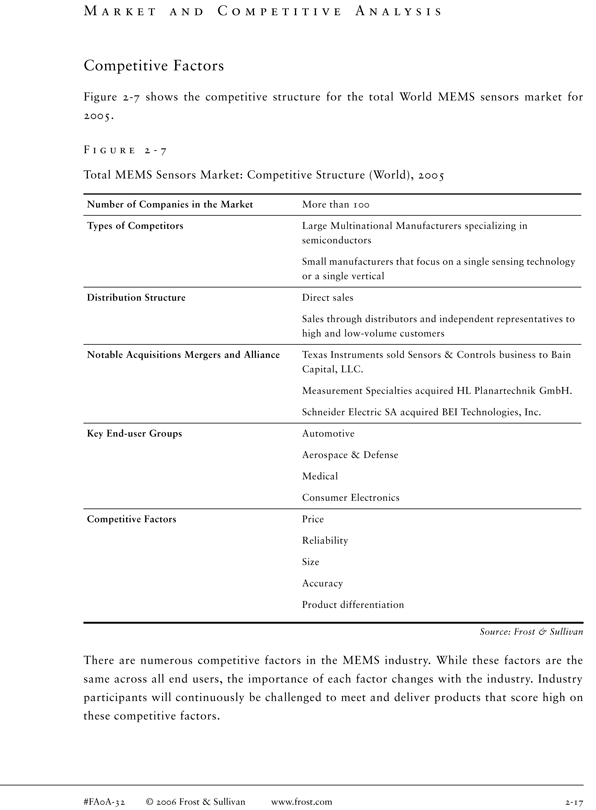

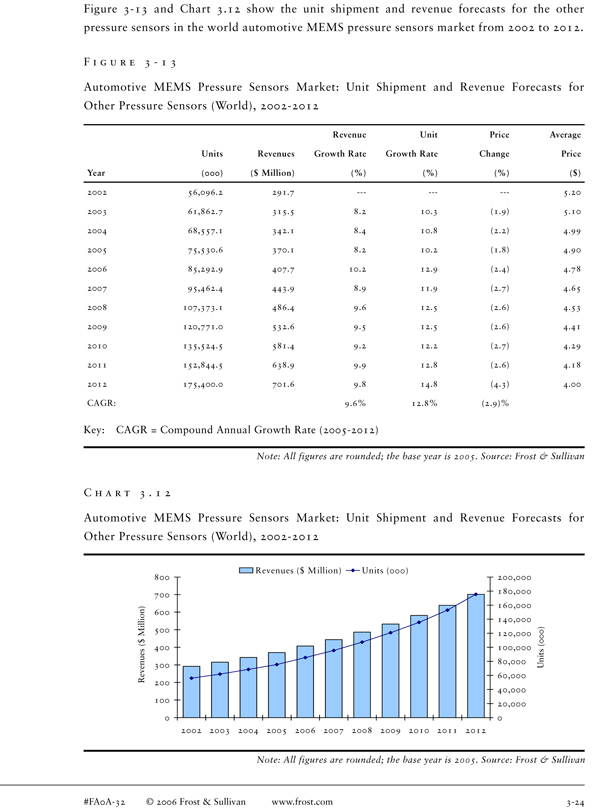

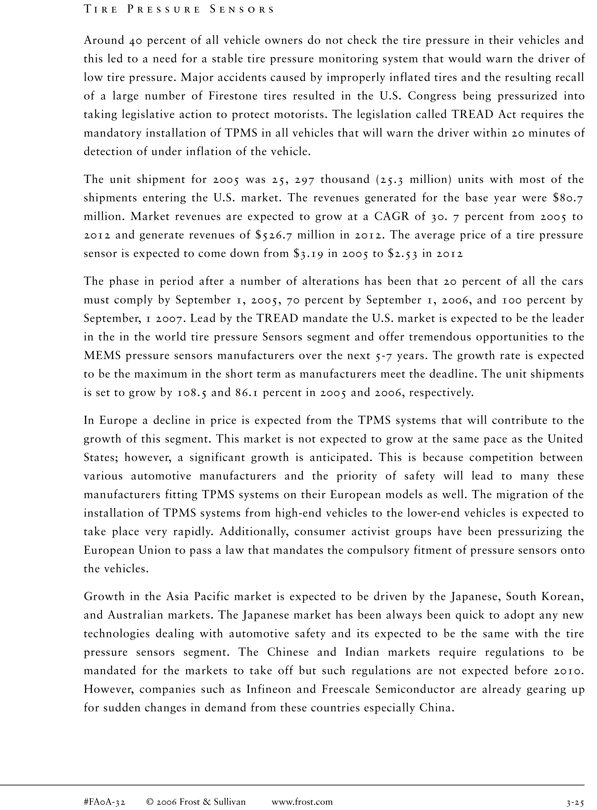

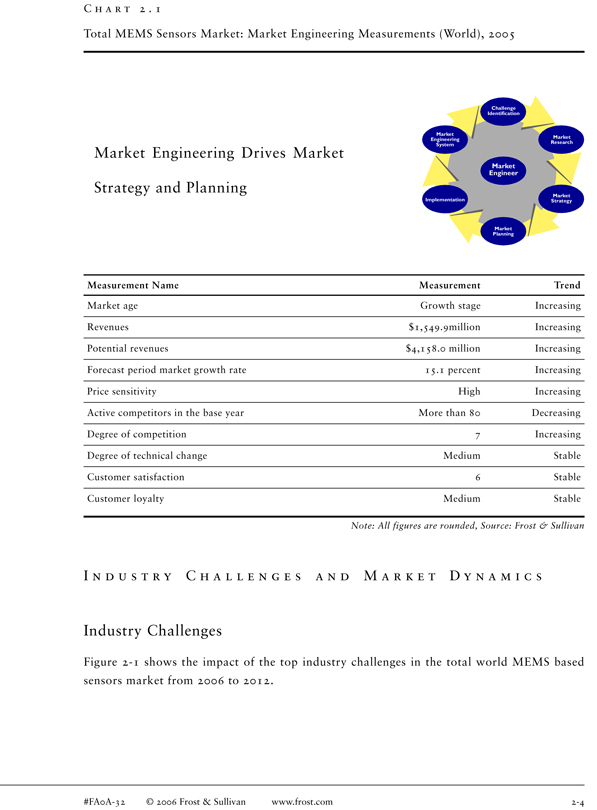

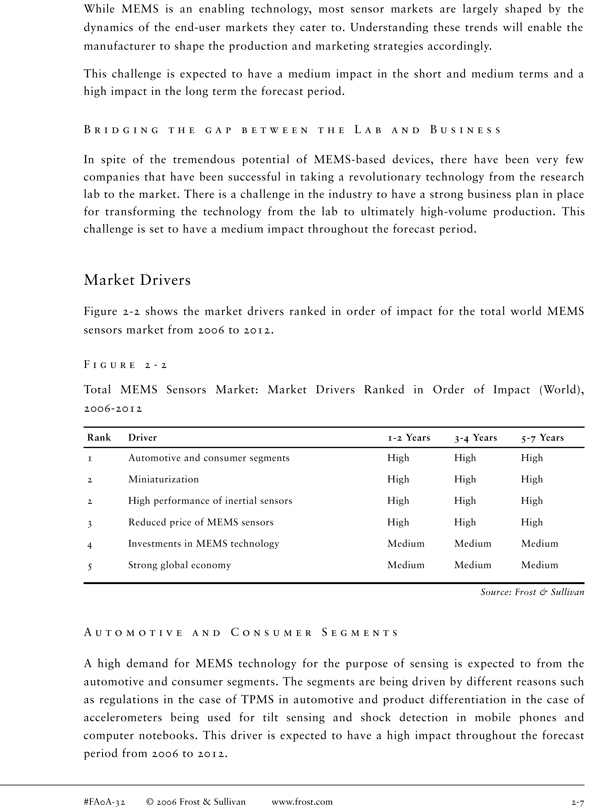

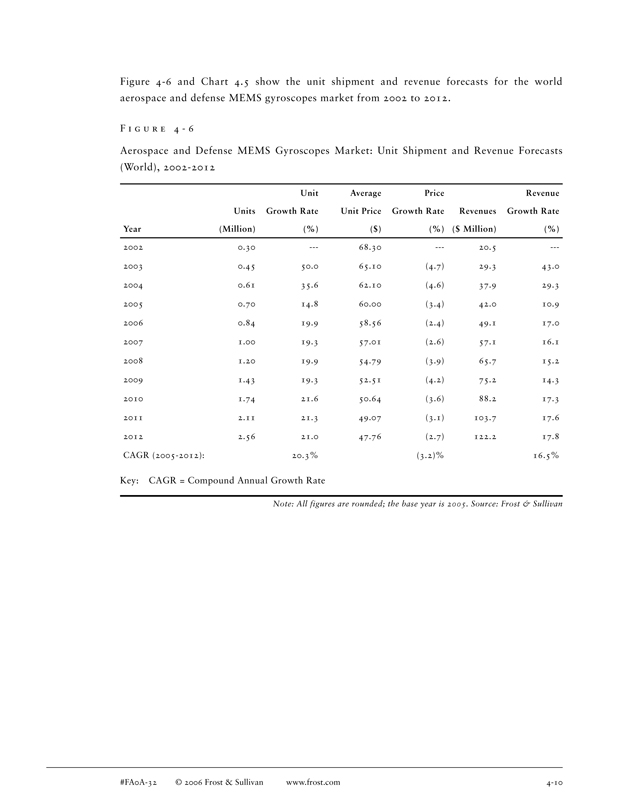

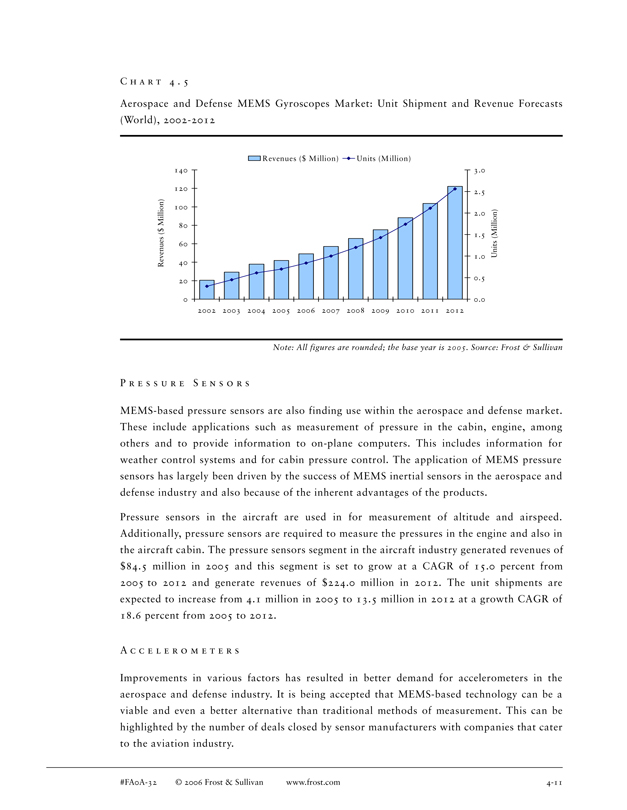

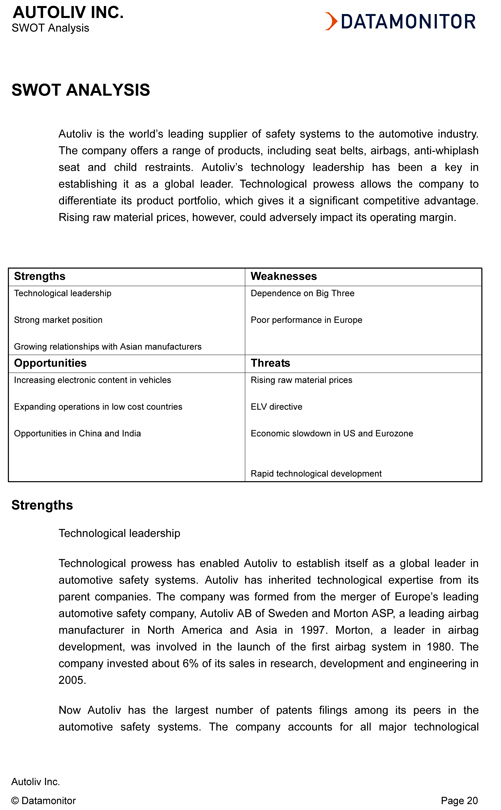

| | | | |

| | SKADDEN, ARPS, SLATE, MEAGHER & FLOM | | |

PARTNERS EDWARD H.P. LAM ¨* NICHOLAS A. NORRIS¨ JONATHAN B. STONE * ALEC P. TRACY * DOMINIC W.L. TSUN¨* ¨ (ALSO ADMITTEDIN ENGLAND & WALES) * (ALSO ADMITTEDIN NEW YORK) REGISTERED FOREIGN LAWYERS GREGORY G.H. MIAO (NEW YORK) ALAN G. SCHIFFMAN (NEW YORK) | |

42/F, EDINBURGH TOWER, THE LANDMARK 15 QUEEN’S ROAD CENTRAL, HONG KONG ____________ TEL: (852) 3740-4700 FAX: (852) 3740-4727 www.skadden.com | | AFFILIATE OFFICES ____ BOSTON CHICAGO HOUSTON LOS ANGELES NEW YORK PALO ALTO SAN FRANCISCO WASHINGTON, D.C. ____ BEIJING BRUSSELS FRANKFURT LONDON MOSCOW MUNICH PARIS SINGAPORE SYDNEY TOKYO TORONTO VIENNA |

November 5, 2007

Mr. Tom Jones

Division of Corporation Finance

Securities and Exchange Commission

100 F Street, N.E., Mail Stop 6010

Washington D.C. 20549

U.S.A.

Registration Statement on Form S-1

Filed on September 28, 2007

File No. 333-146377

Dear Mr. Jones:

On behalf of our client, MEMSIC, Inc. (“Memsic” or “the Company”), set forth below are the Company’s responses to your comment letter dated October 25, 2007 (the “Comment Letter”) with respect to the above-referenced Registration Statement on Form S-1 (the “Registration Statement”) filed with the Securities and Exchange Commission (the “Commission”) on September 28, 2007. We are also providing you in hard copy form a copy of Amendment No. 1 to the Registration Statement (“Amendment No. 1”), with exhibits to show changes made to the Registration Statement filed on September 28, 2007.

We would like to bring to your attention that in addition to the revisions made in response to the Staff’s comments, Amendment No.1 includes the Company’s September 30, 2007 interim financial statements and updated quarterly financial information.

For your convenience, we have reproduced the comments from the Commission’s staff (the “Staff”) in the order provided followed by Memsic’s

Mr. Tom Jones

Securities and Exchange Commission

November 5, 2007

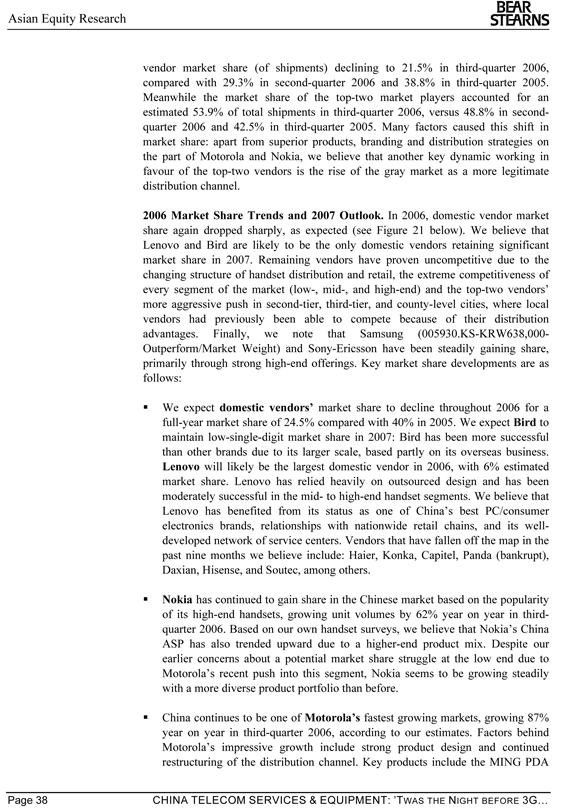

RE: MEMSIC, Inc. S-1 Registration Statement (File No. 333-146377)

Page 2

corresponding response. All references in Memsic’s responses to pages and captioned sections are to Amendment No.1 to the Registration Statement as filed today. Capitalized terms used in this letter and not otherwise defined herein have the meaning ascribed to them in the prospectus included in Amendment No. 1.

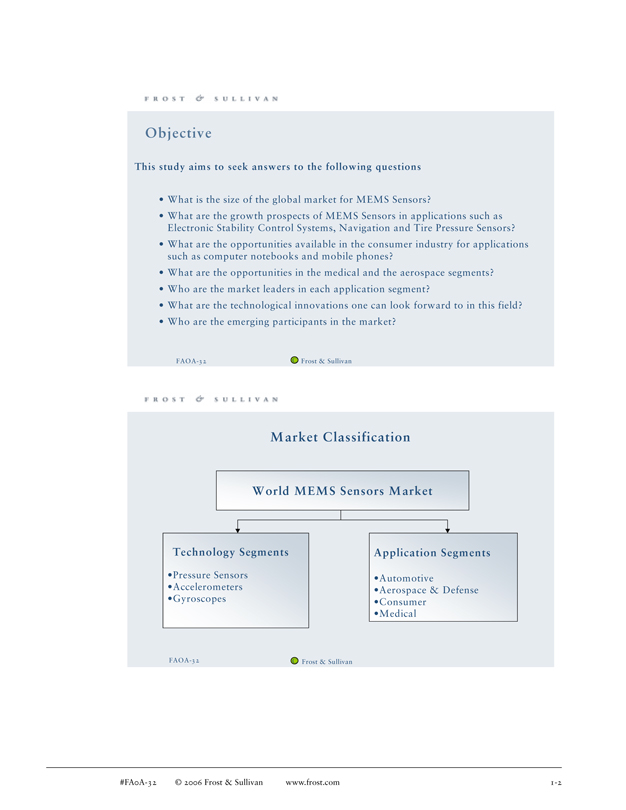

Prospectus Cover Page

| 1. | Please confirm that any preliminary prospectus you circulate will include all non-Rule 430A information. This includes the price range and related information based on a bona fide estimate of the public offering price within that range. Also note that we may have additional comments after you include this information. |

The Company will provide all non-Rule 430A information in a subsequent amendment to the Registration Statement prior to the circulation of any preliminary prospectus and acknowledges that the Staff may have additional comments thereafter.

| 2. | Please furnish copies of any graphics you intend to use in your prospectus. |

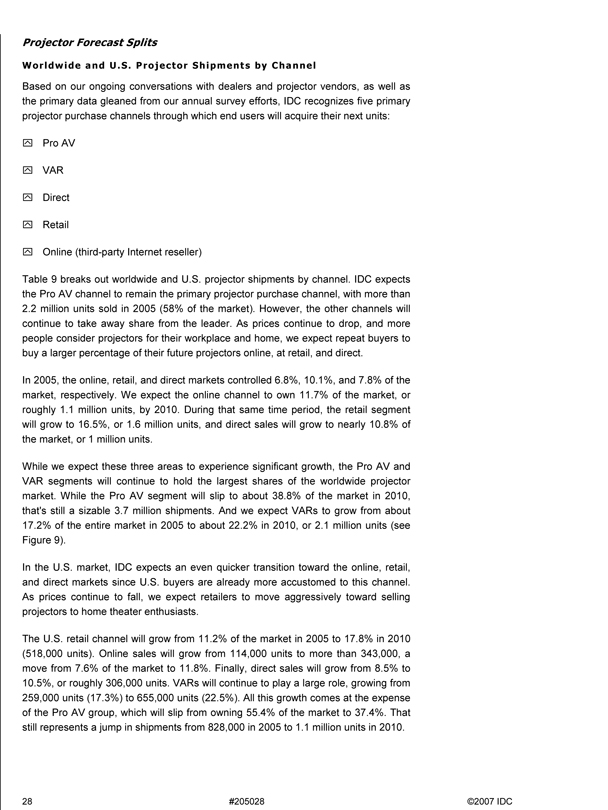

The Company has provided the artwork it intends to use asExhibit A hereto. The Company intends to use the artwork in the inside front cover of the prospectus.

| 3. | Please remove the reference to “Sole Book-Runner.” |

The Company has deleted the reference to “Sole Book-Runner” on the cover page of the prospectus.

Overview, page 1

| 4. | Please provide us independent, objective support for the statements regarding your leadership and market standing. For example, you state on page 1 of your prospectus that you “are a pioneer in providing accelerometers to China’s fast growing mobile phone market and are among the leading providers of accelerometers for image projector supplying to several Japanese OEMs,” that your products “have been used by leading international and China-based manufacturers” and that one of your customers includes “a leading European automotive safety systems supplier”. Please also provide us with independent support for your statement that the thermal technology you are using to produce MEMS accelerometers has a “higher shock tolerance, lower failure rate and lower cost relative to alternative mechanical solutions”. |

Mr. Tom Jones

Securities and Exchange Commission

November 5, 2007

RE: MEMSIC, Inc. S-1 Registration Statement (File No. 333-146377)

Page 3

In response to the Staff’s comment, the Company sets forth below independent sources of information to support each of the statements relating to the Company’s leadership and market standing. None of the cited reports or data was commissioned by the Company.

| | Specifically | with respect to the claim that: |

| | (i) | the Company is “a pioneer in providing accelerometers to China’s fast growing mobile phone market,” |

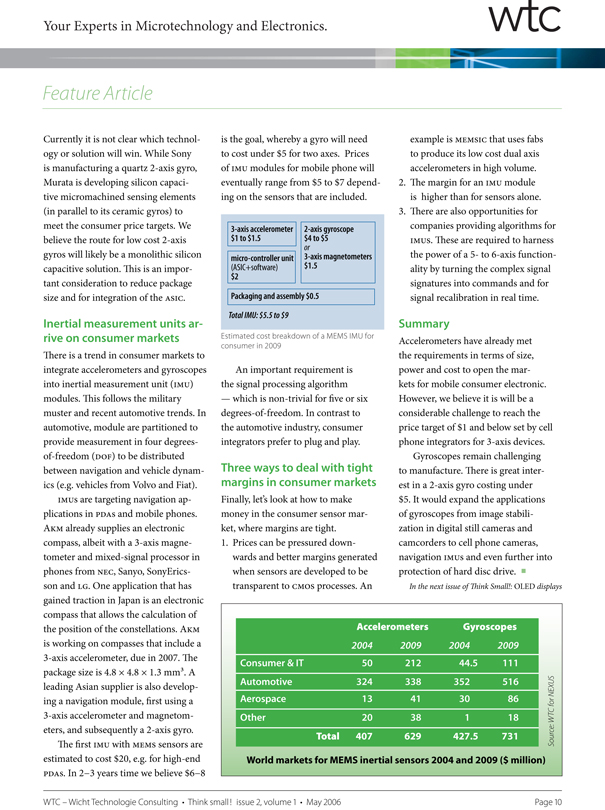

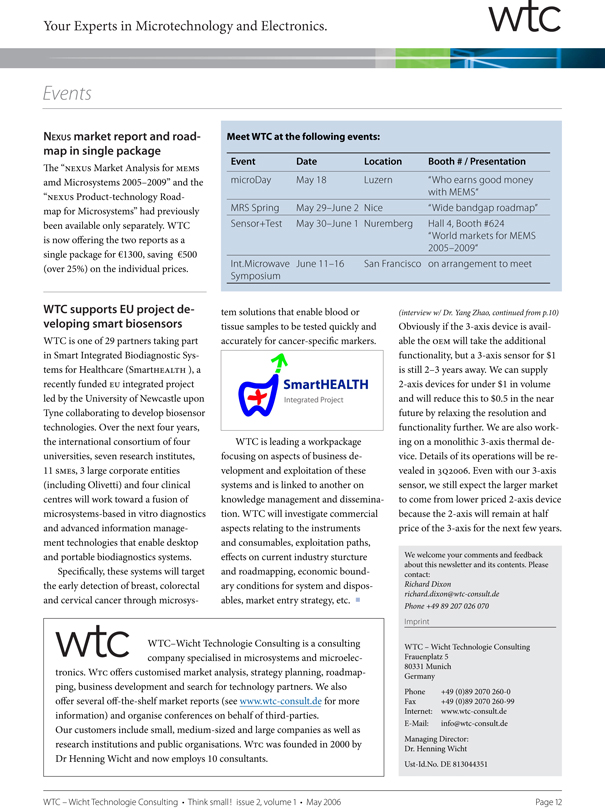

According to page 8 of Wicht Technologie Consulting feature article of May 2006 (Issue 2, Volume 1), commercialization of accelerometers in mobile phones began in 2003. SeeExhibit B. The Company commenced sales of accelerometers in 2003 and sold 543,000 units of accelerometers to mobile phone manufacturers in 2004. Since 2005, the Company’s revenue from mobile phone applications has grown primarily in the China market. Sales to China mobile phone manufacturers through distributors increased from $0.3 million in 2005, to $6.2 million in 2006, and to $9.3 million in the first nine months of 2007.

In addition, the Company’s current largest end-customer is Tianyu, who according to iSuppli, is the third largest China based handset OEM. SeeExhibit C. Tianyu has been a customer of the Company since 2006 and the Company believes Tianyu was one of the pioneers in the China market to introduce accelerometer-based features such as motion games and pedometers.

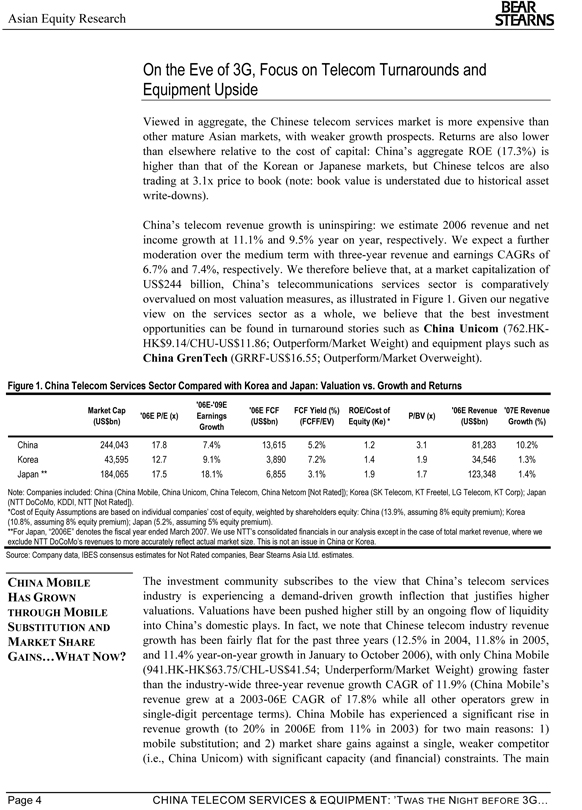

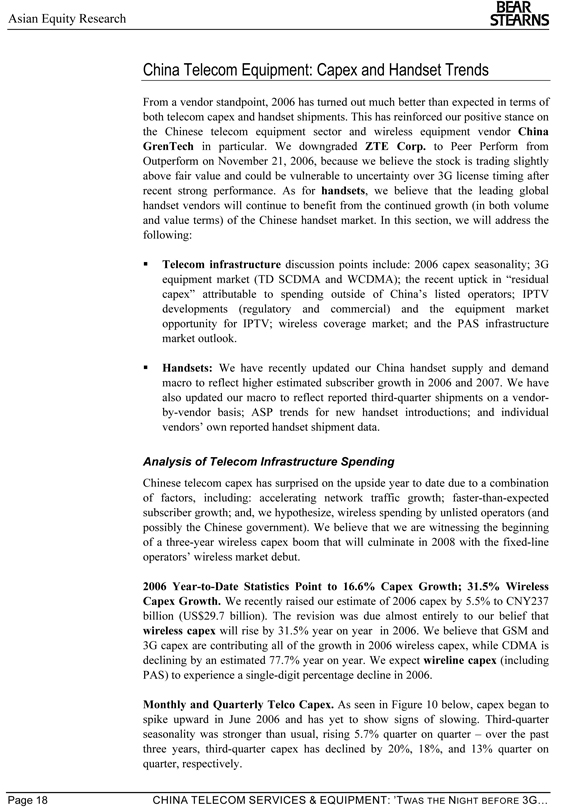

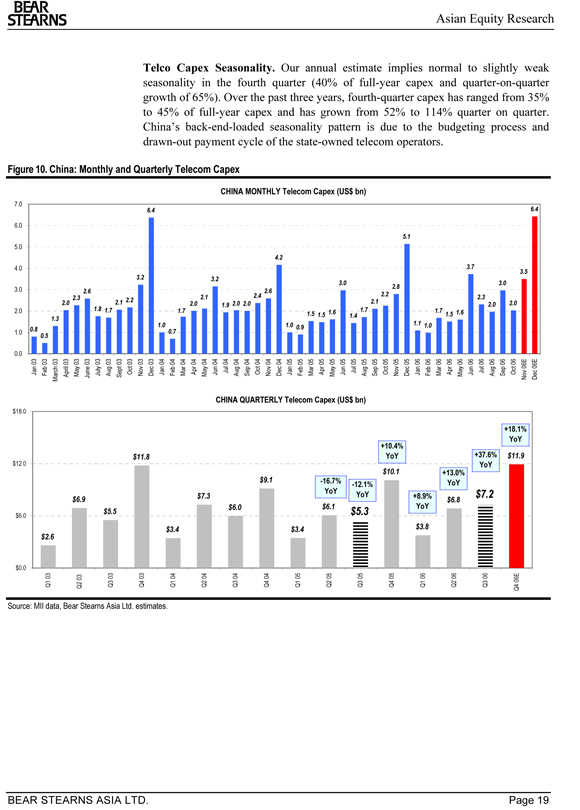

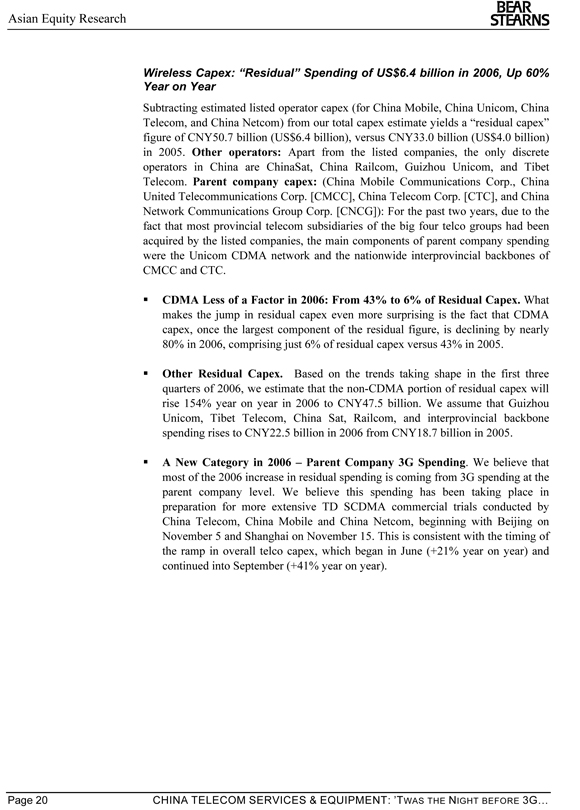

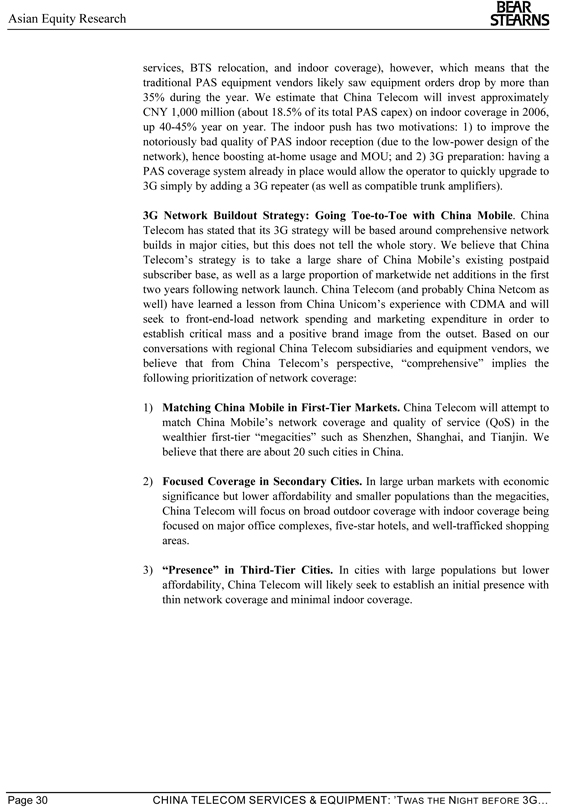

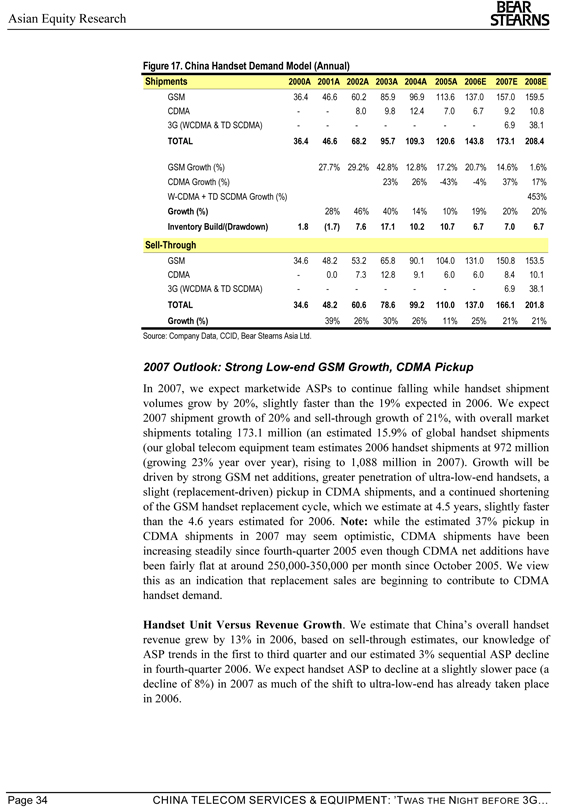

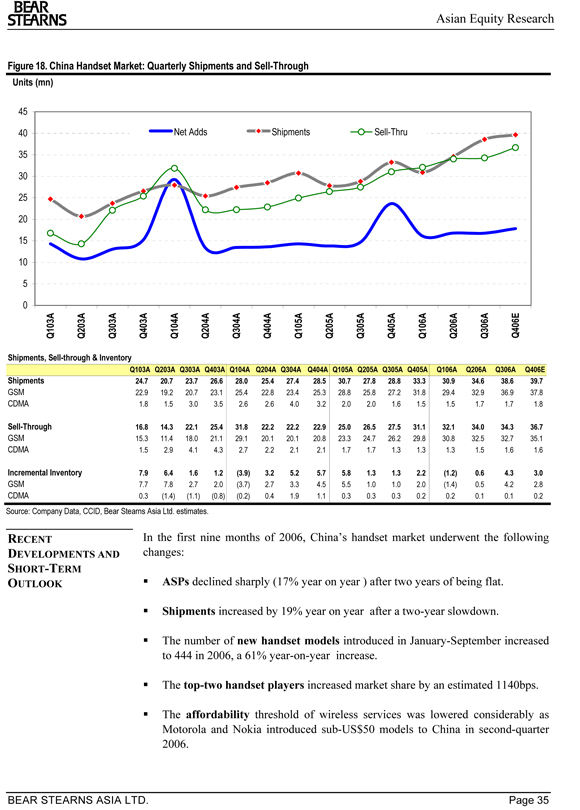

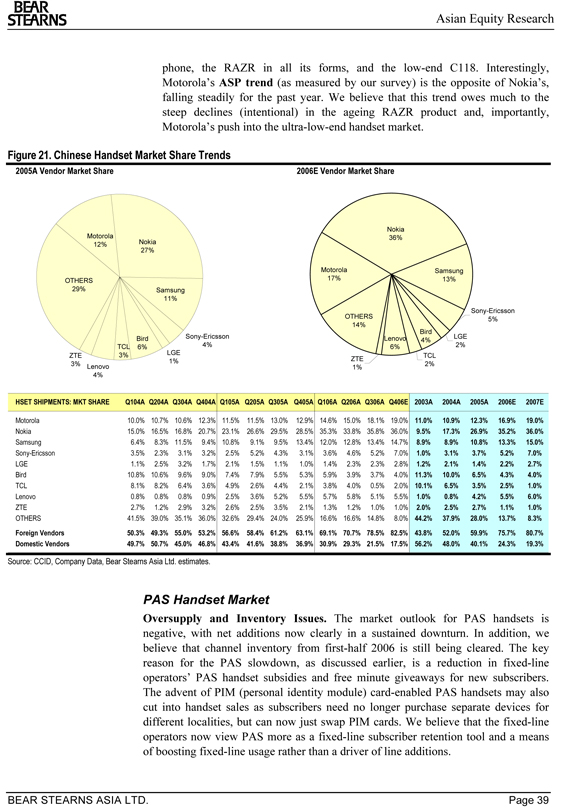

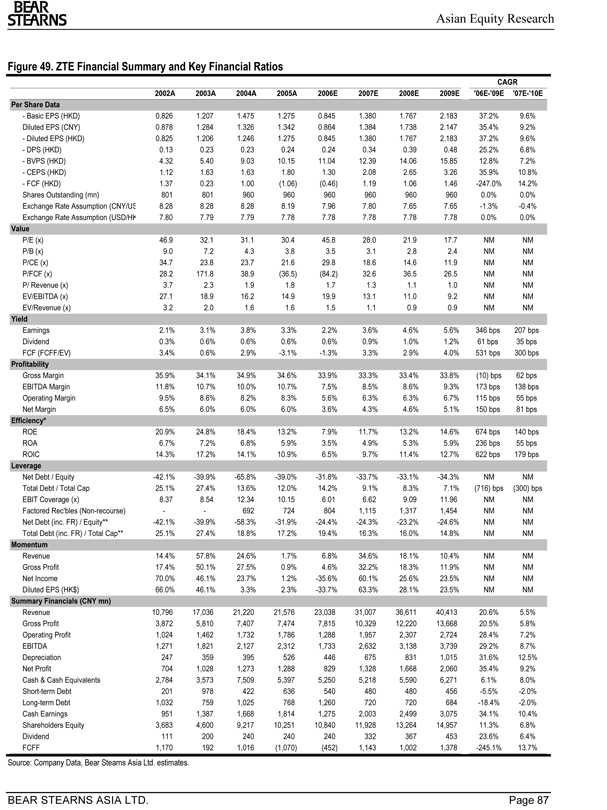

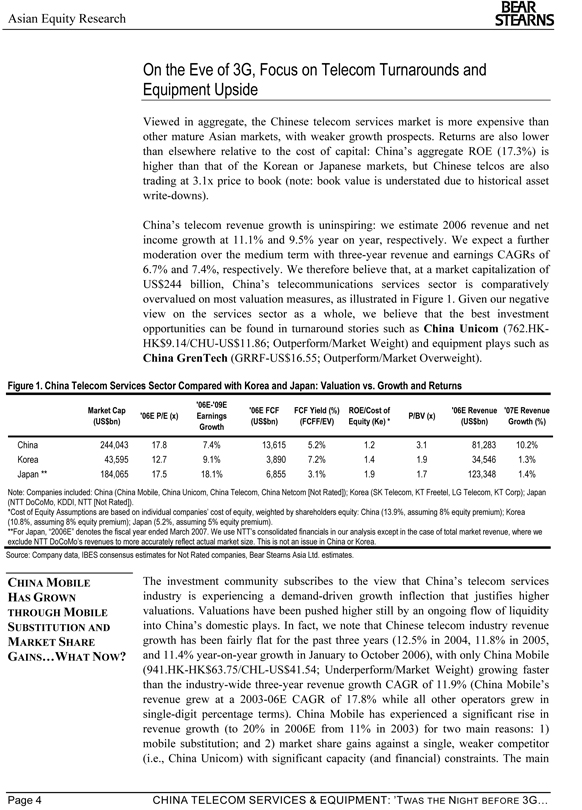

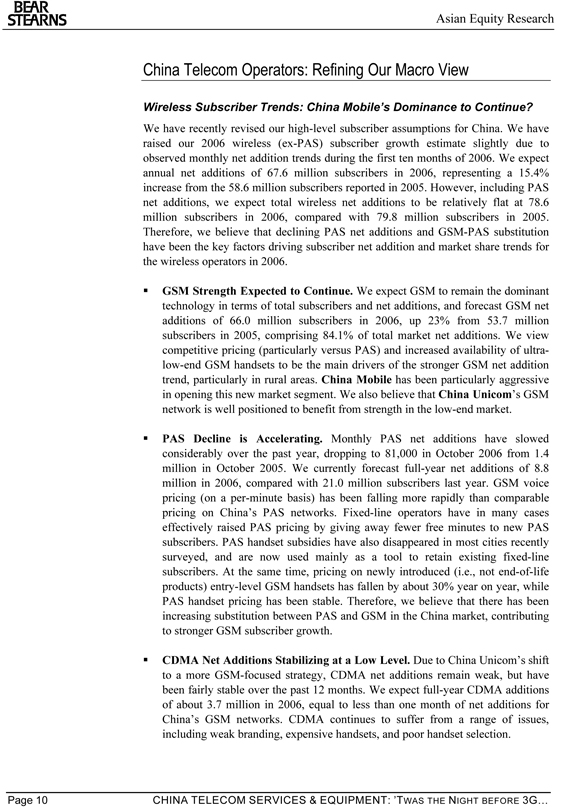

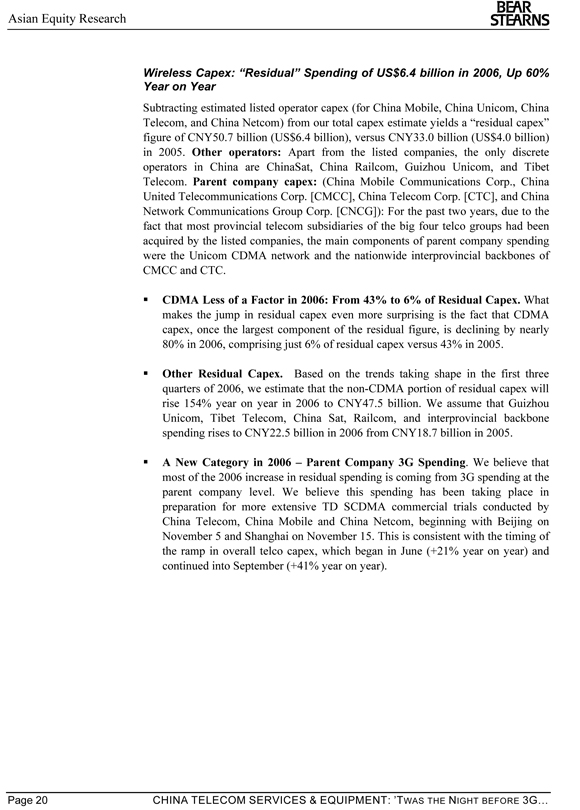

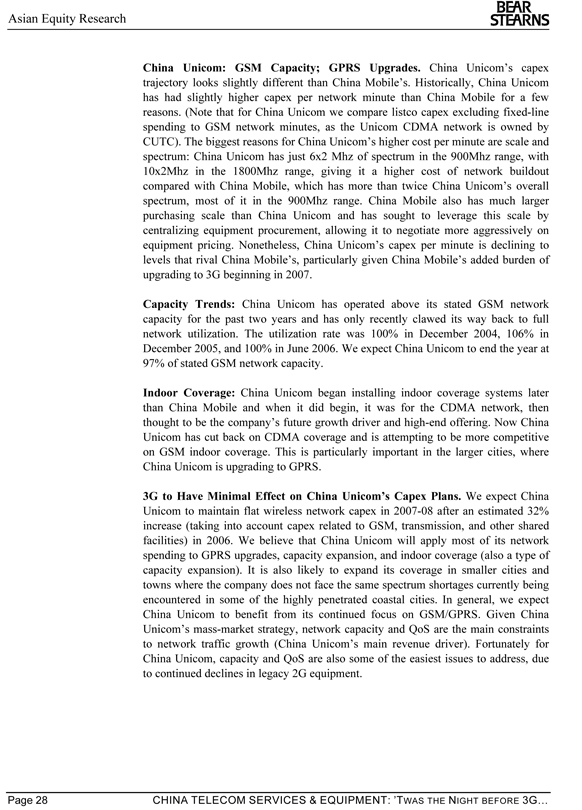

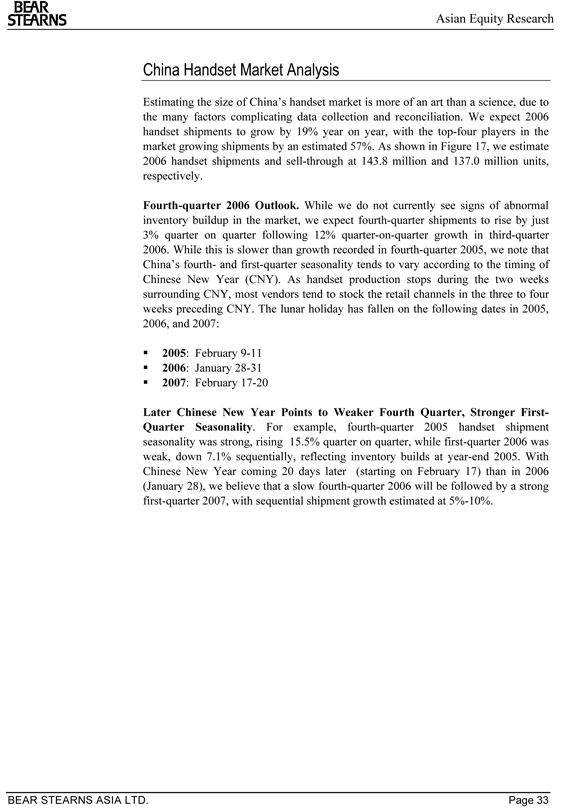

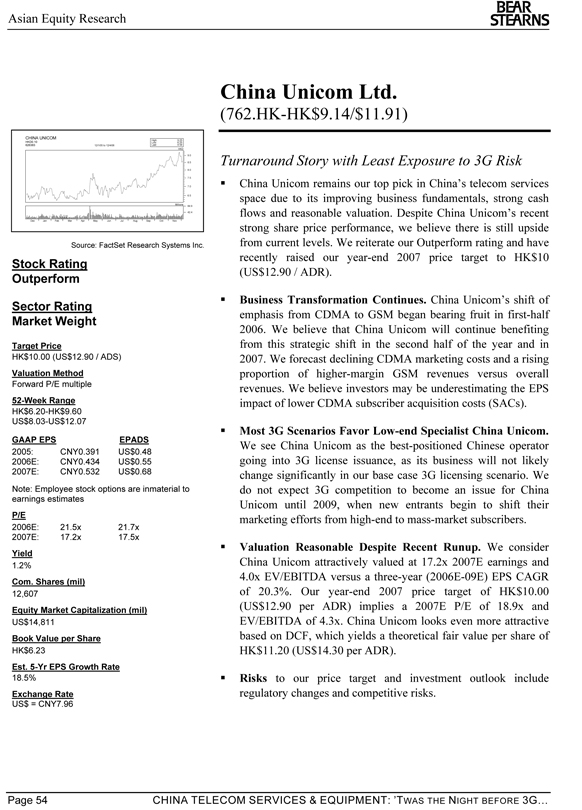

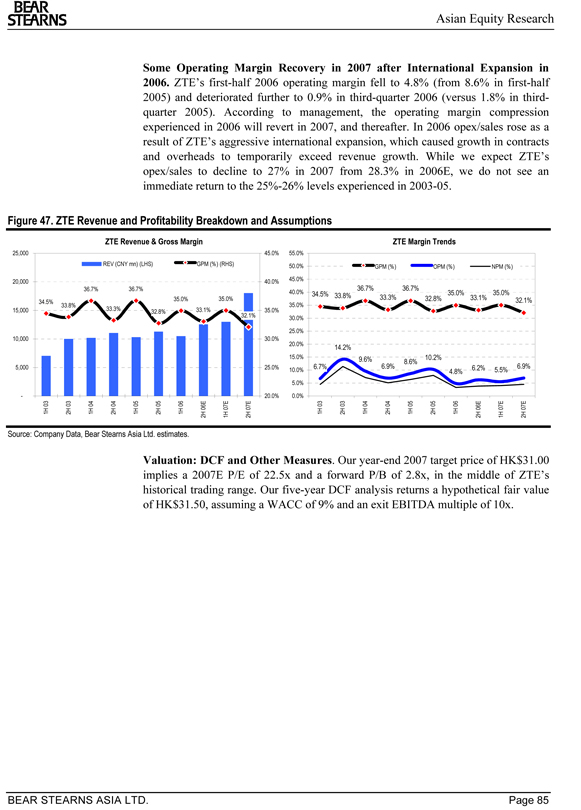

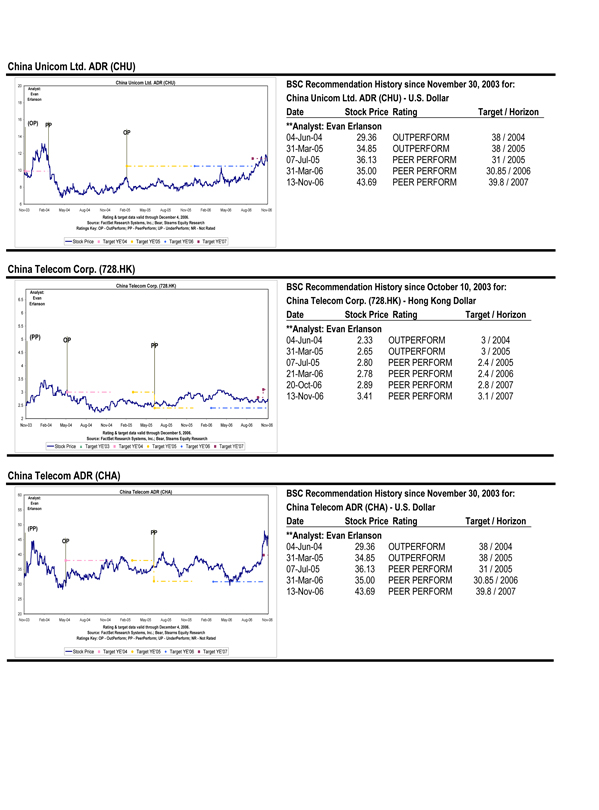

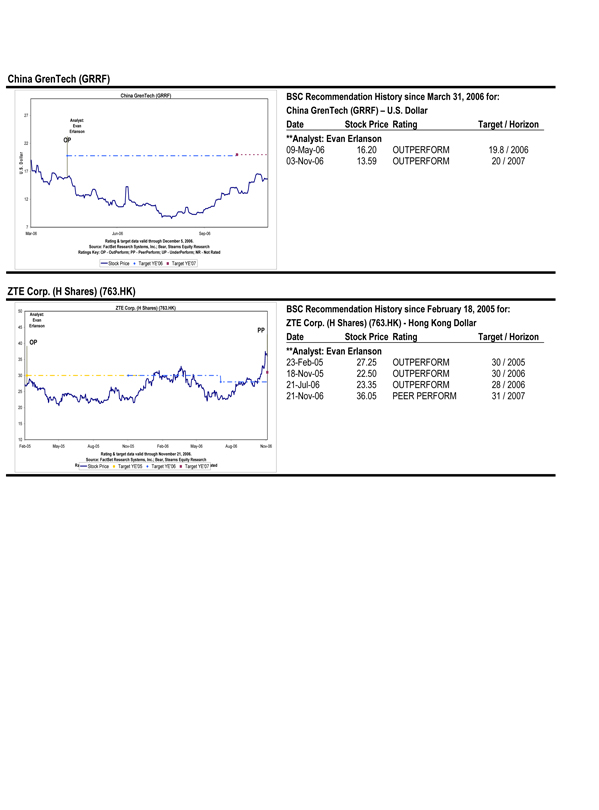

According to a report from Bear Stearns published in December 2006, shipments of mobile handsets in China increased from 36.4 million units in 2000 to an estimated 143.8 million units in 2006, representing a compound annual growth rate of 31.6%. See page 34 ofExhibit D.

| | (ii) | the Company is “among the leading providers of accelerometers for image projector supplying to several Japanese OEMs,” |

