 | |

| Common shares issued for acquisition of interests in mineral claims | | | 175,000 | | | | 18 | | | | 104,982 | | | | | | | | | | | | 105,000 | |

| Common stock issued to a consultant | | | 100,000 | | | | 10 | | | | 57,990 | | | | | | | | | | | | 58,000 | |

| Amortization of deferred stock compensation | | | | | | | | | | | | | | | 562,500 | | | | | | | | 562,500 | |

| Net loss for the year | | | | | | | | | | | | | | | | | | | (3,791,042 | ) | | | (3,791,042 | ) |

| Balance June 30, 2008 (audited) | | | 43,785,569 | | | | 4,379 | | | | 10,738,801 | | | | (1,312,500 | ) | | | (6,730,845 | ) | | | 2,699,835 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Common shares issued for cash (net) | | | 7,040,000 | | | | 704 | | | | 3,372,296 | | | | - | | | | - | | | | 3,373,000 | |

| Common stock issued to a consultant | | | 75,000 | | | | 7 | | | | 43,493 | | | | - | | | | - | | | | 43,500 | |

| Common stock issued on acquisition of a subsidiary | | | 397,024 | | | | 40 | | | | 31,722 | | | | - | | | | - | | | | 31,762 | |

| Common shares issued on warrant exercises | | | 8,900,907 | | | | 890 | | | | 2,224,337 | | | | - | | | | - | | | | 2,225,227 | |

| Stock based compensation | | | | | | | | | | | 814,050 | | | | | | | | | | | | 814,050 | |

| Amortization of deferred stock compensation | | | | | | | | | | | | | | | 1 ,125,000 | | | | | | | | 1 ,125,000 | |

| Net loss for the year | | | | | | | | | | | | | | | | | | | (5,698,804 | ) | | | (5,698,804 | ) |

| Balance June 30, 2009 (audited) | | | 60,198,500 | | | | 6,020 | | | | 17,224,699 | | | | (187,500 | ) | | | (12,429,649 | ) | | | 4,613,570 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock based compensation | | | | | | | | | | | 167,322 | | | | | | | | - | | | | 167,322 | |

| Amortization of deferred stock compensation | | | | | | | | | | | | | | | 187,500 | | | | | | | | 187,500 | |

| Net loss for the six month period | | | | | | | | | | | | | | | | | | | (2,289,880 | ) | | | (2,289,880 | ) |

| Balance December 31, 2009 (unaudited) | | | 60,198,500 | | | | 6,020 | | | | 17,392,021 | | | | - | | | | (14,719,529 | ) | | | 2,678,512 | |

See Condensed notes to the Interim Financial Statements

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Interim Consolidated Statements of Cash Flows

For the six months ended December 31, 2009 and December 31, 2008

and for the period from Inception (June 3, 1999) to December 31, 2009.

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| | | | | | For the six | | | For the six | |

| | | Cumulative | | | months ended | | | months ended | |

| | | Since | | | Dec 31, | | | Dec 31, | |

| | | Inception | | | 2009 | | | 2008 | |

| Cash Flows from Operating Activities | | | | | | | | | |

| Net loss | | | (14,719,529 | ) | | | (2,289,880 | ) | | | (3,128,343 | ) |

| Adjustment for: | | | | | | | | | | | | |

| Amortization | | | 801,761 | | | | 90,368 | | | | 106,333 | |

| Amortization of debt issuance cost | | | 247,490 | | | | - | | | | - | |

| Stock based compensation | | | 1,150,670 | | | | 167,322 | | | | 594,612 | |

| Shares issued for mineral claims, as part of project expenses | | | 1,452,650 | | | | - | | | | - | |

| Shares issued for consultant services expensed | | | 2,351,500 | | | | 187,500 | | | | 606,000 | |

| Shares issued on acquisition of subsidiary | | | 31,762 | | | | - | | | | 31,762 | |

| Interest on convertible debentures | | | 90,453 | | | | - | | | | - | |

| Changes in non-cash working capital | | | | | | | | | | | | |

| Prepaid expenses | | | (191,191 | ) | | | 14,291 | | | | 22,467 | |

| Accounts payable | | | 130,497 | | | | (56,503 | ) | | | (42,864 | ) |

| Accrued liabilities | | | 157,147 | | | | 72,805 | | | | (104,001 | ) |

| | | | | | | | | | | | | |

| Net cash used in operating activities | | | (8,496,790 | ) | | | (1,814,097 | ) | | | (1,914,034 | ) |

| | | | | | | | | | | | | |

| Cash Flows from Investing Activities | | | | | | | | | | | | |

| Decrease (Increase) in Short-term investments | | | (1,534,147 | ) | | | 1,582,656 | | | | - | |

| Acquisition of plant and equipment for cash | | | (95,203 | ) | | | (5,431 | ) | | | (8,905 | ) |

| Proceeds from sale of plant and equipment | | | 2,500 | | | | - | | | | - | |

| | | | | | | | | | | | | |

| Net cash provided (used) in investing activities | | | (1,626,850 | ) | | | 1,577,225 | | | | (8,905 | ) |

| | | | | | | | | | | | | |

| Cash Flows from Financing Activities | | | | | | | | | | | | |

| Issuance of common shares for cash | | | 4,790,740 | | | | - | | | | 3,520,000 | |

| Issuance of common shares for warrant exercises | | | 2,225,227 | | | | - | | | | - | |

| Issuance of convertible debentures subsequently converted to cash | | | 3,501,067 | | | | - | | | | - | |

| Stock and debenture placement commissions paid in cash | | | (210,000 | ) | | | - | | | | (147,000 | ) |

| | | | | | | | | | | | | |

| Net cash provided by financing activities | | | 10,307,034 | | | | - | | | | 3,373,000 | |

| | | | | | | | | | | | | |

| Net Change in Cash | | | 183,394 | | | | (236,872 | ) | | | 1,450,061 | |

| | | | | | | | | | | | | |

| Cash- beginning of period | | | - | | | | 420,266 | | | | 1,553,855 | |

| | | | | | | | | | | | | |

| Cash - end of period | | | 183,394 | | | | 183,394 | | | | 3,003,916 | |

| | | | | | | | | | | | | |

| Supplemental Cash Flow Information | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Interest paid | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | |

| Income taxes paid | | | - | | | | - | | | | - | |

See Condensed notes to the Interim Financial Statements

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

December 31, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with the instructions to Form 10-Q and therefore do not include all information and footnotes necessary for a fair presentation of financial position, results of operations and cash flows in conformity with U.S. generally accepted accounting principles (GAAP); however, such information reflects all adjustments (consisting solely of normal recurring adjustments), which are, in the opinion of management, necessary for a fair statement of the results for the interim periods. The condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and Notes thereto together with management’s discussion and analysis of financial condition and results of operations contained in the Company’s annual report on Form 10-K for the year ended June 30, 2009. In the opinion of management, the accompanying condensed consolidated financial statements reflect all adjustments of a normal recurring nature considered necessary to fairly state the financial position of the Company at December 31, 2009 and June 30, 2009, the results of its operations for the six-month periods ended December 31, 2009 and December 31, 2008, and its cash flows for the six-month periods ended December 31, 2009 and December 31, 2008. In addition, some of the Company’s statements in this quarterly report on Form 10-Q may be considered forward-looking and involve risks and uncertainties that could significantly impact expected results. The results of operations for the six-month period ended December 31, 2009 are not necessarily indicative of results to be expected for the full year.

