UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22001

db-X Exchange-Traded Funds Inc.

(Exact name of Registrant as specified in charter)

60 Wall Street

New York, New York 10005

(Address of principal executive offices) (Zip code)

Alex Depetris

db-X Exchange-Traded Funds Inc.

60 Wall Street

New York, New York 10005

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 250-4352

Date of fiscal year end: May 31, 2012

Date of reporting period: November 30, 2012

Item 1. Report to Stockholders.

The Registrant’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

SEMI-ANNUAL REPORT

November 30, 2012

Unaudited

db-X Exchange-Traded Funds Inc.

db-X 2010 Target Date Fund (TDD)

db-X 2020 Target Date Fund (TDH)

db-X 2030 Target Date Fund (TDN)

db-X 2040 Target Date Fund (TDV)

db-X In-Target Date Fund (TDX)

db-X Exchange-Traded Funds Inc.

TABLE OF CONTENTS

TO OUR SHAREHOLDERS:

Dear Shareholder,

We are pleased to present this Semi-Annual Report for db-X Exchange-Traded Funds Inc, which covers the six-month period ending November 30, 2012.

We believe that these funds provide convenience and clarity for investors seeking a sophisticated product in one single investment. Over the past six months, the funds have continued to highlight the benefits of target-date investing. During the six months covered by this report, investors with a longer investment horizon benefitted from higher exposure to equities as the db-X 2040 Target Date Fund and the db-X 2030 Target Date Fund, which allocate a large percentage of assets to domestic and international equity securities, experienced net asset value (“NAV”) returns of 11.31% and 9.58%, respectively. The db-X 2020 Target Date Fund, with a more balanced allocation between equity and fixed income securities, experienced a NAV return of 6.36%. The db-X 2010 Target Date Fund and the db-X In-Target Date Fund, which have the greatest percentage allocations to fixed income securities experienced NAV returns of 1.74% and 3.44%, respectively.

Deutsche Bank, a leading global banking institution, has managed and operated a successful and growing platform of exchange-traded products since 2006. Our team at Deutsche Bank values the trust that you have placed in us and we look forward to meeting your investment needs by continuing to offer innovative index-driven strategies.

Very truly yours,

|

|

Alex Depetris Chairman, President and Chief Executive Officer |

Performance quoted above represents past performance, assumes reinvestment of all dividends and capital gains distributions at net asset value (“NAV”), and does not guarantee future results. A Fund’s NAV return is based on the changes in the Fund’s NAV per share for the period indicated. A Fund’s NAV per share is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. Current Fund performance may be higher or lower than the performance quoted. Fund performance data current to the most recent month end may be obtained by visiting www.dbxstrategicadvisors.db.com.

An index is a statistical measure of a specified financial market or sector. An index is unmanaged and one cannot invest directly in an index. An index does not actually hold a portfolio of securities, incur expenses, or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses. In comparison, a Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes that a shareholder would pay on Fund distributions or on transactions in Fund shares.

The views expressed in this report reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The management team’s views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Current and future portfolio holdings are subject to risk. Investment in the Funds poses investment risk, including possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost.

1

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

db-X 2010 Target Date Fund (TDD) (Unaudited)

The db-X 2010 Target Date Fund (the “Fund”) commenced investment operations and its shares began trading on NYSE Arca, Inc. (“NYSE Arca”) on October 1, 2007. The Fund seeks to track the performance, before fees and expenses, of the Zacks 2010 Lifecycle Index. Both the Fund’s equity and bond portfolios held fewer securities than the Zacks 2010 Lifecycle Index, a constraint imposed by the relatively small size of the Fund.

For the six-month period ended November 30, 2012, the Fund’s net asset value increased 1.74%, compared to an increase of 1.92% for the Zacks 2010 Lifecycle Index and 3.95% for the Dow Jones Target 2010 Index.

Performance as of 11/30/12

| | | | | | | | |

| Average Annual Total Returns |

| | | Net Asset Value | | Market Price | | Zacks 2010 Lifecycle

Index | | Dow Jones Target 2010

Index |

One Year | | 2.13% | | -6.89% | | 2.63% | | 7.21% |

Since Inception1 | | 0.95% | | -1.32% | | 1.24% | | 4.46% |

|

| Cumulative Total Return |

| | | Net Asset Value | | Market Price | | Zacks 2010 Lifecycle

Index | | Dow Jones Target 2010

Index |

Six Months | | 1.74% | | -3.58% | | 1.92% | | 3.95% |

One Year | | 2.13% | | -6.89% | | 2.63% | | 7.21% |

Since Inception1 | | 5.02% | | -6.63% | | 6.56% | | 25.33% |

1 Total returns are calculated based on the commencement of trading, 10/1/07 (“Inception”).

Performance quoted represents past performance, assumes reinvestment of all dividends and capital gain distributions, and does not guarantee future results. Current performance may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.dbxstrategicadvisors.db.com. Investment in the fund poses investment risk including possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The gross expense ratio for the fiscal year ended May 31, 2012, as disclosed in the most recent prospectus dated September 28, 2012, was 1.39%. DBX Strategic Advisors LLC, the advisor to the Fund, has agreed to cap its fees and/or pay certain Fund operating expenses in order to limit Fund net annual operating expenses for shares of the Fund to 0.65% of the Fund’s average net assets until 9/30/13.

The preceding performance chart is provided for comparative purposes and represents the period(s) noted. The net asset value return is based on the changes in the Fund’s net asset value per share (“NAV”). The Fund’s NAV is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. The market price return is based on the change in the market price on the NYSE Arca of a share of the Fund for the period(s) indicated. The price used to calculate market price returns is the midpoint of the bid/ask spread for Fund shares at 4 p.m. Eastern Time on the NYSE Arca. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. The Dow Jones Target Date Indexes are indexes whose allocations are automatically adjusted to reduce potential risk over time. The Dow Jones Target Date Indexes are designed to measure the performance of multi-asset class portfolios that allocate among U.S. and global stock, bond and cash sub indexes on a monthly basis. The indexes automatically adjust their asset allocation over time to reflect reductions in potential risk as the investor’s target date approaches.

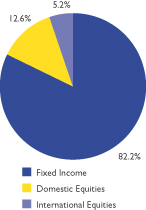

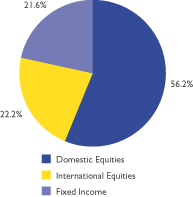

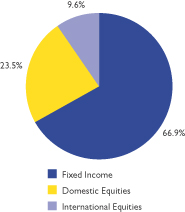

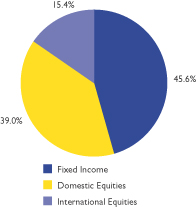

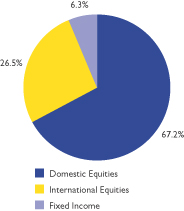

Asset Class Breakdown* as of 11/30/12

* Weightings are expressed as a percentage of total investments and may change over time.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes that a shareholder would pay on Fund distributions or on transactions in Fund shares.

“Target Date” refers to a time in the future, generally a specified year, in which the investor expects to retire or otherwise require the use of the invested funds. Target date funds are generally more aggressive the further the target date is from the present, with an objective of capital appreciation. As the target date approaches, the fund’s objective will generally become more conservative, aiming to achieve a higher level of capital preservation. Upon reaching the target date, the index whose performance the Fund seeks to track will have approximately a 10% allocation to equity securities. Over the next five years, allocations shift from conservative to more moderately-conservative allocations, allowing for a larger exposure to equities than at the target date (“Moderately-Conservative Allocation”).

Investors should note that although target date funds aim to preserve capital as the target date approaches, there is no guarantee that the Fund will achieve this objective.

2

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

db-X 2010 Target Date Fund (TDD) (Unaudited) (Continued)

Top Ten Holdings2 as of 11/30/12

| | | | | | | | | | | | |

| |

| Top Ten Equity Holdings | |

| | | |

| Description | | Shares | | | Value | | | % of Net Assets | |

Exxon Mobil Corp. | | | 497 | | | | $43,806 | | | | 0.5% | |

Apple, Inc. | | | 74 | | | | 43,311 | | | | 0.5% | |

Chevron Corp. | | | 250 | | | | 26,423 | | | | 0.3% | |

General Electric Co. | | | 1,210 | | | | 25,568 | | | | 0.3% | |

Microsoft Corp. | | | 879 | | | | 23,399 | | | | 0.2% | |

Procter & Gamble (The) Co. | | | 328 | | | | 22,904 | | | | 0.2% | |

Johnson & Johnson | | | 324 | | | | 22,592 | | | | 0.2% | |

Wal-Mart Stores, Inc. | | | 301 | | | | 21,677 | | | | 0.2% | |

Coca-Cola (The) Co. | | | 562 | | | | 21,312 | | | | 0.2% | |

Pfizer, Inc. | | | 823 | | | | 20,591 | | | | 0.2% | |

| | | | | | | | | | | | |

| |

| Top Ten Fixed Income Holdings | |

| | | |

| Description | | Principal Amount | | | Value | | | % of Net Assets | |

US Treasury Bond/Note 2.50%, 3/31/13 | | | $775,000 | | | | $781,085 | | | | 8.1% | |

US Treasury Bond/Note 1.75%, 3/31/14 | | | 500,000 | | | | 510,077 | | | | 5.3% | |

US Treasury Bond/Note 4.75%, 5/15/14 | | | 434,800 | | | | 463,232 | | | | 4.8% | |

US Treasury Bond/Note 2.375%, 9/30/14 | | | 435,000 | | | | 451,873 | | | | 4.7% | |

US Treasury Bond/Note 4.25%, 11/15/14 | | | 409,000 | | | | 440,745 | | | | 4.6% | |

US Treasury Bond/Note 3.50%, 5/31/13 | | | 429,500 | | | | 436,614 | | | | 4.5% | |

US Treasury Bond/Note 1.00%, 7/15/13 | | | 395,000 | | | | 397,099 | | | | 4.1% | |

US Treasury Bond/Note 0.50%, 10/15/14 | | | 395,000 | | | | 396,821 | | | | 4.1% | |

US Treasury Bond/Note 0.75%, 6/15/14 | | | 392,000 | | | | 395,109 | | | | 4.1% | |

US Treasury Bond/Note 0.25%, 12/15/14 | | | 395,000 | | | | 394,938 | | | | 4.1% | |

2 Holdings are subject to change without notice and there is no guarantee that the Fund will remain invested in any particular security. For a complete list of holdings go to www.dbxstrategicadvisors.db.com.