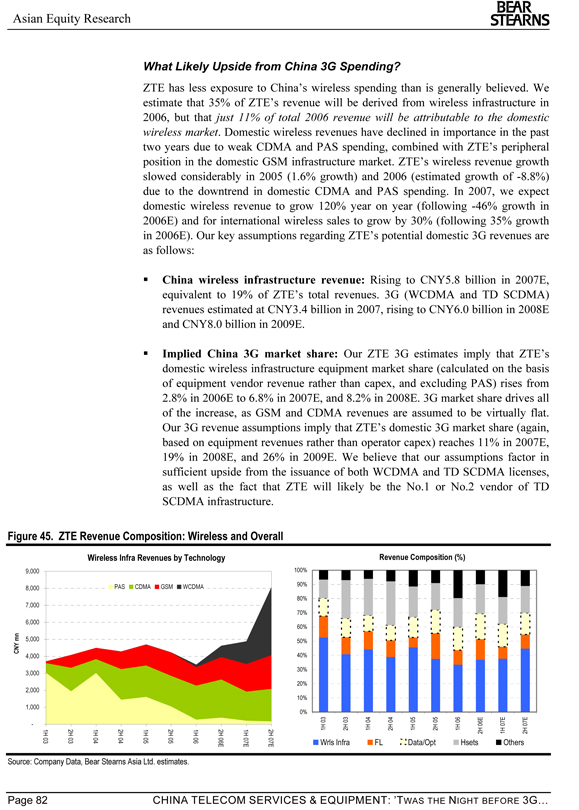

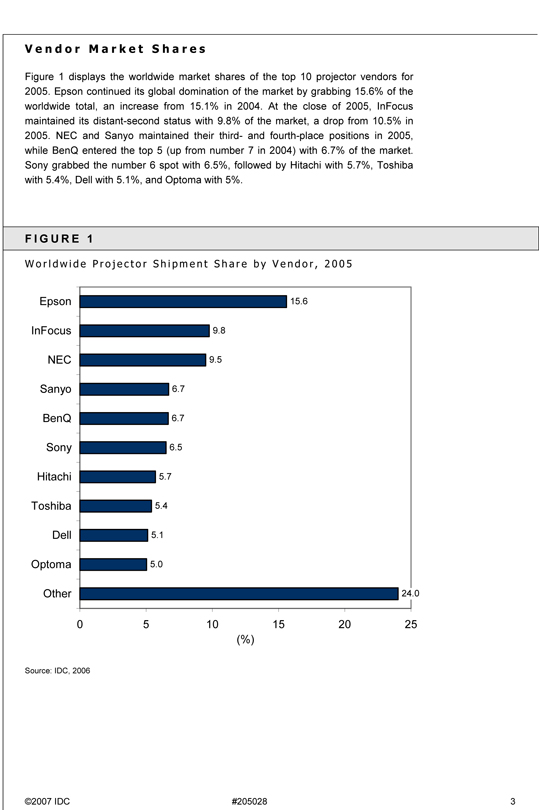

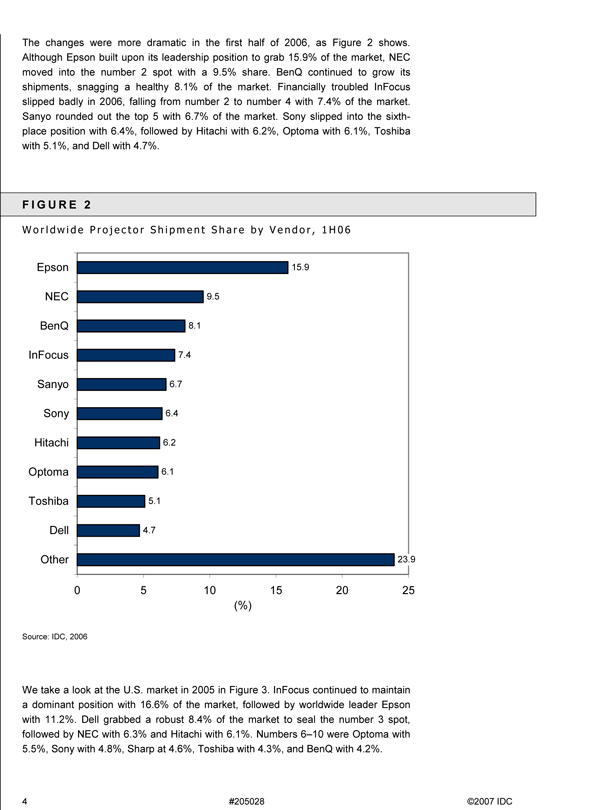

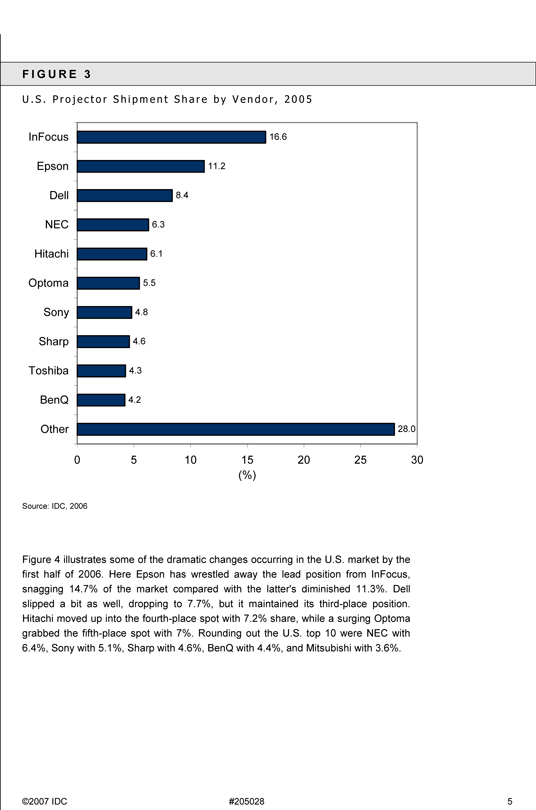

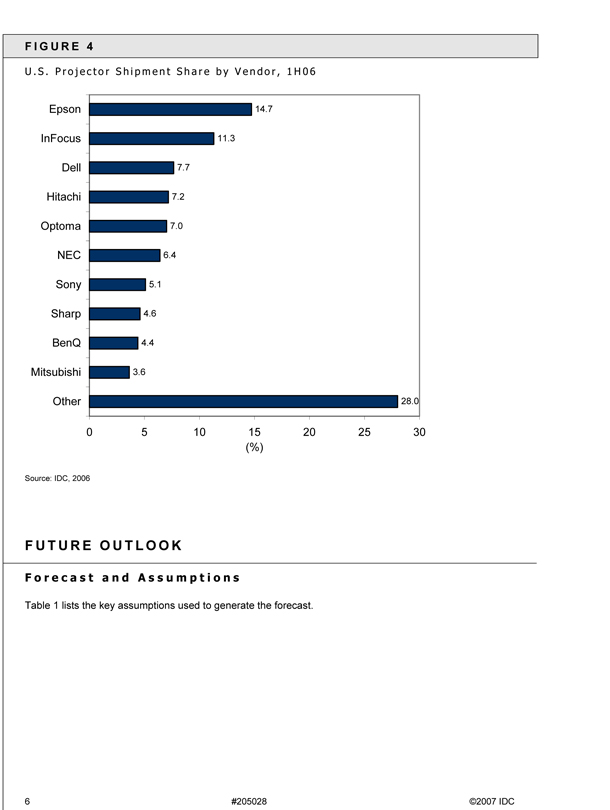

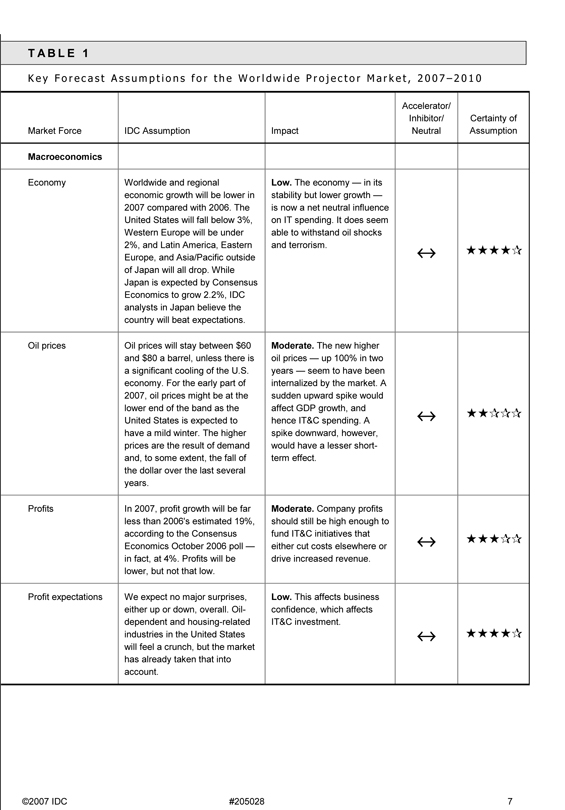

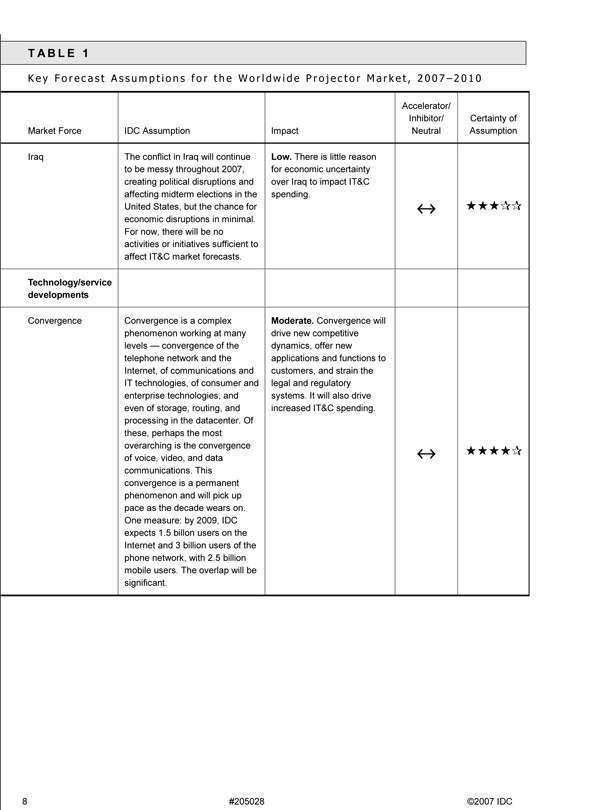

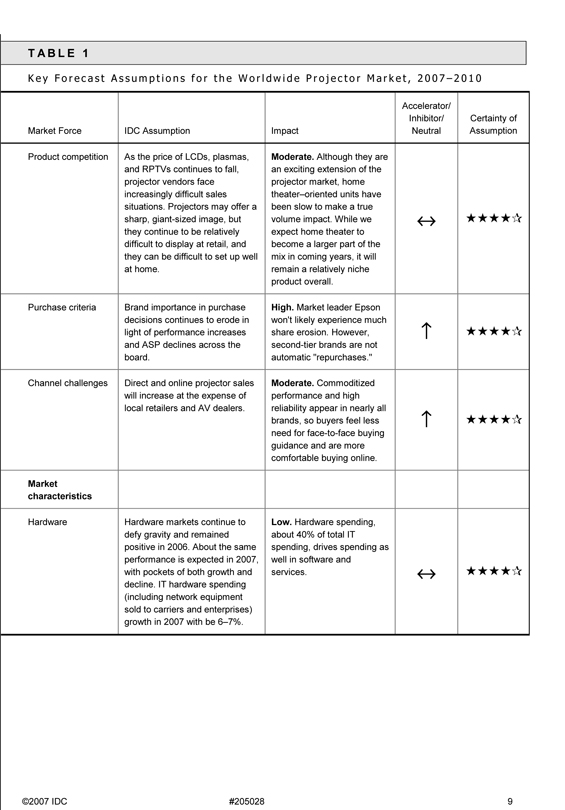

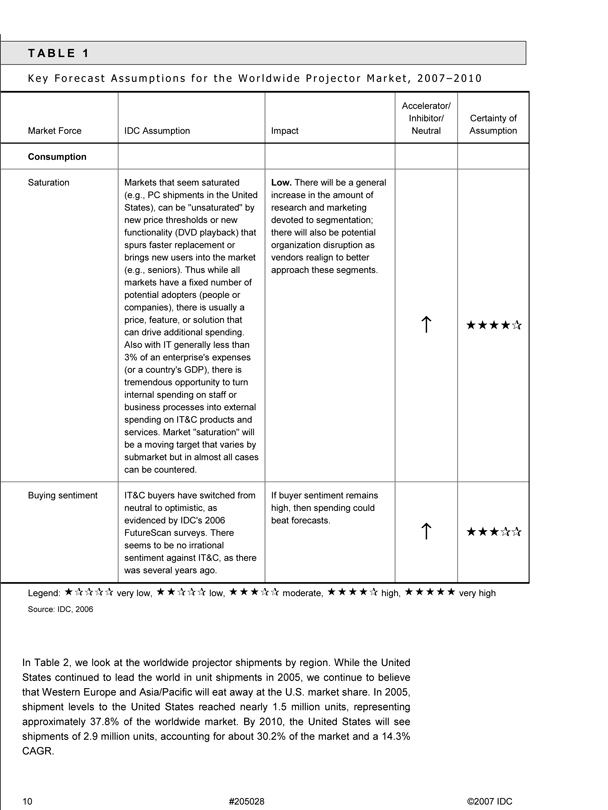

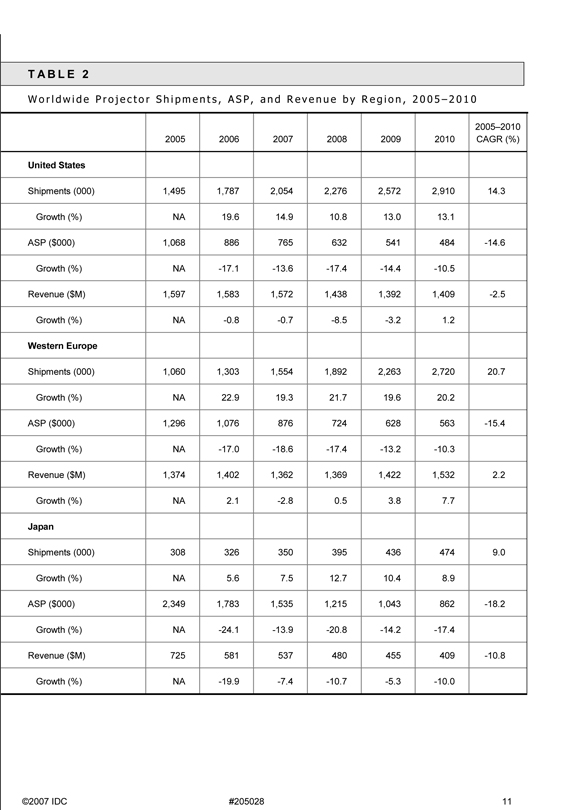

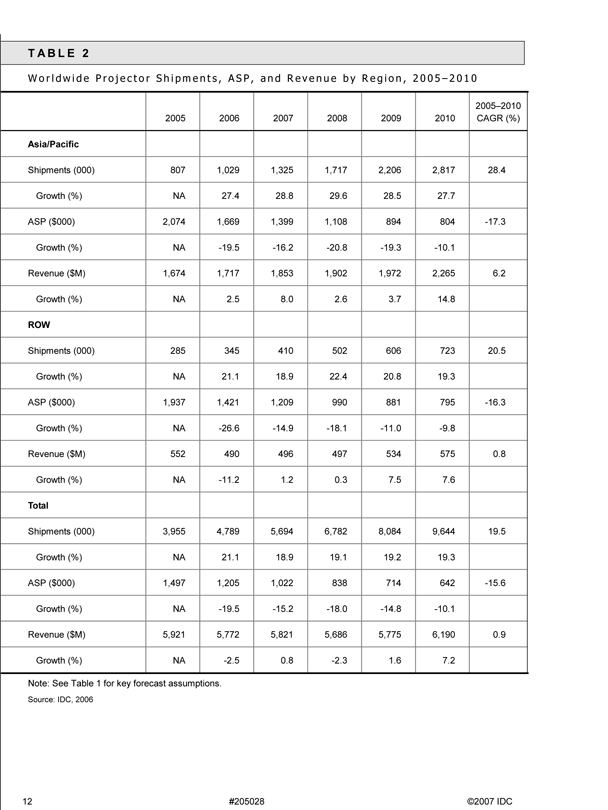

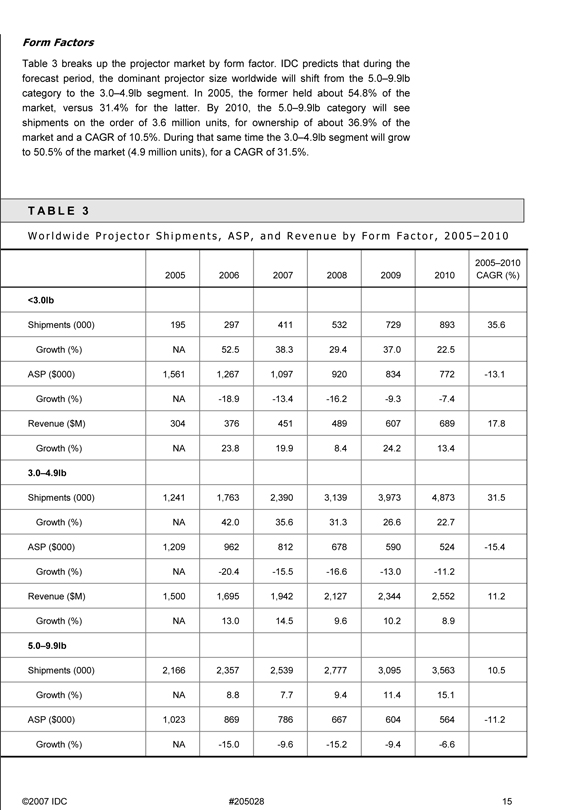

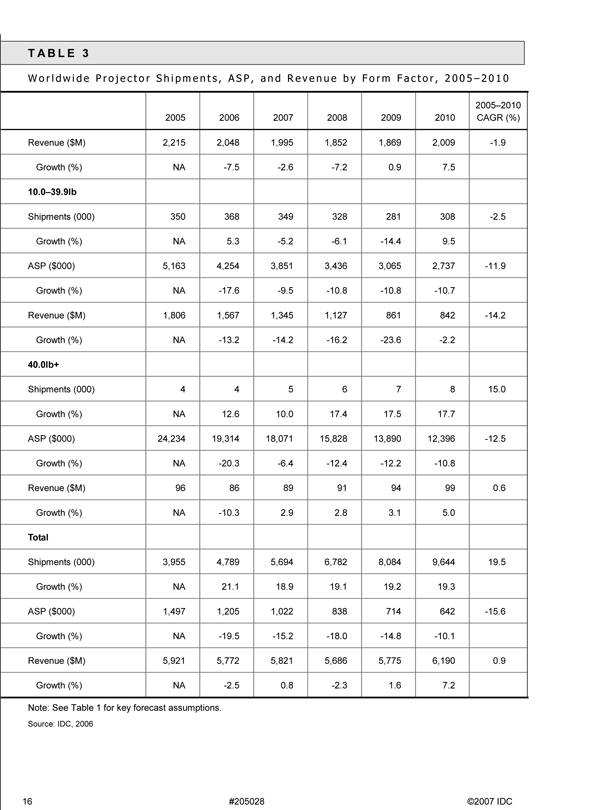

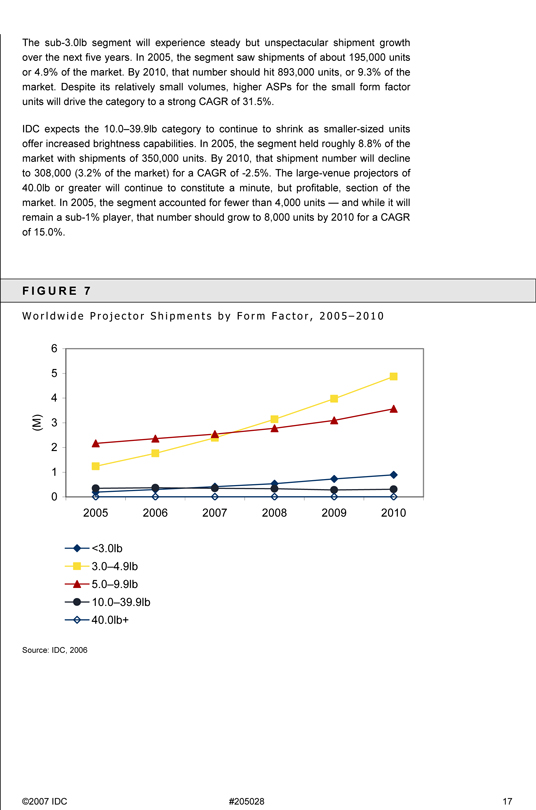

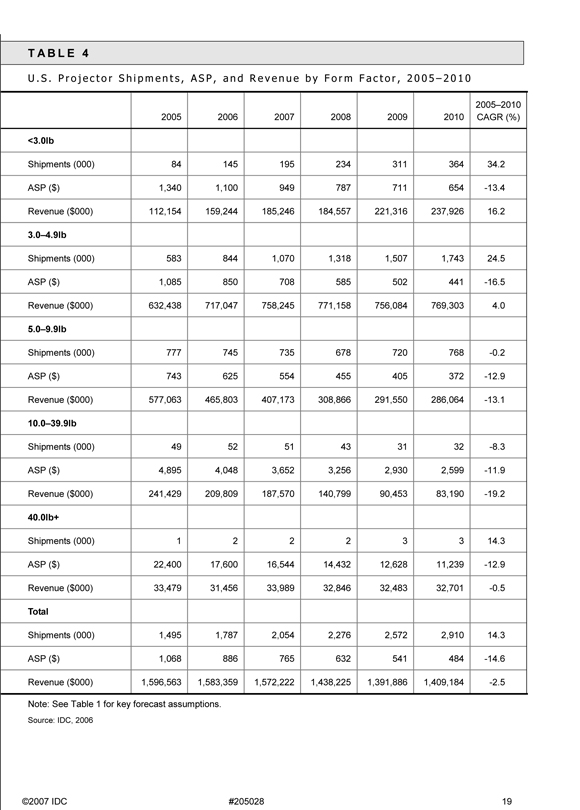

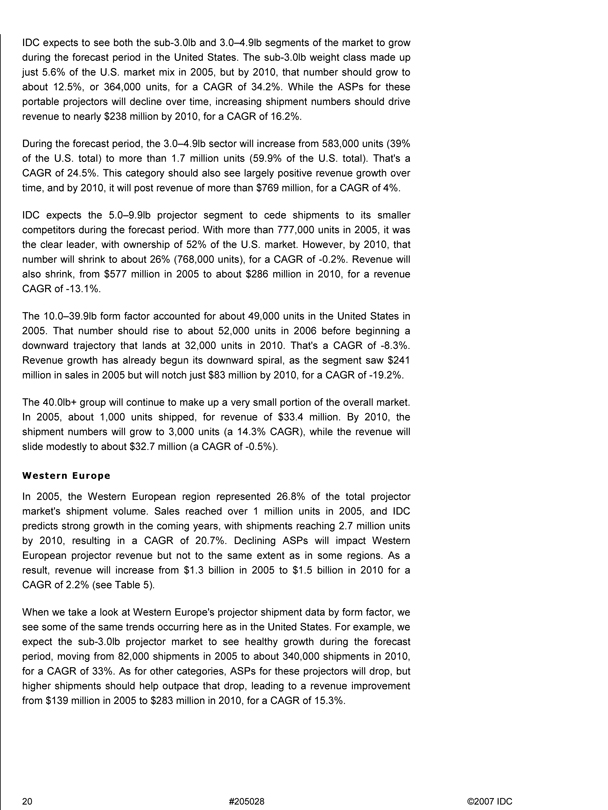

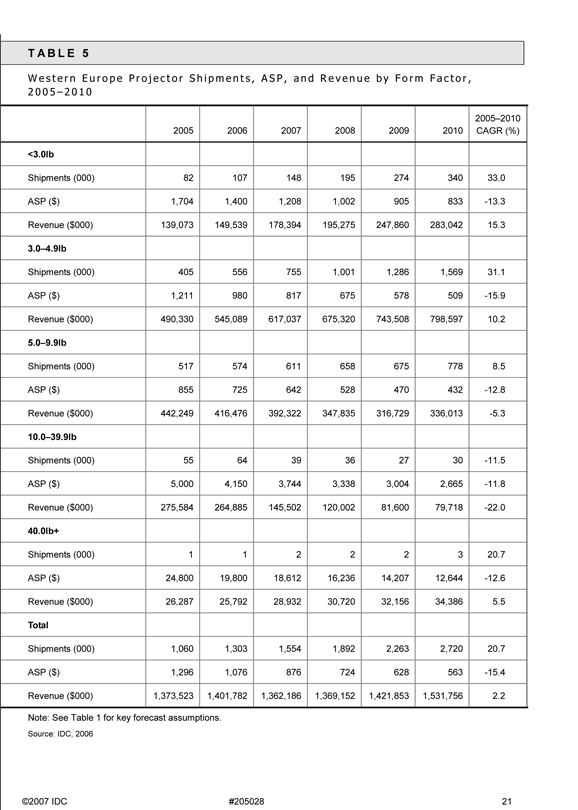

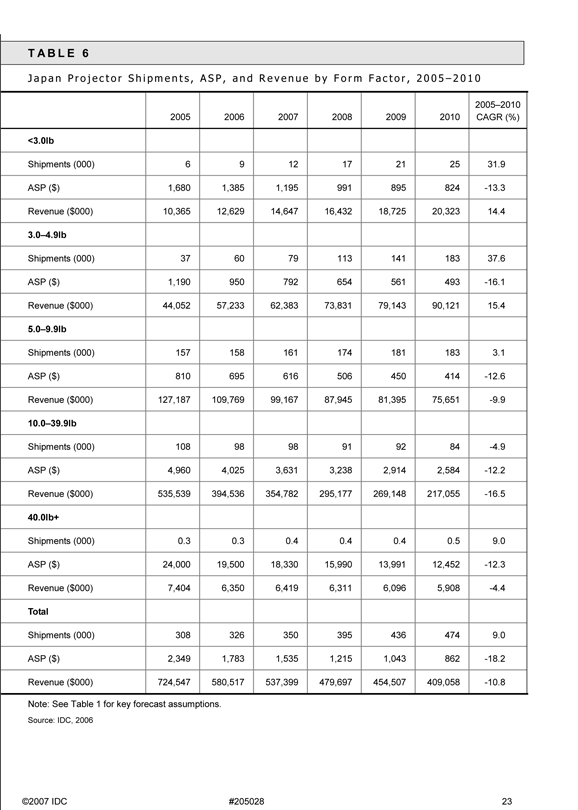

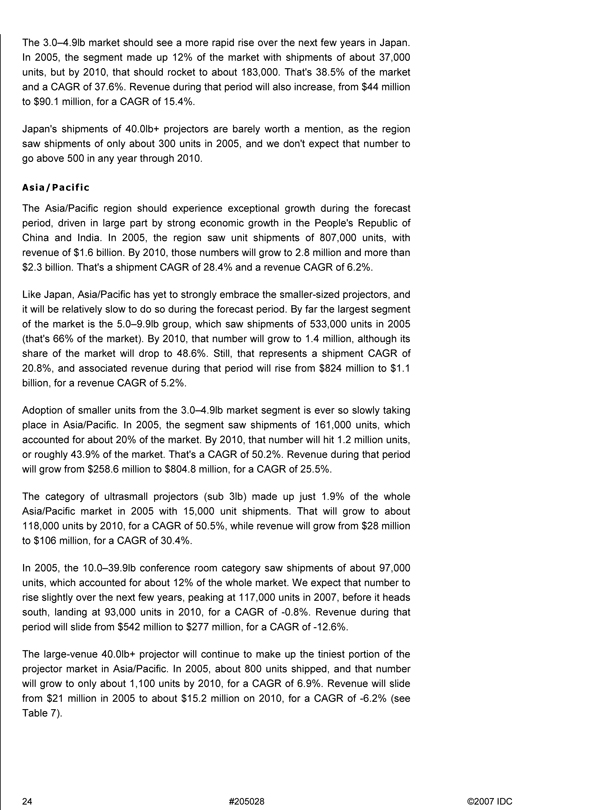

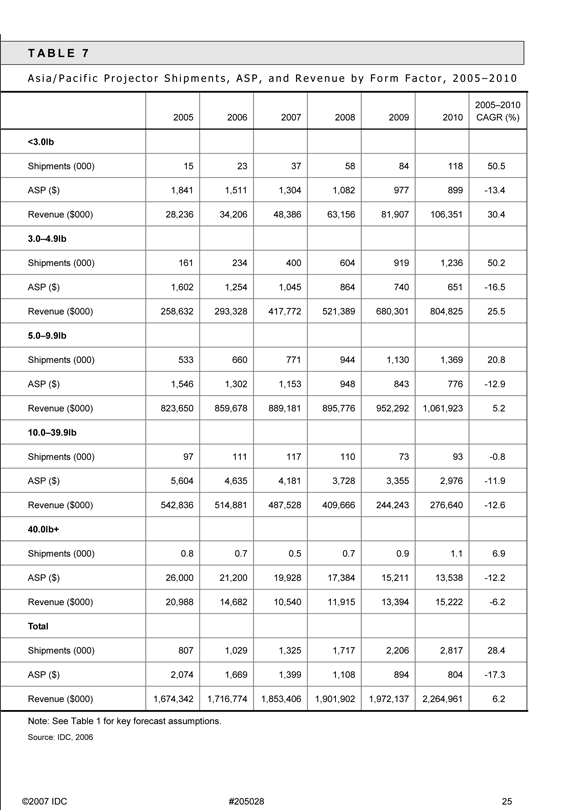

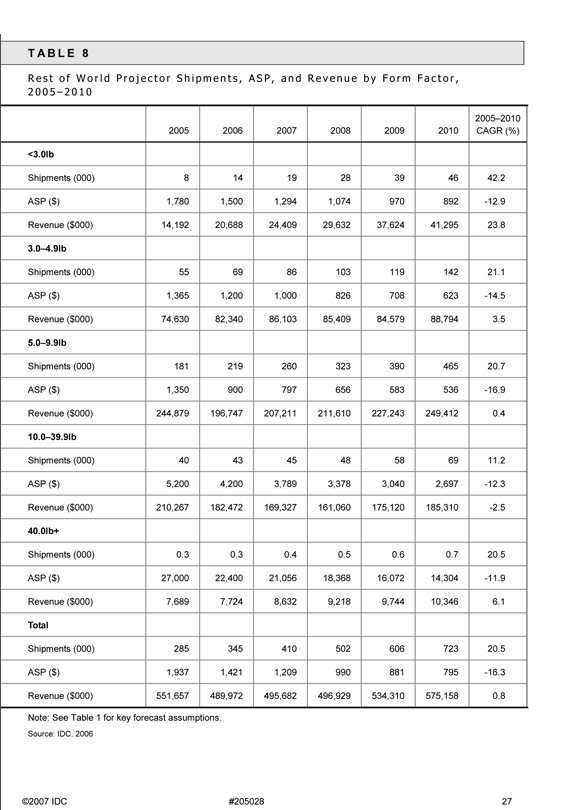

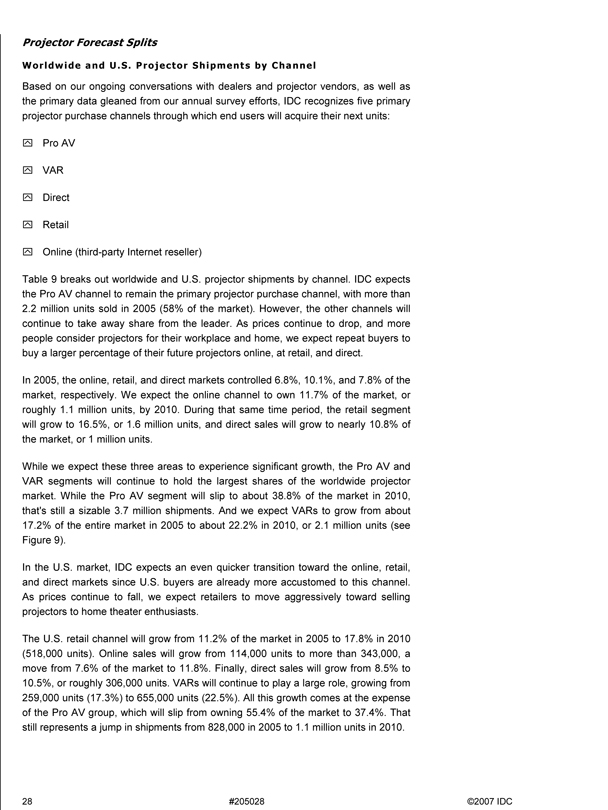

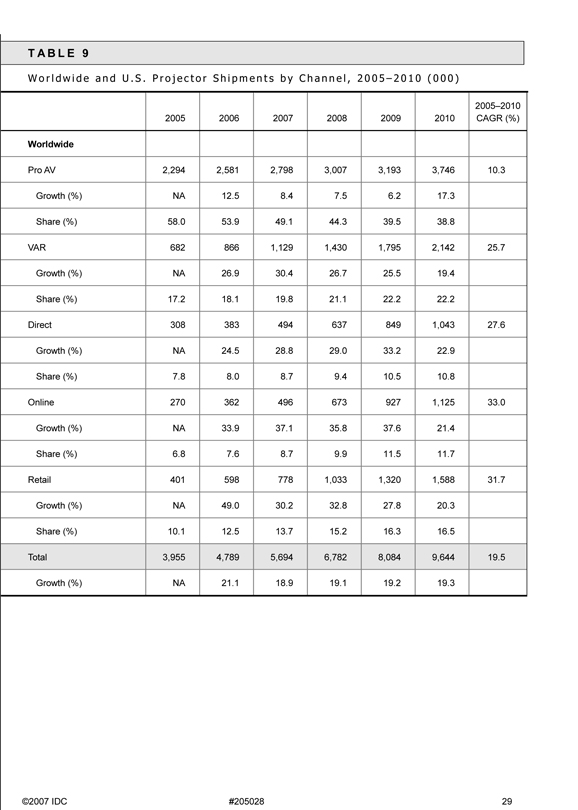

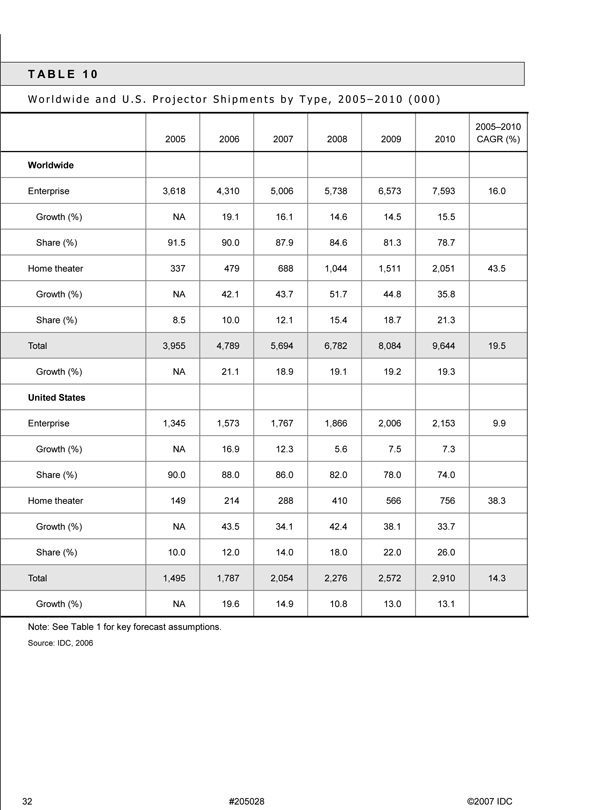

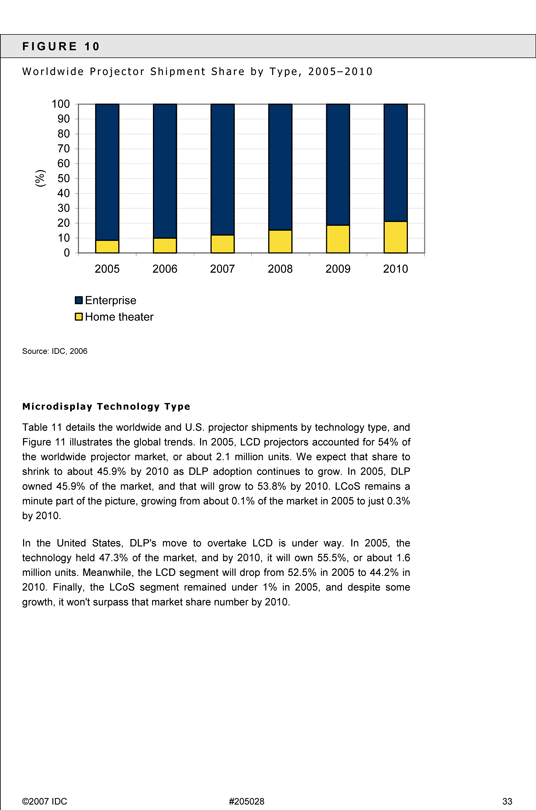

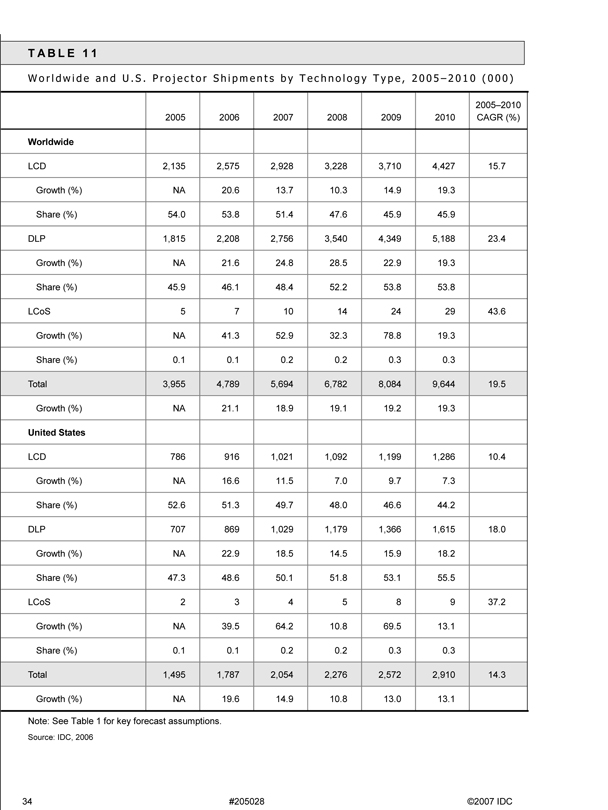

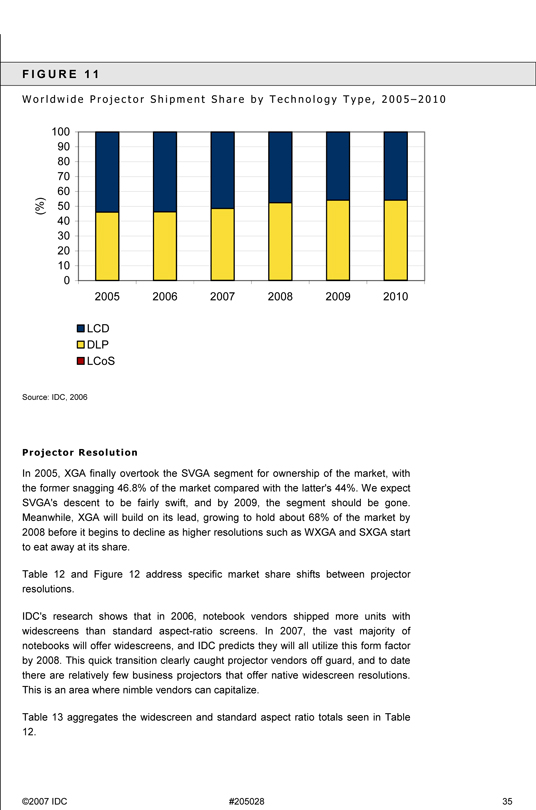

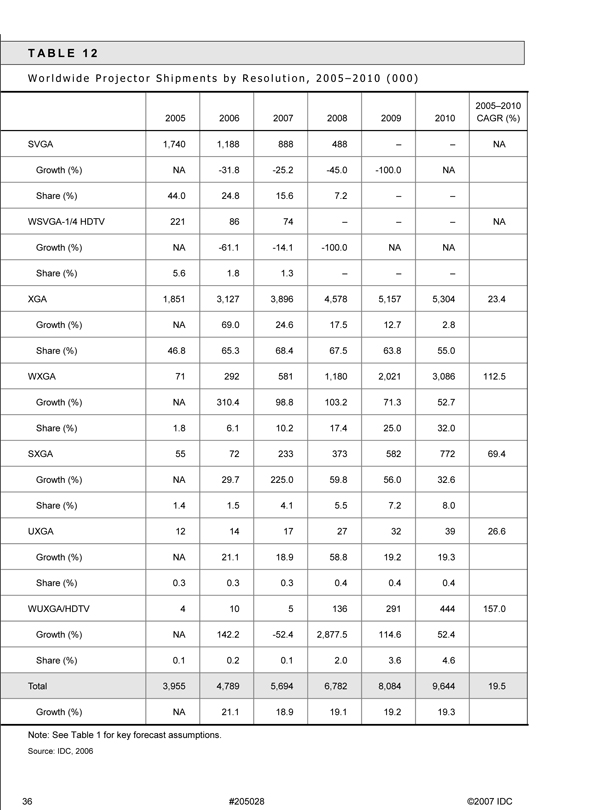

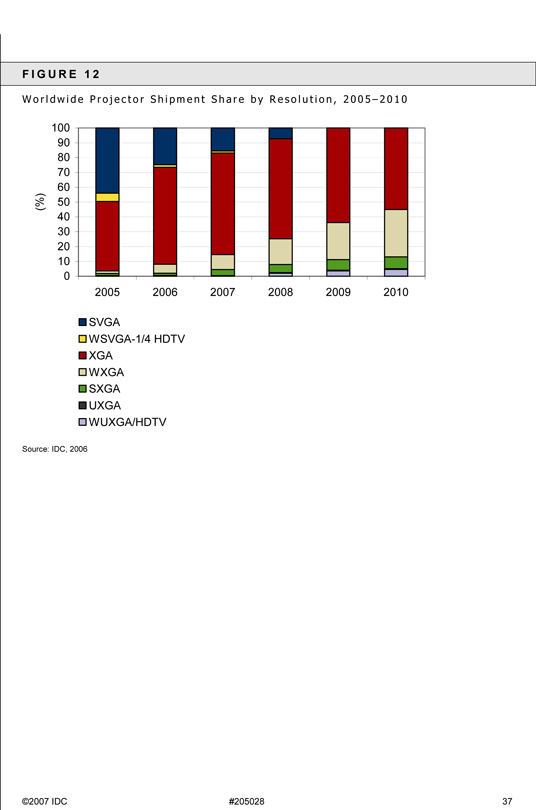

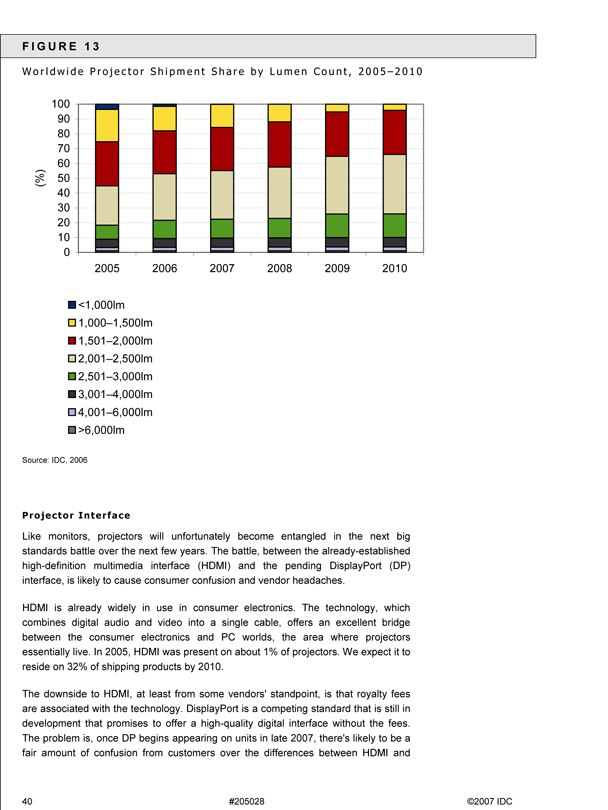

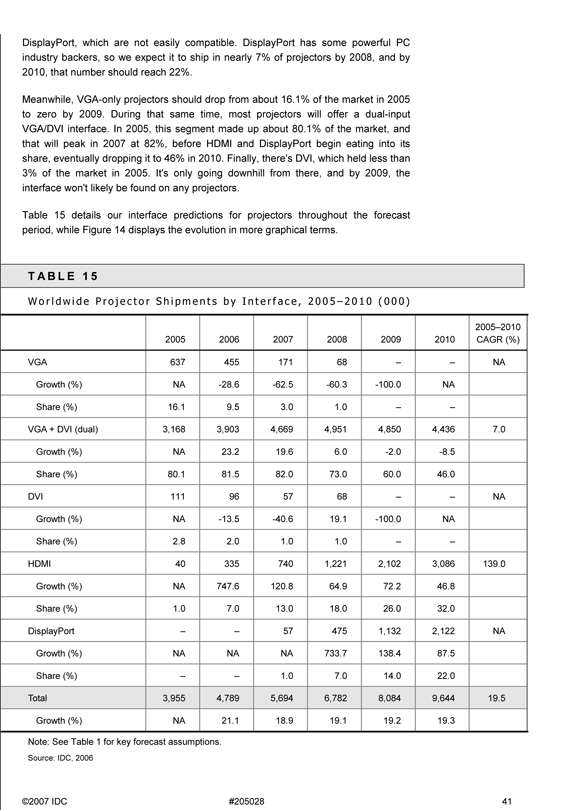

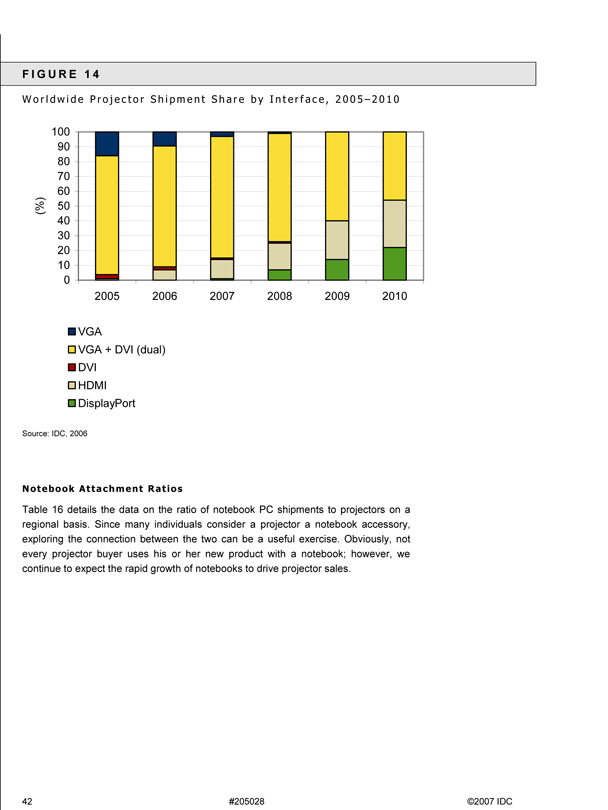

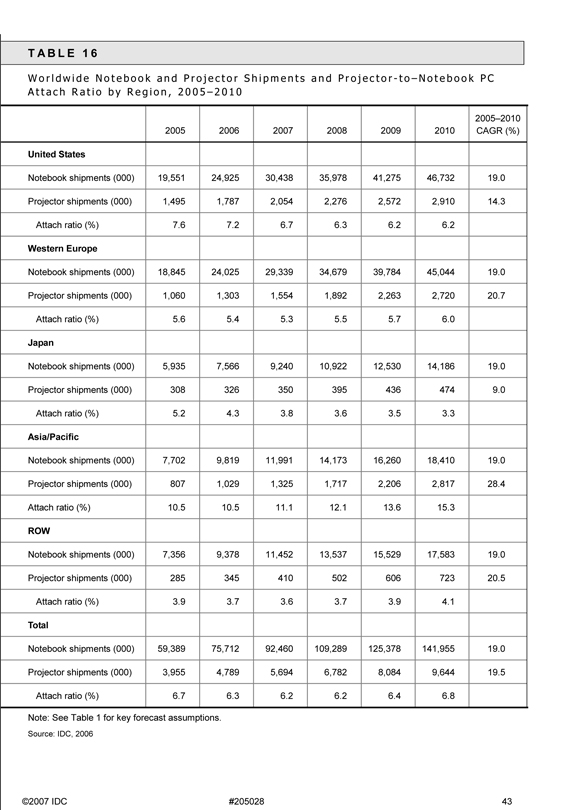

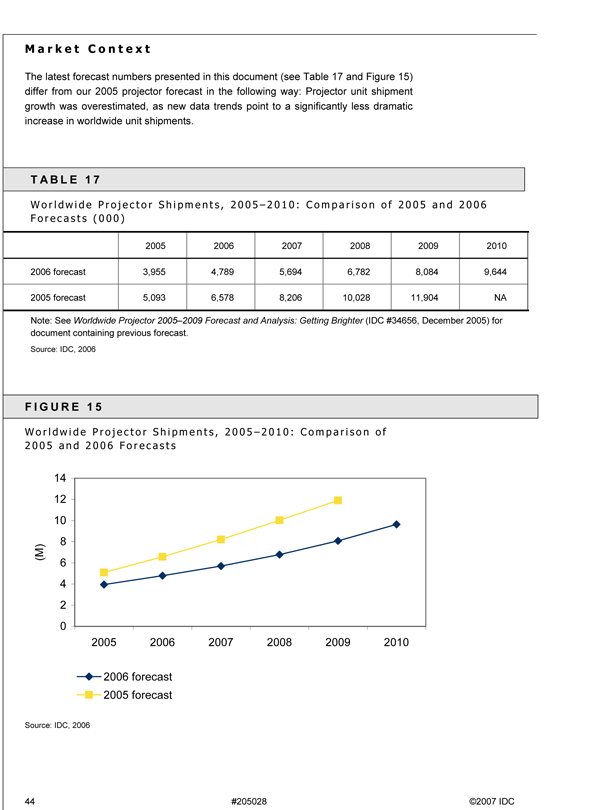

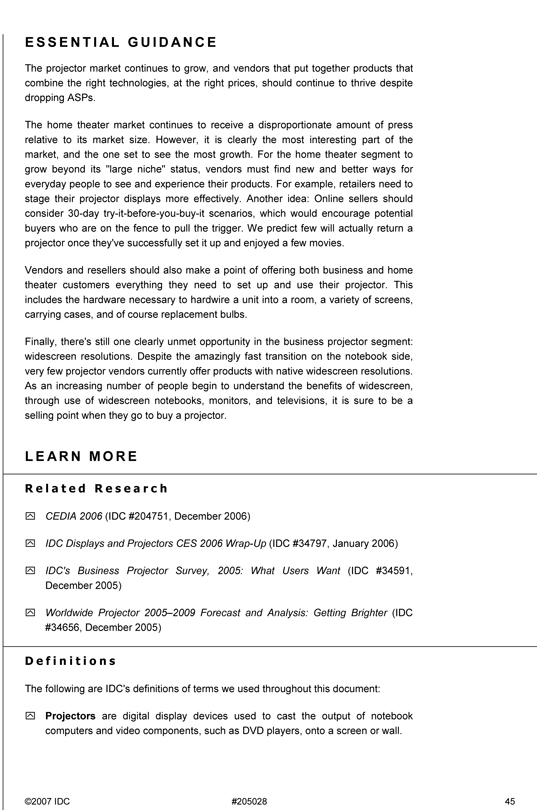

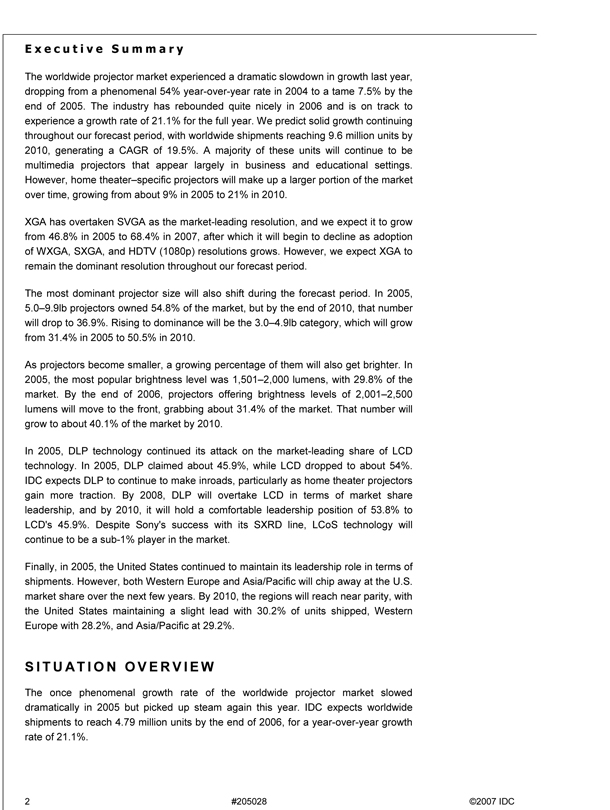

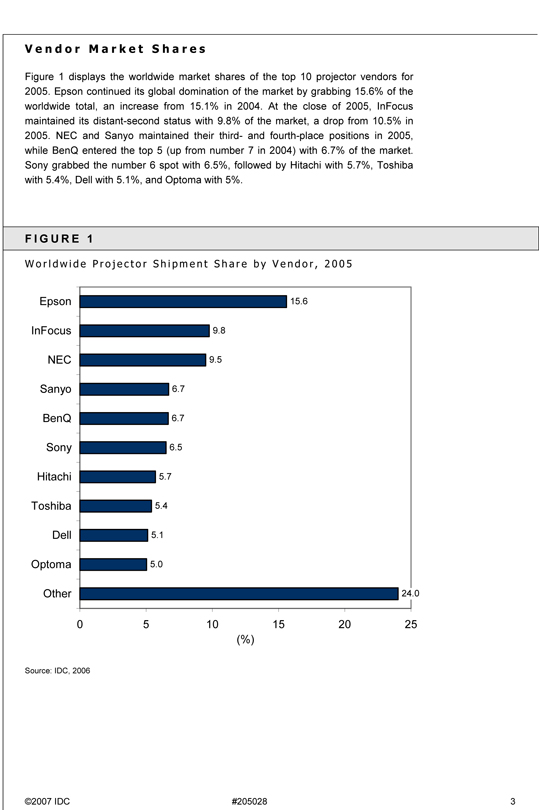

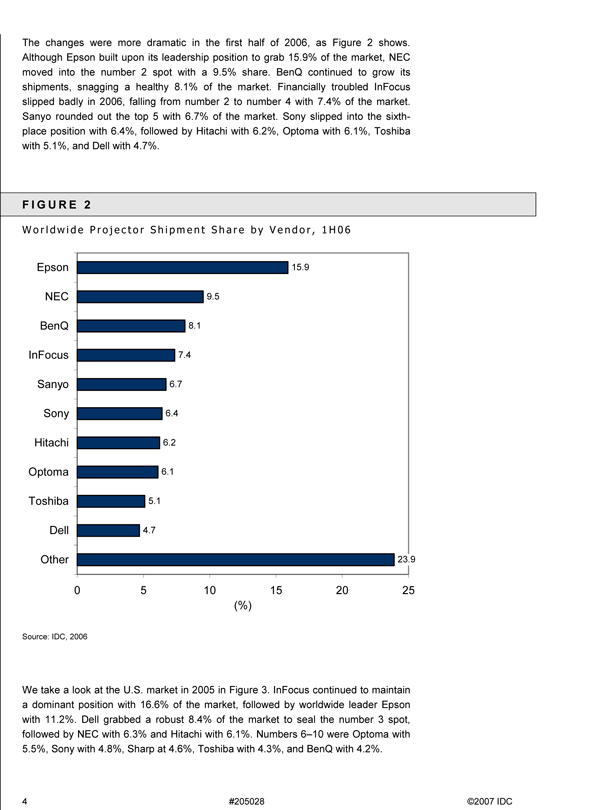

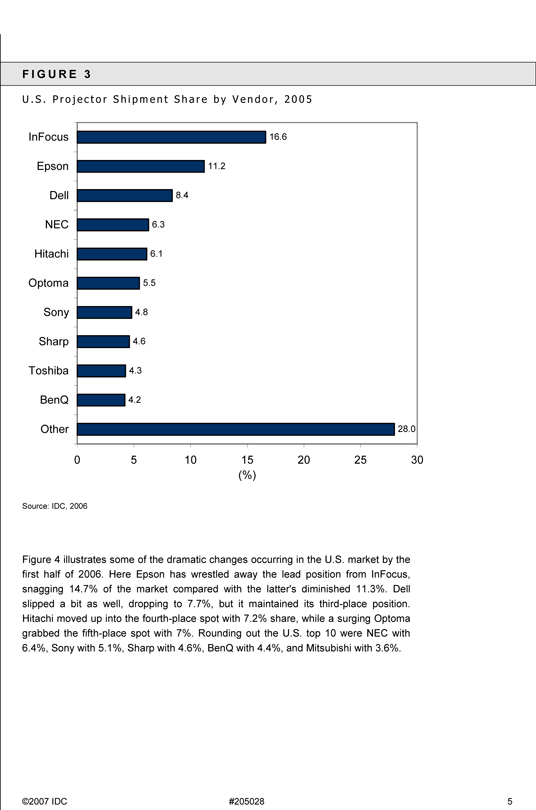

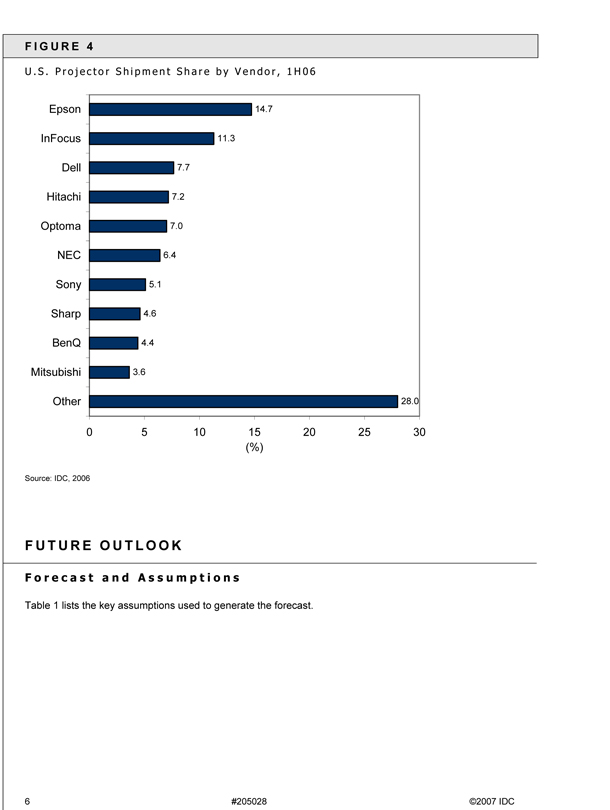

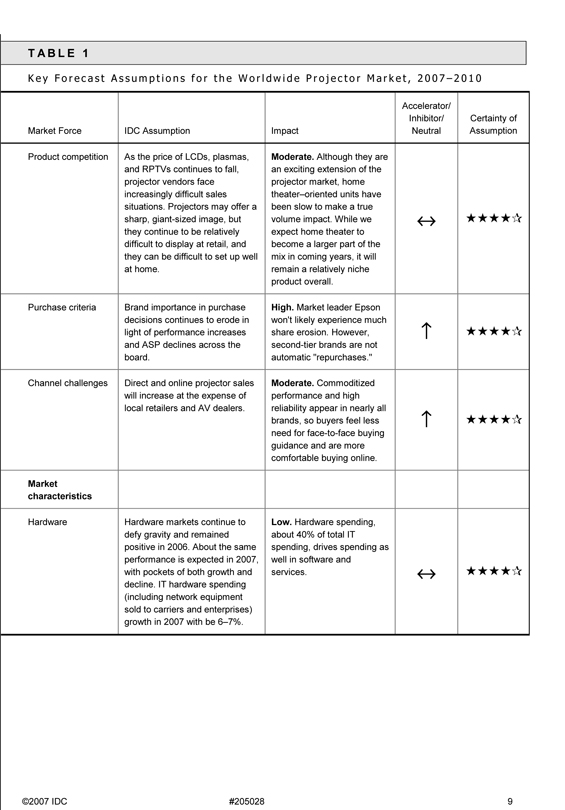

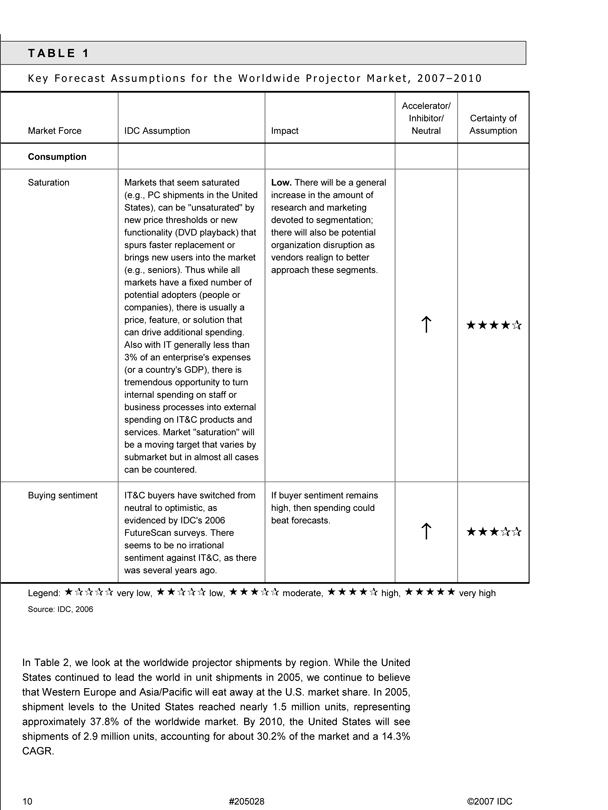

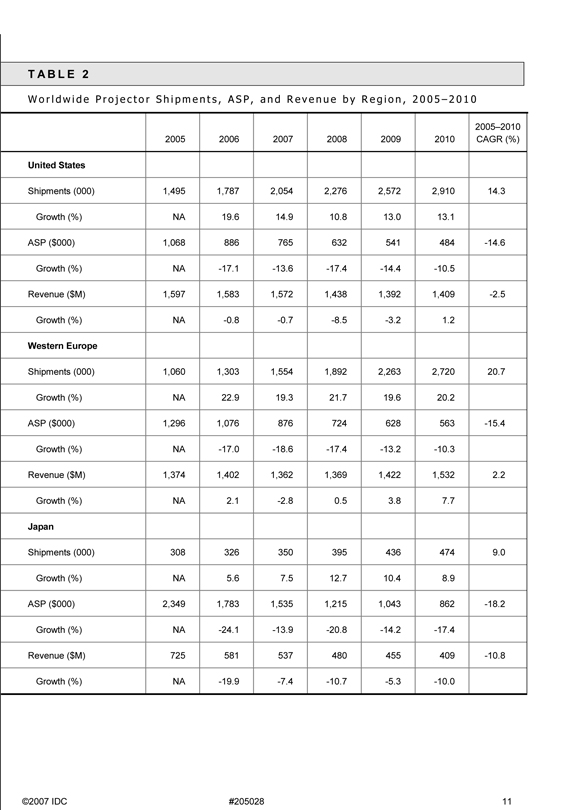

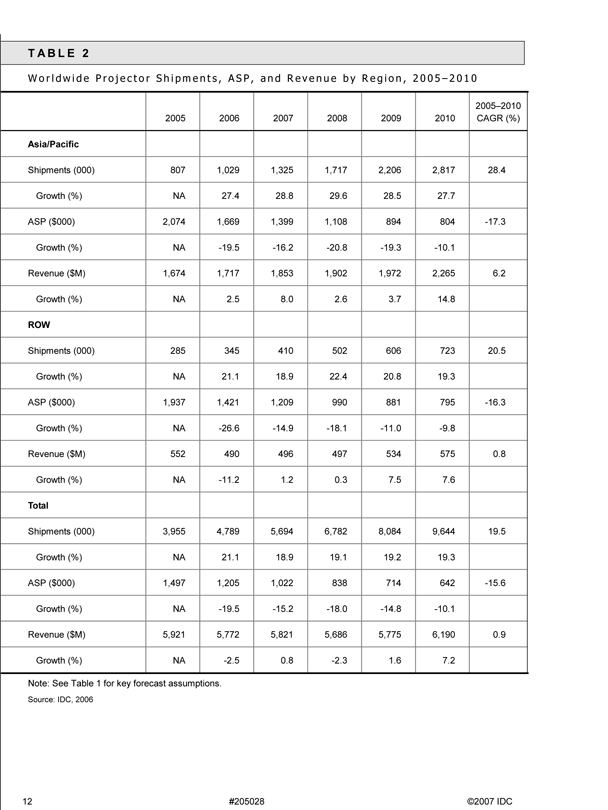

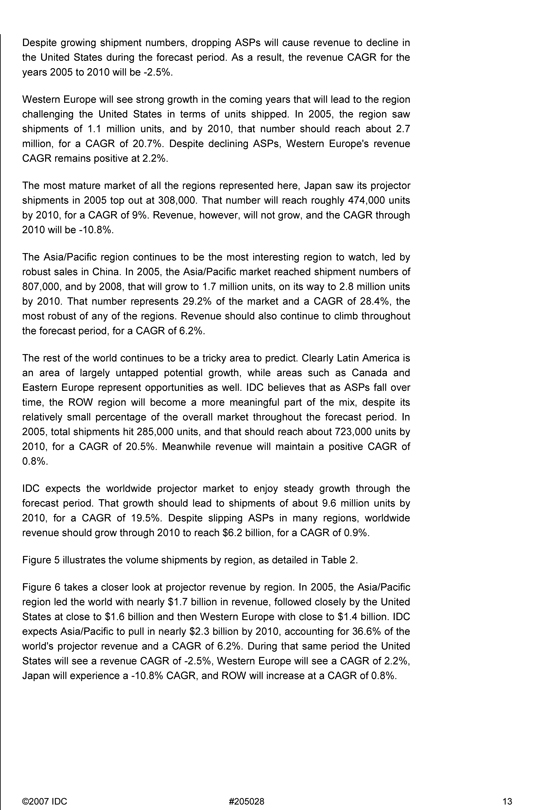

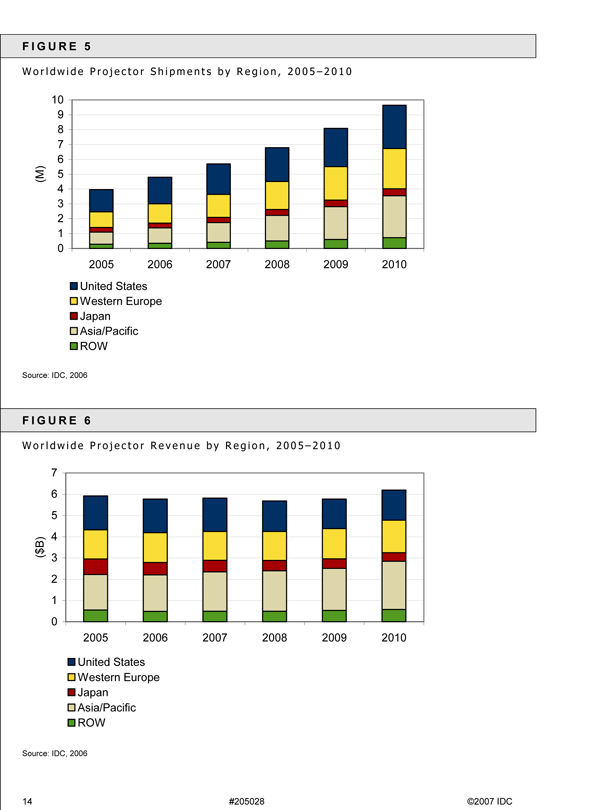

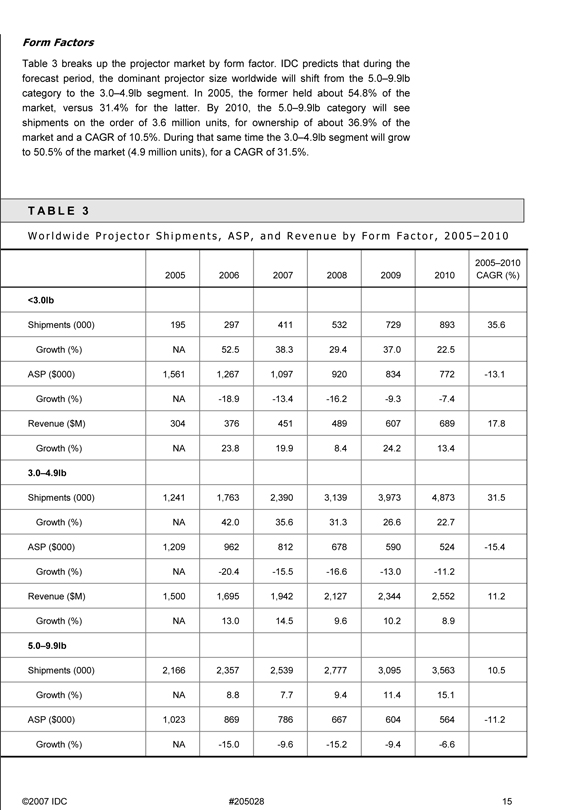

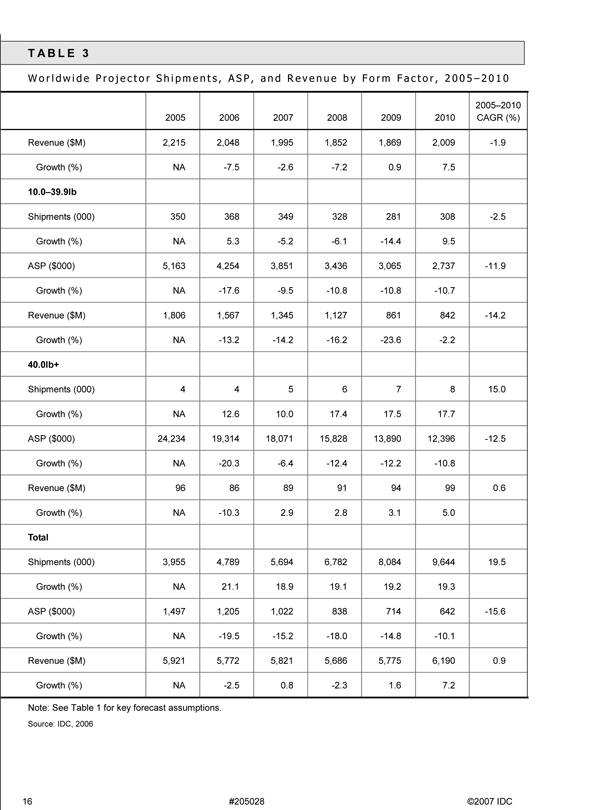

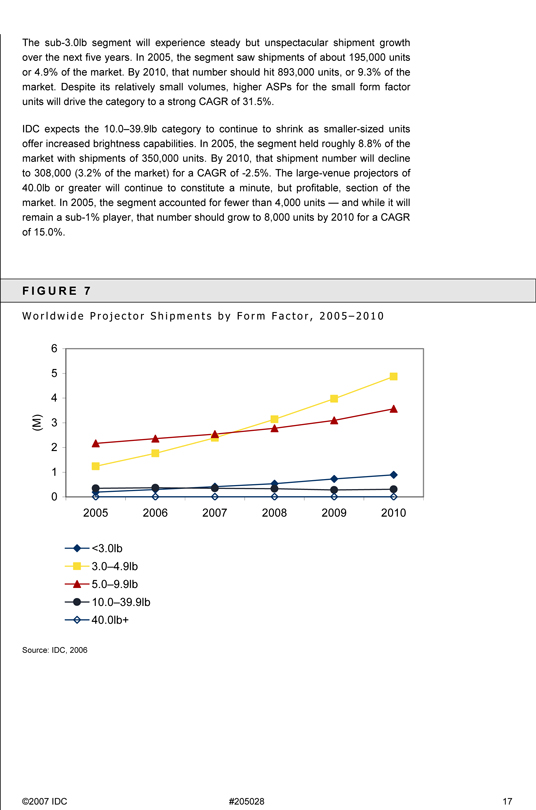

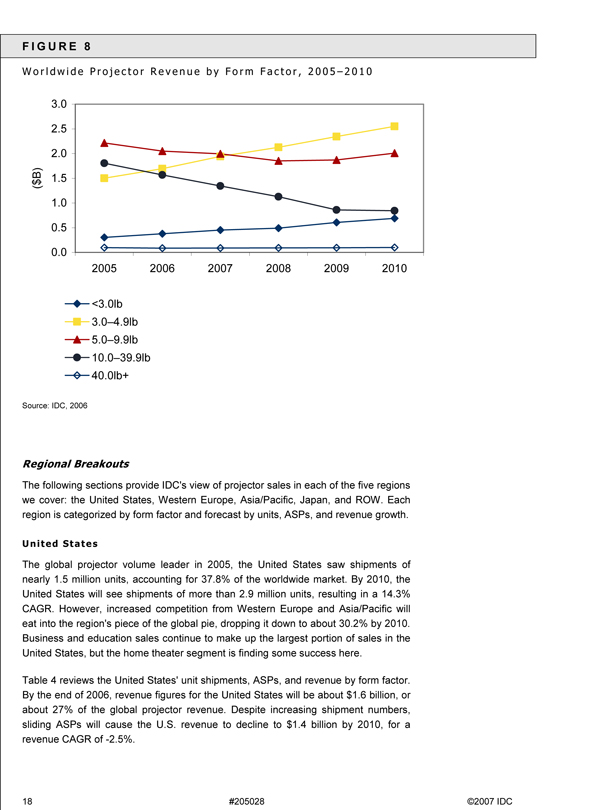

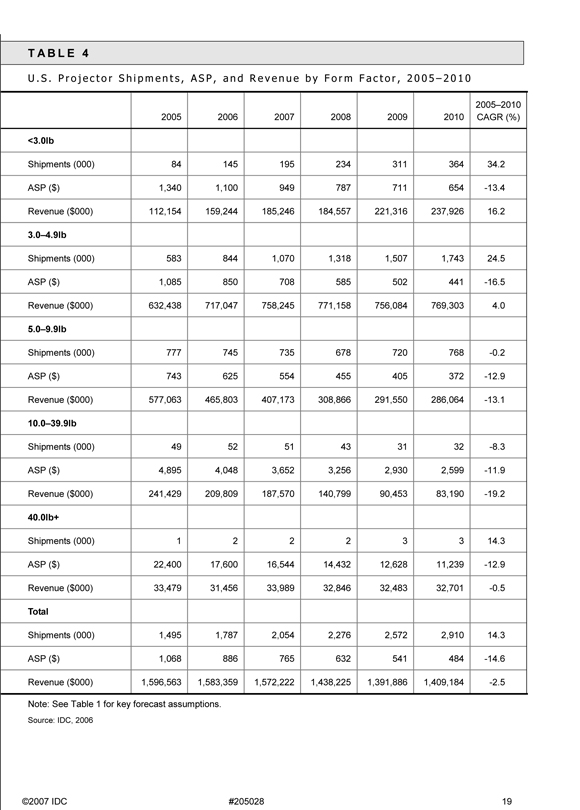

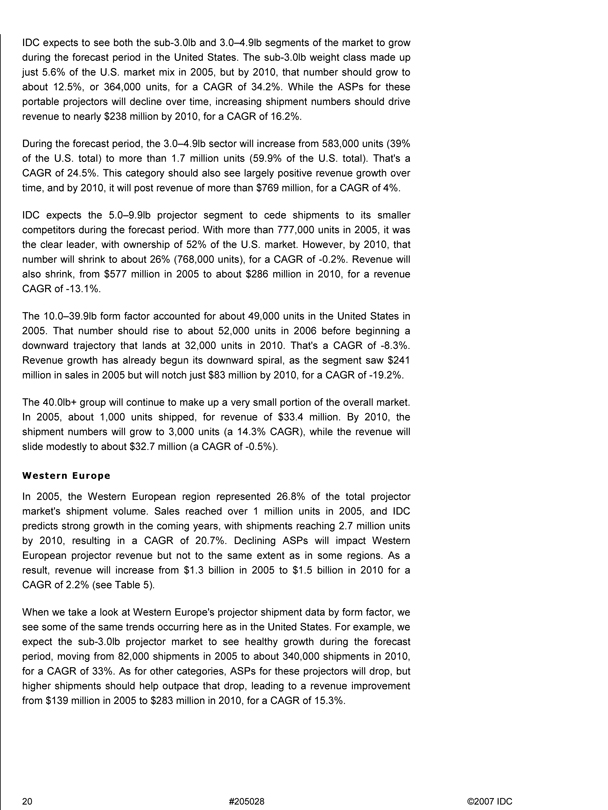

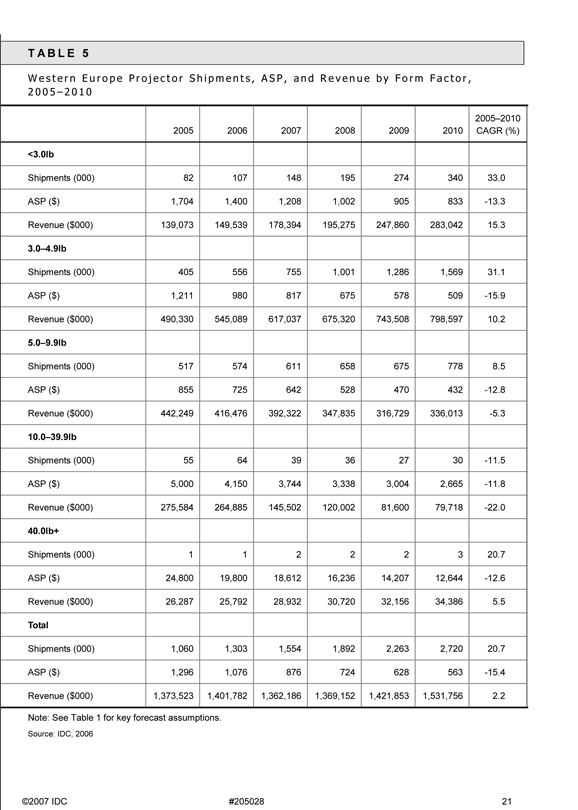

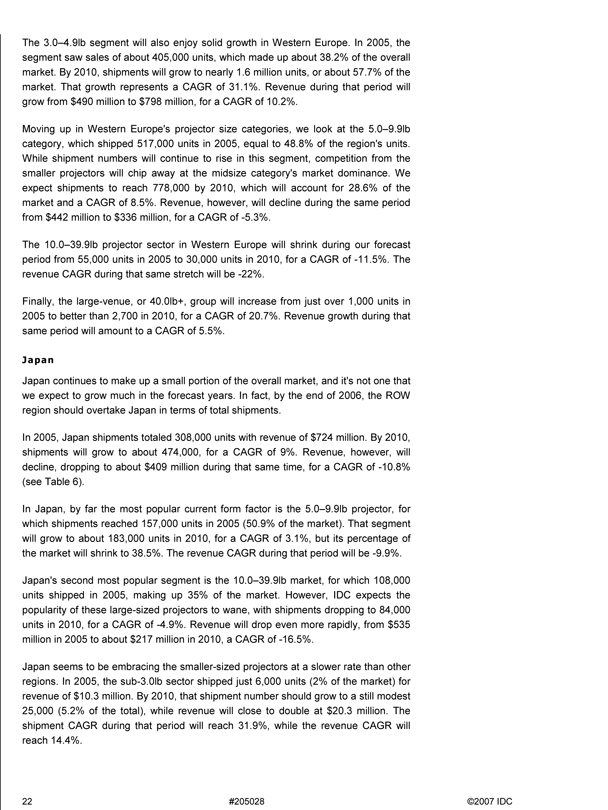

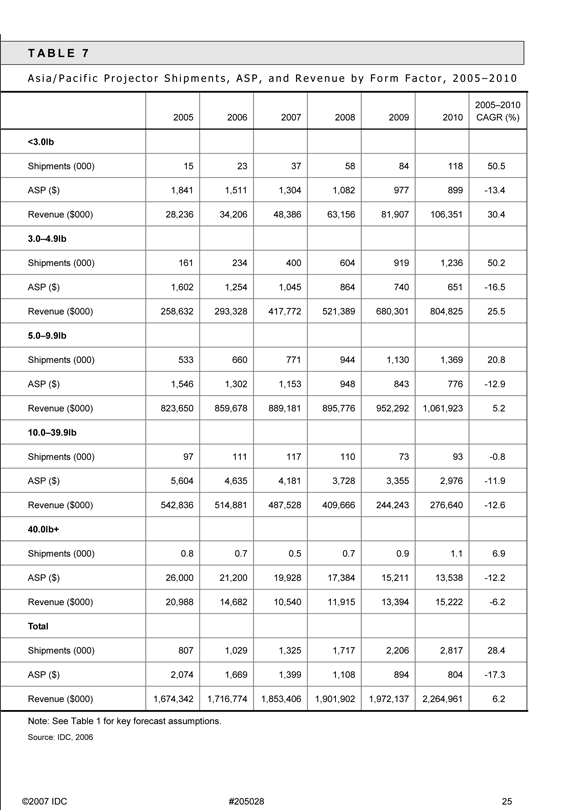

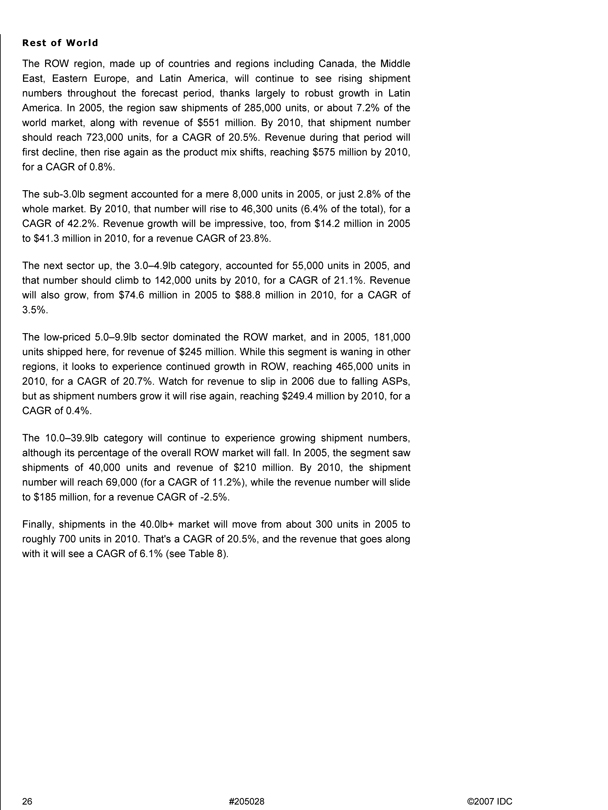

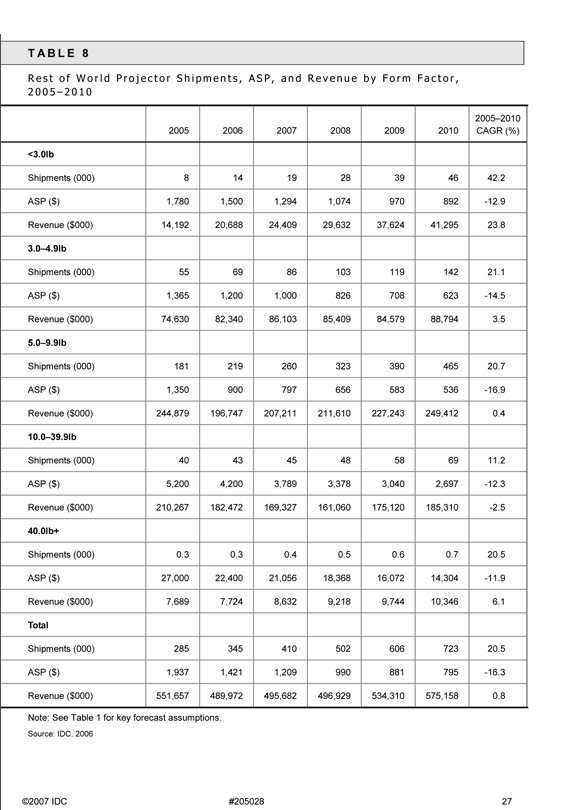

