SMARTHEAT INC.

A-1, 10, Street 7

Shenyang Economic and Technological Development Zone

Shenyang, China 110141

(86) 24-2519-7699

October 7, 2011

VIA EDGAR

John Cash

Account Branch Chief

Division of Corporation Finance

Mail Stop 3720

U.S. Securities and Exchange Commission

100 F. Street, N.E.

Washington, DC 20549

| Re: | SmartHeat Inc. |

| | Form 10-K for the Fiscal Year Ended December 31, 2010 |

| | Filed March 15, 2011 |

| | Form 10-Q for the Fiscal Quarter Ended June 30, 2011 |

| | Filed August 9, 2011 |

| | Definitive Proxy Statement on Schedule 14A |

| | Filed August 8, 2011 |

| | File No. 001-34246 |

Dear Mr. Cash:

This letter responds to the comment letter of the Staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”), dated September 20, 2011, to SmartHeat Inc. (the “Company”) regarding the above-captioned filings of the Company. Please note that the Staff’s comments are restated below along with the Company’s responses.

Form 10-K for the Fiscal Year Ended December 31, 2010

Item 1. Business, page 1

General, page 1

| 1. | We note your disclosure in the second paragraph regarding your 2008 acquisition of Shenyang Taiyu Machinery & Electronic Equipment Co., Ltd. Please tell us how you exercise effective control over your PRC operating subsidiaries in light of the restrictions on foreign investment in China. To the extent that you exercise control over your PRC operating subsidiaries through contractual arrangements, please include in future filings a separate section to describe your corporate structure. The disclosure should include a chart of your corporate structure and a description of such contractual arrangements. Please show us what your disclosure will look like in future filings. |

Mr. John Cash

U.S. Securities and Exchange Commission

October 7, 2011

Page 2 of 25

Response:

The Company proposes to include the following disclosure regarding its corporate structure in future filings in accordance with the Staff’s comment.

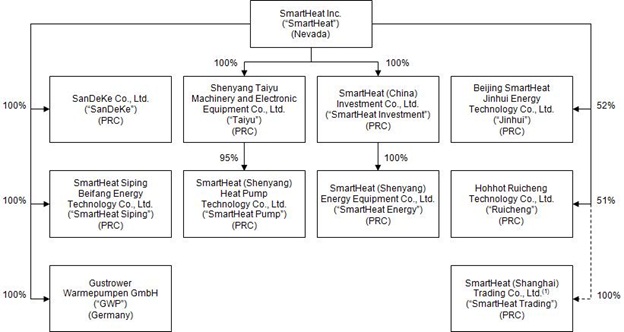

Our Corporate Structure

We are a U.S. holding company with no material assets other than the ownership interests of our subsidiaries through which we design, manufacture and sell our clean technology PHEs and related systems. Taiyu, SanDeKe, SmartHeat Siping and SmartHeat Investment are our wholly foreign-owned enterprises (“WFOEs”) authorized by their respective business licenses to operate our businesses in China. GWP is our wholly owned subsidiary in Germany. We own 52% and 51%, respectively, of our PRC-based joint ventures, Jinhui and Ruicheng. SmartHeat Energy is a wholly owned subsidiary of SmartHeat Investment. Taiyu owns 95% of SmartHeat Pump. We control SmartHeat Trading through an investment agreement, dated February 1, 2010 (the “SmartHeat Trading Agreement”), entered into with the nominee owner of SmartHeat Trading, Cleantech Holdings Inc., a British Virgin Islands company (“Cleantech Holdings”). We have no direct ownership interest in SmartHeat Trading or Cleantech Holdings; instead, pursuant to the SmartHeat Trading Agreement, we invested $1.5 million as the registered capital of SmartHeat Trading in exchange for our right to control 100% of the shareholder rights in SmartHeat Trading and our rights to 100% of its profit or loss.

Our current corporate structure is set forth in the following diagram:

Mr. John Cash

U.S. Securities and Exchange Commission

October 7, 2011

Page 3 of 25

(1) We control and are entitled to 100% of the profit or loss of SmartHeat Trading pursuant to contractual arrangements between SmartHeat and the nominee owner of SmartHeat Trading. We have no direct ownership interest in SmartHeat Trading.

Item 1A. Risk Factors, page 8

Risks Related to Doing Business in China, page 14

| 2. | In future filings, please include a risk factor to disclose that you may be deemed as a “resident enterprise” of China under the Enterprise Income Tax Law and discuss the potential tax consequences such classification would cause to you and your non-PRC shareholders. |

Response:

The Company will include the disclosure in future filings in accordance with the Staff’s comment.

| 3. | In future filings, please include a risk factor discussing China’s new Labor Contract Law and its potential impact on your business. |

Response:

The Company will include the disclosure in future filings in accordance with the Staff’s comment.

Mr. John Cash

U.S. Securities and Exchange Commission

October 7, 2011

Page 4 of 25

Item 2. Properties, page 20

| 4. | We note your disclosure here and in Note 16 to your consolidated financial statements. Please file all material leases in future filings. |

Response:

The Company acknowledges the requirement to file any material leases as exhibits and affirms its ongoing duty to assess existing and new leases for their materiality. The Company with file all leases deemed material in future filings in accordance with the Staff’s comment.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 24

Critical Accounting Policies, page 25

General

| 5. | We remind you that your critical accounting policies should supplement, not duplicate, the description of your accounting policies disclosed in the notes to your financial statements. Your critical accounting policies should disclose and discuss accounting estimates and assumptions where the nature of the estimates and assumptions could be material to your financial statements due to the level of subjectivity and judgment necessary to account for uncertain matters and due to the susceptibility of such matters to change. Refer to section 501.14 of the SEC Codification of Financial Reporting Policies. |

Response:

The Company will review and revise the disclosure in future filings in accordance with the Staff’s comment.

Intangible and Other Long-Lived Assets

| 6. | Please revise future filings to provide a critical accounting policy for your impairment assessment of intangible and other long-lived assets, including a specific and comprehensive discussion regarding how you consider current events and circumstances in determining whether it is necessary to test such assets for impairment. If an analysis is conducted in a given period, please revise future filings to include a specific and comprehensive discussion regarding the results of that analysis. Please provide us a draft of your proposed disclosures. |

Mr. John Cash

U.S. Securities and Exchange Commission

October 7, 2011

Page 5 of 25

Response:

The Company proposes to include the following critical accounting policy disclosure regarding its impairment assessment of long-lived assets in future filings in accordance with the Staff’s comment.