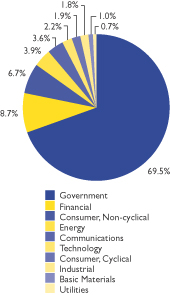

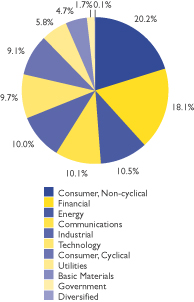

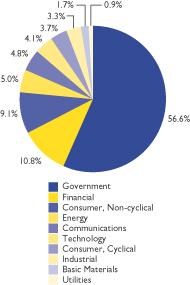

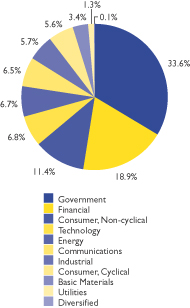

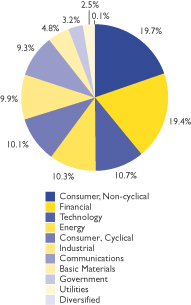

Sector Breakdown* as of 11/30/12

* Weightings are expressed as a percentage of total investments and may change over time. The sector classifications used above are based on company classifications under Bloomberg industry name.

3

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

db-X 2020 Target Date Fund (TDH) (Unaudited)

The db-X 2020 Target Date Fund (the “Fund”) commenced investment operations and its shares began trading on NYSE Arca, Inc. (“NYSE Arca”) on October 1, 2007. The Fund seeks to track the performance, before fees and expenses, of the Zacks 2020 Lifecycle Index. Both the Fund’s equity and bond portfolios held fewer securities than the Zacks 2020 Lifecycle Index, a constraint imposed by the relatively small size of the Fund.

For the six-month period ended November 30, 2012, the Fund’s net asset value increased 6.36%, compared to an increase of 6.64% for the Zacks 2020 Lifecycle Index and 5.98% for the Dow Jones Target 2020 Index.

Performance as of 11/30/12

| | | | | | | | |

| Average Annual Total Returns |

| | | Net Asset Value | | Market Price | | Zacks 2020 Lifecycle

Index | | Dow Jones Target 2020

Index |

One Year | | 8.20% | | 1.35% | | 7.96% | | 9.00% |

Since Inception1 | | 0.91% | | -0.58% | | 1.06% | | 2.84% |

|

| Cumulative Total Return |

| | | Net Asset Value | | Market Price | | Zacks 2020 Lifecycle

Index | | Dow Jones Target 2020

Index |

Six months | | 6.36% | | 5.76% | | 6.64% | | 5.98% |

One Year | | 8.20% | | 1.35% | | 7.96% | | 9.00% |

Since Inception1 | | 4.78% | | -2.98% | | 5.59% | | 15.59% |

1 Total returns are calculated based on the commencement of trading, 10/1/07 (“Inception”).

Performance quoted represents past performance, assumes reinvestment of all dividends and capital gain distributions, and does not guarantee future results. Current performance may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.dbxstrategicadvisors.db.com. Investment in the fund poses investment risk including possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The gross expense ratio for the fiscal year ended May 31, 2012, as disclosed in the most recent prospectus dated September 28, 2012, was 1.16%. DBX Strategic Advisors LLC, the advisor to the Fund, has agreed to cap its fees and/or pay certain Fund operating expenses in order to limit Fund net annual operating expenses for shares of the Fund to 0.65% of the Fund’s average net assets until 9/30/13.

The preceding performance chart is provided for comparative purposes and represents the period(s) noted. The net asset value return is based on the changes in the Fund’s net asset value per share (“NAV”). The Fund’s NAV is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. The market price return is based on the change in the market price on the NYSE Arca of a share of the Fund for the period(s) indicated. The price used to calculate market price returns is the midpoint of the bid/ask spread for Fund shares at 4 p.m. Eastern Time on the NYSE Arca. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. The Dow Jones Target Date Indexes are indexes whose allocations are automatically adjusted to reduce potential risk over time. The Dow Jones Target Date Indexes are designed to measure the performance of multi-asset class portfolios that allocate among U.S. and global stock, bond and cash subindexes on a monthly basis. The indexes automatically adjust their asset allocation over time to reflect reductions in potential risk as the investor’s target date approaches.

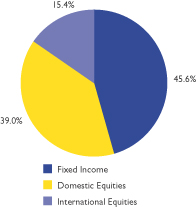

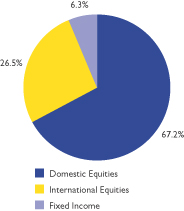

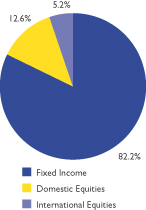

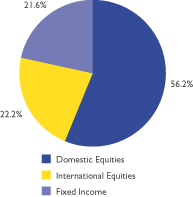

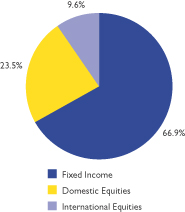

Asset Class Breakdown* as of 11/30/12

* Weightings are expressed as a percentage of total investments and may change over time.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes that a shareholder would pay on Fund distributions or on transactions in Fund shares.

“Target Date” refers to a time in the future, generally a specified year, in which the investor expects to retire or otherwise require the use of the invested funds. Target date funds are generally more aggressive the further the target date is from the present, with an objective of capital appreciation. As the target date approaches, the fund’s objective will generally become more conservative, aiming to achieve a higher level of capital preservation. Upon reaching the target date, the index whose performance the Fund seeks to track will have approximately a 10% allocation to equity securities. Over the next five years, allocations shift from conservative to more moderately-conservative allocations, allowing for a larger exposure to equities than at the target date (“Moderately-Conservative Allocation”).

Investors should note that although target date funds aim to preserve capital as the target date approaches, there is no guarantee that the Fund will achieve this objective.

4

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

db-X 2020 Target Date Fund (TDH) (Unaudited) (Continued)

Top Ten Holdings2 as of 11/30/12

| | | | | | | | | | | | |

| |

| Top Ten Equity Holdings | |

| | | |

| Description | | Shares | | | Value | | | % of Net Assets | |

Apple, Inc. | | | 919 | | | | $537,873 | | | | 1.8% | |

Exxon Mobil Corp. | | | 4,578 | | | | 403,505 | | | | 1.4% | |

Wal-Mart Stores, Inc. | | | 3,305 | | | | 238,026 | | | | 0.8% | |

International Business Machines Corp. | | | 1,212 | | | | 230,364 | | | | 0.8% | |

Microsoft Corp. | | | 8,581 | | | | 228,427 | | | | 0.8% | |

General Electric Co. | | | 10,791 | | | | 228,013 | | | | 0.8% | |

Google, Inc., Class A | | | 317 | | | | 221,383 | | | | 0.8% | |

Berkshire Hathaway, Inc., Class B | | | 2,420 | | | | 213,153 | | | | 0.7% | |

Chevron Corp. | | | 1,927 | | | | 203,665 | | | | 0.7% | |

AT&T, Inc. | | | 5,967 | | | | 203,654 | | | | 0.7% | |

| | | | | | | | | | | | |

| |

| Top Ten Fixed Income Holdings | |

| | | |

| Description | | Principal Amount | | | Value | | | % of Net Assets | |

US Treasury Bond/Note 0.75%, 9/15/13 | | | $1,111,900 | | | | $1,116,981 | | | | 3.8% | |

National Rural Utilities Cooperative Finance Corp. 1.00%, 2/02/15 | | | 784,000 | | | | 791,608 | | | | 2.7% | |

US Treasury Bond/Note 2.50%, 3/31/15 | | | 684,800 | | | | 720,164 | | | | 2.5% | |

US Treasury Bond/Note 2.625%, 12/31/14 | | | 652,400 | | | | 684,460 | | | | 2.4% | |

US Treasury Bond/Note 2.375%, 9/30/14 | | | 652,400 | | | | 677,706 | | | | 2.3% | |

US Treasury Bond/Note 2.375%, 2/28/15 | | | 641,800 | | | | 671,834 | | | | 2.3% | |

US Treasury Bond/Note 2.125%, 5/31/15 | | | 641,800 | | | | 670,982 | | | | 2.3% | |

US Treasury Bond/Note 0.375%, 3/15/15 | | | 659,800 | | | | 661,347 | | | | 2.3% | |

US Treasury Bond/Note 0.25%, 12/15/14 | | | 659,800 | | | | 659,697 | | | | 2.3% | |

US Treasury Bond/Note 1.25%, 9/30/15 | | | 642,700 | | | | 659,621 | | | | 2.3% | |

| | | | | | | | | | | | | |

2 Holdings are subject to change without notice and there is no guarantee that the Fund will remain invested in any particular security. For a complete list of holdings go to www.dbxstrategicadvisors.db.com.

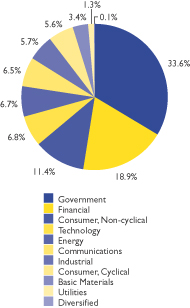

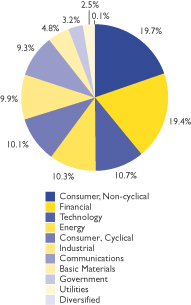

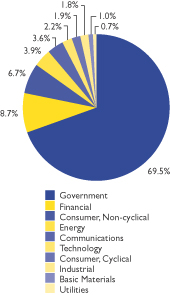

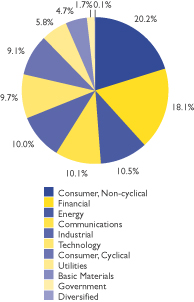

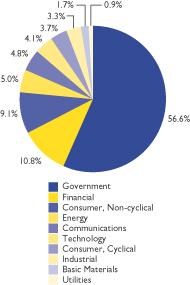

Sector Breakdown* as of 11/30/12

* Weightings are expressed as a percentage of total investments and may change over time. The sector classifications used above are based on company classifications under Bloomberg industry name.

