SMARTHEAT INC.

A-1, 10, Street 7

Shenyang Economic and Technological Development Zone

Shenyang, China 110141

(86) 24-2519-7699

December 14, 2011

VIA EDGAR

John Cash

Accounting Branch Chief

Division of Corporation Finance

Mail Stop 3720

U.S. Securities and Exchange Commission

100 F. Street, N.E.

Washington, DC 20549

| | Form 10-K for the Fiscal Year Ended December 31, 2010 |

| | Form 10-Q for the Fiscal Quarter Ended September 30, 2011 |

Dear Mr. Cash:

This letter responds to the comment letter of the Staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”), dated November 23, 2011, to SmartHeat Inc. (the “Company”) regarding the above-captioned filings of the Company. Please note that the Staff’s comments are restated below along with the Company’s responses.

Form 10-K for the Fiscal Year Ended December 31, 2010

Item 1A. Risk Factors, page 8

Risks Related to Doing Business in China, page 14

| 1. | We note that your corporate structure indicates that you currently have a one-tiered, rather than a two-tiered, foreign ownership structure. Please provide us with your analysis of how your one-tiered foreign ownership structure in which the listing company and holding company are the same complies with PRC regulations on foreign ownership. Please tell us of any limitations or prohibitions on your business activities under the current MOFCOM guidance as they relate to your corporate structure. We further note your disclosure in the first risk factor on page 16 that you “cannot warrant that such [MOFCOM] approval procedures have been completely satisfied due to a number of reasons, including changes in laws and government interpretations.” Please tell us why you believe you may not have met the current conditions for your MOFCOM approval, with a view toward future disclosure in this risk factor. |

Mr. John Cash

U.S. Securities and Exchange Commission

December 14, 2011

Page 2 of 10

Response:

The Company established its one-tiered foreign ownership corporate structure in China through the acquisition by its U.S. parent (“SmartHeat”) of Shenyang Taiyu Machinery & Electronic Equipment Co., Ltd., subsequently renamed SmartHeat Taiyu (Shenyang) Energy Technology Co., Ltd. (“Taiyu”), pursuant to a share exchange agreement dated April 14, 2008 (the “Share Exchange Agreement”) and subsequent transactions contemplated by the Share Exchange Agreement. Prior to the Share Exchange Agreement, Taiyu was a Sino-foreign joint venture company, not a PRC domestic enterprise, with three shareholders. Accordingly, the Company believes that its process of acquisition of Taiyu by SmartHeat was not subject to the 2006 Rules on Acquisition of Domestic Enterprises by Foreign Investors (the “M&A Regulations”) but instead the 1997 Provisions on Changes in Equity Interest of Foreign Investment Enterprises, which do not require the approval of MOFCOM’s central office in connection with the acquisition of interests in a foreign-invested entity operating in an industry not restricted or prohibited under PRC law. We received PRC government approval on May 28, 2008, of our subscription for 71.6% of the registered capital of Taiyu, and approval on June 3, 2009, of the transfer of the remaining 28.4% ownership of Taiyu from the original joint venture shareholders, who had received shares of the common stock of the Company pursuant to the Share Exchange Agreement. As a result of these approved transactions, Taiyu became our wholly foreign-owned enterprise (“WFOE”) under a single tier of foreign ownership. We subsequently established and acquired WFOE subsidiaries in China, including SanDeKe, SmartHeat Siping and SmartHeat Investment, with SmartHeat as the sole incorporator and shareholder, and Sino-foreign joint venture subsidiaries, including Jinhui and Ruicheng, with SmartHeat as the foreign investing entity, further maintaining a one-tiered foreign ownership corporate structure in compliance with PRC regulations on foreign ownership. Our other PRC subsidiaries, SmartHeat Energy and SmartHeat Pump, are owned by our PRC subsidiaries SmartHeat Investment and Taiyu, respectively. Our one-tiered foreign ownership structure restricts the business activities of our PRC subsidiaries to the scope of manufacturing and general service activities approved of by their respective business licenses pursuant to PRC corporate laws.