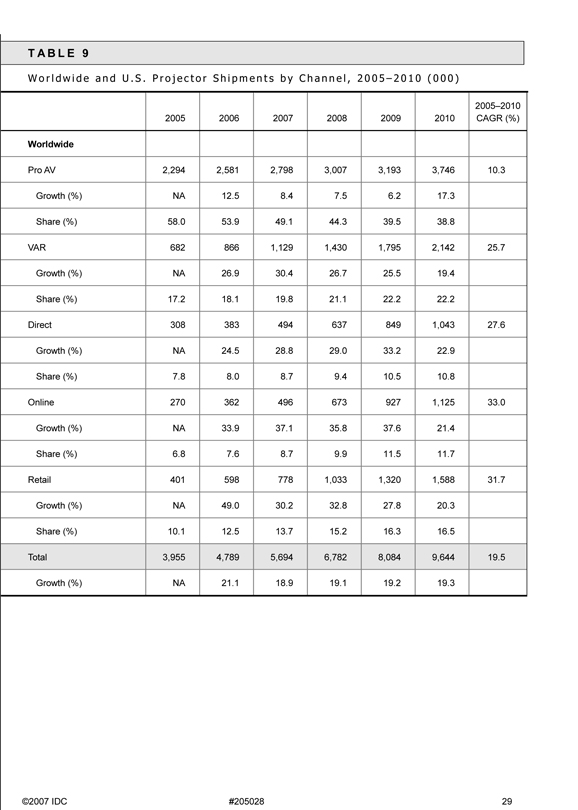

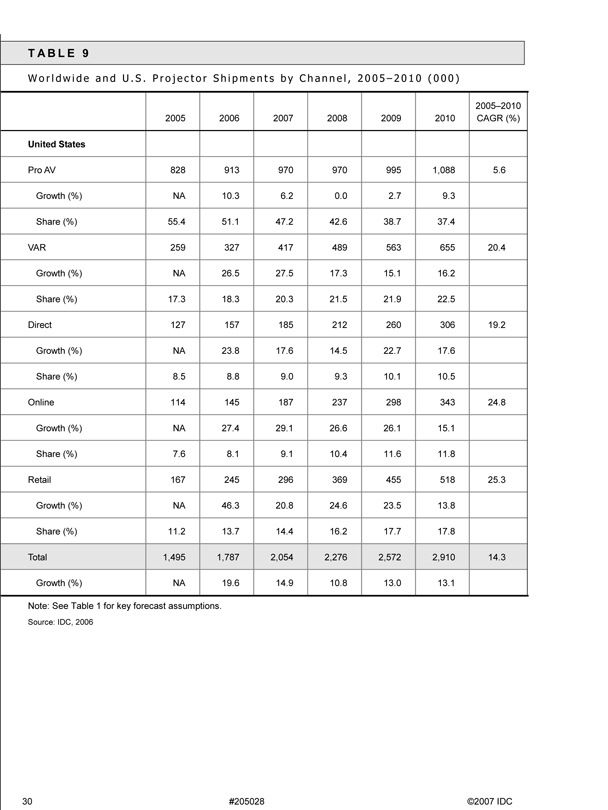

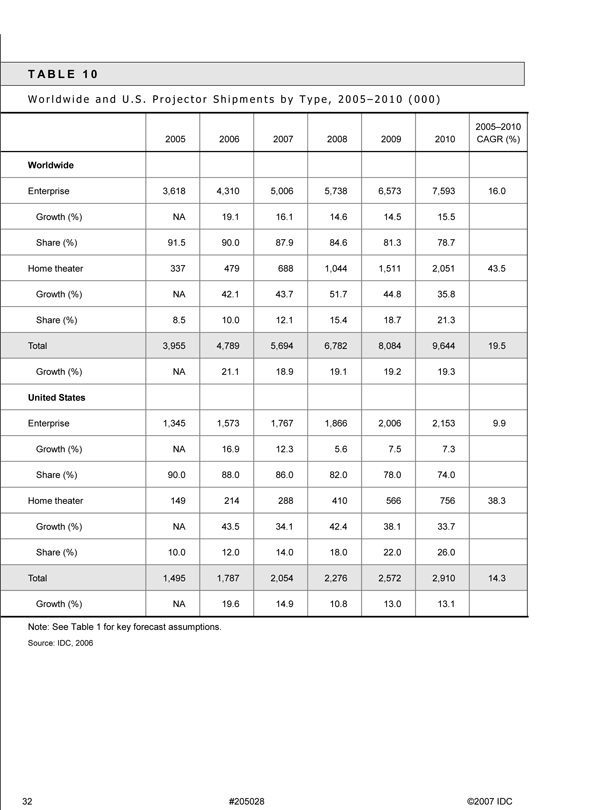

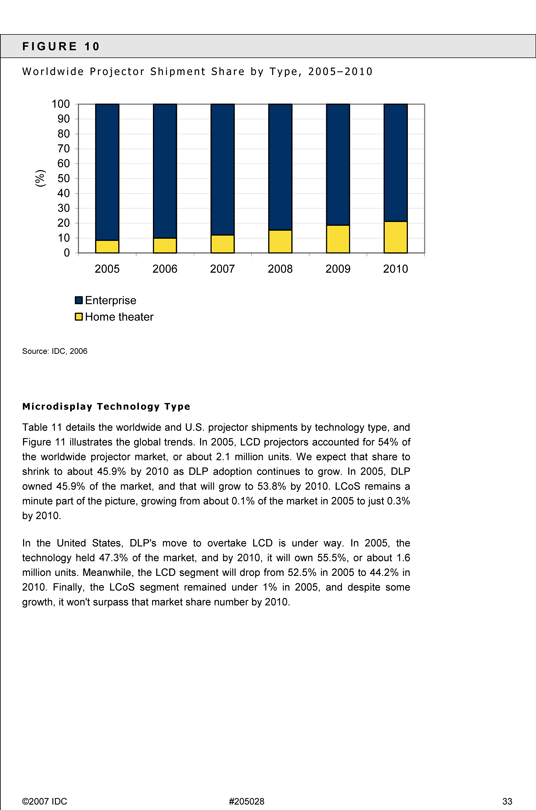

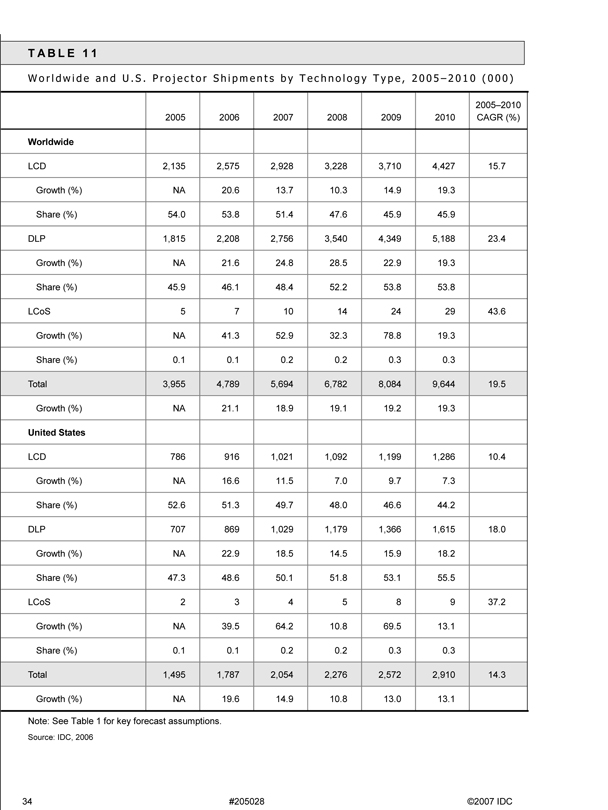

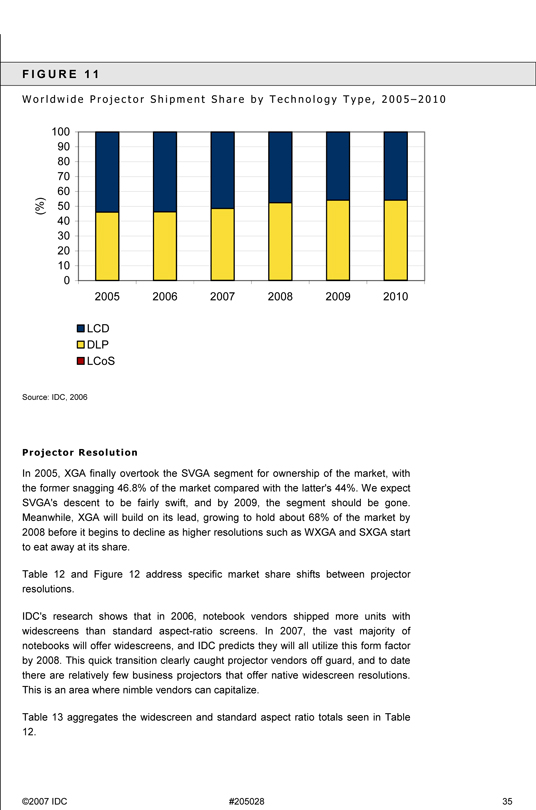

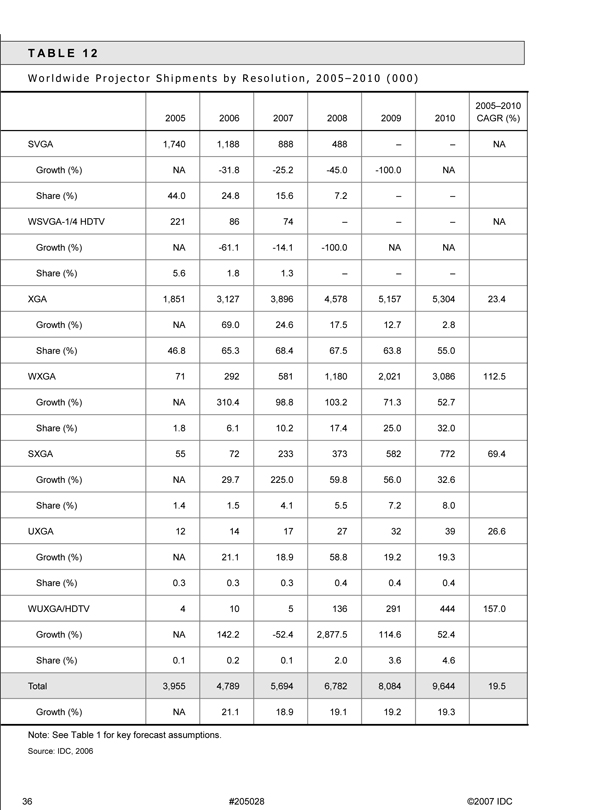

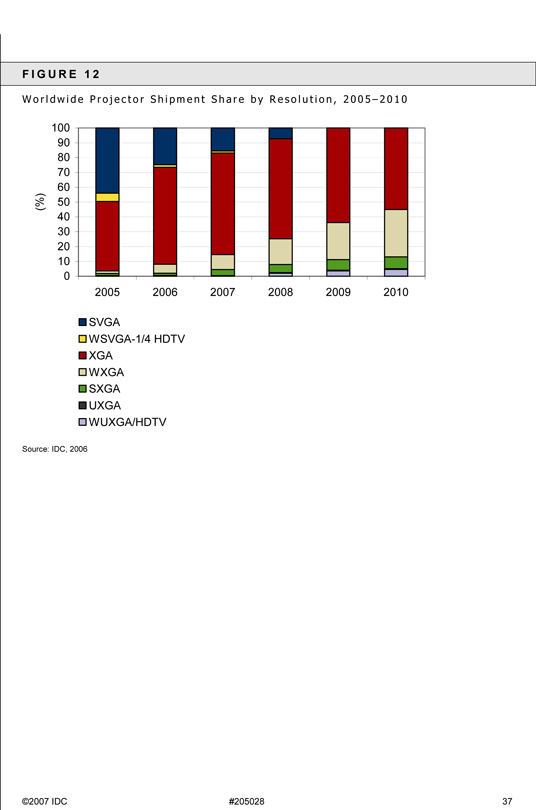

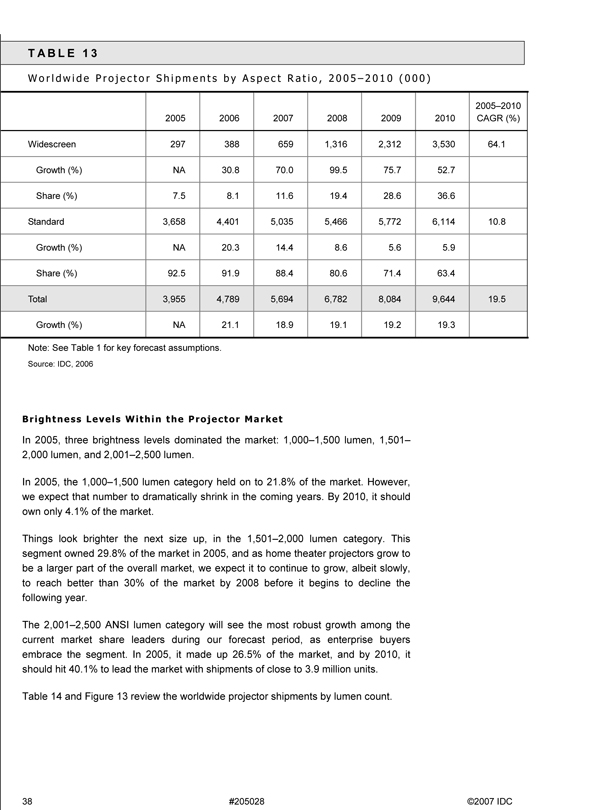

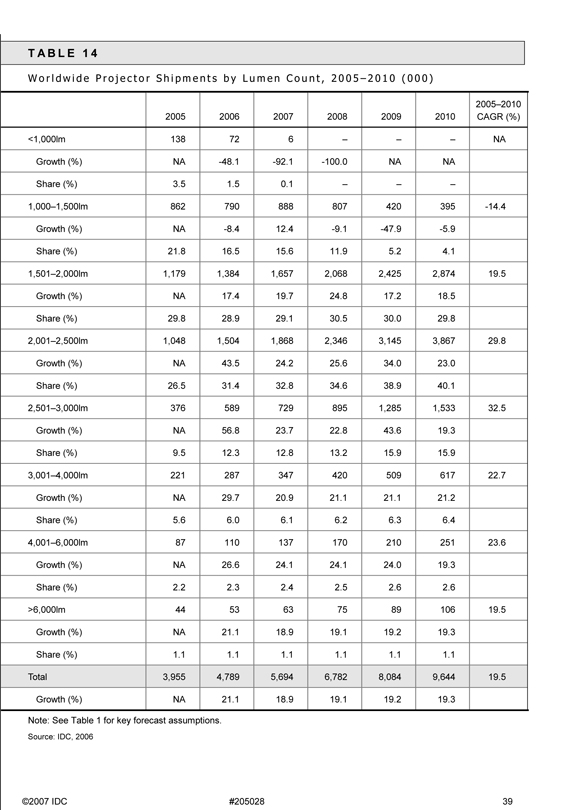

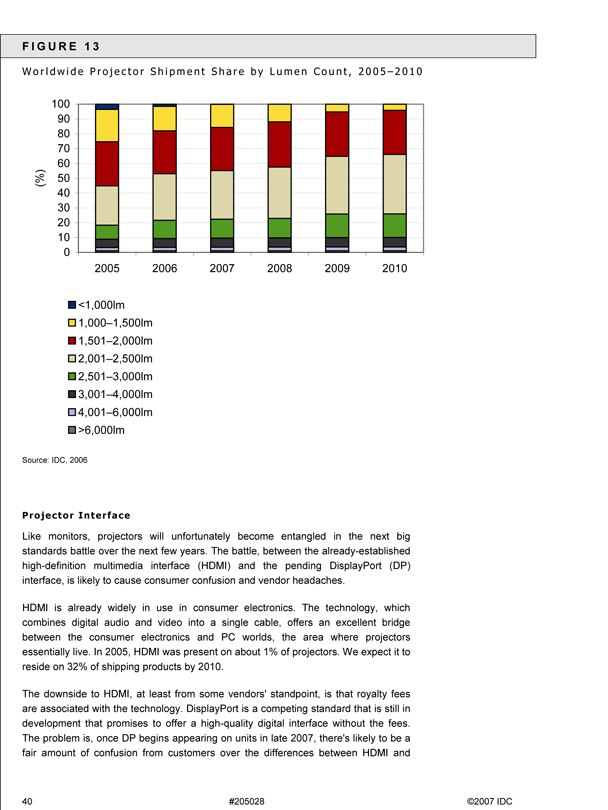

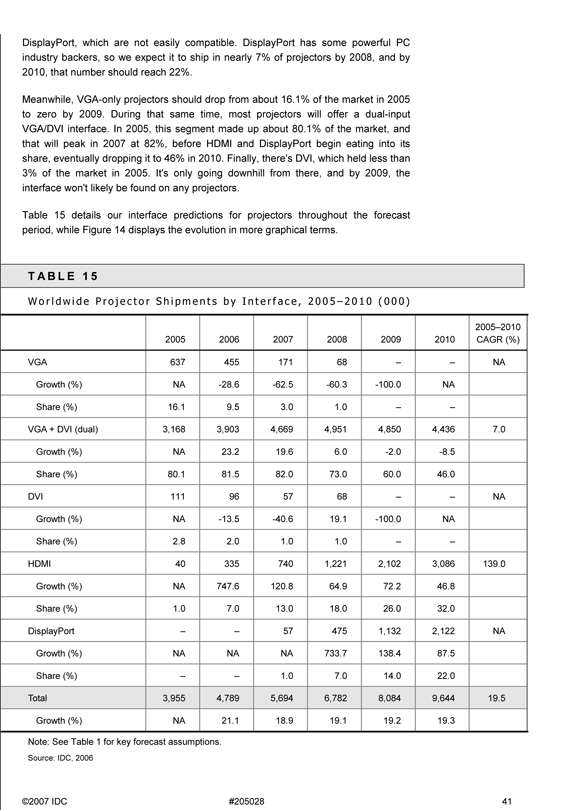

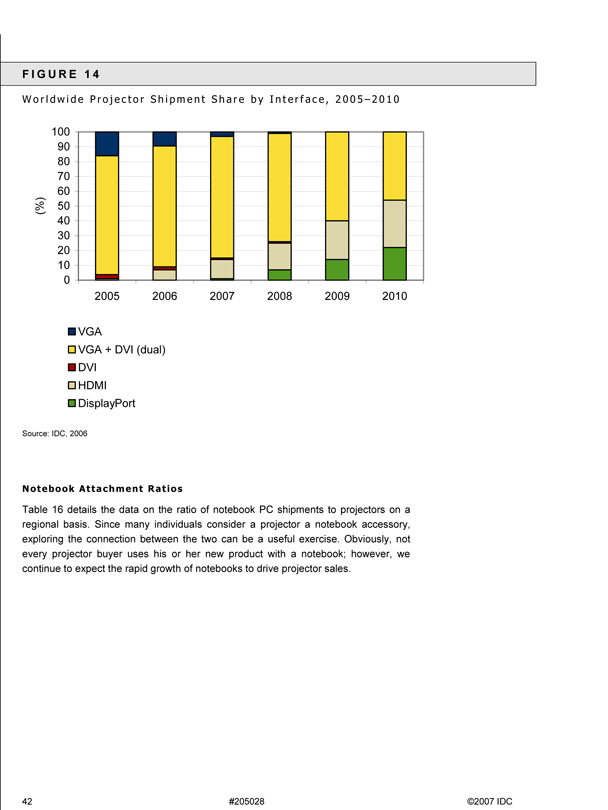

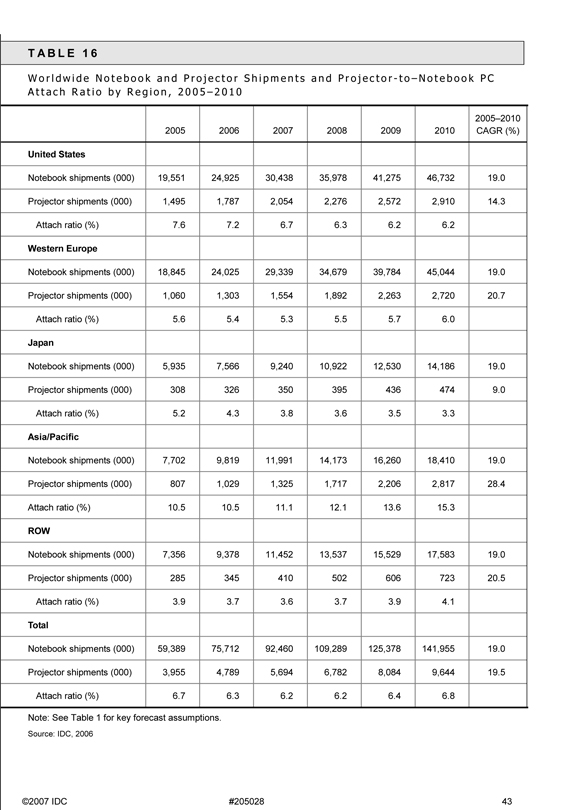

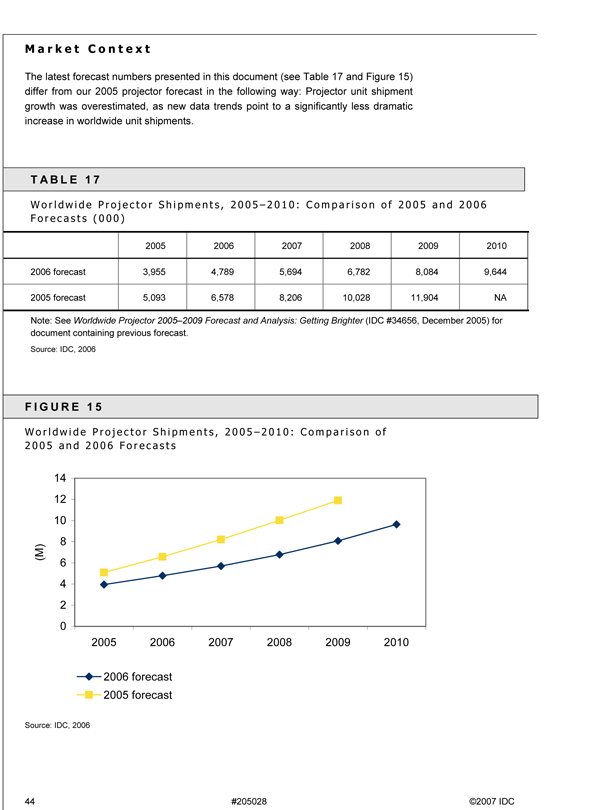

According to page 12 of IDC report titled Worldwide Projector 2007-2010 Forecast and Analysis, total worldwide projector shipments were 4.79 million units in 2006. In the same year, the Company shipped approximately 1.24 million accelerometers (or approximately 26% of worldwide total) for projector usage. SeeExhibit E. Most of the Company’s products were provided to prominent Japanese OEMs such as Epson, Sony, NEC, Panasonic and Toshiba. The function for projectors that require accelerometers are only incorporated in some higher end projectors, which consequently means that the Company’s market

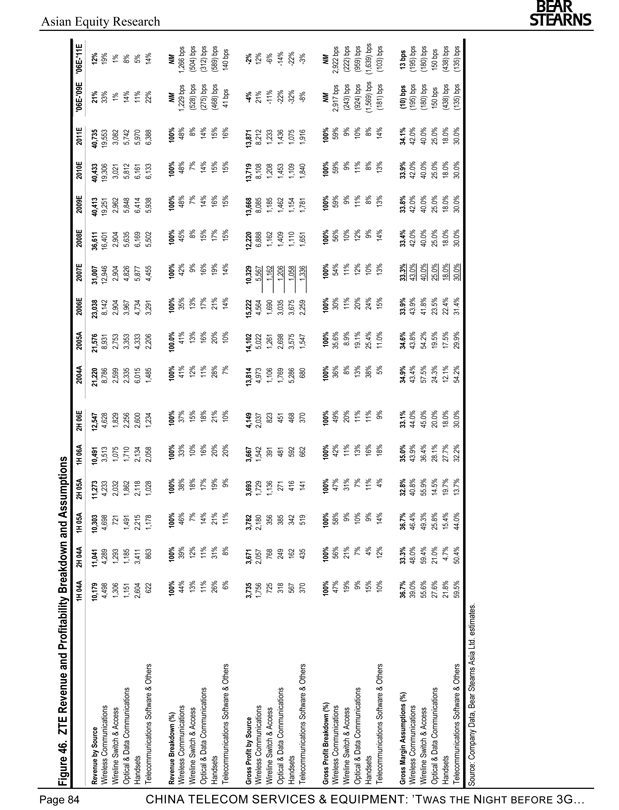

Mr. Tom Jones

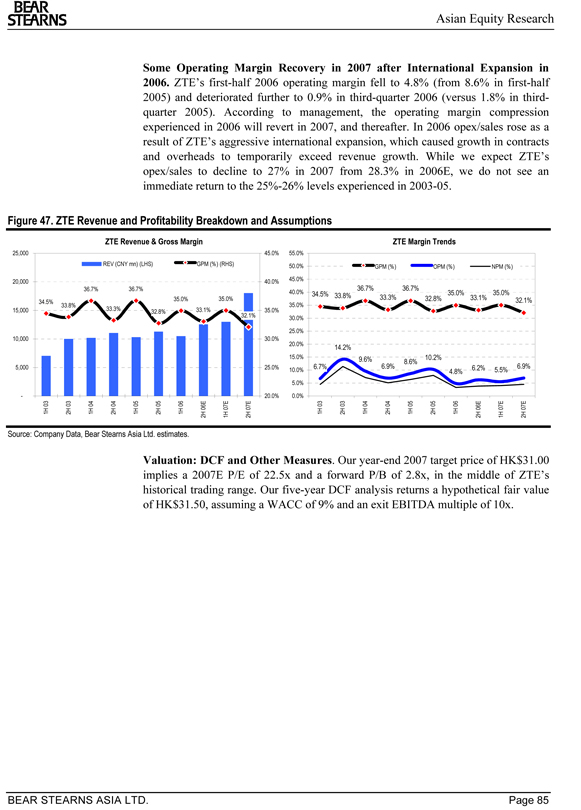

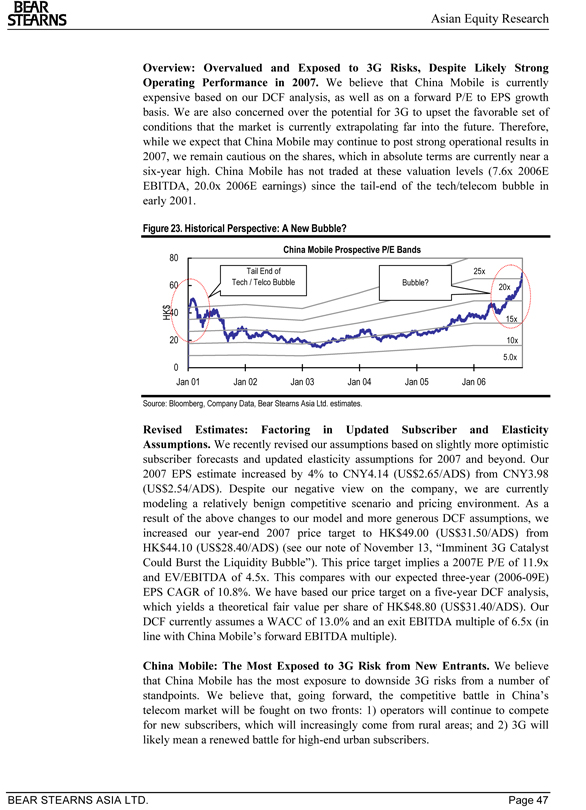

Securities and Exchange Commission

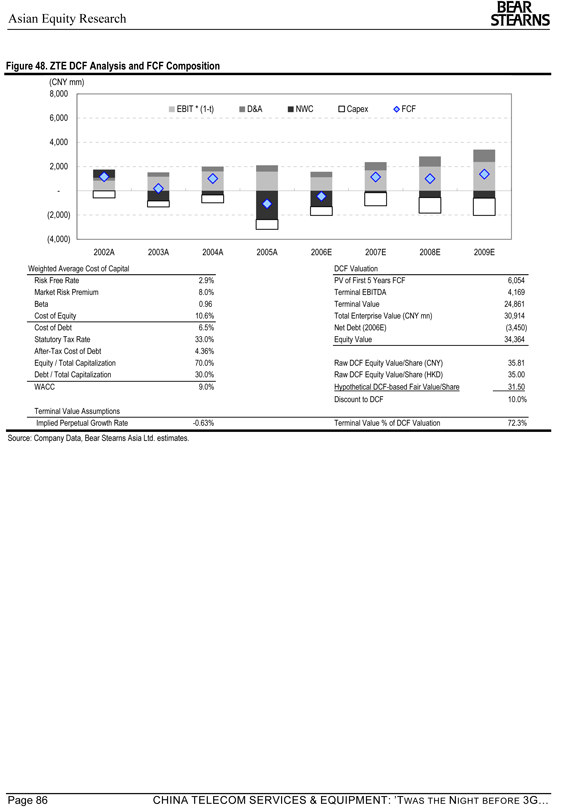

November 5, 2007

RE: MEMSIC, Inc. S-1 Registration Statement (File No. 333-146377)

Page 4

share in this smaller sub-segment is higher than the 26% of the worldwide total for all projectors noted above. Based on this information, the Company supplementally advises the Staff that the Company believes it is the single largest accelerometer provider for the projector market. However, the claims in the prospectus to be merely “among the leading providers” are due to a lack of independent tracking of this sub-segment of the projector market.

| | (iii) | the Company’s products “have been used by leading international and China-based manufacturers,” |

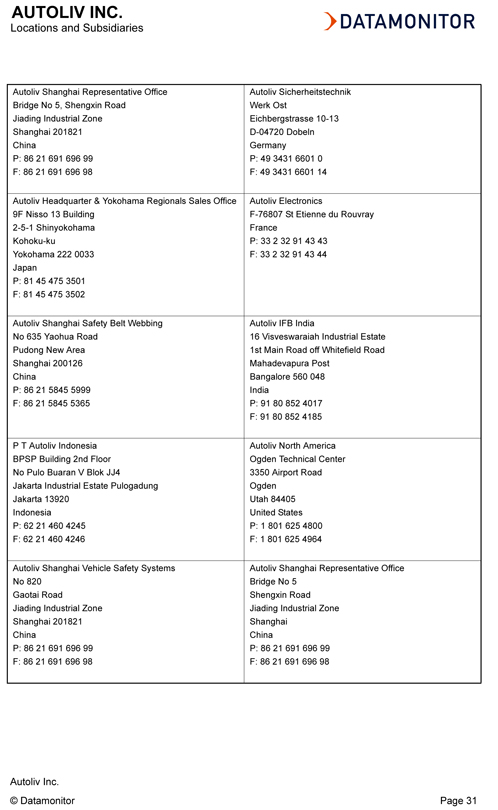

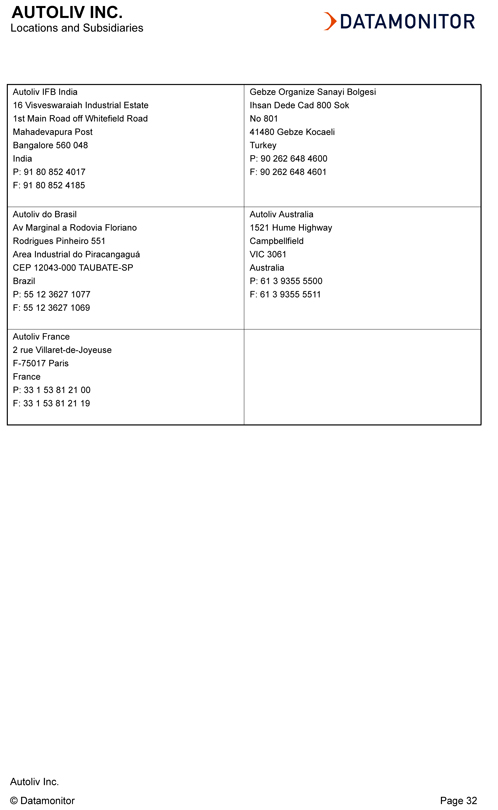

The Company supplementally advises the Staff that its customers include IBM, Sony, Mitsubishi and Autoliv Inc., each of which the Company respectfully submits is recognized as a leading international manufacturer.