The consolidated financial statements include the accounts of the Company and its subsidiaries, Infrastructure Materials Corp. US and Silver Reserve Corp. All material inter-company accounts and transactions have been eliminated.

| 2. | Exploration Stage Activities |

The Company's financial statements are presented on a going concern basis, which contemplates the realization of assets and satisfaction of liabilities in the normal course of business.

The Company is in the exploration stage and has not yet realized revenues from its planned operations. The Company has incurred a cumulative loss of $14,719,529 from inception to December 31, 2009. The Company has funded operations through the issuance of capital stock and convertible debentures. In May and June of 2006, the Company closed a private placement of its common stock for gross proceeds of $415,000. During the year ended June 30, 2007 the Company raised $848,935 (including $300,000 received in the prior year as stock subscriptions) through private placement of its common stock for cash. The Company also issued Convertible Debentures in the amount of $1,020,862 during the year ended June 30, 2006 and issued Convertible Debentures in the amount of $2,480,205 during the year ended June 30, 2007. During the three-month period ended September 30, 2008 the Company completed private placements of common stock for proceeds of $3,373,000 net of cash expenses. During the three-month period ended March 31, 2009 as a result of warrant exercises the Company issued common stock for proceeds of $2,225,227. Management's plan is to continue raising additional funds through future equity or debt financing until it achieves profitable operations from production of minerals or metals on its properties, if feasible.

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

December 31, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

On December 1, 2008, the Company amended its Certificate of Incorporation to change its name from “Silver Reserve Corp.” to “Infrastructure Materials Corp.”

The Company’s focus is on the exploration and extraction of limestone, silver and other metals, if feasible, from its claims in the States of Nevada, Idaho and Arizona.

The Company is an exploration stage mining company and has not yet realized any revenue from its operations. It is primarily engaged in the acquisition and exploration of mineral properties. Mineral property acquisition costs are initially capitalized in accordance with ASC 805-20-55-37, previously referenced as the FASB Emerging Issues Task Force ("EITF") Issue 04-2. The Company assesses the carrying costs for impairment under ASC 930 at each fiscal quarter end. When it has been determined that a mineral property can be economically developed as a result of establishing proven and probable reserves, the costs incurred to develop such property will be capitalized. The Company has determined that all property payments are impaired and accordingly has written off the acquisition costs to project expenses. Once capitalized, such costs will be amortized using the units-of-production method over the estimated life of the probable reserve.

To date, mineral property exploration costs have been expensed as incurred. To date the Company has not established any proven or probable reserves on its mineral properties.

In November of 2008, the Company expanded its business focus to include the exploration and, if warranted, development of cement grade limestone properties, located in the States of Nevada, Idaho and Arizona. The Company acquired, as a wholly-owned subsidiary, Infrastructure Materials Corp US (“IMC US”), a Nevada Corporation, pursuant to a Share Exchange Agreement (the “Nevada Agreement”) among the Company, IMC US and Todd D. Montgomery dated as of November 7, 2008. Mr. Montgomery was the sole shareholder of IMC US. He also serves as the Company’s Chief Executive Officer and a member of its Board of Directors. The Nevada Agreement was approved by the disinterested members of the Company’s Board of Directors on November 6, 2008. Under the terms of the Nevada Agreement, the Company acquired all of the issued and outstanding stock of IMC US in exchange for 397,024 shares of the Company’s common stock (“Shares” or a “Share”) at the agreed price of $0.50 per Share. The transaction was measured at fair value, being the market value of the equity instruments delivered on the transaction date. The fair value of the Company’s 397,024 Shares issued at closing was measured at $31,762.

| | | $ | |

| Fair value of assets acquired | | | - | |

| Consideration given | | | 31,762 | |

| Goodwill on acquisition | | | 31,762 | |

Subsequent to the acquisition of IMC US, it was determined that the Goodwill on acquisition was impaired and thus written off.

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

December 31, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| 3. | Nature of Operations - Cont'd |

IMC US controls ten limestone Projects in Nevada, made up of 1,095 mineral claims covering 22,623 acres. IMC US has leased 100% of the Mineral Rights on an additional 1,120 acres and 50% of the Mineral Rights on 6,740 acres. In addition IMC US controls one limestone project in Idaho consisting of 63 mineral claims covering 1,302 acres.. The Company does not consider the claims or mineral rights to be material at this time and has expensed this cost to project expense. The Company’s assessment of the claims and mineral rights may change after exploration of the claims.

On December 18, 2008, the Company incorporated a second wholly owned subsidiary in the State of Delaware under its former name, “Silver Reserve Corp.” (”SRC”). The Company assigned all fourteen of its silver/base metal projects in Nevada to this subsidiary. The fourteen claim groups contain 556 claims covering 11,487 acres which include 9 patented claims and 2 leased patented claims.

SRC also has a milling facility located in Mina, Nevada on six claims covering 124 acres.

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

December 31, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| 4. | Plant and Equipment, Net |

Plant and equipment are recorded at cost less accumulated depreciation. Depreciation is provided commencing in the month following acquisition using the following annual rate and method:

| Computer equipment | | 30% | | declining balance method |

| Office furniture and fixtures | | 20% | | declining balance method |

| Leasehold improvements | | 3 years | | straight line method |

| Plant and Machinery | | 15% | | declining balance method |

| Tools | | 25% | | declining balance method |

| Vehicles | | 20% | | declining balance method |

| Consumables | | 50% | | declining balance method |

| Molds | | 30% | | declining balance method |

| Mobile Equipment | | 20% | | declining balance method |

| Factory Buildings | | 5% | | declining balance method |

| | | Dec 31, 2009 | | | Accumulated | | | June 30, 2009 | | | Accumulated | |

| | | Cost | | | Depreciation | | | Cost | | | Depreciation | |

| | | $ | | | $ | | | $ | | | $ | |

| | | | | | | | | | | | | | | |

| Office, furniture and fixtures | | | 18,830 | | | | 9,550 | | | | 18,830 | | | | 8,506 | |

| Computer equipment | | | 12,002 | | | | 4,628 | | | | 6,571 | | | | 3,405 | |

| Leasehold improvements | | | 16,230 | | | | 16,230 | | | | 16,230 | | | | 14,815 | |