5

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

db-X 2030 Target Date Fund (TDN) (Unaudited)

The db-X 2030 Target Date Fund (the “Fund”) commenced investment operations and its shares began trading on NYSE Arca, Inc. (“NYSE Arca”) on October 1, 2007. The Fund seeks to track the performance, before fees and expenses, of the Zacks 2030 Lifecycle Index. Both the Fund’s equity and bond portfolios held fewer securities than the Zacks 2030 Lifecycle Index, a constraint imposed by the relatively small size of the Fund.

For the six-month period ended November 30, 2012, the Fund’s net asset value increased 9.58%, compared to an increase of 10.36% for the Zacks 2030 Lifecycle Index and 8.11% for the Dow Jones Target 2030 Index.

Performance as of 11/30/12

| | | | | | | | |

| Average Annual Total Returns |

| | | Net Asset Value | | Market Price | | Zacks 2030 Lifecycle

Index | | Dow Jones Target 2030

Index |

One Year | | 14.30% | | 9.06% | | 15.33% | | 11.08% |

Since Inception1 | | -0.06% | | -1.57% | | 0.40% | | 1.61% |

|

| Cumulative Total Return |

| | | Net Asset Value | | Market Price | | Zacks 2030 Lifecycle

Index | | Dow Jones Target 2030

Index |

Six Months | | 9.58% | | 8.39% | | 10.36% | | 8.11% |

One Year | | 14.30% | | 9.06% | | 15.33% | | 11.08% |

Since Inception1 | | -0.32% | | -7.86% | | 2.07% | | 8.63% |

1 Total returns are calculated based on the commencement of trading, 10/1/07 (“Inception”).

Performance quoted represents past performance, assumes reinvestment of all dividends and capital gain distributions, and does not guarantee future results. Current performance may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.dbxstrategicadvisors.db.com. Investment in the fund poses investment risk including possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The gross expense ratio for the fiscal year ended May 31, 2012, as disclosed in the most recent prospectus dated September 28, 2012, was 1.18%. DBX Strategic Advisors LLC, the advisor to the Fund, has agreed to cap its fees and/or pay certain Fund operating expenses in order to limit Fund net annual operating expenses for shares of the Fund to 0.65% of the Fund’s average net assets until 9/30/13.

The preceding performance chart is provided for comparative purposes and represents the period(s) noted. The net asset value return is based on the changes in the Fund’s net asset value per share (“NAV”). The Fund’s NAV is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. The market price return is based on the change in the market price on the NYSE Arca of a share of the Fund for the period(s) indicated. The price used to calculate market price returns is the midpoint of the bid/ask spread for Fund shares at 4 p.m. Eastern Time on the NYSE Arca. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. The Dow Jones Target Date Indexes are indexes whose allocations are automatically adjusted to reduce potential risk over time. The Dow Jones Target Date Indexes are designed to measure the performance of multi-asset class portfolios that allocate among U.S. and global stock, bond and cash subindexes on a monthly basis. The indexes automatically adjust their asset allocation over time to reflect reductions in potential risk as the investor’s target date approaches.

Asset Class Breakdown* as of 11/30/12

* Weightings are expressed as a percentage of total investments and may change over time.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes that a shareholder would pay on Fund distributions or on transactions in Fund shares.

“Target Date” refers to a time in the future, generally a specified year, in which the investor expects to retire or otherwise require the use of the invested funds. Target date funds are generally more aggressive the further the target date is from the present, with an objective of capital appreciation. As the target date approaches, the fund’s objective will generally become more conservative, aiming to achieve a higher level of capital preservation. Upon reaching the target date, the index whose performance the Fund seeks to track will have approximately a 10% allocation to equity securities. Over the next five years, allocations shift from conservative to more moderately-conservative allocations, allowing for a larger exposure to equities than at the target date (“Moderately-Conservative Allocation”).

Investors should note that although target date funds aim to preserve capital as the target date approaches, there is no guarantee that the Fund will achieve this objective.

6

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

db-X 2030 Target Date Fund (TDN) (Unaudited) (Continued)

Top Ten Holdings2 as of 11/30/12

| | | | | | | | | | | | |

| |

| Top Ten Equity Holdings | |

| | | |

| Description | | Shares | | | Value | | | % of Net Assets | |

Apple, Inc. | | | 1,486 | | | | $869,726 | | | | 2.7% | |

Exxon Mobil Corp. | | | 7,528 | | | | 663,518 | | | | 2.0% | |

Wal-Mart Stores, Inc. | | | 5,396 | | | | 388,620 | | | | 1.2% | |

General Electric Co. | | | 18,117 | | | | 382,811 | | | | 1.2% | |

Microsoft Corp. | | | 13,964 | | | | 371,723 | | | | 1.1% | |

International Business Machines Corp. | | | 1,940 | | | | 368,735 | | | | 1.1% | |

Google, Inc., Class A | | | 521 | | | | 363,851 | | | | 1.1% | |

Berkshire Hathaway, Inc., Class B | | | 4,014 | | | | 353,554 | | | | 1.1% | |

AT&T, Inc. | | | 9,696 | | | | 330,924 | | | | 1.0% | |

Chevron Corp. | | | 3,083 | | | | 325,842 | | | | 1.0% | |

| | | | | | | | | | | | |

| |

| Top Ten Fixed Income Holdings | |

| | | |

| Description | | Principal Amount | | | Value | | | % of Net Assets | |

Procter & Gamble (The) Co., 5.55%, 3/05/37 | | | $217,000 | | | | $296,930 | | | | 0.9% | |

AT&T, Inc., 5.55%, 8/15/41 | | | 235,000 | | | | 282,926 | | | | 0.9% | |

Southern California Edison Co., 6.05%, 3/15/39 | | | 193,000 | | | | 268,183 | | | | 0.8% | |

General Electric Capital Corp., 2.10%, 1/07/14 | | | 260,000 | | | | 264,497 | | | | 0.8% | |

Shell International Finance BV (Netherlands)

6.375%, 12/15/38 | | | 176,000 | | | | 253,670 | | | | 0.8% | |

Amgen, Inc., 5.65%, 6/15/42 | | | 185,000 | | | | 225,299 | | | | 0.7% | |

Cisco Systems, Inc., 5.90%, 2/15/39 | | | 160,000 | | | | 211,731 | | | | 0.6% | |

US Treasury Bond/Note 4.375%, 5/15/41 | | | 130,000 | | | | 173,448 | | | | 0.5% | |

Johnson & Johnson, 5.95%, 8/15/37 | | | 118,000 | | | | 166,388 | | | | 0.5% | |

Florida Power & Light Co., 5.95%, 2/01/38 | | | 121,000 | | | | 163,980 | | | | 0.5% | |

2 Holdings are subject to change without notice and there is no guarantee that the Fund will remain invested in any particular security. For a complete list of holdings go to www.dbxstrategicadvisors.db.com.

Sector Breakdown* as of 11/30/12

* Weightings are expressed as a percentage of total investments and may change over time. The sector classifications used above are based on company classifications under Bloomberg industry name.

7

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

db-X 2040 Target Date Fund (TDV) (Unaudited)

The db-X 2040 Target Date Fund (the “Fund”) commenced investment operations and its shares began trading on NYSE Arca, Inc. (“NYSE Arca”) on October 1, 2007. The Fund seeks to track the performance, before fees and expenses, of the Zacks 2040 Lifecycle Index. Both the Fund’s equity and bond portfolios held fewer securities than the Zacks 2040 Lifecycle Index, a constraint imposed by the relatively small size of the Fund.

For the six-month period ended November 30, 2012, the Fund’s net asset value increased 11.31%, compared to an increase of 11.41% for the Zacks 2040 Lifecycle Index and 9.64% for the Dow Jones Target 2040 Index.

Performance as of 11/30/12

| | | | | | | | |

| Average Annual Total Returns |

| | | Net Asset Value | | Market Price | | Zacks 2040 Lifecycle

Index | | Dow Jones Target 2040

Index |

One Year | | 15.02% | | 18.96% | | 13.94% | | 12.49% |

Since Inception1 | | -0.96% | | -0.89% | | -1.00% | | 0.95% |

|

| Cumulative Total Return |

| | | Net Asset Value | | Market Price | | Zacks 2040 Lifecycle

Index | | Dow Jones Target 2040

Index |

Six Months | | 11.31% | | 10.31% | | 11.41% | | 9.64% |

One Year | | 15.02% | | 18.96% | | 13.94% | | 12.49% |

Since Inception1 | | -4.87% | | -4.50% | | -5.05% | | 5.00% |

1 Total returns are calculated based on the commencement of trading, 10/1/07 (“Inception”).

Performance quoted represents past performance, assumes reinvestment of all dividends and capital gain distributions, and does not guarantee future results. Current performance may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.dbxstrategicadvisors.db.com. Investment in the fund poses investment risk including possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The gross expense ratio for the fiscal year ended May 31, 2012, as disclosed in the most recent prospectus dated September 28, 2012, was 1.20%. DBX Strategic Advisors LLC, the advisor to the Fund, has agreed to cap its fees and/or pay certain Fund operating expenses in order to limit Fund net annual operating expenses for shares of the Fund to 0.65% of the Fund’s average net assets until 9/30/13.

The preceding performance chart is provided for comparative purposes and represents the period(s) noted. The net asset value return is based on the changes in the Fund’s net asset value per share (“NAV”). The Fund’s NAV is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. The market price return is based on the change in the market price on the NYSE Arca of a share of the Fund for the period(s) indicated. The price used to calculate market price returns is the midpoint of the bid/ask spread for Fund shares at 4 p.m. Eastern Time on the NYSE Arca. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. The Dow Jones Target Date Indexes are indexes whose allocations are automatically adjusted to reduce potential risk over time. The Dow Jones Target Date Indexes are designed to measure the performance of multi-asset class portfolios that allocate among U.S. and global stock, bond and cash subindexes on a monthly basis. The indexes automatically adjust their asset allocation over time to reflect reductions in potential risk as the investor’s target date approaches.

Asset Class Breakdown* as of 11/30/12

* Weightings are expressed as a percentage of total investments and may change over time.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes that a shareholder would pay on Fund distributions or on transactions in Fund shares.