The Company further supplementally advises the Staff that its China-based customers include Tianyu and Bird. According to a news article published in the Shanghai Daily on October 26, 2007 quoting a recent iSuppli report, Tianyu and Bird are expected to be the third and fourth, respectively, largest OEM handset makers in China in 2007 based on units sold. SeeExhibit C.

| | (iv) | one of the Company’s customers is “a leading European automotive safety systems supplier,” |

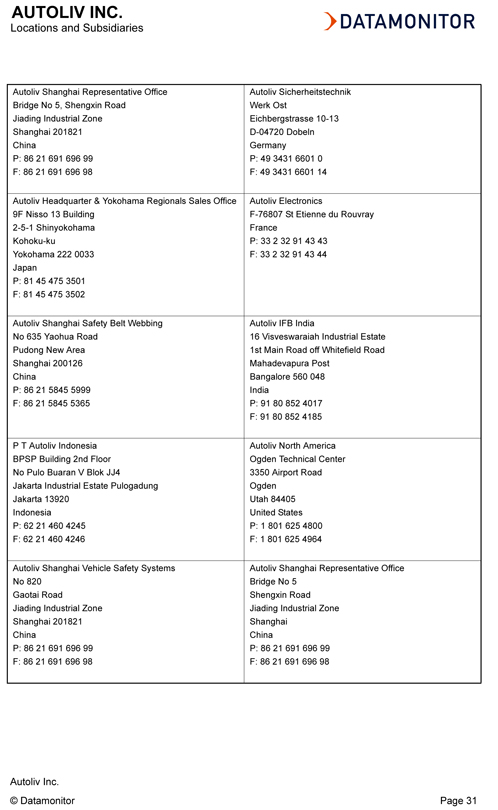

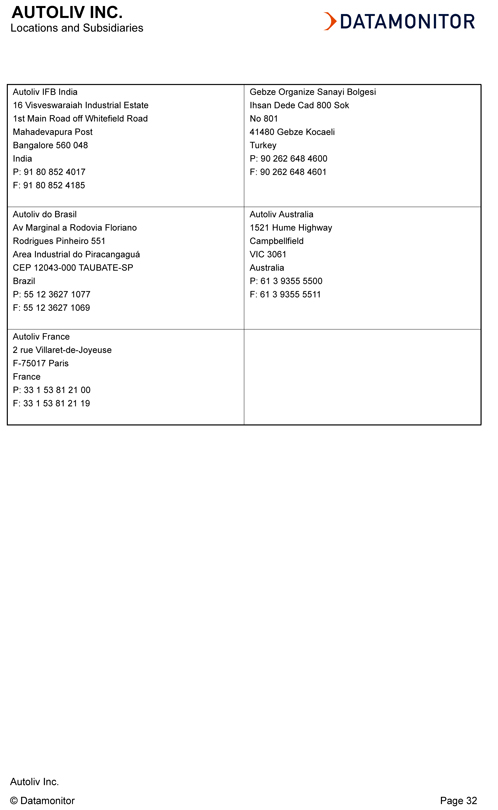

The Company supplementally advises the Staff that the customer being referred to is Autoliv Inc., which the Company respectfully submits is recognized as a leading European automotive safety systems supplier.

Moreover, Datamonitor, an independent provider of online database and analysis services for key industry sectors, also states that Autoliv Inc. is a leading supplier of safety systems to the global automotive industry – page 5 of Autoliv Inc. Company Profile (publication date: January 2007, reference code: 4268). SeeExhibit F.

| | (v) | Please provide with independent support for the Company’s statement that the thermal technology it is using to produce MEMS accelerometers has a “higher shock tolerance, lower failure rate and lower cost relative to alternative mechanical solutions”. |

According to a press release dated October 16, 2007 from Frost & Sullivan, an independent market research firm, the Company’s accelerometers (a) can withstand a theoretical shock limit of over

Mr. Tom Jones

Securities and Exchange Commission

November 5, 2007

RE: MEMSIC, Inc. S-1 Registration Statement (File No. 333-146377)

Page 5

50,000 g which is over five times that of traditional accelerometers; and (b) have the lowest failure rate for any device in its class.

The same press release also notes that the Company has a competitive edge over other MEMS inertial sensor manufacturers in terms of performance versus price. SeeExhibit G.

On page 8 of the Wicht Technologie Consulting feature article, it is stated that the Company provides the lowest cost solution for 2-axis sensors. SeeExhibit B.

| 5. | You state on page 1 that you have shipped more than 20 million units since 2004, yet you state on page 38 that you have shipped more than 19 million units since that time. Please reconcile these two statements. |

The Company has updated and amended the disclosure on pages 1 and 38.

| 6. | Please tell us the criteria used to identify Autoliv Electronics. Also, tell us whether there are any other customers that satisfy those criteria. |

The Company supplementally advises the Staff that the Company has amended references to Autoliv Electronics in the disclosure to Autoliv Inc., parent company of Autoliv Electronics.

The Company also supplementally advises the Staff that Autoliv Inc. has historically been, and continues to be, the Company’s largest customer for automotive applications, and has accounted for a significant majority of the Company’s revenue for automotive application products during the periods presented in the financial statements. The Company has revised the disclosure to clarify the relevant statements on pages 1 and 62.

Industry Overview, page 2

| | 7. | Please provide us with copies of the sources of all third-party data included in the prospectus. Please mark the relevant sections of those reports and key them to the disclosure. Please tell us whether: |

| | (i) | the data is publicly available, |

| | (ii) | the sources of the cited data have consented to your use of their names and data, |

| | (iii) | you commissioned any of the data, or |

| | (iv) | it was prepared for use in this registration statement. |

Mr. Tom Jones

Securities and Exchange Commission

November 5, 2007

RE: MEMSIC, Inc. S-1 Registration Statement (File No. 333-146377)

Page 6

Also, tell us about any other relationship between you and the authors of the data.