Impairment of Long-Lived Assets

We assess the impairment of long-lived assets, which include property, plant and equipment and intangible assets, whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable.

The following are indicators the Company considers in determining whether it is necessary to test an asset for impairment.

| · | Significant decrease in the market price of a long-lived asset, or asset group. |

| · | Significant adverse change in the extent or manner in which a long-lived asset or asset group is being used. |

| · | Significant adverse change in the long-lived asset or asset group’s physical condition. |

| · | Significant adverse change in the legal or business environment that could affect the value of a long-lived asset or asset group, including an adverse action or assessment by a regulator. |

| · | Accumulation of costs significantly in excess of the amount originally expected for the acquisition or construction of a long-lived asset or asset group. |

| · | Current-period operating or cash flow loss combined with a history of operating or cash flow losses, or a projection or forecast that demonstrates continuing losses associated with the use of a long-lived asset or asset group. |

| · | Current expectation that, more likely than not, a long-lived asset or asset group will be sold or otherwise disposed of significantly before the end of its previously estimated useful life (ASC 360-10-35-21). |

Recoverability of long-lived assets to be held and used is measured by comparing the carrying amount of an asset to the estimated undiscounted future cash flows expected to be generated by the asset. If the carrying amount of an asset exceeds its estimated undiscounted future cash flows, an impairment charge is recognized based on the excess of the carrying amount over the fair value of the assets. Fair value is generally determined using the asset’s expected future discounted cash flows or market value, if readily determinable. We believe at this time that the carrying amounts and useful lives of our long-lived assets continue to be appropriate; there can be no assurance, however, that there will not be significant changes from our current forecasts, which could result in future impairment charges.

Mr. John Cash

U.S. Securities and Exchange Commission

October 7, 2011

Page 6 of 25

Results of Operations, page 27

| 7. | Please revise future annual and quarterly filings to quantify the impact of changes in volumes versus changes in prices on increases or decreases in sales by product line. |

Response:

The Company will include the disclosure in future filings in accordance with the Staff’s comment.

| 8. | We note that 80% of your costs are material costs. Additionally, we note that you discuss the cost of raw materials, including stainless steel, in Item 7A. In this regard, please revise future annual and quarterly filings to discuss the reasons for fluctuations in material costs and the impact of such costs on gross margins during each period presented. Please also provide a narrative of management’s expectations of how material costs may impact future results, including your historic ability or inability to pass along changes in material costs to customers. |

Response:

The Company will include the disclosure in future filings in accordance with the Staff’s comment.

| 9. | Please revise future annual and quarterly filings to quantify each reason you provide for fluctuations in operating expenses from period-to-period. |

Response:

The Company will include the disclosure in future filings in accordance with the Staff’s comment.

| 10. | Please revise future annual and quarterly filings to discuss changes in non-operating income (expense) items and income tax expense from period-to-period. Your discussion of income taxes should quantify your effective tax rate and discuss the reasons for significant changes in such rates between comparative periods, as well as significant differences between such rates and your statutory tax rate. |

Response:

The Company will include the disclosure in future filings in accordance with the Staff’s comment.

Mr. John Cash

U.S. Securities and Exchange Commission

October 7, 2011

Page 7 of 25

| 11. | In your narrative of your operating expenses, you mention an increase in depreciation expense. To the extent you do not include depreciation expense in cost of goods sold, please revise future annual and quarterly filings to comply with SAB Topic 11B. |

Response:

The Company will include the disclosure in future filings in accordance with the Staff’s comment.

Liquidity and Capital Resources, page 29

General

| 12. | We refer to your risk factor on page 14, Limitations on the ability of our operating subsidiaries to make payments to us could have a material adverse effect on our ability to conduct our business and fund our operations and to your dividend policy on page 21. Please expand your liquidity disclosures in future annual and quarterly filings to discuss such restrictions and their impact on your ability to make dividend payments and to transfer funds outside of China. |

Response:

The Company will include the disclosure in future filings in accordance with the Staff’s comment.

Item 9A. Controls and Procedures, page 32

General

| 13. | We note you conduct substantially all your operations outside of the United States. In addition, in your risk factor on page 16, we note you “may have difficulty establishing adequate management, legal and financial controls.” In order to enhance our understanding of how you prepare your financial statements and assess your internal control over financial reporting, please provide us with information that will help us answer the following questions. |

In connection with your process to determine that your internal control over financial reporting was effective, please describe whether and how you considered controls to address financial reporting risks that are relevant to all locations where you have operations. If you have an internal audit function, please describe it and explain how, if at all, that function impacted your evaluation of your internal control over financial reporting.

Mr. John Cash

U.S. Securities and Exchange Commission

October 7, 2011

Page 8 of 25

Response:

The Company’s internal audit function and its assessment of financial reporting risk is based on an internal audit plan developed by ShineWing Strategy Management Consulting Co., Ltd., the China-based partner of ShineWing (HK) CPA Limited (“ShineWing”), a full-service consulting firm with expertise in accounting and regulatory compliance. The Company engaged ShineWing in May 2010 to evaluate its internal control environment across all subsidiaries and locations and to develop an internal audit plan intended to meet the requirements of Rule 13a-15 and Rule 15d-15 under the Securities Exchange Act of 1934. These evaluations are based on the COSO internal control framework and the Commission’s “Guidance Regarding Management’s Reporting on ICFR” (Internal Controls over Financial Reporting) and with reference to the PCAOB’s Auditing Standard No. 5. The scope of the engagement included a risk assessment, documentation of process-level and entity-level controls, internal control testing and evaluation of deficiencies. ShineWing performed the internal control testing on the Company for fiscal 2010 and has been engaged to perform testing for fiscal 2011. The Company’s internal audit department, established in March 2010 and consisting of a cross-functional, cross-divisional team of Company employees, adopted the framework established by ShineWing for internal control procedures and performs testing and risk assessment during the year. The results of this testing were then communicated to the Company’s senior management. The Company’s Chief Executive Officer and Chief Financial Officer relied on this process in evaluating the effectiveness of the Company’s internal control over financial reporting for the year ended December 31, 2010.