We believe we have satisfied all MOFCOM approval procedures for our PRC subsidiaries owned by SmartHeat under a one-tiered foreign ownership corporate structure. The meaning of many of the provisions of the M&A Regulations is still unclear, however, and PRC regulators have wide latitude in the enforcement of these and other relevant regulations. Consequently, the MOFCOM approval procedures or interpretations of its approval procedures may be different from our understanding or may change. If MOFCOM subsequently determines that we should have obtained the approval of MOFCOM’s central office for any or all of the transactions described above, we may need to apply for a remedial approval or waiver of such approval requirements, and may be subject to certain administrative punishments or other sanctions from PRC regulatory agencies.

Mr. John Cash

U.S. Securities and Exchange Commission

December 14, 2011

Page 3 of 10

The Company proposes to replace its disclosure for this risk factor as follows in future filings in accordance with the Staff’s comment.

We operate in the PRC through our operating entities whose foreign-investment status has been approved by the local office of the PRC Ministry of Commerce (“MOFCOM”). If MOFCOM subsequently determines that such approval procedures have not been completely satisfied for our wholly foreign-owned enterprises (“WFOEs”), we may lose the WFOE status of certain of our subsidiaries, which could negatively impact our business in China.

Our operating entities in the PRC have received approval from their respective local offices of MOFCOM as WFOEs and foreign-invested joint ventures. We believe we have satisfied all MOFCOM approval procedures for having obtained such status, but there may be conditions subsequent to complete and maintain such status. In particular, we believe that our acquisition of Taiyu was not subject to the 2006 M&A Regulations but instead the 1997 Provisions on Changes in Equity Interest of Foreign Investment Enterprises, which do not require the approval of MOFCOM’s central office in connection with the acquisition of interests in a foreign-invested entity operating in an industry not restricted or prohibited under PRC law. The meaning of many of the provisions of the M&A Regulations is still unclear, however, and PRC regulators have wide latitude in the enforcement of these and other relevant regulations. Consequently, the MOFCOM approval procedures or interpretations of its approval procedures may be different from our understanding or may change. If MOFCOM subsequently determines that we should have obtained the approval of MOFCOM’s central office for our investments in any or all of our PRC foreign-invested subsidiaries, we may need to apply for a remedial approval or waiver of such approval requirements, and may be subject to certain administrative punishments or other sanctions from PRC regulatory agencies. As a result, if we lose the WFOE status of any of our PRC operating subsidiaries for any reason, there may be a material adverse effect on our business, financial condition, results of operations, reputation and prospects, as well as the trading price of our shares of common stock.

| 2. | Please tell us the following: |

| · | whether you employ the use of contractual arrangements with your PRC entities to allow you to exercise effective control over your PRC entities, and if so, discuss the material terms of each agreement, how each functions to give you control and the enforceability of each agreement; and |

| · | whether you operate in a prohibited or restricted industry under PRC law, and if so, how those restrictions limit your operations as a foreign-invested entity in the PRC. |

Mr. John Cash

U.S. Securities and Exchange Commission

December 14, 2011

Page 4 of 10

Response:

The Company does not employ the use of contractual arrangements with its PRC subsidiaries, other than for SmartHeat Trading, to allow for the exercise of effective control over such entities. We and our PRC subsidiaries exercise control over such entities through our majority equity interests in our WFOEs, Taiyu, SanDeKe, SmartHeat Siping and SmartHeat Investment, our joint ventures, Jinhui, Ruicheng and SmartHeat Pump, and domestic enterprise, SmartHeat Energy. We control SmartHeat Trading through an investment agreement, dated February 1, 2010 (the “SmartHeat Trading Agreement”), entered into with the nominee owner of SmartHeat Trading, Cleantech Holdings Inc., a British Virgin Islands company (“Cleantech Holdings”). We have no direct ownership interest in SmartHeat Trading or Cleantech Holdings; instead, pursuant to the SmartHeat Trading Agreement, we invested $1.5 million as the registered capital of SmartHeat Trading in exchange for our right to control 100% of the shareholder rights in SmartHeat Trading and our rights to 100% of its profit or loss.