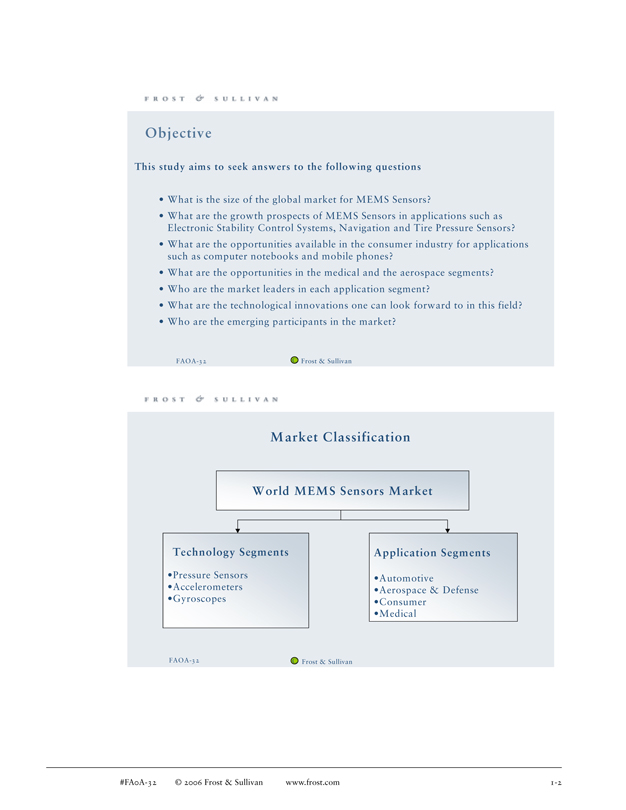

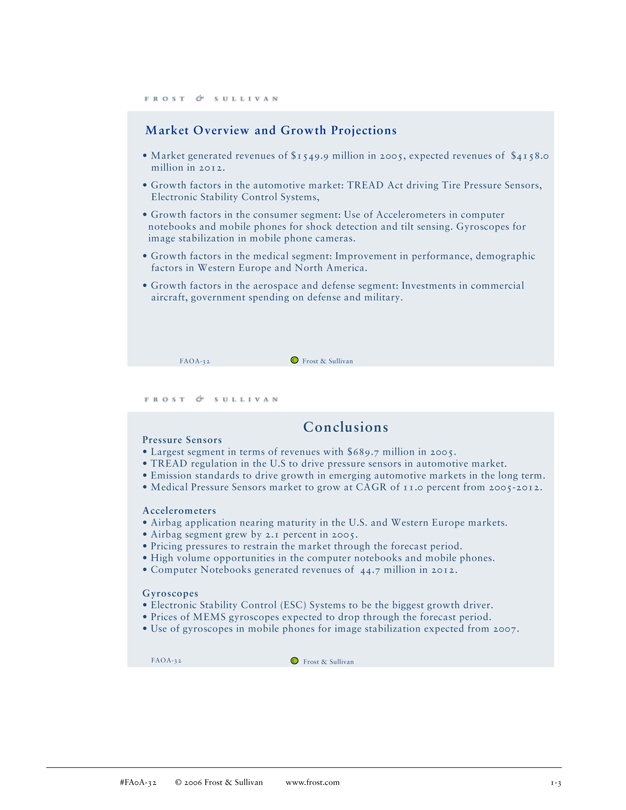

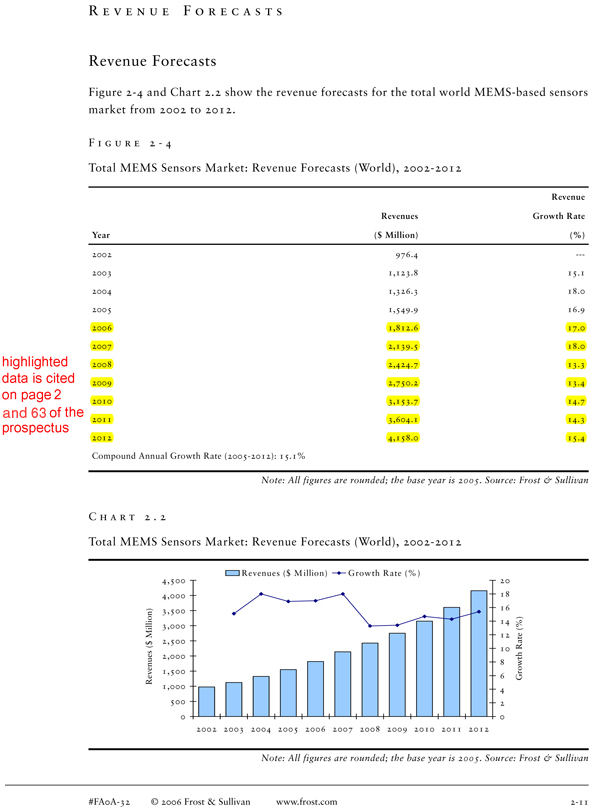

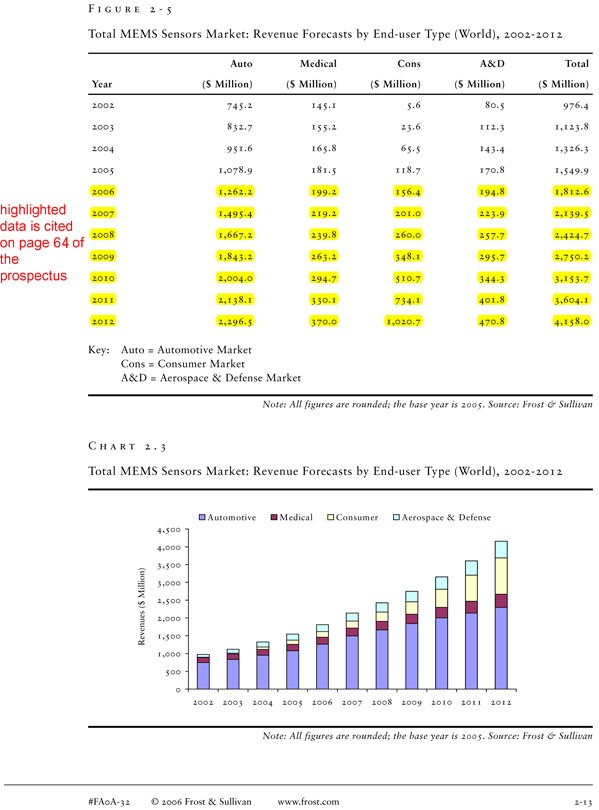

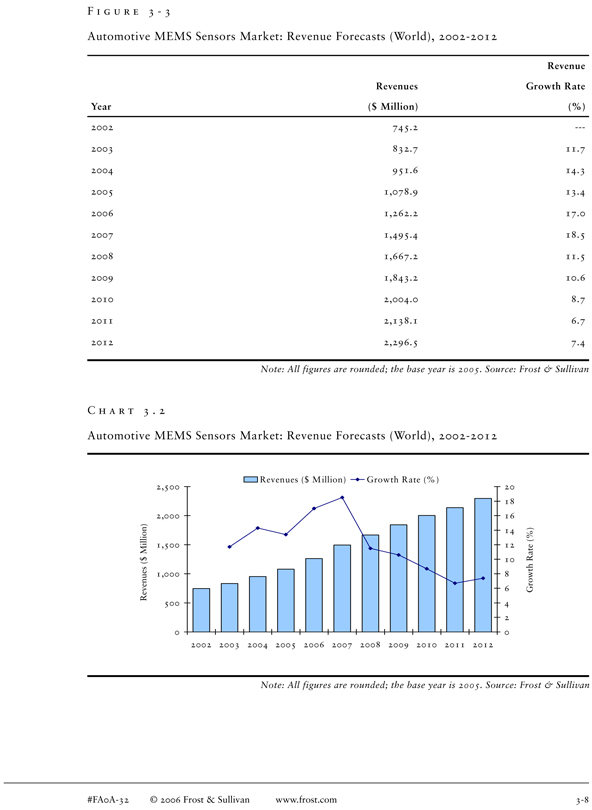

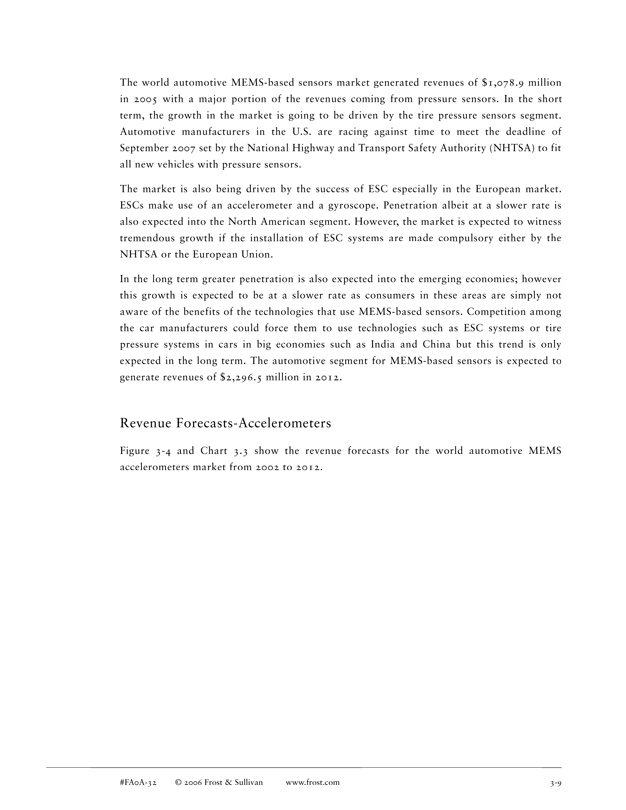

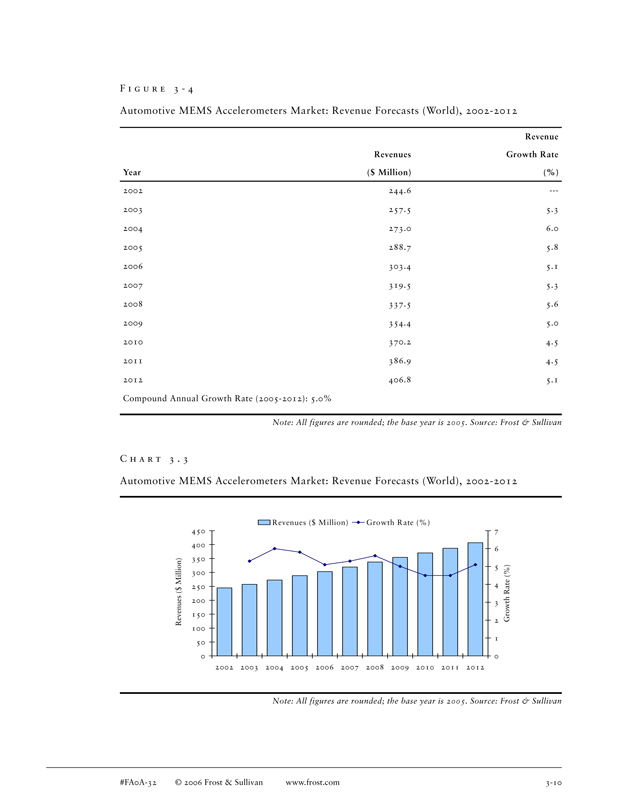

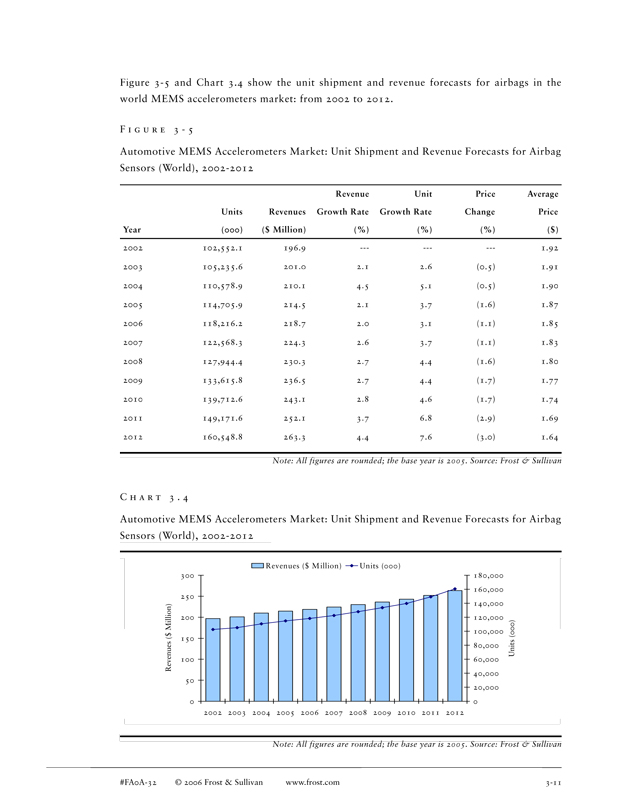

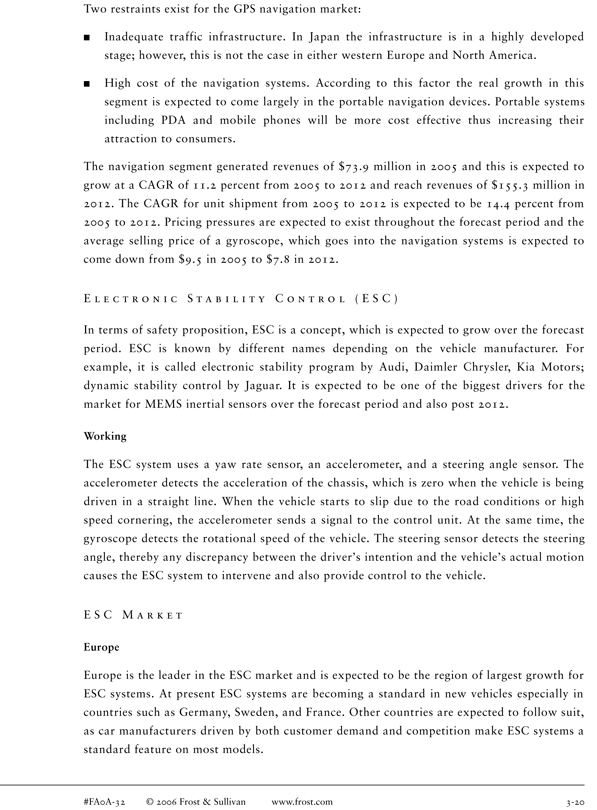

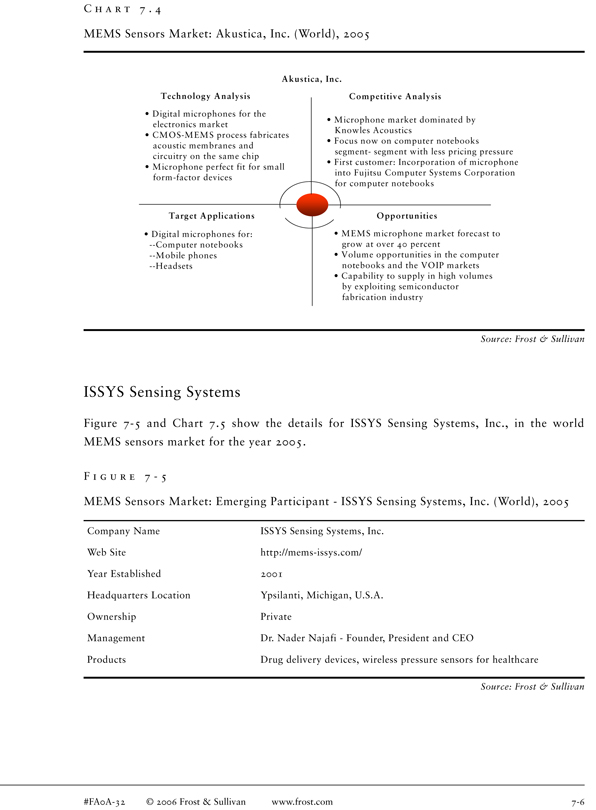

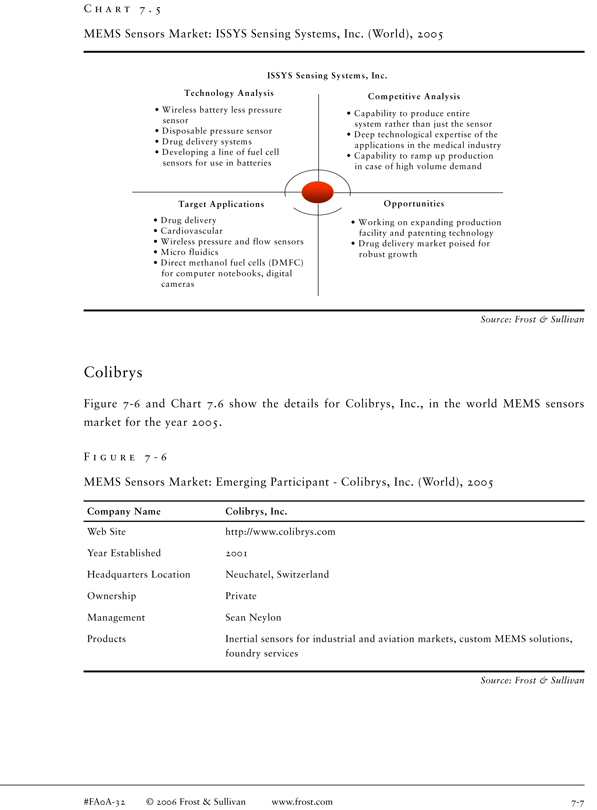

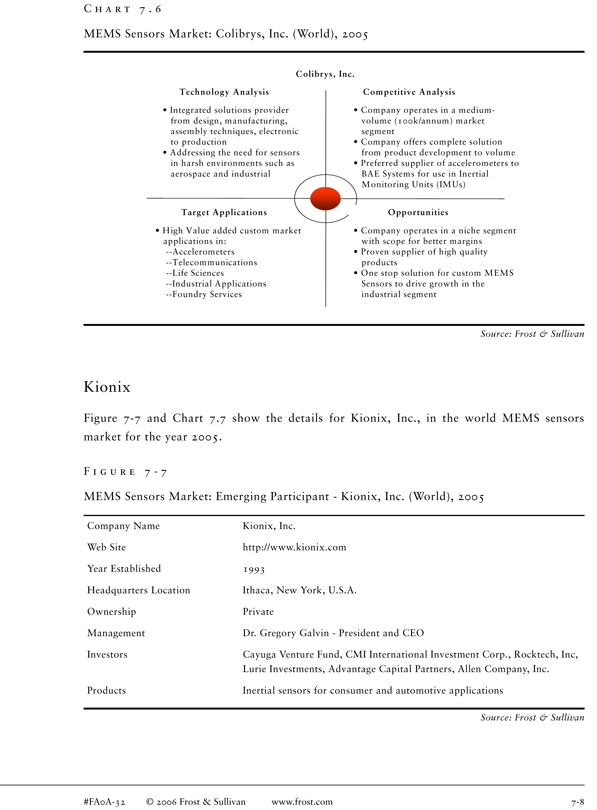

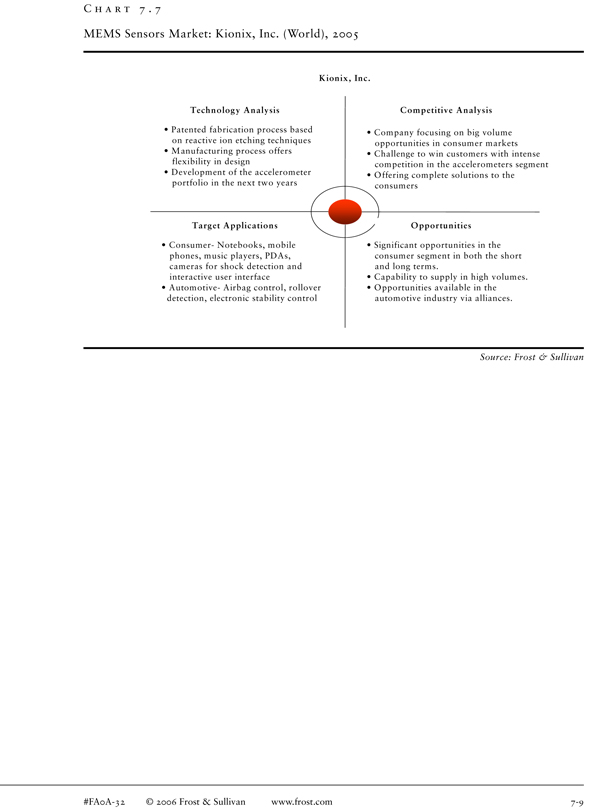

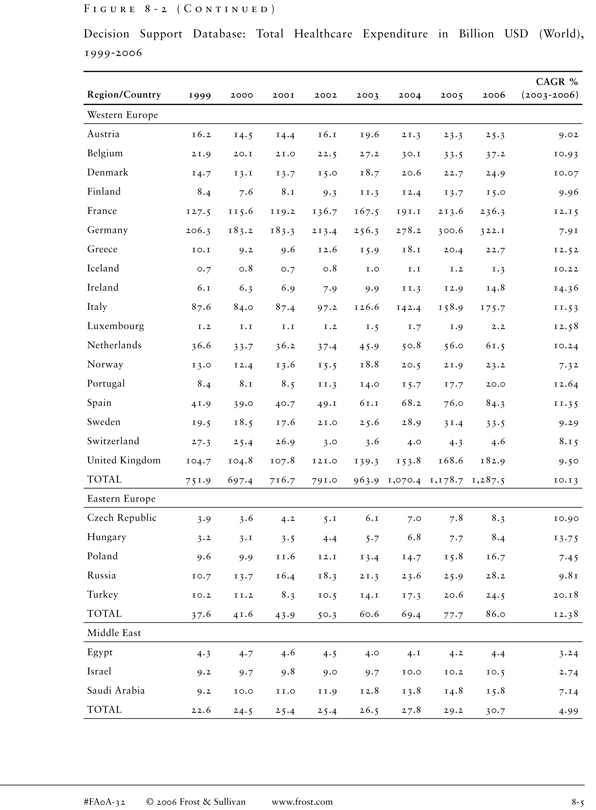

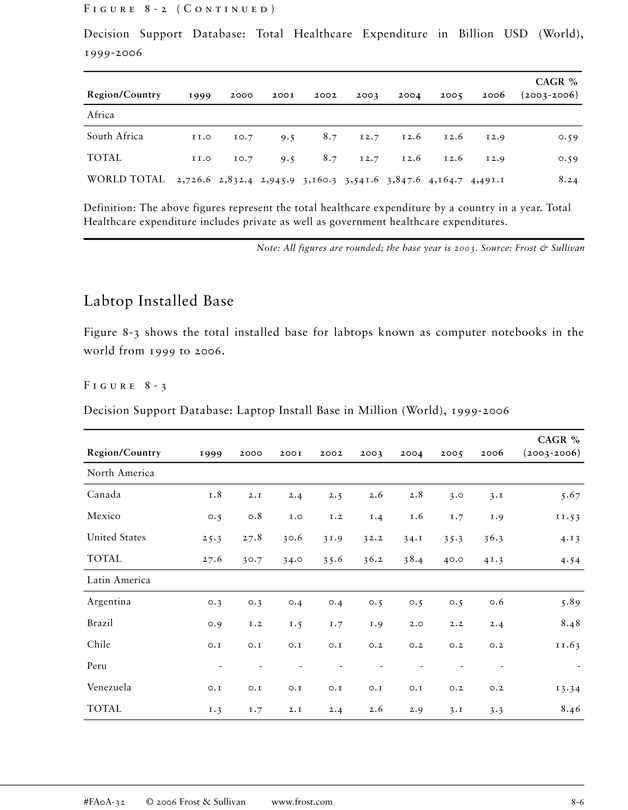

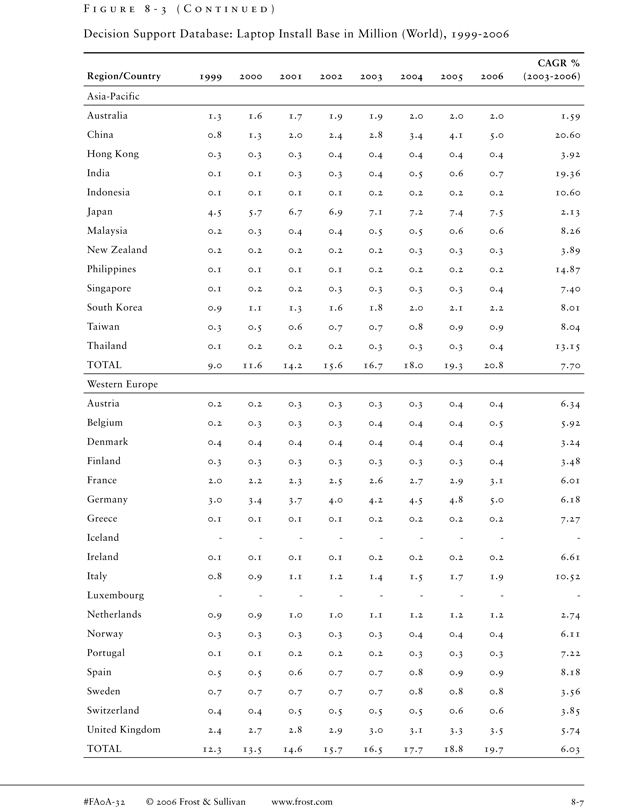

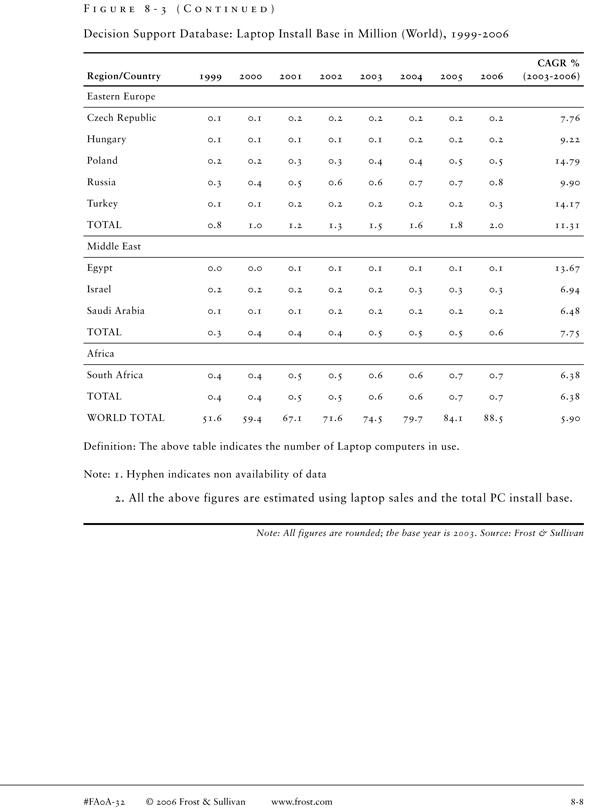

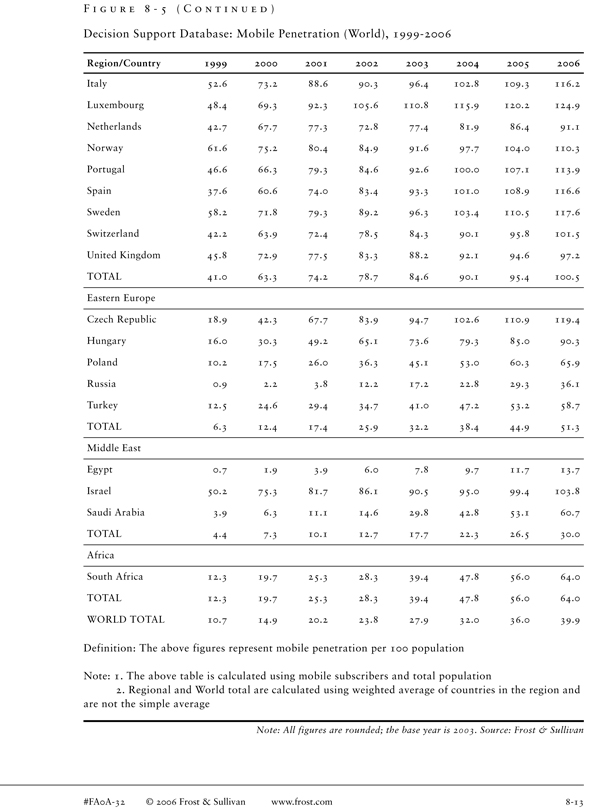

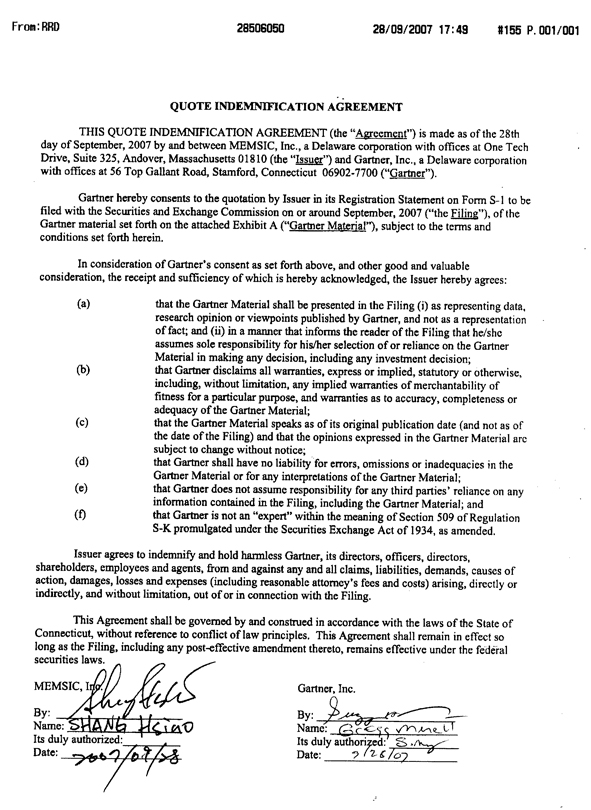

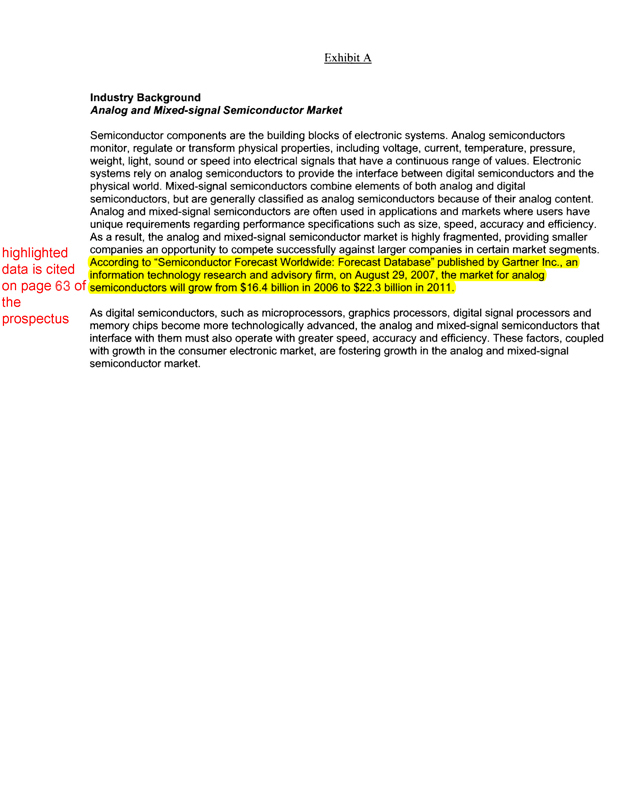

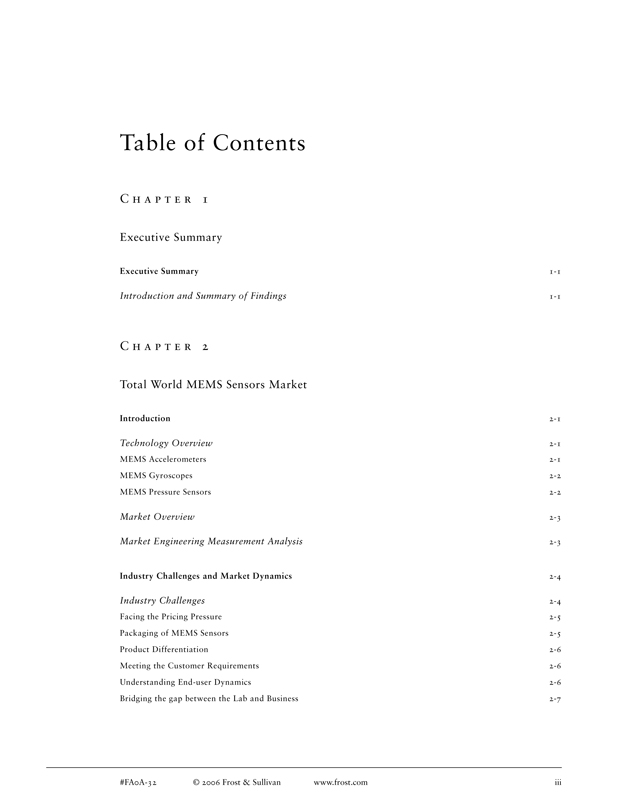

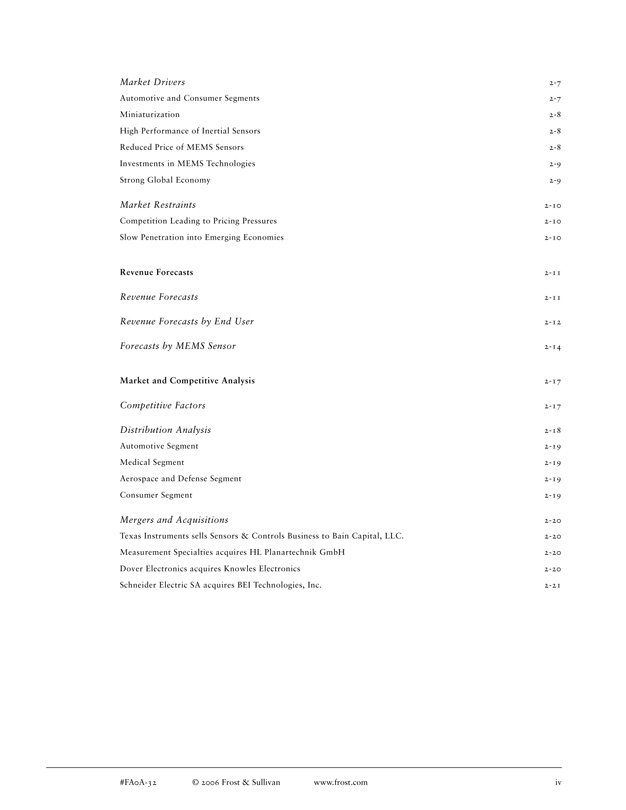

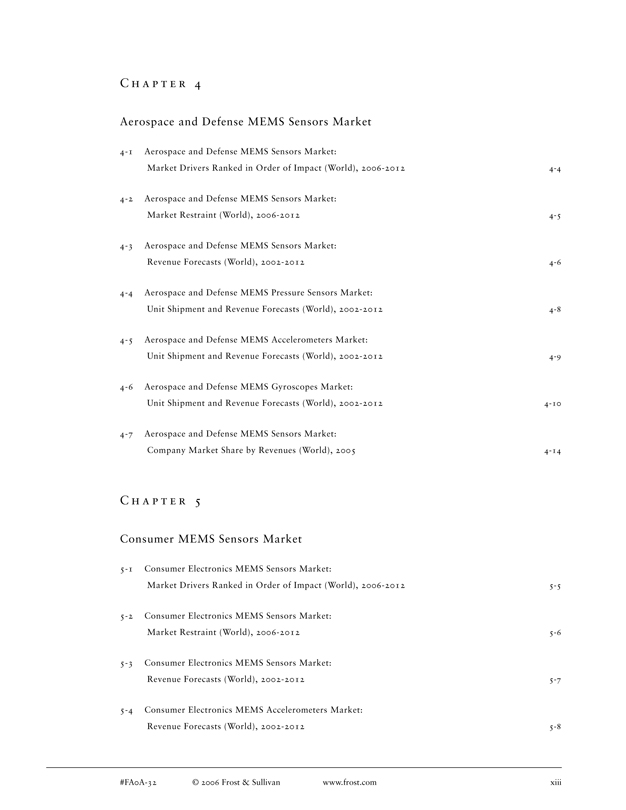

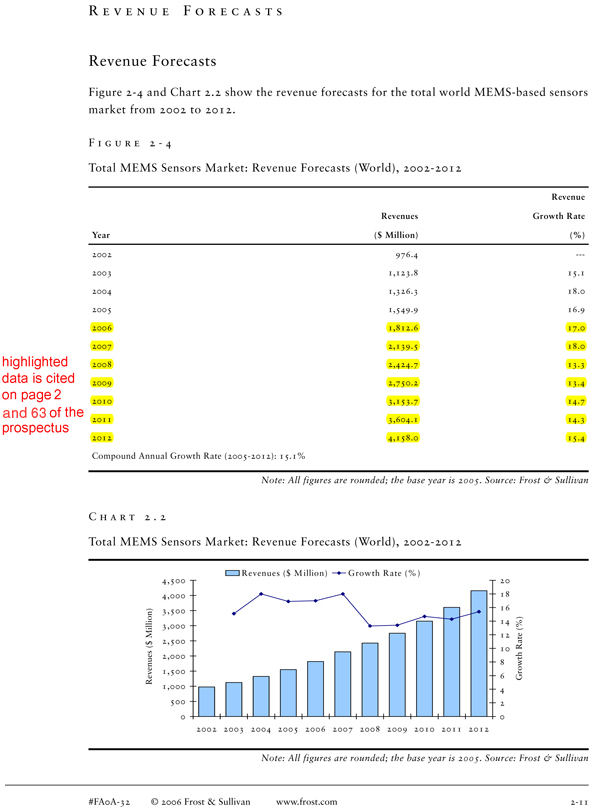

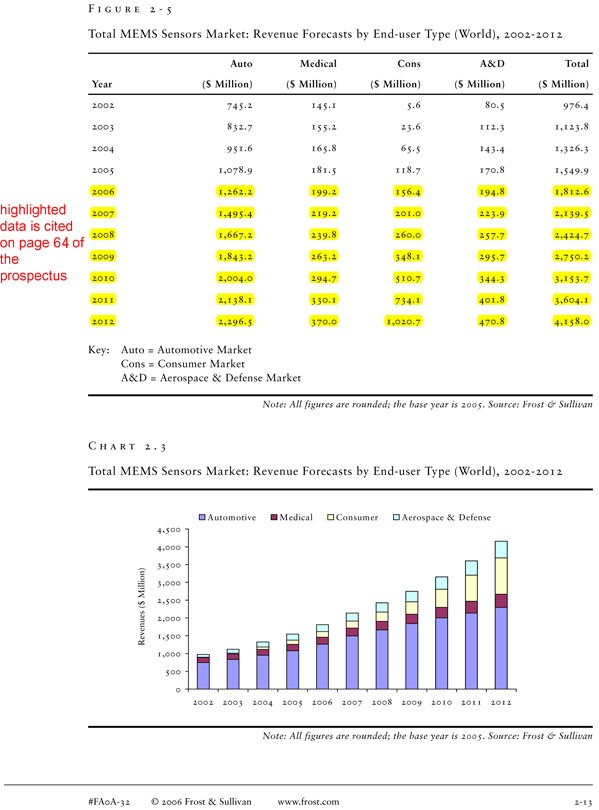

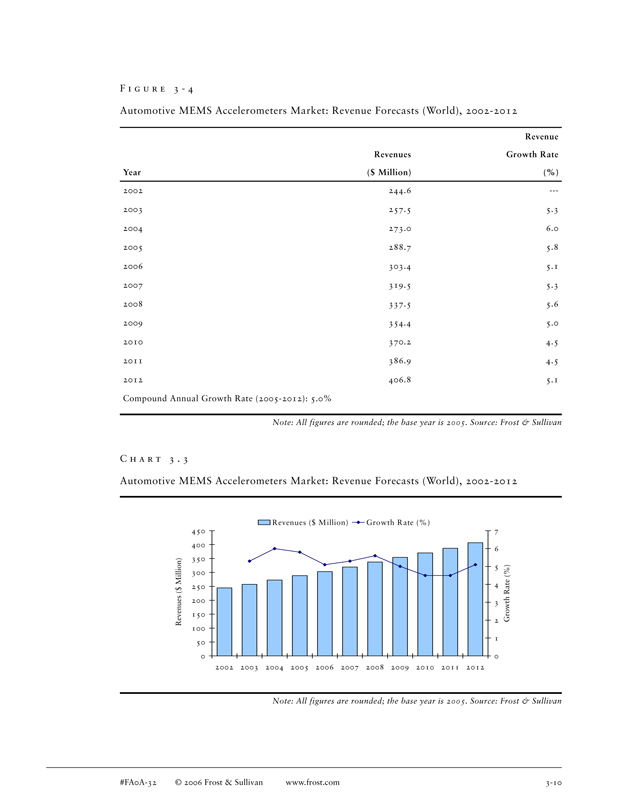

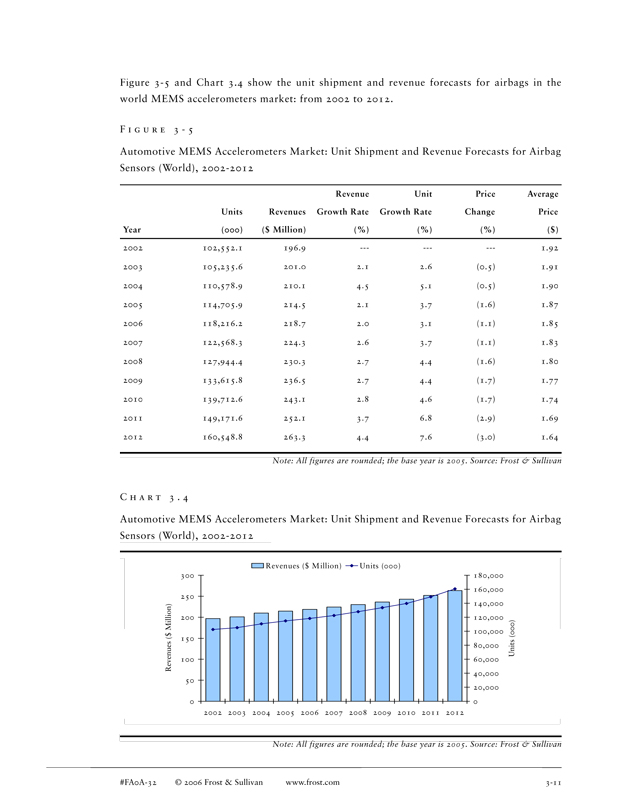

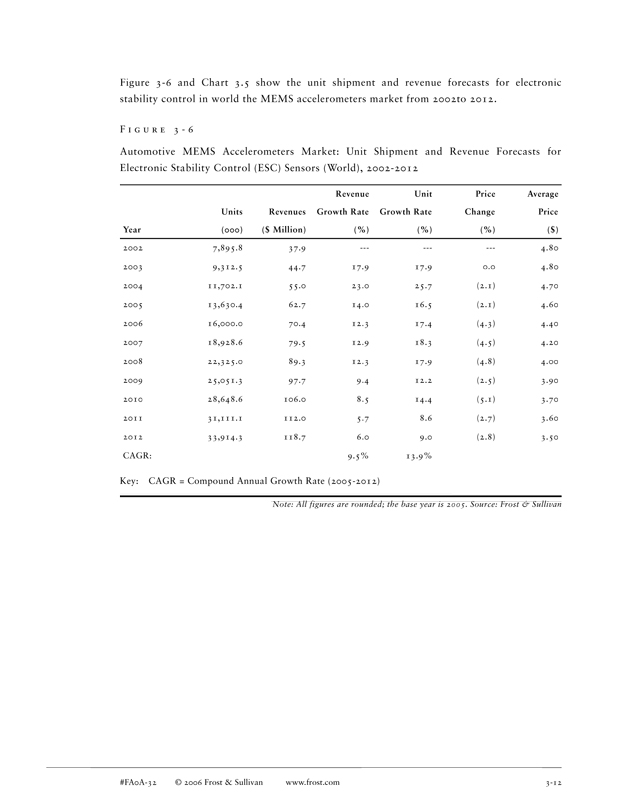

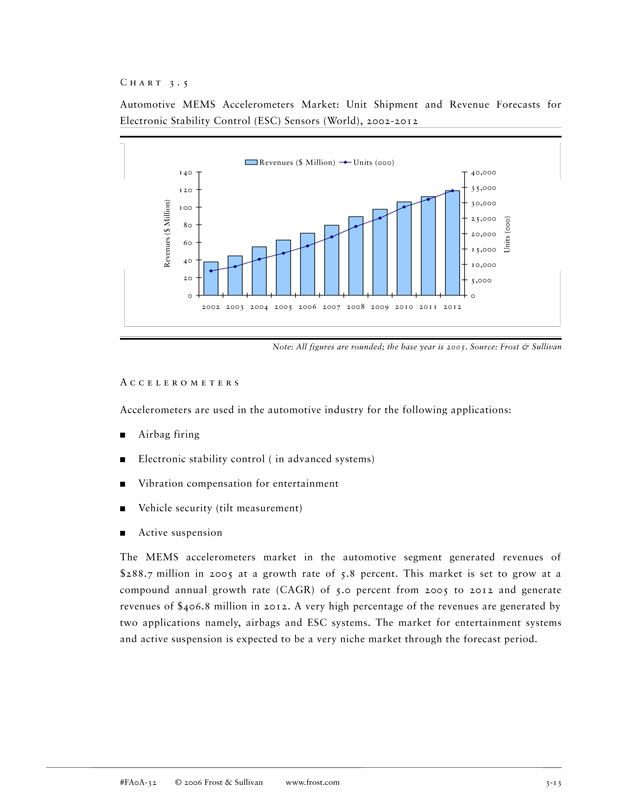

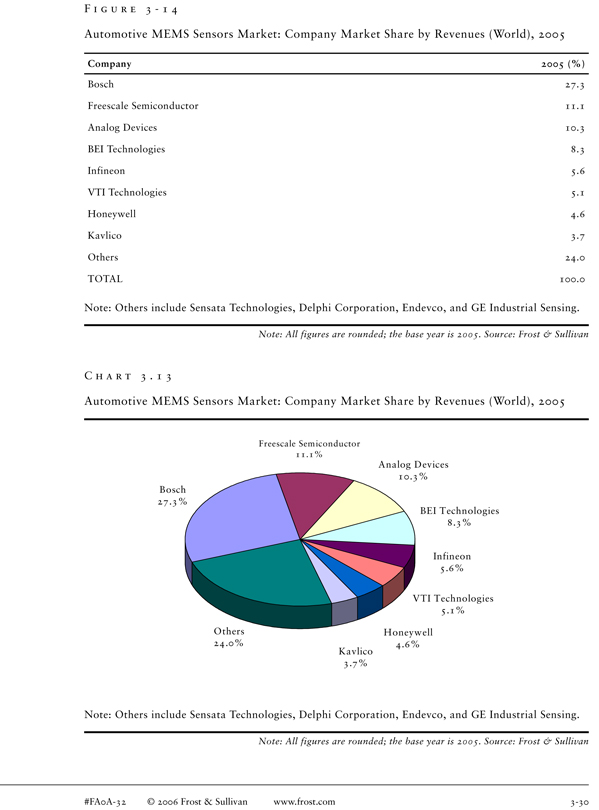

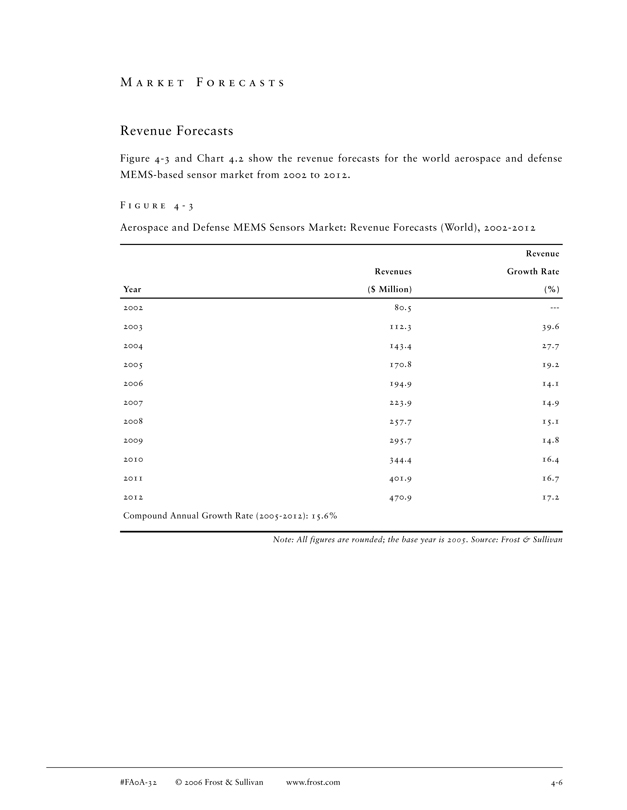

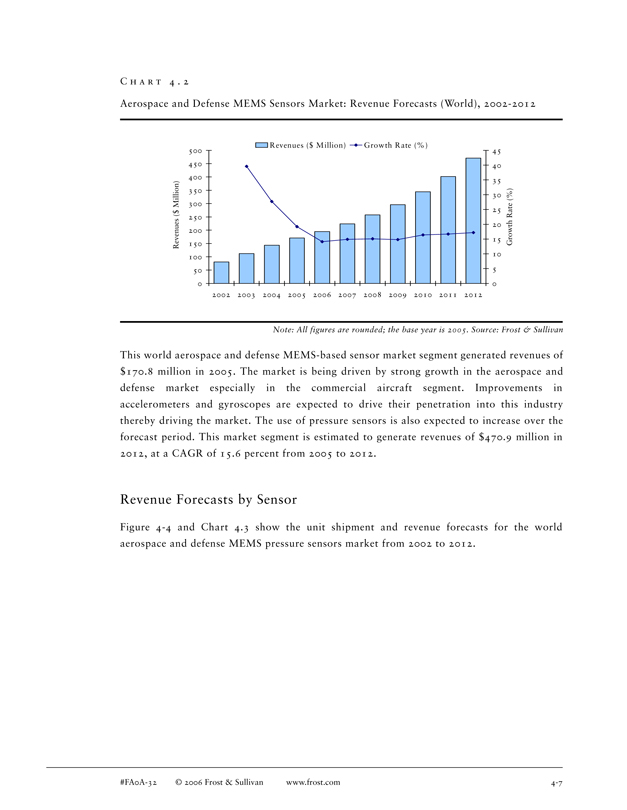

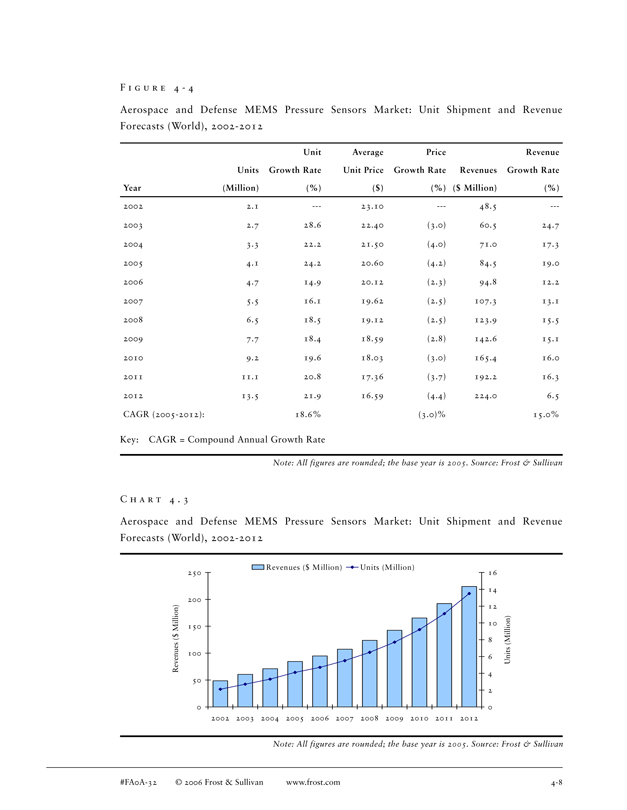

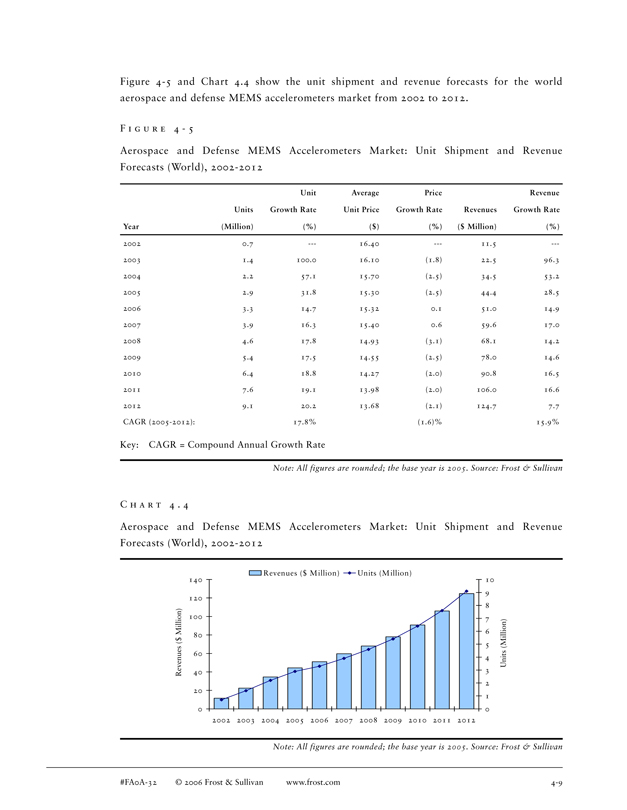

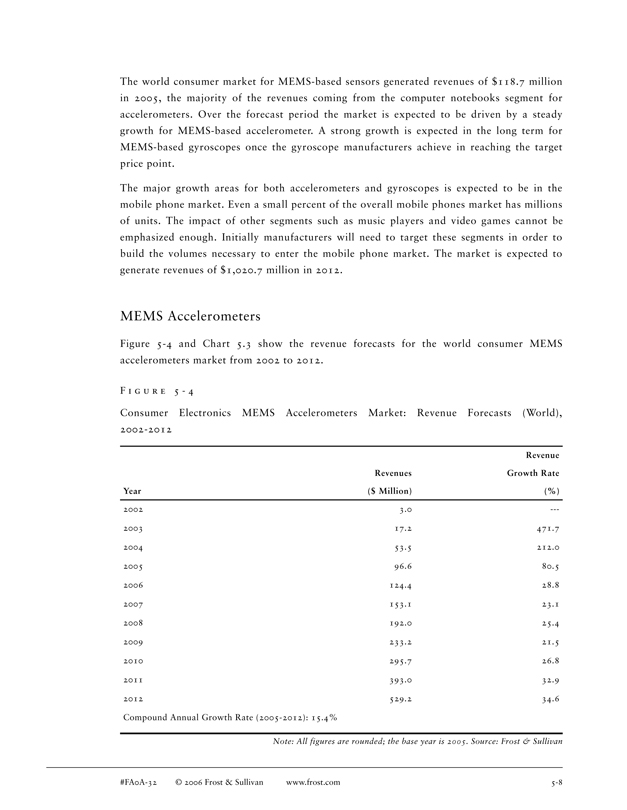

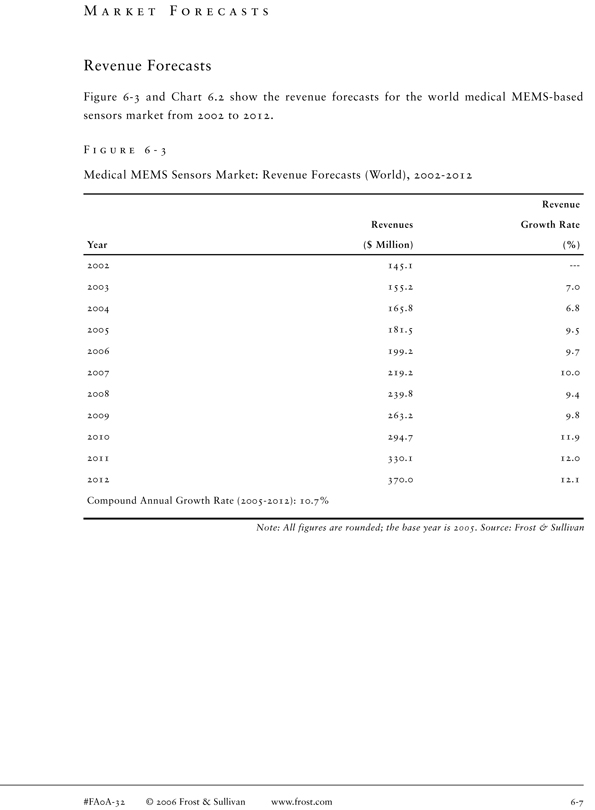

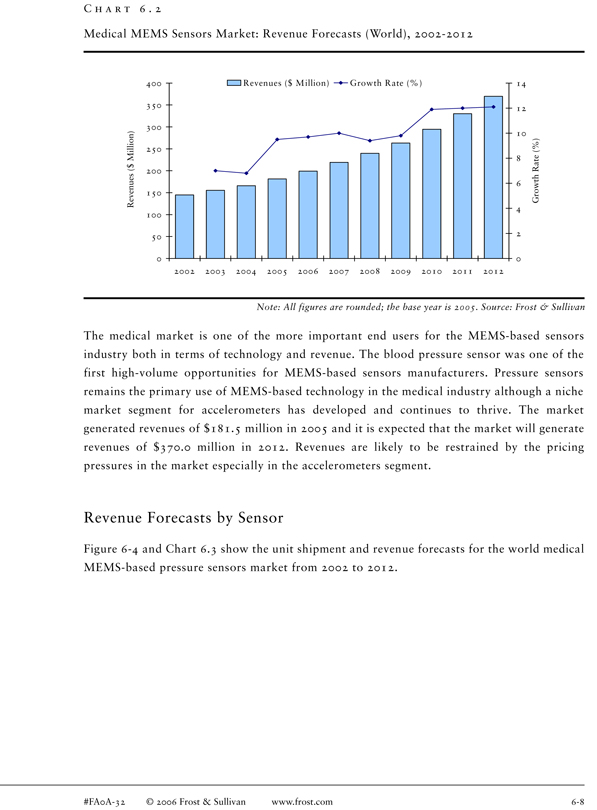

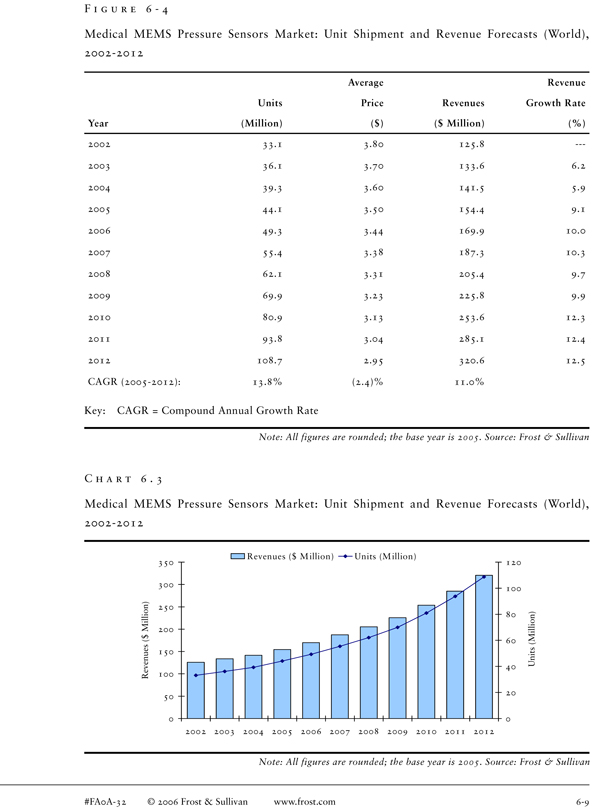

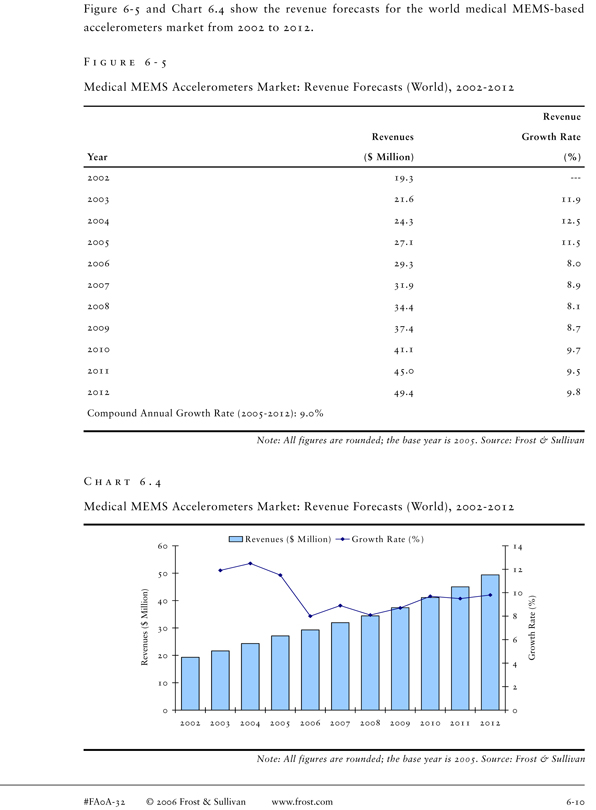

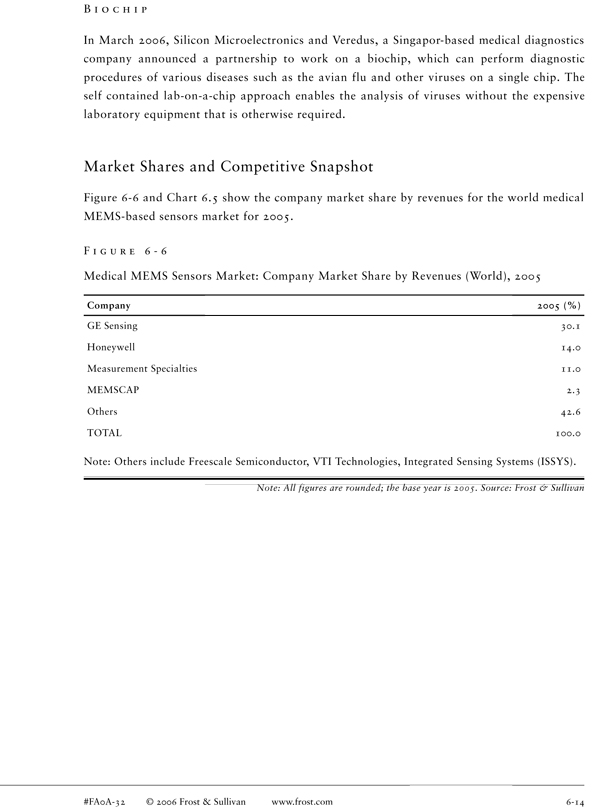

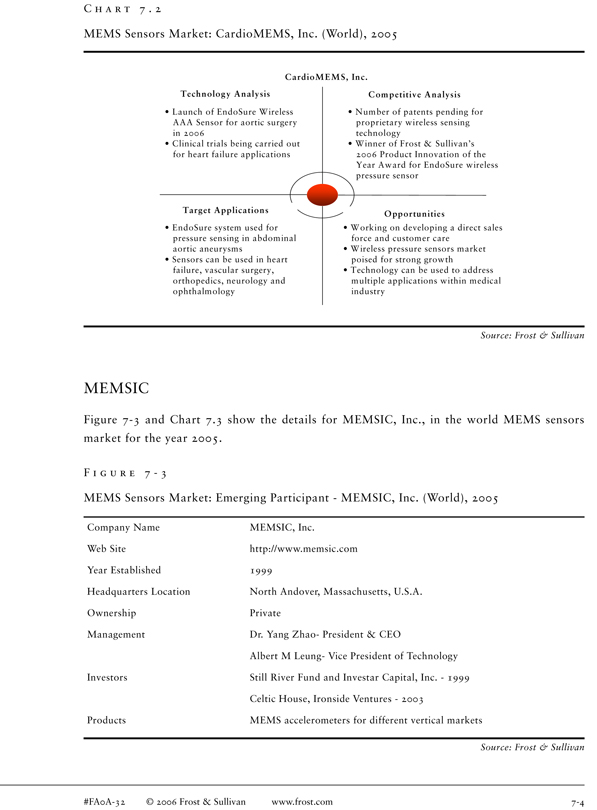

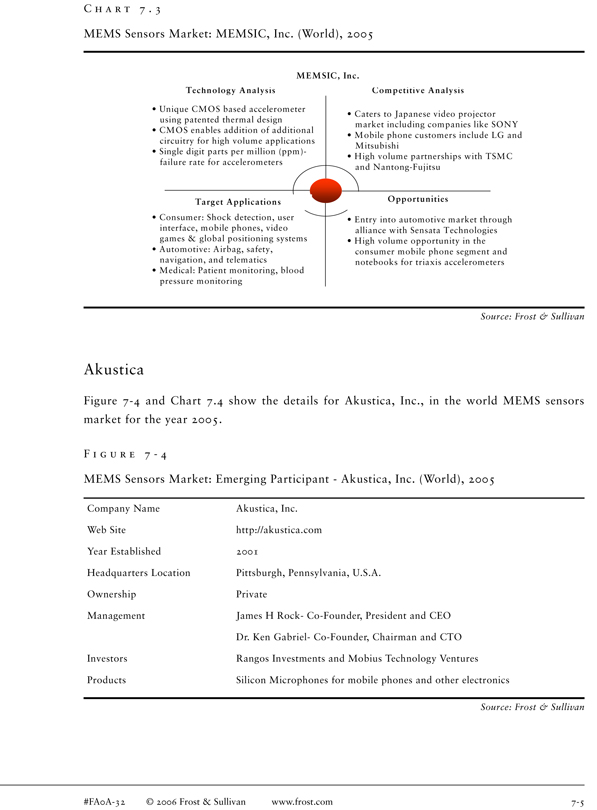

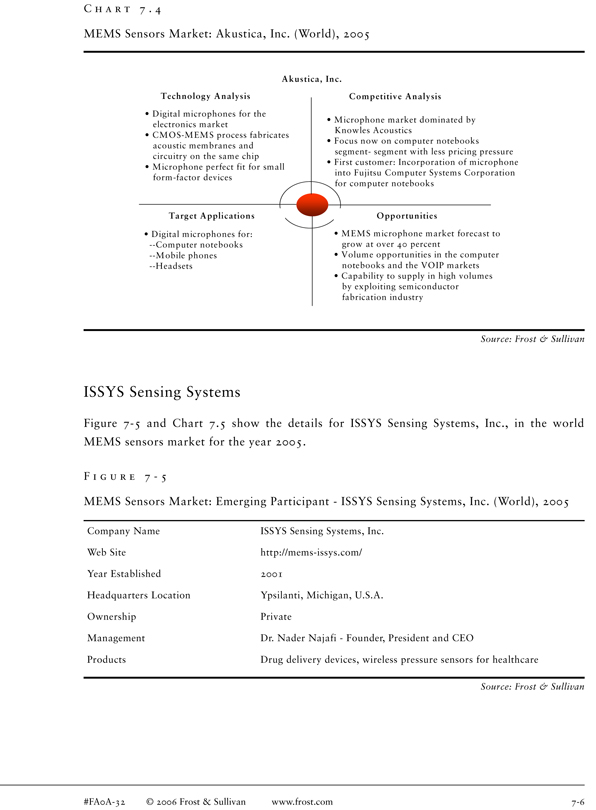

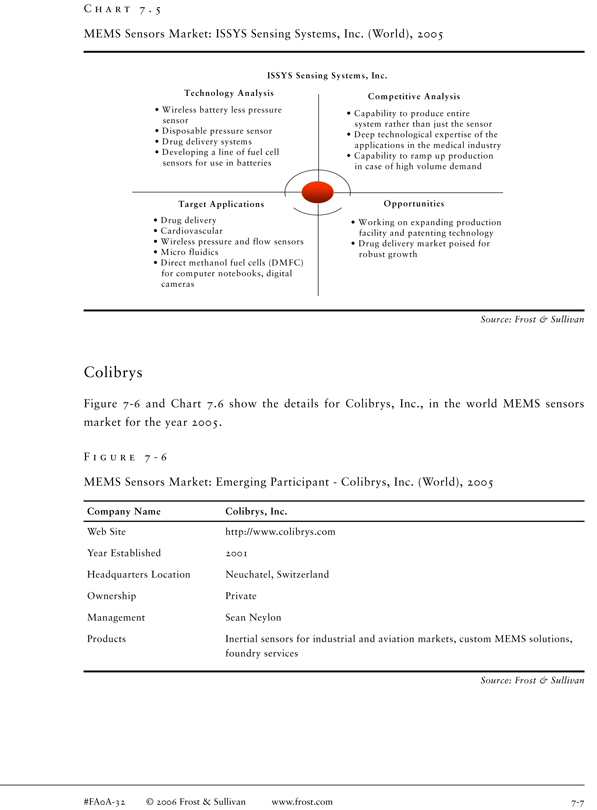

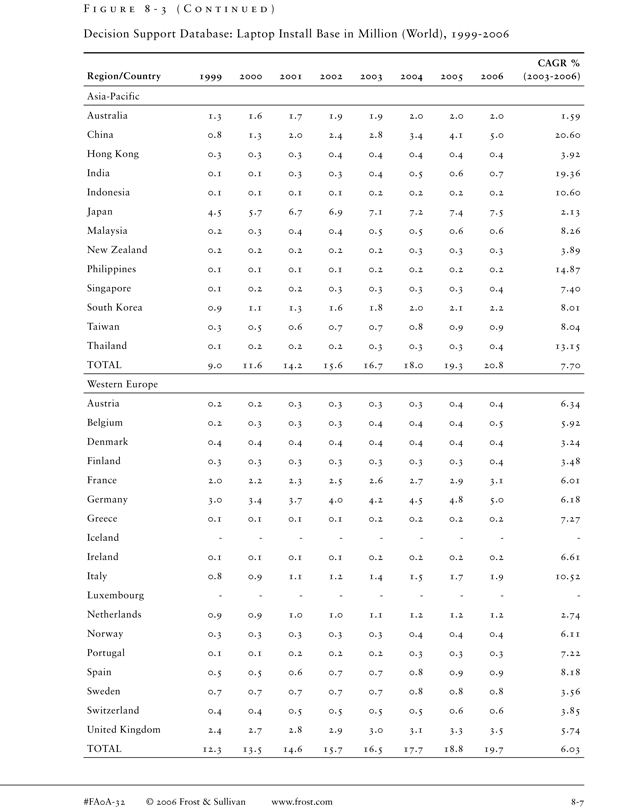

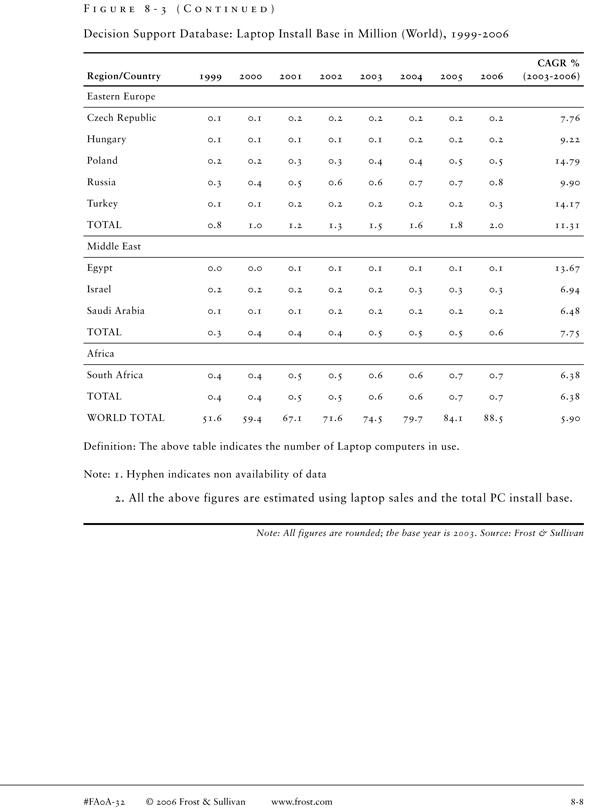

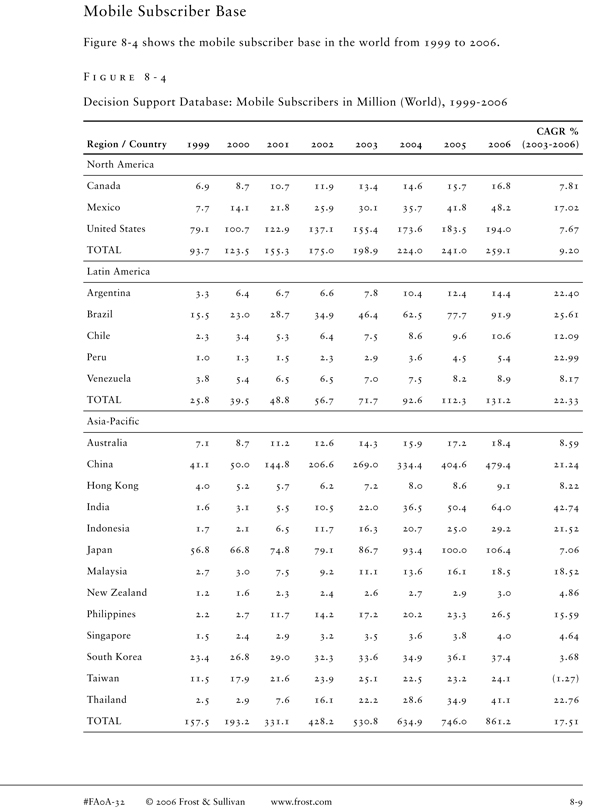

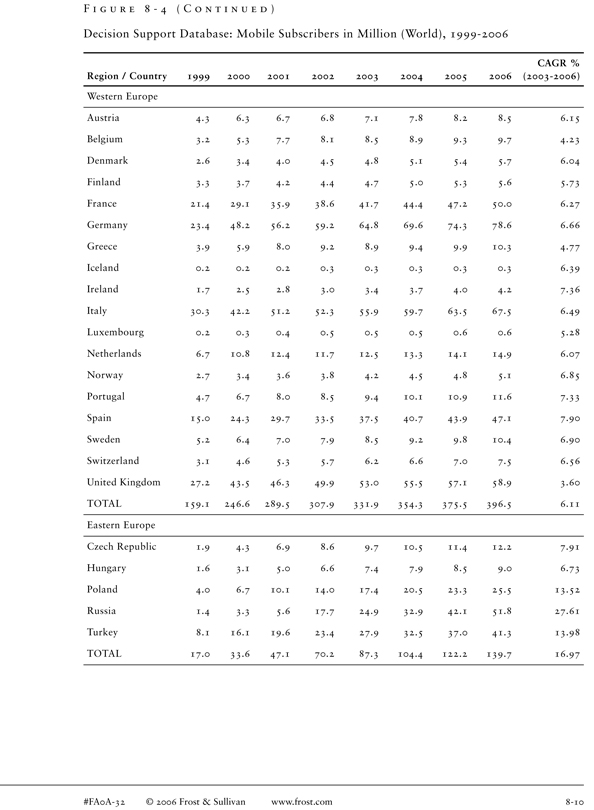

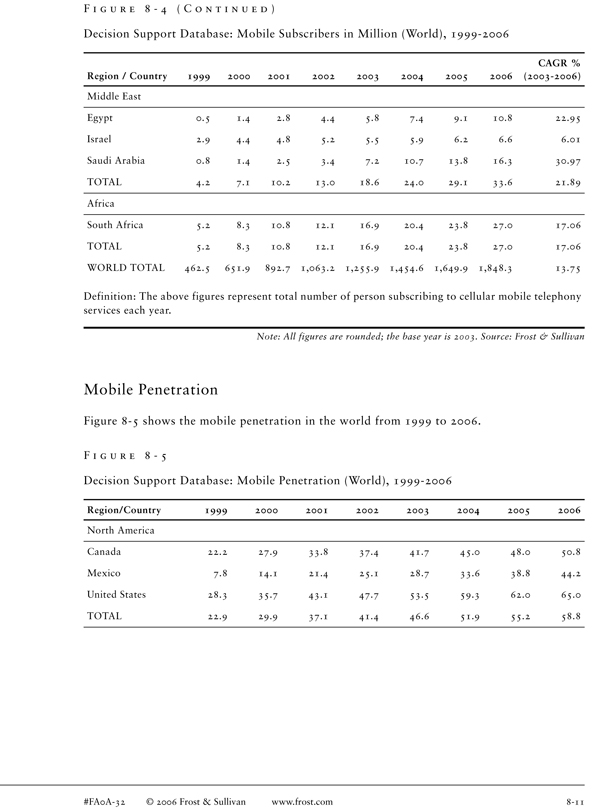

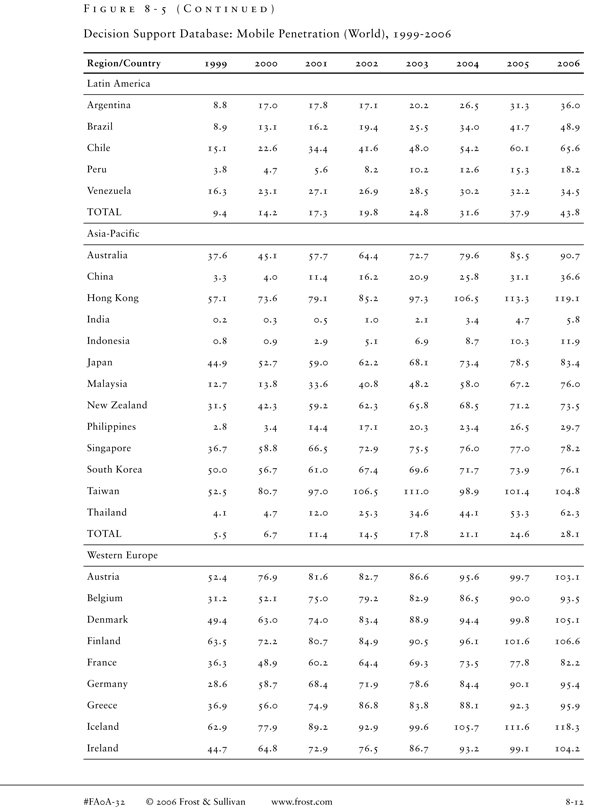

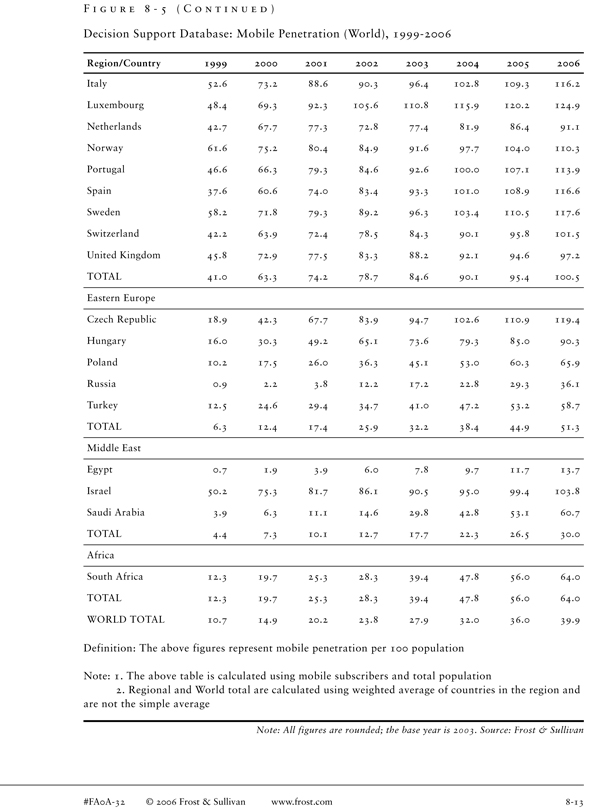

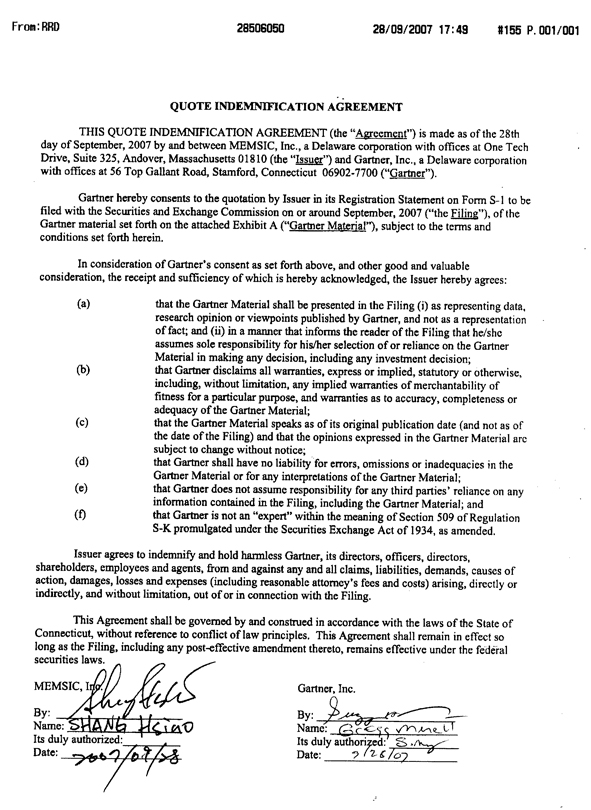

The sources of the third-party data included in the prospectus are from: (1) the Frost & Sullivan Report on World MEMS Sensors Markets (the “Frost Report”), attached hereto asExhibit H; and (2) the Quote Indemnification Agreement with Gartner, Inc. (the “Gartner Agreement”), attached hereto asExhibit I. The relevant sections of the reports have been marked and keyed to the disclosure. The data in these two sources are publicly available, were not commissioned by the Company and were not prepared for use in the Registration Statement. Frost & Sullivan and Gartner, Inc. have consented to the Company’s use of their names and data. There are no relationships between the Company and the authors of these two reports.

Risk Factors, page 10

| 8. | Please note that your risk factors must immediately follow a one-page prospectus cover or your prospectus summary. Although we do not object to the placement of your table of contents, please relocate the disclosure on page ii to a more appropriate section of your document. |

In response to the Staff’s comment, this information has been moved from page ii to page 5.

We depend and expect to continue to depend on a limited number, page 12

| 9. | Please expand this section and page 70 to identify the customers that represent over 10% of your revenues. |

The Company respectfully submits that both the Company and its customers consider the identities of such customers to be highly confidential and commercially sensitive. In addition, the Company believes that, to prospective investors, the identities of its customers are of significantly less importance than a qualitative and quantitative description of the profiles of the Company’s largest customers and the extent to which revenue from such customers are relied upon. The Company believes that the current disclosure on pages 12, 40 and 72 is sufficient. Accordingly, the Company proposes not to specifically identify its largest customers in the prospectus.

Failure of suppliers to deliver on a timely basis, page 14

| 10. | Please clarify whether you have written agreements with your two suppliers of ceramic packaging materials and your third party packaging service provider disclosed on page 17. In addition, expand the |

Mr. Tom Jones

Securities and Exchange Commission

November 5, 2007

RE: MEMSIC, Inc. S-1 Registration Statement (File No. 333-146377)

Page 7

| | appropriate section to discuss the material terms of such agreements, such as the duration and cancellation provisions of the agreements. Also, tell us why you have not filed the agreements as exhibits. |

| | (i) | Suppliers of ceramic packaging materials. Purchases from these suppliers are documented with purchase orders and quotations. The Company enters into these purchase orders and quotations in the ordinary course of its business. The Company has revised the prospectus to disclose that it has not entered into any long-term agreements with its suppliers of ceramic packaging materials. See page 74. The Company’s purchase orders and quotations contain basic terms and conditions, including method of payment, payment terms and terms of shipment, which the Company believes to be standard within the industry in which it operates. The Company further supplementally advises the Staff that ceramic packaging materials that it uses for its products are readily available in the market, and that it believes that it would be able to replace its current suppliers without significantly disrupting its business operations. Accordingly, the Company believes that it is not “substantially dependent” on its relationship with its ceramic packaging material suppliers. |

| | (ii) | Third party packaging service provider. The Company supplementally advises the Staff that although it has entered into an agreement with its third party packaging service provider and has historically outsourced some of its packaging services to such provider, since the second half of 2005, the Company has increasingly met its packaging requirements in-house. As a result, cost of third party packaging services as a percentage of the Company’s total cost of goods sold declined from 2004 to 2005 and has since remained relatively stable. In 2004, 2005, 2006 and for the nine months ended September 30, 2007, the Company’s cost of third party packaging services totaled approximately $350,000, $110,000, $330,000 and $335,000, respectively, or approximately 11%, 6%, 6.5% and 5.6%, respectively, of the Company’s cost of goods sold during the corresponding period. For the nine months ended September 30, 2007, a majority of the Company’s products were packaged in-house. The Company further supplementally advises the Staff that the packaging services provided by such provider are readily available in the market, and that it believes that it would be able to obtain such services from alternative service providers without significantly disrupting its business operations. Accordingly, the Company believes that it is not “substantially dependent” on its relationship with its third party packaging service provider. |

Mr. Tom Jones

Securities and Exchange Commission

November 5, 2007

RE: MEMSIC, Inc. S-1 Registration Statement (File No. 333-146377)

Page 8

For the foregoing reasons, the Company respectfully submits that its purchase orders and quotations with its ceramic packaging materials suppliers and written agreement with its third party packaging service provider are not “material contracts” within the definition of Item 601(b)(10) of Regulation S-K, and as a result, are not required to be filed as exhibits.

Use of Proceeds, page 32

| 11. | Please revise to state the approximate amount intended to be used for each purpose for which the net proceeds from the securities to be offered are intended to be used. Refer to Item 504 of Regulation S-K. |

In response to the Staff’s comment, the Company has revised the disclosure on page 32 to state the approximate amount intended to be used for each purpose.

Capitalization, page 34

| 12. | Please revise to remove the caption “cash and cash equivalents” from the capitalization table. |

In response to the Staff’s comment, the Company has revised the disclosure on page 34.

| 13. | Please revise the table to separately show a column for the pro forma effect of the conversion of the preferred shares. |

In response to the Staff’s comment, the Company has revised the disclosure on page 34 to separately show a column for the pro forma effect of the conversion of the preferred shares.

Critical Accounting Policies, page 45

| 14. | We note that on pages 48, 89 and F-23 you refer to using the valuation of an independent third party when determining fair value of your common stock and valuing assets acquired in the business combination. While management may elect to take full responsibility for valuing the equity instruments and assets, if you choose to continue to refer to the expert in any capacity, please revise the filing to name the independent valuation expert and include its consent as an exhibit. Refer to Rule 436 and Item 601(b)(23) of Regulation S-K. |

In response to the Staff’s comment, the Company has revised the disclosure on page 123 to identify Orchard Partners, Inc. as an expert and has filed its consent as an exhibit to Amendment No. 1.

Mr. Tom Jones

Securities and Exchange Commission

November 5, 2007

RE: MEMSIC, Inc. S-1 Registration Statement (File No. 333-146377)

Page 9

Stock-Based Compensation, page 47

| 15. | Since the valuation of your common stock as of December 31,2006 was retrospective, we believe the following disclosures would be helpful to an investor since changes in methodologies and assumptions could have a material impact upon your financial statements. Please revise to provide the following disclosures in MD&A: |

| | (i) | The aggregate intrinsic value of all outstanding options based on the midpoint of the estimated IPO price range. |

| | (ii) | A discussion of each significant factor contributing to the difference between the estimated fair value as of the date of grant and the estimated IPO price (or pricing range) for options granted during the twelve months prior to the date of the most recent balance sheet. |

The Company respectfully submits to the Staff that the Company and its underwriters do not presently have such information which would enable them to derive a sufficiently accurate estimated IPO price or price range for disclosure in the prospectus. However, as soon as an estimated IPO price or price range is determined, the Company will submit to the Staff its response to this question as well as the corresponding revision in the prospectus. The Company recognizes that the Staff will require a reasonable amount of time to review such amendments prior to considering any request for effectiveness.

Results of Operations, page 52

Six months ended June 30, 2007 compared to the six months ended June 30, 2006

Net Sales, page 52

| 16. | Please revise to quantify the impact of increases in number of units sold and the decline in average selling prices of your products on net sales. Your discussion should also address whether you expect the trend of the declining gross margins to continue. Please also apply to your discussion for the year ended December 31, 2006. |

In response to the Staff’s comment, the Company has added disclosure to quantify the impact of the increase in quantity sold and the decline in average selling prices of its products on net sales on pages 52 and 54.

| 17. | Please disclose the reasons for the change in revenues from material customers. Provide similar disclosure in your discussion for the year ended December 31, 2006. |

Mr. Tom Jones

Securities and Exchange Commission

November 5, 2007

RE: MEMSIC, Inc. S-1 Registration Statement (File No. 333-146377)

Page 10

In response to the Staff’s comment, the Company has added disclosure to provide reasons for the change in revenues from material customers on pages 52 and 54.

Research and Development, page 53

| 18. | Please revise to quantify the items listed as responsible for the increase in research and development expense and to identify the number of new employees added during the period, Please also apply to your discussion of the increases in sales and marketing and general and administrative expenses. In addition, please apply this comment to your discussion of research and development, sales and marketing and general and administrative expenses for the year ended December 31, 2006. |

In response to the Staff’s comment, the Company has revised the disclosure on pages 53 and 54.

Sales and Customers, page 70

| 19. | Please expand to discuss the material terms of the agreements with your major customers. Also, file the agreements as exhibits. |

The Company supplementally advises the Staff that the distribution agreements entered into by the Company and its distributors have been generally based on the Company’s form, and consequently contain substantially similar terms and conditions. The Company has filed as exhibits its distribution agreements with its largest distributor customer, World Peace Industrial Co., Ltd, or WPI. Please see Exhibits 10.3A and 10.3B as previously filed. In 2006 and for the nine months ended September 30, 2007, WPI accounted for 34.6% and 45.7%, respectively, of the Company’s total net sales. The Company has amended the disclosure to clarify that the description on pages 71 and 72 summarizes the material terms of the Company’s distribution agreements.

The Company supplementally advises the Staff that it generally does not enter into long-term agreements with its OEM and ODM customers. Sales to these customers are solely documented in quotations. The Company enters into these quotations in the ordinary course of its business. The Company has amended the disclosure to summarize the material terms of the quotations on page 72. Because these quotations are made in the ordinary course of the Company’s business, and the terms and conditions contained in each quotation apply only to a single transaction, the Company respectfully submits that its quotations with its OEM and ODM customers are not “material contracts” within the definition of Item 601(b)(10), and as a result, are not required to be filed as exhibits.

Mr. Tom Jones

Securities and Exchange Commission

November 5, 2007

RE: MEMSIC, Inc. S-1 Registration Statement (File No. 333-146377)

Page 11

Wafer Production, page 72

| 20. | Please expand to discuss the material terms of your agreements with TSMC and your two additional foundry service providers, such as the duration and cancellation provisions of the agreements. |

In response to the Staff’s comment, the Company has revised its disclosure to expand the discussion of the material terms of its agreements with TSMC and its two other foundry service providers on page 73.

| 21. | Please file the agreement with TSMC as an exhibit. Also, tell us why you have not filed the agreements as exhibits with your two foundry service providers. |

The Company supplementally advises the Staff that with respect to the Company’s agreement with TSMC, the Company does not enter into long-term agreements with TSMC and places orders solely on a purchase order basis. Such information has been disclosed on pages 13 and 73. The Company enters into these purchase orders in the ordinary course of its business. The Company further supplementally advises the Staff that, although TSMC has to date produced substantially all of the wafers used by the Company in its products, the Company’s wafers use a standard CMOS process. See pages 1 and 62 for further discussion of the standard CMOS process. Accordingly, the Company believes that it is not “substantially dependent” on its relationship with TSMC.

With respect to the Company’s agreements with its two other foundry service providers, the Company supplementally advises the Staff that, orders placed under these agreements totaled $16,041 in 2006 and $88,562 for the nine months ended September 30, 2007, and are therefore insignificant compared to orders placed with TSMC. The Company supplementally advises the Staff that it does not believe purchases under these contracts will become a major part of its wafer requirements for the foreseeable future. Accordingly, the Company believes that it is not “substantially dependent” on its relationship with these foundry service providers.

For the foregoing reasons, the Company respectfully submits that its purchase orders with TSMC and agreements with the two other foundry service providers are not “material contracts” within the definition of Item 601(b)(10) of Regulation S-K, and as a result, are not required to be filed as exhibits.

Compensation Discussion and Analysis, page 88

| 22. | We direct your attention to theStaff Observations in the Review of Executive Compensation Disclosure, dated October 9, 2007, and |

Mr. Tom Jones

Securities and Exchange Commission

November 5, 2007

RE: MEMSIC, Inc. S-1 Registration Statement (File No. 333-146377)

Page 12

available on our website, for specific guidance in the preparation of this discussion. In addition to the specific comments that follow, please consider this report in providing a more fulsome compensation discussion and analysis in your amended filing. We may have further comment.

The Company has considered the guidance in Staff Observations in the Review of Executive Compensation Disclosure dated October 9, 2007 with respect to its responses herein and the Company has revised the “Compensation and Discussion and Analysis” in accordance therewith.