“Target Date” refers to a time in the future, generally a specified year, in which the investor expects to retire or otherwise require the use of the invested funds. Target date funds are generally more aggressive the further the target date is from the present, with an objective of capital appreciation. As the target date approaches, the fund’s objective will generally become more conservative, aiming to achieve a higher level of capital preservation. Upon reaching the target date, the index whose performance the Fund seeks to track will have approximately a 10% allocation to equity securities. Over the next five years, allocations shift from conservative to more moderately-conservative allocations, allowing for a larger exposure to equities than at the target date (“Moderately-Conservative Allocation”).

Investors should note that although target date funds aim to preserve capital as the target date approaches, there is no guarantee that the Fund will achieve this objective.

8

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

db-X 2040 Target Date Fund (TDV) (Unaudited) (Continued)

Top Ten Holdings2 as of 11/30/12

| | | | | | | | | | | | |

| |

| Top Ten Equity Holdings | |

| | | |

| Description | | Shares | | | Value | | | % of Net Assets | |

Apple, Inc. | | | 1,466 | | | | $858,021 | | | | 3.2% | |

Exxon Mobil Corp. | | | 7,397 | | | | 651,971 | | | | 2.4% | |

Wal-Mart Stores, Inc. | | | 5,478 | | | | 394,525 | | | | 1.5% | |

Google, Inc., Class A | | | 549 | | | | 383,405 | | | | 1.4% | |

International Business Machines Corp. | | | 1,982 | | | | 376,720 | | | | 1.4% | |

Microsoft Corp. | | | 13,749 | | | | 365,999 | | | | 1.4% | |

General Electric Co. | | | 17,320 | | | | 365,972 | | | | 1.4% | |

Berkshire Hathaway, Inc., Class B | | | 4,042 | | | | 356,018 | | | | 1.3% | |

AT&T, Inc. | | | 9,806 | | | | 334,679 | | | | 1.2% | |

Chevron Corp. | | | 3,114 | | | | 329,118 | | | | 1.2% | |

| | | | | | | | | | | | |

| |

| Top Ten Fixed Income Holdings | |

| | | |

| Description | | Principal Amount | | | Value | | | % of Net Assets | |

US Treasury Bond/Note 4.375%, 11/15/39 | | | $112,200 | | | | $149,402 | | | | 0.6% | |

US Treasury Bond/Note 3.125%, 2/15/42 | | | 119,100 | | | | 127,827 | | | | 0.5% | |

US Treasury Bond/Note 4.625%, 2/15/40 | | | 85,700 | | | | 118,507 | | | | 0.4% | |

US Treasury Bond/Note 4.375%, 5/15/41 | | | 81,400 | | | | 108,605 | | | | 0.4% | |

US Treasury Bond/Note 3.875%, 8/15/40 | | | 84,800 | | | | 104,410 | | | | 0.4% | |

US Treasury Bond/Note 4.375%, 5/15/40 | | | 75,800 | | | | 101,027 | | | | 0.4% | |

US Treasury Bond/Note 4.75%, 2/15/41 | | | 68,500 | | | | 96,660 | | | | 0.4% | |

US Treasury Bond/Note 4.50%, 2/15/36 | | | 40,200 | | | | 54,038 | | | | 0.2% | |

AT&T, Inc., 5.55%, 8/15/41 | | | 30,000 | | | | 36,118 | | | | 0.1% | |

Procter & Gamble (The) Co., 5.55%, 3/05/37 | | | 26,000 | | | | 35,577 | | | | 0.1% | |

2 Holdings are subject to change without notice and there is no guarantee that the Fund will remain invested in any particular security. For a complete list of holdings go to www.dbxstrategicadvisors.db.com.

Sector Breakdown*

as of 11/30/12

* Weightings are expressed as a percentage of total investments and may change over time. The sector classifications used above are based on company classifications under Bloomberg industry name.

9

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

db-X In-Target Date Fund (TDX) (Unaudited)

The db-X In-Target Date Fund (the “Fund”) commenced investment operations and its shares began trading on NYSE Arca, Inc. (“NYSE Arca”) on October 1, 2007. The Fund seeks to track the performance, before fees and expenses, of the Zacks In-Target Lifecycle Index. Both the Fund’s equity and bond portfolios held fewer securities than the Zacks In-Target Lifecycle Index, a constraint imposed by the relatively small size of the Fund.

For the six-month period ended November 30, 2012, the Fund’s net asset value 3.44%, compared to an increase of 3.69% for the Zacks In-Target Lifecycle Index and an increase of 3.41% for the Dow Jones Target Today Index.

Performance as of 11/30/12

| | | | | | | | |

| Average Annual Total Returns |

| | | Net Asset Value | | Market Price | | Zacks In-Target Lifecycle

Index | | Dow Jones Target Today

Index |

One Year | | 4.32% | | -1.23% | | 4.83% | | 6.54% |

Since Inception1 | | 2.57% | | 0.96% | | 2.76% | | 5.36% |

|

| Cumulative Total Return |

| | | Net Asset Value | | Market Price | | Zacks In-Target Lifecycle

Index | | Dow Jones Target Today

Index |

Six Months | | 3.44% | | 3.43% | | 3.69% | | 3.41% |

One Year | | 4.32% | | -1.23% | | 4.83% | | 6.54% |

Since Inception1 | | 14.01% | | 5.05% | | 15.11% | | 30.99% |

1 Total returns are calculated based on the commencement of trading, 10/1/07 (“Inception”).

Performance quoted represents past performance, assumes reinvestment of all dividends and capital gain distributions, and does not guarantee future results. Current performance may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.dbxstrategicadvisors.db.com. Investment in the fund poses investment risk including possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The gross expense ratio for the fiscal year ended May 31, 2012, as disclosed in the most recent prospectus dated September 28, 2012, was 1.36%. DBX Strategic Advisors LLC, the advisor to the Fund, has agreed to cap its fees and/or pay certain Fund operating expenses in order to limit Fund net annual operating expenses for shares of the Fund to 0.65% of the Fund’s average net assets until 9/30/13.

The preceding performance chart is provided for comparative purposes and represents the period(s) noted. The net asset value return is based on the changes in the Fund’s net asset value per share (“NAV”). The Fund’s NAV is calculated by dividing the value of the Fund’s total assets less total liabilities by the number of shares outstanding. The market price return is based on the change in the market price on the NYSE Arca of a share of the Fund for the period(s) indicated. The price used to calculate market price returns is the midpoint of the bid/ask spread for Fund shares at 4 p.m. Eastern Time on the NYSE Arca. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. The Dow Jones Target Date Indexes are indexes whose allocations are automatically adjusted to reduce potential risk over time. The Dow Jones Target Date Indexes are designed to measure the performance of multi-asset class portfolios that allocate among U.S. and global stock, bond and cash subindexes on a monthly basis. The indexes automatically adjust their asset allocation over time to reflect reductions in potential risk as the investor’s target date approaches.

Asset Class Breakdown* as of 11/30/12

* Weightings are expressed as a percentage of total investments and may change over time.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes that a shareholder would pay on Fund distributions or on transactions in Fund shares.

“Target Date” refers to a time in the future, generally a specified year, in which the investor expects to retire or otherwise require the use of the invested funds. Target date funds are generally more aggressive the further the target date is from the present, with an objective of capital appreciation. As the target date approaches, the fund’s objective will generally become more conservative, aiming to achieve a higher level of capital preservation. Upon reaching the target date, the index whose performance the Fund seeks to track will have approximately a 10% allocation to equity securities. Over the next five years, allocations shift from conservative to more moderately-conservative allocations, allowing for a larger exposure to equities than at the target date (“Moderately-Conservative Allocation”).

Investors should note that although target date funds aim to preserve capital as the target date approaches, there is no guarantee that the Fund will achieve this objective.

10

db-X Exchange-Traded Funds Inc.

PERFORMANCE SUMMARY

db-X In-Target Date Fund (TDX) (Unaudited) (Continued)

Top Ten Holdings2 as of 11/30/12

| | | | | | | | | | | | |

| |

| Top Ten Equity Holdings | |

| | | |

| Description | | Shares | | | Value | | | % of Net Assets | |

Apple, Inc. | | | 193 | | | | $112,959 | | | | 1.1% | |

Exxon Mobil Corp. | | | 1,055 | | | | 92,989 | | | | 0.9% | |

Microsoft Corp. | | | 1,970 | | | | 52,441 | | | | 0.5% | |

General Electric Co. | | | 2,465 | | | | 52,086 | | | | 0.5% | |

Wal-Mart Stores, Inc. | | | 684 | | | | 49,262 | | | | 0.5% | |

International Business Machines Corp. | | | 250 | | | | 47,517 | | | | 0.4% | |

Berkshire Hathaway, Inc., Class B | | | 539 | | | | 47,474 | | | | 0.4% | |

AT&T, Inc. | | | 1,365 | | | | 46,588 | | | | 0.4% | |

Chevron Corp. | | | 431 | | | | 45,552 | | | | 0.4% | |

Johnson & Johnson | | | 625 | | | | 43,582 | | | | 0.4% | |

| | | | | | | | | | | | |

| |

| Top Ten Fixed Income Holdings | |

| | | |

| Description | | Principal Amount | | | Value | | | % of Net Assets | |

US Treasury Bond/Note 2.50%, 3/31/13 | | | $713,700 | | | | $719,304 | | | | 6.7% | |

US Treasury Bond/Note 4.75%, 5/15/14 | | | 602,900 | | | | 642,323 | | | | 6.0% | |

US Treasury Bond/Note 2.625%, 7/31/14 | | | 372,000 | | | | 386,706 | | | | 3.6% | |

US Treasury Bond/Note 1.25%, 2/15/14 | | | 363,700 | | | | 368,204 | | | | 3.4% | |

US Treasury Bond/Note 0.25%, 12/15/14 | | | 360,000 | | | | 359,944 | | | | 3.4% | |

US Treasury Bond/Note 2.125%,11/30/14 | | | 345,000 | | | | 357,776 | | | | 3.3% | |

US Treasury Bond/Note 1.75%, 4/15/13 | | | 355,000 | | | | 357,163 | | | | 3.3% | |

US Treasury Bond/Note 0.50%, 10/15/14 | | | 355,000 | | | | 356,637 | | | | 3.3% | |

US Treasury Bond/Note 1.375%, 2/15/13 | | | 355,000 | | | | 355,957 | | | | 3.3% | |

US Treasury Bond/Note 0.75%, 615/14 | | | 352,000 | | | | 354,791 | | | | 3.3% | |

2 Holdings are subject to change without notice and there is no guarantee that the Fund will remain invested in any particular security. For a complete list of holdings go to www.dbxstrategicadvisors.db.com.