| Plant and Machinery | | | 1,514,677 | | | | 630,132 | | | | 1,514,677 | | | | 557,350 | |

| Tools | | | 6,725 | | | | 3,729 | | | | 6,725 | | | | 3,281 | |

| Vehicles | | | 76,407 | | | | 29,754 | | | | 76,407 | | | | 24,276 | |

| Consumables | | | 64,197 | | | | 57,176 | | | | 64,197 | | | | 54,835 | |

| Molds | | | 900 | | | | 619 | | | | 900 | | | | 569 | |

| Mobile Equipment | | | 73,927 | | | | 38,212 | | | | 73,927 | | | | 34,244 | |

| Factory Buildings | | | 74,849 | | | | 11,731 | | | | 74,849 | | | | 10,112 | |

| | | | 1,858,744 | | | | 801,761 | | | | 1,853,313 | | | | 711,393 | |

| | | | | | | | | | | | | | | | | |

| Net carrying amount | | | | | | | 1,056,983 | | | | | | | | 1,141,920 | |

| Amortization charges | | | | | | | 90,368 | | | | | | | | 214,204 | |

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

December 31, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

During the years ended June 30, 2006 and June 30, 2007, the Company issued convertible debentures for $1,020,862 and $2,480,205 respectively, for a total of $3,501,067. During the quarter ended December 31, 2007, all holders of the Company’s convertible debentures exercised their conversion rights. Under the terms of the convertible debentures, the holders converted the principal amount of their convertible debentures into “units” at $0.50 per unit, where each unit consisted of one Share and one warrant to purchase a Share at a purchase price of $0.75 per Share. An aggregate of 7,002,134 Shares and an aggregate of 7,002,134 Share purchase warrants were issued upon conversion of the principal amount.

The convertible debentures had a maturity of December 31, 2007 and an interest rate of 2% per annum. Pursuant to the terms of the convertible debentures, the Company had the option of paying interest in Shares or in cash. The Company elected to pay interest in Shares, which were restricted upon issuance. An aggregate of 184,596 Shares were issued upon the conversion of the convertible debentures as payment of interest converted at one Share for each $0.49 of interest. The Shares issued upon conversion of the convertible debentures and the Shares underlying the warrants were subject to “lock-up” agreements limiting the re-sale of the Shares following exercise. All such restrictions have expired. All of these Shares and Shares underlying the warrants were registered under the Securities Act of 1933, as amended (the “Securities Act”), in a registration statement that became effective on April 24, 2007.

| 6. | Issuance of common shares and warrants |

Six month period ended December 31, 2009

There were no securities issued during this period.

Year ended June 30, 2009

The Company issued 25,000 Shares to Endeavor Holdings, Inc. on each of July 1, August 1 and September 1, of 2008 for a total of 75,000 Shares valued at $43,500 in accordance with the terms of a contract dated March 3, 2008. The contract was terminated on October 1, 2008.

On August 12, 2008, the Company announced that it had entered into a non-binding letter of intent (the “LOI”) dated as of August 12, 2008 to acquire, as a wholly-owned subsidiary, Infrastructure Materials Corp US (“IMC US”), a Nevada corporation. The Company completed the acquisition of all of the outstanding shares of IMC US pursuant to a Share Exchange Agreement that was closed on November 7, 2008. IMC US holds limestone mineral properties in the United States, and is actively engaged in acquiring additional limestone mineral properties. Todd Montgomery, a director and chief executive officer of the Company, was the sole shareholder of IMC US. The transaction was approved by the disinterested members of the Company’s Board of Directors.

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

December 31, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| 6. | Issuance of common shares and warrants - Cont'd |

Under the terms of the Share Exchange Agreement, Mr. Montgomery received 397,024 Shares at an agreed value of $0.50 per Share in exchange for all of the outstanding shares of IMC US. The transaction was measured at the fair value, being the market value of the Shares delivered on the transaction date. The fair value of the Company’s 397,024 Shares was measured at $31,762. IMC US owns certain limestone mineral claims in the States of Nevada and Idaho which the Company does not consider material at this time and has expensed this cost to project expense. The Company’s assessment of the claims may change after exploration of the claims.

Between February and March 2009, the Company issued 8,900,907 Shares under the exercise of warrants at $0.25 per Share. This exercise price of $0.25 per Share was part of a one time offer to all warrant holders (approved by the Board of Directors on December 11, 2008) that reduced the exercise price from $0.75 to $0.25 per Share if the warrants were exercised prior to February 28, 2009. The Company received $2,225,227 and issued 8,900,907 shares.

Warrants

During the year ended June 30, 2007, the Company issued 700,214 broker warrants at an exercise price of $0.50 per Share to purchase convertible debentures as part of the commission due to the agents who placed the offering of common shares and convertible debentures. These warrants represented an amount equal to 10% of the convertible debentures placed. The expiry date of the above listed broker warrants, was extended by the Board of Directors from June 30, 2007 to December 31, 2007 and further extended to December 31, 2008 and further extended to December 31, 2009. All outstanding warrants with an exercise price of $0.50 per Share expired on December 31, 2009.

During the year ended June 30, 2008, all holders of the Company’s convertible debentures exercised their conversion rights. Under the terms of the convertible debentures, the holders converted the principal amount of their convertible debentures into “Units” at $0.50 per Unit, where each Unit consisted of a Share and a warrant to purchase a Share at an exercise price of $0.75 per Share. An aggregate of 7,002,134 Shares and an aggregate of 7,002,134 share purchase warrants were issued upon conversion of the principal amount. The expiry date of these warrants was extended to December 31, 2009 by the Board of Directors on June 18, 2008 and the exercise price was reduced to $0.25 by the Board on December 11, 2008. During the year ended June 30, 2009, 6,080,907 warrants were exercised at $0.25. The remaining 921,227 warrants, with an exercise price of $0.75, expired on December 31, 2009.

On December 11, 2008, the Board of Directors approved a one time offer to all warrant holders to reduce the exercise price of all unexercised warrants from $0.75 to $0.25 per Share, if the warrants were exercised prior to February 28, 2009. The Company received elections to purchase 8,900,907 common shares under the exercise of warrants at $0.25 per share. The Company received total consideration of $2,225,227 and issued 8,900,907 common shares.

During the year ended June 30, 2009, the Company completed the private placements of 7,040,000 “Units” at $0.50 per Unit. Each Unit consisted of one Share and one half-Share purchase warrant (a “Warrant”). Each full Warrant entitles the holder to purchase one share at $0.75 on or before September 1, 2010. The Company paid a commission of $147,000 and issued 294,000 broker warrants to purchase Units at $0.50 per Unit in connection with the private placement. The Units have the same terms as those sold to investors. The broker warrants expire on September 1, 2010. During the year ended June 30, 2009, 2,820,000 warrants were exercised at $0.25 per Share. 700,000 warrants and 294,000 broker warrants remain outstanding until September 1, 2010.