None of our PRC subsidiaries operates in prohibited or restricted industries under PRC law, as such industries have been identified by the PRC National Development and Reform Commission in its Catalog for the Guidance of Foreign Invested Enterprises, as amended in 2011.

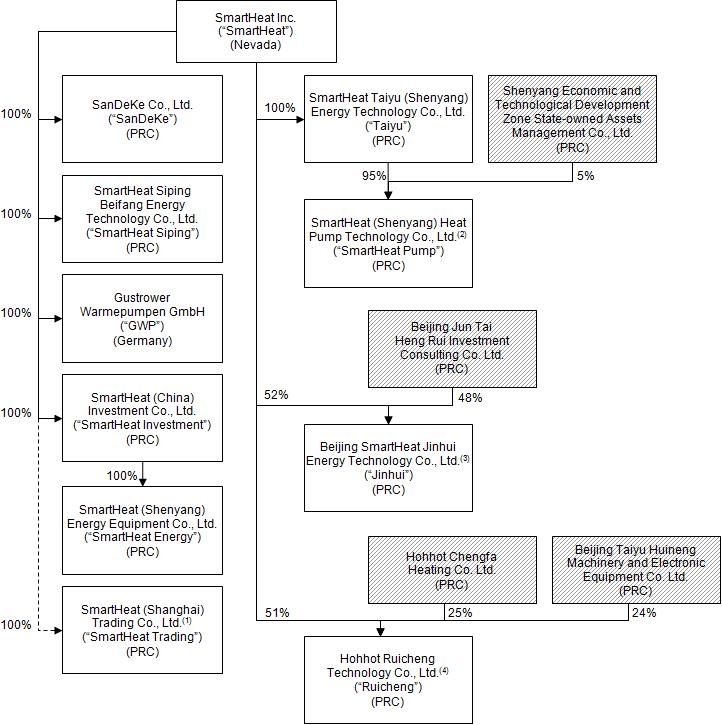

| 3. | With a view towards future disclosure, please provide us with a diagram exhibiting your company’s organizational structure, including your PRC subsidiaries. The chart should include the names and percentage ownership of the shareholders of your PRC operating subsidiaries and reflect the contractual arrangements and loans in place, if any, between the entities. |

Response:

The Company proposes to include the following diagram exhibiting its corporate structure, including PRC subsidiaries, in future filings in accordance with the Staff’s comment.

Mr. John Cash

U.S. Securities and Exchange Commission

December 14, 2011

Page 5 of 10

(1) We control and are entitled to 100% of the profit or loss of SmartHeat Trading pursuant to contractual arrangements between SmartHeat and the nominee owner of SmartHeat Trading, Cleantech Holdings Inc., a British Virgin Islands company. We have no direct ownership interest in SmartHeat Trading.

(2) Taiyu holds 95% of the equity interest in SmartHeat Pump, with the remaining 5% of the equity interest held by Shenyang Economic and Technological Development Zone State-owned Assets Management Co., Ltd.

(3) We control 52% of Jinhui pursuant to a joint venture agreement entered into with the minority owner, Beijing Jun Tai Heng Rui Investment Consulting Co. Ltd.

(4) We control 51% of Ruicheng pursuant to a joint venture agreement entered into with the minority owners, Hohhot Chengfa Heating Co. Ltd. and Beijing Taiyu Huineng Machinery and Electronic Equipment Co. Ltd.