Sector Breakdown* as of 11/30/12

* Weightings are expressed as a percentage of total investments and may change over time. The sector classifications used above are based on company classifications under Bloomberg industry name.

11

db-X Exchange-Traded Funds Inc.

FEES AND EXPENSES (Unaudited)

As a shareholder of one or more of the funds of db-X Exchange-Traded Funds Inc. (each, a “Fund” and collectively, the “Funds” or “db-X Target Date Funds”), you incur advisory fees and other Fund expenses. The expense examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other funds.

The examples are based on an investment of $1,000 made at the beginning of the period and held through the six month period ended November 30, 2012.

ACTUAL EXPENSES

The first line in the following tables provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line in the following tables provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses (which is not the Funds’ actual return). The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only, and do not reflect any transactional costs. Therefore the second line in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

June 1, 2012 | | | Ending

Account Value

November 30, 2012 | | | Annualized

Expense Ratio(1)

based on the number of

days in the period | | | Expenses Paid

During the Period(2)

June 1, 2012 to

November 30, 2012 | |

| db-X 2010 Target Date Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,017.40 | | | | 0.65 | % | | $ | 3.29 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.81 | | | | 0.65 | % | | $ | 3.29 | |

| db-X 2020 Target Date Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,063.60 | | | | 0.65 | % | | $ | 3.36 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.81 | | | | 0.65 | % | | $ | 3.29 | |

| db-X 2030 Target Date Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,095.80 | | | | 0.65 | % | | $ | 3.42 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.81 | | | | 0.65 | % | | $ | 3.29 | |

| db-X 2040 Target Date Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,113.10 | | | | 0.65 | % | | $ | 3.44 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.81 | | | | 0.65 | % | | $ | 3.29 | |

| db-X In-Target Date Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,034.40 | | | | 0.65 | % | | $ | 3.31 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.81 | | | | 0.65 | % | | $ | 3.29 | |

(1) DBX Strategic Advisors LLC (the “Advisor”), has contractually agreed to reduce its fees and/or pay Fund operating expenses (excluding, among other things, acquired fund fees and expenses, interest, taxes and extraordinary expenses) in order to limit each Fund’s net annual operating expenses for shares of each Fund to 0.65% of the Fund’s average net assets (the “Expense Cap”). The Expense Cap will remain in effect until September 30, 2013. The Advisor is permitted to be reimbursed for fee reductions and/or expense payments made in the prior three fiscal years. This reimbursement may be paid to the Advisor if the aggregate amount actually paid by a Fund toward operating expenses for such fiscal year (taking into account the reimbursement) does not exceed the Expense Cap. Ratios would have been higher if fees were not reduced by the Advisor.

(2) Expenses are calculated using the annualized expense ratio, which represents the ongoing expenses as a percentage of net assets for the period June 1, 2012 to November 30, 2012. Expenses are calculated by multiplying the Fund’s annualized expense ratio by the average account value for the period; then multiplying the result by 183 days and then dividing the result by 365.

12

db-X Exchange-Traded Funds Inc.

SCHEDULE OF INVESTMENTS

db-X 2010 Target Date Fund

November 30, 2012 (Unaudited)