Please clarify how you maintain your books and records and prepare your financial statements.

| · | If you maintain your books and records in accordance with U.S. GAAP, describe the controls you maintain to ensure that the activities you conduct and the transactions you consummate are recorded in accordance with U.S. GAAP. |

| · | If you do not maintain your books and records in accordance with U.S. GAAP, tell us what basis of accounting you use and describe the process you go through to convert your books and records to U.S. GAAP for SEC reporting. Describe the controls you maintain to ensure that you have made all necessary and appropriate adjustments in your conversions and disclosures. |

Response:

The Company’s operating subsidiaries in China maintain their books and records in accordance with accounting standards generally accepted in the People’s Republic of China (“PRC GAAP”). Our operating subsidiary in Germany maintains its books and records in accordance with the International Financial Reporting Standards (“IFRS”) promulgated by the International Accounting Standards Board. The financial statements of these subsidiaries are converted to U.S. GAAP for financial statement reporting purposes on a quarterly basis. The Company provides its internally generated financial statements and related supporting schedules prepared under PRC GAAP in Renminbi Yuan (“RMB”) and under IFRS in Euro (“EUR”) to the Company’s contracted U.S. Certified Public Accountant (the “Company CPA”), who is unrelated to the Company’s independent registered public accounting firm, for conversion and consolidation. The Company’s CPA prepares the Company’s consolidated financial statements and footnotes under U.S. GAAP in U.S. dollars by: (i) adjusting and converting entries for the purpose of converting the financial statements from PRC GAAP and IFRS to U.S. GAAP, which conversion process includes, but is not limited to, the proper accounting for foreign currency translation and transactions in accordance with ASC Topic 830; (ii) preparing consolidated financial statements worksheets and related schedules; and (iii) preparing footnote disclosures with related schedules and worksheets to support the financial statements, using the PPC Disclosure Checklist as guidance. The Company’s auditor reviews and audits the consolidated financial statements, with the Company’s CPA answering any questions raised by management, legal counsel or the auditor and posting additional review and audit adjustments proposed by the auditor and approved by management, if necessary. Once all comments and issues are cleared, the financial statements are provided to the Company’s Audit Committee for its review and approval of the financial statements prior to filing in connection with the Company’s periodic reports.

Mr. John Cash

U.S. Securities and Exchange Commission

October 7, 2011

Page 9 of 25

We would like to understand more about the background of the people who are primarily responsible for preparing and supervising the preparation of your financial statements and evaluating the effectiveness of your internal control over financial reporting and their knowledge of U.S. GAAP and SEC rules and regulations. Do not identify people by name, but for each person, please tell us:

| · | what role he or she takes in preparing your financial statements and evaluating the effectiveness of your internal control; |

| · | what relevant education and ongoing training he or she has had relating to U.S. GAAP; |

| · | the nature of his or her contractual or other relationship to you; |

| · | whether he or she holds and maintains any professional designations such as Certified Public Accountant (U.S.) or Certified Management Accountant; and |

| · | his or her professional experience, including experience in preparing and/or auditing financial statements prepared in accordance with U.S. GAAP and evaluating effectiveness of internal control over financial reporting. |

Response:

The Company’s personnel who are primarily responsible for preparing and supervising the preparation of the Company’s financial statements and evaluating the effectiveness of internal controls are listed following. All of the listed financial personnel are full time employees of the Company and employed under labor contracts standard for PRC domestic enterprises. All of the listed financial personnel hold accounting licenses issued by the PRC Ministry of Finance.

| (1) | The CFO is responsible for reviewing the financial reports under U.S. GAAP, supervising the financial activities of the Company and supervising the design of internal control over financial reporting. The CFO ensures that the financial statements, and other financial information, filed by the Company fairly present in all material respects the financial condition, results of operations and cash flows of the Company. Our CFO has served in such position since April 2008, and previously served as the CFO of Taiyu since its inception in 2002. Our CFO is a CPA licensed through the Chinese Institute of Certified Public Accountants and has nearly 20 years of broad financial, internal control and accounting management experience. She has relevant education and training in U.S. GAAP and limited experience in preparing financial statements in accordance with U.S. GAAP, and attended training conducted by ShineWing in U.S. GAAP in July 2008. Our CFO has extensive relevant education and training in PRC GAAP and extensive experience preparing and auditing financial statements prepared in accordance with PRC GAAP. Prior to joining Taiyu, she served as the Production Planning Director of Shenyang Thermoelectric Co. Ltd., the Auditing Director of Shenyang Dongyu Group Corp. and the finance manager of a regional Shenyang real estate development firm. She obtained her MBA in Finance from Northeastern University in Shenyang. |

Mr. John Cash

U.S. Securities and Exchange Commission

October 7, 2011

Page 10 of 25

| (2) | The Financial Managers supervise accounting and are responsible for the preparation of financial reports under PRC GAAP. Our Financial Manager at Taiyu has over 20 years experience as an accountant and graduated from Shenyang University of Technology in 1991 with a major in financial accounting. She holds a title of Senior Accountant issued by the PRC Ministry of Finance. Our Financial Manager at SmartHeat Siping graduated from Changchun Taxation College in 1997 with a major in accounting. Our Financial Manager at SanDeKe graduated from Anhui University of Technology in 2004 with a major in accounting. Our Financial Managers have limited relevant education and training in U.S. GAAP and limited experience in preparing financial statements in accordance with U.S. GAAP, but have extensive education and training in PRC GAAP and extensive experience preparing financial statements prepared in accordance with PRC GAAP. |

| (3) | The Accountant is responsible for conducting assessments related to inventory, salary and company expenses, reviewing and verifying vouchers related to expenses and costs and controlling daily expenditures and voucher preparation. Our Accountant graduated from Wuhan University of Technology in 2006 with a major in business administration and previously served as Cashier. Our Accountant has limited relevant education and training in U.S. GAAP and limited experience in preparing financial statements in accordance with U.S. GAAP, but has extensive education and training in PRC GAAP and extensive experience preparing financial statements prepared in accordance with PRC GAAP. |

| (4) | The Internal Auditing Manager is responsible for reviewing, evaluating and testing specific controls or elements within the internal control system. Our Internal Auditing Manager graduated from Qiqihar University with a major in financial management in 2000, and is a Certified Public Accountant in China and a Certified Internal Auditor in China. Our Internal Auditing Manager has extensive business, financial and auditing knowledge and participated in government audits conducted by the Department of Finance of Liaoning Province. Our Internal Auditing Manager has extensive auditing experience gained from prior employment at a large accounting firm in China and internal control and loan risk control at Bank of East Asia, a foreign capital bank in China. As a Certified Public Accountant and Certified Internal Auditor, our Auditing Manager attends continuing professional education given by the PRC Institute of Certified Public Accountants and Institute of Internal Auditors. Through this training and prior work experience, our Internal Auditing Manager has gained relevant training in U.S. GAAP, experience in the preparation of financial statements in PRC GAAP and U.S. GAAP, auditing theory and methods and an understanding of the requirements of the Sarbanes-Oxley Act. |