Mr. John Cash

U.S. Securities and Exchange Commission

December 14, 2011

Page 6 of 10

Item 9A. Controls and Procedures, page 32

General

| 4. | We note your responses to our prior comment 13. With respect to your CFO’s education and training, please tell us whether knowledge of U.S. GAAP is a requisite to obtaining a CPA license through the Chinese Institute of Certified Public Accountants. To the extent that education in U.S. GAAP is not a requirement of obtaining a CPA license through the Chinese Institute of Certified Public Accountants, coupled with your CFO being “responsible for reviewing the financial reports under U.S. GAAP, supervising the financial activities of the Company and supervising the design of internal control over financial reporting,” it appears to us that a material weakness may exist in your internal control over financial reporting. Absent further information or significant changes to your internal level of U.S. GAAP expertise, we believe you should carefully consider your level of U.S. GAAP expertise when performing your assessment of internal control over financial reporting and revise future filings to disclose such material weakness and how this weakness is being mitigated and/or remediated. |

Response:

The Company respectively believes that no material weakness exists in its internal control over financial reporting as it relates to the Company’s internal level of U.S. GAAP expertise. As stated in the Company’s letter dated October 7, 2011, in response to the Staff’s prior comment 13, our CFO is a CPA licensed through the Chinese Institute of Certified Public Accountants. According to the Chinese Institute of Certified Public Accountants and the PRC laws on Certified Public Accountants currently in effect, U.S. GAAP is not a requisite to obtaining a PRC CPA license. Our CFO has attended training in U.S. GAAP conducted by our outside internal control consultant, ShineWing Strategy Management Consulting Co., Ltd., however, and plans to attend further training in the coming year. Our outside internal control consultant developed an internal audit plan for our businesses, including process-level and entity-level controls, which has been implemented by our internal audit department. We retain an outside U.S. Certified Public Accountant, V Trust Accounting and Tax Services, to prepare our U.S. GAAP financial statements and assist with our financial disclosures. Our CFO and internal financial personnel consult with our outside U.S. GAAP consultant on an ongoing basis with regards to our treatment and conversion of financials from PRC GAAP to U.S. GAAP. Accordingly, our management believes that our internal control over financial reporting is adequate and our ability to prepare our financial statements for external purposes in accordance with U.S. GAAP is not materially affected by our internal level of U.S. GAAP expertise because of our outside U.S. GAAP consultant’s extensive familiarity with U.S. GAAP and such consultant’s involvement in the preparation of our U.S. GAAP financial statements.

Mr. John Cash

U.S. Securities and Exchange Commission

December 14, 2011

Page 7 of 10

Form 10-Q for the Fiscal Quarter Ended September 30, 2011

Item 1. Financial Statements, page 1

Note 17. Commitments, page 20

| 5. | We note your response to prior comment 24 and the additional disclosures you provided in your Form 10-Q for the fiscal quarter ended September 30, 2011. Please explain to us and clarify in future filings the expected magnitude of the potential penalty if you are unable to raise the remaining $40 million capital contribution. In addition, please also tell us and clarify in your future filings, the likelihood of obtaining an extension to make the required capital contribution should you apply for a grace period. |

Response:

As a PRC investment holding company, the $70 million in approved registered capital of SmartHeat Investment is deemed a planned investment amount for the entity, not a traditional registered capital requirement under PRC corporate law. Accordingly, if we are unable to satisfy the contribution by April 2015, SmartHeat Investment may apply to extend the payment period or otherwise reduce the amount of registered capital to the amount already contributed. There is no penalty for failure to satisfy in full the approved registered capital of an investment holding company. An application for extension of payment is commonly granted by the relevant PRC government agencies for six months or more.