| | | | | | | | |

| | | Number

of Shares | | | Value | |

| | | | | | | | |

| COMMON STOCKS — 17.7% | | | | | | | | |

| Basic Materials — 1.0% | | | | | | | | |

Air Liquide S.A. (France) | | | 29 | | | $ | 3,542 | |

Anglo American PLC (United Kingdom) | | | 139 | | | | 3,859 | |

BASF SE (Germany) | | | 80 | | | | 7,169 | |

BHP Billiton Ltd. (Australia) | | | 274 | | | | 9,831 | |

BHP Billiton PLC (United Kingdom) | | | 167 | | | | 5,251 | |

Coeur d’Alene Mines Corp.* | | | 50 | | | | 1,163 | |

Dow Chemical (The) Co. | | | 116 | | | | 3,502 | |

E.I. du Pont de Nemours & Co. | | | 137 | | | | 5,910 | |

Freeport-McMoRan Copper & Gold, Inc. | | | 100 | | | | 3,901 | |

International Paper Co. | | | 200 | | | | 7,428 | |

Linde AG (Germany) | | | 17 | | | | 2,940 | |

Monsanto Co. | | | 100 | | | | 9,159 | |

Rio Tinto Ltd. (Australia) | | | 46 | | | | 2,819 | |

Rio Tinto PLC (United Kingdom) | | | 123 | | | | 6,099 | |

Sherwin-Williams (The) Co. | | | 100 | | | | 15,251 | |

Syngenta AG (Switzerland) | | | 8 | | | | 3,208 | |

Xstrata PLC (United Kingdom) | | | 191 | | | | 3,165 | |

| | | | | | | | |

| | | | | | | 94,197 | |

| | | | | | | | |

| Communications — 1.6% | | | | | | | | |

Amazon.com, Inc.* | | | 33 | | | | 8,318 | |

Anixter International, Inc. | | | 105 | | | | 6,413 | |

AT&T, Inc. | | | 598 | | | | 20,410 | |

Bankrate, Inc.* | | | 100 | | | | 1,203 | |

Brightcove, Inc.* | | | 100 | | | | 972 | |

BT Group PLC, Class A (United Kingdom) | | | 709 | | | | 2,653 | |

Centurylink, Inc. | | | 100 | | | | 3,884 | |

Cisco Systems, Inc. | | | 600 | | | | 11,346 | |

Comcast Corp., Class A | | | 240 | | | | 8,923 | |

Consolidated Communications Holdings, Inc. | | | 100 | | | | 1,504 | |

Corning, Inc. | | | 156 | | | | 1,908 | |

Deutsche Telekom AG (Germany) | | | 290 | | | | 3,195 | |

France Telecom S.A. (France) | | | 197 | | | | 2,085 | |

Google, Inc., Class A* | | | 19 | | | | 13,269 | |

Leap Wireless International, Inc.* | | | 300 | | | | 1,950 | |

News Corp., Class A | | | 165 | | | | 4,066 | |

Softbank Corp. (Japan) | | | 100 | | | | 3,747 | |

Telefonaktiebolaget LM Ericsson, Class B (Sweden) | | | 574 | | | | 5,345 | |

Telefonica S.A. (Spain) | | | 387 | | | | 5,079 | |

Thomson Reuters Corp. (Canada) | | | 100 | | | | 2,754 | |

Time Warner, Inc. | | | 123 | | | | 5,818 | |

Verizon Communications, Inc. | | | 329 | | | | 14,515 | |

Vodafone Group PLC (United Kingdom) | | | 3,915 | | | | 10,111 | |

Vonage Holdings Corp.* | | | 1,000 | | | | 2,430 | |

Walt Disney (The) Co. | | | 185 | | | | 9,187 | |

| | | | | | | | |

| | | | | | | 151,085 | |

| | | | | | | | |

| Consumer, Cyclical — 1.9% | | | | | | | | |

Arctic Cat, Inc.* | | | 100 | | | | 3,763 | |

Ascena Retail Group, Inc.* | | | 67 | | | | 1,347 | |

Bayerische Motoren Werke AG (Germany) | | | 35 | | | | 3,104 | |

Cash America International, Inc. | | | 100 | | | | 3,724 | |

Cie Financiere Richemont S.A. (Switzerland) | | | 54 | | | | 4,165 | |

Cinemark Holdings, Inc. | | | 34 | | | | 925 | |

Compass Group PLC (United Kingdom) | | | 241 | | | | 2,785 | |

| | | | | | | | |

| | | Number

of Shares | | | Value | |

| | | | | | | | |

| Consumer, Cyclical (Continued) | | | | | | | | |

CVS Caremark Corp. | | | 227 | | | $ | 10,558 | |

Daimler AG (Germany) | | | 84 | | | | 4,149 | |

Dana Holding Corp. | | | 100 | | | | 1,418 | |

Dr Horton, Inc. | | | 100 | | | | 1,946 | |

DTS, Inc.* | | | 100 | | | | 1,528 | |

Ford Motor Co. | | | 499 | | | | 5,714 | |

GNC Holdings, Inc., Class A | | | 100 | | | | 3,513 | |

Hennes & Mauritz AB, Class B (Sweden) | | | 31 | | | | 1,005 | |

Honda Motor Co. Ltd. (Japan) | | | 131 | | | | 4,340 | |

Inditex S.A. (Spain) | | | 26 | | | | 3,564 | |

JetBlue Airways Corp.* | | | 200 | | | | 1,028 | |

Kohl’s Corp. | | | 134 | | | | 5,982 | |

Krispy Kreme Doughnuts, Inc.* | | | 300 | | | | 2,730 | |

Las Vegas Sands Corp. | | | 67 | | | | 3,126 | |

Lennar Corp., Class A | | | 100 | | | | 3,804 | |

Life Time Fitness, Inc.* | | | 100 | | | | 4,705 | |

Lions Gate Entertainment Corp. (Canada)* | | | 100 | | | | 1,638 | |

Lowe’s Cos., Inc. | | | 100 | | | | 3,609 | |

LVMH Moet Hennessy Louis Vuitton S.A. (France) | | | 19 | | | | 3,334 | |

Maidenform Brands, Inc.* | | | 100 | | | | 1,837 | |

MDC Holdings, Inc. | | | 100 | | | | 3,524 | |

Men’s Wearhouse (The), Inc. | | | 100 | | | | 3,244 | |

Mitsui & Co. Ltd. (Japan) | | | 200 | | | | 2,762 | |

Nissan Motor Co. Ltd. (Japan) | | | 300 | | | | 2,907 | |

Penske Automotive Group, Inc. | | | 167 | | | | 4,865 | |

Red Robin Gourmet Burgers, Inc.* | | | 100 | | | | 3,275 | |

Ross Stores, Inc. | | | 100 | | | | 5,692 | |

Ruby Tuesday, Inc.* | | | 300 | | | | 2,343 | |

Ryman Hospitality Properties REIT | | | 100 | | | | 3,322 | |

Saks, Inc.* | | | 167 | | | | 1,754 | |

Southwest Airlines Co. | | | 400 | | | | 3,812 | |

Systemax, Inc.* | | | 100 | | | | 1,030 | |

Target Corp. | | | 67 | | | | 4,230 | |

Toyota Motor Corp. (Japan) | | | 233 | | | | 9,986 | |

VF Corp. | | | 100 | | | | 16,050 | |

Wabash National Corp.* | | | 300 | | | | 2,427 | |

Wal-Mart Stores, Inc. | | | 301 | | | | 21,677 | |

World Fuel Services Corp. | | | 10 | | | | 390 | |

| | | | | | | | |

| | | | | | | 182,631 | |

| | | | | | | | |

| Consumer, Non-cyclical — 3.7% | | | | | | | | |

Abbott Laboratories | | | 150 | | | | 9,750 | |

Acacia Research — Acacia Technologies* | | | 100 | | | | 2,223 | |

Accuray, Inc.* | | | 300 | | | | 1,884 | |

Aetna, Inc. | | | 200 | | | | 8,639 | |

Align Technology, Inc.* | | | 100 | | | | 2,739 | |

Anheuser-Busch InBev NV (Belgium) | | | 67 | | | | 5,872 | |

Ariad Pharmaceuticals, Inc.* | | | 100 | | | | 2,236 | |

AstraZeneca PLC (United Kingdom) | | | 81 | | | | 3,851 | |

Avanir Pharmaceuticals, Inc., Class A* | | | 600 | | | | 1,584 | |

Bayer AG (Germany) | | | 65 | | | | 5,880 | |

Becton Dickinson and Co. | | | 100 | | | | 7,667 | |

BioScrip, Inc.* | | | 300 | | | | 3,090 | |

Bristol-Myers Squibb Co. | | | 134 | | | | 4,372 | |

British American Tobacco PLC

(United Kingdom) | | | 179 | | | | 9,393 | |

| | | | |

| See Notes to Financial Statements. | | 13 | | |

db-X Exchange-Traded Funds Inc.

SCHEDULE OF INVESTMENTS

db-X 2010 Target Date Fund (Continued)

November 30, 2012 (Unaudited)

| | | | | | | | |

| | | Number

of Shares | | | Value | |

| | | | | | | | |

| Consumer, Non-cyclical (Continued) | | | | | | | | |

Capella Education Co.* | | | 100 | | | $ | 2,767 | |

Centene Corp.* | | | 100 | | | | 4,391 | |

Chemocentryx, Inc.* | | | 100 | | | | 1,185 | |

Coca-Cola (The) Co. | | | 562 | | | | 21,312 | |

CONMED Corp. | | | 67 | | | | 1,851 | |

Convergys Corp. | | | 100 | | | | 1,561 | |

CSL Ltd. (Australia) | | | 61 | | | | 3,290 | |

DANONE S.A. (France) | | | 45 | | | | 2,855 | |

Diageo PLC (United Kingdom) | | | 238 | | | | 7,083 | |

Fresh Del Monte Produce, Inc. | | | 100 | | | | 2,595 | |

FTI Consulting, Inc.* | | | 100 | | | | 3,091 | |

Geo Group (The), Inc. | | | 67 | | | | 1,889 | |

GlaxoSmithKline PLC (United Kingdom) | | | 412 | | | | 8,812 | |

Hanger, Inc.* | | | 100 | | | | 2,611 | |

Harris Teeter Supermarkets, Inc. | | | 25 | | | | 950 | |

Imperial Tobacco Group PLC

(United Kingdom) | | | 70 | | | | 2,801 | |

Incyte Corp. Ltd.* | | | 67 | | | | 1,179 | |

JM Smucker (The) Co. | | | 67 | | | | 5,927 | |

Johnson & Johnson | | | 324 | | | | 22,592 | |

Live Nation Entertainment, Inc.* | | | 83 | | | | 729 | |

Magellan Health Services, Inc.* | | | 7 | | | | 363 | |

Medtronic, Inc. | | | 100 | | | | 4,211 | |

Merck & Co., Inc. | | | 284 | | | | 12,581 | |

Molina Healthcare, Inc.* | | | 67 | | | | 1,865 | |

Mondelez International, Inc., Class A | | | 252 | | | | 6,524 | |

Nestle S.A. (Switzerland) | | | 264 | | | | 17,283 | |

Novartis AG (Switzerland) | | | 183 | | | | 11,329 | |

Novo Nordisk A/S, Class B (Denmark) | | | 32 | | | | 5,082 | |

Pfizer, Inc. | | | 823 | | | | 20,591 | |

Pilgrim’s Pride Corp.* | | | 400 | | | | 2,856 | |

Procter & Gamble (The) Co. | | | 328 | | | | 22,904 | |

Quad/Graphics, Inc. | | | 100 | | | | 1,620 | |

Reckitt Benckiser Group PLC

(United Kingdom) | | | 51 | | | | 3,208 | |

Rent-A-Center, Inc. | | | 100 | | | | 3,476 | |

Roche Holding AG (Switzerland) | | | 59 | | | | 11,617 | |

Rollins, Inc. | | | 21 | | | | 478 | |

Sabmiller PLC (United Kingdom) | | | 67 | | | | 3,036 | |

Salix Pharmaceuticals Ltd.* | | | 50 | | | | 2,143 | |

Sanofi (France) | | | 62 | | | | 5,537 | |

Santarus, Inc.* | | | 300 | | | | 2,991 | |

Seaboard Corp.* | | | 1 | | | | 2,360 | |

Seattle Genetics, Inc.* | | | 67 | | | | 1,696 | |

Select Medical Holdings Corp.* | | | 67 | | | | 740 | |

Sequenom, Inc.* | | | 500 | | | | 2,435 | |

Spectrum Brands Holdings, Inc. | | | 100 | | | | 4,783 | |

Takeda Pharmaceutical Co. Ltd. (Japan) | | | 100 | | | | 4,571 | |

Tesco PLC (United Kingdom) | | | 779 | | | | 4,059 | |

Teva Pharmaceutical Industries Ltd. (Israel) | | | 93 | | | | 3,782 | |

TNS, Inc.* | | | 100 | | | | 1,460 | |

Unilever NV (Netherlands) | | | 159 | | | | 6,033 | |

Unilever PLC (United Kingdom) | | | 125 | | | | 4,814 | |

UnitedHealth Group, Inc. | | | 114 | | | | 6,200 | |

Viropharma, Inc.* | | | 67 | | | | 1,661 | |

Woolworths Ltd. (Australia) | | | 100 | | | | 3,055 | |

| | | | | | | | |

| | | | | | | 355,995 | |

| | | | | | | | |

| | | | | | | | |

| | | Number

of Shares | | | Value | |

| | | | | | | | |

| Energy — 2.0% | | | | | | | | |

BG Group PLC (United Kingdom) | | | 277 | | | $ | 4,750 | |

BP PLC (United Kingdom) | | | 1,477 | | | | 10,216 | |

Cameron International Corp.* | | | 167 | | | | 9,010 | |

Cheniere Energy, Inc.* | | | 100 | | | | 1,680 | |

Chevron Corp. | | | 250 | | | | 26,423 | |

ConocoPhillips | | | 126 | | | | 7,174 | |

Continental Resources, Inc.* | | | 100 | | | | 6,870 | |

CVR Energy, Inc.* | | | 100 | | | | 4,574 | |

Dril-Quip, Inc.* | | | 9 | | | | 633 | |

Energy XXI Bermuda Ltd. (Bermuda) | | | 100 | | | | 3,168 | |

ENI S.p.A (Italy) | | | 153 | | | | 3,618 | |

Exxon Mobil Corp. | | | 497 | | | | 43,806 | |

Hess Corp. | | | 200 | | | | 9,922 | |

Kodiak Oil & Gas Corp.* | | | 200 | | | | 1,716 | |

McMoRan Exploration Co.* | | | 67 | | | | 572 | |

Oasis Petroleum, Inc.* | | | 100 | | | | 3,022 | |

Royal Dutch Shell PLC, Class A

(United Kingdom) | | | 298 | | | | 9,979 | |

Royal Dutch Shell PLC, Class B

(United Kingdom) | | | 208 | | | | 7,182 | |

Schlumberger Ltd. (Netherland Antilles) | | | 105 | | | | 7,520 | |

Southwestern Energy Co.* | | | 196 | | | | 6,803 | |

Statoil ASA (Norway) | | | 106 | | | | 2,592 | |

Targa Resources Corp. | | | 100 | | | | 5,009 | |

Tesco Corp.* | | | 200 | | | | 2,160 | |

Total S.A. (France) | | | 184 | | | | 9,207 | |

Vantage Drilling Co.* | | | 1,267 | | | | 2,281 | |

Williams (The) Cos., Inc. | | | 100 | | | | 3,284 | |

Woodside Petroleum Ltd. (Australia) | | | 80 | | | | 2,821 | |

| | | | | | | | |

| | | | | | | 195,992 | |

| | | | | | | | |

| Financial — 3.5% | | | | | | | | |

AIA Group Ltd. (Hong Kong) | | | 800 | | | | 3,112 | |

Allianz SE (Germany) | | | 21 | | | | 2,730 | |

Alterra Capital Holdings Ltd. (Bermuda) | | | 67 | | | | 1,568 | |

American Campus Communities, Inc. REIT | | | 7 | | | | 307 | |

American Express Co. | | | 100 | | | | 5,590 | |

American International Group, Inc.* | | | 234 | | | | 7,752 | |

AON PLC (United Kingdom) | | | 200 | | | | 11,360 | |

Australia & New Zealand Banking Group Ltd. (Australia) | | | 186 | | | | 4,727 | |

Banco Bilbao Vizcaya Argentaria S.A. (Spain) | | | 321 | | | | 2,724 | |

Banco Santander S.A. (Spain) | | | 1,346 | | | | 10,353 | |

Bank of America Corp. | | | 1,160 | | | | 11,438 | |

Barclays PLC (United Kingdom) | | | 757 | | | | 2,984 | |

Berkshire Hathaway, Inc., Class B* | | | 212 | | | | 18,674 | |

BioMed Realty Trust, Inc. REIT | | | 133 | | | | 2,563 | |

BNP Paribas (France) | | | 152 | | | | 8,490 | |

Boston Properties, Inc. REIT | | | 80 | | | | 8,210 | |

CBL & Associates Properties, Inc. REIT | | | 100 | | | | 2,251 | |

Citigroup, Inc. | | | 328 | | | | 11,339 | |

Citizens, Inc.* | | | 200 | | | | 2,012 | |

Commonwealth Bank of Australia (Australia) | | | 129 | | | | 8,033 | |

Deutsche Bank AG (Germany) (a) | | | 56 | | | | 2,472 | |

Equity One, Inc. REIT | | | 73 | | | | 1,509 | |

Extra Space Storage, Inc. REIT | | | 100 | | | | 3,515 | |

Franklin Resources, Inc. | | | 21 | | | | 2,772 | |

| | | | |

| See Notes to Financial Statements. | | 14 | | |

db-X Exchange-Traded Funds Inc.