Mr. John Cash

U.S. Securities and Exchange Commission

October 7, 2011

Page 11 of 25

| (5) | The Internal Auditing Director is responsible for conducting internal audits, due diligence, risk management and procedures for internal control under the supervision of the Internal Auditing Manager. Our Internal Auditing Director is pursuing her certification exams to become Certified Public Accountant in China and graduated from Heilongjiang University with a major in accounting in 2003. Our Internal Auditing Director has extensive auditing experience gained through three years working for Fengda, a regional accounting firm in Liaoning Province, China. Our Internal Auditing Director has limited relevant education and training in U.S. GAAP and limited experience in preparing financial statements in accordance with U.S. GAAP, but has extensive education and training in PRC GAAP, extensive experience preparing financial statements prepared in accordance with PRC GAAP and understands the latest auditing theory and methods and an understanding of the requirements of the Sarbanes-Oxley Act. |

The Company employs a total of 26 full time accounting and auditing staff members. The above-listed personnel supervise the accounting and auditing staff members who are responsible for recording the Company’s business and financial transactions in the Company’s accounting records and ensure that all disbursements are properly authorized, as well as performing other tasks normally associated with accounting and financial controls. The Company’s financial personnel attended a one-week training course conducted by ShineWing in October 2009 on Section 404 of the Sarbanes-Oxley Act.

If you retain an accounting firm or other similar organization to prepare your financial statements or evaluate your internal control over financial reporting, please tell us:

| · | the name and address of the accounting firm or organization; |

| · | the qualifications of their employees who perform the services for your company; |

| · | how and why they are qualified to prepare your financial statements or evaluate your internal control over financial reporting; |

| · | how many hours they spent last year performing these services for you; and |

| · | the total amount of fees you paid to each accounting firm or organization in connection with the preparation of your financial statements and in connection with the evaluation of internal control over financial reporting for the most recent fiscal year end. |

Mr. John Cash

U.S. Securities and Exchange Commission

October 7, 2011

Page 12 of 25

Response:

The Company retains a U.S. Certified Public Accountant, V Trust Accounting and Tax Services (“V Trust Accounting”), to prepare its U.S. GAAP financial statements and assist with its financial disclosures.

| · | Name and Address: Yvonne Zhang, Certified Public Accountant (DBA: V Trust Accounting and Tax Services); 32 S Almansor St., Alhambra, CA 91801 |

| · | Qualifications and Personnel: Ms. Zhang, a U.S. CPA licensed in the State of California, is responsible for preparing the Company’s U.S. GAAP financial statements. |

| · | Reasons for Qualification: Ms. Zhang is a CPA with 10 years of experience working in various U.S. accounting firms supervising, planning and performing financial statement audits and reviews for both SEC reporting and private companies; preparing financial statement compilations and related footnote disclosures and special reports; and preparing corporate, partnership and personal income tax returns. She has a strong background in accounting systems and financial operations reporting in a variety of industries including clean technology, manufacturing, mining, trading, high technology, professional services, real estate investments, foods, entertainment and shipping. Ms. Zhang has traveled extensively in mainland China to lead audit teams conducting SEC financial statement audits for U.S. publicly traded companies with operating subsidiaries located in China. In addition, she has experience performing CFO duties for a U.S. publicly traded company with primarily China-based operations, where she supervised and trained the PRC accounting staff in U.S. GAAP. Ms Zhang’s professional designations include Member of AICPA and Institute of Management Accountants. |

| · | Hours Spent Performing Company’s Work: V Trust Accounting spent approximately 220 hours on the preparation of quarterly and annual financial statements for the Company in 2010. |

| · | The Company paid $9,600 to V Trust Accounting in connection with the preparation of the Company’s financial statements for 2010. |

The Company engaged ShineWing in May 2010 to evaluate its internal control environment and to develop an internal audit plan. ShineWing is a full-service consulting firm with expertise in accounting and regulatory compliance that provides risk management and internal audit services to U.S. public companies that operate primarily in China. ShineWing was formed out of the Coopers & Lybrand International management consulting service in Beijing. ShineWing’s address is Fu Hua Building A, 14th Floor, 8 North Avenue, Dongcheng District, Beijing, China. ShineWing has more than 100 employees in offices in Beijing, Chengdu, Qindao and Jinan. ShineWing employs a staff of accountants and auditors with extensive and relevant experience in its internal controls team, including Certified Public Accountants, Certified Management Consultants, Certified Internal Auditors, Certified Tax Agents and Certified Information System Auditors. ShineWing spent approximately 20 weeks performing internal control evaluation services for the Company in 2010, for which the Company paid ShineWing RMB 650,000 ($96,000).

Mr. John Cash

U.S. Securities and Exchange Commission

October 7, 2011

Page 13 of 25

If you retain individuals who are not your employees and are not employed by an accounting firm or other similar organization to prepare your financial statements or evaluate your internal control over financial reporting, do not provide us with their names, but please tell us:

| · | why you believe they are qualified to prepare your financial statements or evaluate your internal control over financial reporting; |

| · | how many hours they spent last year performing these services for you; and |

| · | the total amount of fees you paid to each individual in connection with the preparation of your financial statements and in connection with the evaluation of internal control over financial reporting for the most recent fiscal year end. |

Response:

The Company does not retain individuals who are not its employees and are not employed by an accounting firm or other similar organization to prepare its financial statements or evaluate its internal control over financial reporting.

We note that you identify an audit committee financial expert in your filings. Please describe to us the extent of his knowledge of U.S. GAAP and internal control over financial reporting.