Elements of Compensation, page 89

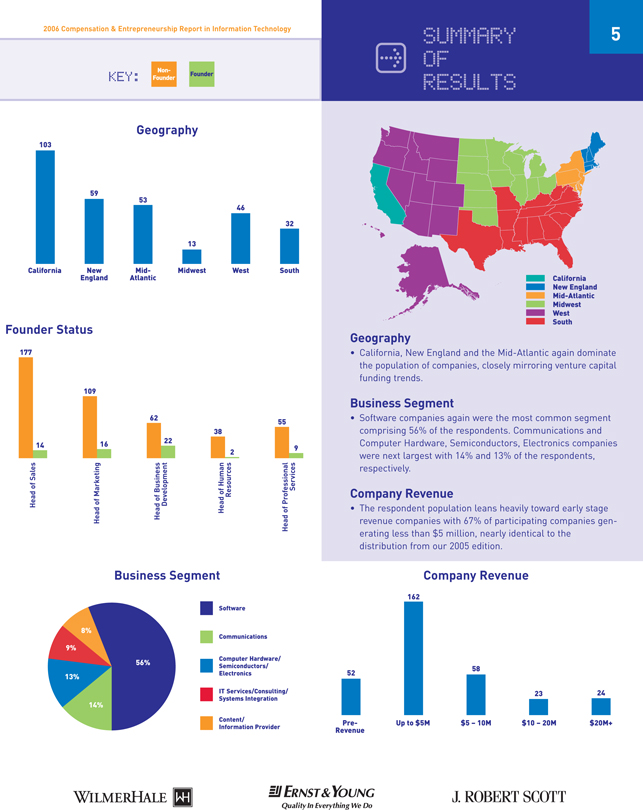

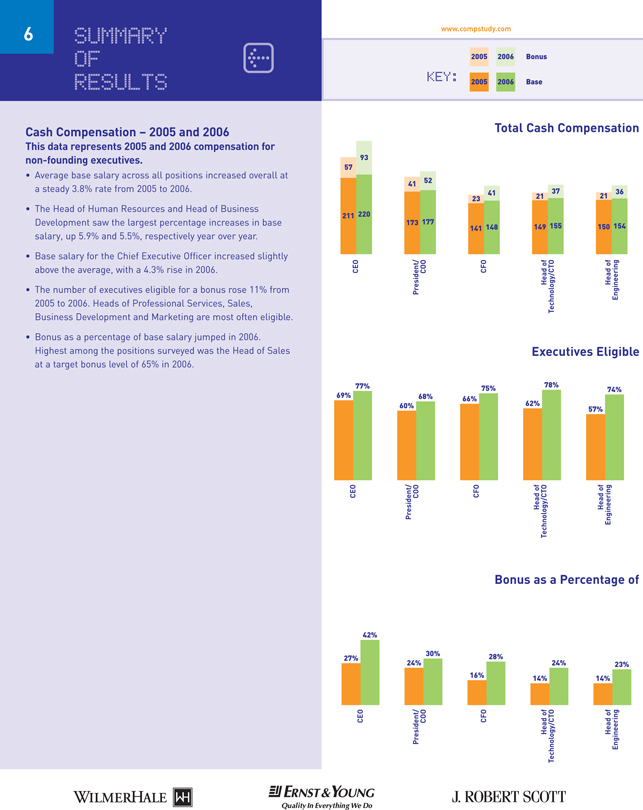

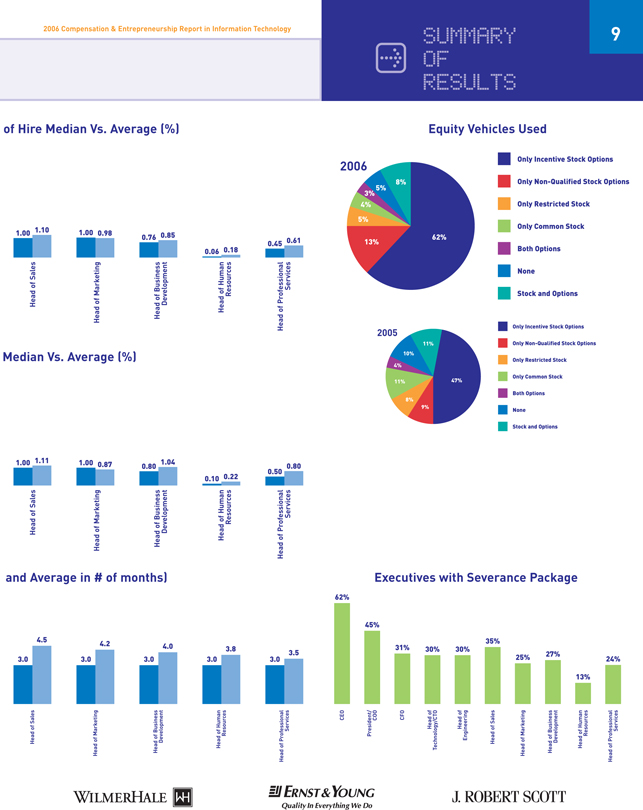

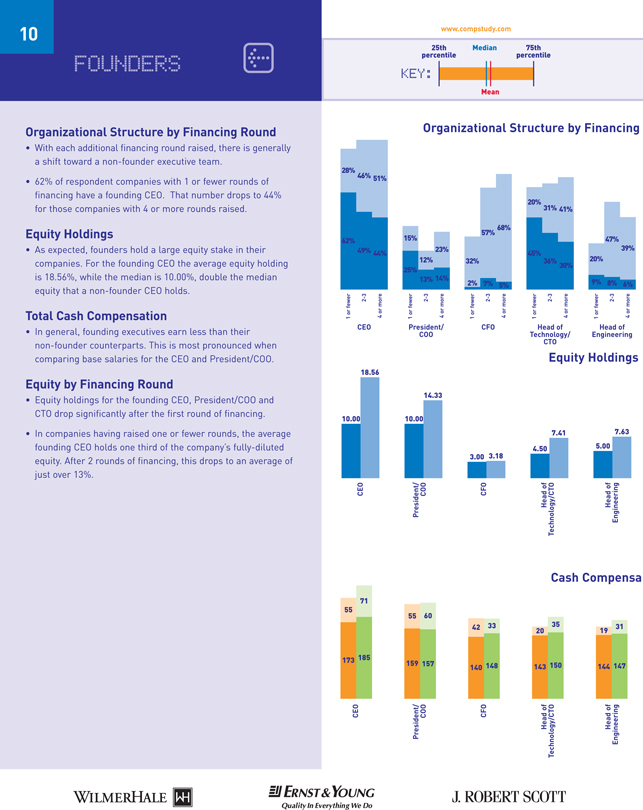

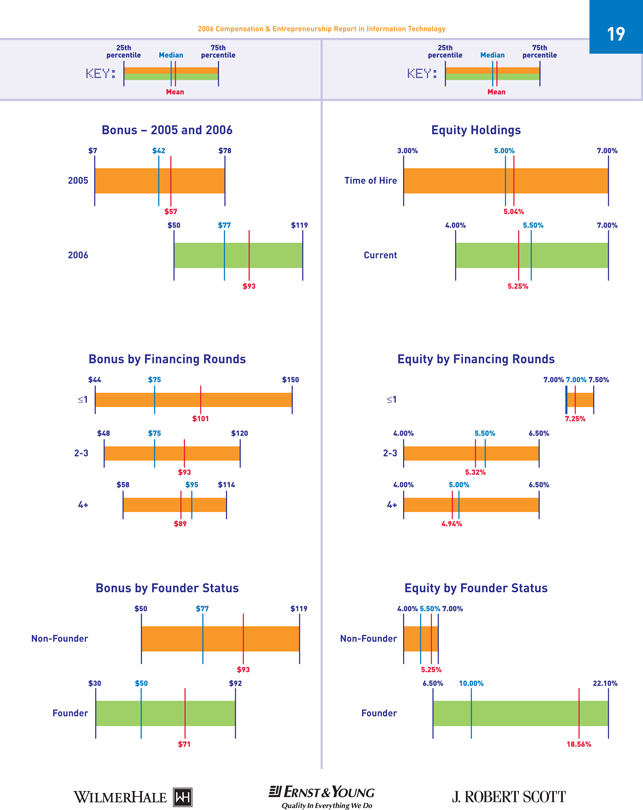

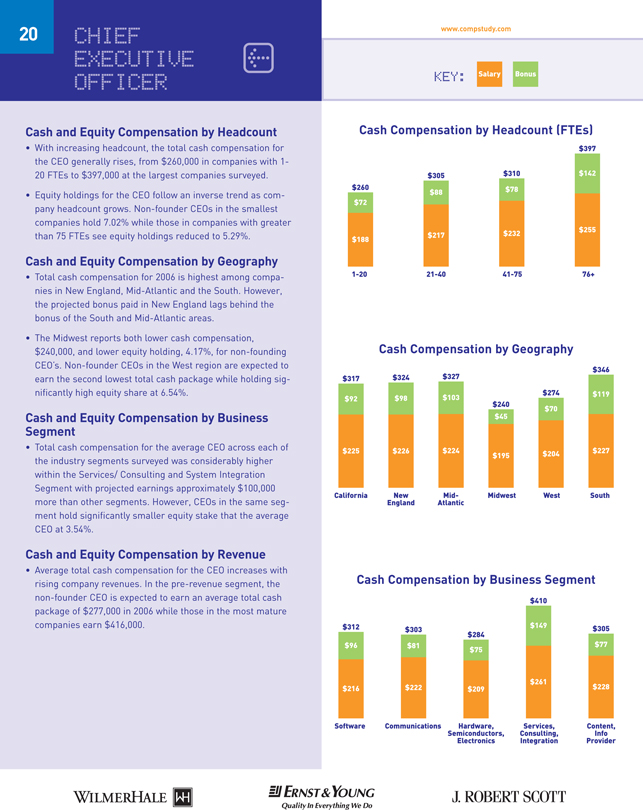

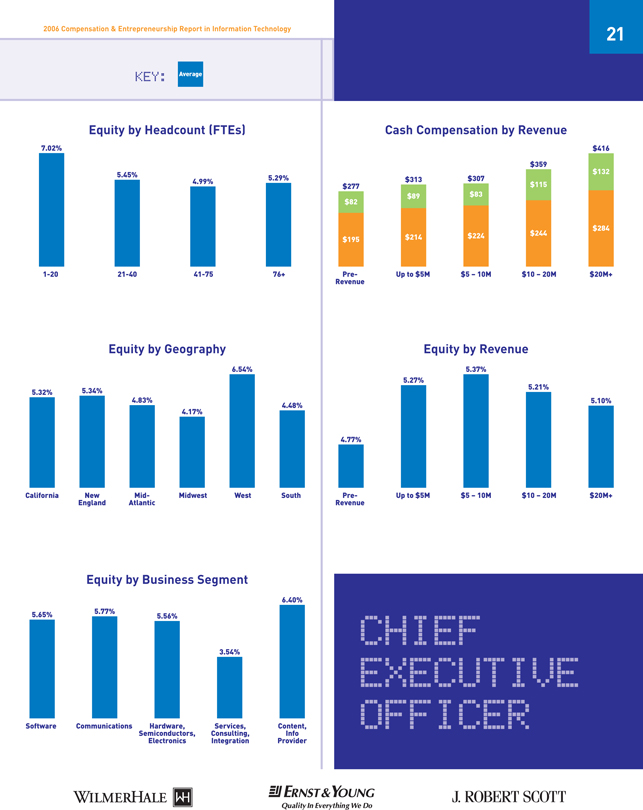

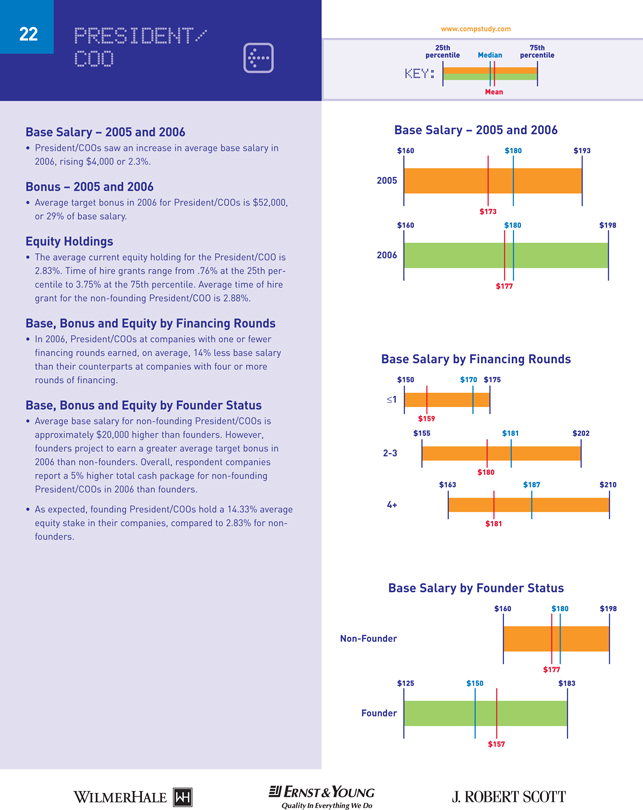

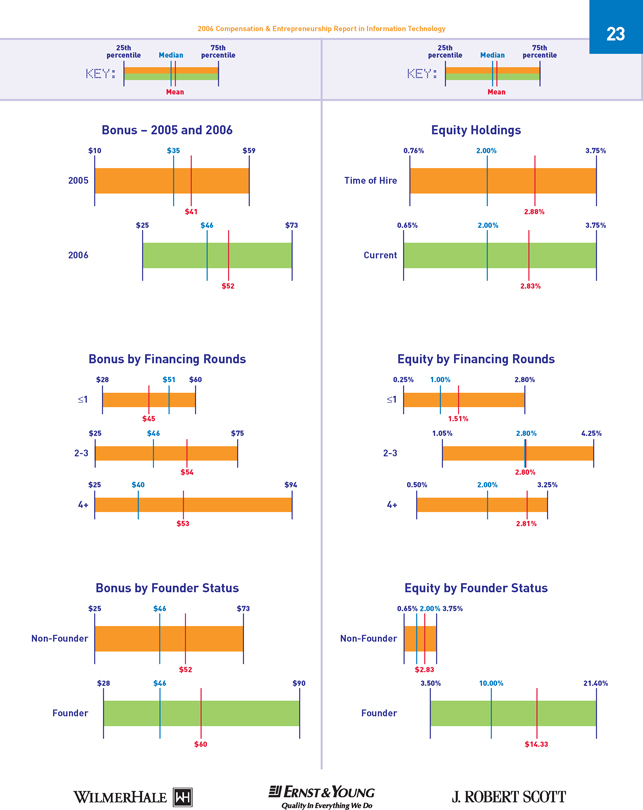

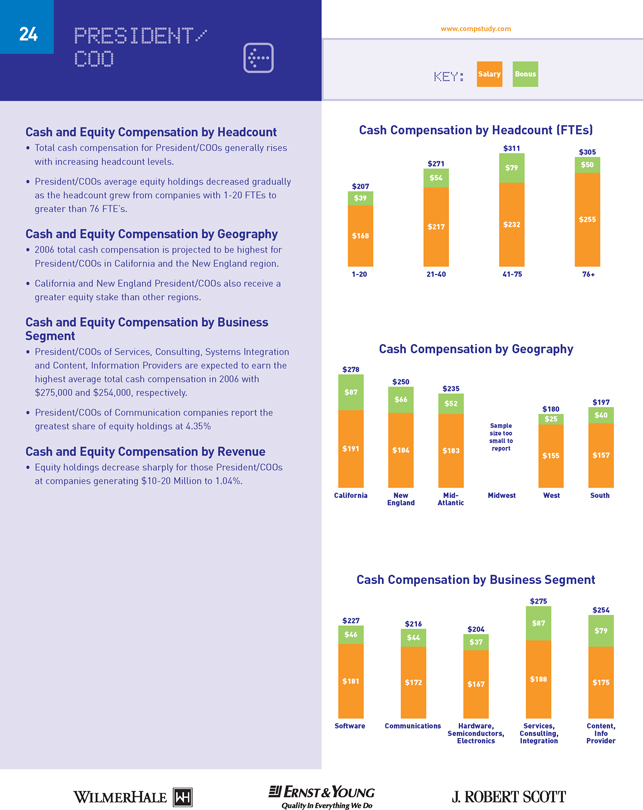

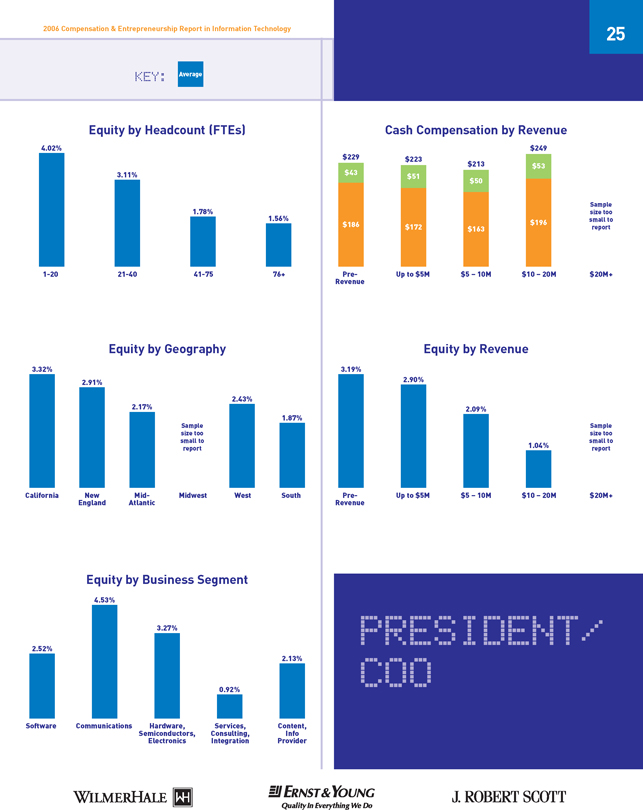

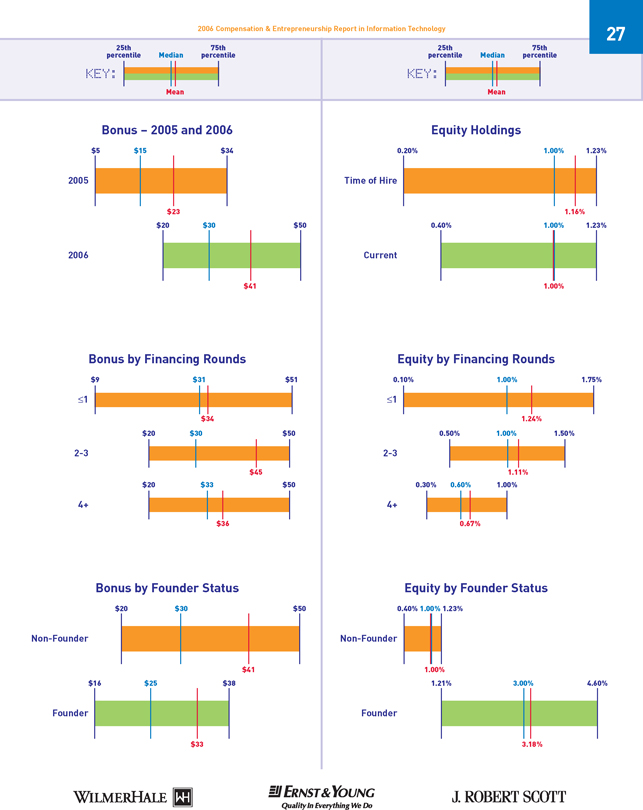

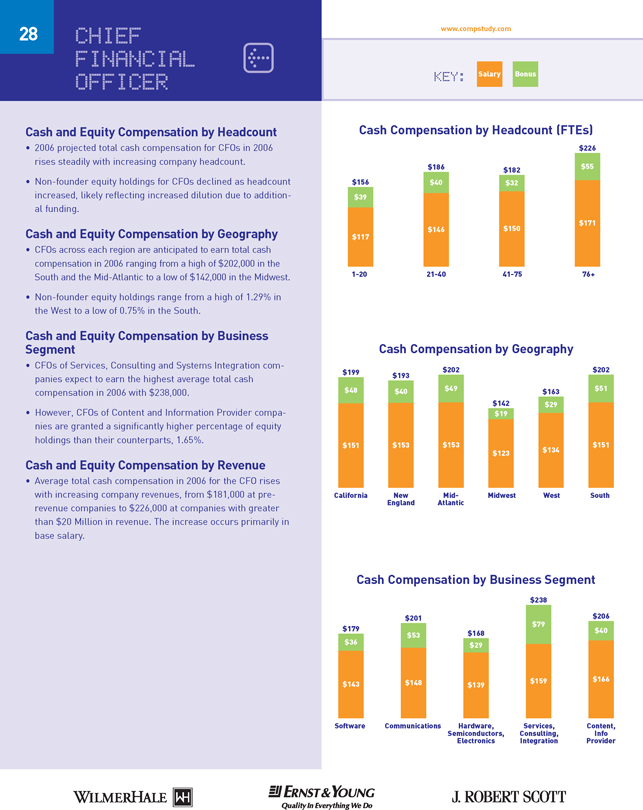

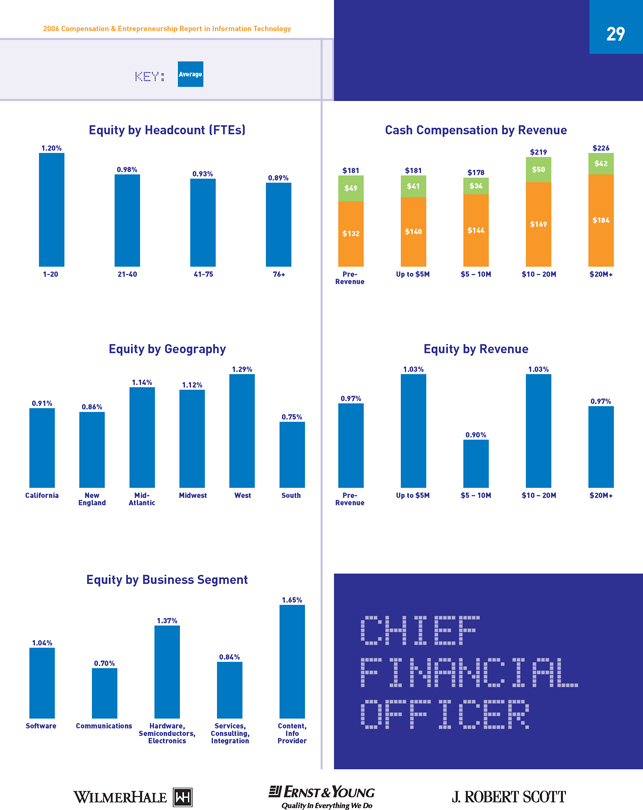

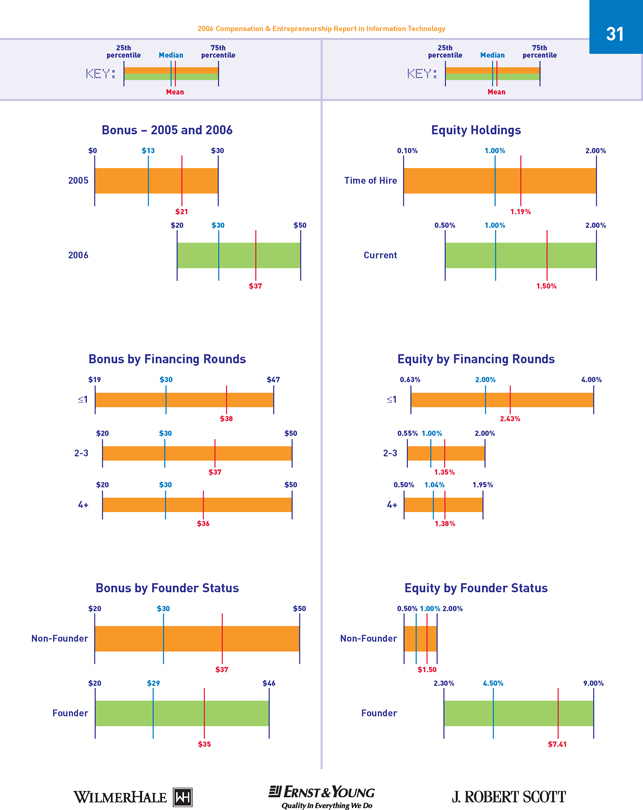

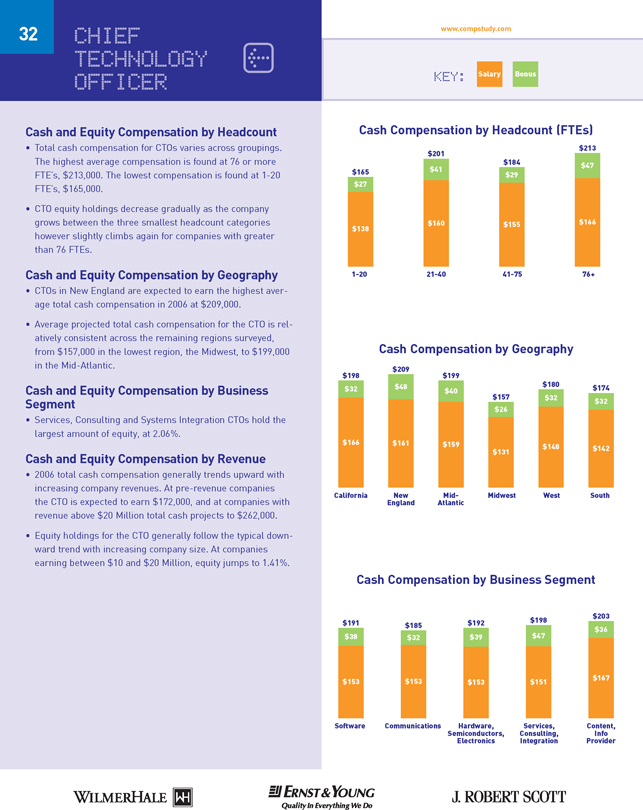

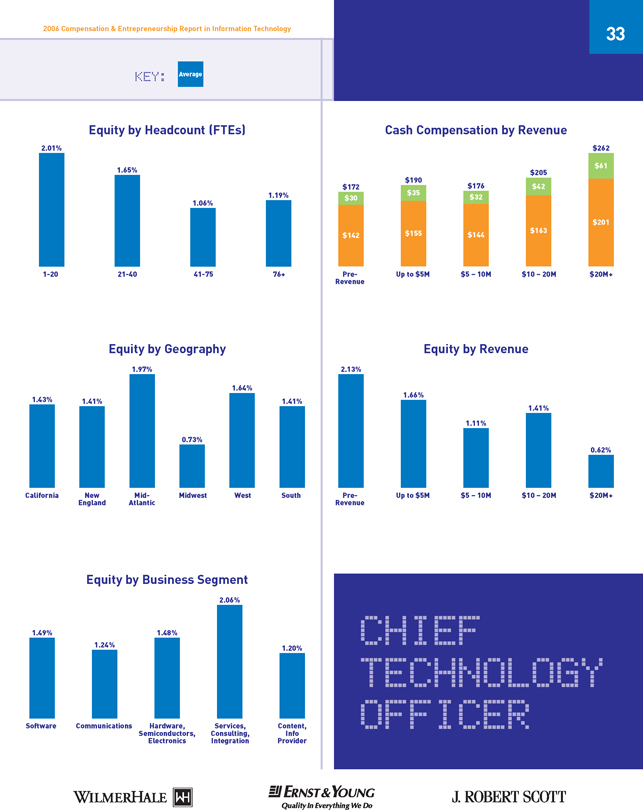

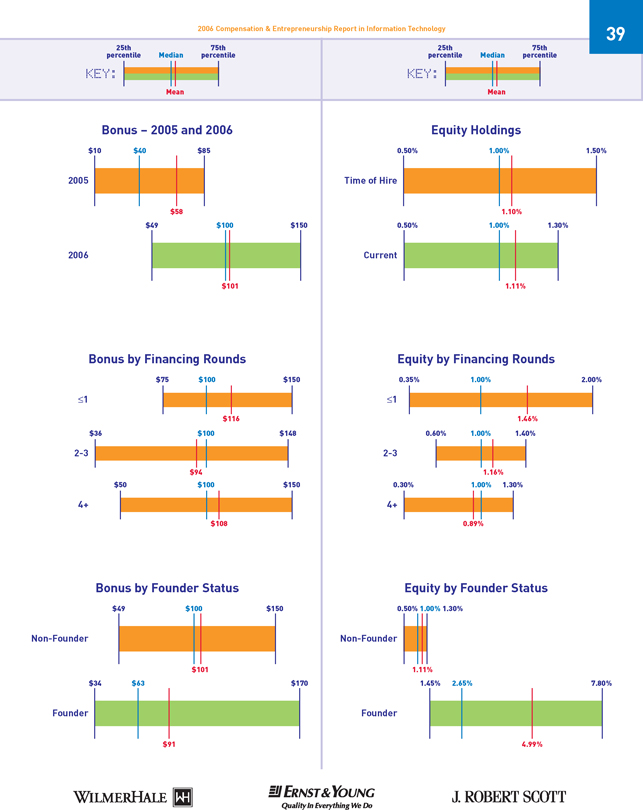

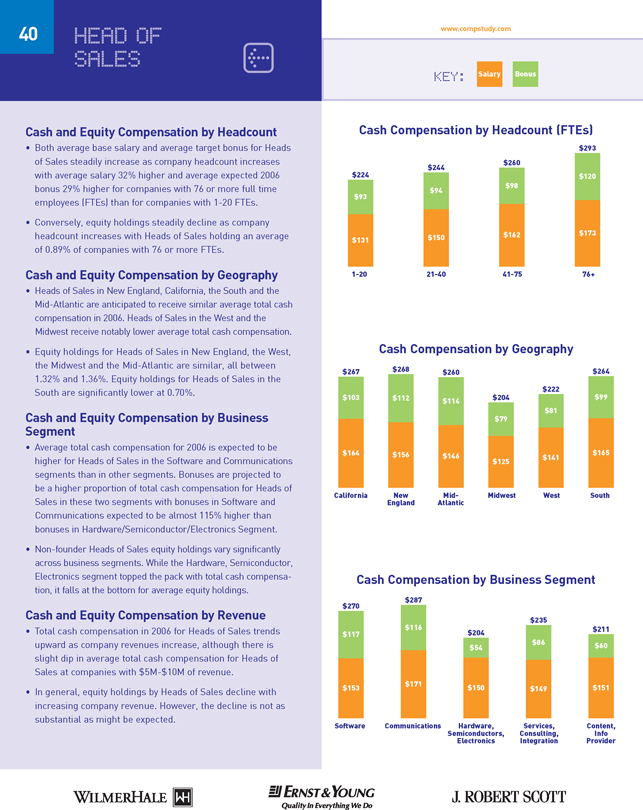

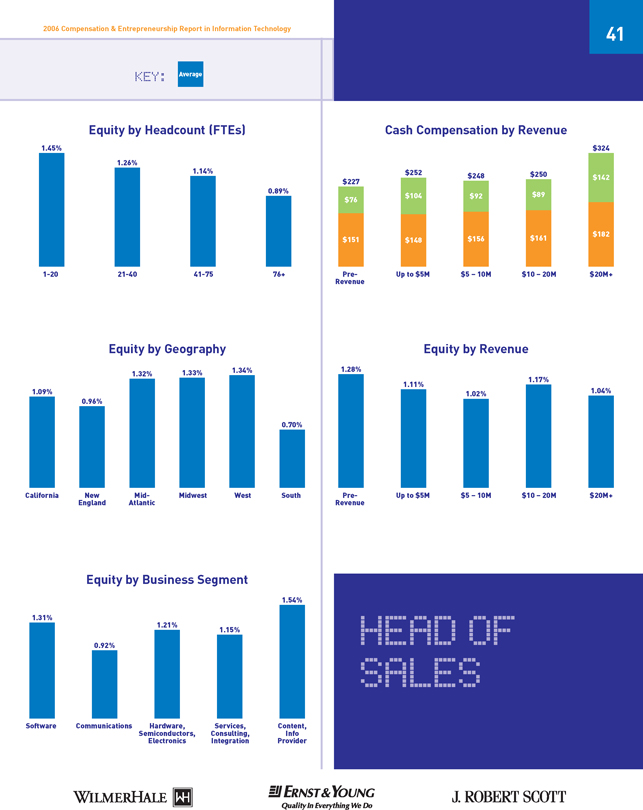

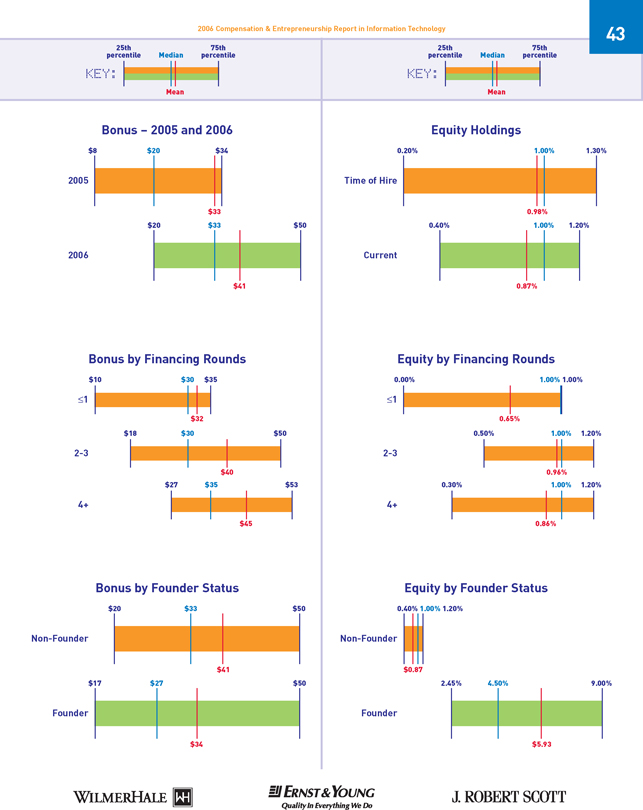

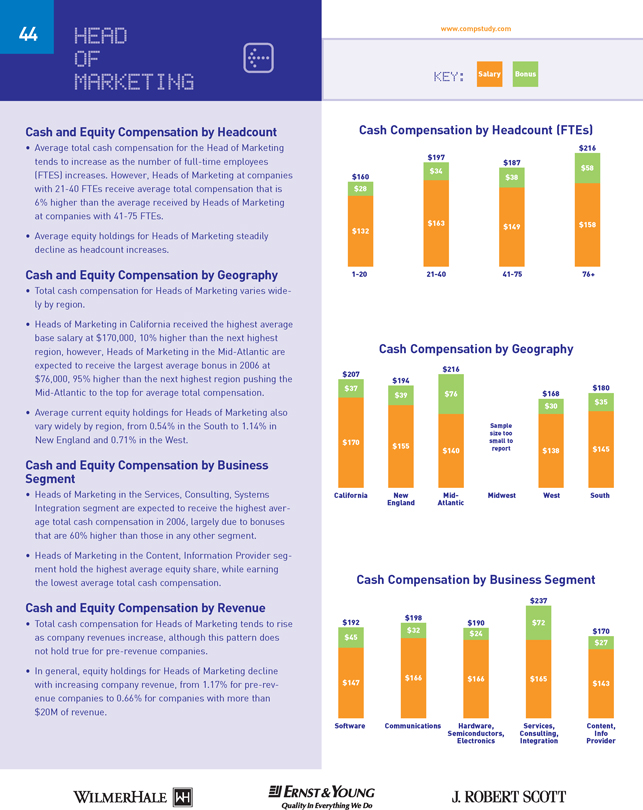

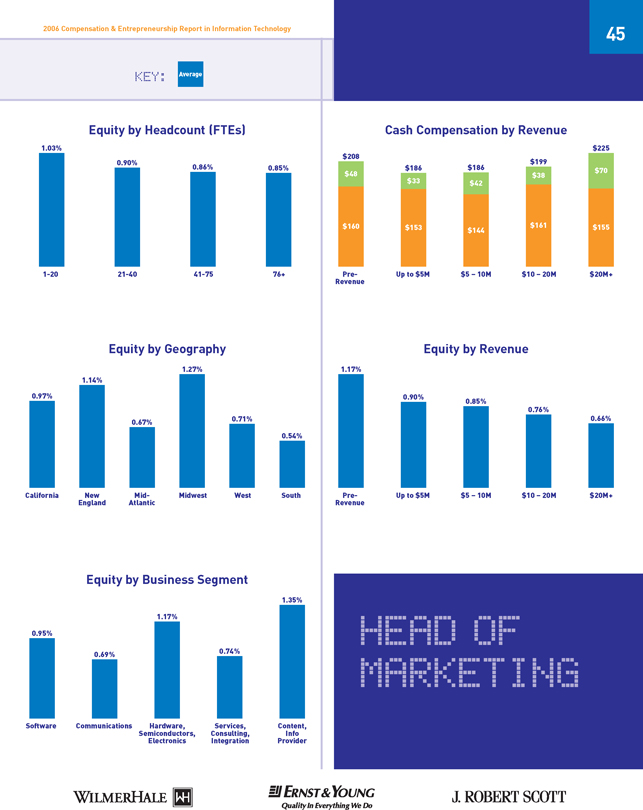

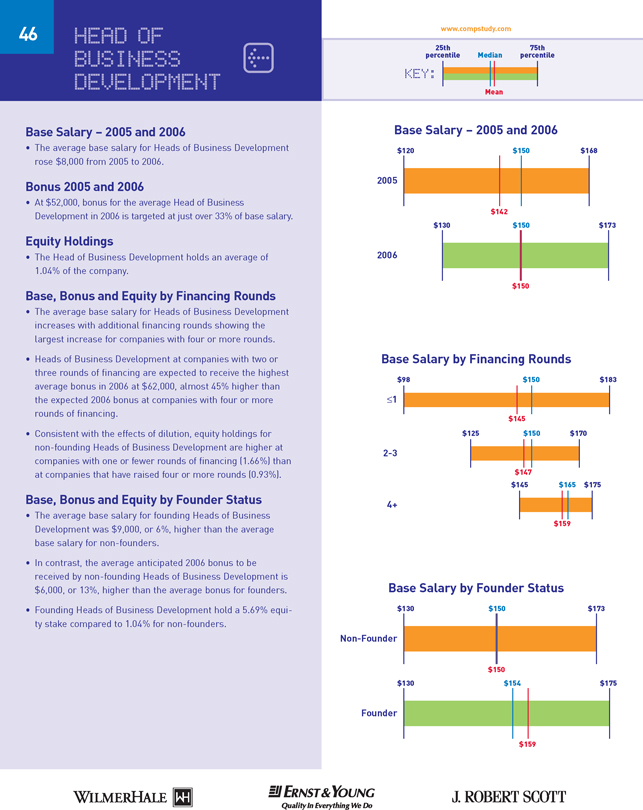

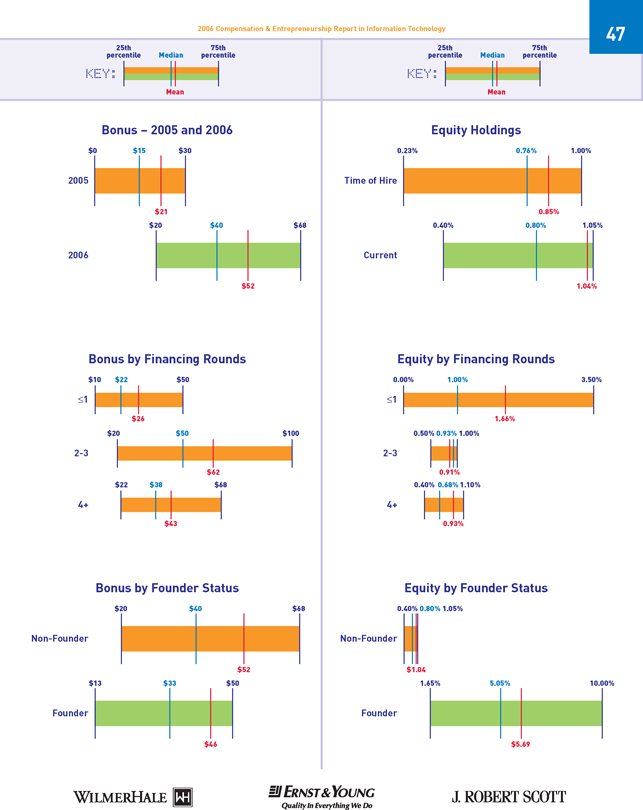

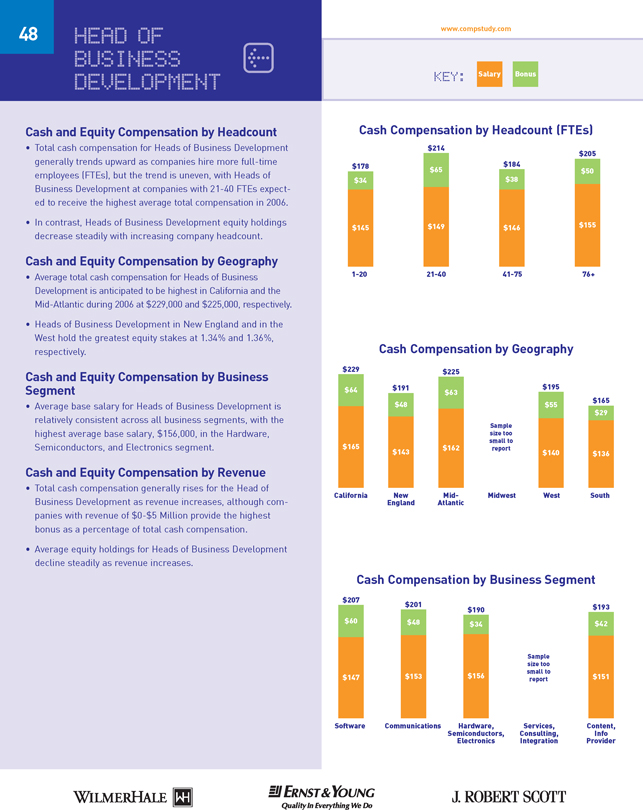

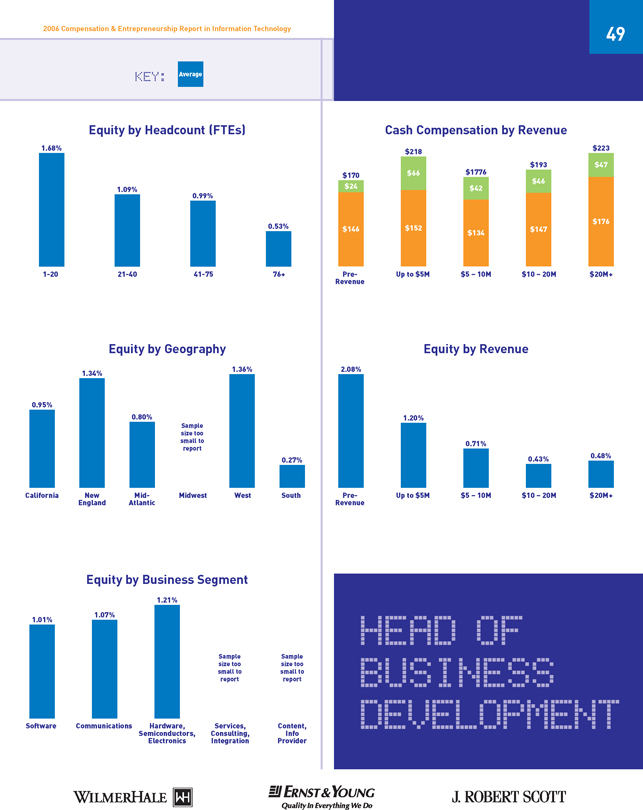

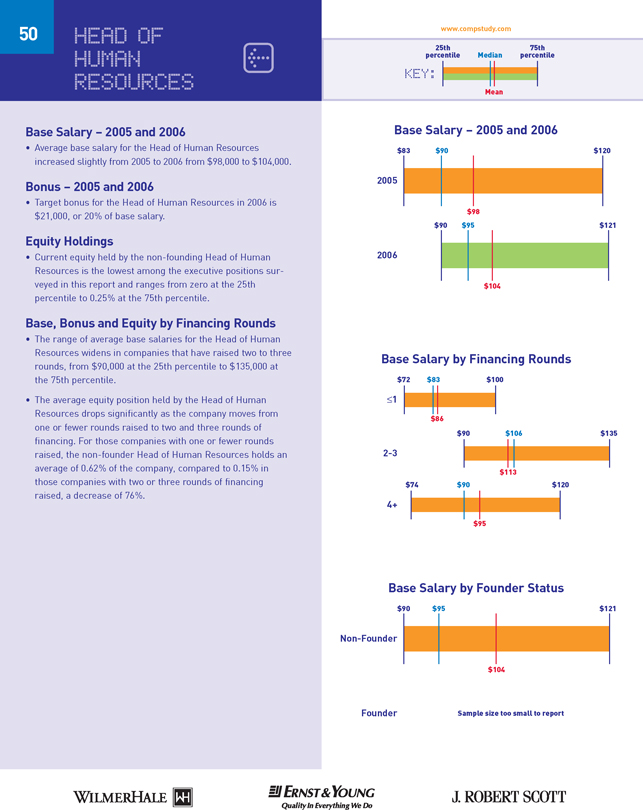

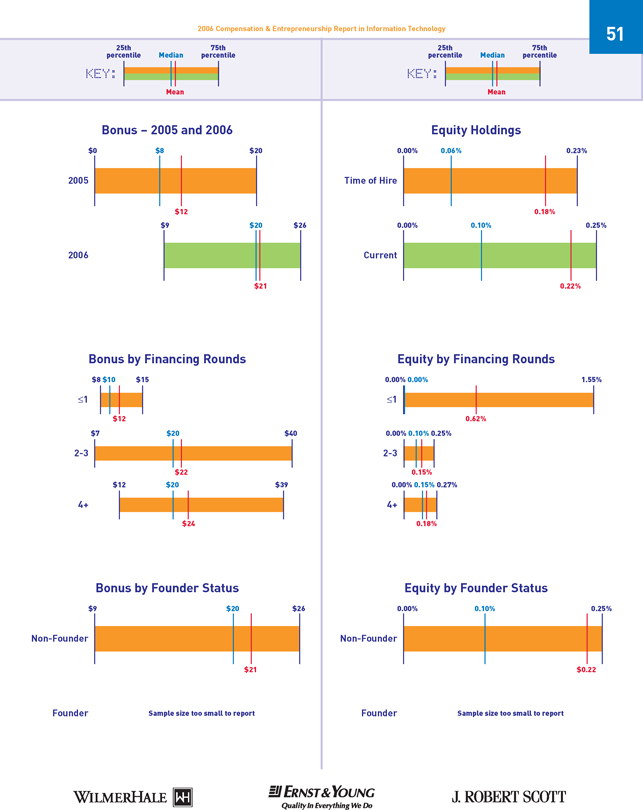

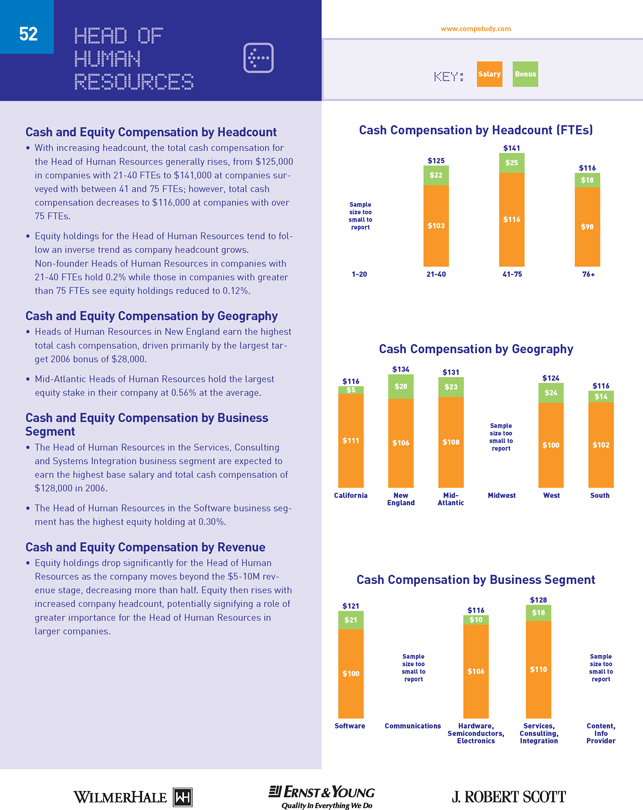

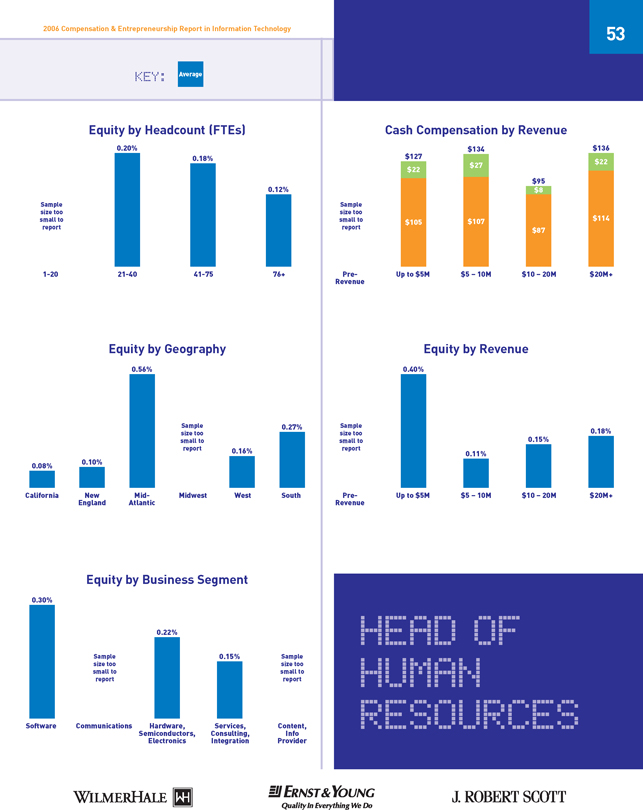

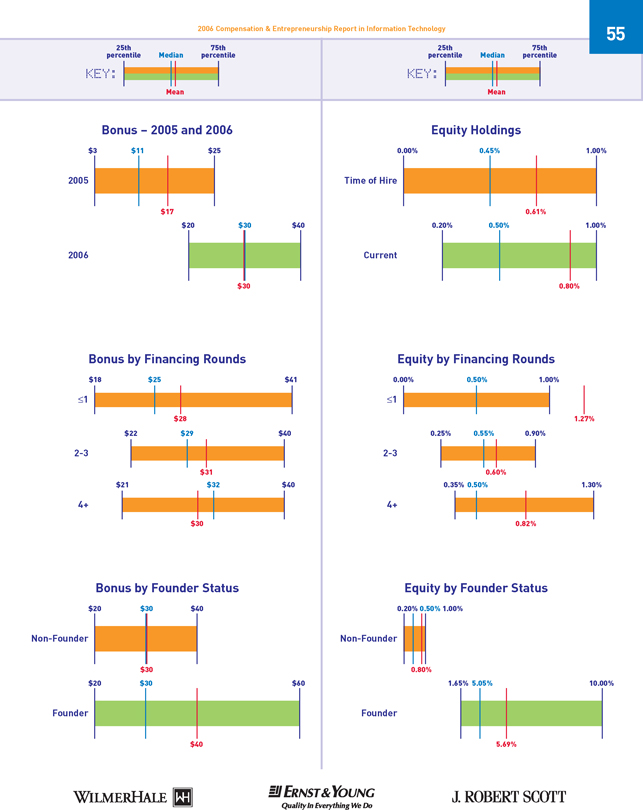

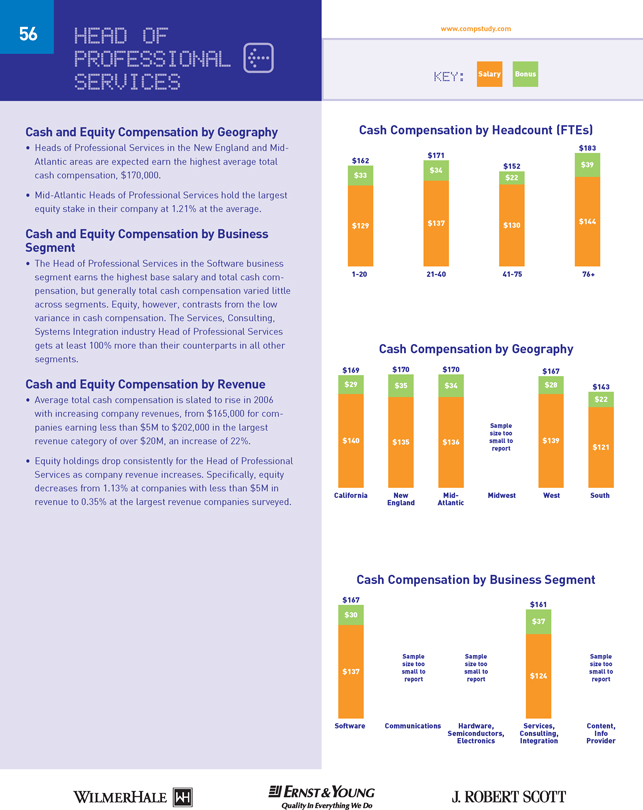

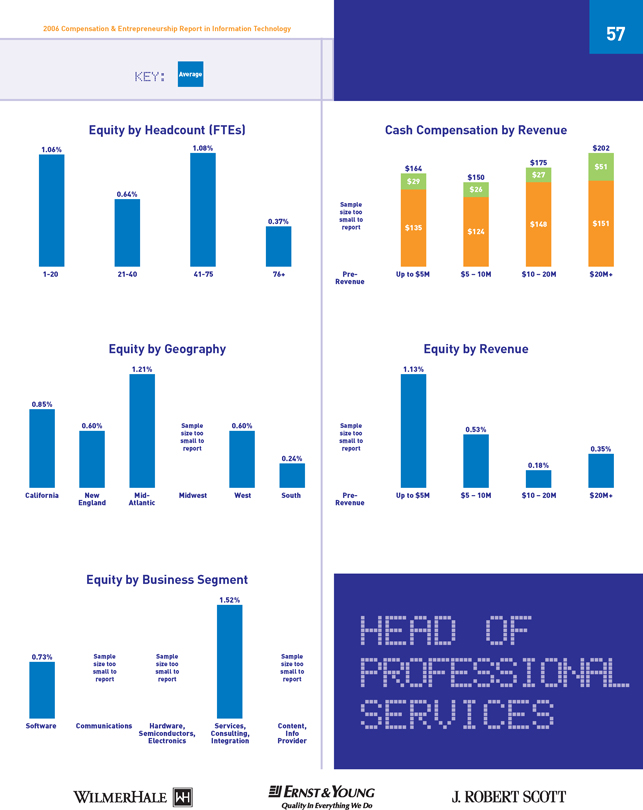

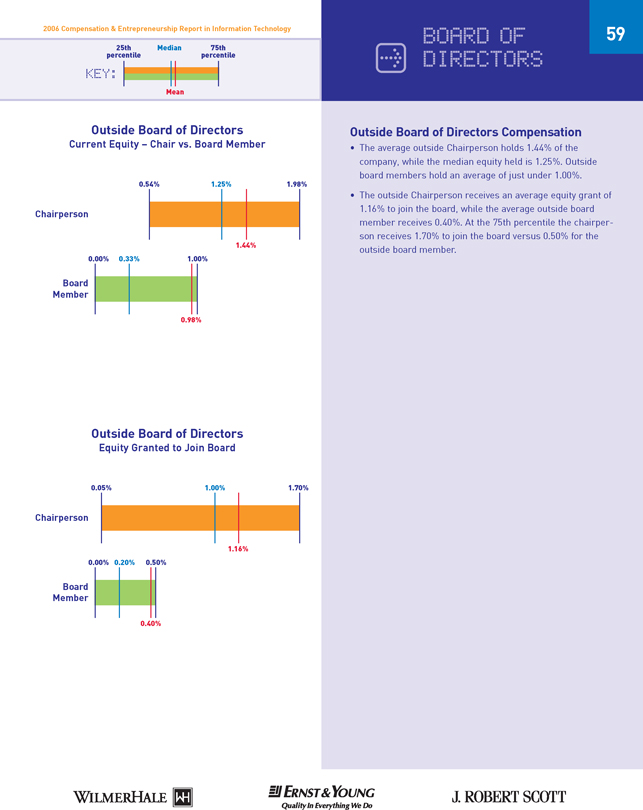

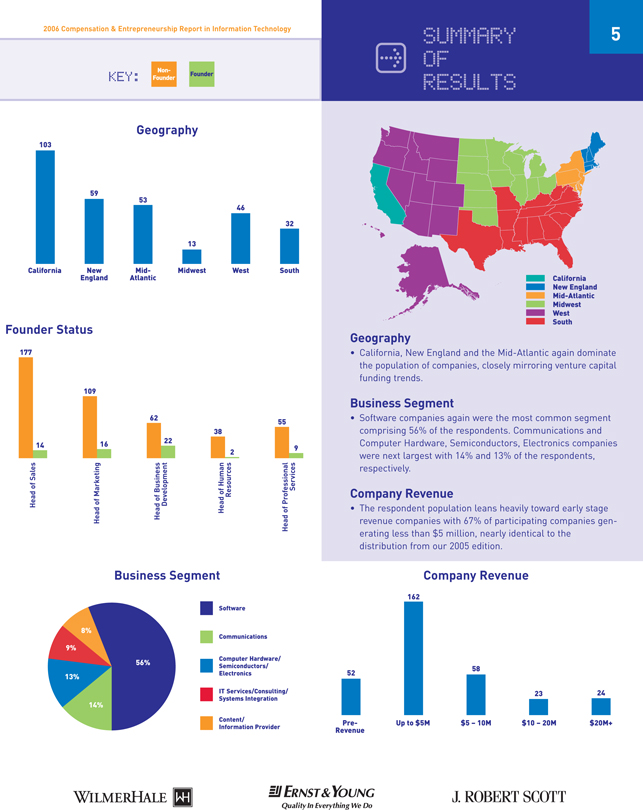

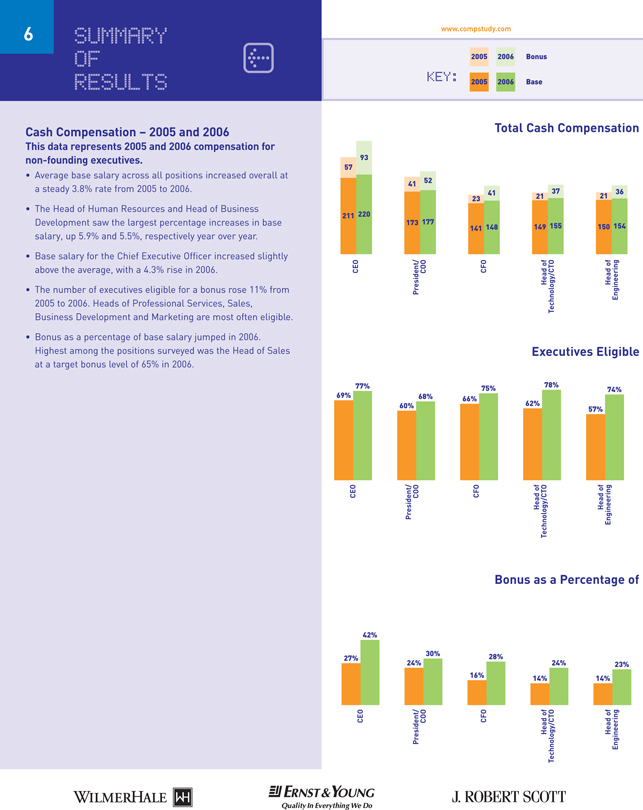

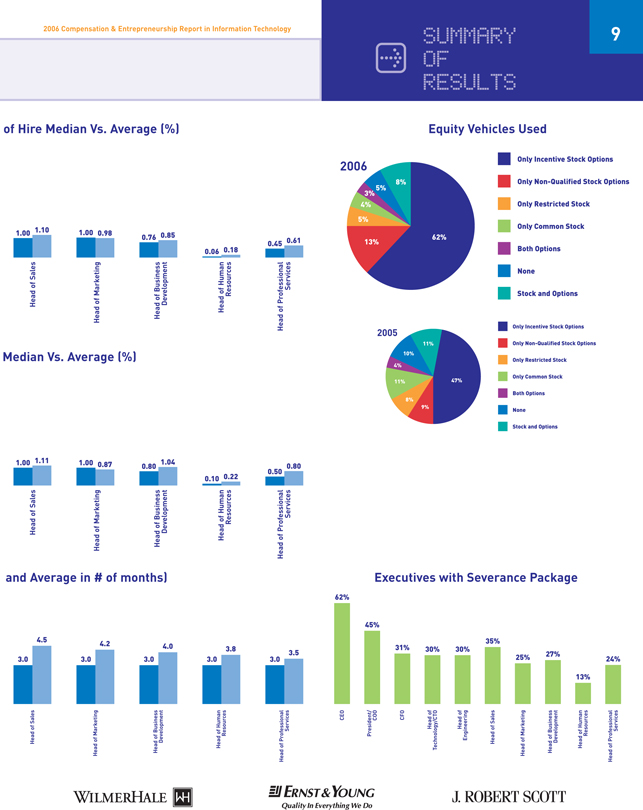

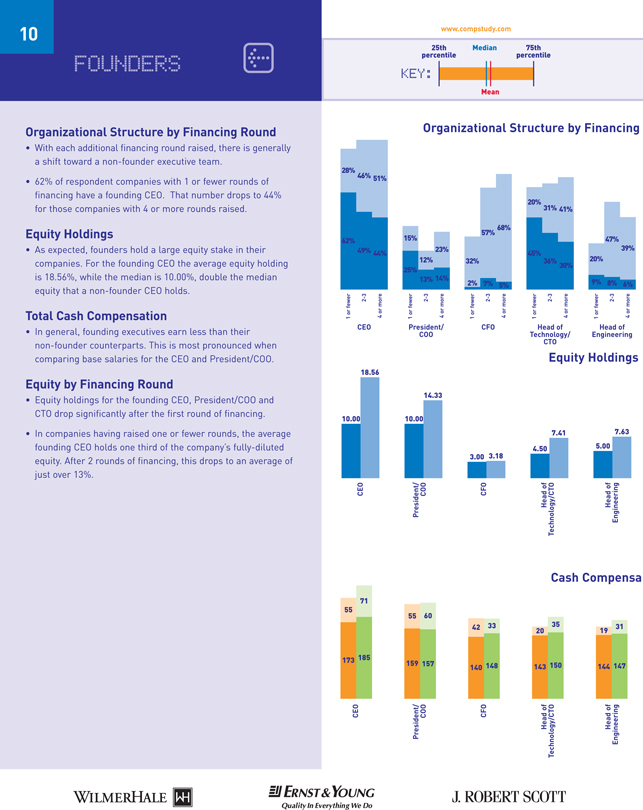

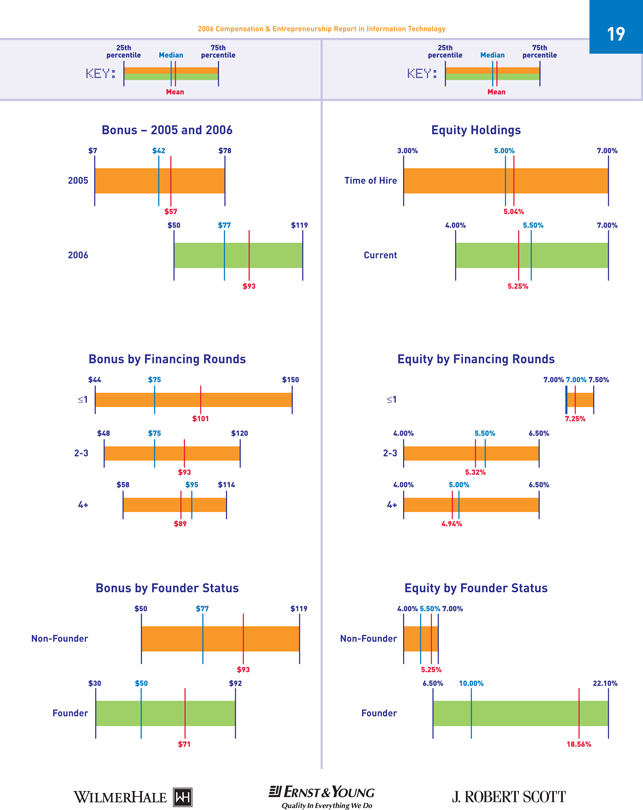

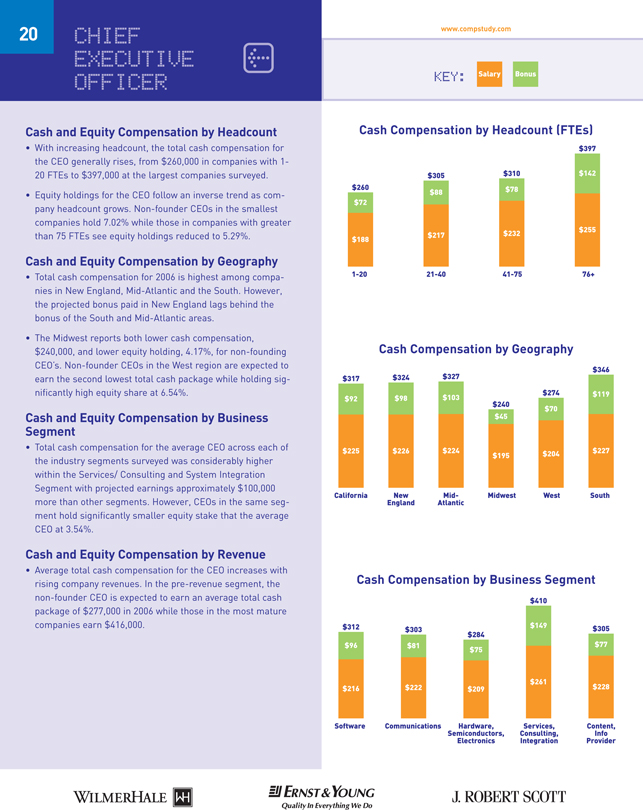

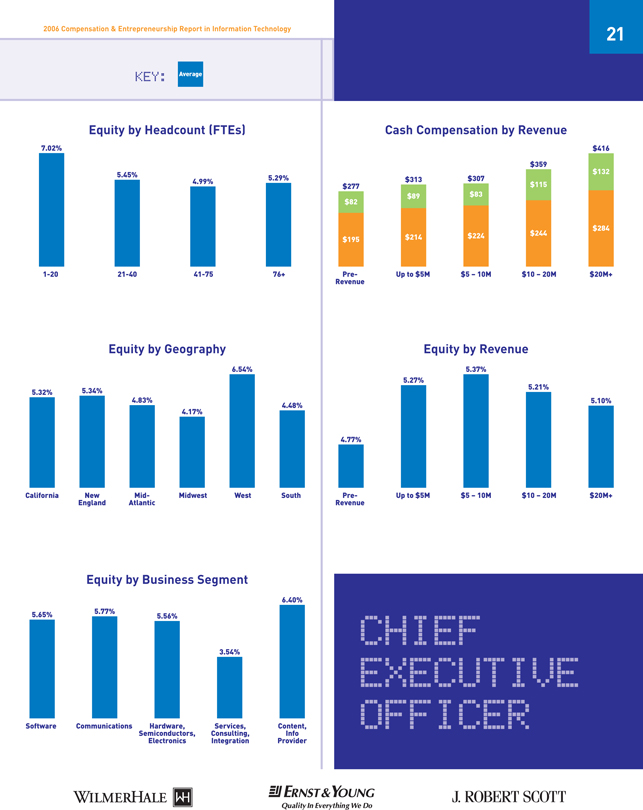

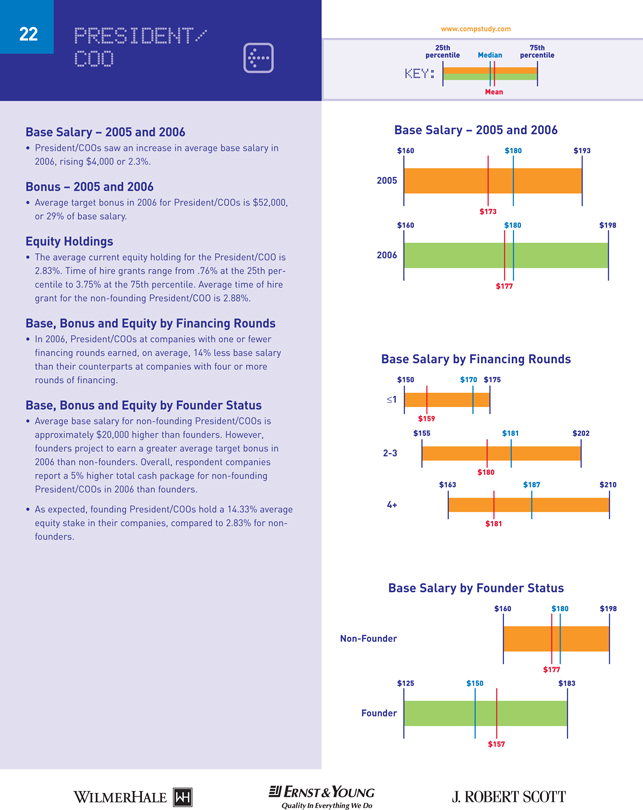

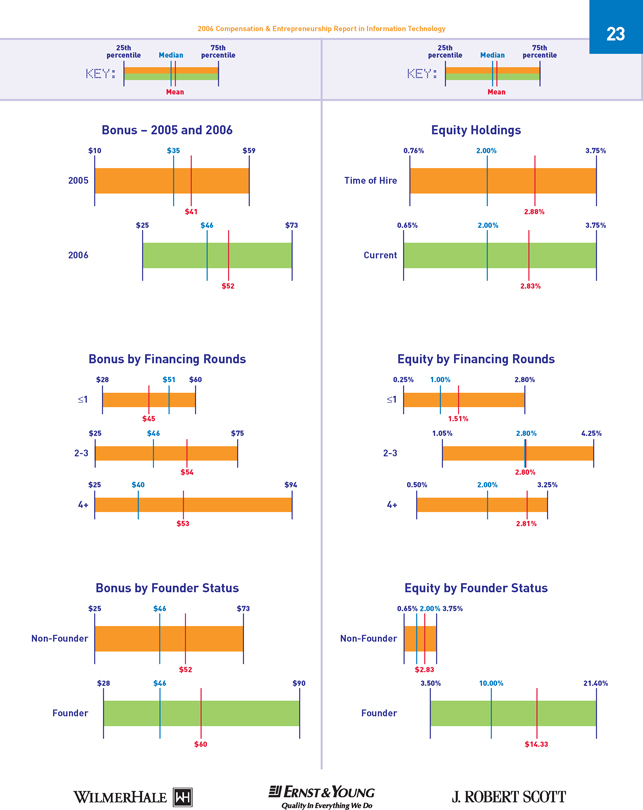

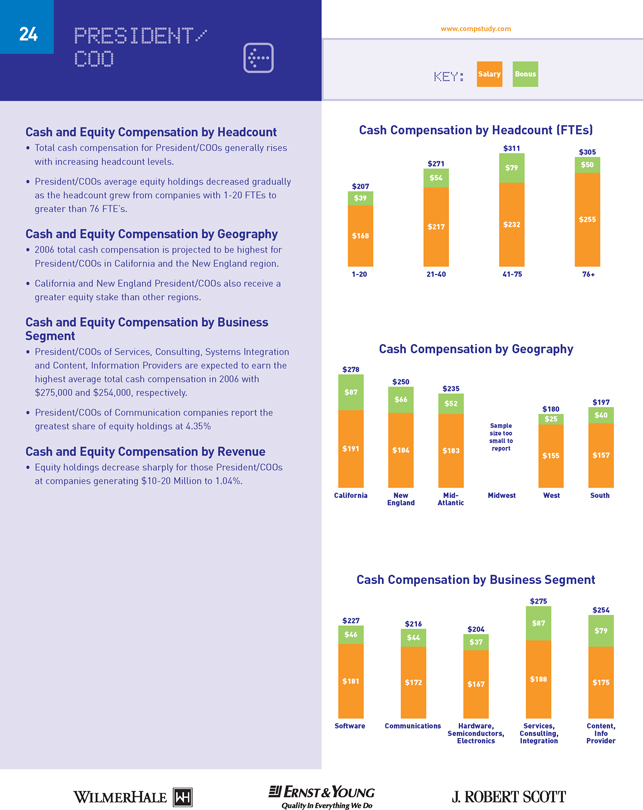

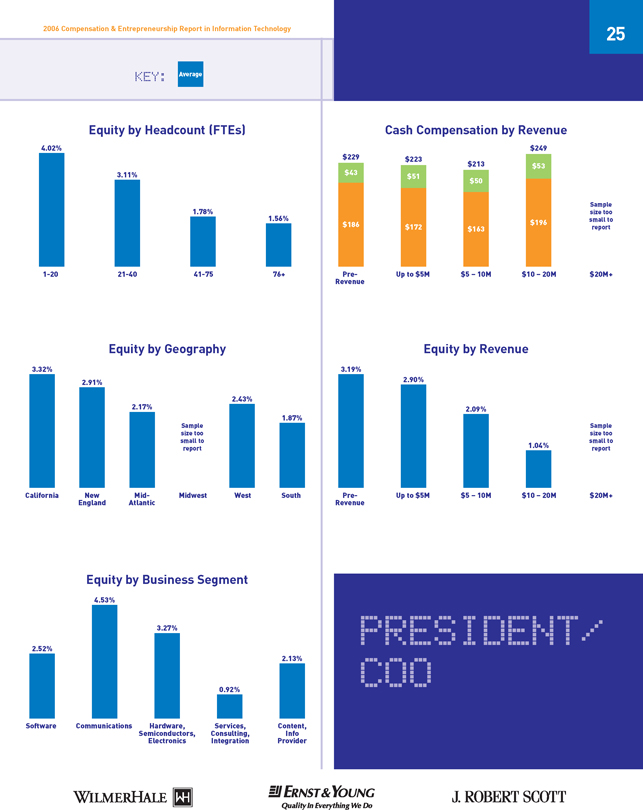

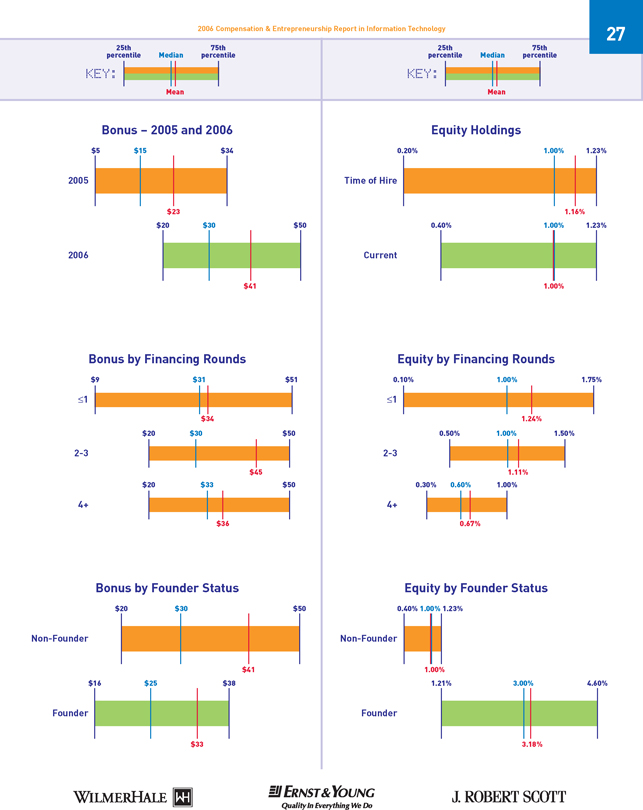

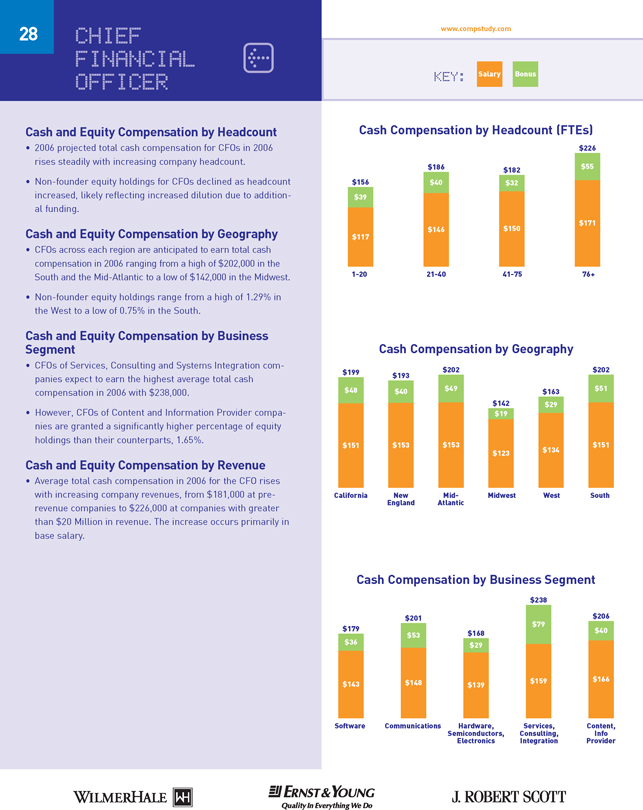

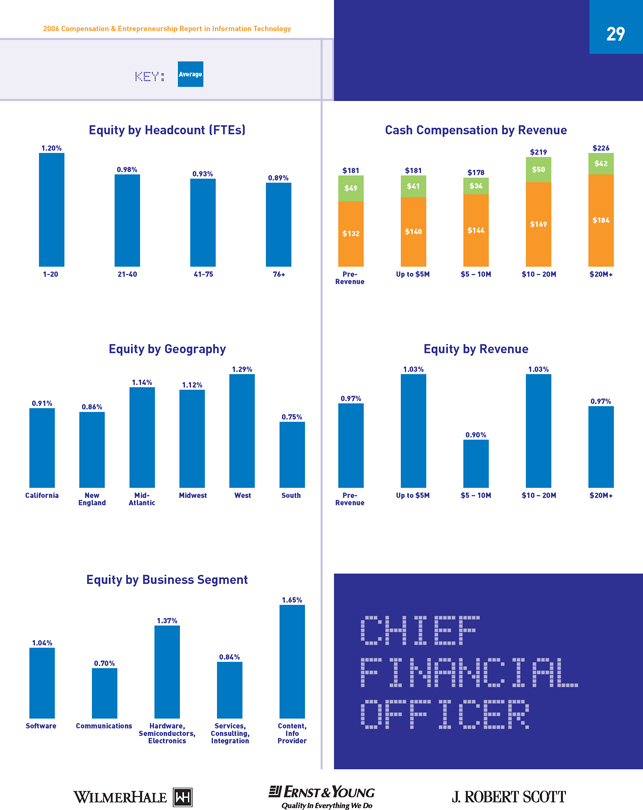

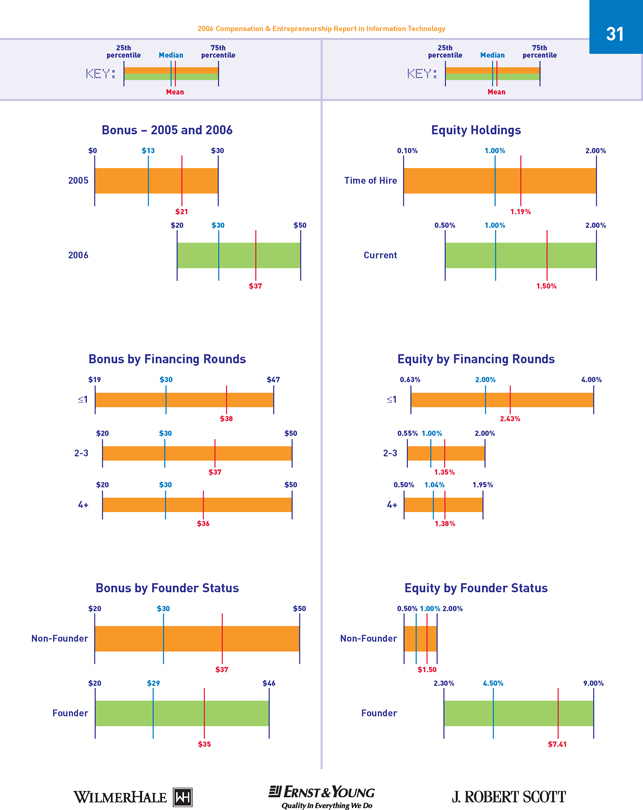

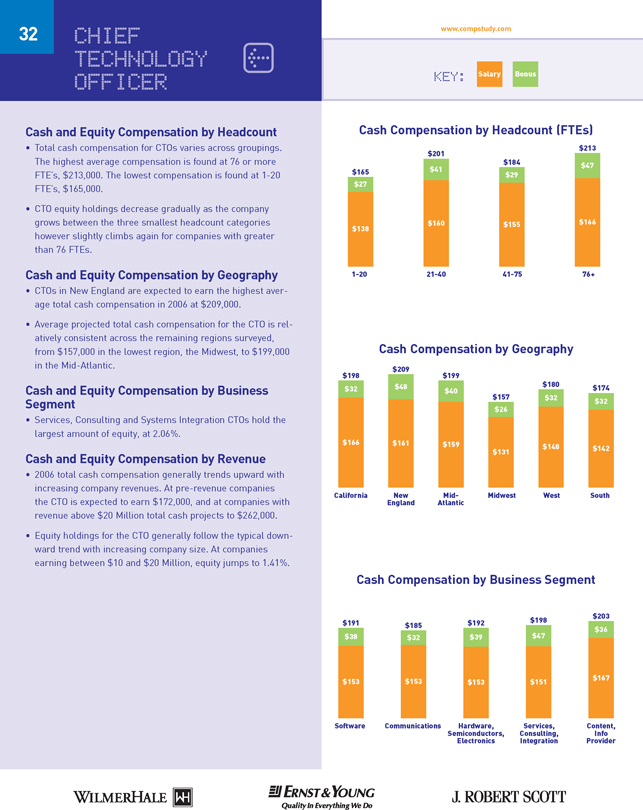

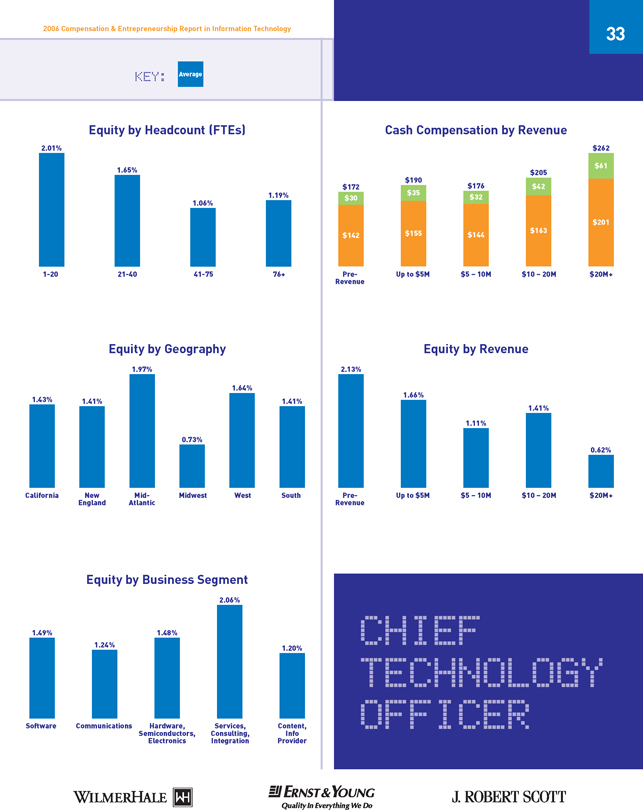

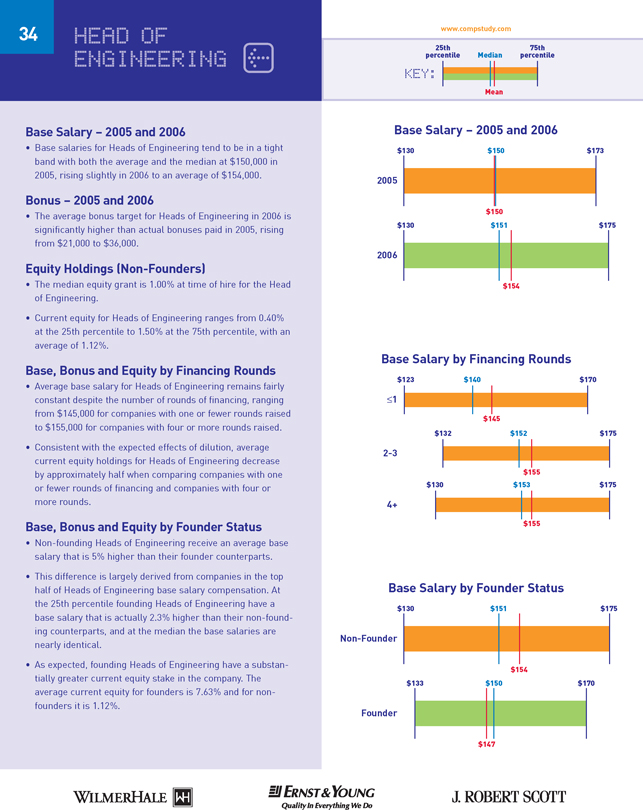

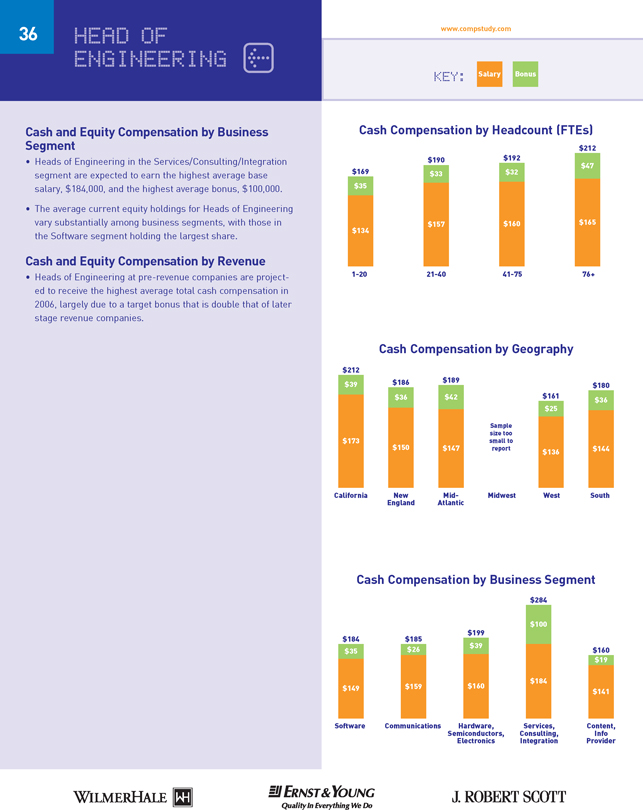

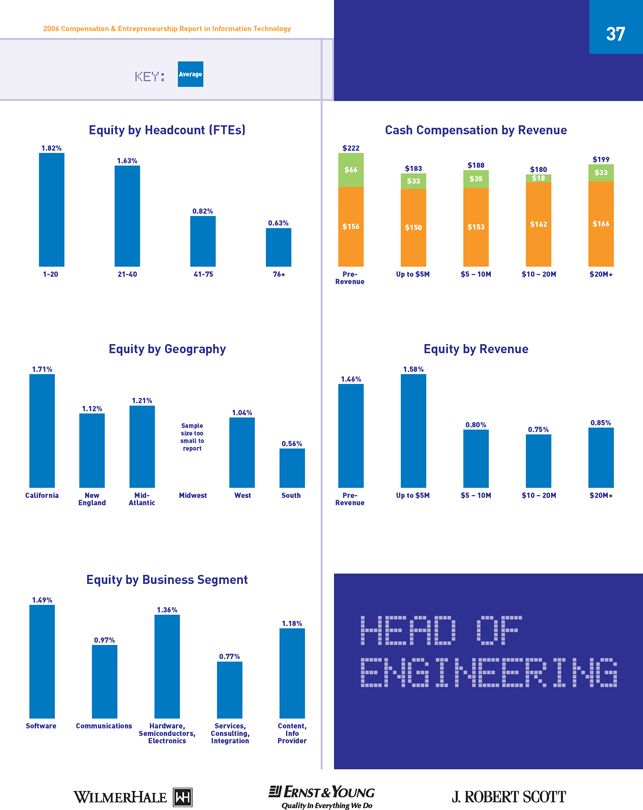

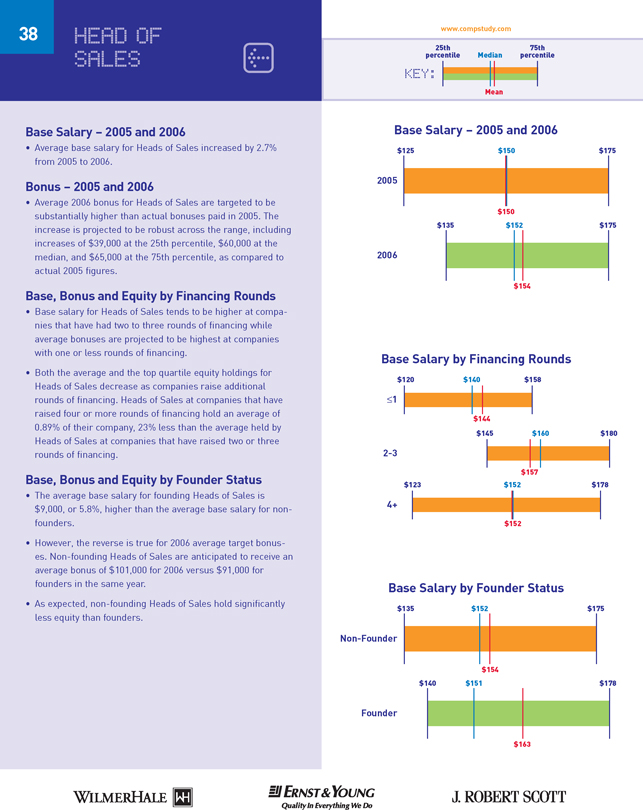

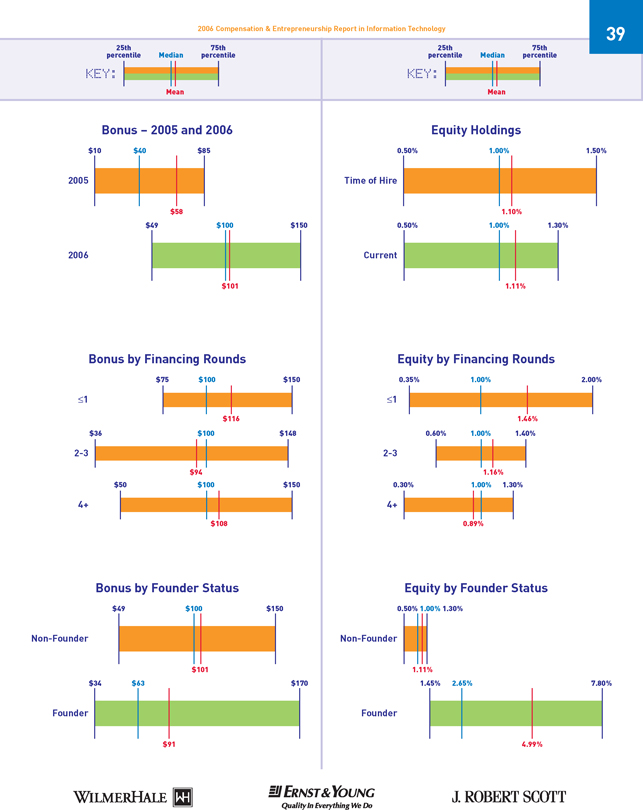

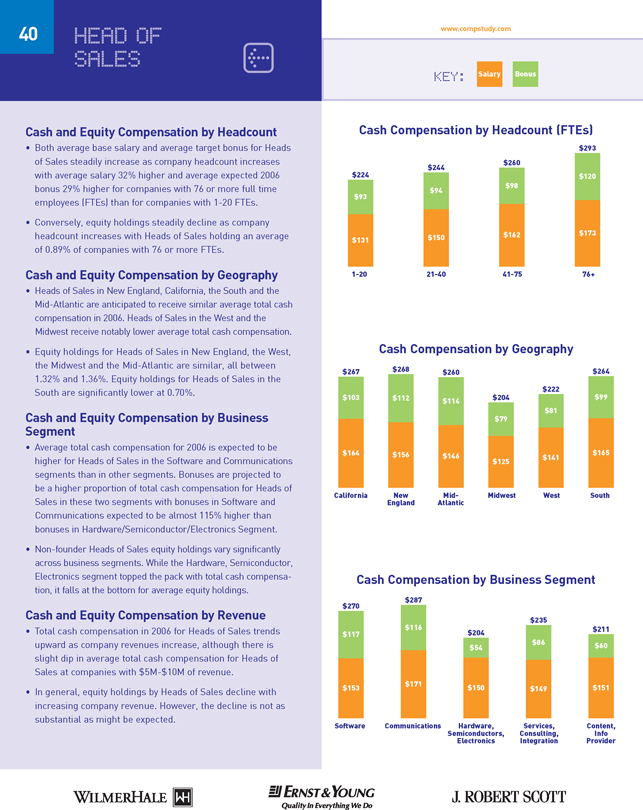

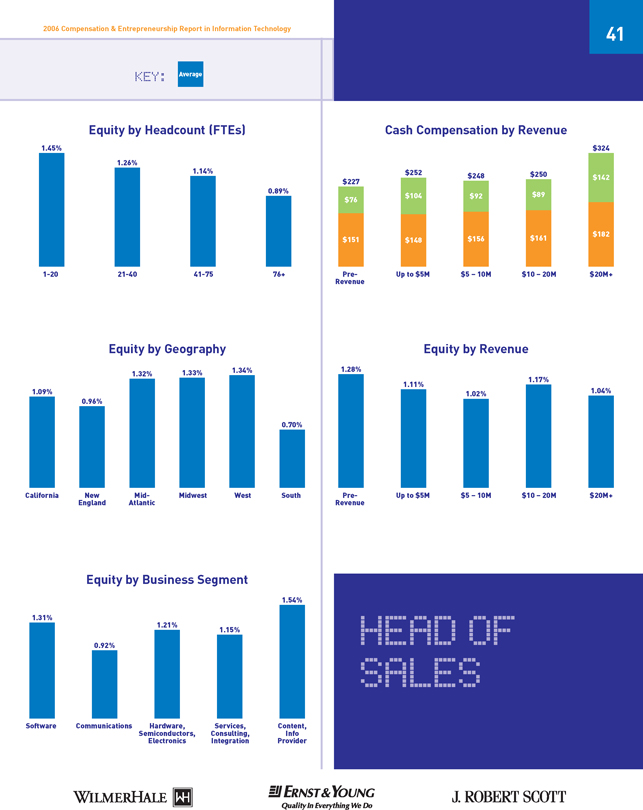

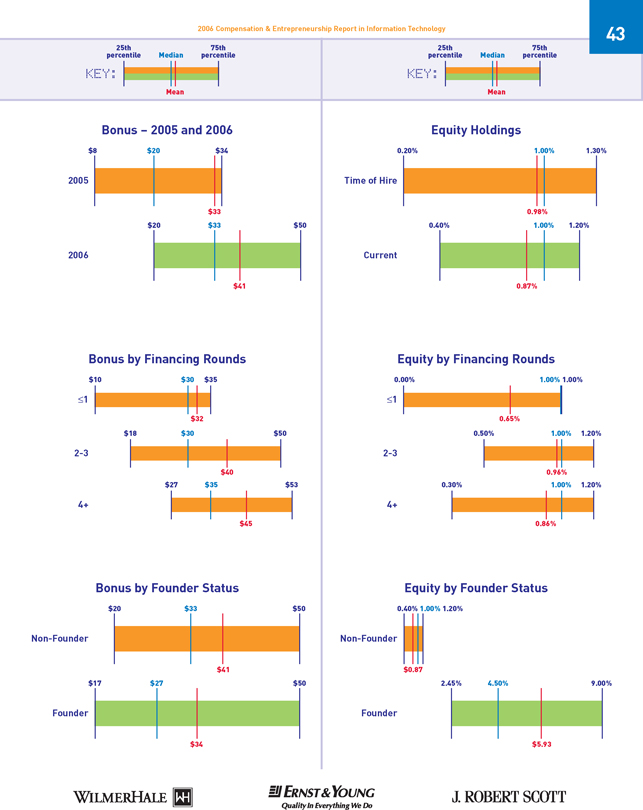

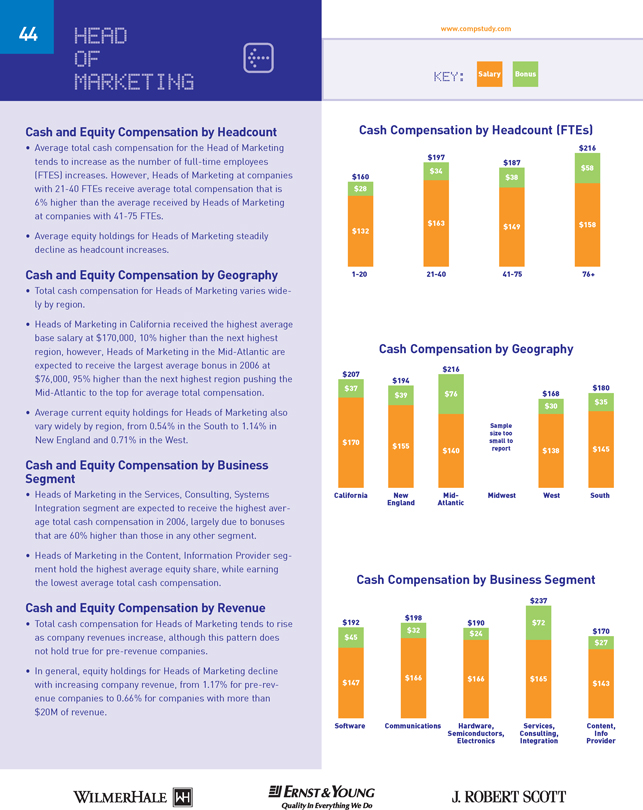

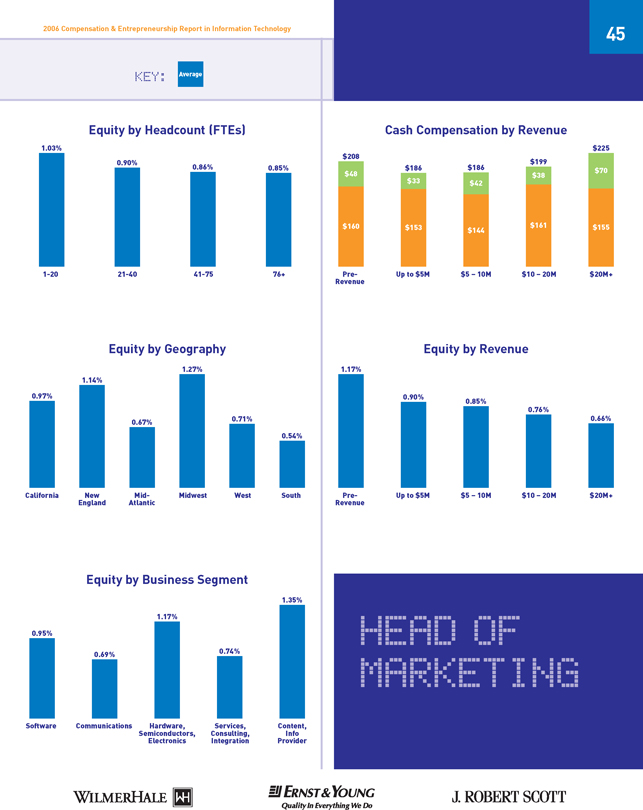

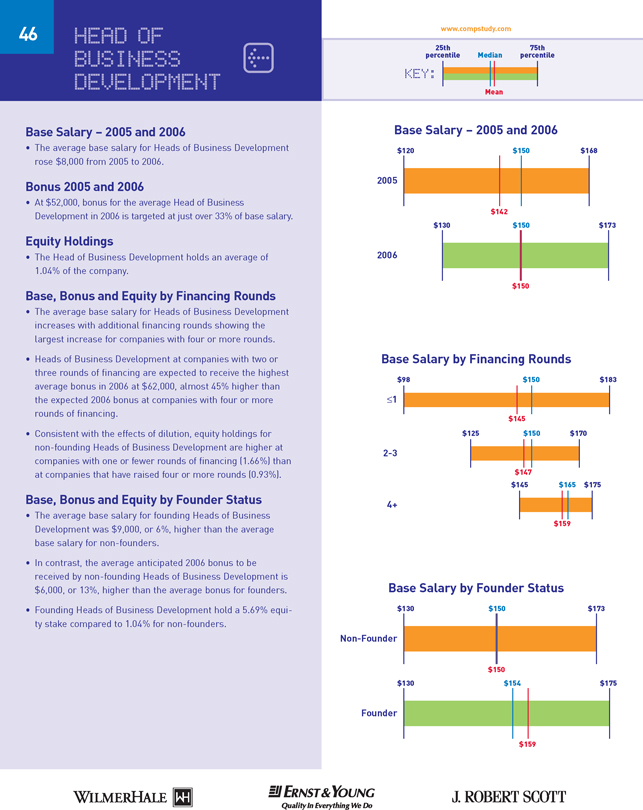

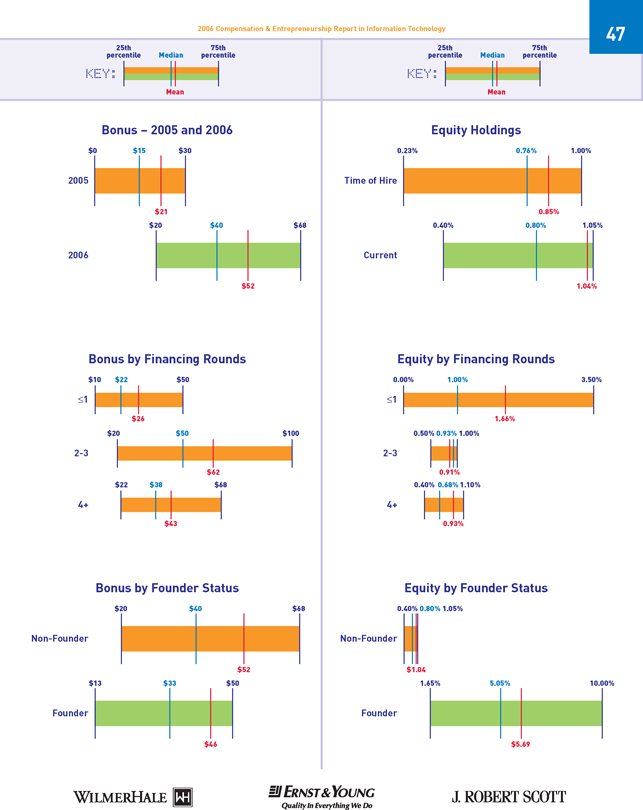

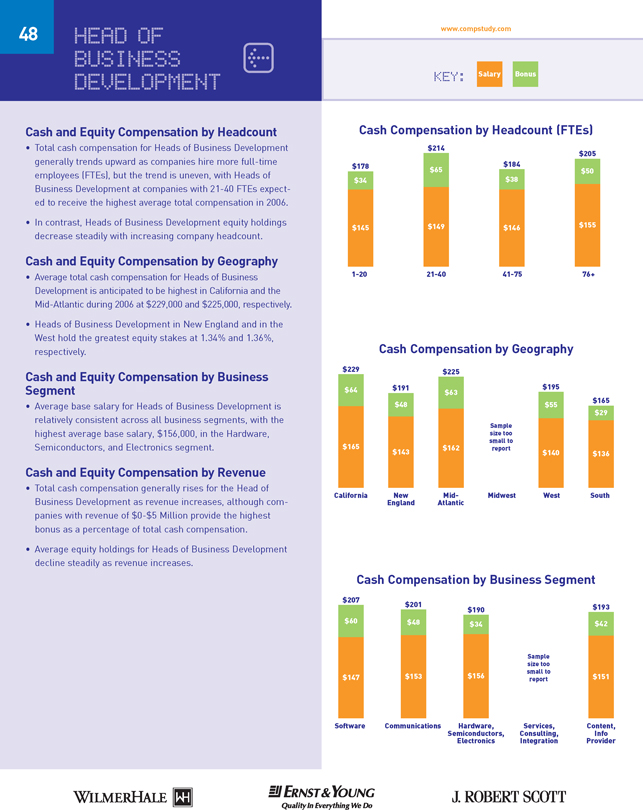

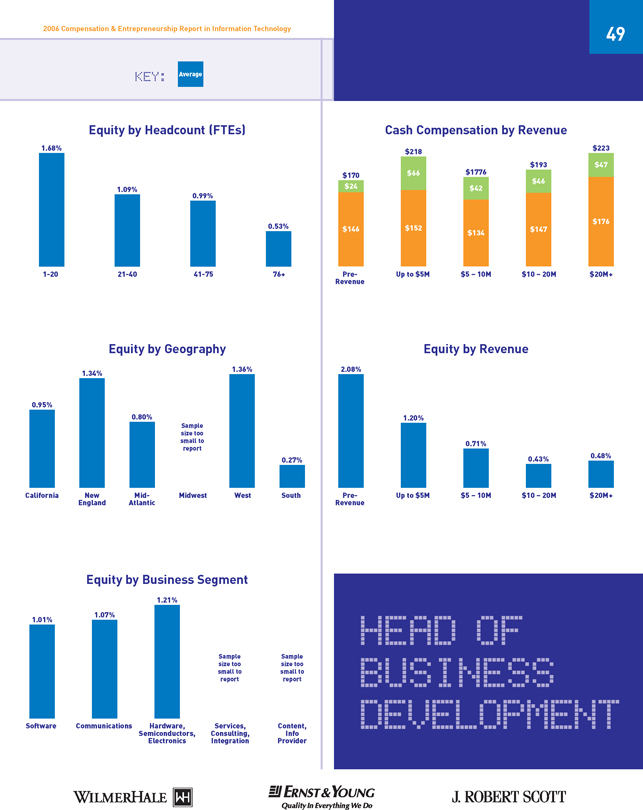

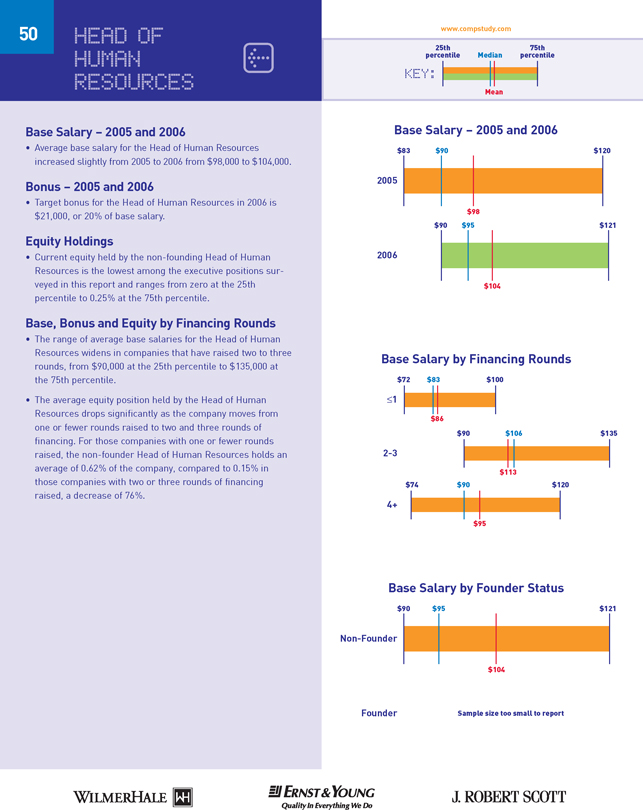

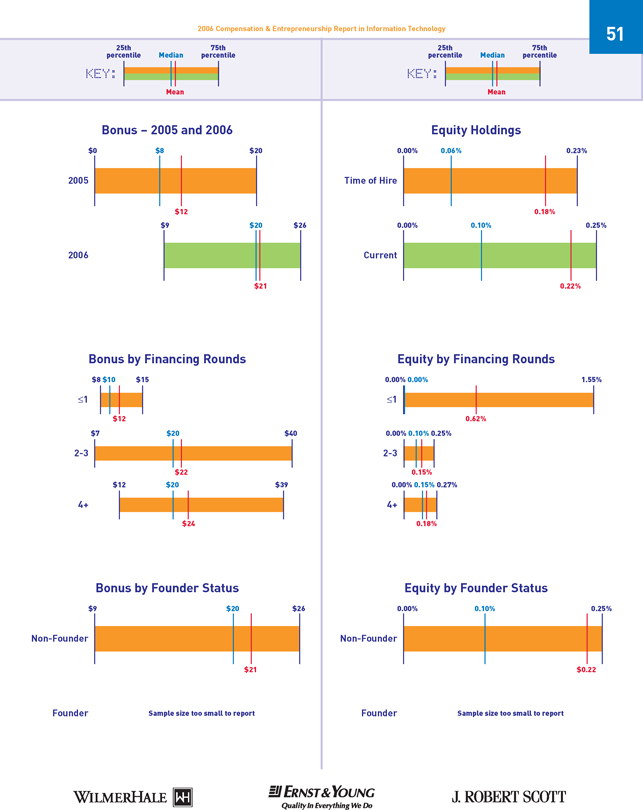

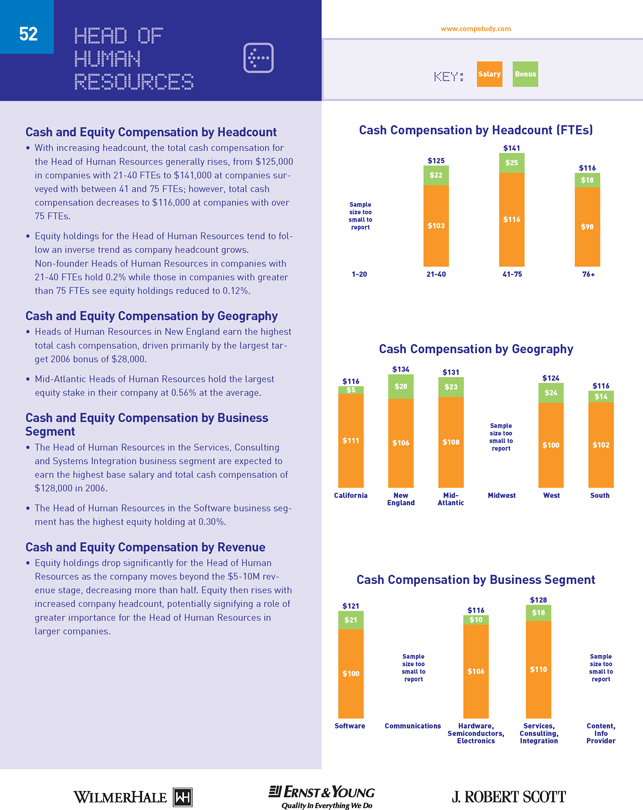

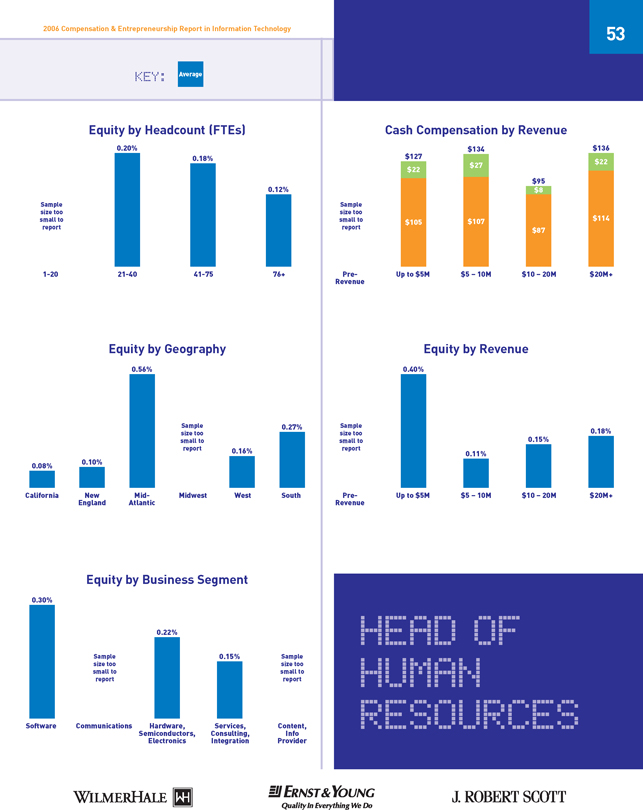

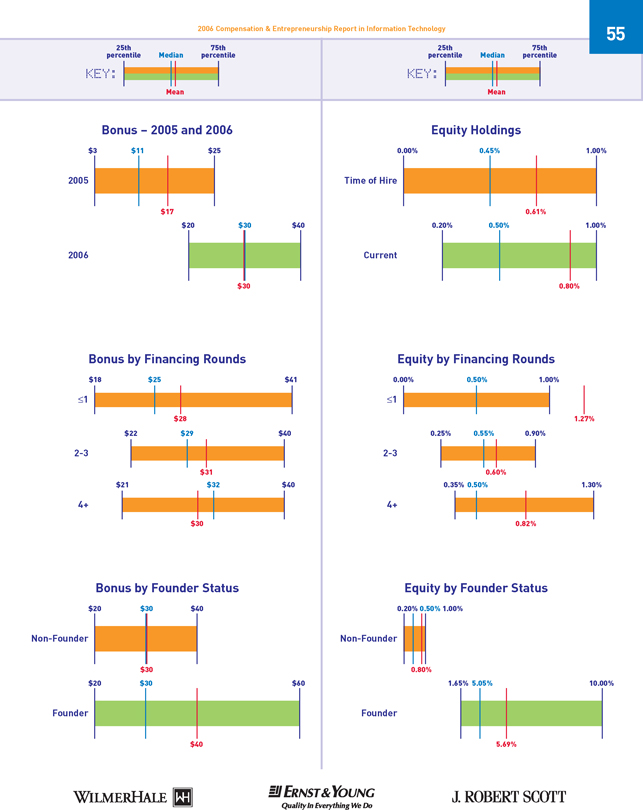

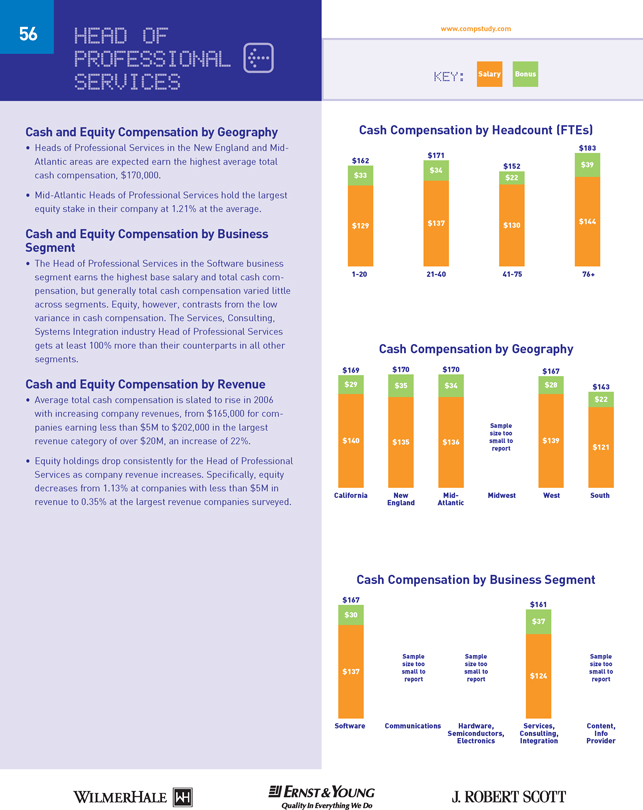

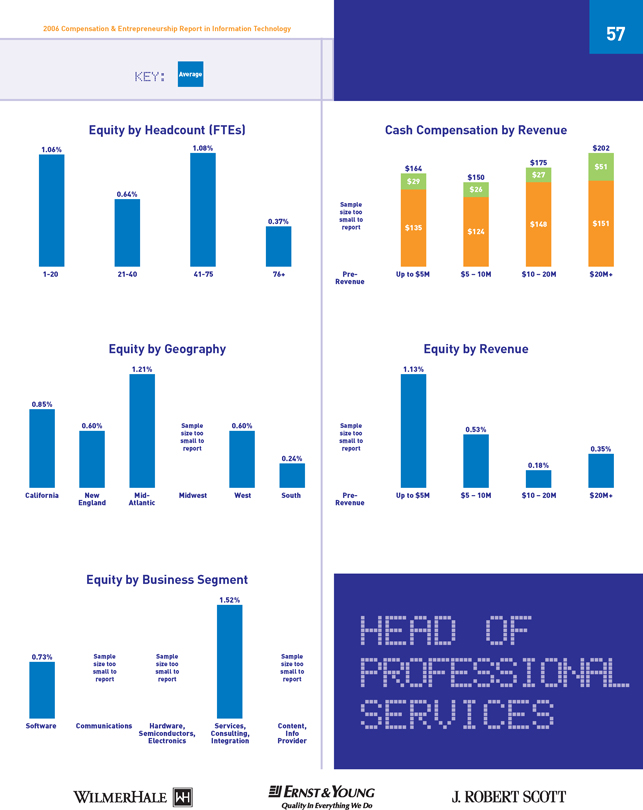

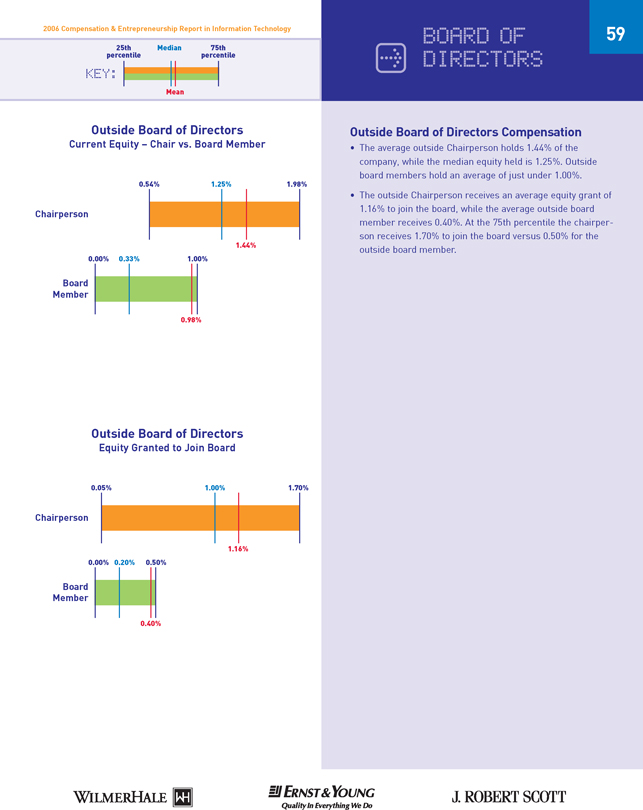

| 23. | It appears from your disclosure on pages 88 through 90 that you benchmark compensation of your named executive officers against peer companies in the semiconductor and other advanced technology and information technology related industries. Please identify these peer companies. We note your statement in the second whole paragraph on page 89 that the annual Compensation & Entrepreneurship Report in Information Technology does not identify the companies sampled, however, your disclosure in this paragraph suggests that this is not the only report from which you derive information relating to compensation levels. If this is the only report you considered, it is unclear how you were able to determine that the data in the report related to companies you deemed your peers. |

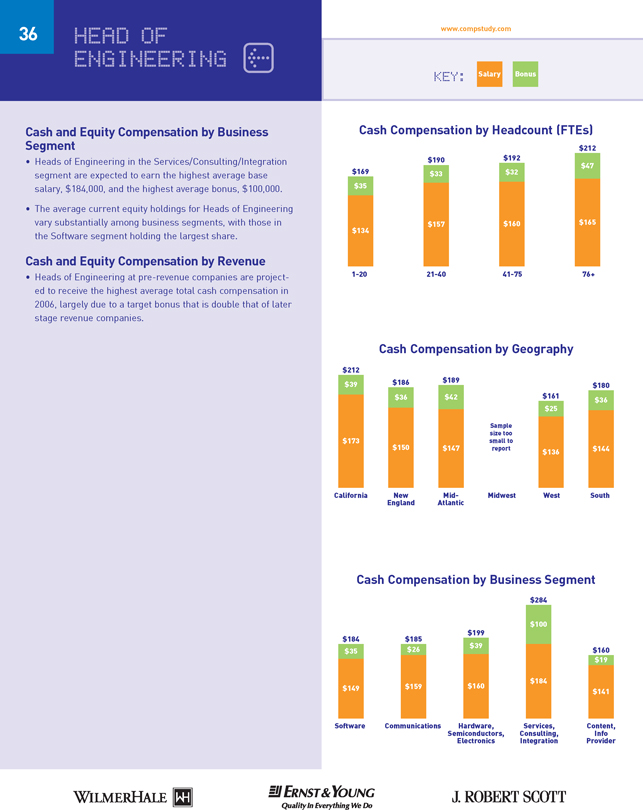

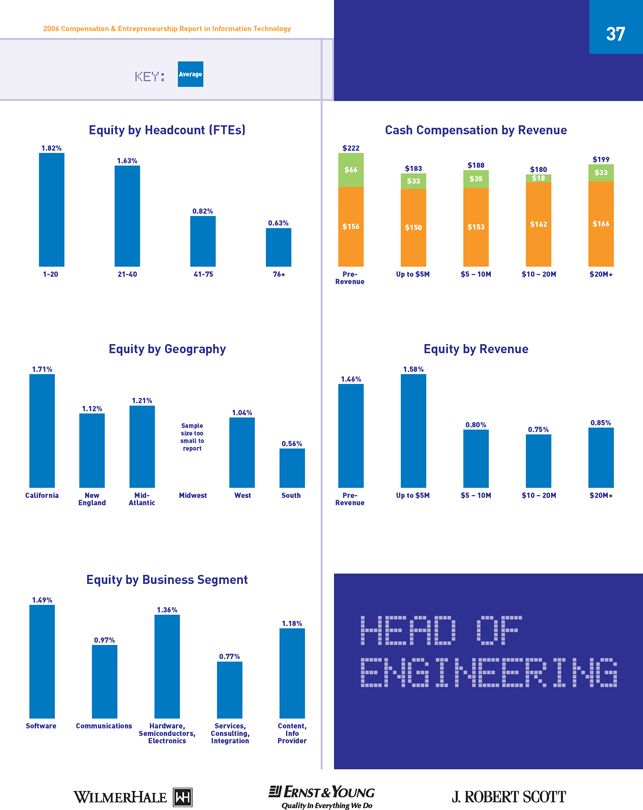

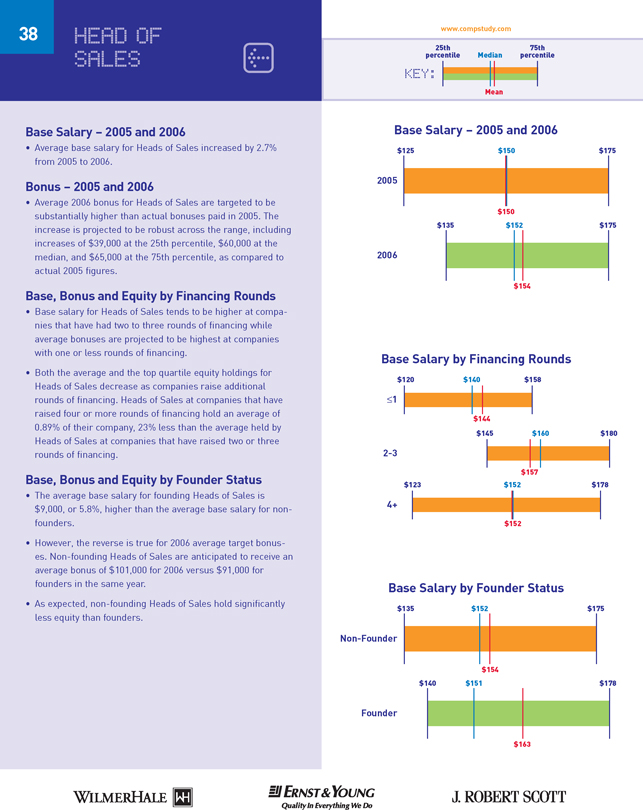

In response to the Staff’s comment, the Company has provided additional disclosure on page 90. In addition, the Company has included a copy the 2006 Compensation & Entrepreneurship Report in Information Technology asExhibit J hereto for the Staff’s reference.