SCHEDULE OF INVESTMENTS

db-X 2010 Target Date Fund (Continued)

November 30, 2012 (Unaudited)

| | | | | | | | |

| | | Number

of Shares | | | Value | |

| | | | | | | | |

| Financial (Continued) | | | | | | | | |

Goldman Sachs Group (The), Inc. | | | 39 | | | $ | 4,594 | |

Hancock Holding Co. | | | 100 | | | | 3,142 | |

Hatteras Financial Corp. REIT | | | 67 | | | | 1,786 | |

Highwoods Properties, Inc. REIT | | | 54 | | | | 1,741 | |

HSBC Holdings PLC (United Kingdom) | | | 1,524 | | | | 15,575 | |

ING Groep NV (Netherlands)* | | | 381 | | | | 3,424 | |

Invesco Mortgage Capital, Inc. REIT | | | 67 | | | | 1,418 | |

JPMorgan Chase & Co. | | | 415 | | | | 17,048 | |

Kilroy Realty Corp. REIT | | | 50 | | | | 2,255 | |

LaSalle Hotel Properties REIT | | | 150 | | | | 3,617 | |

Marsh & McLennan Cos., Inc. | | | 100 | | | | 3,522 | |

Meadowbrook Insurance Group, Inc. | | | 234 | | | | 1,301 | |

MFA Financial, Inc. REIT | | | 226 | | | | 1,901 | |

Mitsubishi UFJ Financial Group, Inc. (Japan) | | | 1,000 | | | | 4,571 | |

Mizuho Financial Group, Inc. (Japan) | | | 1,113 | | | | 1,781 | |

Monmouth Real Estate Investment Corp.,

Class A REIT | | | 200 | | | | 2,100 | |

Muenchener Rueckversicherungs-Gesellschaft AG (Germany) | | | 18 | | | | 3,073 | |

National Australia Bank Ltd. (Australia) | | | 175 | | | | 4,436 | |

National Retail Properties, Inc. REIT | | | 65 | | | | 1,997 | |

Ocwen Financial Corp.* | | | 100 | | | | 3,586 | |

OMEGA Healthcare Investors, Inc. REIT | | | 65 | | | | 1,490 | |

Primerica, Inc. | | | 67 | | | | 1,918 | |

ProLogis, Inc. REIT | | | 200 | | | | 6,788 | |

Prudential PLC (United Kingdom) | | | 237 | | | | 3,437 | |

PS Business Parks, Inc. REIT | | | 100 | | | | 6,449 | |

Republic Bancorp, Inc., Class A | | | 100 | | | | 2,047 | |

Shopping Centres Australasia Property Group REIT (Australia)* | | | 20 | | | | 30 | |

Simon Property Group, Inc. REIT | | | 42 | | | | 6,389 | |

Sovran Self Storage, Inc. REIT | | | 100 | | | | 6,179 | |

Standard Chartered PLC (United Kingdom) | | | 300 | | | | 6,996 | |

Starwood Property Trust, Inc. REIT | | | 100 | | | | 2,286 | |

Sumitomo Mitsui Financial Group, Inc. (Japan) | | | 81 | | | | 2,607 | |

T. Rowe Price Group, Inc. | | | 183 | | | | 11,835 | |

Tanger Factory Outlet Centers, Inc. REIT | | | 67 | | | | 2,203 | |

Taylor Capital Group, Inc.* | | | 100 | | | | 1,760 | |

Texas Capital Bancshares, Inc.* | | | 100 | | | | 4,504 | |

Two Harbors Investment Corp. REIT | | | 200 | | | | 2,264 | |

U.S. Bancorp | | | 200 | | | | 6,452 | |

UBS AG (Switzerland) | | | 337 | | | | 5,275 | |

Visa, Inc., Class A | | | 93 | | | | 13,923 | |

Washington Real Estate Investment Trust REIT | | | 33 | | | | 855 | |

Wells Fargo & Co. | | | 572 | | | | 18,882 | |

Westpac Banking Corp. (Australia) | | | 261 | | | | 6,943 | |

Zurich Financial Services AG (Switzerland) | | | 3 | | | | 766 | |

| | | | | | | | |

| | | | | | | 341,631 | |

| | | | | | | | |

| Industrial — 1.8% | | | | | | | | |

ABB Ltd. (Switzerland) | | | 219 | | | | 4,269 | |

Altra Holdings, Inc. | | | 100 | | | | 1,881 | |

Apogee Enterprises, Inc. | | | 100 | | | | 2,292 | |

Boeing (The) Co. | | | 100 | | | | 7,428 | |

Builders FirstSource, Inc.* | | | 400 | | | | 2,080 | |

Caterpillar, Inc. | | | 66 | | | | 5,626 | |

Chart Industries, Inc.* | | | 100 | | | | 6,048 | |

| | | | | | | | |

| | | Number

of Shares | | | Value | |

| | | | | | | | |

| Industrial (Continued) | | | | | | | | |

Colfax Corp.* | | | 100 | | | $ | 3,899 | |

Darling International, Inc.* | | | 100 | | | | 1,687 | |

Eaton Corp.* | | | 136 | | | | 7,093 | |

EMCOR Group, Inc. | | | 100 | | | | 3,285 | |

Emerson Electric Co. | | | 87 | | | | 4,370 | |

Fabrinet (Cayman Islands)* | | | 200 | | | | 2,484 | |

FedEx Corp. | | | 50 | | | | 4,477 | |

FEI Co. | | | 100 | | | | 5,503 | |

General Dynamics Corp. | | | 25 | | | | 1,663 | |

General Electric Co. | | | 1,210 | | | | 25,568 | |

Graphic Packaging Holding Co.* | | | 300 | | | | 1,947 | |

Hexcel Corp.* | | | 100 | | | | 2,585 | |

Ingersoll-Rand PLC (Ireland) | | | 134 | | | | 6,537 | |

Koninklijke Philips Electronics NV (Netherlands) | | | 106 | | | | 2,738 | |

Mueller Industries, Inc. | | | 100 | | | | 4,776 | |

Robbins & Myers, Inc. | | | 100 | | | | 5,940 | |

Rolls-Royce Holdings PLC (United Kingdom) | | | 186 | | | | 2,655 | |

Schneider Electric S.A. (France) | | | 44 | | | | 3,093 | |

Siemens AG (Germany) | | | 67 | | | | 6,910 | |

Smith & Wesson Holding Corp.* | | | 200 | | | | 2,120 | |

Stanley Black & Decker, Inc. | | | 67 | | | | 4,818 | |

Tetra Tech, Inc.* | | | 100 | | | | 2,577 | |

Tredegar Corp. | | | 100 | | | | 1,885 | |

Union Pacific Corp. | | | 100 | | | | 12,278 | |

United Parcel Service, Inc., Class B | | | 77 | | | | 5,629 | |

United Technologies Corp. | | | 100 | | | | 8,010 | |

Vinci S.A. (France) | | | 41 | | | | 1,809 | |

Woodward, Inc. | | | 100 | | | | 3,657 | |

| | | | | | | | |

| | | | | | | 169,617 | |

| | | | | | | | |

| Technology — 1.9% | | | | | | | | |

Accelrys, Inc.* | | | 200 | | | | 1,762 | |

Activision Blizzard, Inc. | | | 501 | | | | 5,731 | |

Apple, Inc. | | | 74 | | | | 43,311 | |

Applied Materials, Inc. | | | 700 | | | | 7,512 | |

ASML Holding NV (Netherlands) | | | 36 | | | | 2,249 | |

Aspen Technology, Inc.* | | | 100 | | | | 2,599 | |

CACI International, Inc., Class A* | | | 100 | | | | 5,115 | |

Canon, Inc. (Japan) | | | 100 | | | | 3,496 | |

Citrix Systems, Inc.* | | | 100 | | | | 6,116 | |

Concur Technologies, Inc.* | | | 21 | | | | 1,380 | |

Cray, Inc.* | | | 200 | | | | 2,844 | |

Dell, Inc. | | | 200 | | | | 1,928 | |

EMC Corp.* | | | 200 | | | | 4,964 | |

EPIQ Systems, Inc. | | | 167 | | | | 2,002 | |

Fidelity National Information Services, Inc. | | | 100 | | | | 3,610 | |

Hewlett-Packard Co. | | | 200 | | | | 2,598 | |

International Business Machines Corp. | | | 100 | | | | 19,007 | |

Jack Henry & Associates, Inc. | | | 169 | | | | 6,569 | |

JDA Software Group, Inc.* | | | 100 | | | | 4,466 | |

Mentor Graphics Corp.* | | | 100 | | | | 1,493 | |

Microsemi Corp.* | | | 67 | | | | 1,282 | |

Microsoft Corp. | | | 879 | | | | 23,399 | |

Netsuite, Inc.* | | | 100 | | | | 5,962 | |

Parametric Technology Corp.* | | | 73 | | | | 1,478 | |

Progress Software Corp.* | | | 100 | | | | 2,011 | |

| | | | |

| See Notes to Financial Statements. | | 15 | | |

db-X Exchange-Traded Funds Inc.