Response:

The Chair of the Company’s Audit Committee since June 2008, Arnold Staloff, has extensive knowledge of U.S. GAAP and internal control over financial reporting acquired through his service as director and audit committee member for a number of public companies and officer of a number of financial services companies. Mr. Staloff has served as a director and the Chair of the Audit Committee at NASDAQ-listed Deer Consumer Products, Inc., a small home and kitchen electronic products manufacturer, since 2009 and OTCQB-listed CleanTech Innovations, Inc., a manufacturer of structural towers for megawatt-class wind turbines, since 2010. From 2007 until his resignations in July 2010, Mr. Staloff served as a director and the Chair of the Audit Committee at NASDAQ-listed Shiner International, Inc., a packaging and anti-counterfeit plastic film company, and NASDAQ-listed AgFeed Industries, Inc., a feed and commercial hog producer. Mr. Staloff served as a director for Lehman Brothers Derivative Products Inc. from 1994 until October 2008. From December 2005 to May 2007, Mr. Staloff served as Chairman of the Board of SFB Market Systems, Inc., a New Jersey-based company that provided technology solutions for the management and generation of options series data. From June 1990 to March 2003, Mr. Staloff served as President and Chief Executive Officer of Bloom Staloff Corporation, an equity and options market-making firm and foreign currency options floor broker. During 1989 and 1990, Mr. Staloff served as President and Chief Executive Officer of Commodity Exchange, Inc., or COMEX. For the Philadelphia Stock Exchange, Mr. Staloff served as an officer from 1971 to 1989, and served as a member of its Board of Governors, Executive Committee and Chairman of the Foreign Currency Options Committee and also served on its Finance, Marketing, Steering and New Products Committees. With the above-mentioned extensive professional background and active roles as an independent audit committee member of two U.S.-listed companies, the Company’s Board of Directors determined that Mr. Staloff qualifies as an audit committee financial expert as defined under Item 407(d) of Regulation S-K.

Mr. John Cash

U.S. Securities and Exchange Commission

October 7, 2011

Page 14 of 25

Evaluation of Disclosure Controls and Procedures, page 32

| 14. | We note that your management concluded that your disclosure controls and procedures were effective “to ensure that information required to be disclosed in the reports that [you] file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in SEC rules and forms.” In future filings, please provide management’s conclusion regarding the effectiveness of your disclosure controls and procedures with respect to the full definition of disclosure controls and procedures as provided in Rule 13a-15(e) and Rule 15d-15(e) of the Securities Exchange Act of 1934. Please confirm to us that management’s conclusion was based on the full definition of disclosure controls and procedures as set forth in the rules. |

Response:

The Company confirms that management’s conclusion was based on the full definition of disclosure controls and procedures as set forth in Rule 13a-15(e) and Rule 15d-15(e) of the Securities Exchange Act of 1934.

The Company will include the disclosure in future filings in accordance with the Staff’s comment.

Item 13. Certain Relationships and Related Transactions, and Director Independence, page 43

| 15. | In future filings, please provide a statement indicating whether your related party transactions policy is in writing. If the policy is not in writing, then state how your policy is evidenced. See Item 404(b)(1)(iv) of Regulation S-K. |

Response:

The Company’s related party transactions policy is evidenced in writing and approved by the Audit Committee.

The Company will include the disclosure in future filings in accordance with the Staff’s comment.

Mr. John Cash

U.S. Securities and Exchange Commission

October 7, 2011

Page 15 of 25

Exhibit 32.1

| 16. | Your certification is dated March 15, 2010. Please file a full amendment of your Form 10-K, including the entire report, signature page, and properly dated certifications. You may include an explanatory note to indicate your reason for filing the amendment. |

Response:

The Company has filed Amendment No. 1 to its Form 10-K for the Fiscal Year Ended December 31, 2010, concurrently with this response in accordance with the Staff’s comment.

Financial Statements, page F-1

Consolidated Statements of Income and Other Comprehensive Income, page F-4

| 17. | In future annual and quarterly filings, please revise the title of the line item after income tax expense to be “net income (loss).” |

Response:

The Company will include the disclosure in future filings in accordance with the Staff’s comment.

Note 2. Summary of Significant Accounting Policies, page F-8

Cash and Cash Equivalents, page F-8

| 18. | Please tell us, and revise future annual and quarterly filings to disclose, the amount of cash and cash equivalents as of each balance sheet date based on the jurisdiction where it is deposited. Please tell us, and clarify in future filings, if cash and cash equivalents of the parent company are held in US banks and denominated in US dollars. |

Response:

The following table presents in U.S. dollars the amount of cash and cash equivalents held by the Company as of June 30, 2011, and December 31, 2010, based on the jurisdiction where it is deposited. The Company’s U.S. parent holds cash and cash equivalents in U.S. bank accounts denominated in U.S. dollars.

Mr. John Cash

U.S. Securities and Exchange Commission

October 7, 2011

Page 16 of 25

| As of June 30, 2011 | | United States | | | China | | | Germany | | | Total | |

| Total cash | | $ | 100,507 | | | $ | 20,875,625 | | | $ | 209,088 | | | $ | 21,185,220 | |

| Less: Cash on hand | | | - | | | | 13,844 | | | | - | | | | 13,844 | |

| Cash in bank | | $ | 100,507 | | | $ | 20,861,781 | | | $ | 209,088 | | | $ | 21,171,376 | |

| | | | | | | | | | | | | | | | | |

| As of December 31, 2010 | | | | | | | | | | | | | | | | |

| Total cash | | $ | 33,299,040 | | | $ | 23,507,431 | | | $ | - | | | $ | 56,806,471 | |

| Less: Cash on hand | | | - | | | | 6,627 | | | | - | | | | 6,627 | |

| Cash in bank | | $ | 33,299,040 | | | $ | 23,500,804 | | | $ | - | | | $ | 56,799,844 | |

The Company will include the disclosure in future filings in accordance with the Staff’s comment.

Basic and Diluted Earnings Per Share, page F-12

| 19. | To the extent applicable, please revise future annual and quarterly filings to provide the disclosure required by FASB ASC 260-10-50-1(c). |

Response:

The Company will include the disclosure in future filings in accordance with the Staff’s comment.

Foreign Currency Translation and Comprehensive Income (Loss), page F-12

| 20. | Please revise future annual and quarterly filings to disclose the average and year end/period-end exchanges rates you use in your foreign currency translations. |

Response:

The Company will include the disclosure in future filings in accordance with the Staff’s comment.

Segment Reporting, page F-13

| 21. | Please revise future filings to disclose revenue by product line as required by FASB ASC 280-10-50-40. |

Response:

The Company will include the disclosure in future filings in accordance with the Staff’s comment.