| 24. | Please clarify the meaning of the phrase “comparable with executive officers in other companies.” Are you targeting total compensation or specific elements of compensation at a specific percentile? For example, is the target level of each element of compensation as well as overall target compensation at the 50th, 60th or 75th percentile of your peer companies? |

In response to the Staff’s comment, the Company has provided additional disclosure on page 90.

Discretionary annual bonus, page 89

| 25. | You indicate that bonus levels depend on each executive officer’s performance measured against their specific performance objectives, but you have not provided a quantitative discussion of the objectives to be achieved in order for your executive officers to earn their annual bonuses. Please disclose the specific financial and operational targets and |

Mr. Tom Jones

Securities and Exchange Commission

November 5, 2007

RE: MEMSIC, Inc. S-1 Registration Statement (File No. 333-146377)

Page 13

| | individual annual performance objectives used to determine incentive amounts. To the extent you believe disclosure of these targets is not required because it would result in competitive harm such that you may omit this information under Instruction 4 to Item 402(b) of Regulation S-K, please provide on a supplemental basis a detailed explanation for such conclusion. Disclose how difficult it would be for the named executive officers or how likely it will be for you to achieve the undisclosed target levels or other factors. General statements regarding the level of difficulty or ease associated with achieving performance goals are not sufficient. In discussing how difficult it will be for an executive or how likely it will be for you to achieve the target levels or other factors, provide as much detail as necessary without providing information that would result in competitive harm. Please provide insight into the factors considered by the compensation committee prior to the awarding of performance-based compensation such as historical analyses prior to the granting of these awards or correlations between historical bonus practice and the incentive parameters set for the relevant fiscal period. |

In response to the Staff’s comment, the Company has provided additional disclosure on pages 91 and 92.

| 26. | You also indicate that in 2006, the compensation committee established a bonus plan focused on revenue, major account wins and introduction of new products to market with the weight of each element varying depending on the executive officer’s responsibilities. Please identify the objectives for each named executive officer and how they were weighted. |

In response to the Staff’s comment, the Company has revised disclosure on pages 91 and 92.

Long term incentives, page 90

| 27. | Please describe with specificity how the compensation committee determined the grants in 2006 and 2007. Include a discussion of how the factors led to decisions about the size of the option grants for the different executive officers. |

In response to the Staff’s comment, the Company has revised the disclosure to include the requested discussion on pages 92 and 93.

Grants of plan-based awards in 2006, page 91

| 28. | Your table in this section indicates that the exercise price of the options granted to Ms. Niu was $0.77. Please reconcile this with footnote (1) to the table on page 92 indicating that the exercise price was $0.15 per share. |

Mr. Tom Jones

Securities and Exchange Commission

November 5, 2007

RE: MEMSIC, Inc. S-1 Registration Statement (File No. 333-146377)

Page 14

In response to the Staff’s comment, the Company has clarified its disclosure on page 94. The Company notes that none of the options in respect of 50,000 shares granted to Ms. Niu on November 9, 2006 at an exercise price of $0.77 shown in the table titled “Grants of plan-based awards in 2006” on page 94 had vested as of December 31, 2006. The shares referenced by footnote (1) on page 95 relates to the option granted on September 25, 2003 with an exercise price of $0.15, which had vested as of December 31, 2006. Such options were exercised by Ms. Niu in 2006.