The Company will revise the disclosure in future filings to reflect the foregoing discussion in response to the Staff’s comment.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 23

Results of Operations, page 28

| 6. | We note your response to bullet 3 of prior comment 27; however, it is unclear to us the reason you continued to significantly increase inventory during the third quarter of 2011, given the significant and continued decline in net sales during 2011. In this regard, please tell us and clarify in future filings, the reason for increasing inventory during the interim periods, in light of the decline in your sales. Please also explain to us if the increase in your inventory is related to the cancellation of orders/abandonment of projects that you disclose in your narrative. If so, please tell us how you have determined that a write-down of inventory is not required. |

Mr. John Cash

U.S. Securities and Exchange Commission

December 14, 2011

Page 8 of 10

Response:

The Company stocks inventory, consisting of raw materials and finished goods, according to projected sales and customer orders. We generally order plates and components for our products two to three months in advance of anticipated production needs, with sales historically strongest during the second half of the year, which is the start of the fall and winter heating seasons in China. Most of our customers are state-owned enterprises that encountered difficulties in obtaining grants from the PRC government and bank loans, both of which typically are used for working capital and to finance the purchase of our products, due to the tightened fiscal policy in China during 2011, which resulted in an unexpected abandonment of projects, cancelation of orders and delays in the performance of PHE Unit and PHE contracts. Management believes that a portion of the canceled PHE Units and PHE orders will be reinstated and contracts that have been partially delayed will be performed within this fiscal year or 2012. Accordingly, management believes that our existing inventory at September 30, 2011, will be consumed gradually through the first half of 2012. We determined that no write-down of raw materials was required because raw materials in inventory consist primarily of steel, for which the possibilities of becoming obsolete are very remote. Finished goods in inventory consist of customized products manufactured for orders that have been delayed or canceled. We will make an impairment analysis at year-end for the write-down of finished goods from canceled contracts that we do not expect to be reinstated and contracts for which we have been unable to find substitute customers. Concurrently, we will also make an analysis of whether to take a reserve for conversion costs of finished goods for resale to substitute customers.

| 7. | We note your responses to bullets 5 and 6 of prior comment 27. With reference to the aging of your accounts receivable at June 30, 2011, please explain to us: |

| · | how your determination/calculation of your bad debt expense at both June 30, 2011 and September 30, 2011 is correct based on the respective agings you have provided as of those dates; and |

| · | how your aging is correct at June 30, 2011 given the amount of net sales during the three and six months ended June 30, 2011. |

Response:

The following table sets forth the aging of the Company’s accounts receivable at June 30, 2011:

| | | <30 days | | | >30 days | | | >90 days | | | >180 days | | | >360 days | | | Total | |

| AR (including retention receivables, current and noncurrent) | | $ | 1,187,919 | | | $ | 8,304,175 | | | $ | 21,158,605 | | | $ | 24,476,680 | | | $ | 1,860,794 | | | $ | 56,988,173 | |

| Less: Bad debt allowance for AR | | | | | | | | | | | | | | | | | | | | | | | (8,554,413 | ) |

| Less: Unearned interest | | | | | | | | | | | | | | | | | | | | | | | (24,356 | ) |

| Less: Retention receivables, current and noncurrent | | | | | | | | | | | | | | | | | | | | | | | (4,165,154 | ) |

| AR, net, at June 30, 2011 | | | | | | | | | | | | | | | | | | | | | | $ | 44,244,250 | |

Mr. John Cash

U.S. Securities and Exchange Commission

December 14, 2011

Page 9 of 10

The following table sets forth the aging of the Company’s accounts receivable at September 30, 2011:

| | | <30 days | | | >30 days | | | >90 days | | | >180 days | | | >360 days | | | Total | |

| AR (including retention receivables, current and noncurrent) | | $ | 4,369,178 | | | $ | 6,690,544 | | | $ | 8,280,705 | | | $ | 29,966,228 | | | $ | 1,989,726 | | | $ | 51,296,381 | |

| Less: Bad debt allowance for AR | | | | | | | | | | | | | | | | | | | | | | | (11,848,994 | ) |

| Less: Unearned interest | | | | | | | | | | | | | | | | | | | | | | | (11,742 | ) |

| Less: Retention receivables, current and noncurrent | | | | | | | | | | | | | | | | | | | | | | | (3,999,682 | ) |

| AR, net, at September 30, 2011 | | | | | | | | | | | | | | | | | | | | | | $ | 35,435,963 | |