Mr. John Cash

U.S. Securities and Exchange Commission

October 7, 2011

Page 17 of 25

Note 14. Statutory Reserves, page F-18

| 22. | Please revise future filings to provide all the disclosures required by Rule 4-08(e) of Regulation S-X. |

Response:

The Company will include the disclosure in future filings in accordance with the Staff’s comment.

Form 10-Q for the Fiscal Quarter Ended June 30, 2011

Consolidated Statements of Cash Flows, page 3

| 23. | Please revise future filings to present bad debt expense, when material, as a separate non-cash expense in the reconciliation of net income (loss) to net cash used in operating activities. |

Response:

The Company will include the disclosure in future filings in accordance with the Staff’s comment.

Note 17. Commitments, page 18

Capital Contribution, page 18

| 24. | Please tell us, and expand your disclosure in future filings to discuss, the purpose of the SmartHeat Investment entity. Specifically, please tell us and clarify in future filings when and how you contributed $30 million in capital and when and how you expect to contribute an additional $40 million in capital. |

Response:

The Company formed SmartHeat Investment on April 7, 2010, as an investment holding company with registered capital of $70 million to enable our establishment and investment in new businesses in China. Under PRC company law, registered capital must be used in the operations of the domestic company within its approved business scope. SmartHeat Investment was established as a separate subsidiary of the Company to allow for our allocation of capital to new businesses in China separate from our existing subsidiaries and operations. We contributed $30 million in capital to SmartHeat Investment on April 15, 2010, from proceeds of our underwritten public offering that closed on September 22, 2009. On April 12, 2010, SmartHeat Investment formed SmartHeat Energy, a wholly owned subsidiary in Shenyang with registered capital of $30 million, subsequently satisfied out of the registered capital of SmartHeat Investment, for the research, development, manufacturing and sale of energy products. We are committed to contribute the remaining $40 million in registered capital to SmartHeat Investment by April 2015. We plan to satisfy this contribution through cash flow provided by operations and funds raised through offerings of our securities, if and when we determine such offerings are required, and at such time that we identify a new acquisition, investment or business opportunity to be financed through SmartHeat Investment, although no specific investment candidate has been identified to date.

Mr. John Cash

U.S. Securities and Exchange Commission

October 7, 2011

Page 18 of 25

The Company will include the disclosure in future filings in accordance with the Staff’s comment.

Note 19. Acquisition and Unaudited Pro Forma Information, page 18

| 25. | Please revise future filings to provide the disclosures required by FASB ASC 805-10-50-2(h)(1) and 50-6. In addition, please explain to us, and clarify in future filings, why the amount of goodwill recognized in each acquisition is so significant relative to each purchase price. Please also explain to us, and clarify in future filings, how you determined that little or no other identifiable intangible assets were acquired. |

Response:

The purchase price for Gustrower Warmepumpen GmbH (“GWP”) and SmartHeat (Shenyang) Heat Pump Technology Co., Ltd., formerly known as Shenyang Bingchuan Refrigerating Machine Co., Ltd. (“SmartHeat Pump” or “Bingchuan”), were negotiated based on a two-times multiple of the target company’s projected net income over the three years following the acquisition. The amount of goodwill recognized is the excess of the purchase price over the fair value of the net tangible and identifiable intangible assets acquired from the respective target company. For each of GWP and SmartHeat Pump, the Company determined that little or no identifiable intangible assets, consisting of outstanding patents, technology and customer lists, were acquired based on its due diligence and discussions with the respective sellers. Accordingly, the purchase price of each target company over the fair value of the assets acquired and liabilities assumed at the date of acquisition was recorded as goodwill.

The Company will include the disclosure in future filings in accordance with the Staff’s comment.

| 26. | It appears to us that your pro forma disclosures for the six months ended June 30, 2010 may not be accurate. Please advise or correct, as applicable, in future filings. |

Response:

The pro forma disclosures for the six months ended June 30, 2010, included in the Company’s Form 10-Q for the Fiscal Quarter Ended June 30, 2011, were not accurate because they incorporated erroneous financial statements of GWP for the six months ended June 30, 2010.

Mr. John Cash

U.S. Securities and Exchange Commission

October 7, 2011

Page 19 of 25

The following corrected unaudited pro forma consolidated results of operations of the Company for the six months ended June 30, 2011 and 2010, present the operations of SmartHeat, GWP and SmartHeat Pump as if the acquisitions occurred at January 1, 2011 and 2010, respectively. The pro forma results are not necessarily indicative of the actual results that would have occurred had the acquisitions been completed as of the beginning of the periods presented, nor are they necessarily indicative of future consolidated results.

| | | | 2011 | | | | 2010 | |

| Net revenue | | $ | 15,367,545 | | | $ | 34,433,983 | |

| Cost of revenue | | | 10,070,434 | | | | 22,638,493 | |

| | | | | | | | | |

| Gross profit | | | 5,297,111 | | | | 11,795,490 | |

| Total operating expenses | | | 17,326,423 | | | | 6,577,380 | |

| | | | | | | | | |

| Income (Loss) from operations | | | (12,029,312 | ) | | | 5,218,110 | |

| Total non-operating expenses | | | (243,961 | ) | | | 283,077 | |

| | | | | | | | | |

| Income (Loss) before income tax | | | (12,273,273 | ) | | | 5,501,187 | |

| Income tax | | | (1,328,051 | ) | | | (966,306 | ) |

| | | | | | | | | |

| Income (Loss) after income tax | | | (10,945,222 | ) | | | 4,534,881 | |

| Noncontrolling interest | | | 145,110 | | | | (6,666 | ) |

| Income (Loss) to SmartHeat Inc. | | $ | (10,800,112 | ) | | $ | 4,528,215 | |

| | | | | | | | | |

| Weighted average shares outstanding | | | 38,572,381 | | | | 32,800,818 | |

| | | | | | | | | |

| Earnings (Loss) per share | | $ | (0.28 | ) | | $ | 0.14 | |

The Company will correct and incorporate the pro forma disclosure in future filings in accordance with the Staff’s comment.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 21