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

December 31, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| 6. | Issuance of common shares and warrants - Cont'd |

| | | Number of | | | | | |

| | | Warrants | | | Exercise | | |

| | | Granted | | | Prices | | Expiry Date |

| | | | | | $ | | |

| | | | | | | | |

| Outstanding at June 30, 2007 and average exercise price | | | 700,214 | | | | 0.50 | | Dec 31, 2009 |

| Granted in year 2007-2008 | | | 7,002,134 | | | | 0.25 | | Dec 31, 2009 |

| Exercised in year 2007-2008 | | | - | | | | - | | |

| Expired in year 2007-2008 | | | - | | | | - | | |

| Cancelled | | | - | | | | - | | |

| Outstanding at June 30, 2008 and average exercise price | | | 7,702,348 | | | | 0.73 | | |

| Granted in year 2008-2009 | | | 3,520,000 | | | | 0.75 | | Sept 1, 2010 |

| Granted in year 2008-2009 | | | 294,000 | | | | 0.50 | | Sept 1, 2010 |

| | | | | | | | | | |

| Exercised in year 2008-2009 | | | (8,900,907 | ) | | | 0.75 | | |

| Expired in year 2008-2009 | | | - | | | | - | | |

| Cancelled | | | - | | | | - | | |

| | | | | | | | | | |

| Outstanding at June 30, 2009 and average exercise price | | | 2,615,441 | | | | 0.66 | | |

| Granted during the six month | | | - | | | | - | | |

| period ended Dec 31, 2009 | | | - | | | | - | | |

| Exercised during the six month period | | | - | | | | - | | |

| ended Dec 31, 2009 | | | - | | | | - | | |

| Expired during the six month period | | | | | | | | | |

| ended Dec 31, 2009 (granted in 2007) ($0.50) | | | (700,214 | ) | | | | | |

| Expired during the six month period | | | | | | | | | |

| ended Dec 31, 2009 (granted in 2008) ($0.75) | | | (921,227 | ) | | | | | |

| Cancelled during six months ended Dec 31, 2009 | | | | | | | | | |

| Outstanding at Dec 31, 2009 and average exercise price | | | 994,000 | | | | 0.66 | | |

| 7. | Stock Based Compensation |

In April of 2006, the Board of Directors approved an employee stock option plan ("2006 Stock Option Plan"), the purpose of which is to enhance the Company's stockholder value and financial performance by attracting, retaining and motivating the Company's officers, directors, key employees, consultants and its affiliates and to encourage stock ownership by such individuals by providing them with a means to acquire a proprietary interest in the Company's success through stock ownership.

Under the 2006 Stock Option Plan, officers, directors, employees and consultants who provide services to the Company may be granted options to acquire Shares of the Company at the fair market value of the stock on the date of grant. Options may have a term of up to 10 years. The total number of Shares reserved for issuance under the 2006 Stock Option Plan is 5,000,000.

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

December 31, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| 7. | Stock Based Compensation - Cont'd |

Six month period ended December 31, 2009

On September 14, 2009, the Company terminated its consulting services agreement with a consultant effective as of October 15, 2009 and agreed to extend the expiry of his options from his termination date to October 15, 2010.

On October 23, 2009, the Company granted options to a consultant to purchase 25,000 common shares at an exercise price of $0.33 per share. These options were granted in accordance with the terms of the Company’s 2006 Stock Option Plan and vest at the rate of 1/3 each month until fully vested. The options granted have a term of 5 years.

For the six month period ended December 31, 2009, the Company recognized in the financial statements, stock-based compensation costs as reflected in the following table. The fair value of each option used for the purpose of estimating the stock compensation is based on the grant date using the Black-Scholes option pricing model with the following weighted average assumptions.

The expected term calculation is based upon the term the option is expected to be held, which is the full term of the option. The risk-free interest rate is based upon the U.S. Treasury yield in effect at the time of grant for an instrument with a maturity that is commensurate with the expected term of the stock options. The dividend yield of zero is based on the fact that we have never paid cash dividends on our common stock and we have no present intention to pay cash dividends. The expected forfeiture rate of 0% is based on the vesting of stock options in a short period of time.

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

December 31, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| 7. | Stock Based Compensation - Cont’d |

| | | 10-Apr | | | 17-Apr | | | 17-May | | | 24-Jan | | | 2-Apr | | | 23-Jun | | | 12-Aug | | | 11-Dec | | | 11-Dec | | | 11-Dec | | | 19-Dec | | | 1-Jan | | | 3-Feb | | | 5-Jun | | | 23-Oct | | | | |

| Date of grant | | 2007 | | | 2007 | | | 2007 | | | 2008 | | | 2008 | | | 2008 | | | 2008 | | | 2008 | | | 2008 | | | 2008 | | | 2008 | | | 2009 | | | 2009 | | | 2009 | | | 2009 | | | Total | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Risk free rate | | | 4.50 | % | | | 4.50 | % | | | 4.50 | % | | | 5.00 | % | | | 5.00 | % | | | 5.00 | % | | | 5.00 | % | | | 2.95 | % | | | 2.95 | % | | | 2.95 | % | | | 2.95 | % | | | 2.95 | % | | | 2.95 | % | | | 2.95 | % | | | 2.61 | % | | | |

| Volatility factor | | | 50 | % | | | 50 | % | | | 50 | % | | | 50 | % | | | 90.86 | % | | | 111.64 | % | | | 112.99 | % | | | 149.96 | % | | | 149.96 | % | | | 149.96 | % | | | 166.69 | % | | | 168.45 | % | | | 170.57 | % | | | 155.95 | % | | | 156.49 | % | | | |

| Expected dividends | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | - | |

| Forfeiture rate | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | - | |

| Expected life | | 5 years | | | 5 years | | | 5 years | | | 5 years | | | 5 years | | | 5 years | | | 5 years | | | 5 years | | | 5 years | | | 5 years | | | 1-4 years | | | 5 years | | | 5 years | | | 5 years | | | 5 years | | | | - | |

| Exercise price | | $ | 0.50 | | | $ | 0.50 | | | $ | 0.50 | | | $ | 0.60 | | | $ | 0.35 | | | $ | 0.52 | | | $ | 0.46 | | | $ | 0.15 | | | $ | 0.25 | | | $ | 0.25 | | | $ | 0.30 | | | $ | 0.15 | | | $ | 0.31 | | | $ | 0.47 | | | $ | 0.33 | | | | - | |

| Total number of options granted | | | 1,850,000 | | | | 50,000 | | | | 10,000 | | | | 50,000 | | | | 400,000 | | | | 250,000 | | | | 50,000 | | | | 1,950,000 | | | | 50,000 | | | | 50,000 | | | | 1,950,000 | | | | 300,000 | | | | 150,000 | | | | 50,000 | | | | 25,000 | | | | 7,185,000 | |