The Company’s management reviews accounts receivable collection on a monthly basis. The sales department work closely with customers for collection of past due accounts. In general, we provide approximately 50% of accounts receivable over 180 days and 100% of accounts receivable over 360 days as bad debt allowance. Management further analyzes individual customers for which we have taken a bad debt allowance to assess likelihood of collectability. Past due accounts of customers from whom we received confirmation of a firm payment date and amount were excluded for the purpose of bad debt allowance calculation. For example, as of September 30, 2011, we had accounts receivable of $51,296,381, of which $4,369,178 was with aging within 30 days, $6,690,544 was with aging over 30 days and within 90 days, $8,280,705 was with aging over 90 days and within 180 days, $29,966,228 was with aging over 180 days and within 360 days and $1,989,726 was with aging over 360 days. After management’s review, it was determined that $8.5 million of accounts receivable with aging over 180 days and $0.88 million of accounts receivable with aging over 360 days will be collected based on customer confirmations and were excluded from the bad debt allowance calculation. Accordingly, we recorded a bad debt allowance of $11.85 million, excluding firm payment commitments, at September 30, 2011, using 50% and 100% as a basis of accounts receivable aged over 180 days and over 360 days, respectively.

Our sales agreements with our customers generally provide that 30% of the purchase price is due upon the placement of an order, 30% upon delivery and 30% upon installation and acceptance of the equipment after customer testing. As a common practice in the heating manufacturing business in China, payment of the final 10% of the purchase price is due no later than the termination date of the standard warranty period, which ranges from 3 to 24 months from the acceptance date. Consequently, our accounts receivable are aged according to each payment due date under the contracted terms.

For example, if we recorded sales of RMB 1.0 million on January 1, 2011, the accounts receivable would be recorded for RMB 1.17 million, which includes 17% VAT receivable. The accounts receivable aging would be analyzed according to the payment terms in the sales contracts, which for purposes of this example will have the first payment of RMB 0.5 million due by January 31, 2011, the second payment of RMB 0.4 million due by April 30, 2011, and the third payment of RMB 0.27 million due by July 31, 2011. Accordingly, the calculation of accounts receivable aging for these receivables would occur on the respective payment due dates. Accounts receivable not past due are included in the current portion of the aging. If we do not receive the expected payments by their respective due dates, the amount due shifts from the current aging category to the within 30-days aging category, with further aging category adjustments made based on the original payment due dates if such payments continue to remain outstanding.

Mr. John Cash

U.S. Securities and Exchange Commission

December 14, 2011

Page 10 of 10

Under this methodology for calculating aging of accounts receivable, we believe that our aging analysis is correct at June 30, 2011, given the amount of net sales during the three and six months ended June 30, 2011. Using the accounts receivable of Taiyu, our largest operating subsidiary in China, as an example, sales of Taiyu were RMB 28.7 million for the three months ended March 31, 2011, and RMB 69.7 million for the six months ended June 30, 2011, an increase of RMB 41 million during the three months ended June 30, 2011. Accounts receivable of Taiyu were RMB 313.0 million as of June 30, 2011, compared to RMB 305.0 million as of March 31, 2011, a net increase of RMB 8.1 million in accounts receivable for Taiyu as of June 30, 2011, after the collection of accounts receivable.

Should you or others have any questions or would like additional information, please contact Robert Newman, Counsel to the Company, at (212) 227-7422 or by fax at (212) 202-6055.

Very truly yours,

/s/ Jun Wang

Jun Wang

Chief Executive Officer

cc: Robert Newman, Newman & Morrison LLP