2000 Omnibus Stock Plan, page 92

| 29. | You indicate that as of June 30, 2007, 2,443,750 shares of stock options were outstanding and were available for future grant under the 2000 Stock Plan. Please clarify. Are you saying that options exerciseable into 2,443,750 shares of common stock have been issued or that such options are available for future issuance? |

In response to the Staff’s comment, the Company has revised the disclosure on page 96.

2006 Director compensation, page 98

| 30. | Please confirm in your response letter whether the options issued to Messrs. Blethen and Zavracky had fully vested in 2005. |

The options issued to Messrs. Blethen and Zavracky did not fully vest in 2005 and the Company has revised the disclosure on page 101 to provide greater clarity.

Certain Relationships and Related Party Transactions, page 99

| 31. | Please revise the first paragraph to comply with the definition of “related person” as set forth in Item 404 of Regulation S-K. |

In response to the Staff’s comment, the Company has revised the disclosure on page 102.

Relationship with InveStar and TSMC, page 101

| 32. | Please disclose the amount of wafers purchased from TSMC since January 1, 2004. |

In response to the Staff’s comment, the Company has revised the disclosure to provide such information on page 104.

Mr. Tom Jones

Securities and Exchange Commission

November 5, 2007

RE: MEMSIC, Inc. S-1 Registration Statement (File No. 333-146377)

Page 15

Policies and Procedures for Related Party Transactions, page 101

| 33. | Please provide the disclosure required by Regulation S-K Item 404(b) regarding the standards to be applied to your policies and procedures. |

In response to the Staff’s comment, the Company has revised the disclosure on page 104.

Principal and Selling Shareholders, page 102

| 34. | Please tell us whether the selling shareholders are broker-dealers or affiliates of broker-dealers. A selling shareholder who is a broker-dealer must be identified in the prospectus as an underwriter. In addition, a selling shareholder who is an affiliate of a broker-dealer must be identified in the prospectus as an underwriter unless that selling shareholder is able to make the following representations in the prospectus: |

| | (i) | The selling shareholder purchased the shares being registered for resale in the ordinary course of business, and |

| | (ii) | At the time of the purchase, the selling shareholder had no agreements or understandings, directly or indirectly, with any person to distribute the securities. |

Please revise as appropriate.

The Company supplementally advises the Staff that currently no selling shareholders have been identified. The Staff’s comment is noted and the Company will provide this information in a subsequent amendment to the Registration Statement if selling shareholders are identified. The Company recognizes that the Staff will require a reasonable amount of time to review such amendments prior to considering any request for effectiveness.

| 35. | With respect to the shares to be offered for resale by each selling shareholder that is a legal entity, please disclose the natural person or persons who exercise the sole or shared voting and/or dispositive powers with respect to the shares to be offered by that selling shareholder. |

Please refer to our response to comment 34.

Common Stock, page 106

| 36. | Please disclose the number of holders of your common equity. |

In response to the Staff’s comment, the Company has provided disclosure on the number of holders of its common equity on page 109.

Mr. Tom Jones

Securities and Exchange Commission

November 5, 2007

RE: MEMSIC, Inc. S-1 Registration Statement (File No. 333-146377)

Page 16

Consolidated Financial Statements

| 37. | Please update the financial statements as required by Rule 3-12 of Regulation S-X. |

In response to the Staff’s comment, the Company has updated the financial statements and related disclosure throughout the prospectus.

Note 3. Summary of Significant Accounting Policies, page F-I0

Note 10. Stock Incentive Plan, page F-22

Determination of Fair Value of Common Stock, page F-22

| 38. | Please provide us with a schedule showing in chronological order, the date of grant, optionee, number of options granted, exercise price and the fair value of the underlying shares of common stock for options issued within the year preceding the contemplated offering. Also include common shares issued during the period. |

| | (i) | Please indicate the compensation recorded for each of these issuances and reconcile to the amounts recorded in the financial statements. |

In response to the Staff’s comment, the Company has supplementally provided the requested schedule asExhibit K which includes the compensation recorded for each of these issuances reconciled to the amounts recorded in the financial statements and the common shares issued during those periods.

| | (ii) | Clarify how you considered the issuances of Series D preferred stock at $2.20 per share in December 2006 and April 2007. We see that the preferred shares are convertible into common stock on a one-for-one basis. |

The Company supplementally advises the Staff that the Series D financing was completed in December 2006. However, the Series D preferred shares were issued on December 2006 and April 2007 because closing of the transaction and subsequent payment and transfer of the shares with one investor was delayed until April 2007.

The Company further supplementally advises the Staff that, under the probability weighted expected returns method, or PWERM, the Company considered the value of the Series D preferred shares as well as the value of common shares in each scenario of (i) an initial public offering, or IPO; (ii) sale above the liquidation

Mr. Tom Jones

Securities and Exchange Commission

November 5, 2007

RE: MEMSIC, Inc. S-1 Registration Statement (File No. 333-146377)

Page 17

preference; (iii) sale at or below the liquidation preference; and (iv) remaining private. For the IPO and sale above liquidation preference scenarios, the Company discounted the future values indicated for Series D preferred shares and common shares to present value. In three of the four scenarios, the Company assumed conversion of the Series D preferred shares to common stock. The Company weighted each scenario according to an assessment of its probability and took into account that the probability weighting should approximate a price for the Series D preferred shares to the price paid for such shares in a market transaction. In aggregate, the three scenarios which indicated conversion to common were assigned a probability weighting of 70%. The value derived from such calculation for the Series D preferred shares as of December 31, 2006 was close to the price paid for those shares on December 22, 2006. The same scenarios and probability weightings provided a basis for valuing the common stock.

The Series D preferred shares are convertible into common stock, initially on a one-for-one basis. However, the Series D preferred shares are valued at a premium over the common shares because holders of the Series D shares are entitled to the following preferential terms:

| | • | | cumulative dividends at an annual rate of $0.066 per share; |

| | • | | in a liquidation event, each Series D share is entitled to receive an amount equal to the greater of (A) $0.55 (appropriately adjusted for any Series D recapitalization event), or (B) the amount per share which would be payable to the holders of Series D shares if all of such shares had been converted into common stock immediately prior to such liquidation event. If the proceeds in liquidation are insufficient to pay out all classes of preferred in full, Series D participates in the distributions on a pari passu basis with the other outstanding classes of preferred shares; and |

| | • | | rights including voting, protective provisions, representation on the board of directors (one member), and anti-dilution provisions. |

| | (iii) | Discuss the nature of any significant business events which occurred between the dates the options were granted and the date the registration statement was filed that would contribute to fluctuations in fair value. |

The Company supplementally advises the Staff that the business events it considered in determining the fair value of its common

Mr. Tom Jones

Securities and Exchange Commission

November 5, 2007

RE: MEMSIC, Inc. S-1 Registration Statement (File No. 333-146377)

Page 18

stock include the Company’s historical financial performance, changes in our estimates of future performance, the risks associated with achieving these results, the trading prices of public companies that are, in material respects, comparable to the Company, the prices paid to acquire companies that are, in material respects, comparable to the Company, and the expected timing of a future liquidity event, such as an IPO or sale. The Company has increased its estimates of the fair value of its common stock as its financial performance has improved and as it has progressed toward a successful liquidity event.

For the period from November 1, 2006 to March 1, 2007, the estimated fair value of the Company’s ordinary shares increased from $1.47 per share to $1.61 per share due to the following factors:

| | • | | The Company closed its Series D financing in December 2006; |

| | • | | Its sales to mobile phone applications increased by 78% from 2005 to 2006; |

| | • | | The Company’s strong 2006 result prompted the preparation of an improved 2007 budget; and |

| | • | | It opened Shanghai and Shenzhen sales offices in China. |

For the period from March 1, 2007 to April 26, 2007, the estimated fair value of the Company’s ordinary shares increased from $1.61 per share to $1.85 per share due to the following factors:

| | • | | The Company’s overall revenue continued to increase with first quarter results exceeding management expectations; and |

| | • | | It hired the Vice President of Marketing and Business Development. |

For the period from April 26, 2007 to July 26, 2007, the estimated fair value of the Company’s ordinary shares increased from $1.85 per share to $3.42 per share due to the following factors:

| | • | | The Company’s overall revenue and net income continued to increase. Its revenue increased by 67% from $3.1 million in the second quarter of 2006 to $5.1 million in the second quarter of 2007. Net income increased by 89% from $0.6 million in the second quarter of 2006 to $1.2 million in the second quarter of 2007; |

| | • | | It hired the Chief Financial Officer and Vice President of Engineering; |

Mr. Tom Jones

Securities and Exchange Commission

November 5, 2007

RE: MEMSIC, Inc. S-1 Registration Statement (File No. 333-146377)

Page 19

| | • | | Its largest mobile phone customer listed the Company’s accelerometers as a standard component in their mid to low-end product lines; |

| | • | | The Company added approximately 15 new design-wins primarily with major mobile phone manufacturers in China; |

| | • | | It held discussions with several investment banks about a potential initial public offering; |

| | • | | It engaged Citigroup as its underwriter for its potential initial public offering; and |

| | • | | It launched the initial public offering process. |

For the period from July 26, 2007 to August 22, 2007, the estimated fair value of the Company’s ordinary shares increased from $3.42 per share to $3.82 per share due to the following factors:

| | • | | As the probability of the Company’s initial public offering increased, the discount for lack of marketability decreased; and |

| | • | | It continued to execute its business plan. |

For the period from August 22, 2007 to September 30, 2007, the estimated fair value of the Company’s ordinary shares increased from $3.82 per share to $4.97 per share due to the following factors:

| | • | | The Company filed its initial S-1 registration statement with SEC; |

| | • | | Its third quarter financial results were very strong. Total revenue increased by 64% from the same period of last year and exceeded budget by 62%; |

| | • | | It successfully won two new design-wins for digital camera applications with two new digital camera manufacturers; and |

| | • | | The management was more confident about a near term initial public offering. |

The Company has re-calibrated its estimates as necessary based on business events which provide independent indicators of the value of its shares. On December 22, 2006, it completed a Series D preferred stock financing priced at $2.20 per Series D share. The issuance of Series D preferred shares provided an opportunity for the Company to evaluate its estimated probabilities for future liquidity events. For its December 31, 2006 retrospective determination of fair value, the Company selected probabilities which generated a value for the Series D preferred shares which was consistent with the Series D price of $2.20 per share.

Mr. Tom Jones

Securities and Exchange Commission

November 5, 2007

RE: MEMSIC, Inc. S-1 Registration Statement (File No. 333-146377)

Page 20

| | (iv) | Provide us with a chronological bridge of management’s fair value per share determinations to the current estimated per share offering price. Indicate when discussions were initiated with your underwriter(s) about possible offering price ranges and provide us a history of pricing discussions. |

The Company supplementally advises the Staff that in the first week of June 2007, prospective bookrunning underwriters provided it with their preliminary assessments of the value of the Company in an IPO. The range of values was very wide because of differences in assumptions regarding the timing of an IPO, the Company’s future performance and the selection of comparable companies. Based on these assessments, the Company assumed a higher probability of achieving an IPO by March 2008.

The Company has engaged Orchard Partners, Inc., an independent third party, to prepare retrospective and contemporaneous valuation since February 2006 to support management estimates of the fair value of the options granted. The fair market value of the Company’s common stock was estimated using a probability-weighted analysis of the present value of the returns afforded to its shareholders under each of four possible future scenarios: (i) an initial public offering, or IPO; (ii) sale above the liquidation preference; (iii) sale at or below the liquidation preference; and (iv) remaining private.

As of November 9, 2006, the Company estimated the fair value of its common stock at $1.47 per share which was supported by a retrospective appraisal performed by Orchard Partners, Inc. The Company maintained the probability of an IPO in March 2008 at 23% and the discount rate at 25%. Factors which contributed to an increase in the estimate of fair value were (a) continued revenue growth of more than 40% from the previous year and (b) shorter discount timeframe for a successful liquidity event.

As of December 31, 2006, the Company estimated the fair value of its common stock at $1.61 per share which was supported by a retrospective appraisal performed by Orchard Partners, Inc. The Company maintained the probability of an IPO in March 2008 at 23% and the discount rate at 25%. Using the same probabilities to value the Series D shares, the Company reached the same price of $2.20 per share as paid by the Series D investors on December 22, 2007. The key factor which contributed to an increase in the estimate of fair value of the common stock was the closing of the Series D financing round.

Mr. Tom Jones

Securities and Exchange Commission

November 5, 2007

RE: MEMSIC, Inc. S-1 Registration Statement (File No. 333-146377)

Page 21

As of March 31, 2007, the Company estimated the fair value of its common stock at $1.85 per share which was supported by a contemporaneous appraisal performed by Orchard Partners, Inc. The Company increased the probability of an IPO in March 2008 to 25% and maintained the discount rate at 25%. Factors which contributed to an increase in the estimate of fair value include: (a) over a 100% growth in revenue in the first quarter of 2007 as compared with the same period in 2006; and (b) the hiring of the Vice President of Marketing and Business Development.

As of June 30, 2007, the Company estimated the fair value of its common stock at $3.42 per share which was supported by a retrospective appraisal performed by Orchard Partners, Inc. The Company raised the probability of an IPO in March 2008 to 60% and decreased the discount rate to 20%. This probability reflected favorable meetings with underwriters in the first week of June 2007. Additional factors which contributed to an increase in the estimate of fair value include: (a) initial discussions with prospective underwriters about a potential IPO; (b) revenue growth of 67% and net income growth of 89% in the second quarter of 2007 as compared with the same period in 2006; and (c) the hiring of the Chief Financial Officer and Vice President of Engineering.

As of August 22, 2007, the Company estimated the fair value of its common stock at $3.82 per share which was supported by a contemporaneous appraisal performed by Orchard Partners, Inc. The Company increased the probability of an IPO in March 2008 to 70% and decreased the discount rate to 18%. Factors which contributed to an increase in the estimate of fair value include the Company’s financial performance and progress toward a successful liquidity event.

| 39. | Please note that we are deferring any final evaluation of stock compensation until the estimated offering price is specified, and we may have further comments in that regard when you file the amendment containing that information. |

The Staff’s comment is acknowledged.

Mr. Tom Jones

Securities and Exchange Commission

November 5, 2007

RE: MEMSIC, Inc. S-1 Registration Statement (File No. 333-146377)

Page 22

Valuation of Stock Options, page F-24

| 40. | Please provide the SFAS 123 pro forma disclosures about stock based compensation for 2005 and 2004 or tell us why those disclosures are not required. Refer to paragraphs 84 and 85 to SFAS 123(R). If you previously used the minimum value method and relied on the paragraph 85 exception, please disclose so. |

In response to the Staff’s comment, the Company has revised the disclosure to provide such information on page F-25.

Note 14. Commitments and Contingencies, page F-31

Licensing Agreement and Marketing Agreements, page F-31

| 41. | We see that you record amounts paid as royalty fees under the license agreement as general and administrative expenses. Please tell us why this amount should not be recorded as cost of sales in the period the underlying products are sold. |

The Company respectfully advises the Staff that the technology which the Company obtained in 1999 was neither mature nor complete at that time. The technology had to be significantly developed or enhanced before the Company was able to use it in its production. Therefore, the Company historically classified the royalty expense related to this technology as general and administrative expenses rather than cost of sales. The Company believes the royalty expenses are immaterial to gross margin and to general and administrative expenses. Please see the table below. Since the royalty expenses are capped at $100,000, such amounts will diminish as a percentage of revenue and general and administrative expenses as our business continues to grow. The Company does not expect to enter into any significant licensing arrangements in the future.

| | | | | | | | | | | | | | | | | | | | |

| | | For the year ended December 31, | | | For the nine

months ended

September 30, | |

| | | 2003 | | | 2004 | | | 2005 | | | 2006 | | | 2007 | |

Gross profit | | $ | 1,140,928 | | | $ | 4,897,587 | | | $ | 6,162,502 | | | $ | 8,786,404 | | | $ | 12,319,981 | |

Royalty | | $ | 10,000 | | | $ | 55,842 | | | $ | 91,419 | | | $ | 100,000 | | | $ | 100,000 | |

Impact on gross margin (%) | | | 0.5 | % | | | 0.8 | % | | | 1.0 | % | | | 0.8 | % | | | 0.5 | % |

General and administrative expenses | | $ | 1,391,847 | | | $ | 1,685,790 | | | $ | 2,003,624 | | | $ | 2,544,747 | | | $ | 2,640,794 | |

Royalty as a percentage of general and administrative expenses (%) | | | 0.7 | % | | | 3.3 | % | | | 4.6 | % | | | 3.9 | % | | | 0.8 | % |

Mr. Tom Jones

Securities and Exchange Commission

November 5, 2007

RE: MEMSIC, Inc. S-1 Registration Statement (File No. 333-146377)

Page 23

Recent Sales of Unregistered Securities, page II-2

| 42. | Please provide the information required by Item 701(d) of Regulation S-K. Also, pursuant to Item 701(b), please also name the purchasers or identify the class of persons to whom the securities were sold. |

In response to the Staff’s comment, the Company has provided additional disclosure on page II-2.

Undertakings, page II-3

| 43. | Please provide the undertakings required by Item 512(a)(5)(ii) and Item 512(a)(6) of Regulation S-K. |

In response to the Staff’s comment, the Company has amended the disclosure to provide such undertakings on page II-3.

Exhibit 23.1

| 44. | Please include a currently dated and signed consent from your independent auditors prior to requesting effectiveness. |

The Staff’s comment is acknowledged and the Company will provide this in a subsequent amendment to the Registration Statement prior to requesting effectiveness. The Company has included a currently dated and signed consent from its independent auditors for purposes of this filing.

*********

Mr. Tom Jones

Securities and Exchange Commission

November 5, 2007

RE: MEMSIC, Inc. S-1 Registration Statement (File No. 333-146377)

Page 24

We appreciate the Staff’s agreement to review this letter and the Company’s Registration Statement. Please feel free to contact the undersigned in Hong Kong at the office: (852) 3740-4780, at home: (852) 2803-1823, or mobile phone: (852) 9460-8675 if you wish to discuss the Company’s revised submission.

|

| Very truly yours, |

|

| /s/ Gregory G.H. Miao |

Gregory G.H. Miao |

| cc: | Dr. Yang Zhao, MEMSIC, Inc. |

David Lau, Citigroup Global Markets

John D. Young, Jr., Sullivan & Cromwell LLP

Edward Nelson, Ernst & Young

Exhibit A

MEMSIC

Exhibit B

Your Experts in Microtechnology and Electronics.

Think Small wtc Issue 2 volume 1 May 2006

The newsletter covering the frontiers of MEMS, optronics and nanotechnology

Published by WTC — Wicht Technologie Consulting

Contents

Editorial 2 MEMS News 2 Nanotechnology News 5 Optotechnology News 6 Feature Article 1, 8 “MEMS Inertial sensors” Interview 11 with Yang Zhao, CEO Memsic Events 12

Contributing staff: Henning Wicht. Jéremie Bouchaud, Olivier Nowak Richard Dixon, Bernardo Knoblich, Stefan De Haan

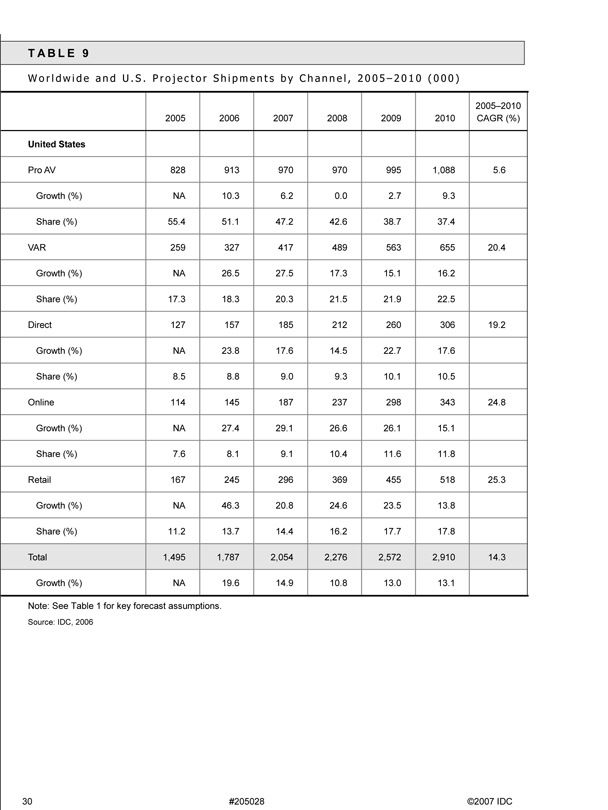

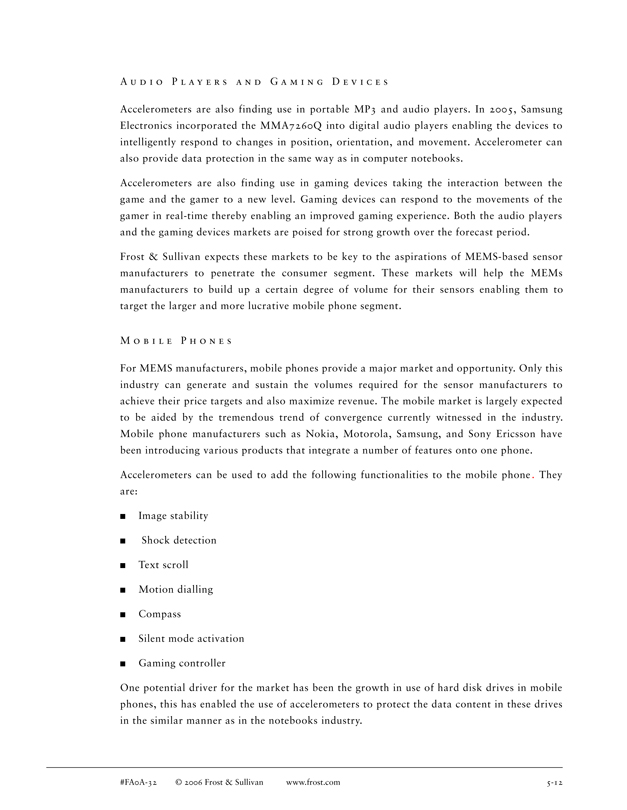

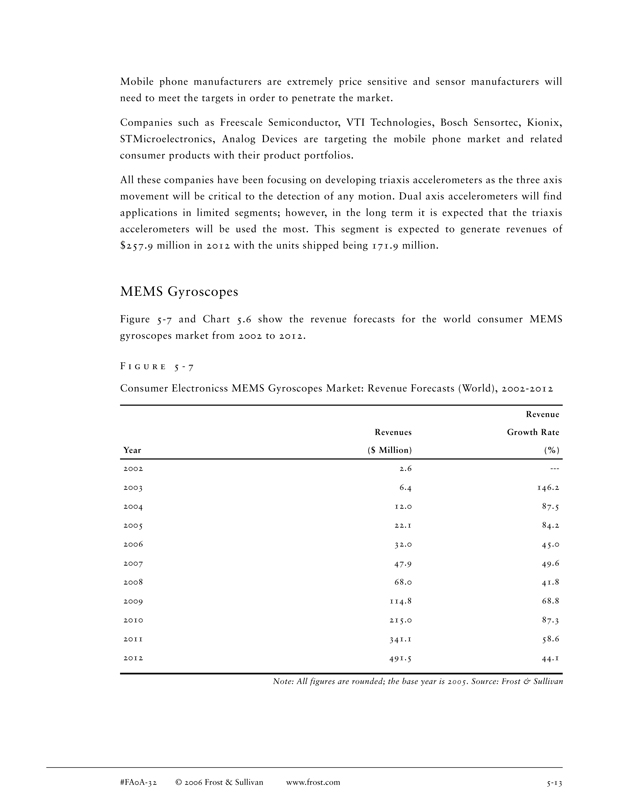

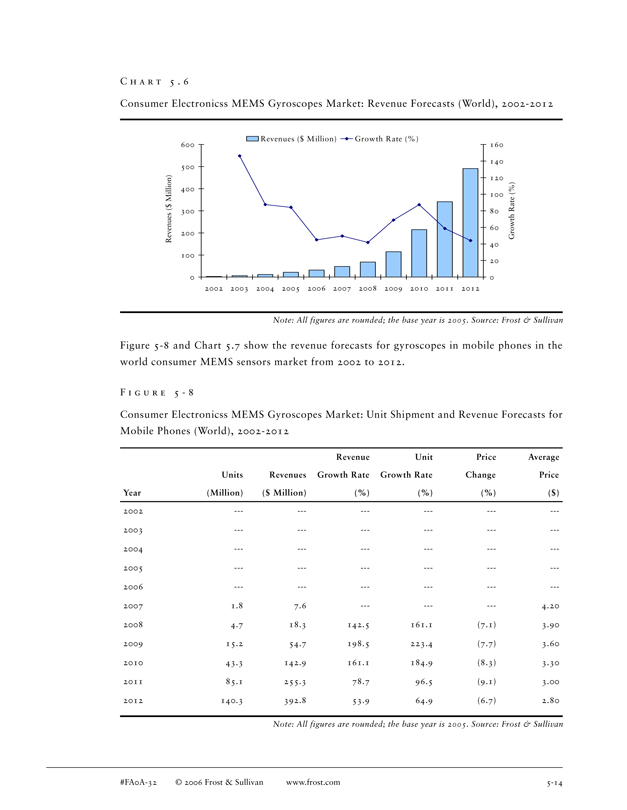

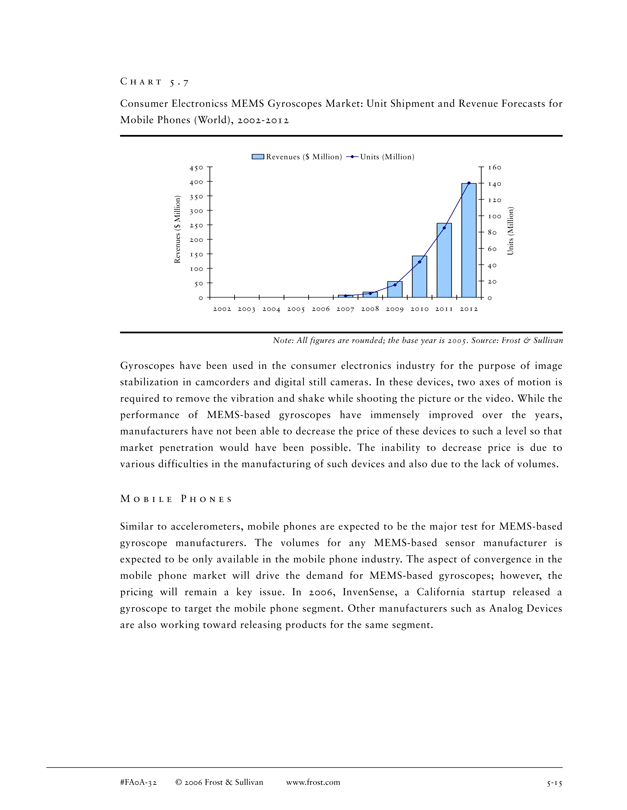

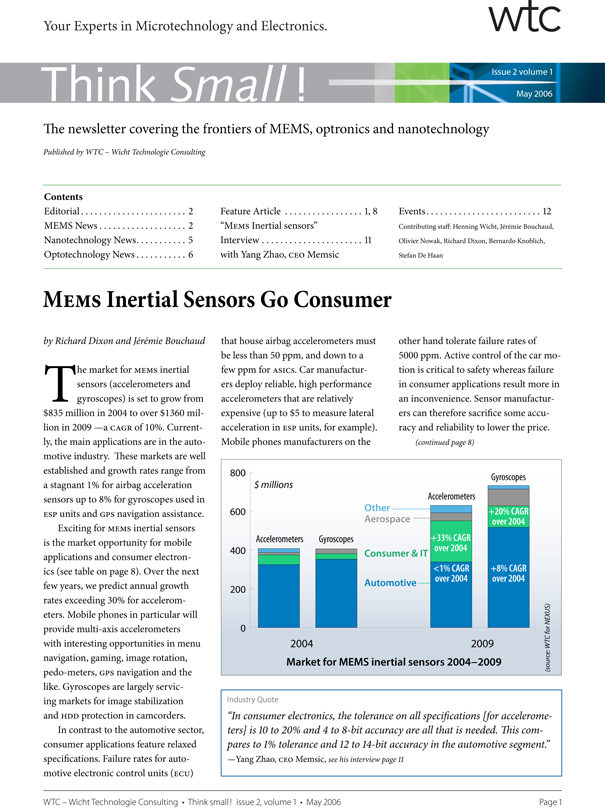

MEMS Inertial Sensors Go Consumer

by Richard Dixon and Jérémie Bouchaud

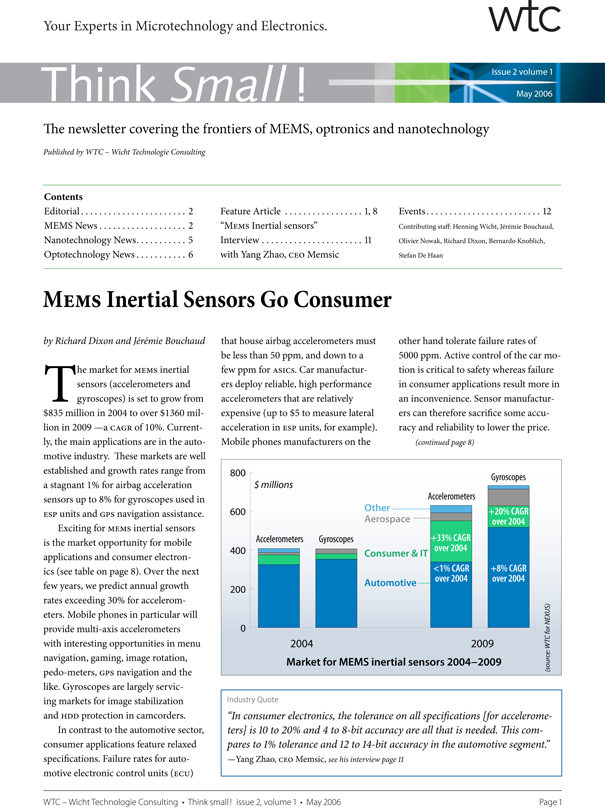

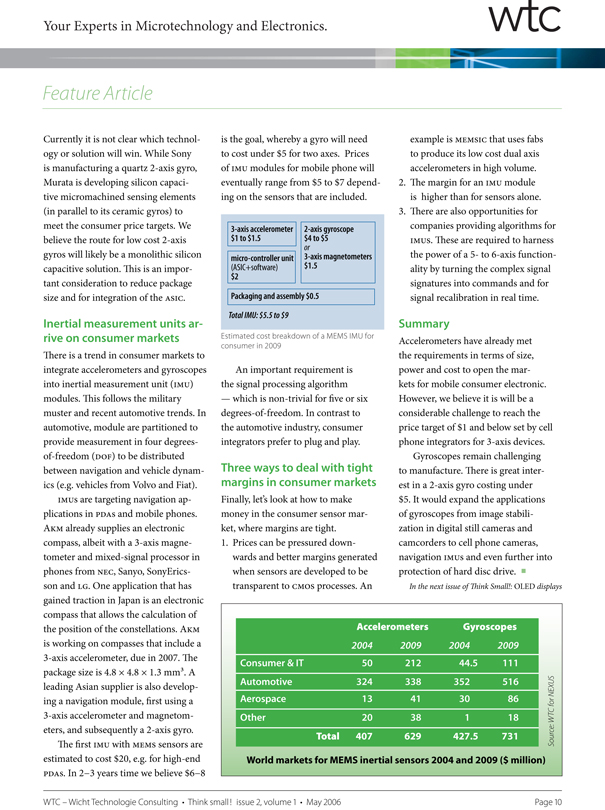

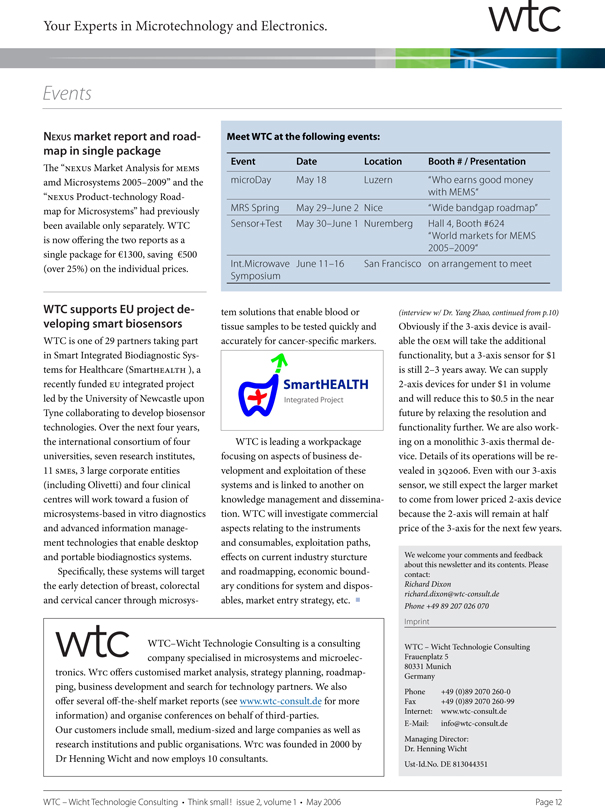

The market for MEMS inertial sensors (accelerometers and gyroscopes) is set to grow from $835 million in 2004 to over $1360 million in 2009 —a CAGR of 10%. Currently, the main applications are in the automotive industry. These markets are well established and growth rates range from a stagnant 1% for airbag acceleration sensors up to 8% for gyroscopes used in ESP units and GPS navigation assistance. Exciting for MEMS inertial sensors is the market opportunity for mobile applications and consumer electronics (see table on page 8). Over the next few years, we predict annual growth rates exceeding 30% for accelerometers. Mobile phones in particular will provide multi-axis accelerometers with interesting opportunities in menu navigation, gaming, image rotation, pedo-meters, GPS navigation and the like. Gyroscopes are largely servicing markets for image stabilization and HDD protection in camcorders. In contrast to the automotive sector, consumer applications feature relaxed specifications. Failure rates for automotive electronic control units (Ecu) that house airbag accelerometers must be less than 50 ppm, and down to a few ppm for ASIC5. Car manufacturers deploy reliable, high performance accelerometers that are relatively expensive (up to $5 to measure lateral acceleration in ESP units, for example). Mobile phones manufacturers on the other hand tolerate failure rates of 5000 ppm. Active control of the car motion is critical to safety whereas failure in consumer applications result more in an inconvenience. Sensor manufacturers can therefore sacrifice some accuracy and reliability to lower the price. (continued page 8) 800 $ millions 600 Gyroscopes Other Aerospace Accelerometers Accelerometers 400 Gyroscopes over 2004 200 Consumer & IT ;•33% CAGR over 2004 ra <1% CAGR over 2004 Automotive — 0 +8% CAGR over 2004 2004 Market for MEMS inertial sensors 2004—2009 2009 Li

Industry Quote

“In consumer electronics, the tolerance on all specifications [for accelerometers] is 10 to 20% and 4 to 8-bit accuracy are all that is needed. This compares to 1% tolerance and 12 to 14-bit accuracy in the automotive segment.” —Yang Zhao, CEO Memsic, see his interview page 11

WTC Wichtlechnologie Consulting Think small! issue 2, volume 1 May 2006 Page 1

Your Experts in Microtechnology and Electronics. wtc

Editorial

Dr. Henning Wicht, CEO

Why so much difference between the MEMS market forecasts? This question came up time and again—and several times at Semicon Europa this April. We had presented the NEXUS figures for MST!MEMS and Yole Development presented its figures for MEMS. Shortly thereafter InStat released a new MEMS market report. But do these forecasts measure the same thing? To compare apples with apples, you need to remove the value of the read-write (Rw) heads market from the NEXUS figures. Read-write heads account for half of the total market value in the NEXUS report but they are not accounted for in the other two reports. Yole also did not include growing polymer microsystems in its figures. Once you do remove the read- write heads, the figures are amazingly similar. The MEMS market was valued around $6bn to $7bn in 2005 and will be around $lObn to $l2bn at the end of the decade. There is also a consensus on major trends:

• Inkjet heads are stagnating.

• Inertial sensors keep growing now driven by consumer applications.

• DLP are growing in spite of strong price erosion.

• Microphones are skyrocketing. But those who would miss animated panel discussions need not worry. Whereas we and Yole Development agree on a 15–16% CAGR for the coming years, InStat forecasts a more modest 6.8% per year until 2010. We are more optimistic than others about the development of the RF-MEMS and MEMS microphones markets. They are more optimistic than us about micro bolometers and liquid lenses. Market forecasting is not an exact science and there will always be room for debate. That’s what makes our job interesting.

MST/MEMS market forecasts from NEXIS, Yole Development and InStat

Microsystem News

Micropelt forms company

Micropelt, a startup of the Fraunhofer Institute for Physical Measurement Techniques (Freiburg, Germany) that manufactures thin- film micropeltier coolers, is now a company. Funding is being provided by a number of institutions, including Infineon Semiconductor.

WTC comment: Micropeltiers join other technologies being considered for chip cooling, including spraying, ion drive airflow, electrokinetic pumps, liquid metal, thermotunnel effect and even nanotubes. According to NEXUS, there is currently no market for cooling devices, although a small opportunity worth $75 million could exist by 2009.

RF-MEMS resonators take on quartz timing market

SiTime has begun sampling a range of MEMS oscillators for consumer product timing applications. The SiT ixxx-series and SiT8002 generate frequencies from ito 125 MHz and are housed in with a CMOS driver in QFN-type packages that measure 2 x 2.5 x 0.85 mm3. Target applications are quartz oscillators in digital still cameras, portable media players and notebook computers, says the company. Eventually SiTime aims to penetrate the high end quartz oscillator market for signal references in cell phones. (continued next page) if Editorial Dr. Henning Wicht, CEO d Peltier coolers MST/MEMS market forecasts from N EXUS, Yole Development and I nStat $25bn NEXUS (includes RW heads) NEXUS (without RW heads) InStat Yole Development (does not include polymer)

$2Obn $l5bn $1 Obn $5bn $Obn 2004 2005 2006 2007 2008 2009 2010 WTC WichtlechnologieConsulting . ThinksmalH issue2,volumel . May2006 Page 2

Your Experts in Microtechnology and Electronics.

Microsystern News wtc

(continued from previous page) MEMS oscillators are tunable, and are significantly smaller and less susceptible to shock and vibration than quartz technology. SiTime claims that the company’s innovative wafer-scale packaging solution makes it competitive on price. This packaging technology is licensed from Bosch and is compatible with CMOS processing. It involves placing resonators on top of an SOT wafer and encapsulating with an epitaxial layer of silicon, facilitating sealing at high temperatures and creating a barrier to moisture. Currently, SiTime’s resonators are two-chip devices, which is a result of the economics of real estate required.

WTC comment: SiTime is one of three us start-ups currently active in RF-MEMS frequency control and timing applications. Discera will ramp resonators (serial production end 2006 or start of 2007), and Silicon Clocks will sample this year. Other larger players are Philips, Freescale and ST. The clock oscillator opportunity is $4 billion. While temperature stability, packaging have found solutions, some industry doubts will dissipate when serial production starts at Discera.

RF-MEMS switches go global

TeraVicta Technologies has chosen Richardson Electronics to globally distribute its RF-MEMS switches. They provide a combination of low insertion loss, high isolation, high linearity, size, power consumption and production advantages compared to equivalent GaAs FET and PiN diodes. Applica tions include automated test equipment (ATE), instrumentation, RF!wireless communications and RF switching. “Our patented, hermetic in-line chip- scale package is designed to improve RF performance and reduce cost by eliminating wire-bonds and leads”, said John Chimoures, vp of worldwide sales. Chimoures added that performance and cost advantages will drive markets for high-performance multi-mode / multi-band devices.

WTC comment: RF-MEM5 switches have been available from Matsushita Electric Works since October 2005, while Advantest has implemented its own RF-MEM5 relays into ATE equipment since late 2005. We expect an $80m market for RF-MEM5 switches in ATE andRF test in 2010.

RF MEMS Market II 2005-2009

260 pages Profiles of 60 companies Over 100 tables and figures Published: December 2005

Price: $4150! €3500, excluding VAT.

What readers are saying

“The study very much helps research organizations and companies in developing a winning strategy for the right RF MEMS component/system for the right application.”

— Harry Tilimans, IMEC, Section Head RF MEMS

“WTC has assembled a comprehensive examination of the ‘teenage’ global RF-MEMS community, presenting a level of detail and application sensitivity that answers many of the critical business questions asked by early developers and users alike.” – Daniel Hyman, Xcom Wireless, Inc. President

Order form at www.wtc-consult.de!english!r_rf0509_e.html or contact us T +49 89 207 0260-98! info©wtc-consult.de

WTC WichtlechnologieConsulting . ThinksmalH issue2,volumel . May2006 Page 3

Your Experts in Microtechnology and Electronics.

Microsystern News wtc

ST and ADI accelerometers power Nintendo controller

Nintendo has unveiled its new console that uses 3-axis accelerometers in the controllers. Tilt measurements allow players to move characters in the game, while the 3-axis acceleration sensing transforms the controller (that can be held in one hand) into a virtual sword, gearshift or musical instrument. The system comprises a main and a freestyle controllers, each using a motion sensor. Am is supplying the accelerometer for the main controller; and ST’S accelerometer won the socket for the freestyle unit. The Wii console will be available in the us at the 4th quarter of this year.

(Credit: Nintendo)

Controllers for the newWn Nintendon console

WTC comment: ADI’s 2-axis accelerometer has long been used in game cartridges for Nintendo’s Game Boy Advance. Sony disclosed that its Playstation 3 will include a videogame controller equipped with a 6-axis sensing system.

Methode and SensorDynamics cooperate on automotive

Methode Electronics International GmbH (Gau-Algeshiem, Germany) and SensorDynamics AG (Graz-Lebring, Austria) have agreed to cooperate on development and manufacturing of smart sensors. The partnership will leverage Methode’s expertise in sensor modules and eddy current inductive sensing and SensorDynamics’ modules and MEMS-based sensors, which include inertial devices and heat resistors. The technology will initially be developed for automotive and eventually industrial applications. The partnership has already sealed an order from a Japanese OEM, and is working with a major European tier I supplier to launch the program in May 2007.

WTC comment: SensorDynamics worked with the Fraunhofer Institute for Silicon Technology on a gyroscope using surface micromachined thick poly-Si and wafer level encapsulation — this product is initially targeting automotive applications such as ESP and navigation.

Automotive markets for gyroscopes will grow at around 8% annually to reach over $510m in 2009.

HDD hits density of 170 Gb/in2

Alps will begin production of hard disc drives (Hun) with 170 Gb/in2 at its plants in Japan and China in mid-2006. The new drives employ tunneling magneto resistive perpendicular thin-film heads — a structure consisting of a few nano-meters of insulating layer sandwiched between highly magnetic layers. Under an applied magnetic field, this structure exhibits a tunnel effect in which an electric signal runs through the insulating body. The thin insulation layer endows low resistance and stability.

Applications include 1.0” (and smaller) to 3.5” HDD for Pcs, DVD recorders, car navigation systems, MP3 and cell phones.

WTC comment: Small-format HDD5 boost the market for RW heads. According to NExus, HDD in phones, cameras, TV recorders, MP3 players jump from $180m in 2004 to $3bn in 2009. MiniHDD and Flash will coexist in mobile TV phones and iPod players. Small format HDD also drives 3D accelerometer markets (free-fall detection).

Philips spin-out is planning electrowetting mobile displays

Philips Research and New Venture Partners LLC announced a spin-out company to commercialize electrowetting displays invented by Philips Research.

Cyan clock with a 2.5” diagonal. (160 dpi pixels)

Liquavista B.V. will commercialize the technology for MP3 players, watches, cameras, mobile phones, DVD players, and automotive applications and enable new markets for Tv-on-mobile. The company claims the new displays will “revolutionize” the mobile display market with bright vivid colours and video viewable in bright sunlight, in addition to substantial power savings over existing technologies. Manufacturing is compatible with existing LCD infrastructure, says the company. Demonstrations are planned for the upcoming Society for Information Display exhibit in San Francisco on June 6—8, 2006.

WTC comment: Electrowetting displays are part of a group ofMsT reflective display technologies, e.g. iMoD from Qualcomm. We do not expect electrowetting displays to enter cell phones before 2009 at the earliest.

WTC WichtlechnologieConsulting . ThinksmalH issue2,volumel . May2006 Page 4

Your Experts in Microtechnology and Electronics.

Nanotechnology News wtc

Infrared light detector built with nanotubes

US researchers have used carbon nanotubes (CNT) to build an infrared bolometer—a device whose resistance changes with temperature as a function of incoming radiation. The bolometer is made by suspending a 0.5 mm wide film of single-walled carbon nanotubes (swNT) over a 3.5 mm gap between two electrical contacts.

A group led by Professor Robert Haddon at the University of California found the absorption coefficient for the SWNT film was 10 times higher than HgCdTe. The best results were obtained from a 40nm thick film, which exhibited a resistance ratio of 100 at 4.2K and 300K, in addition to a responsivity up to 1000V!W

“We have shown that the introduction of various chemical species — such as octadecylamine and polyamino benzene sulphonic acid — greatly affects the electrical resistivity properties of CNT films:’ said Haddon. Two-dimensional arrays of such devices could find applications in thermal imaging, spectroscopy and astronomy.

WTC comment: Microbolometers are sensitive devices that operate in adverse conditions — an advatange over low cost thermopiles. They cost thousands of dollars which limits their use to medical and military applications. The market will grow at 10% annually to $80m in 2009.

Philips makes molecular electronics breakthrough

Philips Research and the University of Groningen have reported high yields for arrays of molecular diodes fabricated using standard substrates. The molecular diodes, which are as thin as one molecule (1.5 nm) — are suitable for integration into standard plastic electronics circuits, say the researchers, who reported the results in Nature (May 4, 2006 Volume 440, Number 7089).

Although still a relatively new field, molecular electronics is regarded as the evolution of plastic electronics. Instead of employing photolithography or printing techniques to make nano-scale circuit features, molecular electronics relies on 1-2 nm thick organic molecules that spontaneously form the correct structures via self-organisation. To form a cirucit the molecular layer is sandwiched between electrondes, and it is this step that can lead to problems.Many approaches attempt to deposit a metal electrode directly onto LI Scientists from Philips Research and the Dutch University of Groningen holding a molecular dec tronics based diode formed from solution. this monolayer, but shorting occurs due to contacts forming between the electrodes as the layers are so thin. The key to the Dutch technology is the deposition of an additional plastic electrode layer on to the monolayer prior to the deposition of the metallic electrode. The plastic electrode protects the monolayer and enables a improved deposition of a gold electrode.

“Plastic electronics is very promising for the manufacture of electronics where low temperature or low cost in-line processing techniques are required:’ said Dago de Leeuw of Philips Research. Dc Leeuw added that the approach would not compete with siliconic technology.

Scientists from Philips Research and the Dutch University of Groningen holding a molecular electronics-based diode formed from solution.

(Credit Philips)

“Thin” graphite could alter view of electronics

A report in Science Express (an online version of ScienceElectronics Weekly) from April 13 highlights work by American and French researchers which shows that thin layers of graphite-known as graphene- could provide devices “of a kind that don’t really have an analogue in silicon-based electronics”. Graphene has a similar “chicken wire” structure to unrolled carbon nanotubes. The researchers, from Georgia Tech and the Centre National de la Recherche Scientifique (CNRS), hope to demonstrate electronic devices that manipulate electrons as waves rather than particles — a very different way of approaching electronics.

According to Professor Walt de Heer from Georgia Tech’s school of physics, integrated electronic structures would work on diffraction of electrons rather than diffusion, offering very small devices with high efficiencies and low power consumption. In addition, as graphene can be patterned by traditional lithography, it would be better for mass production than nanotubes.

Graphene circuitry employs narrow ribbon structures to confine the electrons using quantum effects similar to carbon nanotubes. The graphene is obtained by baking SiC wafers to remove the Si. Devices are initially produced using spin-coated layers and standard photolithography (see image). The researchers claim a mobility of 25,000 cm2! Vs, compared with 1,500 cm2!Vs for doped Si. r’I

WTC WichtlechnologieConsulung . ThinksmalH issue2volumel .. May2006 Page 5

Your Experts in Microtechnology and Electronics. wtc

Optotechnology News.

Startup raises $7.5m for nanotech solar cells

Innovalight, a Santa Clara, CA startup developing nanotechnology-based printed solar cells has been awarded a series B cash injection of $7.5 million. Innovalight will use the funding to develop low-cost solutions for solar cells based on silicon ink technology. Today most solar energy modules are made from costly crystalline Si wafers that are currently in short supply due to semiconductor demand.

Conrad Burke shows off Innovalights solution based nano silicon crystals near Oakland, CA Si particles have direct bandgaps, are tunable and due to their solvent base can be applied using existing cheap roll-to-roll approaches already used for printing film or paper. If proven, says president and CEO Conrad Burke, this method could alter the cost structure for producing solar-generated electricity up to ten-fold. How efficient the crystals are has not been revealed. White OLEDs challenge bulbs US researchers have improved the efficiency of white OLED5 to deliver a peak of 38 lm/W (vs. 15 lm/W for incandescent bulbs). One of the reseachers, Prof. Mark Thompson from the University of Southern California said the same structure could eventually achieve 60 lm/W According to an article in Electronics Weekly (26/04/06), the devices cover the red and green spectrum with phosphorescent molecules and use a fluorophore species for the blue. The fluorophore appears to improve lifetime issues associated with other blue phosphors and which has held up OLED development, say the researchers. Generally, manufacturing costs and lifetimes for white OLED5 remain an open question, but red, green and blue OLED5 outlive incandescent bulbs. Olympus and Movaz joint venture targets optical networks Olympus and Movaz Networks have launched Olympus Microsystems America, to be located in San Jose, CA. The joint venture company will initially service the optical equipment market. Its first product is a compact reconfigurable optical add-drop optical module (bAUM) with MEMS wavelength switch, ASIC5 and optics. The first networks featuring Movaz’s ROADM were deployed last August at NASA Goddard Space Flight Center as well as universities. As part of the jv Movaz will augment patented optical switching technologies and engineering resources with Olympus’ established MEMS foundry services and optical technology. The new entity anticipates sales of $60m in 5 years, and also intends to develop a range of variable optical attenuators, small switches, optical cross connects, aspheric lenses and tunable filters. WTC comment: Olympus’forecast of $60m within 5 years is rather optimistic. NEXUS Iliforecasts MOEMS for telecom to be worth $170m in 2009. Companies such as JDSU, Dicon, Lightconnect and Bookham are already well established. Micro-mirrors eye ophthalmology improvements Physical Sciences has chosen Boston Microsystems (BMC) to supply its multi-deformable mirror for use in an adaptive optics spectral domain optical coherence tomography (AoSDOCT) system. According to the company, the aberration compensation of BMC’s component is said to allow better resolution imaging of the human retina than previously. Multi deformable mirror 0 0 0 WTC comment: There are a number of players supplying micro mirrors for adaptive optics used in ophthalmology: LETI with Mauna Kea Technologies (France), FhG IPMS with Perfect Vision (Germany) and Topcon (Japan). CNT offers promise for printable solar cells Eikos Inc. and the National Renewable Energy Laboratory (NREL) have make a significant step towards fully printable organic solar cells, which are under consideration as a potentially attractive alternative to silicon-based solar cells. Such devices are expected to be cheaper, offer more efficient and flexible manufacturing, and lower

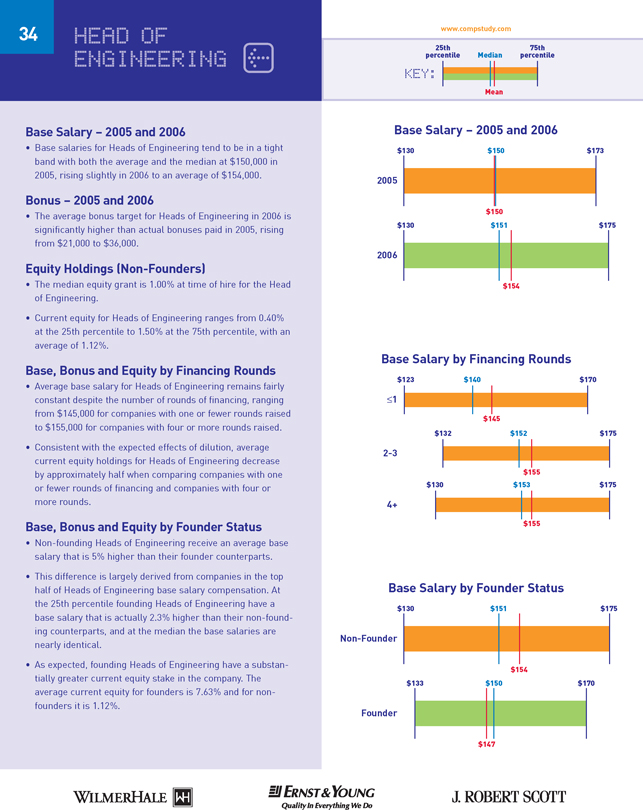

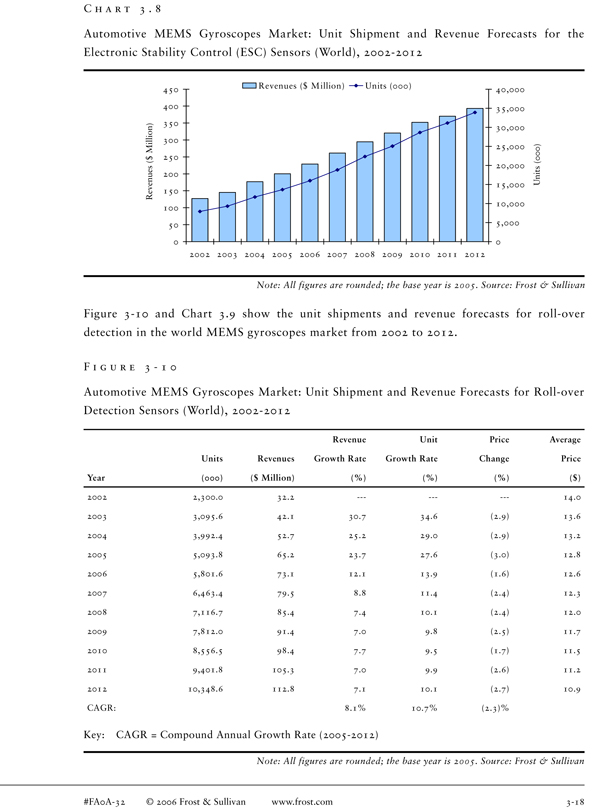

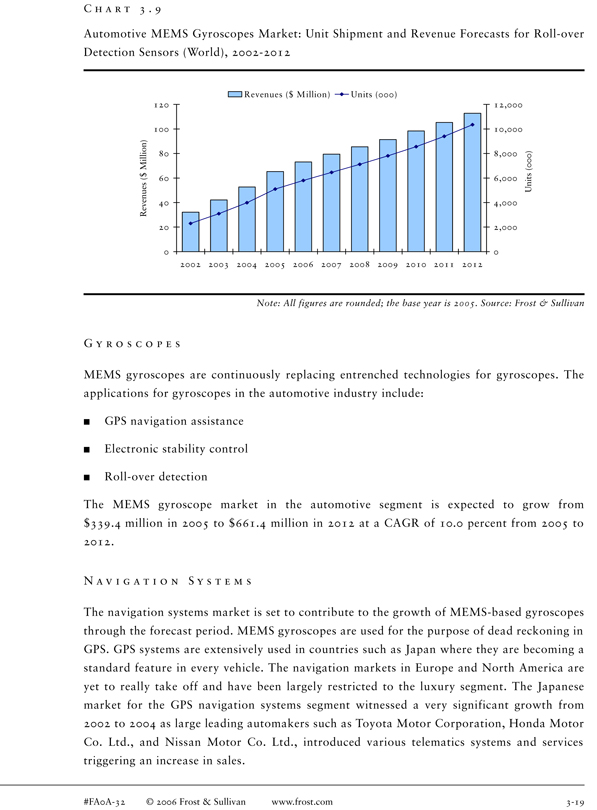

weight. (continued next page) if -. I l-’o_ 0”o • Innovalight’s non-toxic nanosized WTC WichtlechnologieConsulting . ThinksmalH issue2,volumel . May2006 Page 6