| Grant date fair value | | $ | 0.07 | | | $ | 0.07 | | | $ | 0.07 | | | $ | 0.29 | | | $ | 0.25 | | | $ | 0.42 | | | $ | 0.38 | | | $ | 0.14 | | | $ | 0.13 | | | $ | 0.45 | | | $ | 0.18-$0.27 | | | $ | 0.14 | | | $ | 0.29 | | | $ | 0.43 | | | $ | 0.33 | | | | - | |

| Total number of options cancelled/forfeited | | | (1,850,000 | ) | | | (50,000 | ) | | | (10,000 | ) | | | (50,000 | ) | | | (350,000 | ) | | | (250,000 | ) | | | (50,000 | ) | | | (25,000 | ) | | | (50,000 | ) | | | (50,000 | ) | | | (50,000 | ) | | | | | | | | | | | | | | | | | | | (2,785,000 | ) |

| Stock-based compensation cost expensed during the six month period ended Dec. 31, 2009 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 125,167 | | | | | | | $ | 2,788 | | | | | | | | | | | $ | 22,392 | | | $ | 11,041 | | | $ | 5,934 | | | | 167,322 | |

| Unexpended Stock-based compensation cost deferred over the vesting period | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 3,304 | | | $ | 9,110 | | | $ | 1.695 | | | $ | 14,109 | |

· Options originally issued on April 10, 2007 and January 24, 2008 with an exercise price of $0.50 and $0.60 respectively were cancelled and reissued with an exercise price of $0.30 on December 19, 2008 with all other terms of the original grant remaining the same.

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

December 31, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| 7. | Stock Based Compensation - Cont'd |

The following table summarizes the options outstanding at December 31, 2009:

| Outstanding, beginning of year | | | 4,639,583 | |

| Granted/re-issued | | | 25,000 | |

| Forfeited/Cancelled | | | (264,583 | ) |

| Outstanding at December 31, 2009 | | | 4,400,000 | |

As of December 31, 2009, there was $14,109 of unrecognized expenses related to non-vested stock-based compensation arrangements granted. The stock-based compensation expense for the six-month period ended December 31, 2009 was $167,322.

| 8. | Deferred Stock Compensation |

In fiscal 2008, the Company issued 1,500,000 Shares each to two consultants, for a total of 3,000,000 Shares valued at $2,250,000. The Shares issued to the consultants are considered “restricted” and cannot be resold unless an exemption from registration is available, such as the exemption afford by Rule 144 promulgated under the Securities Act. The Company expensed proportionate consulting expenses of $187,500 during the six months ended December 31, 2009 and $1,125,000 during the year ended June 30, 2009. Consulting expenses were fully expensed by the end of December 31, 2009 and are no longer reflected as a deferred stock compensation expense under Stockholders’ Equity in the Consolidated Balance Sheet as of December 31, 2009.

| 9. | Commitments and Contingencies |

On August 1, 2006, the Company acquired the Pansy Lee Claims from Anglo Gold Mining Inc. in exchange for 1,850,000 shares of the Company’s common stock. The Company’s interest was acquired pursuant to an Asset Purchase Agreement dated August 1, 2006 (the “Pansy Lee Purchase Agreement”). Pursuant to the Pansy Lee Purchase Agreement, in the event that any one or more claims becomes a producing claim, the Company’s revenue is subject to a 2% net smelter return royalty where net smelter returns are based upon gross revenue. Gross revenue would be calculated after commercial production commences and includes the aggregate of the following amounts: revenue received by the Company from arm’s length purchasers of all mineral products produced from the property, the fair market value of all products sold by the Company to persons not dealing with the Company at arms length and the Company’s share of the proceeds of insurance on products. From such revenue, the Company would be permitted to deduct: sales charges levied by any sales agent on the sale of products; transportation costs for products; all costs, expenses and charges of any nature whatsoever which are either paid or incurred by the Company in connection with the refinement and beneficiation of products after leaving the property and all insurance costs and taxes.

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

December 31, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| 9. | Commitments and Contingencies - Cont'd |

On September 14, 2007, the Company accepted a proposal from Lumos & Associates to complete the regulatory permitting process for the Company’s Mill in Mina, Nevada. The total consideration to be paid under the contract is approximately $350,000. The permitting process is being carried out in twelve stages. The completion date has not been determined. The Company is required to authorize in writing each stage of the work before the work proceeds. As at December 31, 2009, the Company had authorized and paid Lumos and Associates $301,767 (June 30, 2009 - $134,181).

On April 4, 2008, the Company entered into a Consultant Agreement with Lumos and Associates, to facilitate the completion of exploration drilling “Notices of Intent” and Plans of Operation in compliance with the requirements of the United States Bureau of Land Management. The Company estimates the costs of each Notice of Intent plan to range from $3,000 to $4,000. Plans of Operation will be priced separately. During the six months ended December 31, 2009, the Company did not incur any costs for Notices of Intent. A Plan of Operation for the Blue Nose Project is projected to cost $10,000.

On May 1, 2008, the Company entered into a Consulting Services Agreement with Lance Capital Ltd. (“Lance”), at $12,500 per month to provide personnel and administrative services to carry out the administration of the Company. On November 1, 2008, the Consulting Services Agreement was amended to reduce the monthly fee to $10,000 for the months of December 2008 and January 2009 and thereafter to $7,500. On October 6, 2009 the Company informed Lance Capital Ltd. of its decision to terminate the agreement with two months notice. It is the Company’s intention to consolidate the administrative duties being provided by Lance into its Reno, Nevada office. It is anticipated that the transition will be completed in February 2010 and Lance has agreed to continue providing services as required.

On May 20, 2008, the Company entered into an option agreement (the “Option Agreement”) with Nevada Eagle Resources, LLC and Steve Sutherland (together, the “Optionees”) effective as of May 1, 2008 (the “Date of Closing”), to acquire 25 mineral claims located in Elko County, Nevada and known as the “Medicine Claims.” During the term of the Option Agreement, the Company has the exclusive right to explore and develop, if warranted, the Medicine Claims. The Company paid $10,000 to the Optionees upon execution of the Option Agreement. The Option Agreement requires the Company to make additional payments as follows: $15,000 on the first anniversary of the Date of Closing, $30,000 on the second anniversary of the Date of Closing, $60,000 on the third anniversary of the Date of Closing and $80,000 on each anniversary of the Date of Closing thereafter until the tenth anniversary of the Date of Closing. The Optionees may elect to receive payment in cash or in Shares. Upon making the final payment on the tenth anniversary of the Date of Closing, the Company will have earned a 100% undivided interest in the Medicine Claims. On April 7, 2009, the Company and the Optionees amended the Option Agreement. This amendment reduced the option payment due on May 1, 2009 from $15,000 to $10,000 and increased the payment due May 1, 2010 from $30,000 to $35,000.