Results of Operations, page 24

| 27. | We note the significant declines in sales and operating results during the current interim periods. We also note that your MD&A fails to address the specific reasons for the declines in any meaningful way. Please explain to us, and revise future filings to clarify, the following: |

| · | Provide comprehensive explanations for the 53% decline in sales during the six months ended June 30, 2011 and the 69% decline in sales during the three months ended June 30, 2011. We note your current reference to “tightened fiscal policy in China” and an implication that you do not expect the declines to continue; however, we note no meaningful discussion of why the declines occurred, why they were so significant, or why they appear to have worsened during the current quarter. We also note certain of your competitors do not appear to have experienced similar declines. Please explain. |

Mr. John Cash

U.S. Securities and Exchange Commission

October 7, 2011

Page 20 of 25

Response:

The Company’s net sales declined 53% and 69% in the six and three months ended June 30, 2011, respectively, compared to the same periods of 2010, principally because of decreased sales of our PHEs and PHE Units in the 2011 periods. Sales of PHEs decreased 58% and 90% in the six and three months ended June 30, 2011, respectively, compared to the same periods of 2010, and sales of PHE Units decreased 68% and 58% in the six and three months ended June 30, 2011, respectively, compared to the same periods of 2010. The decrease in sales was primarily due to tightened fiscal policy in China, which has contributed to a general slowdown in many sectors of the Chinese economy and caused the decrease in sales of our PHE Units and PHEs. Most of our customers are state-owned enterprises that encountered difficulties in obtaining grants from the PRC government and faced an extended bank loan application process, both of which typically are used to finance the purchase of our products, which resulted in an unexpected cancelation of orders and delays in the performance of PHE Unit and PHE contracts. Historically, sales to state-owned enterprises represent approximately 60% of our total sales, and approximately 40% of our customers consist of state-owned enterprises. In the first half of 2011, the Company canceled contracts with certain of these state-owned customers that were unable to make payments or that had requested adjustments to their payment terms in response to their financial difficulties. Additionally, the deflationary policy of the PRC government affected the number of new sales of PHE Units and PHEs as certain state-owned enterprises deferred the bidding for new projects in the first half of 2011 because of their working capital difficulties. The decline in new projects among state-owned enterprises and increased peer competition contributed to the continued decline in sales of our PHE Units and PHEs. Management believes that our principal competitors have not experienced as significant a decline in sales because they possess a smaller market share. Although these events caused a decrease in our sales, we expect that a portion of the canceled PHE Unit and PHE orders will be reinstated and contracts that have been partially delayed will be performed within this fiscal year or 2012, reducing the impact of the drop in sales over the long term.

| · | Provide comprehensive explanations for the increases in operating expenses during the three and six months ended June 30, 2011, particularly in light of the declines in sales. |

Response:

Operating expenses of the Company, consisting of selling, general and administrative expenses, totaled $16.83 million for the six months ended June 30, 2011, compared to $5.20 million for the same period of 2010, an increase of $11.63 million or 224%. The increase in operating expenses resulted primarily from expansion of our business and increased bad debt allowance of approximately $5.75 million attributed to working capital difficulties of many of our state-owned customers. The Company’s legal, audit and related expenses were approximately $662,000 in the first half of 2011 in connection with the acquisitions of GWP and SmartHeat Pump in March 2011. As part of our strategy to expand market share in China, consolidate management and reduce reliance on our current state-owned customers that have encountered financial difficulties in 2011, we increased sales personnel and management. This strategy includes the opening of additional branch offices and centralizing management over sales and marketing across subsidiaries, which increased costs for personnel, training and rent in the first half of 2011.

Taiyu hired an additional 100 employees, resulting in an increase in employee compensation and employee welfare and benefit expenses totaling $1.07 million in the first half of 2011. Legal and consulting fees incurred with respect to business development strategy consulting and human resources management for Taiyu and Siping increased $1.20 million for the six months ended June 30, 2011, compared to the same period of last year. R&D expenses increased $289,000, travel and entertainment expenses increased $406,000 and freight costs increased $189,000. The Company’s newly acquired subsidiaries, Ruicheng, Shanghai Trading and GWP, increased operating expenses by another $1.13 million. Rental expense for the six months ended June 30, 2011 and 2010, was approximately $252,350 and $71,000, respectively. In addition, we canceled certain contracts with some of our state-owned customers that have experienced financial difficulties attributed to the current deflationary policy in China. We will continue to review each sales contract, especially with respect to the determination of a sales price and financial stability of the customer, as we continue to supply our long-term customers and expand into new regional areas of China, and continue to make progress establishing sales channels in North and South America, which we expect will meaningfully contribute to revenue in 2012.

Mr. John Cash

U.S. Securities and Exchange Commission

October 7, 2011

Page 21 of 25

| · | Provide a comprehensive explanation as to why you increased inventory and advances to suppliers during the interim period, particularly in light of the declines in sales. Based on your sales during the current interim period, it appears to us that your inventory and advances to suppliers represent almost three years of sales. |

Response:

The Company increased inventory and advances to suppliers in the first half of 2011 in anticipation of our historical high season for production in the third and fourth quarters. We typically experience significantly stronger sales during the second half of the year, which is the fall and winter season in China, during which we historically generate approximately 74% of our revenue. We are exposed to the price risk that the rising cost of commodities has on certain of our raw materials, including stainless steel used to produce plates for our PHEs and PHE Units. We monitor the commodities markets for pricing trends and changes, which have been considerably higher for stainless steel in 2011 compared to 2010, but we do not engage in hedging transactions to protect against raw material fluctuations. Instead, we attempt to mitigate the short-term risks of price swings by purchasing raw materials in advance based on production needs and projected sales. Accordingly, we generally order plates and components for our products, which constituted approximately 86% of our raw material purchases in 2010, two to three months in advance of anticipated production needs. Although the deflationary policies in China have caused a decrease in sales in 2011, we expect that a portion of the canceled PHE Unit and PHE orders will be reinstated and contracts that have been partially delayed will be performed within this fiscal year or 2012.

| · | Provide a comprehensive explanation of how you determined accounts receivable turnover, accounts receivable days outstanding, and inventory turnover as disclosed in MD&A. |

Mr. John Cash

U.S. Securities and Exchange Commission

October 7, 2011

Page 22 of 25

Response:

The Company determines accounts receivable turnover, accounts receivable days outstanding and inventory turnover using the following formulas:

| · | Accounts Receivable Turnover Rate (Annualized) at June 30, 2011 = Estimated annualized sales (Sales for period July 1, 2010, through June 30, 2011) / Average Accounts Receivable |

| o | Average Accounts Receivable = (Beginning accounts receivable (current + noncurrent) + Ending accounts receivable (current + noncurrent) / 2 |

| · | Days of Accounts Receivable Turnover = 365 / Accounts Receivable Turnover Rate |

| · | Inventory Turnover = Estimated annualized cost of goods sold (COGS for period July 1, 2010, through June 30, 2011) / Average inventory |

| o | Average Inventory = (Beginning inventory + Ending inventory) / 2 |

| · | Provide a comprehensive explanation of how you determined bad debt expense during the interim periods. |

Response:

The Company recorded a bad debt allowance of $5.81 million for the six months ended June 30, 2011, primarily attributed to payment delays caused by the working capital difficulties of many of our state-owned customers. Due to the current deflationary fiscal policy of the PRC government, some of our state-owned customers encountered difficulties in obtaining grants from the government and loans from state-owned banks, both of which typically are used to finance the purchase of our products, which resulted in unexpected delays in paying our accounts receivable in a timely manner. We do not expect a significant risk with respect to the overdue accounts receivable for which we took the bad debt allowance and believe that a substantial portion of the bad debt will be repaid as the PRC government restores grants and credit policies. The Company accounted for 50% of the amount of accounts receivable with aging over 180 days and 100% of the amount of accounts receivable with aging over 360 days as of June 30, 2011, as the bad debt allowance.

| · | Provide an aging of your accounts receivable at June 30, 2011. Tell us the amount of outstanding receivables you have collected in cash since June 30, 2011. Based on your disclosed payment terms, provide a comprehensive explanation as to why almost 70% of your accounts receivable at June 30, 2011 have been outstanding for over six months. |

Mr. John Cash

U.S. Securities and Exchange Commission

October 7, 2011

Page 23 of 25

Response:

The aging of our accounts receivable at June 30, 2011, follows in table below. As of September 30, 2011, we have collected $9,890,000 of the accounts receivable which were outstanding as of June 30, 2011.

| SmartHeat, Inc. | | | | | | | | | | | | | | | | | | |

| AR aging at June 30, 2011 | | | | | | | | | | | | | | | | | | |

| | | <30 days | | | >30 days | | | >90 days | | | >180 days | | | >360 days | | | Total | |

| AR (including Retention Receivables, current & non-current) | | $ | 1,187,919 | | | $ | 8,304,175 | | | $ | 21,158,605 | | | $ | 24,476,680 | | | $ | 1,860,794 | | | $ | 56,988,173 | |

| Less: Bad debt allowance for AR | | | | | | | | | | | | | | | | | | | | | | | (8,554,413 | ) |

| Less: Unearned interest | | | | | | | | | | | | | | | | | | | | | | | (24,356 | ) |

| Less: Retention Receivables, current & non-current | | | | | | | | | | | | | | | | | | | | | | | (4,165,154 | ) |

| AR, net | | | | | | | | | | | | | | | | | | | | | | $ | 44,244,250 | |

Our accounts receivable typically remain outstanding for a significant period of time based on the standard payment terms with our customers, which provide that the final 10% of the purchase price is due no later than the termination date of the standard warranty period that ranges up to 24 months, or up to 2 heating seasons. The increase in amount of accounts receivable outstanding for more than 180 days in 2011 was due mainly to payment delays from certain state-owned customers that experienced working capital difficulties in the first half of 2011 because of the current deflationary fiscal policy of the PRC government. We do not expect a significant risk with respect to these overdue accounts receivable for which we took the bad debt allowance and believe that a substantial portion of accounts receivable will be recovered in 2011 and first quarter of 2012 as the PRC government restores grants and credit policies.

The Company will include the disclosure in future filings in accordance with the Staff’s comment.

Definitive Proxy Statement on Schedule 14A

Certain Relationships and Related Transactions, page 17

| 28. | In future filings, please disclose whether your policy is in writing, and if not, how your policy and procedures are evidenced. See Item 404(b)(1)(iv) of Regulation S-K. |

Response:

The Company’s related party transactions policy is evidenced in writing and approved by the Audit Committee.

Mr. John Cash

U.S. Securities and Exchange Commission

October 7, 2011

Page 24 of 25

The Company will include the disclosure in future filings in accordance with the Staff’s comment.

Employment Agreements, page 22

| 29. | In future filings, please disclose why the compensation committee approved increases in the salary of your named executive officer. Mr. Wang’s salary increased from $18,000 to $150,000. Please tell us why the compensation committee determined to substantially increase his salary in 2010. See Item 402(b)(2)(ix) of Regulation S-K. |

Response:

On February 1, 2010, the Compensation Committee of the Company approved an increase in the annual compensation of Mr. Wang to a base salary of $150,000 per year. Prior to this increase, Mr. Wang’s base salary had remained the same since 2005, approximately $18,000 per annum, and was based on Taiyu’s operations as a private company. Mr. Wang’s base salary was not adjusted in connection with the Share Exchange on April 14, 2008, whereby he became the President and Chief Executive Officer of a U.S.-listed public company. Since the Share Exchange, the Company has expanded substantially, with net sales increasing to $125.41 million in 2010 from $32.67 million in 2008 and its acquisition or formation of an additional 9 subsidiaries worldwide, and Mr. Wang’s responsibilities have increased accordingly. Based on these circumstances, and Mr. Wang’s continued importance to the Company’s long-term strategy and success, the Compensation Committee believed it in the best interests of the Company to increase Mr. Wang’s base salary in 2010.

The Company will include the disclosure in future filings in accordance with the Staff’s comment.

Compensation of Directors, page 23

| 30. | We note your disclosure in footnote 2 to the Director Compensation Table for 2010 in which you state that you awarded Mr. Staloff a bonus in the amount of $15,000. In future filings, please revise your narrative disclosure to state the factors you considered in awarding directors bonuses and how you determined the bonus amount awarded. See Item 402(k)(3)(ii) of Regulation S-K. |

Response:

The Company will include the disclosure in future filings in accordance with the Staff’s comment.

Mr. John Cash

U.S. Securities and Exchange Commission

October 7, 2011

Page 25 of 25

In making our responses, we acknowledge that:

| · | the Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| · | staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| · | the Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Should you or others have any questions or would like additional information, please contact Robert Newman, Counsel to the Company, at (212) 227-7422 or by fax at (212) 202-6055.

Very truly yours,

/s/ Jun Wang

Jun Wang

Chief Executive Officer

cc: Robert Newman, Newman & Morrison LLP