SCHEDULE OF INVESTMENTS

db-X 2010 Target Date Fund (Continued)

November 30, 2012 (Unaudited)

| | | | | | | | |

| | | Number

of Shares | | | Value | |

| | | | | | | | |

| Technology (Continued) | | | | | | | | |

QLIK Technologies, Inc.* | | | 167 | | | $ | 3,236 | |

SAP AG (Germany) | | | 77 | | | | 6,013 | |

Solarwinds, Inc.* | | | 100 | | | | 5,603 | |

SYNNEX Corp.* | | | 100 | | | | 3,302 | |

| | | | | | | | |

| | | | | | | 181,038 | |

| | | | | | | | |

| Utilities — 0.3% | | | | | | | | |

Centrica PLC (United Kingdom) | | | 497 | | | | 2,596 | |

Dominion Resources, Inc. | | | 100 | | | | 5,110 | |

E.ON SE (Germany) | | | 84 | | | | 1,513 | |

Edison International | | | 200 | | | | 9,096 | |

GDF Suez (France) | | | 121 | | | | 2,722 | |

National Grid PLC (United Kingdom) | | | 270 | | | | 3,051 | |

Piedmont Natural Gas Co., Inc. | | | 24 | | | | 741 | |

SJW Corp. | | | 100 | | | | 2,446 | |

Wisconsin Energy Corp. | | | 100 | | | | 3,753 | |

| | | | | | | | |

| | | | | | | 31,028 | |

| | | | | | | | |

TOTAL COMMON STOCKS

(Cost $1,621,395) | | | | | | | 1,703,214 | |

| | | | | | | | |

| PREFERRED STOCKS — 0.0% (b) | | | | | | | | |

| Consumer, Cyclical — 0.0% (b) | | | | | | | | |

Volkswagen AG (Germany) | | | 15 | | | | 3,247 | |

| | | | | | | | |

| Industrial — 0.0% (b) | | | | | | | | |

Rolls-Royce Holdings PLC, Class C

(United Kingdom) | | | 14,136 | | | | 23 | |

| | | | | | | | |

TOTAL PREFERRED STOCKS

(Cost $2,535) | | | | | | | 3,270 | |

| | | | | | | | |

| | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

| CORPORATE BONDS — 12.6% | | | | | | | | |

| Communications — 2.1% | | | | | | | | |

Cellco Partnership/Verizon Wireless Capital LLC

5.55%, 2/01/14 | | $ | 170,000 | | | | 179,034 | |

Google, Inc.

1.25%, 5/19/14 | | | 7,000 | | | | 7,089 | |

Telefonica Emisiones S.A.U. (Spain)

4.949%, 1/15/15 | | | 10,000 | | | | 10,377 | |

| | | | | | | | |

| | | | | | | 196,500 | |

| | | | | | | | |

| Consumer, Non-cyclical — 3.0% | | | | | | | | |

Clorox (The) Co.

5.00%, 1/15/15 | | | 55,000 | | | | 59,503 | |

PepsiCo, Inc.

0.75%, 3/05/15 | | | 80,000 | | | | 80,438 | |

Wyeth

5.50%, 2/01/14 | | | 37,000 | | | | 39,189 | |

Yale University, MTN

2.90%, 10/15/14 | | | 105,000 | | | | 109,792 | |

| | | | | | | | |

| | | | | | | 288,922 | |

| | | | | | | | |

| Energy — 1.8% | | | | | | | | |

BP Capital Markets PLC (United Kingdom)

3.625%, 5/08/14 | | | 168,000 | | | | 175,260 | |

| | | | | | | | |

| Financial — 5.1% | | | | | | | | |

American Tower Corp.

4.625%, 4/01/15 | | | 50,000 | | | | 53,591 | |

Bank of New York Mellon (The) Corp.

4.30%, 5/15/14 | | | 57,000 | | | | 60,075 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | | | | | | | |

| Financial (Continued) | | | | | | | | |

Caterpillar Financial Services Corp., MTN

6.125%, 2/17/14 | | $ | 13,000 | | | $ | 13,873 | |

Citigroup, Inc.

6.375%, 8/12/14 | | | 20,000 | | | | 21,678 | |

National Rural Utilities Cooperative Finance Corp.

1.00%, 2/02/15 | | | 280,000 | | | | 282,717 | |

Prudential Financial, Inc., Series B, MTN

5.10%, 9/20/14 | | | 22,000 | | | | 23,595 | |

Wachovia Corp.

5.25%, 8/01/14 | | | 33,000 | | | | 35,368 | |

| | | | | | | | |

| | | | | | | 490,897 | |

| | | | | | | | |

| Technology — 0.3% | | | | | | | | |

Microsoft Corp.

0.875%, 9/27/13 | | | 30,000 | | | | 30,151 | |

| | | | | | | | |

| Utilities — 0.3% | | | | | | | | |

Exelon Generation Co. LLC

5.35%, 1/15/14 | | | 30,000 | | | | 31,444 | |

| | | | | | | | |

TOTAL CORPORATE BONDS

(Cost $1,205,549) | | | | | | | 1,213,174 | |

| | | | | | | | |

| UNITED STATES GOVERNMENT & AGENCIES OBLIGATIONS — 69.4% | | | | | | | | |

United States Treasury Bonds/

Notes — 69.4% | | | | | |

1.375%, 2/15/13 | | | 391,700 | | | | 392,756 | |

2.50%, 3/31/13 | | | 775,000 | | | | 781,085 | |

1.75%, 4/15/13 | | | 390,000 | | | | 392,377 | |

3.50%, 5/31/13 | | | 429,500 | | | | 436,614 | |

1.00%, 7/15/13 | | | 395,000 | | | | 397,099 | |

0.25%, 3/31/14 | | | 220,000 | | | | 220,095 | |

1.75%, 3/31/14 | | | 500,000 | | | | 510,077 | |

4.75%, 5/15/14 | | | 434,800 | | | | 463,232 | |

0.75%, 6/15/14 | | | 392,000 | | | | 395,109 | |

2.375%, 9/30/14 | | | 435,000 | | | | 451,873 | |

0.50%, 10/15/14 | | | 395,000 | | | | 396,821 | |

0.375%, 11/15/14 | | | 132,000 | | | | 132,315 | |

4.25%, 11/15/14 | | | 409,000 | | | | 440,745 | |

2.125%, 11/30/14 | | | 378,000 | | | | 391,998 | |

0.25%, 12/15/14 | | | 395,000 | | | | 394,938 | |

4.00%, 2/15/15 | | | 355,000 | | | | 383,983 | |

2.50%, 3/31/15 | | | 83,000 | | | | 87,286 | |

| | | | | | | | |

| | | | | | | 6,668,403 | |

| | | | | | | | |

TOTAL UNITED STATES GOVERNMENT

& AGENCIES OBLIGATIONS

(Cost $6,650,373) | | | | | | | 6,668,403 | |

| | | | | | | | |

| | |

TOTAL INVESTMENTS — 99.7% | | | | | | | | |

(Cost $9,479,852) | | | | | | $ | 9,588,061 | |

Other assets less liabilities — 0.3% | | | | | | | 29,309 | |

| | | | | | | | |

NET ASSETS — 100.0% | | | | | | $ | 9,617,370 | |

| | | | | | | | |

MTN – Medium Term Note.

REIT – Real Estate Investment Trust.

* Non-Income producing securities.

(a) Affiliated company. The Advisor is a subsidiary of Deutsche Bank AG. Therefore, Deutsche Bank AG is considered to be affiliated with the Fund.

(b) Less than 0.1%.

| | | | |

| See Notes to Financial Statements. | | 16 | | |

db-X Exchange-Traded Funds Inc.

SCHEDULE OF INVESTMENTS

db-X 2020 Target Date Fund

November 30, 2012 (Unaudited)

| | | | | | | | |

| | | Number

of Shares | | | Value | |

| | | | | | | | |

| COMMON STOCKS — 54.1% | | | | | | | | |

| Basic Materials — 2.7% | | | | | | | | |

Air Liquide S.A. (France) | | | 207 | | | $ | 25,283 | |

Anglo American PLC (United Kingdom) | | | 1,078 | | | | 29,932 | |

BASF SE (Germany) | | | 684 | | | | 61,294 | |

BHP Billiton Ltd. (Australia) | | | 2,481 | | | | 89,011 | |

BHP Billiton PLC (United Kingdom) | | | 1,567 | | | | 49,273 | |

Coeur d’Alene Mines Corp.* | | | 565 | | | | 13,142 | |

Dow Chemical (The) Co. | | | 1,361 | | | | 41,089 | |

E.I. du Pont de Nemours & Co. | | | 1,003 | | | | 43,269 | |

Freeport-McMoRan Copper & Gold, Inc. | | | 960 | | | | 37,450 | |

HB Fuller Co. | | | 300 | | | | 9,855 | |

International Paper Co. | | | 1,971 | | | | 73,203 | |

Linde AG (Germany) | | | 111 | | | | 19,194 | |

Monsanto Co. | | | 514 | | | | 47,077 | |

NewMarket Corp. | | | 86 | | | | 22,820 | |

Rio Tinto Ltd. (Australia) | | | 269 | | | | 16,487 | |

Rio Tinto PLC (United Kingdom) | | | 1,022 | | | | 50,668 | |

Sensient Technologies Corp. | | | 343 | | | | 12,417 | |

Sherwin-Williams (The) Co. | | | 514 | | | | 78,394 | |

Syngenta AG (Switzerland) | | | 72 | | | | 28,873 | |

Xstrata PLC (United Kingdom) | | | 1,554 | | | | 25,752 | |

| | | | | | | | |

| | | | | | | 774,483 | |

| | | | | | | | |

| Communications — 5.1% | | | | | | | | |

Amazon.com, Inc.* | | | 450 | | | | 113,423 | |

Anixter International, Inc. | | | 159 | | | | 9,712 | |

Arris Group, Inc.* | | | 771 | | | | 10,771 | |

AT&T, Inc. | | | 5,967 | | | | 203,654 | |

Bankrate, Inc.* | | | 857 | | | | 10,310 | |

Brightcove, Inc.* | | | 943 | | | | 9,166 | |

BT Group PLC, Class A (United Kingdom) | | | 5,694 | | | | 21,308 | |

Centurylink, Inc. | | | 600 | | | | 23,304 | |

Cisco Systems, Inc. | | | 5,829 | | | | 110,227 | |

Comcast Corp., Class A | | | 2,694 | | | | 100,162 | |

Consolidated Communications Holdings, Inc. | | | 857 | | | | 12,889 | |