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

December 31, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| 9. | Commitments and Contingencies - Cont'd |

Pursuant to the Option Agreement, the Medicine Claims are subject to a 3% net smelter return (“NSR”) royalty payable to the Optionees. The payments made during the term of the Option Agreement are to be applied as advance NSR royalty payments. Beginning on the eleventh anniversary of the Date of Closing, the Company is required to make annual advance royalty payments of $80,000. At such time as the Medicine Claims are in production, if ever, the Company shall make annual royalty payments equal to the greater of the actual 3% NSR or $80,000. The Company may terminate the Option Agreement at any time before the option is fully exercised upon 60 days notice to the Optionees. The Company does not consider the Medicine Claims to be material assets at this time; however this assessment may change upon further exploration.

Effective as of June 23, 2008, the Company appointed Mason Douglas as the President of the Company. Mr. Douglas is also a director of the Company. In connection with the appointment, the Company entered into a consulting services agreement with a corporation that is controlled by Mr. Douglas (the “Consulting Agreement”). The Consulting Agreement has a term of one year and is then automatically renewable. Either party may terminate the Consulting Agreement upon 90 days notice to the other party. During the term of the Consulting Agreement the Company will pay a fee of $8,500 per month and reimburse related business expenses. Mr. Douglas does not receive a salary from the Company.

On December 8, 2008 IMC US entered into a Mineral Rights Lease Agreement (the “Lease Agreement”) with the Earl Edgar Mineral Trust (the “Lessor”) to lease certain mineral rights in Elko County, Nevada. The term of the Lease Agreement is ten years and will automatically renew on the same terms and conditions for additional ten-year periods, provided the Company is conducting exploration, development or mining either on the surface or underground at the property. The rent is to be paid each year on January 1st.

$1.00 per net acre was paid upon execution of the Lease Agreement. On January 1, of each year commencing in 2010 and extending for so long as the Lease Agreement is in effect the Company is obligated to make the following payments during:

| 2010 | | $1.00 per net acre |

| 2011 | | $2.00 per net acre |

| 2012 | | $2.00 per net acre |

| 2013 | | $3.00 per net acre |

| 2014 | | $3.00 per net acre |

| 2015 | | $4.00 per net acre |

| 2016 | | $4.00 per net acre |

| 2017 | | $5.00 per net acre in each year for the duration of the Lease Agreement. |

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

December 31, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| 9. | Commitments and Contingencies - Cont'd |

The Lease Agreement covers 100% of the mineral rights on 1,120 acres (“Property A”) and 50% of the mineral rights on 6,740 acres (“Property B”).

The Lessor is entitled to receive a royalty of $0.50 per ton for material mined and removed from Property A and $0.25 per ton for material mined and removed from Property B during the term of the Lease Agreement and any renewal thereof.

On April 9, 2009 the Board of Directors approved an Amendment to the Lease Agreement (the “Amendment”), effective as of December 8, 2008. The Amendment provides for Standard Steam LLC to carry out exploration for geothermal energy sources on the leased mineral rights property after obtaining the written consent of the Company. The Amendment also provides for other cooperation with Standard Steam LLC regarding mineral rights on the properties in which the Company holds a 50% interest in the mineral rights.

Effective as of January 1, 2009, the Company entered into a Consulting Agreement with Scott Koyich (the “Consultant”) for a period of six months, which was extended on June 29, 2009 to December 31, 2009 to provide consulting services with respect to financial public relations, business promotion, business growth and development. On September 14, 2009, this agreement was terminated, effective as of October 15, 2009. The Consultant was paid $5,000 per month for his services during the term of the Agreement and was granted options to acquire 300,000 Shares at $0.15 per Share for a term of five years. These options vested at the rate of 50,000 options per month and all options had vested by the termination of the agreement. The expiry of the options was extended to October 15, 2010.

On February 23, 2009, the Board of Directors approved a drilling contract with Harris Exploration Drilling and Associates Inc. dated February 25, 2009, to carry out up to 30,000 feet of drilling programs in Nevada. The Company will pay $12.00 per foot for drilling plus various other costs related to mobilization and demobilization, travel, down time and moving time, plus other costs dependant on conditions and supplies. The Company paid a $25,000 refundable deposit upon execution of the contract to be applied to the final invoice. During the six-month period ended December 31, 2009, the Company paid Harris Exploration Drilling $229,394 to complete 9,290 feet of drilling. During the year ended June 30, 2009, the Company paid Harris Exploration Drilling $223,265 to complete 10,495 feet of drilling.

On April 24, 2009, IMC US entered into a consulting agreement with PHW Consulting (“PHW). PHW is to provide collection, analysis and interpretation of data pertaining to mineral claims in Clark and Lincoln counties of Nevada owned by IMC US. PHW is also required to write and submit Canadian National Instrument 43-101 compliant Technical Reports on the Morgan Hill, Project in Elko County and the Blue Nose Project in Lincoln County, both in the State of Nevada. The cost is $15,000 for each NI 43-101 compliant technical report plus $500.00 per day and out-of-pocket expenses for data collection, analysis and interpretation. As of December 31, 2009 the Company paid $15,150 for the 43-101 report on the Morgan Hill, Project in Elko County and $12,943 for data collection and out-of-pocket expenses.

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

December 31, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| 9. | Commitments and Contingencies - Cont'd |

On May 20, 2009, IMC US hired Lumos & Associates to conduct base line studies for the Blue Nose Project located in Lincoln County, Nevada with the intention of determining if a suitable plant site can be located. The study will include analysis of rail and road access and environmental considerations that could impede development. The total consideration to be paid under the contract is approximately $74,500. The Company has to authorize each phase of the work. The Company paid Lumos & Associates $42,794 during the six-months ended December 31, 2009 and $9,952 during the year ended June 30, 2009.

On November 30, 2009, the Company entered into a consulting services agreement with CLL Consulting, LLC (“CLL”) to provide for business and administrative services. The Consulting Agreement has a term of one year and is automatically renewable thereafter. Either party may terminate the Consulting Agreement upon 60 days notice. During the term of the Consulting Agreement the Company will pay CLL a fee of $6,083 per month and reimburse related business expenses. CLL received $6,586 during the period ended December 31, 2009.

On November 30, 2009 IMC US entered into a Mineral Rights Agreement with Perdriau Investment Corp. (“Perdriau”) to purchase 50% of the mineral rights, including all easements, rights of way and appurtenant rights of any type that run with the mineral rights in certain sections of Elko County, Nevada (the “Property”). The purchase price was $10 per net acre for 340 net acres for a total purchase price of $3,400. Perdriau will be entitled to receive a royalty of $0.25 per ton for material mined and removed from the Property. Material mined and stored on the Property or adjacent property for reclamation purposes will not be subject to any royalty. Material removed from the Property for the purposes of testing or bulk sampling, provided it does not exceed 50,000 tons, will also not be subject to any royalty. The royalty will be calculated and paid within 45 days after the end of each calendar quarter.

In November 2009, the Company made a decision to expand its area of exploration to include cement grade limestone properties located in Manitoba, Canada. The Company entered into an agreement to acquire, as a wholly-owned subsidiary, Canadian Infrastructure Corp. (“CIC”), a Canadian corporation, pursuant to a Share Exchange Agreement (the “Agreement”) between the Company, CIC and Todd D. Montgomery dated as of December 15, 2009. Mr. Montgomery is the sole shareholder of CIC in addition to serving as the Company’s Chief Executive Officer and as a member of its Board of Directors. The Agreement was approved by the disinterested members of the Company’s Board of Directors on November 27, 2009. Under the terms of the Agreement, the Company acquired all of the issued and outstanding stock of CIC in exchange for 1,021,777 Shares at the agreed upon price of $0.40 per Share. The total price of $408,710.90 represented Mr. Montgomery’s cost of forming CIC, assembling the limestone properties and obtaining exploration work and reports on the properties. The purchase price was significantly below an independent valuation.. The Agreement was initially expected to close on January 1, 2010, but was extended by an addendum dated January 14, 2010 and closed on February 9, 2010. The transaction will be measured at the fair value, being the market value of the Shares on the date of the Share Exchange Agreement, which was $0.20 per Share. CIC controls 94 quarry leases issued by the Province of Manitoba, Canada, covering 6,090.052 hectares (15,048,846 acres) requiring annual rental payments of $143,465 (CAD $150,782). See Note 11, Subsequent Events.

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

December 31, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| 9. | Commitments and Contingencies - Cont'd |

The Company is required to pay to the Department of Interior Bureau of Land Management (“BLM”) on or before August 31st of each year, a fee in the amount of $140 per mineral claim held by the Company. The total amount paid on August 31, 2009 was $172,620 for 1,233 claims held by the Company at that date. During the six-month period ended December 31, 2009, the Company acquired 436 mineral claims in Lincoln County, Nevada and 44 mineral claims in Pershing County, Nevada. Four mineral claims in Elko County, Nevada were abandoned.

The Company is also required to pay annual fees to counties in which the claims are held. At August 31, 2009, the Company paid $12,356 to nine counties in Nevada.

The Company also holds 9 patented claims and 2 leased patented claims in Nevada. A patented claim is fee simple title to the property. Patented claims are subject to taxes assessed by the local community based on assessment rates set annually.

By letter dated November 27, 2009, the U.S. Attorney’s Office asked for contribution from the Company for the cost of putting out a fire that occurred on May 8, 2008 on approximately 451 acres of land owned by the BLM. The cost of putting out the fire and rehabilitating the burned area was approximately $550,000. The Company has denied any responsibility for the fire and has alerted its liability insurance carrier. The Company has not accrued any costs for this claim in its financial statements.

| 10. | Related Party Transactions |

Six months ended December 31, 2009

Roger M. Hall, former Chief Operating officer and member of the Company’s Board of Directors, received $85,390 in connection with services he performed for the Company as a senior geologist during the six-month period ended December 31, 2009.

Joanne Hughes served as Corporate Secretary and received $22,746 during the six-month period ended December 31, 2009

A company owned and operated by Mason Douglas, President and a member of the Company’s Board of Directors, received $51,000 during the six-month period ended December 31, 2009.

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

December 31, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| 10. | Related Party Transactions - Cont'd |

Rakesh Malhotra, Chief Financial Officer of the Company, received $4,749. during the six-month period ended December 31, 2009.

Six months ended December 31, 2008

Roger M. Hall, former Chief Operating Officer and a member of the Company’s Board of Directors , received $86,318 in connection with services he performed for the Company as a senior geologist during the six-month period ended December 31, 2008.

Janet Shuttleworth, former Treasurer and Corporate Secretary, was paid $27,476. Ms. Shuttleworth resigned on December 31, 2008.

Joanne Hughes, Corporate Secretary, received $4,110 from July 1, 2008 to July 30, 2008 (date of resignation). Ms. Hughes was re-appointed as Corporate Secretary on January 1, 2009.

A Company owned by Mason Douglas, a member of the Company’s Board of Directors and President, was paid $51,000 during the six-month period ended December 31, 2008.

The Company has reviewed subsequent events up to February 12, 2010. Subsequent events are as follows.

On January 12, 2010, the Company entered into an agreement with Railroad Industries Incorporated to prepare a market analysis for calcium carbonate, quicklime and other materials marketable from high grade limestone deposits for the regions of Central Canada and Western Unites States. The cost of the study is estimated to be between $28,875 and $39,900, depending on the number of hours required. The Company paid a $5,000 refundable deposit upon execution of the contract to be applied to the final invoice.

On January 15, 2010, Roger M. Hall resigned as the Company’s Chief Operating Officer and as a member of the Company’s Board of Directors. Mr. Hall subsequently resigned as Vice President - Exploration of IMC US. As of January 12, 2010 the Company terminated its Independent Contractor Agreement with Mr. Hall dated April 1, 2007. Both parties waived any applicable notice periods and the termination was effective immediately. As consideration for his services, stock options previously granted to Mr. Hall were extended and will expire as follows: 200,000 options to acquire Shares at $0.15 per Share will expire on April 15, 2010; 200,000 options to acquire Shares at $0.15 per Share will expire on December 10, 2013 and 250,000 to acquire Shares at $0.30 per Share will expire on April 9, 2012 There were no disagreements between Mr. Hall and the Company with respect to with the Company’s management, policies, procedures, internal controls or public disclosure documents.

INFRASTRUCTURE MATERIALS CORP.

(AN EXPLORATION STAGE MINING COMPANY)

Condensed Notes to Interim Consolidated Financial Statements

December 31, 2009

(Amounts expressed in US Dollars)

(Unaudited-Prepared by Management)

| 11. | Subsequent Events - Cont'd |

On January 15, 2010, the Company entered into an “Independent Contractor Agreement” with Karl Frost. Mr. Frost was given the title of Chief Geologist and will be responsible for the preparation and oversight of all geological programs and activities. The Independent Contractor Agreement has a term of one year and is automatically renewable thereafter. Either party may terminate the agreement upon 60 days notice or in the case of breach or default with 5 days of written notice. During the term of the agreement the Company will pay Mr. Frost a fee of $12,500 per month and reimburse him for related business expenses. In addition, during the first term of this agreement, the Company granted Mr. Frost an option to purchase 250,000 common shares of the Company at an exercise price of $0.25 per share. These options were granted in accordance with the terms of the Company’s 2006 Stock Option Plan and vest at the rate of 1/12 each month until fully vested. The options granted have a term of 5 years.

On January 15, 2010, the Company entered into a Property Lease Agreement (the “Lease Agreement”) with the Eugene M. Hammond to lease the surface rights on 80 acres of vacant land located in Elko County, Nevada. The term of the Lease Agreement is five years with an option in favor of IMC US to purchase the property. IMC US will pay rent of $500 on the anniversary date for so long as this Lease is in effect.

On January 15, 2010, the Company entered into a Mineral Rights Agreement with Eugene M. Hammond. to purchase 25% of the mineral rights, including all easements, rights of way and appurtenant rights of any type that run with the mineral rights on 80 acres of vacant land in certain sections of Elko County, Nevada (the “Property”). The purchase price was $10 per net acre for a total purchase price of $200.

Eugene M. Hammond will be entitled to receive a royalty of $0.125 per ton for material mined and removed from the Property. Material mined and stored on the Property or adjacent property for reclamation purposes will not be subject to any royalty. Material removed from the Property for the purposes of testing or bulk sampling, provided it does not exceed 50,000 tons, will also not be subject to any royalty. The royalty will be calculated and paid within 45 days after the end of each calendar quarter.

Two additional projects with 200 mineral claims in Elko County, Nevada were recorded. IMC US submitted to the State of Arizona applications for leases on 18 sections or portions of sections.

As of February 1, 2010, the Company entered into a Consulting Services Agreement to provide for receptionist and administrative services at its Reno, Nevada corporate headquarters. Pursuant to this Agreement, the Company will pay $51,000 per year for such services. The Agreement is terminable by either party upon 30 days prior notice.

On February 9, 2010 the Company completed the acquisition of Canadian Infrastructure Corp. (“CIC”). CIC holds three limestone properties located in southern Manitoba, Canada. These properties consist of 94 quarry leases issued by the Province of Manitoba, Canada covering 6,090.052 hectares (15,048,846 acres). The transaction will be measured at the fair value, being the market value of the Shares on the date of the Share Exchange Agreement, which was $0.20 per Share.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATION

Forward-Looking Statements

Except for historical information, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements involve risks and uncertainties, including, among other things, statements regarding our business strategy, exploration strategy, future revenues and anticipated costs and expenses. Such forward-looking statements include, among others, those statements including the words “expects,” “anticipates,” “intends,” “believes” and similar language. Our actual results may differ significantly from those projected in the forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those discussed herein as well as in the “RISK FACTORS” section herein. You are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this report. We undertake no obligation to publicly release any revisions to the forward-looking statements or reflect events or circumstances after the date of this document.

Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements.

FOR THE SIX MONTH AND THREE MONTH PERIODS ENDED DECEMBER 31, 2009

PLAN OF OPERATIONS

We will require additional capital to implement the further exploration and possible development of our claim groups. We expect to raise this capital through private placements of our securities or through debt financing or some combination of the foregoing. We have limited assets and no “reserves” in accordance with the definitions adopted by the Securities and Exchange Commission, and there is no assurance that any exploration programs that we undertake will establish reserves.

Discussion of Operations and Financial Condition

Six Month and Three Month Periods ended December 31, 2009

The Company has no source of revenue and we continue to operate at a loss. We expect our operating losses to continue for so long as we remain in an exploration stage and perhaps thereafter. As at December 31, 2009, we had accumulated losses since the Company’s inception of $14,719,529. Our ability to emerge from the exploration stage and conduct mining operations is dependent, in large part, upon our raising additional capital. We are continuing our efforts to raise capital and are moving forward with development of our projects.

In November of 2008, the Company substantially changed its business focus to the exploration and development of cement grade limestone properties and acquired Infrastructure Materials Corp. US with limestone properties located in the states of Nevada and Idaho. In December of 2008, the Company changed its name to Infrastructure Materials Corp. We have identified and recorded 1,295 claims on Department of Interior Bureau of Land Management (“BLM”) land covering twelve projects in Nevada and 63 claims covering one project in Idaho. We have applied to the State of Arizona for leases on 18 sections or portions of sections covering two additional projects. On private land we acquired 100% of the Mineral Rights on 1,120 acres, 50% of the Mineral Rights on 7,080 acres, all of which have potential for cement grade limestone. Exploration on these limestone properties indicates that the Morgan Hill Project and the Blue Nose Project have potential for development of substantial cement grade limestone resources. Our efforts going forward through our current fiscal year ending June 30, 2010, will be concentrated on development of the Blue Nose Project and the search for other limestone deposits in strategic locations that can service areas with a shortage of cement production.

The Company’s major endeavor during the six months ended December 31, 2009 has been its effort to pursue exploration activities on its limestone claims. We have also completed the evaluation of all our silver/base metal projects and determined that the Pansy Lee, Medicine, Silver Queen and Nivloc Projects provide the best opportunity for development of resources that could go to production. Permitting of the Red Rock mill site at Mina, Nevada is close to completion. The Company transferred incorporated a wholly owned subsidiary, Silver reserve Corp in December of 2008 and transferred all of the silver/base metal projects and the mill the this subsidiary. We are attempting to secure a sale of its silver properties and milling facility held by its subsidiary, Silver Reserve Corp.

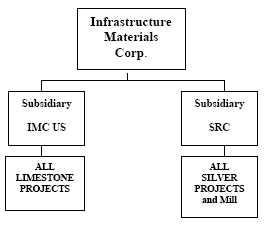

The following diagram illustrates the Company’s present structure and ownership of its mineral properties and Milling Facility:

Stock Based Compensation

On September 14, 2009 the Company terminated its consulting services agreement with a consultant effective as of October 15, 2009 and extended the expiry of his options from his termination date to October 15, 2010.

On October 23, 2009, the Company granted options to a consultant to purchase 25,000 common shares at an exercise price of $0.33 per share. These options were granted in accordance with the terms of the Company’s 2006 Stock Option Plan and vest at the rate of 1/3 each month until fully vested. The options granted are for a term of 5 years.

SELECTED FINANCIAL INFORMATION

| | | Three months ended | | | Three months ended | |

| | | Dec. 31, 2009 | | | Dec. 31, 2008 | |

| | | | | | | |

| Revenues | | $ | Nil | | | $ | Nil | |

| Net Loss | | $ | 1,024,011 | | | $ | 1,721,105 | |

| Loss per share-basic and diluted | | $ | 0.02 | | | $ | 0.03 | |

| | | Six months ended | | | Six months ended | |

| | | Dec. 31, 2009 | | | Dec. 31, 2008 | |

| | | | | | | |

| Revenues | | $ | Nil | | | $ | Nil | |

| Net Loss | | $ | 2,289,880 | | | $ | 3,128,343 | |

| Loss per share-basic and diluted | | $ | 0.04 | | | $ | 0.06 | |

| | | As at | | | As at | |

| | | Dec. 31, 2009 | | | June 30, 2009 | |

| | | | | | | |

| Total Assets | | $ | 2,965,715 | | | $ | 4,884,471 | |

| Total Liabilities | | $ | 287,203 | | | $ | 270,901 | |

| Cash dividends declared per share | | $ | Nil | | | $ | Nil | |